Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - NEOPHOTONICS CORP | nptn-20160930x10q.htm |

| EX-32.1 - EX-32.1 - NEOPHOTONICS CORP | nptn-20160930ex321055b8b.htm |

| EX-31.2 - EX-31.2 - NEOPHOTONICS CORP | nptn-20160930ex312eb0be4.htm |

| EX-31.1 - EX-31.1 - NEOPHOTONICS CORP | nptn-20160930ex3112b35f9.htm |

| EX-10.9 - EX-10.9 - NEOPHOTONICS CORP | nptn-20160930ex109679acd.htm |

| EX-10.8 - EX-10.8 - NEOPHOTONICS CORP | nptn-20160930ex1087ee846.htm |

| EX-10.14 - EX-10.14 - NEOPHOTONICS CORP | nptn-20160930ex10141cb65.htm |

| EX-10.13 - EX-10.13 - NEOPHOTONICS CORP | nptn-20160930ex1013c2585.htm |

| EX-10.12 - EX-10.12 - NEOPHOTONICS CORP | nptn-20160930ex1012e62f2.htm |

| EX-10.11 - EX-10.11 - NEOPHOTONICS CORP | nptn-20160930ex1011b6da9.htm |

| EX-10.10 - EX-10.10 - NEOPHOTONICS CORP | nptn-20160930ex1010f3c0e.htm |

Exhibit 10.7

LEASE

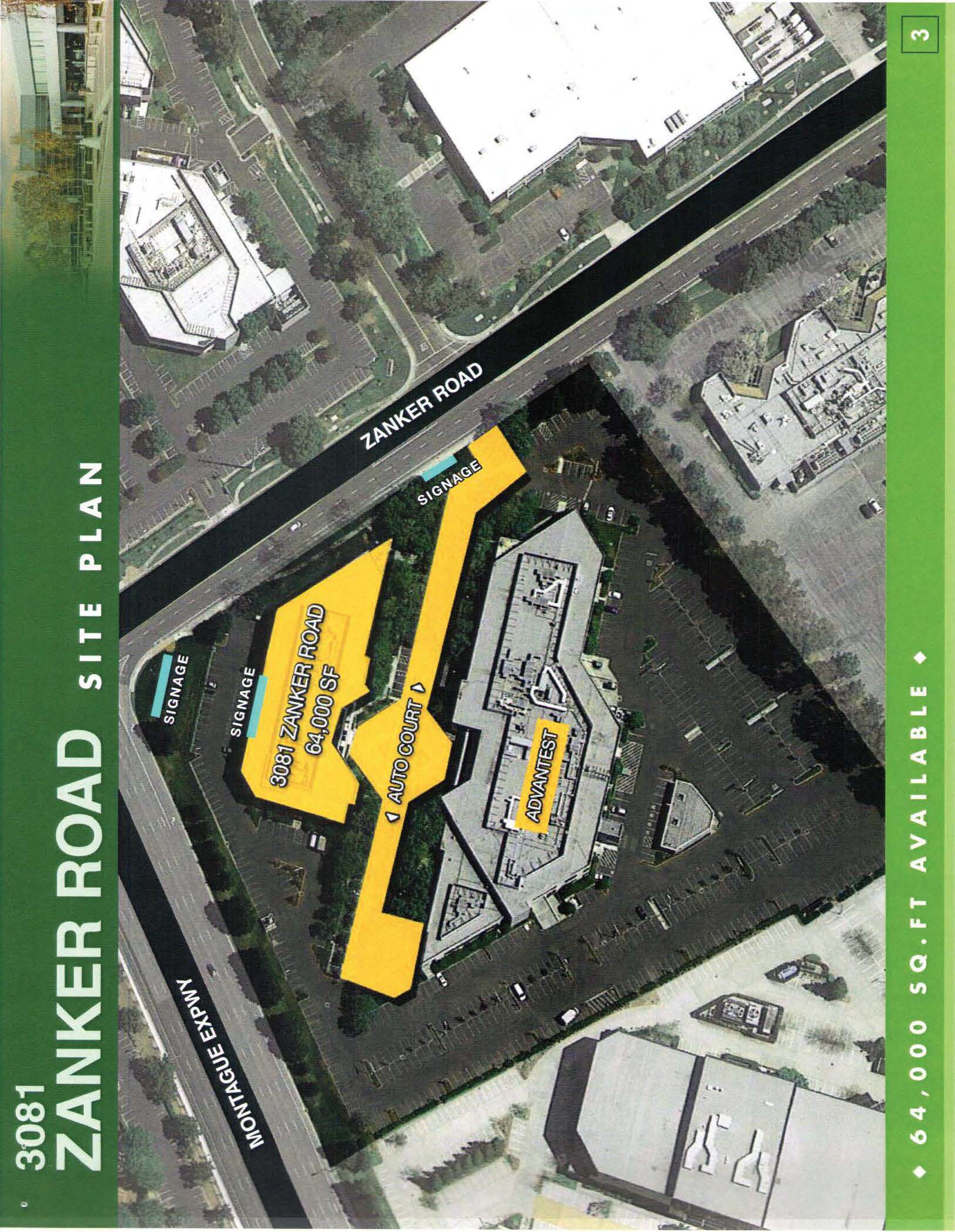

3081 ZANKER ROAD

SAN JOSE, CALIFORNIA

SP ZANKER PROPERTY, LLC

a Delaware limited liability company,

as Landlord,

and

NEOPHOTONICS CORPORATION,

a Delaware corporation,

as Tenant.

TABLE OF CONTENTS

|

1. |

DEMISE OF PREMISES |

|

|

2. |

USE. |

|

|

3. |

TERM. |

|

|

4. |

SECURITY DEPOSIT. |

|

|

5. |

RENT. |

|

|

6. |

RULES AND REGULATIONS AND COMMON AREA. |

|

|

7. |

PARKING. |

|

|

8. |

EXPENSES OF OPERATION, MANAGEMENT, AND MAINTENANCE OF THE COMMON AREAS OF THE COMPLEX. |

|

|

9. |

ACCEPTANCE AND SURRENDER OF PREMISES. |

|

|

10. |

“AS-IS” BASIS. |

|

|

11. |

ALTERATIONS AND ADDITIONS. |

|

|

12. |

TENANT MAINTENANCE. |

|

|

13. |

UTILITIES. |

|

|

14. |

TAXES. |

|

|

15. |

CABLING AND LINES. |

|

|

16. |

ABATEMENT. |

|

|

17. |

TENANT’S INSURANCE. |

|

|

18. |

PROPERTY AND LANDLORD’S LIABILITY INSURANCE. |

|

|

19. |

WAIVER OF CERTAIN CLAIMS. |

|

|

20. |

INDEMNIFICATION. |

|

|

21. |

COMPLIANCE. |

|

|

22. |

LIENS. |

|

|

23. |

SUBLEASING, ASSIGNMENT AND OTHER TRANSFERS. |

|

|

24. |

ESTOPPEL CERTIFICATES; SUBORDINATION; LENDER PROTECTIONS. |

|

|

25. |

ENTRY BY LANDLORD. |

|

|

26. |

TENANT'S DEFAULTS; LANDLORD'S REMEDIES. |

|

|

27. |

ABANDONMENT. |

|

|

28. |

DAMAGE AND DESTRUCTION. |

|

|

29. |

EMINENT DOMAIN. |

|

|

30. |

SALE OR CONVEYANCE BY LANDLORD. |

|

|

31. |

EXTENSION AND EXPANSION RIGHTS. |

|

|

32. |

HOLDING OVER. |

|

|

33. |

QUIET ENJOYMENT. |

|

|

34. |

CONSTRUCTION CHANGES. |

|

|

35. |

[OMITTED] |

|

|

36. |

ATTORNEYS’ FEES. |

|

|

37. |

WAIVER. |

|

|

38. |

NOTICES. |

|

|

39. |

EXAMINATION OF LEASE. |

|

|

40. |

DEFAULT BY LANDLORD. |

|

|

41. |

[OMITTED] |

|

|

42. |

LIMITATION OF LIABILITY. |

|

|

43. |

SIGNS. |

|

|

44. |

Utility Billing Information. |

|

|

45. |

Rooftop Equipment. |

|

|

46. |

HAZARDOUS MATERIALS. |

|

|

47. |

BROKERS. |

|

|

48. |

MISCELLANEOUS AND GENERAL PROVISIONS. |

|

ii

LEASE AGREEMENT

THIS LEASE AGREEMENT (this “Lease”) is entered into this 9th day of September, 2016 (the “Effective Date”), by and between SP ZANKER PROPERTY LLC, a Delaware limited liability company (“Landlord”), and NEOPHOTONICS CORPORATION, a Delaware corporation (“Tenant”).

WITNESSETH:

1

associated parking areas or which would unreasonably diminish Tenant’s rights hereunder (other than in a de minimus manner) or materially increase Tenant’s costs hereunder without the prior written consent of Tenant. Landlord shall have the right to require Tenant to execute (or make good faith and reasonable corrective comments to) and acknowledge, within fifteen (15) business days of a request by Landlord, an agreement in form and substance reasonably acceptable to Landlord and Tenant agreeing to and acknowledging the CC&Rs. Tenant shall not do or permit to be done in or about the Premises or the Complex nor bring or keep or permit to be brought or kept in or about the Premises or the Complex anything that is prohibited by or will in any way increase the existing rate of (or otherwise adversely affect) any fire insurance or other insurance covering the Complex or any part thereof, or any of its contents, or will cause a cancellation of any insurance covering the Complex or any part thereof, or any of its contents. Tenant shall not do or permit to be done anything in, on or about the Premises or the Complex that will in any way obstruct or interfere with the rights of other tenants or occupants of the Complex or injure them, or use or allow the Premises to be used for any unlawful purpose, nor shall Tenant cause, maintain or permit any nuisance in, on or about the Premises or the Complex. No sale by auction shall be permitted on the Premises. Tenant shall not place any loads upon the floors, walls, or ceiling that endanger or impair the Building Structure (defined in Paragraph 11(a)), or place any harmful fluids or other materials in the drainage system of the Building, or overload existing electrical or other mechanical systems. No waste materials or refuse shall be dumped upon or permitted to remain upon any part of the Premises or outside of the Building, except in trash containers placed inside exterior enclosures designated by Landlord for that purpose or inside of the Building where designated by Landlord. No materials, supplies, equipment, finished products or semi-finished products, raw materials or articles of any nature shall be stored upon or permitted to remain outside the Premises or on any portion of the Common Areas. Tenant shall not place anything or allow anything to be placed near the glass of any window, door partition or wall that may reasonably be deemed to appear unsightly from outside the Premises. No loudspeaker or other device, system or apparatus that can be heard outside the Premises shall be used in or at the Premises without the prior written consent of Landlord. Tenant shall not commit or suffer to be committed any waste in or upon the Premises subject to Paragraph 19 below. Tenant shall indemnify, defend, protect, and hold Landlord and its Mortgagees, officers, partners, members, shareholders, trustees, parent companies, directors, employees, representatives, successors and assigns (each, an “Indemnified Party” and collectively, the “Indemnified Parties”) harmless from and against all liabilities, obligations, losses, damages, penalties, actions, judgments, suits, costs, charges, expenses, disbursements, demands and claims, including attorneys’ fees and costs incurred as a result of such claims or in enforcing this indemnification provision (collectively, “Claims”), arising out of any failure of Tenant or any person controlled by Tenant to comply with any applicable Law relating to the Premises or Tenant’s use thereof or for which Tenant is otherwise obligated to comply under the terms of this Lease. The provisions of this Paragraph 2 are for the benefit of Landlord and the other Indemnified Parties only and shall not be construed to be for the benefit of any other tenant or occupant of the Complex other than Tenant. Landlord and Tenant hereby acknowledge that the Premises has not undergone inspection by a Certified Access Specialist (CASp). |

