Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PARK NATIONAL CORP /OH/ | prk201611158-kb.htm |

November 16-17, 2016

Sandler O’Neill

East Coast Financial Services Conference

1

Safe Harbor Statement

Park cautions that any forward-looking statements contained in this presentation or made by management of Park are provided to assist in

the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future

events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are

subject to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking

statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties

that could cause actual results to differ materially include, without limitation: Park's ability to execute its business plan successfully and within

the expected timeframe; general economic and financial market conditions, and the uneven spread of positive impacts of the recovery on the

economy, specifically in the real estate markets and the credit markets, either nationally or in the states in which Park and its subsidiaries do

business, may be worse or slower than expected which could adversely impact the demand for loan, deposit and other financial services as

well as loan delinquencies and defaults; changes in interest rates and prices may adversely impact the value of securities, loans, deposits

and other financial instruments and the interest rate sensitivity of our consolidated balance sheet; changes in consumer spending, borrowing

and saving habits; changes in unemployment; asset/liability repricing risks and liquidity risks; our liquidity requirements could be adversely

affected by changes to regulations governing bank capital and liquidity standards as well as by changes in our assets and liabilities;

competitive factors among financial services organizations could increase significantly, including product and pricing pressures and our

ability to attract, develop and retain qualified bank professionals; the nature, timing and effect of changes in banking regulations or other

regulatory or legislative requirements affecting the respective businesses of Park and its subsidiaries, including changes in laws and

regulations concerning taxes, accounting, banking, securities and other aspects of the financial services industry, specifically the Dodd-

Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), as well as future regulations which will be adopted

by the relevant regulatory agencies, including the Consumer Financial Protection Bureau, to implement the Dodd-Frank Act's provisions, the

Budget Control Act of 2011, the American Taxpayer Relief Act of 2012 and the Basel III regulatory capital reforms; the effect of changes in

accounting policies and practices, as may be adopted by the Financial Accounting Standards Board, the SEC, the Public Company

Accounting Oversight Board and other regulatory agencies, and the accuracy of our assumptions and estimates used to prepare our

financial statements; the effect of fiscal and governmental policies of the United States federal government; the adequacy of our risk

management program; a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors and

other service providers, including as a result of cyber attacks; demand for loans in the respective market areas served by Park and its

subsidiaries; and other risk factors relating to the banking industry as detailed from time to time in Park's reports filed with the Securities and

Exchange Commission including those described in "Item 1A. Risk Factors" of Part I of Park's Annual Report on Form 10-K for the fiscal

year ended December 31, 2015. Park does not undertake, and specifically disclaims any obligation, to publicly release the results of any

revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the

forward-looking statement was made, or reflect the occurrence of unanticipated events, except to the extent required by law.

2

Park National Corporation (PRK) Profile

(as of September 30, 2016)

• 11 Community Bank Divisions

• 2 Specialty Finance Companies

• One non-bank workout subsidiary

• 29 Ohio counties

• 110 bank branches

• 6 specialty finance offices

• 1,732 FTEs

3

Park Executive Management

David L. Trautman – President and CEO– Age: 55

President , CEO and Board Member of The Park National Bank and Park National Corporation (Park)

headquartered in Newark, Ohio. He served as President of First-Knox National Bank, a division of The Park

National Bank, from May 1997 through January 2002, and as its Chairman from 2001 to 2006. In addition, he

served on the Board of the United Bank of Bucyrus, a division of The Park National bank, from 2000 to 2006.

Mr. Trautman received his BA from Duke University and joined Park immediately following graduation. He holds

an MBA, with honors, from The Ohio State University. He is a graduate of The Stonier Graduate School of

Banking at The University of Delaware and the Ohio Bankers Association Leadership Institute.

Mr. Trautman is past Chairman of the Ohio Bankers League, member of Newark Rotary Club, past campaign

chair for United Way of Licking County, and serves as a Trustee of the Licking County Foundation and Dawes

Arboretum.

C. Daniel DeLawder – Chairman – Age: 67

Chairman and Board Member of The Park National Bank and Park National Corporation headquartered in

Newark, Ohio. He served previously as CEO of The Park National Bank and Park for 15 years. He served as

President of the Fairfield National Bank, a division of The Park National Bank, from 1985 through 1991. He also

currently serves on the Boards of MedBen, Truck One, Inc. and Fleet Service, Inc.

Mr. DeLawder received his B.S.Ed., cum laude from Ohio University in Athens and joined Park immediately

following graduation. He is a graduate of numerous bank industry educational programs.

Mr. DeLawder is a past member of the Board of Directors of the Federal Reserve Bank of Cleveland. He is the

past chairman of the Board of Trustees of Ohio University. He served as a member of the American Bankers

Association (ABA) BankPac Committee as well as a member of the Government Relations Council of the ABA.

He is past Chairman of the Ohio Bankers Association and a past Director-at-Large of the Community Bankers

Association of Ohio.

Leadership Team

4

Park Executive Management

(continued)

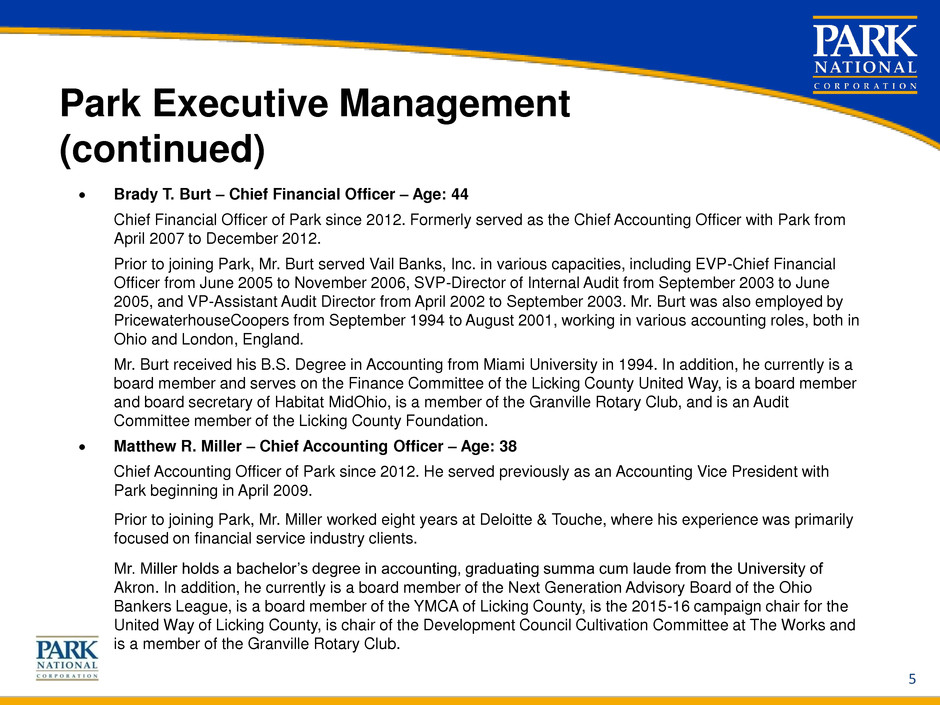

Brady T. Burt – Chief Financial Officer – Age: 44

Chief Financial Officer of Park since 2012. Formerly served as the Chief Accounting Officer with Park from

April 2007 to December 2012.

Prior to joining Park, Mr. Burt served Vail Banks, Inc. in various capacities, including EVP-Chief Financial

Officer from June 2005 to November 2006, SVP-Director of Internal Audit from September 2003 to June

2005, and VP-Assistant Audit Director from April 2002 to September 2003. Mr. Burt was also employed by

PricewaterhouseCoopers from September 1994 to August 2001, working in various accounting roles, both in

Ohio and London, England.

Mr. Burt received his B.S. Degree in Accounting from Miami University in 1994. In addition, he currently is a

board member and serves on the Finance Committee of the Licking County United Way, is a board member

and board secretary of Habitat MidOhio, is a member of the Granville Rotary Club, and is an Audit

Committee member of the Licking County Foundation.

Matthew R. Miller – Chief Accounting Officer – Age: 38

Chief Accounting Officer of Park since 2012. He served previously as an Accounting Vice President with

Park beginning in April 2009.

