Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TARONIS TECHNOLOGIES, INC. | v454596_8k.htm |

Exhibit 99.1

MagneGas Corporation Investor Presentation - December 2016 Scott Mahoney, CFO Luisa Ingargiola, EVP Capital Markets NASDAQ:MNGA

Safe Harbor NASDAQ:MNGA 2 This presentation may contain “forward - looking statements” that are made pursuant to the “safe harbor” provisions as defined within the Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by words including “anticipates,” “believes,” “intends,” “estimates,” and similar expressions. These statements are based upon management’s current expectations as of the date of this presentation. Such forward - looking statements may include statements regarding the Company’s future financial performance or results of operations, including expected revenue growth, cash flow growth, future expenses and other future or expected performances. The Company cautions readers there may be events in the future that the Company is not able to accurately predict or control and the information contained in the forward - looking statements is inherently uncertain and subject to a number of risks that could cause actual results to differ materially from those indicated in the forward - looking statements. Further information on these and other potential factors that could affect the Company’s financial results is included in the Company’s filings with the SEC under the “Risk Factors” sections and elsewhere in those filings.

Investment Highlights x Only submerged, plasma arc gasification system; protected by numerous patents x Hottest flame temperature of any gas (10,500 F); independently verified by the City College of New York x Disruptive applications across numerous verticals including welding, agriculture, and energy markets x Organically growing Fortune 500 customer base supported by accretive acquisition strategy x Ability to rapidly scale and improve margins leveraging fixed overhead x Emphasis on transition to EBITDA positive business model in 2017 through organic and acquired revenue growth x Solid balance sheet with over $4M cash and clean capital structure NASDAQ:MNGA 3

Corporate Growth Strategy ▪ Organic growth of MagneGas core technology in welding applications, co - combustion, and sterilization ▪ Partnering to accelerate technology validation and commercialization ▪ Expansion through acquisitions: – Acquisitions that accelerate commercialization of existing technologies, i.e. expand geographic footprint, new distribution channels, synergistic customers, etc. – Acquisitions that expand the technology portfolio within core areas of expertise and leverage existing distribution channels – Pipeline of accretive acquisition opportunities at attractive multiples NASDAQ:MNGA 4 Strategy in place to accelerate timeline to achieve positive EBITDA and cash flow

MagneGas™ Technology NASDAQ:MNGA 5 *Certain liquids require dilution or further testing *

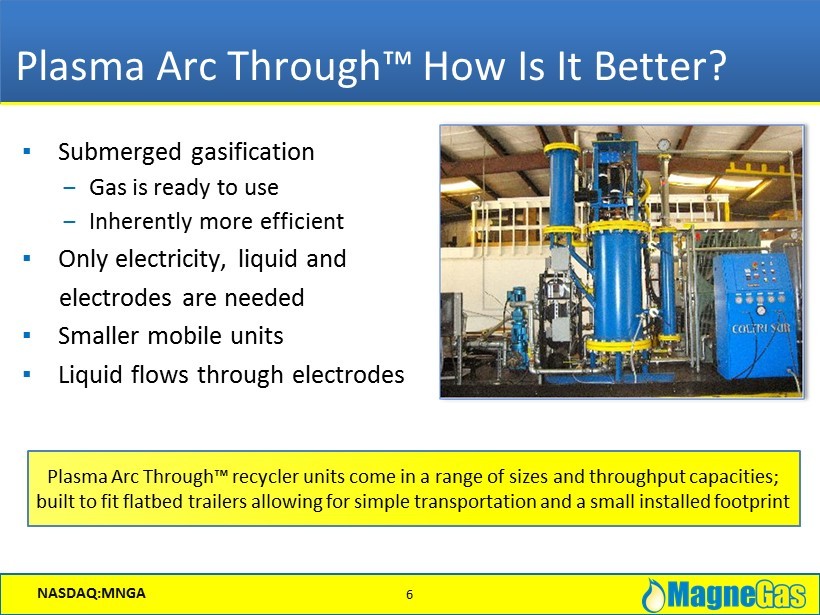

Plasma Arc Through™ How Is It Better? ▪ Submerged gasification ‒ Gas is ready to use ‒ Inherently more efficient ▪ Only electricity, liquid and electrodes are needed ▪ Smaller mobile units ▪ Liquid flows through electrodes NASDAQ:MNGA 6 Plasma Arc Through™ recycler units come in a range of sizes and throughput capacities; built to fit flatbed trailers allowing for simple transportation and a small installed footprint

