Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COVANTA HOLDING CORP | form8-kq316earnings.htm |

| EX-99.1 - EXHIBIT 99.1 - COVANTA HOLDING CORP | exhibit991q316.htm |

NYSE: CVA October 25, 2016

Third Quarter 2016

Earnings Conference Call

Exhibit 99.2

October 25, 2016 2

Cautionary Statements

All information included in this earnings presentation is based on continuing operations, unless otherwise noted.

Forward-Looking Statements

Certain statements in this press release constitute “forward-looking” statements as defined in Section 27A of the Securities Act of 1933 (the “Securities Act”), Section 21E of

the Securities Exchange Act of 1934 (the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the Securities and

Exchange Commission (“SEC”), all as may be amended from time to time. Such forward-looking statements involve known and unknown risks, uncertainties and other

important factors that could cause the actual results, performance or achievements of Covanta Holding Corporation and its subsidiaries (“Covanta”) or industry results, to

differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not historical fact are

forward-looking statements. Forward-looking statements can be identified by, among other things, the use of forward-looking language, such as the words “plan,” “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “project,” “may,” “will,” “would,” “could,” “should,” “seeks,” or “scheduled to,” or other similar words, or the negative of these terms or

other variations of these terms or comparable language, or by discussion of strategy or intentions. These cautionary statements are being made pursuant to the Securities

Act, the Exchange Act and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws. Covanta cautions investors that any forward-

looking statements made by us are not guarantees or indicative of future performance. Important assumptions and other important factors that could cause actual results to

differ materially from those forward-looking statements with respect to Covanta, include, but are not limited to, the risk that Covanta may not successfully grow its business

as expected or close its announced or planned acquisitions or projects in development, and those factors, risks and uncertainties that are described in periodic securities

filings by Covanta with the SEC. Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are

reasonable, actual results could differ materially from a projection or assumption in any of our forward-looking statements. Our future financial condition and results of

operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The forward-looking statements contained in this press

release are made only as of the date hereof and we do not have, or undertake, any obligation to update or revise any forward-looking statements whether as a result of new

information, subsequent events or otherwise, unless otherwise required by law.

Note: All estimates with respect to 2016 and future periods are as of October 25, 2016. Covanta does not have or undertake any obligation to update or revise any forward-

looking statements whether as a result of new information, subsequent events or otherwise, unless otherwise required by law.

Non-GAAP Financial Measures

We use a number of different financial measures, both United States generally accepted accounting principles (“GAAP”) and non-GAAP, in assessing the overall

performance of our business. The non-GAAP financial measures of Adjusted EBITDA, Free Cash Flow and Adjusted EPS, as described and used in this earnings

presentation, are not intended as a substitute or as an alternative to net income, cash flow provided by operating activities or diluted earnings per share as indicators of our

performance or liquidity or any other measures of performance or liquidity derived in accordance with GAAP. In addition, our non-GAAP financial measures may be different

from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. The presentations of Adjusted EBITDA, Free Cash Flow and

Adjusted EPS are intended to enhance the usefulness of our financial information by providing measures which management internally use to assess and evaluate the

overall performance of its business and those of possible acquisition candidates, and highlight trends in the overall business. Please refer to the appendix of this

presentation for reconciliations of non-GAAP financial measures.

October 25, 2016 3

Q3 2016 Summary

(in millions, except per share amounts) Q3 2015 Q3 2016

FY 2016

Guidance (1)

Revenue $422 $421 N/A

Adjusted EBITDA $139 $124 $390 - $430

Cash flow provided by operating activities $123 $88 N/A

Free Cash Flow $107 $74 $140 - $180

Diluted Earnings Per Share $0.25 $0.42 N/A

Adjusted EPS $0.22 $0.18 N/A

(Unaudited)

• Completed sale of China equity interests for net proceeds of $103 million in cash

▪ $52 million repatriated and used to repay revolver borrowings

▪ Remaining funds available for potential future overseas investment

• Construction of Dublin EfW facility over 75% complete; signed waste contracts for 90% of facility capacity

• Reaffirming 2016 full-year guidance

1) Reaffirmed guidance as of October 25, 2016.

