Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 906 - Pacific Oak Strategic Opportunity REIT II, Inc. | kbssoriiq32016exhibit321.htm |

| 10-Q - FORM 10-Q - Pacific Oak Strategic Opportunity REIT II, Inc. | kbssoriiq3201610q.htm |

| EX-32.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO SECTION 906 - Pacific Oak Strategic Opportunity REIT II, Inc. | kbssoriiq32016exhibit322.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO SECTION 302 - Pacific Oak Strategic Opportunity REIT II, Inc. | kbssoriiq32016exhibit312.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 302 - Pacific Oak Strategic Opportunity REIT II, Inc. | kbssoriiq32016exhibit311.htm |

| EX-10.3 - PURCHASE AND SALE AGREEMENT (NOHO) - Pacific Oak Strategic Opportunity REIT II, Inc. | kbssoriiq32016exhibit103.htm |

| EX-10.1 - ADVISORY AGREEMENT - Pacific Oak Strategic Opportunity REIT II, Inc. | kbssoriiq32016exhibit101.htm |

Execution Version

LIMITED LIABILITY COMPANY AGREEMENT OF KBS SOR II LOFTS AT NOHO COMMONS, LLC |

This LIMITED LIABILITY COMPANY AGREEMENT OF KBS SOR II LOFTS AT NOHO COMMONS, LLC (this “Agreement”), is entered into effective as of September 29 , 2016, by and between NOHO COMMONS PACIFIC INVESTORS LLC, a Delaware limited liability company (“JV Member”), and KBS SOR II LOFTS AT NOHO COMMONS JV, LLC, a Delaware limited liability company (“KBS Member”). JV Member and KBS Member may hereinafter be referred to herein collectively, as the “Members” or individually as a “Member.”

RECITALS

WHEREAS, the Members desire to form KBS SOR II LOFTS AT NOHO COMMONS, LLC, a Delaware limited liability company (the “Company”).

WHEREAS, the Company shall cause NoHo Commons Pacific Owner LLC, a Delaware limited liability company (“Property Owner Subsidiary”) and a wholly owned subsidiary of the Company, to enter into that certain Sale, Purchase and Escrow Agreement (the “Purchase Agreement”) with Redrock Noho Residential, LLC, a Delaware limited liability company (“Seller”), in a form approved by the Members, for the purchase of a multifamily apartment project commonly known as the Lofts at NoHo Commons with an address of 11136 Chandler Boulevard, North Hollywood, Los Angeles, California (the “Property”), and the improvements located thereon (the “Improvements”, together with the Property are referred to as the “Project”).

WHEREAS, the Purchase Agreement requires Property Owner Subsidiary to deposit the amount of Three Million and No/100 Dollars (the “Purchase Deposit”) with Escrow Agent (as defined in the Purchase Agreement) within two (2) business days of the effective date of the Purchase Agreement.

WHEREAS, at the closing of the transaction contemplated by the Purchase Agreement (the “Property Closing”), the Company will cause Property Owner Subsidiary to obtain a mortgage loan (“Mortgage Loan”) from the Federal Home Loan Mortgage Corporation (“Lender”), on and subject to the terms and conditions of this Agreement.

ARTICLE I

FORMATION

FORMATION

1.01. Formation. The limited liability company created pursuant to this Agreement and the filing of that certain Certificate of Formation dated September 22, 2016 (the “Company”) was formed under and pursuant to the Act. The term “Act” means the 6 Delaware Code §§18 101, et. seq., Delaware Limited Liability Code, as hereafter amended from time to time. Robert M. Zimmerman, Esq. is designated as an “authorized person” within the meaning of the Act, and such “authorized person” has executed, delivered and filed the Certificate of Formation with the Secretary of State of the State of Delaware. Upon the filing of the Certificate of Formation, his power as an

SMRH:479102057.10 | 1# | |

“authorized person” ceased, and Managing Member thereupon became the designated “authorized person” and shall continue as the designated “authorized person” within the meaning of the Act. Subject to the terms of this Agreement, Managing Member or an attorney authorized by Managing Member shall execute, acknowledge and file such other documents and instruments as are necessary and/or appropriate to register, qualify to do business and/or operate the Company as a foreign limited liability company in any jurisdiction in which the Company may own property or wish to conduct business. The existence of the Company as a separate legal entity shall continue until cancellation of the Certificate of Formation as provided in the Act.

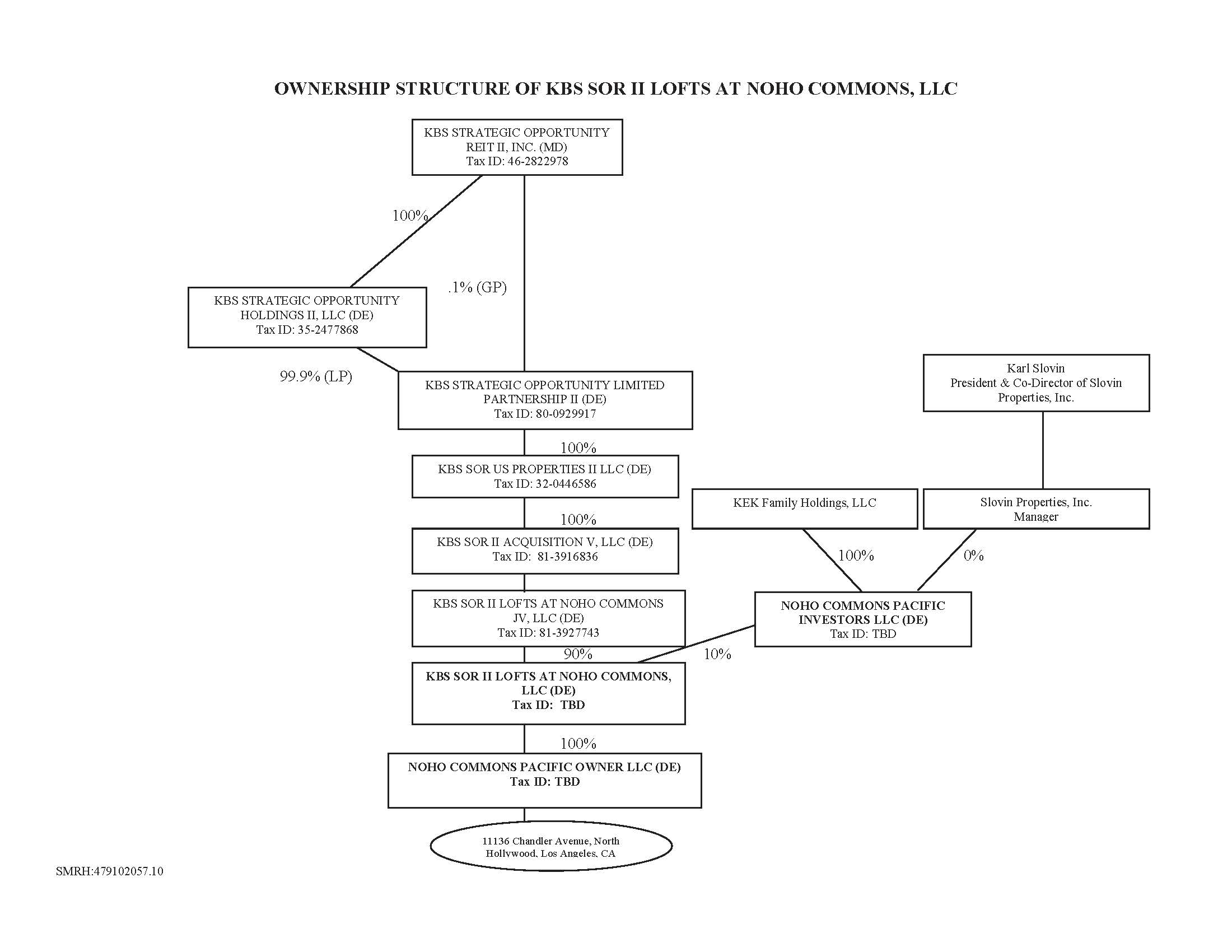

1.02. Names and Addresses. The name of the Company is KBS SOR II LOFTS AT NOHO COMMONS, LLC. The principal office of the Company in the State of Delaware. The name and address of the registered agent of the Company in the State of Delaware currently is National Registered Agents, Inc., 160 Greentree Drive, Suite 101, Dover, Delaware 19904, until changed by the Managing Member with written notice to all Members. The names and addresses of the Members are set forth on Exhibit A attached hereto. The organizational structure of the Company and any subsidiaries directly or indirectly owned by the Company, including Property Owner Subsidiary (each, a “Subsidiary” and collectively, the “Subsidiaries”), as of the date hereof, is as set forth on Exhibit G attached hereto. The ownership interests of the Members in the Company shall not be certificated interests, unless otherwise determined as a Major Decision pursuant to Section 2.02 below.

