Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - REGAL BELOIT CORP | a3q2016earningsannouncement.htm |

| 8-K - 8-K - REGAL BELOIT CORP | form8-k3q2016earningsrelea.htm |

©2016 Regal Beloit Corporation, Proprietary and Confidential

Mark Gliebe

Chairman and

Chief Executive Officer

Jon Schlemmer

Chief Operating Officer

Chuck Hinrichs

Vice President

Chief Financial Officer

Robert Cherry

Vice President

Investor Relations

Third Quarter 2016 Earnings Conference Call

November 7, 2016

Regal Beloit Corporation

2

Safe Harbor Statement

This presentation contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements represent our management’s judgment regarding future events. In many cases, you can

identify forward-looking statements by terminology such as “may,” “will,” “plan,” “expect,” “anticipate,” “estimate,” “believe,”

or “continue” or the negative of these terms or other similar words. Actual results and events could differ materially and

adversely from those contained in the forward-looking statements due to a number of factors, including: uncertainties

regarding our ability to execute our restructuring plans within expected costs and timing; increases in our overall debt levels

as a result of the acquisition of the Power Transmission Solutions (“PTS”) business from Emerson Electric Co., or otherwise

and our ability to repay principal and interest on our outstanding debt; actions taken by our competitors and our ability to

effectively compete in the increasingly competitive global electric motor, power generation and mechanical motion control

industries; our ability to develop new products based on technological innovation and the marketplace acceptance of new

and existing products; fluctuations in commodity prices and raw material costs; our dependence on significant customers;

issues and costs arising from the integration of acquired companies and businesses such as PTS, including the timing and

impact of purchase accounting adjustments; prolonged declines in oil and gas up stream capital spending; unanticipated

costs or expenses we may incur related to product warranty issues; our dependence on key suppliers and the potential

effects of supply disruptions; infringement of our intellectual property by third parties, challenges to our intellectual property,

and claims of infringement by us of third party technologies; product liability and other litigation, or the failure of our

products to perform as anticipated, particularly in high volume applications; economic changes in global markets where we

do business, such as reduced demand for the products we sell, currency exchange rates, inflation rates, interest rates,

recession, foreign government policies and other external factors that we cannot control; unanticipated liabilities of acquired

businesses; effects on earnings of any significant impairment of goodwill or intangible assets; cyclical downturns affecting

the global market for capital goods; difficulties associated with managing foreign operations; and other risks and

uncertainties including but not limited to those described in Item 1A-Risk Factors of the Company’s Annual Report on Form

10-K filed on March 2, 2016 and from time to time in our reports filed with U.S. Securities and Exchange Commission. All

subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly

qualified in their entirety by the applicable cautionary statements. The forward-looking statements included in this

presentation are made only as of their respective dates, and we undertake no obligation to update these statements to

reflect subsequent events or circumstances.

3

Non-GAAP Financial Measures

We prepare financial statements in accordance with accounting principles generally accepted in the United

States (“GAAP”). We also periodically disclose certain financial measures in our quarterly earnings releases, on

investor conference calls, and in investor presentations and similar events that may be considered “non-GAAP”

financial measures. We believe that these non-GAAP financial measures are useful measures for providing

investors with additional information regarding our results of operations and for helping investors understand

and compare our operating results across accounting periods and compared to our peers. In addition, since our

management often uses these non-GAAP financial measures to manage and evaluate our business, make

operating decisions, and forecast our future results, we believe disclosing these measures helps investors

evaluate our business in the same manner as management. This additional information is not meant to be

considered in isolation or as a substitute for our results of operations prepared and presented in accordance

with GAAP.

In this presentation, we disclose the following non-GAAP financial measures, and we reconcile these measures

in the Appendix to the most directly comparable GAAP financial measures: adjusted diluted earnings per share

(both historical and projected), adjusted operating profit, adjusted operating profit margin, free cash flow, and

free cash flow as a percentage of net income attributable to Regal Beloit Corporation.

In addition to these non-GAAP measures, we also use the term “organic sales” to refer to GAAP sales from

existing operations excluding sales from acquired businesses recorded prior to the first anniversary of the

acquisition less the amount of sales attributable to any divested businesses (“acquisition sales”), and the impact

of foreign currency translation. The impact of foreign currency translation is determined by translating the

respective period’s sales (excluding acquisition sales) using the same currency exchange rates that were in

effect during the prior year periods. We use the term “organic sales growth” to refer to the increase in our sales

between periods that is attributable to organic sales. We use the term “acquisition growth” to refer to the

increase in our sales between periods that is attributable to acquisition sales.

