Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Atlas Financial Holdings, Inc. | q32016pressrelease.htm |

| 8-K - 8-K - Atlas Financial Holdings, Inc. | a8-kreq32016earningsrelease.htm |

2016 Third Quarter

Conference Call

November 1, 2016

Nasdaq: AFH

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 2

Statements in this presentation, including the information set forth as to the future financial or operating performance of Atlas Financial Holdings, Inc., American Country

Insurance Company, American Service Insurance Company, Gateway Insurance Company and/or Global Insurance Company of New York (collectively, “Atlas”), that are not

current or historical factual statements may constitute “forward looking” information within the meaning of securities laws. Such forward looking statements involve known

and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Atlas, or industry results, to be materially different

from any future results, performance or achievements expressed or implied by such forward looking statements. When used in this presentation, such statements may

include, among other terms, such words as “may,” “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “estimate” and other similar terminology. These statements

reflect current expectations, estimates and projections regarding future events and operating performance and speak only as to the date of this presentation. Readers

should not place undue importance on forward looking statements and should not rely upon this information as of any other date. These forward looking statements

involve a number of risks and uncertainties. Some of the factors facing Atlas that could cause actual results to differ materially from those expressed in or underlying such

forward looking statements include: (i) market fluctuations, changes in interest rates or the need to generate liquidity; (ii) access to capital; (iii) recognition of future tax

benefits on realized and unrealized investment losses; (iv) managing expansion effectively; (v) conditions affecting the industries in which we operate; (vi) competition from

industry participants; (vii) attracting and retaining independent agents and brokers; (viii) comprehensive industry regulation; (ix) our holding company structure; (x) our

ratings with A.M. Best; (xi) new claim and coverage issues; (xii) claims payments and related expenses; (xiii) reinsurance arrangements; (xiv) credit risk; (xv) our ability to

retain key personnel; (xvi) our ability to replace or remove management or Directors; (xvii) future sales of common shares; (xviii) public company challenges; and (xix)

failure to effectively execute our business plan. The foregoing list of factors is not exhaustive. See also “Risk Factors” listed in the Company’s most recent registration

statement filed with the SEC. Many of these issues can affect Atlas’ actual results and could cause the actual results to differ materially from those expressed or implied in

any forward looking statements made by, or on behalf of, Atlas. Readers are cautioned that forward looking statements are not guarantees of future performance, and

should not place undue reliance on them. In formulating the forward looking statements contained in this presentation, it has been assumed that business and economic

conditions affecting Atlas will continue substantially in the ordinary course. These assumptions, although considered reasonable at the time of preparation, may prove to be

incorrect.

When discussing our business operations, we may use certain terms of art which are not defined under U.S. GAAP. In the event of any unintentional difference between

presentation materials and our GAAP results, investors should rely on the financial information in our public filings.

Safe Harbor

2

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 3 3

Atlas Key Quarterly Takeaways / Snapshot

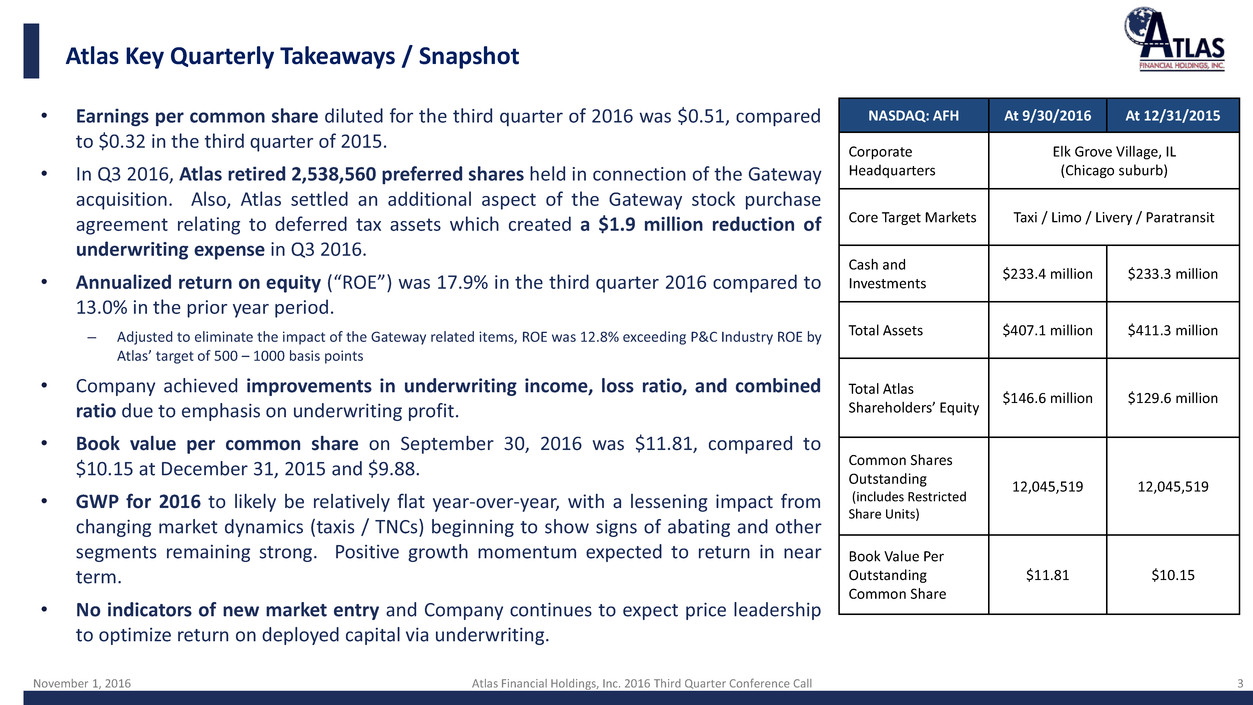

NASDAQ: AFH At 9/30/2016 At 12/31/2015

Corporate

Headquarters

Elk Grove Village, IL

(Chicago suburb)

Core Target Markets Taxi / Limo / Livery / Paratransit

Cash and

Investments

$233.4 million $233.3 million

Total Assets $407.1 million $411.3 million

Total Atlas

Shareholders’ Equity

$146.6 million $129.6 million

Common Shares

Outstanding

(includes Restricted

Share Units)

12,045,519 12,045,519

Book Value Per

Outstanding

Common Share

$11.81 $10.15

• Earnings per common share diluted for the third quarter of 2016 was $0.51, compared

to $0.32 in the third quarter of 2015.

• In Q3 2016, Atlas retired 2,538,560 preferred shares held in connection of the Gateway

acquisition. Also, Atlas settled an additional aspect of the Gateway stock purchase

agreement relating to deferred tax assets which created a $1.9 million reduction of

underwriting expense in Q3 2016.

• Annualized return on equity (“ROE”) was 17.9% in the third quarter 2016 compared to

13.0% in the prior year period.

– Adjusted to eliminate the impact of the Gateway related items, ROE was 12.8% exceeding P&C Industry ROE by

Atlas’ target of 500 – 1000 basis points

• Company achieved improvements in underwriting income, loss ratio, and combined

ratio due to emphasis on underwriting profit.

