Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GLACIER BANCORP, INC. | d266339d8k.htm |

| EX-99.1 - EX-99.1 - GLACIER BANCORP, INC. | d266339dex991.htm |

Expands into Arizona with Acquisition of November 15, 2016 Exhibit 99.2

Forward Looking Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 ("PSLRA"). Such forward-looking statements include but are not limited to statements about the benefits of the business combination transaction involving Glacier Bancorp, Inc. (“Glacier Bancorp” or “Glacier”) and TFB Bancorp, Inc., including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those projected, including but not limited to the following: the possibility that the merger does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Glacier Bancorp and TFB Bancorp, Inc. operate; the ability to promptly and effectively integrate the businesses of Glacier Bank and TFB Bancorp, Inc.; the reaction to the transaction of the companies’ customers, employees, and counterparties; and the diversion of management time on merger-related issues. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management’s current estimates, projections, expectations and beliefs. Glacier Bancorp undertakes no obligation to publicly revise or update the forward-looking statements to reflect events or circumstances that arise after the date of this release. This statement is included for the express purpose of invoking PSLRA's safe harbor provisions.

Transaction Overview Glacier Bancorp will acquire TFB Bancorp, Inc. (“TFB Bancorp”) (OTC: TBBN), a Yuma, Arizona-based bank holding company for The Foothills Bank, with $316 million in assets, as of September 30, 2016 Transaction marks Glacier’s first entry into the Arizona market and the seventh Glacier acquisition announcement in the past four years Each TBBN shareholder will receive a unit consisting of $7.36152 per share in cash and 0.607387 shares of Glacier common stock Based on the closing price of $32.13 for Glacier shares on November 11, 2016, the transaction would result in an aggregate value of $62.4 million, or $26.88 per fully diluted TBBN common share. The Foothills Bank will be merged into Glacier Bank and operate as Glacier’s 14th separate banking division, continuing to do business under The Foothills Bank name Management and employees of The Foothills Bank will remain in place Closing of transaction is subject to required regulatory approvals, TBBN shareholder approval, and customary closing conditions Targeted closing date is in the first quarter of 2017