October 25, 2016 4

Waste Update

North America EfW (1)

(in millions, except price) Q3 2015A Q3 2016A 2016E

Waste & Service Revenue:

Waste Processing $230 $241 $935 - $965

Debt Service 4 2 9

Other (2) 2 3 5 - 10

Total $236 $246 $950 - $980

Tons: (3)

Contracted (4) 4.4 4.6

Uncontracted 0.5 0.5

Total 4.9 5.1 19.5 - 19.7

Revenue per Ton: (5)

Contracted $44.57 $44.21

Uncontracted $69.21 $76.76

Average $47.01 $47.45 $48.00 - $49.00

• Client and new business activity:

▪ Extended waste contracts with clients at Indianapolis

(to 2025) and Huntsville (to 2020)

• Q3 2016 EfW waste processing revenue vs. Q3 2015:

▪ Same store price up $6 million (2.5%);

volume up $2 million (0.9%)

▪ EfW profiled waste up 13% year-over-year

• Trends and outlook:

▪ Uncontracted price improvement driven by strong

Northeast price environment and continued mix shift

away from low-priced spot MSW

▪ Contractual price escalations running at ~1%

1) North America EfW results include only Energy-from-Waste assets.

2) Other includes service revenue not directly related to waste processing.

3) Excludes liquid waste.

(Unaudited)

4) Includes contracts at transfer stations from which waste is internalized.

5) Calculated for waste and service revenue, excluding debt service and other revenue.

October 25, 2016 5

Energy Update

North America EfW

(in millions, except price) Q3 2015A Q3 2016A 2016E

Energy Revenue:

Energy Sales $76 $81 $305 - $315

Capacity 10 11 ~40

Total $86 $92 $345 - $360

MWh Sold:

Contracted 0.8 0.8 3.0 - 3.1

Hedged 0.3 0.5 ~1.9

Market 0.4 0.2 ~1.1

Total 1.5 1.5 6.0 - 6.2

Revenue per MWh: (1)

Contracted $63.69 $65.82 ~$65

Hedged $44.05 $37.98 ~$42

Market $30.86 $37.32 ~$30

Average $50.78 $52.63 ~$52

• Q3 2016 EfW energy revenue drivers vs. Q3 2015:

▪ Same store revenue up 0.6%

◦ Price up $4 million

◦ Volume down $4 million as a result of downtime at

a few merchant facilities

• Trends and outlook:

▪ Average contracted price benefited by strong prices

under LIPA collar contract

▪ Hot summer weather extending into September

supported market prices

▪ End of season gas storage and winter weather

forecasts will drive forward markets

▪ Remaining uncontracted exposure in 2016

approximately 500k MWh

▪ Hedging activity:

◦ Market exposure in 2017 and 2018 hedged down

to 1.7 and 4.1 million MWh, respectively

◦ Average hedge price for 2017 is approximately

$35 per MWh

1) Excludes capacity revenue.

(Unaudited)

October 25, 2016 6

Recycled Metals Update

North America

($ in millions, except price;

tons in thousands) Q3 2015A Q3 2016A 2016E

Metals Revenue:

Ferrous $10 $8 $30 - $37

Non-Ferrous 6 6 20 - 25

Total $16 $14 $50 - $60

Tons Sold:

Ferrous 90 72 330 - 340

Non-Ferrous 9 10 34 - 38

Revenue per Ton:

Ferrous $113 $117 $100 - $110

Non-Ferrous $716 $581 $600 - $650

Average HMS index price (1) $219 $212 $180 - $200

• Q3 2016 revenue drivers vs. Q3 2015:

▪ Volume:

◦ Ferrous down 21% – sales volume impacted by

centralized processing and timing of shipments

◦ Non-ferrous up 13%

▪ Price:

◦ Ferrous up 3.1%, with lower market price more

than offset by higher realized revenue as % of

index

◦ Non-ferrous down 19%

• Market trends and outlook:

▪ Market pricing held steady in Q3, but starting to show

seasonal shift downward as expected

1) Q3 2016 and Q3 2015 average #1 Heavy Melt Steel composite index ($ / gross ton) as published by American Metal Market.

