Attached files

| file | filename |

|---|---|

| 8-K - FIRST HORIZON CORP | c86305_8k.htm |

Exhibit 99.1

THIRD QUARTER 2016

FINANCIAL SUPPLEMENT

If you need further information, please contact:

Aarti Bowman, Investor Relations

901-523-4017

aagoorha@firsthorizon.com

FHN TABLE OF CONTENTS

| Page | ||

| First Horizon National Corporation Segment Structure | 3 | |

| Performance Highlights | 4 | |

| Consolidated Results | ||

| Income Statement | ||

| Income Statement | 6 | |

| Other Income and Other Expense | 7 | |

| Balance Sheet | ||

| Period End Balance Sheet | 8 | |

| Average Balance Sheet | 9 | |

| Net Interest Income | 10 | |

| Average Balance Sheet: Yields and Rates | 11 | |

| Capital Highlights | 12 | |

| Business Segment Detail | ||

| Segment Highlights | 13 | |

| Regional Banking | 14 | |

| Fixed Income and Corporate | 15 | |

| Non-Strategic | 16 | |

| Asset Quality | ||

| Asset Quality: Consolidated | 17 | |

| Asset Quality: Regional Banking and Corporate | 19 | |

| Asset Quality: Non-Strategic | 20 | |

| Portfolio Metrics | 21 | |

| Non-GAAP to GAAP Reconciliation | 22 | |

| Glossary of Terms | 23 |

Other Information

This financial supplement contains forward-looking statements involving significant risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking information. Those factors include general economic and financial market conditions, including expectations of and actual timing and amount of interest rate movements including the slope of the yield curve, competition, customer and investor responses to these conditions, ability to execute business plans, geopolitical developments, recent and future legislative and regulatory developments, natural disasters, and items mentioned in this financial supplement and in First Horizon National Corporation’s (“FHN”) most recent press release, as well as critical accounting estimates and other factors described in FHN’s recent filings with the SEC. FHN disclaims any obligation to update any such forward-looking statements or to publicly announce the result of any revisions to any of the forward-looking statements to reflect future events or developments.

Use of Non-GAAP Measures and Regulatory Measures that are not GAAP

Certain measures are included in this financial supplement that are “non-GAAP,” meaning (under U.S. financial reporting rules) they are not presented in accordance with generally accepted accounting principles (“GAAP”) in the U.S. and also are not codified in U.S. banking regulations currently applicable to FHN. Although other entities may use calculation methods that differ from those used by FHN for non-GAAP measures, FHN’s management believes such measures are relevant to understanding the financial condition, capital position, and financial results of FHN and its business segments. Non-GAAP measures are reported to FHN’s management and Board of Directors through various internal reports.

Presentation of regulatory measures, some which follow regulatory definitions rather than GAAP, provides a meaningful base for comparability to other financial institutions subject to the same regulations as FHN. Such measures are used by the various banking regulators in reviewing the performance, stability, and capital adequacy of financial institutions they regulate. Although not GAAP terms, these regulatory measures are not considered “non-GAAP” under U.S. financial reporting rules as long as their presentation conforms to regulatory standards. Regulatory measures used in this financial supplement include: common equity tier 1 capital, generally defined as common equity less goodwill, other intangibles, and certain other required regulatory deductions; tier 1 capital, generally defined as the sum of core capital (including common equity and instruments that cannot be redeemed at the option of the holder) adjusted for certain items under risk based capital regulations; risk weighted assets (“RWA”), which is a measure of total on- and off-balance sheet assets adjusted for credit and market risk, used to determine regulatory capital ratios; and pre-provision net revenue (“PPNR”), calculated by adding the provision/(provision credit) for loan losses to income before income taxes.

The non-GAAP measures presented in this financial supplement are return on average tangible common equity (“ROTCE”), tangible common equity (“TCE”) to tangible assets (“TA”), and tangible book value per common share.

Refer to the tabular reconciliation of non-GAAP to GAAP measures and presentation of the most comparable GAAP items on page 22 of this financial supplement.

| 2 |

| FIRST HORIZON NATIONAL CORPORATION SEGMENT STRUCTURE |  |

| 3 |

FHN PERFORMANCE HIGHLIGHTS

Third Quarter 2016 Notable Items

| Segment | Item | Income Statement | Amount | Comments | ||||||

| · | Non-Strategic | Mortgage recoveries | Noninterest Income: Mortgage banking | $4.4 million | Pre-tax gains primarily related to recoveries associated with prior mortgage servicing sales | |||||

| · | Non-Strategic | Litigation expense | Noninterest Expense: Litigation and regulatory matters | $4.5 million | Pre-tax loss accruals related to legal matters | |||||

| · | Regional Banking | Litigation expense reversal | Noninterest Expense: Litigation and regulatory matters | $(4.3) million | Favorable pre-tax reversal of loss accruals related to legal matters | |||||

Third Quarter 2016 vs. Second Quarter 2016

Consolidated

| · | Net income available to common shareholders was $63.2 million, or $.27 per diluted share in third quarter, compared to $56.5 million, or $.24 per diluted share in second quarter |

| · | Acquired $537.4 million of UPB in franchise finance loans from GE Capital on September 16, 2016 |

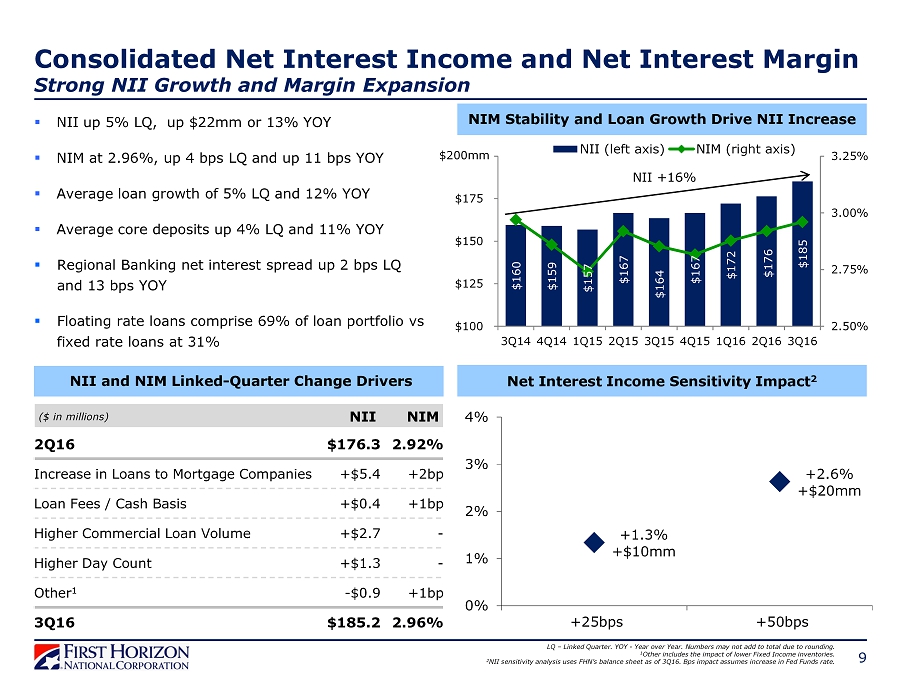

| · | Net Interest Income (“NII”) increased to $185.2 million in third quarter from $176.3 million in second quarter; Net Interest Margin (“NIM”) increased to 2.96 percent in third quarter from 2.92 percent in prior quarter |