1.03. Nature of Business. The express, limited and only purposes of the Company shall be (i) to indirectly acquire, own, lease, hold for long-term investment, sell, exchange, dispose of and otherwise realize the economic benefit from the Project, and (ii) to conduct such other activities with respect to the Project as are appropriate to carrying out the foregoing purposes and to do all things incidental to or in furtherance of the above-enumerated purposes. Neither the Company nor any of the Subsidiaries shall engage in any other business or activity, unless such other business or activity has been approved as a Major Decision (as defined below).

1.04. Term of Company. The term of the Company shall commence on the date the Certificate of Formation for the Company is filed with the Office of the Delaware Division of Corporations and shall continue until dissolved pursuant to Article VIII. The existence of the Company as a separate legal entity shall continue until the cancellation of the Company’s Certificate of Formation.

1.05. Purchase Agreement. The Members acknowledge that the Purchase Agreement will provide for certain conditions to the Property Owner Subsidiary’s obligation to close, including the absence of a default by Seller (“Buyer Closing Conditions”). The decision as to whether each of such conditions have been satisfied as of the closing date under the Purchase Agreement shall be decided by the Members, subject to the following:

(a) Failed Conditions; Members Agree to Terminate. If both Members determine that any of the Buyer Closing Conditions have not been satisfied (after expiration of any notice and cure periods) and do not desire to close over any unsatisfied Buyer Closing Conditions, Managing Member (as defined below) shall deliver to Seller a termination notice under the Purchase Agreement and seek a return of the Purchase Deposit (as such term is defined under the Purchase Agreement)

SMRH:479102057.10 | 2 | |

to the extent all or any portion of the Purchase Deposit is refundable and thereafter cause the Company to be dissolved pursuant to Article VIII.

(b) Failed Conditions; KBS Member Desires to Proceed. If KBS Member has notified JV Member in writing that it desires to close over any unsatisfied Buyer Closing Condition, but JV Member has notified KBS Member in writing of its desire to terminate the Purchase Agreement, then KBS Member shall have the right, in its sole and absolute discretion, to elect to (A) deliver to Seller a termination notice under the Purchase Agreement and seek a return of the Purchase Deposit to the extent all or any portion of the Purchase Deposit is refundable, or (B) deliver written notice to JV Member requiring JV Member to withdraw from the Company. If Managing Member elects to deliver a notice pursuant to clause (B), then the KBS Member shall reimburse JV Member for the amount of the Purchase Deposit then posted by JV Member and KBS Member shall be free to cause the Property Owner Subsidiary or an Affiliate of KBS Member to consummate the Property Closing without JV Member being a Member of the Company or otherwise a party to such transaction.

(c) Failed Conditions; JV Member Desires to Proceed. If JV Member has notified KBS Member in writing that it desires to close, but KBS Member has notified JV Member in writing of its desire to terminate the Purchase Agreement, then JV Member shall have the right, in its sole and absolute discretion, to elect to (A) deliver to Seller a termination notice under the Purchase Agreement and seek a return of the Purchase Deposit to the extent all or any portion of the Purchase Deposit is refundable, or (B) deliver written notice to KBS Member requiring KBS Member to withdraw from the Company. If JV Member elects to deliver a notice pursuant to clause (B), then JV Member shall reimburse KBS Member for the amount of the Purchase Deposit then posted by KBS Member and JV Member shall be free to cause the Property Owner Subsidiary or an Affiliate of JV Member to consummate the Property Closing without KBS Member being a Member of the Company or otherwise a party to such transaction.

ARTICLE II

MANAGEMENT OF THE COMPANY

2.01. Management of the Company.

(a) Generally. JV Member is hereby designated as the managing member (the “Managing Member”) of the Company and shall serve as the Managing Member of the Company unless and until it resigns or is removed pursuant to Section 2.06. Subject to the restrictions set forth in this Agreement, Managing Member shall manage and administer the day-to-day business and affairs of the Company and its Subsidiaries. Managing Member shall at all times faithfully perform its duties and responsibilities in compliance with all applicable laws, the Business Plan (as defined below), the Annual Budget (as defined below) and this Agreement, and in an efficient, thorough, businesslike manner, devoting such time, efforts and managerial resources to the business of the Company and its Subsidiaries as is reasonably necessary for the operation of the day-to-day business and affairs of the Company and its Subsidiaries. In the performance of its duties under this Agreement, Managing Member shall regularly consult with the KBS Member. Managing Member and KBS Member may each engage in business efforts and affairs which are not related to the Company or the Project, and will not be precluded from owning and operating other businesses

SMRH:479102057.10 | 3 | |

and/or real estate projects and neither the Company nor the other Members shall have any interest in such businesses or real estate projects.

(b) Specific Day to Day Duties. Without limiting the generality of the foregoing, Managing Member shall perform the following duties with respect to the Project, all to be carried out in accordance with this Agreement, the Annual Budget and the Business Plan:

(i) Use reasonable commercial efforts to obtain and cause to be maintained all governmental and agency approvals, permits and other entitlements necessary for ownership, renovation, operation, management and leasing of the Project.

(ii) Coordinate the services of all employees, supervisors, architects, engineers, contractors, construction or development managers, accountants, attorneys, real estate brokers, advertising personnel and other persons necessary or appropriate for the ownership, renovation, operation, management and leasing of the Project.

(iii) Supervise the performance of all work in connection with the ownership, renovation, operation, management and leasing of the Project.

(iv) Except to the extent such action is a Major Decision, use commercially reasonable efforts to enforce all of the Company’s and its Subsidiaries’ rights and cause performance of all of the Company’s obligations arising in connection with any contract or agreement entered into in connection with the Project, excluding de minimis obligations where the cost to pursue the obligation exceeds the benefit to be gained.

(v) Deliver to the Members, promptly upon its receipt, copies of any written notices or other written materials received by Managing Member in connection with any material dispute or material claims relating to the Project.

(vi) Otherwise diligently perform those duties and services that are reasonably necessary in order to acquire, own, renovate, operate, manage and lease the Project in accordance with the Business Plan, the Annual Budget (including the Renovation Budget (as defined below)) and this Agreement.

(c) Additional Duties. Without limiting the generality of the foregoing, Managing Member shall have the following additional duties with respect to the overall operation of the Company and its Subsidiaries and the ownership of the Project, all to be carried out in accordance with this Agreement:

(i) Provide operating reports and financial statements in accordance with Article IX.

(ii) Notify KBS Member of such matters and render such reports to KBS Member from time to time as KBS Member may reasonably request in writing, including, without limitation, at all times and in each event no less frequently than monthly, keeping KBS Member informed of material information relating to the Project by (1) notifying KBS

SMRH:479102057.10 | 4 | |

Member in advance of public hearings and other proceedings relating to any existing or proposed entitlements, mapping, subdivision or material permits for the Project and (2) notifying KBS Member within five (5) business days and promptly delivering to KBS Member copies of any written offers to purchase or otherwise acquire the Project, or any interest therein, and of any written indications of interest, written invitations to deal, written solicitations of sales which represent bona fide offers regarding the Project.