4

Agenda and Opening Comments

Opening Comments Mark Gliebe

Financial Update Chuck Hinrichs

Segment Update Jon Schlemmer

Summary Mark Gliebe

Q&A All

5

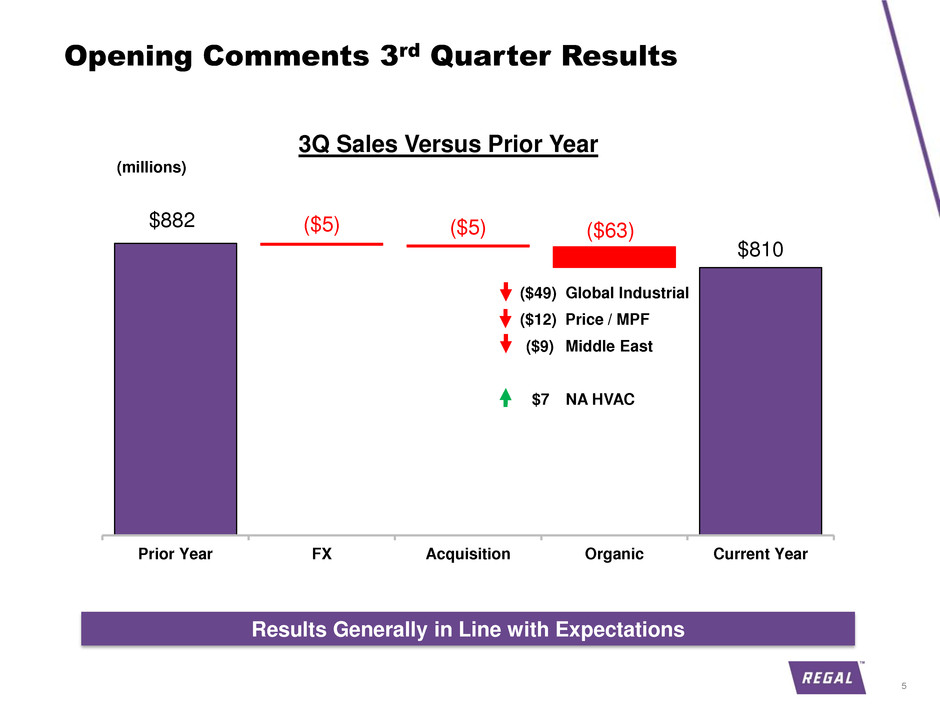

Opening Comments 3rd Quarter Results

$882

$810

($5) ($5)

Prior Year FX Acquisition Organic Current Year

($63)

($49) Global Industrial

($12) Price / MPF

($9) Middle East

$7 NA HVAC

3Q Sales Versus Prior Year

(millions)

Results Generally in Line with Expectations

6

3rd Quarter Adjusted Operating Profit Margin* 11.1%

– Sequential Improvement from 2Q 2016

– Prior Year Included a 50 Basis Points Benefit from GSP Tariff Refund

– Strong Margin Performance Despite Sales Headwinds

Strong Free Cash Flow and Debt Reduction

– Delivered 234% Free Cash Flow* to Net Income

– Improved Cash Cycle Days** by 2 Days and Reduced Inventory by $26 Million

– Paid Down $105 Million in Debt

Looking Forward

– Expecting 4Q Organic Sales Growth Rate to Improve Sequentially

– Slow Start to Heating Season, Order Rates in C&I and PTS Improving

– Expecting 4Q Organic Sales Flat to Slightly Down to Prior Year

– Expecting Second Half Adj. EPS* to Increase 11% - 15% Over First Half

Opening Comments 3rd Quarter Results

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

** Cash Cycle Days = A/R Days Sales Outstanding + Days Sales Inventory Outstanding – A/P Days Payable Outstanding

Guidance Confirms Positive Second Half Momentum

7

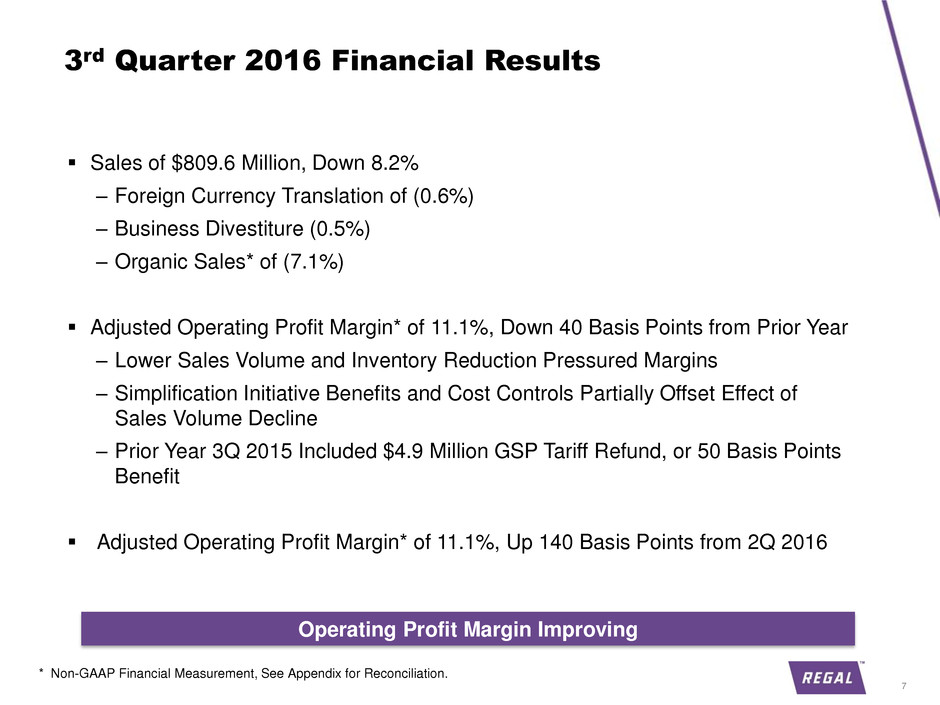

Sales of $809.6 Million, Down 8.2%

– Foreign Currency Translation of (0.6%)

– Business Divestiture (0.5%)

– Organic Sales* of (7.1%)

Adjusted Operating Profit Margin* of 11.1%, Down 40 Basis Points from Prior Year

– Lower Sales Volume and Inventory Reduction Pressured Margins

– Simplification Initiative Benefits and Cost Controls Partially Offset Effect of