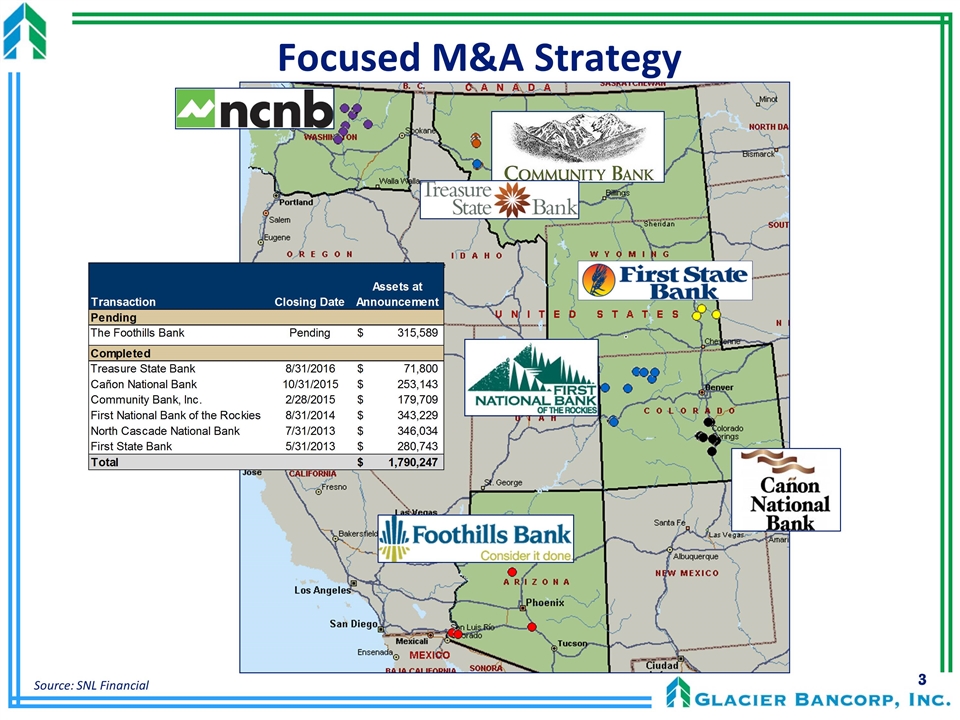

Focused M&A Strategy Source: SNL Financial

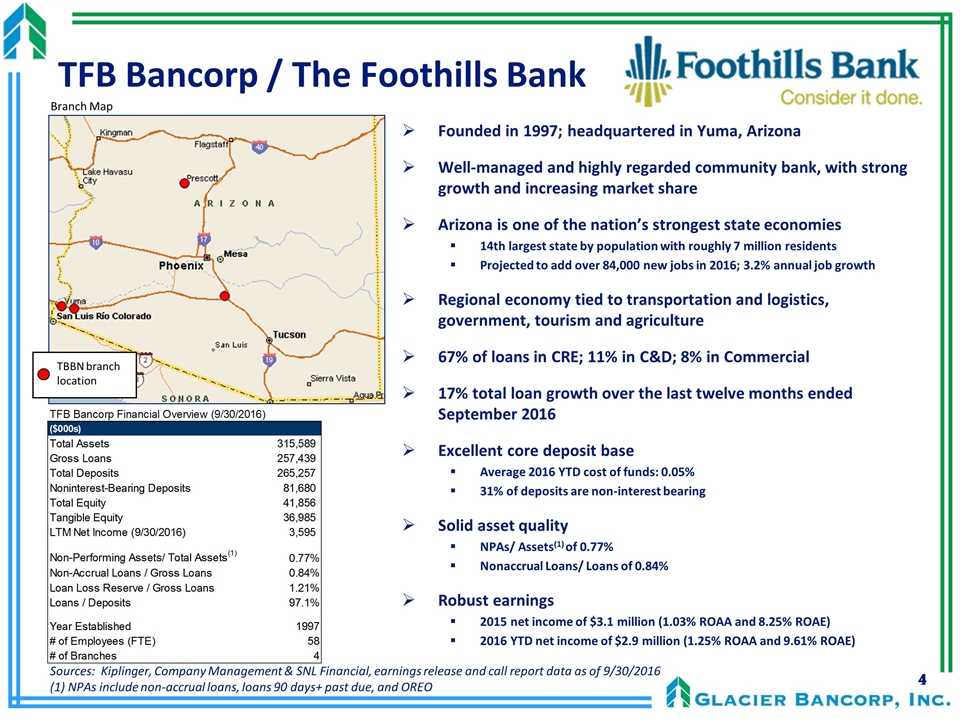

TFB Bancorp / The Foothills Bank Founded in 1997; headquartered in Yuma, Arizona Well-managed and highly regarded community bank, with strong growth and increasing market share Arizona is one of the nation’s strongest state economies 14th largest state by population with roughly 7 million residents Projected to add over 84,000 new jobs in 2016; 3.2% annual job growth Regional economy tied to transportation and logistics, government, tourism and agriculture 67% of loans in CRE; 11% in C&D; 8% in Commercial 17% total loan growth over the last twelve months ended September 2016 Excellent core deposit base Average 2016 YTD cost of funds: 0.05% 31% of deposits are non-interest bearing Solid asset quality NPAs/ Assets(1) of 0.77% Nonaccrual Loans/ Loans of 0.84% Robust earnings 2015 net income of $3.1 million (1.03% ROAA and 8.25% ROAE) 2016 YTD net income of $2.9 million (1.25% ROAA and 9.61% ROAE) Branch Map Sources: Kiplinger, Company Management & SNL Financial, earnings release and call report data as of 9/30/2016 (1) NPAs include non-accrual loans, loans 90 days+ past due, and OREO TBBN branch location