2

occurs on the Anticipated Delivery Date, then the Expiration Date will be September 30, 2027, and if the Delivery Date occurs on January 10, 2017 (i.e., after the Anticipated Delivery Date), then the Expiration Date shall be October 31, 2027. During the Construction Period, Tenant and Tenant’s representatives, vendors, employees and contractors shall have the right to enter the Premises for the purposes of installing and constructing the Tenant Improvements pursuant to the provisions of the Tenant Work Letter and of installing Tenant’s personal property and equipment, furniture, fixtures, voice and data cabling, as well as occupying the Premises for the conduct of Tenant’s business operations prior to the Commencement Date, all subject to the terms, conditions and requirements of this Lease other than the obligation to pay Base Rent (hereinafter defined) or the Direct Expenses (hereinafter defined). Tenant agrees that if for any reason Landlord is unable to achieve Delivery on or before the Anticipated Delivery Date, Tenant shall have no right to terminate this Lease and Landlord shall not be liable for any damage resulting from such inability, but except to the extent such delay is the result of the acts or omissions of Tenant, the Commencement Date, the Rent Commencement Date (as defined in Paragraph 5(a)) and the Additional Rent Commencement Date (as defined in Paragraph 5(h)) shall be delayed beyond the Target Rent Commencement Date and the Target Additional Rent Commencement Date (each as hereafter defined) on a day-for-day basis for each day of such delay in Delivery. At any time after the Commencement Date, Landlord shall have the right to submit to Tenant an amendment to this Lease in the form of Exhibit B to this Lease (the “Amendment”) confirming the Commencement Date, the Expiration Date, the Rent Commencement Date, the Base Rent Schedule and such other terms as may reasonably be provided in such amendment, and Tenant shall execute (or make good faith and reasonable corrective comments to) and deliver the Amendment to Landlord within ten (10) business days after Tenant’s receipt thereof. If Tenant fails to execute (or make good faith and reasonable corrective comments to) and return the Amendment within such ten (10) business day period, Tenant shall be deemed to have approved and confirmed the dates set forth therein, provided that such deemed approval shall not relieve Tenant of its obligation to execute and return the Amendment. |

3

other provisions of any Laws, now or hereinafter in force, to the extent the same restricts the amount or types of claim that a landlord may make upon a security deposit or imposes upon a landlord (or its successors) any obligation with respect to the handling or return of security deposits. Landlord and Tenant agree that Landlord may, in addition, claim those sums reasonably necessary to compensate Landlord for any foreseeable or unforeseeable loss or damage caused by the act or omission of Tenant. Tenant may not assign or encumber the Security Deposit, and any attempt to do so shall be void and, in all events, not binding upon Landlord. |

|

(a) Base Rent. From and after the Rent Commencement Date, Tenant shall pay, without notice or demand, to Landlord, or at such other place as Landlord may from time to time designate in writing at least ten (10) business days before the effective date of the change in the Rent payment address, in cash or other immediately available good funds, base rent (“Base Rent”), payable in monthly installments as set forth in the Base Rent Schedule set forth below, in advance on or before the first (1st) day of each and every month during the Term, without any setoff or deduction whatsoever except as expressly set forth herein. As used in this Lease, the term “Rent Commencement Date” means the date that is nine (9) months after the Commencement Date. The Rent Commencement Date is anticipated to be October 1, 2017 (the “Target Rent Commencement Date”), provided that if the Delivery Date occurs after the Anticipated Delivery Date, then for each day after the Anticipated Delivery Date that elapses until the actual Delivery Date occurs, the Rent Commencement Date shall be extended by the same number of days. The period of time elapsing between the Commencement Date and the Rent Commencement Date is referred to as the “Base Rent Abatement Period.” Base Rent shall increase by three (3%) on the first day of the first full calendar month that is twelve (12) months after the Commencement Date (the “First Adjustment Date”) and on each subsequent anniversary of the First Adjustment Date (each, an “Adjustment Date”), as set forth in the Base Rent Schedule set forth below. The First Adjustment Date is anticipated to occur on January 1, 2018. |

4

BASE RENT SCHEDULE

|

Months |

Monthly Base Rent |

|

|

Commencement Date until Rent Commencement Date |

$0.00 (Abated)* |

|

|

$144,000.00 |

||

|

First Rent Adjustment Date until Second Adjustment Date |

$148,320.00 |

|

|

Second Adjustment Date until Third Adjustment Date |

$152,769.60 |

|

|

Third Adjustment Date until Fourth Adjustment Date |

$157,352.69 |

|

|

Fourth Adjustment Date until Fifth Adjustment Date |

$162,073.27 |

|

|

Fifth Adjustment Date until Sixth Adjustment Date |

$166,935.47 |

|

|

Sixth Adjustment Date until Seventh Adjustment Date |

$171,943.53 |

|

|

Seventh Adjustment Date until Eighth Adjustment Date |

$177,101.84 |

|

|

Eighth Adjustment Date until Ninth Adjustment Date |

$182,414.89 |

|

|

Ninth Adjustment Date until Tenth Adjustment Date |

$187,887.34 |

|

|

Tenth Adjustment Date until Expiration Date |

$193,523.96 |

*The abatement of Base Rent during the Base Rent Abatement Period is subject to Paragraph 5(h) below.

|

(b) Additional Rent and Rent Defined. As used herein, the term “Additional Rent” means Operating Expenses (as defined below), Management Fees (as defined in Paragraph 5(f)), and all other amounts payable by Tenant to Landlord pursuant to the terms of this Lease other than Base Rent. “Rent” or “rent” means Base Rent and Additional Rent. In the event of nonpayment by Tenant of Operating Expenses or other Additional Rent, Landlord shall have all the rights and remedies with respect thereto as Landlord has for nonpayment of Base Rent. During the Construction Period, in addition to not being obligated to pay Base Rent, Tenant shall not be obligated to pay Operating Expenses, Real Property |

5

Taxes or the Management Fee (the “Additional Rent Abatement”); the Additional Rent Abatement will expire as of the expiration of the Construction Period. The date on which Tenant is required to commence paying Operating Expenses, Real Property Taxes and the Management Fee (i.e., the day following the date of expiration of the Construction Period) is referred to as the “Additional Rent Commencement Date.” The Additional Rent Commencement Date is anticipated to be April 1, 2017 (the “Target Additional Rent Commencement Date”), provided that if the Delivery Date occurs after the Anticipated Delivery Date, then for each day after the Anticipated Delivery Date that elapses until the actual Delivery Date occurs, the Additional Rent Commencement Date shall be extended by the same number of days. |

|

(c) Time for Payment. Starting on the first day of the first month after the Additional Rent Commencement Date and/or the Rent Commencement Date, as applicable, monthly Rent (which will not include Base Rent until the Rent Commencement Date) shall be due in advance on the first day of each such calendar month. Notwithstanding the preceding sentence to the contrary, the full monthly payment of Base Rent and estimated Operating Expenses for the first full month of the Term after the Base Rent Abatement Period (the “Prepaid Rent”) shall be due and payable concurrent with the execution and delivery of this Lease. Accordingly, concurrently with the full execution and delivery of this Lease, Tenant shall pay to Landlord as Prepaid Rent the sum of One Hundred Sixty-Eight Thousand Seven Hundred Fifty-Five and 20/100 Dollars ($168,755.20). The Rent for any fractional month shall be a proportionate amount of a full calendar month’s Rent based on the proportion that the number of days in such fractional month bears to the number of days in the calendar month during which such fractional month occurs. All other payments or adjustments required to be made under the terms of this Lease that require proration on a time basis shall be prorated on the same basis. |

|

(d) Late Charge. Notwithstanding any other provision of this Lease, if any installment of Rent or any other sum due from Tenant shall not be received by Landlord or Landlord's designee by the due date therefor, then Tenant shall pay to Landlord a late charge equal to five percent (5%) of the amount due plus any reasonable attorneys’ fees incurred by Landlord by reason of Tenant's failure to pay Rent and/or other charges when due hereunder; notwithstanding the foregoing, Tenant shall be entitled to a notice of non-payment and a five (5) day cure period prior to the imposition of such late charge on the first (1st) occasion during the first five (5) years of the Term or any subsequent five (5) year period of the Term or any extension thereof in which any installment of Rent is not timely paid. The late charge shall be deemed Additional Rent and the right to require it shall be in addition to all of Landlord's other rights and remedies hereunder, at law and/or in equity, and shall not be construed as liquidated damages or as limiting Landlord's remedies in any manner. In addition to the late charge described above, any Rent or other amounts owing hereunder which are not paid by the date that they are due shall thereafter bear interest until paid at a rate (the "Interest Rate") equal to the lesser of (i) the "Prime Rate" or "Reference Rate" announced from time to time by Bank of America, N.A. (or such reasonable comparable national banking institution as selected by Landlord in the event Bank of America, N.A. ceases to exist or publish a Prime Rate or Reference Rate), plus four percent (4%), or (ii) the highest rate permitted by applicable Law. |

|

(e) Operating Expenses. This Lease is a triple net lease, and Base Rent shall be paid to Landlord absolutely net of all costs and expenses relating to the Building and Tenant’s Proportionate Share (defined below) of the Complex, except as specifically provided to the contrary in this Lease. As used in this Lease, Tenant’s “Proportionate Share” of Operating Expenses, Real Property Taxes and other Direct Expenses (as defined below in this Paragraph 5(e)) or other amounts payable by Tenant shall be deemed to be thirty-six percent (36%), provided that with respect to any Operating Expenses that are allocable solely to the Building (and not to the Other Building) Tenant’s Proportionate Share shall be one hundred percent (100%). Similarly, with respect to Operating Expenses that are allocable solely to the Other Building (or any collection of buildings now or hereafter located at the Complex but not the |

6

Building), Tenant’s Proportionate Share will be zero percent (0%). The parties hereby agree that the Premises contain 64,000 rentable square feet, there shall be no adjustment in the Base Rent or other amounts set forth in this Lease that are determined based upon rentable or usable square feet of the Premises, and Tenant shall have no right to terminate this Lease or receive any adjustment or rebate of any Base Rent or Additional Rent payable hereunder if the square footage of the Complex or the Premises is incorrect. However, if the rentable area of the Complex is changed by the construction of new rentable area on the Land (other than with regard to increases to the rentable area of the Building as the result of the Lobby Changes, if any, made by Tenant pursuant to Section 5.7 of the Tenant Work Letter), Tenant’s Proportionate Share shall be adjusted accordingly. Beginning on the first (1st) day immediately following the expiration of the Additional Rent Abatement Period, Tenant shall pay to Landlord or to Landlord’s designated agent, in addition to the Base Rent and as Additional Rent, the following (collectively, “Direct Expenses”): |

|

(i) Tenant’s Proportionate Share of all Real Property Taxes for the Complex as set forth in Paragraph 14, and |

|

(ii) Tenant’s Proportionate Share of insurance premiums and deductibles relating to the Complex and Premises, as set forth in Paragraph 18, and |

|

(iii) Tenant’s Proportionate Share of other Operating Expenses required to be paid under Paragraph 8, and |

|

(iv) All charges, costs and expenses that Tenant is required to pay hereunder other than Base Rent, together with all interest and penalties, costs and expenses (including reasonable attorneys’ fees and legal expenses), that may accrue thereto in the event of Tenant’s failure to pay such amounts, and all damages, reasonable costs and expenses that Landlord may incur by reason of default of Tenant or failure on Tenant’s part to comply with the terms of this Lease. |

