Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IRIDEX CORP | irix-8k_20161108.htm |

IRIDEX Corporation Corporate Presentation November 2016 NASDAQ: IRIX IRIDEX Corporation Corporate Presentation November 2016 NASDAQ: IRIX

Safe Harbor Participation in this presentation requires that you be aware of the Federal legislation regarding forward-looking statements. Accordingly, during the course of this presentation we may make forward-looking statements regarding future events or the future performance of the Company. We caution you that such statements are just predictions that involve risks and uncertainties, and that actual events or results could differ materially. We discuss a number of the risks in our business in detail in the Company’s SEC reports, including our latest Form 10-K and our latest Form 10-Q. Safe Harbor Participation in this presentation requires that you be aware of the Federal legislation regarding forward-looking statements. Accordingly, during the course of this presentation we may make forward-looking statements regarding future events or the future performance of the Company. We caution you that such statements are just predictions that involve risks and uncertainties, and that actual events or results could differ materially. We discuss a number of the risks in our business in detail in the Company’s SEC reports, including our latest Form 10-K and our latest Form 10-Q. 2

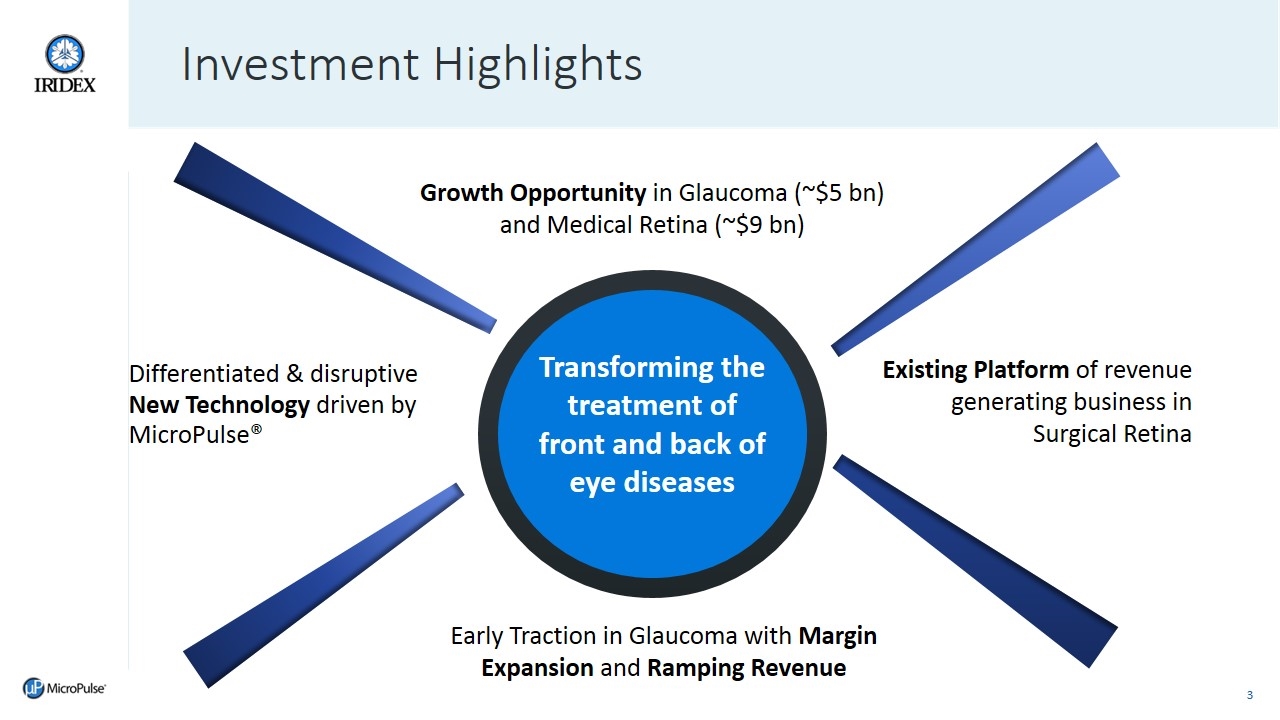

Investment Highlights Transforming the treatment of front and back of eye diseases Growth Opportunity in Glaucoma (~$5 bn) and Medical Retina (~$9 bn) Differentiated & disruptive New Technology driven by MicroPulse® Existing Platform of revenue generating business in Surgical Retina Early Traction in Glaucoma with Margin Expansion and Ramping Revenue Investment Highlights 3 Transforming the treatment of front and back of eye diseases Growth Opportunity in Glaucoma (~$5 bn) and Medical Retina (~$9 bn) Differentiated & disruptive New Technology driven by MicroPulse® Existing Platform of revenue generating business in Surgical Retina Early Traction in Glaucoma with Margin Expansion and Ramping Revenue

Transitioning to High Growth Legacy Premium Proprietary Scalable Platform Razor/Razorblade Surgical Retina Medical Retina Glaucoma 4 Transitioning to High Growth Legacy Premium Proprietary Scalable Platform Razor/Razorblade Surgical Retina Medical Retina Glaucoma