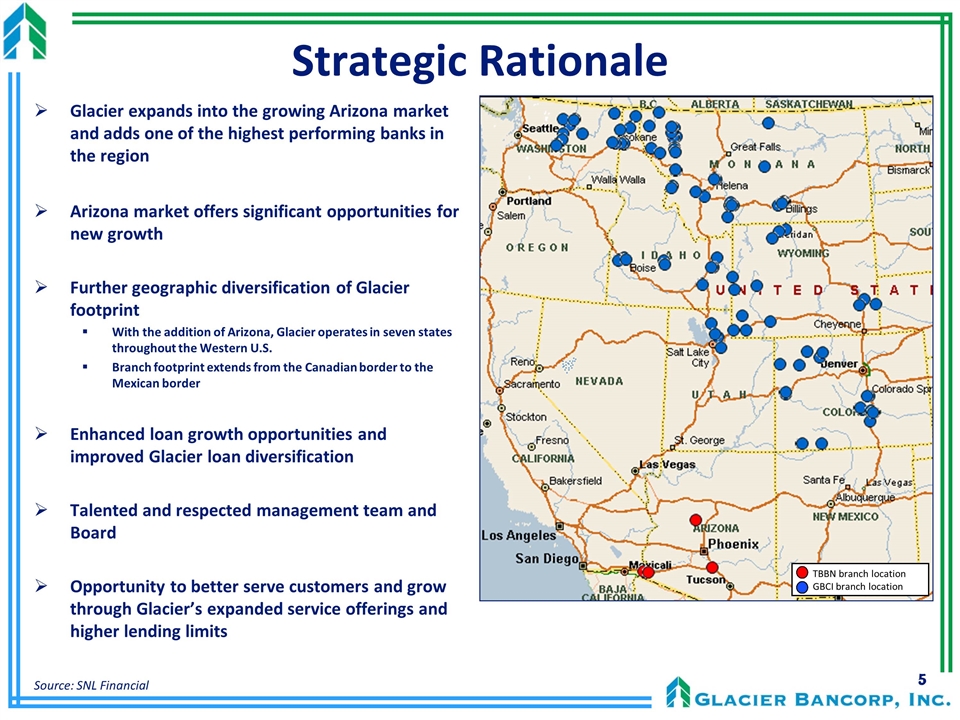

Strategic Rationale Glacier expands into the growing Arizona market and adds one of the highest performing banks in the region Arizona market offers significant opportunities for new growth Further geographic diversification of Glacier footprint With the addition of Arizona, Glacier operates in seven states throughout the Western U.S. Branch footprint extends from the Canadian border to the Mexican border Enhanced loan growth opportunities and improved Glacier loan diversification Talented and respected management team and Board Opportunity to better serve customers and grow through Glacier’s expanded service offerings and higher lending limits Source: SNL Financial TBBN branch location GBCI branch location

Attractive Economic Profile of Arizona Arizona is the 14th largest state by population with roughly 7 million residents Total GDP of Arizona was $297 billion in Q1 2016 Ranked 22nd highest in the country and 4th highest in the Western U.S.(1) Arizona has rebounded from the recession and the population is expected to grow steadily due to the low cost of living and favorable tax rate Kiplinger expects Arizona to be the second fastest job growth state in 2016 Arizona projected to add over 84,000 new jobs in 2016; 3.2% annual job growth Arizona was the eighth fastest growing state in 2015, adding 99,300 new residents from 2014 Arizona population is projected to grow 5.9% through 2022, 7th fastest in the country Sources: Nielsen, Kiplinger, U.S. Census Bureau, U.S. Bureau of Economic Analysis (1) Includes AZ, CA, CO, ID, MT, NV, NM, OR, UT, WA and WY

