Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - READING INTERNATIONAL INC | rdi-20160930x10q.htm |

| EX-32 - EX-32 - READING INTERNATIONAL INC | rdi-20160930xex32.htm |

| EX-31.2 - EX-31.2 - READING INTERNATIONAL INC | rdi-20160930xex31_2.htm |

| EX-31.1 - EX-31.1 - READING INTERNATIONAL INC | rdi-20160930xex31_1.htm |

EXHIBIT 10.1

MORTGAGE CONSOLIDATION,

MODIFICATION AND EXTENSION AGREEMENT

Dated: August 31, 2016

in the original principal amount of

$20,000,000.00

between

SUTTON HILL PROPERTIES, LLC, Mortgagor

a Nevada limited liability company,

having its principal place of business at:

6100 Center Drive, Suite 900

Los Angeles, California 90045

and

VALLEY NATIONAL BANK, Mortgagee

a national banking association,

having an office at:

1455 Valley Road

Wayne, New Jersey 07470

LOCATION OF PREMISES:

|

Street Address |

: 1001-1007 Third Avenue |

|

City of |

: New York |

|

County of |

: New York |

|

State of |

: New York |

|

Section |

: |

|

Block |

: 1414 |

|

Lots |

: 48 |

AFTER RECORDING, PLEASE RETURN TO:

VALLEY NATIONAL BANK

1720 ROUTE 23 NORTH

WAYNE, NEW JERSEY 07470

EXHIBIT 10.1

MORTGAGE CONSOLIDATION, MODIFICATION AND EXTENSION AGREEMENT (the “Consolidation Agreement”), made as of August __, 2016, given between SUTTON HILL PROPERTIES, LLC, a Nevada limited liability company, having its principal place of business at 6100 Center Drive, Suite 900, Los Angeles, California 90045 (“Mortgagor”) and VALLEY NATIONAL BANK, a national banking association having an office at 1455 Valley Road, Wayne, New Jersey 07470 (“Mortgagee”).

W I T N E S S E T H :

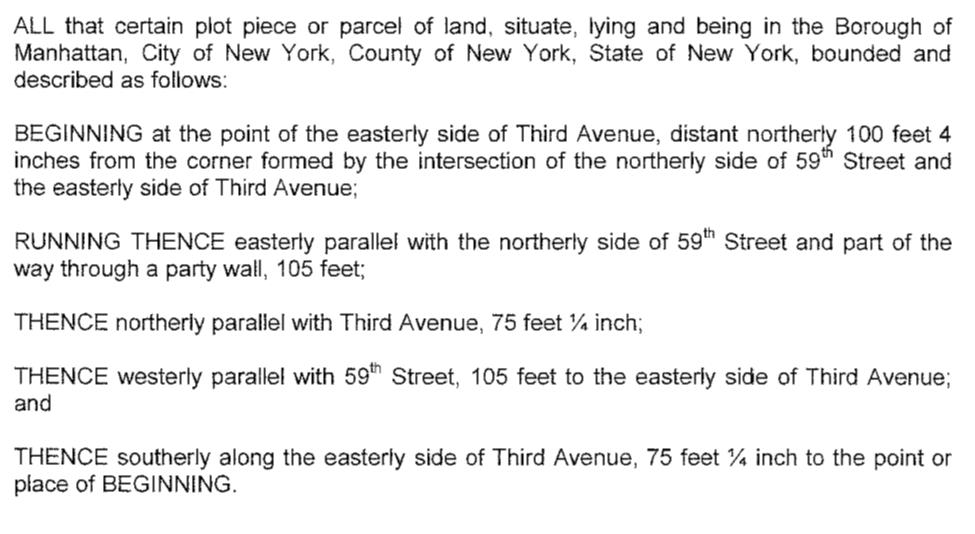

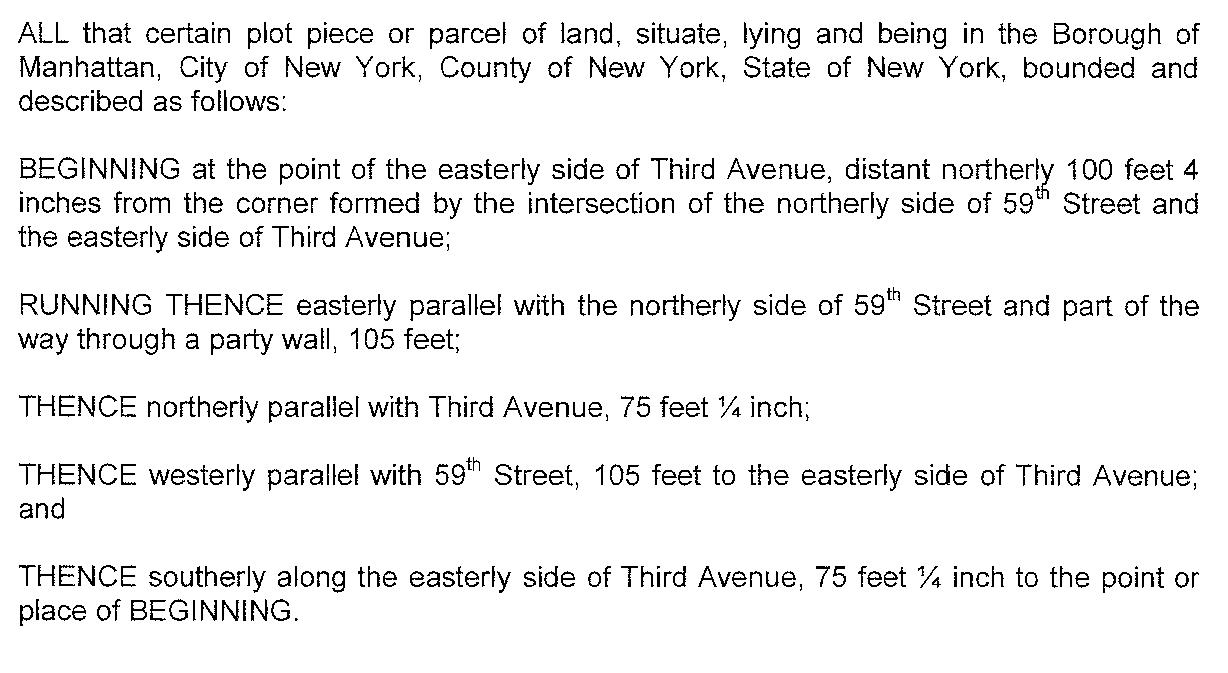

WHEREAS, Mortgagor is the lawful owner of that certain parcel of real property known as 1001-1007 Third Avenue, New York, New York 10022, in the City, County and State of New York, as more particularly described in Schedule A attached hereto and made a part hereof (the “Land”), together with all buildings and other improvements located on the Land (the Land, together with all such buildings and other improvements, collectively, the “Premises”);

WHEREAS, Mortgagee is the lawful owner and holder of those certain mortgages set forth on Schedule B attached hereto and made a part hereof (collectively, the “Mortgages”) and the notes secured thereby (collectively, the “Notes”) in the aggregate original principal amount of $20,000,000.00 on which Notes there is currently outstanding, in the aggregate, the principal amount of $20,000,000.00; and

WHEREAS, Mortgagor and Mortgagee have agreed in the manner hereinafter set forth to (i) consolidate and coordinate the respective liens of the Mortgages, (ii) combine and coordinate the Notes and the principal sums evidenced thereby and (iii) modify the time and manner of payment and the terms and provisions of the Notes and the Mortgages.

NOW, THEREFORE, in consideration of the foregoing and of the mutual agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto hereby agree as follows:

|

1. Representations and Warranties. Mortgagor represents and warrants to Mortgagee that: |

|

(a) There is, as of the date hereof, due and owing upon the Mortgages, the aggregate principal amount of TWENTY MILLION AND 00/100 DOLLARS ($20,000,000.00), together with interest thereon and other charges evidenced thereby, in each case without offset, defense or counterclaim of any kind or nature whatsoever. (Such outstanding amounts, together with all interest thereon and such other amounts as may be outstanding from time to time under the Notes and Mortgages and under the Consolidated Note (as hereafter defined), being hereinafter referred to, collectively, as the “Indebtedness”). |

EXHIBIT 10.1

|

(b) As of the date hereof, there are no defaults or events of default under the Notes and Mortgages, nor has any event occurred that would be a default thereunder with the passage of time, the giving of notice, or both. |

|

(c) Mortgagor is the holder of good, marketable, insurable fee title in and to the Premises, subject to the Permitted Encumbrances (as defined in Schedule C attached hereto) and has full power, good right and lawful authority to encumber the Premises in the manner and form set forth in the Mortgages and to execute and deliver this Consolidation Agreement. |

|

(d) The execution and delivery of this Consolidation Agreement does not and will not violate the terms of Mortgagor’s operating agreement or articles of organization, or any other lease, agreement, mortgage, indenture or instrument affecting Mortgagor or the Premises or any law, rule, order, ordinance or statute of any governmental authority, purporting to have jurisdiction over Mortgagor or the Premises. |

|

2. Consolidation of Notes. The Notes and the respective principal indebtedness evidenced thereby are hereby combined and consolidated to constitute a single indebtedness in the aggregate principal amount of TWENTY MILLION AND 00/100 DOLLARS ($20,000,000.00), together with interest heretofore accrued on each of such Notes. |

|

3. Consolidated Note. Concurrently herewith, Mortgagor is executing and delivering to Mortgagee that certain Restated Mortgage Promissory Note (the “Consolidated Note”), dated of even date herewith, made by Mortgagor, as maker, in favor of Mortgagee, as payee, evidencing the consolidation of the Notes, which Consolidated Note amends, modifies and restates the terms, provisions and time of payment of the Notes in all respects and from and after the date hereof, the Notes shall be deemed replaced by the Consolidated Note and Mortgagor shall pay the Indebtedness in accordance with, and shall comply with the terms and conditions set forth in the Consolidated Note, which Consolidated Note is hereby substituted for the Notes. |