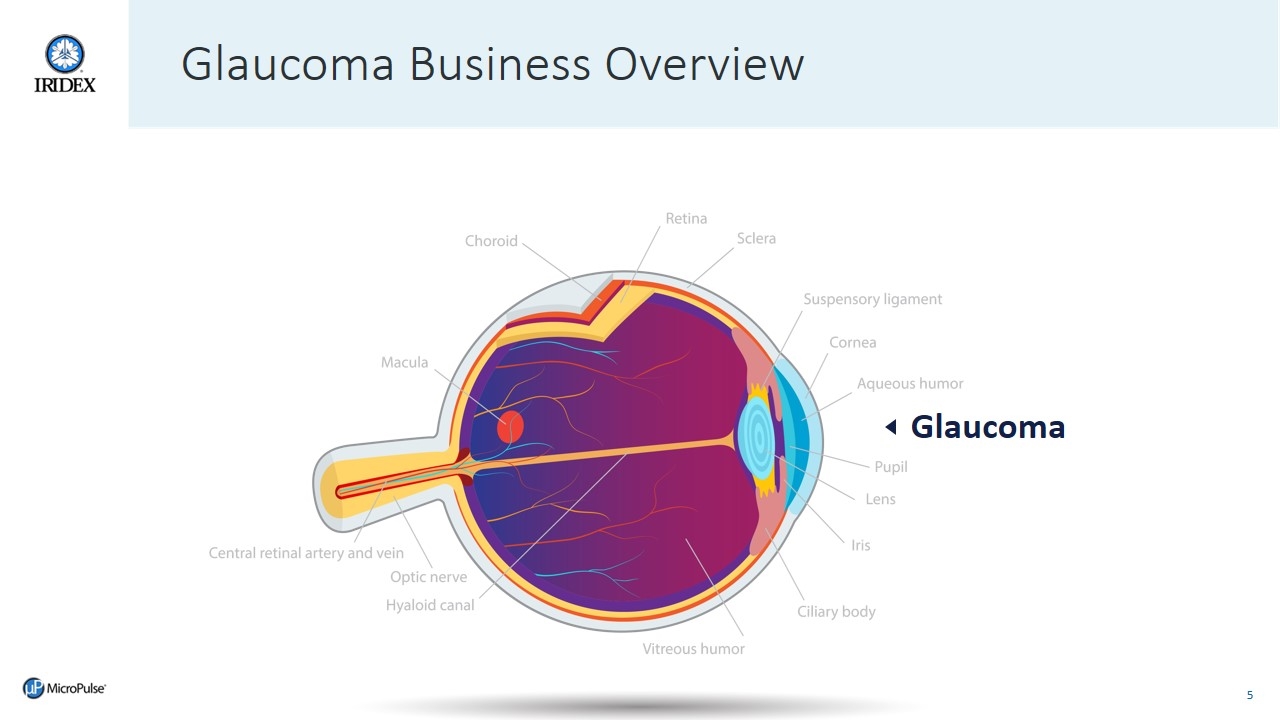

Glaucoma Business Overview Glaucoma 5 Glaucoma Business Overview Glaucoma

Glaucoma: Growth Opportunity Large Market: $5B* 65M people with glaucoma; 17M diagnosed Unmet Need Significant shortcomings in current pharmaceutical and device treatment alternatives New business model Scalable platform: Recurring probe sales from installed base of systems *Source: Market Scope estimate of 2015 global glaucoma treatment market excluding glaucoma diagnostic equipment 6 Glaucoma: Growth Opportunity Large Market: $5B* 65M people with glaucoma; 17M diagnosed Unmet Need Significant shortcomings in current pharmaceutical and device treatment alternatives New business model Scalable platform: Recurring probe sales from installed base of systems *Source: Market Scope estimate of 2015 global glaucoma treatment market excluding glaucoma diagnostic equipment

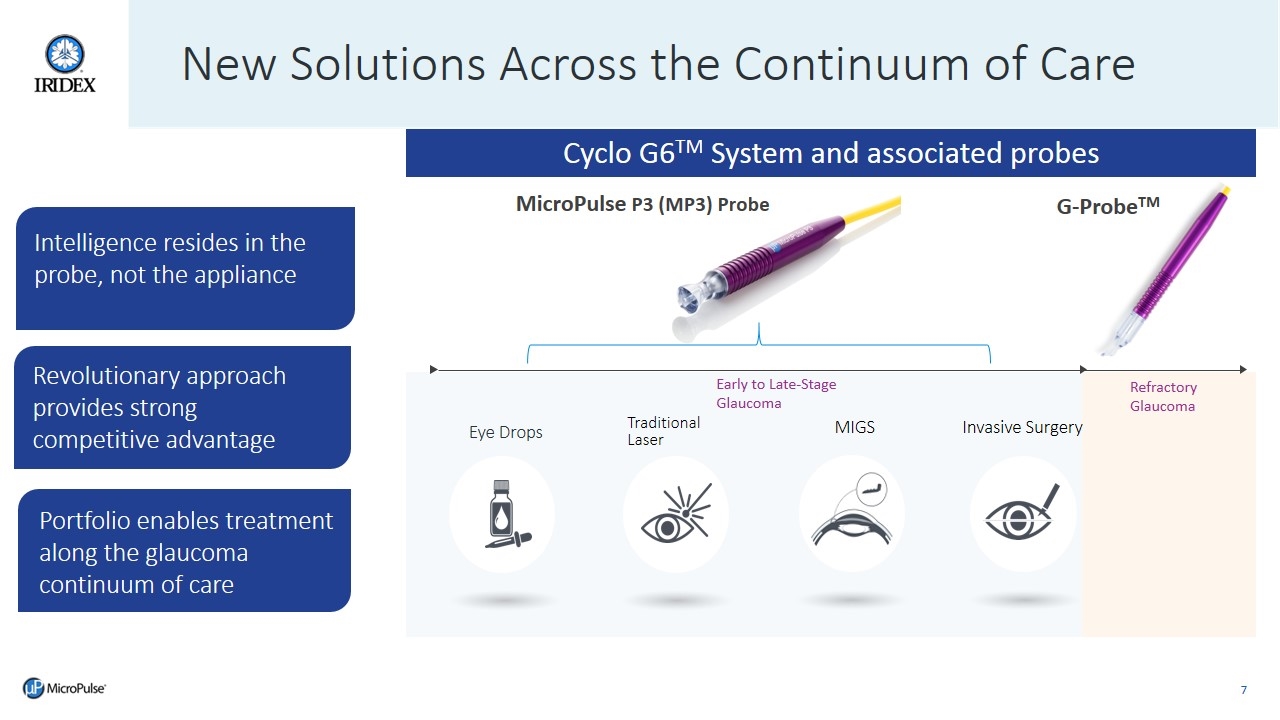

New Solutions Across the Continuum of Care Eye Drops Traditional Laser MIGS Invasive Surgery MicroPulse P3 (MP3) Probe G-ProbeTM Early to Late-Stage Glaucoma Refractory Glaucoma Intelligence resides in the probe, not the appliance Revolutionary approach provides strong competitive advantage Portfolio enables treatment along the glaucoma continuum of care Cyclo G6TM System and associated probes 7 New Solutions Across the Continuum of Care Eye Drops Traditional Laser MIGS Invasive Surgery MicroPulse P3 (MP3) Probe G-ProbeTM Early to Late-Stage Glaucoma Refractory Glaucoma Intelligence resides in the probe, not the appliance Revolutionary approach provides strong competitive advantage Portfolio enables treatment along the glaucoma continuum of care Cyclo G6TM System and associated probes