Three Targeted Industries NASDAQ:MNGA 7 Value Proposition Market Segments MagneGas sterilizes quickly and efficiently using Plasma Arc Through™ technology MagneGas has many benefits over existing fuels and a safer production process to replace acetylene Waste Water Treatment Industrial Gas The high flame temperature of MagneGas burns existing fuels cleaner through co - combustion* Electric Utilities and Co - Combustion * Results based on internal testing, independent verification underway

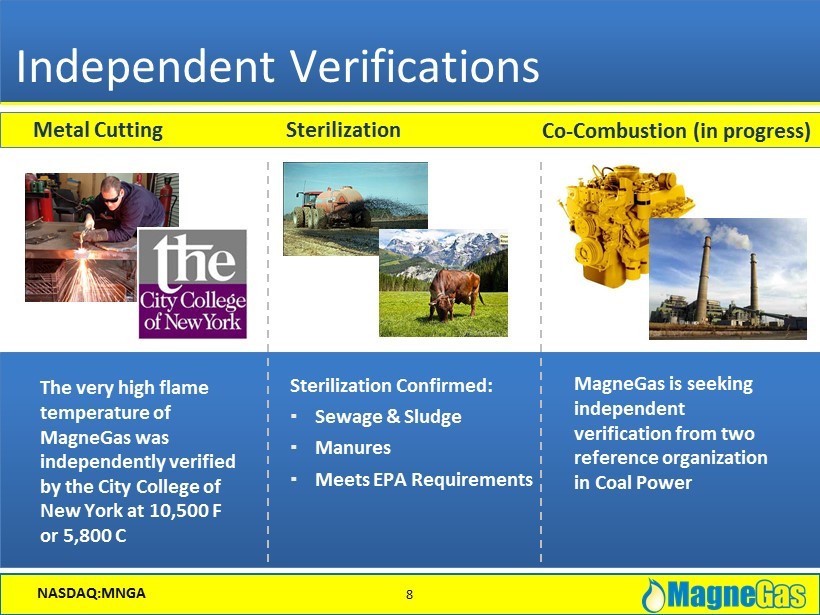

Independent Verifications NASDAQ:MNGA 8 Sterilization Confirmed: ▪ Sewage & Sludge ▪ Manures ▪ Meets EPA Requirements Metal Cutting Sterilization The very high flame temperature of MagneGas was independently verified by the City College of New York at 10,500 F or 5,800 C Co - Combustion (in progress) MagneGas is seeking independent verification from two reference organization in Coal Power

Industrial Gas ▪ Can be used for metal cutting, cooking, heating, or powering natural gas bi - fuel automobiles ▪ Interchangeable with natural gas or can be co - combusted with existing hydrocarbon fuels ▪ Cost competitive /clean burning fuel ▪ Lowest green house gas emissions when compared to fossil fuel ▪ Rises and escapes into the atmosphere, unlike acetylene, which pools on the ground creating major explosion risk NASDAQ:MNGA 9 MagneGas has many benefits over existing fuels and a safer production process to replace acetylene Industrial Gas Value Proposition Market Segment

Industrial Gas: MagneGas2® ▪ It’s Less Expensive – Acetylene costs have risen 50 - 60% over the last 5 years ▪ It’s Faster – BTUs directed, not dispersed – target area heats more quickly ▪ It’s Cleaner – Company believes it burns cleaner than competitive industrial gases ▪ Its Hotter – Measured 10,500F / 5,800C degree flame temperature *Company Estimate NASDAQ:MNGA 10 Attribute Acetylene Slag Significant Little to None Top Edge Rollover Significant None Soot Significant Limited Noxious/Harmful Fumes Significant Hazard Minimal (Yields 12% Oxygen) Pooling if Leaked Significant Hazard None (Lighter than Air) Heat Affected Zone Wide Narrow Useable Gas in Cylinder 80% 100% Market Opportunity: $5+ Billion*

