Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | fbiz3q16ceoletter8-k.htm |

Exhibit 99.1

DEAR SHAREHOLDERS AND FRIENDS OF FIRST BUSINESS:

The third quarter of 2016 was an unusual quarter for First Business. While we have encountered some significant and uncharacteristic credit issues, we have also made some great strides in working on our business and improving our long term earnings power. The credit issues, which we take very seriously, were disclosed in our third quarter earnings press release and 10-Q and we have made great efforts to make the changes necessary to improve our processes to mitigate future credit costs, although they will always remain part of the banking business.

In this report, I would like to explain further the recent work that has been done to continue to build long term shareholder value in a challenging business lending environment by continuing to improve on our core business. These improvements include revenue generating initiatives, such as investments in our trust and investment and SBA businesses, and disciplined expense management, which we believe will be meaningful contributors towards achieving positive operating leverage as we move forward.

ECONOMIC TRENDS

Our progress toward integrating Alterra’s SBA lending platform across the Company generated non-interest revenue growth in the first half of 2016 that far exceeded our expectations. Nationally, loan balances under the SBA’s most popular 7(a) program were up more than 25% from just two years ago, as of the SBA’s fiscal year ended September 30, 2016, and we captured a disproportionately large share of that growth as evidenced by our inclusion on the SBA's list of the 100 most active 7(a) lenders(1). In order to meet continued market demand and drive high-quality, relationship-based growth in 2017 and beyond, we are working to ensure First Business’s future SBA growth is achieved in a measured and sustainable way. Consequently, we have temporarily slowed our SBA production while we make proactive investments to enhance the infrastructure, capacity and scalability of the business.

