Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - REATA PHARMACEUTICALS INC | reta-ex312_8.htm |

| EX-32.2 - EX-32.2 - REATA PHARMACEUTICALS INC | reta-ex322_9.htm |

| EX-32.1 - EX-32.1 - REATA PHARMACEUTICALS INC | reta-ex321_7.htm |

| EX-31.1 - EX-31.1 - REATA PHARMACEUTICALS INC | reta-ex311_6.htm |

| EX-10.4 - EX-10.4 - REATA PHARMACEUTICALS INC | reta-ex104_349.htm |

| EX-10.3 - EX-10.3 - REATA PHARMACEUTICALS INC | reta-ex103_350.htm |

| EX-10.2 - EX-10.2 - REATA PHARMACEUTICALS INC | reta-ex102_352.htm |

| EX-10.1 - EX-10.1 - REATA PHARMACEUTICALS INC | reta-ex101_619.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-37785

Reata Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

DELAWARE |

|

11-3651945 |

|

( State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer |

|

|

|

|

|

2801 Gateway Dr, Suite 150 |

|

75063 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (972) 865-2219

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☒ (Do not check if a small reporting company) |

|

Small reporting company |

|

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 10, 2016, the registrant had 8,310,113 shares of Class A common stock, $0.001 par value per share, and 14,026,267 shares of Class B common stock, $0.001 par value per share, outstanding.

|

|

|

Page |

|

3 |

||

|

PART I. |

|

|

|

Item 1. |

4 |

|

|

|

4 |

|

|

|

5 |

|

|

|

6 |

|

|

|

7 |

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

12 |

|

Item 3. |

32 |

|

|

Item 4. |

32 |

|

|

PART II. |

|

|

|

Item 1. |

33 |

|

|

Item 1A. |

33 |

|

|

Item 2. |

33 |

|

|

Item 3. |

33 |

|

|

Item 4. |

33 |

|

|

Item 5. |

33 |

|

|

Item 6. |

34 |

|

|

35 |

||

|

|

|

|

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that involve substantial risks and uncertainties. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. All statements, other than statements of historical facts, contained in this Quarterly Report on Form 10-Q, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans, and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “goals,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” “could,” “should,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements about:

|

• |

our expectations regarding the timing, costs, conduct, and outcome of our clinical trials, including statements regarding the timing of the initiation and availability of data from such trials; |

|

• |

the timing and likelihood of regulatory filings and approvals for our product candidates; |

|

• |

our expectations regarding the potential market size and the size of the patient populations for our product candidates, if approved for commercial use, and the potential market opportunities for commercializing our product candidates; |

|

• |

our expectations related to the use of our available cash; |

|

• |

estimates of our expenses, future revenue, capital requirements, and our needs for additional financing; |

|

• |

our ability to develop, acquire, and advance product candidates into, and successfully complete, clinical trials; |

|

• |

the initiation, timing, progress, and results of future preclinical studies and clinical trials, and our research and development programs; |

|

• |

the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates; |

|

• |

our ability to maintain and establish collaborations or obtain additional funding; |

|

• |

our ability to maintain and establish relationships with third parties, such as contract research organizations, suppliers, and distributors; |

|

• |

our expectations regarding the time during which we will be an emerging growth company under the JOBS Act; |

|

• |

our ability to establish and maintain arrangements for manufacture of our product candidates; |

|

• |

the impact of governmental laws and regulations; |

|

• |

developments and projections relating to our competitors and our industry; and |

|

• |

other risks and uncertainties, including those described under the heading “Risk Factors” included in our final prospectus, or Final Prospectus, dated May 25, 2016, and filed with the U.S. Securities and Exchange Commission, or SEC, pursuant to Rule 424b under the Securities Act of 1933, or the Securities Act, on May 26, 2016. |

Any forward-looking statements in this Quarterly Report on Form 10-Q reflect our current views with respect to future events or to our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those described under the heading “Risk Factors” in the Final Prospectus and discussed elsewhere in this Quarterly Report on Form 10-Q. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should read this Quarterly Report on Form 10-Q and the documents that we have filed as exhibits to this Quarterly Report on Form 10-Q completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

3

PART I - FINANCIAL INFORMATION

Reata Pharmaceuticals, Inc.

(in thousands, except share data)

|

|

|

September 30, 2016 (unaudited) |

|

|

December 31, 2015 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

95,660 |

|

|

$ |

42,008 |

|

|

Federal income tax receivable |

|

|

— |

|

|

|

31,926 |

|

|

Prepaid expenses and other current assets |

|

|

4,260 |

|

|

|

3,325 |

|

|

Total current assets |

|

|

99,920 |

|

|

|

77,259 |

|

|

Property and equipment, net |

|

|

899 |

|

|

|

1,142 |

|

|

Other assets |

|

|

1,004 |

|

|

|

553 |

|

|

Total assets |

|

$ |

101,823 |

|

|

$ |

78,954 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ deficit |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,296 |

|

|

$ |

3,531 |

|

|

Accrued direct research liabilities |

|

|

4,424 |

|

|

|

3,529 |

|

|

Other current liabilities |

|

|

4,756 |

|

|

|

4,030 |

|

|

Current portion of deferred revenue |

|

|

49,595 |

|

|

|

49,730 |

|

|

Total current liabilities |

|

|

60,071 |

|

|

|

60,820 |

|

|

Other long-term liabilities |

|

|

94 |

|

|

|

249 |

|

|

Deferred revenue, net of current portion |

|

|

253,947 |

|

|

|

291,041 |

|

|

Total noncurrent liabilities |

|

|

254,041 |

|

|

|

291,290 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

|

|

|

Common stock A, $0.001 par value: 500,000,000 shares authorized; issued and outstanding – 7,758,499 and 0 shares at September 30, 2016 and December 31, 2015 |

|

|

8 |

|

|

|

— |

|

|

Common stock B, $0.001 par value: 150,000,000 shares authorized; issued and outstanding – 14,577,568 and 15,998,106 shares at September 30, 2016 and December 31, 2015 |

|

|

15 |

|

|

|

16 |

|

|

Additional paid-in capital |

|

|

72,987 |

|

|

|

10,036 |

|

|

Shareholder notes receivable |

|

|

(81 |

) |

|

|

(81 |

) |

|

Accumulated deficit |

|

|

(285,218 |

) |

|

|

(283,127 |

) |

|

Total stockholders’ deficit |

|

|

(212,289 |

) |

|

|

(273,156 |

) |

|

Total liabilities and stockholders’ deficit |

|

$ |

101,823 |

|

|

$ |

78,954 |

|

See accompanying notes.