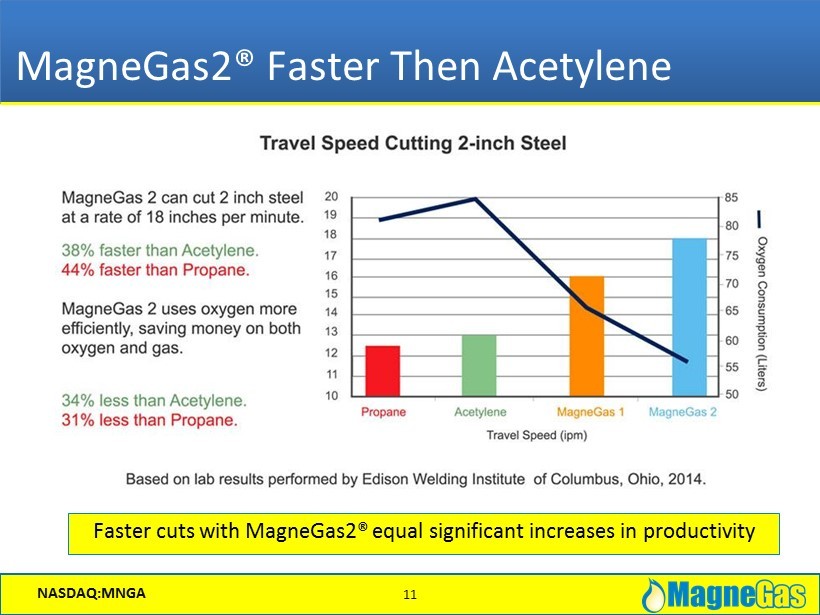

MagneGas2® Faster Then Acetylene Faster cuts with MagneGas2® equal significant increases in productivity NASDAQ:MNGA 11

Gas Distributor Acquisition ▪ Acquired Equipment Sales and Service, Inc. (ESSI) in October 2014 for $3 million in cash ▪ One of the largest independently owned industrial gas distribution companies in Clearwater, Florida ▪ Provides a platform to further MagneGas2® fuel sales and expand its customer product availability ▪ Generated $2.4M revenue in 2015 12

Electric Utilities and Co - Combustion ▪ MagneGas fuel has a very high combustion flame temperature of 10,500 F or 3,800 C ▪ The higher the temperature, the more complete the combustion of the fuel and the cleaner the emissions ▪ Ability to inject MagneGas into any form of fossil fuel as a catalyst to improve combustion* ▪ Independent verification underway from two reference organizations in Coal Power NASDAQ:MNGA 13 The high flame temperature of MagneGas burns existing fuels cleaner through co - combustion Electric Utilities & Co - Combustion Value Proposition Market Segment *Results based on internal testing, independent verification underway

MagneGas™ Co - Combustion NASDAQ:MNGA 14 1. Based on EU Carbon Pricing and internal estimates . Advantages* Value Proposition Financial Upside Waste Emissions Energy Fuel Power Plant ▪ CO 2 is Reduced ▪ Heat is Increased ▪ Nox & CO Reduced ▪ Particulates Almost Eliminated ▪ High flame temperature of MagneGas when utilized in the co - combustion vertical unlocks greater energy creation potential with fewer emission from hydrocarbon fuels ▪ Estimated $4 million of annual revenue per coal fired plant converted to MagneGas 1 ▪ Mgmt. estimates a total market of 547 coal fired power plants in USA alone *Based on internal testing, independent verification underway

Coal Co - Combustion Testing NASDAQ:MNGA 15 Heating Phase Initial Combustion MagneGas Co - Combustion

