Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - UNIVERSAL INSURANCE HOLDINGS, INC. | uve-ex32_9.htm |

| EX-31.2 - EX-31.2 - UNIVERSAL INSURANCE HOLDINGS, INC. | uve-ex312_7.htm |

| EX-31.1 - EX-31.1 - UNIVERSAL INSURANCE HOLDINGS, INC. | uve-ex311_6.htm |

| EX-15.1 - EX-15.1 - UNIVERSAL INSURANCE HOLDINGS, INC. | uve-ex151_8.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2016

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33251

UNIVERSAL INSURANCE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

65-0231984 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer |

1110 W. Commercial Blvd., Fort Lauderdale, Florida 33309

(Address of principal executive offices)

(954) 958-1200

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “large accelerated filer” and “accelerated filer” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 35,038,483 shares of common stock, par value $0.01 per share, outstanding on October 31, 2016.

UNIVERSAL INSURANCE HOLDINGS, INC.

TABLE OF CONTENTS

PART I – FINANCIAL INFORMATION

|

|

|

|

|

Page No. |

|

|

|

|

|

|

|

Item 1. |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets as of September 30, 2016 and December 31, 2015 (unaudited) |

|

4 |

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

Notes to Condensed Consolidated Financial Statements (unaudited) |

|

7 |

|

|

|

|

|

|

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

27 |

|

|

|

|

|

|

|

Item 3. |

|

|

46 |

|

|

|

|

|

|

|

|

Item 4. |

|

|

47 |

|

|

|

||||

|

|

|

|

|

|

|

Item 1. |

|

|

48 |

|

|

|

|

|

|

|

|

Item 1A. |

|

|

49 |

|

|

|

|

|

|

|

|

Item 2. |

|

|

49 |

|

|

|

|

|

|

|

|

Item 6. |

|

|

50 |

|

|

|

|

|

|

|

|

|

51 |

|||

2

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Board of Directors and Stockholders of

Universal Insurance Holdings, Inc. and Subsidiaries

Fort Lauderdale, Florida

We have reviewed the accompanying condensed consolidated balance sheet of Universal Insurance Holdings, Inc. and its wholly-owned subsidiaries (the “Company”) as of September 30, 2016 and the related condensed consolidated statements of income and comprehensive income for the three and nine-month periods ended September 30, 2016 and 2015 and the related condensed consolidated statements of cash flows for the nine-month periods ended September 30, 2016 and 2015. These interim financial statements are the responsibility of the Company’s management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the accompanying interim financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

We have previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet of Universal Insurance Holdings, Inc. and Subsidiaries as of December 31, 2015 and the related consolidated statements of income, comprehensive income, stockholders’ equity and cash flows for the year then ended (not presented herein) and we expressed an unqualified audit opinion on those consolidated financial statements in our report dated February 24, 2016. In our opinion, the information set forth in the accompanying consolidated balance sheet as of December 31, 2015, is fairly stated, in all material respects, in relation to the consolidated balance sheet from which it has been derived.

|

/s/ Plante & Moran, PLLC |

|

Chicago, Illinois November 4, 2016 |

3

PART I — FINANCIAL INFORMATION

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

(in thousands, except per share data)

|

|

As of |

|

|||||

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2016 |

|

|

2015 |

|

||

|

ASSETS |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

205,241 |

|

|

$ |

197,014 |

|

|

Restricted cash and cash equivalents |

|

2,635 |

|

|

|

2,635 |

|

|

Fixed maturities, at fair value |

|

584,274 |

|

|

|

416,083 |

|

|

Equity securities, at fair value |

|

44,240 |

|

|

|

42,214 |

|

|

Short-term investments, at fair value |

|

5,003 |

|

|

|

25,021 |

|

|

Investment real estate, net |

|

10,384 |

|

|

|

6,117 |

|

|

Prepaid reinsurance premiums |

|

198,910 |

|

|

|

114,673 |

|

|

Reinsurance recoverable |

|

— |

|

|

|

22,853 |

|

|

Premiums receivable, net |

|

60,570 |

|

|

|

50,980 |

|

|

Other receivables |

|

5,863 |

|

|

|

4,979 |

|

|

Property and equipment, net |

|

30,845 |

|

|

|

27,065 |

|

|

Deferred policy acquisition costs, net |

|

68,300 |

|

|

|

60,019 |

|

|

Income taxes recoverable |

|

10,643 |

|

|

|

5,420 |

|

|

Deferred income tax asset, net |

|

1,877 |

|

|

|

13,912 |

|

|

Other assets |

|

5,437 |

|

|

|

4,563 |

|

|

Total assets |

$ |

1,234,222 |

|

|

$ |

993,548 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

|

|

|

Unpaid losses and loss adjustment expenses |

$ |

54,209 |

|

|

$ |

98,840 |

|

|

Unearned premiums |

|

501,577 |

|

|

|

442,366 |

|

|

Advance premium |

|

28,721 |

|

|

|

24,813 |

|

|

Accounts payable |

|

2,294 |

|

|

|

378 |

|

|

Reinsurance payable, net |

|

211,863 |

|

|

|

73,585 |

|

|

Dividends payable |

|

4,903 |

|

|

|

— |

|

|

Other liabilities and accrued expenses |

|

41,995 |

|

|

|

36,424 |

|

|

Long-term debt |

|

15,396 |

|

|

|

24,050 |

|

|

Total liabilities |

|

860,958 |

|

|

|

700,456 |

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies (Note 12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

Cumulative convertible preferred stock, $.01 par value |

|

— |

|

|

|

— |

|

|

Authorized shares - 1,000 |

|

|

|

|

|

|

|

|

Issued shares - 10 and 10 |

|

|

|

|

|

|

|

|

Outstanding shares - 10 and 10 |

|

|

|

|

|

|

|

|

Minimum liquidation preference, $9.99 and $9.99 per share |

|

|

|

|

|

|

|

|

Common stock, $.01 par value |

|

453 |

|

|

|

455 |

|

|

Authorized shares - 55,000 |

|

|

|

|

|

|

|

|

Issued shares - 45,292 and 45,525 |

|

|

|

|

|

|

|

|

Outstanding shares - 35,024 and 35,110 |

|

|

|

|

|

|

|

|

Treasury shares, at cost - 10,268 and 10,415 |

|

(86,887 |

) |

|

|

(80,802 |

) |

|

Additional paid-in capital |

|

80,399 |

|

|

|

70,789 |

|

|

Accumulated other comprehensive income (loss), net of taxes |

|

1,625 |

|

|

|

(4,006 |

) |

|

Retained earnings |

|

377,674 |

|

|

|

306,656 |

|

|

Total stockholders' equity |

|

373,264 |

|

|

|

293,092 |

|

|

Total liabilities and stockholders' equity |

$ |

1,234,222 |

|

|

$ |

993,548 |

|

The accompanying notes to condensed consolidated financial statements are an integral part of these statements.