4

Unaudited Consolidated Statements of Operations

(in thousands, except share and per share data)

|

|

|

Three Months ended |

|

|

Nine Months ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

||||

|

Collaboration revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License and milestone |

|

$ |

12,500 |

|

|

$ |

12,500 |

|

|

$ |

37,230 |

|

|

$ |

37,794 |

|

|

Other revenue |

|

|

51 |

|

|

|

— |

|

|

|

125 |

|

|

|

— |

|

|

Total collaboration revenue |

|

|

12,551 |

|

|

|

12,500 |

|

|

|

37,355 |

|

|

|

37,794 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

9,300 |

|

|

|

8,550 |

|

|

|

27,681 |

|

|

|

26,816 |

|

|

General and administrative |

|

|

4,039 |

|

|

|

2,980 |

|

|

|

11,783 |

|

|

|

9,203 |

|

|

Depreciation and amortization |

|

|

170 |

|

|

|

486 |

|

|

|

537 |

|

|

|

1,548 |

|

|

Total expenses |

|

|

13,509 |

|

|

|

12,016 |

|

|

|

40,001 |

|

|

|

37,567 |

|

|

Other income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income |

|

|

62 |

|

|

|

9 |

|

|

|

113 |

|

|

|

25 |

|

|

Total other income |

|

|

62 |

|

|

|

9 |

|

|

|

113 |

|

|

|

25 |

|

|

(Loss) income before provision (benefit) for taxes on income |

|

|

(896 |

) |

|

|

493 |

|

|

|

(2,533 |

) |

|

|

252 |

|

|

Provision (benefit) for taxes on income |

|

|

1 |

|

|

|

(140 |

) |

|

|

(442 |

) |

|

|

(44 |

) |

|

Net (loss) income |

|

$ |

(897 |

) |

|

$ |

633 |

|

|

$ |

(2,091 |

) |

|

$ |

296 |

|

|

Net (loss) income per share—basic |

|

$ |

(0.04 |

) |

|

$ |

0.04 |

|

|

$ |

(0.11 |

) |

|

$ |

0.02 |

|

|

Net (loss) income per share—diluted |

|

$ |

(0.04 |

) |

|

$ |

0.04 |

|

|

$ |

(0.11 |

) |

|

$ |

0.02 |

|

|

Weighted-average number of common shares used in net (loss) income per share basic |

|

|

22,324,374 |

|

|

|

15,979,614 |

|

|

|

18,970,128 |

|

|

|

15,974,510 |

|

|

Weighted-average number of common shares used in net (loss) income per share diluted |

|

|

22,324,374 |

|

|

|

16,149,149 |

|

|

|

18,970,128 |

|

|

|

16,082,963 |

|

See accompanying notes.

5

Unaudited Consolidated Statements of Cash Flows

(in thousands)

|

|

|

Nine Months ended |

|

|||||

|

|

|

September 30, |

|

|||||

|

|

|

2016 |

|

|

2015 |

|

||

|

Operating activities |

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(2,091 |

) |

|

$ |

296 |

|

|

Adjustments to reconcile net (loss) income to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

537 |

|

|

|

1,548 |

|

|

Stock-based compensation expense |

|

|

1,451 |

|

|

|

1,019 |

|

|

Provision for deferred taxes on income |

|

|

— |

|

|

|

13,427 |

|

|

Loss on disposal of property and equipment |

|

|

— |

|

|

|

2 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

(2,899 |

) |

|

|

(327 |

) |

|

Other assets |

|

|

(451 |

) |

|

|

282 |

|

|

Accounts payable |

|

|

(2,235 |

) |

|

|

665 |

|

|

Accrued direct research and other current liabilities |

|

|

2,869 |

|

|

|

1,576 |

|

|

Federal income tax receivable/payable |

|

|

31,926 |

|

|

|

(13,470 |

) |

|

Deferred revenue |

|

|

(37,230 |

) |

|

|

(37,095 |

) |

|

Net cash used in operating activities |

|

|

(8,123 |

) |

|

|

(32,077 |

) |

|

Investing activities |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(281 |

) |

|

|

(257 |

) |

|

Net cash used in investing activities |

|

|

(281 |

) |

|

|

(257 |

) |

|

Financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock from initial public offering, net of issuance costs |

|

|

64,705 |

|

|

|

— |

|

|

Payments on deferred offering costs |

|

|

(2,531 |

) |

|

|

(343 |

) |

|

Exercise of options and related tax withholdings |

|

|

(73 |

) |

|

|

15 |

|

|

Payment of capital lease obligation |

|

|

(45 |

) |

|

|

(45 |

) |

|

Net cash provided by (used in) financing activities |

|

|

62,056 |

|

|

|

(373 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

|

53,652 |

|

|

|

(32,707 |

) |

|

Cash and cash equivalents at beginning of year |

|

|

42,008 |

|

|

|

87,758 |

|

|

Cash and cash equivalents at end of period |

|

$ |

95,660 |

|

|

$ |

55,051 |

|

|

Supplemental disclosures |

|

|

|

|

|

|

|

|

|

Income taxes paid |

|

$ |

18 |

|

|

$ |

— |

|

|

Purchases of equipment in accounts payable and other current liabilities |

|

$ |

13 |

|

|

$ |

— |

|

|

Vested prepaid restricted stock |

|

$ |

348 |

|

|

$ |

348 |

|

See accompanying notes.

6

Notes to Unaudited Consolidated Financial Statements

1. Description of Business

Reata Pharmaceuticals, Inc., or the Company, is a clinical stage biopharmaceutical company located in Irving, Texas focused on identifying, developing, and commercializing product candidates to address rare and life-threatening diseases with few or no approved therapies by targeting molecular pathways involved in how cells produce energy and regulate inflammation. The Company operates as a single segment of business.

The Company’s lead product candidates, bardoxolone methyl and omaveloxolone, are members of a class of small molecules called antioxidant inflammation modulators and target an important transcription factor, called Nrf2, to restore mitochondrial function, reduce oxidative stress, and resolve inflammation. Bardoxolone methyl is in Phase 3 clinical development for the treatment of pulmonary arterial hypertension associated with connective tissue disease (CTD-PAH), and Phase 2 clinical development for the treatment of pulmonary hypertension due to interstitial lung disease and pulmonary arterial hypertension, each of which are subsets of pulmonary hypertension (PH). The Company began enrolling patients in its Phase 3 trial in CTD-PAH in October 2016. In addition, the Company recently met with the U.S. Food and Drug Administration and received guidance on endpoints and general design for a single, pivotal Phase 2/3 trial in chronic kidney disease caused by Alport syndrome. Omaveloxolone is in Phase 2 clinical development for the treatment of multiple diseases, including Friedreich’s ataxia, mitochondrial myopathies, and metastatic melanoma. Beyond its lead product candidates, the Company has several promising preclinical programs. The Company believes its product candidates and preclinical programs have the potential to improve clinical outcomes in numerous underserved patient populations.

The Company’s consolidated financial statements include the accounts of all majority-owned subsidiaries that are required to be consolidated. Accordingly, the Company’s share of net earnings and losses from these subsidiaries is included in the consolidated statements of operations. Intracompany profits, transactions, and balances have been eliminated in consolidation.

On January 6, 2016, the Company effected a 4.4-to-1 reverse split of its common stock, and an automatic conversion of its common stock into Class B common stock. Upon the effectiveness of the reverse stock split and conversion, (i) every 4.4 shares of outstanding common stock were combined into one share of Class B common stock, (ii) the number of shares of common stock for which each outstanding option to purchase common stock is exercisable was proportionally decreased on a 4.4-to-1 basis and converted into an option to purchase Class B common stock, and (iii) the exercise price of each outstanding option to purchase common stock was proportionately increased on a 4.4-to-1 basis. All of the outstanding common stock share numbers, common stock options, share prices, exercise prices and per share amounts have been adjusted in these consolidated financial statements, on a retroactive basis, to reflect this 4.4-to-1 reverse stock split for all periods presented. The par value per share was not adjusted as a result of the reverse stock split.