(iii) Comply with the Annual Budget, as it may be modified in accordance with this Agreement. Except for expenditures made and obligations incurred, in each case as previously approved pursuant to the Annual Budget and the Permitted Budget Variance (as hereinafter defined) or in writing by KBS Member, the Managing Member shall have no authority to make any expenditure or incur any obligation or liability on behalf of the Company or any Subsidiary. Subject to the Annual Budget and the Permitted Budget Variance or as may be approved in writing by KBS Member, the Managing Member shall not expend on behalf of the Company or any Subsidiary more than what it in good faith believes to be the fair and reasonable market value at the time and place of contracting or any goods purchased or services engaged on behalf of the Company or any Subsidiary. Subject to Section 2.02(d) below, Managing Member may enter into any such contracts on behalf of the Company or any Subsidiary for goods purchased or services contemplated by the Annual Budget, if any, provided that such contracts shall be terminable by the Company or any applicable Subsidiary upon thirty (30) days’ notice without penalty or if such contracts are not contemplated by the Annual Budget they shall be for an amount not to exceed (A) the sum of $10,000 as to any single expenditure, and (B) the sum of $50,000 annually (in each case, such expenditures may hereinafter be referred to as the "De Minimis Expenditures"). Any such contract (other than contracts that are for De Minimis Expenditures) that is either (x) not terminable by the Company or the applicable Subsidiary upon thirty (30) days’ notice or (y) are not contemplated by the Annual Budget shall in each case require the prior written approval of KBS Member. As used in this Agreement, the term “Permitted Budget Variance” means, with respect to any Annual Budget, any disbursement of funds in any amount that would not result in a particular line item being exceeded 10% of such line item for the year in question or the total Annual Budget being exceeded by more than 5% in the aggregate.

(d) Affiliate Agreements; Special Powers of KBS Member Regarding Affiliate Agreements.

(i) JV Member, in its capacity as Managing Member, shall not cause the Company or any of its Subsidiaries to enter any agreement or other arrangement for the furnishing to or by the Company or any Subsidiary of goods or services or for any other contract or agreement pursuant to which the JV Member or any Affiliate or Related Person (defined below) will receive any benefit with, or pay any fees or compensation to, itself or any Person that is an Affiliate of the JV Member or a Related Person (an “Affiliate Agreement”), unless such agreement or arrangement has been previously approved in writing by KBS Member. JV Member shall not amend, modify or terminate any such Affiliate Agreement after the entry by the Company, or any Subsidiary, into such Affiliate Agreement

SMRH:479102057.10 | 5 | |

without the prior consent of KBS Member. As used in this agreement, the term “Related Person” shall mean the JV Member Principal (defined below) and such JV Member Principal’s spouse and the ancestors, descendants, aunts, uncles or first cousins of such JV Member Principal, whether by birth or adoption.

(ii) Notwithstanding anything to the contrary contained herein but subject to Section 2.06(d) below, KBS Member shall have the right, in its sole discretion upon prior written notice to JV Member, to take all actions on behalf of the Company or any Subsidiary with respect to: (A) the determination of the existence of any default by any Affiliate of JV Member under any Affiliate Agreements made between the Company or any Subsidiary and any Affiliate of JV Member, (B) the enforcement of all rights and remedies of the Company under any Affiliate Agreements made between the Company or any Subsidiary and any Affiliate of any JV Member, and (C) termination of any Affiliate Agreements made between the Company or any Subsidiary and any Affiliate of any JV Member (subject to the terms and conditions set forth therein for notice of defaults and applicable cure periods). All Affiliate Agreements shall be terminated upon sale of the portion of the Project to which they relate and in the event of other circumstances or defaults (including, without limitation, any Removal Event (as defined below)) as more particularly set forth therein or herein. JV Member will cooperate in good faith with KBS Member in the exercise by KBS Member of the foregoing rights and actions hereunder.

(iii) As used in this Agreement, the term “Affiliate” means any person or entity which, directly or indirectly through one (1) or more intermediaries, controls or is controlled by or is under common control with another person or entity. The term “control” as used herein (including the terms “controlling,” “controlled by,” and “under common control with”) means the possession, direct or indirect, of the power (i) to vote 51% or more of the outstanding voting securities of such person or entity, or (ii) to otherwise direct management policies of such person by contract (at commercially reasonable rates) or otherwise. Karl Slovin (the “JV Member Principal”) and his Related Persons and Affiliates shall be deemed “Affiliates” of JV Member. Any reference in this Agreement to a “Person and an Affiliate” shall be deemed to refer to such Person and an Affiliate of such Person and any references in this Agreement to a “Person or an Affiliate” shall be deemed to refer to such Person or an Affiliate of such Person.

2.02. Major Decisions. Notwithstanding anything contained in this Agreement to the contrary, Managing Member shall not take, or cause or permit the Company or any Subsidiary to enter into any agreement to take, any of the following actions on behalf of the Company or any Subsidiary (in each case the taking of which hereinafter shall be referred to as a “Major Decision”) without the prior written consent of KBS Member, which consent may be given or withheld in KBS Member’s sole and absolute discretion.

(a) Purchase Agreement. Except as set forth in Section 1.05 above, enter into, amend, modify, terminate, or expressly waive any material rights of the Property Owner Subsidiary under, the Purchase Agreement.

SMRH:479102057.10 | 6 | |

(b) Annual Budget; Business Plan. Subject to Section 2.01(c)(iii) cause the Company or its Subsidiaries to deviate from, amend, update or replace the Business Plan or deviate from, amend, update or replace the Annual Budget (subject to the Permitted Budget Variance), except as provided in Section 2.10 below.

(c) Sale of the Company or the Project. Subject to Articles VI and VII, sell, convey, exchange, hypothecate, pledge, encumber or otherwise transfer any portion of or any interest in the Company or any Subsidiary or all or any portion of the Project, or enter into any agreement to sell, convey, exchange, hypothecate, pledge, encumber or otherwise transfer any portion or any interest in the Company or any Subsidiary or all or any portion of the Project.

(d) Pre-Approved Affiliate Agreements. Amend, modify, terminate, or waive any rights under, the any of the Pre-Approved Affiliate Agreements (as such term is defined below), or enter into any agreements that would replace any of the Pre-Approved Affiliate Agreements.

(e) Acquire Real Property. Purchase or otherwise acquire any interest in real property other than the Company’s indirect ownership interest in the Project.

(f) Financing. Cause the Company or any Subsidiary to enter into (or commit to enter into) the Mortgage Loan or to finance or refinance the operations of the Company or any Subsidiary and/or any of the Company’s or any Subsidiary’s assets (including, without limitation, any acquisition, development, construction, interim and long-term financing or refinancing in connection with the Project (or any portion thereof) or the improvement or expansion thereof) (each, a “Financing” including the Mortgage Loan) or retain any mortgage bankers or brokers on behalf of the Company or any Subsidiary in connection therewith or enter into any modifications, amendments, extensions, substitutions or other agreements regarding any Financing, provided, however, without KBS Member’s consent, JV Member may take such actions with respect to any Financing as necessary for JV Member to prevent a breach under the Financing that would reasonably be expected to trigger liability under any Guaranty (including the Completion Guaranty), provided such potential breach was not caused by the gross negligence, willful misconduct or acts taken in bad faith of JV Member or any of its Affiliates. Notwithstanding the foregoing, the Members agree that (1) it shall not be a Major Decision (and shall only require the consent of KBS Member and not of JV Member), for the Property Owner Subsidiary to enter into any interest rate swap agreement, interest rate cap agreement, or any other similar agreement (collectively, “Interest Rate Protection Agreements”), and (2) if necessary to amend any Financing in order to allow the Property Owner Subsidiary to enter into any Interest Rate Protection Agreements that KBS Member determines in its sole discretion is necessary or desirable, in each case, except to the extent the JV Member or its Affiliates have any personal liability under such Interest Rate Protection Agreement in which case the decisions in clauses (1) and (2) would be a Fundamental Decision (as defined below). In the event the Property Owner Subsidiary enters into any Interest Rate Protection Agreements in accordance with the preceding sentence, the Members shall each pay their pro rata share of the costs and expenses incurred by the Property Owner Subsidiary in connection therewith (including reasonable attorneys’ fees and expenses) in accordance with their Percentage Interests (as defined below).

SMRH:479102057.10 | 7 | |

(g) Indemnity. Make, execute or deliver on behalf of the Company or any Subsidiary any indemnity bond or surety bond or obligate the Company, any Subsidiary or any other Member as a surety, guaranty, guarantor or accommodation party to any obligation or grant any lien or encumbrance on any of the assets of the Company or any Subsidiary, including the Project, other than with respect to any Financing that has been approved as a Major Decision.

(h) Loans. Lend funds belonging to the Company or any Subsidiary to any Member or its Affiliate or to any third party, or extend any person, firm or corporation credit on behalf of the Company or cause any Member Loan (as defined below) to be made to the Company as provided in Section 3.03.