|

4. Consolidation of Mortgages. The liens of the Mortgages are hereby consolidated and coordinated so that together they shall hereafter constitute in law but one mortgage, a single, first lien upon the Premises securing the Indebtedness. |

|

5. Modification of Consolidated Mortgage. The Mortgages, as consolidated and coordinated hereby, are also modified, extended, amended and restated in their entirety and the terms, covenants and conditions of the Mortgages, as consolidated, shall be and hereby are superseded and replaced by the terms, covenants and conditions set forth in Schedule C annexed hereto and made a part hereof (the Mortgages, as so consolidated, modified, extended, amended and restated in Schedule C hereto, together with this Consolidation Agreement, are referred to,

|

EXHIBIT 10.1

collectively, as the “Consolidated Mortgage”). Mortgagor agrees to comply with and be subject to all of the terms, covenants and conditions of this Consolidated Mortgage. |

|

6. Use of Terms. The terms “Land”, “Improvements”, “Premises” and “Mortgaged Property” shall have the meanings ascribed to them in Schedule C attached hereto when used in this Consolidated Mortgage. Whenever the term “note” or “Note”, shall be used in this Consolidated Mortgage or in the Consolidated Note, such term shall mean and refer to the Consolidated Note, as such Consolidated Note may be further modified from time to time. Whenever the terms “mortgage” or “Mortgage” shall be used in this Consolidated Mortgage (including, without limitation, Schedule C hereto), or in the Consolidated Note, such terms shall mean and refer to this Consolidated Mortgage, as this Consolidated Mortgage may be further modified from time to time. Terms defined in this Consolidation Agreement that are used in Schedule C hereto that are not otherwise defined in such schedule, shall have the meaning accorded such terms in this Consolidation Agreement. |

|

7. Subsequent Modifications. Any written agreement or agreements hereafter entered into by the Mortgagee that (i) extend the time of payment of the Indebtedness, (ii) change or modify the time or times of payment or the amount of the installments or fixed sums or the interest or the rate thereof, (iii) change, modify, extend, renew or terminate other terms, provisions, covenants or conditions of the Consolidated Mortgage or the obligations that it secures or this Consolidation Agreement, or (iv) consolidate, spread, release or sever the lien of the Consolidated Mortgage shall be effective in accordance with the terms and provisions thereof and shall be binding according to the tenor thereof on the owner or holder of subordinate, intervening or subsequent liens or security interests on the Premises and any such liens or security interests shall continue to be subject and subordinate to this Consolidated Mortgage and any such agreement or agreements. |

|

8. No New Indebtedness; Maximum Principal Amount. |

(a) The parties hereto hereby certify that this Consolidation Agreement secures the same indebtedness evidenced by the Notes, together with interest thereon, and secured by this Consolidated Mortgage, and evidences and secures no further or other indebtedness or obligation.

|

(b) Notwithstanding anything to the contrary contained herein, the maximum principal that which is secured by the Consolidated Mortgage as of the date hereof, or that under any contingency may be secured by the Consolidated Mortgage at any time in the future, shall not exceed the principal sum of TWENTY MILLION AND 00/100 DOLLARS ($20,000,000.00) plus (i) taxes, charges and assessments which may be imposed by law on the Premises, (ii) premiums on the insurance policies required to be maintained under the Consolidated Mortgage, and (iii) expenses incurred in upholding the lien of this Agreement including, but not limited to, the expenses of any litigation to prosecute or defend the rights and liens created by this

|

EXHIBIT 10.1

Agreement, any amount, cost or charge to which this Agreement becomes subrogated, upon payment, whether under recognized principles of law or equity, or under express statutory authority, and interest at the regular interest rate or Default Rate (as defined in the Consolidated Note). |

|

9. No Oral Modification. The terms hereof may not be waived, changed, modified, terminated or discharged orally, but only by an agreement in writing signed by the party against whom enforcement of any such waiver, change, modification, termination or discharge is sought. |

|

10. Ratification. Mortgagor hereby (i) ratifies and confirms the Indebtedness and the lien, conveyance and grant contained in and created by this Consolidated Mortgage and (ii) agrees that nothing contained in this Consolidation Agreement is intended to or shall impair the validity of the Indebtedness or the lien, conveyance and grant of the Consolidated Mortgage. Unless specifically modified by the terms hereof, the parties hereto ratify and confirm each and every term of the Consolidated Mortgage and the Consolidated Note, which shall continue in full force and effect. |

|

11. Further Assurances. Mortgagor shall execute and deliver, at Mortgagor’s sole cost and expense, such additional documents as shall be requested by Mortgagee from time to time to effectuate the terms and conditions of this Consolidation Agreement, the Consolidated Note and the Consolidated Mortgage, including, without limitation, such affidavits as shall be necessary to permit this Consolidation Agreement to be recorded in the appropriate public records. Mortgagor hereby appoints Mortgagee its attorney in fact to execute, acknowledge and deliver for and in the name of the Mortgagor any and all of the instruments mentioned in this section, and this power, being coupled with an interest, shall be, irrevocable as long as any part of the Indebtedness remains unpaid. |

|

12. Successors and Assigns. This Consolidation Agreement shall bind, and inure to the benefit of, the parties hereto, their respective successors and permitted assigns. |

|

13. Counterparts. This Consolidation Agreement may be executed in any number of counterparts, each of which shall be an original, but all of which together shall constitute one instrument. |

