Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UR-ENERGY INC | v452011_8k.htm |

Exhibit 99.1

NYSE MKT: URG • TSX: URE Ur - Energy 2016 Q3 Teleconference and Webcast

NYSE MKT: URG • TSX: URE This presentation contains “forward - looking statements,” within the meaning of applicable securities laws, regarding events or conditions that may occur in the future . Such statements include without limitation the Company’s ability to maintain steady - state operations ; ability to timely make product deliveries and realize anticipated revenues ; the technical and economic viability of Lost Creek (including the production and cost projections contained in the preliminary economic analysis of the Lost Creek Property) ; whether higher - than - expected head grades will continue to be realized throughout Lost Creek ; the ability to complete additional favorable uranium sales agreements and ability to reduce exposure to volatile market ; the further exploration and development of Lost Creek and the ability to continue to grow resources throughout the property ; the technical and economic viability of Shirley Basin (including the production and cost projections contained in the preliminary economic analysis of the Shirley Basin project) ; completion of (and timing for) regulatory approvals and other development at Shirley Basin and in other areas of the Lost Creek Property ; and the long term effects on the uranium market of events in Japan in 2011 including supply and demand projections . These statements are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies . Numerous factors could cause actual events to differ materially from those in the forward - looking statements . Factors that could cause such differences, without limiting the generality of the following, include : risks inherent in exploration activities ; volatility and sensitivity to market prices for uranium ; volatility and sensitivity to capital market fluctuations ; the impact of exploration competition ; the ability to raise funds through private or public equity financings ; imprecision in resource and reserve estimates ; environmental and safety risks including increased regulatory burdens ; unexpected geological or hydrological conditions ; a possible deterioration in political support for nuclear energy ; changes in government regulations and policies, including trade laws and policies ; demand for nuclear power ; weather and other natural phenomena ; delays in obtaining or failures to obtain required governmental, environmental or other project approvals ; and other exploration, development, operating, financial market and regulatory risks . Although Ur - Energy Inc . believes that the assumptions inherent in the forward - looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this presentation . Ur - Energy Inc . disclaims any intention or obligation to update or revise any forward - looking statement, whether as a result of new information, future events or otherwise . Cautionary Note Regarding Projections : Similarly, t his presentation also may contain projections relating to an extended future period and, accordingly, the estimates and assumptions underlying the projections are inherently highly uncertain, based on events that have not taken place, and are subject to significant economic, financial, regulatory, competitive and other uncertainties and contingencies beyond the control of Ur - Energy Inc . Further, given the nature of the Company's business and industry that is subject to a number of significant risk factors, there can be no assurance that the projections can be or will be realized . It is probable that the actual results and outcomes will differ, possibly materially, from those projected . The attention of investors is drawn to the Risk Factors set out in the Company's Annual Report on Form 10 - K, filed February 26 , 2016 , which is filed with the U . S . Securities and Exchange Commission on EDGAR (http : //www . sec . gov/edgar . shtml) and the regulatory authorities in Canada on SEDAR (www . sedar . com) . Cautionary Note to U . S . Investors Concerning Estimates of Measured, Indicated or Inferred Resources : the information presented uses the terms "measured", "indicated" and "inferred" mineral resources . United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize these terms . United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves . United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally minable . James A Bonner, Ur - Energy Vice President, Geology, P . Geo . , and Qualified Person as defined by National Instrument 43 - 101 , reviewed and approved the technical information contained in this presentation . 2

NYSE MKT: URG • TSX: URE 3 See Disclaimer re Forward - looking Statements and Projections (slide 2 ) *October 31, 2016, average of Ux Consulting Company, LLC and Trade Tech, LLC ▪ Lost Creek Resource Growth • Near term resource growth will be realized thru the development of Mine Unit 2 ▪ Realizing better sales prices through long term sales agreements • Spot = $18.75*; Term = $35.50* ▪ Lost Creek ISR Uranium Facility Initiated Production 3Q 2013 • Produced net 2.0M pounds of U 3 0 8 thru Q3 2016 • Results demonstrate that Lost Creek is a reliable, low cost production center – “steady state” production ▪ Pathfinder - Shirley Basin, our Next Development • Advancing application for State permit to mine • Work on other applications ongoing • Low cost to advance permitting