| · | NII was favorably impacted by loan growth within the regional bank |

| · | The increase in NIM was largely the result of an increase in loans to mortgage companies coupled with lower average trading securities balances in third quarter |

| · | Noninterest income (including securities gains) increased to $148.5 million in third quarter from $145.5 million in prior quarter |

| · | The increase was largely driven by recoveries associated with prior legacy mortgage servicing sales and a $1.8 million gain on the sale of properties, which more than offset lower Fixed income revenue |

| · | Noninterest expense was $233.6 million in third quarter compared to $226.8 million in second quarter |

| · | Expense increase is largely the result of the favorable impact on second quarter expense of a $31.4 million reversal of repurchase and foreclosure provision as a result of the settlements of certain repurchase claims, somewhat offset by a $25.7 million decline in loss accruals related to legal matters in third quarter relative to the prior quarter |

| · | Period-end loans were $19.6 billion and $18.6 billion in third quarter and second quarter, respectively; average loans increased 5 percent to $18.7 billion in third quarter |

| · | Period-end core deposits were $21.0 billion and $20.1 billion in third quarter and second quarter, respectively; average core deposits increased 4 percent linked quarter to $20.6 billion in third quarter |

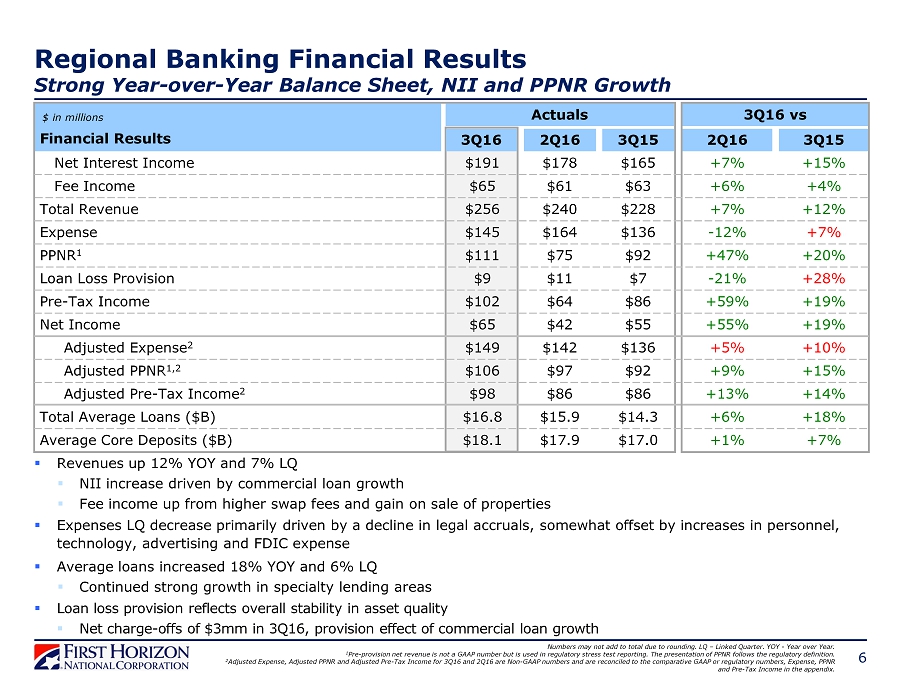

Regional Banking

| · | Pre-tax income increased to $102.1 million in third quarter from $64.4 million in second quarter; pre-provision net revenue was $110.7 million and $75.3 million in third and second quarters, respectively |

| · | Period-end loans increased to $17.8 billion in third quarter from $16.7 billion in second quarter; average loans increased 6 percent to $16.8 billion in third quarter |

| · | Increase in period-end loans largely driven by the GE Capital franchise finance loan purchase, as well as increases in loans to mortgage companies and other commercial loan portfolios |

| · | Increase in average loans primarily driven by increases in loans to mortgage companies and other commercial loan portfolios |

| · | Period-end core deposits were $18.2 billion in both third and second quarter; average core deposits increased 1 percent to $18.1 billion |

| · | NII increased to $190.5 million in third quarter from $178.3 million in second quarter; NIM decreased 2 basis points to 4.55 percent in third quarter |

| · | The increase in NII was largely the result of higher average balances of loans to mortgage companies and other commercial loans |

| · | Provision expense was $8.5 million in third quarter compared to $10.9 million in the prior quarter |

| · | Provision in third quarter was primarily driven by improved performance of the consumer real estate portfolio which offset increased reserves as a result of commercial loan growth |

| · | Net charge-offs declined by $4.1 million in third quarter to $3.5 million driven by lower commercial charge-offs |

| · | Noninterest income increased to $65.1 million in third quarter from $61.3 million in second quarter largely the result of a $1.8 million gain on the sale of properties and higher fee income associated with derivative sales |

| · | Noninterest expense decreased to $145.0 million in third quarter from $164.3 million in second quarter primarily driven by a decline in loss accruals related to legal matters. These declines were somewhat offset by increases in personnel, technology, advertising and FDIC expense relative to the prior quarter |

| · | Third quarter includes a $4.3 million reversal of loss accruals related to legal matters compared to $22.0 million of loss accruals related to legal matters in second quarter |