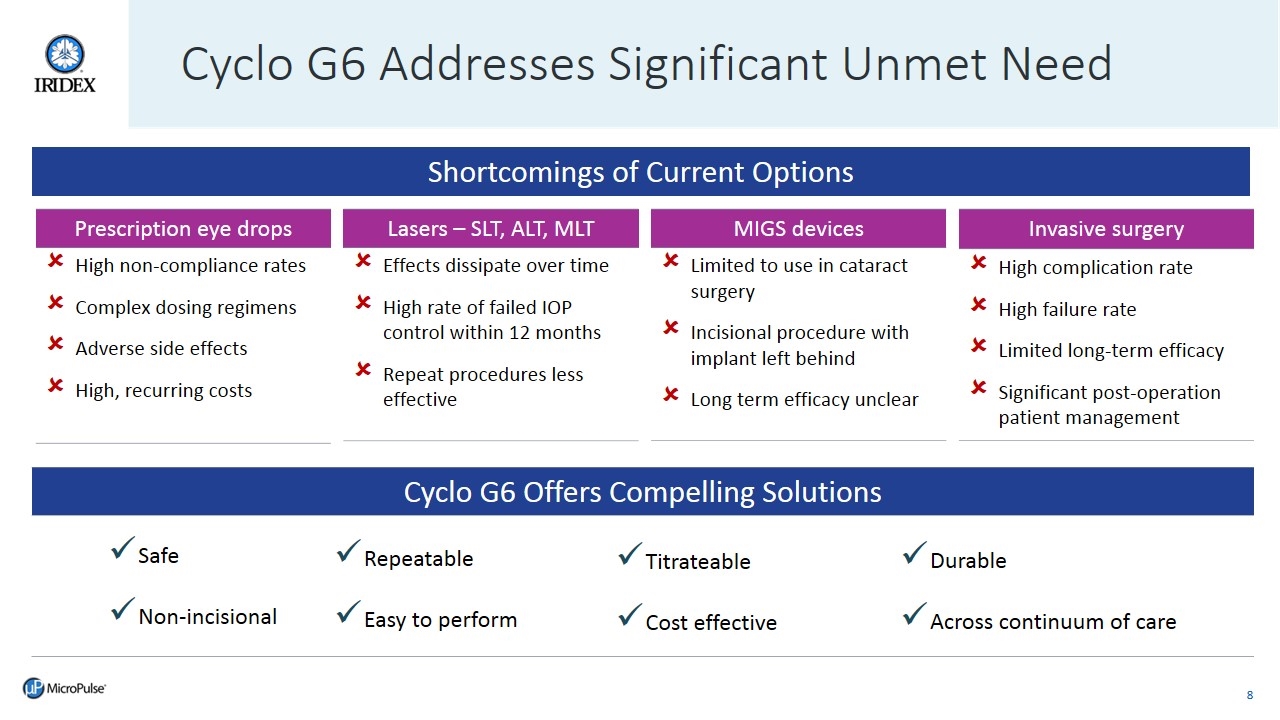

Cyclo G6 Addresses Significant Unmet Need MIGS devices Limited to use in cataract surgery Incisional procedure with implant left behind Long term efficacy unclear Prescription eye drops High non-compliance rates Complex dosing regimens Adverse side effects High, recurring costs Lasers – SLT, ALT, MLT Effects dissipate over time High rate of failed IOP control within 12 months Repeat procedures less effective Invasive surgery High complication rate High failure rate Limited long-term efficacy Significant post-operation patient management Cyclo G6 Offers Compelling Solutions Safe Non-incisional Repeatable Easy to perform Titrateable Cost effective Durable Across continuum of care Shortcomings of Current Options 8 Cyclo G6 Addresses Significant Unmet Need MIGS devices ûLimited to use in cataract surgery ûIncisional procedure with implant left behind ûLong term efficacy unclear