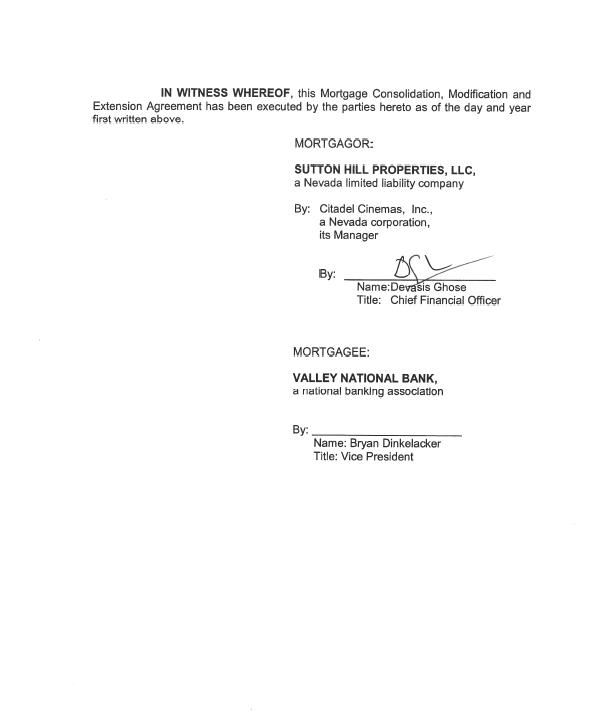

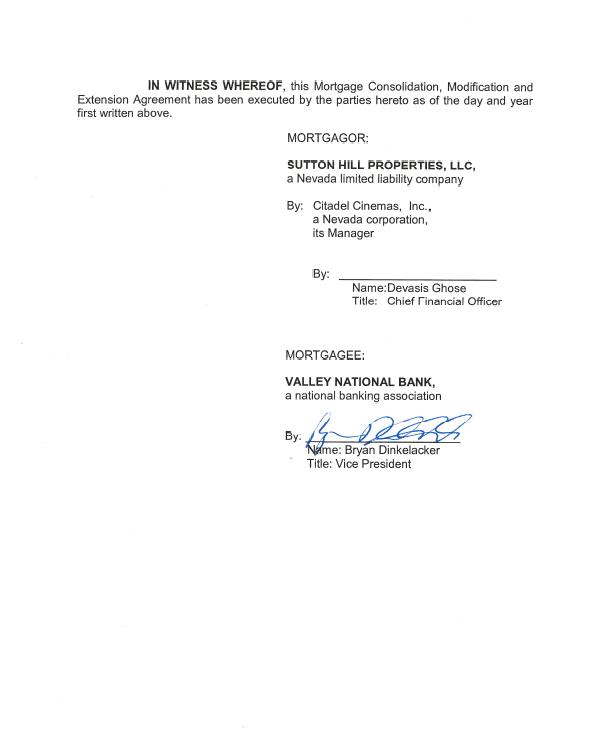

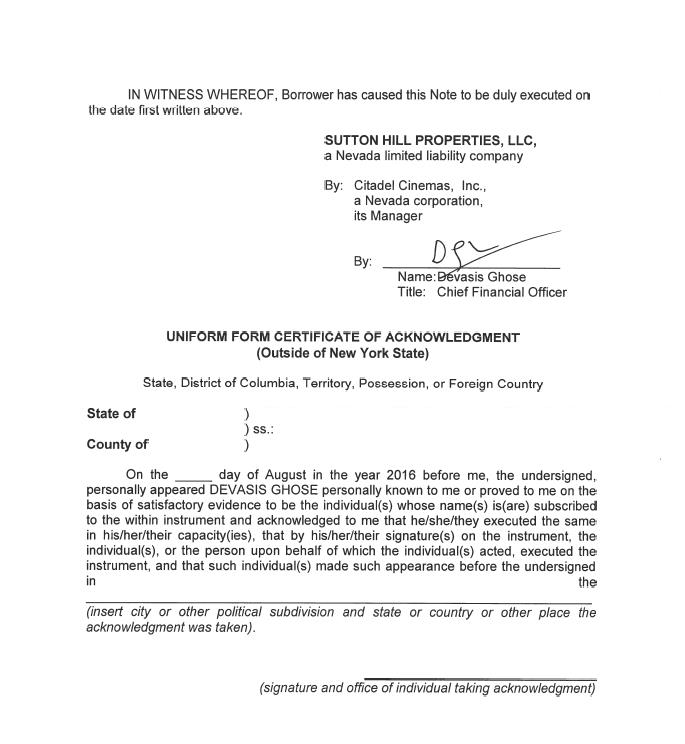

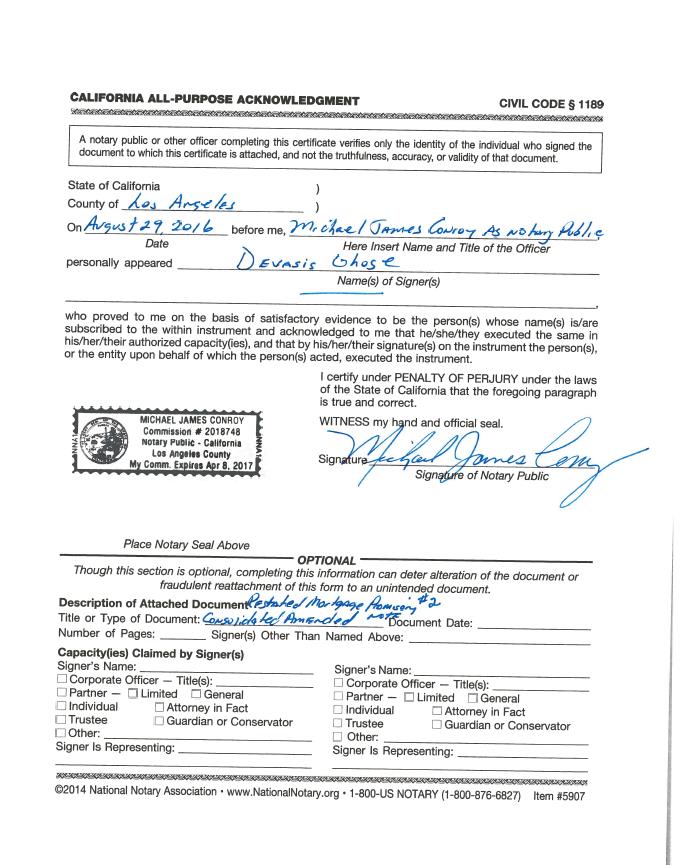

[SIGNATURE PAGE FOLLOWS.]

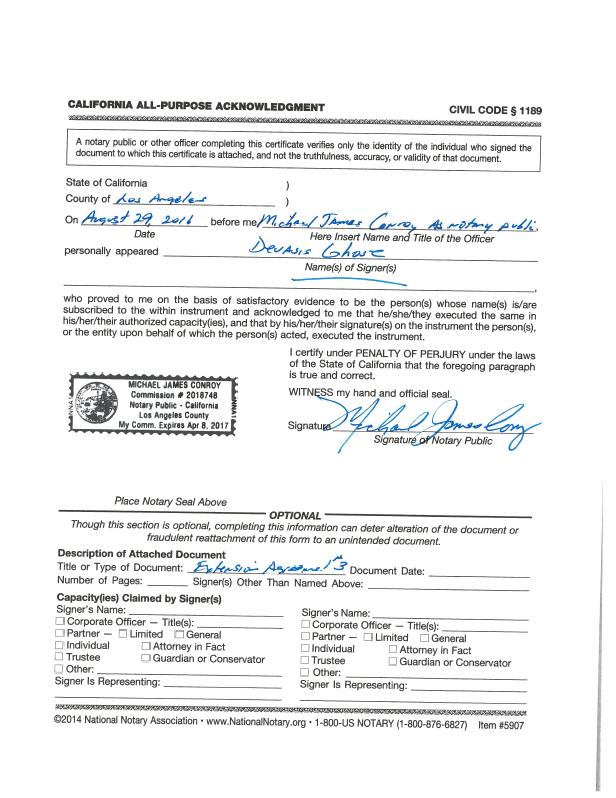

EXHIBIT 10.1

EXHIBIT 10.1

EXHIBIT 10.1

EXHIBIT 10.1

EXHIBIT 10.1

SCHEDULE A

Legal Description

EXHIBIT 10.1

SCHEDULE B

Schedule of Mortgages

|

1. |

Mortgage made by SUTTON HILL PROPERTIES, LLC to EUROHYPO AG, NEW YORK BRANCH in the original principal amount of $15,000,000.00 dated June 28, 2007 and recorded in the Office of the City Register, County of New York (the “Register’s Office”) on July 10, 2007 as CRFN No. 2007000350847 (upon which mortgage recording tax in the amount of $420,000.00 was duly paid); |

Which said mortgage (1) was thereafter duly assigned by Assignment of Mortgage from EUROHYPO AG, NEW YORK BRANCH to WELLS FARGO BANK, AS TRUSTEE, IN TRUST FOR THE REGISTERED HOLDERS OF BANK OF AMERICA COMMERCIAL MORTGAGE INC., COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICAGTES, SERIES 2007-3 dated June 28, 2007 and recorded in the Register’s Office on February 21, 2008 under CRFN No. 2008000070990.

Which said mortgage (1) was thereafter further duly assigned by Assignment of Mortgage from WELLS FARGO BANK, AS TRUSTEE, IN TRUST FOR THE REGISTERED HOLDERS OF BANK OF AMERICA COMMERCIAL MORTGAGE INC., COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICAGTES, SERIES 2007-3 to U.S. BANK NATIONAL ASSOCIATION, AS TRUSTEE, IN TRUST FOR THE REGISTERED HOLDERS OF BANK OF AMERICA COMMERCIAL MORTGAGE INC., COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICAGTES, SERIES 2007-3 dated July 6, 2009 and recorded in the Register’s Office on December 11, 2009 under CRFN No. 2009000407157.

Which said mortgage (1) was thereafter further duly assigned by Assignment of Mortgage from U.S. BANK NATIONAL ASSOCIATION, AS TRUSTEE, IN TRUST FOR THE REGISTERED HOLDERS OF BANK OF AMERICA COMMERCIAL MORTGAGE INC., COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICAGTES, SERIES 2007-3 to SOVEREIGN BANK, N.A. dated June 28, 2012 and recorded in the Register’s Office on July 20, 2012 under CRFN No. 2012000288511.

Amended and Restated Mortgage, Assignment of Leases and Rents, Security Agreement and Fixture Filing made by SUTTON HILL PROPERTIES, LLC to SOVEREIGN BANK, N.A. dated June 28, 2012 and recorded in the Register’s Office on July 20, 2012 under CRFN No. 2012000288512 (amends and restates said mortgage (1), as assigned).

Amendment No. 1 to Amended and Restated Mortgage, Assignment of Leases and Rents, Security Agreement and Fixture Filing made by SUTTON HILL PROPERTIES, LLC to SANTANDER BANK, N.A., f/k/a SOVEREIGN BANK, N.A. dated June 26, 2014 and recorded in the Register’s Office on August 4, 2014 under CRFN No. 2014000256252 (amends said mortgage (1), as amended, restated and assigned).

EXHIBIT 10.1

Which mortgage (1), as amended, restated and assigned, was thereafter assigned by Assignment of Mortgage from SANTANDER BANK, N.A., f/k/a SOVEREIGN BANK, N.A. to VALLEY NATIONAL BANK dated August 31, 2016 and intended to be duly recorded in said Register’s Office simultaneously herewith.

The outstanding principal balance secured by said mortgage, as assigned, is $15,000,000.00.

|

2. |

Gap Mortgage made by SUTTON HILL PROPERTIES, LLC to VALLEY NATIONAL BANK in the original principal amount of $5,000,000.00 dated August 31, 2016 and intended to be duly recorded in said Register’s Office simultaneously herewith (upon which the mortgage recording tax imposed by law was duly paid). |

EXHIBIT 10.1

SCHEDULE C

Consolidated Mortgage

EXHIBIT 10.1

AMENDED AND RESTATED MORTGAGE

AND

SECURITY AGREEMENT

FROM

SUTTON HILL PROPERTIES, LLC

TO

VALLEY NATIONAL BANK

DATED: AUGUST 31, 2016

RECORD AND RETURN TO:

Commercial Mortgage Department

Valley National Bank

1720 Route 23 North

Wayne, New Jersey 07470

EXHIBIT 10.1

AMENDED AND RESTATED MORTGAGE AND SECURITY AGREEMENT

This Amended and Restated Mortgage and Security Agreement ("Mortgage" and referred in the Consolidation Agreement as the “Consolidated Mortgage”) is made on the 31st day of August, 2016

BYSUTTON HILL PROPERTIES, LLC, a Nevada limited liability company, having its principal place of business at 6100 Center Drive, Suite 900, Los Angeles, California 90045 ("Mortgagor"),

ANDVALLEY NATIONAL BANK, a national banking association, having offices at 1455 Valley Road, Wayne, New Jersey 07470 ("Mortgagee");

Background.This Mortgage secures various Obligations (as defined below) including, without limitation, a loan by Mortgagee to Mortgagor in the original principal amount of TWENTY MILLION AND 00/100 DOLLARS ($20,000,000.00), plus interest thereon, as evidenced by the Note. In consideration of the above-referenced loan and other good and valuable consideration, receipt of which is hereby acknowledged, Mortgagor agrees as follows:

SECTION 1 - DEFINITIONS AND INTERPRETATIONS

The definitions of the capitalized terms used in this Mortgage and the Note are set forth in the body of this Mortgage and in Appendix A attached hereto and incorporated herein in its entirety.

SECTION 2 - GRANTING CLAUSE

To secure the observance, payment and performance of all Obligations, Mortgagor hereby mortgages, grants a security interest in, and absolutely assigns all rents, profits, leases, income and proceeds arising from, the Mortgaged Property to Mortgagee and to Mortgagee's successors and assigns forever. These grants are, however, made upon the express condition that after all Obligations are paid and performed in full, Mortgagee shall discharge this Mortgage upon Mortgagor's request.

SECTION 3 - MORTGAGED PROPERTY

The "Mortgaged Property" consists of a two story commercial building located at 1001-1007 Third Avenue, New York, New York 10022 as more particularly described on the attached Exhibit “A” (the “Mortgaged Property”) located upon the Land, the Improvements, all of Mortgagor’s right, title and interest in and to the Fixtures and Equipment, all Leases and Rents, all Awards and Proceeds, all Other Rights, and all present and future estate, right, title, interest, property, possessory interest and claims whatsoever in law as well as in equity of Mortgagor or any other owner in and to the

EXHIBIT 10.1

Land, Improvements and Fixtures, Equipment and Other Rights.