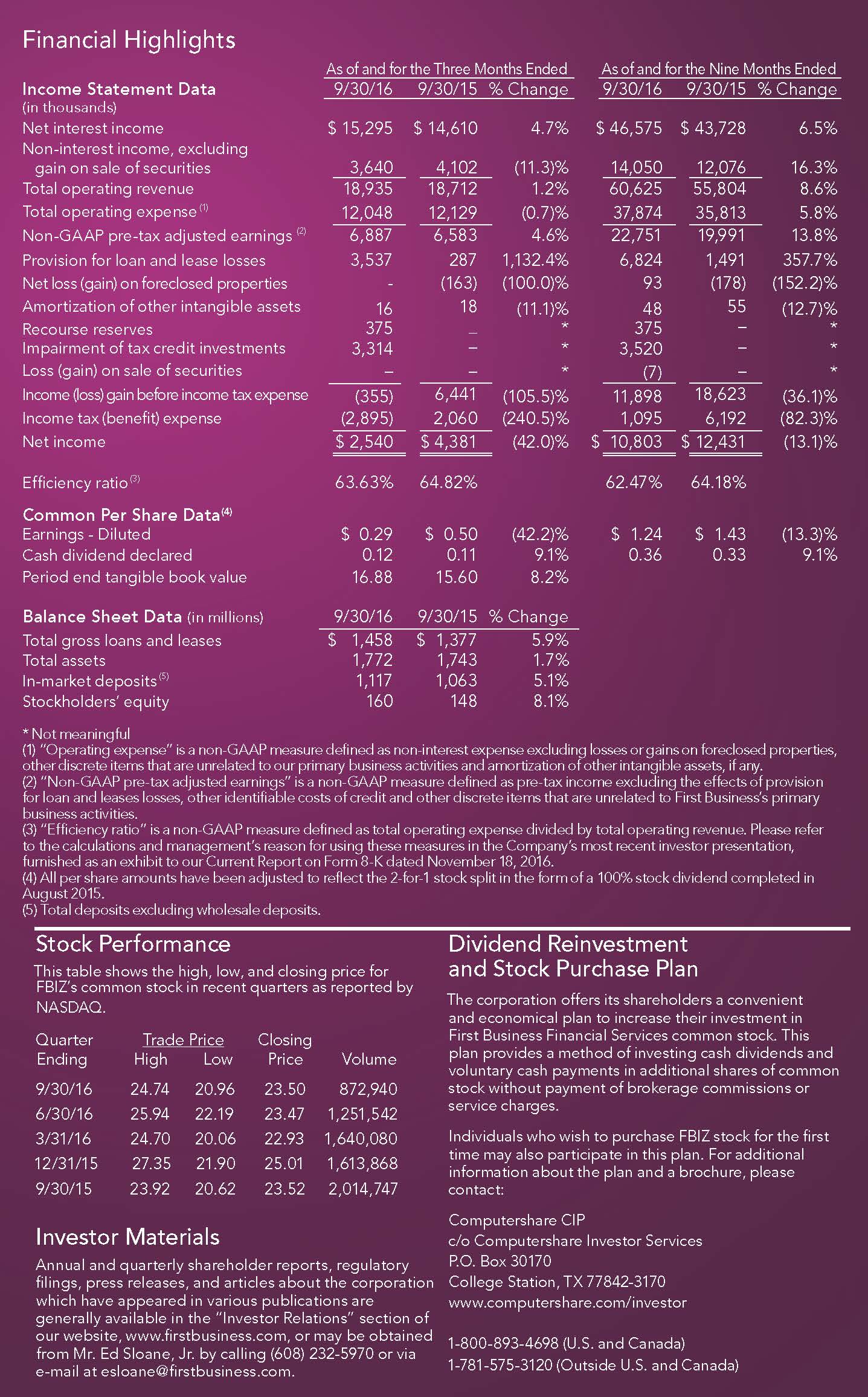

The deliberate, temporary reduction in SBA production is accompanied by broader industry headwinds for our rate of near-term growth. While the national economy has been expanding at a moderate pace this year, it has been primarily driven by growth in the consumer segment, a segment in which we do not meaningfully participate. Commercial and industrial lending in our market has been stagnant or shrinking as the manufacturing sector loan demand has been particularly sluggish. This makes the competition for quality commercial credits that much more aggressive, and we are witnessing other banks loosening structures and cutting pricing in a manner that we simply won’t consider. Our commitment to quality, combined with elevated payoffs during the first half of the year, has resulted in loans growing in 2016, but at a modest rate by First Business’s historical standards. Period-end gross loans and leases receivable grew to $1.458 billion at September 30, 2016, increasing $81.1 million, or 5.9%, from September 30, 2015.

REVENUE DIVERSIFICATION ABATES HEADWINDS

In light of these short-term challenges, we have taken several important steps to improve our revenue outlook. We expect our SBA platform investments to yield meaningful and sustainable income streams as we move into the future. In addition, we’ve recently reduced the rate paid on the majority of money market and interest-bearing transaction accounts across the First Business footprint. Exclusive of any material market-driven rate or deposit-mix changes, we expect this will have a favorable impact on our net interest margin as we continue to manage to our long-term target of 3.50%.

