Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - Biostage, Inc. | v456124_ex23-2.htm |

As filed with the Securities and Exchange Commission on January 3, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Biostage, Inc.

(Exact name of registrant as specified in its Charter)

| Delaware | 3841 | 45-5210462 | ||

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

84 October Hill Road, Suite 11, Holliston, Massachusetts 01746

(774) 233-7300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

James McGorry

President and Chief Executive Officer

Biostage, Inc.

84 October Hill Road, Suite 11, Holliston, Massachusetts 01746

(774) 233-7300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

|

Josef B. Volman, Esq. Chad J. Porter, Esq. Burns &

Levinson LLP

|

Joseph A. Smith, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, NY 10105 (212) 370-1300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one)

| Large Accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

Title of each Class of Securities to be Registered

|

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee

| ||

| Common Stock, par value $0.01 per share (2) | ||||

| Series C Convertible Preferred Stock, par value $0.01 per share (2) | ||||

| Common Stock issuable upon conversion of Preferred Stock (2) | ||||

| Warrants to purchase Common Stock (2) | ||||

| Common Stock issuable upon exercise of Warrants (2) | ||||

| Placement agent’s warrants (3) | ||||

| Common stock issuable upon exercise of placement agent’s warrants (3) | ||||

| Total | $8,000,000 | $928 (4) | ||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. This Registration Statement also relates to the Rights to purchase shares of Series A Junior Participating Cumulative Preferred Stock of the Registrant which are attached to all shares of Common Stock pursuant to the terms of the Registrant’s Shareholder Rights Agreement dated October 31, 2008, as amended by Amendment No. 1 dated February 12, 2015. Until the occurrence of certain prescribed events, the Rights are not exercisable, are evidenced by the certificates for the Common Stock and will be transferred only with such stock. |

| (2) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (3) | Represents warrants to purchase a number of shares of common stock equal to 5% of the common stock sold in this offering (including the number of shares of common stock issuable upon conversion of shares of Series C Preferred Stock sold in this offering but excluding any shares of common stock underlying the warrants issued in this offering). |

| (4) | Calculated in accordance with Rule 457(o) of the Securities Act at the statutory rate of $115.90 per $1,000,000 of securities registered. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED JANUARY 3, 2017

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Up to

$8,000,000 in Shares of Common Stock,

Warrants to Purchase Shares of Common Stock and

Shares of Series C Convertible Preferred Stock

We are offering up to shares of common stock, together with warrants to purchase shares of common stock at a purchase price of (and the shares issuable from time to time upon exercise of the warrants) pursuant to this prospectus. The shares and warrants will be separately issued but will be purchased together in this offering. Each warrant will have an exercise price of per share, will be exercisable upon issuance and will expire years from the date of issuance.

We are also offering to those purchasers, whose purchase of shares of common stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock following the consummation of this offering, the opportunity to purchase, if they so choose, in lieu of the shares of our common stock that would result in ownership in excess of 4.99%, shares of Series C Convertible Preferred Stock (“Series C Preferred Stock”), convertible at any time at the holder’s option into a number of shares of common stock equal to $1,000 divided by $ (the “Conversion Price”), at a public offering price of $1,000 per share of Series C Preferred Stock. Each share of Series C Preferred Stock is being sold together with the same warrants described above being sold with each share of common stock. Each share of Series C Preferred Stock entitles its holder to receive shares of common stock upon conversion, subject to certain adjustments.

Our common stock is listed on the NASDAQ Capital Market under the symbol “BSTG.” On December 30, 2016, the closing price for our common stock, as reported on the NASDAQ Capital Market, was $0.89 per share. The warrants and any shares of Series C Preferred Stock that we issue are not and will not be listed for trading on the NASDAQ Capital Market.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in this prospectus beginning on page 8 and any applicable prospectus supplement, and under similar headings in the other documents that are incorporated by reference into this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS ACCURATE, TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Share of Common Stock and Warrant |

Per Share of Series C Preferred Stock and Warrant |

Total | ||||||||

| Public offering price | ||||||||||

| Placement agent fees (1) | ||||||||||

| Proceeds, before expenses, to us |

| (1) | We have also agreed to (i) grant warrants to purchase shares of common stock to the placement agent as described under “Plan of Distribution” on page 25 of this prospectus, (ii) pay the placement agent a management fee equal to 1% of the gross proceeds raised in this offering and (iii) pay the placement agent a reimbursement for out of pocket expenses in connection with marketing the transaction in the amount of up to $45,000 and a reimbursement for legal fees and expenses of the placement agent in the amount of $100,000. For additional information about the compensation to be paid to the placement agent, see “Plan of Distribution.” |

We have retained H.C. Wainwright & Co., LLC as our exclusive placement agent to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities.

We expect to deliver the shares and the warrants to purchasers in this offering on or about , 2017.

Rodman

& Renshaw

a unit of H.C. Wainwright & Co.

The date of this prospectus is , 2017.

TABLE OF CONTENTS

We have not, and the placement agent has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any prospectus supplement or free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus or in any applicable prospectus supplement or free writing prospectus is current only as of its date, regardless of its time of delivery or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not, and the placement agent has not, done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of this prospectus outside the United States.

You should rely only on the information contained in or incorporated by reference into this prospectus and any prospectus supplement or free writing prospectus authorized by us. To the extent the information contained in this prospectus differs or varies from the information contained in any document filed prior to the date of this prospectus and incorporated by reference, the information in this prospectus will control. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The information in this prospectus is accurate only as of the date it is presented. You should read this prospectus, the documents incorporated by reference described in the section entitled “Incorporation of Certain Information by Reference” into this prospectus, and any prospectus supplement or free writing prospectus that we have authorized for use in connection with this offering, in their entirety before investing in our securities.

We are offering to sell, and seeking offers to buy, the securities offered by this prospectus only in jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of the securities offered by this prospectus in certain jurisdictions may be restricted by law. This prospectus does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

| i |

The following summary highlights information contained elsewhere in this prospectus. It may not contain all of the information that is important to you. You should read the entire prospectus carefully, especially the discussion regarding the risks of investing in our securities under the heading “Risk Factors,” before investing in our securities. All references to “Company” “we,” “our” or “us” refer solely to Biostage, Inc. and its subsidiaries and not to the persons who manage us or constitute our Board of Directors.

About Biostage, Inc.

We are a biotechnology company developing bioengineered organ implants based on our novel CellframeTM technology. Our Cellframe technology is comprised of a biocompatible scaffold seeded with the patient’s own stem cells. Our platform technology is being developed to treat life-threatening conditions of the esophagus, bronchi and trachea. By focusing on these underserved patients, we hope to dramatically improve the treatment paradigm for these patients. Our unique Cellframe technology combines the clinically proven principles of tissue engineering, cell biology and material science.