SECTION 4 - REPRESENTATIONS

Mortgagor, knowing and agreeing that Mortgagee shall rely hereon, hereby represents and warrants to Mortgagee that:

4.1Warranty of Title. Mortgagor holds good and marketable title in fee simple to the Mortgaged Property free of all liens, restrictions, taxes and encumbrances, other than any Permitted Encumbrances, and warrants and forever defend that title and the enforceability and priority of all liens created under this Mortgage against all claims whatsoever, except for Permitted Encumbrances, at Mortgagor's sole expense.

4.2Valid Obligations. The Loan Documents are the valid and binding obligations of Mortgagor, enforceable in accordance with their terms to the maximum extent permitted by law. This Mortgage constitutes a valid first priority mortgage lien on, and absolute assignment of Leases and Rents, and security interest in the Mortgaged Property, subject to any Permitted Encumbrances.

4.3Existence and Authority. Mortgagor is a duly organized and validly existing limited liability company that is in good standing under the laws of the State of Nevada and is authorized to do business in and is in good standing under the laws of the State of New York. Mortgagor has full power, authority and license to enter into and perform this Mortgage and the other Loan Documents to which Mortgagor is a party and Mortgagor has full power, authority and license to own and operate the Mortgaged Property and to conduct its business as now being conducted. Mortgagor has obtained all necessary consents, authorizations, permits, licenses and approvals required before Mortgagor may execute and deliver this Mortgage and operate the Mortgaged Property. There is no provision in Mortgagor’s Articles of Organization or Operating Agreement (as the same may have been heretofore amended or modified), or in any other document applicable to the conduct of Mortgagor, requiring further consent for such action by any other entity or person, which has not been obtained and provided to Mortgagee.

4.4No Conflicts. The execution, delivery and performance of this Mortgage and other Loan Documents by Mortgagor will violate no charter, bylaw, lease, indenture, agreement, instrument, law, ordinance, regulation, order or administrative ruling to which Mortgagor is subject or a party or that affects or relates to the Mortgaged Property.

4.5Proceedings. Except as otherwise previously disclosed to Mortgagee pursuant to that certain Disclosure Schedule of even date herewith by Mortgagor (the “Disclosure Schedule”), there is no action, application, petition, proceeding or hearing pending or, to Mortgagor’s knowledge, threatened against any Obligor or the Mortgaged Property that might (a) adversely affect any Obligor's ability to perform the Mortgage or

EXHIBIT 10.1

any other Loan Document, (b) involve the possibility of any material adverse change in any Obligor's economic condition, (c) relate to any land use variance, subdivision, zoning or other similar matters, (d) involve the possibility of any limitation on any intended uses of the Mortgaged Property, (e) impair the lien or security of this Mortgage or the value of the Mortgaged Property or (f) involve possible or threatened claims totaling in excess of $10,000.00, except as heretofore disclosed to Mortgagee and its attorney in writing.

4.6Compliance with Laws. Except as otherwise expressly set forth in the Title Report (hereinafter defined) and Environmental Report (hereinafter defined), Mortgagor and the Mortgaged Property are in compliance with all laws, regulations, ordinances and codes that are applicable to the use and operation of the Mortgaged Property, including, without limitation, all Environmental Laws. All present and planned uses and tenants of the Mortgaged Property are in full compliance with applicable zoning, environmental and building laws, ordinances, regulations and codes. Mortgagor and all tenants of the Mortgaged Property have obtained all certificates of occupancy and building and other permits that are required for all intended uses of, and for any construction, renovations and repairs with respect to, the Mortgaged Property.

4.7Condition of Property. The Mortgaged Property is structurally sound, in good condition and suitable for its intended use. To Mortgagor’s knowledge, there are no violations of any federal, state or local law, ordinance or regulation affecting or against the Mortgaged Property, except those violations which have been listed by the New York Metro Title Agency, Inc. (the “Title Company”) in its title report #16-30624, dated May 18, 2016 and re-dated as of the date hereof (the “Title Report”), which violations are dealt with in that certain Undertaking of even date herewith made by Mortgagor to Mortgagee (the “Undertaking”).

4.8Taxes. All property taxes and assessments due and owing in connection with the Mortgaged Property have been paid in full through the date of this Mortgage, including any penalties, deficiency assessments and interest. Mortgagor has filed all federal, state, county, municipal, and city income and other tax returns required to be filed by it and has paid all taxes that are due and owing pursuant to such returns or pursuant to any assessments received by it, including penalties, deficiency assessments and interest.

4.9Financial Information and Condition. The financial statement of Mortgagor and all tax returns delivered to Mortgagee truly set forth the financial condition of Mortgagor and the results of operations as of that date and there has been no material adverse change since then. All other statements, representations and warranties made by or, to Mortgagor’s knowledge, on behalf of Mortgagor to Mortgagee have been, and as of the date of the Mortgage are, accurate and complete and no information has been omitted that would make any of them misleading or incomplete. Immediately prior to and after the making of this Mortgage, Mortgagor was not, nor will be, "insolvent" as that term is defined in, New York Business Corporation Law §1201, et. seq. or 11 U.S.C.A.

EXHIBIT 10.1

101(31).

4.10Leases. There exist no leases or tenancies with respect to the Mortgaged Property other than as set forth on the Schedule of Leases (as more particularly described in that certain Assignment of Leases and Rents dated of even date herewith made by Mortgagor in favor of Mortgagee) (being herein collectively referred to as the “Existing Lease”), copies of which have been delivered to Mortgagee. The Existing Lease is in full force and effect and has not been further amended or modified. There has not occurred, and, to Mortgagor’s knowledge, there is no circumstance or state of facts that with notice or lapse of time would constitute, a default under any the Existing Lease. Mortgagee shall have all of the rights against any lessees of the Mortgaged Property set forth in Section 291-f of the Real Property Law of New York.

4.11No Broker. No broker or finder other than Meridian Capital Group (the “Broker”) introduced Mortgagor to Mortgagee. The Broker’s commission shall be paid in full by Mortgagor on the date hereof.

4.12Commercial Mortgage. This Mortgage does not encumber real property principally improved or to be improved by one or more structures containing in the aggregate not more than six (6) residential units each having their own separate cooking facilities.

4.13Governmental Licenses. All licenses, consents and approvals required from, and all registrations and filings required to be made with, any governmental or other public body or authority to authorize the performance of its obligations under this Mortgage have been obtained and effected.

4.14Litigation Affecting Mortgaged Property. There is no action, suit, proceeding or investigation pending or threatened, or, to the best of Mortgagor's knowledge, any basis therefor known to Mortgagor, which questions the validity of this Mortgage or the Note, or any action taken or threatened to be taken pursuant thereto. No notice has been given by any governmental authority of any proceeding to condemn, purchase or otherwise acquire the Mortgaged Property or any part thereof or interest therein and, to Mortgagor's knowledge, no such proceeding is contemplated.

4.15Compliance with Laws. Except as otherwise expressly set forth in the Disclosure Schedule, the Title Report and the Environmental Report, Mortgagor is in compliance in all material respects with all governmental laws, rules and regulations and other requirements which are applicable to the Mortgaged Property or any part thereof, or any use or condition of the Mortgaged Property or any part thereof. Mortgagor has no knowledge of any violation, nor is there any notice or other record of violation, of any zoning, health, safety, building, fire, labor, environment, or other statute, ordinance, rule, regulation or restriction applicable to the Mortgaged Property or any part or use thereof, except as set forth in the Title Report.

EXHIBIT 10.1

4.16Survival. All representations and warranties made by, or on behalf of Mortgagor in this Mortgage or otherwise made to Mortgagee shall survive the closing of this Mortgage and any independent investigation by Mortgagee.

SECTION 5 - MORTGAGOR'S COVENANTS

Mortgagor and any other owner of the Mortgaged Property who shall assume the Obligations covenant and agree that they shall do all of the following:

5.1Obligations. Pay all indebtedness, and abide by all terms and conditions, under all Obligations, including without limitation this Mortgage and the Note;

5.2Escrow Account. At the time of each monthly payment, pay to Mortgagee (A) the sum equal to one-twelfth (1/12th) of the known (or if not known, reasonably estimated by Mortgagee) annual real estate taxes and assessments, water, sewer, property, casualty and liability insurance and other charges levied or to be levied against the premises by governmental entities and (B) such sums, if required by Mortgagee, as are necessary to assure the timely payment of all charges described in Section 6 below, to be held by Mortgagee in a non-interest bearing account and applied by Mortgagee to the payment of such taxes, assessments and other charges when due. If the total of such monthly payments shall exceed the amounts actually paid by Mortgagee for taxes, assessments and other charges, as the case may be, such excess shall be credited on subsequent monthly payments of the same nature or promptly refunded to Mortgagor upon payment and performance in full of all Obligations; but if the total of such monthly payments shall be insufficient to pay taxes, assessments and other charges when due, then Mortgagor shall pay to Mortgagee, on demand, any amount necessary to make up the deficiency. Notwithstanding the foregoing, upon the occurrence of an Event of Default, Mortgagee may apply all sums in said escrow account to the reduction of the Obligations. Notwithstanding the above, the Mortgagee shall not require such escrow for annual real estate taxes and assessments, water, sewer, property, casualty, liability or any other insurance unless:

(a) intentionally omitted;

(b)an Event of Default exists;

(c)intentionally omitted.