On May 11, 2016, the Company effected a 1.45-to-1 reverse split of its common stock. Upon the effectiveness of the reverse stock split, (i) every 1.45 shares of outstanding common stock were combined into one share of common stock of the same class, (ii) the number of shares of common stock for which each outstanding option to purchase common stock is exercisable was proportionally decreased on a 1.45-to-1 basis, and (iii) the exercise price of each outstanding option to purchase common stock was proportionately increased on a 1.45-to-1 basis. All of the outstanding common stock share numbers, common stock options, share prices, exercise prices and per share amounts have been adjusted in these consolidated financial statements, on a retroactive basis, to reflect this 1.45-to-1 reverse stock split for all periods presented. The par value per share was not adjusted as a result of the reverse stock split.

On May 25, 2016, the Company’s registration statement on Form S-1 (File No. 333-208843) relating to its initial public offering (IPO), of its common stock was declared effective by the U.S. Securities and Exchange Commission (SEC). The shares began trading on The NASDAQ Global Market on May 26, 2016. The public offering price of the shares sold in the offering was $11.00 per share. The IPO closed on June 1, 2016 for 6,325,000 shares of its Class A common stock, which included 825,000 shares of its Class A common stock issued pursuant to the over-allotment option granted to the underwriters. The Company received total proceeds from the offering of $60.9 million, net of underwriting discounts and commissions and offering expenses.

7

Reata Pharmaceuticals, Inc.

Notes to Unaudited Consolidated Financial Statements (continued)

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (U.S. GAAP) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the nine months ended September 30, 2016 are not necessarily indicative of the results that may be expected for the year ending December 31, 2016. The consolidated balance sheet at December 31, 2015 has been derived from the audited consolidated financial statements at that date but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements. For further information, refer to the annual consolidated financial statements and footnotes thereto of the Company.

Revenue Recognition

The Company’s revenue to date has been generated primarily through collaborative licensing agreements with AbbVie Ltd. (AbbVie) and Kyowa Hakko Kirin Co., Ltd. Revenues for periods shown consist of the recognition of deferred revenue from upfront payments and milestone payments received in 2012 and prior years. The Company has not generated any revenue based on the sale of products.

In June 2013, the Company entered into a research collaboration with a disease advocacy organization. Under the agreement, the Company may be provided milestone payments to fund research and development activities estimated over a two-year period. The Company recorded collaboration revenue totaling $700,000 related to milestone payments during the nine months ended September 30, 2015.

Research and Development Costs

AbbVie is not currently participating in the development of bardoxolone methyl for the treatment of PH and we are therefore incurring all costs for this program. With respect to its omaveloxolone programs and its collaboration agreement with AbbVie, the Company was responsible for a certain initial amount in early development costs before AbbVie began sharing development costs equally. As of April 2016, the Company had incurred all of these initial costs, after which payments from AbbVie with respect to research and development costs incurred by the Company were recorded as a reduction in research and development expenses. The Company’s expenses were reduced by $773,000 and $1,434,000 for AbbVie’s share of research and development costs for the three months and nine months ended September 30, 2016. Accordingly, as of September 30, 2016, the Company had receivables in the amount of $1,434,000 included in prepaid expenses and other current assets on the consolidated balance sheet. The Company received $661,000 from AbbVie in October 2016.

In September 2016, the Company and AbbVie mutually agreed that the Company would continue unilateral development of omaveloxolone. Therefore, AbbVie no longer co-funds the exploratory development costs of this program, but retains the right to opt back in at certain points in development. Depending upon what point, if any, AbbVie opts back into development, AbbVie may retain its right to commercialize a product outside the U.S. or the Company may be responsible for commercializing the product on a worldwide basis. Upon opting back in, AbbVie would be required to pay an agreed upon amount of all development costs accumulated up to the point of exercising their opt-in right, after which development costs incurred and product revenue worldwide would be split equally.

The Company bases its expense accruals related to clinical trials on its estimates of the services received and efforts expended pursuant to contracts with multiple research institutions and contract research organizations that conduct and manage clinical trials on its behalf. The financial terms of these agreements vary from contract to contract and may result in uneven payment flows. Payments under some of these contracts depend on factors such as the successful enrollment of patients and the completion of clinical trial milestones. In accruing costs, the Company estimates the time period over which services will be performed and the level of effort to be expended in each period. If the Company does not identify costs that it has begun to incur or if the Company underestimates or overestimates the level of services performed or the costs of these services, its actual expenses could differ from its estimates.

8

Reata Pharmaceuticals, Inc.

Notes to Unaudited Consolidated Financial Statements (continued)

To date, the Company has not experienced significant changes in its estimates of accrued research and development expenses after a reporting period. However, due to the nature of estimates, the Company cannot assure that it will not make changes to its estimates in the future as the Company becomes aware of additional information about the status or conduct of its clinical trials and other research activities.

Stock-Based Compensation

The Company accounts for its equity-based compensation awards in accordance with Accounting Standard Codification ASC 718 Compensation—Stock Compensation (ASC 718). ASC 718 requires companies to recognize compensation expense using a fair value based method for costs related to stock-based payments, including stock options. The expense is measured based on the grant date fair value of the awards that are expected to vest, and the expense is recorded over the applicable requisite service period.

The Company uses the Black-Scholes option-pricing model to estimate the fair value of stock option awards, which takes into consideration various factors, including the exercise price of the award, the expected term of the award, the current price of the underlying shares, the expected volatility of the underlying share price based on peer companies, forfeitures rate, and the risk-free interest rate. Prior to the Company’s IPO of its common stock, the fair values of the shares of common stock underlying the Company’s share-based awards were estimated on each grant date using a probability-weighted expected return method. Following the close of its IPO in June 2016, the fair values of its common stock underlying its share-based awards were estimated using observable market prices.

Risks and Uncertainties

The Company has experienced losses and negative operating cash flows for many years since inception and has no marketed drug or other products. The Company’s ability to generate future revenue depends upon the results of its development programs, the success of which cannot be guaranteed. The Company will need to raise additional equity capital in the future in order to fund its operations.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Fair Value of Financial Instruments

The fair values of the Company’s stockholder notes receivable were approximately $166,000 and $138,000 at September 30, 2016 and December 31, 2015, respectively. The fair value was calculated using an income approach to estimate the present value of expected future cash flows to be received under the notes. The measurement is considered to be based primarily on Level 3 inputs used in the calculation, including the discount rate applied and the estimate of future cash flows.

Net Income (Loss) per Share

Basic and diluted net income (loss) per common share is calculated by dividing net income (loss) attributable to common stockholders by the weighted average number of common shares outstanding during the period, without consideration for common stock equivalents. The Company’s potentially dilutive shares, which include unvested restricted stock and options to purchase common stock, are considered to be common stock equivalents and are only included in the calculation of diluted net income (loss) per share when their effect is dilutive. For periods in which the Company reports a net loss attributable to common stockholders, diluted net loss per share attributable to common stockholders is the same as basic net loss per share attributable to common stockholders, since dilutive common shares are not assumed to have been issued if their effect is anti-dilutive.

