Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - SCANDIUM INTERNATIONAL MINING CORP. | exhibit31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2016

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE EXCHANGE ACT

For the transition period from _________to

__________________

000-54416

(Commission File Number)

SCANDIUM INTERNATIONAL MINING

CORP.

(Exact name of registrant as specified in its

charter)

| British Columbia, Canada | 98-1009717 |

| (State or other jurisdiction | (IRS Employer |

| of incorporation or organization) | Identification No.) |

| 1430 Greg Street, Suite 501, Sparks, Nevada | 89431 |

| (Address of principal executive offices) | (Zip Code) |

(775) 355-9500

(Registrant’s telephone

number, including area code)

N/A

(Former name, former address and

former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) filed all

reports required to be filed by sections 13 or 15(d) of the Securities and

Exchange Act of 1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

Yes [ X

] No [ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

Yes [ X ] No [ ]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company.

Large accelerated filer [

]

Accelerated filer [

]

Non-accelerated filed [

]

Smaller reporting company [ X ]

Indicate by check mark whether the registrant is a shell

company, as defined in Rule 12b-2 of the Exchange Act.

Yes

[ ] No [ X ]

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of November 07, 2016, the registrant’s outstanding common stock consisted of 225,047,200 shares.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

NINE MONTHS AND QUARTER ENDED SEPTEMBER 30, 2016

Scandium International Mining Corp.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(Expressed in US Dollars) (Unaudited)

| As at: | September 30, 2016 | December 31, 2015 | ||||

| ASSETS | ||||||

| Current | ||||||

| Cash | $ | 513,975 | $ | 2,249,676 | ||

| Prepaid expenses and receivables | 18,310 | 107,529 | ||||

| Total Current Assets | 532,285 | 2,357,205 | ||||

| Equipment (Note 3) | 3,245 | 2,611 | ||||

| Mineral interests (Note 4) | 942,723 | 942,723 | ||||

| Total Assets | $ | 1,478,253 | $ | 3,302,539 | ||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||

| Current | ||||||

| Accounts payable and accrued liabilities | $ | 51,079 | $ | 196,322 | ||

| Accounts payable with related parties | - | 11,009 | ||||

| Total Liabilities | 51,079 | 207,331 | ||||

| Stockholders’ Equity | ||||||

| Capital stock (Note 6)

(Authorized: Unlimited number of common shares

with no par value; Issued and outstanding: 225,047,200 (2015 – 225,047,200)) |

91,142,335 | 91,142,335 | ||||

| Treasury stock (Note 7) (1,033,333 common shares) | (1,264,194 | ) | (1,264,194 | ) | ||

| Additional paid in capital (Note 6) | 6,809,339 | 6,375,237 | ||||

| Accumulated other comprehensive loss | (853,400 | ) | (853,400 | ) | ||

| Deficit | (93,248,427 | ) | (91,338,182 | ) | ||

| Total Stockholders’ Equity | 2,585,653 | 4,061,796 | ||||

| Non-controlling Interest in a Subsidiary (Note 10) | (1,158,479 | ) | (966,588 | ) | ||

| Total Equity | 1,427,174 | 3,095,208 | ||||

| Total Liabilities and Equity | $ | 1,478,253 | $ | 3,302,539 |

Nature and continuance of operations (Note 1)

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Scandium International Mining Corp.

CONDENSED

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(Expressed

in US Dollars) (Unaudited)

| Three months | Three months | Nine months | Nine months | |||||||||

| ended September | ended | ended | ended | |||||||||

| 30, 2016 | September 30, | September 30, | September 30, | |||||||||

| 2015 | 2016 | 2015 | ||||||||||

| EXPENSES | ||||||||||||

| Amortization (Note 3) | $ | 343 | $ | 959 | $ | 2,523 | $ | 2,875 | ||||

| Consulting | 18,067 | 25,500 | 76,500 | 79,000 | ||||||||

| Exploration | 89,797 | 139,946 | 906,585 | 327,758 | ||||||||

| General and administrative | 42,595 | 33,613 | 151,581 | 123,973 | ||||||||

| Insurance | 8,568 | 7,351 | 25,597 | 12,396 | ||||||||

| Professional fees | 16,273 | 24,805 | 84,575 | 74,614 | ||||||||

| Salaries and benefits | 146,915 | 114,890 | 378,925 | 347,256 | ||||||||

| Stock-based compensation (Note 6) | 16,242 | 52,851 | 434,102 | 375,864 | ||||||||

| Travel and entertainment | 15,284 | 16,719 | 43,330 | 32,987 | ||||||||

| Loss before other items | (354,084 | ) | (416,634 | ) | (2,103,718 | ) | (1,376,723 | ) | ||||

| OTHER ITEMS | ||||||||||||

| Foreign exchange gain (loss) | 552 | 8,727 | 1,582 | (3,844 | ) | |||||||

| Interest expense | - | (95,450 | ) | - | (226,142 | ) | ||||||

| 552 | (86,723 | ) | 1,582 | (229,986 | ) | |||||||

| Loss and comprehensive loss for the period | $ | (353,532 | ) | $ | (503,357 | ) | $ | (2,102,136 | ) | $ | (1,606,709 | ) |

| Costs allocable to non-controlling interest in a subsidiary | 20,502 | - | 191,891 | - | ||||||||

| Loss and comprehensive loss for the period

attributable to Scandium International Mining Corp. |

$ | (333,030 | ) | $ | (503,357 | ) | $ | (1,910,245 | ) | $ | (1,606,709 | ) |

| Basic and diluted loss per common

share attributable to Scandium International Mining Corp. |

$ | (0.00 | ) | $ | (0.00 | ) | $ | (0.01 | ) | $ | (0.01 | ) |

| Weighted average number of common shares outstanding – basic and diluted | 225,047,200 | 209,225,377 | 225,047,200 | 202,316,308 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Scandium International Mining Corp.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in US Dollars) (Unaudited)

| Nine months | Nine months | |||||

| ended | ended | |||||

| September 30, | September 30, | |||||

| 2016 | 2015 | |||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||

| Loss for the period | $ | (2,102,136 | ) | $ | (1,606,709 | ) |

| Items not affecting cash: | ||||||

| Amortization | 2,523 | 2,875 | ||||

| Stock-based compensation | 434,102 | 375,864 | ||||

| Changes in non-cash working capital items: | ||||||

| Decrease in prepaids and receivables | 89,219 | 42,013 | ||||

| (Decrease) increase in accounts payable and accrued liabilities | (145,243 | ) | 145,837 | |||

| (Decrease) increase in accounts payable with related parties | (11,009 | ) | - | |||

| (1,732,544 | ) | (1,040,120 | ) | |||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||

| Additions to equipment | (3,157 | ) | - | |||

| (3,157 | ) | - | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||

| Common shares issued | - | 1,812,047 | ||||

| Share issuance costs | - | (60,000 | ) | |||

| Stock options exercised | - | 23,838 | ||||

| - | 1,775,885 | |||||

| Change in cash during the period | (1,735,701 | ) | 735,765 | |||

| Cash, beginning of period | 2,249,676 | 417,386 | ||||

| Cash, end of period | $ | 513,975 | $ | 1,153,151 |

Supplemental disclosure with respect to cash flows (Note 9)

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Scandium International Mining Corp.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN

EQUITY

(Expressed in US Dollars)