• Book value per common share on September 30, 2016 was $11.81, compared to

$10.15 at December 31, 2015 and $9.88.

• GWP for 2016 to likely be relatively flat year-over-year, with a lessening impact from

changing market dynamics (taxis / TNCs) beginning to show signs of abating and other

segments remaining strong. Positive growth momentum expected to return in near

term.

• No indicators of new market entry and Company continues to expect price leadership

to optimize return on deployed capital via underwriting.

November 1, 2016 Atlas Financial Holdings, Inc. Third Quarter Conference Call 4

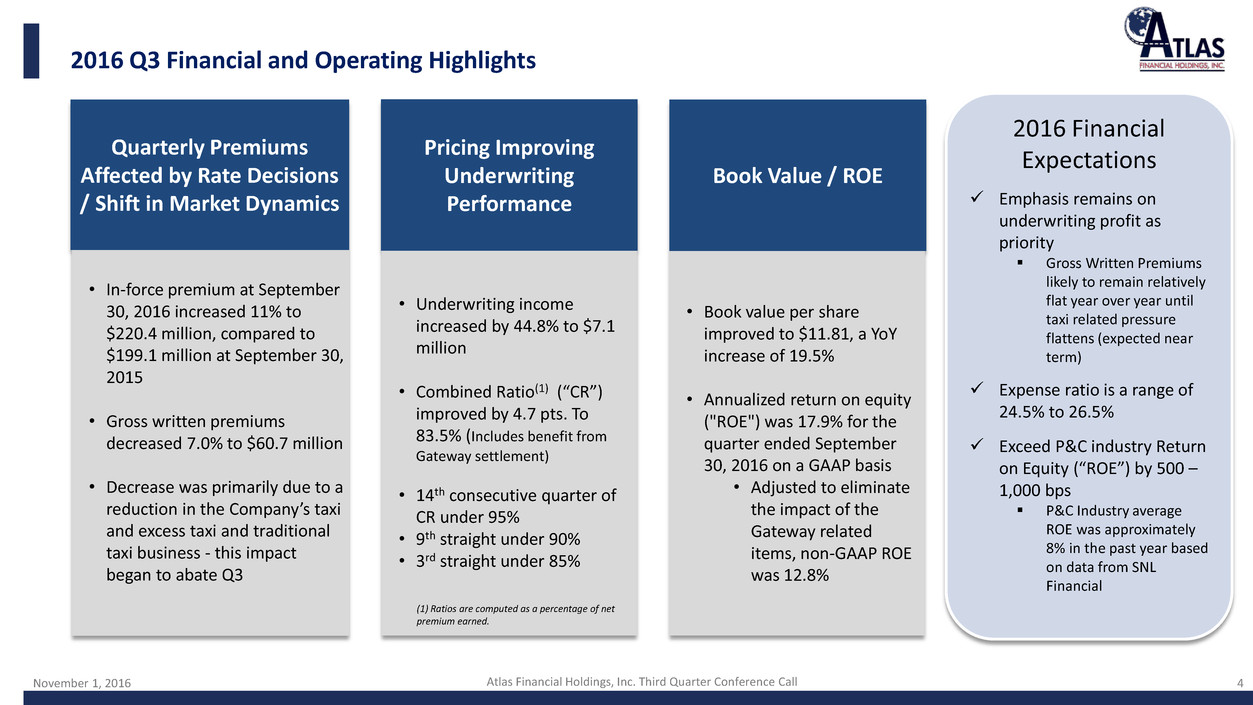

• In-force premium at September

30, 2016 increased 11% to

$220.4 million, compared to

$199.1 million at September 30,

2015

• Gross written premiums

decreased 7.0% to $60.7 million

• Decrease was primarily due to a

reduction in the Company’s taxi

and excess taxi and traditional

taxi business - this impact

began to abate Q3

Quarterly Premiums

Affected by Rate Decisions

/ Shift in Market Dynamics

2016 Financial

Expectations

Emphasis remains on

underwriting profit as

priority

Gross Written Premiums

likely to remain relatively

flat year over year until

taxi related pressure

flattens (expected near

term)

Expense ratio is a range of

24.5% to 26.5%

Exceed P&C industry Return

on Equity (“ROE”) by 500 –

1,000 bps

P&C Industry average

ROE was approximately

8% in the past year based

on data from SNL

Financial

2016 Q3 Financial and Operating Highlights

4

• Underwriting income

increased by 44.8% to $7.1

million

• Combined Ratio(1) (“CR”)

improved by 4.7 pts. To

83.5% (Includes benefit from

Gateway settlement)

• 14th consecutive quarter of

CR under 95%

• 9th straight under 90%

• 3rd straight under 85%

Pricing Improving

Underwriting

Performance

• Book value per share

improved to $11.81, a YoY

increase of 19.5%

• Annualized return on equity

("ROE") was 17.9% for the

quarter ended September

30, 2016 on a GAAP basis

• Adjusted to eliminate

the impact of the

Gateway related

items, non-GAAP ROE

was 12.8%

Book Value / ROE

(1) Ratios are computed as a percentage of net

premium earned.