Prior to joining Park, Mr. Miller worked eight years at Deloitte & Touche, where his experience was primarily

focused on financial service industry clients.

Mr. Miller holds a bachelor’s degree in accounting, graduating summa cum laude from the University of

Akron. In addition, he currently is a board member of the Next Generation Advisory Board of the Ohio

Bankers League, is a board member of the YMCA of Licking County, is the 2015-16 campaign chair for the

United Way of Licking County, is chair of the Development Council Cultivation Committee at The Works and

is a member of the Granville Rotary Club.

5

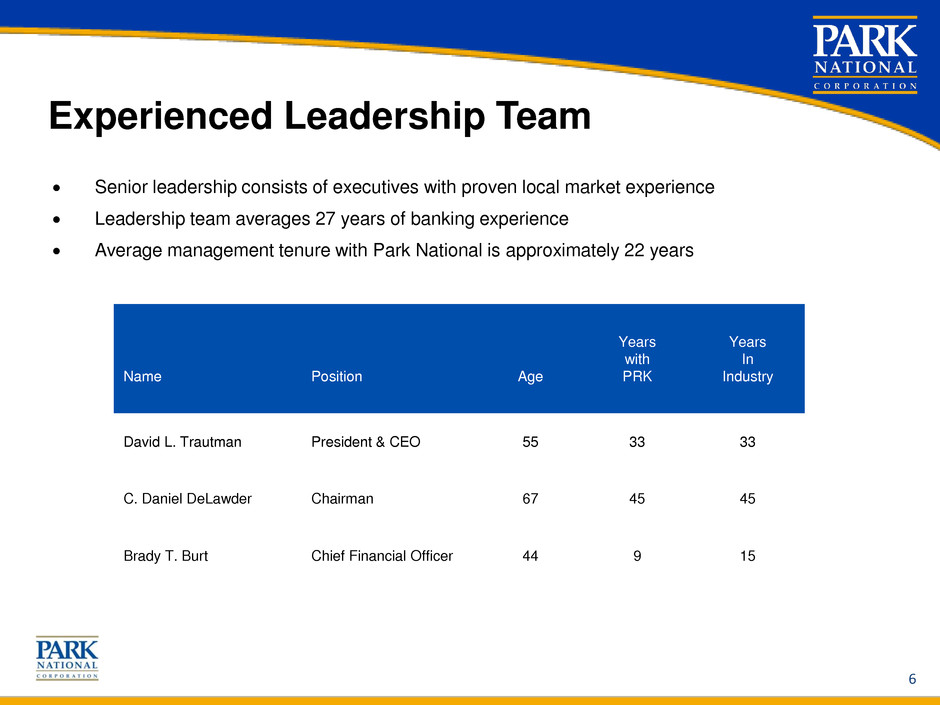

Experienced Leadership Team

Name Position Age

Years

with

PRK

Years

In

Industry

David L. Trautman President & CEO 55 33 33

C. Daniel DeLawder Chairman 67 45 45

Brady T. Burt Chief Financial Officer 44 9 15

Senior leadership consists of executives with proven local market experience

Leadership team averages 27 years of banking experience

Average management tenure with Park National is approximately 22 years

6

Leadership Team – continued

Name Position Age

Years

with

PRK

Years

In

Industry

Adrienne M. Brokaw SVP – Director of Internal Audit 48 3 17

Thomas J. Button SVP – Chief Credit Officer 56 19 30

Thomas M. Cummiskey SVP – Trust 47 17 19

Robert N. Kent, Jr. President – Scope Aircraft Finance 59 13 33

Timothy J. Lehman SVP and Chief Operating Officer 52 21 21

Laura B. Lewis SVP – Human Resources & Marketing 57 32 32

Matthew R. Miller SVP – Chief Accounting Officer 38 7 13

Jason L. Painley SVP – Chief Risk Officer 39 5 16

Greg M. Rhoads VP – Chief Information Officer 38 14 14

Cheryl L. Snyder SVP – Consumer Banking 60 37 39

Paul E. Turner SVP - Treasury 49 26 26

Jeffrey A. Wilson SVP – Chief Administrative Officer 50 12 20

7

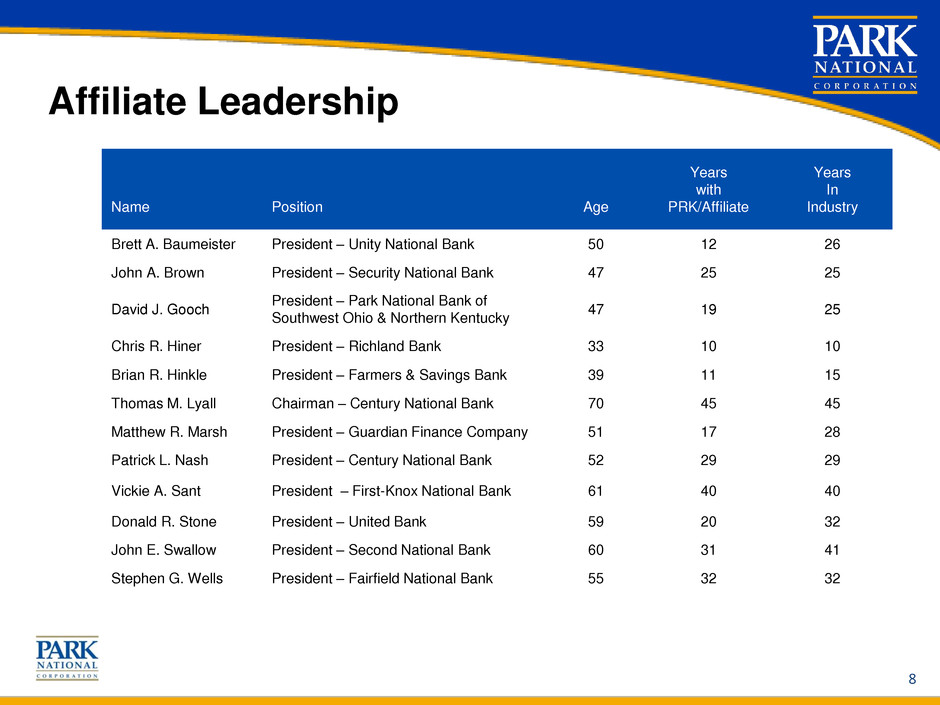

Affiliate Leadership

Name Position Age

Years

with

PRK/Affiliate

Years

In

Industry

Brett A. Baumeister President – Unity National Bank 50 12 26

John A. Brown President – Security National Bank 47 25 25

David J. Gooch

President – Park National Bank of

Southwest Ohio & Northern Kentucky

47 19 25

Chris R. Hiner President – Richland Bank 33 10 10

Brian R. Hinkle President – Farmers & Savings Bank 39 11 15

Thomas M. Lyall Chairman – Century National Bank 70 45 45

Matthew R. Marsh President – Guardian Finance Company 51 17 28

Patrick L. Nash President – Century National Bank 52 29 29

Vickie A. Sant President – First-Knox National Bank 61 40 40

Donald R. Stone President – United Bank 59 20 32

John E. Swallow President – Second National Bank 60 31 41

Stephen G. Wells President – Fairfield National Bank 55 32 32

8

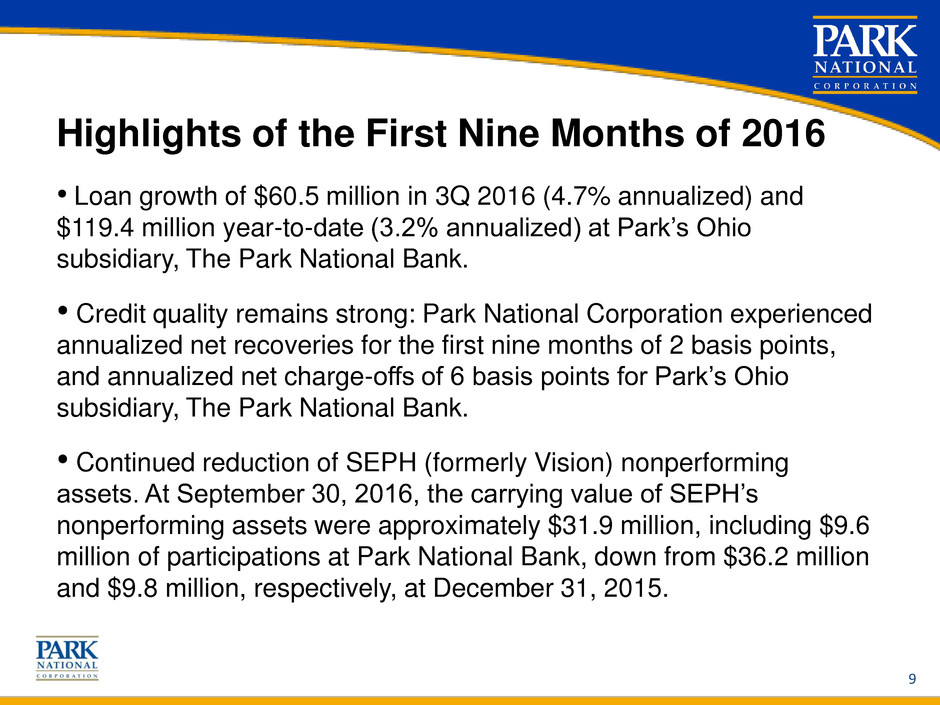

Highlights of the First Nine Months of 2016