Fixed Income

| · | Pre-tax income was $14.9 million in third quarter compared to $18.3 million in second quarter |

| · | Noninterest income decreased to $72.1 million in third quarter from $78.1 million in the prior quarter |

| · | Fixed income product revenue was $59.0 million in third quarter compared to $69.3 million in second quarter |

| · | Fixed income product average daily revenue (“ADR”) was $922 thousand and $1.1 million in third and second quarters, respectively |

| · | Other product revenue increased $4.3 million to $13.1 million in third quarter driven by increases in fees from loan and derivative sales |

| · | Noninterest expense decreased to $59.6 million in third quarter from $62.9 million in the prior quarter primarily due to lower variable compensation costs |

| 4 |

| FHN PERFORMANCE HIGHLIGHTS (continued) | |||

| Third Quarter 2016 vs. Second Quarter 2016 (continued) | |||

Corporate

| · | Pre-tax loss was $27.9 million in third quarter compared to pre-tax loss of $27.0 million in prior quarter |

| · | NII was negative $18.2 million and negative $15.9 million in third and second quarter, respectively |

| · | Estimated effective duration of the securities portfolio was 2.5 years in third quarter compared to 1.9 years in second quarter |

| · | Estimated modified duration of the securities portfolio was 3.8 years in third quarter compared to 3.4 years in second quarter |

| · | Noninterest income (including net securities gains) was $5.1 million in third quarter compared to $4.9 million in second quarter |

| · | Noninterest expense decreased to $14.8 million in third quarter from $16.1 million in second quarter |

| · | Second quarter expense included $2.5 million of negative valuation adjustments associated with derivatives related to prior sales of Visa Class B shares; no similar adjustment was made in third quarter |

Non-Strategic

| · | Pre-tax income was $7.1 million in third quarter compared to $35.2 million in second quarter |

| · | NII was $10.5 million and $10.6 million in third and second quarter, respectively |

| · | The provision credit was $4.5 million in third quarter compared to a provision credit of $6.9 million in second quarter |

| · | The level of provision continues to reflect declining balances combined with stable performance within the legacy portfolio |

| · | Noninterest income increased to $6.2 million in third quarter from $1.2 million in prior quarter driven by recoveries associated with prior legacy mortgage servicing sales |

| · | Noninterest expense increased to $14.2 million in third quarter from negative $16.4 million in second quarter |

| · | Expense increase primarily driven by a $31.4 million reversal of repurchase and foreclosure provision in second quarter as a result of the settlements of certain repurchase claims |

| · | Third quarter includes $4.5 million of loss accruals related to legal matters compared to $4.0 million in the prior quarter |

Asset Quality

| · | Allowance for loan losses increased to $201.6 million in third quarter from $199.8 million in second quarter; the allowance to loans ratio was 103 basis points in third quarter compared to 107 basis points in second quarter |

| · | Reserves for the consumer portfolio declined by $6.3 million which partially offset an increase in regional bank commercial reserves |

| · | The increase in regional bank commercial reserves was primarily due to increased balances compared to second quarter |

| · | Net charge-offs (“NCOs”) were $2.3 million in third quarter compared to $8.2 million in second quarter; annualized net charge-offs decreased to 5 basis points of average loans in third quarter from 19 basis points in prior quarter |

| · | The regional bank had net charge-offs of $3.5 million in third quarter compared to net charge-offs of $7.6 million in second quarter |

| · | Nonperforming loans (“NPLs”), excluding loans held-for-sale, decreased to $152.1 million in third quarter from $176.6 million in second quarter; the decrease was largely driven by the consumer real estate portfolio primarily as a result of performing troubled debt restructurings (“TDRs”) returning to accrual status combined with a decrease in the commercial real estate portfolio due to payoffs |

| · | Nonperforming assets (“NPAs”), excluding loans held-for-sale, were $165.7 million compared to $190.7 million |

| · | 30+ delinquencies increased $4.6 million from second quarter to $63.4 million in third quarter primarily driven by the consumer real estate and commercial portfolios within regional bank while 30+ delinquencies as a percentage of total loans remained flat at 32 basis points in third quarter compared to second quarter |

| · | TDRs decreased to $360.8 million in third quarter from $373.1 million in prior quarter |

Taxes

| · | The effective tax rates for third and second quarters were 29.68 percent and 33.00 percent, respectively. The rate difference was primarily attributable to a $2.3 million change in discrete items |

| · | The rates reflect the favorable effect from permanent benefits. Permanent benefits primarily consist of tax credit investments, life insurance, and tax-exempt interest |

Capital and Liquidity

| · | Declared $.07 per common share quarterly dividend in third quarter, aggregating $16.3 million, which was paid on October 3, 2016 |

| · | Declared aggregate preferred quarterly dividend of $1.6 million in third quarter which was paid on October 11, 2016 |

| · | Repurchased shares costing $7.1 million in third quarter; $189.7 million remaining authorization under the current share repurchase program at September 30, 2016 |

| · | Cumulative shares repurchased since October 2011 are $423.0 million with a volume weighted average price of $10.36 per share |

| · | Capital ratios (regulatory capital ratios calculated under the Basel III risk-based capital rules as phased-in; current quarter is an estimate) |

| · | Total equity to total assets (GAAP) of 9.65 percent in third quarter compared to 9.77 percent in prior quarter |

| · | Tangible common equity to tangible assets (Non-GAAP) of 7.58 percent in third quarter compared to 7.63 percent in prior quarter |

| · | Common Equity Tier 1 of 9.79 percent in third quarter compared to 10.05 percent in prior quarter |

| · | Tier 1 of 11.00 percent in third quarter compared to 11.28 percent in prior quarter |

| · | Total Capital of 12.06 percent in third quarter compared to 12.39 percent in prior quarter |

| · | Leverage of 9.52 percent in third quarter compared to 9.50 percent in prior quarter |

| 5 |

FHN CONSOLIDATED INCOME STATEMENT

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| (Dollars in thousands, except per share data) | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | ||||||||||||||

| Interest income | $206,972 | $197,376 | $193,664 | $187,620 | $183,687 | 5 | % | 13 | % | ||||||||||||

| Less: interest expense | 21,777 | 21,112 | 21,590 | 20,968 | 20,125 | 3 | % | 8 | % | ||||||||||||

| Net interest income | 185,195 | 176,264 | 172,074 | 166,652 | 163,562 | 5 | % | 13 | % | ||||||||||||

| Provision for loan losses | 4,000 | 4,000 | 3,000 | 1,000 | 1,000 | * | NM | ||||||||||||||

| Net interest income after provision for loan losses | 181,195 | 172,264 | 169,074 | 165,652 | 162,562 | 5 | % | 11 | % | ||||||||||||

| Noninterest income: | |||||||||||||||||||||

| Fixed income | 71,748 | 77,913 | 66,977 | 61,673 | 51,804 | (8 | )% | 38 | % | ||||||||||||

| Deposit transactions and cash management | 27,221 | 26,991 | 26,837 | 28,951 | 28,911 | 1 | % | (6 | )% | ||||||||||||

| Brokerage, management fees and commissions | 10,828 | 10,665 | 10,415 | 11,021 | 11,620 | 2 | % | (7 | )% | ||||||||||||