We believe that our Cellframe technology may provide surgeons a new paradigm to address life-threatening conditions of the esophagus, bronchi, and trachea due to cancer, infection, trauma or congenital abnormalities. Our novel technology harnesses the body’s response and modulates it toward the healing process to restore the continuity and integrity of the organ. We are pursuing the CellspanTM esophageal implant as our first product candidate to address esophageal atresia and esophageal cancer, and we are also developing our technology’s applications to address conditions of the bronchi and trachea.

In collaboration with world-class institutions, such as Mayo Clinic and Connecticut Children’s Medical Center, we are expecting to transition from a pre-clinical company to a clinical company in 2017. We plan to file an Investigational New Drug application (IND) with the U.S. Food and Drug Administration (FDA) for our Cellspan esophageal implant in the third quarter of 2017 and expect to begin first in human clinical trials in the fourth quarter of 2017.

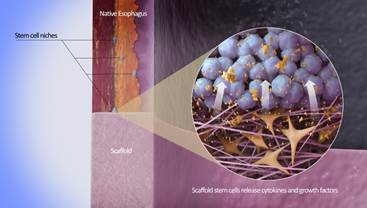

Our Cellspan technology platform: how it works

Our Cellframe process begins with the collection of an adipose (fat) tissue biopsy from the patient followed by the use of standard tissue culture techniques to isolate and expand the patient’s own (autologous) mesenchymal (multipotent) stem cells, or MSC. The cells are seeded onto a biocompatible, synthetic scaffold, produced to mimic the dimensions of the organ to be regenerated, and incubated in a proprietary, organ bioreactor. The scaffold is electrospun from polyurethane (PU) to form a non-woven, hollow tube. The specific microstructure of the Cellspan implant are designed to allow the cultured cells to attach to and cover the scaffold fibers.

| 1 |

We have conducted large-animal studies to investigate the use of the Cellspan implants for the reconstitution of the continuity and integrity of tubular shape organs, such as the esophagus and the large airways, following a full circumferential resection of a clinically relevant segment, just as would occur in a clinical setting. We announced favorable preliminary preclinical results of large-animal studies for the esophagus, bronchus and trachea in November 2015. Based on the results of those studies, we chose the esophagus to be the initial focus for our organ regeneration technology.

Illustration of intersection of Cellspan esophageal implant and native

esophagus at time of implant

In May 2016, we reported an update of results from additional, confirmatory pre-clinical large-animal studies. We disclosed that the studies had demonstrated in a predictive large-animal model the ability of our Cellspan organ implant to successfully stimulate the regeneration of a section of esophagus that had been surgically removed. Cellspan esophageal implants, consisting of a proprietary biocompatible synthetic scaffold seeded with the recipient animal’s own stem cells, were surgically implanted in place of the esophagus section that had been removed. After the surgical full circumferential resection of a portion of the thoracic esophagus, the Cellspan implant stimulated the reconstitution of full esophageal structural integrity and continuity.

Illustration of esophageal reconstitution over Cellspan esophageal

implant following time of implant

Study animals were returned to a solid diet three weeks after the implantation surgery. The implants, which are intended to be in place only temporarily, were retrieved three weeks post-surgery via the animal’s mouth in a non-surgical endoscopic procedure. Therefore, no synthetic material remained in the animals after the esophageal tube was reconstituted. Within 2.5 to 3 months, a complete inner epithelium layer and other specialized esophagus tissue layers were fully regenerated. Two animals in the study have not been sacrificed and are alive at nine and ten

| 2 |

months, respectively. These animals have demonstrated significant weight gain and appear healthy and free of any significant side effects and are receiving no specialized care.

Platform technology in life-threatening orphan indications

In December 2016, we were granted Orphan Drug Designation for our Cellspan esophageal implant by the FDA to restore the structure and function of the esophagus subsequent to esophageal damage due to cancer, injury or congenital abnormalities. Orphan drug designation provides a seven-year marketing exclusivity period against competition in the U.S. from the date of a product’s approval for marketing. This exclusivity would be in addition to any exclusivity we may obtain from our patents. Additionally, orphan designation provides certain incentives, including tax credits and a waiver of the Biologics License Application fee. We also plan to apply for orphan drug designation for our Cellspan esophageal implant in Europe. Orphan drug designation in Europe provides market exclusivity in Europe for ten years from the date of the product’s approval for marketing.

We are now advancing the development of our Cellframe technology, specifically a Cellspan esophageal implant, in large-animal studies with collaborators. As we believe that our recent studies provided sufficient data, we have initiated the Good Laboratory Practice (GLP) studies to demonstrate that our technology, personnel, systems and practices are sufficient for advancing into human clinical trials. In order to seek approval for the initiation of clinical trials for Biostage Cellspan esophageal implants in humans, GLP studies are required to submit an Investigational New Drug (IND) application with the FDA.

Our goal is to submit an IND filing in the third quarter of 2017.

Our product candidates are currently in development and have not yet received regulatory approval for sale anywhere in the world.

Changing the surgical treatment of Esophageal Cancer

|  | |

| Illustration of esophageal cancer site | Illustration of potential human application of Cellspan esophageal implant at site of esophageal cancer (depicting implant prior to esophageal reconstitution over implant) |

According to the World Health Organization’s International Agency for Research on Cancer, there are approximately 450,000 new cases of esophageal cancer worldwide each year. A portion of all patients diagnosed with esophageal cancer are treated via a surgical procedure known as an esophagectomy. The current standard of care for an esophagectomy requires a complex surgical procedure that involves moving the patient’s stomach or a portion of their colon into the chest to replace the portion of esophagus resected by the removal of the tumor. These current procedures have high rates of complications, and can lead to a severely diminished quality of life and require costly ongoing care. Our Cellspan esophageal implants aim to simplify the procedure, reduce complications, result in a better quality of life and reduce the overall cost of these patients to the healthcare system.

| 3 |

Congenital Abnormalities - Esophageal Atresia: a much needed focus on children

Each year, several thousand births worldwide come with a congenital abnormality known as esophageal atresia, a condition where the baby is born with an esophagus that does not extend completely from the mouth to the stomach. When a long segment of the esophagus is lacking, the current standard of care is a series of surgical procedures where surgical sutures are applied to both ends of the esophagus in an attempt to stretch them and pull them together so they can be connected at a later date. This process can take weeks and the procedure is plagued by serious complications and may carry high rates of failure. Such approach also requires, in time, at least two separate surgical interventions. Other options include the use of the child’s stomach or intestine that would be pulled up into the chest to allow a connection to the mouth. We are working to develop a Cellspan esophageal implant solution to address newborns’ esophageal atresia, that could potentially be life-saving or organ-sparing, or both.

