Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Gogo Inc. | d243770dex991.htm |

| 8-K - FORM 8-K - Gogo Inc. | d243770d8k.htm |

December 2016 Investor Presentation Exhibit 99.2

SAFE HARBOR STATEMENT This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are based on management’s beliefs and assumptions and on information currently available to management. Most forward-looking statements contain words that identify them as forward-looking, such as “anticipates,” “believes,” “continues,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms that relate to future events. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause Gogo’s actual results, performance or achievements to be materially different from any projected results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent the beliefs and assumptions of Gogo only as of the date of this presentation and Gogo undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events or otherwise. As such, Gogo’s future results may vary from any expectations or goals expressed in, or implied by, the forward-looking statements included in this presentation, possibly to a material degree. Gogo cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or that any long-term financial or operational goals and targets will be realized. In particular, the availability and performance of certain technology solutions yet to be implemented by the Company set forth in this presentation represent aspirational long-term goals based on current expectations. For a discussion of some of the important factors that could cause Gogo’s results to differ materially from those expressed in, or implied by, the forward-looking statements included in this presentation, investors should refer to the disclosure contained under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Note to Certain Operating and Financial Data In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles (“GAAP”), Gogo also discloses in this presentation certain non-GAAP financial information, including Adjusted EBITDA. This financial measure is not a recognized measure under GAAP, and when analyzing our performance, investors should use Adjusted EBITDA in addition to, and not as an alternative to, net loss attributable to common stock as a measure of operating results. In addition, this presentation contains various customer metrics and operating data, including numbers of aircraft or units online, that are based on internal company data, as well as information relating to the commercial and business aviation market, and our position within those markets. While management believes such information and data are reliable, they have not been verified by an independent source and there are inherent challenges and limitations involved in compiling data across various geographies and from various sources.

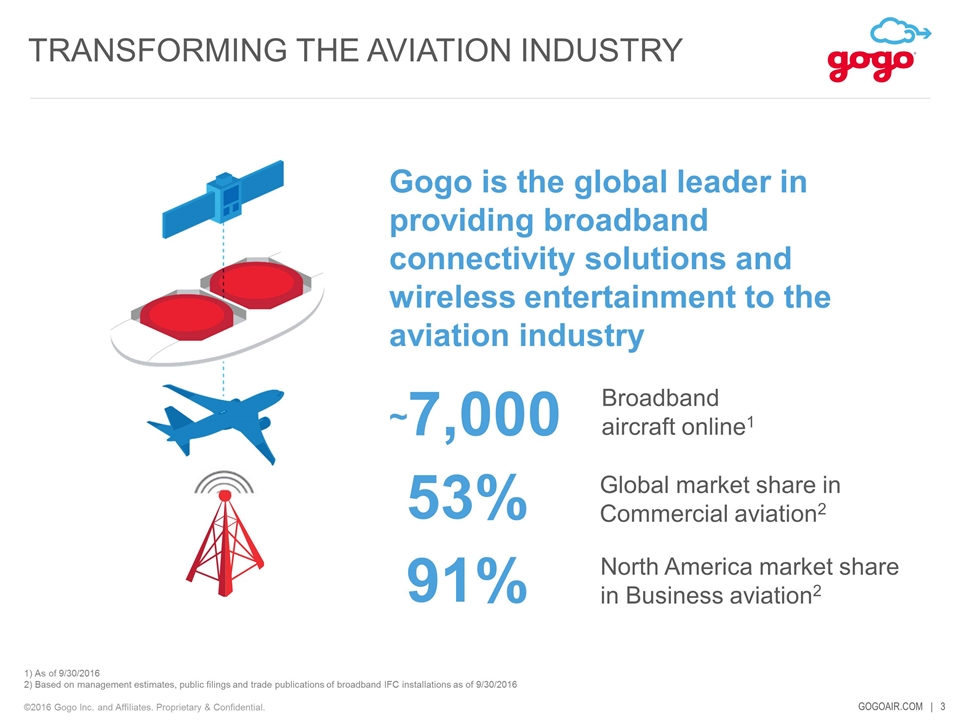

TRANSFORMING THE AVIATION INDUSTRY 1) As of 9/30/2016 2) Based on management estimates, public filings and trade publications of broadband IFC installations as of 9/30/2016 Gogo is the global leader in providing broadband connectivity solutions and wireless entertainment to the aviation industry ~7,000 53% 91% North America market share in Business aviation2 Broadband aircraft online1 Global market share in Commercial aviation2