| Trust services and investment management | 6,885 | 7,224 | 6,565 | 6,873 | 6,590 | (5 | )% | 4 | % | ||||||||||||

| Bankcard income (a) | 6,260 | 6,558 | 5,259 | 5,607 | 5,561 | (5 | )% | 13 | % | ||||||||||||

| Bank-owned life insurance | 3,997 | 3,743 | 3,389 | 3,738 | 4,135 | 7 | % | (3 | )% | ||||||||||||

| Other service charges | 3,004 | 2,996 | 2,713 | 2,751 | 2,968 | * | 1 | % | |||||||||||||

| Insurance commissions | 1,262 | 552 | 487 | 769 | 608 | NM | NM | ||||||||||||||

| Securities gains/(losses), net | (200 | ) | 99 | 1,574 | 1,439 | (345 | ) | NM | 42 | % | |||||||||||

| Other (b) | 17,540 | 8,773 | 10,089 | 9,410 | 13,251 | NM | 32 | % | |||||||||||||

| Total noninterest income | 148,545 | 145,514 | 134,305 | 132,232 | 125,103 | 2 | % | 19 | % | ||||||||||||

| Adjusted gross income after provision for loan losses | 329,740 | 317,778 | 303,379 | 297,884 | 287,665 | 4 | % | 15 | % | ||||||||||||

| Noninterest expense: | |||||||||||||||||||||

| Employee compensation, incentives, and benefits (c) | 145,103 | 143,370 | 137,151 | 136,000 | 116,219 | 1 | % | 25 | % | ||||||||||||

| Repurchase and foreclosure provision (d) | (218 | ) | (31,400 | ) | - | - | - | 99 | % | NM | |||||||||||

| Legal fees | 4,750 | 5,891 | 4,879 | 4,601 | 3,626 | (19 | )% | 31 | % | ||||||||||||

| Professional fees | 4,859 | 4,284 | 5,199 | 4,859 | 5,139 | 13 | % | (5 | )% | ||||||||||||

| Occupancy | 12,722 | 12,736 | 12,604 | 13,853 | 13,282 | * | (4 | )% | |||||||||||||

| Computer software | 10,400 | 11,226 | 11,587 | 11,432 | 11,010 | (7 | )% | (6 | )% | ||||||||||||

| Contract employment and outsourcing | 2,443 | 2,497 | 2,425 | 3,159 | 3,414 | (2 | )% | (28 | )% | ||||||||||||

| Operations services | 10,518 | 10,521 | 9,900 | 9,761 | 10,130 | * | 4 | % | |||||||||||||

| Equipment rentals, depreciation, and maintenance | 6,085 | 7,182 | 6,159 | 8,568 | 7,093 | (15 | )% | (14 | )% | ||||||||||||

| FDIC premium expense | 5,721 | 4,848 | 4,921 | 5,098 | 4,529 | 18 | % | 26 | % | ||||||||||||

| Advertising and public relations (e) | 6,065 | 4,481 | 4,973 | 5,273 | 4,832 | 35 | % | 26 | % | ||||||||||||

| Communications and courier | 3,883 | 3,039 | 3,750 | 4,089 | 4,054 | 28 | % | (4 | )% | ||||||||||||

| Other insurance and taxes | 2,625 | 3,014 | 3,313 | 2,874 | 3,283 | (13 | )% | (20 | )% | ||||||||||||

| Foreclosed real estate | 815 | (432 | ) | (258 | ) | 475 | 431 | NM | 89 | % | |||||||||||

| Amortization of intangible assets | 1,299 | 1,299 | 1,300 | 1,359 | 1,298 | * | * | ||||||||||||||

| Other (b) | 16,488 | 44,266 | 19,024 | 32,339 | 27,096 | (63 | )% | (39 | )% | ||||||||||||

| Total noninterest expense | 233,558 | 226,822 | 226,927 | 243,740 | 215,436 | 3 | % | 8 | % | ||||||||||||

| Income before income taxes | 96,182 | 90,956 | 76,452 | 54,144 | 72,229 | 6 | % | 33 | % | ||||||||||||

| Provision for income taxes | 28,547 | 30,016 | 24,239 | 2,715 | 8,897 | (5 | )% | NM | |||||||||||||

| Net income | 67,635 | 60,940 | 52,213 | 51,429 | 63,332 | 11 | % | 7 | % | ||||||||||||

| Net income attributable to noncontrolling interest | 2,883 | 2,852 | 2,851 | 2,848 | 2,977 | 1 | % | (3 | )% | ||||||||||||

| Net income attributable to controlling interest | 64,752 | 58,088 | 49,362 | 48,581 | 60,355 | 11 | % | 7 | % | ||||||||||||

| Preferred stock dividends | 1,550 | 1,550 | 1,550 | 1,550 | 1,550 | * | * | ||||||||||||||

| Net income available to common shareholders | $63,202 | $56,538 | $47,812 | $47,031 | $58,805 | 12 | % | 7 | % | ||||||||||||

| Common Stock Data | |||||||||||||||||||||

| EPS | $0.27 | $0.24 | $0.20 | $0.20 | $0.25 | 13 | % | 8 | % | ||||||||||||

| Basic shares (thousands) (f) | 231,856 | 231,573 | 234,651 | 237,983 | 233,111 | * | (1 | )% | |||||||||||||

| Diluted EPS | $0.27 | $0.24 | $0.20 | $0.20 | $0.25 | 13 | % | 8 | % | ||||||||||||

| Diluted shares (thousands) (f) | 234,092 | 233,576 | 236,666 | 240,072 | 235,058 | * | * | ||||||||||||||

| Key Ratios & Other | |||||||||||||||||||||

| Return on average assets (annualized) (g) | 0.97 | % | 0.91 | % | 0.79 | % | 0.78 | % | 0.99 | % | |||||||||||

| Return on average common equity (“ROE”) (annualized) (g) | 10.80 | % | 10.04 | % | 8.53 | % | 8.23 | % | 10.83 | % | |||||||||||

| Return on average tangible common equity (“ROTCE”) (annualized) (g) (h) | 11.90 | % | 11.10 | % | 9.44 | % | 9.07 | % | 11.77 | % | |||||||||||

| Fee income to total revenue (g) | 44.54 | % | 45.21 | % | 43.55 | % | 43.97 | % | 43.41 | % | |||||||||||

| Efficiency ratio (g) | 69.94 | % | 70.51 | % | 74.45 | % | 81.94 | % | 74.54 | % | |||||||||||

| Full time equivalent employees | 4,246 | 4,228 | 4,241 | 4,260 | 4,202 | ||||||||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | 2Q16 increase driven by a significant new relationship. |