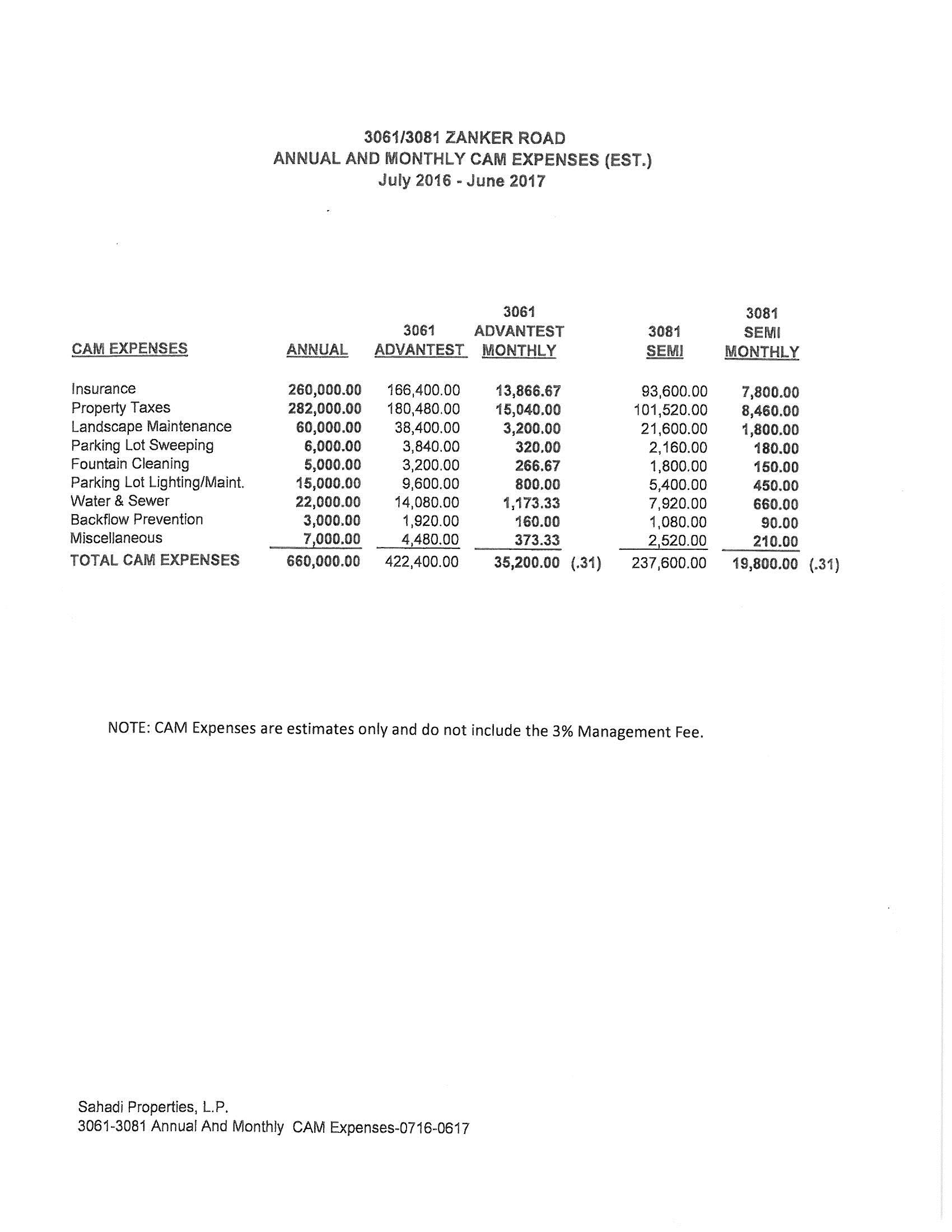

Tenant shall pay to Landlord monthly, in advance, Tenant’s Proportionate Share of the amount estimated by Landlord (as described below) to be Landlord’s approximate average monthly expenditure for such Direct Expenses. Landlord shall endeavor to give Tenant, on or before July 1 each year during the Term, a yearly expense estimate statement (the “Estimate Statement”), which shall set forth Landlord's reasonable estimate (the “Estimate”) of what the total amount of the Operating Expenses, Real Property Taxes and Management Fee charges allocated to the Building shall be and the estimated amount of Tenant's Proportionate Share of such amounts (the “Estimated Expense Payments”) for the upcoming fiscal year. Landlord's Estimate Statement for any fiscal year shall be set forth in reasonable detail, and shall contain a line-item breakdown of component costs and the method of calculation of any categories of Direct Expenses which represents an equitable proration by Landlord between the Building and the Other Building (or any other building subsequently constructed in the Complex) as set forth below. As used in this Lease, the term “fiscal year” shall mean July 1 to June 30 of each year during the Term of the Lease. Landlord shall have the right to update the Estimate Statement and Estimated Expense Payments from time to time, in which event Tenant thereafter shall pay the revised Estimated Expense Payments set forth in such updated Estimate Statement commencing as of the first (1st) day and the first (1st) calendar month which occurs at least thirty (30) days after Landlord’s delivery to Tenant of notice of such revision. The failure of Landlord to timely furnish an Estimate Statement for any fiscal year shall not preclude Landlord from enforcing its rights to collect any Operating Expenses, Real Property Taxes or other amounts payable by Tenant hereunder. Upon delivery of the Estimate Statement, Tenant shall pay, with its next installment of Base Rent due at least thirty (30) days after the date of delivery of the Estimate Statement, a fraction of the Estimated Expense Payments for the then-current fiscal year (reduced by any amounts paid pursuant to the last sentence of this paragraph). Such fraction shall have as its numerator the number of months which have elapsed in such current fiscal year to the

7

month of such payment, both months inclusive, and shall have twelve (12) as its denominator. Until a new Estimate Statement is furnished, Tenant shall pay monthly, with the monthly Base Rent installments, an amount equal to one-twelfth (1/12) of the total Estimated Expense Payments set forth in the previous Estimate Statement delivered by Landlord to Tenant.

Within one hundred eighty (180) days after the end of each fiscal year, or more frequently if Landlord elects to do so, at Landlord’s sole and absolute discretion, the Estimate Expense Payments shall be reconciled with Landlord’s actual expenditure for such Additional Rent items and set forth in a reasonably detailed statement (the “Statement”).

Landlord has provided Tenant with an example of, and Tenant has approved, the form of Estimate Statement/ Statement currently used by Landlord, a copy of which is attached to this Lease as Exhibit J-1 (the “Sample Statement”). Tenant acknowledges that the amounts specified in the Sample Statement are estimates only and do not constitute a representation or warranty by Landlord of what actual Direct Expenses are or will be during the Term. If Landlord hereafter makes any material changes to the form of the Sample Statement, any future Estimate Statement and Statement shall contain, to the extent applicable, the following:

(A)a line-item breakdown showing at least the following major categories of costs:

|

(i) maintenance and repairs (including landscape maintenance, parking lot sweeping, fountain cleaning, and parking lot lighting maintenance); |

|

(i) utilities (electricity, water, sewer, and backflow prevention, maintenance and repairs); |

|

(i) insurance; |

|

(i) salaries (engineering and administrative); |

|

(i) general and administrative (Management Fees; professional services; office supplies; and other); and |

|

(i) Real Property Taxes; |

(B)the anticipated savings to be realized in the subject calendar year by any Permitted Capital Item (defined below), the cost of which is included as a portion of Operating Expenses because such Capital Item was intended to reduce other Operating Expenses;

(C)to the extent that the Direct Expenses include wages, salaries and payroll burdens that are not included in the Management Fee, the method of prorating the wages, salaries and payroll burden of employees engaged primarily, but not solely, in the management, operation or maintenance of the Building or portions of the Complex benefitting the Building versus taxes which primarily or solely benefit the Other Building or any other building(s) now or hereafter located on the Complex; and

(D)an explanation in reasonable detail of any other proportionate cost attributable to the Building which represents a proration of costs shared by one or more buildings.

Tenant shall pay to Landlord, within thirty (30) days after delivery of the applicable Statement, the amount of actual Direct Expenses expended by Landlord in excess of the Estimated Expense Payments, or if the Estimated Expense Payments actually paid by Tenant exceeds Tenant’s Proportionate Share of the

8

actual amounts of Direct Expenses paid by Landlord, Landlord shall reimburse or credit to Tenant (provided Tenant is not in Default) any amount of Estimated Expense Payments made by Tenant in excess of Tenant’s Proportionate Share of Landlord’s actual expenditures for such Additional Rent items.

Notwithstanding the foregoing, at Landlord’s Option, Landlord shall have the right to separately charge and collect in a lump sum from Tenant any Real Property Taxes and insurance premiums by delivering to Tenant an invoice setting forth the applicable Real Property Taxes and insurance premiums that are due. In such event, Tenant shall pay Landlord Tenant’s Proportionate Share of such expenses within thirty (30) days (or, in the case of insurance premiums, within fifteen (15) days) after Landlord’s delivery of the applicable invoice to Tenant. Tenant acknowledges that to the extent Landlord has prepaid any Operating Expenses (such as insurance premiums) or Real Property Taxes for the Premises or the Complex prior to the Additional Rent Commencement Date that relate to Operating Expenses that are payable by Tenant following the Additional Rent Commencement Date, Tenant shall reimburse Landlord for its Proportionate Share of such expenses as set forth in this Paragraph 5(e).

|

(f) Fixed Management Fee. Beginning on the Additional Rent Commencement Date, Tenant shall pay to Landlord, in addition to the Base Rent and as part of the Additional Rent, a fixed monthly management fee (“Management Fee”) equal to three percent (3%) per month of all Base Rent and Direct Expenses. |

|

(g) Place of Payment of Rent. All Rent hereunder shall be paid to Landlord at the office of Landlord at: SP Zanker Property, LLC, c/o Sahadi Properties, L.P. 800 Pollard Road, C-36, Los Gatos, California 95032, or to such other person or to such other place as Landlord may from time to time designate in writing at least thirty (30) days prior to the effective date of the address change. |

|

(h) Abated Rent. Landlord and Tenant acknowledge that Tenant shall not be obligated to pay Base Rent attributable to the Premises during the Base Rent Abatement Period (the "Base Rent Abatement") and that the aggregate amount of the Base Rent Abatement equals One Million Two Hundred Ninety-Six Thousand and 00/100 Dollars ($1,296,000.00). Tenant acknowledges and agrees that during the Base Rent Abatement Period, such abatement of Base Rent for the Premises shall have no effect on the calculation of any future increases in Base Rent or Operating Expenses payable by Tenant pursuant to the terms of this Lease, which increases shall be calculated without regard to such Base Rent Abatement. Tenant acknowledges and agrees that the foregoing Base Rent Abatement has been granted to Tenant as additional consideration for entering into this Lease, and for agreeing to pay the Rent and perform the terms and conditions otherwise required under this Lease. If Tenant shall be in Default hereunder, and if Landlord terminates this Lease as a consequence of such Default, then Landlord may include in its calculation of termination damages the then (as of the date of the Default) unamortized portion of the Base Rent Abatement, assuming amortization of the Abated Rent (without interest) on a straight line basis over the Term. |

|

(i) Landlord’s Records. Landlord shall maintain during the Term complete and accurate books of account and records in accordance with sound real estate management and accounting practices as are reasonably necessary to properly audit Direct Expenses. Upon Tenant’s written request given not more than one hundred twenty (120) days after Tenant’s receipt of a Statement for a particular fiscal year, and provided that Tenant is not then in Default, specifically including, but not limited to, the timely payment of Additional Rent (whether or not a component thereof is the subject of the audit contemplated herein), Landlord shall furnish Tenant with such reasonable supporting documentation pertaining to the calculation of the Direct Expenses payable by Tenant as set forth in the Statement as Tenant may reasonably request. Landlord shall provide said documentation pertaining to the relevant |