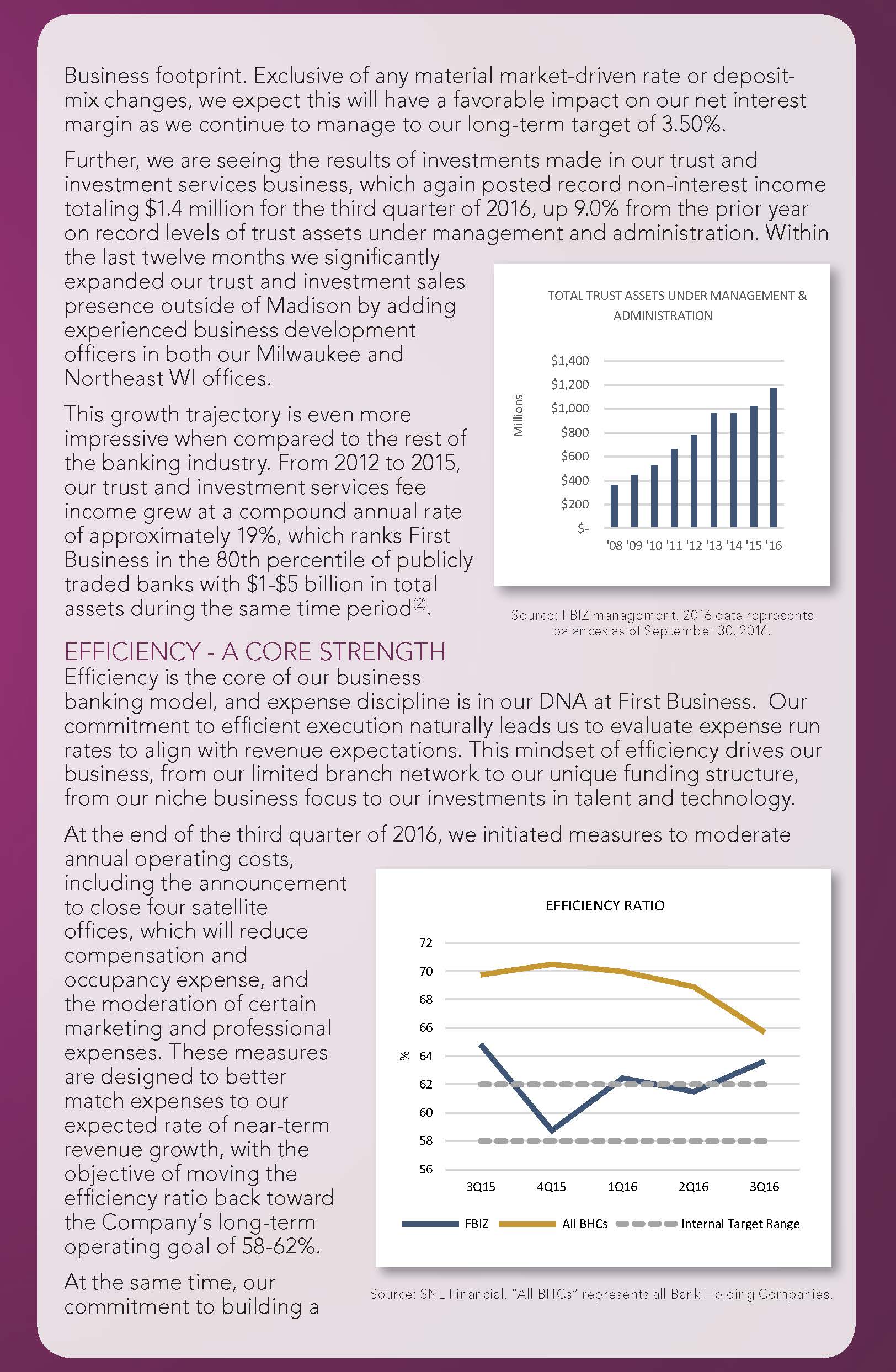

Further, we are seeing the results of investments made in our trust and investment services business, which again posted record non-interest income totaling $1.4 million for the third quarter of 2016, up 9.0% from the prior year on record levels of trust assets under management and administration. Within the last twelve months we significantly expanded our trust and investment sales presence outside of Madison by adding experienced business development officers in both our Milwaukee and Northeast WI offices.

This growth trajectory is even more impressive when compared to the rest of the banking industry. From 2012 to 2015, our trust and investment services fee income grew at a compound annual rate of approximately 19%, which ranks First Business in the 80th percentile of publicly traded banks with $1-$5 billion in total assets during the same time period(2). [INSERT AUMA BAR GRAPH HERE]

EFFICIENCY - A CORE STRENGTH

Efficiency is the core of our business banking model, and expense discipline is in our DNA at First Business. Our commitment to efficient execution naturally leads us to evaluate expense run rates to align with revenue expectations. This mindset of efficiency drives our business, from our limited branch network to our unique funding structure, from our niche business focus to our investments in talent and technology.

At the end of the third quarter of 2016, we initiated measures to moderate annual operating costs, including the announcement to close four satellite offices, which will reduce compensation and occupancy expense, and the moderation of certain marketing and professional expenses. These measures are designed to better match expenses to our expected rate of near-term revenue growth, with the objective of moving the efficiency ratio back toward the Company’s long-term operating goal of 58-62%. [INSERT EFFICIENCY RATIO GRAPHIC HERE]

At the same time, our commitment to building a scalable organization remains unchanged. Excluding the impact of tax credit investment impairment expense, the $455,000 increase in total non-interest expense year-over-year primarily reflects an 11.4% increase in full-time equivalent employees to 263 at September 30, 2016 from 236 at September 30, 2015. We have scaled back in other areas in order to maintain our commitment to investing in our greatest asset - talent. Accelerating growth in our Milwaukee market, for example, is a direct outcome of the additional investment in talent we strategically made there two years ago.

Similarly, our SBA business has demonstrated its clear potential to provide a meaningful earnings catalyst for First Business. When our investments are complete, we expect our enhanced SBA program to further build franchise value with a relationship approach that is unique in a typically transactional SBA lending market.

LOOKING FORWARD

At First Business, we continue to do the work necessary to build long term value in our differentiated business banking franchise.

We are committed to our long-term key objectives: drive top line revenue growth, strengthen in-market deposit mix, generate consistent, strong profitability, and deliver earnings per share growth. We strongly believe our recent and current expense reductions, revenue initiatives, investments in talent, core asset quality and ongoing discipline in the day-to-day management of our franchise will serve us well in achieving these objectives over the long term.

We fully believe our unique, niche business banking model has substantial capacity for high-quality growth, and we plan to achieve it over time, in a responsible, profitable and sustainable way.

As always, thank you for your continued support of First Business.

Sincerely,

Corey Chambas

President and CEO

(1) Source: www.SBA.gov

(2) Source: SNL. Represents publicly traded banks with $1-$5 billion in total assets as of September 30, 2016 and that reported trust and investment services fee income of at least $1 million for the full year ended 2015.

This letter includes “forward-looking statements" related to First Business Financial Services, Inc. (the “Company”) that can generally be identified as describing the Company’s future plans, objectives, goals or expectations. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those currently anticipated. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For further information about the factors that could affect the Company’s future results, please see the Company’s most recent quarterly report on Form 10-Q and other filings with the Securities and Exchange Commission.