Financial Conditions

We have incurred substantial operating losses since our inception, and as of September 30, 2016, we have an accumulated deficit of approximately $33.0 million. We expect to continue to incur operating losses and negative cash flows from operations in 2017 and for the foreseeable future.

In their audit report dated March 30, 2016 included in this Form 10-K, our independent registered public accounting firm included a “going concern” qualification as to our ability to continue as a going concern. We believe that if we do not raise additional capital from outside sources in the near future, we may be forced to curtail or cease our operations. We believe that our existing cash resources will be sufficient to fund our planned operations through March 2017. Our cash requirements and cash resources will vary significantly depending upon the timing, financial and other resources that will be required to complete ongoing development and pre-clinical and clinical testing of our products as well as regulatory efforts and collaborative arrangements necessary for our products that are currently under development. In addition to development and other costs, we expect to incur capital expenditures from time to time. These capital expenditures will be influenced by our regulatory compliance efforts, our success, if any, at developing collaborative arrangements with strategic partners, our needs for additional facilities and capital equipment and the growth, if any, of our business in general. We will require additional funding to continue our anticipated operations and support our capital needs. We may seek to raise necessary funds through a combination of public or private equity offerings, debt financings, other financing mechanisms, strategic collaborations and licensing arrangements. We may not be able to obtain additional financing on terms favorable to us, if at all.

We are and we will remain an “emerging growth company” until the earliest to occur of (i) the last day of the fiscal year during which our total annual revenues equal or exceed $1 billion (subject to adjustment for inflation), (ii) the last day of the fiscal year following the fifth anniversary of the date of our first sale of common equity securities pursuant to an effective registration statement, (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt, or (iv) the date on which we are deemed a “large accelerated filer” under the Securities and Exchange Act of 1934, as amended, or the Exchange Act. For so long as we remain an “emerging growth company” as defined in the JOBS Act, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

| 4 |

Corporate Information

We were incorporated under the laws of the State of Delaware on May 3, 2012 by Harvard Bioscience, Inc. (“Harvard Bioscience”) to provide a means for separating its regenerative medicine business from its other businesses. On March 31, 2016, we changed our name from Harvard Apparatus Regenerative Technology, Inc. to Biostage, Inc. Our principal executive offices are located at 84 October Hill Road, Suite 11, Holliston, Massachusetts. Our telephone number is (774) 233-7300. We maintain a web site at http://www.biostage.com. The reference to our web site is intended to be an inactive textual reference only. The information contained on, or that can be accessed through, our web site is not a part of this prospectus.

| 5 |

| Securities offered by us |

Up to shares of our common stock

Warrants to purchase up to shares of our common stock

Up to shares of Series C Preferred Stock that are convertible into an aggregate of up to shares of common stock, subject to certain adjustments.

| |

| Warrants | The warrants will be exercisable at an initial exercise price of $ per share. The warrants are exercisable at any time for a period of years from the date of issuance. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the warrants. | |

| Series C Preferred Stock | Each share of Series C Preferred Stock is convertible at any time at the holder’s option into a number of shares of common stock equal to $1,000 divided by the Conversion Price. Notwithstanding the foregoing, we shall not effect any conversion of Series C Preferred Stock, to the extent that, after giving effect to an attempted conversion, the holder of shares of Series C Preferred Stock (together with such holder’s affiliates, and any persons acting as a group together with such holder or any of such holder’s affiliates) would beneficially own a number of shares of our common stock in excess of 4.99% of the shares of our common stock then outstanding after giving effect to such exercise. For additional information, see “Description of Our Capital Stock—Series C Convertible Preferred Stock” on page 18 of this prospectus. | |

| Common stock outstanding before this offering | 17,108,968 shares | |

| Common stock outstanding after this offering | shares | |

| Price per share of common stock and warrant | $ | |

| Price per share of Series C Preferred Stock and _____ warrants | $ | |

| Use of proceeds | We intend to use the net proceeds from this offering for research and development, including funding preclinical and clinical trials relating to the Cellframe™ technology, business development, sales and marketing, capital expenditures, working capital and other general corporate purposes. See “Use of Proceeds” on page 13. | |

| NASDAQ Capital Market symbol for common stock | BSTG. We do not plan on applying to list the warrants or the Series C Preferred Stock on NASDAQ, any national securities exchange or any other nationally recognized trading system. Without an active trading market, the liquidity of the warrants and Series C Preferred Stock will be limited. | |

| Risk factors | This investment involves a high degree of risk. See the information contained in or incorporated by reference under “Risk Factors” beginning on page 8 of this prospectus and in the documents incorporated by reference into this prospectus. | |

| 6 |

The number of shares of our common stock to be outstanding after this offering is based on 17,108,968 shares of our common stock outstanding as of December 30, 2016 and assumes the conversion of all shares of Series C Preferred Stock being offered in this offering into an aggregate of shares of common stock, but does not include, as of such date:

| · | 3,878,082 shares issuable upon exercise of outstanding stock options; |

| · | 268 shares issuable pursuant to outstanding deferred stock awards of restricted stock units; |

| · | 1,560,284 shares issuable upon exercise of outstanding warrants to purchase shares of our common stock; |

| · | 2,036,994 shares available for future grants under our 2013 Equity Incentive Plan and our Employee Stock Purchase Plan; |

| · | shares of common stock issuable upon the exercise of warrants to be issued to investors in this offering at an exercise price of $ per share; and |

| · | shares of common stock issuable upon exercise of warrants to be issued to the placement agent as described in “Plan of Distribution.” |

| 7 |

Investing in our securities involves a high degree of risk. You should carefully consider the risks described herein and in the documents incorporated by reference in this prospectus, as well as other information we include or incorporate by reference into this prospectus, before making an investment decision. In particular, you should consider the risk factors under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K, as may be revised or supplemented by our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, each of which are on file with the SEC and are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described herein and in the documents incorporated herein by reference.

We have broad discretion to determine how to use the proceeds raised in this offering, and we may not use the proceeds effectively.