(Unaudited)

October 25, 2016 7

Plant Operating Expense and Maintenance Capex Update

• Q3 2016 summary:

▪ North America EfW plant maintenance expense up

8.5% vs. Q3 2015 on same store basis, driven

primarily by scheduled capital projects at certain

public facilities (expensed)

▪ North America EfW other plant operating expenses:

◦ Same store up 2.7% ($4 million) vs. Q3 2015

primarily due to wage and benefit inflation

◦ Total North America EfW other plant operating

expense up additional $3 million, primarily

due to the Durham-York facility coming online

• Trends and outlook:

▪ 2016 full-year maintenance spend now anticipated

around the high end of our initial range, primarily as

a result of increased maintenance activity and

capital improvements at Fairfax facility

Total Company

(in millions) Q3 2015A Q3 2016A 2016E

Plant Maintenance Expense:

North America EfW $43 $46 $265 - $275

Other 3 2

Total $46 $48

Maintenance Capex:

North America EfW $7 $12 $85 - $95

Other 9 2 ~20

Total $16 $14 $105 - $115

Total EfW Maintenance Spend $50 $58 $350 - $370

Other Plant Operating Expense:

North America EfW $151 $159

Other 63 65

Total $214 $224

(Unaudited)

October 25, 2016 8

Financial Overview

October 25, 2016 9

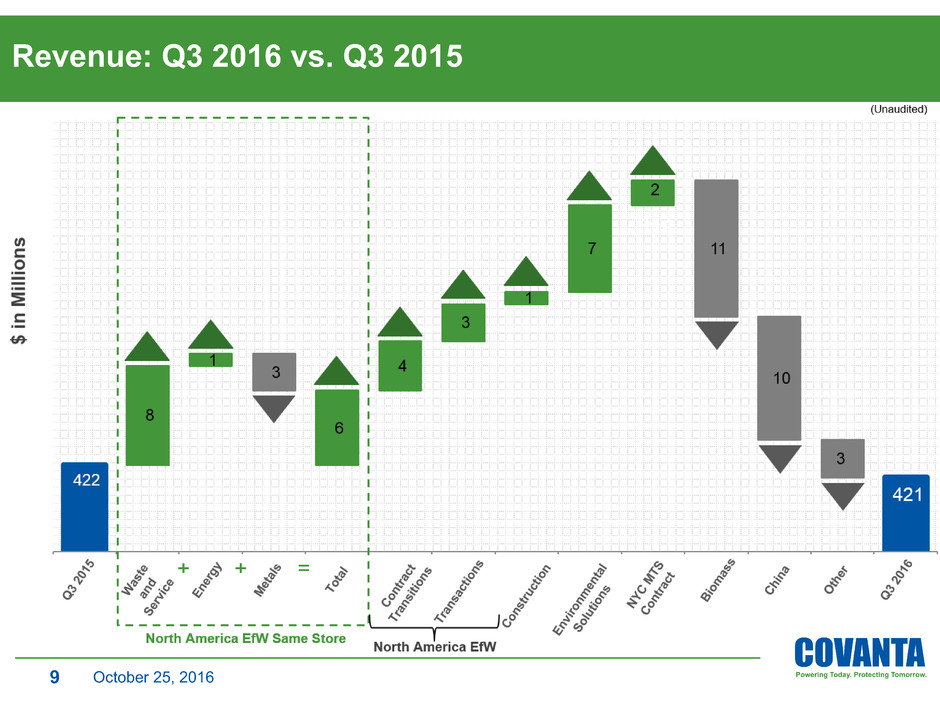

Revenue: Q3 2016 vs. Q3 2015

Price 6

Vol 2

Price 4

Vol (4)

Capacity 1

Price (4)

Vol 1

Waste 7

DS (1)

PPA (2)

DY 3

Pinellas 7

DY (6)

Sus. sol.

(3)

October 25, 2016 10

Adjusted EBITDA: Q3 2016 vs. Q3 2015

Waste 4

PPA (1)

MPF 1

Waste Pricing 6

DY 2

Other OH (5)

Biomass (3)

October 25, 2016 11

Free Cash Flow: Q3 2016 vs. Q3 2015

Restricted Funds 4

October 25, 2016 12

Growth Investment Outlook

Growth Investments (Unaudited, in millions)

FY 2015

Actual

YTD

9/30/16

FY 2016

Outlook

Organic growth investments (1) $34 $38 ~ $50

New York City contract 30 3 ~5

Essex County EfW emissions control system (2) 26 27 ~35

Acquisitions 72 9 9

Subtotal: Corporate funded $162 $77 ~ $100

Dublin facility construction 184 132 175 - 200

Total growth investments $346 $209 ~ $275 - 300

1) Organic growth programs are focused primarily on growing waste and metal revenue.

2) Classified as growth investment because cost is reflected in overall economic benefit of contract restructuring completed in 2013.

