Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Colfax CORP | a8-kguidancecalldecember20.htm |

December 16, 2016

Path Forward Into 2017

2

Forward-looking Statements

These slides and accompanying oral presentation contain forward-looking statements, including forward-looking

statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, statements concerning Colfax's plans, objectives, expectations and intentions

and other statements that are not historical or current fact. Forward-looking statements are based on Colfax's current

expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed

or implied in such forward-looking statements. Factors that could cause Colfax's results to differ materially from current

expectations include, but are not limited to factors detailed in Colfax's reports filed with the U.S. Securities and

Exchange Commission including its 2015 Annual Report on Form 10-K under the caption "Risk Factors." In addition,

these statements are based on a number of assumptions that are subject to change. These slides speak only as of this

date. Colfax disclaims any duty to update the information herein.

The term "Colfax" in reference to the activities described in these slides may mean one or more of Colfax's global

operating subsidiaries and/or their internal business divisions and does not necessarily indicate activities engaged in by

Colfax Corporation.

3

Colfax Strategy – A Winning Model

Focus and

Empower Top

Talent

Acquire Good

Companies

Use CBS to Make

Them Great

Attractive markets

Strong brands and

solutions

Opportunities to

improve and expand

Values

Tools and

processes

Way of working

Independent

businesses

Great leaders, strong

teams, winning spirit

Lean, high value

corporate

WE USE CBS TO MAKE GOOD BUSINESSES GREAT

4

Executing in 2016

Achieving target of $50 million restructuring cost savings

Affirming 2016 guidance of $1.50 to $1.55 Adj. EPS

Strengthening position in key welding markets like Europe, Russia,

India, and South America

Improving service levels

Success on key projects and aftermarket initiatives

Investing in regional organizations in Middle East, South Asia, and

Southeast Asia

Exciting pace of new products Rebel, Renegade, Cutmaster,

WeldCloud, SmartEXEC, and many more

BUILDING MOMENTUM INTO 2017

5

Driving Shareholder Value

Mid-teen

segment

margins

GDP +1-2%

organic

growth

Acquire to

compound

returns

Strengthen the foundation

− Deeper, empowered talent accelerating performance

− Colfax Business System – delivering results

− Cost realignment to simplify and leverage scale

Pivot to growth

− Aftermarket and expanding industrial applications

− Dynamic resource allocation to growth regions & markets

− Drive innovation – new products & IoT advantage

Strengthen the portfolio

− Bolt-on acquisitions leverage technology and channel

− Adjacency acquisitions expand technology and markets

− New platforms broaden, diversify portfolio

3-5 Year Objectives

6

Markets Near Bottom of Cycle

Current Environment

• Sluggish as customers minimize

expenses

• Lower power utilization rates in

the US and China

• NA welding stabilizing

sequentially; Europe flat

• Environmental spend starting in

China

• Lower capex spending YOY

• Current projects progressing but

few new projects

• Policy changes in China slow

new build, accelerate environ.

• Steady pace in SEA

• New regulations in India

Aftermarket

General

Industrial

Oil & Gas

Power

Source: Internal company management estimates.

Order Indicators

• Increasing oil prices

• Maintenance deferments

already in comps

• Aging power fleet in China

• Stable to up global PMI

• GDP forecast uptick in ’17

• Increasing oil prices

• Refinery utilization

• Refined products demand

• Thermal power generation

announced projects

• Utilization

• Announced regulations

STABLE OUTLOOK BUT NO MARKET UPTICK EXPECTED BEFORE SECOND HALF 2017

7

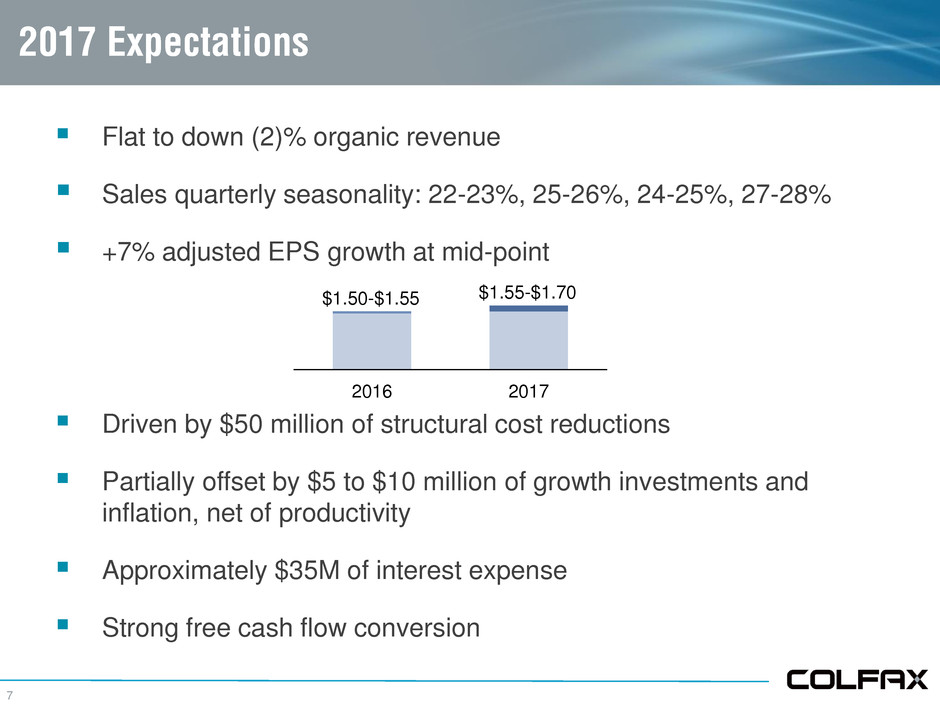

2017 Expectations

Flat to down (2)% organic revenue

Sales quarterly seasonality: 22-23%, 25-26%, 24-25%, 27-28%

+7% adjusted EPS growth at mid-point

Driven by $50 million of structural cost reductions

Partially offset by $5 to $10 million of growth investments and

inflation, net of productivity

Approximately $35M of interest expense

Strong free cash flow conversion

2017 2016

$1.50-$1.55 $1.55-$1.70

FINANCIAL SCHEDULE

9

Non-GAAP Reconciliation

(Unaudited)

Note: Guidance as of 12/16/16.

2017 EPS Range

Projected net income per share – diluted $1.29 $1.44

Restructuring costs 0.36 0.36

Tax Adjustment (0.10) (0.10)

Projected adjusted net income per share - diluted $1.55 $1.70

Colfax has provided financial information in this presentation that has not been prepared in accordance with GAAP. The

non-GAAP financial measure of adjusted net income per share excludes restructuring charges. This non-GAAP financial

measure assists Colfax in comparing its operating performance on a consistent basis by removing the impact of charges

associated with major restructuring programs.