Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Adtalem Global Education Inc. | a51451444ex99_1.htm |

| 8-K - DEVRY EDUCATION GROUP INC. 8-K - Adtalem Global Education Inc. | a51451444.htm |

Exhibit 99.2

1stQuarter Fiscal 2017Financial Results November 1, 2016

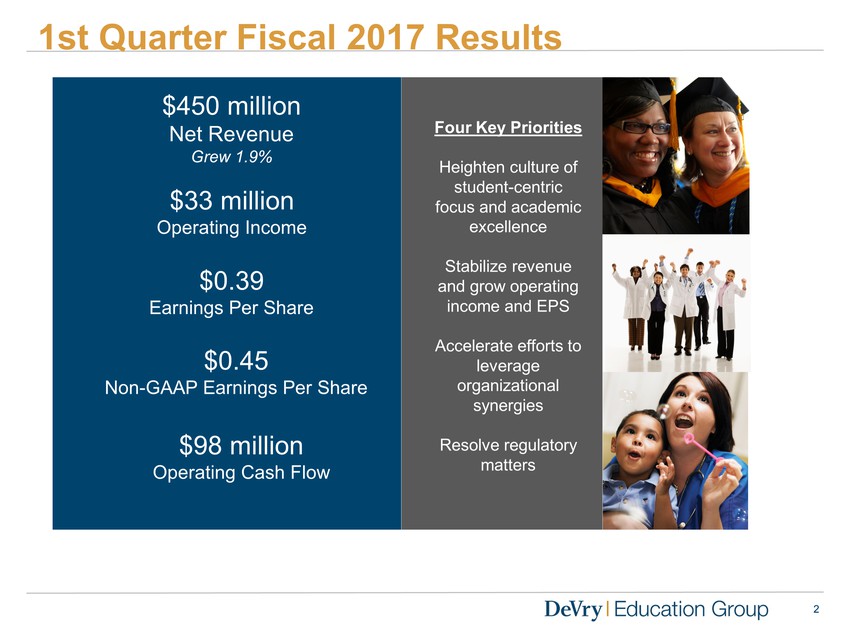

2 2 Four Key Priorities Heighten culture of student-centric focus and academic excellenceStabilize revenue and grow operating income and EPSAccelerate efforts to leverage organizational synergiesResolve regulatory matters 1st Quarter Fiscal 2017 Results $0.39Earnings Per Share $33 millionOperating Income $98 millionOperating Cash Flow $450 millionNet RevenueGrew 1.9% $0.45Non-GAAP Earnings Per Share

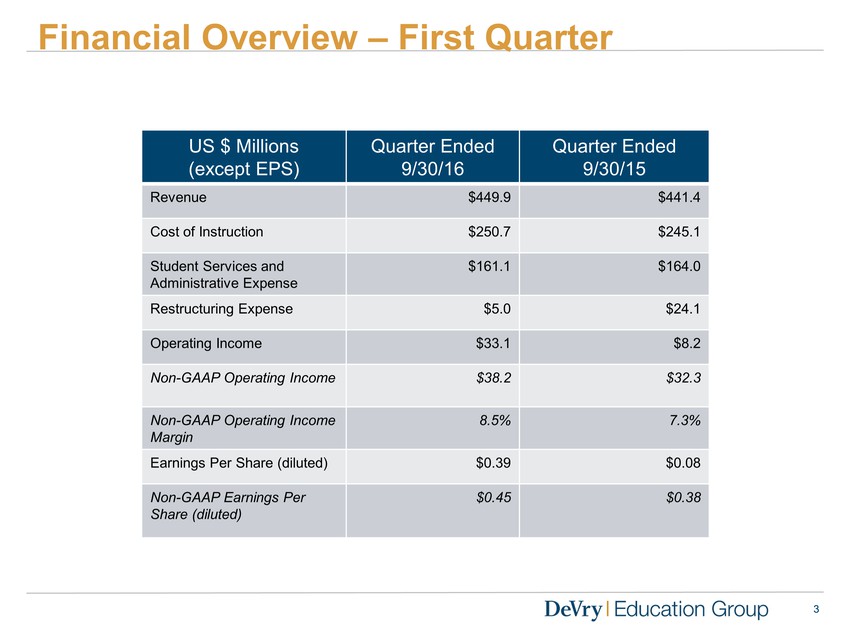

3 3 Financial Overview – First Quarter US $ Millions(except EPS) Quarter Ended 9/30/16 Quarter Ended 9/30/15 Revenue $449.9 $441.4 Cost of Instruction $250.7 $245.1 Student Services and Administrative Expense $161.1 $164.0 Restructuring Expense $5.0 $24.1 Operating Income $33.1 $8.2 Non-GAAP Operating Income $38.2 $32.3 Non-GAAP Operating Income Margin 8.5% 7.3% Earnings Per Share (diluted) $0.39 $0.08 Non-GAAP Earnings Per Share (diluted) $0.45 $0.38

