Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PARKER HANNIFIN CORP | exhibit9911q17.htm |

| 8-K - 8-K - PARKER HANNIFIN CORP | form8-k1qfy17.htm |

1st Quarter Fiscal Year 2017

Earnings Release

Parker Hannifin Corporation

October 21, 2016

Exhibit 99.2

Forward-Looking Statements and

Non-GAAP Financial Measures

Safe Harbor Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the

time of release, and as such, are subject in the future to unforeseen uncertainties and risks. All statements regarding future performance, earnings

projections, events or developments are forward-looking statements. It is possible that the future performance and earnings projections of the company,

including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and

aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic

initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global

diversification initiatives. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance.

Among other factors which may affect future performance are: changes in business relationships with and purchases by or from major customers,

suppliers or distributors, including delays or cancellations in shipments, disputes regarding contract terms or significant changes in financial condition,

changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic

acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions; the ability to successfully

divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment

activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such

activities; the ability to implement successfully the company's capital allocation initiatives; increases in raw material costs that cannot be recovered in

product pricing; the company's ability to manage costs related to insurance and employee retirement and health care benefits; threats associated with and

efforts to combat terrorism and cyber-security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the

outcome of any appeals; competitive market conditions and resulting effects on sales and pricing; and global economic factors, including manufacturing

activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest

rates and credit availability. The company makes these statements as of the date of this disclosure, and undertakes no obligation to update them unless

otherwise required by law.

This presentation reconciles (a) sales amounts reported in accordance with U.S. GAAP to sales amounts adjusted to remove the effects of acquisitions

and the effects of currency exchange rates, (b) cash flow from operating activities and cash flow from operating activities as a percent of sales in

accordance with U.S. GAAP to cash flow from operating activities and cash flow from operating activities as a percent of sales without the effect of

discretionary pension plan contributions, (c) segment operating income, marginal return on sales (MROS), defined as the change in segment operating

income divided by the change in sales, and operating margins reported in accordance with U.S. GAAP to segment operating income, MROS and operating

margins without the effect of business realignment charges and, (d) actual and forecast earnings per diluted share reported in accordance with U.S. GAAP

to actual and forecast earnings per diluted share without the effect of business realignment charges. The effects of acquisitions, currency exchange rates,

discretionary pension plan contributions, business realignment charges are removed to allow investors and the company to meaningfully evaluate changes

in sales, and cash flow from operating activities as a percent of sales, segment operating income, operating margins and earnings per diluted share on a

comparable basis from period to period. Full year adjusted guidance removes business realignment charges.

Please visit www.PHstock.com for more information

2

Agenda

3

• Chairman & CEO Comments

• Results & Outlook

• Questions & Answers

Chairman and CEO Comments

4

1st Quarter FY2017

Recordable Accident Reduction of 35% in the First Quarter

First Quarter Sales of $2.74B, Orders Turn Positive

As Reported Earnings per Share of $1.55 ($1.61 Adjusted)