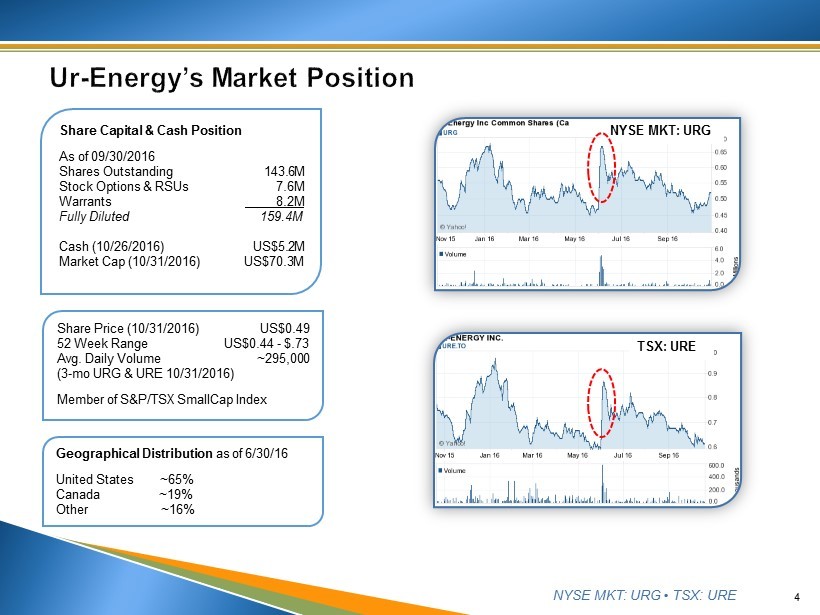

NYSE MKT: URG • TSX: URE 4 Share Capital & Cash Position As of 09/30/2016 Shares Outstanding 143.6M Stock Options & RSUs 7.6M Warrants 8.2M Fully Diluted 159.4M Cash (10/26/2016 ) US$5.2M Market Cap ( 10/31/2016 ) US$70.3M Share Price ( 10/31/2016 ) US$0.49 52 Week Range US$0.44 - $.73 Avg . Daily Volume ~295,000 (3 - mo URG & URE 10/31/2016 ) Member of S&P/TSX SmallCap Index Geographical Distribution as of 6/30/16 United States ~65% Canada ~19% Other ~16% NYSE MKT: URG TSX: URE