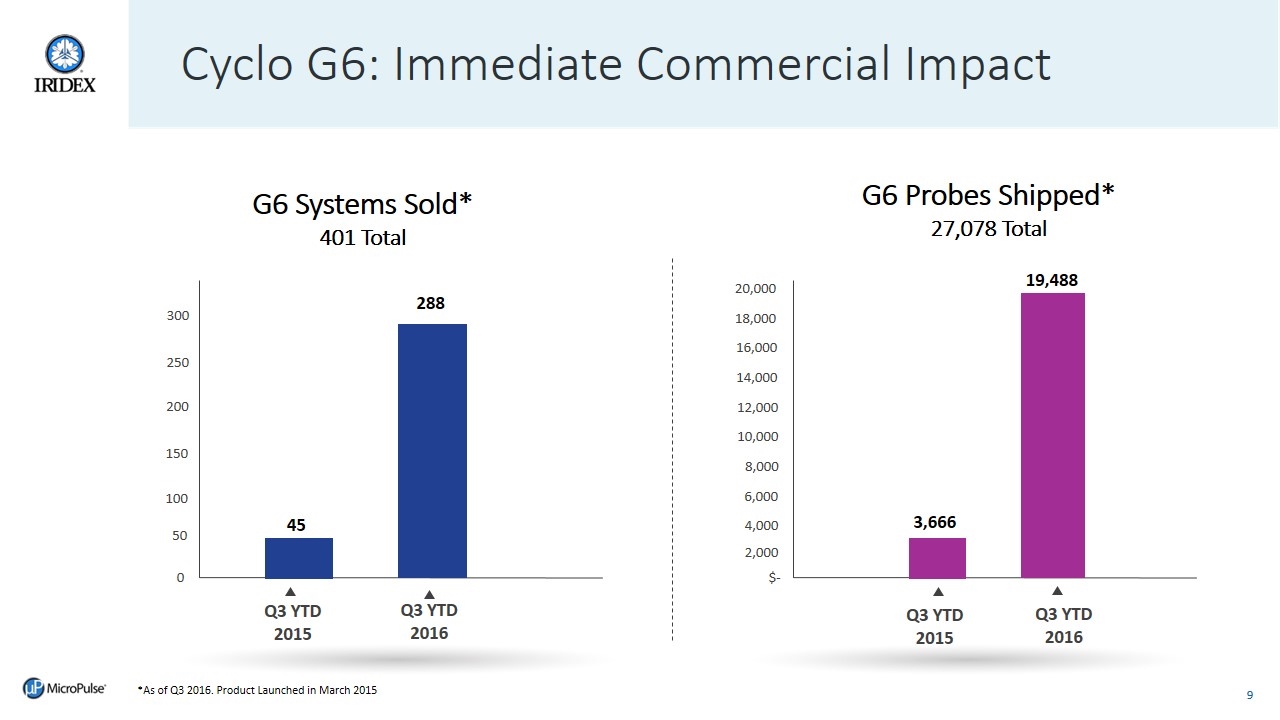

Cyclo G6: Immediate Commercial Impact G6 Systems Sold* 401 Total G6 Probes Shipped* 27,078 Total Q3 YTD 2015 45 0 50 100 150 250 300 $- 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 3,666 Q3 YTD 2016 288 200 Q3 YTD 2015 Q3 YTD 2016 19,488 2,000 *As of Q3 2016. Product Launched in March 2015 9 Cyclo G6: Immediate Commercial Impact G6 Systems Sold* 401 Total G6 Probes Shipped* 27,078 Total Q3 YTD 2015 45 0 50 100 150 250 300 $- 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 3,666 Q3 YTD 2016 288 200 Q3 YTD 2015 Q3 YTD 2016 19,488 2,000 *As of Q3 2016. Product Launched in March 2015

Cyclo G6: Broad Global Support Selected customers 40 countries have purchased with pending approvals in China and Japan Reimbursement established with permanent U.S. CPT code Three of six probes for G6 have been authorized by FDA 10 Cyclo G6: Broad Global Support Selected customers

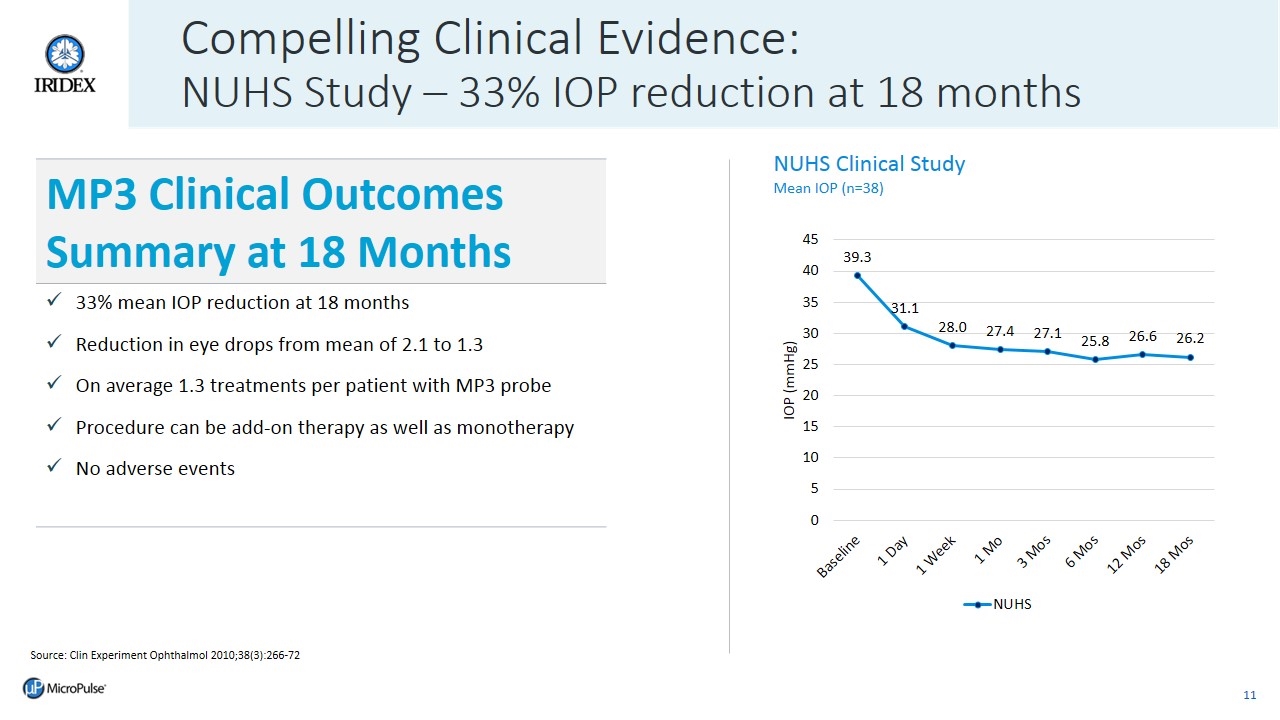

Compelling Clinical Evidence: NUHS Study – 33% IOP reduction at 18 months NUHS Clinical Study Mean IOP (n=38) Source: Clin Experiment Ophthalmol 2010;38(3):266-72 MP3 Clinical Outcomes Summary at 18 Months 33% mean IOP reduction at 18 months Reduction in eye drops from mean of 2.1 to 1.3 On average 1.3 treatments per patient with MP3 probe Procedure can be add-on therapy as well as monotherapy No adverse events 11 Compelling Clinical Evidence: NUHS Study – 33% IOP reduction at 18 months NUHS Clinical Study Mean IOP (n=38) 39.3 31.1 [VALUE].0 27.4 27.1 25.8 26.6 26.2 0 5 10 15 20 25 30 35 40 45 IOP (mmHg) NUHS Source: Clin Experiment Ophthalmol 2010;38(3):266-72 MP3 Clinical Outcomes Summary at 18 Months ü33% mean IOP reduction at 18 months üReduction in eye drops from mean of 2.1 to 1.3 üOn average 1.3 treatments per patient with MP3 probe üProcedure can be add-on therapy as well as monotherapy üNo adverse events