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 5

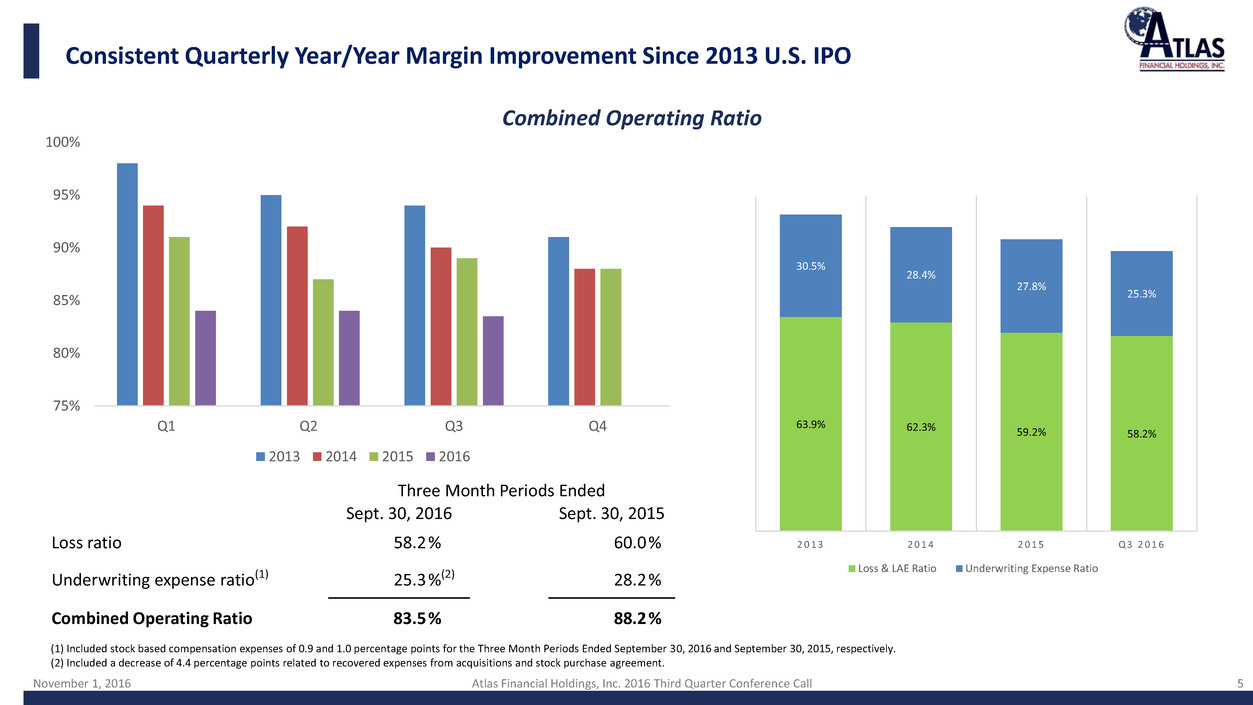

Consistent Quarterly Year/Year Margin Improvement Since 2013 U.S. IPO

5

Combined Operating Ratio

63.9% 62.3% 59.2% 58.2%

30.5%

28.4%

27.8%

25.3%

2 0 1 3 2 0 1 4 2 0 1 5 Q 3 2 0 1 6

Loss & LAE Ratio Underwriting Expense Ratio

75%

80%

85%

90%

95%

100%

Q1 Q2 Q3 Q4

2013 2014 2015 2016

Three Month Periods Ended

Sept. 30, 2016 Sept. 30, 2015

Loss ratio 58.2 % 60.0 %

Underwriting expense ratio(1) 25.3 %(2) 28.2 %

Combined Operating Ratio 83.5 % 88.2 %

(1) Included stock based compensation expenses of 0.9 and 1.0 percentage points for the Three Month Periods Ended September 30, 2016 and September 30, 2015, respectively.

(2) Included a decrease of 4.4 percentage points related to recovered expenses from acquisitions and stock purchase agreement.

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 6

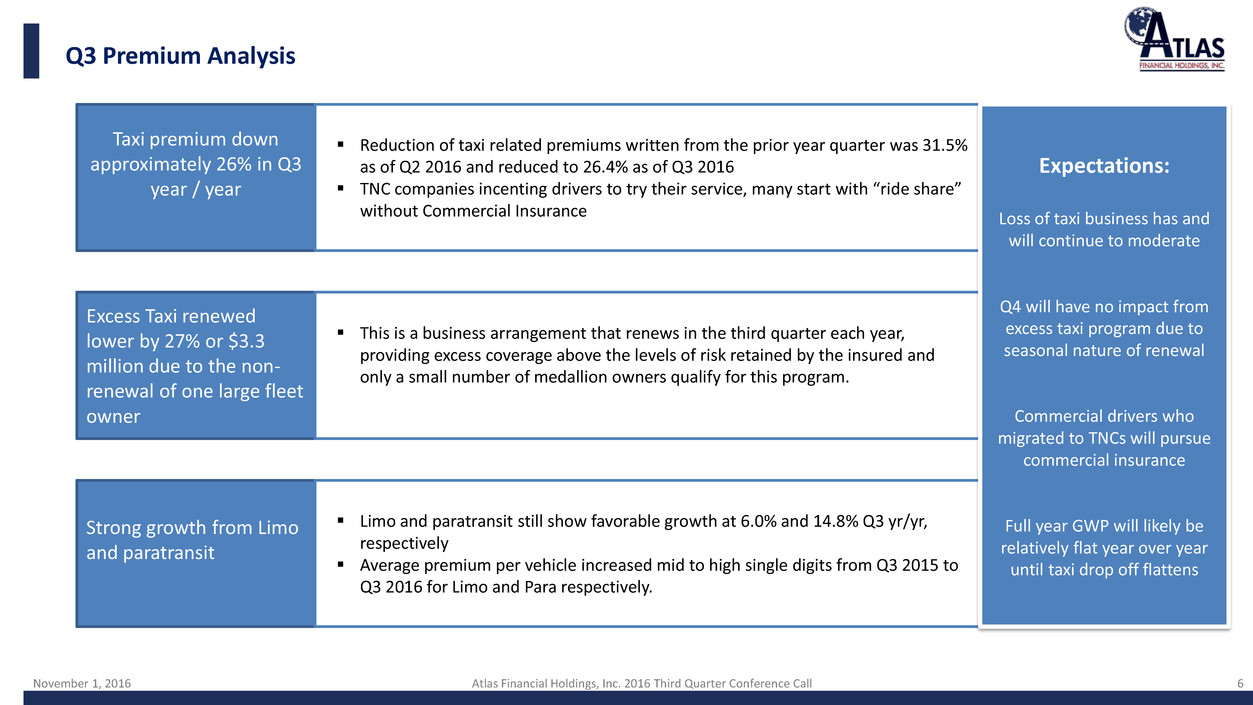

Q3 Premium Analysis

Taxi premium down

approximately 26% in Q3

year / year

Reduction of taxi related premiums written from the prior year quarter was 31.5%

as of Q2 2016 and reduced to 26.4% as of Q3 2016

TNC companies incenting drivers to try their service, many start with “ride share”

without Commercial Insurance

Excess Taxi renewed

lower by 27% or $3.3

million due to the non-

renewal of one large fleet

owner

This is a business arrangement that renews in the third quarter each year,

providing excess coverage above the levels of risk retained by the insured and

only a small number of medallion owners qualify for this program.

Strong growth from Limo

and paratransit

Limo and paratransit still show favorable growth at 6.0% and 14.8% Q3 yr/yr,

respectively

Average premium per vehicle increased mid to high single digits from Q3 2015 to

Q3 2016 for Limo and Para respectively.

Expectations:

Loss of taxi business has and

will continue to moderate

Q4 will have no impact from

excess taxi program due to

seasonal nature of renewal

Commercial drivers who

migrated to TNCs will pursue

commercial insurance

Full year GWP will likely be

relatively flat year over year

until taxi drop off flattens

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 7

Written Premium: Rate Activity

7

-10

-5

0

5

10

15

20

25

Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16

Sequential Rate Changes

Average ISO Recommendation (for period) Atlas Rate Change (Ave)