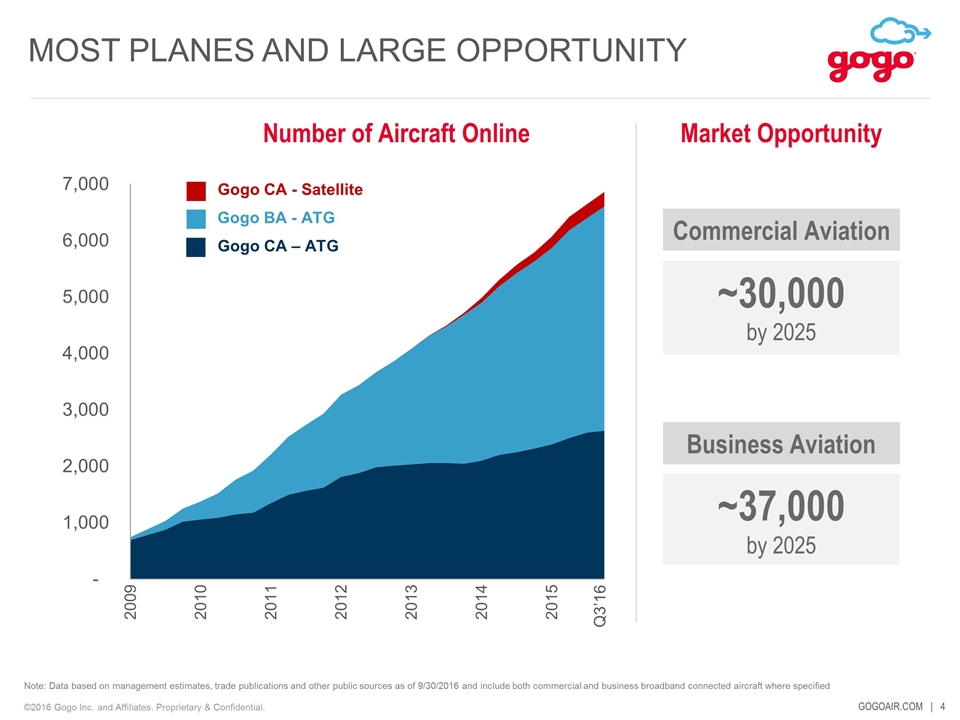

MOST PLANES AND LARGE OPPORTUNITY Gogo CA - Satellite Gogo BA - ATG Gogo CA – ATG Note: Data based on management estimates, trade publications and other public sources as of 9/30/2016 and include both commercial and business broadband connected aircraft where specified Q3’16 Number of Aircraft Online Commercial Aviation ~30,000 by 2025 ~37,000 by 2025 Business Aviation Market Opportunity

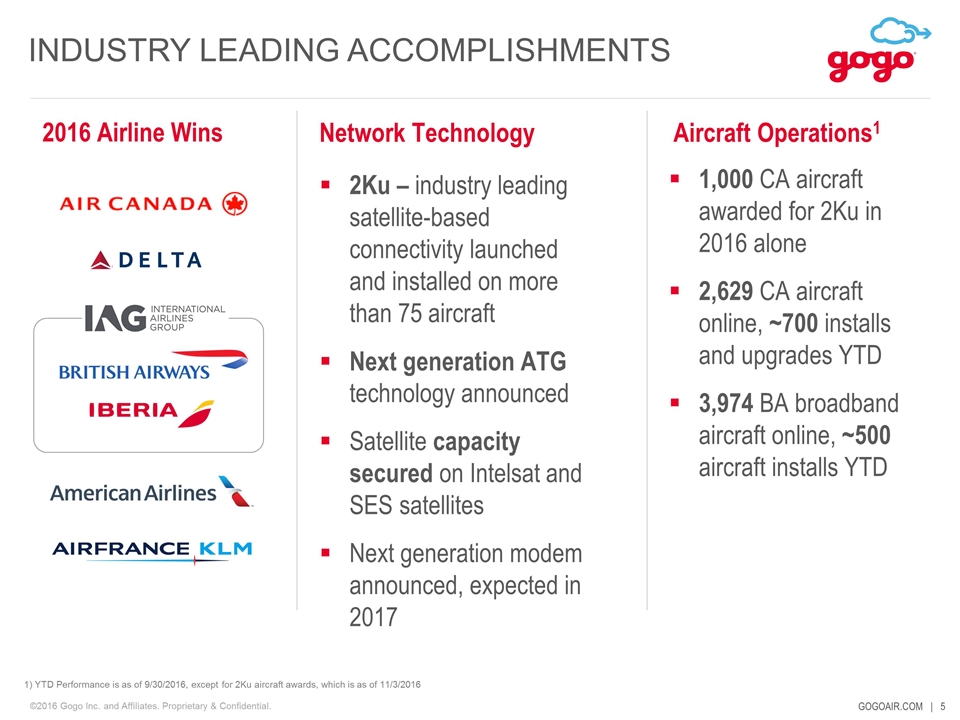

Network Technology Aircraft Operations1 INDUSTRY LEADING ACCOMPLISHMENTS 2016 Airline Wins 2Ku – industry leading satellite-based connectivity launched and installed on more than 75 aircraft Next generation ATG technology announced Satellite capacity secured on Intelsat and SES satellites Next generation modem announced, expected in 2017 1,000 CA aircraft awarded for 2Ku in 2016 alone 2,629 CA aircraft online, ~700 installs and upgrades YTD 3,974 BA broadband aircraft online, ~500 aircraft installs YTD 1) YTD Performance is as of 9/30/2016, except for 2Ku aircraft awards, which is as of 11/3/2016

