Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STONEMOR PARTNERS LP | d305199d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

StoneMor Partners L.P.

2016 Investor Day – The London NYC Hotel

December 14, 2016

|

|

Forward Looking Statements

2

This presentation contains forward-looking statements that involve a number of assumptions, risks and

uncertainties that could cause actual results to differ materially from those contained in the forward-looking

statements. The Partnership cautions readers that any forward-looking information is not a guarantee of future

performance. Such forward-looking statements include, but are not limited to, statements about future financial

and operating results, the Partnership’s plans, objectives, expectations and intentions and other statements that

are not historical facts. Risks, assumptions and uncertainties that could cause actual results to materially differ from

the forward-looking statements include, but are not limited to, those associated with the cash flow from our preneed

and at-need sales, our trusts, and financings, which may impact our ability to meet our financial projections,

our ability to service our debt and pay distributions, and our ability to increase our distributions; future revenue

and revenue growth; the integration or anticipated benefits of our recent acquisitions or any future acquisitions;

our ability to complete and fund additional acquisitions; the effect of economic downturns; the impact of our

leverage on our operating plans; the decline in the fair value of certain equity and debt securities held in our trusts;

our ability to attract, train and retain an adequate number of sales people; the volume and timing of pre-need sales

of cemetery services and products; increased use of cremation; changes in the death rate; changes in the political

or regulatory environments, including potential changes in tax accounting and trusting policies; litigation or legal

proceedings that could expose us to significant liabilities and damage our reputation; the effects of cyber security

attacks due to our significant reliance on information technology; the financial condition of third-party insurance

companies that fund our pre-need funeral contracts; and other risks, assumptions and uncertainties detailed from

time to time in the Partnership’s reports filed with the U.S. Securities and Exchange Commission, including

quarterly reports on Form 10-Q, reports on Form 8-K and annual reports on Form 10-K. Forward-looking statements

speak only as of the date hereof, and the Partnership assumes no obligation to update such statements, except as

may be required by applicable law.

|

|

Today’s Agenda

3

Topic Speaker

Introduction & History Bob Hellman, Chairman of the GP

Deathcare Industry Trends Larry Miller, CEO

How StoneMor Makes Money Sean McGrath, CFO

What Went Wrong Bob Hellman, Chairman of the GP

Action Plans Larry Miller, CEO

Next Steps / Progress Visibility Bob Hellman, Chairman of the GP

Q&A

|

|

Answers First…

4

StoneMor has been operating for over a dozen years as a master limited

partnership, pursuing one consistent strategy and operational model

Distribution cut driven by self-induced operating challenges which manifested

over the past few quarters

Not an industry problem – industry has terrific tailwinds

Not a business model problem

Operating challenges are known, solutions identified and progress underway

As progress manifests itself in increase cash flow, we expect that distributions

will be increased over the next 12-24 months

|

|

Discussion Topics

Topics This Presentation Will Address

5

StoneMor history

Deathcare industry trends

How StoneMor makes money

What went wrong?

Sustainability of current distribution

Action plans

Next steps / progress visibility

|

|

Who We Are

6

317 cemeteries / 105 funeral homes across 28 states and Puerto Rico

Complete range of funeral merchandise and services, sold both at the time of

need and on a pre-need basis

$840 million of trust investments

~53,500/ 16,800 funeral service calls performed in the last twelve months

Structured as a master limited partnership (MLP) to optimize tax efficiency

Note: As of September 30, 2016.

Second Largest Owner And Operator Of Cemeteries In The U.S.

|

|

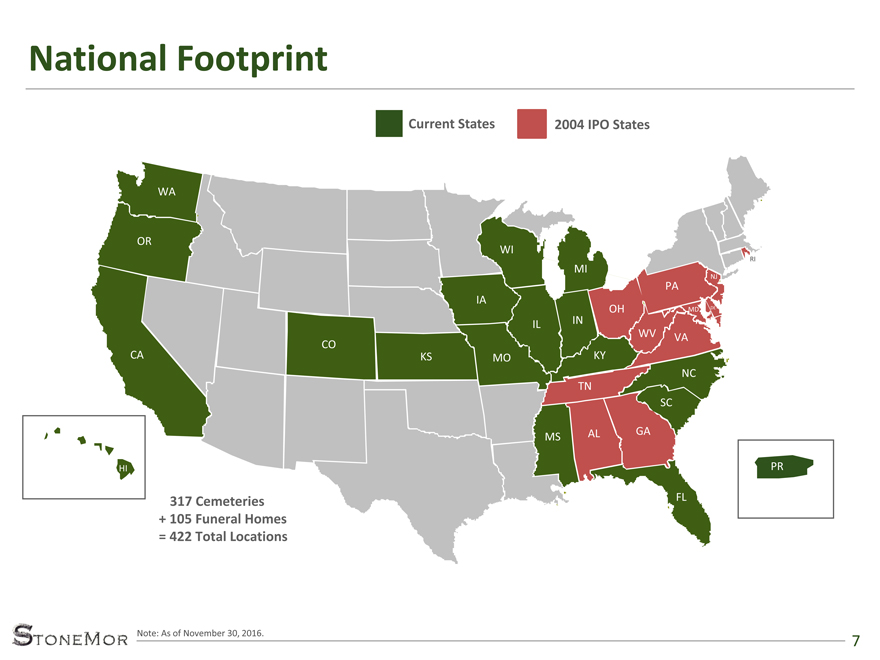

National Footprint

7

317 Cemeteries

+ 105 Funeral Homes

= 422 Total Locations

WA

OR

CA

CO

KS

IA

IL

MO

IN

MI

OH

PA

WV

KY

TN

VA

NC

SC

MS AL GA

FL

WI

Current States 2004 IPO States

Note: As of November 30, 2016.

NJ

MD DE

RI

HI PR

|

|

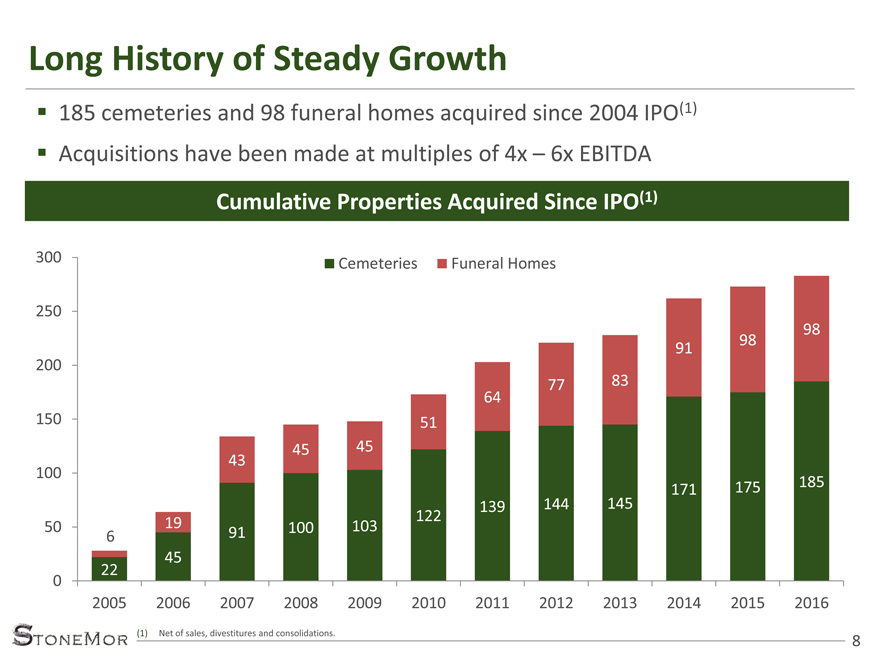

22

45

91 100 103

122

139 144 145

171 175 185

6

19

43

45 45

51

64

77 83

91 98

98

0

50

100

150

200

250

300

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Cemeteries Funeral Homes

8

Long History of Steady Growth

185 cemeteries and 98 funeral homes acquired since 2004 IPO(1)