Sales Volume Decline

– Prior Year 3Q 2015 Included $4.9 Million GSP Tariff Refund, or 50 Basis Points

Benefit

Adjusted Operating Profit Margin* of 11.1%, Up 140 Basis Points from 2Q 2016

3rd Quarter 2016 Financial Results

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

Operating Profit Margin Improving

8

3rd Quarter 2016 Financial Results

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

$2.2 Million, or $0.05 per share, Tax Benefit from the Finalization of our

2015 Income Taxes

ADJUSTED DILUTED EARNINGS PER SHARE Three Months Ended Nine Months Ended

Oct 1,

2016

Oct 3,

2015

Oct 1,

2016

Oct 3,

2015

Diluted Earnings Per Share $ 1.32 $ 1.41 $ 3.51 $ 3.61

Restructuring and Related Costs 0.02 0.02 0.06 0.07

Gain on Sale of Assets (0.03 ) — (0.03 ) —

Gain on Disposal of Business — — (0.14 ) —

Purchase Accounting and Transaction Costs — — — 0.47

Venezuelan Currency Devaluation — — — 0.02

Adjusted Diluted Earnings Per Share $ 1.31 $ 1.43 $ 3.40 $ 4.17

*

9

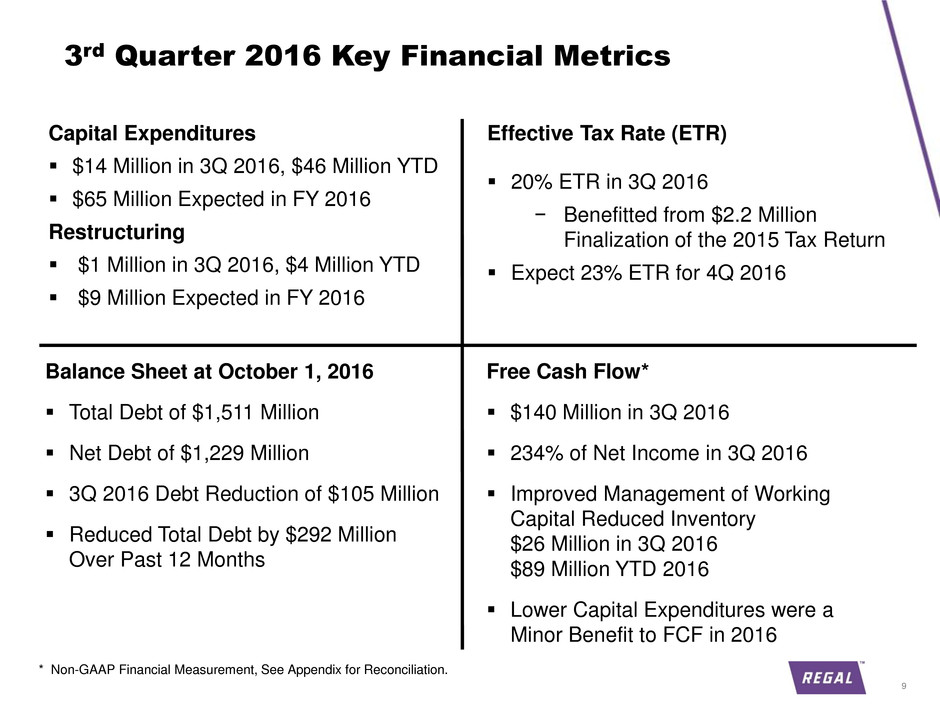

Capital Expenditures

$14 Million in 3Q 2016, $46 Million YTD

$65 Million Expected in FY 2016

Restructuring

$1 Million in 3Q 2016, $4 Million YTD

$9 Million Expected in FY 2016

Effective Tax Rate (ETR)

20% ETR in 3Q 2016

− Benefitted from $2.2 Million

Finalization of the 2015 Tax Return

Expect 23% ETR for 4Q 2016

Balance Sheet at October 1, 2016

Total Debt of $1,511 Million

Net Debt of $1,229 Million

3Q 2016 Debt Reduction of $105 Million

Reduced Total Debt by $292 Million

Over Past 12 Months

3rd Quarter 2016 Key Financial Metrics

Free Cash Flow*

$140 Million in 3Q 2016

234% of Net Income in 3Q 2016

Improved Management of Working

Capital Reduced Inventory

$26 Million in 3Q 2016

$89 Million YTD 2016

Lower Capital Expenditures were a

Minor Benefit to FCF in 2016

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

10

4th Quarter Organic Sales Growth Rate to Improve Sequentially

– Expected to be Flat to Slightly Down as Compared to Prior Year

4th Quarter Adjusted Operating Profit Margin Rate Expected to be Down Slightly

− No LIFO Impact Included in 4th Quarter Guidance

− Prior Year 4th Quarter Included $15 Million LIFO Benefit

4th Quarter 2016 GAAP EPS Guidance of $0.94 to $1.04

Full Year 2016 GAAP EPS Guidance of $4.45 to $4.55

4th Quarter 2016 Adjusted EPS Guidance of $1.00 to $1.10

− Addition of Restructuring and Related Expenses of $0.07

− Subtraction of Gain on Sales of Assets of $0.01

Full Year 2016 Adjusted EPS Guidance of $4.40 to $4.50

− Addition of Restructuring and Related Expenses of $0.13

− Subtraction of Gains on Sales of Business and Assets of $0.18

2016 Full Year Guidance

2nd Half 2016 Adj. EPS Expected to Increase 11% to 15% Over 1st Half 2016

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

11

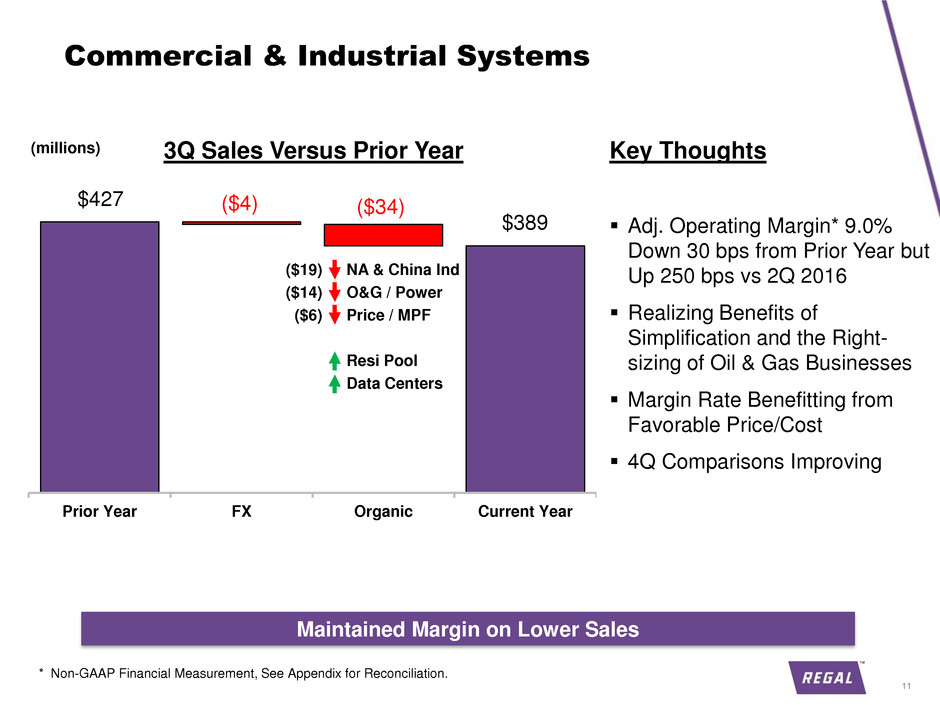

$427

$389

($4) ($34)