Acquisition of Coal Co - Combustion Company NASDAQ:MNGA 16 ▪ Recently signed L OI to purchase all of the outstanding stock of a privately held coal combustion environmental technology company ▪ Revenue in excess of $14 million in 2015 and profitable for over 20 years ▪ Services some of the largest utility companies in the United States ▪ Synergies with MagneGas include cross - selling of customers , complementary product offerings and real world combustion expertise with power companies ▪ Transaction is anticipated to close on or about January 31, 2017

Sterilization Business Line ▪ High volume of liquid sterilized in Sterilization mode ▪ Complete elimination of small quantity liquid in Gasification Mode ▪ Space savings over existing methods of treatment ▪ A versatile syngas and sterilized water are the results of the gasification process NASDAQ:MNGA 17 MagneGas’ first business line uses heat from the plasma arc system to gasify or sterilize liquid wastes

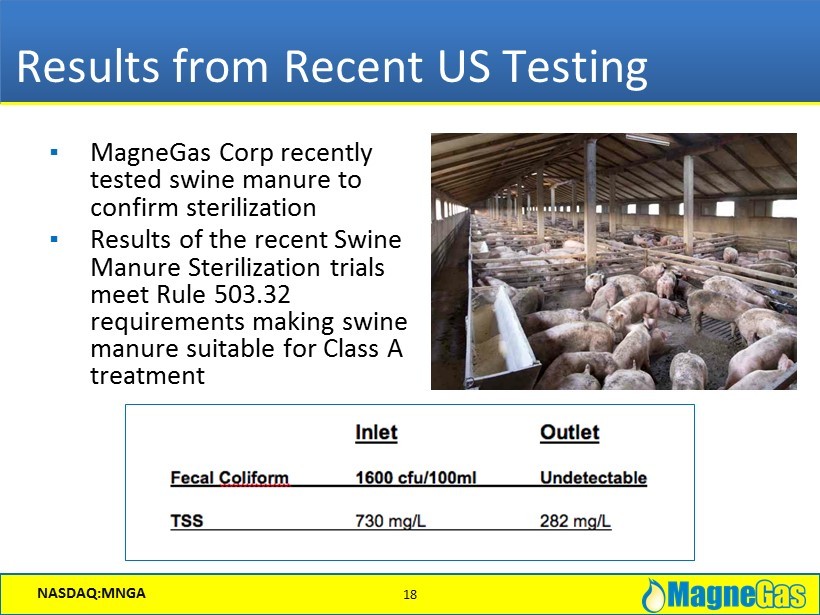

Results from Recent US Testing ▪ MagneGas Corp recently tested swine manure to confirm sterilization ▪ Results of the recent Swine Manure Sterilization trials meet Rule 503.32 requirements making swine manure suitable for Class A treatment NASDAQ:MNGA 18

50 KW Mobile Demo Unit NASDAQ:MNGA 19

Liquid Waste Treatment ▪ Sterilized water is a byproduct of processing water - based liquid waste such as sewage ▪ The Plasma Arc Flow™ process sterilizes bio - contaminants in the liquid, and other conventional downstream equipment is available to remove other contaminants NASDAQ:MNGA 20 The Plasma Arc Flow TM system can be used as a mobile recycler, producing sterilized water from bio - contaminated liquids

NASDAQ:MNGA 21 Acquisition of Coal Co - Combustion Technology Company ▪ LOI signed to purchase all of the outstanding stock of a privately held coal combustion environmental technology company ▪ Revenue in excess of $14 million in 2015 and profitable for over 20 years ▪ Services some of the largest utility companies in the United States ▪ Synergies with MagneGas include cross - selling of customers, complementary product offerings and real world combustion expertise with power companies 21 MagneGas’ Recent Business Highlights Letter of Intent for $2.65 Million Equipment Sale to German Company ▪ A Letter of Intent was signed with a German company to purchase $2.65 million in MagneGas sterilization equipment and fuel ▪ Largest single sale in company history ▪ LOI calls for exclusive distribution rights in Germany, with an option to purchase the rights to other countries as well as future unit purchase requirements and royalties on gas sales. Industrial Gas Sales of MagneGas2® Fuel & Equipment Sale ▪ A Fortune 100 auto manufacturing company selected MagneGas for metal cutting at two factories in U.S. ▪ Leading industrial gas distributor in the Southeast began distributing MagneGas2® fuel for metal cutting as an alternative to acetylene ▪ Thousands of additional fuel cylinders purchased to keep up with increasing demand for MagneGas2® fuel ▪ Completed construction of gasification system for sale to Green Arc Supply from Louisiana