Our management will have broad discretion over the use of proceeds from this offering, and we could spend the proceeds from this offering in ways with which you may not agree or that do not yield a favorable return. We intend to use the net proceeds from this offering for research and development, including funding preclinical and clinical trials relating to the Cellframe™ technology, business development, sales and marketing, capital expenditures, working capital and other general corporate purposes. If we do not invest or apply the proceeds of this offering in ways that improve our operating results, we may fail to achieve expected financial results, which could cause our stock price to decline.

You will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

Since the price per share of our common stock being offered is substantially higher than the net tangible book value per share of our common stock, you will suffer immediate dilution in the net tangible book value of the common stock you purchase in this offering. After giving effect to the sale of shares of our common stock in this offering at the offering price of $ per share, and after deducting the placement agent fees and expenses and estimated offering expenses payable by us, you will experience immediate dilution of $ per share, representing the difference between our net tangible book value per share as of September 30, 2016 after giving effect to this offering and the offering price. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase the common stock in this offering.

You will experience immediate and substantial dilution in the net tangible book value per share of the Series C Preferred Stock you purchase.

Since the price per share of our Series C Preferred Stock being offered is substantially higher than the net tangible book per share of our underlying common stock, you will suffer substantial dilution in the net tangible book value of the shares that you purchase in this offering. Based on an assumed offering price to the public of $ per share, if you purchase Series C Preferred Stock in this offering, you will suffer immediate and substantial dilution of $ per share in the net tangible book value of the shares of common stock underlying the Series C Preferred Stock. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase Series C Preferred Stock in this offering.

| 8 |

The issuance of additional equity securities may negatively impact the trading price of our common stock.

We have issued equity securities in the past, will issue equity securities in this offering and expect to continue to issue equity securities to finance our activities in the future. In addition, outstanding options and warrants to purchase our common stock may be exercised and additional options and warrants may be issued, resulting in the issuance of additional shares of common stock. The issuance by us of additional equity securities, including the shares of common stock issuable upon exercise of the warrants issued by us in this offering, would result in dilution to our stockholders, and even the perception that such an issuance may occur could have a negative impact on the trading price of our common stock.

There is no public market for the warrants to purchase shares of our common stock being offered by us in this offering.

There is no established public trading market for the warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the warrants on any national securities exchange or other nationally recognized trading system, including the NASDAQ Capital Market. Without an active market, the liquidity of the warrants will be limited.

The warrants are speculative in nature.

The warrants do not confer any rights of common stock ownership on its holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire shares of common stock at a fixed price for a limited period of time. Specifically, commencing on the date of issuance, holders of the warrants may exercise their right to acquire the common stock and pay an exercise price of $ per share, subject to certain adjustments, prior to ___ years from the date of issuance, after which date any unexercised warrants will expire and have no further value. Moreover, following this offering, the market value of the warrants, if any, is uncertain and there can be no assurance that the market value of the warrants will equal or exceed their imputed offering price. The warrants will not be listed or quoted for trading on any market or exchange. There can be no assurance that the market price of the common stock will ever equal or exceed the exercise price of the warrants, and consequently, whether it will ever be profitable for holders of the warrants to exercise the warrants.

A substantial number of shares of our common stock may be sold in this offering, which could cause the price of our common stock to decline.

In this offering, in addition to the Series C Preferred Stock, we will sell shares of common stock representing approximately % of our outstanding common stock as of , 2017. This sale and any future sales of a substantial number of shares of our common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock. We cannot predict the effect, if any, that market sales of those shares of common stock or the availability of those shares of common stock for sale will have on the market price of our common stock.

A significant number of additional shares of our common stock may be issued upon the conversion of existing securities, including the Series C Preferred Stock, which issuances would substantially dilute existing stockholders and may depress the market price of our common stock.

As of December 30, 2016, there were 17,108,968 shares of common stock outstanding. In addition, shares of common stock, representing approximately % of our outstanding common stock as of December 30, 2016, will be issuable upon conversion of our Series C Preferred Stock. The issuance of any such shares of common stock would substantially dilute the proportionate ownership and voting power of existing security holders, and their issuance, or the possibility of their issuance, may depress the market price of our common stock.

| 9 |

There is no public market for the Series C Preferred Stock being offered by us in this offering.

Prior to this offering, there has been no public market for our Series C Preferred Stock. We are not listing our Series C Preferred Stock on an exchange or any trading system, including the Nasdaq Capital Market, and we do not expect that a trading market for our Series C Preferred Stock will develop.

Upon conversion of the Series C Preferred Stock, holders may receive less valuable consideration than expected because the value of our common stock may decline after such holders exercise their conversion right but before we settle our conversion obligation.

Under the Series C Preferred Stock, a converting holder will be exposed to fluctuations in the value of our common stock during the period from the date such holder surrenders shares of Series C Preferred Stock for conversion until the date we settle our conversion obligation. Upon conversion, we will be required to deliver the shares of our common stock, together with a cash payment for any fractional share (if so elected by the Company), on the third business day following the relevant conversion date. Accordingly, if the price of our common stock decreases during this period, the value of the shares of common stock that you receive will be adversely affected and would be less than the conversion value of the Series C Preferred Stock on the conversion date.

We may issue additional series of preferred stock that rank senior or equally to the Series C Preferred Stock as to dividend payments and liquidation preference.

Neither our amended and restated certificate of incorporation nor the Certificate of Designation for the Series C Preferred Stock prohibits us from issuing additional series of preferred stock that would rank senior or equally to the Series C Preferred Stock as to dividend payments and liquidation preference. Our amended and restated certificate of incorporation provides that we have the authority to issue up to 2,000,000 shares of preferred stock. The issuances of other series of preferred stock could have the effect of reducing the amounts available to the Series C Preferred Stock in the event of our liquidation, winding-up or dissolution. It may also reduce cash dividend payments on the Series C Preferred Stock if we do not have sufficient funds to pay dividends on all Series C Preferred Stock outstanding and outstanding parity preferred stock.

Our Series C Preferred Stock will rank junior to all our liabilities to third party creditors in the event of a bankruptcy, liquidation or winding up of our assets.

In the event of bankruptcy, liquidation or winding up, our assets will be available to pay obligations on our Series C Preferred Stock only after all our liabilities have been paid. Our Series C Preferred Stock will effectively rank junior to all existing and future liabilities held by third party creditors. The terms of our Series C Preferred Stock do not restrict our ability to raise additional capital in the future through the issuance of debt. In the event of bankruptcy, liquidation or winding up, there may not be sufficient assets remaining, after paying our liabilities, to pay amounts due on any or all of our Series C Preferred Stock then outstanding.

Future issuances of preferred stock may adversely affect the market price for our common stock.