Prior Year FX Organic Current Year

NA & China Ind

O&G / Power

Price / MPF

Resi Pool

Data Centers

Commercial & Industrial Systems

(millions)

($19)

($14)

($6)

3Q Sales Versus Prior Year Key Thoughts

Adj. Operating Margin* 9.0%

Down 30 bps from Prior Year but

Up 250 bps vs 2Q 2016

Realizing Benefits of

Simplification and the Right-

sizing of Oil & Gas Businesses

Margin Rate Benefitting from

Favorable Price/Cost

4Q Comparisons Improving

Maintained Margin on Lower Sales

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

12

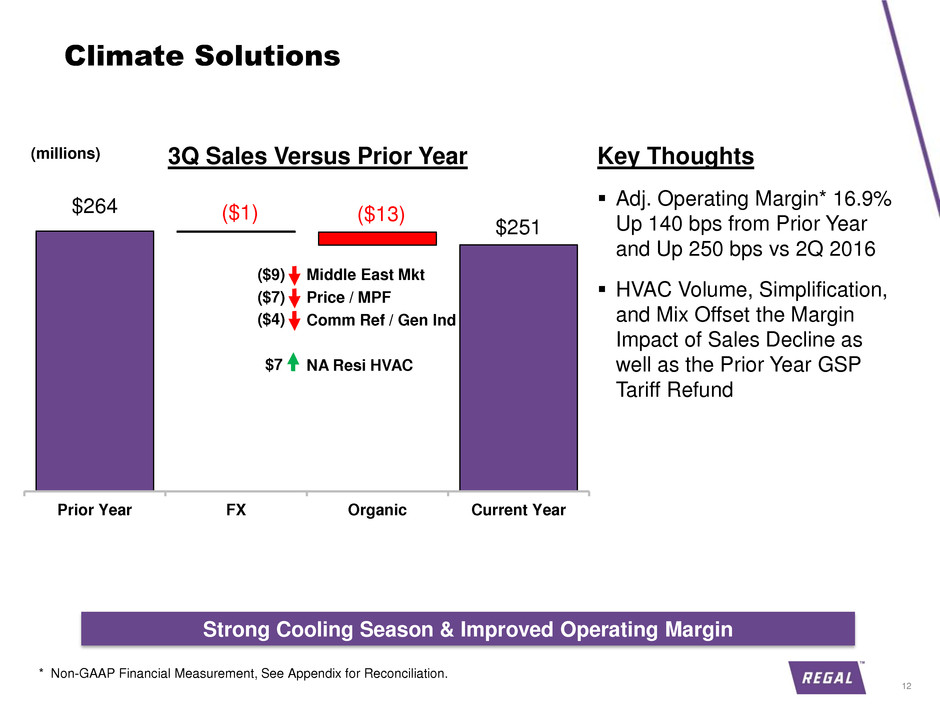

$264

$251

($1) ($13)

Prior Year FX Organic Current Year

Middle East Mkt

Price / MPF

Comm Ref / Gen Ind

NA Resi HVAC

Climate Solutions

(millions) 3Q Sales Versus Prior Year Key Thoughts

Adj. Operating Margin* 16.9%

Up 140 bps from Prior Year

and Up 250 bps vs 2Q 2016

HVAC Volume, Simplification,

and Mix Offset the Margin

Impact of Sales Decline as

well as the Prior Year GSP

Tariff Refund

($9)

($7)

($4)

Strong Cooling Season & Improved Operating Margin

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

$7

13

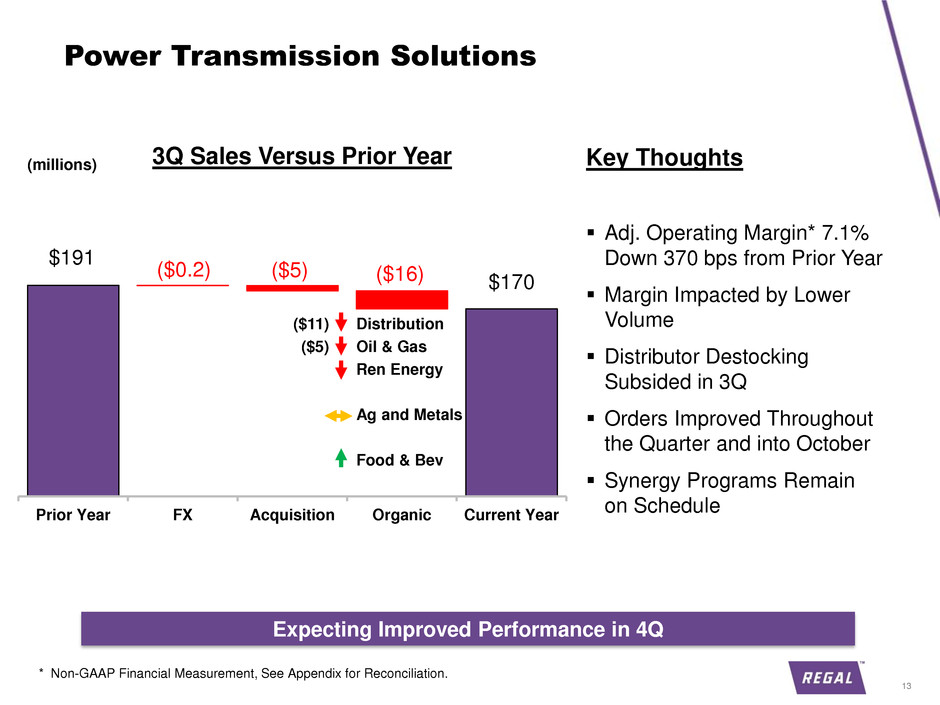

Key Thoughts

Adj. Operating Margin* 7.1%

Down 370 bps from Prior Year

Margin Impacted by Lower

Volume

Distributor Destocking

Subsided in 3Q

Orders Improved Throughout

the Quarter and into October

Synergy Programs Remain

on Schedule

Power Transmission Solutions

(millions) 3Q Sales Versus Prior Year

$191

$170

($5) ($0.2)