4

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (unaudited)

(in thousands, except per share data)

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

||||

|

PREMIUMS EARNED AND OTHER REVENUES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct premiums written |

$ |

241,888 |

|

|

$ |

222,572 |

|

|

$ |

741,782 |

|

|

$ |

684,147 |

|

|

Change in unearned premium |

|

(7,388 |

) |

|

|

(7,769 |

) |

|

|

(59,211 |

) |

|

|

(67,903 |

) |

|

Direct premium earned |

|

234,500 |

|

|

|

214,803 |

|

|

|

682,571 |

|

|

|

616,244 |

|

|

Ceded premium earned |

|

(74,966 |

) |

|

|

(68,650 |

) |

|

|

(214,128 |

) |

|

|

(262,843 |

) |

|

Premiums earned, net |

|

159,534 |

|

|

|

146,153 |

|

|

|

468,443 |

|

|

|

353,401 |

|

|

Net investment income (expense) |

|

2,304 |

|

|

|

1,307 |

|

|

|

6,051 |

|

|

|

3,376 |

|

|

Net realized gains (losses) on investments |

|

101 |

|

|

|

11 |

|

|

|

1,344 |

|

|

|

292 |

|

|

Commission revenue |

|

4,603 |

|

|

|

4,115 |

|

|

|

12,927 |

|

|

|

10,757 |

|

|

Policy fees |

|

4,226 |

|

|

|

3,820 |

|

|

|

13,093 |

|

|

|

12,003 |

|

|

Other revenue |

|

1,668 |

|

|

|

1,637 |

|

|

|

4,827 |

|

|

|

4,614 |

|

|

Total premiums earned and other revenues |

|

172,436 |

|

|

|

157,043 |

|

|

|

506,685 |

|

|

|

384,443 |

|

|

OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Losses and loss adjustment expenses |

|

73,548 |

|

|

|

53,854 |

|

|

|

199,749 |

|

|

|

127,148 |

|

|

General and administrative expenses |

|

54,725 |

|

|

|

55,289 |

|

|

|

166,780 |

|

|

|

130,152 |

|

|

Total operating costs and expenses |

|

128,273 |

|

|

|

109,143 |

|

|

|

366,529 |

|

|

|

257,300 |

|

|

INCOME BEFORE INCOME TAXES |

|

44,163 |

|

|

|

47,900 |

|

|

|

140,156 |

|

|

|

127,143 |

|

|

Income tax expense |

|

17,281 |

|

|

|

17,602 |

|

|

|

54,400 |

|

|

|

49,811 |

|

|

NET INCOME |

$ |

26,882 |

|

|

$ |

30,298 |

|

|

$ |

85,756 |

|

|

$ |

77,332 |

|

|

Basic earnings per common share |

$ |

0.77 |

|

|

$ |

0.87 |

|

|

$ |

2.46 |

|

|

$ |

2.22 |

|

|

Weighted average common shares outstanding - Basic |

|

35,042 |

|

|

|

34,911 |

|

|

|

34,878 |

|

|

|

34,837 |

|

|

Fully diluted earnings per common share |

$ |

0.75 |

|

|

$ |

0.84 |

|

|

$ |

2.41 |

|

|

$ |

2.15 |

|

|

Weighted average common shares outstanding - Diluted |

|

35,723 |

|

|

|

35,999 |

|

|

|

35,594 |

|

|

|

35,918 |

|

|

Cash dividend declared per common share |

$ |

0.14 |

|

|

$ |

0.12 |

|

|

$ |

0.42 |

|

|

$ |

0.36 |

|

The accompanying notes to condensed consolidated financial statements are an integral part of these statements.

5

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

(in thousands)

|

|

|

|

|||||

|

|

Nine Months Ended September 30, |

|

|||||

|

|

2016 |

|

|

2015 |

|

||

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities |

$ |

178,637 |

|

|

$ |

241,182 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Proceeds from sale of property and equipment |

|

31 |

|

|

|

55 |

|

|

Purchases of property and equipment |

|

(6,041 |

) |

|

|

(10,310 |

) |

|

Payments to acquire a business |

|

— |

|

|

|

(1,000 |

) |

|

Purchases of equity securities |

|

(46,414 |

) |

|

|

(46,668 |

) |

|

Purchases of fixed maturities |

|

(278,961 |

) |

|

|

(145,118 |

) |

|

Purchases of short-term investments |

|

— |

|

|

|

(87,538 |

) |

|

Purchases of investment real estate, net |

|

(4,400 |

) |

|

|

(5,888 |

) |

|

Proceeds from sales of equity securities |

|

46,819 |

|

|

|

17,412 |

|

|

Proceeds from sales of fixed maturities |

|

78,966 |

|

|

|

26,154 |

|

|

Proceeds from sales of short-term investments |

|

— |

|

|

|

12,500 |

|

|

Maturities of fixed maturities |

|

38,111 |

|

|

|

63,201 |

|

|

Maturities of short-term investments |

|

25,000 |

|

|

|

50,000 |

|

|

Net cash provided by (used in) investing activities |

|

(146,889 |

) |

|

|

(127,200 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Preferred stock dividend |

|

(7 |

) |

|

|

(7 |

) |

|

Common stock dividend |

|

(9,828 |

) |

|

|

(8,520 |

) |

|

Issuance of common stock |

|

— |

|

|

|

511 |

|

|

Purchase of treasury stock |

|

(8,415 |

) |

|

|

(7,665 |

) |

|

Sale of treasury stock |

|

2,965 |

|

|

|

— |

|

|

Purchase of preferred stock |

|

— |

|

|

|

(257 |

) |

|

Payments related to tax withholding for share-based compensation |

|

(4,905 |

) |

|

|

(10,195 |

) |

|

Excess tax benefits (shortfall) from share-based compensation |

|

(1,563 |

) |

|

|

5,241 |

|

|

Borrowings under promissory note |

|

— |

|

|

|

1,390 |

|

|

Repayment of debt |

|

(1,768 |

) |

|

|

(8,103 |

) |

|

Net cash provided by (used in) financing activities |

|

(23,521 |

) |

|

|

(27,605 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

8,227 |

|

|

|

86,377 |

|

|

Cash and cash equivalents at beginning of period |

|

197,014 |

|

|

|

115,397 |

|

|

Cash and cash equivalents at end of period |

$ |

205,241 |

|

|

$ |

201,774 |

|

|

Supplemental cash and non-cash flow disclosures: |

|

|

|

|

|

|

|

|

Interest paid |

$ |

362 |

|

|

$ |

767 |

|

|

Income taxes paid |

$ |

58,268 |

|

|

$ |

51,554 |

|

|

Income tax refund |

$ |

5,694 |

|

|

$ |

— |

|

The accompanying notes to condensed consolidated financial statements are an integral part of these statements.