Acquisitions have been made at multiples of 4x – 6x EBITDA

Cumulative Properties Acquired Since IPO(1)

(1) Net of sales, divestitures and consolidations.

|

|

9

Deathcare Industry Trends

|

|

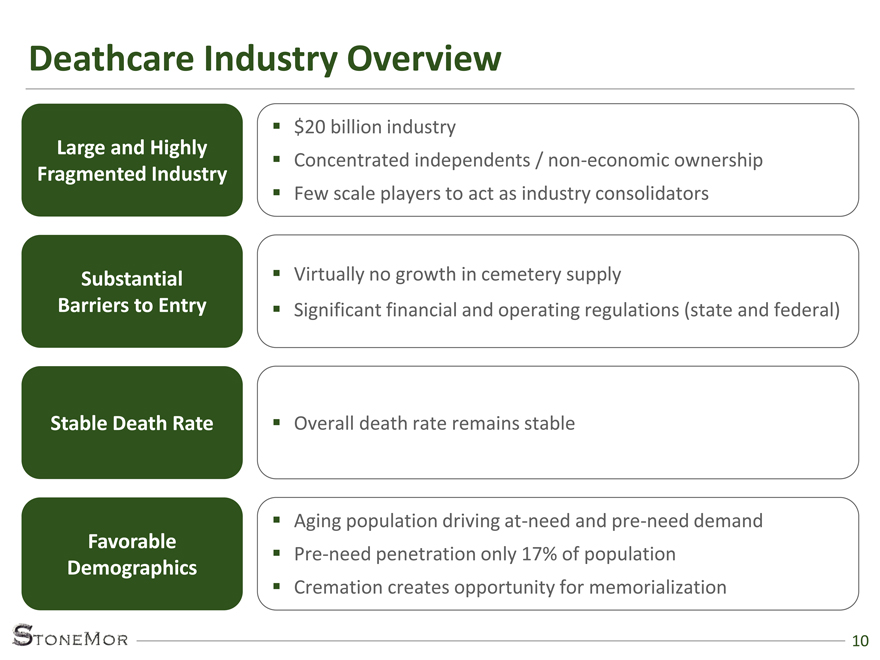

Deathcare Industry Overview

10

$20 billion industry

Concentrated independents / non-economic ownership

Few scale players to act as industry consolidators

Substantial

Barriers to Entry

Stable Death Rate

Favorable

Demographics

Virtually no growth in cemetery supply

Significant financial and operating regulations (state and federal)

Overall death rate remains stable

Aging population driving at-need and pre-need demand

Pre-need penetration only 17% of population

Cremation creates opportunity for memorialization

Large and Highly

Fragmented Industry

|

|

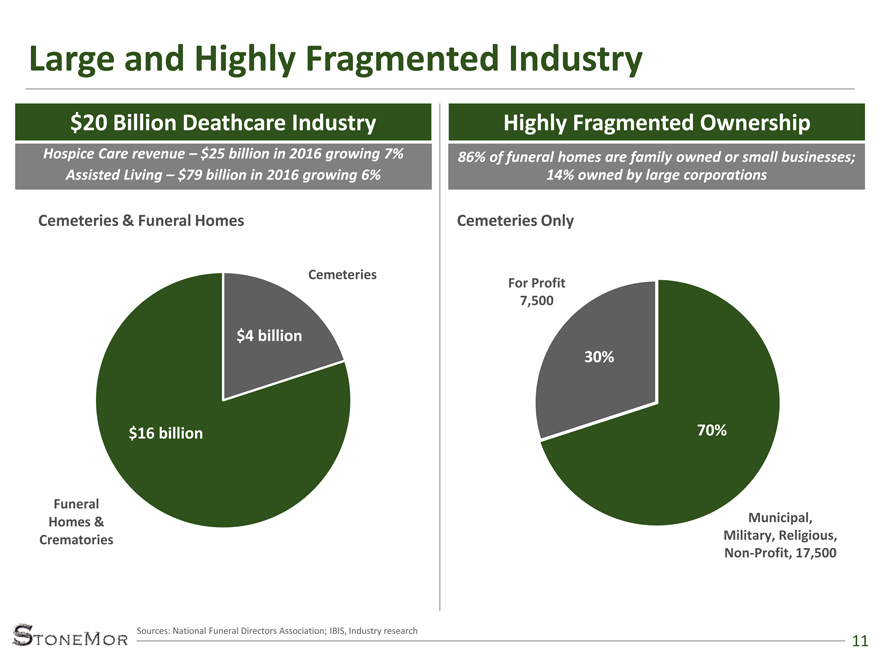

Cemeteries

Funeral

Homes &

Crematories

$16 billion

$4 billion

Cemeteries & Funeral Homes

Large and Highly Fragmented Industry

11

$20 Billion Deathcare Industry Highly Fragmented Ownership

86% of funeral homes are family owned or small businesses;

14% owned by large corporations

Sources: National Funeral Directors Association; IBIS, Industry research

70%

30%

For Profit

7,500

Municipal,

Military, Religious,

Non-Profit, 17,500

Hospice Care revenue – $25 billion in 2016 growing 7%

Assisted Living – $79 billion in 2016 growing 6%

Cemeteries Only

|

|

12

Substantial Barriers to Entry

Scarcity and cost of real estate near densely populated areas

Zoning restrictions

Initial capital requirements

Administratively complex business for new entrants

Cemeteries (Social Infrastructure)

Funeral Homes (Specialty Retail)

Licensing requirements

Funeral homes are part of the community

Strength of family tradition and heritage

Barriers to entry driven by heritage

|

|

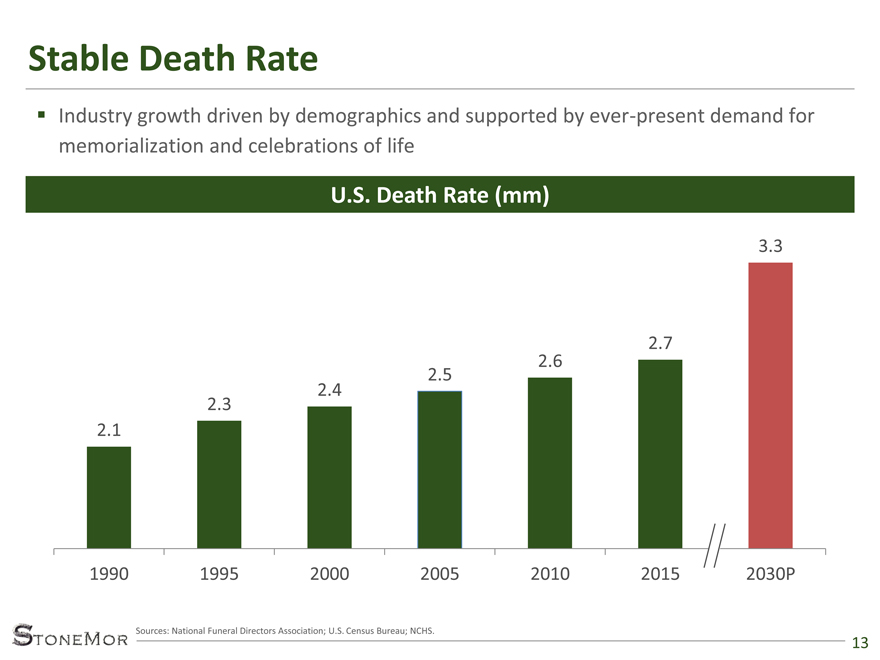

Stable Death Rate

13

Industry growth driven by demographics and supported by ever-present demand for

memorialization and celebrations of life

2.1

2.3

2.4

2.5

2.6

2.7

3.3

1990 1995 2000 2005 2010 2015 2030P

U.S. Death Rate (mm)