| (b) | Refer to the Other Income and Other Expense table on page 7 for additional information. |

| (c) | 3Q15 includes $8.3 million of gains associated with an employee benefit plan amendment. |

| (d) | 2Q16 expense reversal driven by the settlements of certain repurchase claims. |

| (e) | 3Q16 increase related to a promotional branding campaign. |

| (f) | 4Q15 increase related to shares issued in connection with the TrustAtlantic acquisition. |

| (g) | See Glossary of Terms for definitions of Key Ratios. |

| (h) | This non-GAAP measure is reconciled to ROE (GAAP) in the Non-GAAP to GAAP reconciliation on page 22 of this financial supplement. |

| 6 |

FHN OTHER INCOME AND OTHER EXPENSE

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| (Thousands) | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | ||||||||||||||

| Other Income | |||||||||||||||||||||

| ATM and interchange fees | $3,081 | $2,879 | $2,958 | $3,133 | $2,998 | 7 | % | 3 | % | ||||||||||||

| Electronic banking fees | 1,398 | 1,381 | 1,397 | 1,474 | 1,479 | 1 | % | (5 | )% | ||||||||||||

| Letter of credit fees | 981 | 1,115 | 1,061 | 988 | 978 | (12 | )% | * | |||||||||||||

| Mortgage banking (a) | 5,524 | 598 | 1,273 | 1,149 | 761 | NM | NM | ||||||||||||||

| Deferred compensation (b) | 1,038 | 795 | 329 | (58 | ) | (2,309 | ) | 31 | % | NM | |||||||||||

| Gain/(loss) on extinguishment of debt (c) | - | - | - | (1 | ) | 5,794 | NM | NM | |||||||||||||

| Other (d) | 5,518 | 2,005 | 3,071 | 2,725 | 3,550 | NM | 55 | % | |||||||||||||

| Total | $17,540 | $8,773 | $10,089 | $9,410 | $13,251 | NM | 32 | % | |||||||||||||

| Other Expense | |||||||||||||||||||||

| Litigation and regulatory matters | $260 | $26,000 | $(475 | ) | $14,185 | $10,922 | (99 | )% | (98 | )% | |||||||||||

| Tax credit investments (e) | 788 | 831 | 706 | 3,199 | 439 | (5 | )% | 79 | % | ||||||||||||

| Travel and entertainment | 2,478 | 2,495 | 2,062 | 2,893 | 2,451 | (1 | )% | 1 | % | ||||||||||||

| Employee training and dues | 1,360 | 1,338 | 1,390 | 1,537 | 1,272 | 2 | % | 7 | % | ||||||||||||

| Customer relations | 1,442 | 1,483 | 1,879 | 1,086 | 1,477 | (3 | )% | (2 | )% | ||||||||||||

| Miscellaneous loan costs | 676 | 565 | 717 | 835 | 726 | 20 | % | (7 | )% | ||||||||||||

| Supplies | 1,158 | 930 | 1,026 | 1,046 | 974 | 25 | % | 19 | % | ||||||||||||

| Other (f) | 8,326 | 10,624 | 11,719 | 7,558 | 8,835 | (22 | )% | (6 | )% | ||||||||||||

| Total | $16,488 | $44,266 | $19,024 | $32,339 | $27,096 | (63 | )% | (39 | )% | ||||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | 3Q16 includes $4.4 million of gains primarily related to recoveries associated with prior legacy mortgage servicing sales. |

| (b) | Amounts driven by market conditions and are mirrored by changes in deferred compensation expense which is included in employee compensation expense. |

| (c) | 3Q15 gain related to the extinguishment of $206 million of junior subordinated notes underlying $200 million of trust preferred debt. |

| (d) | 3Q16 includes a $1.8 million gain on the sales of properties. |

| (e) | 4Q15 includes $2.8 million of impairment related to a tax credit investment accounted for under the equity method. |

| (f) | 2Q16 includes $2.5 million of negative valuation adjustments associated with derivatives related to prior sales of Visa Class B shares; 1Q16 includes $3.7 million of impairment related to branch closures. |

| 7 |

FHN CONSOLIDATED PERIOD-END BALANCE SHEET

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| (Thousands) | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | ||||||||||||||

| Assets: | |||||||||||||||||||||

| Investment securities | $4,041,934 | $4,023,576 | $4,028,731 | $3,944,166 | $3,677,954 | * | 10 | % | |||||||||||||

| Loans held-for-sale | 155,215 | 117,976 | 116,270 | 126,342 | 124,308 | 32 | % | 25 | % | ||||||||||||

| Loans, net of unearned income | 19,555,787 | 18,589,337 | 17,574,994 | 17,686,502 | 16,725,492 | 5 | % | 17 | % | ||||||||||||

| Federal funds sold | 27,097 | 40,570 | 34,061 | 114,479 | 64,438 | (33 | )% | (58 | )% | ||||||||||||

| Securities purchased under agreements to resell | 802,815 | 881,732 | 767,483 | 615,773 | 793,098 | (9 | )% | 1 | % | ||||||||||||

| Interest-bearing cash (a) | 219,834 | 321,743 | 951,920 | 602,836 | 596,689 | (32 | )% | (63 | )% | ||||||||||||

| Trading securities | 1,320,535 | 1,162,959 | 1,226,521 | 881,450 | 1,229,180 | 14 | % | 7 | % | ||||||||||||

| Total earning assets | 26,123,217 | 25,137,893 | 24,699,980 | 23,971,548 | 23,211,159 | 4 | % | 13 | % | ||||||||||||

| Cash and due from banks | 327,639 | 283,648 | 280,625 | 300,811 | 256,342 | 16 | % | 28 | % | ||||||||||||

| Fixed income receivables (b) | 91,997 | 219,939 | 114,854 | 63,660 | 83,547 | (58 | )% | 10 | % | ||||||||||||

| Goodwill (c) | 191,371 | 191,307 | 191,307 | 191,307 | 145,932 | * | 31 | % | |||||||||||||

| Other intangible assets, net (c) | 22,317 | 23,616 | 24,915 | 26,215 | 25,624 | (6 | )% | (13 | )% | ||||||||||||

| Premises and equipment, net | 279,178 | 279,676 | 274,347 | 275,619 | 269,332 | * | 4 | % | |||||||||||||

| Real estate acquired by foreclosure | 18,945 | 20,053 | 24,521 | 33,063 | 35,332 | (6 | )% | (46 | )% | ||||||||||||

| Allowance for loan losses | (201,557 | ) | (199,807 | ) | (204,034 | ) | (210,242 | ) | (210,814 | ) | 1 | % | (4 | )% | |||||||