Impressive Margin & Decremental MROS and Cash Flow Performance

Full Year FY2017 Guidance

Sales Essentially Flat for the Year, Increased Earnings

Holding FY17 EPS Guidance Midpoint of $6.50 As Reported, $6.75 Adjusted

Realignment Expenses of $48 million or $0.25 per share

Win Strategy Execution

Meaningful Progress Across our Strategic Initiatives

Confident in Achieving our FY20 Financial Objectives

Diluted Earnings Per Share

1st Quarter FY2017

5

*Adjusted for Business Realignment Charges

Influences on Adjusted Earnings Per Share

1st Quarter FY2017 vs. 1st Quarter FY2016

6

*Adjusted for Business Realignment Charges

Sales & Segment Operating Margin

Total Parker

7

$ in millions 1st Quarter

FY2017

%

Change FY2016

Sales

As Reported 2,743$ (4.4)% 2,869$

Acquisitions 9 0.3 %

Currency (4) (0.1)%

Organic Sales 2,738$ (4.6)%

FY2017

% of

Sales FY2016

% of

Sales

Segment Operating Margin

As Reported 411$ 15.0 % 416$ 14.5 %

Business Realignment 11 22

Adjusted 422$ 15.4 % 438$ 15.3 %

Sales & Segment Operating Margin

Diversified Industrial North America

8

$ in millions 1st Quarter

FY2017

%

Change FY2016

Sales

As Reported 1,167$ (9.3)% 1,286$

Acquisitions - - %

Currency (4) (0.3)%

Organic Sales 1,171$ (9.0)%

FY2017

% of

Sales FY2016

% of

Sales

Segment Operating Margin

As Reported 201$ 17.2 % 213$ 16.5 %

Business Realignment 4 8

Adjusted 205$ 17.5 % 221$ 17.2 %

Sales & Segment Operating Margin

Diversified Industrial International

9

$ in millions 1st Quarter

FY2017

%

Change FY2016

Sales

As Reported 1,015$ (2.3)% 1,038$

Acquisitions 9 0.9 %

Currency - - %

Organic Sales 1,006$ (3.2)%

FY2017

% of

Sales FY2016

% of

Sales

Segment Operating Margin

As Reported 137$ 13.5 % 129$ 12.5 %

Business Realignment 7 12

Adjusted 144$ 14.2 % 141$ 13.6 %

Sales & Segment Operating Margin

Aerospace Systems

10

$ in millions 1st Quarter

FY2017

%

Change FY2016

Sales

As Reported 561$ 3.1 % 545$

Acquisitions - - %