1stQuarter Fiscal 2017 Highlights •Total DeVry Group enrollments up 8% •Third consecutive quarter of Operating Income(1)growth •90% of Operating Income(1)coming from Medical and Healthcare and Professional and International segments •Reached agreement with ED regarding its Jan. 27, 2016 Notice of Intent to Limit •Chamberlain grew revenue by more than 10% •Chamberlain’s RN-BSN new student enrollment was its largest in history with more than 2,000 students •Acquired ACAMS, which furthers Becker’s global growth strategy into professional education •DeVry University received a published Cohort Default Rate for federal student loans for 2013 of 10.6%, down from 12.6% in the prior year •DeVry Group’s financial position remained strong, generating $97.8 million of operating cash flow •At 9/30/16, cash and cash equivalents totaled $189.0 million and outstanding borrowings totaled $130.0 million (1) Excluding special items 4

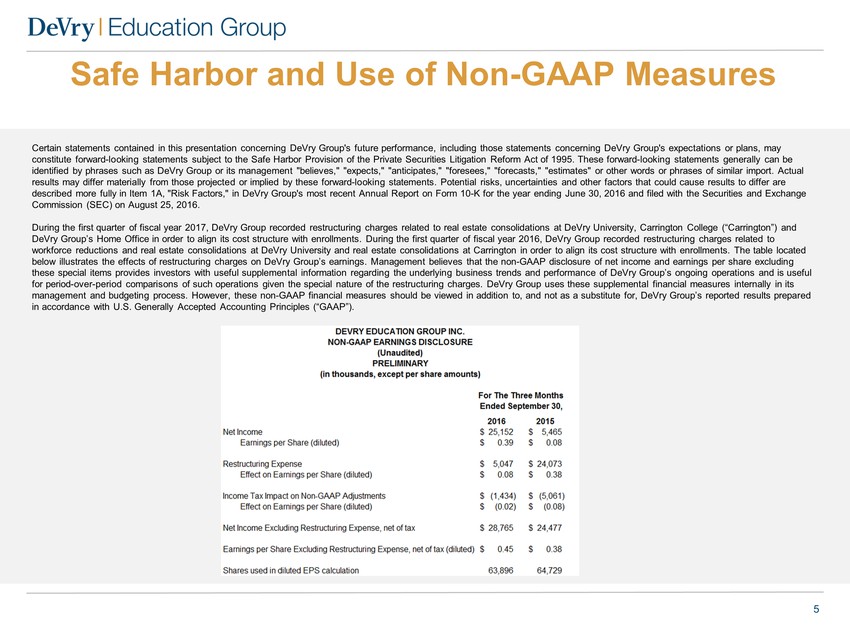

Four Key Priorities Certain statements contained in this presentation concerning DeVry Group's future performance, including those statements concerning DeVry Group's expectations or plans, may constitute forward-looking statements subject to the Safe Harbor Provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by phrases such as DeVry Group or its management "believes," "expects," "anticipates," "foresees," "forecasts," "estimates" or other words or phrases of similar import. Actual results may differ materially from those projected or implied by these forward-looking statements. Potential risks, uncertainties and other factors that could cause results to differ are described more fully in Item 1A, "Risk Factors," in DeVry Group's most recent Annual Report on Form 10-K for the year ending June 30, 2016 and filed with the Securities and Exchange Commission (SEC) on August 25, 2016. During the first quarter of fiscal year 2017, DeVry Group recorded restructuring charges related to real estate consolidations at DeVry University, Carrington College (“Carrington”) and DeVry Group’s Home Office in order to align its cost structure with enrollments. During the first quarter of fiscal year 2016, DeVry Group recorded restructuring charges related to workforce reductions and real estate consolidations at DeVry University and real estate consolidations at Carrington in ordertoalign its cost structure with enrollments. The table located on page 6 illustrates the effects of restructuring charges on DeVry Group’s earnings. Management believes that the non-GAAP disclosure of net income and earnings per share excluding these special items provides investors with useful supplemental information regarding the underlying business trends and performance of DeVry Group’s ongoing operations and is useful for period-over-period comparisons of such operations given the special nature of the restructuring charges. DeVry Group uses these supplemental financial measures internally in its management and budgeting process. However, these non-GAAP financial measures should be viewed in addition to, and not as a substitute for, DeVry Group’s reported results prepared in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”).