(Unaudited)

| Accumulated | Total | Non- | |||||||||||||||||||||||||

| Additional | Treasury | Other | Stockholders’ | controlling | |||||||||||||||||||||||

| Number of | Paid in | Stock | Comprehensive | Deficit | Equity | Interest in a | |||||||||||||||||||||

| Shares | Capital Stock | Capital | Loss | Subsidiary | Total Equity | ||||||||||||||||||||||

| Balance, December 31, 2014 | 198,604,790 | $ | 89,186,471 | $ | 2,419,615 | $ | (1,264,194 | ) | $ | (853,400 | ) | $ | (88,567,751 | ) | $ | 920,741 | $ | - | $ | 920,741 | |||||||

| Private placements | 23,654,930 | 1,812,047 | - | - | - | - | 1,812,047 | - | 1,812,047 | ||||||||||||||||||

| Shares issued in settlement of debt | 2,237,480 | 169,262 | - | - | - | - | 169,262 | - | 169,262 | ||||||||||||||||||

| Share issue costs | - | (60,000 | ) | - | - | - | - | (60,000 | ) | - | (60,000 | ) | |||||||||||||||

| Stock options exercised | 550,000 | 34,555 | (10,717 | ) | - | - | - | 23,838 | - | 23,838 | |||||||||||||||||

| Stock-based compensation | - | - | 673,224 | - | - | - | 673,224 | - | 673,224 | ||||||||||||||||||

| Sale of 20% of Australian subsidiary | - | - | 3,293,115 | - | - | - | 3,293,115 | (793,115 | ) | 2,500,000 | |||||||||||||||||

| Loss for the year | - | - | - | - | - | (2,770,431 | ) | (2,770,431 | ) | (173,473 | ) | (2,943,904 | ) | ||||||||||||||

| Balance, December 31, 2015 | 225,047,200 | 91,142,335 | 6,375,237 | (1,264,194 | ) | (853,400 | ) | (91,338,182 | ) | 4,061,796 | (966,588 | ) | 3,095,208 | ||||||||||||||

| Stock-based compensation | - | - | 434,102 | - | - | - | 434,102 | - | 434,102 | ||||||||||||||||||

| Loss for the period | - | - | - | - | - | (1,910,245 | ) | (1,910,245 | ) | (191,891 | ) | (2,102,136 | ) | ||||||||||||||

| Balance, September 30, 2016 | 225,047,200 | $ | 91,142,335 | $ | 6,809,339 | $ | (1,264,194 | ) | $ | (853,400 | ) | $ | (93,248,427 | ) | $ | 2,585,653 | $ | (1,158,479 | ) | $ | 1,427,174 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

| Scandium International Mining Corp. |

| NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| September 30, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 1. |

NATURE AND CONTINUANCE OF OPERATIONS |

Scandium International Mining Corp. (the “Company”) is a specialty metals and alloys company focusing on scandium and other specialty metals.

The Company was incorporated under the laws of the Province of British Columbia, Canada in 2006. The Company currently trades on the Toronto Stock Exchange under the symbol “SCY”.

The Company’s focus is on the exploration and evaluation of its specialty metals assets, specifically the Nyngan scandium deposit located in New South Wales, Australia (“Nyngan Scandium Project”) and the Tørdal scandium/rare earth minerals deposit in Norway. In June 2014, the Company made the final installment payment to acquire the Nyngan Scandium Project. The Company is an exploration stage company and anticipates incurring significant additional expenditures prior to production at any and all of its properties.

In fiscal 2015, the Company settled a $2,500,000 promissory note payable in exchange for a 20% interest in its Australian subsidiary which holds the Nyngan and Honeybugle properties. Accordingly, the Company holds an 80% interest in its Australian subsidiary as at period end.

These condensed consolidated financial statements have been prepared on a going concern basis that contemplates the realization of assets and discharge of liabilities at their carrying values in the normal course of business for the foreseeable future. These financial statements do not reflect any adjustments that may be necessary if the Company is unable to continue as a going concern.

The Company currently earns no operating revenues and will require additional capital in order to advance both the Nyngan and Tørdal properties. The Company’s ability to continue as a going concern is uncertain and is dependent upon the generation of profits from mineral properties, obtaining additional financing and maintaining continued support from its shareholders and creditors. These are material uncertainties that raise substantial doubt about the Company’s ability to continue as a going concern. In the event that additional financial support is not received or operating profits are not generated, the carrying values of the Company’s assets may be adversely affected.

| 2. |

BASIS OF PRESENTATION |

Basis of presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”). The interim condensed consolidated financial statements include the consolidated accounts of the Company and its wholly-owned subsidiaries with all significant intercompany transactions eliminated. In the opinion of management, all adjustments necessary for a fair statement of the consolidated financial position, results of operations and cash flows for the interim periods have been made. Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with generally accepted accounting principles of the United States of America (“US GAAP”) have been condensed or omitted pursuant to such SEC rules and regulations. These interim condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2015 and with our Annual Report on Form 10-K filed with the SEC on March 15, 2016. Operating results for the nine-month period ended September 30, 2016 may not necessarily be indicative of the results for the year ending December 31, 2016.

These unaudited condensed consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries, EMC Metals USA Inc., Wolfram Jack Mining Corp., and The Technology Store, Inc. Non-controlling interest represents the minority shareholders’ 20% proportionate share of the net assets and results of the Company’s majority-owned Australian subsidiary, EMC Metals Australia Pty Ltd., from the date the 20% interest was disposed by the Company (Note 10). All significant intercompany accounts and transactions have been eliminated on consolidation.

Use of estimates and judgements

The preparation of interim condensed consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the deferred income tax asset valuations, asset impairment, stock-based compensation and loss contingencies. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between estimates and the actual results, future results of operations will be affected.

The Company considers itself to be an exploration stage company and will consider the transition to development stage company based on all relevant factors including receipt of a mining license for its Nyngan Scandium project from the Mines Department of New South Wales, Australia, and financing for the project.

Fair value of financial assets and liabilities

The Company measures the fair value of financial assets and liabilities based on US GAAP guidance which defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements.

6

| Scandium International Mining Corp. |

| NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| September 30, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 2. |

BASIS OF PRESENTATION (cont’d…) |

The Company classifies financial assets and liabilities as held-for-trading, available-for-sale, held-to-maturity, loans and receivables or other financial liabilities depending on their nature. Financial assets and financial liabilities are recognized at fair value on their initial recognition, except for those arising from certain related party transactions which are accounted for at the transferor’s carrying amount or exchange amount.

Financial assets and liabilities classified as held-for-trading are measured at fair value, with gains and losses recognized in net income. Financial assets classified as held-to-maturity, loans and receivables, and financial liabilities other than those classified as held-for-trading are measured at amortized cost, using the effective interest method of amortization. Financial assets classified as available-for-sale are measured at fair value, with unrealized gains and losses being recognized as other comprehensive income until realized, or if an unrealized loss is considered other than temporary, the unrealized loss is recorded in income.

Financial instruments, including receivables, accounts payable and accrued liabilities, and accounts payable with related parties, are carried at amortized cost, which management believes approximates fair value due to the short term nature of these instruments.

The following table presents information about the assets that are measured at fair value on a recurring basis as at September 30, 2016, and indicates the fair value hierarchy of the valuation techniques the Company utilized to determine such fair value. In general, fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets. Fair values determined by Level 2 inputs utilize data points that are observable such as quoted prices, interest rates and yield curves. Fair values determined by Level 3 inputs are unobservable data points for the asset or liability, and included situations where there is little, if any, market activity for the asset:

| Quoted Prices | Significant Other | Significant | |||||||||||

| September 30, | in Active Markets | Observable Inputs | Unobservable Inputs | ||||||||||

| 2016 | (Level 1) | (Level 2) | (Level 3) | ||||||||||

| Assets: | |||||||||||||

| Cash | $ | 513,975 | $ | 513,975 | $ | — | $ | — | |||||

| Total | $ | 513,975 | $ | 513,975 | $ | — | $ | — |

The fair values of cash are determined through market, observable and corroborated sources.

Recently Issued Accounting Standards

Accounting Standards Update 2016-09 – Compensation—Stock Compensation (Topic 718) Improvements to Employee Share-Based Payment Accounting. This accounting pronouncement, which goes into effect December 16, 2016, addresses the simplification of several aspects of the accounting for share-based payment transactions, including the income tax consequences, classification of awards as either equity or liabilities, and classification on the statement of cash flows. The Company is reviewing this update to determine the impact it will have on its financial statements.