6

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Nature of Operations and Basis of Presentation

Nature of Operations

Universal Insurance Holdings, Inc. (“UVE”) is a Delaware corporation incorporated in 1990. UVE with its wholly-owned subsidiaries (the “Company”) is a vertically integrated insurance holding company performing all aspects of insurance underwriting, distribution and claims. Through its wholly-owned subsidiaries, Universal Property & Casualty Insurance Company (“UPCIC”) and American Platinum Property and Casualty Insurance Company (“APPCIC”), together referred to as the “Insurance Entities,” the Company is principally engaged in the property and casualty insurance business offered primarily through a network of independent agents. Risk from catastrophic losses is managed through the use of reinsurance agreements. The Company’s primary product is homeowners’ insurance currently offered in thirteen states as of September 30, 2016, including Florida, which comprises the vast majority of the Company’s in-force policies. See “—Note 5 (Insurance Operations)” for more information regarding the Company’s insurance operations.

The Company generates revenues primarily from the collection of premiums and invests funds in excess of those retained for claims-paying obligations and insurance operations. Other significant sources of revenue include brokerage commissions collected from reinsurers on reinsurance programs placed by the Insurance Entities, policy fees collected from policyholders by our wholly-owned managing general agency subsidiary and payment plan fees charged to policyholders who choose to pay their premiums in installments.

Basis of Presentation

The Company has prepared the accompanying unaudited Condensed Consolidated Financial Statements (“Financial Statements”) in accordance with the rules and regulations of the United States Securities and Exchange Commission (“SEC”) for interim financial information. Accordingly, the Financial Statements do not include all of the information and footnotes required by United States Generally Accepted Accounting Principles (“GAAP”) for annual financial statements. Therefore, the Financial Statements should be read in conjunction with the audited Consolidated Financial Statements contained in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the SEC on February 24, 2016. The condensed consolidated balance sheet at December 31, 2015, was derived from audited financial statements, but does not include all disclosures required by GAAP. In the opinion of management, all adjustments (consisting of normal recurring adjustments) necessary for a fair presentation have been included in the Financial Statements. The results for interim periods do not necessarily indicate the results that may be expected for any other interim period or for the full year.

To conform to the current period presentation, certain amounts in the prior periods’ consolidated financial statements and notes have been reclassified. Such reclassifications were of an immaterial amount and had no effect on net income or stockholders’ equity.

The Financial Statements include the accounts of UVE and its wholly-owned subsidiaries. All material intercompany balances and transactions have been eliminated in consolidation.

Management must make estimates and assumptions that affect amounts reported in the Company’s Financial Statements and in disclosures of contingent assets and liabilities. Actual results could differ from those estimates.

Condensed Consolidated Statement of Cash Flows – Additional Disclosure

As discussed in “—Note 7 (Stockholders’ Equity)”, in April 2016 the Company entered into a Purchase and Exchange Agreement with RenaissanceRe Ventures Ltd. pursuant to which the Company sold an aggregate of 583,771 shares of UVE common stock at a price of $17.13 per share for a total consideration of $10 million of which $7.035 million represents cancellation of indebtedness, non-cash portion, and the balance of $2.965 million was received in cash. The non-cash portion of the transaction has been excluded from the statement of cash flows.

7

2. Significant Accounting Policies

The Company reported Significant Accounting Policies in its Annual Report on Form 10-K for the year ended December 31, 2015. Below are revised disclosures required to be reported on a quarterly basis.

Reinsurance. Ceded written premium is recorded upon the effective date of the reinsurance contracts and earned over the contract period. Amounts recoverable from reinsurers are estimated in a manner consistent with the provisions of the reinsurance agreements and consistent with the establishment of the liability of the Company. Allowances are established for amounts deemed uncollectible if any.

8

Securities Available for Sale

The following table provides the cost or amortized cost and fair value of securities available for sale as of the dates presented (in thousands):

|

|

September 30, 2016 |

|

|||||||||||||

|

|

Cost or |

|

|

Gross |

|

|

Gross |

|

|

|

|

|

|||

|

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

|

|

|

|||

|

|

Cost |

|

|

Gains |

|

|

Losses |

|

|

Fair Value |

|

||||

|

Fixed Maturities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government obligations and agencies |

$ |

77,076 |

|

|

$ |

618 |

|

|

$ |

(63 |

) |

|

$ |

77,631 |

|

|

Corporate bonds |

|

191,342 |

|

|

|

2,485 |

|

|

|

(125 |

) |

|

|

193,702 |

|

|

Mortgage-backed and asset-backed securities |

|

224,423 |

|

|

|

1,830 |

|

|

|

(182 |

) |

|

|

226,071 |

|

|

Municipal bonds |

|

77,135 |

|

|

|

270 |

|

|

|

(224 |

) |

|

|

77,181 |

|

|

Redeemable preferred stock |

|

9,095 |

|

|

|

607 |

|

|

|

(13 |

) |

|

|

9,689 |

|

|

Equity Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

11,210 |

|

|

|

— |

|

|

|

(374 |

) |

|

|

10,836 |

|

|

Mutual funds |

|

35,644 |

|

|

|

266 |

|

|

|

(2,506 |

) |

|

|

33,404 |

|

|

Short-term investments |

|

5,000 |

|

|

|

3 |

|

|

|

— |

|

|

|

5,003 |

|

|

Total |

$ |

630,925 |

|

|

$ |

6,079 |

|

|

$ |

(3,487 |

) |

|

$ |

633,517 |

|

|

|

December 31, 2015 |

|

|||||||||||||

|

|

Cost or |

|

|

Gross |

|

|

Gross |

|

|

|

|

|

|||

|

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

|

|

|

|||

|

|

Cost |

|

|

Gains |

|

|

Losses |

|

|

Fair Value |

|

||||

|

Fixed Maturities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government obligations and agencies |