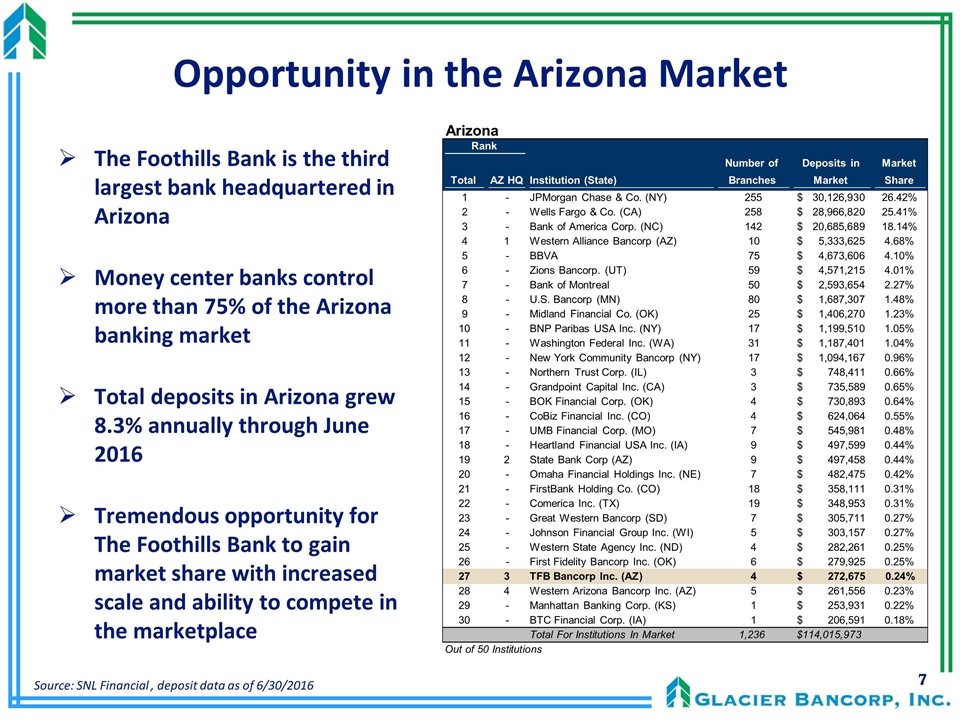

The Foothills Bank is the third largest bank headquartered in Arizona Money center banks control more than 75% of the Arizona banking market Total deposits in Arizona grew 8.3% annually through June 2016 Tremendous opportunity for The Foothills Bank to gain market share with increased scale and ability to compete in the marketplace Opportunity in the Arizona Market Source: SNL Financial , deposit data as of 6/30/2016 Total AZ HQ Institution (State) Number of Branches Deposits in Market Market Share 1 - JPMorgan Chase & Co. (NY) 255 30,126,930 $ 26.42% 2 - Wells Fargo & Co. (CA) 258 28,966,820 $ 25.41% 3 - Bank of America Corp. (NC) 142 20,685,689 $ 18.14% 4 1 Western Alliance Bancorp (AZ) 10 5,333,625 $ 4.68% 5 - BBVA 75 4,673,606 $ 4.10% 6 - Zions Bancorp. (UT) 59 4,571,215 $ 4.01% 7 - Bank of Montreal 50 2,593,654 $ 2.27% 8 - U.S. Bancorp (MN) 80 1,687,307 $ 1.48% 9 - Midland Financial Co. (OK) 25 1,406,270 $ 1.23% 10 - BNP Paribas USA Inc. (NY) 17 1,199,510 $ 1.05% 11 - Washington Federal Inc. (WA) 31 1,187,401 $ 1.04% 12 - New York Community Bancorp (NY) 17 1,094,167 $ 0.96% 13 - Northern Trust Corp. (IL) 3 748,411 $ 0.66% 14 - Grandpoint Capital Inc. (CA) 3 735,589 $ 0.65% 15 - BOK Financial Corp. (OK) 4 730,893 $ 0.64% 16 - CoBiz Financial Inc. (CO) 4 624,064 $ 0.55% 17 - UMB Financial Corp. (MO) 7 545,981 $ 0.48% 18 - Heartland Financial USA Inc. (IA) 9 497,599 $ 0.44% 19 2 State Bank Corp (AZ) 9 497,458 $ 0.44% 20 - Omaha Financial Holdings Inc. (NE) 7 482,475 $ 0.42% 21 - FirstBank Holding Co. (CO) 18 358,111 $ 0.31% 22 - Comerica Inc. (TX) 19 348,953 $ 0.31% 23 - Great Western Bancorp (SD) 7 305,711 $ 0.27% 24 - Johnson Financial Group Inc. (WI) 5 303,157 $ 0.27% 25 - Western State Agency Inc. (ND) 4 282,261 $ 0.25% 26 - First Fidelity Bancorp Inc. (OK) 6 279,925 $ 0.25% 27 3 TFB Bancorp Inc. (AZ) 4 272,675 $ 0.24% 28 4 Western Arizona Bancorp Inc. (AZ) 5 261,556 $ 0.23% 29 - Manhattan Banking Corp. (KS) 1 253,931 $ 0.22% 30 - BTC Financial Corp. (IA) 1 206,591 $ 0.18% Total For Institutions In Market 1,236 $114,015,973 Out of 50 Institutions Arizona Rank