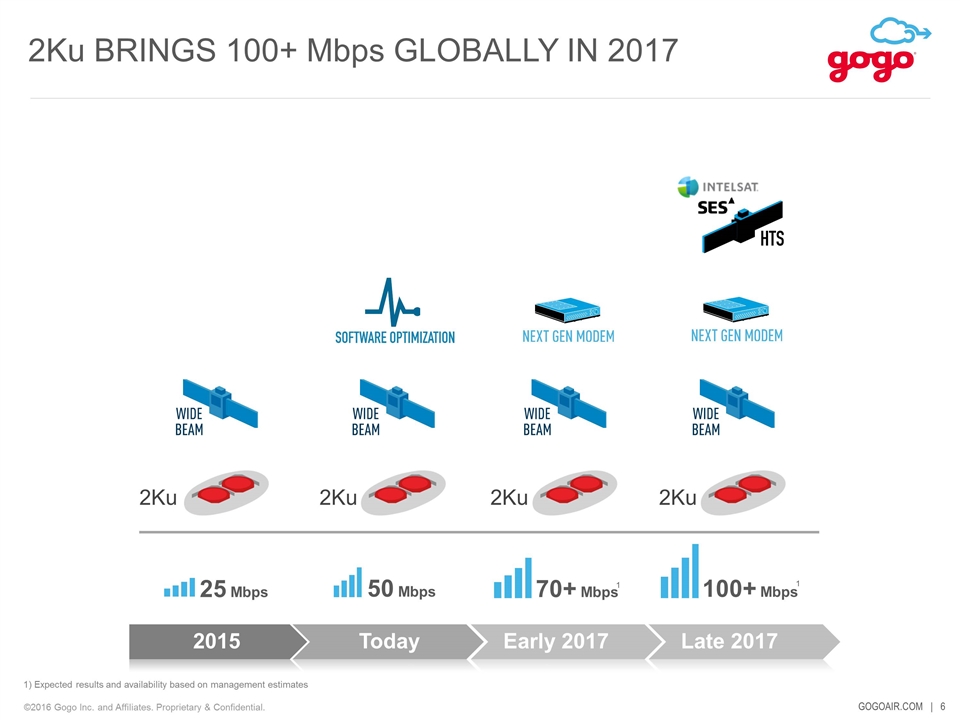

2Ku BRINGS 100+ Mbps GLOBALLY IN 2017 2015 Early 2017 Today Late 2017 2Ku 2Ku 2Ku 2Ku 1 1) Expected results and availability based on management estimates 25 Mbps 50 Mbps 70+ Mbps 100+ Mbps 1