Sources: National Funeral Directors Association; U.S. Census Bureau; NCHS.

|

|

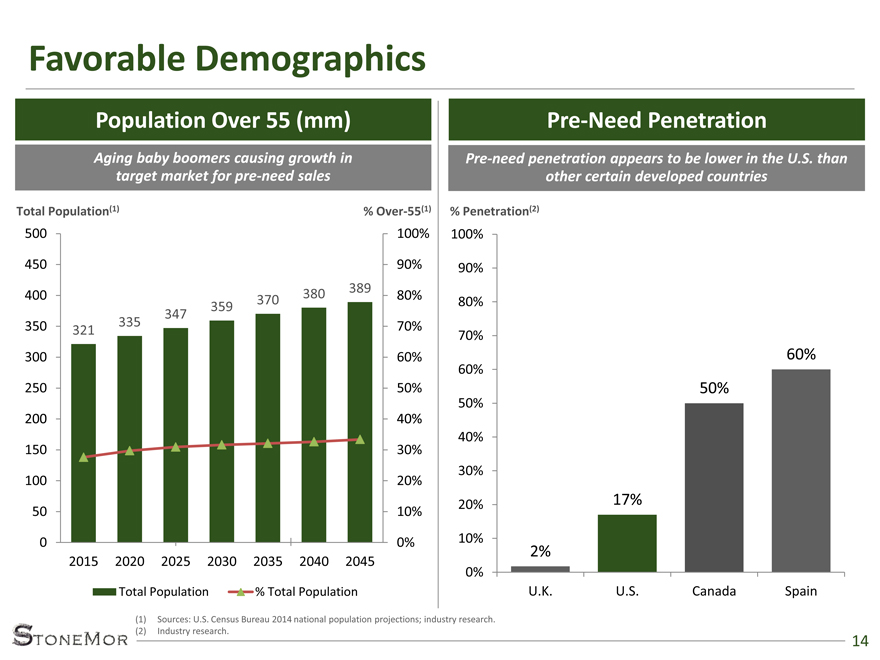

Favorable Demographics

14

Population Over 55 (mm) Pre-Need Penetration

Aging baby boomers causing growth in

target market for pre-need sales

Total Population(1) % Over-55(1)

(1) Sources: U.S. Census Bureau 2014 national population projections; industry research.

(2) Industry research.

321

335

347

359 370 380 389

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0

50

100

150

200

250

300

350

400

450

500

2015 2020 2025 2030 2035 2040 2045

Total Population % Total Population

Pre-need penetration appears to be lower in the U.S. than

other certain developed countries

% Penetration(2)

2%

17%

50%

60%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

U.K. U.S. Canada Spain

|

|

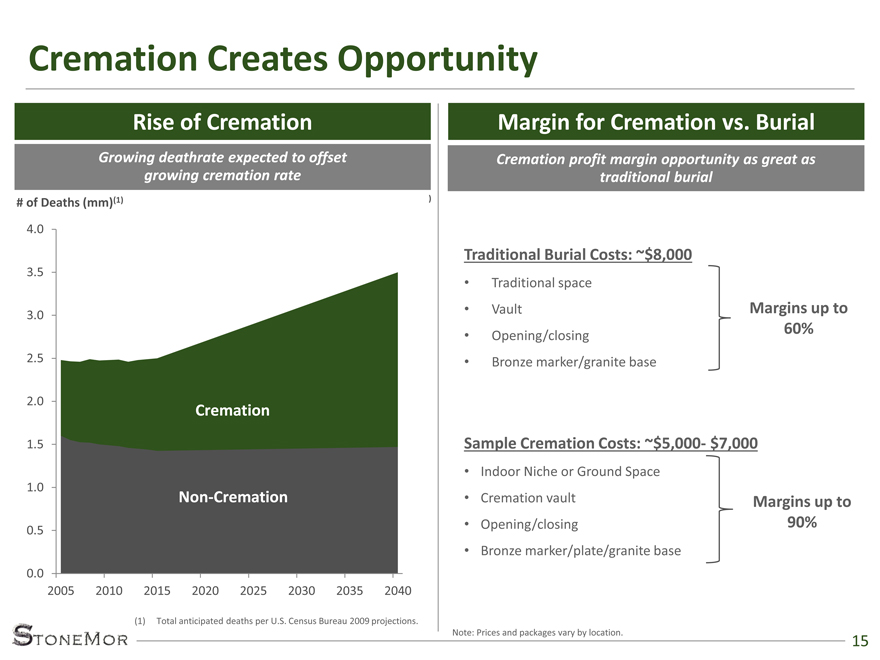

Cremation Creates Opportunity

15

Cremation

Non-Cremation

# of Deaths (mm)(1) )

(1) Total anticipated deaths per U.S. Census Bureau 2009 projections.

Traditional Burial Costs: ~$8,000

• Traditional space

• Vault

• Opening/closing

• Bronze marker/granite base

Sample Cremation Costs: ~$5,000- $7,000

• Indoor Niche or Ground Space

• Cremation vault

• Opening/closing

• Bronze marker/plate/granite base

Margins up to

90%

Margins up to

60%

Note: Prices and packages vary by location.