• Loan growth of $60.5 million in 3Q 2016 (4.7% annualized) and

$119.4 million year-to-date (3.2% annualized) at Park’s Ohio

subsidiary, The Park National Bank.

• Credit quality remains strong: Park National Corporation experienced

annualized net recoveries for the first nine months of 2 basis points,

and annualized net charge-offs of 6 basis points for Park’s Ohio

subsidiary, The Park National Bank.

• Continued reduction of SEPH (formerly Vision) nonperforming

assets. At September 30, 2016, the carrying value of SEPH’s

nonperforming assets were approximately $31.9 million, including $9.6

million of participations at Park National Bank, down from $36.2 million

and $9.8 million, respectively, at December 31, 2015.

9

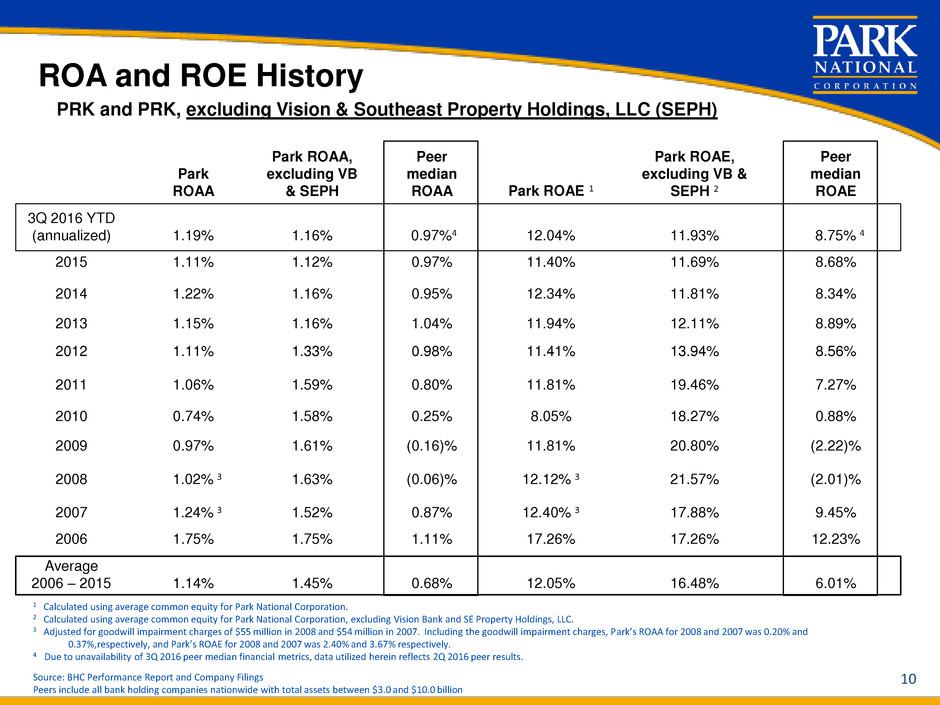

PRK and PRK, excluding Vision & Southeast Property Holdings, LLC (SEPH)

ROA and ROE History

1 Calculated using average common equity for Park National Corporation.

2 Calculated using average common equity for Park National Corporation, excluding Vision Bank and SE Property Holdings, LLC.

3 Adjusted for goodwill impairment charges of $55 million in 2008 and $54 million in 2007. Including the goodwill impairment charges, Park’s ROAA for 2008 and 2007 was 0.20% and

0.37%,respectively, and Park’s ROAE for 2008 and 2007 was 2.40% and 3.67% respectively.

4 Due to unavailability of 3Q 2016 peer median financial metrics, data utilized herein reflects 2Q 2016 peer results.

Source: BHC Performance Report and Company Filings

Peers include all bank holding companies nationwide with total assets between $3.0 and $10.0 billion

Park

ROAA

Park ROAA,

excluding VB

& SEPH

Peer

median

ROAA Park ROAE 1

Park ROAE,

excluding VB &

SEPH 2

Peer

median

ROAE

3Q 2016 YTD

(annualized) 1.19% 1.16% 0.97%4 12.04% 11.93% 8.75% 4

2015 1.11% 1.12% 0.97% 11.40% 11.69% 8.68%

2014 1.22% 1.16% 0.95% 12.34% 11.81% 8.34%

2013 1.15% 1.16% 1.04% 11.94% 12.11% 8.89%

2012 1.11% 1.33% 0.98% 11.41% 13.94% 8.56%

2011 1.06% 1.59% 0.80% 11.81% 19.46% 7.27%

2010 0.74% 1.58% 0.25% 8.05% 18.27% 0.88%

2009 0.97% 1.61% (0.16)% 11.81% 20.80% (2.22)%

2008 1.02% 3 1.63% (0.06)% 12.12% 3 21.57% (2.01)%

2007 1.24% 3 1.52% 0.87% 12.40% 3 17.88% 9.45%

2006 1.75% 1.75% 1.11% 17.26% 17.26% 12.23%

Average

2006 – 2015 1.14% 1.45% 0.68% 12.05% 16.48% 6.01%

10

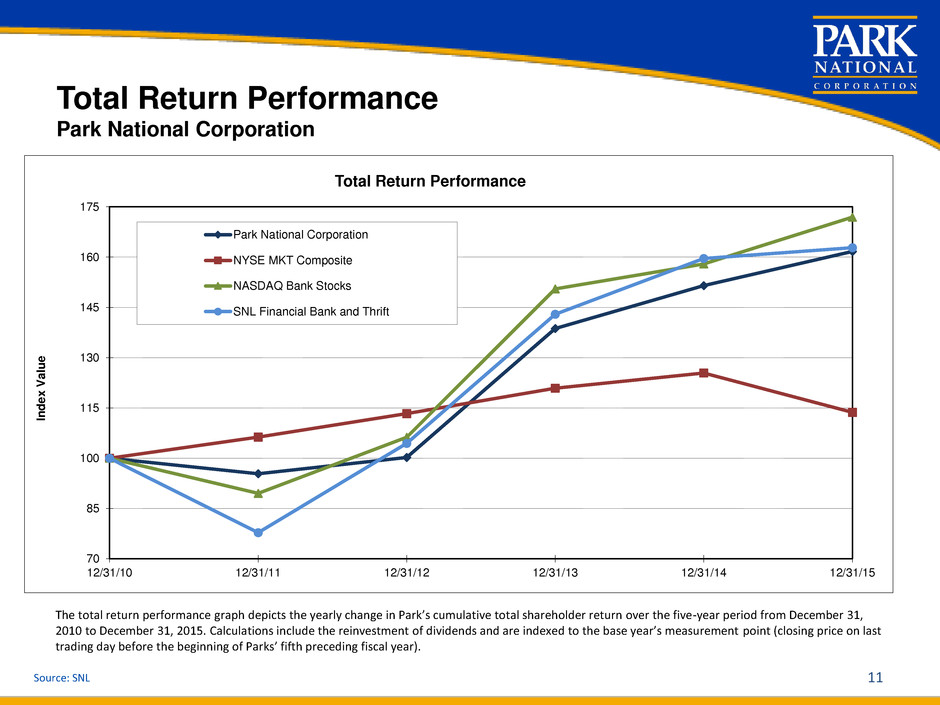

Total Return Performance

Park National Corporation

The total return performance graph depicts the yearly change in Park’s cumulative total shareholder return over the five-year period from December 31,

2010 to December 31, 2015. Calculations include the reinvestment of dividends and are indexed to the base year’s measurement point (closing price on last

trading day before the beginning of Parks’ fifth preceding fiscal year).