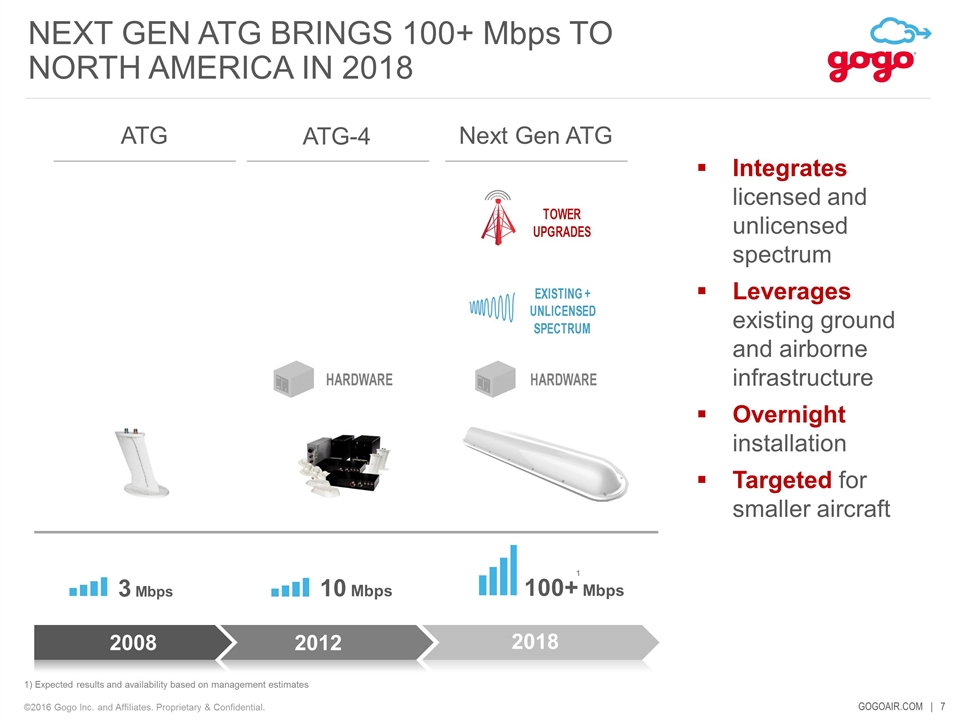

1) Expected results and availability based on management estimates 1 3 Mbps 10 Mbps 100+ Mbps Integrates licensed and unlicensed spectrum Leverages existing ground and airborne infrastructure Overnight installation Targeted for smaller aircraft NEXT GEN ATG BRINGS 100+ Mbps TO NORTH AMERICA IN 2018 2008 2018 2012 ATG ATG-4 Next Gen ATG

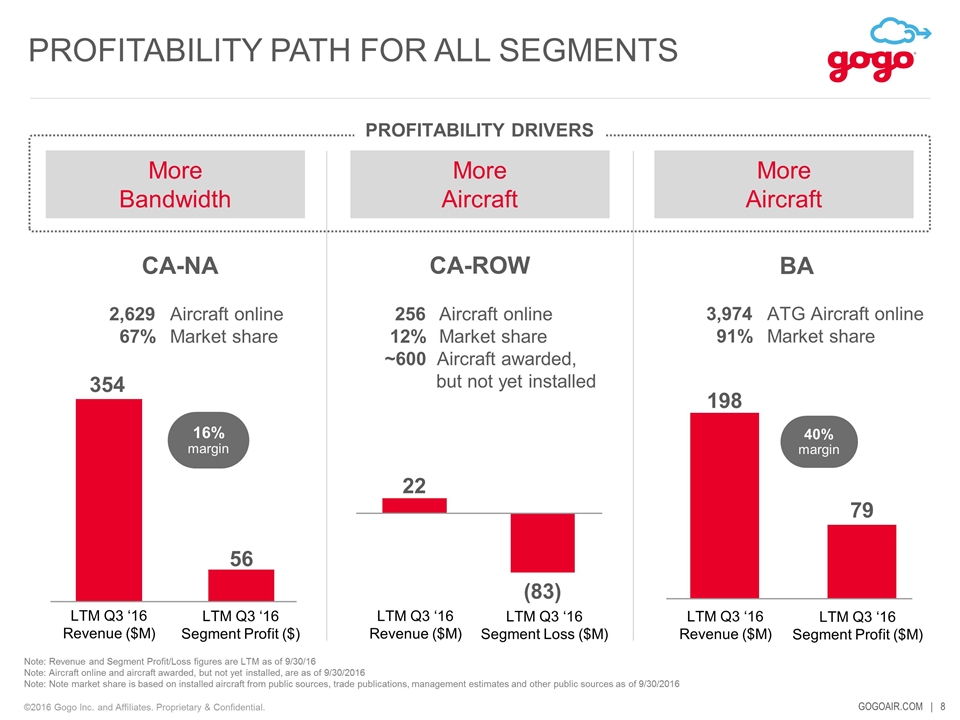

#1 More Bandwidth PROFITABILITY PATH FOR ALL SEGMENTS 16% margin 40% margin Note: Revenue and Segment Profit/Loss figures are LTM as of 9/30/16 Note: Aircraft online and aircraft awarded, but not yet installed, are as of 9/30/2016 Note: Note market share is based on installed aircraft from public sources, trade publications, management estimates and other public sources as of 9/30/2016 CA-NA CA-ROW BA 2,629 Aircraft online 67% Market share 256 Aircraft online 12% Market share ~600 Aircraft awarded, but not yet installed 3,974 ATG Aircraft online 91% Market share More Aircraft More Aircraft Profitability Drivers LTM Q3 ‘16 Revenue ($M) LTM Q3 ‘16 Segment Profit ($) LTM Q3 ‘16 Revenue ($M) LTM Q3 ‘16 Segment Loss ($M) LTM Q3 ‘16 Revenue ($M) LTM Q3 ‘16 Segment Profit ($M)

Scale CA-ROW segment to profitability Further reduce 2Ku installation costs Double ARPA Achieve free cash flow Scale Globally Expand Technology Leadership Free Cash Flow Generation 1 2 3 STRATEGIC GOALS Extend global 2Ku roadmap Deploy next gen ATG solution Invest in our industry leading IFC & IFE platforms Install 1,500 2Ku aircraft awards Achieve 2Ku OEM offerability Increase penetration of ATG systems in BA market