Prior Year FX Acquisition Organic Current Year

($16)

($11) Distribution

($5) Oil & Gas

Ren Energy

Ag and Metals

Food & Bev

Expecting Improved Performance in 4Q

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

14

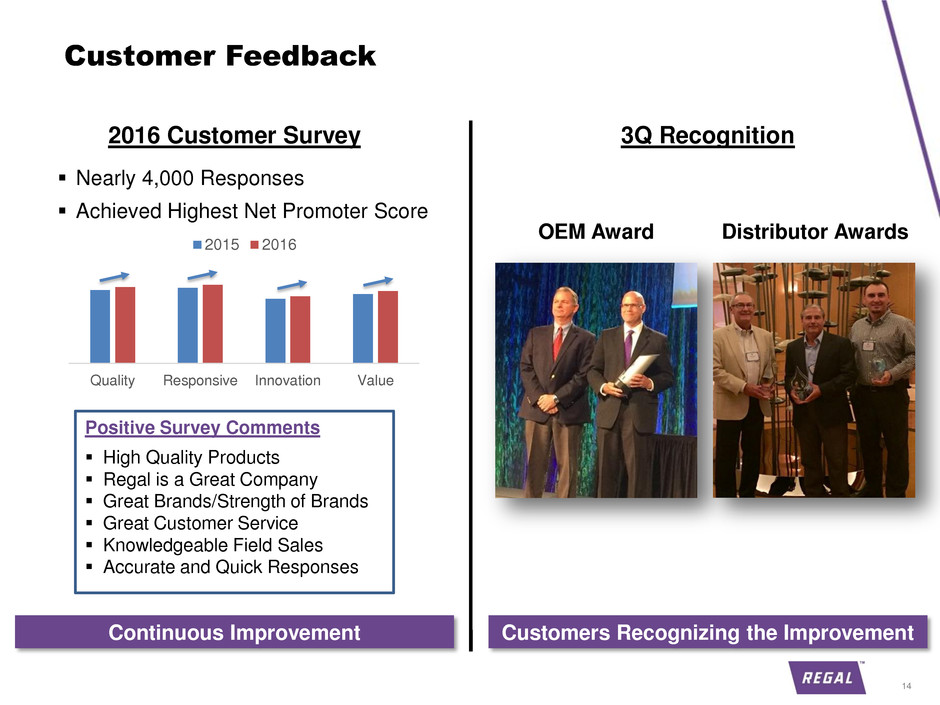

Customer Feedback

Positive Survey Comments

High Quality Products

Regal is a Great Company

Great Brands/Strength of Brands

Great Customer Service

Knowledgeable Field Sales

Accurate and Quick Responses

OEM Award Distributor Awards

Continuous Improvement Customers Recognizing the Improvement

2016 Customer Survey 3Q Recognition

Nearly 4,000 Responses

Achieved Highest Net Promoter Score

Quality Responsive Innovation Value

2015 2016

15

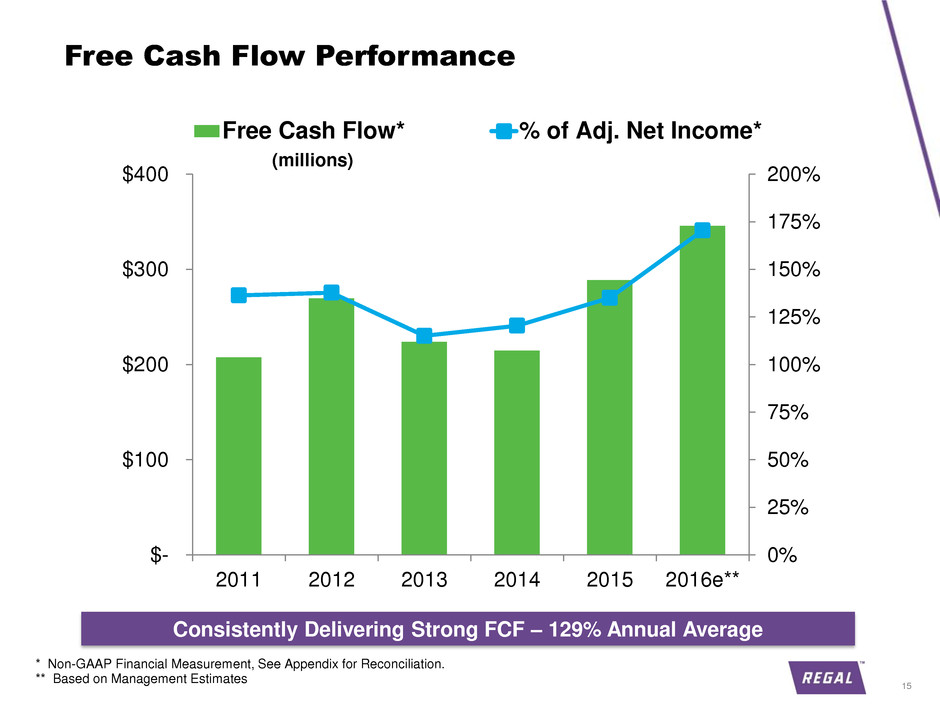

Free Cash Flow Performance

0%

25%

50%

75%

100%

125%

150%

175%

200%

$-

$100

$200

$300

$400

2011 2012 2013 2014 2015 2016e**

Free Cash Flow* % of Adj. Net Income*

** Based on Management Estimates

(millions)

Consistently Delivering Strong FCF – 129% Annual Average

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

16

3rd Quarter Sales In Line with Expectations

– Global Industrial Market Weakness

– Strong NA Residential HVAC, Offset by Middle East and MPF

Resilient Margins

Delivered 234% Free Cash Flow* to Net Income and Reduced Debt by $105 Million

Encouraging Performance Feedback from Customers

Expect 4th Quarter Organic Sales Flat to Slightly Down

– Slow Start to Heating Season

– Sequential Improvement in Organic Growth Rates in All Segments

– Sequentially Improving Two-Way Material Price Formula Impact

– Easier Comparisons in Oil & Gas and Power Gen Businesses

2nd Half Adj. EPS Guidance 11% - 15% Stronger than 1st Half 2016

Save the Date!

– Investor Day on March 10th, 2017 in NYC

Summary

* Non-GAAP Financial Measurement, See Appendix for Reconciliation.

©2016 Regal Beloit Corporation, Proprietary and Confidential

Questions and Answers

18

Appendix Non-GAAP Reconciliations

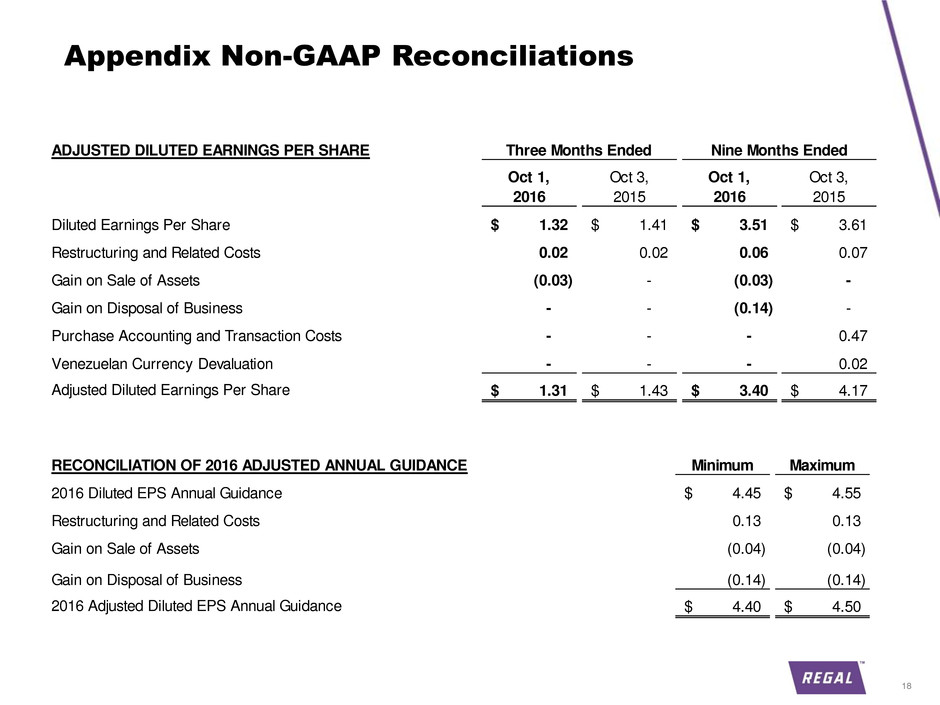

ADJUSTED DILUTED EARNINGS PER SHARE

Oct 1,

2016

Oct 3,

2015

Oct 1,

2016

Oct 3,

2015

Diluted Earnings Per Share 1.32$ 1.41$ 3.51$ 3.61$

Restructuring and Related Costs 0.02 0.02 0.06 0.07

Gai on Sale of Assets (0.03) - (0.03) -

Gain on Disposal of Business - - (0.14) -

Purchase Accounting and Transaction Costs - - - 0.47

Venezuelan Currency Devaluation - - - 0.02

Adjusted Diluted Earnings Per Share 1.31$ 1.43$ 3.40$ 4.17$

Three Months Ended Nine Months Ended

Minimum Maximum

2016 Diluted EPS Annual Guidance 4.45$ 4.55$

Restructuring and Related Costs 0.13 0.13

Gain on Sale of Assets (0.04) (0.04)

Gain on Disposal of Business (0.14) (0.14)

2016 Adjusted Diluted EPS Annual Guidance 4.40$ 4.50$

RECONCILIATION OF 2016 ADJUSTED ANNUAL GUIDANCE

19

Appendix Non-GAAP Reconciliations

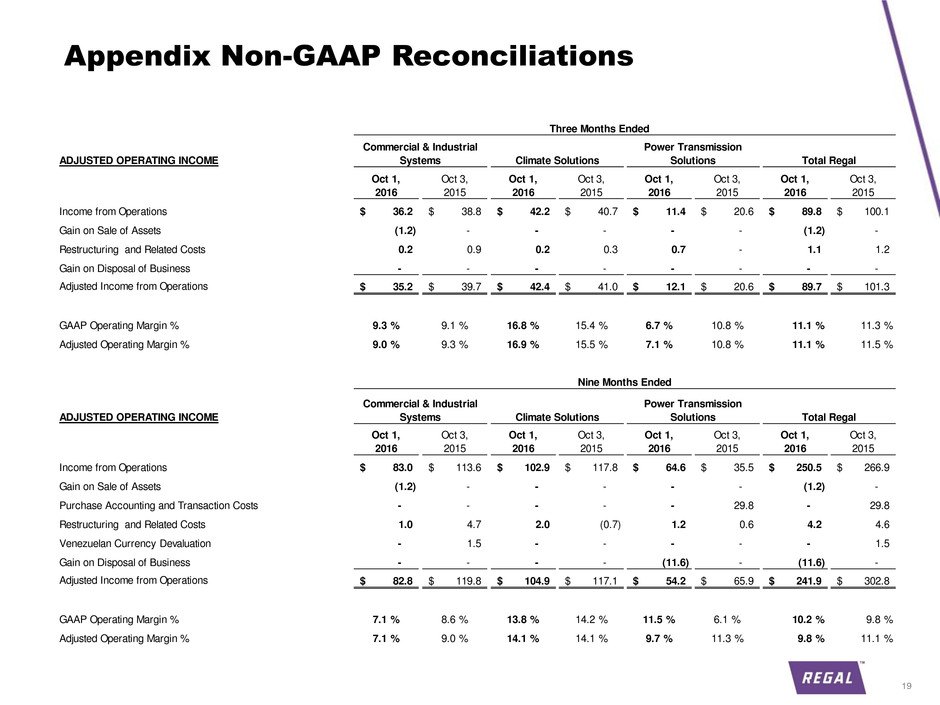

ADJUSTED OPERATING INCOME

Oct 1,

2016

Oct 3,

2015

Oct 1,

2016

Oct 3,

2015

Oct 1,

2016

Oct 3,

2015

Oct 1,

2016

Oct 3,

2015

Income from Operations 36.2$ 38.8$ 42.2$ 40.7$ 11.4$ 20.6$ 89.8$ 100.1$

Gain on Sale of Assets (1.2) - - - - - (1.2) -

Restructuring and Related Costs 0.2 0.9 0.2 0.3 0.7 - 1.1 1.2

Gain on Disposal of Business - - - - - - - -

Adjusted Income from Operations 35.2$ 39.7$ 42.4$ 41.0$ 12.1$ 20.6$ 89.7$ 101.3$

GAAP Operating Margin % 9.3 % 9.1 % 16.8 % 15.4 % 6.7 % 10.8 % 11.1 % 11.3 %

Adjusted Operating Margin % 9.0 % 9.3 % 16.9 % 15.5 % 7.1 % 10.8 % 11.1 % 11.5 %

ADJUSTED OPERATING INCOME

Oct 1,

2016

Oct 3,

2015

Oct 1,

2016

Oct 3,

2015

Oct 1,

2016

Oct 3,

2015

Oct 1,

2016

Oct 3,

2015

Income from Operations 83.0$ 113.6$ 102.9$ 117.8$ 64.6$ 35.5$ 250.5$ 266.9$

Gain on Sale of Assets (1.2) - - - - - (1.2) -

Purchase Accounting and Transaction Costs - - - - - 29.8 - 29.8

Restructuring and Related Costs 1.0 4.7 2.0 (0.7) 1.2 0.6 4.2 4.6

Venezuelan Currency Devaluation - 1.5 - - - - - 1.5

Gai on Di posal of Business - - - - (11.6) - (11.6) -

Adjusted Income from Operations 82.8$ 119.8$ 104.9$ 117.1$ 54.2$ 65.9$ 241.9$ 302.8$

GAAP Operating Margin % 7.1 % 8.6 % 13.8 % 14.2 % 11.5 % 6.1 % 10.2 % 9.8 %

Adjusted Operating Margin % 7.1 % 9.0 % 14.1 % 14.1 % 9.7 % 11.3 % 9.8 % 11.1 %

Nine Months Ended

Commercial & Industrial

Systems Climate Solutions

Power Transmission

Solutions Total Regal

Total Regal

Three Months Ended

Commercial & Industrial

Systems Climate Solutions

Power Transmission

Solutions

20

Appendix Non-GAAP Reconciliations

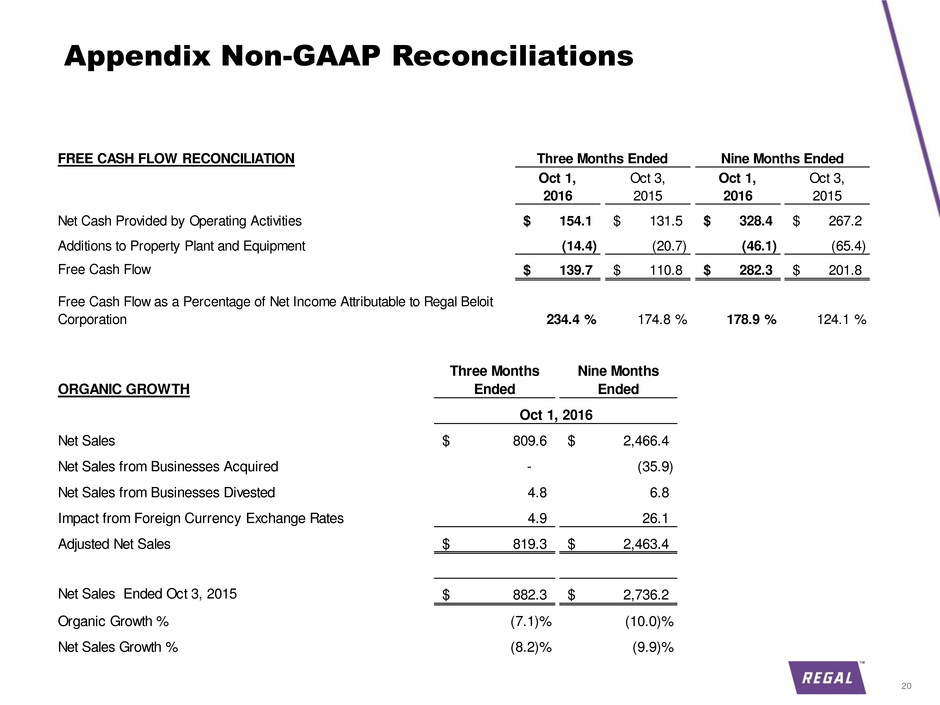

FREE CASH FLOW RECONCILIATION

Oct 1,

2016

Oct 3,

2015

Oct 1,

2016

Oct 3,

2015

Net Cash Provided by Operating Activities 154.1$ 131.5$ 328.4$ 267.2$

Additions to Property Plant and Equipment (14.4) (20.7) (46.1) (65.4)