• Remaining Dublin investment to be funded entirely with project financing – no impact on domestic capital allocation

• Acquisitions to be targeted on an opportunistic basis – potential additional activity not reflected in FY 2016 outlook

October 25, 2016 13

Capitalization Summary

1) Net debt is calculated as total principal amount of debt outstanding less cash and cash equivalents, debt service principal-related restricted funds ($16 million at

September 30, 2016), and escrowed construction financing proceeds ($42 million at September 30, 2016).

2) Excludes $191 million of net debt (debt of $203 million less restricted funds of $12 million) outstanding at September 30, 2016 at Dublin project subsidiary.

3) Leverage ratio as calculated for senior credit facility covenant. Effectively represents leverage at Covanta Energy, LLC and subsidiaries.

(Face value; unaudited, in millions) 12/31/2014 12/31/2015 9/30/2016

Cash and Cash Equivalents $84 $94 $113

Corporate Debt:

Secured $405 $621 $651

Unsecured 1,569 1,664 1,664

Total Corporate Debt $1,974 $2,285 $2,315

Project Debt 225 197 428

Total Debt $2,199 $2,482 $2,743

Net Debt (1) $2,029 $2,326 $2,572

Stockholders’ Equity $784 $640 $500

Credit Ratios:

Net Debt / Adjusted EBITDA Ratio 4.3x 5.4x 6.3x

Excluding Non-Recourse Construction Debt (2) 4.3x 5.3x 5.8x

Senior Credit Facility Leverage Ratio (3) 2.1x 2.9x 3.2x

October 25, 2016 14

Appendix

October 25, 2016 15

Long-term Outlook: Energy Detail

North America EfW Facilities

(Unaudited, in millions, except price) 2014A 2015A 2016E 2017E 2018E 2019E 2020E

MWh Sold – CVA Share:

Contracted 3.2 3.0 3.1 2.4 2.1 2.1 2.1

Hedged 1.4 1.4 1.9 2.4 0.3 — —

Market 1.1 1.4 1.1 1.7 4.1 4.5 4.5

Total MWh Sold 5.6 5.8 ~6.1 ~6.5 ~6.5 ~6.6 ~6.6

Market Sales (MWh) by Geography:

PJM East 0.4 0.5 0.5 0.8 2.4 2.7 2.7

NEPOOL 0.3 0.3 0.1 0.4 1.0 1.1 1.1

NYISO — 0.1 0.1 0.1 0.2 0.2 0.2

Other 0.3 0.4 0.4 0.4 0.5 0.5 0.5

Total Market Sales 1.1 1.4 1.1 1.7 4.1 4.5 4.5

Revenue per MWh: (1)

Contracted $67.56 $65.56 ~$65

Average ~$57 / MWh on contracts expiring through

2020

Hedged $42.87 $45.64 ~$42

Market $49.12 $33.18 ~$30

Average Revenue per MWh $58.06 $53.17 ~$52

Note: hedged generation as presented above reflects only existing hedges.

1) Excludes capacity revenue.

• Note: Production estimates for 2017 - 2020 are approximated based on historical operating performance and expected

contract structures

October 25, 2016 16

Long-term Outlook: Debt Service Revenue

Project Debt Repayment (Unaudited, in millions): 2008–2015 2016 2017 2018 2019 2020

Beyond

2020

Total Principal Payments (2) $909 $16 $17 $18 $13 $2 $75

Total Change in Principal-Related Restricted Funds (193) — — (5) (9) — (1)

Net Cash Used for Project Debt Principal Repayment $716 $16 $17 $13 $4 $2 $74

Client Payments for Debt Service:

(Unaudited, in millions) 2008–2015 2016 2017 2018 2019 2020

Beyond

2020

Debt Service Revenue – Principal $352 $6 $6 $5 $3 $3 $39

Debt Service Revenue – Interest 98 4 3 3 2 2 16

Debt Service Billings in Excess of Revenue Recognized 106 4 5 (1) (1) (1) 4

Client Payments for Debt Service (1) $556 $14 $14 $7 $4 $4 $60

Net Change in Debt Service Billings per Period $(108) $(1) $— $(7) $(3) $— $—

1) Related to Service Fee facilities only.

2) Excludes payments associated with Union capital lease.

Note: North American operations only. Excludes payments related to project debt refinancing.