9

Direct Expenses to Tenant within sixty (60) days after Tenant’s written request therefor. Within sixty (60) days after Landlord’s delivery of all of such supporting documentation (the "Audit Period"), if Tenant disputes the amount of the Direct Expenses payable by Tenant set forth in the Statement, after reasonable notice to Landlord and at reasonable times, Tenant may retain an independent certified public accountant to conduct an audit at Landlord’s office of Landlord’s records with respect to the Direct Expenses payable by Tenant set forth in the Statement, provided that (i) Tenant is not then in Default, (ii) Tenant has paid all amounts required to be paid under the applicable Estimate Statement and Statement, and (iii) a copy of the audit agreement between Tenant and its particular certified public accounting firm has been delivered to Landlord prior to the commencement of the audit. Any such accountant shall (A) be a member of a nationally or regionally recognized certified public accounting firm which has previous experience in auditing financial operating records of landlords of office buildings, (B) not already be providing primary accounting and/or lease administration services to Tenant and shall not have provided primary accounting and/or lease administration services to Tenant in the past three (3) years, (C) not be working on a contingency fee basis [i.e., Tenant must be billed based on the actual time and materials that are incurred by the certified public accounting firm in the performance of the audit], and (D) not currently be providing accounting and/or lease administration services to another tenant of the Complex in connection with a review or audit by such other tenant of similar expense records). In connection with such audit, Tenant and Tenant’s certified public accounting firm must execute a commercially reasonable confidentiality agreement regarding such audit. Any audit report prepared by Tenant’s certified public accounting firm shall be delivered concurrently to Landlord and Tenant within the Audit Period. Tenant’s failure to audit the amount of the Direct Expenses payable by Tenant set forth in any Statement within the Audit Period shall be deemed to be Tenant’s approval of such Statement and Tenant, thereafter, waives the right or ability to audit the amounts set forth in such Statement. If after such audit, Tenant still disputes the Direct Expenses payable by Tenant, an audit to determine the proper amount shall be made, at Tenant’s expense, by an independent certified public accountant (the "Accountant") selected by Landlord and subject to Tenant’s reasonable approval. Tenant hereby acknowledges that Tenant’s sole right to audit Landlord’s records and to contest the amount of Direct Expenses payable by Tenant shall be as set forth in this Paragraph 5(i), and Tenant hereby waives any and all other rights pursuant to applicable law to audit such records and/or to contest the amount of Direct Expenses payable by Tenant. If Landlord's Statement is ultimately determined to be in error, within thirty (30) days after such determination, Landlord will reimburse to Tenant, or Tenant will pay to Landlord, any amount which may be determined to have been due as a result of the Accountant’s audit; additionally, if Landlord is determined to have overcharged Tenant for Direct Expenses by five percent (5%) or more, Landlord shall reimburse Tenant within thirty (30) days following such determination for the reasonable cost of the Accountant (which cost may not be included as a Direct Expense). |

|

(j) Survival. The respective obligations of Landlord and Tenant under this Paragraph 5 shall survive the expiration or other termination of the Term of this Lease, and if the Term hereof shall expire or shall otherwise terminate on a day other than the last day of a fiscal year, the actual Base Rent or Additional Rent incurred for the fiscal year in which the Term hereof expires or otherwise terminates shall be determined and settled on the basis of the statement of actual Base Rent or Additional Rent for such fiscal year and shall be prorated in the proportion which the number of days in such fiscal year preceding such expiration or termination bears to 365. Notwithstanding the foregoing, Tenant will not be responsible for any Direct Expenses attributable to any fiscal year which is first billed to Tenant more than thirty (30) months after the date of expiration of the expiration of the fiscal year to which such Direct Expenses apply, provided that Tenant shall nonetheless be responsible for any such sums for any fiscal year if the same are first levied by any governmental authority or by any public utility companies following the date that is thirty (30) months following the expiration of such fiscal year. |

10

may be reasonably modified from time to time in Landlord’s good faith discretion (collectively, the “Rules and Regulations”), Tenant and Tenant’s employees, agents, contractors, customers, guests and invitees (collectively, “Tenant Parties”) shall, in common with other occupants of the Complex and their respective employees, invitees and customers, and others entitled to the use thereof, have the non-exclusive right to use the access roads, Parking Area, and facilities provided and designated by Landlord for the general use and convenience of the occupants of the Complex (collectively, “Common Areas”). Tenant’s right to use the Common Areas shall terminate upon the termination of this Lease. Landlord reserves the right from time to time to make changes in the shape, size, location, amount and extent of the Common Areas, provided that the same do not (other than on a temporary basis) materially and adversely affect Tenant’s ability to have access to and/or use of the Premises and have access to and use of all of the spaces in the Parking Area allocated to Tenant hereunder. Landlord further reserves the right to promulgate such reasonable changes or amendments to the Rules and Regulations as Landlord may deem appropriate for the best interests of the occupants of the Complex. The Rules and Regulations shall be binding upon Tenant upon ten (10) days following delivery of a copy of them to Tenant, and Tenant shall abide by them and cooperate in their observance. Landlord shall not be responsible to Tenant for the non-performance by any other tenant or occupant of the Complex of any of the Rules and Regulations and shall not be required to provide or otherwise be responsible for providing security in the Premises, the Common Areas, or anywhere in the Complex for Tenant or any Tenant Parties. Landlord further reserves the right from time to time without notice to Tenant (i) to close temporarily any of the Common Areas; (ii) to make changes to the Common Areas as described above; (iii) add additional buildings and improvements to the Common Areas subject to the limitations described above; (v) to remove buildings (other than the Premises/Building) and land from the Common Areas subject to the limitations described above; (v) to designate land outside the Complex to be part of the Common Areas, and in connection with the improvement of such land to add additional buildings and Common Areas to the Land; (vi) to use the Common Areas while engaged in making additional improvements, repairs or alterations to the Land or to any adjacent land, or any portion thereof subject to the limitations described above; and (vii) to do and perform such other acts and make such other changes in, to or with respect to the Land, the Common Areas or the expansion thereof as Landlord may, in the exercise of its reasonable judgment, deem to be appropriate subject to the limitations described above. Landlord shall operate, manage, and maintain the Common Areas in good condition and repair, provided that all the costs thereof shall be Common Areas Expenses to the extent permissible hereunder. |

11

Tenant’s parking spaces (other than Tenant’s Exclusive Parking Spaces) within the Parking Area in the event of a dispute among the tenants occupying the building and/or Complex referred to herein, in which event Tenant agrees that Tenant and the Tenant Parties shall not use any parking spaces other than those parking spaces specifically designated by Landlord for Tenant’s use; in such event, Landlord will use reasonable efforts to locate such parking spaces in a contiguous block, as close as possible to the Building. Such parking spaces, if specifically designated by Landlord to Tenant, may be relocated by Landlord at any time, and from time to time, and Landlord reserves the right, at Landlord’s sole discretion, to rescind any specific designation of parking spaces (other than Tenant’s Exclusive Parking Spaces), thereby returning Tenant’s parking spaces to the common Parking Area. Landlord shall give Tenant written notice of any change in Tenant’s parking spaces. Tenant shall not, at any time, park or permit to be parked, any trucks or vehicles adjacent to the loading areas so as to interfere in any way with the use of such areas, nor shall Tenant at any time park or permit the parking of Tenant’s trucks or other vehicles or the trucks and vehicles of Tenant’s suppliers or others, in any portion of the Common Areas not designated by Landlord for such use by Tenant. Tenant shall not park nor permit to be parked, any inoperative vehicles or equipment on any portion of the common Parking Area or other Common Areas of the Complex. Tenant agrees to assume responsibility for compliance by its employees and other Tenant Parties with the parking provisions contained herein. At Tenant’s sole expense, Landlord shall have the right to tow away from the Complex any vehicle belonging to Tenant or any Tenant Party parked in violation of these provisions, or to attach violation stickers or notices to such vehicles. Tenant shall use the parking spaces for vehicle parking only and shall not use the Parking Areas for storage. |

12

Complex or to any portion of the Complex which is reserved for the exclusive use of any one Complex tenant (other than Tenant) or any collection of Complex tenants which excludes Tenant); (H) the Management Fees (I) accounting, legal and other professional services incurred in connection with the operation of the Complex and the calculation of Operating Expenses and Taxes; (J) a reasonable allowance for depreciation on machinery and equipment used to operate and maintain the Complex; (K) the reasonable cost of contesting the validity or applicability of any Laws that may affect the Complex; (L) [OMITTED]; (M) supplies, materials, tools and rental equipment; (N) license, permit, and inspection fees; utility charges associated with exterior landscaping and lighting (including water and sewer charges); (O) costs incurred in connection with a governmentally mandated transportation system management program or similar program; (P) costs under any instrument pertaining to the sharing of costs by the Complex, including without limitation payments under any easement, license, operating agreement, declaration, restrictive covenant, or instrument pertaining to the sharing of costs by the Complex, including, without limitation, any covenants, conditions and restrictions affecting the Property, and reciprocal easement agreements affecting the property, parking licenses, and any agreements with transit agencies affecting the Property; (P) fees, charges or assessments imposed by, or resulting from any mandate imposed on Landlord by, any federal, state or local government for fire and police protection, trash removal, community services, or other services which do not constitute Real Property Taxes; and (Q) any other cost, expenditure, fee or charge, whether or not hereinbefore described which in accordance with generally accepted property management practices would be considered an expense of owning, managing, operating, maintaining, repairing, replacing, restoring, and/or improving the Complex which is properly passed through to tenants on a so-called “triple net” basis. As used herein, however “Operating Expenses” shall not include: |

|

(i) Landlord’s principal or interest payments on indebtedness secured by the Complex; |

|

(i) expenses by Landlord for the particular benefit of any other tenant; |

|

(i) cost for the installation of any other tenant improvements; |

|

(i) cost of attracting and leasing (or attempting to lease) to tenants; |

|

(i) executive salaries; |

|

(i) any capital item whatsoever, except Permitted Capital Items; |

|

(i) repairs or other work occasioned by fire, windstorm or other insured casualty or hazard, to the extent that Landlord shall receive proceeds of such insurance (provided that Landlord’s failure to maintain the insurance coverage required to be carried by Landlord under this Lease will not be a valid basis for including in Operating Expenses to the extent that the cost of repair otherwise would have been covered by such insurance); |

|

(i) the cost of tenant newsletters and Building promotional gifts, events or parties for existing or future occupants, and the costs of signs in or on the Building identifying the owner of the Building or other third parties’ signs and any costs related to the celebration or acknowledgment of holidays; |

|

(i) repairs or rebuilding necessitated by condemnation; |

|

(i) Real Estate Taxes; |

13

|

(i) salaries of individuals who hold a position which is generally considered to be higher in rank than the position of the manager of the Complex or the chief engineer of the Complex; |

|

(i) subject to Paragraph 46, any costs incurred to test, survey, clean up, contain, abate, remove or otherwise remedy any spill or discharge of Hazardous Materials; |

|

(i) the costs of electrical power or any other utility provided to the premises of other tenants or occupants of the Complex or to any portion of the Complex which solely benefits other Complex occupants but not Tenant; |

|

(i) the cost of any service sold to any tenant or occupant of the Complex for which Landlord is entitled to be reimbursed as an additional charge or rental over and above the basic rent and escalations payable under the lease or occupancy agreement with that tenant or other occupant; |

|

(i) costs incurred by Landlord in connection with rooftop communications equipment of Landlord or other third parties, or Complex occupants; |

|

(i) amounts paid to any person, firm or corporation related or otherwise affiliated with Landlord or any general partner, officer or director of Landlord or any of its general partners, to the extent same materially exceeds arms-length competitive prices paid in the Relevant Market for the services or goods provided; |

|

(i) costs relating to maintaining Landlord's existence, either as a corporation, partnership, or other entity, such as trustee's fees, annual fees, partnership or organization or administration expenses, deed recordation expenses, as well as the operation of the entity which constitutes Landlord, as the same are distinguished from the costs of operation of the Complex, as well as partnership accounting and legal matters, costs of defending any lawsuits with any mortgagee, costs of any disputes between Landlord and its employees, disputes of Landlord with Complex management or personnel, or outside fees paid in connection with disputes with other tenants; |

|

(i) increased costs incurred due to Landlord's violation of any terms and conditions of this Lease or any other lease relating to the Building or of any Law to the extent that compliance with such Law is Landlord’s responsibility under this Lease; |

|

(i) increased costs arising from the negligence of Landlord or its agents, or of any other tenant, or any vendors, contractors, or providers of materials or services selected, hired or engaged by Landlord or its agents; |

|

(i) costs incurred in removing and storing the property of former tenants or occupants of the Building; |

|

(i) (i) the cost of installing, operating and maintaining any specialty service, observatory, broadcasting facilities, luncheon club, museum, athletic or recreational club, or child care facility, and (ii) the cost of installing, operating and maintaining any other service operated or supplied by or normally operated or supplied by a third party under an agreement between a third party and a landlord; |

|

(i) costs for acquisition of sculpture, paintings, other objects of art, as well as the cost of insuring, repairing or maintaining the same; |

14

|

(i) title insurance, key man and other life insurance, long-term disability insurance and health, accident and sickness insurance, except only for group plans providing reasonable benefits to persons of the grade of building manager and below employed and engaged on a substantially full time basis in operating and managing the Building; |

|

(i) any costs, fees, dues, contributions or similar expenses for industry associations or similar organizations; |

|

(i) the entertainment expenses and travel expenses of Landlord, its employees, agents, partners and affiliates; |

|

(i) consulting costs and expenses paid by Landlord unless they relate exclusively to the improved management or operation of the Complex. |

The cost of Permitted Capital Items will, for the purpose of inclusion in Operating Expenses, be amortized by Landlord on a straight line basis over a ten (10) year term. The amortized cost of any Permitted Capital Items may include interest at the rate paid by Landlord on any funds borrowed (or, if Landlord elects to fund such expenditure using its own funds, at the market rate of interest, as reasonably determined by Landlord, that Landlord reasonably would have paid had Landlord elected to finance such expenditure) from an unaffiliated third-party financial institution, but in no event greater than the Interest Rate.