Currency - - %

Organic Sales 561$ 3.1 %

FY2017

% of

Sales FY2016

% of

Sales

Segment Operating Margin

As Reported 73$ 13.1 % 74$ 13.6 %

Business Realignment - 2

Adjusted 73$ 13.1 % 76$ 13.9 %

Order Rates

11

Excludes Acquisitions, Divestitures & Currency

3-month year-over-year comparisons of total dollars, except Aerospace Systems

Aerospace Systems is calculated using a 12-month rolling average

Sep 2016 Jun 2016 Sep 2015 Jun 2015

Total Parker 2 %+ 1 %- 11 %- 9 %-

Diversified Industrial North America 4 %- 10 %- 12 %- 9 %-

Diversified Industrial International 3 %+ 3 %+ 8 %- 5 %-

Aerospace Systems 14 %+ 14 %+ 16 %- 14 %-

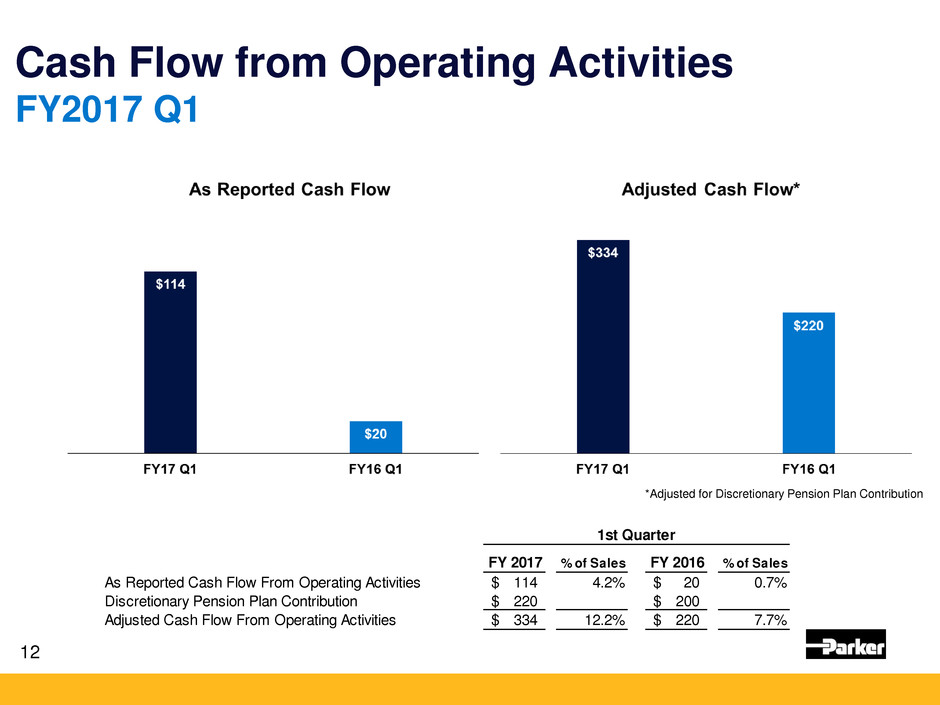

Cash Flow from Operating Activities

FY2017 Q1

12

*Adjusted for Discretionary Pension Plan Contribution

1st Quarter Full Year

FY 2017 % of Sales FY 2016 % of Sales

As Reported Cash Flow From Operating Activities 114$ 4.2% 20$ 0.7%

Discretionary Pension Plan Contribution 220$ 200$

Adjusted Cash Flow From Operating Activities 334$ 12.2% 220$ 7.7%

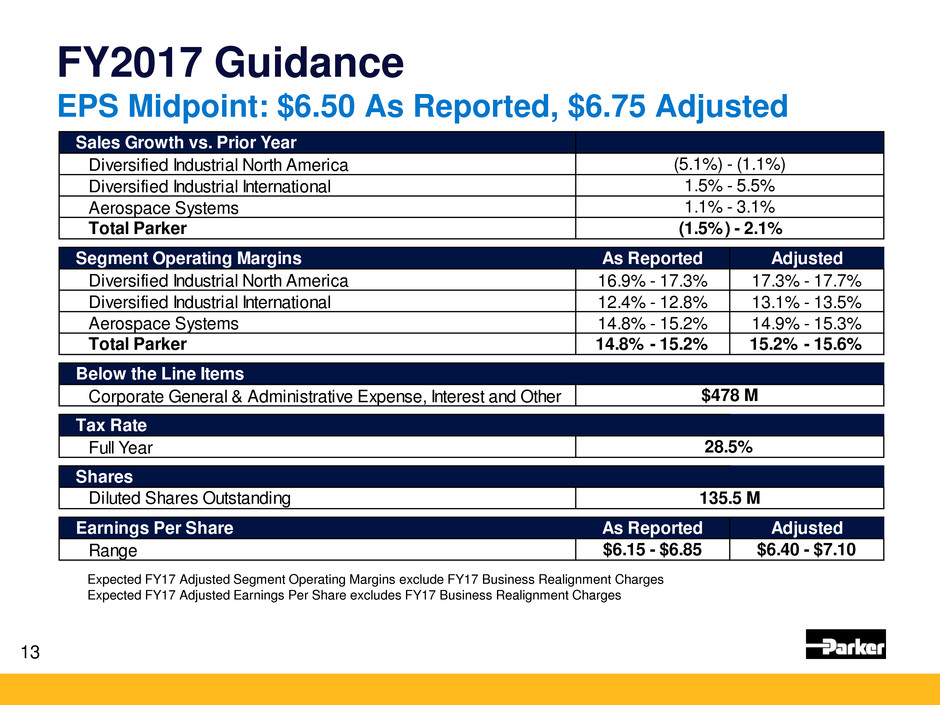

FY2017 Guidance

EPS Midpoint: $6.50 As Reported, $6.75 Adjusted

13

Expected FY17 Adjusted Segment Operating Margins exclude FY17 Business Realignment Charges

Expected FY17 Adjusted Earnings Per Share excludes FY17 Business Realignment Charges

Sales Growth vs. Prior Year

Diversified Industrial North America

Diversified Industrial International

Aerospace Systems

Total Parker

Segment Operating Margins As Reported Adjusted

Diversified Industrial North America 16.9% - 17.3% 17.3% - 17.7%

Diversified Industrial International 12.4% - 12.8% 13.1% - 13.5%

Aerospace Systems 14.8% - 15.2% 14.9% - 15.3%

Total Parker 14.8% - 15.2% 15.2% - 15.6%

Below the Line Items

Corporate General & Administrative Expense, Interest and Other

Tax Rate

Full Year

Shares

Diluted Shares Outstanding

Earnings Per Share As Reported Adjusted

Range $6.15 - $6.85 $6.40 - $7.10

(5.1%) - (1.1%)