Source: SNL 11

70

85

100

115

130

145

160

175

12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15

In

d

e

x

V

a

lu

e

Total Return Performance

Park National Corporation

NYSE MKT Composite

NASDAQ Bank Stocks

SNL Financial Bank and Thrift

The Park National Bank – The bank of choice

Source: SNL, June 30, 2016

Headquarter Counties – Deposits (in thousands)

12

Bank Division

Year Joined

Park

Hdqtr. Co.

Deposits

Total County

Deposits

% of 2016

Market Share

% of 2015

Market Share

2016

Headquarter

County

Market Share

Rank

2015

Headquarter

County

Market Share

Rank

Park National 1908 $1,554,977 $2,506,245 62.04% 62.98% 1 1

Fairfield National 1985 374,719 2,005,731 18.68% 20.58% 1 1

Richland Bank 1987 529,316 1,814,562 29.17% 28.94% 1 1

Century National 1990 462,466 1,363,558 33.92% 33.51% 1 1

First-Knox National 1997 527,959 856,851 61.62% 60.70% 1 1

Second National 2000 276,029 1,116,268 24.73% 24.11% 2 2

Security National 2001 478,881 1,478,541 32.39% 32.82% 1 1

Seven largest OH divisions $4,204,347 $11,141,756 37.74% 38.06%

Other OH divisions – headquarter counties 596,693 5,195,471 11.48% 11.30%

Total OH divisions – headquarter counties $4,801,040 $16,337,227 29.39% 29.66%

Remaining Ohio bank deposits $926,030

Total Ohio bank deposits $5,727,070

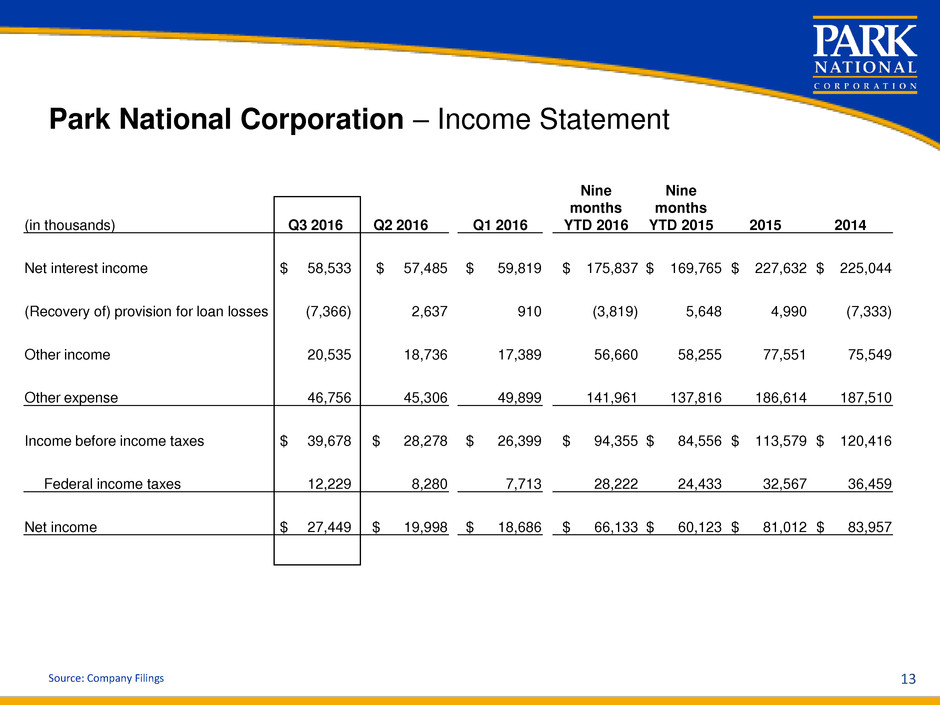

Park National Corporation – Income Statement

Source: Company Filings

(in thousands) Q3 2016 Q2 2016 Q1 2016

Nine

months

YTD 2016

Nine

months

YTD 2015 2015 2014

Net interest income $ 58,533 $ 57,485 $ 59,819 $ 175,837 $ 169,765 $ 227,632 $ 225,044

(Recovery of) provision for loan losses (7,366) 2,637 910 (3,819) 5,648 4,990 (7,333)

Other income 20,535 18,736 17,389 56,660 58,255 77,551 75,549

Other expense 46,756 45,306 49,899 141,961 137,816 186,614 187,510

Income before income taxes $ 39,678 $ 28,278 $ 26,399 $ 94,355 $ 84,556 $ 113,579 $ 120,416

Federal income taxes 12,229 8,280 7,713 28,222 24,433 32,567 36,459

Net income $ 27,449 $ 19,998 $ 18,686 $ 66,133 $ 60,123 $ 81,012 $ 83,957

13

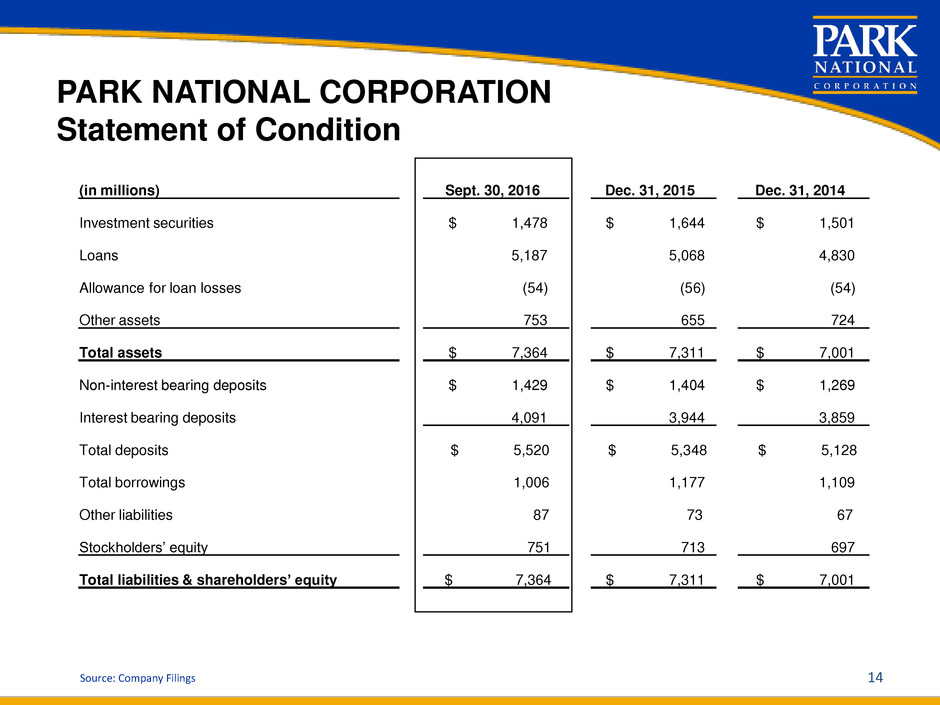

PARK NATIONAL CORPORATION

Statement of Condition

Source: Company Filings

(in millions) Sept. 30, 2016 Dec. 31, 2015 Dec. 31, 2014

Investment securities $ 1,478 $ 1,644 $ 1,501

Loans 5,187 5,068 4,830

Allowance for loan losses (54) (56) (54)