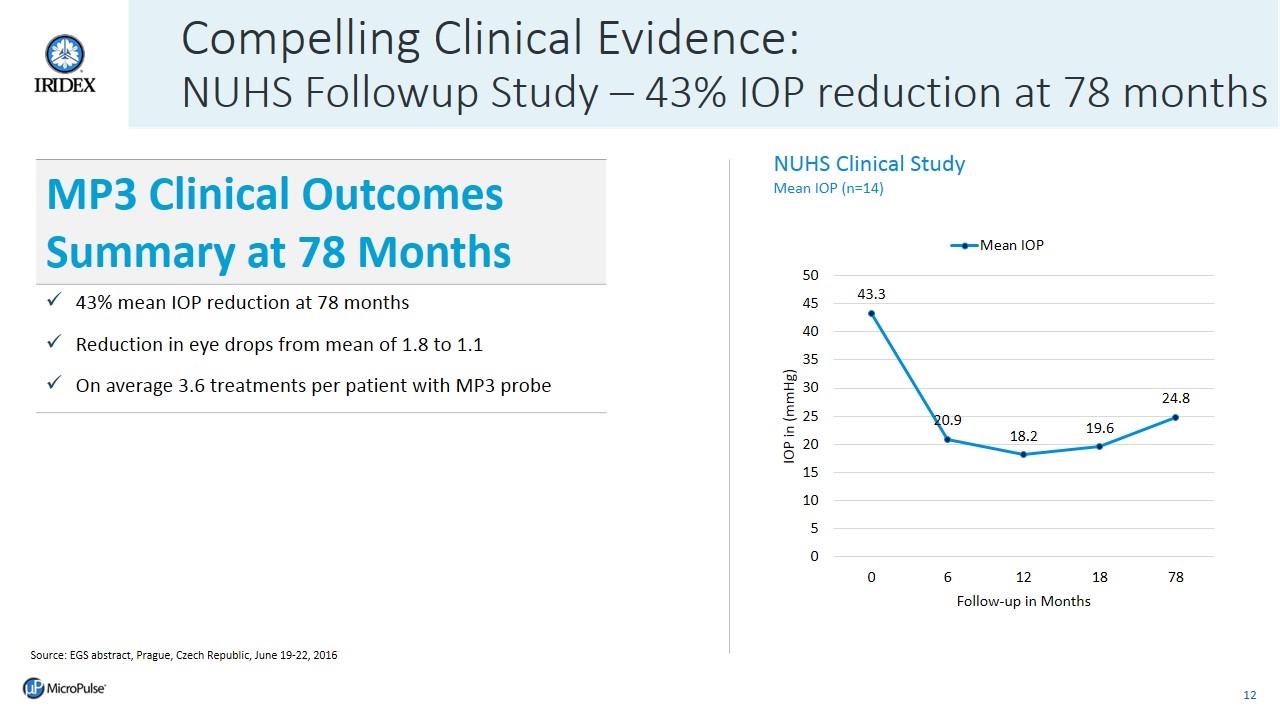

Compelling Clinical Evidence: NUHS Followup Study – 43% IOP reduction at 78 months NUHS Clinical Study Mean IOP (n=14) Source: EGS abstract, Prague, Czech Republic, June 19-22, 2016 MP3 Clinical Outcomes Summary at 78 Months 43% mean IOP reduction at 78 months Reduction in eye drops from mean of 1.8 to 1.1 On average 3.6 treatments per patient with MP3 probe 43.3 20.9 18.2 19.6 24.8 0 5 10 15 20 25 30 35 40 45 50 0 6 12 18 78 IOP in (mmHg) Follow-up in Months Mean IOP 12 Compelling Clinical Evidence: NUHS Followup Study – 43% IOP reduction at 78 months NUHS Clinical Study Mean IOP (n=14) Source: EGS abstract, Prague, Czech Republic, June 19-22, 2016 MP3 Clinical Outcomes Summary at 78 Months ü43% mean IOP reduction at 78 months üReduction in eye drops from mean of 1.8 to 1.1 üOn average 3.6 treatments per patient with MP3 probe