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 8

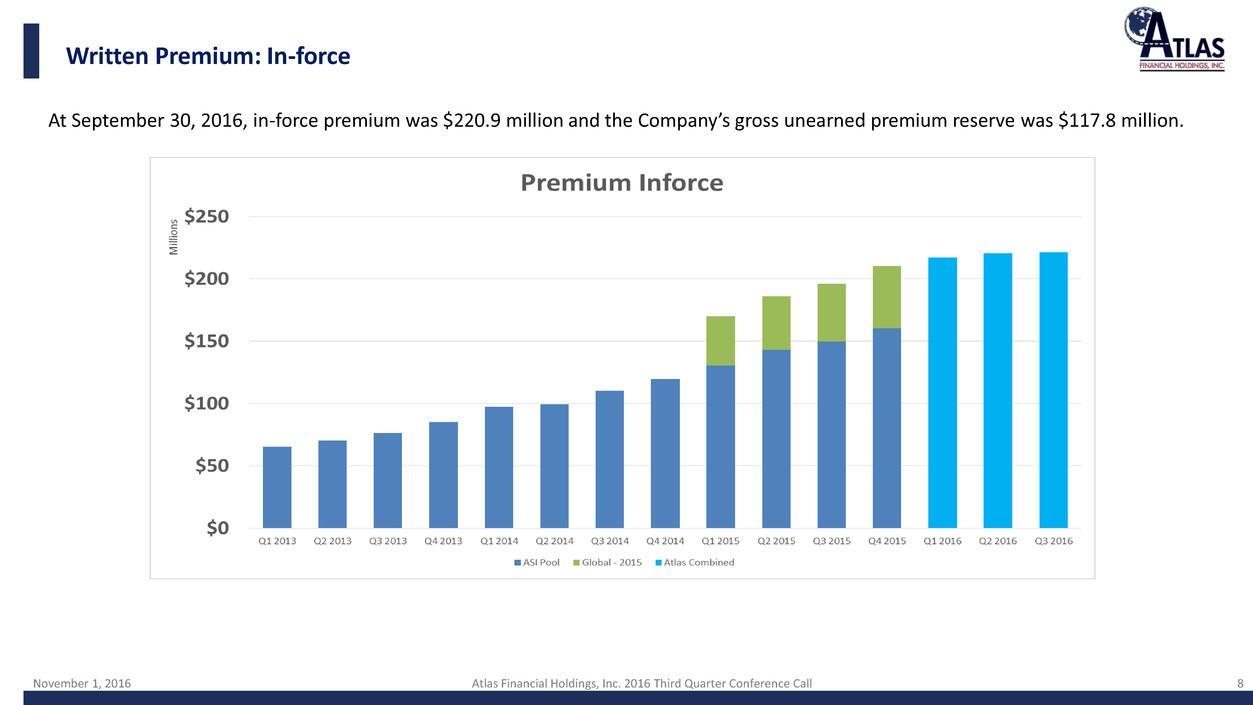

Written Premium: In-force

8

At September 30, 2016, in-force premium was $220.9 million and the Company’s gross unearned premium reserve was $117.8 million.

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 9

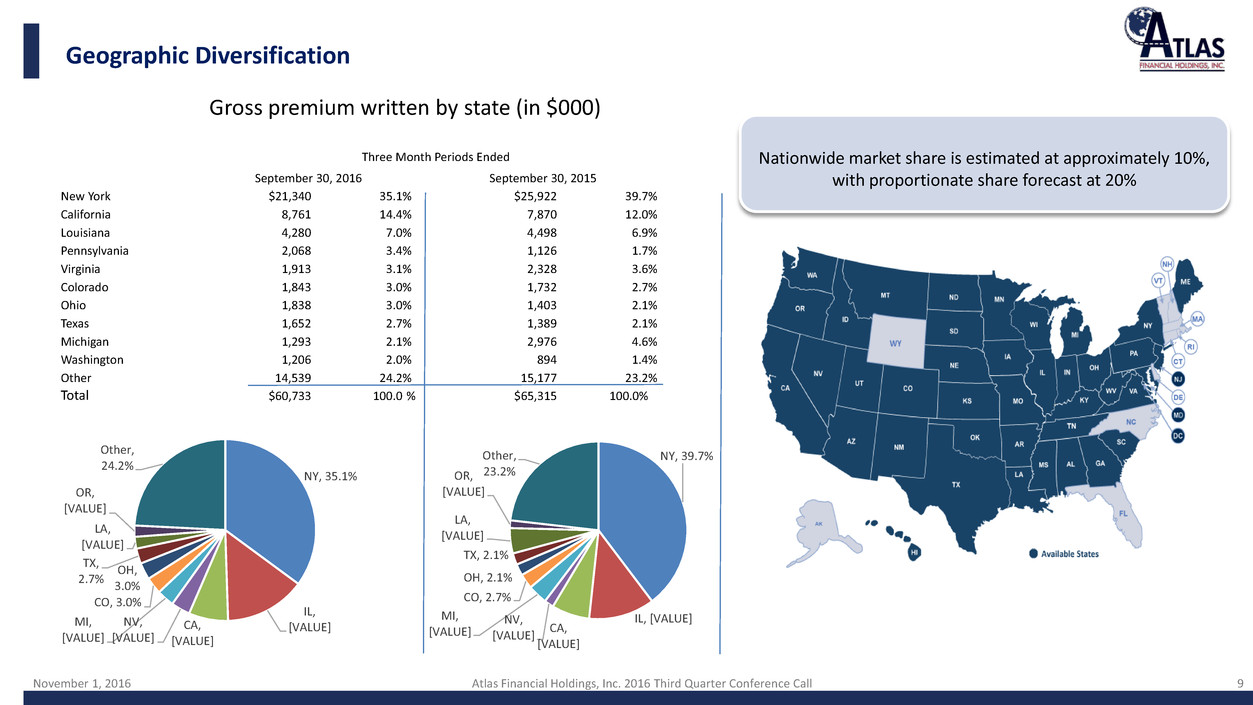

Geographic Diversification

9 9

NY, 35.1%

IL,

[VALUE] CA,

[VALUE]

NV,

[VALUE]

MI,

[VALUE]

CO, 3.0%

OH,

3.0%

TX,

2.7%

LA,

[VALUE]

OR,

[VALUE]

Other,

24.2%

NY, 39.7%

IL, [VALUE]

CA,

[VALUE]

NV,

[VALUE]

MI,

[VALUE]

CO, 2.7%

OH, 2.1%

TX, 2.1%

LA,

[VALUE]

OR,

[VALUE]

Other,

23.2%

Nationwide market share is estimated at approximately 10%,

with proportionate share forecast at 20%

Gross premium written by state (in $000)