(i) Expenditures. Except for De Minimis Expenditures and other amounts contemplated by the Annual Budget (subject to the Permitted Budget Variance), cause the Company or any Subsidiary to take any action or make any expenditure or incur any obligation by or on behalf of the Company or any Subsidiary (including, without limitation, obligating the Company or any Subsidiary to pay for any goods or services in excess of the foregoing), in addition, in the event that the then current Financing is within ninety (90) days of its stated maturity, or after its term has expired, or is in default, Managing Member may not reallocate any excess funds among line items or make any expenditures from any reserves without KBS Member’s consent.

(j) Duties. Delegate any of the duties of Managing Member set forth herein except as set forth in the Management Agreement or the Asset Management Agreement or any other approved contract with an Affiliate under the terms of this Agreement or to the officers and employees of Managing Member. For avoidance of doubt, accounting duties with respect to the Company and its Subsidiaries are to be handled by a certified public accounting firm engaged by Managing Member and approved by KBS Member pursuant to Section 2.02(bb) below.

(k) Assignment Benefiting Creditors. Make, execute or deliver on behalf of the Company or any Subsidiary an assignment for the benefit of creditors; file, consent to or cause the Company or any Subsidiary, a Member’s Interest, or the Project, or any part thereof or interest therein, to be subject to the authority of any trustee, custodian or receiver or be subject to any proceeding for bankruptcy, insolvency, reorganization, arrangement, readjustment of debt, relief of debtors, dissolution or liquidation or similar proceedings.

(l) Partition of Company Assets. Partition all or any portion of the assets of the Company or any Subsidiary, or file any complaint or institute any proceeding at law or in equity seeking such partition.

(m) Governmental Proposals. Make application to, or enter into any agreements with, any government officials relating to mapping, development, zoning, subdivision, environmental or other land use or entitlement matters which may affect the Project or any portion thereof; provided the foregoing shall not include obtaining building permits and other routine approvals for construction work contemplated by the Business Plan.

(n) Purchase Assets. Except as may be provided in the then-applicable Annual Budget, (A) cause the Company or any Subsidiary to purchase any automobiles or vehicular

SMRH:479102057.10 | 8 | |

equipment on behalf of or in the name of the Company or any Subsidiary or (B) purchase any fixed assets on behalf of or in the name of the Company or any Subsidiary.

(o) Commence Renovations. Commence the Renovations (defined below) unless and until the detailed Renovation Budget has been approved by KBS Member pursuant to Section 2.10(a) below. Except as otherwise expressly provided for in any Business Plan, Annual Budget (and/or the Renovation Budget after approval by KBS Member as set forth herein) or any Financing document, undertake any Renovations (defined below) or significant construction on the Project or any significant off-site improvement work, any environmental remediation on the Project.

(p) Confess Judgments; Legal Actions. Confess a judgment against the Company or any Subsidiary; settle or adjust any claims against the Company or any Subsidiary; or commence, negotiate and/or settle any legal actions or proceedings brought by the Company or any Subsidiary against unaffiliated third parties; in each case, other than any landlord-tenant actions in the ordinary course of business or actions defended by an insurance company and provided further Managing Member may settle or adjust any claim which is not the subject of a legal action or proceeding of $50,000 or less.

(q) Dissolve the Company. Except as provided in this Agreement, dissolve, terminate or liquidate the Company or any Subsidiary prior to the expiration of the term.

(r) Acts Making Business Impossible. Do any act that would make it impossible to carry on the business of the Company or any Subsidiary.

(s) Material Agreements. Except as provided in the Annual Budget or in the express terms of this Agreement, cause the Company or any Subsidiary to enter into any agreement obligating the Company or any Subsidiary to pay an amount of more than a De Minimis Expenditure and any amendment, modification or termination of any such agreement, including, without limitation, any agreement providing for the payment of any commission, fee or other compensation payable in connection with the sale of all or any portion of the Project or any portion thereof.

(t) Limited Liability Company Act. Take any other action for which the consent of the Members is required under the Act (and such consent is not waivable under the Act) or this Agreement.

(u) Leasing. Deviate in any material respect from, amend or replace the Leasing Guidelines (defined below). Cause or permit the Company or any Subsidiary to enter into any new space or other lease affecting the Project, unless such lease is in the standard form of lease approved by the Members with economic terms consistent with the Leasing Guidelines, or amend, modify, terminate, or waive rights under any existing leases with the Company or any Subsidiary except in the ordinary course of business consistent with the Leasing Guidelines. Prior to the Property Closing, the Members shall have approved leasing guidelines for the Project (the "Leasing Guidelines") setting forth the minimum approved rents, minimum required security and other deposits, and the maximum free rent periods, concessions and finder's fees that are to be used for the leasing of the Project. Upon the request of either Member, Managing Member shall prepare an update to the Leasing Guidelines for review and approval by KBS Member.

SMRH:479102057.10 | 9 | |

(v) Insurance. Change the insurance program for the Company, any Subsidiary or the Project in a manner inconsistent with the Business Plan or inconsistent with the insurance requirements set forth in Section 2.05 below.

(w) Employees. Employ any individual as an employee of the Company or any Subsidiary.

(x) Awards and Proceeds. Settle, apply or dispose of any casualty insurance proceeds in excess $50,000 or any condemnation award, from any insurance company or any condemning authority, as applicable.

(y) No REIT Prohibited Transactions. Take, or permit to be taken, any action that is or results in a REIT Prohibited Transaction (as defined below).

(z) Pledge and Assignment. Subject to the provisions of Article VI below, sell, transfer or pledge JV Member’s interests in the Company or any Subsidiary.

(aa) Additional Capital Contributions. Except as expressly (1) set forth in Section 3.01 below, (2) set forth in the approved Annual Budget or (3) otherwise approved by the Members in writing, require any additional capital contributions of the Members

(bb) Consultants. Retain or dismiss on behalf of the Company or any Subsidiary any accountants, auditors, property managers or leasing agents. Ernst & Young is hereby approved as the approved audit and tax firm for the Company.

(cc) Member Loans. Except as expressly set forth in Section 3.03 or otherwise approved by the Members in writing, require or request any Member Loan.

(dd) Certificated Interests. Elect to have the Members interests in the Company become certificated interests.

(ee) Amendment to this Agreement. Except as contemplated by Section 2.06(e) or Section 6.03 or as otherwise approved by the Members, amend or supplement this Agreement.

(ff) Amendment to Subsidiary Documents. Except as necessary to consummate a Financing permitted by this Agreement or as otherwise approved by the Members, amend or supplement any formation documents or governing agreements of any Subsidiary.

In the event the KBS Member does not respond to any Major Decision in writing within ten (10) days after KBS Member’s receipt of a request therefor from Managing Member, Managing Member may send a second notice by certified mail, return receipt requested, containing a statement in all caps that the failure to respond to such Major Decision within five (5) days will result in deemed approval of such Major Decision. If KBS Member does not timely respond to the second notice, then the Major Decision shall be deemed approved. Nothing in this Agreement shall limit or prevent KBS Member from requesting that Managing Member initiate a Major Decision. If, however, Managing Member does not to implement the Major Decision requested by KBS Member, KBS Member shall have the right to cause the Company and any of its Subsidiaries to undertake

SMRH:479102057.10 | 10 | |

such Major Decision notwithstanding Managing Member’s position; provided that prior to the removal of JV Member as Managing Member pursuant to Section 2.06, KBS Member shall not have the right to cause the Company or any of its Subsidiaries to undertake any action with respect to a Fundamental Decision without JV Member’s prior written consent; provided further that after any such removal with respect to Fundamental Decisions, (A) Section 2.06(c)(iv) shall govern if such removal was for cause, and (B) Section 2.06(d)(iii) shall govern if such removal was without cause.

2.03. Company Funds. No Company funds, assets, credit or other resources of any kind or description shall be paid to, or used for, the benefit of any Member, except as specifically provided in this Agreement or the Annual Budget or after the written approval of all the Members has been obtained. All funds of the Company shall be deposited only in such federally insured checking and savings accounts of the Company in the Company name with banks and other financial institutions having not less than $1,000,000,000 in assets as the KBS Member shall approve in writing, shall not be commingled with funds of any other person or entity, and shall be withdrawn only upon such signature or signatures as may be designated in writing from time to time by Managing Member after receiving approval of the KBS Member. KBS Member hereby pre-approves JP Morgan Chase Bank N.A. as the initial holder of the Company’s bank accounts.