Financial Benefits TBBN has posted strong earnings despite the challenging banking environment 1.03% ROAA in 2015 and 1.25% year-to-date through September Impressive long-term growth trends, with total assets growing from $109 million in 2005 to $303 million in 2015 Glacier adds nearly $257 million in high quality loans, further diversifying Glacier’s loan mix by geography and industry Glacier adds $248 million in core deposits, with 31% of deposits non-interest bearing Average 2016 YTD cost of funds: 0.05% Solid asset quality metrics contribute to favorable trends at Glacier Further realization of Glacier’s capital deployment strategy Glacier anticipates year 1 EPS accretion of 1.4%(1) Glacier Tangible Book Value / Share dilution of 0.6%; estimated EPS accretion provides TBV dilution payback in less than 2.5 years Excluding one-time transaction costs and assuming 100% realization of estimated cost-saves in 2018

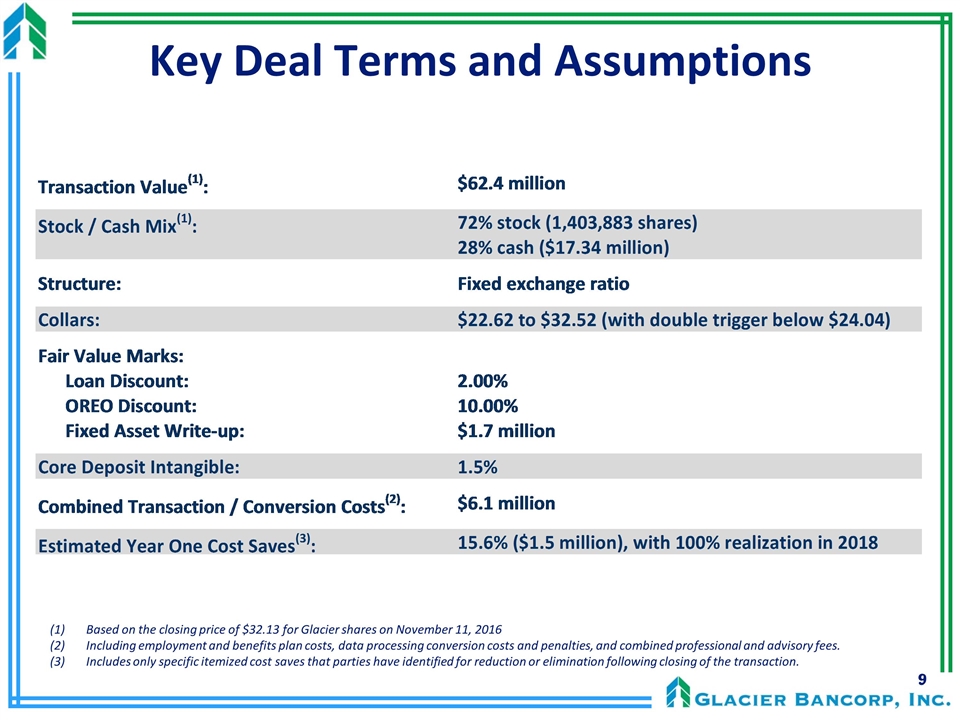

Key Deal Terms and Assumptions Based on the closing price of $32.13 for Glacier shares on November 11, 2016 Including employment and benefits plan costs, data processing conversion costs and penalties, and combined professional and advisory fees. Includes only specific itemized cost saves that parties have identified for reduction or elimination following closing of the transaction.

