Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE STREET CORP | form8-kgoldmansachspresent.htm |

1

Digital Transformation Through

Technology Driven Innovation

Goldman Sachs U.S. Financial Services Conference

Antoine Shagoury

Executive Vice President and Global Chief Information Officer

Wednesday, December 7, 2016

Exhibit 99.1

2

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of United States securities laws, including statements about our goals and expectations regarding our business, financial and capital condition, results of operations, strategies, the

financial and market outlook, dividend and stock purchase programs, governmental and regulatory initiatives and developments, and the business environment. Forward-looking statements are often, but not always, identified by such forward-looking

terminology as “vision,” “outlook,” “expect,” "priority," “objective,” “intend,” “plan,” “forecast,” “believe,” “anticipate,” “estimate,” “seek,” “may,” “will,” “trend,” “target,” “strategy” and “goal,” or similar statements or variations of such terms. These statements are no t

guarantees of future performance, are inherently uncertain, are based on current assumptions that are difficult to predict and involve a number of risks and uncertainties. Therefore, actual outcomes and results may differ materially from what is expressed in

those statements, and those statements should not be relied upon as representing our expectations or beliefs as of any date subsequent to December 7, 2016.

Important factors that may affect future results and outcomes include, but are not limited to: the financial strength and continuing viability of the counterparties with which we or our clients do business and to which we have investment, credit or financial

exposure, including, for example, the direct and indirect effects on counterparties of the sovereign-debt risks in the U.S., Europe and other regions; increases in the volatility of, or declines in the level of, our net interest revenue, changes in the composition or

valuation of the assets recorded in our consolidated statement of condition (and our ability to measure the fair value of investment securities) and the possibility that we may change the manner in which we fund those assets; the liquidity of the U.S. and

international securities markets, particularly the markets for fixed-income securities and inter-bank credits, and the liquidity requirements of our clients; the level and volatility of interest rates, the valuation of the U.S. dollar relative to other currencies in which we

record revenue or accrue expenses and the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; the credit quality, credit-agency ratings and fair values of the securities in our investment securities portfolio, a

deterioration or downgrade of which could lead to other-than-temporary impairment of the respective securities and the recognition of an impairment loss in our consolidated statement of income; our ability to attract deposits and other low-cost, short-term

funding, our ability to manage levels of such deposits and the relative portion of our deposits that are determined to be operational under regulatory guidelines and our ability to deploy deposits in a profitable manner consistent with our liquidity requirements and

risk profile; the manner and timing with which the Federal Reserve and other U.S. and foreign regulators implement changes to the regulatory framework applicable to our operations, including implementation of the Dodd-Frank Act, the Basel III final rule and

European legislation (such as the Alternative Investment Fund Managers Directive, Undertakings for Collective Investment in Transferable Securities Directives and Markets in Financial Instruments Directive II); among other consequences, these regulatory

changes impact the levels of regulatory capital we must maintain, acceptable levels of credit exposure to third parties, margin requirements applicable to derivatives, and restrictions on banking and financial activities. In addition, our regulatory posture and

related expenses have been and will continue to be affected by changes in regulatory expectations for global systemically important financial institutions applicable to, among other things, risk management, liquidity and capital planning, resolution planning and

compliance programs, and changes in governmental enforcement approaches to perceived failures to comply with regulatory or legal obligat ions; we may not successfully implement our plans to address the deficiencies jointly identified by the Federal Reserve

and the FDIC in April 2016 with respect to our 2015 resolution plan, or those plans may not be considered to be sufficient by the Federal Reserve and the FDIC, due to a number of factors, including, but not limited to challenges we may experience in

interpreting and addressing regulatory expectations, failure to implement remediation in a timely manner, the complexities of development of a comprehensive plan to resolve a global custodial bank and related costs and dependencies. If we fail to meet

regulatory expectations to the satisfaction of the Federal Reserve and the FDIC in our resolution plan submission filed on October 1, 2016 or in any future submission, we could be subject to more stringent capital, leverage or liquidity requirements, or