1.5% - 5.5%

1.1% - 3.1%

(1.5%) - 2.1%

$478 M

28.5%

135.5 M

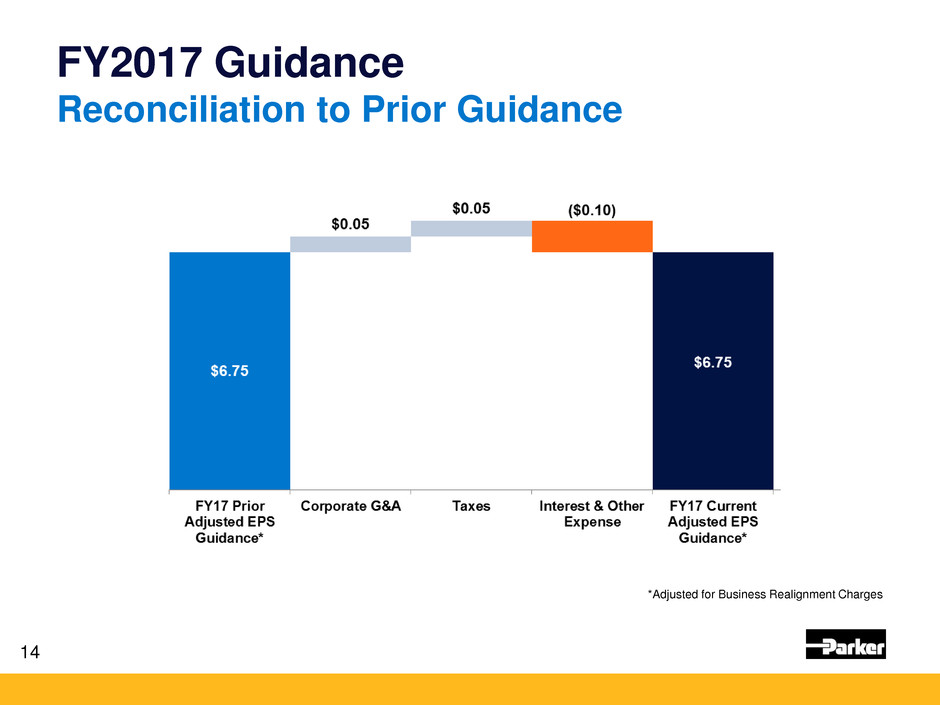

FY2017 Guidance

Reconciliation to Prior Guidance

14

*Adjusted for Business Realignment Charges

15

Appendix

• Consolidated Statement of Income

• Reconciliation of EPS

• Business Segment Information

• Consolidated Balance Sheet

• Consolidated Statement of Cash Flows

• Reconciliation of Cash Flow from Operations to Adjusted Cash

Flow from Operations

• Reconciliation of Net Income and MROS

• Reconciliation of Forecasted Segment Operating Margins and EPS

• Supplemental Sales Information – Global Technology Platforms

Consolidated Statement of Income

17

(Unaudited) Three Months Ended September 30,

(Dollars in thousands except per share amounts) 2016 2015

Net sales 2,743,131$ 2,869,348$

Cost of sales 2,106,006 2,200,904

Gross profit 637,125 668,444

Selling, general and administrative expenses 322,969 370,214

Interest expense 34,148 35,760

Other (income), net (12,237) (13,179)

Income before income taxes 292,245 275,649

Income taxes 82,007 80,623

Net income 210,238 195,026

Less: Noncontrolling interests 109 48

Net income attributable to common shareholders 210,129$ 194,978$

Earnings per share attributable to common shareholders:

Basic earnings per share 1.57$ 1.42$

Diluted earnings per share 1.55$ 1.41$

Average shares outstanding during period - Basic 133,679,378 136,844,504

Average shares outstanding during period - Diluted 135,825,658 138,574,908

Cash dividends per common share .63$ .63$

Reconciliation of EPS

18

(Unaudited)

(Amounts in dollars) Three Months Ended September 30,

2016 2015

Earnings per diluted share 1.55$ 1.41$

Adjustments:

Business realignment charges 0.06 0.11

Adjusted earnings per diluted share 1.61$ 1.52$

Business Segment Information

19

(Unaudited) Three Months Ended September 30,

(Dollars in thousands) 2016 2015

Net sales

Diversif ied Industrial:

North America 1,166,971$ 1,286,330$

International 1,014,923 1,038,447

Aerospace Systems 561,237 544,571

Total 2,743,131$ 2,869,348$

Segment operating income

Diversif ied Industrial:

North America 200,611$ 212,748$

International 137,196 129,295

Aerospace Systems 73,281 74,003

Total segment operating income 411,088 416,046

Corporate general and administrative expenses 31,034 53,051

Income before interest and other expense 380,054 362,995

Interest expense 34,148 35,760

Other expense 53,661 51,586

Income before income taxes 292,245$ 275,649$

Consolidated Balance Sheet

20

(Unaudited) September 30, June 30, September 30,

(Dollars in thousands) 2016 2016 2015

Assets

Current assets:

Cash and cash equivalents 1,393,850$ 1,221,653$ 974,268$

Marketable securities and other investments 746,708 882,342 815,483

Trade accounts receivable, net 1,498,384 1,593,920 1,561,054

Non-trade and notes receivable 250,520 232,183 315,943

Inventories 1,247,972 1,173,329 1,320,204

Prepaid expenses 144,444 104,360 196,917

Total current assets 5,281,878 5,207,787 5,183,869

Plant and equipment, net 1,562,933 1,568,100 1,632,803

Deferred income taxes 495,708 605,155 381,737

Goodw ill 2,910,765 2,903,037 2,947,955

Intangible assets, net 901,939 922,571 1,003,386

Other assets 817,691 827,492 811,012

Total assets 11,970,914$ 12,034,142$ 11,960,762$

Liabilities and equity

Current liabilities:

Notes payable 595,956$ 361,787$ 630,620$

Accounts payable 1,017,905 1,034,589 1,014,265

Accrued liabilities 766,849 841,915 774,145

Accrued domestic and foreign taxes 113,528 127,597 126,487

Total current liabilities 2,494,238 2,365,888 2,545,517

Long-term debt 2,653,008 2,652,457 2,701,098

Pensions and other postretirement benefits 1,806,366 2,076,143 1,480,466

Deferred income taxes 55,079 54,395 66,062

Other liabilities 311,634 306,581 312,868

Shareholders' equity 4,647,281 4,575,255 4,851,518

Noncontrolling interests 3,308 3,423 3,233

Total liabilities and equity 11,970,914$ 12,034,142$ 11,960,762$

Consolidated Statement of Cash Flows

21

(Unaudited) Three Months Ended September 30,

(Dollars in thousands) 2016 2015

Cash flows from operating activities:

Net income 210,238$ 195,026$

Depreciation and amortization 75,333 78,222

Stock incentive plan compensation 35,818 35,381

Gain on sale of plant and equipment (681) (1,071)

Gain on sale of marketable securities (167) (54)

Net change in receivables, inventories, and trade payables 59,690 (35,163)

Net change in other assets and liabilities (361,999) (250,118)

Other, net 95,700 (2,284)

Net cash provided by operating activities 113,932 19,939

Cash flows from investing activities:

Acquisitions (net of cash of $1,760 in 2016 and $3,814 in 2015) (29,927) (67,552)

Capital expenditures (32,526) (38,681)

Proceeds from sale of plant and equipment 4,498 3,847

Purchases of marketable securities and other investments (189,654) (430,533)

Maturities and sales of marketable securities and other investments 291,372 371,766

Other, net 1,450 (40,273)

Net cash provided by (used in) investing activities 45,213 (201,426)

Cash flows from financing activities:

Net payments for common stock activity (131,738) (319,435)

Net proceeds from debt 231,948 404,787

Dividen s (84,749) (85,987)

Net cash provided by (used in) financing activities 15,461 (635)

Effect of exchange rate changes on cash (2,409) (24,194)

Net increase (decrease) in cash and cash equivalents 172,197 (206,316)

Cash and cash equivalents at beginning of period 1,221,653 1,180,584

Cash and cash equivalents at end of period 1,393,850$ 974,268$

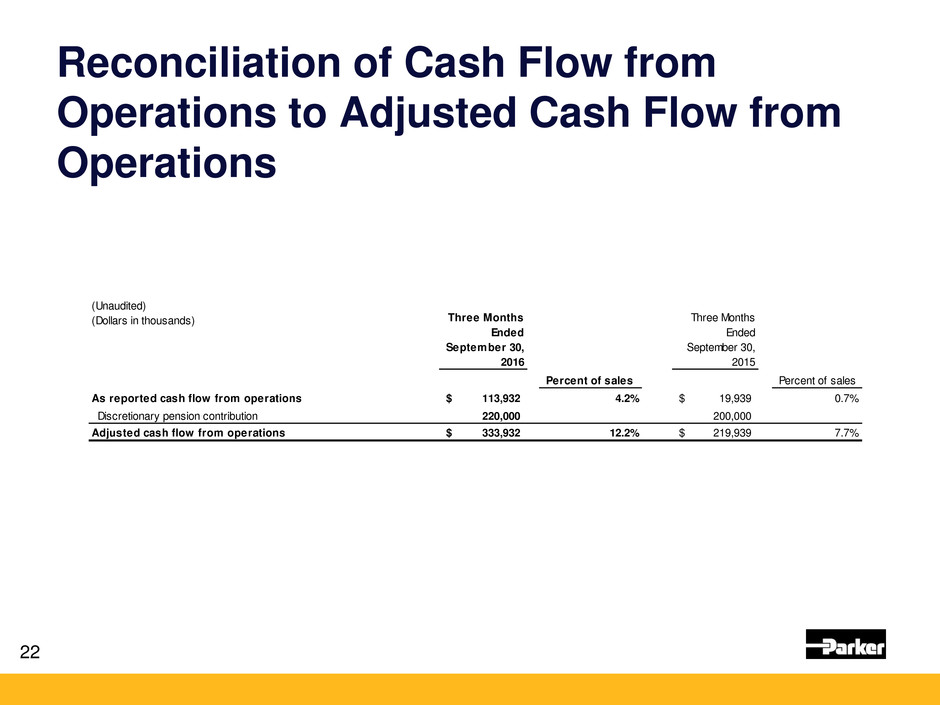

Reconciliation of Cash Flow from

Operations to Adjusted Cash Flow from

Operations

22

(Unaudited)

(Dollars in thousands) Three Months

Ended

September 30,

2016

Three Months

Ended

September 30,

2015

Percent of sales Percent of sales

As reported cash flow from operations 113,932$ 4.2% 19,939$ 0.7%

Discretionary pension contribution 220,000 200,000

Adjusted cash flow from operations 333,932$ 12.2% 219,939$ 7.7%

Reconciliation of Net Income and MROS

23

(Unaudited)

(Dollars in thousands) Three Months Ended September 30,

2016 2015

As Reported Net Income 210,238$ 195,026$

Business Realignment Charges 7,844 15,552

Adjusted Net Income 218,082$ 210,578$

Net Sales 2,743,131$ 2,869,348$

As Reported S gment Operating Income 411,088$ 416,046$

Business Realignment Charges 10,745 21,788

Adjusted Segment Operating Income 421,833$ 437,834$

As Reported MROS* -3.9%

Change in Business Realignment Charges as % Sales -8.7%

Adjusted MROS* -12.7%

*MROS = change in operating income/change in sales

Reconciliation of Forecasted Segment

Operating Margins and EPS

24

(Unaudited)