Three Month Periods Ended

September 30, 2016 September 30, 2015

New York $21,340 35.1 % $25,922 39.7 %

California 8,761 14.4 % 7,870 12.0 %

Louisiana 4,280 7.0 % 4,498 6.9 %

Pennsylvania 2,068 3.4 % 1,126 1.7 %

Virginia 1,913 3.1 % 2,328 3.6 %

Colorado 1,843 3.0 % 1,732 2.7 %

Ohio 1,838 3.0 % 1,403 2.1 %

Texas 1,652 2.7 % 1,389 2.1 %

Michigan 1,293 2.1 % 2,976 4.6 %

Washington 1,206 2.0 % 894 1.4 %

Other 14,539 24.2 % 15,177 23.2 %

Total $60,733 100.0 % $65,315 100.0%

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 10

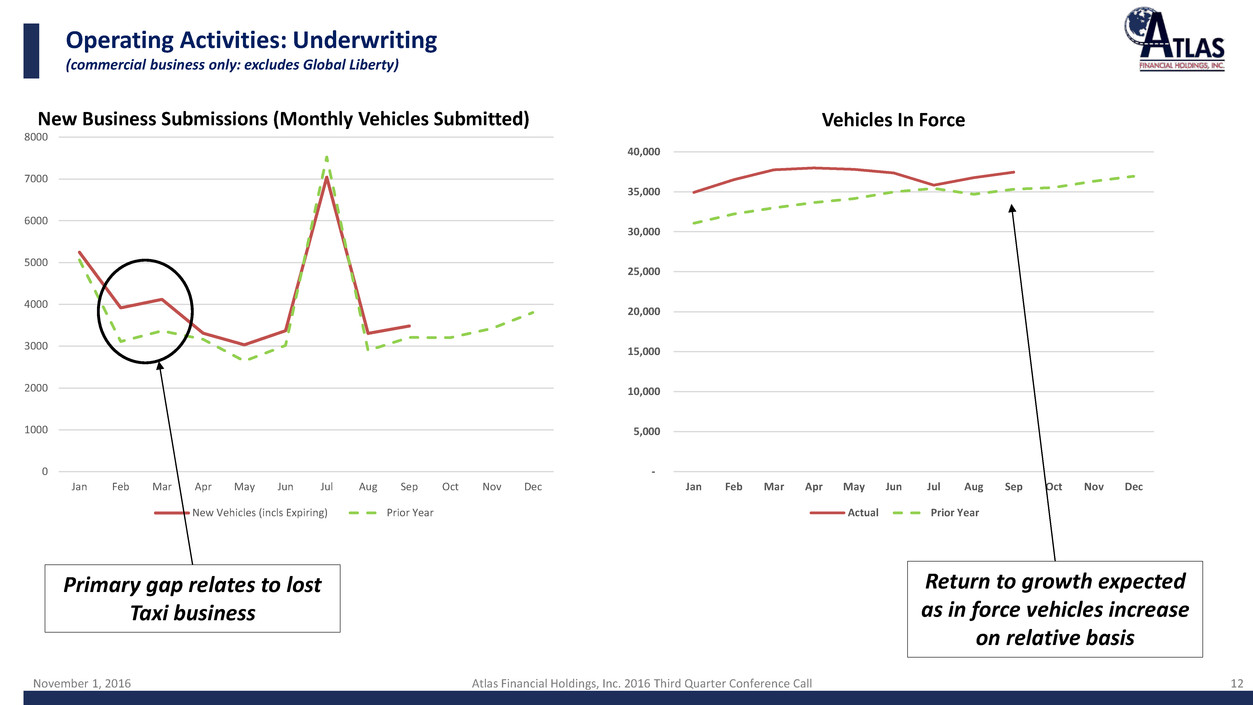

Operating Activities: Underwriting

(commercial business only: excludes Global Liberty)

10

Current target of 52%. Market conditions continue to

show support for mid single digit rate increases

(magnitude varies by geography).

Note: From Q4 ’15 forward, data is compiled from the newly

launched Atlas Xpress (Duck Creek) policy system. The basis for

hit ratio now includes additional submission information (not

just commercial auto accounts that are quoted)

Target of 85% based

on current market

conditions.

Increased use of pricing

relativity based on predictive

analytics tools are expected

to have a positive impact on

both ratios.

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 11

Operating Activities: Underwriting

(commercial business only: excludes Global Liberty)

11

0

2000

4000

6000

8000

0-100 101-200 201-300 301-400 401-500 501-600 601-700 701-800 801-900 901+

Score Group

Written Premium Policy Quote

0

200

400

600

800

0-100 101-200 201-300 301-400 401-500 501-600 601-700 701-800 801-900 901+

Score Group

Policy Count Policy Quote

Positive risk

differentiation using

predictive analytics

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 12

0

1000

2000

3000

4000

5000

6000

7000

8000

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

New Vehicles (incls Expiring) Prior Year

Operating Activities: Underwriting

(commercial business only: excludes Global Liberty)

New Business Submissions (Monthly Vehicles Submitted) Vehicles In Force

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Actual Prior Year

Primary gap relates to lost

Taxi business

Return to growth expected

as in force vehicles increase

on relative basis

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 13

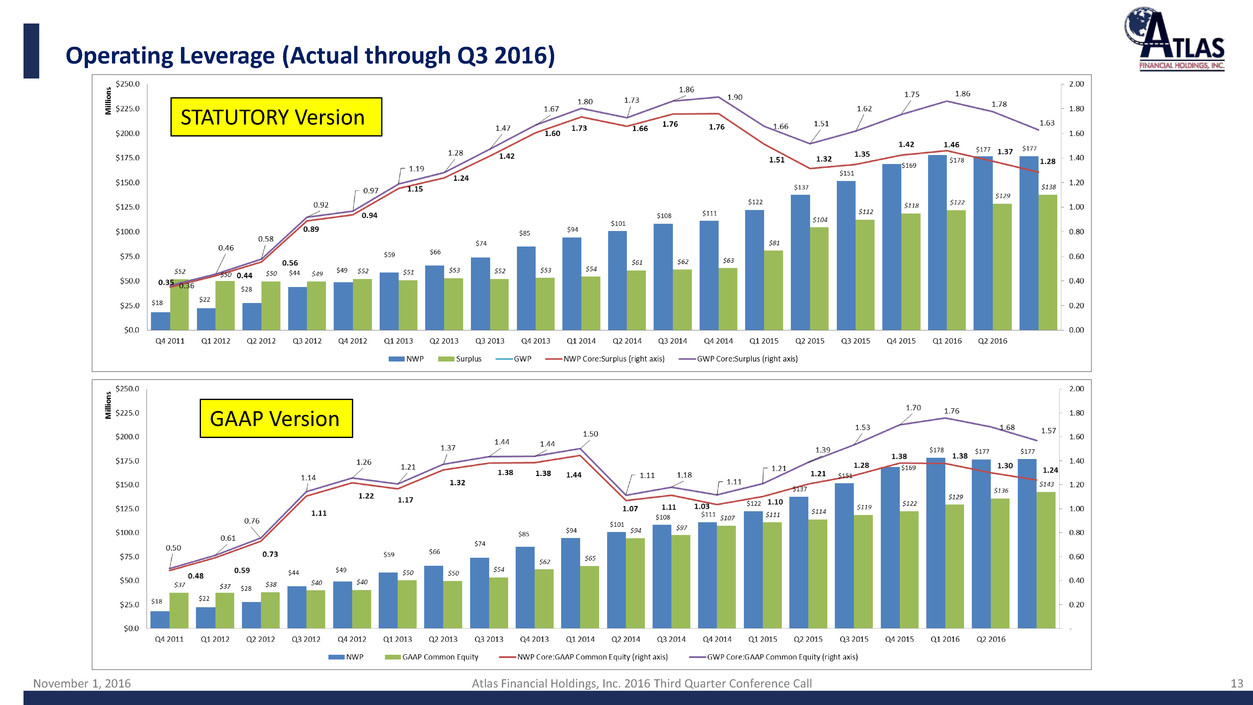

Operating Leverage (Actual through Q3 2016)