5.3Financial Reporting. Immediately notify Mortgagee of any material adverse change in the financial condition of Mortgagor and deliver to the Mortgagee the following:

(a)annually, as soon as available but no later than 120 days after the close of each fiscal year of Mortgagor, compiled financial statements for Mortgagor

EXHIBIT 10.1

which annual financial statements shall disclose in reasonable detail all assets and liabilities of Mortgagor and shall be certified by an officer of Reading;

(b)annually, copies of filed federal income tax returns for Mortgagor, including all schedules thereto (including, without limitation, K-1’s for all principals thereof), within 30 days after filing of same; provided that if Mortgagor shall file an extension, Mortgagor shall provide evidence satisfactory to Mortgagee of each such request and approval, and thereafter, a copy of the filed federal income tax return, including all schedules thereto, within 30 days after filing of same;

(c)intentionally omitted;

(d)annually, a copy of Form 10-K annual report of Guarantor, including all schedules thereto, within 30 days after filing of same;

(e)simultaneously with the submission of financial statements for Mortgagor, a certificate of Mortgagor's CFO stating that (i) the signer has no knowledge of a default under any Loan Document for the Mortgagor or (ii) if any default existed or exists, its nature, when it occurred and what remedial action is being taken;

(f)intentionally omitted;

(g)a certified rent roll for the Mortgaged Property, within thirty (30) days after the end of each calendar year or simultaneously with the submission of financial statements for Mortgagor, whichever is later, which rent roll shall include the name of each tenant, the term of each tenancy, the current rent due from each such tenant, and a schedule of any arrears or prepaid rents and security deposits for each tenant of the Mortgaged Property; and

(h)such other information as Mortgagee reasonably may request.

5.4Use of Property. Make or permit no use of the Mortgaged Property other than as a movie theater, or as otherwise permitted under the current certificate of occupancy, in compliance with all laws, ordinances, regulations and restrictions affecting the Mortgaged Property.

5.5Condition of Property. Prevent any waste with respect to the Mortgaged Property, keep or cause the tenant under the Existing Lease or any other tenant(s) to keep the Mortgaged Property in good and clean condition and make all repairs that are required in the ordinary course of business to operate the Mortgaged Property.

5.6Alterations. Make no material change to or renovation of, nor remove, any material Improvements or Fixtures and Equipment without the express prior written consent of Mortgagee in its reasonable discretion (except that Mortgagee’s consent shall not be required with respect to non-structural alterations necessary or convenient

EXHIBIT 10.1

to achieve ADA compliance required by law or as a result of a settlement or resolution of a claim, and work required in the ordinary course in connection with the maintenance and operation of a cinema, including, but not limited to, repair of HVAC system, the hard and soft costs of which work shall be less than $250,000.00, provided, however, that Mortgagor shall provide written notice to Mortgagee prior to the commencement of any such work which shall require a building permit or other approval from any Governmental Authority). All changes, renovations, removals and repairs shall be made in a good and workmanlike manner to the reasonable satisfaction of Mortgagee and in accordance with all applicable building and zoning laws. As used herein, the term “ADA” means the Americans with Disabilities Act of 1990, as amended and supplemented from time to time, and any New York City laws, rules, and regulations concerning the subject matter thereof.

5.7Notice of Loss or Condemnation. Notify Mortgagee immediately in writing upon learning that (a) there has occurred any casualty on, or loss to or of, any Mortgaged Property or (b) condemnation proceedings have commenced with respect to the Mortgaged Property.

5.8Inspections. At any time during regular business hours and as often as requested upon not less than 24 hours prior notice (which may be oral), permit Mortgagee and its agents and employees to examine, audit and make copies and abstracts from any and all books and records of Mortgagor, and, subject to any rights of the tenant under the Existing Lease, if any, to visit and inspect the Mortgaged Property.

5.9Compliance With Laws. Comply with all laws, ordinances, regulations and restrictions affecting the Mortgaged Property.

5.10Transfers of Interests. Without the express prior written consent of Mortgagee in its absolute discretion, make or permit no Transfer in the ownership or control of Mortgagor or the Mortgaged Property or any part thereof (including, without limitation, the conveyance of all or any portion of the air rights with respect to the Mortgaged Property), directly or indirectly, voluntarily or involuntarily. Without the prior written consent of Mortgagee in its absolute discretion, Mortgagor shall not create or permit to exist any lien, encumbrance or security interest in favor of any third party with respect to the Mortgaged Property and Mortgagor shall keep the Mortgaged Property free from any such lien or security interest other than those created in favor of Mortgagee pursuant to the Loan Documents and liens for taxes not yet due and payable. Notwithstanding the foregoing, so long as Reading International, Inc., a Nevada corporation (“Reading”), shall remain a publicly traded company, Mortgagee’s prior written consent shall not be required for any Permitted Transfer (as defined below), so long as all Transfer Requirements (as defined below) are timely satisfied. For purposes of this Section, (i) the term “Permitted Transfer” shall mean the transfer of any or all of the Equity Interests (as defined below) in Reading, (ii) the term “Transfer Requirements” means, with respect to any Permitted Transfer, all of the following: (1) Reading shall not be released from any liability under any guaranty, and (2) no Event of

EXHIBIT 10.1

Default hereunder or under any of the other Loan Documents shall exist and be continuing, and (iii) the term “Equity Interest” means shares of stock of Reading.

5.11Preservation. Preserve and maintain all authorizations, consents, licenses, permits, registrations and qualifications that are necessary for the transaction of business and the operation of the Mortgaged Property.

5.12 Indemnification. Indemnify, defend (with counsel reasonably acceptable to Mortgagee) and hold harmless Mortgagee (including Mortgagee's agents, employees, officers and directors) against all losses, claims, suits, fines, damages and expenses, including reasonable attorney's fees and disbursements, incurred by reason of, or in connection with, this Mortgage or the Mortgaged Property or in maintaining Mortgagee's interest in the Mortgaged Property, including, without limitation, all losses, claims, suits, fines, damages and expenses incurred by reason of, or in connection with, Mortgagor's breach of any provision of Section 7 of this Mortgage or any violation of any Environmental Law of the Use of Hazardous Substances on the Mortgaged Property.

5.13Cooperation. Mortgagor will, at its sole cost and expense, and without expense to Mortgagee, do, execute, acknowledge and deliver all and every such further acts, deeds, conveyances, mortgages, assignments, notices of assignment, transfers and assurances as Mortgagee shall from time to time reasonably require for the better assuring, conveying, assigning, transferring and confirming unto Mortgagee the property and rights hereby conveyed, mortgaged or assigned or intended now or hereafter so to be, or which Mortgagor may be or may hereafter become bound to convey, mortgage or assign to Mortgagee or for carrying out the intention or facilitating the performance of the terms of this Mortgage, and for filing or recording this Mortgage and, on demand, will execute and deliver, and hereby authorizes Mortgagee to execute in the name of Mortgagor to the extent it may lawfully do so, one or more financing statements or comparable security instruments, and renewals thereof to evidence more effectively the lien hereof upon the Fixtures and Equipment.

5.14Governmental Charges re: Mortgage. Mortgagor will pay all taxes, filing and recording fees, and all expenses incident to the execution and acknowledgement of the Note, this Mortgage, any mortgage supplemental hereto, and any security instrument with respect to the Fixtures and Equipment, any instrument of further assurance, and all federal, state, county and municipal stamp taxes and other taxes, duties, imposts, assessments and charges arising out of or in connection with the execution and delivery of the Note, this Mortgage, any mortgage supplemental hereto, any security instrument with respect to the Fixtures and Equipment or any instrument of further assurance, other than income, franchise or other similar taxes imposed upon Mortgagee.

5.15Mechanic’s Liens. Mortgagor will pay, from time to time when the same shall become due, all lawful claims and lawful demands of mechanics, materialmen, laborers and others, which, if unpaid, might result in, or permit the creation of, a lien on

EXHIBIT 10.1

the Mortgaged Property or any part thereof, or on the revenues, rents, issues, income and profits arising therefrom, and in general will do or cause to be done everything necessary so that the lien hereof shall be fully preserved, at the cost of Mortgagor, without expense to Mortgagee.

5.16Taxation of Mortgage. Mortgagor will pay all taxes, including, without limitation, any taxes imposed on Mortgagee by reason of its ownership of the Note or this Mortgage or foreclosure of same. Mortgagor shall not, however, be liable for any income taxes payable by or due from Mortgagee with respect to interest earned on the Loan or for any taxes payable by or due from Mortgagee by reason of the sale or transfer of this Mortgage or the Note. In the event of the present existence or the passage after the date of this Mortgage of any law of the State of New York deducting from the value of real property for the purposes of taxation any lien thereon or changing in any way the laws for the taxation of mortgages or debts secured by a mortgage for state or local purposes or the manner of collection of any such taxes and imposing a tax, either directly or indirectly, on this Mortgage or the Note, Mortgagor shall promptly pay or cause such tax to be paid or discharged. In the event Mortgagor does not promptly cause any such tax to be discharged, the holder of this Mortgage shall have the right to declare the unpaid principal balance of the Note and all accrued and unpaid interest due on a date to be specified by not less than twenty (20) days' written notice to be given to Mortgagor by Mortgagee.