restrictions on our growth, activities or operations; adverse changes in the regulatory ratios that we are required or will be required to meet, whether arising under the Dodd-Frank Act or the Basel III final rule, or due to changes in regulatory positions, practices

or regulations in jurisdictions in which we engage in banking activities, including changes in internal or external data, formulae, models, assumptions or other advanced systems used in the calculation of our capital ratios that cause changes in those ratios as

they are measured from period to period; increasing requirements to obtain the prior approval of the Federal Reserve or our other U.S. and non-U.S. regulators for the use, allocation or distribution of our capital or other specific capital actions or programs,

including acquisitions, dividends and stock purchases, without which our growth plans, distributions to shareholders, share repurchase programs or other capital initiatives may be restricted; changes in law or regulation, or the enforcement of law or regulation,

that may adversely affect our business activities or those of our clients or our counterparties, and the products or services that we sell, including additional or increased taxes or assessments thereon, capital adequacy requirements, margin requirements and

changes that expose us to risks related to the adequacy of our controls or compliance programs; economic or financial market disruptions in the U.S. or internationally, including that which may result from recessions or political instability, for example, the

decision by the U.K.'s referendum to exit from the European Union may continue to disrupt financial markets or economic growth in Europe; our ability to develop and execute State Street Beacon, our multi-year transformation program to digitize our business to

deliver significant value and innovation for our clients and lower expenses across the organization, any failure of which, in whole or in part, may among other things, reduce our competitive position, diminish the cost-effectiveness of our systems and processes

or provide an insufficient return on our associated investment; our ability to promote a strong culture of risk management, operating controls, compliance oversight and governance that meet our expectations and those of our clients and our regulators; the

results of our review of our billing practices, including additional amounts we may be required to reimburse clients, as well as potential consequences of such review, including damage to our client relationships and adverse actions by governmental authorities;

the results of, and costs associated with, governmental or regulatory inquiries and investigations, litigation and similar claims, disputes, or civil or criminal proceedings; the potential for losses arising from our investments in sponsored investment funds; the

possibility that our clients will incur substantial losses in investment pools for which we act as agent, and the possibility of significant reductions in the liquidity or valuation of assets underlying those pools; our ability to anticipate and manage the level and timing

of redemptions and withdrawals from our collateral pools and other collective investment products; the credit agency ratings of our debt and depositary obligations and investor and client perceptions of our financial strength; adverse publicity, whether specific to

State Street or regarding other industry participants or industry-wide factors, or other reputational harm; our ability to control operational risks, data security breach risks and outsourcing risks, our ability to protect our intellectual property rights, the possibility of

errors in the quantitative models we use to manage our business and the possibility that our controls will prove insufficient, fail or be circumvented; our ability to expand our use of technology to enhance the efficiency, accuracy and reliability of our operations

and our dependencies on information technology and our ability to control related risks, including cyber-crime and other threats to our information technology infrastructure and systems including those of our third-party service providers and their effective

operation both independently and with external systems, and complexities and costs of protecting the security of such systems and data; our ability to grow revenue, manage expenses, attract and retain highly skilled people and raise the capital necessary to

achieve our business goals and comply with regulatory requirements and expectations; changes or potential changes to the competitive environment, including changes due to regulatory and technological changes, the effects of industry consolidation and

perceptions of State Street as a suitable service provider or counterparty; changes or potential changes in the amount of compensation we receive from clients for our services, and the mix of services provided by us that clients choose; our ability to complete

acquisitions, joint ventures and divestitures, including the ability to obtain regulatory approvals, the ability to arrange f inancing as required and the ability to satisfy closing conditions; the risks that our acquired businesses and joint ventures wi ll not achieve their

anticipated financial and operational benefits or will not be integrated successfully, or that the integration will take longer than anticipated, that expected synergies will not be achieved or unexpected negative synergies or liabilities will be experienced, that client

and deposit retention goals will not be met, that other regulatory or operational challenges will be experienced, and that disruptions from the transaction will harm our relationships with our clients, our employees or regulators; our ability to recognize emerging

needs of our clients and to develop products that are responsive to such trends and profitable to us, the performance of and demand for the products and services we offer, and the potential for new products and services to impose additional costs on us and

expose us to increased operational risk; changes in accounting standards and practices; and changes in tax legislation and in the interpretation of existing tax laws by U.S. and non-U.S. tax authorities that affect the amount of taxes due.