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

2005 2010 2015 2020 2025 2030 2035 2040

Non-Cremation

Rise of Cremation Margin for Cremation vs. Burial

Cremation profit margin opportunity as great as

traditional burial

Growing deathrate expected to offset

|

|

Deathcare Industry Context

16

Death care industry continues to grow, driven by demographic tailwinds

Fragmented ownership and lack of industry consolidators results in substantial

consolidation opportunity

Cremation as much of an opportunity as a threat

Barriers to entry serve as the basis for company stability

|

|

17

How StoneMor Makes Money

|

|

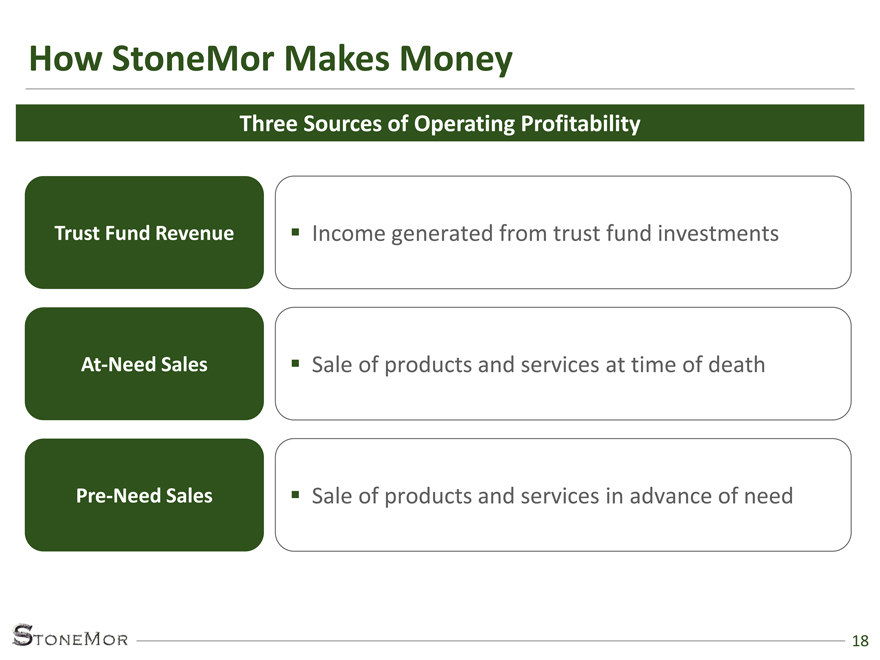

How StoneMor Makes Money

18

Income generated from trust fund investments

At-Need Sales

Pre-Need Sales

Sale of products and services at time of death

Sale of products and services in advance of need

Trust Fund Revenue

Three Sources of Operating Profitability

|

|

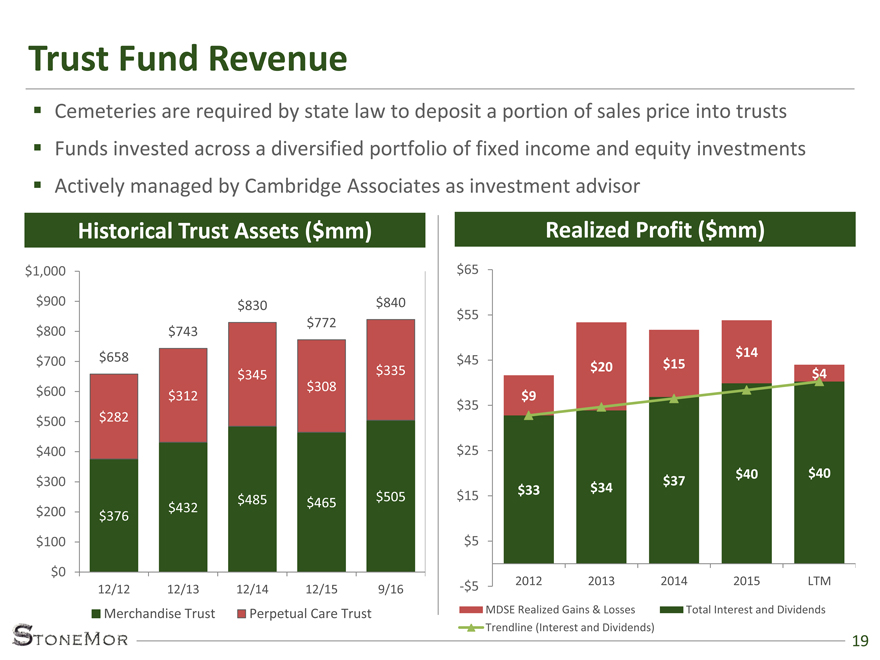

Trust Fund Revenue

19

Cemeteries are required by state law to deposit a portion of sales price into trusts

Funds invested across a diversified portfolio of fixed income and equity investments

Actively managed by Cambridge Associates as investment advisor

$376

$432

$485 $465 $505

$282

$312

$345

$308

$335

$658

$743

$830

$772

$840

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

12/12 12/13 12/14 12/15 9/16

Merchandise Trust Perpetual Care Trust

Historical Trust Assets ($mm) Realized Profit ($mm)

$33 $34 $37 $40 $40

$9

$20 $15

$14

$4

-$5

$5

$15

$25

$35

$45

$55

$65

2012 2013 2014 2015 LTM

MDSE Realized Gains & Losses Total Interest and Dividends

Trendline (Interest and Dividends)

|

|

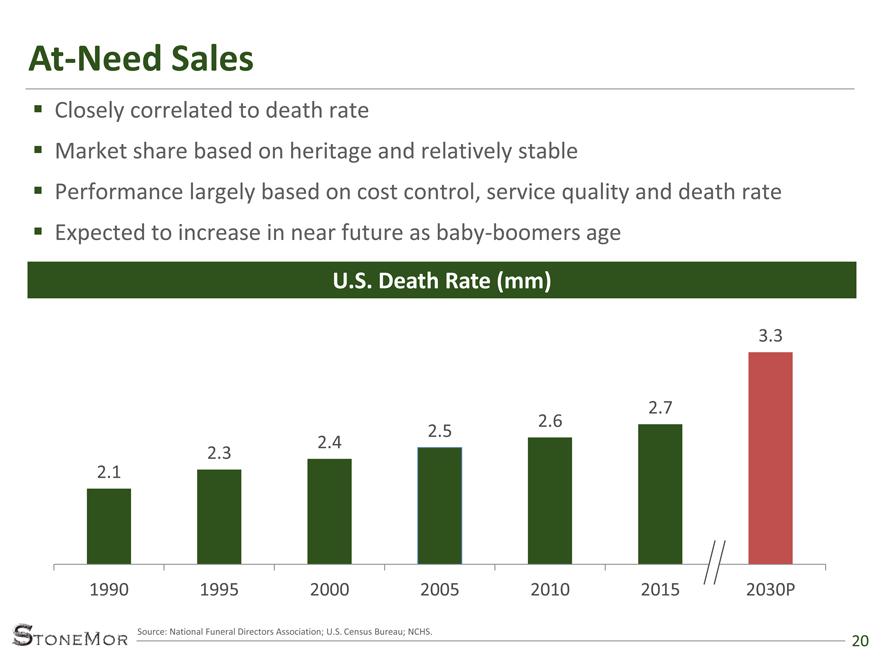

At-Need Sales

20

Closely correlated to death rate

Market share based on heritage and relatively stable

Performance largely based on cost control, service quality and death rate

Expected to increase in near future as baby-boomers age

U.S. Death Rate (mm)

Source: National Funeral Directors Association; U.S. Census Bureau; NCHS.

2.1

2.3

2.4

2.5

2.6

2.7

3.3

1990 1995 2000 2005 2010 2015 2030P

|

|

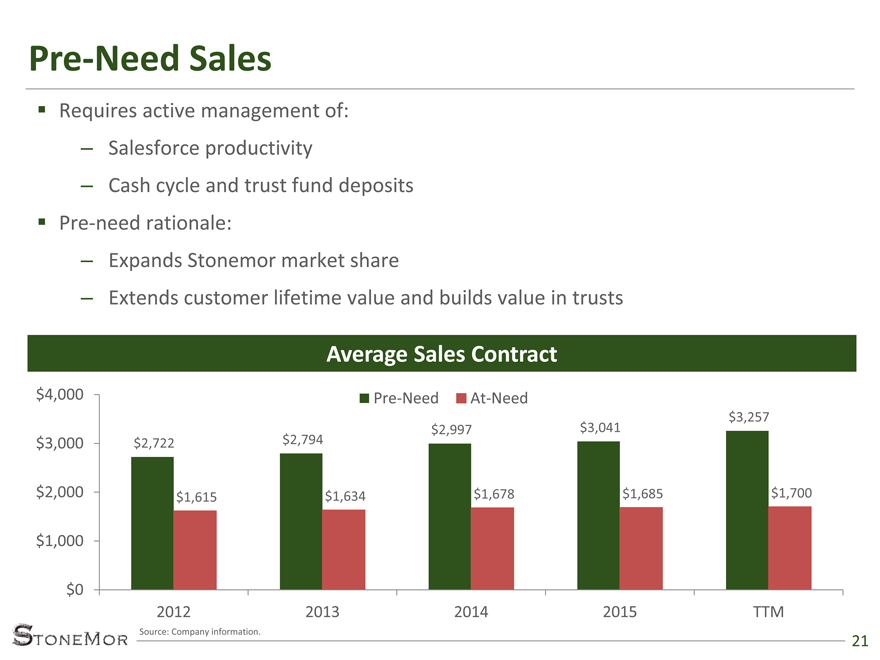

Pre-Need Sales

21

Requires active management of:

– Salesforce productivity

– Cash cycle and trust fund deposits

Pre-need rationale:

– Expands Stonemor market share

– Extends customer lifetime value and builds value in trusts

$2,722 $2,794

$2,997 $3,041

$3,257

$1,615 $1,634 $1,678 $1,685 $1,700

$0

$1,000

$2,000

$3,000

$4,000

2012 2013 2014 2015 TTM

Pre-Need At-Need

Average Sales Contract

Source: Company information.

|

|

22

What Went Wrong?

|

|

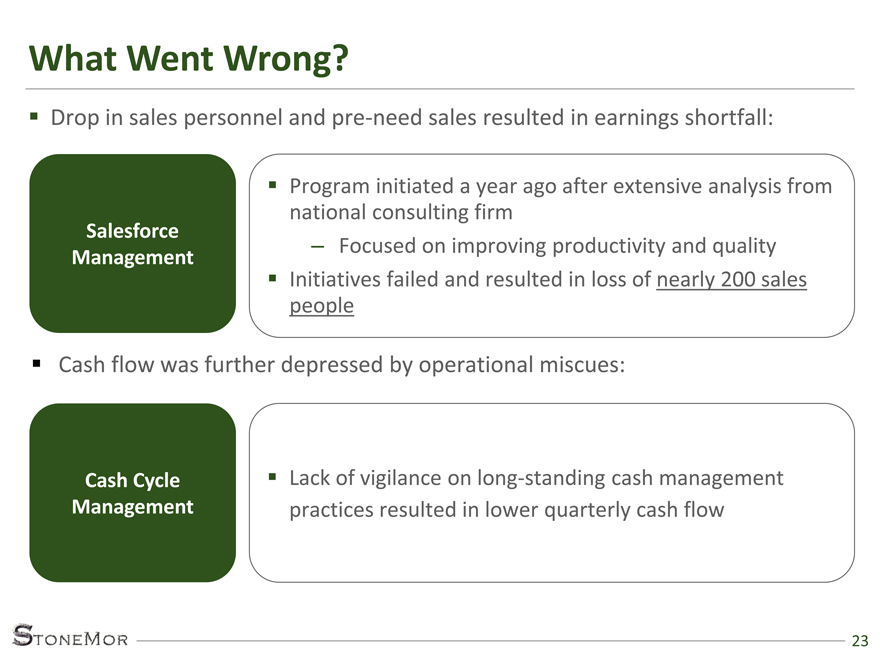

What Went Wrong

Drop in sales personnel and pre-need sales resulted in earnings shortfall:

23

Program initiated a year ago after extensive analysis from

national consulting firm

– Focused on improving productivity and quality

Initiatives failed and resulted in loss of nearly 200 sales

people

Cash Cycle

Management

Lack of vigilance on long-standing cash management

practices resulted in lower quarterly cash flow

Salesforce

Management

Cash flow was further depressed by operational miscues:

|

|

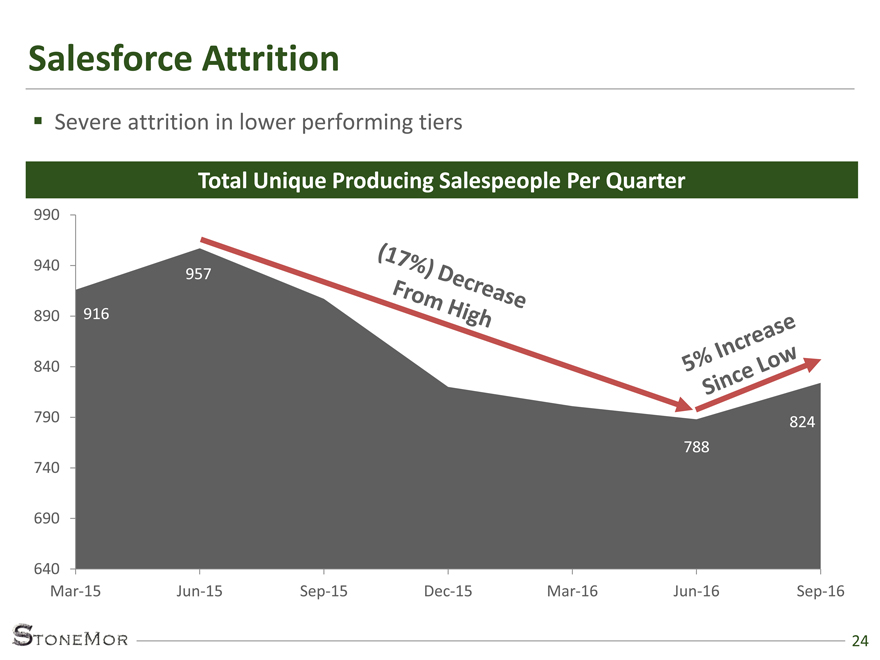

Salesforce Attrition

24

Severe attrition in lower performing tiers

Total Unique Producing Salespeople Per Quarter

916

957

788

824

640

690

740

790

840

890

940

990

Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16

|

|

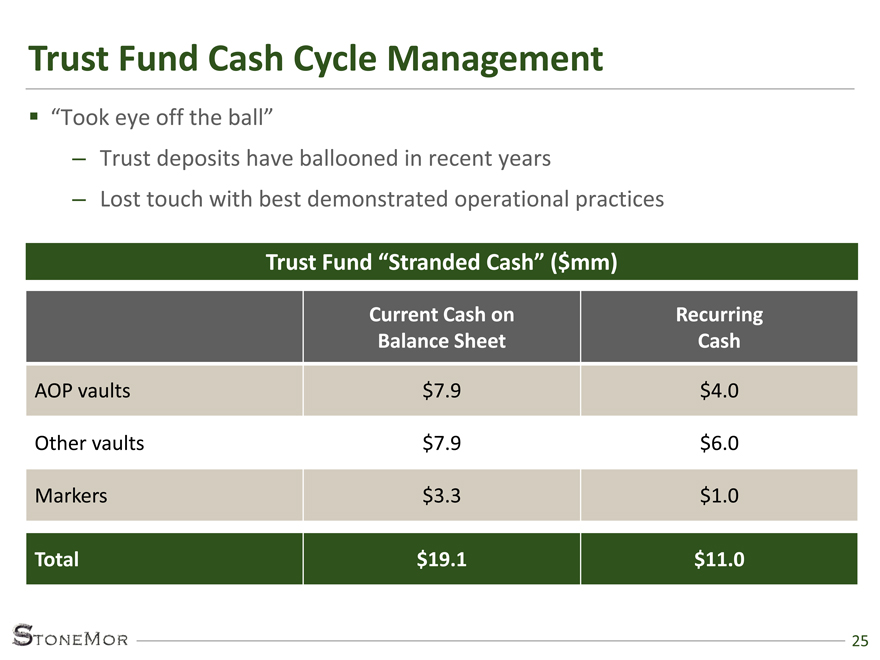

Trust Fund Cash Cycle Management

“Took eye off the ball”