Accounting Standards Update 2016-02-Leases (Topic 842). This accounting pronouncement allows lessees to make an accounting policy election to not recognize a lease asset and liability for leases with a term of 12 months or less and do not have a purchase option that is expected to be exercised. This standard is effective for interim and annual reporting periods beginning after December 15, 2018, with early adoption permitted. The Company is currently evaluating the impact this guidance will have on its financial statements.

Accounting Standards Update 2016-01 – Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. This accounting pronouncement, which goes into effect December 12, 2017, is far reaching and covers several presentation areas dealing with measurement, impairment, assumptions used in estimating fair value and several other areas. The Company is reviewing this update to determine the impact it may have on its financial statements.

Accounting Standards Update 2015-17 – Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes. This accounting pronouncement requires that deferred tax liabilities and assets be classified as noncurrent in a classified statement of financial position. Currently deferred tax liabilities and assets must be presented as current and noncurrent. The policy is effective December 16, 2016. The Company is evaluating this guidance and believes it will have little impact on the presentation of its financial statements.

Accounting Standards Update 2015-02 - Consolidation (Topic 810) - Amendments to the Consolidation Analysis. This update provides guidance with respect to the analysis that a reporting entity must perform to determine whether it should consolidate certain types of legal entities. The amendments in this Update are effective for public business entities for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2015. The Company has adopted this standard which has little impact on the presentation of its financial statements.

Accounting Standards Update 2015-01 - Income Statement—Extraordinary and Unusual Items (Subtopic 225-20). This Update is part of an initiative to reduce complexity in accounting standards (the Simplification Initiative). This Update eliminates from GAAP the concept of extraordinary items. The amendments in this Update are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2015. The Company has adopted this standard.

7

| Scandium International Mining Corp. |

| NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| September 30, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 2. |

BASIS OF PRESENTATION (cont’d…) |

Accounting Standards Update 2014-15 – Presentation of Financial Statements – Going Concern (Subtopic 205-40). This accounting pronouncement provides guidance in GAAP about management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to provide related footnote disclosures. In doing so, the amendments should reduce diversity in the timing and content of footnote disclosures. The policy is effective December 15, 2016. The Company is evaluating this guidance and believes it will have little impact on the presentation of its financial statements.

| 3. |

EQUIPMENT |

| December 31, | Additions | September 30, | |||||||||||

| 2015 Net Book | (disposals) | Amortization | 2016 Net Book | ||||||||||

| Value | (write-offs) | Value | |||||||||||

| Computer equipment | $ | 1,017 | $ | 3,157 | $ | (929 | ) | $ | 3,245 | ||||

| Office equipment | 1,594 | - | (1,594 | ) | - | ||||||||

| Equipment | $ | 2,611 | $ | 3,157 | $ | (2,523 | ) | $ | 3,245 |

| December 31, | Additions | December 31, | |||||||||||

| 2014 Net Book | (disposals) | 2015 Net Book | |||||||||||

| Value | (write-offs) | Amortization | Value | ||||||||||

| Computer equipment | $ | 1,696 | $ | - | $ | (679 | ) | $ | 1,017 | ||||

| Office equipment | 4,748 | - | (3,154 | ) | 1,594 | ||||||||

| Equipment | $ | 6,444 | $ | - | $ | (3,833 | ) | $ | 2,611 |

| 4. |

MINERAL INTERESTS |

| Scandium and | ||||

| September 30, 2016 | other | |||

| Acquisition costs | ||||

| Balance, December 31, 2015 | $ | 942,723 | ||

| Additions | - | |||

| Balance September 30, 2016 | $ | 942,723 |

| Scandium and | ||||

| December 31, 2015 | other | |||

| Acquisition costs | ||||

| Balance, December 31, 2014 | $ | 3,012,723 | ||

| Sale of net smelter royalty | (2,070,000 | ) | ||

| Balance, December 31, 2015 | $ | 942,723 |

Title to mineral property interests involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyancing history characteristic of many mineral property interests. The Company has investigated title to all of its mineral property interests and, to the best of its knowledge, title to all of its properties is in good standing.

On October 13, 2015, the Company received US$2.07M from a private investor in return for the granting of a 0.7% royalty on gross mineral sales from both the Nyngan Scandium Project and the Honeybugle property. The amount received in return for the royalty interest was deducted from the value of the mineral interests of Nyngan and Honeybugle.

8

| Scandium International Mining Corp. |

| NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| September 30, 2016 |

| (Expressed in US Dollars) (Unaudited) |

SCANDIUM PROPERTIES

Nyngan, New South Wales Property

On February 6, 2013, the Company announced that it had acquired 100% of the Nyngan Scandium Project, in return for AUD$2.6 million cash payments and a percentage royalty payable to its previous partner on sales of product from the project.

| 4. |

MINERAL PROPERTY INTERESTS (cont’d…) |

During fiscal 2015, the Company settled a $2,500,000 promissory note payable in exchange for a 20% interest in its Australian subsidiary which holds title to both the Nyngan and Honeybugle properties.

Royalties attached to the Nyngan Scandium Project include a 1.5% Net Profits Interest royalty to private parties involved with the early exploration on the project, and a 1.7% Net Smelter Returns royalty payable to Jervois for 12 years after production commences, subject to terms in the settlement agreement. Another revenue royalty is payable to private interests of 0.2%, subject to a $370,000 cap. A New South Wales minerals royalty will also be levied on the project, subject to negotiation, currently 4% on revenue.

Honeybugle property, Australia

In April of 2014 the Company also acquired an exploration license referred to as the Honeybugle property, a prospective scandium exploration property located 24 kilometers from the Nyngan Scandium Project. As described in the previous Nyngan Scandium Project section, during fiscal 2015, the Company settled its $2,500,000 promissory note payable in exchange for a 20% interest in its Australian subsidiary which holds title to both the Nyngan and Honeybugle properties.

Tørdal and Evje-Iveland properties, Norway

During 2012 the Company entered into an option agreement with REE Mining AS (“REE”) to earn up to a 100% interest in the Tørdal and Evje-Iveland properties pursuant to which the Company paid $130,000 and issued 1,000,000 common shares valued at $40,000. The Company subsequently renegotiated the payments required to earn the interest and the Evje-Iveland property was removed from the option agreement. Pursuant to the amendment, the Company earned a 100% interest in the Tørdal property by paying an additional $35,000 and granting a 1% Net Smelter Return (“NSR”) payable to REE.

| 5. |

RELATED PARTY TRANSACTIONS |

During the 9-month period ended September 30, 2016, the Company recognized $334,129 for stock-based compensation for stock options issued to Company directors (2015 -$235,972).

During the 9-month period ended September 30, 2016, the Company paid a consulting fee of $76,500 to one of its directors (2015 - $79,000).

Accounts payable to related parties at September 30, 2016 were $Nil (2015 - $11,009).

| 6. |

CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL |

On September 1, 2015, the Company issued 1,982,850 common shares at a value of C$0.10 per common share for total proceeds of C$198,285 ($150,000).

On August 31, 2015, the Company issued 2,237,480 common shares at a value of C$0.10 per common share in settlement of interest payable on the promissory note with a fair value of C$223,748 ($169,262).

On August 24, 2015, the Company issued 21,672,080 common shares at a value of C$0.10 per common share for total proceeds of C$2,167,208 ($1,662,047). The Company paid $60,000 in share issuance costs with regard to this common share issue.

Stock Options

The Company established a stock option plan (the “Plan”) under which it is authorized to grant options to executive officers and directors, employees and consultants and the number of options granted under the Plan shall not exceed 15% of the shares outstanding. Under the Plan, the exercise period of the options may not exceed five years from the date of grant and vesting is determined by the Board of Directors.

9

| Scandium International Mining Corp. |

| NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| September 30, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 6. |

CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL (cont’d…) |

Stock option transactions are summarized as follows:

| Weighted average | |||||||

| Number | exercise price in Canadian $ | ||||||

| Outstanding, December 31, 2014 | 15,378,750 | $ | 0.11 | ||||

| Granted | 5,350,000 | 0.14 | |||||

| Cancelled | (2,568,750 | ) | 0.16 | ||||

| Exercised | (550,000 | ) | 0.05 | ||||

| Outstanding, December 31, 2015 | 17,610,000 | 0.12 | |||||

| Granted | 5,260,000 | 0.14 | |||||

| Cancelled | (1,050,000 | ) | 0.24 | ||||

| Outstanding, September 30, 2016 | 21,820,000 | $ | 0.11 | ||||

| Number currently exercisable | 20,896,500 | $ | 0.11 |

As at September 30, 2016, incentive stock options were outstanding and exercisable as follows:

| Number of | Number of | Exercise | |||||||||

| Options | Options | Price in | Expiry Date | ||||||||

| outstanding | exercisable | Canadian $ | |||||||||

| Options | |||||||||||

| 2,285,000 | 2,285,000 | 0.080 | April 24, 2017 | ||||||||

| 150,000 | 150,000 | 0.120 | July 25, 2017 | ||||||||

| 1,400,000 | 1,400,000 | 0.070 | August 8, 2017 | ||||||||

| 1,000,000 | 1,000,000 | 0.100 | May 9, 2018 | ||||||||

| 3,375,000 | 3,375,000 | 0.120 | July 25, 2019 | ||||||||

| 200,000 | 200,000 | 0.100 | December 30, 2019 | ||||||||

| 3,450,000 | 3,070,000 | 0.140 | April 17, 2020 | ||||||||

| 400,000 | 400,000 | 0.115 | August 28, 2020 | ||||||||

| 4,300,000* | 4,300,000* | 0.100 | November 5, 2020 | ||||||||

| 4,860,000 | 4,636,500 | 0.130 | February 8, 2021 | ||||||||

| 400,000 | 80,000 | 0.200 | June 14, 2021 | ||||||||

| 21,820,000 | 20,896,500 |

* These options were extended by the Company shareholder’s at the Company’s annual meeting in October 2015. The Company recognized an additional expense of $281,962 related to this extension during theyear ended December 31, 2015. Black-Scholes option pricing model assumptions used were a risk-free interest rate of 1.49%, expected life of 5 years, with a 0.00% forfeiture and dividend rate as well as a volatility rate of 145.92% .

As at September 30, 2016 the Company’s outstanding and exercisable stock options have an aggregate intrinsic value of $918,074 (2015 - $524,946).

As at September 30, 2016, there were no warrants outstanding.

Stock-based compensation

During the nine months ended September 30, 2016, the Company recognized stock-based compensation of $434,102 (September 30, 2015 - $375,864) in the statement of operations and comprehensive loss as a result of incentive stock options granted and vested in the current period. There were 5,260,000 stock options issued during the nine months ended September 30, 2016 (September 30, 2015 – 5,350,000).

The weighted average fair value of the options granted in the period was C$0.12 (2015 - C$0.14) .

The fair value of all compensatory options and warrants granted is estimated on grant date using the Black-Scholes option pricing model. The weighted average assumptions used in calculating the fair values are as follows:

10

| Scandium International Mining Corp. |

| NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| September 30, 2016 |

| (Expressed in US Dollars) (Unaudited) |

| 2016 | 2015 | ||||||

| Risk-free interest rate | 1.13% | 1.02% | |||||

| Expected life | 5 years | 5 years | |||||

| Volatility | 141.12% | 145.65% | |||||

| Forfeiture rate | N/A | N/A | |||||

| Dividend rate | N/A | N/A |

| 7. |

TREASURY STOCK |

| Number | Amount | ||||||

| Treasury shares, September 30, 2016 and December 31 2015 | 1,033,333 | $ | 1,264,194 | ||||

| 1,033,333 | $ | 1,264,194 |

Treasury shares comprise shares of the Company which cannot be sold without the prior approval of the TSX.

| 8. |

SEGMENTED INFORMATION |

The Company’s mineral properties are located in Norway and Australia. The Company’s capital assets’ geographic information is as follows:

| September 30, 2016 | Norway | Australia | United States | Total | |||||||||

| Equipment | $ | - | $ | - | $ | 3,245 | $ | 3,245 | |||||

| Mineral interests | 238,670 | 704,053 | - | 942,723 | |||||||||

| $ | 238,670 | $ | 704,053 | $ | 3,245 | $ | 945,968 |

| December 31, 2015 | Norway | Australia | United States | Total | |||||||||

| Equipment | $ | - | $ | - | $ | 2,611 | $ | 2,611 | |||||

| Mineral interests | 238,670 | 704,053 | - | 942,723 | |||||||||

| $ | 238,670 | $ | 704,053 | $ | 2,611 | $ | 945,334 |

| 9. |

SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS |

| 2016 | 2015 | |||||||||

| Cash paid during the nine months for interest | $ | - $ | 56,250 | |||||||

| Cash paid during the first months for income taxes | $ | - | $ | - |

There were no significant non-cash transactions in either of the nine month periods ending September 30, 2016 and September 30, 2015.

| 10. |

EMC METALS AUSTRALIA PTY LTD |

On August 24, 2015, the Company’s $2,500,000 promissory note payable converted into a 20% ownership interest in EMC Metals Australia Pty Ltd (“EMC Australia”), with the Company holding an 80% ownership interest. EMC Australia holds the Company’s interests in the Nyngan Scandium Project and Honeybugle Scandium property. Upon conversion of the promissory note payable, EMC Australia is now operated as a joint venture between Scandium Investments LLC (“SIL”) and the Company. SIL holds a carried interest in the Nyngan Scandium Project and is not required to contribute cash for the operation of EMC Australia until the Company meets two development milestones: (1) filing a feasibility study on SEDAR, and (2) receiving a mining license on either joint venture property. At such time as the two development milestones are met, SIL becomes fully participating on project costs thereafter. The first development milestone has been met and the Company is in the process of obtaining a mining license on the Nyngan Scandium Project.

Completion of the development milestones by the Company, as described above, activates a second one-time, limited period option for SIL to elect to convert the fair market value of its 20% joint venture interest in the Nyngan Scandium Project and Honeybugle Scandium property into an equivalent value of the Company’s common shares, at then prevailing market prices, rather than continue with ownership at the project level.

SIL’s interest in EMC Australia is consolidated in the Company’s Consolidated Financial Statements for the nine-month period ended September 30, 2016 as a non-controlling interest.

11

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of the operating results, corporate activities and financial condition of Scandium International Mining Corp. (hereinafter referred to as “we”, “us”, “SCY”, “Scandium”, “Scandium International” or the “Company”) and its subsidiaries provides an analysis of the operating and financial results for the three and nine month periods ended September 30, 2016 and should be read in conjunction with our unaudited interim consolidated financial statements and the notes thereto for the nine month period ended September 30, 2016, and with the Company’s audited consolidated financial statements and the notes thereto for the year ended December 31, 2015 (the “Annual Statements”).

This discussion and analysis contains forward-looking statements that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth under the heading “Risk Factors and Uncertainties” in our Annual Report on Form 10-K for the year ended December 31, 2015, and elsewhere in this Quarterly Report on Form 10-Q.

The interim statements have been prepared in accordance with US Generally Accepted Accounting Principles (“US GAAP”) as required under U.S. federal securities laws applicable to the Company, and as permitted under applicable Canadian securities laws. The Company is a reporting company under applicable securities laws in Canada and the United States. The reporting currency used in our financial statements is the United States Dollar.

The information contained within this report is current as of November 7, 2016 unless otherwise noted. Additional information relevant to the Company’s activities can be found on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Technical information in this MD&A has been reviewed and approved by Willem Duyvesteyn, a Qualified Person as defined by Canadian National Instrument 43-101 (“NI 43-101”). Mr. Duyvesteyn is a director and consultant of Scandium International.

Cautionary Note to U.S. Investors Regarding Reserve and Resource Estimates

The Company uses Canadian Institute of Mining, Metallurgy and Petroleum definitions for the terms “proven reserves”, “probable reserves”, “measured resources” and “indicated resources”. U.S. investors are cautioned that while these terms are recognized and required by Canadian regulations, including National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”), the U.S. Securities and Exchange Commission (“SEC”) does not recognize them. Canadian mining disclosure standards differ from the requirements of the SEC under SEC Industry Guide 7, and reserve and resource information referenced in this Form 10-Q may not be comparable to similar information disclosed by companies reporting under U.S. standards. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve”. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources” or “indicated mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. Disclosure of “contained ounces” in a resource estimate is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves in compliance with NI 43-101 may not qualify as “reserves” under SEC standards.

Cautionary Note Regarding Forward-Looking Statements

Certain statements made in this Quarterly Report on Form 10-Q may constitute “forward-looking statements about the Company and its business. Forward looking statements are statements that are not historical facts and include, but are not limited to, reserve and resource estimates, estimated value of the project, projected investment returns, anticipated mining and processing methods for the project, the estimated economics of the project, anticipated scandium recoveries, production rates, scandium grades, estimated capital costs, operating cash costs and total production costs, planned additional processing work and environmental permitting. The forward-looking statements in this report are subject to various risks, uncertainties and other factors that could cause the Company's actual results or achievements to differ materially from those expressed in or implied by forward looking statements. These risks, uncertainties and other factors include, without limitation risks related to uncertainty in the demand for scandium and pricing assumptions; uncertainties related to raising sufficient financing to fund the project in a timely manner and on acceptable terms; changes in planned work resulting from logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company's properties; uncertainties involved in the estimation of scandium reserves and resources; the possibility that required permits may not be obtained on a timely manner or at all; the possibility that capital and operating costs may be higher than currently estimated and may preclude commercial development or render operations uneconomic; the possibility that the estimated recovery rates may not be achieved; risk of accidents, equipment breakdowns and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; risks related to projected project economics, recovery rates, and estimated NPV and anticipated IRR and other factors identified in the Company's SEC filings and its filings with Canadian securities regulatory authorities. Forward-looking statements are based on the beliefs, opinions and expectations of the Company's management at the time they are made, and other than as required by applicable securities laws, the Company does not assume any obligation to update its forward-looking statements if those beliefs, opinions or expectations, or other circumstances, should change.

Scandium International Corporate Overview

Scandium International is a specialty metals and alloys company focused on developing the production and sales of scandium and other specialty metals. The Company intends to utilize its knowhow and, in certain instances, patented technologies to maximize opportunities in scandium and other specialty metals.

The Company was formed in 2006, under the name Golden Predator Mines Inc. As part of a reorganization and spin-out of the Company’s precious metals portfolio in March 2009, the Company changed its name to EMC Metals Corp. In order to reflect our emphasis on mining for scandium minerals, effective November 19, 2014, we changed our name to Scandium International Mining Corp. The Company currently trades on the Toronto Stock Exchange (the “TSX”) under the symbol “SCY”.

Our focus of operations is the exploration and development of the Nyngan scandium deposit located in New South Wales (“NSW”), Australia (“Nyngan” or the “Nyngan Scandium Project”). We also hold an exploration stage property in Norway, known as the Tørdal scandium/rare earth minerals property and an exploration stage property in Australia, known as the Honeybugle scandium property.

We acquired a 100% interest in the Nyngan Scandium Project in June of 2014 pursuant to the terms of a settlement agreement with Jervois Mining Ltd. of Melbourne, Australia. The project is held through our Australian subsidiary, EMC Metals Australia Pty Ltd. (“EMC Australia”), which also holds the Honeybugle scandium property.

During Q3 of 2015, the Company converted a $2,500,000 loan from Scandium Investments LLC (“SIL”), an unrelated investment company, into a 20% minority interest in EMC Australia. As a result, the Company currently holds an 80% equity interest in its Australian subsidiary, with SIL holding a 20% interest. EMC Australia is operated as a joint venture between SIL and SCY with SIL holding a carried interest in the Nyngan Scandium Project until the Company meets two development milestones: (1) filing a feasibility study on SEDAR (the report was filed on May 6, 2016), and (2) receiving a mining license on either joint venture property. At such time as the two development milestones are met, SIL becomes fully participating on project costs thereafter.

Completion of the development milestones by the Company, as described above, triggers a limited period option whereby SIL can elect to convert the fair market value of its 20% interest in EMC Australia into an equivalent value of SCY common shares, at then prevailing market prices.

During the third quarter of 2016, we focused on Nyngan Scandium Project activities including scandium marketing arrangements, completion of the environmental impact statement (“EIS”) and application for a mining lease (“MLA”) with NSW Mines Department.

Principal Properties Review

Nyngan Scandium Project (NSW, Australia)

Nyngan Property Description and Location

The Nyngan Scandium Project site is located approximately 450 kilometers northwest of Sydney, NSW, Australia and approximately 20 kilometres due west of the town of Nyngan, a rural town of approximately 2900 people. The general area can be characterized as flat countryside and is classified as agricultural land, used predominantly for wheat farming and livestock grazing.

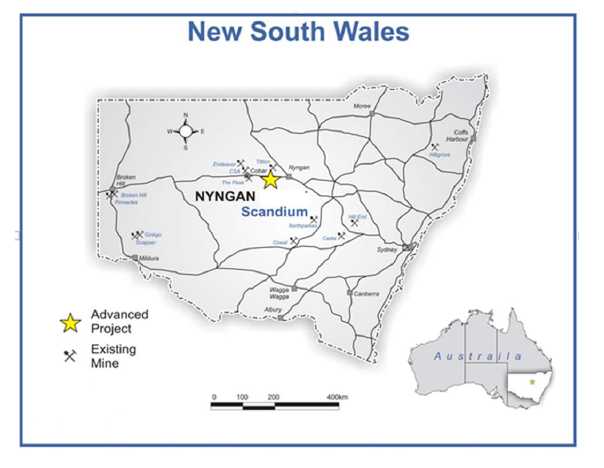

The specific location of the exploration licenses are provided in Figure 2 below.

Figure 1: Location of Nyngan Project

Figure 2: Location of the Exploration Licenses

Nyngan Feasibility Study

On April 18, 2016 the Company announced the results of an independently prepared feasibility study on the Nyngan Scandium Project. The technical report on the feasibility study entitled “Feasibility Study – Nyngan Scandium Project, Bogan Shire, NSW, Australia” is dated May 4, 2016 and was independently compiled pursuant to the requirements of NI 43-101. The report was filed on May 6, 2016 and is available on SEDAR (www.sedar.com) and on the Company’s website (www.scandiummining.com) and the SEC’s website (www.sec.gov). A full discussion on the technical report was provided in the Company’s Form 10Q for the quarterly period ending March 31, 2016, as filed with the SEC and on SEDAR on May 13, 2016.

The feasibility study concluded that the Nyngan Scandium Project has the potential to produce an average of 37,690 kilograms of scandium oxide (scandia) per year, at grades of 98.0% -99.9%, generating an after tax cumulative cash flow over a 20 year Project life of US$629 million, with an NPV10% of US$177 million. The average process plant feed grade over the 20 year Project life is 409ppm of scandium.

The financial results of the feasibility study are based on a conventional flow sheet, employing continuous high pressure acid leach (HPAL) and solvent extraction (SX) techniques. The flow sheet was modeled and validated from METSIM modeling and considerable bench scale/pilot scale metallurgical test work utilising Nyngan resource material. A number of the key elements of this flowsheet work have been protected by the Company under US Patent Applications.

The Feasibility Study has been developed and compiled to an accuracy level of +15%/-5%, by a globally recognized engineering firm that has considerable expertise in laterite deposits and process facilities, as well as in smaller mining and processing projects, and has excellent familiarity with the Nyngan Scandium Project location and environment.

Nyngan Scandium Project Highlights

| • | Capital cost estimate for the Project is US$87.1 million, | |

|

• |

Annual scandium oxide product volume averages 37,690 kg per year, over 20 years | |

|

• |

Annual revenue of US$75.4 million (oxide price assumption of US$2,000/kg) | |

|

• |

Operating cost estimate for the Project is US$557/kg scandium oxide, | |

|

• |

Project Constant Dollar NPV10% is US$177 million, (NPV8% is US$225 million), | |

|

• |

Project Constant Dollar IRR is 33.1%, | |

|

• |

Oxide product grades of 98-99.8%, as based on customer requirements, | |

| • | Project resource increases by 40% to 16.9 million tonnes, grading 235ppm Sc, at a 100ppm cut- off in the measured and indicated categories, and | |

| • | Project Reserve totalling 1.43 million tonnes, grading 409ppm Sc was established on part of the resource. |

DFS Conclusions and Recommendations

The production assumptions in the Feasibility Study are backed by solid independent flow sheet test work on the planned process for scandium recovery. The Feasibility Study consolidates a significant amount of metallurgical test work and prior study on the Nyngan Scandium Project, including important test work results completed since the PEA was generated in 2014. The entire body of work demonstrates a viable, conventional process flow sheet utilizing a continuous-system HPAL leaching process, and good metallurgical recoveries of scandium from the resource. The metallurgical assumptions are supported by various bench and pilot scale independent test work programs that are consistent with known outcomes in other laterite resources. The continuous autoclave configuration, as opposed to batch systems explored in previous flow sheets, is also a more conventional and current design choice.

The level of accuracy established in the Feasibility Study substantially reduces the uncertainty levels inherent in earlier studies, specifically the PEA. The greater confidence intervals around the Feasibility Study were achieved by reliance on significant project engineering work, a capital and operating cost estimate supported by detailed requirements and vendor pricing, plus one offtake agreement and an independent marketing assessment, both supportive of the marketing assumptions on the business.

The Feasibility Study delivered a positive result on the Nyngan Scandium Project, and recommends the Nyngan Scandium Project owners seek finance and proceed to construction. Recommendations were made therein for additional immediate work, notably to win additional offtake agreements with customers, complete some optimizing flow sheet studies, and to initiate as early as possible detailed engineering required on certain long-lead capital items.

Confirmatory Metallurgical Test Results

On June 29, 2016 we announced the results of a confirmatory metallurgical test work report from Altrius Engineering Services (AES) of Brisbane, Australia. The test work results directly relate to the list of recommended programs included in the Feasibility Study. AES devised and supervised these test work programs at the SGS laboratory in Perth, Australia and at the Nagrom laboratory in Brisbane, Australia.

The project DFS recommended a number of process flowsheet test work programs be investigated prior to commencing detailed engineering and construction. Those study areas included pressure leach ("HPAL"), counter-current decant circuits ("CCD"), solvent extraction ("SX"), and oxalate precipitation, with specific work steps suggested in each area. This latest test work program addresses all of these recommended areas, and the results confirm recoveries and efficiencies that either meet or exceed the parameters used in the DFS. Highlights of the testing are:

| • | Pressure leach test work achieved 88% recoveries, from larger volume tests, | |

| • | Settling characteristics of leach discharge slurry show substantial improvement, |

|

• |

Residue neutralization work meets or exceeds all environmental requirements as presented in the DFS and the environmental impact statement ("EIS"), | |

|

• |

Solvent extraction circuit optimization tests generated improved performance, exceeding 99% recovery in single pass systems, and | |

|

• |

Product finish circuits produced 99.8% scandium oxide, completing the recovery process from Nyngan ore to finished scandia product. |

Environmental Permitting/Development Consent/Mining Lease

On May 2, 2016 the Company announced the filing of an Environmental Impact Statement (“EIS”) with the New South Wales, Australia, Department of Planning and Environment, (the “Department”) in support of the planned development of the Nyngan Scandium Project. The EIS was prepared by R.W. Corkery & Co. Pty. Limited, on behalf of the Company’s 80% owned subsidiary, EMC Australia to support an application for Development Consent for the Nyngan Scandium Project. The EIS is a complete document, including a Specialist Consultants Study Compendium, and was submitted to the Department on Friday, April 29, 2016.

EIS Highlights:

|

• |

The EIS finds residual environmental impacts represent negligible risk. | |

|

• |

The proposed development design achieves sustainable environmental outcomes. | |

|

• |

The EIS finds net-positive social and economic outcomes for the community. | |

|

• |

Nine independent environmental consulting groups conducted analysis over five years, and contributed report findings to the EIS. | |

|

• |

The Nyngan Project development is estimated to contribute A$12.4M to the local and regional economies, and A$39M to the State and Federal economies, annually | |

|

• |

The EIS is fully aligned with the DFS and with a NSW Mining License Application for the Nyngan Project. |

Conclusion statement in the EIS:

“In light of the conclusions included throughout this Environmental Impact Statement, it is assessed that the Proposal could be constructed and operated in a manner that would satisfy all relevant statutory goals and criteria, environmental objectives and reasonable community expectations.”

EIS Discussion:

The EIS is the foundation document submitted by a developer intending to build a mine facility in Australia. The Nyngan Scandium Project is considered a State Significant Project, in that capital cost exceeds A$30million, which means State agencies are designated to manage the investigation and approval process for granting a Development Consent, from the Minister of Planning and Environment. This Department will manage the review of the Proposal through a number of State and local governmental agencies.

The EIS is a self-contained set of documents used to seek a Development Consent. It is however, supported in many ways by the recently completed feasibility study.

Once the Development Consent is granted, there are a number of operating licenses that are required from various regulatory agencies to construct and operate a mining operation in NSW.

The key license approvals are:

|

• |

An Environment Protection Licence, | |

|

• |

A Mining Lease, | |

|

• |

Water Supply Works and Use Approval and Water Access Licence, |

|

• |

A Section 138 Permit issued by the Bogan Shire Council, for construction of the intersection of the Site Access Road and Gilgai Road, | |

|

• |

An approval from the NSW Dams Safety Committee for the design and construction of the Residue Storage Facility, and | |

|

• |

A high voltage connection agreement with Essential Energy. |

The EIS represents the cornerstone of all of these approvals and licenses, along with the multi-interagency review that will precede the approval authorization for a Development Consent. The timeframe for completion of these reviews and granting of licenses is not fixed, and is dependent on the quality of the EIS, the extent of the questions that may arise from the project review, and the available resources in government to address the review itself. General estimates range from 6-9 months, with some proposals taking longer, particularly larger proposals, or proposals with more community and environmental impacts to consider.

The Company held a town hall meeting in Nyngan on May 23, 2016, to brief the community on project plans and impacts. The meeting was announced in the local Nyngan Observer newspaper, and attended by local members of the community, the town Council, and the Mayor. Discussion was encouraged and issues raised were general in nature.

The EIS was accepted by the NSW Department of Planning and Environment after an adequacy review, and the Company met with Department staff on May 25th, for detailed discussions on details of the document and development plans. After this formal departmental review meeting, the EIS was subsequently placed on public exhibition on May 26th, for access by the public and other NSW governmental agencies, for a period of 30 days.

The exhibition period was completed on Friday, June 24th. The filing received relatively few comments, none that represent an issue with development, and has been followed by further internal reviews and discussions between the Company and various governmental agencies.

The Company intends to follow and support the progress of governmental agency reviews in coming months.

ALCERECO MOU and Offtake Agreements

On March 30, 2015, the Company announced that it had signed a memorandum of understanding (“MOU”) with ALCERECO Inc. of Kingston, Ontario (ALCERECO”), forming a strategic alliance to develop markets and applications for aluminum alloys containing scandium. To further that alliance, and to reinforce the capability of both companies to deliver product developed for Sc-Al alloy markets, Scandium International and ALCERECO also signed an offtake agreement governing sales terms of scandium oxide product (scandia) produced from the Nyngan Scandium Project. The offtake agreement specifies deliveries of scandium oxide product commencing in 2017.

Scandium as an alloying agent in aluminum allows for aluminum metal products that are much stronger, more easily weldable and exhibit improved performance at higher temperatures than current aluminum based materials. This means lighter structures, lower manufacturing costs and improved performance in areas that aluminum alloys do not currently compete.

|

• |

The MOU covers areas of joint cooperation and development of aluminum alloys that contain and are enhanced by the addition of scandium, | |

|

• |

The MOU recognizes the specialized capabilities ALCERECO holds for the design, manufacture, and testing of Sc-Al alloy materials, | |

|

• |

The offtake agreement outlines standard sale terms on 7,500 kg of scandia per annum, for a term of three years beginning in 2017, which can be extended, and | |

|

• |

The offtake agreement contains both fixed and variable pricing components, which are subject to confidentiality. |

ALCERECO is an advanced materials development company that provides services and specialty processing capabilities to companies innovating in a diverse range of markets, including aerospace, automotive, electronics and consumer/sporting goods. ALCERECO staff work with a range of materials and processes and have the tools and knowledge to take on leading-edge projects such as development of aluminum-scandium alloys, specialty ceramics, composites and graphene enhanced materials. The company has a particular focus on lightweight materials capable of delivering greater strength, functionality and exceptional performance.

ALCERECO operates out of the Grafoid Global Technology Centre in Kingston, Ontario that was originally founded by Alcan Aluminum in the 1940s. ALCERECO is a Canadian private company, and a wholly-owned subsidiary of Ottawa-based Grafoid Inc., a graphene application development company.

Nyngan Scandium Project - Planned Activities for 2016-2017

The following steps are planned for Nyngan during the 2016 and 2017 Calendar years:

|

• |

Complete and file an EIS on the Nyngan Scandium Project in Q2 2016 (EIS was filed on April 29, 2016); | |

|

• |

Complete and file an advanced stage economic study (the DFS) with a +/- 15% accuracy level, in Q2 2016 (the report was filed on May 6, 2016 and is available on SEDAR); | |

|

• |

Make formal application for a mining lease (MLA) pertaining to the Nyngan Scandium Project with NSW Mines Department in Q3 2016 (mining lease application was made on July 14, 2016); | |

|

• |

Pursue additional offtake agreements in support of planned future scandium sales; | |

|

• |

Seek and secure project financing to fund the construction of the Nyngan Scandium Project; | |

|

• |

Undertake final investment decision (FID) in Q1 2017, subject to concluded/approved financing arrangements and receipt of all required permits, licenses and the MLA, | |

|

• |

Commence site construction in 2017, and | |

|

• |

Initiate project commissioning in 2018. |

Other Properties Review

Tørdal Scandium/REE Property (Norway)

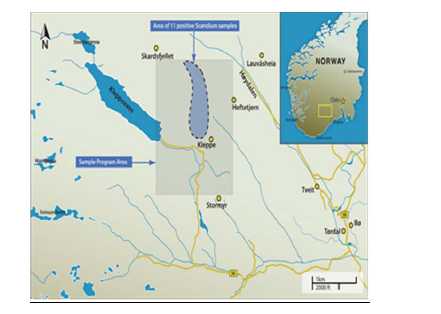

During 2011, we entered into agreements with REE Mining AS of Norway to obtain exploration rights to 90 sq km in Southern Norway, which we call the Tørdal scandium exploration property.

Exploration rights for the Tørdal property include certain minimum expenditure requirements. The Company intends to fulfill those minimum expenditure requirements.

Tørdal Property Location

The location of the Tørdal exploration property is provided in Figure 4 below.

Figure 3. Location of the Tordal Exploration Property

2012 Tørdal Field Exploration

On February 14, 2013, we announced promising results from field exploration work on the Tørdal property during the summer and fall months of 2012, focused on scandium-bearing pegmatites. The 2012 work included independent assay results of pegmatite rock samples taken from one specific property area, and also includes an extensive pegmatite mapping program covering approximately 30 sq km. The assay results indicated the presence of high levels of scandium and various rare earth elements (“REEs”), including heavy rare earth elements (“HREEs”) in particular. Field XRF readings indicated elevated scandium content in hundreds of large and small pegmatite bodies, found and mapped in the reconnaissance area.

Highlights of the results of the 2012 field exploration are as follows:

|

• |

Tørdal 2012 assays of pegmatite rocks show presence of both scandium and REEs, | |

|

• |

Best scandium assays exceed 1,600 ppm, | |

|

• |

Promising HREE assay results from pegmatites with gadolinite mineralization, | |

|

• |

Host rock mineralization points to higher grade scandium or HREE contents, | |

|

• |

2012 summer exploration program mapped and sampled over 300 pegmatites, | |

|

• |

A total of 1,940 Niton XRF scandium readings were taken on whole rock samples, and | |

|

• |

Overall program results at Tørdal are very encouraging and warrant expanded exploration. |

SCY’s mapping and sampling work has confirmed that much of the Tørdal property is heavily populated with complex, near-surface pegmatite bodies. Based on hand-held XRF readings and mineralogy, these pegmatites show excellent promise for significant scandium enrichment, particularly within bodies containing micas, and for REE mineralization where the rare earth silicate gadolinite is present. Based on the results of 2012 exploration work, planning for future exploration work is warranted, subject to funding constraints.

We are currently in the planning process for work during 2016 to meet the minimum funding requirements to hold the exploration rights.

Honeybugle Scandium Property (NSW, Australia)

On April 2, 2014, the Company announced that it had secured a 100% interest in an exploration license (EL 7977) covering 34.7 square kilometers in New South Wales, Australia. The license area, we call the Honeybugle scandium exploration property, is located approximately 24 kilometers west-southwest from the Company’s Nyngan Scandium Project and approximately 36 kilometers southwest from the town of Nyngan, NSW.

Exploration rights for the Honeybugle property include certain minimum expenditure requirements. The Company intends to fulfill those minimum expenditure requirements.

Honeybugle Drill Results

On May 7, 2014, the Company announced completion of an initial program of 30 air core (“AC”) drill holes on the property, specifically at the Seaford anomaly, targeting scandium (Sc). Results on 13 of these holes are shown in detail, in the table below. These holes suggest the potential for scandium mineralization on the property similar to Nyngan.

|

• |

Highlights of initial drilling program results include the following: The highest 3-meter intercept graded 572 ppm scandium (hole EHAC 11), | |

|

• |

EHAC 11 also generated two additional high grade scandium intercepts, grading 510 ppm and 415 ppm, each over 3 meters, | |

|

• |

The program identified a 13-hole cluster which was of particular interest; intercepts on these 13 holes averaged 270 ppm scandium over a total 273 meters, at an average continuous thickness of 21 meters per hole, representing a total of 57% (354 meters) of total initial program drilling, | |

|

• |

The 13 holes produced 29 individual (3-meter) intercepts over 300 ppm, representing 31% of the mineralized intercepts in the 273 meters of interest, and | |

|

• |

This initial 30-hole AC exploratory drill program generated a total of 620 meters of scandium drill/assay results, over approximately 1 square kilometer on the property. |

Other Developments – Third Quarter 2015

None [Note to legal: nothing to report, can we delete this section?]

Operating results - Revenues and Expenses

The Company’s results reflect lower operating costs as the focus of business has turned to its scandium projects.

Summary of quarterly results

A summary of the Company’s quarterly results are shown below at Table 10.

Table 10. Quarterly Results Summary

| 2016 | 2015 | 2014 | ||||||

| Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | |

| Net Sales | - | - | - | - | - | - | - | - |

| Net Income | ||||||||

| (Loss) | (333,031) | (496,118) | (1,081,096) | (1,163,542) | (503,537) | (632,698) | (470,654) | (577,174) |

| attributable to | ||||||||

| Scandium | ||||||||

| Basic and | ||||||||

| diluted | ||||||||

| Net Income | (0.00) | (0.00) | (0.01) | (0.01) | (0.00) | (0.00) | (0.00) | (0.00) |

| (Loss) per | ||||||||

| share | ||||||||

| attributable to | ||||||||

| Scandium | ||||||||

Results of Operations for the three months ended September 30, 2016

The net loss attributable to Scandium for the quarter was $333,031, a decrease of $170,506 from $503,537 during the same period of the prior year. Details of the individual items contributing to the decreased net loss are as follows:

| Q3 2016 vs. Q3 2015 - Variance Analysis | ||

| Item | Variance | |

| Favourable / | Explanation | |

| (Unfavourable) | ||

|

Interest expense |

$95,450 |

Interest expense reduction due to Company debt extinguishment with the conversion of that debt into a 20% stake in the Company’s Australian projects in Q3 0f 2015. |

|

Exploration |

$50,149 |

The Company incurred lower costs in the current quarter as the preparation of a DFS on the Nyngan Scandium Project development began in Q3 2015 with significant spending occurring from Q3 2015 through Q2, 2016. The DFS is completed and current quarter costs reflect much lower costs in this area. |

|

Stock-based compensation |

$36,609 |

No stock options were issued in Q3 2016 while in Q3 2015 400,000 options were granted that vested immediately. |

|

Costs allocable to non-controlling interest |

$20,502 |

During August 2015 a $2,500,000 loan was converted into a 20% interest in the Company’s Australian properties. Upon recognition of the 20% holder, a portion of the operating loss is allocated to the minority interest partner. |

| Q3 2016 vs. Q3 2015 - Variance Analysis | ||

| Item | Variance | |

| Favourable / | Explanation | |

| (Unfavourable) | ||

|

Professional fees |

$8,532 |

Lower fees in Q3 2016 are due to lower activity levels when compared to the same period one year ago when the Company was embarking on the preparation of a DFS for the Nyngan Scandium project. |

|

Consulting |

$7,433 |

In the comparable quarter of 2015 a one-time use of a consultant was incurred. |

|

Travel and entertainment |

$1,435 |

Costs are relatively the same when compared to Q3 2015. |

|

Amortization |

$616 |

Certain assets are currently fully depreciated resulting in the lower amortization costs when compared to 2015. |

|

Insurance |

$(1,217) |

Higher policy premiums in 2016 resulted in this unfavourable variance. |

|

Foreign exchange gain |

$(8,175) |

The Company held very little amounts in foreign currencies in Q2 2016 resulting in minimum exposure to foreign exchange swings when compared to the same quarter one year ago. |

|

General and administrative |

$(8,982) |

General and administrative costs in the current quarter are higher when compared to one year ago are a result higher marketing and transfer agent fees. |

|

Salaries and benefits |

$(32,035) |

The company hired new staff at the end of Q2, 2016 resulting in this unfavorable variance. |

Results of Operations for the nine months ended September 30, 2016

The net loss attributable to Scandium for the nine-month period was $1,910,245, an increase of $303,536 from $1,606,709 during the same period of the prior year. Details of the individual items contributing to the increased net loss are as follows:

Nine months ending September 30, 2016 Vs. nine months ending September 30, 2015 Variance Analyasis | ||

| Item | Variance | |

| Favourable / | Explanation | |

| (Unfavourable) | ||

|

Exploration |

$(578,827) |

The Company has incurred increased costs in the current nine-month period with ongoing costs of the Nyngan Scandium Project development, and preparation of a DFS on that project. |

|

Stock-based compensation |

$(58,238) |

In the first nine months of 2016, the Company issued 5,260,000 stock options with 95% vesting while in the same period one year ago, 5,350,000 stock option were granted but those grants were at a lower exercise price resulting in less expensing for the period under review. |

|

Salaries and benefits |

$(31,669) |

The company hired new staff at the end of Q2, 2016 resulting in this unfavorable variance. |

|

General and administrative |

$(27,608) |

The increased level of activity in the first nine months of 2016 has resulted in higher G&A costs. In the comparable period of 2015 activities were kept to a minimum until Q3 when the preparation of the DFS on the Nyngan Scandium project began. |

|

Insurance |

$(13,201) |

In Q1 2015, the Company received a refund with respect to an appeal of a worker’s compensation audit. No similar refund was received in 2016. |

|

Travel and entertainment |

$(10,343) |

This unfavorable variance is due to travel to promote the Company to potential investors in as well as meetings in Australia to further the development of the Nyngan Scandium project. |

|

Professional fees |

$(9,961) |

Fees associated with the application of an R&D credit in Australia have resulted in the negative variance when compared to one year ago. |

|

Amortization |

$352 |

Year over year, amortization if fairly equal. |

|

Consulting |

$2,500 |

In 2015 a one-time use of a consultant was incurred. No such charge was recognized in 2016. |

|

Foreign exchange gain |

$5,426 |

There was very little foreign exchange exposure in the first nine months of 2016 as the Australian and Canadian dollar stabilized against the US dollar. One year ago the exchange rates were more volatile resulting in negative exposure. |

|

|

| |

|

Costs allocable to non-controlling interest |

$191,891 |

During August 2015 a $2,500,000 loan was converted into a 20% interest in the Company’s Australian properties. Upon recognition of the 20% holder, a portion of the operating loss is allocated to the minority interest partner. |

Nine months ending September 30, 2016 vs. nine months ending September 30, 2015 - Variance Analysis | ||

| Item | Variance | |

| Favourable / | Explanation | |

| (Unfavourable) | ||

| Interest expense | $226,142 |

Interest expense reduction due to Company debt extinguishment with the conversion of that debt into a 20% stake in the Company’s Australian projects in Q3 0f 2015. |

Cash flow discussion for the nine-month period ended September 30, 2016 compared to September 30, 2015

The cash outflow for operating activities was $1,732,544, an increase of $692,424 (September 30, 2015 – $1,040,120), due to increased activity levels as described in the variance analysis in addition to a decrease in accounts payable during the period. Cash outflows from operations are net of $79,346 received as a result of payments received under the Australian research and development tax incentive program.

Cash outflows for investing activities were $3,157 (September 30, 2015 – $Nil). In 2016, the Company purchased computer equipment.

Cash inflows from financing activities decreased by $1,775,885 to $Nil (September 30, 2015 – $1,775,885), reflecting the issuance of shares and the exercise of stock options in the nine months ended June 30, 2015.

Financial Position

Cash

The Company’s cash position decreased during the nine-month period by $1,735,701 to $513,975 (December 31, 2015 - $2,249,676) due primarily to the payment of expenditures related to the commissioning of the definitive feasibility study on the Nyngan Scandium Project.

Prepaid expenses and receivables

Prepaid expenses and accounts receivable decreased by $89,219 to $18,310 due to expensing of prepaid insurances and receipt of value added tax refunds from Australia and Canada (December 31, 2015 - $107,529).

Equipment

Equipment consists of office furniture and computer equipment at the Sparks, Nevada office. The increase of $634 to $3,245 (December 2015 - $2,611) is due to the purchase of computer equipment which is partially offset by amortization of net fixed assets.

Mineral interests

Mineral interests remained the same at $942,723.

Accounts payable and accrued liabilities and accounts payable with related parties

Accounts payable has decreased by $156,252 to $51,079 (December 2015 – $207,331) due to the winding down of activities related to the definitive feasibility study.

Capital Stock

Capital stock remained the same at $91,142,335.

Additional paid-in capital increased by $434,102 to $6,809,339 (December 31, 2015 - $6,375,237) as a result of expensing of stock options.

Liquidity and Capital Resources

At September 30, 2016, the Company had working capital of $481,206, including cash of $513,975, as compared to working capital of $2,149,874, including cash of $2,249,676, at December 31, 2015. The Company intends to fund its working capital and project development activities through the sales of equity, issuance of debt or sale of non-core assets.

At September 30, 2016, the Company had a total of 20,896,500 stock options exercisable between CAD$0.07 and CAD$0.20 that have the potential upon exercise to generate a total of C$2,348,300 in cash over the next five years. There is no assurance that these securities will be exercised.

The Company’s continued development is contingent upon its ability to raise sufficient financing both in the short and long term. There are no guarantees that additional sources of funding will be available to the Company. However, management is committed to pursuing all possible sources of financing (internal and external) in order to execute its business plan. The Company continues its cost cutting measures to conserve cash to meet its operational obligations.

Outstanding share data

At the date of this report, the Company has 225,047,200 issued and outstanding common shares and 21,820,000 stock options currently outstanding at a weighted average exercise price of CAD$0.11.

Off-balance sheet arrangements