Other assets 753 655 724

Total assets $ 7,364 $ 7,311 $ 7,001

Non-interest bearing deposits $ 1,429 $ 1,404 $ 1,269

Interest bearing deposits 4,091 3,944 3,859

Total deposits $ 5,520 $ 5,348 $ 5,128

Total borrowings 1,006 1,177 1,109

Other liabilities 87 73 67

Stockholders’ equity 751 713 697

Total liabilities & shareholders’ equity $ 7,364 $ 7,311 $ 7,001

14

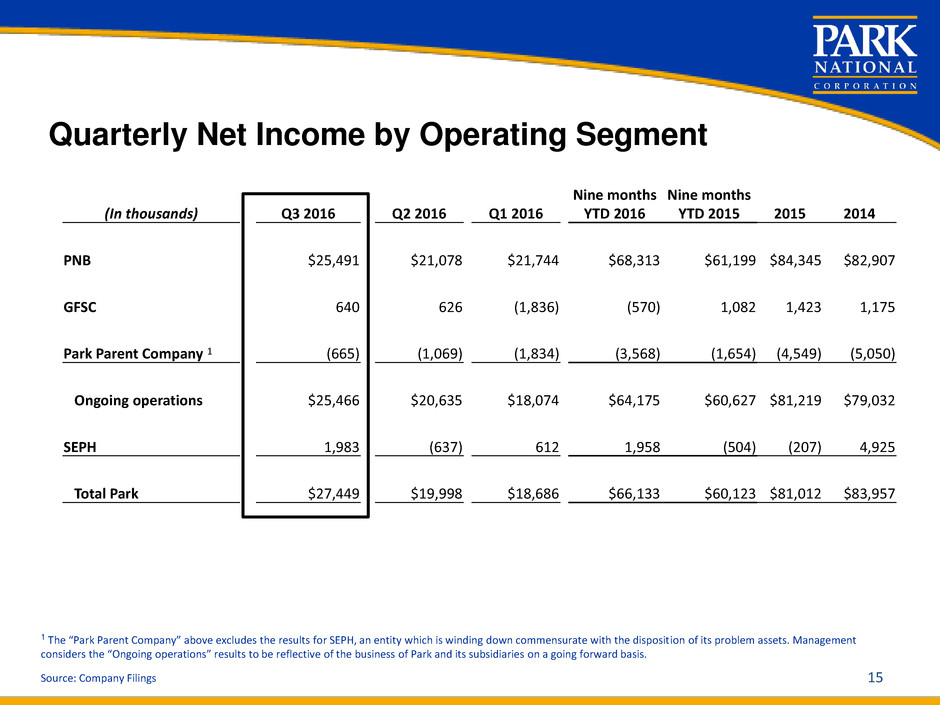

Quarterly Net Income by Operating Segment

Source: Company Filings

(In thousands) Q3 2016 Q2 2016 Q1 2016

Nine months

YTD 2016

Nine months

YTD 2015 2015 2014

PNB $25,491 $21,078 $21,744 $68,313 $61,199 $84,345 $82,907

GFSC 640 626 (1,836) (570) 1,082 1,423 1,175

Park Parent Company 1 (665) (1,069) (1,834) (3,568) (1,654) (4,549) (5,050)

Ongoing operations $25,466 $20,635 $18,074 $64,175 $60,627 $81,219 $79,032

SEPH 1,983 (637) 612 1,958 (504) (207) 4,925

Total Park $27,449 $19,998 $18,686 $66,133 $60,123 $81,012 $83,957

1 The “Park Parent Company” above excludes the results for SEPH, an entity which is winding down commensurate with the disposition of its problem assets. Management

considers the “Ongoing operations” results to be reflective of the business of Park and its subsidiaries on a going forward basis.

15

Source: Company Filings

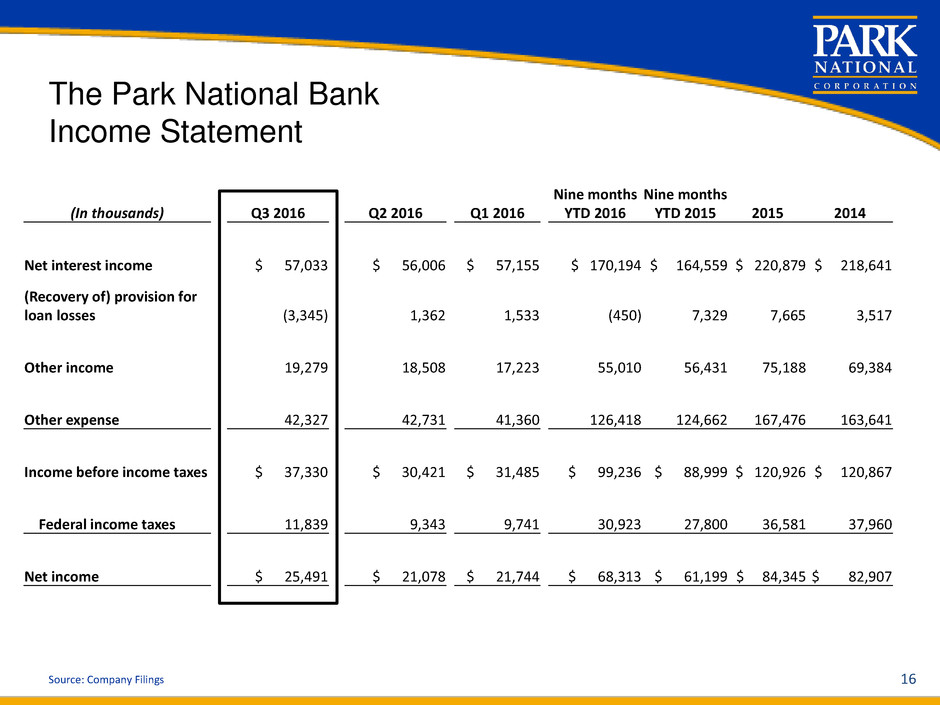

The Park National Bank

Income Statement

(In thousands) Q3 2016 Q2 2016 Q1 2016

Nine months

YTD 2016

Nine months

YTD 2015 2015 2014

Net interest income $ 57,033 $ 56,006 $ 57,155 $ 170,194 $ 164,559 $ 220,879 $ 218,641

(Recovery of) provision for

loan losses (3,345) 1,362 1,533 (450) 7,329 7,665 3,517

Other income 19,279 18,508 17,223 55,010 56,431 75,188 69,384

Other expense 42,327 42,731 41,360 126,418 124,662 167,476 163,641

Income before income taxes $ 37,330 $ 30,421 $ 31,485 $ 99,236 $ 88,999 $ 120,926 $ 120,867

Federal income taxes 11,839 9,343 9,741 30,923 27,800 36,581 37,960

Net income $ 25,491 $ 21,078 $ 21,744 $ 68,313 $ 61,199 $ 84,345 $ 82,907

16

Park National Bank

Statement of Condition

Source: Company Filings

(In thousands)

September 30,

2016

December 31,

2015

September 30,

2015

% change

from

12/31/15

% change

from

9/30/15

Loans $ 5,148,482 $ 5,029,072 $ 4,960,654 2.37% 3.79%

Allowance for loan losses 51,573 54,453 56,403 (5.29%) (8.56%)

Net loans 5,096,909 4,974,619 4,904,251 2.46% 3.93%

Investment securities 1,475,863 1,641,539 1,467,009 (10.09%) 0.60%

Total assets 7,287,923 7,229,764 7,216,773 0.80% 0.99%

Average assets (1) 7,339,517 7,219,898 7,206,175 1.66% 1.85%

Return on average assets (2) 1.24% 1.17% 1.14% 5.98% 8.77%

(1) Average assets for the nine-month periods ended September 30, 2016 and 2015, and for the year ended December 31, 2015.

(2) Annualized for the nine months ended September 30, 2016 and 2015.

17

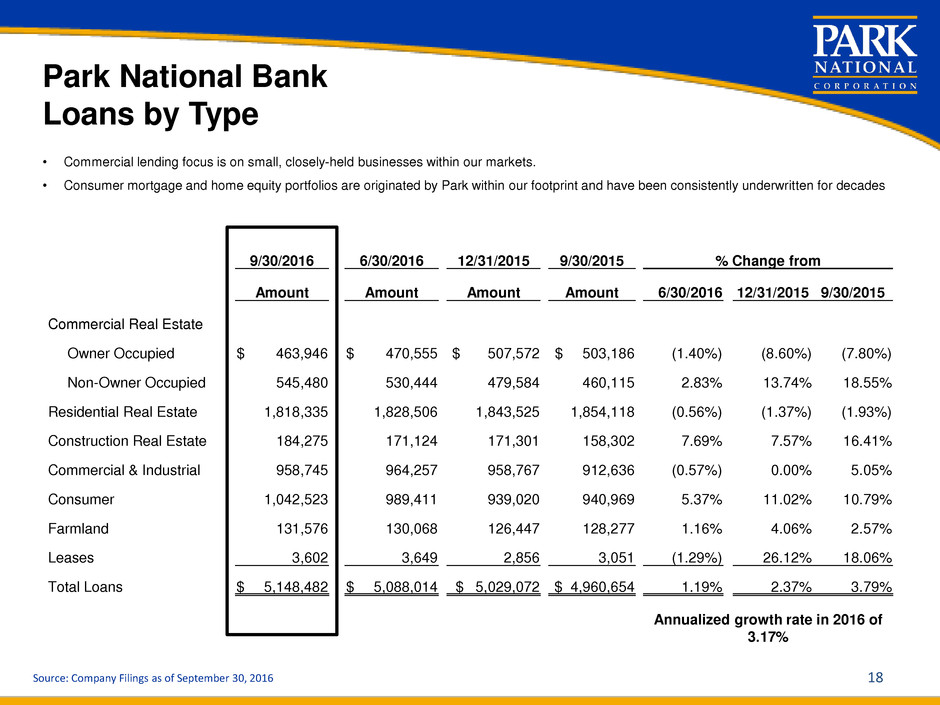

Park National Bank

Loans by Type

Source: Company Filings as of September 30, 2016

• Commercial lending focus is on small, closely-held businesses within our markets.

• Consumer mortgage and home equity portfolios are originated by Park within our footprint and have been consistently underwritten for decades

9/30/2016 6/30/2016 12/31/2015 9/30/2015 % Change from

Amount Amount Amount Amount 6/30/2016 12/31/2015 9/30/2015

Commercial Real Estate

Owner Occupied $ 463,946 $ 470,555 $ 507,572 $ 503,186 (1.40%) (8.60%) (7.80%)

Non-Owner Occupied 545,480 530,444 479,584 460,115 2.83% 13.74% 18.55%

Residential Real Estate 1,818,335 1,828,506 1,843,525 1,854,118 (0.56%) (1.37%) (1.93%)

Construction Real Estate 184,275 171,124 171,301 158,302 7.69% 7.57% 16.41%

Commercial & Industrial 958,745 964,257 958,767 912,636 (0.57%) 0.00% 5.05%

Consumer 1,042,523 989,411 939,020 940,969 5.37% 11.02% 10.79%

Farmland 131,576 130,068 126,447 128,277 1.16% 4.06% 2.57%

Leases 3,602 3,649 2,856 3,051 (1.29%) 26.12% 18.06%

Total Loans $ 5,148,482 $ 5,088,014 $ 5,029,072 $ 4,960,654 1.19% 2.37% 3.79%

Annualized growth rate in 2016 of

3.17%

18

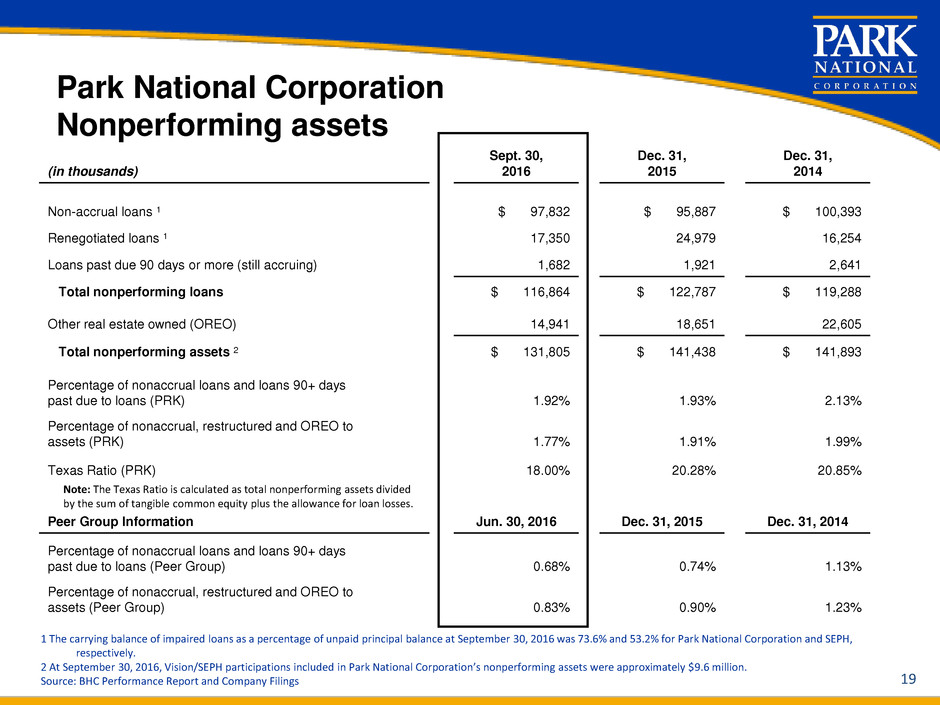

Park National Corporation

Nonperforming assets

1 The carrying balance of impaired loans as a percentage of unpaid principal balance at September 30, 2016 was 73.6% and 53.2% for Park National Corporation and SEPH,

respectively.

2 At September 30, 2016, Vision/SEPH participations included in Park National Corporation’s nonperforming assets were approximately $9.6 million.

Source: BHC Performance Report and Company Filings

(in thousands)

Sept. 30,

2016

Dec. 31,

2015

Dec. 31,

2014

Non-accrual loans 1 $ 97,832 $ 95,887 $ 100,393

Renegotiated loans 1 17,350 24,979 16,254

Loans past due 90 days or more (still accruing) 1,682 1,921 2,641

Total nonperforming loans $ 116,864 $ 122,787 $ 119,288

Other real estate owned (OREO) 14,941 18,651 22,605

Total nonperforming assets 2 $ 131,805 $ 141,438 $ 141,893

Percentage of nonaccrual loans and loans 90+ days

past due to loans (PRK) 1.92% 1.93% 2.13%

Percentage of nonaccrual, restructured and OREO to

assets (PRK) 1.77% 1.91% 1.99%

Texas Ratio (PRK) 18.00% 20.28% 20.85%

Peer Group Information Jun. 30, 2016 Dec. 31, 2015 Dec. 31, 2014

Percentage of nonaccrual loans and loans 90+ days

past due to loans (Peer Group) 0.68% 0.74% 1.13%

Percentage of nonaccrual, restructured and OREO to

assets (Peer Group) 0.83% 0.90% 1.23%

Note: The Texas Ratio is calculated as total nonperforming assets divided

by the sum of tangible common equity plus the allowance for loan losses.

19

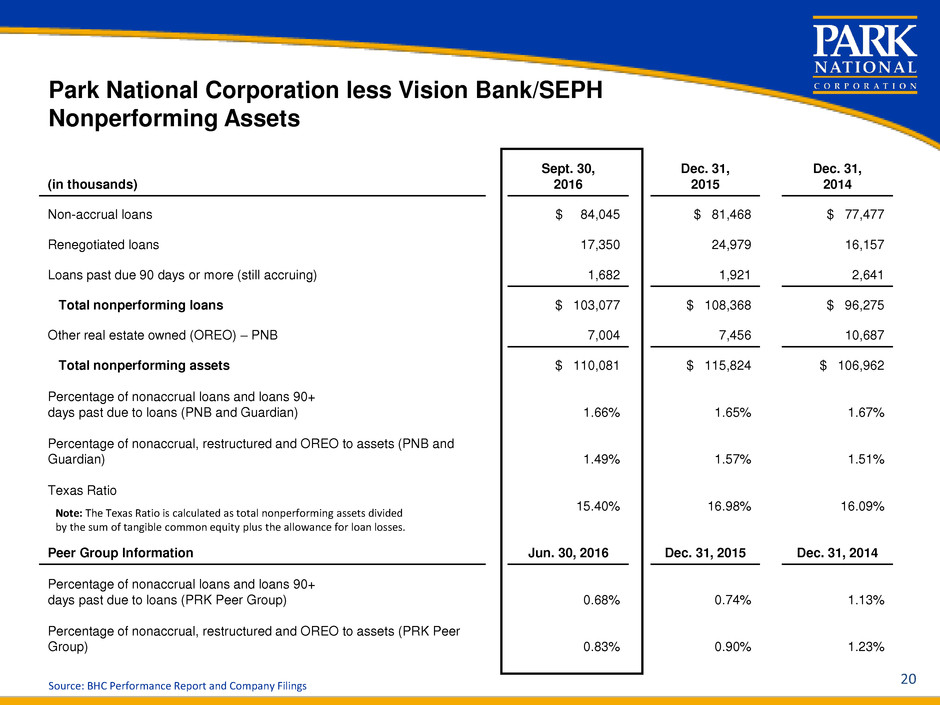

Source: BHC Performance Report and Company Filings

(in thousands)