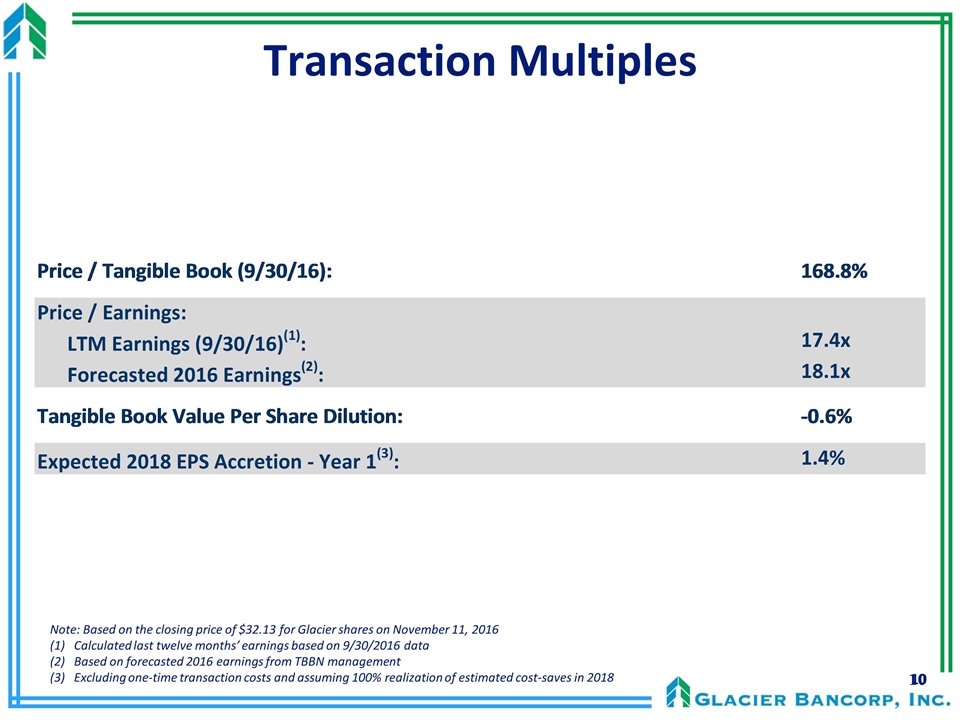

Transaction Multiples Note: Based on the closing price of $32.13 for Glacier shares on November 11, 2016 Calculated last twelve months’ earnings based on 9/30/2016 data Based on forecasted 2016 earnings from TBBN management Excluding one-time transaction costs and assuming 100% realization of estimated cost-saves in 2018

Concluding Observations The Foothills Bank acquisition continues Glacier’s tradition of adding high quality regional banks that fit the Glacier community banking model Unique opportunity for Glacier to enter the Arizona market Arizona is an attractive growth market and is complementary to Glacier’s existing markets Pricing metrics, deal structure, and conservative assumptions reflective of Glacier’s disciplined approach to acquisitions The Foothills Bank staff provides Glacier with additional lending talent, deep market knowledge, and strong customer relationships Under the Glacier structure, The Foothills Bank employees will be able to focus even greater attention on customers and community With Glacier providing regulatory, operational, and financial support Transaction will enhance GBCI’s long-term track record of creating shareholder value