Landlord shall have the right, from time to time, to equitably allocate some or all of the Operating Expenses, Real Property Taxes and other charges among different tenants or buildings comprising the Complex as and when such different buildings are constructed and added to (and/or excluded from) the Complex or otherwise (the “Cost Pools”). In addition, Landlord shall have the right from time to time, in its reasonable discretion, to include or exclude existing or future buildings in the Complex for purposes of determining Operating Expenses and Real Property Taxes.

If at any time during the Term the Building or the Complex is damaged by an earthquake and if in connection with such earthquake Landlord is required to make a deductible payment that is less than an amount that exceeds two hundred fifty percent (250%) of the then-applicable monthly Base Rent (the “Earthquake Deductible Threshold”) under Landlord’s policy of earthquake insurance, Operating Expenses for the applicable calendar year will include such deductible, which will be payable in monthly installments during the remainder of the calendar year. If as a result of any such earthquake Landlord is required to make a deductible payment equal to or in excess of the Earthquake Deductible Threshold, Operating Expenses for the applicable calendar year will include the deductible up to the amount of the Earthquake Deductible Threshold as described above, and the remaining balance of any such deductible payment (together with interest thereon) shall, for the purposes of inclusion in Operating Expenses, be treated as a Permitted Capital Item (and the amortization period associated therewith shall be deemed to be ten (10) years).