The Company uses the two-class method to compute net income (loss) per common share attributable to common stockholders because the Company has issued securities, other than Class A and Class B common stock, that contractually entitle the holders to participate in dividends and earnings of the Company. The two-class method requires earnings for the period to be allocated between common stock and participating securities based upon their respective rights to receive distributed and undistributed earnings. Holders of restricted common stock are entitled to the dividend amount paid to common stockholders on an as-if-converted-to-common stock basis when declared by the Company’s Board of Directors. As a result, all restricted common stock are considered to be participating securities.

9

Reata Pharmaceuticals, Inc.

Notes to Unaudited Consolidated Financial Statements (continued)

Deferred offering costs, which primarily consist of direct incremental accounting, legal, and printing fees relating to the IPO, were initially capitalized. The deferred offering costs totaling $3,489,000 were subsequently offset against IPO proceeds upon the completion of the IPO on June 1, 2016.

Recent Accounting Pronouncements

In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2016-02, Leases (Topic 842), which supersedes the leases in ASC 840, Leases. This ASU requires the recognition of lease assets and lease liabilities by lessees for those leases previously classified as operating leases. The ASU is effective for public companies for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2018. Early adoption is permitted. The Company will apply the guidance and disclosure provisions of the new standard upon adoption. The Company is currently evaluating this standard and has not yet determined what, if any, effect ASU No. 2016-02 will have on its consolidated results of operations or financial position.

In March 2016, the FASB issued ASU No. 2016-09, Compensation–Stock Compensation: Improvements to Employee Share-Based Payment Accounting, to simplify several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. The ASU is effective for public companies for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2016. Early adoption is permitted. The Company will apply the guidance and disclosure provisions of the new standard upon adoption. The Company is currently evaluating this standard and has not yet determined what, if any, effect ASU No. 2016-09 will have on its consolidated results of operations or financial position.

In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments, This update addresses eight specific cash flow issues with the objective of reducing the existing diversity in practice. The ASU is effective for public companies for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. The Company is currently evaluating this standard and has not yet determined what, if any, effect ASU No. 2016-15 will have on its consolidated results of operations or financial position.

3. Income Taxes

The Company’s effective tax rate varies with the statutory rate due primarily to the impact of nondeductible stock-based compensation and the changes in valuation allowance related to certain deferred tax assets generated or utilized in the applicable period. The Company’s deferred tax assets have been fully offset by a valuation allowance at September 30, 2016, and the Company expects to maintain this valuation allowance until there is sufficient evidence that future earnings can be achieved, which is uncertain at this time.

4. Stock-Based Compensation

Stock Options

The following table summarizes stock-based compensation expense reflected in the consolidated statements of operations (in thousands):

|

|

|

Three Months ended |

|

|

Nine Months ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

||||

|

Research and development |

|

$ |

375 |

|

|

$ |

164 |

|

|

$ |

725 |

|

|

$ |

519 |

|

|

General and administrative |

|

|

341 |

|

|

|

162 |

|

|

|

726 |

|

|

|

500 |

|

|

|

|

|

716 |

|

|

|

326 |

|

|

|

1,451 |

|

|

|

1,019 |

|

10

Reata Pharmaceuticals, Inc.

Notes to Unaudited Consolidated Financial Statements (continued)

The following table summarizes stock option activity as of September 30, 2016, and changes during the nine months ended September 30, 2016, under the 2007 Long Term Incentive Plan (the 2007 LTIP) and standalone option agreements:

|

|

|

Number of Options |

|

|

Weighted- Average Exercise Price |

|

||

|

Outstanding at January 1, 2016 |

|

|

550,675 |

|

|

|

16.11 |

|

|

Granted |

|

|

986,845 |

|

|

|

12.63 |

|

|

Exercised |

|

|

(26,382 |

) |

|

|

10.29 |

|

|

Forfeited |

|

|

(16,536 |

) |

|

|

11.62 |

|

|

Expired |

|

|

(19,709 |

) |

|

|

11.50 |

|

|

Outstanding at September 30, 2016 |

|

|

1,474,893 |

|

|

|

14.00 |

|

|

Exercisable at September 30, 2016 |

|

|

385,776 |

|

|

|

17.13 |

|

The total intrinsic value of all outstanding options and exercisable options at September 30, 2016 was $17,143,701 and $4,646,688, respectively.

5. Related-Party Transactions

The Company paid approximately $772,000 and $896,000 to certain stockholders for sponsored research, research and development consulting services, contract manufacturing services, regulatory and medical consulting services, license fees, and clinical study services during nine months ended September 30, 2016 and 2015, respectively. These amounts are recorded in research and development expense in the accompanying consolidated statements of operations.

6. Net (Loss) income per Share

The following table sets forth the computation of basic and diluted net (loss) income per share attributable to common stockholders:

|

|

|

Three Months ended |

|

|

Nine Months ended |

|

||||||||||

|

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

||||

|

Numerator |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income (in thousands) |

|

$ |

(897 |

) |

|

$ |

633 |

|

|

$ |

(2,091 |

) |

|

$ |

296 |

|

|

Denominator |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of common shares used in net (loss) income per share – basic |

|

|

22,324,374 |

|

|

|

15,979,614 |

|

|

|

18,970,128 |

|

|

|

15,974,510 |

|

|

Dilutive potential common shares |

|

|

— |

|

|

|

169,535 |

|

|

|

— |

|

|

|

108,453 |

|

|

Weighted-average number of common shares used in net (loss) income per share – diluted |

|

|

22,324,374 |

|

|

|

16,149,149 |

|

|

|

18,970,128 |

|

|

|

16,082,963 |

|

|

Net (loss) income per share – basic |

|

|

(0.04 |

) |

|

|

0.04 |

|

|

|

(0.11 |

) |

|

|

0.02 |

|

|

Net (loss) income per share – diluted |

|

|

(0.04 |

) |

|

|

0.04 |

|

|

|

(0.11 |

) |

|

|

0.02 |

|

The number of weighted average options that were not included in the diluted earnings per share calculation because the effect would have been anti-dilutive represented 1,474,893 shares for the three and nine months ended September 30, 2016 and 132,918 and 126,433 shares for the three months and nine months ended September 30, 2015, respectively.

11

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of operations together with our consolidated financial statements and related notes and other financial information appearing in this Quarterly Report on Form 10-Q. Some of the information contained in this discussion and analysis or set forth elsewhere in this Quarterly Report on Form 10-Q, including information with respect to our plans and strategy for our business, operations, and product candidates, includes forward-looking statements that involve risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, among other things, those described under the heading “Risk Factors” and discussed elsewhere in this Quarterly Report on Form 10-Q.

Overview

We are a clinical stage biopharmaceutical company focused on identifying, developing, and commercializing product candidates to address rare and life-threatening diseases with few or no approved therapies by targeting molecular pathways that regulate cellular metabolism and inflammation. Our lead product candidates, bardoxolone methyl and omaveloxolone, are members of a class of small molecules called antioxidant inflammation modulators, or AIMs, and target an important transcription factor, called Nrf2, to restore mitochondrial function, reduce oxidative stress, and resolve inflammation. Bardoxolone methyl is currently being studied in a Phase 3 trial, known as CATALYST, for the treatment of pulmonary arterial hypertension, or PAH, associated with connective tissue disease, or CTD-PAH, as well as a Phase 2 trial, known as LARIAT, for the treatment of pulmonary hypertension due to interstitial lung disease, or PH-ILD, and PAH, each of which are subsets of pulmonary hypertension, or PH. We began enrolling patients in CATALYST in October 2016. In addition, we recently met with the U.S. Food and Drug Administration, or the FDA, and received guidance on endpoints and general design for a single, pivotal Phase 2/3 trial in chronic kidney disease, or CKD, caused by Alport syndrome. Omaveloxolone is being studied in Phase 2 trials for the treatment of multiple diseases, including Friedreich’s ataxia, or FA, mitochondrial myopathies, or MM, and metastatic melanoma, known as MOXIe, MOTOR, and REVEAL, respectively. Beyond our lead product candidates, we have several promising preclinical development programs. We believe that our product candidates and preclinical programs have the potential to improve clinical outcomes in numerous underserved patient populations.

To date, we have focused most of our efforts and resources on developing our product candidates and conducting preclinical studies and clinical trials. We have historically financed our operations primarily through revenue generated from our collaborations with AbbVie Ltd., or AbbVie, and Kyowa Hakko Kirin Co., Ltd., or KHK, and from sales of our securities. We have not received any payments or revenue from collaborations other than nonrefundable upfront, milestone, and cost sharing payments from our collaborations with AbbVie and KHK and reimbursements of expenses under the terms of our agreement with KHK. We have incurred losses in each year since our inception, other than in 2014. As of September 30, 2016, we had $95.7 million of cash and cash equivalents and an accumulated deficit of $285.2 million. We continue to incur significant research and development and other expenses related to our ongoing operations. Despite contractual product development commitments and the potential to receive future payments from our collaborators, we anticipate that, without taking into account deferred revenue, we will continue to incur losses for the foreseeable future, and we anticipate that our losses will increase as we continue our development of, and seek regulatory approval for, our product candidates. If we do not successfully develop and obtain regulatory approval of our existing product candidates or any future product candidates and effectively manufacture, market, and sell any products that are approved, we may never generate revenue from product sales. Furthermore, even if we do generate revenue from product sales, we may never again achieve or sustain profitability on a quarterly or annual basis. Our prior losses, combined with expected future losses, have had and will continue to have an adverse effect on our stockholders’ equity and working capital. Our failure to become and remain profitable could depress the market price of our Class A common stock and could impair our ability to raise capital, expand our business, diversify our product offerings, or continue our operations.

The probability of success for each of our product candidates and clinical programs and our ability to generate product revenue and become profitable depend upon a variety of factors, including the quality of the product candidate, clinical results, investment in the program, competition, manufacturing capability, commercial viability, and our collaborators’ ability to successfully execute our development and commercialization plans. We will also require additional capital through equity or debt financings in order to fund our operations and execute on our business plans, and there is no assurance that such financing will be available to us on commercially reasonable terms or at all. For a description of the numerous risks and uncertainties associated with product development and raising additional capital, see “Risk Factors” included in the Final Prospectus.

12

The chart below is a summary of our current clinical programs:

|

|

(1) |

We are currently designing a Phase 2/3 clinical trial, which we expect to initiate in the first half of 2017. |

|

|

(2) |

We continue to evaluate development of omaveloxolone for this indication. |

Bardoxolone Methyl

Bardoxolone methyl activates molecular pathways that promote the resolution of inflammation by restoring mitochondrial function, reducing oxidative stress, and inhibiting pro-inflammatory signaling. Bardoxolone methyl binds to Keap1, which activates Nrf2, a transcription factor that promotes normal mitochondrial function, increases production of antioxidant and detoxification enzymes, reduces oxidative stress, and reduces pro-inflammatory signaling. Bardoxolone methyl is currently being tested in a Phase 3 trial in CTD-PAH as well as Phase 2 trials in several forms of PH-ILD. In addition, we recently met with the FDA and received guidance on endpoints and general design characteristics of a single, pivotal Phase 2/3 trial in CKD caused by Alport syndrome and are in the process of designing that trial.

Although CTD-PAH and Alport syndrome have different causes and inflammatory stimuli, at a molecular level, mitochondrial dysfunction, inflammation, and proliferative signaling are common to the pathophysiology of both diseases. The anti-inflammatory and anti-fibrotic properties of bardoxolone methyl may therefore be relevant to preventing remodeling of the pulmonary vasculature in CTD-PAH as well as inhibiting structural alterations and glomerulosclerosis in Alport syndrome.

Bardoxolone Methyl in Pulmonary Hypertension

Pulmonary Hypertension Overview

PH is a multi-organ condition characterized by an abnormally high pressure in the network of arteries and veins that lead to and from the lungs due, in part, to narrowing of the pulmonary vasculature as a result of inflammation, remodeling, proliferation, and endothelial dysfunction. Mitochondrial dysfunction has also been implicated in PH, and impaired energetics of skeletal muscle is a common feature of PH. PH can be caused by a number of different underlying defects, which have been classified into five groups by the World Health Organization, or WHO. We are currently studying bardoxolone methyl in CATALYST in patients with WHO Group 1 CTD-PAH. We are also studying bardoxolone methyl in patients from certain subgroups of WHO Groups 3 and 5 PH-ILD.

While there are vasodilator therapies approved for the treatment of PAH, there are currently no therapies to treat PH-ILD. Further, current therapies for PAH are less effective in CTD-PAH, which makes up about 30% of the PAH population. CTD-PAH is a late and often fatal manifestation of many types of autoimmune disease, including systemic sclerosis, or scleroderma, systemic lupus erythematosus, mixed connective tissue disease, and others. PAH results in a progressive remodeling and fibrosis of the pulmonary vasculature, which increases pulmonary vascular resistance and ultimately leads to right ventricular heart failure and death. Patients with CTD-PAH are generally less responsive to existing therapies and have shorter survival than patients with other forms of PAH. In the United States, the five-year survival rate for CTD-PAH patients is approximately 44% compared to idiopathic PAH patients, who have a 68% five-year survival rate.

13

Currently approved therapies to treat PAH include endothelin receptor antagonists, nitric oxide pathway modulators, and prostacyclin pathway agonists, all of which are systemic vasodilators that directly modulate vasoconstrictive and vasodilatory pathways. All three classes of existing therapies do not specifically target the pulmonary vasculature and have systemic hemodynamic effects. These systemic hemodynamic effects can result in hypotension and syncope, or fainting, which generally limits their clinical effectiveness. These hemodynamic effects can be exacerbated when a patient is prescribed multiple vasodilators. In addition, clinically significant drug-drug interactions have been observed that can further limit the ability to deliver effective drug combinations.

Vasodilators approved for PAH also generally do not yield significant functional improvements in CTD-PAH patients because their disease involves more remodeling and fibrosis that is less affected by vasodilators. Recent research has indicated that PAH patients, and particularly CTD-PAH patients, experience mitochondrial dysfunction, which occurs in the pulmonary vasculature, heart, and other organ systems. Mitochondrial dysfunction promotes reduced energy production, inflammation, and tissue remodeling, which causes impaired cardiac and skeletal muscle function, fibrosis, and eventual death. As described in a recently published large meta-analysis performed at the University of Pennsylvania that analyzed data from eleven Phase 3 and Phase 4 clinical trials, CTD-PAH patients treated with vasodilator therapies have 6-minute walk distance, or 6MWD, improvements of only one third compared to the improvements seen in I-PAH patients.

Further, due to their vasodilatory mechanism, the efficacy of currently approved therapies is impacted by the number of other PAH therapies being administered to a patient, with each new therapy yielding lower marginal efficacy.

Bardoxolone methyl directly targets the bioenergetic and inflammatory components of PH. PH patients experience mitochondrial dysfunction, increased activation of NF-κB and related inflammatory pathways involved in reactive oxygen species, or ROS, signaling, cellular proliferation, and fibrosis. Bardoxolone methyl, through the combined effect of Nrf2 activation and NF-κB suppression, has the potential to inhibit inflammatory and proliferative signaling, suppress ROS production and signaling, reduce the production of enzymes related to fibrosis and tissue remodeling, and increase ATP production and cellular respiration. Bardoxolone methyl targets multiple cell types relevant to PH, including endothelial cells, smooth muscle cells, and macrophages. Additionally, unlike current therapies, bardoxolone methyl does not have systemic hemodynamic effects or drug-drug interactions in PH patients. Therefore, by addressing a novel pathway in PH, we believe that bardoxolone methyl may provide additional benefits beyond current PAH therapies, including increased functional capacity, potential effects beyond functional improvements, broader applicability to underserviced PH patients, and potential as a combination therapy with other current therapies.

Phase 3 Development

On October 6, 2016, the first patient was enrolled in CATALYST, an international, randomized, double-blind, placebo-controlled Phase 3 trial examining the safety, tolerability, and efficacy of bardoxolone methyl in patients with WHO Group 1 CTD-PAH when added to standard-of-care vasodilator therapy. Patients will be on up to two background therapies and will be randomized 1:1 to bardoxolone methyl or placebo. Patients will be enrolled at approximately 100 sites in the U.S., Canada, Australia, Japan, Mexico, Europe, Israel, and South America, and the study drug will be administered once daily for 24 weeks. Patients randomized to bardoxolone methyl will start at 5 mg and will dose-escalate to 10 mg at Week 4 unless contraindicated clinically. The primary endpoint is the change from baseline in 6MWD relative to placebo at Week 24. Secondary endpoints include time to first clinical improvement as measured by improvement in WHO functional class, increase from baseline in 6MWD by at least 10%, or decrease from baseline in creatine kinase (as a surrogate biomarker for muscle injury and inflammation) by at least 10%. The trial will enroll between 130 and 200 patients. To determine the final sample size, a pre-specified, blinded sample size re-calculation based on 6MWD variability and baseline characteristics will be conducted after 100 patients have been enrolled in the trial. Data from CATALYST are expected to be available during the first half of 2018.

During our interaction with the FDA in October 2015, the FDA noted that CATALYST, together with the Phase 2 data from our LARIAT trial in PAH patients and prior clinical trials with bardoxolone methyl, would provide adequate data for a New Drug Application, or NDA, review of the safety profile of bardoxolone methyl. Prior to this meeting, we had completed a series of clinical pharmacology studies, including a Thorough QT study, hepatic impairment study, food effect study, and three drug-drug interaction studies. The FDA recommended conducting a single additional clinical drug-drug interaction study and otherwise had no clinical trial, clinical pharmacology, or preclinical study requests.

In preparation for, and in advance of, the initiation of CATALYST, we analyzed data for all CTD-PAH patients treated with doses of up to 10 mg who had completed the 16-week treatment period (or terminated early) in the ongoing LARIAT trial. A total of 22 CTD-PAH patients, including patients from Cohorts 1, 2, and 3a, which are discussed below, met these criteria, with 15 randomized to bardoxolone methyl and seven randomized to placebo. Baseline characteristics of the 22 CTD-PAH patients can be found in the table below.

14

Baseline Characteristics for CTD-PAH Patients in LARIAT

|

|

Bard |

Placebo |

|

N |

15 |

7 |

|

Mean Age (years) |

56.4 |

52.4 |

|

Female/Male |

80%/20% |

100%/0% |

|

Mean Weight (kg) |

75.5 |

68.2 |

|

Mean BMI (kg/m^2) |

27.5 |

26.3 |

|

WHO Functional Class: |

|

|

|

II |

9 (60%) |

4 (57%) |

|

III |

6 (40%) |

3 (43%) |

|

Mean Time Since Diagnosis (years) |

2.9 |

3.0 |

|

Mean Baseline 6MWD (m) |

381 |

396 |

The LARIAT statistical analysis plan defined the treatment effect as the time-averaged change from baseline in 6MWD values using a longitudinal model to assess the average of all available 6MWD timepoints, improving the study’s sensitivity to detect a significant difference between the active drug and placebo groups. Change from baseline in 6MWD at Weeks 4, 8, 12, and 16 were analyzed using a mixed-model repeated measures, or MMRM, analysis to compare the difference between the active drug and placebo groups. The analysis showed that patients treated with bardoxolone methyl demonstrated a statistically significant mean time-averaged increase in 6MWD compared to baseline of 26.7 meters (p=0.001). Placebo-treated patients had a non-significant time-averaged mean change from baseline in 6MWD of 0.6 meters (p=0.96). The placebo-corrected time-averaged change in 6MWD was 26.1 meters (p=0.06).

Patients with moderate to severe anemia, which represents a small percentage of the patient population, will be excluded from CATALYST because treatment with iron supplementation or erythropoietin post-randomization can affect 6MWD values independent of study drug effect. Three CTD-PAH patients enrolled in LARIAT and included in the above analysis were anemic at screening (as defined by low hemoglobin values), and two of these patients, both randomized to placebo, received post-randomization anemia treatments. An analysis was conducted excluding patients with anemia at screening to estimate the treatment effect in patients who meet the final CATALYST eligibility criteria. MMRM analysis showed that CATALYST-eligible patients treated with bardoxolone methyl in LARIAT demonstrated a statistically significant mean time-averaged increase in 6MWD compared to baseline of 30.2 meters (p<0.001), and placebo-treated patients had a non-significant mean change from baseline in 6MWD of –10.1 meters (p=0.39) for a placebo-corrected change of 40.3 meters (p=0.009). The pooled standard deviation of change of 6MWD was 34.1 meters. The time-averaged change in 6MWD is shown in the table below.

Summary of Time-Averaged 6MWD Changes for CTD-PAH Patients in LARIAT

|

Treatment |

N |

All Patients |

N |

CATALYST-Eligible Patients |

||

|

Change from Baseline (m) |

Placebo-corrected (m) |

Change from Baseline (m) |

Placebo-corrected (m) |

|||

|

Placebo |

7 |

0.6 p=0.96 |

— |

5 |

–10.1 p=0.39 |

— |

|

Bardoxolone Methyl |

15 |

26.7 p=0.001 |

26.1 p=0.06 |

14 |

30.2 p < 0.001 |

40.3 p=0.009 |

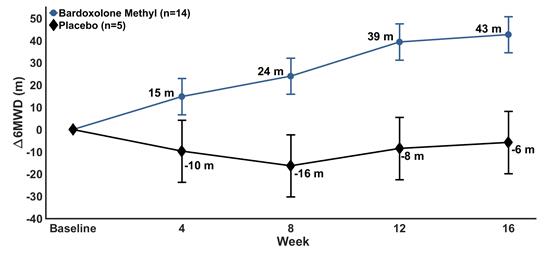

The method of statistical analysis for the CATALYST primary endpoint is the placebo-corrected change from baseline in 6MWD at the end-of-treatment at 24 weeks. This method allows for greater separation in 6MWD values between active and placebo groups assuming improved efficacy over time, which was observed in the CTD-PAH patients in LARIAT as shown in the figure below.

15

Mean Change in 6MWD (+/- SEM) Over Time in CATALYST-Eligible Patients from LARIAT

We performed an analysis applying the statistical methods for CATALYST to the available end-of-treatment (Week 16) change in 6MWD data from CTD-PAH patients in LARIAT as seen in the table below. Using MMRM to estimate change from baseline in 6MWD at Week 16, patients treated with bardoxolone methyl demonstrated a statistically significant mean increase of 38.2 meters (p<0.001). Placebo-treated patients had a non-significant mean change from baseline in 6MWD of 9.8 meters (p=0.44). The placebo-corrected change in 6MWD at Week 16 was 28.4 meters (p=0.07). Excluding patients with moderate to severe anemia at screening, the patients treated with bardoxolone methyl demonstrated a statistically significant mean increase in 6MWD compared to baseline of 42.7 meters (p<0.001). Placebo-treated patients had a non-significant mean change from baseline in 6MWD of –5.8 meters (p=0.68). The placebo-corrected change in 6MWD at Week 16 was 48.5 meters (p=0.005).

Summary of End-of-Treatment 6MWD Changes for CTD-PAH Patients in LARIAT

|

Treatment |

N |

All Patients |

N |

CATALYST Eligible Patients |

||

|

Change from Baseline |

Placebo-corrected |

Change from Baseline |

Placebo-corrected |

|||

|

Placebo |

7 |

9.8 p=0.44 |

— |

5 |

–5.8 p=0.68 |

— |

|

Bardoxolone Methyl |

15 |

38.2 p < 0.001 |

28.4 p=0.07 |

14 |

42.7 p < 0.001 |

48.5 p=0.005 |

With respect to safety, bardoxolone methyl continued to be well-tolerated. None of the 15 bardoxolone methyl treated patients discontinued early, whereas one of the seven placebo treated patients discontinued prematurely. The expanded data set shows no clinically meaningful differences in safety variables including vital signs and laboratory data. Bardoxolone methyl was combined with approved vasodilator therapies without increasing the risk of hypotensive events or exacerbating their adverse event profile.

CATALYST is designed to detect a minimum treatment effect of 12.5 meters assuming a standard deviation of 50 meters. The observed treatment effect in the LARIAT CTD-PAH subgroup analyses, both with and without the anemic patients included, was larger than the minimally detectable treatment effect in CATALYST. Further, the pooled standard deviation observed in LARIAT of 37 meters is lower than the estimated standard deviation of 50 meters in CATALYST.

Phase 2 Development

We initially tested bardoxolone methyl in PH patients in LARIAT, a randomized, placebo-controlled, double-blinded, dose-escalation Phase 2 trial evaluating the safety and efficacy of once daily, orally administered bardoxolone methyl in PH patients with PAH or PH-ILD. LARIAT is comprised of four separate cohort groups.

16

The primary endpoint of the LARIAT trial is change in 6MWD during a 16 week treatment period. All patients who complete the treatment period are eligible to continue into an extension trial to evaluate the intermediate and long-term safety and efficacy of bardoxolone methyl. Those patients who had been receiving placebo are converted to bardoxolone methyl in the extension trial. The initial treatment period for cohorts 1 and 2 has been completed and, as discussed above, data from cohorts 1 and 2 have been publicly presented, as has initial data from cohort 3. We also intend to use data from CTD-PAH patients to help support an application to the FDA for breakthrough status for the treatment of CTD-PAH, once we have enough data to do so.

Because bardoxolone methyl was active in patients with CTD-PAH, a fibrotic disease, we believe that bardoxolone methyl may be effective in PH-ILD patients. We have also begun enrolling patients with PH-ILD caused by CTD, idiopathic pulmonary fibrosis, non-specific interstitial pneumonia, and sarcoidosis in LARIAT cohorts 4a, 4b, 4c, and 4d, respectively. Data have not been presented from cohort 4. We previously reported that a serious adverse event, or SAE, involving a patient death had occurred in cohort 4a and that the investigator had initially reported it as possibly related to study drug. The investigator has since changed his evaluation to unlikely related. In addition, the Protocol Safety Review Committee that oversees safety for the LARIAT trial concluded that the SAE was unlikely treatment-related. We anticipate that data from PH-ILD patients in the LARIAT trial will be available in the second half of 2017.

The cohorts from the LARIAT trial are described below.

|

|

• |

Cohort 1. The first cohort began enrolling in May 2014 and consisted of PAH patients in the United States. Eligible patients must have had a baseline 6MWD of greater than or equal to 150 meters but less than or equal to 450 meters and must have been receiving at least one disease-specific PAH background therapy. Patients were randomized 3:1 in each dose group to either bardoxolone methyl at doses of 2.5 mg, 5 mg, 10 mg, or 20 mg, or placebo. |

|

|

• |

Cohort 2. The second cohort began enrolling in January 2015 and consisted of PAH patients in the United States. Eligible patients must have had a baseline 6MWD of greater than 450 meters and must have been receiving at least one disease-specific PAH background therapy. Patients were are randomized 3:1 in each dose group to bardoxolone methyl at doses of 5 mg or 20 mg, or placebo. |

|

|

• |

Cohort 3. The third cohort began enrolling in September 2015, and consists of PAH patients in the United States and potentially other countries, and is comprised of two sub-cohorts for CTD-PAH (cohort 3a) patients and non-CTD-PAH (cohort 3b) patients. Eligible patients must have a baseline 6MWD of greater than or equal to 150 meters and must be receiving zero to two disease-specific PAH background therapies. Patients are randomized 2:1 to bardoxolone methyl or placebo. Patients in the treatment group are titrated from 5 mg to 10 mg doses based on tolerability. |

|

|

• |

Cohort 4. The fourth cohort began enrolling in September 2015, consists of PH-ILD patients in the United States and potentially other countries, and is comprised of four sub-cohorts based on the patient’s underlying type of ILD: (a) PH-ILD caused by CTD, such as scleroderma and lupus, or CTD-PH-ILD; (b) PH-ILD caused by idiopathic pulmonary fibrosis, or IPF-PH-ILD; (c) PH-ILD caused by non-specific interstitial pneumonia, or NSIP-PH-ILD; and (d) PH-ILD caused by sarcoidosis, or SA-PH-ILD. Eligible patients must have a baseline 6MWD of greater than or equal to 150 meters. As no therapies are approved to treat these patients’ PH, no background therapies are required for enrollment. Patients are randomized 2:1 to bardoxolone methyl or placebo. Patients in the treatment group are titrated from 5 mg to 10 mg doses based on tolerability. |

Bardoxolone Methyl in Chronic Kidney Disease caused by Alport Syndrome

Alport Syndrome Overview

Alport syndrome is a rare and serious hereditary disease that affects approximately 12,000 children and adults in the United States and 40,000 globally. It is caused by mutations in the genes encoding type IV collagen, a major structural component of the glomerular basement membrane, or GBM, in the kidney. The abnormal expression of type IV collagen causes loss of GBM integrity, abnormal leakage of proteins through the GBM, and excessive reabsorption of protein in the proximal tubules of the kidney. Like other forms of CKD, excessive reabsorption of protein in the tubules induces oxidative stress and renal interstitial inflammation and fibrosis.