2.04. Employees. The Company and the Subsidiaries shall not have employees. Except as may be otherwise provided for in the Management Agreement, each Member shall be solely responsible for all wages, benefits, insurance and payroll taxes with respect to any of its employees or those of its Affiliates. Each Member agrees to perform its duties under this Agreement as an independent contractor and not as the agent, employee or servant of the Company. Each Member shall be solely responsible for its own acts and those of its subordinates, employees and agents during the term of this Agreement and, subject to, and without the waiver of the benefits of, the provisions of Section 2.09, each Member hereby indemnifies and holds harmless the Company and each other Member from any liabilities, damages, costs and expenses (including, without limitation, reasonable attorneys’ fees) arising from the acts of any such subordinates, employees and agents of such Member or its Affiliates.

2.05. Insurance.

(a) Company Policies. Managing Member shall purchase and maintain, or shall cause to be purchased and maintained, for and at the expense of the Company, policies of insurance (i) for the Company’s and its Subsidiaries' operations, (ii) for the protection of the Company’s and its Subsidiaries' assets (including the Project), and (iii) as may be reasonably required to comply with third-party requirements in accordance with guidelines approved by KBS Member, and shall provide the Members upon request with the certificates or other evidence of insurance coverage as provided therein.

(b) Contractor’s Insurance Obligations. Managing Member shall require the Project’s general contractors and all subcontractors retained by the Company and any Subsidiary working at the Project, or any portion thereof, to obtain and maintain at all times during performance of work for the Company or any Subsidiary an occurrence form commercial general liability policy on a primary and non-contributing basis with a minimum of $1,000,000 per occurrence/$1,000,000

SMRH:479102057.10 | 11 | |

annual aggregate, or in such other amounts as may be approved by the KBS Member, on which the Company or any Subsidiary is named as an additional insured. In addition, Managing Member shall require that the Project’s general contractors and all subcontractors retained by the Company and any Subsidiary carry worker’s compensation coverage as required by law.

(c) D&O Insurance. Managing Member may purchase and maintain insurance on behalf of the executive officers of Managing Member (and if requested by KBS Member, executive officers of KBS Member) against liability asserted against such Person and incurred by such Person arising out of such Person’s actions on behalf of Managing Member (or KBS Member, as applicable) under this Agreement; provided that the cost of such insurance is included in the approved Annual Budget for the applicable year and such coverage is available at commercially reasonable rates.

2.06. Election, Removal, Resignation of Managing Member.

(a) Number, Term and Qualifications of Managing Member. The Company shall have one Managing Member, which shall initially be JV Member.

(b) Removal of Managing Member for Cause. KBS Member may, but shall not be obligated to, exercise any of the remedies provided in Section 2.06(c) below under any of the following circumstances (each, a “Removal Event”):

(i) if JV Member, or any principal, officer, executive or employee of JV Member engages in fraud, misappropriation of funds, intentional misrepresentation or willful misconduct with respect to the Company, any Subsidiary or the Project;

(ii) if JV Member, or any principal, officer, executive or employee of JV Member is convicted or pleads guilty or nolo contendere to (1) any felony that involves the Company and/or any Subsidiary, and/or (2) any crime involving moral turpitude or breach of trust;

(iii) the affairs of JV Member cease to be principally controlled by a JV Member Principal;

(iv) a material default by the JV Member as the Managing Member under this Agreement which is not timely cured within ten (10) business days after written notice from KBS Member (or, if such default is not susceptible of cure within such ten (10) business day period, within such period as is required to effect such cure so long as JV Member has commenced such cure within such ten (10) business day period and thereafter prosecutes such cure to completion with diligence), not to exceed ninety (90) days in the aggregate;

(v) Bankruptcy of the Company or any Subsidiary filed by the Managing Member without the written approval of KBS Member;

(vi) Bankruptcy of JV Member or any JV Member Principal;

SMRH:479102057.10 | 12 | |

(vii) if any default under any Financing, including under any Required Guaranty (defined below) (for which there are no notice and cure rights or for which such rights have expired and the lender has not otherwise waived such default in accordance with the terms of any Financing document) occurs, if such default is caused by JV Member or any Affiliate thereof; provided that it shall not be a Removal Event if the event of default in question is a result of the Company having insufficient funds or revenues due to the performance of the Project or if the default was caused by KBS Member or any Affiliate thereof;

(viii) the failure of JV Member to fund any capital contributions as and when required pursuant to Section 3.01(a) or Section 3.06 below, as applicable, and such failure is not cured within the earlier of: (A) ten (10) business days of written notice from KBS Member; or (B) with respect to the capital contributions set forth in Section 3.01(a)(i) and (ii), the date required under the Purchase Agreement; and

(ix) JV Member resigns as Managing Member without the prior written consent of KBS Member.

Notwithstanding the foregoing, a Removal Event shall not be deemed to have occurred and the following shall not give rise to any rights in favor of KBS Member if (A) the misappropriation of funds, intentional misrepresentation, willful misconduct, felony or crime of moral turpitude or breach of trust, as the case may be, that gave rise to any right to remove the Managing Member was the action or inaction solely of any person other than Karl Slovin, without the prior knowledge of Karl Slovin of the act or inaction in question, (B) to the extent permitted by applicable law, the employment of such person is terminated within ten (10) Business Days after the earlier of (i) receipt by Managing Member of notice, or (ii) the date on which Managing Member obtained actual knowledge of such employee’s misappropriation of funds, intentional misrepresentation, willful misconduct, felony or crime of moral turpitude or breach of trust and evidence thereof, and (C) Managing Member takes such actions as shall be reasonably required in order to cure or ameliorate (and provide for financial compensation for any actual losses suffered for) any damage suffered by the Company or the applicable Subsidiary as a consequence of such employee’s misappropriation of funds, intentional misrepresentation, willful misconduct, felony or crime of moral turpitude or breach of trust.

(c) Remedies Upon Removal Event(i) terminate any or all of the Affiliate Agreements, in each case, without penalty or payment of termination fees, but any fees earned under any Affiliate Agreement prior to such termination shall be paid through the applicable termination date, but not thereafter;

(ii) replace JV Member as Managing Member by delivering written notice of removal (“Removal Notice”) to JV Member, and designate a new Managing Member (which may be KBS Member or one of its Affiliates);

(iii) terminate distributions of Net Cash (defined below) of the Company in accordance with Section 5.01 below and have any and all Net Cash of the Company thereafter distributed in accordance with the provisions of Section 5.02 (i.e., JV Member

SMRH:479102057.10 | 13 | |

shall lose its “promote” and Net Cash shall be thereafter distributed pro rata to the Members in accordance with their Percentage Interests in accordance with Section 5.02);

(iv) terminate JV Member’s right to participate in Major Decisions, other than the Fundamental Decisions set forth in Section 2.06(d)(iii)(1) through (7), inclusive, and (13) through (20), inclusive;

(v) terminate JV Member’s right to sell the Project set forth in Section 7.02 below; and/or

(vi) terminate any or all Affiliate Agreements.

If, after a Removal Event but prior to the date JV Member cures the underlying default that caused the Removal Event, KBS Member desires to exercise any or all of the foregoing remedies, KBS Member may do so at any time thereafter and from time to time, by delivering written notice to JV Member, which notice shall specify the effective date of the election of its remedies and which remedies KBS Member is electing. KBS Member shall not be required to exercise all of the foregoing remedies at one time and no delay in or decision not to exercise all of the foregoing remedies at one time shall limit or impair KBS Member’s right to exercise any other remedy at a later time or be construed as a waiver thereof provided that KBS Member delivers written notice to Managing Member or its decision to exercise such subsequent remedies.

As used in this Agreement, the term “Net Cash” shall mean the gross cash receipts of the Company from all sources as of any applicable date of determination, less the portion thereof used to pay (i) all cash disbursements (inclusive of any guaranteed payment within the meaning of Section 707(c) of the Code (as defined below) paid to any Member, including, without limitation, any reimbursements made to any Member and any amounts applied to repay any Member Loans (as defined below), of the Company prior to that date); and (ii) all reserves, established by the Annual Budget or any Financing or otherwise approved by KBS Member for anticipated cash disbursements that will have to be made before additional cash receipts from third parties will provide the funds therefor, including for payment of debt service, capital improvements and other anticipated contingencies and expenses of the Company.

(d) Removal of Managing Member Without Cause. JV Member may be removed as Managing Member for any reason or no reason upon sixty (60) days’ prior written notice by KBS Member. If KBS Member elects, in its sole discretion, to remove the Managing Member under this Section 2.06(d) and no Removal Event has occurred, then:

(i) KBS Member may elect to: (1) cause the Company to terminate any and all Affiliate Agreements as provided in Section 2.06(c)(i) above provided that the Company shall pay the Termination Fee to Managing Member within twenty (20) days after the effective date of any such termination, (2) replace Managing Member with a new Managing Member as provided in Section 2.06(c)(ii) above, and/or (3) terminate JV Member’s right to participate in Major Decisions as provided in Section 2.06(c)(iv) above (but not as to Fundamental Decisions), but in no event shall KBS Member have the remedies in Section 2.06(c)(iii) (terminate JV Member’s “promote”) or Section 2.06(c)(v) (terminate

SMRH:479102057.10 | 14 | |

JV Member's right to sell the Project). For purposes of this Section 2.06(d)(i), the “Termination Fee” payable to JV Member shall be an amount equal the net present value of the future fees that JV Member (through its Affiliate) would have received under the Asset Management Agreement and the construction management fees to be paid pursuant to the Management Agreement (but not the monthly property management fees paid pursuant to the Management Agreement), discounted at 10%, assuming that the term of the Asset Management Agreement and the Management Agreement would be the greater of (i) five (5) years from the date of this Agreement or (ii) three (3) years from the effective date of the removal of the Manager. KBS shall deliver to JV Member a calculation of the Termination Fee with sufficient supporting information for JV Member to understand KBS’s calculation. The Termination Fee shall be determined by KBS using is good faith reasonable judgment, which determination shall be final and conclusive absent manifest error.

(ii) Intentionally omitted.

(iii) Notwithstanding the provisions of Section 2.06(d)(i)(3) above, in no event shall KBS Member, without the written consent of JV Member (each, a “Fundamental Decision” and collectively, the “Fundamental Decisions”):

1) amend or supplement this Agreement; provided, however, that the prior written consent of JV Member shall not be required to the extent such amendment or supplement is expressly contemplated herein to effect an otherwise approved decision or action;

2) amend or supplement any Subsidiary Documents; provided, however, that the prior written consent of JV Member shall not be required to the extent such amendment or supplement is expressly contemplated herein to effect an otherwise approved decision or action;

3) (A) cause the Company or any Subsidiary to enter any Financing, or (B) to enter into any modifications, amendments, extensions, of any existing Financing; provided, however, that, in each case, the prior written consent of JV Member shall not be required if: (1) the Financing is with a lender that is not an Affiliate of the KBS Member or the KBS Credit Party (as defined below); and (2) the Financing or the modification, amendments or extension of an existing Financing would not require (A) additional Capital Contributions from JV Member, or (B) a guaranty from JV Member or an Affiliate of JV Member;

4) cause the Company or any Subsidiary to issue any securities (debt or equity) which would have rights to distributions prior to the rights of JV Member;

5) admit a new member to the Company or any Subsidiary if and only if such new member would have rights to distributions that dilute the distribution to JV Member;

SMRH:479102057.10 | 15 | |

6) cause the Company or any Subsidiary to acquire (directly or indirectly) any real property other than the Property;

7) cause the Company or any Subsidiary to enter into or modify any agreement or transaction with any Affiliate of KBS Member; provided, however, that the prior written consent of JV Member shall not be required if such agreement is on terms at least as favorable to the Company or any Subsidiary as it would receive pursuant to similar agreement with a third party;

8) distribution of any property in kind;

9) exercise any rights under Section 2.02(c) (Sale of the Company or the Project) other than in accordance with the provisions of Section 7.01;

10) confession of any judgement on behalf of the Company or any Subsidiary;

11) the merger or consolidation of the Company or any Subsidiary with any other entity;

12) any act by or on behalf of the Company or any Subsidiary in contravention of this Agreement or which would make it impossible to carry on the business of the Company or any Subsidiary;

13) any action or decision that would reasonably be expected to cause liability under any of the Required Guaranties or the Completion Guaranty;

14) the filing on behalf of the Company or any Subsidiary (where the Company or a Subsidiary is the debtor) of any petition, or consent to the appointment of a trustee or receiver or any judgement or order, under state or federal bankruptcy laws;

15) approving any distributions that would reasonably be expected to cause the Company to be unable to pay Necessary Costs (as hereinafter defined);

16) a loan by the Company or any Subsidiary to any Member or any other person or entity;

17) making a tax election that is disproportionately adverse to the tax position of JV Member after taking into account the Members' different Percentage Interests;

SMRH:479102057.10 | 16 | |

18) any action that would reasonably be expected to result in JV Member or JV Member Principals to have any civil or criminal liability;

19) any action by the Company or any Subsidiary that would reasonably be expected to result in a violation of any law; or

20) the use of the name M West Holdings in any press release or otherwise.

(e) Attorney-in-Fact. If KBS Member elects to remove JV Member as Managing Member pursuant to Section 2.06(c) or Section 2.06(d), KBS Member shall deliver written notice to Managing Member and JV Member, which notice shall specify the effective date of the removal of JV Member as Managing Member in accordance with such Sections. Upon the occurrence of the removal of JV Member as Managing Member, JV Member hereby appoints KBS Member as its attorney in fact (such power of attorney coupled with an interest and irrevocable) for the purpose of executing, delivering and filing such documents that are necessary (including, without limitation, any amendment to the Certificate or this Agreement) for the purpose of effecting the remedies selected by KBS Member, but only to the extent such documents and remedies are consistent with this Agreement.

2.07. Members Have No Managerial Authority. The Members shall have no power to participate in the management of the Company, except as expressly authorized by this Agreement.

2.08. Meetings. The Company shall not be required to hold regular meetings of Members. Any Member may call a meeting of Members for the purpose of discussing Company business. Unless otherwise approved by the Members, any meeting of Members shall be held during normal business hours either telephonically or in person at the Company's principal office on such day and at such time as are reasonably convenient for the Members.

2.09. Liability and Indemnity. No Member (nor any officer, director, member, manager, constituent partner, agent or employee of the Company or a Member) shall be liable or accountable in damages or otherwise to the Company or to any other Member for any good faith error of judgment or any good faith mistake of fact or law in connection with this Agreement, or the services provided to the Company, except in the case of willful misconduct or gross negligence. To the maximum extent permitted by law, the Company does hereby indemnify, defend and agree to hold each Member and its Affiliates (and each such officer, director, member, manager, constituent partner, agent or employee) wholly harmless from and against any loss, expense or damage (including, without limitation, attorneys’ fees and costs) suffered by such Member and its Affiliates (and/or such officer, director, member, manager, constituent partner, agent or employee) by reason of anything which such Member and its Affiliates (and/or such officer, director, member, manager, constituent partner, agent or employee) may do or refrain from doing hereafter for and on behalf of the Company and in furtherance of its interest, except in the case of willful misconduct or gross negligence. To the maximum extent permitted by law, each Member does hereby indemnify, defend and agree to hold the Company and each other Member wholly harmless from and against any loss, expense or damage (including, without limitation, attorneys’ fees and costs) suffered by the Company or such other Member as a result of such indemnifying Member’s willful misconduct or

SMRH:479102057.10 | 17 | |

gross negligence in performing or failing to perform such indemnifying Member’s duties hereunder. No person shall be entitled to indemnification under this Section 2.09 to the extent any losses arise directly or indirectly our of such Indemnitee’s gross negligence, willful misconduct, fraud, intentional misrepresentation or criminal conduct.