| Derivative assets | 160,736 | 196,989 | 165,007 | 104,365 | 152,548 | (18 | )% | 5 | % | ||||||||||||

| Other assets | 1,435,379 | 1,387,756 | 1,392,160 | 1,436,291 | 1,417,071 | 3 | % | 1 | % | ||||||||||||

| Total assets | $28,449,222 | $27,541,070 | $26,963,682 | $26,192,637 | $25,386,073 | 3 | % | 12 | % | ||||||||||||

| Liabilities and Equity: | |||||||||||||||||||||

| Deposits: | |||||||||||||||||||||

| Savings | $8,753,115 | $7,960,182 | $7,921,344 | $7,811,191 | $7,554,338 | 10 | % | 16 | % | ||||||||||||

| Other interest-bearing deposits | 5,605,734 | 5,720,628 | 5,371,864 | 5,388,526 | 4,885,601 | (2 | )% | 15 | % | ||||||||||||

| Time deposits | 732,561 | 741,992 | 763,897 | 788,487 | 743,158 | (1 | )% | (1 | )% | ||||||||||||

| Total interest-bearing core deposits | 15,091,410 | 14,422,802 | 14,057,105 | 13,988,204 | 13,183,097 | 5 | % | 14 | % | ||||||||||||

| Noninterest-bearing deposits | 5,890,252 | 5,684,732 | 5,717,195 | 5,535,885 | 5,391,385 | 4 | % | 9 | % | ||||||||||||

| Total core deposits (d) | 20,981,662 | 20,107,534 | 19,774,300 | 19,524,089 | 18,574,482 | 4 | % | 13 | % | ||||||||||||

| Certificates of deposit $100,000 and more | 592,518 | 522,643 | 553,534 | 443,389 | 290,738 | 13 | % | NM | |||||||||||||

| Total deposits | 21,574,180 | 20,630,177 | 20,327,834 | 19,967,478 | 18,865,220 | 5 | % | 14 | % | ||||||||||||

| Federal funds purchased | 538,284 | 508,669 | 588,413 | 464,166 | 520,992 | 6 | % | 3 | % | ||||||||||||

| Securities sold under agreements to repurchase | 341,998 | 451,129 | 425,217 | 338,133 | 332,329 | (24 | )% | 3 | % | ||||||||||||

| Trading liabilities | 702,226 | 789,540 | 738,653 | 566,019 | 788,563 | (11 | )% | (11 | )% | ||||||||||||

| Other short-term borrowings (e) | 792,736 | 543,033 | 96,723 | 137,861 | 99,887 | 46 | % | NM | |||||||||||||

| Term borrowings (f) | 1,065,651 | 1,076,943 | 1,323,749 | 1,312,677 | 1,339,940 | (1 | )% | (20 | )% | ||||||||||||

| Fixed income payables (b) | 68,897 | 90,400 | 56,399 | 23,072 | 95,346 | (24 | )% | (28 | )% | ||||||||||||

| Derivative liabilities | 144,829 | 170,619 | 146,297 | 108,339 | 140,965 | (15 | )% | 3 | % | ||||||||||||

| Other liabilities | 475,839 | 588,636 | 617,449 | 635,306 | 622,586 | (19 | )% | (24 | )% | ||||||||||||

| Total liabilities | 25,704,640 | 24,849,146 | 24,320,734 | 23,553,051 | 22,805,828 | 3 | % | 13 | % | ||||||||||||

| Equity: | |||||||||||||||||||||

| Common stock (g) | 145,772 | 145,012 | 145,342 | 149,117 | 146,398 | 1 | % | * | |||||||||||||

| Capital surplus (g) | 1,376,319 | 1,362,528 | 1,371,397 | 1,439,303 | 1,377,731 | 1 | % | * | |||||||||||||

| Undivided profits | 992,264 | 945,663 | 905,595 | 874,303 | 841,737 | 5 | % | 18 | % | ||||||||||||

| Accumulated other comprehensive loss, net | (160,828 | ) | (152,334 | ) | (170,441 | ) | (214,192 | ) | (176,676 | ) | 6 | % | (9 | )% | |||||||

| Preferred stock | 95,624 | 95,624 | 95,624 | 95,624 | 95,624 | * | * | ||||||||||||||

| Noncontrolling interest (h) | 295,431 | 295,431 | 295,431 | 295,431 | 295,431 | * | * | ||||||||||||||

| Total equity | 2,744,582 | 2,691,924 | 2,642,948 | 2,639,586 | 2,580,245 | 2 | % | 6 | % | ||||||||||||

| Total liabilities and equity | $28,449,222 | $27,541,070 | $26,963,682 | $26,192,637 | $25,386,073 | 3 | % | 12 | % | ||||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | Includes excess balances held at Fed. |

| (b) | Period-end balances fluctuate based on the level of pending unsettled trades. |

| (c) | 4Q15 increase related to TrustAtlantic acquisition. |

| (d) | 3Q16 average core deposits were $20.6 billion. |

| (e) | 3Q16 and 2Q16 increase related to higher FHLB borrowings as a result of increased loan demand. |

| (f) | In 2Q16 $250 million of FTBNA subordinated notes matured. |

| (g) | 4Q15 increase related to shares issued in connection with the TrustAtlantic acquisition. |

| (h) | Consists of preferred stock of subsidiaries. |

| 8 |

FHN CONSOLIDATED AVERAGE BALANCE SHEET

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| (Thousands) | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | ||||||||||||||

| Assets: | |||||||||||||||||||||

| Earning assets: | |||||||||||||||||||||

| Loans, net of unearned income: | |||||||||||||||||||||

| Commercial, financial, and industrial (C&I) | $11,281,691 | $10,451,954 | $9,994,084 | $9,720,115 | $9,539,650 | 8 | % | 18 | % | ||||||||||||

| Commercial real estate | 1,997,121 | 1,901,592 | 1,765,435 | 1,612,730 | 1,425,528 | 5 | % | 40 | % | ||||||||||||

| Consumer real estate | 4,601,420 | 4,662,172 | 4,732,968 | 4,798,067 | 4,838,984 | (1 | )% | (5 | )% | ||||||||||||

| Permanent mortgage | 436,952 | 435,521 | 447,800 | 455,299 | 475,684 | * | (8 | )% | |||||||||||||

| Credit card and other | 362,166 | 360,874 | 353,661 | 356,948 | 353,148 | * | 3 | % | |||||||||||||

| Total loans, net of unearned income (a) | 18,679,350 | 17,812,113 | 17,293,948 | 16,943,159 | 16,632,994 | 5 | % | 12 | % | ||||||||||||