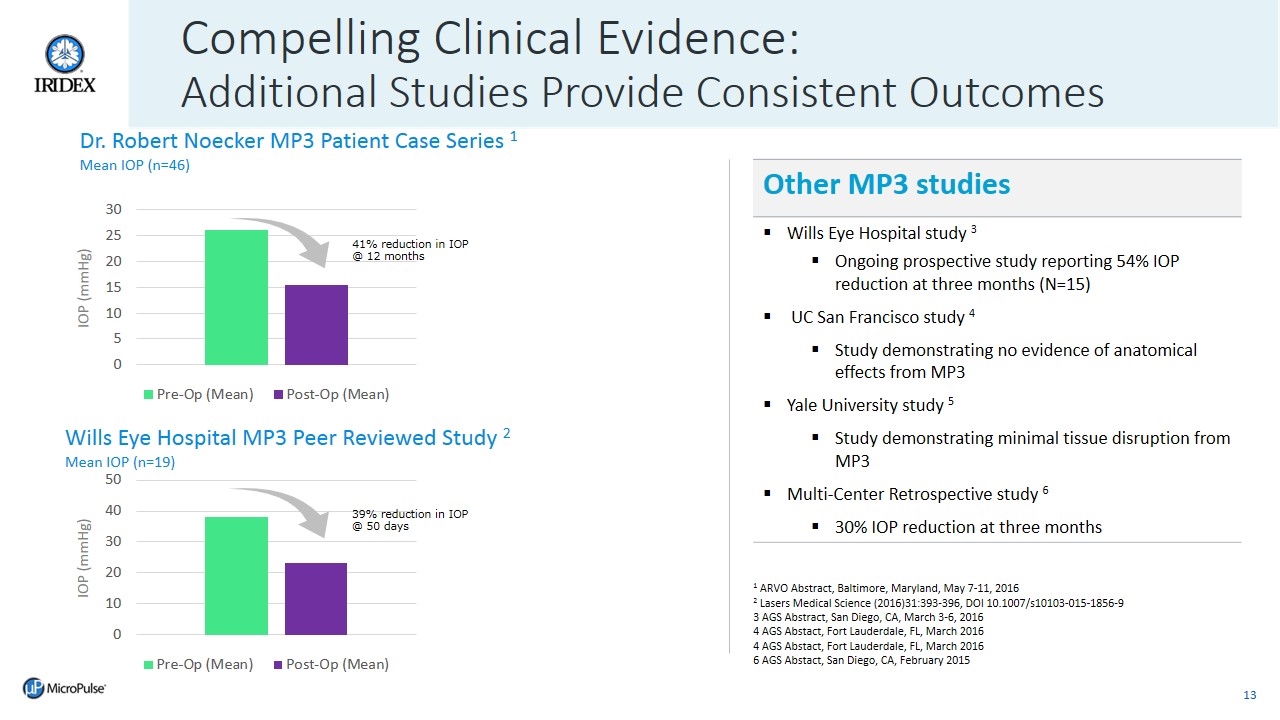

Compelling Clinical Evidence: Additional Studies Provide Consistent Outcomes Dr. Robert Noecker MP3 Patient Case Series 1 Mean IOP (n=46) 41% reduction in IOP @ 12 months IOP (mmHg) 1 ARVO Abstract, Baltimore, Maryland, May 7-11, 2016 2 Lasers Medical Science (2016)31:393-396, DOI 10.1007/s10103-015-1856-9 3 AGS Abstract, San Diego, CA, March 3-6, 2016 4 AGS Abstact, Fort Lauderdale, FL, March 2016 4 AGS Abstact, Fort Lauderdale, FL, March 2016 6 AGS Abstact, San Diego, CA, February 2015 Wills Eye Hospital MP3 Peer Reviewed Study 2 Mean IOP (n=19) 39% reduction in IOP @ 50 days IOP (mmHg) Other MP3 studies Wills Eye Hospital study 3 Ongoing prospective study reporting 54% IOP reduction at three months (N=15) UC San Francisco study 4 Study demonstrating no evidence of anatomical effects from MP3 Yale University study 5 Study demonstrating minimal tissue disruption from MP3 Multi-Center Retrospective study 6 30% IOP reduction at three months 13 Compelling Clinical Evidence: Additional Studies Provide Consistent Outcomes 0 5 10 15 20 25 30 Pre-Op (Mean) Post-Op (Mean) Dr. Robert Noecker MP3 Patient Case Series 1 Mean IOP (n=46) 41% reduction in IOP @ 12 months IOP (mmHg) 1 ARVO Abstract, Baltimore, Maryland, May 7-11, 2016 2 Lasers Medical Science (2016)31:393-396, DOI 10.1007/s10103-015-1856-9 3 AGS Abstract, San Diego, CA, March 3-6, 2016 4 AGS Abstact, Fort Lauderdale, FL, March 2016 4 AGS Abstact, Fort Lauderdale, FL, March 2016 6 AGS Abstact, San Diego, CA, February 2015 Wills Eye Hospital MP3 Peer Reviewed Study 2 Mean IOP (n=19) 0 10 20 30 40 50 Pre-Op (Mean) Post-Op (Mean)39% reduction in IOP @ 50 days IOP (mmHg) Other MP3 studies §Wills Eye Hospital study 3 §Ongoing prospective study reporting 54% IOP reduction at three months (N=15) § UC San Francisco study 4 §Study demonstrating no evidence of anatomical effects from MP3 §Yale University study 5 §Study demonstrating minimal tissue disruption from MP3 §Multi-Center Retrospective study 6 §30% IOP reduction at three months

Medical Retina Business Overview Retina 14 Medical Retina Business Overview Retina

Medical Retina: Growth Opportunity Large Market for DME: $9B* Aging population and diabetes epidemic Unmet Need High cost of treatment and treatment burden to physicians and patients Evolving business model Capital equipment model transitioning to include additional revenue sources * Source: Market Scope estimate of global retinal pharmaceutical market plus retinal laser market in 2015 Medical Retina: Growth Opportunity 15 15 Large Market for DME: $9B* Aging population and diabetes epidemic Unmet Need High cost of treatment and treatment burden to physicians and patients Evolving business model Capital equipment model transitioning to include additional revenue sources * Source: Market Scope estimate of global retinal pharmaceutical market plus retinal laser market in 2015

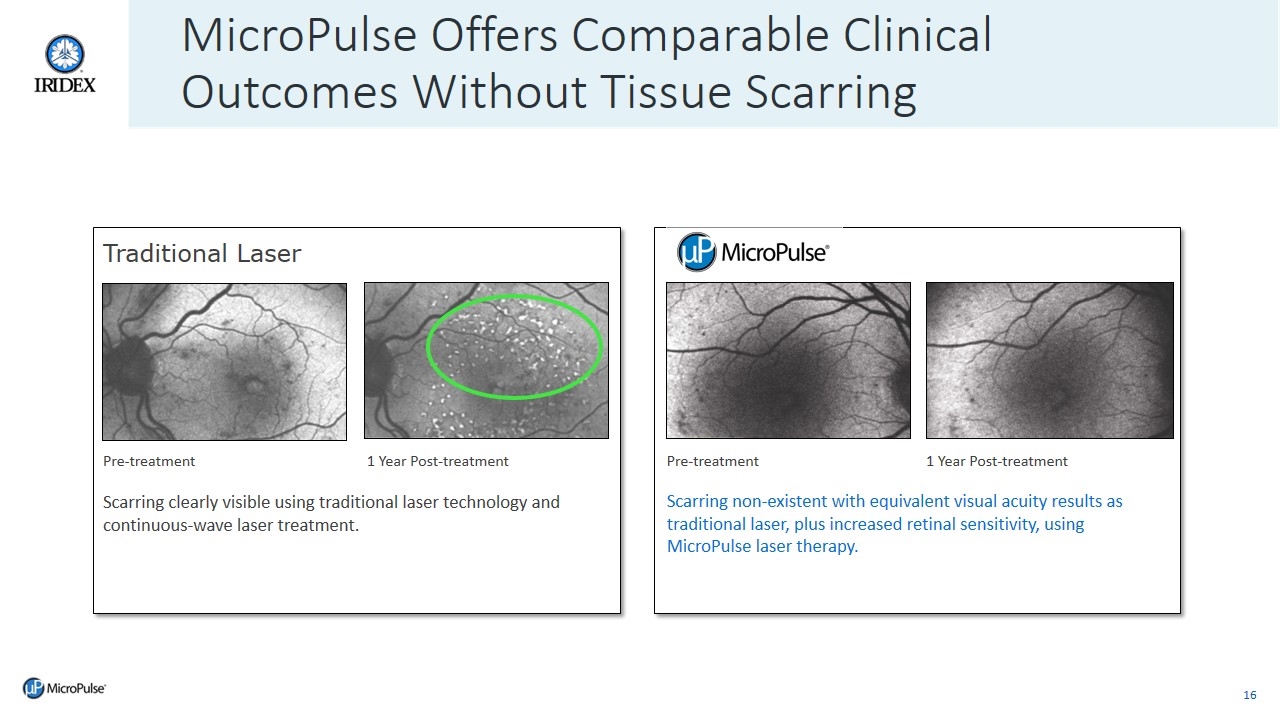

MicroPulse Offers Comparable Clinical Outcomes Without Tissue Scarring Traditional Laser Pre-treatment 1 Year Post-treatment Pre-treatment 1 Year Post-treatment Scarring non-existent with equivalent visual acuity results as traditional laser, plus increased retinal sensitivity, using MicroPulse laser therapy. Scarring clearly visible using traditional laser technology and continuous-wave laser treatment. MicroPulse Offers Comparable Clinical Outcomes Without Tissue Scarring 16 Traditional Laser Pre-treatment 1 Year Post-treatment Pre-treatment 1 Year Post-treatment Scarring non-existent with equivalent visual acuity results as traditional laser, plus increased retinal sensitivity, using MicroPulse laser therapy. Scarring clearly visible using traditional laser technology and continuous-wave laser treatment.

Medical Retina: Substantial Evidence Supports MicroPulse Safety Efficacy Efficiency Economics 10-year follow-up data proved no detectable retina damage. Control randomized trials showed improved vision and improved retinal sensitivity. More treatable patients. Improved patient pass-through rates. Using anti-VEGF and MicroPulse may reduce treatment burden and costs. 17 Medical Retina: Substantial Evidence Supports MicroPulse Safety Efficacy Efficiency Economics 10-year follow-up data proved no detectable retina damage. Control randomized trials showed improved vision and improved retinal sensitivity. More treatable patients. Improved patient pass-through rates. Using anti-VEGF and MicroPulse may reduce treatment burden and costs.

Medical Retina: Broad Global Support Selected customers Over 65 countries have purchased Over 135 publications, posters and podium presentations Over 700 systems sold and estimated ~1 million patients treated 18 Medical Retina: Broad Global Support Selected customers

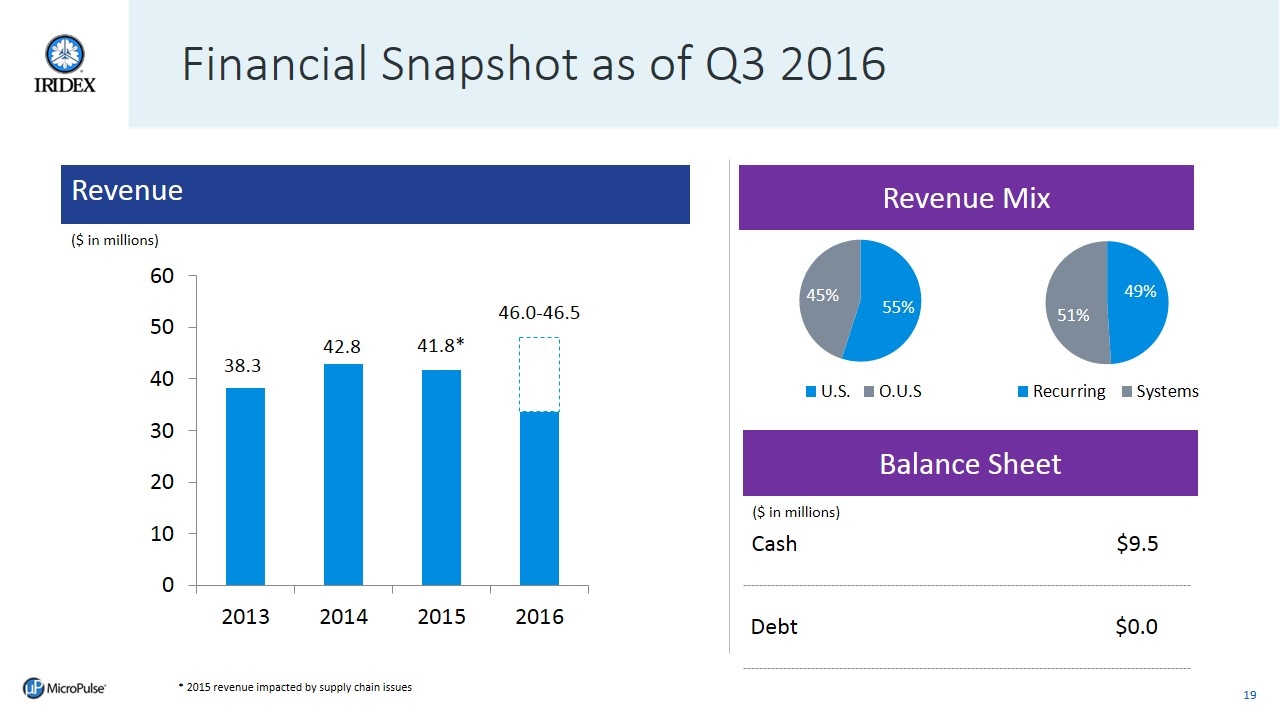

Financial Snapshot as of Q3 2016 Balance Sheet Debt $0.0 Cash $9.5 Revenue * 2015 revenue impacted by supply chain issues Revenue Mix ($ in millions) ($ in millions) 19 Financial Snapshot as of Q3 2016 Balance Sheet Debt $0.0 Cash $9.5 38.3 42.8 41.8* 46.0-46.5 0 10 20 30 40 50 60 2013 2014 2015 2016 Revenue * 2015 revenue impacted by supply chain issues 55% 45% U.S. O.U.S49% 51% Recurring Systems Revenue Mix ($ in millions) ($ in millions)

Focused Execution to Achieve Goals MicroPulse technology for other eye diseases Lower cost and improved reliability laser technologies New delivery modalities Near and Mid-Term Goals Future Programs in Development Expand US and International salesforce; further penetrate territories Increase manufacturing capacity; improve design and processes for scale Product enhancements to introduce new features and benefits 20 Focused Execution to Achieve Goals ØMicroPulse technology for other eye diseases ØLower cost and improved reliability laser technologies ØNew delivery modalities Near and Mid-Term Goals Future Programs in Development ØExpand US and International salesforce; further penetrate territories ØIncrease manufacturing capacity; improve design and processes for scale ØProduct enhancements to introduce new features and benefits