Sept. 30,

2016

Dec. 31,

2015

Dec. 31,

2014

Non-accrual loans $ 84,045 $ 81,468 $ 77,477

Renegotiated loans 17,350 24,979 16,157

Loans past due 90 days or more (still accruing) 1,682 1,921 2,641

Total nonperforming loans $ 103,077 $ 108,368 $ 96,275

Other real estate owned (OREO) – PNB 7,004 7,456 10,687

Total nonperforming assets $ 110,081 $ 115,824 $ 106,962

Percentage of nonaccrual loans and loans 90+

days past due to loans (PNB and Guardian) 1.66% 1.65% 1.67%

Percentage of nonaccrual, restructured and OREO to assets (PNB and

Guardian) 1.49% 1.57% 1.51%

Texas Ratio

15.40% 16.98% 16.09%

Peer Group Information Jun. 30, 2016 Dec. 31, 2015 Dec. 31, 2014

Percentage of nonaccrual loans and loans 90+

days past due to loans (PRK Peer Group) 0.68% 0.74% 1.13%

Percentage of nonaccrual, restructured and OREO to assets (PRK Peer

Group) 0.83% 0.90% 1.23%

Park National Corporation less Vision Bank/SEPH

Nonperforming Assets

Note: The Texas Ratio is calculated as total nonperforming assets divided

by the sum of tangible common equity plus the allowance for loan losses.

20

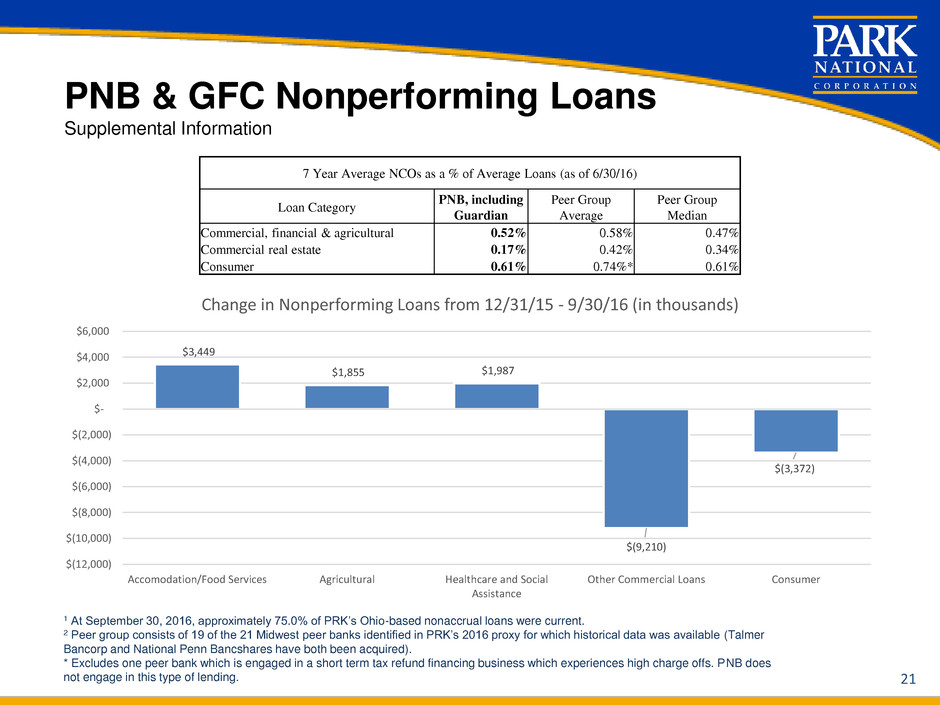

PNB & GFC Nonperforming Loans

Supplemental Information

21

7 Year Average NCOs as a % of Average Loans (as of 6/30/16)

Loan Category

PNB, including

Guardian

Peer Group

Average

Peer Group

Median

Commercial, financial & agricultural 0.52% 0.58% 0.47%

Commercial real estate 0.17% 0.42% 0.34%

Consumer 0.61% 0.74%* 0.61%

1 At September 30, 2016, approximately 75.0% of PRK’s Ohio-based nonaccrual loans were current.

2 Peer group consists of 19 of the 21 Midwest peer banks identified in PRK’s 2016 proxy for which historical data was available (Talmer

Bancorp and National Penn Bancshares have both been acquired).

* Excludes one peer bank which is engaged in a short term tax refund financing business which experiences high charge offs. PNB does

not engage in this type of lending.

$3,449

$1,855 $1,987

$(9,210)

$(3,372)

$(12,000)

$(10,000)

$(8,000)

$(6,000)

$(4,000)

$(2,000)

$-

$2,000

$4,000

$6,000

Accomodation/Food Services Agricultural Healthcare and Social

Assistance

Other Commercial Loans Consumer

Change in Nonperforming Loans from 12/31/15 - 9/30/16 (in thousands)

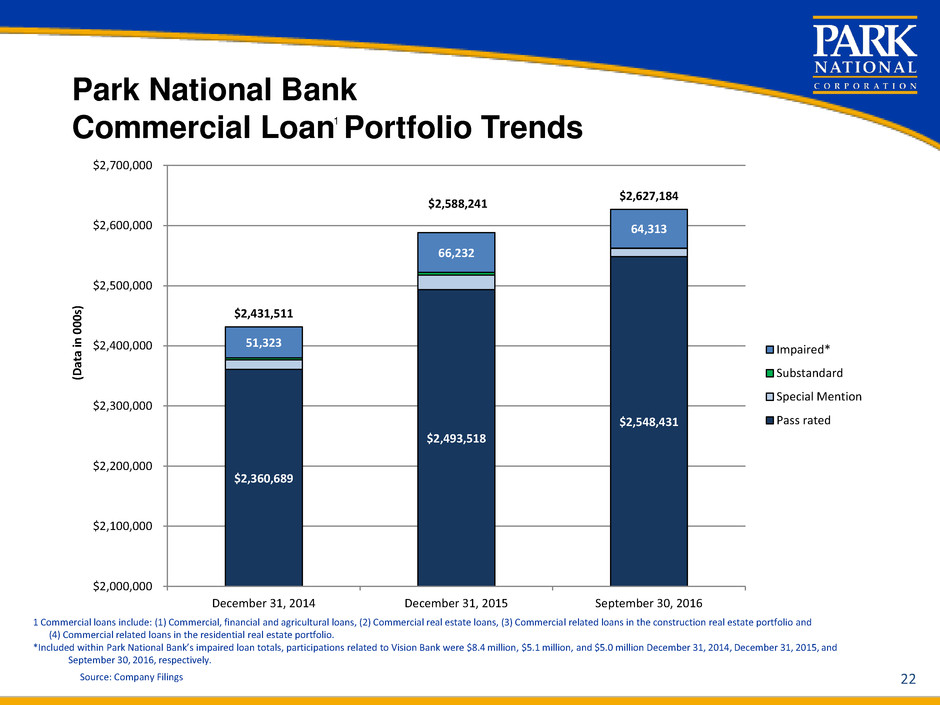

Park National Bank

Commercial Loan Portfolio Trends

1 Commercial loans include: (1) Commercial, financial and agricultural loans, (2) Commercial real estate loans, (3) Commercial related loans in the construction real estate portfolio and

(4) Commercial related loans in the residential real estate portfolio.

*Included within Park National Bank’s impaired loan totals, participations related to Vision Bank were $8.4 million, $5.1 million, and $5.0 million December 31, 2014, December 31, 2015, and

September 30, 2016, respectively.