October 25, 2016 17

Non-GAAP Reconciliation: Adjusted EBITDA &

Free Cash Flow

Q3 YTD Full Year

(Unaudited, in millions) 2016 2015 2016 2015 Estimated 2016 (1)

Net Income (Loss) Attributable to Covanta Holding Corporation $54 $34 $(12) $(9)

Depreciation and amortization expense 52 50 155 148

Interest expense, net 35 34 103 102

Income tax expense (benefit) 12 11 5 (19)

Impairment charges — — 19 24

Gain on sale of business (43) — (43) —

Loss on extinguishment of debt — — — 2

Debt service billings in excess of revenue recognized 1 — 3 1

Severance and reorganization costs 1 1 3 3

Non-cash compensation expense 4 4 13 15

Capital type expenditures at service fee operated facilities (2) 6 3 29 25

Other 2 2 7 9

Total adjustments 70 105 294 310

Adjusted EBITDA $124 $139 $282 $301 $390 - $430

Cash paid for interest, net of capitalized interest (24) (22) (91) (83)

Cash paid for taxes (3) (2) (7) (6)

Capital type expenditures at service fee operated facilities (2) (6) (3) (29) (25)

Adjustment for working capital and other (3) 11 (9) (33)

Cash flow provided by operating activities from continuing operations $88 $123 $146 $154 $245 - $295

Maintenance capital expenditures (14) (16) (82) (71) (105) - (115)

Free Cash Flow $74 $107 $64 $83 $140 - $180

Weighted Average Diluted Shares Outstanding 131 134 129 132

1) Guidance reaffirmed as of October 25, 2016.

2) Adjustment for impact of adoption of FASB ASC 853 – Service Concession Arrangements.

October 25, 2016 18

Non-GAAP Reconciliation: Adjusted EBITDA

Full Year LTM

(Unaudited, in millions) 2014 2015 9/30/2016

Net (Loss) Income Attributable to Covanta Holding Corporation $(2) $68 $65

Operating loss related to insurance subsidiaries 2 — —

Depreciation and amortization expense 211 198 205

Debt service expense 147 134 135

Income tax expense (benefit) 15 (84) (60)

Impairment charges 64 43 38

Gain on sale of business — — (43)

Loss on extinguishment of debt 2 2 —

Net income attributable to noncontrolling interests in subsidiaries 1 1 1

Debt service billings in excess of revenue recognized 2 1 3

Severance and reorganization costs 9 4 4

Non-cash compensation expense 17 18 16

Capital type expenditures at service fee operated facilities (1) — 31 35

Other 6 12 10

Total adjustments 476 360 344

Adjusted EBITDA $474 $428 $409

1) Adjustment for impact of adoption of FASB ASC 853 – Service Concession Arrangements.

Note: Adjusted EBITDA results provided to reconcile the denominator of the Net Debt / Adjusted EBITDA ratios on slide 13.

October 25, 2016 19

Non-GAAP Reconciliation: Adjusted EPS

Q3 YTD

(Unaudited, in millions, except per share amounts) 2016 2015 2016 2015

Diluted Earnings (Loss) Per Share $0.42 $0.25 $(0.09) $(0.07)

Reconciling Items (0.24) (0.03) (0.14) 0.11

Adjusted EPS $0.18 $0.22 $(0.23) $0.04

Reconciling Items

Impairment charges $— $— $19 $24

Severance and reorganization costs — 1 2 7

Gain on sale of business (43) — (43) —

Loss on extinguishment of debt — — — 2

Effect on income of derivative instruments not designated as hedging instruments 1 (3) 2 (3)

Effect of foreign exchange loss (gain) on indebtedness — 1 (1) 2

Total Reconciling Items, pre-tax (42) (1) (21) 32

Pro forma income tax impact 10 (4) 2 (18)

Grantor trust activity 1 1 1 1

Total Reconciling Items, net of tax $(31) $(4) $(18) $15

Diluted Earnings Per Share Impact $(0.24) $(0.03) $(0.14) $0.11

October 25, 2016 20

Non-GAAP Financial Measures

Free Cash Flow

Free Cash Flow is defined as cash flow provided by operating activities, less maintenance capital expenditures, which are capital expenditures primarily to maintain our existing facilities. We use the non-

GAAP measure of Free Cash Flow as a criterion of liquidity and performance-based components of employee compensation. We use Free Cash Flow as a measure of liquidity to determine amounts we can

reinvest in our core businesses, such as amounts available to make acquisitions, invest in construction of new projects, make principal payments on debt, or amounts we can return to our stockholders

through dividends and/or stock repurchases. In order to provide a meaningful basis for comparison, we are providing information with respect to our Free Cash Flow for the three and nine months ended

September 30, 2016 and 2015, reconciled for each such period to cash flow provided by operating activities, which we believe to be the most directly comparable measure under GAAP.