| Loans held-for-sale | 132,434 | 114,859 | 122,146 | 122,046 | 126,072 | 15 | % | 5 | % | ||||||||||||

| Investment securities: | |||||||||||||||||||||

| U.S. treasuries | 100 | 100 | 100 | 100 | 100 | * | * | ||||||||||||||

| U.S. government agencies | 3,844,103 | 3,814,059 | 3,790,568 | 3,619,334 | 3,482,658 | 1 | % | 10 | % | ||||||||||||

| States and municipalities | 4,516 | 5,830 | 5,823 | 8,881 | 13,673 | (23 | )% | (67 | )% | ||||||||||||

| Corporate bonds | 10,000 | 10,000 | 10,000 | 1,522 | - | * | NM | ||||||||||||||

| Other | 186,632 | 186,812 | 185,638 | 188,813 | 181,817 | * | 3 | % | |||||||||||||

| Total investment securities | 4,045,351 | 4,016,801 | 3,992,129 | 3,818,650 | 3,678,248 | 1 | % | 10 | % | ||||||||||||

| Trading securities | 1,155,776 | 1,269,909 | 1,142,215 | 1,307,102 | 1,137,877 | (9 | )% | 2 | % | ||||||||||||

| Other earning assets: | |||||||||||||||||||||

| Federal funds sold | 28,049 | 20,825 | 25,454 | 19,832 | 35,191 | 35 | % | (20 | )% | ||||||||||||

| Securities purchased under agreements to resell | 808,861 | 891,973 | 817,963 | 804,000 | 762,744 | (9 | )% | 6 | % | ||||||||||||

| Interest-bearing cash (b) | 491,164 | 475,881 | 1,009,739 | 913,432 | 806,648 | 3 | % | (39 | )% | ||||||||||||

| Total other earning assets | 1,328,074 | 1,388,679 | 1,853,156 | 1,737,264 | 1,604,583 | (4 | )% | (17 | )% | ||||||||||||

| Total earning assets | 25,340,985 | 24,602,361 | 24,403,594 | 23,928,221 | 23,179,774 | 3 | % | 9 | % | ||||||||||||

| Allowance for loan losses | (200,654 | ) | (201,622 | ) | (208,884 | ) | (208,804 | ) | (216,833 | ) | * | (7 | )% | ||||||||

| Cash and due from banks | 320,549 | 310,691 | 316,467 | 320,147 | 308,409 | 3 | % | 4 | % | ||||||||||||

| Fixed income receivables | 75,255 | 73,029 | 74,495 | 91,510 | 59,470 | 3 | % | 27 | % | ||||||||||||

| Premises and equipment, net | 278,042 | 275,206 | 275,764 | 273,365 | 268,061 | 1 | % | 4 | % | ||||||||||||

| Derivative assets | 170,546 | 147,561 | 117,815 | 131,479 | 113,927 | 16 | % | 50 | % | ||||||||||||

| Other assets | 1,624,979 | 1,621,322 | 1,639,443 | 1,639,256 | 1,600,095 | * | 2 | % | |||||||||||||

| Total assets | $27,609,702 | $26,828,548 | $26,618,694 | $26,175,174 | $25,312,903 | 3 | % | 9 | % | ||||||||||||

| Liabilities and equity: | |||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||

| Savings | $8,507,474 | $7,865,977 | $7,898,580 | $7,589,314 | $7,578,288 | 8 | % | 12 | % | ||||||||||||

| Other interest-bearing deposits | 5,450,401 | 5,431,736 | 5,281,059 | 4,956,451 | 4,806,813 | * | 13 | % | |||||||||||||

| Time deposits | 748,135 | 755,273 | 774,345 | 798,661 | 756,397 | (1 | )% | (1 | )% | ||||||||||||

| Total interest-bearing core deposits | 14,706,010 | 14,052,986 | 13,953,984 | 13,344,426 | 13,141,498 | 5 | % | 12 | % | ||||||||||||

| Certificates of deposit $100,000 and more | 518,630 | 545,436 | 511,975 | 389,682 | 354,376 | (5 | )% | 46 | % | ||||||||||||

| Federal funds purchased | 598,666 | 600,381 | 630,143 | 569,603 | 529,156 | * | 13 | % | |||||||||||||

| Securities sold under agreements to repurchase | 387,486 | 490,449 | 445,964 | 337,893 | 330,114 | (21 | )% | 17 | % | ||||||||||||

| Trading liabilities | 752,270 | 828,629 | 758,739 | 768,721 | 722,031 | (9 | )% | 4 | % | ||||||||||||

| Other short-term borrowings (c) | 252,048 | 184,602 | 112,498 | 128,740 | 138,698 | 37 | % | 82 | % | ||||||||||||

| Term borrowings (d) | 1,075,039 | 1,072,393 | 1,310,370 | 1,583,213 | 1,459,315 | * | (26 | )% | |||||||||||||

| Total interest-bearing liabilities | 18,290,149 | 17,774,876 | 17,723,673 | 17,122,278 | 16,675,188 | 3 | % | 10 | % | ||||||||||||

| Noninterest-bearing deposits | 5,874,857 | 5,654,446 | 5,470,855 | 5,627,935 | 5,392,294 | 4 | % | 9 | % | ||||||||||||

| Fixed income payables | 44,600 | 30,872 | 53,004 | 52,034 | 26,220 | 44 | % | 70 | % | ||||||||||||

| Derivative liabilities | 146,063 | 129,260 | 122,378 | 120,728 | 105,644 | 13 | % | 38 | % | ||||||||||||

| Other liabilities | 535,714 | 583,606 | 604,410 | 592,624 | 568,013 | (8 | )% | (6 | )% | ||||||||||||

| Total liabilities | 24,891,383 | 24,173,060 | 23,974,320 | 23,515,599 | 22,767,359 | 3 | % | 9 | % | ||||||||||||

| Equity: | |||||||||||||||||||||

| Common stock (e) | 145,362 | 145,226 | 147,287 | 149,401 | 146,324 | * | (1 | )% | |||||||||||||

| Capital surplus (e) | 1,369,708 | 1,367,468 | 1,405,996 | 1,443,988 | 1,374,195 | * | * | ||||||||||||||

| Undivided profits | 967,872 | 924,822 | 889,209 | 860,778 | 818,909 | 5 | % | 18 | % | ||||||||||||

| Accumulated other comprehensive loss, net | (155,678 | ) | (173,083 | ) | (189,173 | ) | (185,647 | ) | (184,939 | ) | (10 | )% | (16 | )% | |||||||

| Preferred stock | 95,624 | 95,624 | 95,624 | 95,624 | 95,624 | * | * | ||||||||||||||