|

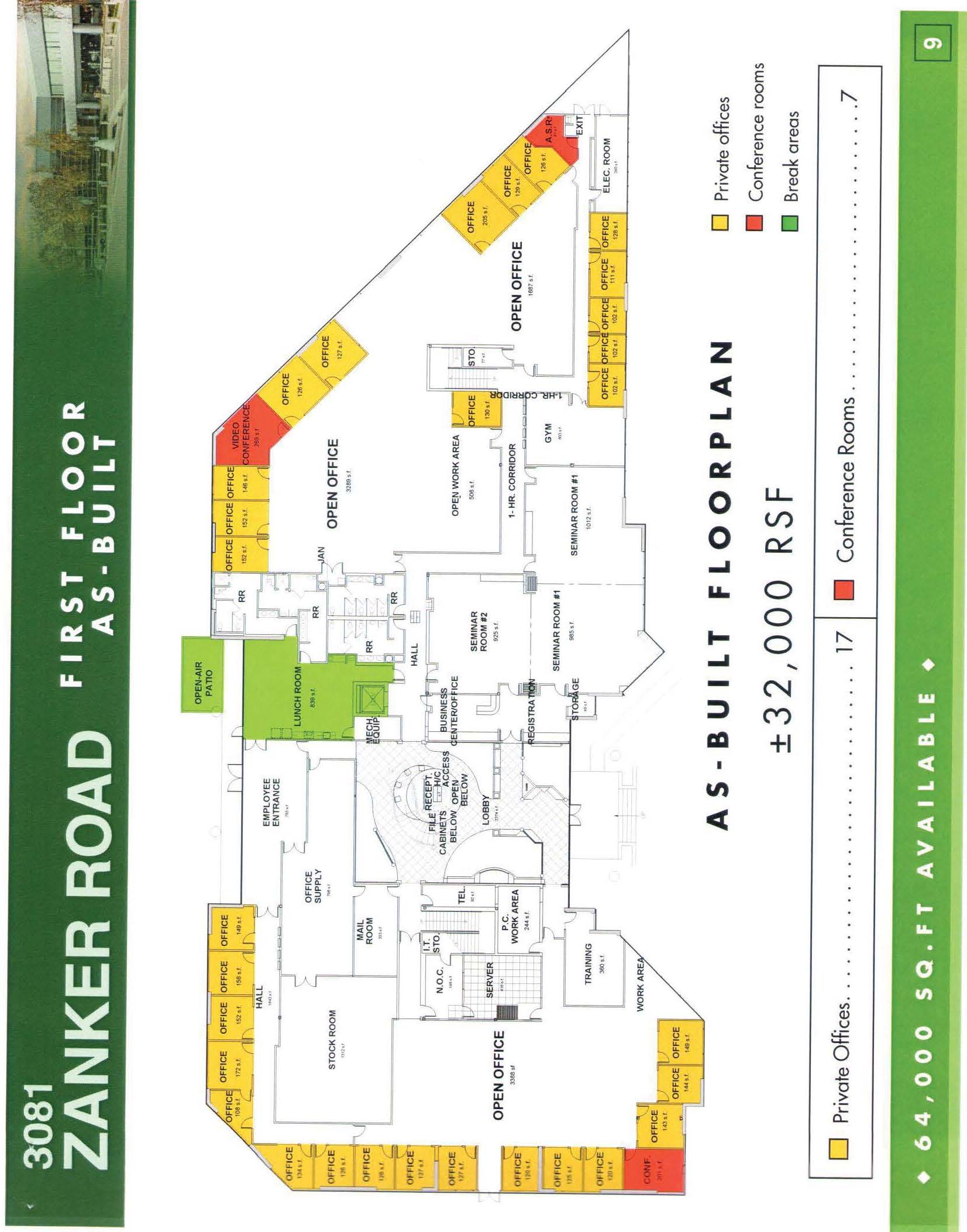

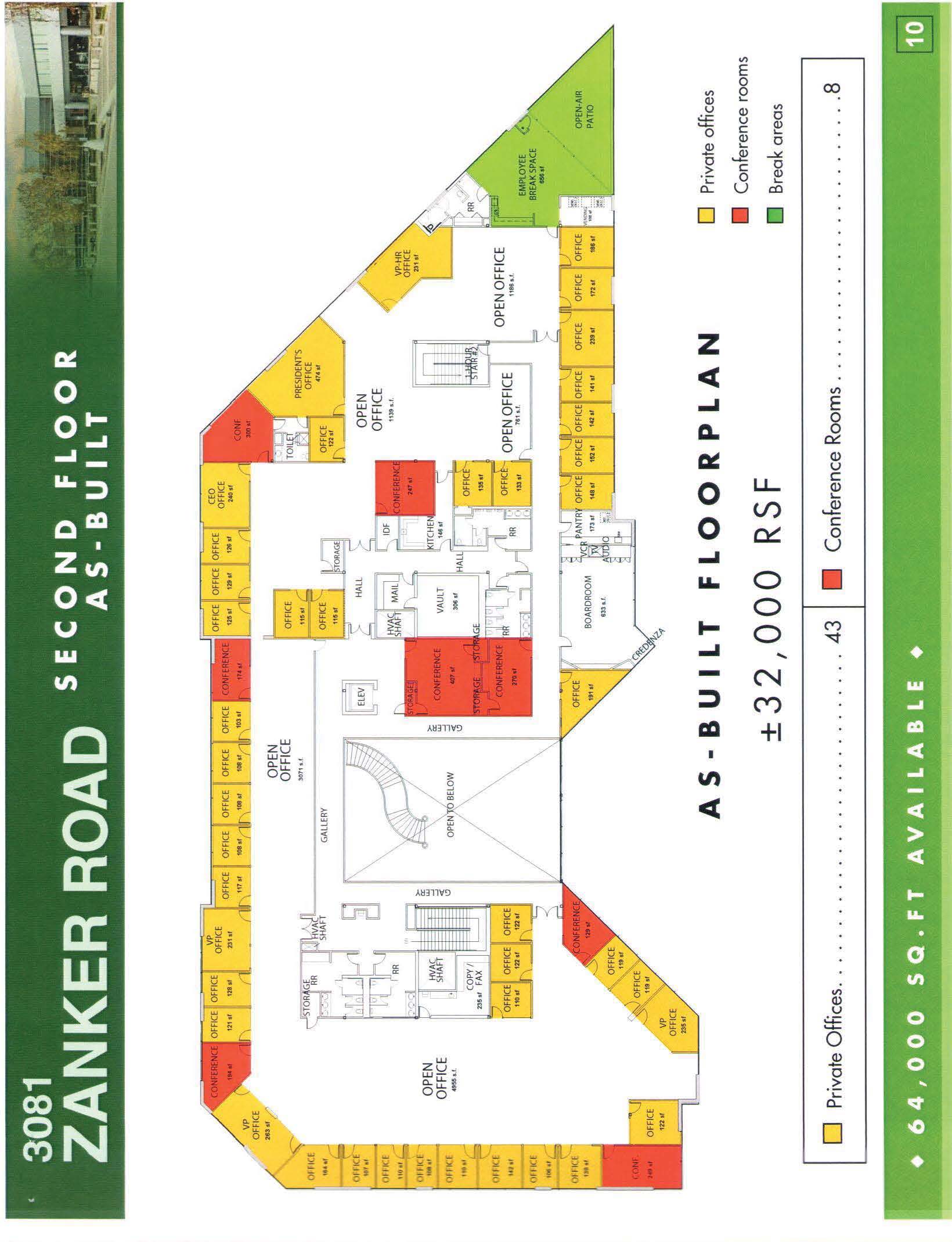

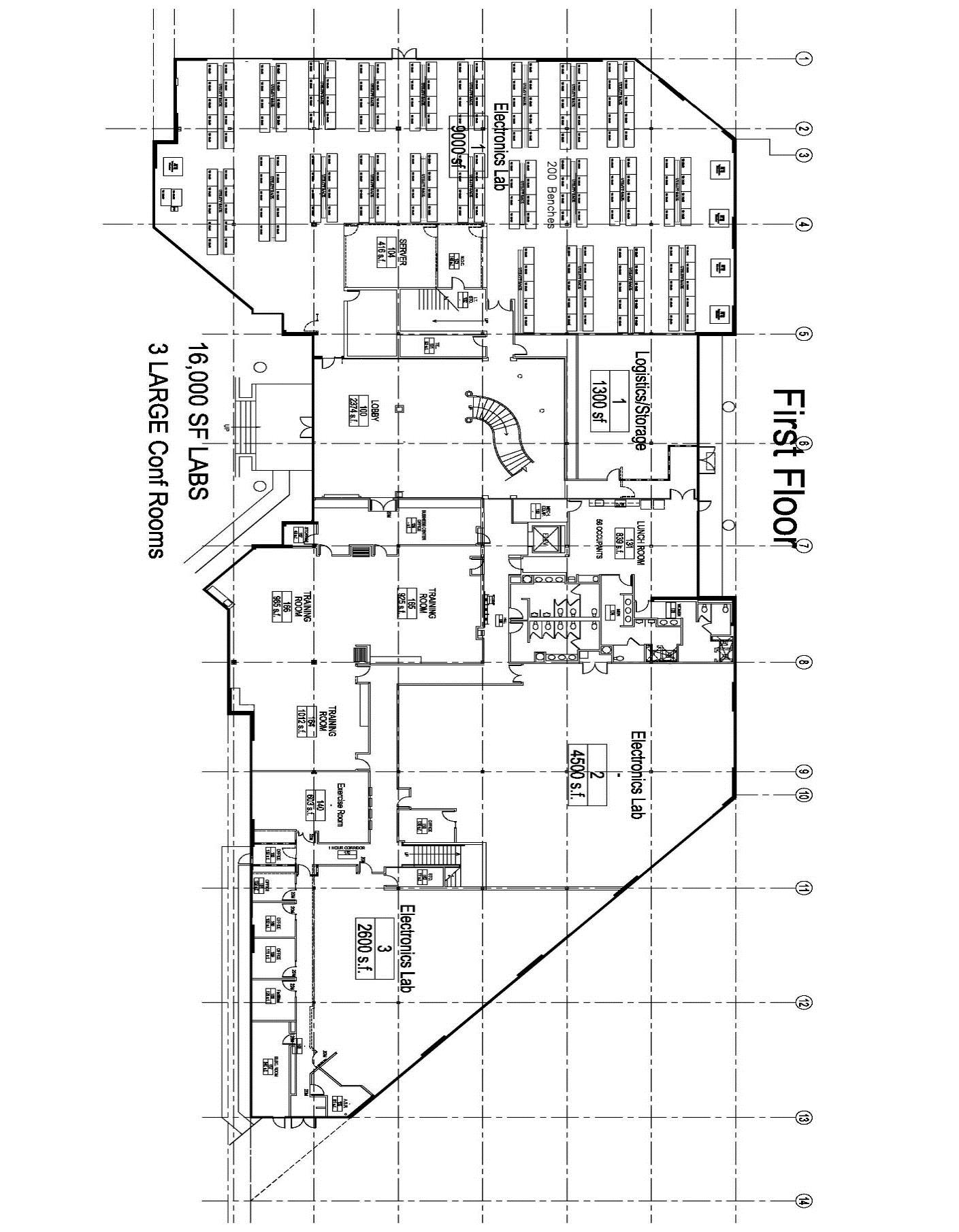

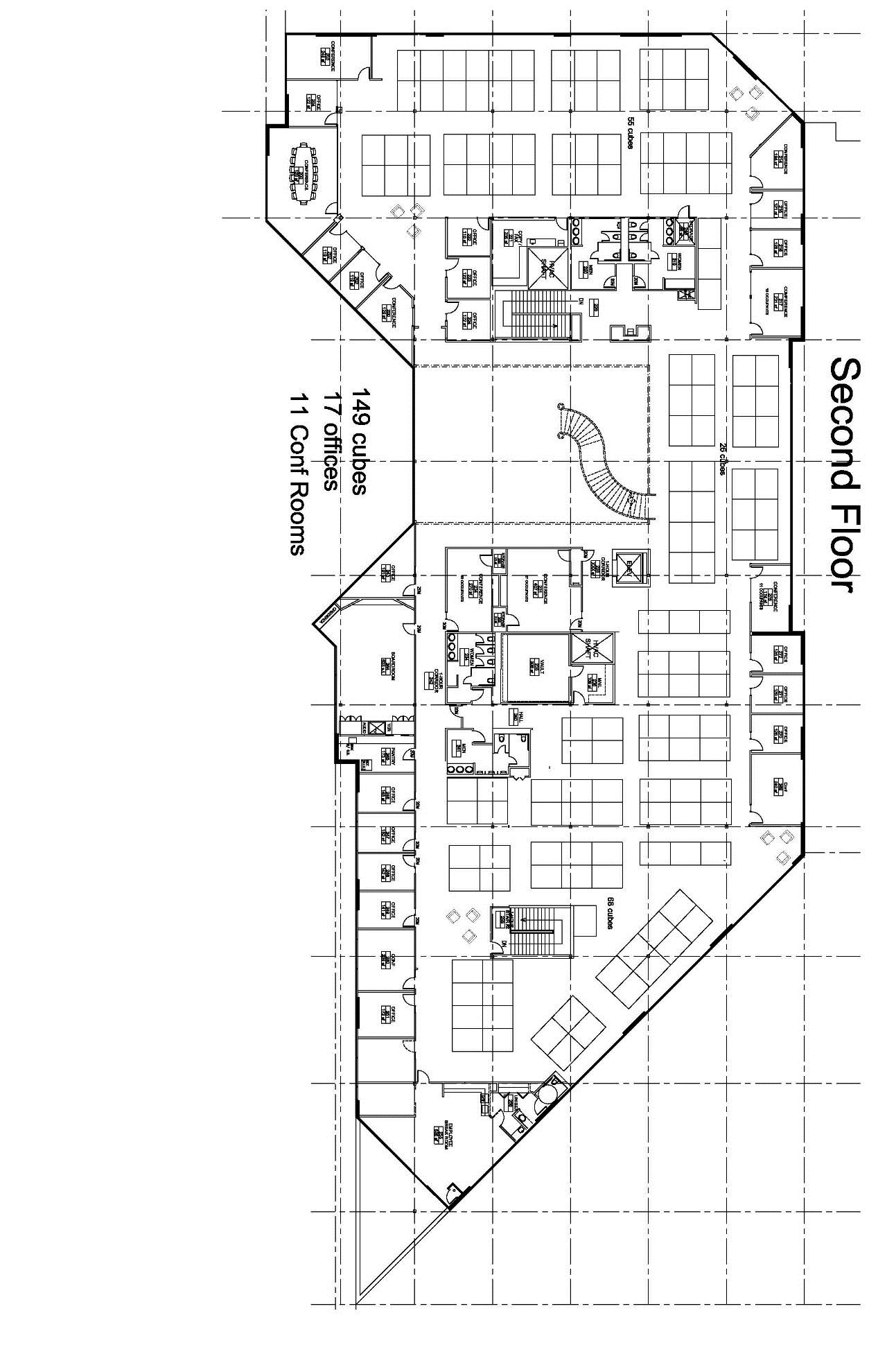

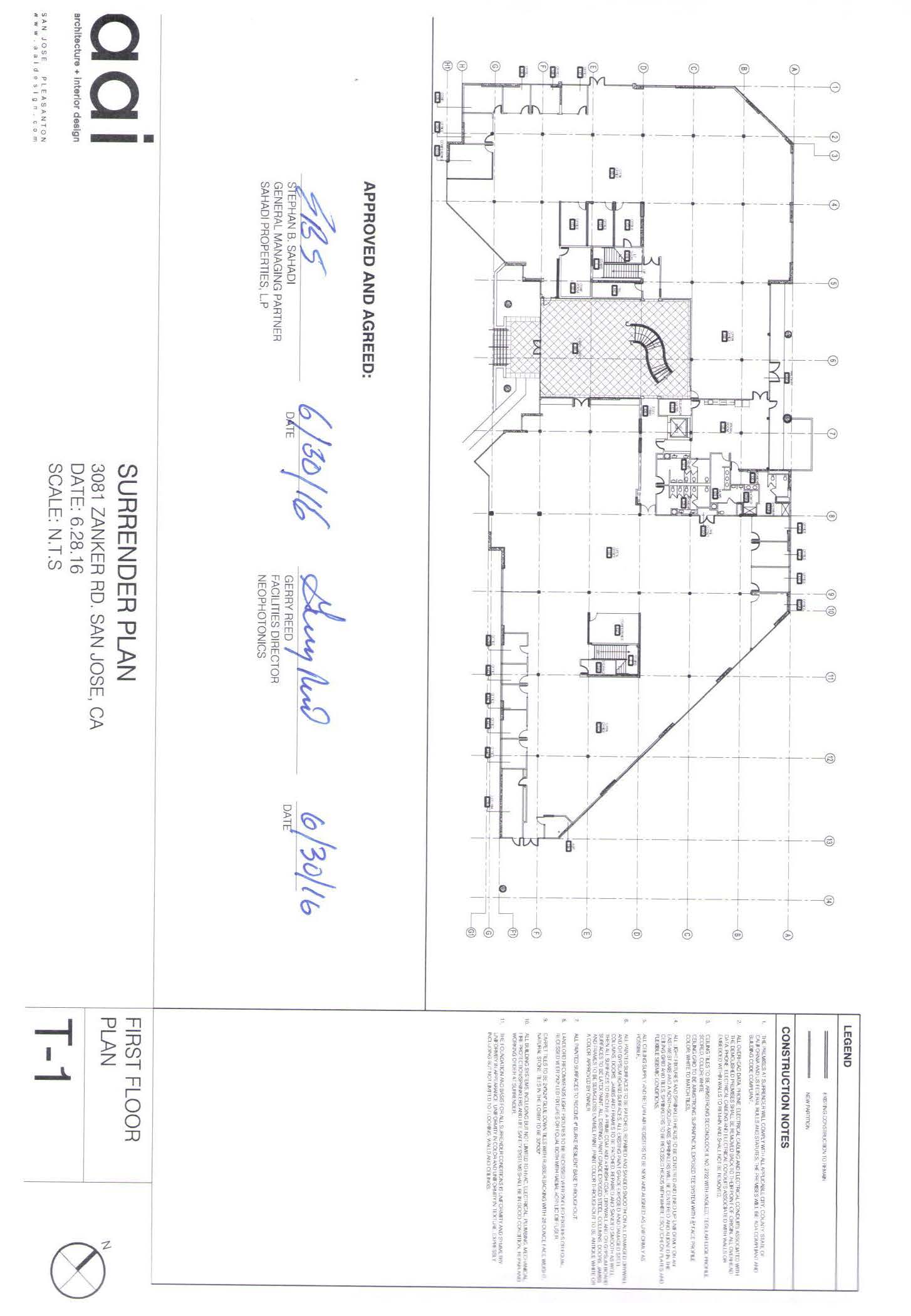

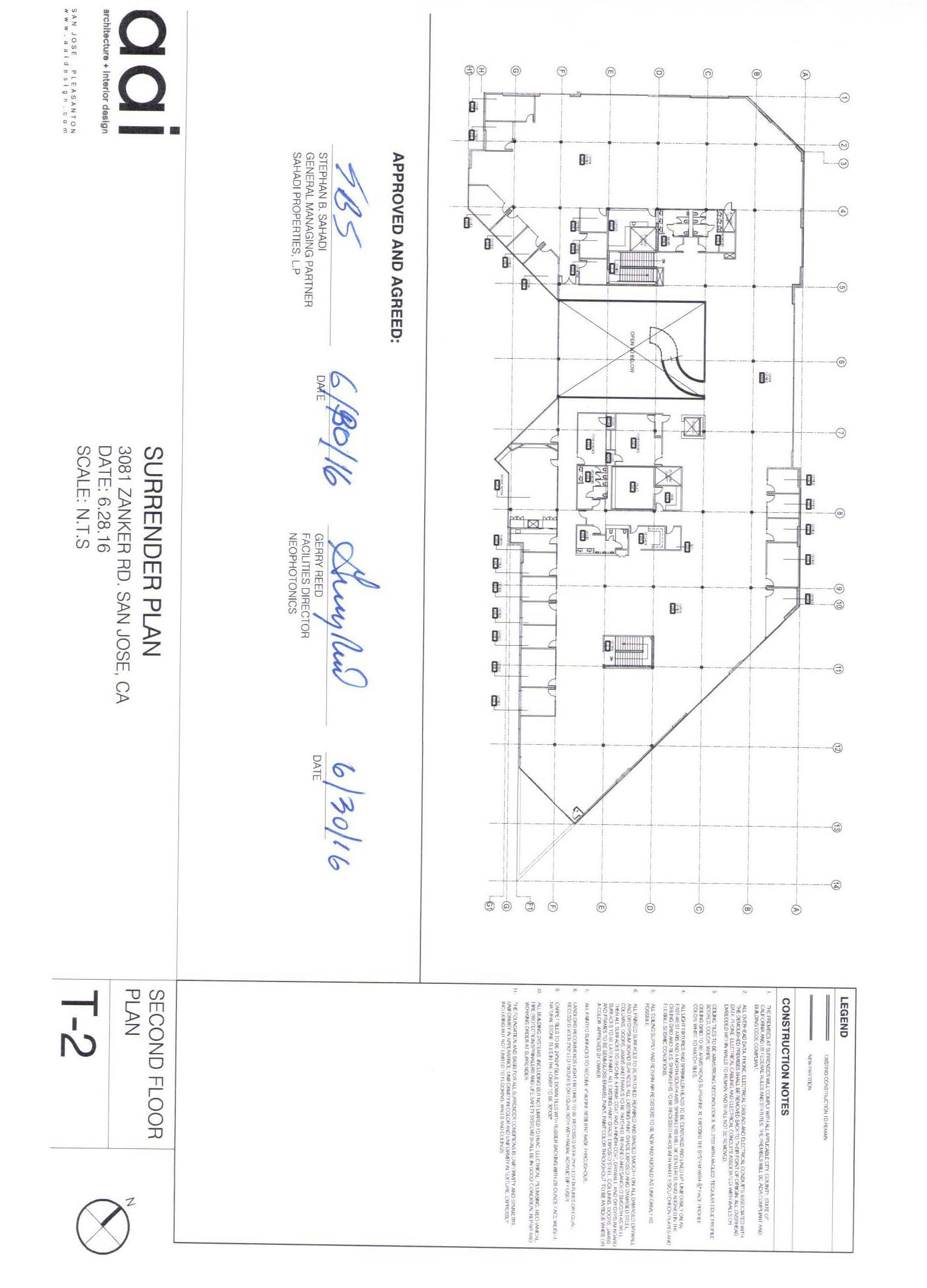

(a) Acceptance of Premises. By entry hereunder, Tenant accepts the Premises and the Building in their “as is” condition and without representation or warranty by Landlord as to the size, condition or suitability of the Premises or as to the use or occupancy which may be made thereof. Tenant acknowledges that on the Commencement Date the Premises shall be delivered to Tenant in the configuration set forth on Exhibit A-3 hereto. |