Key Investment Highlights Large Target Markets Significant Unmet Need Compelling Recurring Revenue Model Value Based Medicine Backed By Clinical Evidence Differentiated Technology with Broad Patent Portfolio Global Commercialization Infrastructure 2 3 5 6 7 1 Strong Brand and Trademarks 4 21 Key Investment Highlights Large Target Markets Significant Unmet Need Compelling Recurring Revenue Model Value Based Medicine Backed By Clinical Evidence Differentiated Technology with Broad Patent Portfolio Global Commercialization Infrastructure 2 3 5 6 7 1 Strong Brand and Trademarks 4

Thank You 22 Thank You

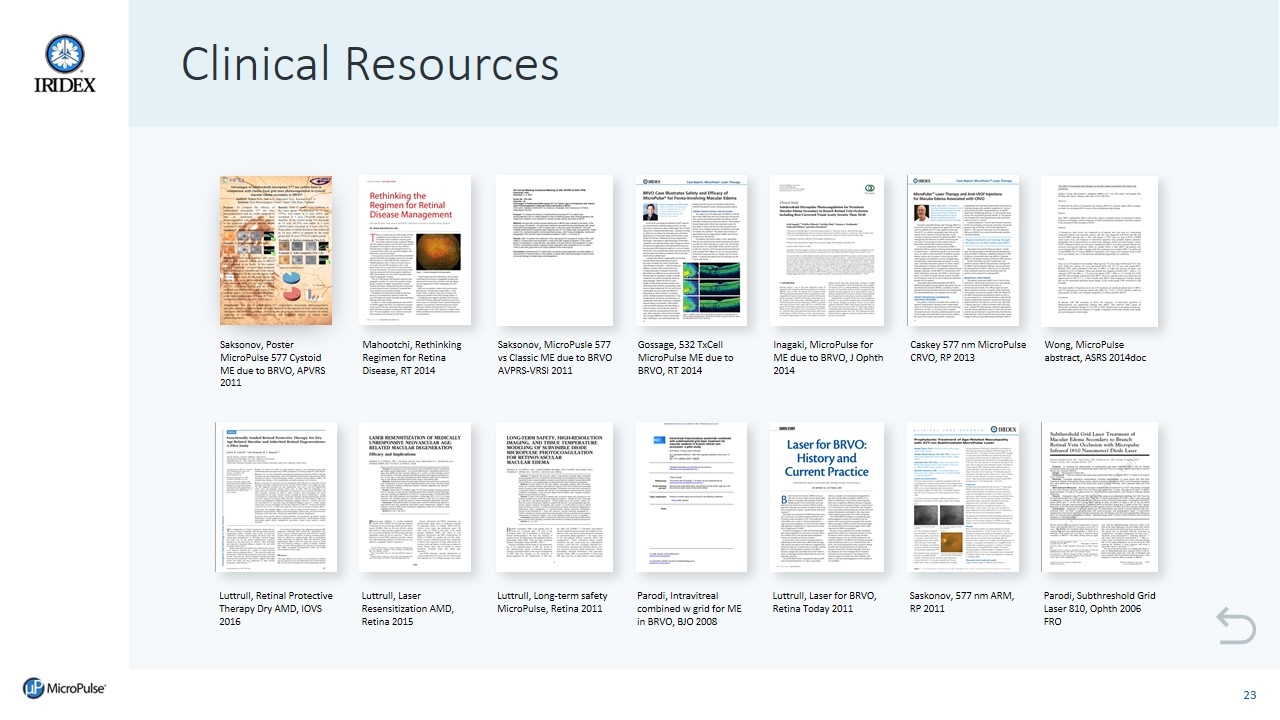

Clinical Resources Saksonov, Poster MicroPulse 577 Cystoid ME due to BRVO, APVRS 2011 Mahootchi, Rethinking Regimen for Retina Disease, RT 2014 Saksonov, MicroPusle 577 vs Classic ME due to BRVO AVPRS-VRSI 2011 Gossage, 532 TxCell MicroPulse ME due to BRVO, RT 2014 Inagaki, MicroPulse for ME due to BRVO, J Ophth 2014 Caskey 577 nm MicroPulse CRVO, RP 2013 Wong, MicroPulse abstract, ASRS 2014doc Luttrull, Retinal Protective Therapy Dry AMD, IOVS 2016 Luttrull, Laser Resensitization AMD, Retina 2015 Luttrull, Long-term safety MicroPulse, Retina 2011 Parodi, Intravitreal combined w grid for ME in BRVO, BJO 2008 Luttrull, Laser for BRVO, Retina Today 2011 Saskonov, 577 nm ARM, RP 2011 Parodi, Subthreshold Grid Laser 810, Ophth 2006 FRO 23 Clinical Resources Saksonov, Poster MicroPulse 577 Cystoid ME due to BRVO, APVRS 2011 Mahootchi, Rethinking Regimen for Retina Disease, RT 2014 Saksonov, MicroPusle 577 vs Classic ME due to BRVO AVPRS-VRSI 2011 Gossage, 532 TxCell MicroPulse ME due to BRVO, RT 2014 Inagaki, MicroPulse for ME due to BRVO, J Ophth 2014 Caskey 577 nm MicroPulse CRVO, RP 2013 Wong, MicroPulse abstract, ASRS 2014doc Luttrull, Retinal Protective Therapy Dry AMD, IOVS 2016 Luttrull, Laser Resensitization AMD, Retina 2015 Luttrull, Long-term safety MicroPulse, Retina 2011 Parodi, Intravitreal combined w grid for ME in BRVO, BJO 2008 Luttrull, Laser for BRVO, Retina Today 2011 Saskonov, 577 nm ARM, RP 2011 Parodi, Subthreshold Grid Laser 810, Ophth 2006 FRO

Video Resources Video 1: MicroPulse Technology Animation Video 2: Cyclo G6 Laser System Technology Video 3: Transscleral Cyclophotocoagulation with Cyclo G6 Video 4: Interview with Dr. Jacky Lee at ESCRS 2015 Video 5: Media Release on New Treatments for Glaucoma (Chinese with English subtitles) Video 6: News Report Dr. Harris on IQ577 for MLT and MP3 24 Video Resources Video 1: MicroPulse Technology Animation Video 2: Cyclo G6 Laser System Technology Video 3: Transscleral Cyclophotocoagulation with Cyclo G6 Video 4: Interview with Dr. Jacky Lee at ESCRS 2015 Video 5: Media Release on New Treatments for Glaucoma (Chinese with English subtitles) Video 6: News Report Dr. Harris on IQ577 for MLT and MP3