Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED NOVEMBER 14, 2016 - MICT, Inc. | f8k111416ex99i_micronet.htm |

| 8-K - CURRENT REPORT - MICT, Inc. | f8k111416_micronetenertec.htm |

Exhibit 99.2

3Q 16 Financial Results Conference Call

Forward Looking Statement 2 This presentation contains express or implied forward - looking statements within the Private Securities Litigation Reform Act of 1995 and other U.S. Federal securities laws. These forward - looking statements include, but are not limited to those statements regarding our future revenue growth, increased volumes and demand in the markets in which we operate, our product offerings and future market opportunities, the market potential of our Command and Control defense systems , the expected market potential created by the ELD mandate in the U.S. and Canada, and expected new opportunities for the Company and anticipated Company growth resulting from the ELD mandate. Such forward - looking statements and their implications involve known and unknown risks, uncertainties and other factors that may cause actual results or performance to differ materially from those projected. The forward - looking statements contained in this presentation are subject to other risks and uncertainties, including those discussed in the "Risk Factors" section and elsewhere in the Company's annual report on Form 10 - K for the year ended December 31 , 2015 and in subsequent filings with the Securities and Exchange Commission. Except as otherwise required by law, the Company is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward - looking statements whether as a result of new information, future events or otherwise. .

3 3 rd Quarter Overview ▪ Positioned for potential significant sector growth as customers evaluate best solution for ELD mandate requirement ▪ Launched TREQr - 5: Continued to evolve industry leading product line ▪ Managed expenses while investing in product development and management to drive long term growth ▪ Continued diversification of customer base in the MRM market ▪ Strengt hened our management and sales capabilities

ELD Mandate Opportunity 4 New regulation implemented in December 2015 mandates all truck drivers to keep electronic records of hours of service (HOS) * • Cannot drive over 11 hours per day • Required rest periods Electronic Logging Devices (ELDs) connect to engine and replace paper logbooks. Micronet’s comprehensive products provide state of the art solutions for the ELD requirements Starting to see increased demand as fleet managers and commercial truck and bus owners comply with ELD mandate in advance of 2017 enforcement date On October 31, United States Court of Appeals voted unanimously to uphold the ELD Mandate (enforcement of the regulations will begin in December 2017) in the case that was filed by the Owner - Operator Independent Drivers Association (OOIDA) remove industry doubt about required implementation * Federal Motor Carrier Safety Administration: ** “ Electronic Logging Devices and Hours of Service Supporting Documents ” - March 2014 2017 ~ 2.6 Million trucks will require ELD ** Our tablets are fully compliant with the regulation

Further Broadening Our Product Line 5 ▪ Launched TREQr 5 product : ▪ Real open architecture ▪ Well - suited for the BYOD market ▪ Pairs easily will smart phones. No customization required ▪ Enhanced safety monitoring features ▪ Will support up to 6 cameras with Android app ▪ Expands market opportunity particularly with smaller size fleets ▪ Strong pipeline with growing amount of customers evaluating product in the field ▪ Expected $1M of initial shipments through the end of FY 2016

6 Improved Backlog at Enertec: Awarded three stage $5.8 Million project ▪ A&D subsidiary Enertec awarded three stage $ 5.8 million project for the production of computer - based Command and Control Defense systems. ▪ The multibillion dollar Aerospace & Defense contractor expects to place additional orders ▪ Enertec was selected as the supplier to develop this sophisticated mission critical system and this new order is a direct result of Enertec strong positioning with the customer ▪ Enertec was awarded with $ 900 , 000 purchase order as part of the implementation in Q 3 2016 ▪ The Company received continuing orders related to the project in a total of $ 4.7 million A&D Deal Pipeline Strengthening as Enertec Builds Reputation as Dependable and Innovative Defense Systems Provider

Positive Outlook 7 MRM ▪ Local fleet market and the ELD expected to be the growth engines of the company ▪ The All In One line of new developed tablets becoming the Company’s leading product with wider market acceptance ▪ ELD mandate is driving increased pipeline for All In One products ▪ Broadening product portfolio to target the additional segments in the MRM market Aerospace/Defense ▪ Continued reliance on missile defense systems supports demand for our missile defense offerings ▪ Three stages $5.8M project in the A&D segment; expect follow - on orders as a result of the project ▪ Expect significant demand for new Mobile Command & Control Centers ▪ Recent U.S. pledge for a $38B military aid to Israel over next 10 years - a significant growth engine Trends

3Q16 vs. 3Q15 Revenues 8 (in millions) $1.76 $ 2.30 $ 1.70 $0 $1 $2 $3 3Q15 2Q16 3Q16 A&D MRM $5.56 $6.70 $5.35 $0 $2 $4 $6 $8 3Q15 2Q16 3Q16 (in millions) (in millions) Sales Breakdown Consolidated revenue for the quarter $3.80 $4.40 $3.65 $0 $2 $4 $6 3Q15 2Q16 3Q16