– Trust deposits have ballooned in recent years

– Lost touch with best demonstrated operational practices

25

Current Cash on

Balance Sheet

Recurring

Cash

AOP vaults $7.9 $4.0

Other vaults $7.9 $6.0

Markers $3.3 $1.0

Total $19.1 $11.0

Trust Fund “Stranded Cash” ($mm)

|

|

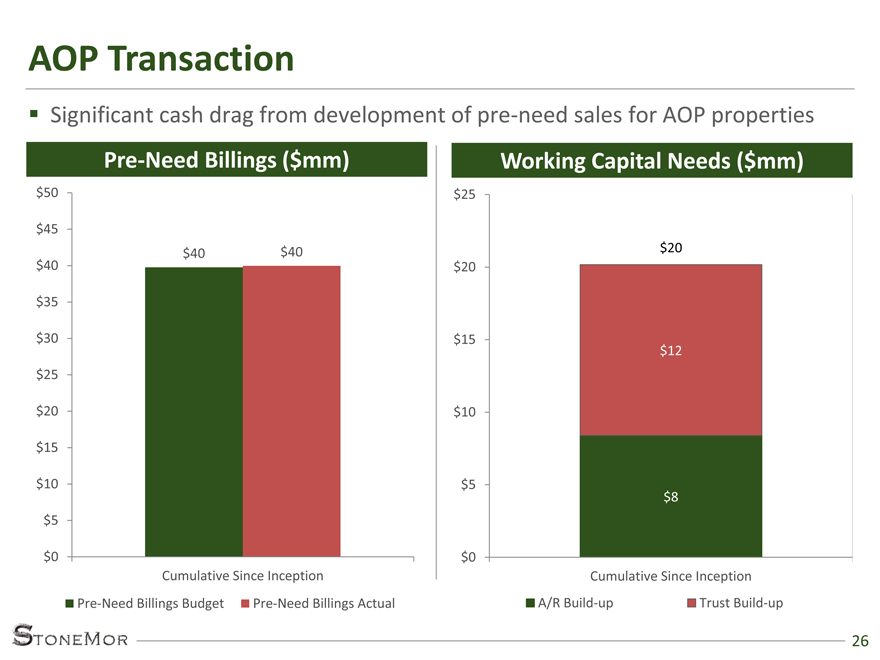

AOP Transaction

Significant cash drag from development of pre-need sales for AOP properties

26

Pre-Need Billings ($mm) Working Capital Needs ($mm)

$8

$12

$20

$0

$5

$10

$15

$20

$25

Cumulative Since Inception

A/R Build-up Trust Build-up

$40 $40

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

Cumulative Since Inception

Pre-Need Billings Budget Pre-Need Billings Actual

|

|

27

Action Plans

|

|

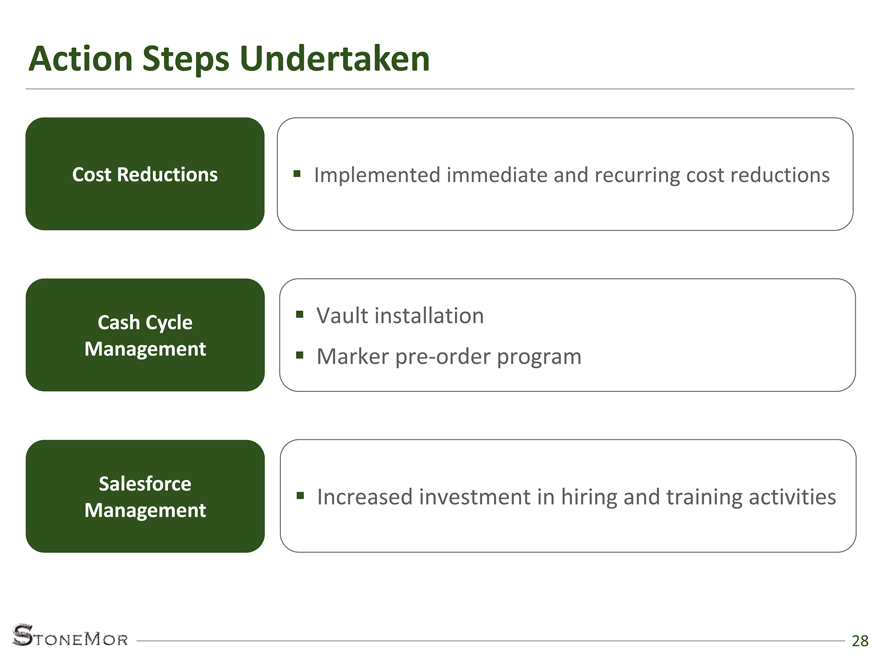

Action Steps Undertaken

28

Increased investment in hiring and training activities

Cash Cycle

Management

Cost Reductions

Vault installation

Marker pre-order program

Implemented immediate and recurring cost reductions

Salesforce

Management

|

|

Cost Reductions

29

Able to achieve real cash savings of over $6mm

Currently implementing $5mm of additional savings (completed by year end)

By year end, StoneMor will have implemented over $11mm of cost savings

that will directly affect 2017 cash flow

In addition, StoneMor is evaluating option of using life insurance contracts to

replace future pre-need trust deposits for Merchandise Trust fund

|

|

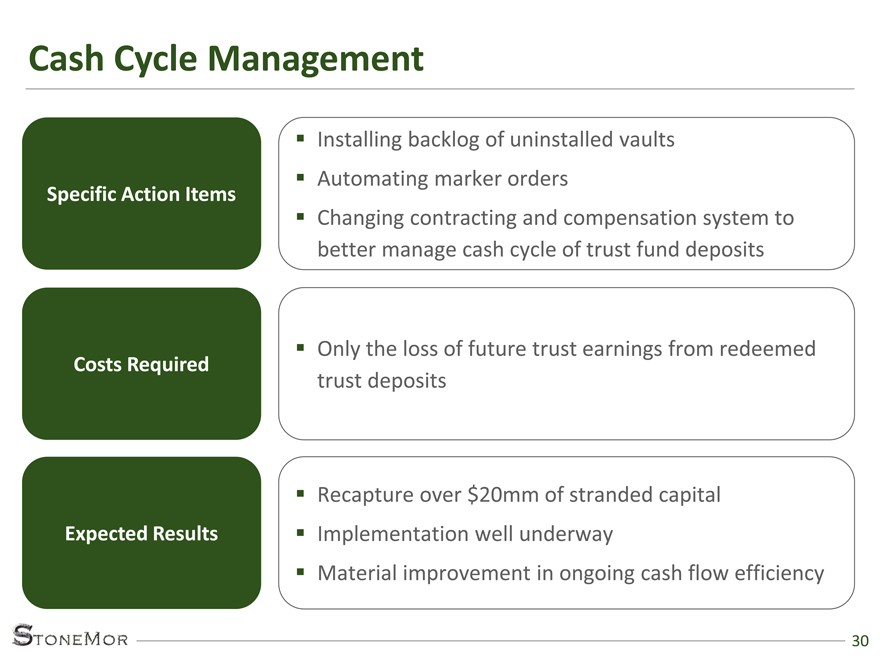

Cash Cycle Management

30

Costs Required

Expected Results

Specific Action Items

Only the loss of future trust earnings from redeemed

trust deposits

Installing backlog of uninstalled vaults

Automating marker orders

Changing contracting and compensation system to

better manage cash cycle of trust fund deposits

Recapture over $20mm of stranded capital

Implementation well underway

Material improvement in ongoing cash flow efficiency

|

|

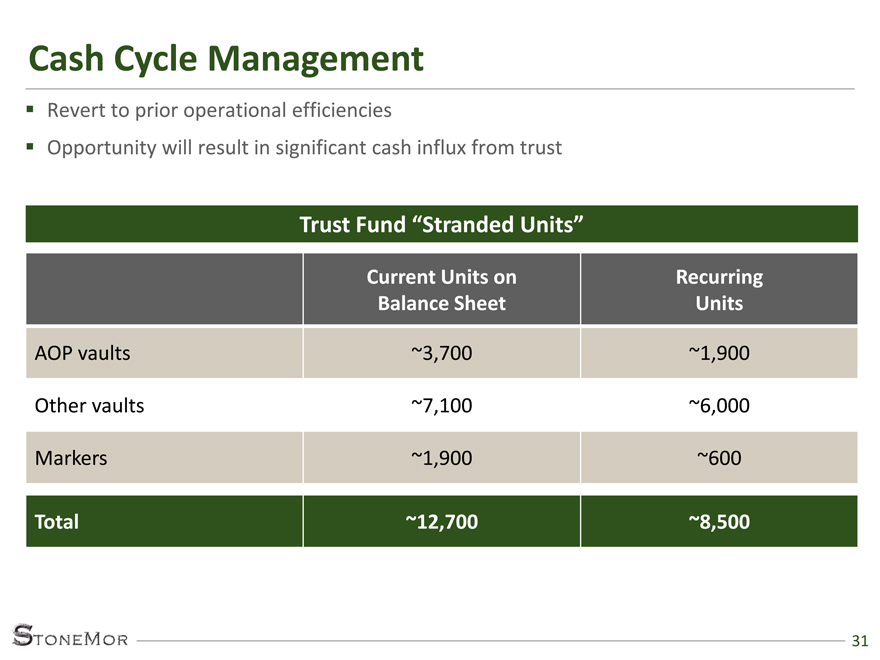

Cash Cycle Management

31

Current Units on

Balance Sheet

Recurring

Units

AOP vaults ~3,700 ~1,900

Other vaults ~7,100 ~6,000

Markers ~1,900 ~600

Total ~12,700 ~8,500

Trust Fund “Stranded Units”

Revert to prior operational efficiencies

Opportunity will result in significant cash influx from trust

|

|

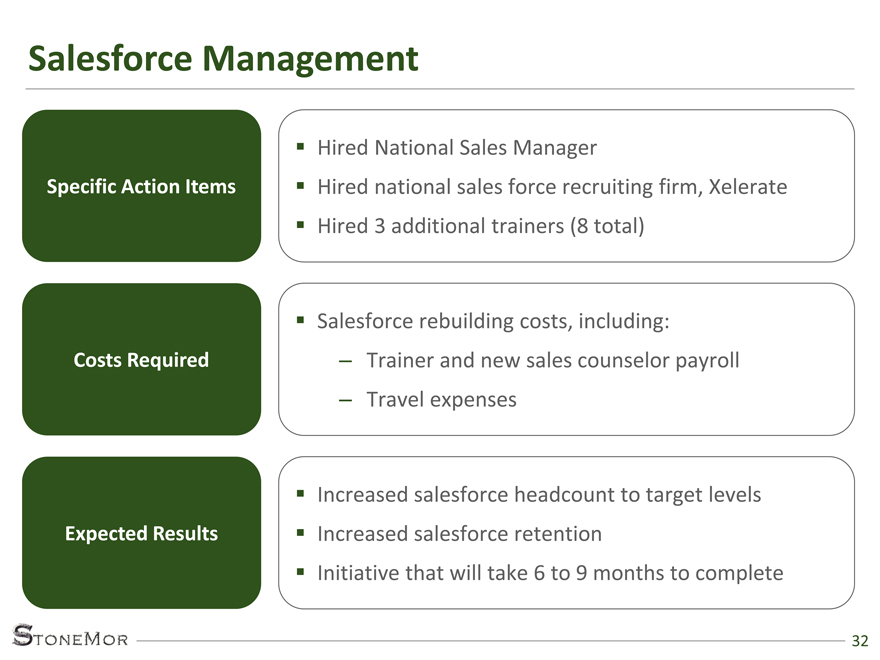

Salesforce Management

32

Costs Required

Expected Results

Specific Action Items

Hired National Sales Manager

Hired national sales force recruiting firm, Xelerate

Hired 3 additional trainers (8 total)

Salesforce rebuilding costs, including:

– Trainer and new sales counselor payroll

– Travel expenses

Increased salesforce headcount to target levels

Increased salesforce retention

Initiative that will take 6 to 9 months to complete

|

|

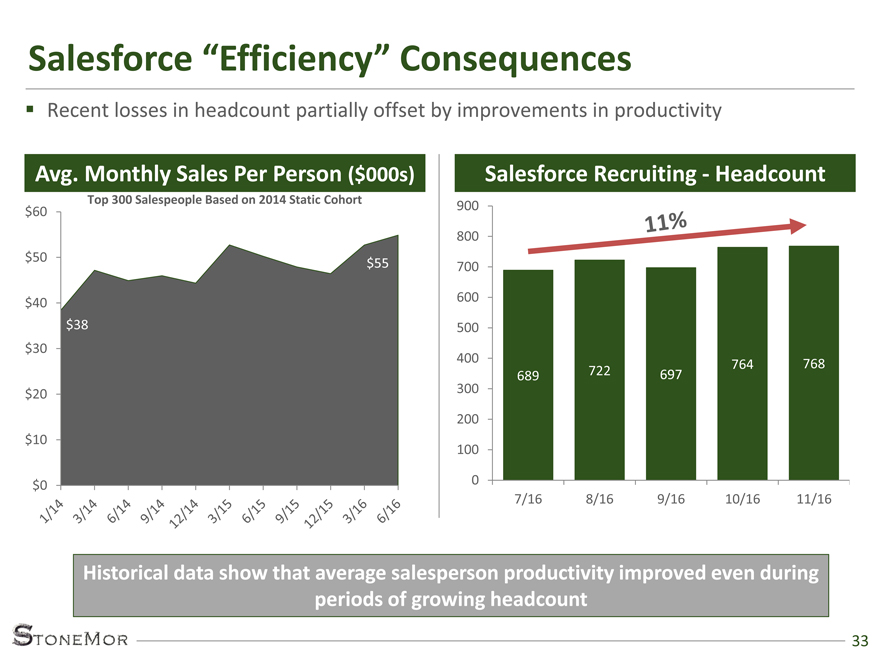

Salesforce “Efficiency” Consequences

33

Recent losses in headcount partially offset by improvements in productivity

Historical data show that average salesperson productivity improved even during

periods of growing headcount

$38

$55

$0

$10

$20

$30

$40

$50

$60

Avg. Monthly Sales Per Person ($000s) Salesforce Recruiting—Headcount

689 722 697

764 768

0

100

200

300

400

500

600

700

800

900

7/16 8/16 9/16 10/16 11/16

Top 300 Salespeople Based on 2014 Static Cohort

|

|

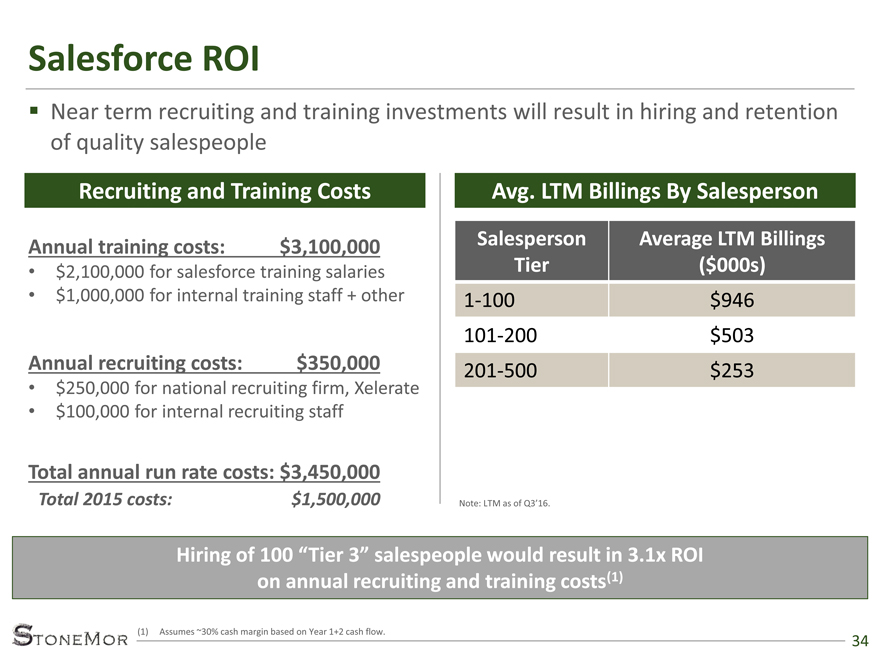

Salesforce ROI

34

Recruiting and Training Costs Avg. LTM Billings By Salesperson

Near term recruiting and training investments will result in hiring and retention

of quality salespeople

Salesperson

Tier

Average LTM Billings

($000s)

1-100 $946

101-200 $503

201-500 $253

Note: LTM as of Q3’16.

Annual recruiting costs: $350,000

• $250,000 for national recruiting firm, Xelerate

• $100,000 for internal recruiting staff

Annual training costs: $3,100,000

• $2,100,000 for salesforce training salaries

• $1,000,000 for internal training staff + other

Total annual run rate costs: $3,450,000

Total 2015 costs: $1,500,000

Hiring of 100 “Tier 3” salespeople would result in 3.1x ROI

on annual recruiting and training costs(1)

(1) Assumes ~30% cash margin based on Year 1+2 cash flow.

|

|

35

Next Steps / Visibility

|

|

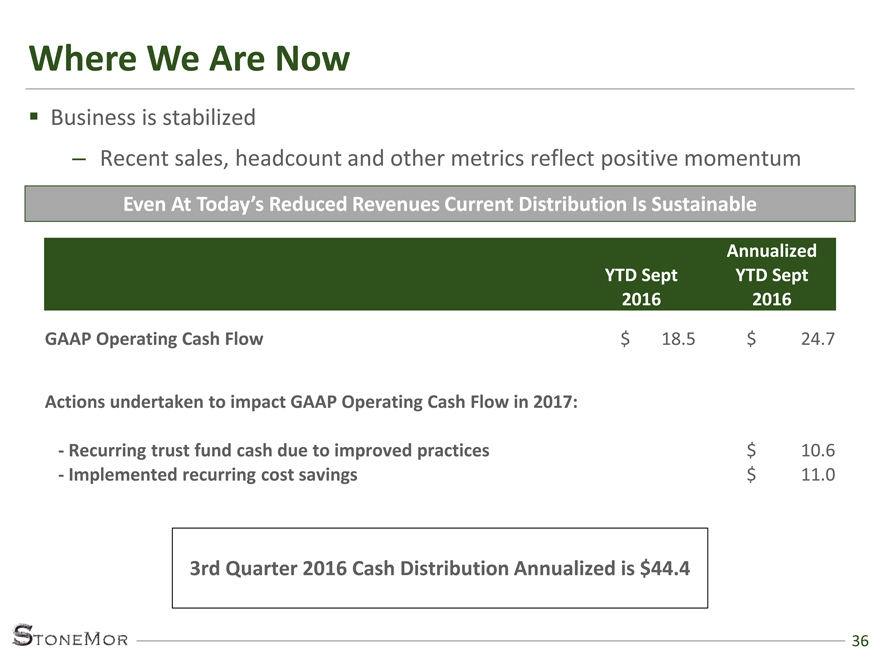

Where We Are Now

Business is stabilized

– Recent sales, headcount and other metrics reflect positive momentum

36

Annualized

YTD Sept YTD Sept

2016 2016

GAAP Operating Cash Flow $ 18.5 $ 24.7

Actions undertaken to impact GAAP Operating Cash Flow in 2017:

- Recurring trust fund cash due to improved practices $ 10.6

- Implemented recurring cost savings $ 11.0

Even At Today’s Reduced Revenues Current Distribution Is Sustainable

3rd Quarter 2016 Cash Distribution Annualized is $44.4

|

|

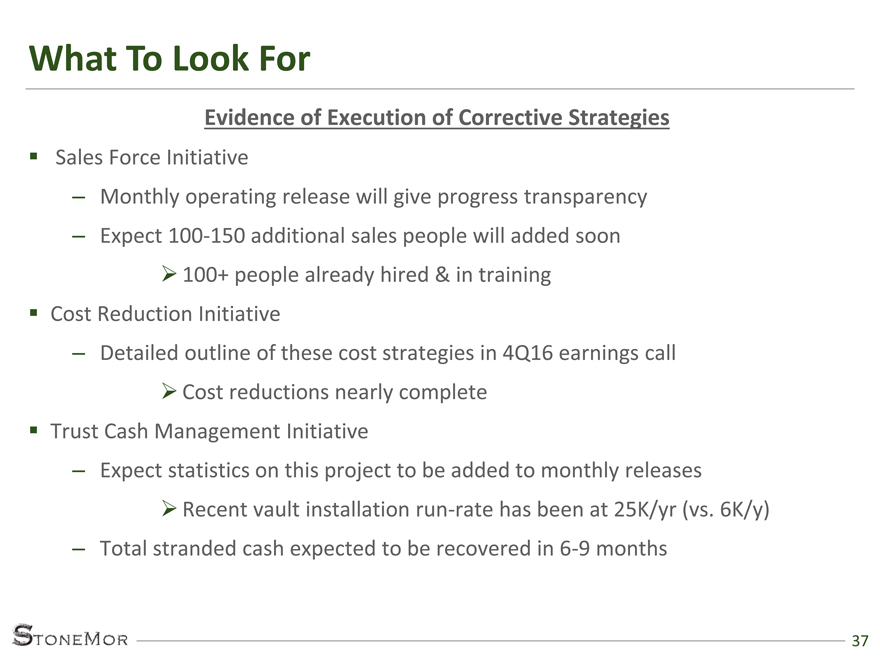

What To Look For

Evidence of Execution of Corrective Strategies

Sales Force Initiative

– Monthly operating release will give progress transparency

– Expect 100-150 additional sales people will added soon

100+ people already hired & in training

Cost Reduction Initiative

– Detailed outline of these cost strategies in 4Q16 earnings call

Cost reductions nearly complete

Trust Cash Management Initiative

– Expect statistics on this project to be added to monthly releases

Recent vault installation run-rate has been at 25K/yr (vs. 6K/y)

– Total stranded cash expected to be recovered in 6-9 months

37

|

|

Path To Distribution Growth

The trust fund cash management and costs initiatives are well underway

We are now singularly focused on the sales recovery effort

There is a direct correlation between sales headcount and operating results

However, success of this initiative initially shows up in non-GAAP operating

results

Visibility of the cash flow impact of this is complicated by SEC focus on non-

GAAP reporting

Therefore, as the sales force recovers, we expect to begin modestly increasing

distributions

However, the bulk of the increase in our DCF will initially be utilized to increase

our coverage ratio

We expect the operating recovery to be complete by YE 2017, with GAAP

operating cash flow demonstrating this in 2018.

38

|

|

39

Q&A

|

|

StoneMor Partners L.P.

3600 Horizon Blvd., Suite 100

Trevose, PA 19053

40

Contact:

John McNamara, Director – Investor Relations

Phone: (215) 826-2945

E-mail: jmcna@stonemor.com