STATUTORY Version

GAAP Version

Financial Highlights

14

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 15 15

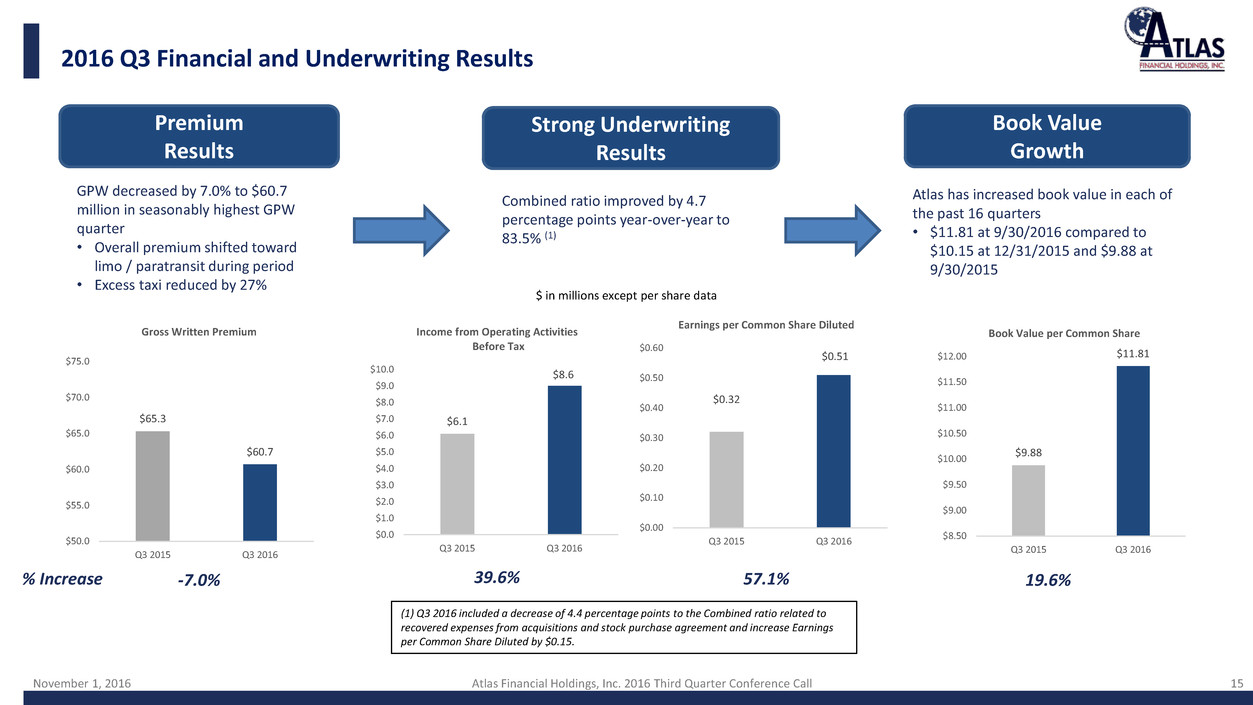

% Increase -7.0% 39.6% 19.6%

2016 Q3 Financial and Underwriting Results

$65.3

$60.7

$50.0

$55.0

$60.0

$65.0

$70.0

$75.0

Q3 2015 Q3 2016

Gross Written Premium

$6.1

$8.6

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

$9.0

$10.0

Q3 2015 Q3 2016

Income from Operating Activities

Before Tax

$0.32

$0.51

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

Q3 2015 Q3 2016

Earnings per Common Share Diluted

$9.88

$11.81

$8.50

$9.00

$9.50

$10.00

$10.50

$11.00

$11.50

$12.00

Q3 2015 Q3 2016

Book Value per Common Share

57.1%

Premium

Results

GPW decreased by 7.0% to $60.7

million in seasonably highest GPW

quarter

• Overall premium shifted toward

limo / paratransit during period

• Excess taxi reduced by 27%

Strong Underwriting

Results

Combined ratio improved by 4.7

percentage points year-over-year to

83.5% (1)

Book Value

Growth

Atlas has increased book value in each of

the past 16 quarters

• $11.81 at 9/30/2016 compared to

$10.15 at 12/31/2015 and $9.88 at

9/30/2015

$ in millions except per share data

(1) Q3 2016 included a decrease of 4.4 percentage points to the Combined ratio related to

recovered expenses from acquisitions and stock purchase agreement and increase Earnings

per Common Share Diluted by $0.15.

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 16

Combined Ratio Analysis

The table below details the comparisons of each component of the Company's combined ratio for the

periods indicated (after accounting for the effect of quota share reinsurance):

Loss Ratio 58.2 % 60.0 % 58.9 % 58.6 %

Underwriting Expense Ratio:

Acquisition cost ratio 11.6 % 12.0 % 10.3 % 12.7 %

Other underwriting expense ratio 17.2 % 15.2 % 15.9 % 14.2 %

Underwriting expense ratio before

expenses related to acquisitions and stock

purchase agreements and stock based

compensation expenses

28.8 % 27.2 % 26.2 % 26.9 %

Expenses (recovered) related to

cqui itions and stock purchase agreement

ratio

(4.4 ) % — % (1.8 ) % 1.7 %

Share based compensation expense ratio 0.9 % 1.0 % 0.9 % 1.1 %

Underwriting expense ratio 25.3 % 28.2 % 25.3 % 29.7 %

Total combined ratio 83.5 % 88.2 % 84.2 % 88.3 %

Three Month Periods Ended

September 30, 2016 September 30, 2015

Nine Month Periods Ended

September 30, 2016 September 30, 2015

Within annual stated target of 24.5% to 26.5% of net earned premium

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 17 17

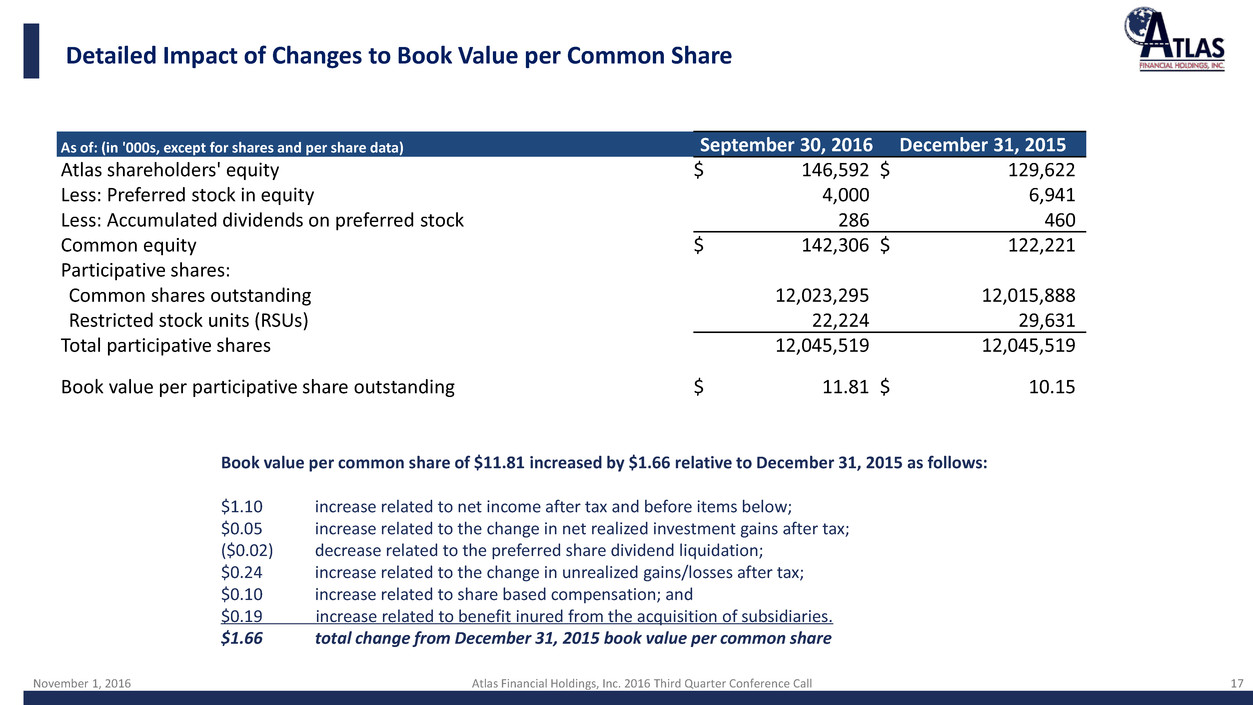

Detailed Impact of Changes to Book Value per Common Share

Book value per common share of $11.81 increased by $1.66 relative to December 31, 2015 as follows:

$1.10 increase related to net income after tax and before items below;

$0.05 increase related to the change in net realized investment gains after tax;

($0.02) decrease related to the preferred share dividend liquidation;

$0.24 increase related to the change in unrealized gains/losses after tax;

$0.10 increase related to share based compensation; and

$0.19 increase related to benefit inured from the acquisition of subsidiaries.

$1.66 total change from December 31, 2015 book value per common share

As of: (in '000s, except for shares and per share data) September 30, 2016 December 31, 2015

Atlas shareholders' equity $ 146,592 $ 129,622

Less: Preferred stock in equity 4,000 6,941

Less: Accumulated dividends on preferred stock 286 460

Common equity $ 142,306 $ 122,221

Participative shares:

Common shares outstanding 12,023,295 12,015,888

Restricted stock units (RSUs) 22,224 29,631

Total participative shares 12,045,519 12,045,519

Book value per participative share outstanding $ 11.81

$ 10.15

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 18

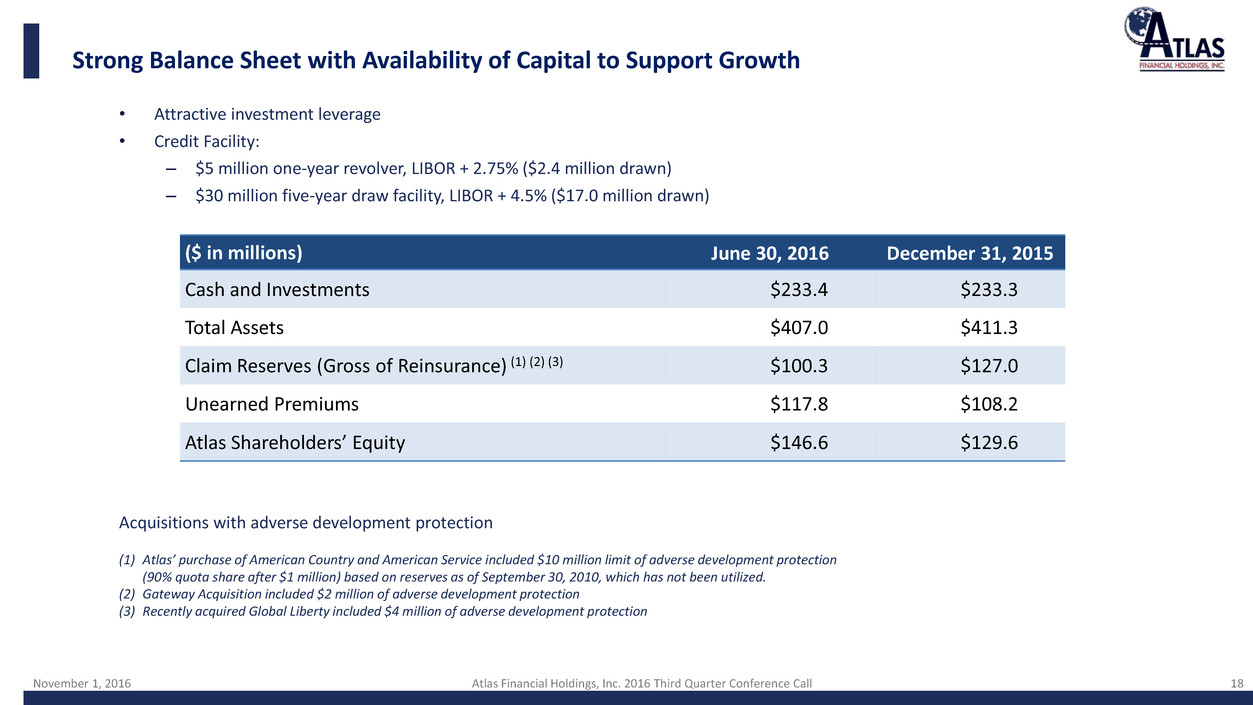

• Attractive investment leverage

• Credit Facility:

– $5 million one-year revolver, LIBOR + 2.75% ($2.4 million drawn)

– $30 million five-year draw facility, LIBOR + 4.5% ($17.0 million drawn)

Acquisitions with adverse development protection

($ in millions) June 30, 2016 December 31, 2015

Cash and Investments $233.4 $233.3

Total Assets $407.0 $411.3

Claim Reserves (Gross of Reinsurance) (1) (2) (3) $100.3 $127.0

Unearned Premiums $117.8 $108.2

Atlas Shareholders’ Equity $146.6 $129.6

18

(1) Atlas’ purchase of American Country and American Service included $10 million limit of adverse development protection

(90% quota share after $1 million) based on reserves as of September 30, 2010, which has not been utilized.

(2) Gateway Acquisition included $2 million of adverse development protection

(3) Recently acquired Global Liberty included $4 million of adverse development protection