2.10. Business Plan and Budget. Attached hereto as Exhibit B is a plan which sets forth the general description of the overall business plan of the Company with respect to the Project (the “Business Plan”), which has been prepared by Managing Member on behalf of the Company, and which is hereby approved by the KBS Member. Notwithstanding the approval of such Business Plan by the KBS Member, in the event of any conflict or inconsistency between any provision of the Business Plan and any provision of this Agreement, the provisions of this Agreement shall control and supersede the provisions of the Business Plan. On or before the Update Date (defined below) in any year, Managing Member shall prepare an update and any other necessary modifications to the Business Plan for KBS Member’s review and approval.

(a) Annual Budget. Attached hereto as Exhibit C is an “Annual Budget” that has been approved by the KBS Member (except as set forth in this Section 2.10(a)) and sets forth, by category, the estimated costs that are projected to be incurred for the remainder of the 2016 fiscal year and the 2017 fiscal year in connection with the ownership, renovation, construction, and leasing of the Project by the Company. The initial Annual Budget (and each subsequent Annual Budget to the extent applicable until the completion of the renovations to be made by the Company at the Project as described in the Business Plan (the “Renovations”)) includes a budget setting forth the estimated renovation costs to be incurred by the Company in connection with the renovation and construction of the Project (the “Renovation Budget”). On or before the last business day of November of each year (each an “Update Date”), Managing Member shall prepare a new Annual Budget for the upcoming calendar year which shall be required to be approved by the KBS Member as a Major Decision under Section 2.02(b), which shall set forth, by individual category, the costs and expenses projected to be incurred by the Company for the ensuing fiscal year. In the event the KBS Member does not respond to the proposed Annual Budget within fifteen (15) business days after receipt of such budget, Managing Member may send a second notice by certified mail, return receipt requested, containing a statement in all caps that the failure to respond to such proposed Annual Budget within ten (10) days will result in deemed approval of such Annual Budget. If KBS Member does not timely respond to the second notice, then the Annual Budget shall be deemed approved. Notwithstanding anything to the contrary herein, the estimated Renovation Budget included in the initial Annual Budget attached hereto as Exhibit C-1 has not been approved by KBS Member and the Company shall not commence (nor shall Managing Member cause the commencement of) the Renovations or expend any funds with respect to the Renovations unless and until KBS Member has approved a detailed Renovation Budget prepared by Managing Member; provided, however, KBS Member shall not withhold its consent if such Renovation Budget is necessary to commence work in order to comply with the terms of the Mortgage Loan.Interim Annual Report. If any Annual Budget (excluding any portion which constitutes the Renovation Budget), or any category thereof, is not approved as a Major Decision under Section 2.02(b) for any fiscal year as of the commencement of such fiscal year (or other period), then the approved categories of the proposed Annual Budget shall be in effect, but as to the categories which were disapproved, the greater of (i) the increase in CPI plus three (3%) percent, and (ii) one hundred

SMRH:479102057.10 | 18 | |

five percent (105%) of the last approved Annual Budget line items, shall be in effect until the new Annual Budget as to such categories is approved as a Major Decision under Section 2.02(b). Adjustments to the last approved Annual Budget shall automatically be made to reflect actual increases in real property taxes, insurance premiums, utility charges and payments required under contracts to which the Company is a party at the time of the expiration of the Annual Budget, and shall not require approval under Section 2.02(b). As used in this Agreement, the term “CPI” means the CONSUMER PRICE INDEX ALL URBAN CONSUMERS (CPI-U; SELECTED AREAS; ALL ITEMS; 1982-84 = 100) published by the United States Department of Labor, Bureau of Labor Statistics. With respect to the Project, the CPI shall be that of Los Angeles Metropolitan Area. If the base of the CPI changes from the 1982-1984 base (100), the CPI shall, thereafter, be adjusted to the 1982-84 base (100) before the computation utilizing the CPI is made. If the CPI cannot be converted to the 1982-84 base or if the CPI is otherwise revised, the adjustment under this Agreement shall be made with the use of such conversion factor, formula or table for converting the CPI as may be published by the Bureau of Labor Statistics. If the CPI is at any time hereafter no longer published, a comparable index generally accepted and employed by the real estate profession in Los Angeles, California, as determined by the Members, shall mean CPI.

(b) Reallocations within Renovation Budget. With respect to any Renovation Budget, Managing Member may, (i) to the extent covered by contingency funds in the Renovation Budget, with respect to any line item in the Renovation Budget, allocate from such contingency funds the lesser of 10% of such line item and $50,000, and (ii) if after the completion of any item, as certified by Managing Member to KBS Member, there remains an excess undisbursed balance, reallocate from such excess balance to any other line item in the Renovation Budget whose funds are insufficient to complete such item, so long as such amount does not exceed the lesser of 10% of such line item and $50,000; provided, however, in no event may any line item (contingency or otherwise) be reallocated to pay any fees or expenses to Managing Member or any Affiliate.

2.11. Pre-Approved Affiliate Agreements. The Members contemplate that the Company shall cause Property Owner Subsidiary to execute the following agreements at the Property Closing (individually a “Pre-Approved Affiliate Agreement” and collectively, the “Pre-Approved Affiliate Agreements”), but if any of them are entered into prior to the Property Closing, no fees or other amounts payable by the Property Owner Subsidiary thereunder shall accrue prior to the date on which the Property Closing occurs:

(a) Management Agreement. At or before the Property Closing, Property Owner Subsidiary shall enter into a property management agreement substantially in the form of Exhibit D attached hereto (the “Management Agreement”) with Polaris Property Management LLC (the "Property Manager") or such other entity approved by the Managing Member and the KBS Member. The fee payable to Property Manager shall be as set forth in the Management Agreement. The Management Agreement is an Affiliate Agreement and KBS Member hereby approves the entering into of the Management Agreement by the Property Owner Subsidiary.

(b) Intentionally Omitted.

(c) Asset Management Agreement. At or before the Property Closing, Property Owner Subsidiary shall also enter into an Asset Management Agreement substantially in the form

SMRH:479102057.10 | 19 | |

of Exhibit E attached hereto (the “Asset Management Agreement”) with MWest Holdings LLC (the “Asset Manager”) or such entity approved by the Managing Member and the KBS Member. The fee payable to Asset Manager shall be as set forth in the Asset Management Agreement. The Asset Management Agreement is an Affiliate Agreement and KBS Member hereby approves the entering into of the Asset Management Agreement by the Property Owner Subsidiary.

2.12. Reimbursements and Fees.

(a) Reimbursements. Except as otherwise provided by this Agreement, none of the Members (or their respective Affiliates and/or other representatives) shall be paid any compensation for rendering services to the Company. Each Member shall be reimbursed for any costs and/or expenses incurred by such Member on behalf of the Company that relate to the business and affairs of the Company to the extent such Member had authority to act on behalf of the Company (without reduction to such Member’s capital account in the Company maintained in accordance with Treasury Regulations Section 1.704-1(b)(2)(iv) (each a “Capital Account”)); provided, however, that except as otherwise provided in this Agreement or in the Annual Budget no Member shall be reimbursed for any such costs and/or expenses that exceed an aggregate amount of $2,000 during any calendar year without the approval of all of the Members. As used in this Agreement, the term: “Treasury Regulation” means any proposed, temporary, and/or final federal income tax regulation promulgated by the United States Department of the Treasury as heretofore and hereafter amended from time to time (and/or any corresponding provisions of any superseding revenue law and/or regulation).

(b) Acquisition Fee. The JV Member shall be paid an acquisition fee in an amount equal to $500,000.00, which shall be payable at the Property Closing.

(c) Reimbursement for Pre-Formation Costs. Subject to the prior reasonable approval of KBS Member, at or within five (5) business days after the acquisition of the Project by the Company, the Company shall reimburse KBS Member and JV Member for any and all reasonable legal and accounting fees, organizational costs and any other formation and due diligence costs incurred by KBS Member and JV Member (and/or any Affiliate or representative thereof) in connection with the formation of the Company, the negotiation and documentation of this Agreement and the acquisition of the Project. The foregoing reimbursements shall not be debited to or otherwise reduce any Member’s Capital Account. KBS Member and JV Member shall use good faith commercially reasonable efforts to cause all such amounts approved by KBS Member to be reimbursed hereunder to be included in the final escrow closing statement for the acquisition of the Project.

2.13. Limited Liability. Except as otherwise provided by the Act, the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of the Company, and the Members shall not be obligated personally for any such debt, obligation or liability of the Company solely by reason of being a Member of the Company.