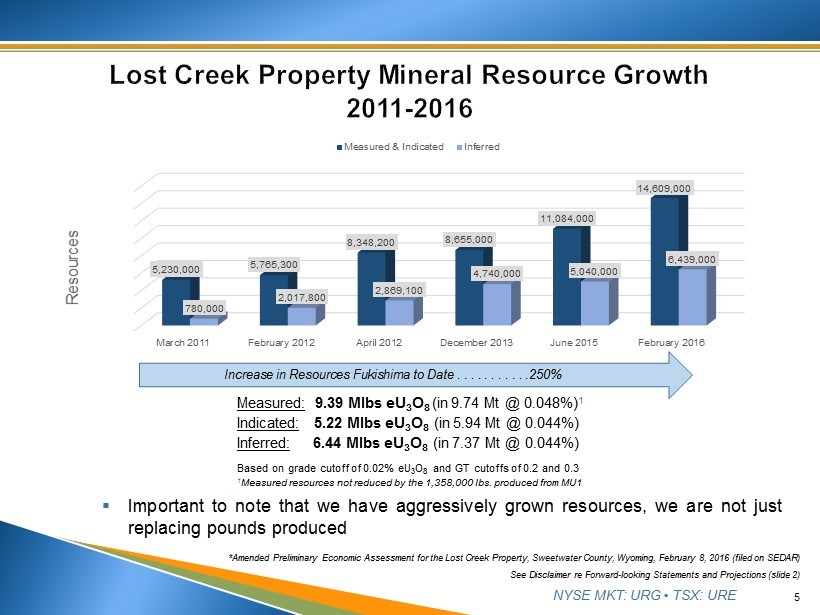

NYSE MKT: URG • TSX: URE 5 See Disclaimer re Forward - looking Statements and Projections (slide 2) Measured: 9.39 Mlbs eU 3 O 8 (in 9.74 Mt @ 0.048%) 1 Indicated: 5.22 Mlbs eU 3 O 8 (in 5 .94 Mt @ 0.044%) Inferred: 6.44 Mlbs eU 3 O 8 (in 7.37 Mt @ 0.044%) Based on grade cutoff of 0.02% eU 3 O 8 and GT cutoffs of 0.2 and 0.3 1 Measured resources not reduced by the 1,358,000 lbs. produced from MU1 *Amended Preliminary Economic Assessment for the Lost Creek Property, Sweetwater County, Wyoming, February 8 , 2016 (filed on SEDAR) Increase in Resources Fukishima to Date . . . . . . . . . . . 250 % March 2011 February 2012 April 2012 December 2013 June 2015 February 2016 5,230,000 5,765,300 8,348,200 8,655,000 11,084,000 14,609,000 780,000 2,017,800 2,869,100 4,740,000 5,040,000 6,439,000 Resources Measured & Indicated Inferred ▪ Important to note that we have aggressively grown resources, we are not just replacing pounds produced

NYSE MKT: URG • TSX: URE ▪ Cash flow is King! ▪ Multiple long - term contracts spanning 2013 - 2021 timeframe, post Fukushima • ~3.1M lbs committed 2016 – 2021 (avg. price $49.81/ lb ) ▪ De - risking by securing future revenue stream in an uncertain market • 2015 : 630,000 lbs U 3 O 8 at avg. price of $49.42/ lb - $31.1M gross revenues • 2016 : 662,000 lbs U 3 O 8 at avg. price of $47.58/ lb - $31.5M gross revenues • Spot sales have supplemented contract revenues 6 ▪ On cash basis, Lost Creek is realizing $30+ margins in a sub - $20 spot price environment ▪ Exclusive representation by Jim Cornell of NuCore Energy, LLC See Disclaimer re Forward - looking Statements and Projections (slide 2)

NYSE MKT: URG • TSX: URE 7 Mine Unit 1 Drilling ▪ MU1: ▪ 100% of original planned header house (HH) wells installed ▪ MU2: ▪ Excellent MU1 recoveries allow for deferred development ▪ Monitor wells and pump testing complete, data package submitted for approval ▪ Wells cased in first 3 header houses ▪ Lost Creek East ▪ Installed 6 monitor wells to support hydrologic testing for LCE Amendment Mine Unit Construction ▪ MU1: ▪ HH 13 completion and construction methods allowing for higher and more sustained flows ▪ Modifying surface installations in MU1 HHs 1 through 12 to incorporate HH 13 operating techniques (70% complete)

NYSE MKT: URG • TSX: URE 8 Wellfield ▪ MU1: ▪ 13 header houses operating ▪ Modifying surface installations to optimize unit production ▪ Swabbing as necessary for flow maintenance Processing Plant ▪ All plant systems functional with maintenance occurring as necessary ▪ Waste Water • Class V UIC water disposal systems installed and final testing underway – will allow for overall reduction in waste water to Class I UIC wells once incorporated • Class I UIC disposal wells are available and utilized as necessary Lost Creek Plant Lost Creek Wellfield

NYSE MKT: URG • TSX: URE 9 2016 Q3 2016 Q2 2016 Q1 2015 Q4 Captured Lbs. 142k 133k 159k 212k Drummed Lbs. 146k 130k 174k 189k Shipped Lbs. 150k 149k 182k 182k HHs Operating 13 13 12 12 Avg. Grade 55 ppm 58 ppm 82 ppm 85 ppm U 3 O 8 Production Lost Creek Plant Yellowcake Shipment

NYSE MKT: URG • TSX: URE 10 2013 2014 2015 2016 YTD thru Q3 190K lbs captured 596K lbs captured 784K lbs captured 434K lbs captured 131K lbs drummed 548K lbs drummed 727K lbs drummed 450K lbs drummed $21.98/lb cash cost* $19.73/ lb cash cost* $16.27/ lb cash cost* $16.91/ lb cash cost* Uranium Production and Cost 2013 2014 2015 2016 YTD thru Q3 $5.7 million $26.5 million $41.8 million $18.9 million 90K lbs at $62.92/lb sold 518K lbs at $51.22/ lb sold 925K lbs at $45.20/ lb sold 462K lbs at $40.95/ lb sold Uranium Revenues From Production * Excludes severance and ad valorem taxes, which for 2015 averaged $3.14 per pound