Additional issuances and sales of preferred stock, or the perception that such issuances and sales could occur, may cause prevailing market prices for our common stock to decline and may adversely affect our ability to raise additional capital in the financial markets at times and prices favorable to us.

| 10 |

We have received notices from NASDAQ of non-compliance with its continuing listing rules.

On July 16, 2015, we received a notice from NASDAQ of non-compliance with its continuing listing rules, namely that the audit committee of our Board of Directors had two members following James McGorry’s appointment as our President and Chief Executive Officer instead of the required minimum of three members. In accordance with NASDAQ continued listing rules, we were given until the earlier of our next annual shareholders’ meeting or July 6, 2016 to add a third audit committee member. On March 10, 2016, Blaine McKee, Ph.D. was appointed as a member of the Board of Directors and its audit committee, and we regained compliance with that requirement.

On November 10, 2015, we received a notice from NASDAQ of non-compliance with its listing rules regarding the requirement that the listed securities maintain a minimum bid price of $1 per share. Based upon the closing bid price for the 30 consecutive business days preceding the notice, the Company no longer met this requirement. However, the NASDAQ rules also provide the Company a period of 180 calendar days in which to regain compliance and, in some circumstances, a second 180-day compliance period. On November 25, 2015, we regained compliance with the minimum bid price requirement when the closing price of our common stock was at least $1 per share for ten consecutive business days.

On November 18, 2016, we received a notice from NASDAQ of non-compliance with its listing rules regarding the minimum bid price requirement. As noted above, the NASDAQ rules provide the Company a period of 180 calendar days in which to regain compliance and, in some circumstances, a second 180-day compliance period. We are monitoring the closing bid price of our common stock and will consider available options to resolve the non-compliance with the minimum bid price requirement as may be necessary, including the possibility of seeking stockholder approval of a reverse stock split. There can be no assurance that we would be successful in receiving such stockholder approval.

The failure to meet continuing compliance standards subjects our common stock to delisting. Delisting of our common stock would have an adverse effect on the market liquidity of our common stock and, as a result, the market price for our common stock could become more volatile. Further, delisting also could make it more difficult for us to raise additional capital.

| 11 |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus (including any related prospectus supplement or free writing prospectus and documents incorporated by reference herein and therein) contains statements with respect to us which constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the “safe harbor” created by those sections. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements may include, but are not limited to, statements relating to the regulatory approval of our CellspanTM product candidates for the esophagus and airways or any other product candidates, by the FDA, EMA, MHRA or otherwise, which such approvals may not be obtained on a timely basis or at all; anticipated future earnings or other financial measures; success with respect to any clinical trials and other regulatory approval efforts and the number of patients who can be treated with our products or product candidates; commercialization efforts and marketing approvals of our products as well as the success thereof, including our Cellspan product candidates for the esophagus and airways; the continued availability of a market for our securities; our ability to raise sufficient capital to finance our planned operations, and our estimates concerning capital requirements and need for additional financing; our ability to continue as a going concern; the amount and timing of costs associated with our development of bioreactors, scaffolds and other devices and products; our failure to comply with regulations and any changes in regulations; our ability to access debt and equity markets; unpredictable difficulties or delays in the development of new technology; our collaborators not devoting sufficient time and resources to successfully carry out their duties or meet expected deadlines; our ability to attract and retain qualified personnel and key employees and retain senior management; the availability and price of acceptable raw materials and components from third-party suppliers; difficulties in obtaining or retaining the management and other human resource competencies that we need to achieve our business objectives; increased competition in the field of regenerative medicine and the financial resources of our competitors; our ability to obtain and maintain intellectual property protection for our device and product candidates; our inability to implement our growth strategy; and our liquidity.

In some cases, you can identify forward-looking statements by terms such as “believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “could,” “would,” “target,” “seek,” “aim,” “believe,” “predicts,” “think,” “objectives,” “optimistic,” “new,” “goal,” “strategy,” “potential,” “is likely,” “will,” “expect,” “plan” “project,” “permit” and similar expressions intended to identify forward-looking statements. These statements reflect our current views with respect to future events, are based on assumptions and are subject to risks and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in greater detail under the heading “Risk Factors” in our SEC filings, and under the caption “Risk Factors” in this prospectus.

You should read this prospectus and any related prospectus supplement and free writing prospectus and the documents that we incorporate by reference herein and therein and have filed as exhibits to the registration statement, of which this prospectus is part, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this prospectus is accurate as of the date on the cover of this prospectus or prospectus supplement only. Our business, financial condition, results of operations and prospects may change. We may not update these forward-looking statements, even though our situation may change in the future, unless we have obligations under the federal securities laws to update and disclose material developments related to previously disclosed information. We qualify all of the information presented in this prospectus and any related prospectus supplement or free writing prospectus, and particularly our forward-looking statements, by these cautionary statements.

| 12 |

We estimate the net proceeds from this offering will be approximately $ million, after deducting placement agent fees and expenses and our estimated offering expenses. In addition, if all of the warrants offered pursuant to this prospectus are exercised in full for cash, we will receive approximately an additional $ million in cash.

We intend to use the net proceeds from this offering, together with other available funds, for research and development, including funding preclinical and clinical trials relating to the Cellframe™ technology, business development, sales and marketing, capital expenditures, working capital and other general corporate purposes.

Pending these uses, we intend to invest the net proceeds to us from this offering in a variety of capital preservation investments, including short-term, investment-grade and interest-bearing instruments. The precise amounts and timing of the application of proceeds will depend upon our funding requirements and the availability of other funds. We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application of the net proceeds and investors will be relying on the judgment of our management regarding the application of the net proceeds from this offering.

Based upon our historical and anticipated future growth and our financial needs, we may engage in additional financings of a character and amount that we determine as the need arises. We may raise additional capital through additional public or private financings, the incurrence of debt and other available sources.

| 13 |

PRICE RANGE OF OUR COMMON EQUITY

Our common stock trades on The NASDAQ Capital Market under the symbol “BSTG.” Prior to April 1, 2016, in connection with our name change, our common stock traded on The NASDAQ Capital Market under the symbol “HART” since October 21, 2013. The following table sets forth, for the quarters shown, the range of high and low sales prices of our common stock on the NASDAQ Capital Market.

| High | Low | |||||||

| Fiscal Year ended December 31, 2016 | ||||||||

| First Quarter | $ | 2.60 | $ | 1.08 | ||||

| Second Quarter | $ | 2.86 | $ | 0.92 | ||||

| Third Quarter | $ | 1.22 | $ | 0.90 | ||||

| Fourth Quarter | $ | 1.42 | $ | 0.73 | ||||

| Fiscal Year ended December 31, 2015 | ||||||||

| First Quarter | $ | 4.32 | $ | 1.89 | ||||

| Second Quarter | $ | 3.47 | $ | 1.39 | ||||

| Third Quarter | $ | 1.49 | $ | 0.59 | ||||

| Fourth Quarter | $ | 3.25 | $ | 0.54 | ||||

The closing price of our common stock on the NASDAQ Capital Market on December 30, 2016 was $0.89 per share. Immediately prior to this offering, we had 17,108,968 shares of common stock outstanding, which were held by approximately 178 stockholders of record as of December 30, 2016.