Adjusted EBITDA

We use Adjusted EBITDA to provide further information that is useful to an understanding of the financial covenants contained in the credit facilities as of September 30, 2016 of our most significant subsidiary,

Covanta Energy, LLC ("Covanta Energy"), through which we conduct our core waste and energy services business, and as additional ways of viewing aspects of its operations that, when viewed with the GAAP

results and the accompanying reconciliations to corresponding GAAP financial measures, provide a more complete understanding of our core business. The calculation of Adjusted EBITDA is based on the

definition in Covanta Energy’s credit facilities as of September 30, 2016, which we have guaranteed. Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization, as adjusted

for additional items subtracted from or added to net income. Because our business is substantially comprised of that of Covanta Energy, our financial performance is substantially similar to that of Covanta Energy.

For this reason, and in order to avoid use of multiple financial measures which are not all from the same entity, the calculation of Adjusted EBITDA and other financial measures presented herein are ours,

measured on a consolidated basis. Under the credit facilities as of September 30, 2016, Covanta Energy is required to satisfy certain financial covenants, including certain ratios of which Adjusted EBITDA is an

important component. Compliance with such financial covenants is expected to be the principal limiting factor which will affect our ability to engage in a broad range of activities in furtherance of our business,

including making certain investments, acquiring businesses and incurring additional debt. Covanta Energy was in compliance with these covenants as of September 30, 2016. Failure to comply with such financial

covenants could result in a default under these credit facilities, which default would have a material adverse affect on our financial condition and liquidity.

These financial covenants are measured on a trailing four quarter period basis and the material covenants are as follows:

• maximum Covanta Energy leverage ratio of 4.00 to 1.00, which measures Covanta Energy’s Consolidated Adjusted Debt (which is the principal amount of its consolidated debt less certain restricted

funds dedicated to repayment of project debt principal and construction costs) to its Adjusted EBITDA (which for purposes of calculating the leverage ratio and interest coverage ratio, is adjusted on

a pro forma basis for acquisitions and dispositions made during the relevant period); and

• minimum Covanta Energy interest coverage ratio of 3.00 to 1.00, which measures Covanta Energy’s Adjusted EBITDA to its consolidated interest expense plus certain interest expense of ours, to

the extent paid by Covanta Energy.

In order to provide a meaningful basis for comparison, we are providing information with respect to our Adjusted EBITDA for the three and nine months ended September 30, 2016 and 2015, reconciled for

each such period to net income and cash flow provided by operating activities, which are believed to be the most directly comparable measures under GAAP. Our projected full year 2016 Adjusted EBITDA is

not based on GAAP net income/loss and is anticipated to be adjusted to exclude the effects of events or circumstances in 2016 that are not representative or indicative of our results of operations. Projected

GAAP net income/loss for the full year would require inclusion of the projected impact of future excluded items, including items that are not currently determinable, but may be significant, such as asset

impairments and one-time items, charges, gains or losses from divestitures, or other items. Due to the uncertainty of the likelihood, amount and timing of any such items, we do not have information available

to provide a quantitative reconciliation of full year 2016 projected net income/loss to an Adjusted EBITDA projection.

Adjusted EPS

Adjusted EPS excludes certain income and expense items that are not representative of our ongoing business and operations, which are included in the calculation of Diluted Earnings Per Share in accordance

with GAAP. The following items are not all-inclusive, but are examples of reconciling items in prior comparative and future periods. They would include impairment charges, the effect of derivative instruments not

designated as hedging instruments, significant gains or losses from the disposition or restructuring of businesses, gains and losses on assets held for sale, transaction-related costs, income and loss on the

extinguishment of debt and other significant items that would not be representative of our ongoing business. We will use the non-GAAP measure of Adjusted EPS to enhance the usefulness of our financial

information by providing a measure which management internally uses to assess and evaluate the overall performance and highlight trends in the ongoing business. In order to provide a meaningful basis for

comparison, we are providing information with respect to our Adjusted EPS for the three and nine months ended September 30, 2016 and 2015, reconciled for each such period to diluted income per share, which

is believed to be the most directly comparable measure under GAAP.