5.17Leases. As to all Leases and Rents, comply with each of the following:

|

(a) The Mortgagor will not, without the prior written consent and approval of the Mortgagee in each instance, (i) execute an assignment of the rents for the Mortgaged Property or any part thereof, (ii) enter into any leases, lettings or license arrangements affecting the Mortgaged Property or any part thereof, (iii) enter into modification of leases in existence on the date hereof, or (iv) in any other manner impair the value of the Mortgaged Property or the security of the Mortgage. Reference is made to Section 291‑(f) of the Real Property Law with respect to the following: Mortgagor will not, without the prior written consent and approval of the Mortgagee, in each instance (x) terminate or consent to the cancellation or surrender of any lease of the Mortgaged Property or of any part thereof, now existing or hereafter to be made, (y) materially modify or vary any such lease, or (z) accept prepayments of any installments of rents to become due under such leases, except prepayments in the nature of security for the performance of the lessees thereunder. Notwithstanding the foregoing, Mortgagee’s prior written consent shall not be required with respect to written license agreements (“License Agreements”) for short term (i.e., less than seven (7) calendar days) individual auditorium usage

|

EXHIBIT 10.1

(e.g., film festival, church service, birthday party, etc.), provided that all such license agreements shall be revocable at will and shall expressly provide that they are subordinate to this Mortgage and shall in no way be construed as granting to any licensee, and licensee shall not receive, be deemed to have received or under any circumstances claim to have received, whether expressly or implicitly, any title, easement, lien, possession or any property interest in, or rights (in rem or otherwise) to, the Mortgaged Property or any part thereof or anything contained therein. |

|

(b) The Mortgagor will at all times promptly and faithfully perform, or cause to be performed, all of the covenants, conditions and agreements contained in all leases of the Mortgaged Property or any part thereof now or hereafter existing on the part of the lessor thereunder to be kept and performed, and shall do all things commercially reasonably necessary to compel performance by the lessee under each lease of all obligations, covenants and agreements by such lessee to be performed thereunder. If any of such leases provide for the giving by the lessee of certificates with respect to the status of such leases, the Mortgagor shall exercise its right to request such certificates within five (5) business days of any demand therefor by the Mortgagee. The Mortgagor shall promptly notify the Mortgagee of (i) the commencement of any action or proceeding by any lessee, the purpose of which shall be the cancellation of any lease or diminution or offset against the rent payable under any such lease, or (ii) the interposition by any lessee of any defense in any action or proceeding brought by the Mortgagor against such lessee, or (iii) a written notice received by the Mortgagor from any lessee claiming constructive eviction, and will cause a copy of any process, pleading or notice received by the Mortgagor in reference to any such action, defense or claim to be promptly delivered to the Mortgagee. |

|

(c) The Mortgagor shall furnish to the Mortgagee, within thirty (30) days after a request by the Mortgagee to do so, a written statement containing a schedule of all leases of all or any part of the Mortgaged Property, the names of the respective lessees, the terms of their respective leases, the space occupied and the rentals payable thereunder, and, if also requested, true copies of all such leases. |

5.18Payments by Mortgagee. If Mortgagor shall fail to perform an act which it

EXHIBIT 10.1

is required to perform hereunder or any of the covenants contained herein or any covenant contained in the Note, or fails to pay any money which it is required to pay hereunder or under the Note, Mortgagee may, after notice to Mortgagor and expiration of any applicable cure period (except in the event of emergency, in which event no notice shall be required and no cure period shall apply), but shall not be obligated to, make advances and/or disbursements to perform the same, and all sums so advanced and/or disbursed shall bear interest at the Default Rate from the date of such advance, and shall be a lien upon the Mortgaged Property and be secured hereby. Mortgagee, in making such advance or payment, shall be subrogated to all the rights of the person receiving such payment. Mortgagor will repay on demand all sums so advanced and/or disbursed with interest at the Default Rate from the date of making such advance and/or disbursement until paid. Any action taken by Mortgagee pursuant to this Section shall not constitute a waiver of any Event of Default or an undertaking to perform or complete any of the Mortgagor’s duties, nor shall it impose any responsibility on Mortgagee to perform any of Mortgagor’s duties in the future.

5.19Mortgagee’s Inspection Requests. Mortgagor will keep adequate records and books of account in accordance with generally accepted accounting principles (as defined by the American Association of Certified Public Accountants) and will permit Mortgagee, by its agents, accountants and attorneys, to visit and inspect the Mortgaged Property and examine its records and books of account with respect to the Mortgaged Property (whether or not the same shall be kept at the Mortgaged Property) and to discuss its affairs, finances and accounts with Mortgagor, at such reasonable times as may be requested by Mortgagee. Mortgagor shall deliver to Mortgagee annually, within one hundred twenty (120) days after the end of Mortgagor's fiscal year, a financial statement of the operation of the Property, certified by the Mortgagor as true and correct.

5.20No Waste. Mortgagor will not (i) threaten, commit, permit or suffer any waste to occur on or to the Mortgaged Property or any part thereof, or (ii) make any change in its use which will in any way (other than to a de minimis extent) increase any fire or other hazards arising out of renovation or operation of the Mortgaged Property. Mortgagor will, at all times, maintain the Mortgaged Property in good operating order and condition and will promptly make, from time to time, all repairs, renewals, replacements, additions and improvements in connection therewith which are needful to such end. The Improvements shall not be removed, demolished or substantially altered, nor shall any Fixtures and Equipment be removed, without the prior written consent of Mortgagee except where appropriate replacements, free of superior title, liens and claims, are promptly made of value or utility at least equal to the value or utility of the Fixtures and Equipment removed, or except where the Fixtures and Equipment are obsolete or no longer useful, in which events Mortgagee shall be entitled to the proceeds of the Fixtures and Equipment so removed.

5.21Mortgagee Litigation Expense. Mortgagor agrees that if any action or proceedings be commenced, excepting an action to foreclose this Mortgage or to collect

EXHIBIT 10.1

the indebtedness hereby secured, to which action or proceeding Mortgagee is made a party by reason of the execution of this Mortgage or the Note which it secures, or in which it becomes necessary to defend or uphold the lien of this Mortgage, all sums paid by Mortgagee for the expense of any litigation to prosecute or defend the transaction and the rights and lien created hereby (including in every case reasonable attorneys' fees and disbursements, and all such sums incurred by Mortgagee in any appellate proceedings and any bankruptcy or reorganization proceedings) shall be paid by Mortgagor together with interest thereon from date of payment by Mortgagee at the Note Rate. All such sums paid and the interest thereon shall, at option of Mortgagee, be immediately due and payable, shall be a lien upon the Mortgaged Property, and shall be secured hereby as shall be all such sums incurred in connection with enforcement by Mortgagee of its rights hereunder.

5.22Curing Violations. Except for those violations disclosed in the Title Report, Mortgagor will promptly cause to be dismissed any and all violations of any federal, state or local laws, ordinances, or regulations affecting or against the Mortgaged Property, but in any event all municipal violations shall be dismissed prior to the date such violations would become a lien or encumbrance against the Mortgaged Property. The violations disclosed in the Title Report are dealt with in the Undertaking signed by Mortgagor and delivered to Mortgagee on this date.

5.23Leasing Covenants. Supplementing Section 5.17 above as to all Leases and Rents, comply with each of the following:

(a)accept no payments more than one month in advance of the due date under any leases relating to the Mortgaged Property; and

(b)permit no use of the Mortgaged Property that would violate any provision of this Mortgage, including all provisions relating to environmental matters; and

(c)intentionally omitted; and

(d)intentionally omitted; and

(e)any existing or future lease, or other agreement for the use or occupancy, of any Mortgaged Property shall provide that:

(i) it is subordinate and subject in all respects to the lien and provisions of this Mortgage including all covenants and restrictions as to the use and condition of the Mortgaged Property; and

EXHIBIT 10.1

(ii)all representations and covenants as to environmental matters, including those set forth in Section 7, are to become express covenants and representations of the tenant or occupant; and

(iii) copies of notices or letters asserting or discussing any defaults on the part of the landlord shall be simultaneously sent to Mortgagee (attention: Commercial Loan Department) by certified mail; and

(iv)within fifteen (15) days of request by Mortgagee, the lessee or occupant will deliver to Mortgagee a notarized statement as to the default status of any lease or occupancy agreement and execute any document reasonably requested by Mortgagee to confirm that any lease or occupancy agreement is subordinate and subject to the lien and provisions of this Mortgage.

5.24Mortgage Tax. At all times pay all required mortgage taxes for this Mortgage, including at the time of original filing and at such time of any supplements or amendments thereto.

5.25Service Contracts; Additional Liabilities. Mortgagor shall not, without the prior written consent of Mortgagee in each instance, such consent not to be unreasonably withheld, enter into any service contracts or other agreements or incur any other liability which would be binding upon a successor owner of the Mortgaged Property or which would create a Mortgagor liability in excess of One Hundred Thousand and 00/100 ($100,000.00) dollars, in each instance, except no consent shall be required to enter into contracts for the performance of capital improvements or repair work required by law and to be performed in accordance with the Mortgage.

5.26Property Management. The Mortgaged Property shall be managed at all times by the Mortgagor or a manager that is approved by Mortgagee, which approval shall not be unreasonably withheld. Any manager, shall be a reputable management company having substantial experience in the management of real property of a similar type, size and quality in New York, New York and shall be reasonably acceptable to Mortgagee. Subject in all respects to this Section 5.26, Mortgagee agrees that Citadel Cinemas, Inc. (the “Managing Agent”) is acceptable as managing agent as of the date hereof and approves the Management Agreement between Mortgagor and Managing Agent, as amended, copies of which have been furnished to Mortgagee. Mortgagor shall cause any manager of the Mortgaged Property to agree that any management agreement shall be subject and subordinate in all respects to the Loan and the lien of this Mortgage and the other Loan Documents. The management agreement may not be modified, amended, or terminated by Mortgagor without Mortgagee’s prior written consent, which consent shall not be unreasonably withheld. Mortgagor shall not consent to the assignment or transfer by a manager of any of its rights or obligations under its management agreement, without the prior written consent of Mortgagee, such consent not to be unreasonably withheld. Mortgagor shall not pay any management fees with respect to the Mortgaged Property except as contemplated by a management

EXHIBIT 10.1

agreement reasonably acceptable to Mortgagee in all material respects. Such manager shall maintain a fidelity bond in an amount and with an insurer reasonably acceptable to Mortgagee and in keeping with bond amounts typically required by Mortgagee with respect to similarly situated properties in Manhattan, New York. Within sixty (60) days after receipt by Mortgagor of a notice from Mortgagee, Mortgagor shall terminate any managing agent if, in the reasonable judgment of Mortgagee, the management of the Mortgaged Property by such managing agent may have an adverse material effect on the value of the Mortgaged Property or on the ability of the Mortgagor to perform its obligations under this Mortgage.