SMRH:479102057.10 | 20 | |

2.14. Representations, Warranties and Covenants.

(a) Certain Representations and Warranties of the Members. Each Member hereby represents and warrants to the Company and the other Member as follows:Such Member is duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization.

(i) Such Member has all requisite power, authority and capacity to enter into and perform its obligations under this Agreement.

(ii) Such Member has duly authorized the execution and delivery of this Agreement, and this Agreement constitutes a binding obligation of such Member, enforceable against such Member in accordance with its terms.

(iii) The execution, delivery and performance of this Agreement by such Member will not violate any agreement to which such Member or any of its Affiliates is a party or order of a governmental body.

(iv) Such Member is otherwise duly qualified to purchase and hold its Interest and to execute and deliver this Agreement and all other instruments executed and delivered on behalf of it in connection with the acquisition of its Interest.

(b) Certain Representations and Warranties of JV Member. None.

ARTICLE III

MEMBERS’ CONTRIBUTIONS TO COMPANY

3.01. Initial Capital Commitments.

(a) JV Member. JV Member shall commit to contribute to the capital of the Company, in cash, as follows:

(i) concurrently with the execution and delivery of this Agreement, an amount equal to 10% of the Purchase Deposit (i.e., $300,000.00);

(ii) at or prior to the Property Closing, an amount equal to 10% of the equity necessary to consummate the Property Closing, acquire the Project and capitalize the Company as set forth in the sources and uses schedule attached hereto Exhibit F; and

(iii) within ten (10) Business Days after demand from Managing Member, an amount equal to the product of the JV Member’s Percentage Interest and the equity needed to complete the Renovations as set forth in the Renovation Budget or to comply with the requirement to make improvements to the Property as set forth in the Mortgage Loan.

SMRH:479102057.10 | 21 | |

(b) KBS Member. KBS Member shall commit to contribute to the capital of the Company, in cash, as follows:

(i) concurrently with the execution and delivery of this Agreement, an amount equal to 90% of the initial equity necessary to fund the Purchase Deposit (i.e., $2,700,000.00);

(ii) at or prior to the Property Closing, an amount equal to 90% of the equity necessary to consummate the Property Closing, acquire the Project and capitalize the Company as set forth in the sources and uses schedule attached hereto as Exhibit F; and

(iii) within ten (10) Business Days after demand from Managing Member, an amount equal to the product of the KBS Member’s Percentage Interest and the equity needed to complete the Renovations as set forth in the Renovation Budget or to comply with the requirement to make improvements to the Property as set forth in the Mortgage Loan.

(c) Failure to Close Property Closing. The Members acknowledge that upon execution of this Agreement, (i) the Property Owner Subsidiary will have funded (or may be obligated to fund) the Purchase Deposit under the Purchase Agreement and (ii) the Members shall be obligated to fund their respective initial capital contributions set forth in this Section 3.01. In the event a Member fails to fund the portion of its initial capital contribution required to be funded at or prior to the Property Closing pursuant to Section 3.01(a) or (b), as applicable, or otherwise refuses to allow the Property Owner Subsidiary to close the Property Closing under the Purchase Agreement and such failure to fund or close results in or would result in a default under the Purchase Agreement, then in addition to any other remedy set forth in this Agreement, the non-defaulting Member shall have the unilateral authority and without the consent of the defaulting Member to cause the Company and the Property Owner Subsidiary to close the Property Closing, in which event the defaulting Member shall be no longer be a Member of the Company and shall receive no return of its capital to the extent such defaulting Member had previously funded any part of its capital under this Section 3.01. In the event a Member fails to fund the portion of its initial capital contribution required to be funded at or prior to the Property Closing pursuant to Section 3.01(a) or (b), as applicable, or otherwise refuses to allow the Property Owner Subsidiary to close the Property Closing under the Purchase Agreement and such failure to fund or close results in or would result in a default under the Purchase Agreement and the non-defaulting member elects not to close the Property Closing, the defaulting Member shall be liable for the non-defaulting Member’s share of the Purchase Deposit that is not returned to the non-defaulting Member and for all costs and expenses incurred by such non-defaulting Member incurred in connection with this Agreement and the Project, including all costs to negotiate this Agreement, to the extent such costs and expenses have not previously been reimbursed to such non-defaulting Member (the lost Purchase Deposit and such costs and expenses, collectively, the “Reimbursable Expenses”). The defaulting Member shall pay to the non-defaulting Member such reimbursement within ten (10) days of the non-defaulting Member’s written request therefor, which request shall reasonably substantiate the costs and expenses incurred. If the defaulting Member is (i) KBS Member then KBS SOR US Properties II LLC (the “KBS Credit Party”) shall guaranty the payment of the Reimbursable Expenses incurred by JV Member, or (ii) JV Member then KEK Family Holdings, LLC, a Delaware limited liability

SMRH:479102057.10 | 22 | |

company (the “JV Member Credit Party”) shall guaranty the Reimbursable Expenses incurred by KBS Member. Except as provided in Section 1.05 above, if the Property Closing does not otherwise occur and the Purchase Deposit is returned to the Property Owner Subsidiary, then the Company shall be dissolved pursuant to Article VIII.

3.02. Default in Capital Commitment. If JV Member or KBS Member (as applicable, the “Defaulting Member”) shall fail to contribute its share of any amounts required to be contributed pursuant to Section 3.01 or any approved additional capital contributions pursuant to Section 3.06 (the “Defaulted Amount”) and such failure shall continue for at least five (5) business days following notice to the Defaulting Member (provided that no notice or cure period shall apply to a Member’s failure to fund its share of the required capital to the Company for the Property Closing pursuant to the Purchase Agreement), KBS Member or JV Member, as applicable, (the “Non-Defaulting Member(s)”) may, but shall not be obligated to, contribute some or all of the Defaulted Amount as a capital contribution to the Company or as a loan to the Defaulting Member (a “Default Loan”). If the Non-Defaulting Member elects to contribute some or all of the Defaulted Amount as a capital contribution to the Company, then the Percentage Interests of KBS Member and the JV Member shall be adjusted as follows: (a) the amount which the Non-Defaulting Member elects to contribute to fund the Defaulted Amount shall be deemed to be equal to 150% of the amount that the Non-Defaulting Member actually funds (the “Deemed Capital”); (b) the Non-Defaulting Member’s Percentage Interest shall be equal to the percentage equivalent of a fraction, the numerator of which is equal to the aggregate capital contributed by the Non-Defaulting Member, exclusive of the amount funded to replace the Defaulted Amount, plus the Deemed Capital, and the denominator of which is the total capital contributed by all Members, other than the amount contributed to replace the Defaulted Amount, plus the Deemed Capital; and (c) the Defaulting Member’s Percentage Interest shall equal 100% minus the recomputed Percentage Interest of the Non-Defaulting Member. If the Non-Defaulting Member elects to provide the Default Loan, then it shall pay the proceeds directly to the Company. A Default Loan shall not be considered a capital contribution by the Non-Defaulting Member and shall not increase the Capital Account balance or the Percentage Interest of the Non-Defaulting Member, but instead shall be treated as a non-recourse loan by the Non-Defaulting Member to the Defaulting Member (and a capital contribution by the Defaulting Member) and shall bear interest at the lesser of (x) the Default Loan Rate (as defined below) or (y) the maximum amount permitted by law. To the extent not repaid directly by the Defaulting Member, a Default Loan, together with any accrued and unpaid interest thereon, shall be repaid out of any subsequent distributions of Net Cash or any other payment from the Company to which the Defaulting Member would otherwise be entitled (but such distributions actually paid to the lending Members shall nonetheless constitute a distribution to the Defaulting Member for purposes of this Agreement), and such payments shall be applied first to the payment of accrued but unpaid interest on each such obligation and then to the payment of the outstanding principal until the Default Loan is paid in full. “Default Loan Rate” is defined as a cumulative annual rate equal to twenty percent (20%), compounded quarterly (pro-rated for periods of less than one year), on the daily average outstanding balance during each fiscal year of the Member’s aggregate unreturned Default Loan.

3.03. Member Loans. In the event Managing Member determines, in its reasonable discretion, that funds in addition to those otherwise obtained pursuant to Section 3.01 are necessary

SMRH:479102057.10 | 23 | |