$ |

126,209 |

|

|

$ |

— |

|

|

$ |

(867 |

) |

|

$ |

125,342 |

|

|

Corporate bonds |

|

126,421 |

|

|

|

137 |

|

|

|

(1,041 |

) |

|

|

125,517 |

|

|

Mortgage-backed and asset-backed securities |

|

151,328 |

|

|

|

97 |

|

|

|

(1,265 |

) |

|

|

150,160 |

|

|

Redeemable preferred stock |

|

9,665 |

|

|

|

429 |

|

|

|

(29 |

) |

|

|

10,065 |

|

|

Other |

|

5,000 |

|

|

|

— |

|

|

|

(1 |

) |

|

|

4,999 |

|

|

Equity Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

10,991 |

|

|

|

15 |

|

|

|

(244 |

) |

|

|

10,762 |

|

|

Mutual funds |

|

35,221 |

|

|

|

5 |

|

|

|

(3,774 |

) |

|

|

31,452 |

|

|

Short-term investments |

|

25,011 |

|

|

|

10 |

|

|

|

— |

|

|

|

25,021 |

|

|

Total |

$ |

489,846 |

|

|

$ |

693 |

|

|

$ |

(7,221 |

) |

|

$ |

483,318 |

|

The following table provides the credit quality of investment securities with contractual maturities or the issuer of such securities as of the dates presented (in thousands):

|

|

|

September 30, 2016 |

|

|

December 31, 2015 |

|

||||||||||

|

|

|

|

|

|

|

% of Total |

|

|

|

|

|

|

% of Total |

|

||

|

Comparable Ratings |

|

Fair Value |

|

|

Fair Value |

|

|

Fair Value |

|

|

Fair Value |

|

||||

|

AAA |

|

$ |

129,018 |

|

|

|

21.9 |

% |

|

$ |

103,097 |

|

|

|

23.4 |

% |

|

AA |

|

|

278,611 |

|

|

|

47.3 |

% |

|

|

189,600 |

|

|

|

43.0 |

% |

|

A |

|

|

110,310 |

|

|

|

18.7 |

% |

|

|

83,850 |

|

|

|

19.0 |

% |

|

BBB |

|

|

66,025 |

|

|

|

11.2 |

% |

|

|

41,408 |

|

|

|

9.4 |

% |

|

BB+ and Below |

|

|

3,817 |

|

|

|

0.6 |

% |

|

|

4,261 |

|

|

|

1.0 |

% |

|

No Rating Available |

|

|

1,496 |

|

|

|

0.3 |

% |

|

|

18,888 |

|

|

|

4.2 |

% |

|

Total |

|

$ |

589,277 |

|

|

|

100.0 |

% |

|

$ |

441,104 |

|

|

|

100.0 |

% |

The tables above include comparable credit quality ratings by Standard and Poor’s Rating Services, Inc., Moody’s Investors Service, Inc. and Fitch Ratings, Inc.

9

The following table summarizes the cost or amortized cost and fair value of mortgage-backed and asset-backed securities as of the dates presented (in thousands):

|

|

September 30, 2016 |

|

|

December 31, 2015 |

|

||||||||||

|

|

Cost or |

|

|

|

|

|

|

Cost or |

|

|

|

|

|

||

|

|

Amortized |

|

|

|

|

|

|

Amortized |

|

|

|

|

|

||

|

|

Cost |

|

|

Fair Value |

|

|

Cost |

|

|

Fair Value |

|

||||

|

Mortgage-backed securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Agency |

$ |

116,085 |

|

|

$ |

116,947 |

|

|

$ |

74,353 |

|

|

$ |

73,854 |

|

|

Non-agency |

|

19,614 |

|

|

|

19,779 |

|

|

|

10,430 |

|

|

|

10,183 |

|

|

Asset-backed securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Auto loan receivables |

|

38,886 |

|

|

|

39,187 |

|

|

|

29,883 |

|

|

|

29,712 |

|

|

Credit card receivables |

|

38,663 |

|

|

|

38,880 |

|

|

|

32,225 |

|

|

|

31,985 |

|

|

Other receivables |

|

11,175 |

|

|

|

11,278 |

|

|

|

4,437 |

|

|

|

4,426 |

|

|

Total |

$ |

224,423 |

|

|

$ |

226,071 |

|

|

$ |

151,328 |

|

|

$ |

150,160 |

|

The following table summarizes the fair value and gross unrealized losses on securities available for sale, aggregated by major investment category and length of time that individual securities have been in a continuous unrealized loss position as of the dates presented (in thousands):

|

|

September 30, 2016 |

|

|||||||||||||||||||||

|

|

Less Than 12 Months |

|

|

12 Months or Longer |

|

||||||||||||||||||

|

|

Number of |

|

|

|

|

|

|

Unrealized |

|

|

Number of |

|

|

|

|

|

|

Unrealized |

|

||||

|

|

Issues |

|

|

Fair Value |

|

|

Losses |

|

|

Issues |

|

|

Fair Value |

|

|

Losses |

|

||||||

|

Fixed maturities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government obligations and agencies |

|

1 |

|

|

$ |

922 |

|

|

$ |

(6 |

) |

|

|

2 |

|

|

$ |

3,518 |

|

|

$ |

(57 |

) |

|

Corporate bonds |

|

18 |

|

|

|

13,627 |

|

|

|

(23 |

) |

|

|

6 |

|

|

|

5,362 |

|

|

|

(102 |

) |

|

Mortgage-backed and asset-backed securities |

|

12 |

|

|

|

25,089 |

|

|

|

(96 |

) |

|

|

4 |

|

|

|

6,858 |

|

|

|

(86 |

) |

|

Municipal bonds |

|

25 |

|

|

|

32,976 |

|

|

|

(224 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Redeemable preferred stock |

|

5 |

|

|

|

479 |

|

|

|

(13 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Equity securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

3 |

|

|

|

10,754 |

|

|

|

(265 |

) |

|

|

2 |

|

|

|

81 |

|

|

|

(109 |

) |

|

Mutual funds |

|

1 |

|

|

|

9,991 |

|

|

|

(49 |

) |

|

|

2 |

|

|

|

11,895 |

|

|

|

(2,457 |

) |

|

Total |

|

65 |

|

|

$ |

93,838 |

|

|

$ |

(676 |

) |

|

|

16 |

|

|

$ |

27,714 |

|

|

$ |

(2,811 |

) |

|

|

December 31, 2015 |

|

|||||||||||||||||||||

|

|

Less Than 12 Months |

|

|

12 Months or Longer |

|

||||||||||||||||||

|

|

Number of |

|

|

|

|

|

|

Unrealized |

|

|

Number of |

|

|

|

|

|

|

Unrealized |

|

||||

|

|

Issues |

|

|

Fair Value |

|

|

Losses |

|

|

Issues |

|

|

Fair Value |

|

|

Losses |

|

||||||

|

Fixed maturities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government obligations and agencies |

|

10 |

|

|

$ |

121,912 |

|

|

$ |

(690 |

) |

|

|

2 |

|

|

$ |

3,429 |

|

|

$ |

(177 |

) |

|

Corporate bonds |

|

101 |

|

|

|

90,717 |

|

|

|

(927 |

) |

|

|

6 |

|

|

|

4,789 |

|

|

|

(114 |

) |

|

Mortgage-backed and asset-backed securities |

|

51 |

|

|

|

118,743 |

|

|

|

(974 |

) |

|

|

6 |

|

|

|

13,902 |

|

|

|

(291 |

) |

|

Redeemable preferred stock |

|

5 |

|

|

|

764 |

|

|

|

(29 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other |

|

1 |

|

|

|

4,999 |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Equity securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