Sequential Revenue Growth NASDAQ:MNGA 22 ($ thousands) Highly scalable business model 0 200 400 600 800 1000 1200 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2'16 Q3'16 Quarterly Revenue Quarterly Revenue

Condensed Balance Sheet NASDAQ:MNGA 23 September 30, December 31, 2016 2015 (Unaudited) (Audited) Assets Cash and cash equivalents $ 1,182,456 $ 5,319,869 Total Current Assets 4,332,817 8,375,320 Total Assets $ 13,850,610 $ 17,760,821 Liabilities Total Current Liabilities 5,899,405 2,592,381 Total Liabilities $ 6,497,054 $ 3,144,558 Total Stockholders' Equity $ 7, 353,556 $ 14,616,263 Raised an additional $3 million in mid November 2016

Accretive Acquisition Strategy ▪ Ability to acquire “mom and pop” industrial gas distributors with an established customer base – Owners currently have limited options for exit strategy – Rapidly introduce MagneGas2 through existing distribution channels in addition to existing products and services – Targeting acquisitions in select regional markets to expand national footprint ▪ Also seeking profitable companies with complementary technologies ▪ Emphasis on accretive/cash flow positive companies ▪ Targeting acquisition multiples of 3 - 5x EBITDA ▪ Ability to significantly reduce facility & back office expenses/overhead ▪ Robust pipeline of target companies with several under LOI NASDAQ:MNGA 24