We have never declared or paid cash dividends on our common stock in the past and do not intend to pay cash dividends on our common stock in the foreseeable future. Any future determination to pay cash dividends will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements and other factors our board of directors deems relevant.

| 14 |

If you purchase our common stock, Series C Preferred Stock, or both, in this offering, assuming conversion of the Series C Preferred Stock into shares of our common stock, your interest will be diluted to the extent of the difference between the public offering price per share and the net tangible book value per share of our common stock after this offering.

The net tangible book value of our common stock on September 30, 2016 was approximately $4.8 million, or approximately $0.28 per share, based on 17,108,968 shares of our common stock outstanding as of September 30, 2016. We calculate net tangible book value per share by subtracting our total liabilities from our total tangible assets and dividing the difference by the number of outstanding shares of our common stock. Dilution in net tangible book value per share to the new investors represents the difference between the amount per share paid by purchasers of shares of our common stock in this offering and the net tangible book value per share of our common stock immediately afterwards.

After giving effect to the sale of shares of common stock by us at the public offering price and shares of Series C Preferred Stock by us at the public offering price (including the shares of common stock issuable upon conversion of the Series C Preferred Stock) and after deducting placement agent fees and expenses and estimated offering expenses, our pro forma net tangible book value as of September 30, 2016 would have been approximately $ million, or $ per share, which excludes the warrants to purchase shares of our common stock to be issued to investors in this offering. This represents an immediate increase in net tangible book value of $ per share to existing stockholders and immediate dilution of $ per share to investors purchasing our common stock in this offering at the public offering price. The following table illustrates this dilution on a per share basis:

| Public offering price per share of common stock | ||||

| Public offering price per share of Series C Preferred Stock (on an as-converted basis) | ||||

| Net tangible book value per share as of September 30, 2016 | $ | 0.28 | ||

| Increase in net tangible book value per share attributable to this offering | ||||

| Pro forma net tangible book value per share as of September 30, 2016 after giving effect to this offering | ||||

| Dilution per share to the new investors in this offering |

The number of shares of our common stock to be outstanding after this offering is based on 17,108,968 shares of our common stock outstanding as of September 30, 2016 and assumes the conversion of all shares of Series C Preferred Stock being offered in this offering into an aggregate of shares of common stock, but does not include, as of such date:

| · | 3,879,033 shares issuable upon exercise of outstanding stock options; |

| · | 268 shares issuable pursuant to outstanding deferred stock awards of restricted stock units; | |

| · | 1,560,284 shares issuable upon exercise of outstanding warrants to purchase shares of our common stock; |

| · | 2,035,775 shares available for future grants under our 2013 Equity Incentive Plan and our Employee Stock Purchase Plan; |

| · | shares of common stock issuable upon the exercise of warrants to be issued to investors in this offering at an exercise price of $ per share; and |

| · | shares of common stock issuable upon exercise of warrants to be issued to the placement agent as described in “Plan of Distribution.” |

| 15 |

To the extent that outstanding options or warrants are exercised, investors purchasing our common stock in this offering will experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

| 16 |

DESCRIPTION OF OUR CAPITAL STOCK

The following description of our common stock, warrants to purchase our common stock and Series C Convertible Preferred Stock summarizes the material terms and provisions of the securities that we may offer under this prospectus. The following description of our capital stock does not purport to be complete and is subject to, and qualified in its entirety by, our amended and restated certificate of incorporation, or our Charter, and our second amended and restated bylaws, or our Bylaws, which are exhibits to the registration statement of which this prospectus forms a part, and by applicable law. The terms of our common stock and warrants to purchase our common stock may also be affected by Delaware law.

Authorized Capital Stock

Our authorized capital stock consists of 60,000,000 shares of common stock, par value $0.01 per share, and 2,000,000 shares of undesignated preferred stock, par value $0.01 per share. As of December 30, 2016, there were 17,108,968 shares of common stock outstanding and no shares of preferred stock outstanding.

Common Stock

Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of shareholders; provided, that, except as otherwise required by law, holders of common stock are not entitled to vote on any amendment to the Charter that changes the powers, preferences, rights or other terms of one or more series of undesignated preferred stock if the holders of the affected series are entitled to vote, separately or together, with the holders of one or more other such series, on such amendment pursuant to our Charter or Delaware General Corporation Law. Our Charter provides that our Board of Directors shall be divided into three classes, each consisting as nearly as reasonably may be possible of one-third of the total number of directors constituting the entire Board of Directors, with each class’s term expiring on a staggered basis. Newly-created directorships and vacancies on our Board of Directors may only be filled by a majority of the members of the incumbent board then in office, though less than a quorum, and not by our stockholders. Directors may be removed from office only for cause by the affirmative vote of the holders of at least seventy-five percent (75%) of the outstanding shares entitled to be cast on the election of directors by the then-outstanding shares of all classes and series of capital stock, voting together as a single class. Holders of common stock have no preemptive, redemption or conversion rights and are not subject to future calls or assessments. No sinking fund provisions apply to our common stock. All outstanding shares are fully-paid and non-assessable. In the event of our liquidation, dissolution or winding up, after the satisfaction in full of the liquidation preferences of holders of any preferred stock, holders of common stock are entitled to ratable distribution of the remaining assets available for distribution to stockholders. Holders of common stock are entitled to receive proportionately any such dividends declared by our Board of Directors, out of legally available funds for dividends, subject to any preferences that may be applicable to any shares of preferred stock that may be outstanding at that time. The rights, preferences and privileges of holders of common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future. To the extent our Shareholder Rights Agreement remains in effect at the time we sell any shares of common stock under this prospectus, such shares of common stock would also be accompanied by certain preferred stock purchase rights. See “Description of Capital Stock – Provisions of our Certificate of Incorporation and Bylaws and Delaware Anti-Takeover Law” for additional details regarding our Shareholder Rights Agreement.