3 |

|

|

|

8,690 |

|

|

|

(148 |

) |

|

|

2 |

|

|

|

93 |

|

|

|

(96 |

) |

|

Mutual funds |

|

3 |

|

|

|

13,192 |

|

|

|

(374 |

) |

|

|

1 |

|

|

|

7,867 |

|

|

|

(3,400 |

) |

|

Total |

|

174 |

|

|

$ |

359,017 |

|

|

$ |

(3,143 |

) |

|

|

17 |

|

|

$ |

30,080 |

|

|

$ |

(4,078 |

) |

Evaluating Investments for OTTI

At September 30, 2016, the Company held fixed maturity, equity securities and short-term investments that were in an unrealized loss position as presented in the table above. For fixed maturity securities with significant declines in value, the Company performs quarterly fundamental credit analysis on a security-by-security basis, which includes consideration of credit quality and credit ratings, review of relevant industry analyst reports and other available market data. For fixed maturity, equity securities and short-term investments, the Company considers whether it has the intent and ability to hold the securities for a period of time sufficient to recover its cost basis. Where the Company lacks the intent and ability to hold to recovery, or believes the recovery period is extended, the

10

security’s decline in fair value is considered other than temporary and is recorded in earnings. Based on our analysis, our fixed income portfolio is of high quality and we believe we will recover the amortized cost basis of our fixed income securities. We continually monitor the credit quality of our fixed income investments to assess if it is probable that we will receive our contractual or estimated cash flows in the form of principal and interest. Additionally, the Company considers management’s intent and ability to hold the securities until recovery and its credit analysis of the individual issuers of the securities. Based on this process and analysis, management has no reason to believe the unrealized losses for securities available for sale at September 30, 2016 are other than temporary.

As of September 30, 2016, we held approximately $12 million equity securities that were in an unrealized loss position twelve months or longer. The unrealized loss on these securities was $2.6 million. Based on our analysis, we believe each security will recover in a reasonable period of time and we have the intent and ability to hold them until recovery. There were no OTTI losses recognized in the periods presented on the equity portfolio.

The following table presents the amortized cost and fair value of investments with contractual maturities as of the date presented (in thousands):

|

|

September 30, 2016 |

|

|||||

|

|

Cost or |

|

|

|

|

|

|

|

|

Amortized Cost |

|

|

Fair Value |

|

||

|

Due in one year or less |

$ |

48,716 |

|

|

$ |

48,738 |

|

|

Due after one year through five years |

|

225,404 |

|

|

|

228,062 |

|

|

Due after five years through ten years |

|

22,056 |

|

|

|

22,408 |

|

|

Due after ten years |

|

54,377 |

|

|

|

54,309 |

|

|

Mortgage-backed and asset-backed securities |

|

224,423 |

|

|

|

226,071 |

|

|

Perpetual maturity securities |

|

9,095 |

|

|

|

9,689 |

|

|

Total |

$ |

584,071 |

|

|

$ |

589,277 |

|

Expected maturities may differ from contractual maturities because borrowers may have the right to call or prepay with or without penalty.

The following table provides certain information related to securities available for sale during the periods presented (in thousands):

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

||||

|

Sales proceeds (fair value) |

$ |

8,111 |

|

|

$ |

12,014 |

|

|

$ |

125,785 |

|

|

$ |

56,066 |

|

|

Gross realized gains |

$ |

107 |

|

|

$ |

12 |

|

|

$ |

1,369 |

|

|

$ |

308 |

|

|

Gross realized losses |

$ |

(6 |

) |

|

$ |

(1 |

) |

|

$ |

(25 |

) |

|

$ |

(16 |

) |

The following table presents the components of net investment income, comprised primarily of interest and dividends, for the periods presented (in thousands):

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

||||

|

Fixed maturities |

$ |

2,456 |

|

|

$ |

1,479 |

|

|

$ |

6,447 |

|

|

$ |

4,001 |

|

|

Equity securities |

|

223 |

|

|

|

277 |

|

|

|

666 |

|

|

|

540 |

|

|

Short-term investments |

|

15 |

|

|

|

89 |

|

|

|

60 |

|

|

|

194 |

|

|

Other (1) |

|

166 |

|

|

|

102 |

|

|

|

603 |

|

|

|

247 |

|

|

Total investment income |

|

2,860 |

|

|

|

1,947 |

|

|

|

7,776 |

|

|

|

4,982 |

|

|

Less: Investment expenses (2) |

|

(556 |

) |

|

|

(640 |

) |

|

|

(1,725 |

) |

|

|

(1,606 |

) |

|

Net investment (expense) income |

$ |

2,304 |

|

|

$ |

1,307 |

|

|

$ |

6,051 |

|

|

$ |

3,376 |

|

|

(1) |

Includes interest earned on cash and cash equivalents and restricted cash and cash equivalents. Also includes investment income earned on real estate investments. |

|

(2) |

Includes bank fees, investment accounting and advisory fees, and expenses associated with real estate investments. |

11

Investment real estate consisted of the following as of the dates presented (in thousands):