Free Cash Flow 139.7$ 110.8$ 282.3$ 201.8$

Free Cash Flow as a Percentage of Net Income Attributable to Regal Beloit

Corporation 234.4 % 174.8 % 178.9 % 124.1 %

Three Months Ended Nine Months Ended

ORGANIC GROWTH

Three Months

Ended

Nine Months

Ended

Net Sales 809.6$ 2,466.4$

Net Sales from Businesses Acquired - (35.9)

et Sales from Businesses Divested 4.8 6.8

Impact from Foreign Currency Exchange Rates 4.9 26.1

Adjusted Net Sales 819.3$ 2,463.4$

Net Sales Ended Oct 3, 2015 882.3$ 2,736.2$

Organic Growth % (7.1)% (10.0)%

Net Sales Growth % (8.2)% (9.9)%

Oct 1, 2016

21

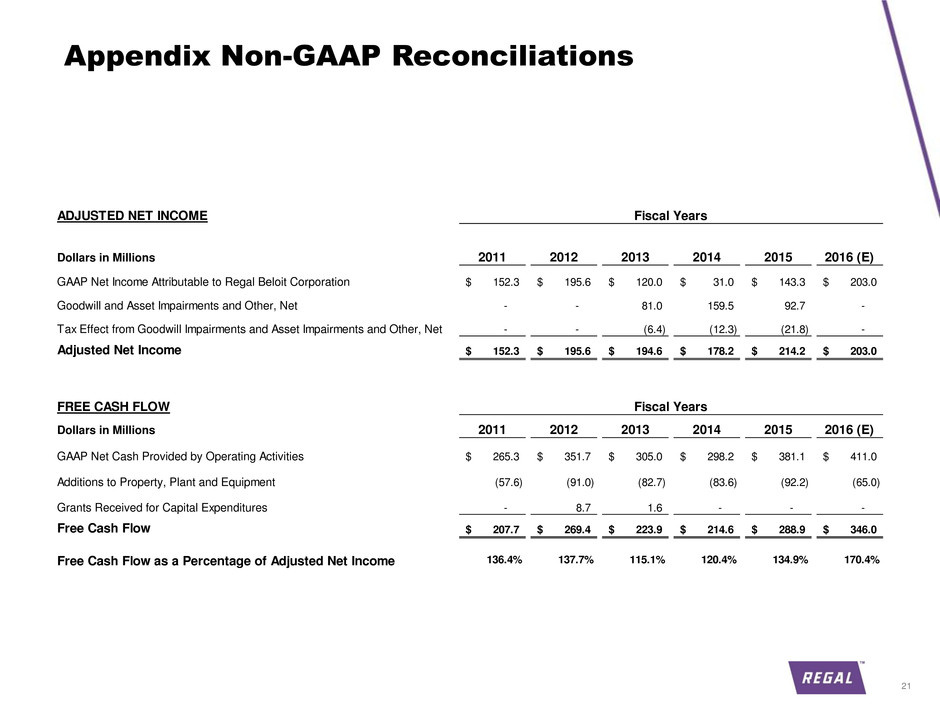

Appendix Non-GAAP Reconciliations

ADJUSTED NET INCOME

Dollars in Millions 2011 2012 2013 2014 2015 2016 (E)

GAAP Net Income Attributable to Regal Beloit Corporation 152.3$ 195.6$ 120.0$ 31.0$ 143.3$ 203.0$

Goodwill and Asset Impairments and Other, Net - - 81.0 159.5 92.7 -

Tax Effect from Goodwill Impairments and Asset Impairments and Other, Net - - (6.4) (12.3) (21.8) -

Adjusted Net Income 152.3$ 195.6$ 194.6$ 178.2$ 214.2$ 203.0$

FREE CASH FLOW

Dollars in Millions 2011 2012 2013 2014 2015 2016 (E)

GAAP Net Cash Provided by Operating Activities 265.3$ 351.7$ 305.0$ 298.2$ 381.1$ 411.0$

Additions to Property, Plant and Equipment (57.6) (91.0) (82.7) (83.6) (92.2) (65.0)

Grants Received for Capital Expenditures - 8.7 1.6 - - -

Free Cash Flow 207.7$ 269.4$ 223.9$ 214.6$ 288.9$ 346.0$

Free Cash Flow as a Percentage of Adjusted Net Income 136.4% 137.7% 115.1% 120.4% 134.9% 170.4%

Fiscal Years

Fiscal Years

22

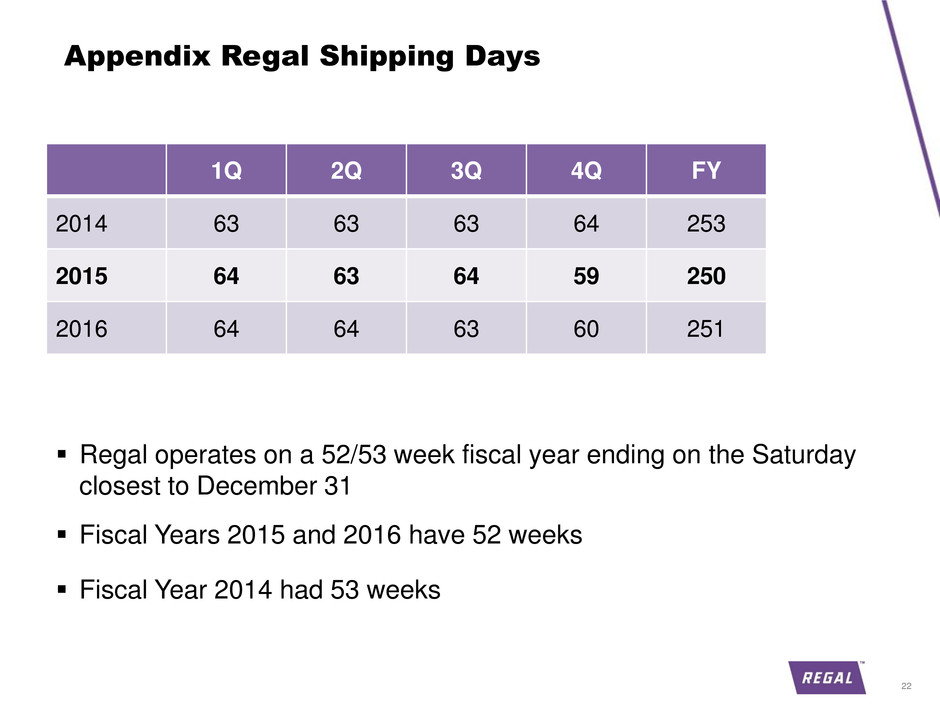

Appendix Regal Shipping Days

1Q 2Q 3Q 4Q FY

2014 63 63 63 64 253

2015 64 63 64 59 250

2016 64 64 63 60 251

Regal operates on a 52/53 week fiscal year ending on the Saturday

closest to December 31

Fiscal Years 2015 and 2016 have 52 weeks

Fiscal Year 2014 had 53 weeks