NYSE MKT: URG • TSX: URE 11 $2.80 $2.61 $2.65 $3.09 $15.42 $15.41 $16.88 $17.50 $8.13 $6.71 $7.71 $8.50 $35.45 $31.85 $27.15 $24.57 $34.47 $36.12 $36.05 $47.36 $- $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 $40.00 $45.00 $50.00 2015 Q4 2016 Q1 2016 Q2 2016 Q3 $ per Pound Quarter Cost per Pound Sold & Average Prices by Quarter Ad valorem and severance tax Cash Non-cash Average spot price Average sales price

NYSE MKT: URG • TSX: URE 12 $2.7 $2.2 $2.4 $5.0 $3.5 $2.4 $5.1 $4.3 $3.8 $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 2014 2015 2016 $ Millions Year Operating Costs Nine Months Ended September 30 $ millions Exploration and evaluation Development General & administrative

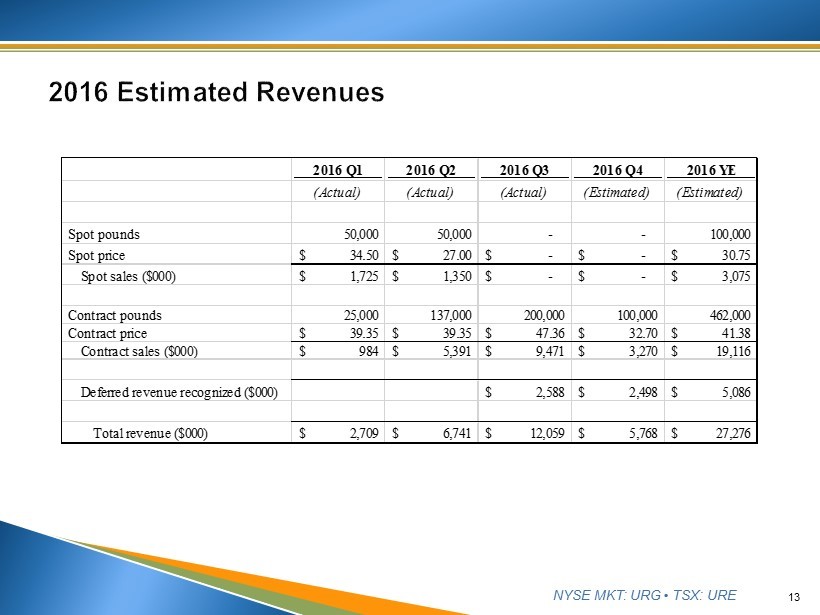

NYSE MKT: URG • TSX: URE 13 2016 Q1 2016 Q2 2016 Q3 2016 Q4 2016 YE (Actual) (Actual) (Actual) (Estimated) (Estimated) Spot pounds 50,000 50,000 - - 100,000 Spot price 34.50$ 27.00$ -$ -$ 30.75$ Spot sales ($000) 1,725$ 1,350$ -$ -$ 3,075$ Contract pounds 25,000 137,000 200,000 100,000 462,000 Contract price 39.35$ 39.35$ 47.36$ 32.70$ 41.38$ Contract sales ($000) 984$ 5,391$ 9,471$ 3,270$ 19,116$ Deferred revenue recognized ($000) 2,588$ 2,498$ 5,086$ Total revenue ($000) 2,709$ 6,741$ 12,059$ 5,768$ 27,276$

NYSE MKT: URG • TSX: URE ▪ Continued focus to attain company - wide cost savings ▪ Long - term s ales a greements • Multiple contracts t hrough 2021 • Unlikely to accept additional agreements at current pricing ▪ 2016 corporate priorities • Lost Creek: continue at steady - state; greater efficiencies • Complete Shirley Basin applications for permits / licenses ▪ M & A activities • Consolidations: opportunities and of necessity • Acquisitions • Uranium space will shrink further 14

NYSE MKT: URG • TSX: URE For more information, please contact: Jeff Klenda , Chairman & Executive Director By Mail: Ur - Energy Corporate Office 10758 W. Centennial Rd., Suite 200 Littleton, CO 80127 USA By Phone: Office 720.981.4588 Toll - Free 866.981.4588 Fax 720.981.5643 By E - mail: jeff.klenda@ur - energy.com 15