15

|

(b) Surrender of Premises. Tenant agrees on the last day of the Term, or on the sooner termination of this Lease, to surrender the Premises promptly and peaceably to Landlord in the configuration set forth in the Surrender Plans attached hereto as Attachment 2 to the Tenant Work Letter attached as Exhibit C to this Lease (the “Tenant Work Letter”) and the Detailed Surrender Plans (as defined below). If the Surrender Plans and/or the construction notes set forth on such plans are inconsistent with the provisions of this Paragraph 9(b), then, in that event, the Surrender Plans will prevail. At least ten (10) months before the Expiration Date, Tenant at its sole cost and expense shall prepare construction drawings that are consistent with and a logical evolution of the Surrender Plans and that contain the specifications and other detailed information required for submittal to and processing by the City of San Jose Building Department (the “Detailed Surrender Plans”) for Landlord’s review and approval, which shall not be unreasonably withheld, delayed or conditioned. The process for preparation and approval of the Detailed Surrender Plans and any iterations thereof shall be governed by Section 11 of this Lease. Tenant shall thereafter, as and when appropriate, submit to and obtain approval by the City of San Jose of the Detailed Surrender Plans. Following approval of the Detailed Surrender Plans by Landlord and the City of San Jose, Tenant shall cause the work described in the Detailed Surrender Plans to be completed as and when required by this Lease. Tenant will surrender the Premises in compliance with all applicable city, county, state and federal laws, including the ADA, and all other applicable Laws. The Premises will be returned uniform in appearance, color scheme and texture, including but not limited to all floor coverings, walls and ceilings. All heating, ventilation and air conditioning (“HVAC”), plumbing, electrical and other Systems and Equipment (as defined in Paragraph 12(a)) will be returned in good operating condition and repair. All windows will be washed. Tenant shall remove all Alterations (as defined in Paragraph 11) that may have been made in or to the Premises except to the extent that Landlord has expressly agreed in writing to allow any particular Alteration to remain within the Premises. All cables and other Lines installed by Tenant shall be removed as provide in Paragraph 15. If Tenant fails to complete the removal of Specialty Alterations and/or to repair any damage caused by the removal thereof, and/or to return the Premises to the condition required by this Paragraph 9(b) prior to the expiration of the Term or prior termination of this Lease, then at Landlord’s option, either (A) Tenant shall be deemed to be holding over in the Premises and Rent shall continue to accrue in accordance with the terms of Paragraph 32, below, until such work shall be completed, and/or (B) Landlord may do so and may charge the cost thereof to Tenant. |

|

(c) Landlord Surveys. During the last nine (9) months of the Term, Landlord shall have the right to hire independent contractors to inspect and survey the Building to confirm the Building’s compliance with ADA and other codes and to confirm the condition of the HVAC, mechanical, life-safety, sprinklers, elevators, and electrical systems serving the Building for the purpose of determining whether they have or have not been properly maintained by Tenant, and Tenant shall pay the commercially reasonable cost of such surveys (but not multiple surveys on the same subject matter) within thirty (30) days after receipt of a statement therefor from Landlord. |

|

(d) Removal of Personal Property. On or before the end of the Term or sooner termination of this Lease, Tenant shall remove all of Tenant’s personal property and trade fixtures from the Premises, and all property not so removed on or before the end of the Term or sooner termination of this Lease shall be deemed abandoned by Tenant and title to same shall thereupon pass to Landlord without compensation to Tenant. Upon termination of this Lease, Landlord may remove all moveable furniture and equipment so abandoned by Tenant, at Tenant’s sole cost, and repair any damage caused by such removal at Tenant’s sole cost. |

|

(e) Indemnity. If the Premises are not surrendered at the end of the Term or sooner termination of this Lease in the condition required by this Lease, Tenant shall indemnify Landlord and the other Indemnified Parties against loss, liability and other Claims resulting from the delay by Tenant in so surrendering the Premises including, without limitation, any Claims made by any succeeding Tenant |

16

founded on such delay. Nothing contained herein shall be construed as an extension of the Term hereof or as consent by Landlord to any holding over by Tenant. The voluntary or other surrender of this Lease or the Premises by Tenant or a mutual cancellation of this Lease shall not work as a merger and, at the option of Landlord, shall either terminate all or any existing subleases or subtenancies or operate as an assignment to Landlord of all or any such subleases or subtenancies. |

|

(a) Landlord's Consent to Alterations. Tenant shall not make any improvements, alterations, additions or changes to the Premises or any mechanical, alarm, sprinkler, plumbing or HVAC facilities or systems pertaining to the Premises (collectively, the "Alterations") without first procuring the prior written consent of Landlord to such Alterations, which consent shall be requested by Tenant not less than thirty (30) days prior to the commencement thereof, and which consent shall not be unreasonably withheld by Landlord with respect to proposed Alterations that (a) comply with all applicable Laws; (b) are reasonably compatible with the design of the Building, its architecture and Systems and Equipment; (c) do not unreasonably interfere with the use and occupancy of other tenants; (d) do not affect the structural portions of the Building , including, without limitation, the foundation, footings, floor slabs, ceilings, roof, columns, beams, shafts, stairs, stairwells, escalators, elevators, base building restrooms and |

17

all Common Areas (collectively, the "Building Structure"); and (e) do not affect the exterior appearance of the Building. Additionally, Landlord’s consent shall not be required for any Alteration that satisfies all of the following criteria (a “Minor Alteration”): (1) is not visible from the exterior of the Premises or Building; (2) complies with clauses (a) through (e) above; and (3) costs less than Fifty Thousand Dollars ($50,000) (the “Alterations Threshold”) for any one project. The Alterations Threshold will be increased every fifth (5th) anniversary of the Commencement Date, by the aggregate increase in the CPI most recently issued prior to such anniversary over the CPI most recently issued prior to the Commencement Date. As used herein, the “CPI” shall mean the Consumer Price Index-All Urban Consumers (San Francisco-Oakland-San Jose All Items, 1982-1984=100), issued by the Bureau of Labor Statistics, or such replacement index as Landlord and Tenant may mutually agree upon. It shall be deemed reasonable for Landlord to withhold its consent to any Alteration which affects the Building Structure or Systems and Equipment or is visible from the exterior of the Building. The construction of the Tenant Improvements shall be governed by the terms of the Tenant Work Letter and not the terms of this Paragraph 11. Landlord agrees to respond to any request by Tenant for approval of Alterations which approval is required hereunder within ten (10) Business Days after delivery of Tenant’s written request (which request shall be accompanied by the proposed plans and drawings prepared by Tenant’s then-architect and engineers). All such plans and drawings shall comply with the drawing format and specifications reasonably required by Landlord, and shall be subject to Landlord's approval, which shall not be unreasonably withheld, delayed or conditioned. Landlord’s response shall be in writing and, if Landlord withholds its consent, Landlord shall specify in reasonable detail in Landlord’s notice of disapproval, the basis for such disapproval, and the changes to Tenant’s plans which would be required in order to obtain Landlord’s approval. If Landlord fails to notify Tenant of Landlord’s approval or disapproval within such ten (10) business day period, Tenant shall have the right to provide Landlord with a second written request for approval (a “Second Request”) that contains the following statement in bold and capital letters: “THIS IS A SECOND REQUEST FOR APPROVAL OF PLANS PURSUANT TO THE PROVISIONS OF PARAGRAPHS 11(a) AND 11(b) OF THE LEASE. IF LANDLORD FAILS TO RESPOND WITHIN FIVE (5) BUSINESS DAYS AFTER RECEIPT OF THIS NOTICE, THEN LANDLORD SHALL BE DEEMED TO HAVE APPROVED THE ALTERATIONS DESCRIBED HEREIN.” If Landlord fails to respond to such Second Request within five (5) business days after receipt by Landlord, the Alterations in question shall be deemed approved by Landlord. Notwithstanding the foregoing, if the time period for Landlord’s response would fall between December 20 and January 2 (the “Blackout Period”), then for each such day falling during the Blackout Period, the time period for Landlord to respond to any request for Alteration shall be extended on a day-for-day basis. If Landlord timely delivers to Tenant notice of Landlord’s disapproval of any plans, Tenant may revise Tenant’s plans to incorporate the changes suggested by Landlord in Landlord’s notice of disapproval, and resubmit such plans to Landlord; in such event, the scope of Landlord’s review of such plans shall be limited to Tenant’s correction of the items in which Landlord had previously objected in writing. Landlord’s review and approval (or deemed approval) of such revised plans shall be governed by the provisions set forth above in this Paragraph 11(a)). The procedure set out above for approval of Tenant’s plans will also apply to any change, addition or amendment to Tenant’s plans. |

|

(b) Manner of Construction. Landlord may impose, as a condition of its consent to any and all Alterations or material repairs of the Premises which involve the Building Structure or material work on the Systems and Equipment or that affect the exterior appearance of the Building (a “Major Alteration”), such requirements as Landlord in its reasonable discretion, commensurate with the provisions of owners of Comparable Buildings (as defined in Section 31(d)), may deem desirable, including, but not limited to, the requirement that Tenant utilize for such purposes only contractors, subcontractors, materials, mechanics and materialmen selected by Tenant and approved by Landlord (such approval not to be unreasonably withheld), and the requirement that upon Landlord's request delivered concurrently with Landlord’s consent to any Specialty Alterations that Tenant, at Tenant's expense, remove such Specialty Alterations upon the expiration or any early termination of the Term. As |