Strong Balance Sheet with Availability of Capital to Support Growth

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 19

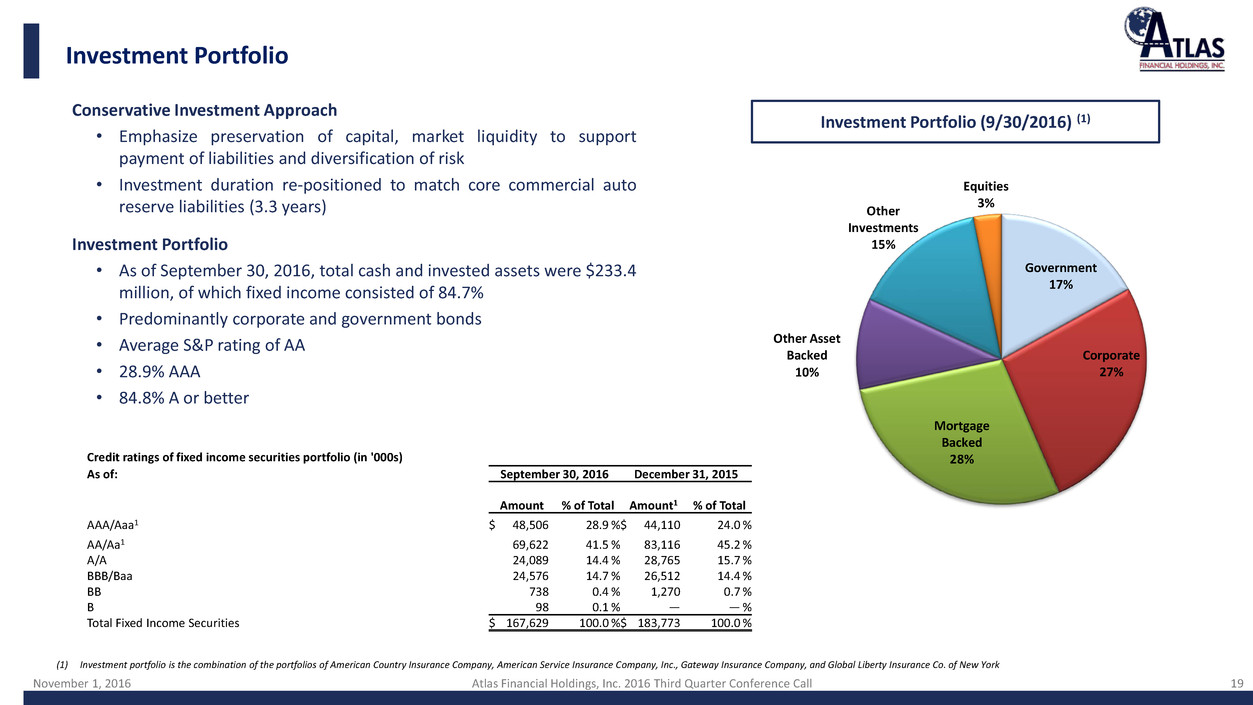

Investment Portfolio

Conservative Investment Approach

• Emphasize preservation of capital, market liquidity to support

payment of liabilities and diversification of risk

• Investment duration re-positioned to match core commercial auto

reserve liabilities (3.3 years)

Investment Portfolio

• As of September 30, 2016, total cash and invested assets were $233.4

million, of which fixed income consisted of 84.7%

• Predominantly corporate and government bonds

• Average S&P rating of AA

• 28.9% AAA

• 84.8% A or better

19

Government

17%

Corporate

27%

Mortgage

Backed

28%

Other Asset

Backed

10%

Other

Investments

15%

Equities

3%

Investment Portfolio (9/30/2016) (1)

(1) Investment portfolio is the combination of the portfolios of American Country Insurance Company, American Service Insurance Company, Inc., Gateway Insurance Company, and Global Liberty Insurance Co. of New York

Credit ratings of fixed income securities portfolio (in '000s)

As of: September 30, 2016 December 31, 2015

Amount % of Total Amount1 % of Total

AAA/Aaa1 $ 48,506 28.9 % $ 44,110 24.0 %

AA/Aa1 69,622 41.5 % 83,116 45.2 %

A/A 24,089 14.4 % 28,765 15.7 %

BBB/Baa 24,576 14.7 % 26,512 14.4 %

BB 738 0.4 % 1,270 0.7 %

B 98 0.1 % — — %

Total Fixed Income Securities $ 167,629 100.0 % $ 183,773 100.0 %

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 20

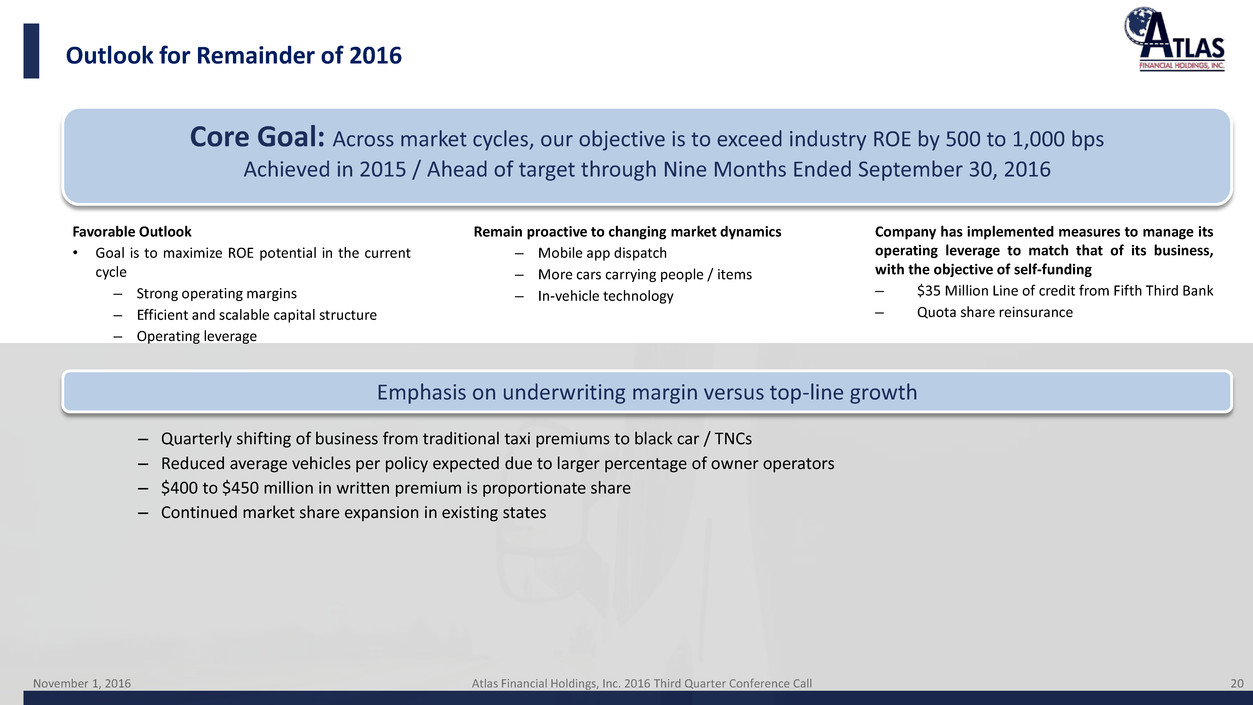

Outlook for Remainder of 2016

Favorable Outlook

• Goal is to maximize ROE potential in the current

cycle

– Strong operating margins

– Efficient and scalable capital structure

– Operating leverage

20

Core Goal: Across market cycles, our objective is to exceed industry ROE by 500 to 1,000 bps

Achieved in 2015 / Ahead of target through Nine Months Ended September 30, 2016

Remain proactive to changing market dynamics

– Mobile app dispatch

– More cars carrying people / items

– In-vehicle technology

Company has implemented measures to manage its

operating leverage to match that of its business,

with the objective of self-funding

– $35 Million Line of credit from Fifth Third Bank

– Quota share reinsurance

– Quarterly shifting of business from traditional taxi premiums to black car / TNCs

– Reduced average vehicles per policy expected due to larger percentage of owner operators

– $400 to $450 million in written premium is proportionate share

– Continued market share expansion in existing states

Emphasis on underwriting margin versus top-line growth

November 1, 2016 Atlas Financial Holdings, Inc. 2016 Third Quarter Conference Call 21

Nasdaq: AFH

For Additional Information

At the Company:

Scott Wollney

Chief Executive Officer

swollney@atlas-fin.com

847-700-8600

Investor Relations:

The Equity Group Inc.

Adam Prior

Senior Vice President

APrior@equityny.com

212-836-9606

21