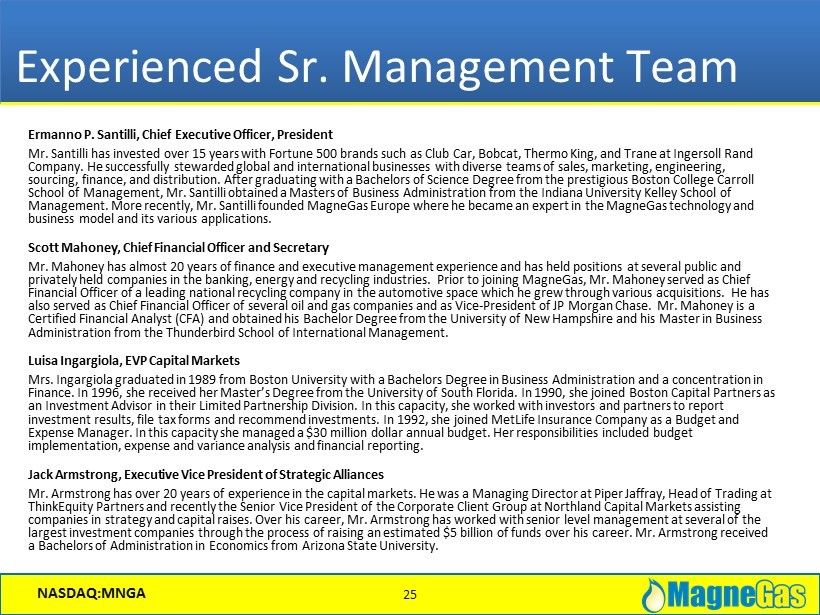

Experienced Sr. Management Team Ermanno P. Santilli, Chief Executive Officer, President Mr. Santilli has invested over 15 years with Fortune 500 brands such as Club Car, Bobcat, Thermo King, and Trane at Ingersoll Ra nd Company. He successfully stewarded global and international businesses with diverse teams of sales, marketing, engineering, sourcing, finance, and distribution. After graduating with a Bachelors of Science Degree from the prestigious Boston College Car roll School of Management, Mr. Santilli obtained a Masters of Business Administration from the Indiana University Kelley School of Management. More recently, Mr. Santilli founded MagneGas Europe where he became an expert in the MagneGas technology and business model and its various applications. Scott Mahoney, Chief Financial Officer and Secretary Mr. Mahoney has almost 20 years of finance and executive management experience and has held positions at several public and privately held companies in the banking, energy and recycling industries. Prior to joining MagneGas, Mr. Mahoney served as C hie f Financial Officer of a leading national recycling company in the automotive space which he grew through various acquisitions. H e has also served as Chief Financial Officer of several oil and gas companies and as Vice - President of JP Morgan Chase. Mr. Mahoney i s a Certified Financial Analyst (CFA) and obtained his Bachelor Degree from the University of New Hampshire and his Master in Bus ine ss Administration from the Thunderbird School of International Management. Luisa Ingargiola, EVP Capital Markets Mrs. Ingargiola graduated in 1989 from Boston University with a Bachelors Degree in Business Administration and a concentrati on in Finance. In 1996, she received her Master’s Degree from the University of South Florida. In 1990, she joined Boston Capital P art ners as an Investment Advisor in their Limited Partnership Division. In this capacity, she worked with investors and partners to repo rt investment results, file tax forms and recommend investments. In 1992, she joined MetLife Insurance Company as a Budget and Expense Manager. In this capacity she managed a $30 million dollar annual budget. Her responsibilities included budget implementation, expense and variance analysis and financial reporting. Jack Armstrong, Executive Vice President of Strategic Alliances Mr. Armstrong has over 20 years of experience in the capital markets. He was a Managing Director at Piper Jaffray, Head of Tr adi ng at ThinkEquity Partners and recently the Senior Vice President of the Corporate Client Group at Northland Capital Markets assist ing companies in strategy and capital raises. Over his career, Mr. Armstrong has worked with senior level management at several o f t he largest investment companies through the process of raising an estimated $5 billion of funds over his career. Mr. Armstrong r ece ived a Bachelors of Administration in Economics from Arizona State University. NASDAQ:MNGA 25

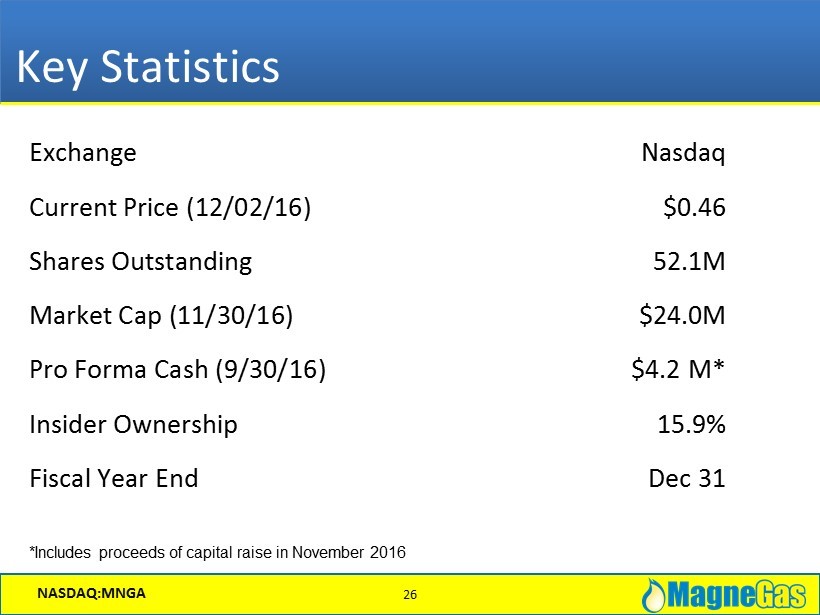

Key Statistics Exchange Nasdaq Current Price (12/02/16) $0.46 Shares Outstanding 52.1M Market Cap (11/30/16) $24.0M Pro Forma Cash (9/30/16) $4.2 M* Insider Ownership 15.9% Fiscal Year End Dec 31 NASDAQ:MNGA 26 *Includes proceeds of capital raise in November 2016

11885 44 th Street N. Clearwater, FL 33762 www.MagneGas.com P. 727 - 934 - 3448 F. 727 - 934 - 6260 E. Info@magnegas.com Thank You Company Contact: