Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RGC RESOURCES INC | financialpresentation8k-20.htm |

RGC Resources, Inc. | NASDAQ: RGCO

Investor Presentation

December 2016

1

Forward-Looking Statements:

The statements in this presentation by RGC Resources, Inc. (the "company") that are not historical facts constitute “forward-looking

statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and

uncertainties. These statements include the company's expectations regarding earnings per share, EBITDA, future expansion opportunities,

natural gas reserves and potential discoverable natural gas reserves, technological advances in natural gas production, comparison of natural

gas consumption and natural gas production, cost of natural gas, including relativity to other fuel sources, demand for natural gas, possibility of

system expansion, general potential for customer growth, relationship of company with primary regulator, future capital expenditures, current

and future economic growth, estimated completion dates for Mountain Valley Pipeline ("MVP") milestones, potential of MVP to provide

additional source of natural gas, additional capacity to meet future demands, increased capital spending and area expansion opportunity,

potential new customers and rate growth in potential expansion area. Management cautions the reader that these forward-looking statements

are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results may differ materially

from those expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without

limitation, financial challenges affecting expected earnings per share and EBITDA, technical, political or regulatory issues with natural gas

exploration, production or transportation, impact of increased natural gas demand on natural gas price, relative cost of alternative fuel

sources, lower demand for natural gas, regulatory, legal, technical, political or economic issues frustrating system or area expansion,

regulatory, legal, technical, political or economic issues that may affect MVP, delay in completion of MVP, increase in cost to complete MVP,

including by an increase in cost of raw materials or labor to due economic factors or regulatory issues such as tariffs, economic challenges that

may affect the service area generally and customer growth or demand and deterioration of relationship with primary regulator, and those risk

factors described in the company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which is

available at www.sec.gov and on the company’s website at www.rgcresources.com. The statements made in this presentation are based on

information available to the company as of the date of this presentation and the company undertakes no obligation to update any of the

forward-looking statements after the date of this presentation.

2

Key investment highlights

Demonstrated track

record of delivering

shareholder value

Total shareholder return of 195% since 2006, compared with 98% for the S&P 500

Announced record earnings for FY 2016, attributable to:

Improved utility margins associated with infrastructure replacement programs

Customer growth

Mountain Valley Pipeline (MVP) investment

Significant growth

potential

Attractive cost recovery mechanisms & opportunities for rate base growth

Service territory centered in the largest metropolitan area in Western Virginia

Additional growth opportunities from investment in MVP, including service territory

expansion

Highly stable business

model

Very constructive relationships with VA State Corporation Commission (SCC)

72 years of consecutive dividend payments

13 consecutive years of dividend increases

Pass-through fuel costs

5% increase in operating margin since 2014

Experienced

management team

30 average years of experience

CEO is member of the AGA Board of Directors

Numerous leadership positions within industry organizations

Attractive economic

backdrop

The U.S. has become a global powerhouse in natural gas production

Natural gas enjoys a significant structural cost advantage to other fuel sources

3

Overview of RGC Resources and Roanoke Gas

Business description

Local distribution company (LDC) located in Roanoke, VA,

founded in 1883, that transports natural gas to residential

and commercial/industrial end users

Publically listed on Nasdaq in 1994

98% earnings from Roanoke Gas – regulated natural gas

utility

60,000 customers in Virginia

‒ 55% industrial/commercial by volume

‒ 45% residential

130 active employees – 74% non-union

RGC Midstream – Est. $35 million investment in Mountain

Valley Pipeline – FERC regulated interstate pipeline

Public market overview

Organizational chart & trading statistics Service territory

Sources: Company filings as of 9/30/2016. Bloomberg market data as of 12/8/16

Share price (as of 12/8/16) $24.55

Diluted shares outstanding 4.8

Market cap $119

Plus: debt 48

Less: cash (1)

Enterprise value $167

% of 52-week high 94%

% off 52-week low 19%

Trading multiples

Price / 2017E EPS 19.4x

Price / 2018E EPS 17.8x

Current dividend yield 3.5%

Credit metrics

Total debt / 2017E EBITDA 2.7x

Total debt / book cap 46.5%

Total liquidity (cash and avail. RLOC) $9

Current service territory

Future expansion

opportunity

RGC

Resources, Inc.

Roanoke Gas

Company

RGC Midstream,

LLC

Shares out (mm) 4.8

% insider owned 8.4%

Float (mm) 4.4

% short interest 0.01%

Residential

21%

Commercial

14%

Industrial

31%

Electricity

Generation

34%

4

Natural gas is an increasingly attractive fuel source

At

tr

a

c

ti

v

e

e

c

o

n

o

m

ic

b

a

c

k

dro

p

At

tr

a

c

ti

v

e

e

c

o

n

o

m

ic

b

a

c

k

dro

p

After years of decline, new reserve discoveries and

technological advances have made the U.S. a global

powerhouse in natural gas production

Natural gas enjoys a significant structural cost advantage

to other fuel sources, made durable by more than 100

years of proved reserves in North America

369 Trillion cubic feet (Tcf) of proved natural gas

reserves in the U.S.; over 2,500 Tcf estimated total

potential recoverable reserves

30 Tcf current annual natural gas production/supply

in the U.S. compares favorably with current

consumption of 26.7 Tcf

Households that use natural gas for heating, cooking, and

clothes drying spend an average of $840 less per year

than homes using electricity for those applications

...Demand for the fuel source continues to grow

Natural Gas Usage by Segment

As the supply of cheaper natural gas has expanded...

Natural gas becomes

primary fuel source

Source: American Gas Association 2016 Playbook

62,000

67,000

72,000

77,000

82,000

87,000

92,000

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

2008 2009 2010 2011 2012 2013 2014 2015 2016

N

at

u

ra

l ga

s

p

ro

d

u

cti

o

n

(M

m

cf

/d

)

N

at

u

ra

l ga

s

p

ric

e ($/M

m

b

tu

)

Henry Hub gas price

Daily production

0%

10%

20%

30%

40%

50%

60%

2008 2009 2010 2011 2012 2013 2014 2015 2016

%

o

f

U

.S.

E

le

ctricit

y

Pr

o

d

u

cti

o

n

Coal Natural Gas

5

Utility cost recovery and return on rate base

St

a

b

le

b

u

s

in

e

s

s

m

o

d

e

l

Utility base rates recover operating costs and investment in fixed assets, allowing the utility to earn a reasonable rate of return

on equity

Infrastructure riders – Steps to Advance Virginia’s Energy (SAVE)

A mechanism to recover investments in infrastructure replacement based on future expenditures

Trued-up and modified annually to adjust for over/under recovery

Approved through 2021

System expansion - Available

Weather normalization adjustment factor (WNA)

Gas volumes adjusted to 30-year normal; removes firm margin volatility associated with weather

Purchased gas adjustment factor (PGA)

Commodity is a pass-through, VA allows quarterly true-up

$17.9

$20.3

$18.7 $18.0 $18.4

$16.9

$0

$5

$10

$15

$20

$25

2016A 2017E 2018E 2019E 2020E 2021E

$ mill

io

n

s

Utility Maintenance Customer Growth

SAVE Rider & Station Replacement Advanced Metering

6

Stable regulation environment for gas utility segment

Established, productive relationships with VA SCC

9.75% authorized ROE

No cast iron or bare steel pipe

Advanced meter reading

Roanoke Gas capital expenditure plan

Forecast period (FYE)