Other important factors that could cause actual results to differ materially from those indicated by any forward-looking statements are set forth in our 2015 Annual Report on Form 10-K and our subsequent SEC filings. We encourage investors to read these

filings, particularly the sections on risk factors, for additional information with respect to any forward-looking statements and prior to making any investment decision. The forward-looking statements contained in this presentation speak only as of the date hereof,

December 7, 2016, and we do not undertake efforts to revise those forward-looking statements to reflect events after that date.

3

Delivering new perspective and

insight into risk management

and investment strategy

Developing investment

strategies aligned with clients’

desired outcomes

Creating access to alpha,

insights, liquidity and financing

Maintaining the inventory of

client capital and dividends /

interest owing products

We have a strong global franchise

• Assets under custody and administration of approximately $29.2 trillion as of

September 30, 2016

• One of the world’s leading investment service providers

• Fund accounting and administration, custody, investment operations outsourcing,

recordkeeping, performance and analytics, and transfer agency services

• Delivering investment research, foreign exchange trading and securities lending

• Providing liquidity across 36 international markets, with approximately $3.23 trillion in

lendable assets as of September 30, 2016

• $23.5 trillion in foreign exchange and interbank volume traded in 2015

• Proven experience, with approximately $2.4 trillion in assets under management* as of

September 30, 2016

• Access to a wide range of investment strategies across the risk/return spectrum

• With approximately $478 billion* in global ETF assets under management, we have one of

the broadest ranges of ETFs in the industry

• Integrated solutions across the lifecycle of trades

• Aligning research and advisory, portfolio performance and risk analytics, information and

data management to deliver innovation

• Customized and flexible multi-asset class products and services

*This AUM includes the assets of the SPDR® Gold ETF (approximately $40.3 billion as of September 30, 2016), for

which State Street Global Markets, LLC, an affiliate of State Street Global Advisors, serves as the distribution agent.