(Amounts in dollars)

Fiscal Year

2017

Forecasted earnings per diluted share $6.15 to $6.85

Adjustments:

Business realignment charges .25

Adjusted forecasted earnings per diluted share $6.40 to $7.10

(Unaudited)

Fiscal Year 2017

Forecasted As Reported Diversif ied Industrial North America Operating Margin 16.9% - 17.3%

Forecasted Segment Business Realignment Charges as % Net Sales 0.4%

Forecasted Adjusted Diversif ied Industrial North America Operating Margin 17.3% - 17.7%

Forecasted As Reported Diversif ied Industrial International Operating Margin 12.4% - 12.8%

Forecasted Segment Business Realignment Charges as % Net Sales 0.7%

Forecast d Adjusted Diversif ied Industrial International Operating Margin 13.1% - 13.5%

Forecasted As Reported Aerospace Systems Operating Margin 14.8% - 15.2%

Forecasted Segment Business Realignment Charges as % Net Sales 0.1%

Forecasted Adjusted Aerospace Systems Operating Margin 14.9% - 15.3%

Forecasted As Reported Total Parker Operating Margin 14.8% - 15.2%

Forecasted Segment Business Realignment Charges as % Net Sales 0.4%

Forecasted Adjusted Total Parker Operating Margin 15.2% - 15.6%

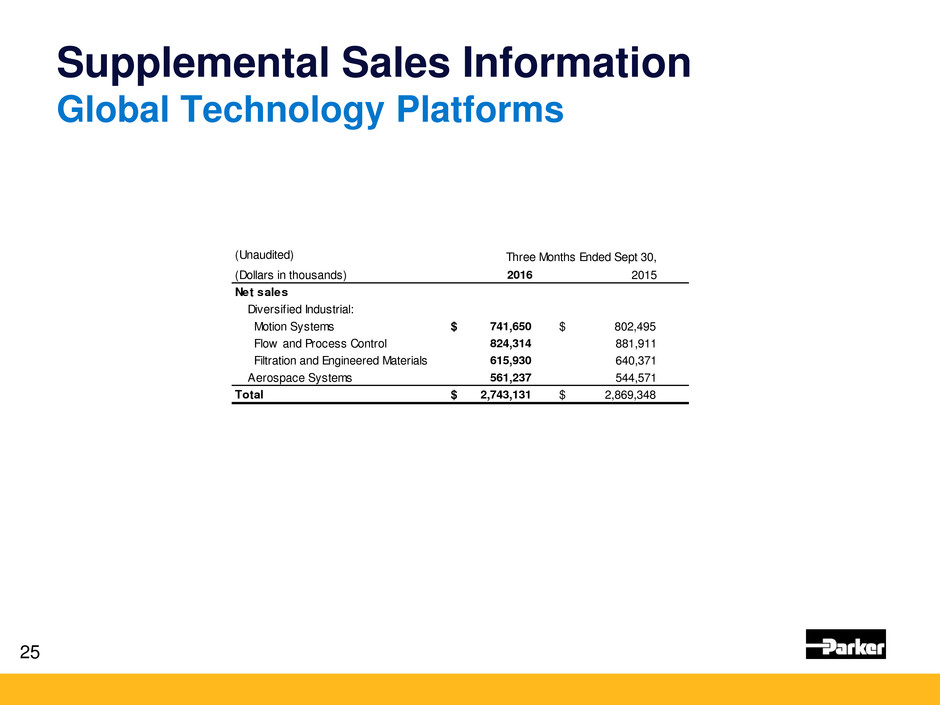

Supplemental Sales Information

Global Technology Platforms

25

(Unaudited) Three Months Ended Sept 30,

(Dollars in thousands) 2016 2015

Net sales

Diversif ied Industrial:

Motion Systems 741,650$ 802,495$

Flow and Process Control 824,314 881,911

Filtration and Engineered Materials 615,930 640,371

Aerospace Systems 561,237 544,571

Total 2,743,131$ 2,869,348$