Advanced Metering $6.2 7%

SAVE Rider & Station Replacement $44.6 48%

Customer Growth $24.4 26%

Utility Maintenance $17.2 19%

Total $92.4 100%

Forecast totals through 2021

St

a

b

le

b

u

s

in

e

s

s

m

o

d

e

l

Infrastructure Replacement Rider - SAVE

Approved through 2021

First Generation Plastic: $35mm

3 interconnect stations: $3mm

Coated steel tubing: $6mm

7

RGC’s service area is enjoying an uptick in economic growth

Focus on innovation: Virginia Tech and Carilion to build research hub in Roanoke

The Roanoke Times – 3.19.16

Eldor Corp. picks Botetourt as a new site for business

The Roanoke Times – 3.15.16

UPS announces plans to deploy new CNG vehicles in 15 cities,

including Roanoke, VA

UPS Pressroom – 4.1.15

Ballast Point closes on Greenfield building for its East

Coast brewery The Roanoke Times – 9.9.16

Deschutes to open brewery in Roanoke

The Roanoke Times – 3.22.16

At

tr

a

c

ti

v

e

e

c

o

n

o

m

ic

b

a

c

k

dro

p

Home to over 300,000 people and an economic hub for more than one

million people throughout western Virginia

Ranked in the Top 100 Best Places for Business and Careers and Top 15

Most Affordable Places for Doing Business by Forbes.com

High concentration of higher education institutions, with 25 colleges and

universities within a 60-mile radius

More than 70 trucking lines serve the Roanoke Region with local, state,

and interstate freight service, considered a foreign trade zone

8

Mountain Valley Pipeline (MVP) – project overview & timeline

RGCO is a 1% owner of the $3.5bn MVP

300 miles of 42” underground natural gas open-access pipeline

spanning from northwestern West Virginia to southern Virginia

MVP expected to provide up to two billion cubic feet (Bcf) of natural

gas per day of transmission capacity to New York, Mid- and South

Atlantic markets

MVP has secured firm commitments for the full capacity of the

project under 20-year contracts

Milestone Estimated completion

Final EIS March 2017

FERC approval Summer 2017

Construction begins Fall 2017

Targeted in-service date End 2018

Project partners (% ownership)

MVP overview

G

ro

w

th

p

o

te

n

ti

a

l

45.5%

BBB-

10%

A+

12.5%

A-

1%

31%

A-

$18 $20 $19 $18 $18 $17

$2 $5

$25

$4

$19 $25 $44 $22 $18 $17

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

2016A 2017E 2018E 2019E 2020E 2021E

($

m

m

)

Roanoke Gas CapEx

Mountain Valley Pipeline

9

MVP – benefits to Roanoke Gas

Provide a third source of gas with 2 interconnects

Provide additional capacity to meet future demands

Increase capital spending in 2017 through 2019

Provide expansion opportunities into Franklin County

Potential to add 1,500 new customers

Rate base growth of $10 million

Natural gas is 30% - 50% cheaper than propane and fuel oil

MVP will: Franklin County Expansion

Total

Estimated $4.8mm annual EBITDA contribution

G

ro

w

th

p

o

te

n

ti

a

l

FYE

$0.91

$1.00

$1.08

$1.22

$0.72 $0.74

$0.77

$0.81

$0.50

$0.60

$0.70

$0.80

$0.90

$1.00

$1.10

$1.20

$1.30

$1.40

2013 2014 2015 2016

Dividends/Share

21.4x

19.9x

18.7x

20.6x

0.0x

5.0x

10.0x

15.0x

20.0x

25.0x

2013 2014 2015 2016Current

10

Financial highlights

EPS Trailing P/E

ROE Net plant growth

20.2x 4yr avg

8.5%

9.3%

9.7%

10.7%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

2013 2014 2015 2016

Source: Bloomberg data as of FY ended 9/30/16 F

in

a

n

c

ia

l

pro

fi

le

Note: Annual P/E ratio is point in time, as of FYE 9/30. Current as of 12/8/2016 $8,684