4

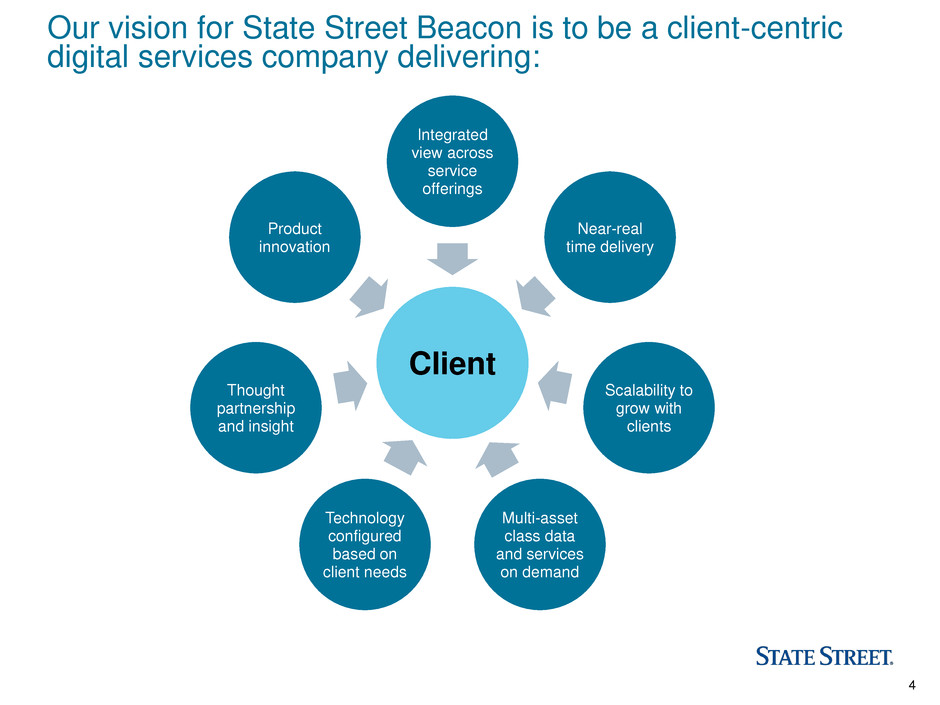

Client

Integrated

view across

service

offerings

Near-real

time delivery

Scalability to

grow with

clients

Multi-asset

class data

and services

on demand

Technology

configured

based on

client needs

Thought

partnership

and insight

Product

innovation

Our vision for State Street Beacon is to be a client-centric

digital services company delivering:

5

To achieve our vision we are undertaking a digital

transformation with a client focus

Client-Centric Digitized Platform

Client Value / Client Experience

Future End State

Focus of State Street Beacon:

Transformational Change

Optimized COE(2)-

based Operating

Model

Current TDE(1)

Program

Fully Digitized

Platform

Integrated Client

Technology

Collaborative

Integrated Client

Technology and

Processes

Pro

c

e

s

s

D

igi

ti

z

a

tio

n

• Rapid and continuous innovation

which adds value across all client

groups

• Products and services in our

clients’ context

• Transparent and validated

control, in all jurisdictions

• “End-to-end” process automation

• “Open Architecture” for ease of

cooperative processing

• Co-creation with clients

Initiated State

Street Beacon

1 TDE stands for “The Digital Enterprise”.

2 COE stands for “Centers of Excellence”.

6

Initiatives designed to drive ongoing value to key

stakeholders

Initiatives Value to State Street Value to Clients

Digitization

of Services

and Solutions

Reduced cost, less labor needed to:

• Process work: from trade capture

to reporting

• Maintain platforms

• Support inquiries: internal and

external, info available on demand,

near real-time

Near real-time data enabling:

• Dynamic analytics and insight

• Process transparency for faster

decision making

• Enhanced risk management for

oversight and control

Next

Generation

of Platforms

Reduced cost, less maintenance

and infrastructure:

• Simplified platform structure:

minimizing complexity

• Capacity: available on demand

• Provides best available technology

Supports client growth and improves

risk management:

• Automated scaling

• Strengthened resiliency

• Best-in-class security

• Greater speed

Themes

• Integrated Infrastructure

• Intelligent Data

• Cloud Scale

• Strong Security

7

State Street Beacon is a technology journey

Enable us and our clients to work more

efficiently and effectively through improved

speed, transparency, and user experience

Deliver an information-edge to transform our

operating model and drive growth for us and

our clients

Near term:

Enhancements to existing

products and solutions

Built on common components

Longer term:

End-to-end transformational

delivery of services

Bringing together the common components

• Quicker data and information: improved

straight through processing and speed

• New data and information: aggregated in one

place for easier use and greater transparency

• Focus on what matters: with alerts and

exception-based processing

• Improved interface: easier to use with new

functionality

• Move towards near-real time updates: increased

transparency to process and data

• Enhanced integration across State Street

services: providing a consistent view across key

solutions

• Enhanced data solutions delivering dynamic and

impactful insights

8

State Street Beacon is already delivering improved

operational and systems performance

Digitization of data,

applications, and services

Client centric design and

execution

Next generation of platforms

• Percentage of service digitized

• Processing cost reduction

• Systems integrations: number of Day 1

defects / reconciliations

• Digitization of processes: number of funds per

FTE

• Number of products enabled

• Number of clients impacted and engaged

• Reduction in cycle time

• Mainframe usage reduction

• Number of cloud-based applications

Initiatives Metrics

9

Challenges and Solutions

Capitalizing on market opportunities to fuel growth with

innovation

Increased

Complexity

with

Regulatory and

Market

Changes

Data Revolution

Client

Challenges

• Data proliferation and analytics providing new insights, but at a

cost

• Distribution effectiveness demands new data solutions

• Data monetization opportunities multiplying, creating revenues

for some and new costs for others

Solutions • State Street Media Stats - Quantitative investment insights

derived from digital media consumer data sets

• Capabilities to help clients meet evolving needs, such as around

U.S. Money Market Reform, Liquidity Stress Testing and other

recent regulatory initiatives

Drivers

Client

Challenges

• Increasing complexity and intensity from multiple regulators as

well changing market dynamics

• Rising costs and greater fee transparency

• Increasing trading and liquidity challenges and requirements

• Managing risk

Solutions • SEC Modernization Solution

• Net Asset Value (NAV) Oversight

• Enhanced Asset Owner Strategy

• Enterprise Pricing Web

• Fund Insights

• TruView

• DataGX

10

Innovation is at our core

A portfolio approach to managing

emerging and disruptive technologies

• Undertake multiple projects concurrently to diversify risk

• There is no one single technology that can define the future

Design-thinking as a way of creative idea

generation and prototype implementation

• Apply analysis then synthesis when evaluating trends

• Start with divergent thinking before converging ideas

Willingness to take action and

experiment without all the information

• Avoid “paralysis by analysis” by taking quick actions

Embracing “not created here” ideas and

encourage “outside-in” thinking

• Ideas are generated everywhere and we must be willing to try

competitive ideas (e.g., Blockchain and Distributed Ledger

Technology)

Acceptance of failure • Must be willing to take calculated risks when evaluating disruptive

trends

• Resiliency is key with this type of work

Emerging Technologies Center Business and IT Teams

Identify Explore Prototype Pilot Scale

11

Innovation at State Street: Target outcomes of the Emerging

Technologies Center

Enhanced

Thought

Leadership

position

through

industry

engagements

Increased

Awareness

of emerging

technologies

and their

impact

Hands-on

Experience

of emerging

technologies

through

prototypes,

proofs of

concept and

pilots

Accelerated

Adoption

of emerging

technologies

by business

units and

support

groups

Monetizing

Opportunities

through new

service

offerings and

generating cost

saving through

efficiency gains

12

Innovation at State Street: Industry Engagement on

Disruptive Technologies

State Street has FinTech relationships in seven global hubs

Dublin, Cork & London

• Start-up mentoring at Level39 and for 3D FinTech Challenge

• Member of Innovate Finance

• Collaboration with Accenture in Dublin accelerator

• 2 research partnerships: University College Cork and CeADAR

Boston & New York

• Founding members of R3 and Hyperledger block chain

consortia

• Prototyping efforts with several block chain technology

providers

• Board member at FinTech Sandbox

• Investments in and collaborations with

several FinTech start-ups

San Francisco Bay area

• Research consortium with

Stanford and UC Berkeley

• Research connection to further

explore machine learning

• Active engagement with VC

community

Hangzhou

• Collaborations with

Alibaba and Ant

• Partnership with

Zhejiang University

13

Innovation at State Street is part of our fabric

• Innovation is essential to our future

• State Street Beacon transformation underway to transform our core businesses

and corporate functions

• Actively testing emerging technologies, assessing their ability to transform our

business, and engaging with the FinTech community to drive toward a more

open technology architecture and business model

• Expect to deliver new processes and product introductions over the coming

years

14

Digital Transformation Through

Technology Driven Innovation

Goldman Sachs U.S. Financial Services Conference

Antoine Shagoury

Executive Vice President and Global Chief Information Officer

Wednesday, December 7, 2016

Questions

and

Answers