5.27Debt Service Coverage. Mortgagor shall at all times maintain a minimum Debt Service Coverage Ratio of at least 1.25:1, tested annually, commencing with the calendar year ending December 31, 2017, “Debt Service Coverage Ratio” means the ratio of (a) net income (which shall include, among other things, all rent and additional rent payable under the Existing Lease, without deduction for the expense represented by such rent and additional rent payable under the Existing Lease) plus depreciation and amortization expense plus interest expense less distributions to any person other than to an Affiliate of Guarantor; to (b) the annual payments of principal and interest hereunder and under the Note. Failure to comply with the provisions of this paragraph, continuing within thirty (30) days after notice, shall constitute an Event of Default under this Mortgage as if such default were specifically listed in Section 8 hereof. If, at any time, a receiver is appointed with respect to all or any portion of the Mortgaged Property, Mortgagor agrees that the order appointing the receiver may contain a provision requiring the receiver to pay all debt service payments under any loan evidenced by the Note and/or secured by this Mortgage, it being recognized that such debt service payments are proper obligations of Mortgagor and must be paid out of the rental charges payable under any leases.

5.28No Stay; Exemption or Moratorium. The Mortgagor will not, except as, and in such event only to the extent, required by law, at any time insist upon, or plead, or in any manner whatsoever claim or take any benefit or advantage of any stay or extension or moratorium law, any exemption from execution or sale of the Mortgaged Property or any part thereof, wherever enacted, now or at any time hereafter in force, which may affect the covenants and terms of performance of this Mortgage, nor claim, take or insist upon any benefit or advantage of any law now or hereafter in force providing for the valuation or appraisal of the Mortgaged Property, or any part thereof, prior to any sale or sales thereof which may be made pursuant to any provision herein, or pursuant to the decree, judgment, or order of any court of competent jurisdiction, and covenants not to hinder, delay or impede the execution of any power herein granted or delegated to the Mortgagee, but to suffer and permit the execution of every power as though no such law or laws had been made or enacted. The Mortgagor for itself and all who may claim under it, waives, to the extent that it lawfully may, all right to have the Mortgaged Property or any part thereof marshaled upon any foreclosure hereof.

5.29No Further Encumbrance. Mortgagor shall not cause, or permit any lien or

EXHIBIT 10.1

encumbrance to be filed against, or attached to, the Mortgaged Property, other than the lien of this Mortgage.

5.30Reserve Account. Mortgagor hereby covenants to open and maintain for the term of the Loan with the Mortgagee an operating account in respect of the Mortgaged Property, which account shall, at all times during the ninety (90) day period commencing from and after the date hereof, have a minimum account balance of at least One Million and 00/100 ($1,000,000.00) Dollars.

SECTION 6 - INSURANCE

6.1Insurance Coverage. Mortgagor shall keep or cause the tenant under the Existing Lease to keep the Mortgaged Property insured as follows:

(a)Property Insurance. Maintain extended coverage property insurance written in the name of Mortgagor in the broadest "all risks" or "special form" causes of loss available on a full replacement cost basis covering all Mortgaged Property, including all Improvements and Fixtures and Equipment. That insurance shall be in amounts that are no less than the full replacement cost value of the Mortgaged Property (without any deduction for depreciation) with a deductible amount of no greater than $25,000.

(b)Liability Insurance. Maintain commercial general liability insurance in the name of Mortgagor, including contractual liability for an insured contract and completed operations and personal injury coverage, with a combined single limit for any one occurrence in amounts reasonably satisfactory to Mortgagee.

(c)Flood Insurance. If any portion of the Mortgaged Property is located in a flood hazard area in Special Flood Hazard Areas (Flood Zones prefixed in “A” or “V”) for which insurance is available under the Flood Disaster Protection Act of 1973 or the National Flood Insurance Act of 1968, maintain flood insurance on that portion in an amount reasonably acceptable to Mortgagee, not to exceed the lesser of the full replacement cost value or the maximum coverage available through the National Flood Insurance Program.

(d) Interruption Insurance. Business interruption insurance for loss caused by perils of the type covered by the above-referenced casualty insurance in amounts as may be reasonably required by Mortgagee covering the loss of rental income and all expenses and carrying costs of the Mortgaged Property for a period of not less than one (1) year.

(e) Boiler and machinery insurance in amounts reasonably acceptable to Mortgagee.

(f) Policy Terms. All policies shall meet the following requirements:

EXHIBIT 10.1

(i) overall blanket or excess coverage policies may be supplied provided, however, that all insurance shall be in amounts sufficient to prevent any insured from being a co-insurer and that the amount of the casualty insurance coverage attributable to the Mortgaged Property is clearly set forth; and

(ii) all policies shall (x) name Mortgagee "and its successors and assigns as their interests may appear" as "mortgagee insured" and "loss payee" on all property insurance as outlined in clauses (a), (c), (d) and (e) above and as "additional insured" as to general liability insurance, (y) contain an endorsement stating that, as to the interest of Mortgagee, such policy "shall not be impaired, invalidated or affected by any statement, act or neglect of any insured, loss payee or other Person, or by any failure to make any report to the insurer, or by the institution of any proceeding to execute upon any lien", and (z) contain a provision stating that such policy "shall not be canceled or modified except after thirty (30) days prior written notice, except ten (10) days prior written notice for non-payment of premium", delivered to Mortgagee (Attn: Commercial Mortgage Department) at Mortgagee's address first listed above or as subsequently directed in writing by Mortgagee; and

(iii) all policies shall be in a form reasonably acceptable to Mortgagee and shall be issued by financially sound insurers duly authorized to conduct that type of insurance business in New York; and

(iv) all policies of insurance and endorsements thereof, together with a paid receipt with respect to any installment(s) of premium(s) which shall be due pursuant to any commercial premium finance agreement in effect with respect thereto, shall be deposited with Mortgagee prior to the closing of this Mortgage. At least thirty (30) days prior to the expiration of any such policies, Mortgagee shall furnish paid receipts and other evidence satisfactory to Mortgagee that all such policies have been renewed or replaced; and

(v)all policies shall provide that the insurance proceeds and awards may be adjusted only after obtaining the prior written consent of Mortgagee and shall be paid directly to Mortgagee to the extent required in Section 6.2.

6.2Insurance Proceeds. Mortgagee shall have the exclusive authority to do each of the following in Mortgagee's absolute discretion:

(a) Receive directly all Awards and Proceeds;

(b) Settle or compromise all claims relating to all Awards and Proceeds; and

EXHIBIT 10.1

|

(c) Determine whether to apply any Awards and Proceeds to reduce the Note or any other Obligations or to repair or replace any Mortgaged Property. |

Notwithstanding the foregoing, if the cost of restoration, as estimated by Mortgagee in its sole discretion, does not exceed fifteen (15%) percent of the then outstanding principal balance of the Loan, then, provided there then exists no Event of Default or state of facts which with the giving of notice and passage of time, or both, would become an Event of Default hereunder or under any of the other Loan Documents, the Awards and Proceeds of such casualty loss shall be made available for the restoration of the Mortgaged Property and in such event shall not cause an acceleration, nor permit Mortgagee to accelerate, the balance due under the Note.

SECTION 7 - ENVIRONMENTAL MATTERS

7.1Environmental Representations. Except as otherwise expressly set forth in the Environmental Report, Mortgagor hereby represents and warrants to Mortgagee that:

(a)Neither Mortgagor nor, to the best knowledge of Mortgagor, any other existing or former occupant of the Mortgaged Property, has (i) Used any Hazardous Substances in violation of any Environmental Law, (ii) received any notice, or is on notice, of any claim, investigation, cleanup or testing program, government expenditures, litigation or administrative proceeding, actual or threatened, or any order, writ or judgment that relates to any Use of pollutants of any kind, including any Hazardous Substances, on, or by any occupant of, the Mortgaged Property.

(b)No Hazardous Substances have been, or will be, used on, or by any occupant of the Mortgaged Property, other than common cleaning and maintenance agents in small quantities for standard maintenance uses.

(c)No asbestos exists on the Mortgaged Property in any form, condition or quantity.

7.2Restrictions on Hazardous Uses. Without Mortgagee's prior written consent, which may be granted or withheld in Mortgagee's sole discretion, Mortgagor shall make or permit no use of the Mortgaged Property that would involve the Use of any Hazardous Substances, except for properly stored safe cleaning and maintenance agents in reasonable amounts for standard maintenance uses or as specifically permitted in advance in writing by Mortgagee in its absolute discretion.

7.3Notice to Mortgagee. Mortgagor shall notify Mortgagee immediately in writing upon learning of:

EXHIBIT 10.1

(a)any spill, discharge or release of any Hazardous Substances on or near the Mortgaged Property that may involve a cleanup;

(b)any circumstances that may result in a violation of Section 7.2;

(c)any governmental inquiry or inspection is undertaken or an enforcement notice issued with respect to Hazardous Substances on or Used with respect to the Mortgaged Property.

7.4Environmental Audits. If Mortgagee has reason to believe that there are any Hazardous Substances on the Mortgaged Property and/or that Mortgagor has breached any of the terms and conditions of this Section 7, Mortgagee may, as it deems necessary in its sole discretion, conduct environmental assessments of the Mortgaged Property from time to time, such audits and tests to be conducted by an environmental consultant chosen by Mortgagee. Mortgagor shall pay Mortgagee on demand the reasonable costs of such audits or tests. Any such environmental assessments shall be considered the property of Mortgagee, and Mortgagee shall owe no duty of confidentiality to Mortgagor with respect to the contents thereof. However, Mortgagor shall be provided with copies of all reports and relevant correspondence. It is hereby acknowledged by Mortgagor that Mortgagee shall not vouch for or assume any responsibility for the scope of detail, contents or accuracy of any such environmental assessment, and that neither Mortgagor nor any other party shall have any recourse to or claim against Mortgagee for any act of omission or commission of the environmental consultant. Mortgagor shall fully cooperate with the environmental consultant. Mortgagee may also from time to time, as it deems to be reasonably necessary and at the expense of Mortgagor, obtain legal advice from an attorney competent in environmental law regarding the environmental condition of the Mortgaged Property. Mortgagee shall also have the right to require, from time to time, but, provided there has occurred no Event of Default, not more frequently than once per year, a certification by Mortgagor and any tenants of the Mortgaged Property whether or not there has been any change(s) in the environmental condition of the Mortgaged Property.