18

used herein, a “Specialty Alteration” shall mean any Alteration that is not a normal and customary general office improvement or that materially deviates from the Surrender Plans, including, but not limited to improvements which (i) perforate, penetrate or require reinforcement of a floor slab (including, without limitation, interior stairwells or high-density filing or racking systems), (ii) consist of the installation of a raised flooring system, (iii) consist of the installation of a vault or other similar device or system intended to secure the Premises or a portion thereof in a manner that exceeds the level of security necessary for ordinary office space, (iv) involve material plumbing connections (such as, for example but not by way of limitation, kitchens, saunas, showers, and executive bathrooms outside of the Building core and/or special fire safety systems), (v) consist of the dedication of any material portion of the Premises to non-office usage (such as laboratories, classrooms, bicycle storage rooms, or “cooking” kitchens), (vi) can be seen from outside the Premises, or (vii) are required to be removed under Paragraph 9(b) or the Surrender Plans (or the Detailed Surrender Plans, as applicable). As a condition to Landlord’s obligation to consider any request for consent to any Alterations, Tenant agrees to pay Landlord within thirty (30) days after Tenant’s receipt of invoices and reasonable supporting documentation for the reasonable out-of-pocket third party costs and expenses of consultants, engineers, architects and others for reasonable review of plans and specifications for the construction of the proposed Alterations. Tenant shall construct such Alterations and perform such repairs in conformance with any and all applicable rules and regulations of any federal, state, county or municipal code or ordinance and pursuant to a valid building permit, issued by the City, and in conformance with Landlord’s construction rules and regulations; provided, however, that prior to commencing to construct any Alteration, Tenant shall meet with Landlord to discuss Landlord's design parameters and code compliance issues. In performing the work of any such Alterations, Tenant shall have the work performed in such manner so as not to obstruct access to the Complex or any portion thereof, by any other tenant of the Complex, and so as not to obstruct the business of Landlord or other tenants in the Complex. Tenant shall not use (and upon notice from Landlord shall cease using) contractors, services, workmen, labor, materials or equipment that, in Landlord's reasonable judgment, would disturb labor harmony with the workforce or trades engaged in performing other work, labor or services in or about the Complex. In addition to Tenant's obligations under Paragraph 22 of this Lease, upon completion of any Alterations, Tenant agrees to cause a Notice of Completion to be recorded in the office of the recorder of the county in which the Building is located in accordance with Section 8182 of the Civil Code of the State of California or any successor statute, and Tenant shall deliver to Landlord a reproducible copy of the "as built" drawings of the Alterations as well as all permits, approvals and other documents issued by any governmental agency in connection with the Alterations. At the conclusion of construction, Tenant shall (i) cause its architect to update the drawings as necessary to reflect all changes made to the Alterations Constructions Drawings during the course of construction, and (ii) deliver to Landlord two (2) sets of sepias of such as-built drawings as well as CAD and pdf copies of same, and (ii) deliver to Landlord a copy of all warranties, guaranties, and operating manuals and information relating to the improvements, equipment, and systems relating to such Alterations. |

|

(c) Payment for Alterations. Tenant shall obtain final lien releases and waivers in a form reasonably satisfactory to Landlord in connection with Tenant's payment for work to contractors, subcontractors and materialmen. Tenant shall pay for all overhead, general conditions, fees and other costs and expenses of the Alterations, and shall pay to Landlord a Landlord supervision fee of three percent (3%) of the cost of the Alterations. |

|

(d) Construction Insurance. In addition to the requirements of Paragraph 17 of this Lease, in the event that Tenant makes any Alterations, prior to the commencement of such Alterations, Tenant shall provide Landlord with evidence that Tenant or Tenant’s general contractor carries "builder's all risk" or “course of construction” insurance in an amount reasonably approved by Landlord covering the construction of such Alterations, and that Tenant and the general contractor carry general liability, worker’s compensation, and such other insurance as Landlord may reasonably require, it being |

19

understood and agreed that all of such Alterations shall be insured by Tenant pursuant to Paragraph 17 of this Lease immediately upon completion thereof. In addition, if the estimated costs of the Alterations exceeds One Hundred Fifty Thousand Dollars ($150,000.00) Landlord may, in its discretion, require Tenant to obtain at Landlord’s option a lien and completion bond or some alternate form of security reasonably satisfactory to Landlord in an amount sufficient to ensure the lien-free completion of such Alterations. |

|

(e) Removal of Alterations; Landlord's Property. All Alterations that may be installed in the Premises, from time to time, shall be made at the sole cost of Tenant. During the final six (6) month of the Term, Landlord and Tenant will endeavor to meet and confer to determine which, if any, of the Specialty Alterations previously made by Tenant which Landlord continues to desire that Tenant surrender with the Premises upon expiration of the Term. If Landlord agrees in writing that any such Specialty Alterations may remain at and be surrendered with the Premises upon expiration of the Term or upon prior termination of this Lease, the same shall become a part of the Premises and the property of Landlord upon expiration of the Term or upon prior termination of this Lease. Notwithstanding the foregoing, if the parties fails to meet prior to the expiration of the Term, or if Landlord does not agree to permit any Specialty Alterations to remain and be surrendered with the Premises, Tenant’s obligations with respect to such Specialty Alterations shall be governed by Paragraph 9(b). If Tenant fails to complete such removal and/or to repair any damage caused by the removal of any Specialty Alterations and return the affected portion of the Premises to the condition required hereunder, (i) Landlord may do so and may charge the cost thereof to Tenant, or (ii) Tenant shall be obligated to do so and will be deemed to be holding over until such time as the removal and restoration is completed (and, accordingly, the terms of Paragraph 32 of this Lease shall be applicable during such period). Tenant hereby protects, defends, indemnifies and holds Landlord harmless from all liens and other Claims in any manner relating to the installation, placement, removal, or financing of any such Alterations, improvements, fixtures and/or equipment in, on or about the Premises except to the extent the same arises out of the gross negligence or willful misconduct of Landlord or Landlord’s agents, employees or contractors, which obligations of Tenant shall survive the expiration or earlier termination of this Lease. |

|

(a) At its sole cost and expense, Tenant shall keep and maintain and repair the Premises (including appurtenances) and every part thereof in a high standard of maintenance and repair, or replacement, and in good and sanitary condition. Tenant’s maintenance and repair responsibilities herein referred to include, but are not limited to, providing janitorial service, cleaning, repair and replacement, as necessary, of all windows (interior and exterior), window frames, plate glass and glazing (destroyed by accident or act of third parties), truck doors, plumbing systems (such as water and drain lines, sinks, toilets, faucets, drains, showers and water fountains), electrical systems (such as panels, conduits, outlets, lighting fixtures, lamps, bulbs, tubes and ballasts), HVAC systems and components thereof (such as compressors, fans, air handlers, VAV boxes, ducts, mixing boxes, thermostats, time clocks, boilers, heaters, supply and return grills), and other Systems and Equipment (as defined below), electrical wiring and conduits, gas lines, water pipes, sprinkler, alarm and other life safety systems, and plumbing and sewage fixtures and pipes (both within the Building and outside the Building up to the point where any such pipe connects to the sewer main), foundations, slabs, structural elements and exterior surfaces of the Premises, roofs, downspouts, all interior improvements within the Premises including but not limited to wall coverings, window coverings, carpet, floor coverings, partitioning, ceilings, doors (both interior and exterior), including closing mechanisms, latches, locks, any exterior ramps and railings at the entrances of the Building, skylights (if any), automatic fire extinguishing systems, security systems, alarm systems, and elevators and all other interior improvements of any nature whatsoever. As used herein, the term “Systems and Equipment” means any plant, machinery, transformers, duct work, cable, wires, and other equipment, facilities, and systems designed to supply |

20

heat, ventilation, air conditioning and humidity or any other services or utilities, or comprising or serving as any component or portion of the electrical, gas, steam, plumbing, sprinkler, communications, alarm, security, or fire/life safety systems or equipment, or any other mechanical, electrical, electronic, computer or other systems or equipment which serve the Building and/or any other building in the Complex in whole or in part. |

Notwithstanding the foregoing to the contrary, if any Systems or Equipment (or major component thereof) or major component of the Building Structure requires replacement during the Term, including any replacement required by Law (and provided such replacement is not necessitated by (w) casualty or condemnation, (x) Tenant’s failure to perform reasonable periodic maintenance and customary and reasonable repairs of such item, (y) Tenant’s misuse of such item, or (z) the negligence or willful misconduct of Tenant or any Tenant Party, it being agreed that Tenant shall be solely responsible for any repairs or replacements necessitated by the preceding clauses (x), (y), and (z)), Landlord and Tenant shall cooperate in good faith to determine the best suitable replacement for such item (or component); in connection therewith, the parties will attempt to identify a substantially similar replacement item, and neither party shall have the right to require that the capacity, quality or size of such item be upgraded as a part of such replacement, unless the party requiring such upgrade agrees to bear any increased cost associated with the acquisition of an upgraded item compared to the acquisition of a reasonably similar substitute item (however, if applicable law requires an upgrade, the parties will share the cost of such upgrade as described herein). Upon determining a mutually agreeable replacement item, the parties shall share the cost of such replacement (other than any increased cost associated with an upgrade, as described above), as follows: (i) Tenant shall bear the first One Hundred Thousand Dollars ($100,000.00) of the cost of the replacement, (ii) Landlord shall initially bear the cost of such replacement in excess of One Hundred Thousand Dollars ($100,000.00) but, from and after the date of such replacement, Tenant shall pay to Landlord, as and when Base Rent is payable hereunder, an amount equal to 1/120 of the applicable replacement cost which was so initially borne by Landlord (it being the intention of the parties hereto that any such item or unit will be assumed to have a useful life of approximately ten (10) years, and that the foregoing formula allocates to Tenant a proportionate share of the cost of such replacement equal to the relationship between the then-remaining Term and the useful life of the unit (or component) in question). The amortized cost of such expenditure may include interest at the rate paid by Landlord on any funds borrowed (or, if Landlord elects to fund such expenditure using its own funds, at the market rate of interest, as reasonably determined by Landlord that Landlord reasonably would have paid had Landlord elected to finance such expenditure) from an unaffiliated third-party financial institution, but in no event greater than the Interest Rate.

|

(b) Without limiting the foregoing, at its sole cost and expense Tenant shall enter into a contract or contracts (each a “Service Contract”) in form and substance reasonably approved by Landlord with qualified, experienced professional third party service companies reasonably approved by Landlord to perform its maintenance, repair and replacement of these portions of the Systems and Equipment which require regularly scheduled periodic maintenance, including the HVAC systems (which shall provide for and include, without limitation, replacement of filters, oiling and lubricating of machinery, parts replacement, adjustment of drive belts, oil changes and other preventive maintenance, including annual maintenance of duct work, interior unit drains and caulking of sheet metal, and recaulking of jacks and vents on an annual basis), elevators, the roof, the building fire/life-safety systems, and the electrical and plumbing systems. On an annual basis, Landlord shall have the right to review and approve each contractor or vendor retained by Tenant to perform scheduled maintenance and repairs and, if Landlord reasonably determines that such contractor or vendor is not performing adequate maintenance or repair, Landlord may require that Tenant replace such contractor or vendor with a contractor or vendor reasonably approved by Landlord. The HVAC Service Contract shall provide for the HVAC service provider to maintain, repair and replace when necessary all HVAC equipment which serves the Premises and to keep the same in good condition through regular inspection and servicing at least once every sixty |

21

(60) days. Tenant also shall maintain continuously throughout the Term a Service Contract for the washing of all windows in the Premises (both interior and exterior surfaces) with a contractor approved by Landlord, which provides for the periodic washing of all such windows at least once every ninety (90) days and Service Contracts for the inspection, testing and servicing of the life-safety and elevator systems in the Premises, with a contractor reasonably approved by Landlord. Upon Tenant’s request, Tenant shall furnish Landlord with copies of all such Service Contracts. |

|

(d) Tenant shall regularly, in accordance with commercially reasonable standards, generate and maintain preventive maintenance records relating to the Systems and Equipment, including copies of all Service Contracts (“Books and Records”). In addition, within thirty (30) days following Landlord’s written request, Tenant shall make available for Landlord’s review (or at Tenant’s option, deliver to Landlord copies of) the Books and Records. Within thirty (30) days following Tenant’s receipt of written request from Landlord, Tenant shall make available for Landlord’s review (or at Tenant’s option, deliver to Landlord copies of) any maintenance and repair reports, documents and back-up materials related to the maintenance, repair and other work required to be performed by Tenant, to the extent the same are regularly and customarily generated and maintained by, and in the possession of, Tenant or its management team (collectively, the “M&R Reports”). Tenant’s obligation to deliver Books and Records and M&R Reports shall survive the Expiration Date and the prior termination of this Lease for a period not to exceed twelve (12) months. |

|

(e) In the event any of the above maintenance responsibilities apply to any other tenant(s) of Landlord where there is common usage with other tenant(s), such maintenance responsibilities and charges shall be allocated to the Premises by square footage or other equitable basis as calculated and determined by Landlord. |

|