|

|

September 30, 2016 |

|

|

December 31, 2015 |

|

||

|

Investment real estate |

$ |

10,620 |

|

|

$ |

6,220 |

|

|

Less: Accumulated depreciation |

|

(236 |

) |

|

|

(103 |

) |

|

Investment real estate, net |

$ |

10,384 |

|

|

$ |

6,117 |

|

12

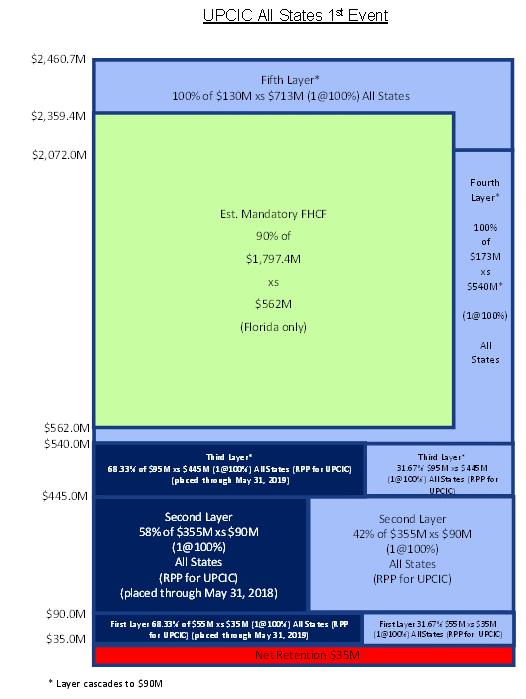

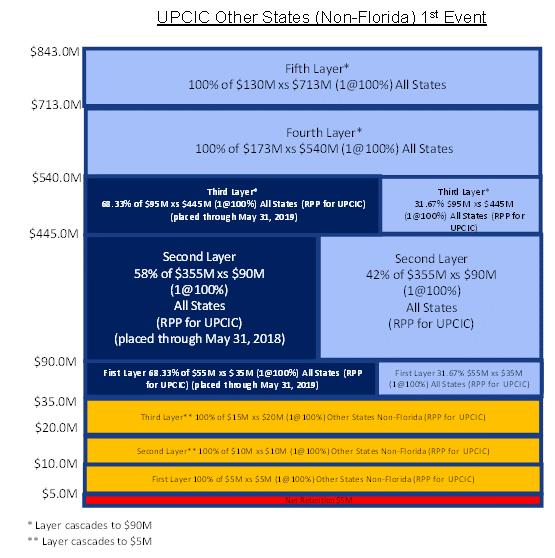

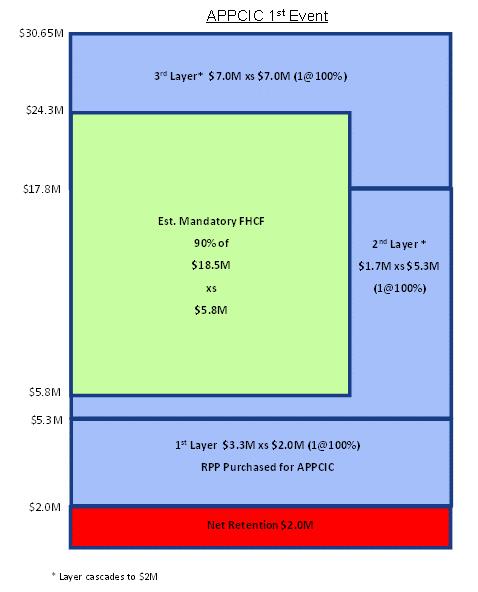

The Company seeks to reduce its risk of loss by reinsuring certain levels of risk in various areas of exposure with other insurance enterprises or reinsurers, generally as of the beginning of the hurricane season on June 1st of each year. The Company’s current reinsurance program consists of catastrophe excess of loss reinsurance, subject to the terms and conditions of the applicable agreements. The Company is responsible for insured losses related to catastrophes and other events in excess of coverage provided by its reinsurance program. The Company remains responsible for the settlement of insured losses irrespective of the failure of any of its reinsurers to make payments otherwise due to the Company.

The Company eliminated the quota share ceded by UPCIC to its reinsurers beginning with the reinsurance program effective June 1, 2015. Under the quota share contracts that were effective June 1, 2014 through May 31, 2015, the quota share ceded by UPCIC to its reinsurers was 30%. By eliminating the quota share, the Company now retains all premiums. The elimination of the quota share also decreases the amount of losses and loss adjustment expenses (“LAE”) that may be ceded by UPCIC and effectively increases the amount of risk retained by UPCIC and the Company. The elimination of the quota share also eliminates ceding commissions earned from the Company’s quota share reinsurer during the contract term and eliminates deferred ceding commissions, netted against deferred policy acquisition costs.

Amounts recoverable from reinsurers are estimated in a manner consistent with the terms of the respective reinsurance contracts. Reinsurance premiums, losses and LAE are accounted for on a basis consistent with those used in accounting for the original policies issued and the terms of the respective reinsurance contracts. Ceding commissions received in connection with quota share reinsurance are deferred and netted against deferred policy acquisition costs and amortized over the effective period of the related insurance policies.

In order to reduce credit risk for amounts due from reinsurers, the Insurance Entities seek to do business with financially sound reinsurance companies and regularly evaluate the financial strength of all reinsurers used.

The following table presents ratings from rating agencies and the unsecured amounts due from the Company’s reinsurers whose aggregate balance exceeded 3% of the Company’s stockholders’ equity as of the dates presented (in thousands):

|

|

|

Ratings as of December 31, 2015 |

|

Due from as of |

|

|||||

|

|

|

|

|

Standard |

|

|

|

|

|

|

|

|

|

|

|

and Poor's |

|

Moody's |

|

|

|

|

|

|

|

AM Best |

|

Rating |

|

Investors |

|

December 31, |

|

|

|

Reinsurer |

|

Company |

|

Services |

|

Service, Inc. |

|

2015 |

|

|

|

Florida Hurricane Catastrophe Fund |

|

n/a |

|

n/a |

|

n/a |

|

$ |

42,086 |

|

|

Odyssey Reinsurance Company |

|

A |

|

A- |

|

A3 |

|

|

18,742 |

|

|

Total (1) |

|

|

|

|

|

|

|

$ |

60,828 |

|

|

|

(1) |

Amounts represent prepaid reinsurance premiums, reinsurance receivables, and net recoverables for paid and unpaid losses, including incurred but not reported reserves, loss adjustment expenses, and offsetting reinsurance payables. |

n/a No rating available, because this state trust fund, which is under the direction of the Florida State Board of Administration, is not rated.

There were no amounts due from the Company’s reinsurers whose aggregate balance exceeded 3% of stockholders’ equity as of September 30, 2016.

13

The Company’s reinsurance arrangements had the following effect on certain items in the Condensed Consolidated Statements of Income for the periods presented (in thousands):