7.5Security for Cleanup. If any investigation, environmental report or governmental investigation or order indicates that there may exist any damage or risk to the Mortgaged Property, or any liability of any Mortgagor relating to any Hazardous Substances or other environmental conditions with respect to the Mortgaged Property, Mortgagee may require Mortgagor to furnish immediately an indemnity bond in an amount reasonably determined by Mortgagee, in its sole discretion, to be sufficient to pay all actual and estimated cleanup costs and to protect against any liens that are likely to arise with respect to such potential cleanup costs. Mortgagee's demand that Mortgagor post any bond or other security shall not be a waiver of any Event of Default or of any other right or remedy available to Mortgagee. Such obligation to post a bond shall not apply during the last six (6) months of the term of the Loan, provided and for so long as no Event of Default shall have occurred and be continuing.

EXHIBIT 10.1

7.6Indemnification. Mortgagor shall fully indemnify, defend and hold harmless Mortgagee, and its successors and assigns, from and against: (a) any third party claims involving Hazardous Substances on or affecting the Mortgaged Property or any violation of Environmental Laws and (b) any fines, penalties, reasonable attorney’s fees, sums paid in connection with any judicial or administrative investigation or proceedings, costs of cleanup assessed by a Governmental Authority, and all similar expenditures that relate in any way to Mortgagor or the Mortgaged Property, without regard to whether Mortgagor would have ultimately been responsible for such third party claims, fines, payments, fees, sums or costs. Any amounts that Mortgagor must pay to Mortgagee under this Section 7.6 are payable upon demand and, if unpaid, shall bear interest per annum, at the “Default Rate” (as defined in the Note) and such amounts, with interest, shall be added to the Indebtedness. The provisions of this Section 7.6 shall not be decreased or rendered ineffective in the event that Mortgagee elects not to pursue its remedies to foreclose the Mortgage. The liability of Mortgagor and any other Obligor hereunder shall be joint and several and shall survive the repayment of the Note and/or the release and/or assignment of the Mortgage or Note or any Guaranty.

7.7Environmental Report. Mortgagor has fully examined and considered the Environmental Review of Merritt Environmental Consulting Corp. dated April 29, 2016 in review of the Phase I Environmental Site Assessment dated June 12, 2012 prepared by Nova Consulting Group, Inc. for Sovereign Santander (collectively, the “Environmental Report”) and has no actual knowledge of any environmental condition on or affecting the Mortgaged Property which is not set forth in such report.

SECTION 8 - EVENTS OF DEFAULT

Any of the following events or conditions shall, at the option of Mortgagee, constitute an "Event of Default" under this Mortgage and the other Loan Documents and Obligations if not cured within the applicable cure period, if any, set forth below:

8.1Payments. Any failure to make on its due date any payment required to be made by Mortgagor under this Mortgage, the Note or any other Loan Document or Obligations (and any applicable grace, notice or cure period as to such payment set forth in that Loan Document shall have expired); or

8.2Other Terms. Any failure to perform or observe any non-monetary term or condition (not otherwise recited under this Section 8) under this Mortgage, the Note or any other Loan Document or Obligations which continues for thirty (30) days after notice thereof by the Mortgagee to the Mortgagor, provided, however, that if such default is capable of cure, but with due diligence cannot be cured within such thirty (30) day period and Mortgagor has promptly commenced to cure within such period and continuously pursues same diligently and expeditiously, then such period to cure shall be extended for so long as is reasonably necessary for Mortgagor in the exercise of due diligence to cure such default, it being agreed that no such extension shall be for a period in excess of one hundred twenty (120) days (subject to further extension by

EXHIBIT 10.1

Mortgagee, in Mortgagee’s sole discretion); or

8.3Representations. Any representation, statement or warranty made by or on behalf of any Obligor in this Mortgage, the Affidavit of Title or any other Loan Document, certificate or other writing made or given to Mortgagee at any time shall be incorrect, incomplete or misleading when made in any material respect; or

8.4Failure to Obtain Permission. Mortgagor shall do, or permit to be done, any act for which Mortgagee's consent is required under this Mortgage or any other Loan Document without first obtaining such consent in writing (except in the event of emergency); or

8.5Financial Information and Inspections. Any failure to furnish financial information which continues for thirty (30) days after notice thereof or to permit inspection of the Mortgaged Property or any records as required under this Mortgage or any other Loan Document; or

8.6Failure to Maintain Insurance. Any failure to maintain, or provide, within five (5) business days after notice, satisfactory evidence of, any insurance coverage required under this Mortgage or any other Loan Document; or

8.7Lien Defaults or Foreclosures. Any default or modification (without Mortgagee's prior written consent) shall have occurred in any mortgage, assignment, encumbrance or agreement constituting a Permitted Encumbrance, and any applicable cure period as to such default shall have expired, or proceedings shall have been instituted or actions taken for the foreclosure or enforcement of any mortgage, judgment, assignment or other lien or encumbrance affecting the Mortgaged Property and such proceedings have not been dismissed with prejudice within thirty (30) days after the commencement thereof; or

8.8Warrants and Tax Liens. Any warrant of attachment or for distraint, or notice of tax or other lien shall be issued relating to, or encumbering, any portion of the Mortgaged Property that is not discharged, or stayed and bonded, to the reasonable satisfaction of Mortgagee within thirty (30) days of notice of entry; or

8.9Judgments. Any judgment that would adversely affect in any material respect Mortgagor's ability to perform any obligations under any of the Loan Documents or the value of the Mortgaged Property or any other collateral under any of the Loan Documents shall be entered against Mortgagor that is not (a) within thirty (30) days of entry, discharged, or stayed and bonded, to the reasonable satisfaction of Mortgagee or (b) fully covered by insurance and the insurance company has unconditionally accepted liability for that judgment; or

8.10Loss of Collateral. There occurs any casualty on, or loss or destruction of, any Mortgaged Property that, in Mortgagee's reasonable judgment, involves material

EXHIBIT 10.1

damage to or loss of property, unless such loss or destruction is fully covered by insurance (subject to a standard insurance policy deductible provision of $25,000 or less) to the reasonable satisfaction of Mortgagee; or

8.11Hazardous Substances. There occurs, or it is found that there has previously occurred, any Use of any Hazardous Substances on the Mortgaged Property or by Mortgagor that will require Mortgagor to remedy and the cost of such remedy shall exceed $125,000; or

8.12Insolvency. Any filing of a petition by or against any Obligor under any bankruptcy or insolvency law or an assignment by any Obligor of any property or assets for the benefit of creditors, or the failure of any Obligor to pay debts in the ordinary course as those debts become due, or the calling of a meeting of creditors of any Obligor to obtain any general financial accommodation provided, however, that any Obligor shall have sixty (60) days to obtain a court order dismissing any bankruptcy or insolvency proceeding that is filed without consent of the debtor; or

8.13Seizure of Property. Any seizure by governmental authorities of, or the imposition of legal restraints against, the Mortgaged Property, which is not, within thirty (30) days of such seizure or imposition, released, discharged or fully bonded to the reasonable satisfaction of Mortgagee; or

8.14Non-Permitted Encumbrance. Any mortgage, assignment, lien, judgment or interest shall encumber any Mortgaged Property with the exception of any Permitted Encumbrances which shall not be discharged within thirty (30) days after notice thereof; or

8.15Default in Leases. Any material default on the part of Mortgagor shall occur under or there shall be a termination of any leases that presently or may in the future affect the Mortgaged Property and account for more than five percent (5%) of the annual rentals from the Mortgaged Property or result in a failure to maintain the required Debt Service Coverage Ratio; or

8.16 Dissolution. Any Obligor shall fail to remain in good standing in its state of incorporation or organization or dissolves or ceases to exist; or

8.17Adverse Change. Any adverse change in the creditworthiness or financial condition of any Obligor that, in the reasonable opinion of Mortgagee, materially increases Mortgagee's risk; or

8.18.Legal Changes. Any laws are enacted whereby there is a change which deducts the value of land or a change in taxation of mortgages and Mortgagor fails to enter into a reasonably satisfactory agreement with Mortgagee; or

8.19Entry. If Mortgagee or its representatives are not permitted, at all

EXHIBIT 10.1

reasonable times, to enter upon the Property and to inspect the Improvements and Fixtures and Equipment in accordance with the terms and provisions of this Mortgage; or

8.20Other Obligations. If the Mortgagor shall default beyond applicable grace and notice periods in the payment of any other indebtedness owed to Mortgagee or default under the terms of any Loan Document between Mortgagor and Mortgagee; or

8.21Transfer or Hypothecation. If Mortgagor or any interest in the Mortgagor is pledged, hypothecated, levied upon, encumbered, assigned or transferred (by operation of law or otherwise) in any manner, without the prior written consent of Mortgagee; or

8.22Easements. If any easement over, across, under or otherwise affecting the Mortgaged Property or any portion thereof shall be granted or released by Mortgagor without the Mortgagee's prior written consent except that Mortgagor may grant utility and other usual easements reasonably necessary for its use of the Mortgaged Property for their intended purposes; or

8.23Other Debts. If the Mortgagor shall default beyond applicable grace periods (as principal or surety) on any indebtedness for borrowed money or otherwise in an amount in excess of $125,000 in any one case or in the aggregate; or

8.24Additional Borrowings. Except as otherwise expressly set forth in this Mortgage, other than unsecured credit extensions or unsecured borrowings between Mortgagor and Affiliates, if the Mortgagor shall borrow funds or obtain credit, whether on a secured or unsecured basis, without the express written consent of Mortgagee, which consent may be granted or withheld in the Mortgagee’s sole discretion.

SECTION 9 - REMEDIES

9.1Remedies. Upon the occurrence of an Event of Default, Mortgagee may, at its option, do any of the following in any order at any time and in any combination:

(a)Acceleration of Obligations. Declare all principal, interest and expenses outstanding under the Note, this Mortgage and any other Obligations to be immediately due and payable in full; or

(b)Foreclosure. Institute proceedings to foreclose on all or any portion of the Mortgaged Property, and following receipt of a judgment of foreclose, cause the sale of the Mortgaged Property in accordance with applicable law, in one or several parcels, at Mortgagee's option; or