Patients with Alport syndrome are normally diagnosed with the disease in childhood to early adulthood and have average glomerular filtration rate, or GFR, declines of 4.0 mL/min/1.73 m2 per year. The progressive decline of GFR in Alport syndrome inexorably leads to renal failure and end-stage renal disease, or ESRD, with a median survival of approximately 55 years. Fifty percent of males with the most prevalent subtype of Alport syndrome require dialysis or kidney transplant by age 25. The incidence of renal failure in these patients increases to 90% by age 40 and nearly 100% by age 60. Similar to patients with other forms of CKD, Alport patients receiving dialysis are at increased risk for cardiovascular disease and infections, which are the most common causes of death in these patients. Currently, there are no approved therapies for the treatment of Alport syndrome.

17

The pathogenic role of inflammatory processes in Alport syndrome disease progression and declining renal function is similar to that of other chronic kidney diseases. The GBM defects and leaked proteins in Alport syndrome, the hyperglycemia in diabetes, and hypertension in cardiovascular disease all activate pro-inflammatory signaling pathways that normally detect cellular damage or pathogens. These signals induce mitochondrial dysfunction in which production of cellular energy, or ATP, is impaired in favor of production of pro-inflammatory ROS. ROS is a central feature of inflammation and activates pro-inflammatory signaling complexes including NF-κB and the NLRP3 complex referred to as the inflammasome. ROS-mediated activation of NF-κB and the inflammasome produce cytokines that promote inflammation in glomerular endothelial cells, mesangial cells, and podocytes while also recruiting activated macrophages and other inflammatory effector cells to the renal interstitium.

Chronic activation of pro-inflammatory pathways in kidney cells promotes GFR loss by at least three mechanisms. First, inflammation-associated ROS reduce the amount of nitric oxide available to the endothelial cells in the blood vessels of the glomerulus. This results in a decrease of the overall surface area of the glomerulus that is available for filtration, and thus decreases GFR. Second, inflammation-associated ROS cause contraction of mesangial cells in the kidney. The primary function of these cells is to remove debris and protein from the glomerular basement membrane, or GBM, allowing proper filtration to occur. Mesangial cell contraction reduces their function, and thus reduces GFR. Third, inflammation-associated ROS lead to fibrosis, which changes the structure of the mesangial cell layer and causes thickening of the GBM, contributing to decline of GFR.

Biological Rationale for Bardoxolone in Alport Syndrome

Bardoxolone methyl has the potential to address the underlying causes of GFR loss in Alport syndrome patients because it activates molecular pathways that promote the resolution of inflammation by restoring mitochondrial function, reducing oxidative stress, and inhibiting ROS-mediated pro-inflammatory signaling. Bardoxolone methyl binds to Keap1 and activates Nrf2, a transcription factor that increases cellular antioxidant and detoxification enzymes and promotes normal mitochondrial function by making reducing equivalents available for ATP production. This reduces mitochondrial ROS production and ROS-mediated activation of inflammatory signaling complexes. Through these effects, bardoxolone methyl restores mitochondrial production of ATP, increases production of antioxidant and detoxification enzymes, reduces oxidative stress, and reduces pro-inflammatory signaling. Bardoxolone methyl reverses endothelial dysfunction and pathogenic mesangial cell contraction, resulting in increased the surface area of the glomerulus and GFR. Additionally, bardoxolone methyl inhibits activation of inflammatory and pro-fibrotic pathways that lead to structural remodeling and glomerulosclerosis.

As a result, bardoxolone methyl and closely related structural analogs have been shown to improve renal function, reduce inflammation, and prevent injury, remodeling, and fibrosis in a number of animal models of renal injury and disease as seen in the table below. Specifically, bardoxolone methyl and analogs reverse endothelial dysfunction and mesangial cell contraction in response to angiotensin II, thereby increasing the surface area of the glomerulus and GFR. Further, data from animal models relevant to chronic renal disease demonstrate that the compounds are anti-fibrotic and have protective effects on the renal interstitium in response to high protein, pressure overload in the setting of hyperfiltration, and dyslipidemia.

18

Bardoxolone Methyl and Analogs are Active in Multiple Animal Models Relevant to Renal Disease

|

Model |

General Findings |

|

Protein overload1

|

-Reduced oxidative/nitrosative stress, interstitial inflammation, and fibrogenic mediators including TGF-β and α-SMA -Decreased proteinuria and tubular damage |

|

Angiotensin II-induced GFR decline2

|

-Increased inulin clearance by increasing Kf without affecting BP or renal plasma flow -Reduced whole glomeruli and mesangial cell contraction due to angiotensin II |

|

5/6 nephrectomy3

|

-Reversed endothelial dysfunction and impaired Nrf2 activity in arterial tissue -Ameliorated hyperfiltration-induced glomerulosclerosis and tubular injury -Suppressed renal inflammation and infiltration of lymphocytes and macrophages -Mitigated systolic blood pressure increase caused by chronic renal failure |

|

12-month monkey safety study4

|

-Improved kidney function for 12 months without adverse renal histological effects -Induced renal Nrf2 targets and suppressed megalin |

|

High-fat (HF) diet-induced CKD5

|

-Prevented HF diet-induced development of structural changes in the heart and kidneys -Prevented HF diet-induced renal corpuscle hypertrophy |

|

Lupus nephritis6

|

-Attenuated renal disease and reduced glomerulonephritis in 3 different models of lupus nephritis -Decreased proteinuria and BUN |

|

Ischemic-reperfusion7

|

-Prevented structural injury from ischemia acute kidney injury -Pre-treatment preserved renal function following ischemic surgery |

|

FeNTA-induced acute kidney injury8 |

-Prevented acute kidney injury and preserved renal function -Reduced severity of proximal tubule degeneration and necrosis |

|

Cisplatin-induced acute kidney injury9

|

-Protected against cisplatin-induced renal toxicity -Reduced proximal tubule degeneration, apoptosis, necrosis, and inflammation |

|

|

1 |

Zoja C, Corna D, Locatelli M, et al. Targeting Keap1-Nrf2 Pathway Ameliorates Renal Inflammation and Fibrosis in Mice with Protein-Overload Proteinuria. Poster American Society of Nephrology Meeting, 2010. |

|

|

2 |

Ding Z, Stidham RD, Bumeister R, Trevino I, Winters A, Sprouse M, Ding M, Ferguson DA, Meyer CJ, Wigley WC, Ma R. The synthetic triterpenoid, RTA 405, increases the glomerular filtration rate and reduces angiotensin II–induced contraction of glomerular mesangial cells. Kidney Intl 2013;83:845-854. |

|

|

3 |