|

|

Three Months Ended September 30, |

|

|||||||||||||||||||||

|

|

2016 |

|

|

2015 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Losses and Loss |

|

|

|

|

|

|

|

|

|

|

Losses and Loss |

|

||

|

|

Premiums |

|

|

Premiums |

|

|

Adjustment |

|

|

Premiums |

|

|

Premiums |

|

|

Adjustment |

|

||||||

|

|

Written * |

|

|

Earned |

|

|

Expenses |

|

|

Written |

|

|

Earned |

|

|

Expenses |

|

||||||

|

Direct |

$ |

241,888 |

|

|

$ |

234,500 |

|

|

$ |

73,487 |

|

|

$ |

222,572 |

|

|

$ |

214,803 |

|

|

$ |

53,560 |

|

|

Ceded |

|

(151,432 |

) |

|

|

(74,966 |

) |

|

|

61 |

|

|

|

(71,148 |

) |

|

|

(68,650 |

) |

|

|

294 |

|

|

Net |

$ |

90,456 |

|

|

$ |

159,534 |

|

|

$ |

73,548 |

|

|

$ |

151,424 |

|

|

$ |

146,153 |

|

|

$ |

53,854 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

|||||||||||||||||||||

|

|

2016 |

|

|

2015 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Losses and Loss |

|

|

|

|

|

|

|

|

|

|

Losses and Loss |

|

||

|

|

Premiums |

|

|

Premiums |

|

|

Adjustment |

|

|

Premiums |

|

|

Premiums |

|

|

Adjustment |

|

||||||

|

|

Written * |

|

|

Earned |

|

|

Expenses |

|

|

Written |

|

|

Earned |

|

|

Expenses |

|

||||||

|

Direct |

$ |

741,782 |

|

|

$ |

682,571 |

|

|

$ |

198,069 |

|

|

$ |

684,147 |

|

|

$ |

616,244 |

|

|

$ |

152,551 |

|

|

Ceded |

|

(298,365 |

) |

|

|

(214,128 |

) |

|

|

1,680 |

|

|

|

(185,578 |

) |

|

|

(262,843 |

) |

|

|

(25,403 |

) |

|

Net |

$ |

443,417 |

|

|

$ |

468,443 |

|

|

$ |

199,749 |

|

|

$ |

498,569 |

|

|

$ |

353,401 |

|

|

$ |

127,148 |

|

*Ceded premiums written include the effect of an out-of-period adjustment reflected in the three and nine month periods ended September 30, 2016 as discussed in “—Note 15 (Out-of-Period Adjustment)”.

The following prepaid reinsurance premiums and reinsurance recoverable and receivable are reflected in the Condensed Consolidated Balance Sheets as of the dates presented (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2016 |

|

|

2015 |

|

||

|

Prepaid reinsurance premiums |

$ |

198,910 |

|

|

$ |

114,673 |

|

|

Reinsurance recoverable on unpaid losses and LAE |

$ |

1,904 |

|

|

$ |

13,540 |

|

|

Reinsurance recoverable (payable) on paid losses |

|

(2,776 |

) |

|

|

9,313 |

|

|

Reinsurance receivable, net |

|

186 |

|

|

|

353 |

|

|

Reinsurance recoverable and receivable |

$ |

(686 |

) |

|

$ |

23,206 |

|

14

Deferred Policy Acquisition Costs, net

The Company defers certain costs in connection with written policies, called Deferred Policy Acquisition Costs (“DPAC”), net of corresponding amounts of ceded reinsurance commissions, called Deferred Reinsurance Ceding Commissions (“DRCC”). Net DPAC is amortized over the effective period of the related insurance policies.

The following table presents the beginning and ending balances and the changes in DPAC, net of DRCC, for the periods presented (in thousands):

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

||||

|

DPAC, beginning of period |

$ |

67,190 |

|

|

$ |

62,181 |

|

|

$ |

60,019 |

|

|

$ |

54,603 |

|

|

Capitalized Costs |

|

33,227 |

|

|

|

30,846 |

|

|

|

100,444 |

|

|

|

91,135 |

|

|

Amortization of DPAC |

|

(32,117 |

) |

|

|

(30,024 |

) |

|

|

(92,163 |

) |

|

|

(82,735 |

) |

|

DPAC, end of period |

$ |

68,300 |

|

|

$ |

63,003 |

|

|

$ |

68,300 |

|

|

$ |

63,003 |

|

|

DRCC, beginning of period |

$ |

— |

|

|

$ |

- |

|

|

$ |

— |

|

|

$ |

28,943 |

|

|

Ceding Commissions Written |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,276 |

) |

|

Earned Ceding Commissions |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(23,667 |

) |

|

DRCC, end of period |

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

DPAC (DRCC), net, beginning of period |

$ |

67,190 |

|

|

$ |

62,181 |

|

|

$ |

60,019 |

|

|

$ |

25,660 |

|

|

Capitalized Costs, net |

|

33,227 |

|

|

|

30,846 |

|

|

|

100,444 |

|

|

|

96,411 |

|

|

Amortization of DPAC (DRCC), net |

|

(32,117 |

) |

|

|

(30,024 |

) |

|

|

(92,163 |

) |

|

|

(59,068 |

) |

|

DPAC (DRCC), net, end of period |

$ |

68,300 |

|

|

$ |

63,003 |

|

|

$ |

68,300 |

|

|

$ |

63,003 |

|

Liability for Unpaid Losses and Loss Adjustment Expenses

Set forth in the following table is the change in liability for unpaid losses and LAE for the periods presented (in thousands):

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|||||||||||

|

|

September 30, |

|

|

September 30, |

|

|||||||||||

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

|||||

|

Balance at beginning of period |

$ |

60,144 |

|

|

$ |

112,117 |

|

|

$ |

98,840 |

|

|

$ |

134,353 |

|

|

|

Less: Reinsurance recoverable |

|

(2,958 |

) |

|

|

(31,777 |

) |

|

|

(13,540 |

) |

|

|

(47,350 |

) |

|

|

Net balance at beginning of period |

|

57,186 |

|

|

|

80,340 |

|

|

|

85,300 |

|

|

|

87,003 |

|

|

|

Incurred (recovered) related to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current year |

|

73,701 |

|

|

|

54,014 |

|

|

|

199,886 |

|

|

|

127,211 |

|

|

|

Prior years |

|

(173 |

) |

|

|

(160 |

) |

|

|

(158 |

) |

|

|

(66 |

) |

|

|

Total incurred |

|

73,528 |

|

|

|

53,854 |

|

|

|

199,728 |

|

|

|

127,145 |

|

|

|

Paid related to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current year |

|

73,332 |

|

|

|

41,818 |

|

|

|

145,991 |

|

|

|

72,438 |

|

|

|

Prior years |

|

5,077 |

|

|

|

10,777 |

|

|

|

86,732 |

|

|

|

60,111 |

|

|

|

Total paid |

|

78,409 |

|

|

|

52,595 |

|

|

|

232,723 |

|

|

|

132,549 |

|

|

|

Net balance at end of period |

|

52,305 |

|

|

|

81,599 |

|

|

|

52,305 |

|

|

|

81,599 |

|

|

|

Plus: Reinsurance recoverable |

|

1,904 |

|

|

|

19,460 |

|

|

|

1,904 |

|

|

|

19,460 |

|

|

|

Balance at end of period |

$ |

54,209 |

|

|

$ |

101,059 |

|

|

$ |

54,209 |

|

|

$ |

101,059 |

|

|

15

Regulatory Requirements and Restrictions

The Insurance Entities are subject to regulations and standards of the Florida Office of Insurance Regulation (“FLOIR”). UPCIC also is subject to regulations and standards of regulatory authorities in other states where it is licensed, although as a Florida-domiciled insurer its principal regulatory authority is the FLOIR. These standards require the Insurance Entities to maintain specified levels of statutory capital and restrict the timing and amount of dividends and other distributions that may be paid by the Insurance Entities to the parent company. Except in the case of extraordinary dividends, these standards generally permit dividends to be paid from statutory unassigned surplus of the regulated subsidiary and are limited based on the regulated subsidiary’s level of statutory net income and statutory capital and surplus. The maximum dividend that may be paid by UPCIC and APPCIC to their immediate parent company, Universal Insurance Holding Company of Florida (“UVECF”), without prior regulatory approval is limited by the provisions of Florida Statutes. These dividends are referred to as “ordinary dividends.” However, if the dividend, together with other dividends paid within the preceding twelve months, exceeds this statutory limit or is paid from sources other than earned surplus, the entire dividend is generally considered an “extraordinary dividend” and must receive prior regulatory approval.