Listing

Our common stock is listed on the NASDAQ Capital Market under the symbol “BSTG.” On December 30, 2016, the closing price for our common stock, as reported on the NASDAQ Capital Market, was $0.89 per share. As of the close of business on December 30, 2016, there were 178 stockholders of record of our common stock. Prior to our name change on March 31, 2016 from Harvard Apparatus Regenerative Technology, Inc. to Biostage, Inc., our common stock was listed on the NASDAQ Capital Market under the symbol “HART.”

On July 16, 2015, we received a notice from NASDAQ of non-compliance with its continuing listing rules, namely that the audit committee of our Board of Directors had two members following James McGorry’s appointment as our President and Chief Executive Officer instead of the required minimum of three members. In accordance with

| 17 |

NASDAQ continued listing rules, we were given until the earlier of our next annual shareholders’ meeting or July 6, 2016 to add a third audit committee member. On March 10, 2016, Blaine McKee, Ph.D. was appointed as a member of the Board of Directors and its audit committee, and we regained compliance with that requirement.

On November 10, 2015, we received a notice from NASDAQ of non-compliance with its listing rules regarding the requirement that the listed securities maintain a minimum bid price of $1 per share. Based upon the closing bid price for the 30 consecutive business days preceding the notice, the Company no longer met this requirement. However, the NASDAQ rules also provide the Company a period of 180 calendar days in which to regain compliance and, in some circumstances, a second 180-day compliance period. On November 25, 2015, we regained compliance with the minimum bid price requirement when the closing price of our common stock was at least $1 per share for ten consecutive business days.

On November 18, 2016, we received a notice from NASDAQ of non-compliance with its listing rules regarding the minimum bid price requirement. As noted above, the NASDAQ rules provide the Company a period of 180 calendar days in which to regain compliance and, in some circumstances, a second 180-day compliance period. We are monitoring the closing bid price of our common stock and will consider available options to resolve the noncompliance with the minimum bid price requirement as may be necessary, including the possibility of seeking stockholder approval of a reverse stock split. There can be no assurance that we would be successful in receiving such stockholder approval.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare.

Series C Convertible Preferred Stock

General

Our Board of Directors is authorized to issue up to 2,000,000 shares of preferred stock in one or more series without shareholder approval. Our Board of Directors may determine the designations, powers, preferences and the relative, participating, optional or other special rights, and any qualification, limitations and restrictions, of each series of preferred stock. Our Board of Directors has designated 5,000 shares of preferred stock as Series A Junior Participating Cumulative Preferred Stock, 1,000,000 shares of preferred stock as Series B Convertible Preferred Stock and shares of preferred stock as Series C Convertible Preferred Stock, which we refer to herein as the Series C Preferred Stock. The Series A Junior Participating Cumulative Preferred Stock and Series B Convertible Preferred Stock is not being registered pursuant to the registration statement of which this prospectus forms a part. As of December 30, 2016, there were no shares of preferred stock outstanding.

Rank

The Series C Preferred Stock ranks (1) on parity with our common stock on an “as converted” basis, (2) on parity with our Series A Junior Participating Cumulative Preferred Stock and Series B Convertible Preferred Stock, (3) senior to any series of our capital stock hereafter created specifically ranking by its terms junior to the Series C Preferred Stock, (4) on parity with any series of our capital stock hereafter created specifically ranking by its terms on parity with the Series C Preferred Stock, and (5) junior to any series of our capital stock hereafter created specifically ranking by its terms senior to the Series C Preferred Stock in each case, as to dividends or distributions of assets upon our liquidation, dissolution or winding up whether voluntary or involuntary.

Conversion

Each share of the Series C Preferred Stock is convertible into shares of common stock at any time at the option of the holder, provided that the holder will be prohibited from converting Series C Preferred Stock into shares of our common stock if, as a result of such conversion, the holder would own more than 4.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of the shares of common stock issuable upon conversion of the Series C Preferred Stock, or such holder, together with its affiliates, would own

| 18 |

more than 9.99% of the number of shares of common stock outstanding immediately after giving effect to the issuance of the shares of common stock issuable upon conversion of the Series C Preferred Stock. The conversion rate of the Series C Preferred Stock is subject to proportionate adjustments for stock splits, reverse stock splits and similar events, but is not subject to adjustment based on price anti-dilution provisions. The Series C Preferred Stock automatically converts into common stock upon the occurrence of certain “Fundamental Transactions,” as described below.

Dividends

In addition to stock dividends or distributions for which proportionate adjustments will be made, holders of Series C Preferred Stock are entitled to receive dividends on shares of Series C Preferred Stock equal, on an as-if-converted-to-common-stock basis, to and in the same form as dividends actually paid on shares of the common stock when, as and if such dividends are paid on shares of the common stock. No other dividends are payable on shares of Series C Preferred Stock.

Voting Rights

Except as provided in the Certificate of Designation or as otherwise required by law, the holders of Series C Preferred Stock will have no voting rights. However, the Company may not, without the consent of holders of a majority of the outstanding shares of Series C Preferred Stock, alter or change adversely the powers, preferences or rights given to the Series C Preferred Stock or alter or amend the Certificate of Designation.

Liquidation Rights

Upon any liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, the holders of Series C Preferred Stock are entitled to receive, pari passu with the holders of common stock, out of the assets available for distribution to stockholders an amount equal to such amount per share as would have been payable had all shares of Series C Preferred Stock been converted into common stock immediately before such liquidation, dissolution or winding up, without giving effect to any limitation on conversion as a result of the Beneficial Ownership Limitation, as described below.

Beneficial Ownership Limitation

The Company may not effect any conversion of the Series C Preferred Stock, and a holder does not have the right to convert any portion of the Series C Preferred Stock to the extent that, after giving effect to the conversion set forth in a notice of conversion such holder would beneficially own in excess of the holder Beneficial Ownership Limitation, or such holder, together with such holder’s affiliates, and any persons acting as a group together with such holder or affiliates, would beneficially own in excess of the affiliates Beneficial Ownership Limitation. The “holder Beneficial Ownership Limitation” is 4.99% of the number of shares of the common stock outstanding immediately after giving effect to the issuance of shares of common stock issuable upon conversion of Series C Preferred Stock held by the applicable holder. The “affiliates Beneficial Ownership Limitation” is 9.99% of the number of shares of the common stock outstanding immediately after giving effect to the issuance of shares of common stock issuable upon conversion of Series C Preferred Stock held by the applicable holder and its affiliates (the holder Beneficial Ownership Limitation together with the affiliates Beneficial Ownership Limitation collectively referred to as the “Beneficial Ownership Limitation”). A holder may, with 61 days prior notice to the Company, or immediately upon notice from the holder to the Company at any time after the public announcement or other disclosure of a Fundamental Transaction, elect to increase or decrease one or both of the holder Beneficial Ownership Limitation and the affiliates Beneficial Ownership Limitation; provided, however, that in no event may either the holder Beneficial Ownership Limitation or the affiliate Beneficial Ownership Limitation be 9.99% or greater.

| 19 |

Exchange Listing

We do not plan on making an application to list the shares of Series C Preferred Stock on the NASDAQ Capital Market, any national securities exchange or other nationally recognized trading system. Our common stock issuable upon conversion of the Series C Preferred Stock is listed on the NASDAQ Capital Market.