Source: Company Filings

1

22

$2,360,689

$2,493,518

$2,548,431

51,323

66,232

64,313

$2,431,511

$2,588,241

$2,627,184

$2,000,000

$2,100,000

$2,200,000

$2,300,000

$2,400,000

$2,500,000

$2,600,000

$2,700,000

December 31, 2014 December 31, 2015 September 30, 2016

(D

ata

in

00

0

s)

Impaired*

Substandard

Special Mention

Pass rated

PRK comparison to peers

1 Calculated for the nine months ended September 30, 2016.

2 Annualized based on dividends and stock price through September 30, 2016.

3 Due to unavailability of 3Q 2016 peer median financial metrics, data utilized herein reflects 2Q 2016 peer results.

Source: Company Filings and SNL data of $3 to $10 billion bank holding companies

PRK

Price to

Book %

Peer

Group

Price to

Book %

PRK

Price to

tangible

book

Peer

Group

Price to

Tangible

Book %

PRK

Price to

Earnings

Peer

Group

Price to

Earnings

PRK

Dividend

Yield

Peer

Group

Dividend

Yield

3Q 2016 196% 126% 3 217% 154% 3 16.8 1 15.0 3 3.9 2 2.4 3

2015 194% 136% 216% 168% 17.2 16.2 4.2 2.1

2014 196% 146% 218% 178% 16.2 19.8 4.2 1.9

2013 202% 170% 227% 192% 17.0 19.9 4.4 2.1

2012 153% 117% 172% 145% 13.2 13.4 5.8 2.8

2011 156% 109% 176% 135% 13.1 14.7 5.8 2.4

2010 177% 127% 202% 155% 21.1 17.8 5.2 2.1

2009 141% 105% 163% 140% 12.2 16.9 6.4 2.5

2008 183% 135% 217% 211% 14.6 15.7 5.3 2.9

2007 155% 138% 207% 206% 11.9 13.2 5.8 3.3

2006 242% 206% 280% 291% 14.7 17.1 3.8 2.3

2005 259% 204% 296% 268% 15.5 15.5 3.6 2.3

23

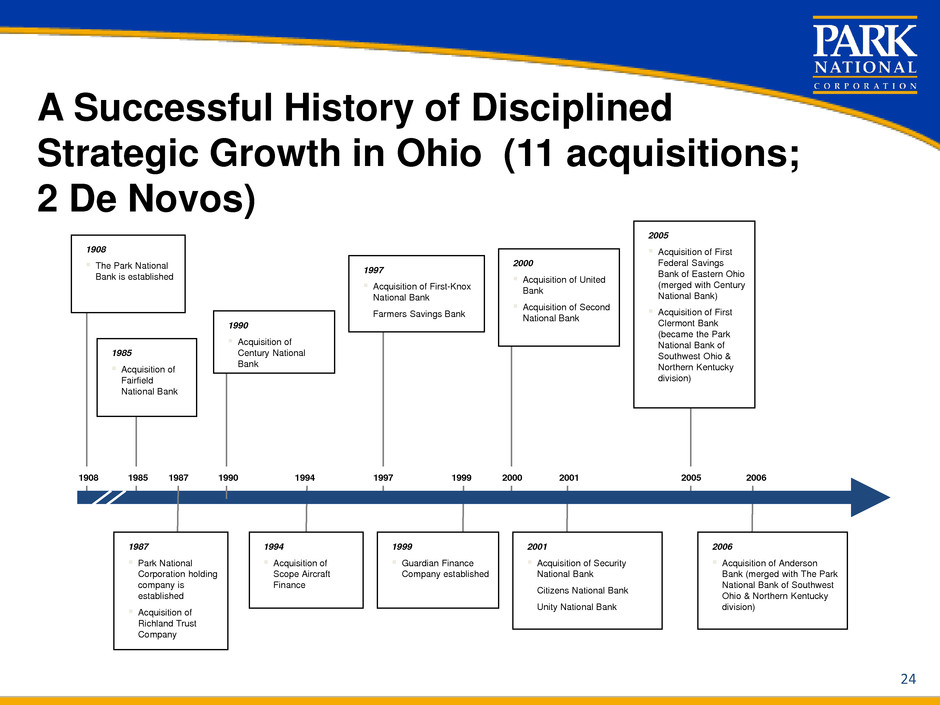

A Successful History of Disciplined

Strategic Growth in Ohio (11 acquisitions;

2 De Novos)

1908

1908

The Park National

Bank is established

1985

1985

Acquisition of

Fairfield

National Bank

1987

1987

Park National

Corporation holding

company is

established

Acquisition of

Richland Trust

Company

1990

1990

Acquisition of

Century National

Bank

1994

1994

Acquisition of

Scope Aircraft

Finance

1997 1999 2000 2001 2005 2006

1997

Acquisition of First-Knox

National Bank

Farmers Savings Bank

1999

Guardian Finance

Company established

2000

Acquisition of United

Bank

Acquisition of Second

National Bank

2001

Acquisition of Security

National Bank

Citizens National Bank

Unity National Bank

2005

Acquisition of First

Federal Savings

Bank of Eastern Ohio

(merged with Century

National Bank)

Acquisition of First

Clermont Bank

(became the Park

National Bank of

Southwest Ohio &

Northern Kentucky

division)

2006

Acquisition of Anderson

Bank (merged with The Park

National Bank of Southwest

Ohio & Northern Kentucky

division)

24

PRK M&A Strategy

Two prong strategy guidelines:

• Traditional M&A

• Strong franchise, good reputation

• Good market share

• Existing leadership continuity

• Traditional community bank structure

• Core deposits

• Metro Strategy – Attractive markets in the

Midwest / Southeast / Mid-Atlantic states

• Open de novo

• Mirror successful Columbus, Ohio

office

• Partner with banks that have the

following characteristics:

• Consistent loan growth

• Acceptable asset quality

• Existing or potential trust and

wealth management business

• Commercial focused

• Proven leadership team

25

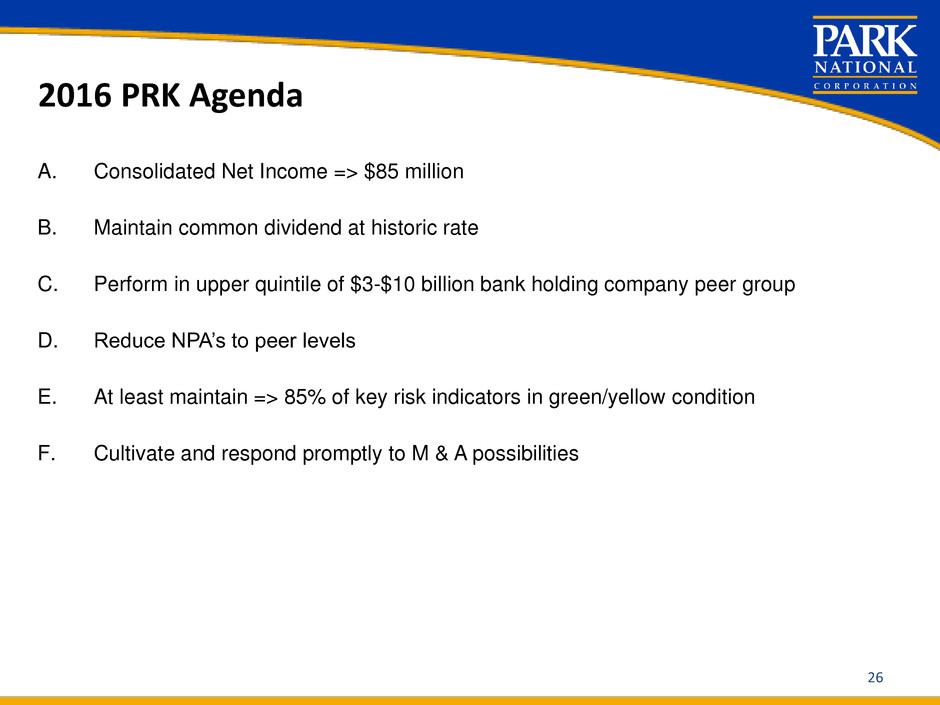

2016 PRK Agenda

26

A. Consolidated Net Income => $85 million

B. Maintain common dividend at historic rate

C. Perform in upper quintile of $3-$10 billion bank holding company peer group

D. Reduce NPA’s to peer levels

E. At least maintain => 85% of key risk indicators in green/yellow condition

F. Cultivate and respond promptly to M & A possibilities

November 16-17, 2016

Sandler O’Neill

East Coast Financial Services Conference

27