In accordance with Florida Statutes, and based on the calculations performed by the Company as of December 31, 2015, UPCIC has the capacity to pay ordinary dividends of $52.9 million during 2016. APPCIC does not have the capacity to pay ordinary dividends during 2016. For the nine months ended September 30, 2016, no dividends were paid from UPCIC or APPCIC to UVECF. Dividends paid to the shareholders of UVE in 2016 have been paid from the earnings of UVE and its non-insurance subsidiaries.

The Florida Insurance Code requires insurance companies to maintain capitalization equivalent to the greater of ten percent of the insurer’s total liabilities or $10.0 million. The following table presents the amount of capital and surplus calculated in accordance with statutory accounting principles, which differ from U.S. GAAP, and an amount representing ten percent of total liabilities for both UPCIC and APPCIC as of the dates presented (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2016 |

|

|

2015 |

|

||

|

Ten percent of total liabilities |

|

|

|

|

|

|

|

|

UPCIC |

$ |

65,976 |

|

|

$ |

55,928 |

|

|

APPCIC |

$ |

512 |

|

|

$ |

463 |

|

|

Statutory capital and surplus |

|

|

|

|

|

|

|

|

UPCIC |

$ |

311,202 |

|

|

$ |

256,987 |

|

|

APPCIC |

$ |

14,967 |

|

|

$ |

14,777 |

|

As of the dates in the table above, both UPCIC and APPCIC met the capitalization requirement. UPCIC also met the capitalization requirements of the other states in which it is licensed as of September 30, 2016. UPCIC and APPCIC are also required to adhere to prescribed premium-to-capital surplus ratios and have met those requirements at such dates.

The Insurance Entities are required by various state laws and regulations to maintain certain assets in depository accounts. The following table represents assets held by insurance regulators as of the dates presented (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2016 |

|

|

2015 |

|

||

|

Restricted cash and cash equivalents |

$ |

2,635 |

|

|

$ |

2,635 |

|

|

Investments |

$ |

3,977 |

|

|

$ |

3,876 |

|

16

Long-term debt consists of the following as of the dates presented (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2016 |

|

|

2015 |

|

||

|

Surplus note |

$ |

14,706 |

|

|

$ |

15,809 |

|

|

Term loan |

|

— |

|

|

|

6,851 |

|

|

Promissory note |

|

690 |

|

|

|

1,390 |

|

|

Total |

$ |

15,396 |

|

|

$ |

24,050 |

|

See “—Note 7 (Stockholders’ Equity)” for details of the cancellation of the Term Loan.

UPCIC was in compliance with the terms of the surplus note as of September 30, 2016.

In addition to the long-term debt listed above, UVE has an unsecured line of credit which contains certain covenants and restrictions applicable while amounts are outstanding thereunder. Although UVE has not borrowed any amounts under this line of credit, if UVE were to do so and it were to be in default of any covenants or restrictions, then UVE would be prohibited from paying dividends to its shareholders.

17

Common Stock

The following table summarizes the activity relating to shares of the Company’s common stock during the nine months ended September 30, 2016 (in thousands):

|

|

Issued |

|

|

Treasury |

|

|

Outstanding |

|

|||

|

|

Shares |

|

|

Shares |

|

|

Shares |

|

|||

|

Balance, as of December 31, 2015 |

|

45,525 |

|

|

|

(10,415 |

) |

|

|

35,110 |

|

|

Shares repurchased |

|

— |

|

|

|

(437 |

) |

|

|

(437 |

) |

|

Shares reissued |

|

— |

|

|

|

584 |

|

|

|

584 |

|

|

Options exercised |

|

56 |

|

|

|

— |

|

|

|

56 |

|

|

Shares acquired through cashless exercise (1) |

|

— |

|

|

|

(289 |

) |

|

|

(289 |

) |

|

Shares cancelled |

|

(289 |

) |

|

|

289 |

|

|

|

— |

|

|

Balance, as of September 30, 2016 |

|

45,292 |

|

|

|

(10,268 |

) |

|

|

35,024 |

|

|

(1) |

All shares acquired represent shares tendered to cover the strike price for options and tax withholdings on the intrinsic value of options exercised or restricted stock vested. These shares have been cancelled by the Company. |

In November 2015, UVE announced that its Board of Directors authorized a share repurchase program under which UVE may repurchase in the open market in compliance with Exchange Act Rule 10b-18 up to $10 million of its outstanding shares of common stock through December 31, 2016. In June 2016, UVE completed the repurchase program and repurchased a total of 342,107 shares, at an aggregate price of $6.4 million, pursuant to such repurchase program.

In June 2016, UVE announced that its Board of Directors authorized a share repurchase program under which UVE may repurchase in the open market in compliance with Exchange Act Rule 10b-18 up to $20 million of its outstanding shares of common stock through December 31, 2017. UVE repurchased 95,000 shares, at an aggregate price of approximately $2.0 million, pursuant to such repurchase program through September 2016.

In April 2016, the Company sold 583,771 shares of UVE common stock in a private placement to RenaissanceRe Ventures Ltd. (“RenRe”) at a price of $17.13 per share for total consideration of $10 million, which was comprised of $2.965 million in cash and $7.035 million in cancellation of outstanding indebtedness. See “—Note 6 (Long-Term Debt)” for details of the Company’s debt structure.

Dividends

On January 14, 2016, UVE declared a cash dividend of $0.14 per share on its outstanding common stock paid on March 2, 2016, to the shareholders of record at the close of business on February 18, 2016.

On April 13, 2016, UVE declared a cash dividend of $0.14 per share on its outstanding common stock paid on July 5, 2016, to the shareholders of record at the close of business on June 15, 2016.

On August 31, 2016, UVE declared a cash dividend of $0.14 per share on its outstanding common stock payable on October 24, 2016, to the shareholders of record at the close of business on September 12, 2016.

18

Scott P. Callahan, a director of the Company, provided the Company with consulting services and advice with respect to the Company’s reinsurance and related matters through SPC Global RE Advisors LLC, an entity affiliated with Mr. Callahan. The Company entered into the consulting agreement with SPC Global RE Advisors LLC effective June 6, 2013. The Company and SPC Global RE Advisors LLC terminated the consulting agreement on September 18, 2015 by mutual consent.

The following table provides payments made by the Company for the periods presented (in thousands):

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

2016 |

|

|

2015 |

|

|

2016 |

|

|

2015 |

|

||||