Failure to Deliver Conversion Shares

If the Company fails to timely deliver shares of common stock upon conversion of the Series C Preferred Stock (the “Conversion Shares”) within the time period specified in the Certificate of Designation (within three trading days after delivery of the notice of conversion), and if the holder has not exercised its Buy-In rights as described below with respect to such shares, then the Company is obligated to pay to the holder, as liquidated damages, an amount equal to $100 per business day (increasing to $200 per business day after the tenth business day) for each $10,000 of Conversion Shares for which the Series C Preferred Stock converted which are not timely delivered. If the Company makes such liquidated damages payments, it is not also obligated to make Buy-In payments with respect to the same Conversion Shares.

Compensation for Buy-In on Failure to Timely Deliver Shares

If the Company fails to timely deliver the Conversion Shares to the holder, and if after the required delivery date the holder is required by its broker to purchase (in an open market transaction or otherwise) or the holder or its brokerage firm otherwise purchases, shares of common stock to deliver in satisfaction of a sale by the holder of the Conversion Shares which the holder anticipated receiving upon such conversion or exercise (a “Buy-In”), then the Company is obligated to (A) pay in cash to the holder the amount, if any, by which (x) the holder’s total purchase price (including brokerage commissions, if any) for the shares of common stock so purchased, minus any amounts paid to the holder by the Company as liquidated damages for late delivery of such shares, exceeds (y) the amount obtained by multiplying (1) the number of Conversion Shares that the Company was required to deliver times (2) the price at which the sell order giving rise to such purchase obligation was executed, and (B) at the option of the holder, either reinstate the portion of the Series C Preferred Stock and equivalent number of Conversion Shares for which such conversion was not honored (in which case such conversion shall be deemed rescinded) or deliver to the holder the number of shares of common stock that would have been issued had the Company timely complied with its conversion and delivery obligations.

Subsequent Rights Offerings; Pro Rata Distributions

If the Company grants, issues or sells any common stock equivalents pro rata to the record holders of any class of shares of common stock (the “Purchase Rights”), then a holder of Series C Preferred Stock will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the holder could have acquired if the holder had held the number of shares of common stock acquirable upon conversion of the Series C Preferred Stock (without regard to any limitations on conversion). If the Company declares or makes any dividend or other distribution of its assets (or rights to acquire its assets) to holders of common stock, then a holder of Series C Preferred Stock is entitled to participate in such distribution to the same extent as if the holder had held the number of shares of common stock acquirable upon complete conversion of the Series C Preferred Stock (without regard to any limitations on conversion).

Fundamental Transaction

If, at any time while the Series C Preferred Stock is outstanding, (i) the Company, directly or indirectly, in one or more related transactions effects any merger or consolidation of the Company with or into another person pursuant to which the shares of capital stock of the Company outstanding immediately prior to such merger or consolidation are converted into or exchanged for shares of another corporation or entity and represent, or are converted into or exchanged for equity securities that represent, immediately following such merger or consolidation, less than a majority, by voting power, of the equity securities of (1) the surviving or resulting party or (2) if the surviving or resulting party is a wholly owned subsidiary of another party immediately following such merger or consolidation,

| 20 |

the parent of such surviving or resulting party, (ii) the Company, directly or indirectly, effects any sale of all or substantially all of its assets in one or a series of related transactions, (iii) any tender offer or exchange offer (whether by the Company or another person) is completed pursuant to which holders of common stock are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the holders of 50% or more of the outstanding common stock, or (iv) the Company, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another person whereby such other person acquires more than 50% of the outstanding shares of common stock (not including any shares of common stock held by the other person or other persons making or party to, or associated or affiliated with the other persons making or party to, such stock or share purchase agreement or other business combination) (each a “Fundamental Transaction”), then the Series C Preferred Stock automatically converts and the holder will receive, for each Conversion Share that would have been issuable upon such conversion immediately prior to the occurrence of such Fundamental Transaction (subject to the Beneficial Ownership Limitation), the number of shares of common stock of the successor or acquiring corporation or of the Company, if it is the surviving corporation, and any additional consideration (the “Alternate Consideration”) receivable as a result of such Fundamental Transaction by a holder of the number of shares of common stock for which the Series C Preferred Stock is convertible immediately prior to such Fundamental Transaction (subject to the Beneficial Ownership Limitation). For purposes of any such conversion, the determination of the conversion ratio will be appropriately adjusted to apply to such Alternate Consideration based on the amount of Alternate Consideration issuable in respect of one share of common stock in such Fundamental Transaction. If holders of common stock are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the holder will be given the same choice as to the Alternate Consideration it receives upon automatic conversion of the Series C Preferred Stock following such Fundamental Transaction.

Warrants

The following is a brief summary of the material terms of the warrants offered pursuant to this prospectus and is subject in all respects to the provisions contained in the warrants, the form of which is incorporated by reference in this prospectus. As of December 30, 2016, there were warrants to purchase 1,560,284 shares of our common stock outstanding. The previously issued warrants all have an exercise price of $1.7625 per warrant and are exercisable commencing November 19, 2016 through their expiration date of May 19, 2021.

Exercisability

Holders may exercise warrants at any time up to 11:59 p.m., New York time, on the date that is years after the date of issuance. The warrants are exercisable, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise discussed below). The holder of warrants does not have the right to exercise any portion of the warrant if the holder would beneficially own in excess of 4.99% of the shares of our common stock outstanding immediately after giving effect to such exercise. This percentage may, however, be raised or lowered to an amount not to exceed 9.99% at the option of the holder upon at least 61 days’ prior notice from the holder to us.

Cashless Exercise

At any time when a registration statement covering the issuance of the shares of common stock issuable upon exercise of the warrants is not effective, the holder may, at its option, exercise its warrants on a cashless basis. When exercised on a cashless basis, a portion of the warrant is cancelled in payment of the purchase price payable in respect of the number of shares of our common stock purchasable upon such exercise.

| 21 |

Exercise Price