$9,977

$14,715

$13,780

$17,946

$-

$5,000

$10,000

$15,000

$20,000

2012 2013 2014 2015 2016

3.54%

3.21% 3.05% 2.86%

2.52%

1.79%

0.00%

1.00%

2.00%

3.00%

4.00%

RGCO SJI DGAS NJR WGL CPK

11

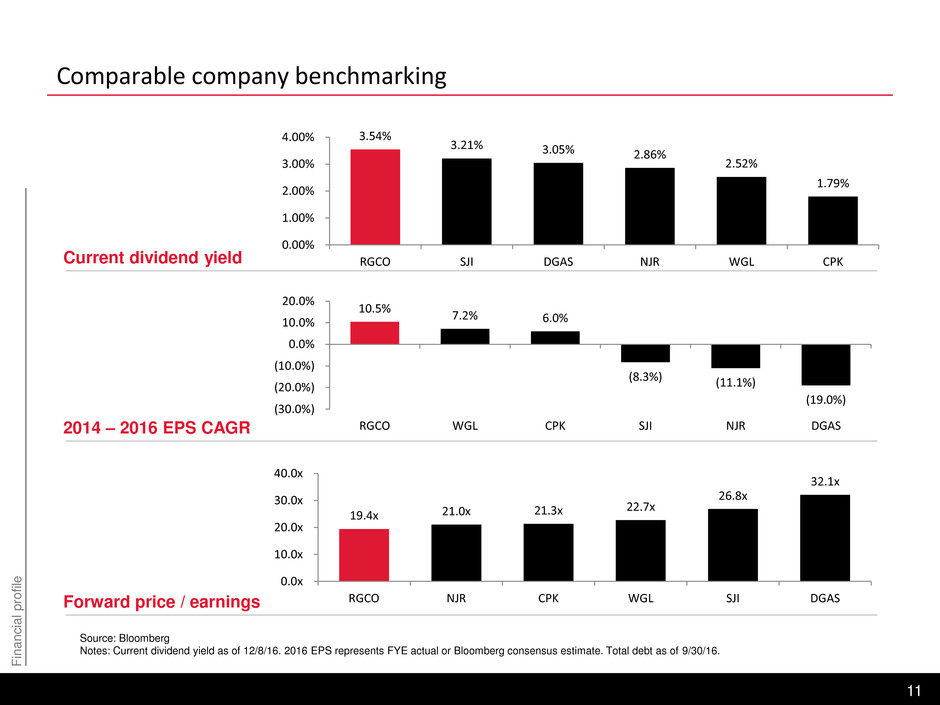

Comparable company benchmarking

F

in

a

n

c

ia

l

pro

fi

le

Current dividend yield

Source: Bloomberg

Notes: Current dividend yield as of 12/8/16. 2016 EPS represents FYE actual or Bloomberg consensus estimate. Total debt as of 9/30/16.

2014 – 2016 EPS CAGR

Forward price / earnings

19.4x 21.0x 21.3x

22.7x

26.8x

32.1x

0.0x

10.0x

20.0x

30.0x

40.0x

RGCO NJR CPK WGL SJI DGAS

10.5%

7.2% 6.0%

(8.3%) (11.1%)

(19.0%)

(30.0%)

(20.0%)

(10.0%)

0.0%

10.0%

20.0%

RGCO WGL CPK SJI NJR DGAS

12

Comparable company benchmarking

F

in

a

n

c

ia

l

pro

fi

le

Total debt / 2016 EBITDA

Source: Company filings as of 9/30/16. RGCO maturity profile reflects the $7 million term loan closed on November 1, 2016, due in 2021, and related revolver reduction.

Debt / book capital

RGCO maturity profile

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

$

0

0

0

2.2x

2.6x 2.9x

3.8x

4.4x 4.6x

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

DGAS CPK RGCO WGL SJI NJR

40.6% 41.5% 46.5%

50.4% 51.6% 55.9%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

DGAS CPK RGCO SJI NJR WGL

$0.45

$0.50

$0.55

$0.60

$0.65

$0.70

$0.75

$0.80

$0.85

$0.90

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

$20.00

$22.00

$24.00

$26.00

Divi

de

nd

s p

er

sh

ar

e (

$)

Sh

ar

e p

rice

($

)

Share price Dividends/share

13

RGC Resources has delivered significant shareholder value

D

e

m

o

n

s

tr

at

e

d

t

ra

c

k

r

e

c

or

d

Source: Bloomberg data as of 12/8/2016

Notes: Total returns include total dividends paid over the time period

RGCO Total returns

6mo 6%

1yr 21%

3yr 46%

5yr 70%

10yr 195%

11/28/16: RGCO

announced 7.4%

dividend increase

14