9 Income Statement Highlights (in 000s except share and per share data) 3 Months Ended September 30, 2016 3 Months Ended September 30, 2015 9 Months Ended September 30, 2016 9 Months Ended September 30, 2015 Revenues $ 5,354 $ 5,556 $ 18,557 $ 16,982 Cost of Revenues 4,299 4,434 13,865 12,275 Gross Profit 1,055 1,122 4,692 4,707 Gross Profit Margin 20% 20% 25% 28% Operating Expenses Research & Development 476 485 1,859 1,951 % of Sales 9% 9% 10% 11% Selling & Marketing 538 395 1,374 1,214 % of Sales 10% 7% 7% 7% General & Administrative 1,323 1,169 3,977 3,407 % of Sales 25% 21% 21% 20% Amortization of intangible assets 234 282 694 889 Total operating expenses 2,571 2,331 7,904 7,461 % of Sales 48% 42% 43% 44% Net income (loss) (1,283) (1,263) (2,841) (2,557) Basic and diluted income (loss) per share (0.22) (0.22) (0.48) (0.44) Basic weighted average common shares outstanding 5,902,074 5,865,221 5,882,529 5,838,873

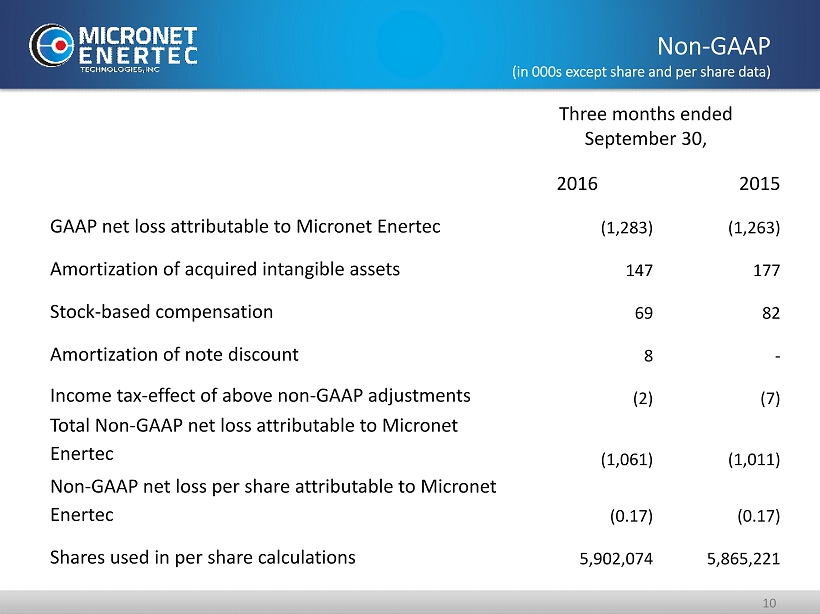

Non - GAAP (in 000 s except share and per share data) 10 2015 2016 (1,263) (1,283) GAAP net loss attributable to Micronet Enertec 177 147 Amortization of acquired intangible assets 82 69 Stock - based compensation - 8 Amortization of note discount (7) (2) Income tax - effect of above non - GAAP adjustments (1,011) (1,061) Total Non - GAAP net loss attributable to Micronet Enertec (0.17) (0.17) Non - GAAP net loss per share attributable to Micronet Enertec 5,865,221 5,902,074 Shares used in per share calculations Three months ended September 30 ,

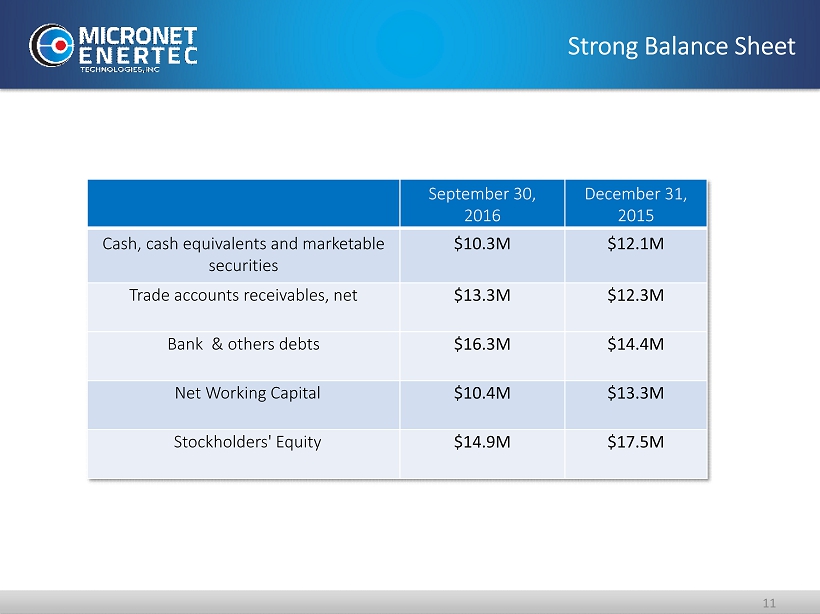

Strong Balance Sheet September 30 , 2016 December 31, 2015 Cash, cash equivalents and marketable securities $10.3M $12.1M Trade accounts receivables, net $13.3M $12.3M Bank & others debts $16.3M $14.4M Net Working Capital $10.4M $13.3M Stockholders' Equity $14.9M $17.5M 11

Thank You 12 Q & A