| Noncontrolling interest (f) | 295,431 | 295,431 | 295,431 | 295,431 | 295,431 | * | * | ||||||||||||||

| Total equity | 2,718,319 | 2,655,488 | 2,644,374 | 2,659,575 | 2,545,544 | 2 | % | 7 | % | ||||||||||||

| Total liabilities and equity | $27,609,702 | $26,828,548 | $26,618,694 | $26,175,174 | $25,312,903 | 3 | % | 9 | % | ||||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | Includes loans on nonaccrual status. |

| (b) | Includes excess balances held at Fed. |

| (c) | 3Q16 and 2Q16 increase related to higher FHLB borrowings as a result of increased loan demand. |

| (d) | In 2Q16 $250 million of FTBNA subordinated notes matured. |

| (e) | 4Q15 increase related to shares issued in connection with the TrustAtlantic acquisition. |

| (f) | Consists of preferred stock of subsidiaries. |

| 9 |

FHN CONSOLIDATED NET INTEREST INCOME (a)

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| (Thousands) | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | ||||||||||||||

| Interest Income: | |||||||||||||||||||||

| Loans, net of unearned income (b) | $176,511 | $165,550 | $160,687 | $154,959 | $152,795 | 7 | % | 16 | % | ||||||||||||

| Loans held-for-sale | 1,445 | 1,198 | 1,261 | 1,305 | 1,311 | 21 | % | 10 | % | ||||||||||||

| Investment securities: | |||||||||||||||||||||

| U.S. government agencies | 22,517 | 22,801 | 23,273 | 22,349 | 21,366 | (1 | )% | 5 | % | ||||||||||||

| States and municipalities | 102 | 106 | 97 | 129 | 97 | (4 | )% | 5 | % | ||||||||||||

| Corporate bonds | 131 | 132 | 131 | 19 | - | (1 | )% | NM | |||||||||||||

| Other | 1,138 | 1,152 | 1,201 | 1,906 | 1,864 | (1 | )% | (39 | )% | ||||||||||||

| Total investment securities | 23,888 | 24,191 | 24,702 | 24,403 | 23,327 | (1 | )% | 2 | % | ||||||||||||

| Trading securities | 7,110 | 8,374 | 8,185 | 9,360 | 8,476 | (15 | )% | (16 | )% | ||||||||||||

| Other earning assets: | |||||||||||||||||||||

| Federal funds sold | 70 | 57 | 80 | 56 | 88 | 23 | % | (20 | )% | ||||||||||||

| Securities purchased under agreements to resell (c) | 169 | 322 | 226 | (277 | ) | (112 | ) | (48 | )% | NM | |||||||||||

| Interest-bearing cash | 604 | 574 | 1,252 | 636 | 490 | 5 | % | 23 | % | ||||||||||||

| Total other earning assets | 843 | 953 | 1,558 | 415 | 466 | (12 | )% | 81 | % | ||||||||||||

| Interest income | $209,797 | $200,266 | $196,393 | $190,442 | $186,375 | 5 | % | 13 | % | ||||||||||||

| Interest Expense: | |||||||||||||||||||||

| Interest-bearing deposits: | |||||||||||||||||||||

| Savings | $4,939 | $4,146 | $4,190 | $2,930 | $2,785 | 19 | % | 77 | % | ||||||||||||

| Other interest-bearing deposits | 2,592 | 2,526 | 2,304 | 1,312 | 1,118 | 3 | % | NM | |||||||||||||

| Time deposits | 1,117 | 1,148 | 1,112 | 1,200 | 1,230 | (3 | )% | (9 | )% | ||||||||||||

| Total interest-bearing core deposits | 8,648 | 7,820 | 7,606 | 5,442 | 5,133 | 11 | % | 68 | % | ||||||||||||

| Certificates of deposit $100,000 and more | 1,379 | 1,326 | 1,211 | 1,013 | 756 | 4 | % | 82 | % | ||||||||||||

| Federal funds purchased | 779 | 762 | 797 | 428 | 338 | 2 | % | NM | |||||||||||||

| Securities sold under agreements to repurchase | 90 | 138 | 59 | 46 | 32 | (35 | )% | NM | |||||||||||||

| Trading liabilities | 3,331 | 3,782 | 4,039 | 4,034 | 4,258 | (12 | )% | (22 | )% | ||||||||||||

| Other short-term borrowings | 385 | 303 | 272 | 262 | 294 | 27 | % | 31 | % | ||||||||||||

| Term borrowings | 7,165 | 6,981 | 7,606 | 9,743 | 9,314 | 3 | % | (23 | )% | ||||||||||||

| Interest expense | 21,777 | 21,112 | 21,590 | 20,968 | 20,125 | 3 | % | 8 | % | ||||||||||||

| Net interest income - tax equivalent basis | 188,020 | 179,154 | 174,803 | 169,474 | 166,250 | 5 | % | 13 | % | ||||||||||||

| Fully taxable equivalent adjustment | (2,825 | ) | (2,890 | ) | (2,729 | ) | (2,822 | ) | (2,688 | ) | 2 | % | (5 | )% | |||||||

| Net interest income | $185,195 | $176,264 | $172,074 | $166,652 | $163,562 | 5 | % | 13 | % | ||||||||||||

NM - Not meaningful

| (a) | Net interest income adjusted to a fully taxable equivalent (“FTE”) basis assuming a statutory federal income tax of 35 percent and, where applicable, state income taxes. |

| (b) | Includes interest on loans in nonaccrual status. |

| (c) | Amounts in 2015 driven by negative market rates on reverse repurchase agreements. |

| 10 |

FHN CONSOLIDATED AVERAGE BALANCE SHEET: YIELDS AND RATES

Quarterly, Unaudited

| 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | |||||||||||

| Assets: | |||||||||||||||

| Earning assets (a): | |||||||||||||||

| Loans, net of unearned income (b): | |||||||||||||||

| Commercial loans | 3.63 | % | 3.58 | % | 3.58 | % | 3.46 | % | 3.50 | % | |||||

| Retail loans | 4.08 | 4.08 | 4.07 | 3.98 | 3.94 | ||||||||||

| Total loans, net of unearned income (c) | 3.76 | 3.74 | 3.73 | 3.63 | 3.65 | ||||||||||

| Loans held-for-sale | 4.36 | 4.17 | 4.13 | 4.28 | 4.16 | ||||||||||

| Investment securities: | |||||||||||||||

| U.S. government agencies | 2.34 | 2.39 | 2.46 | 2.47 | 2.45 | ||||||||||

| States and municipalities | 9.01 | 7.27 | 6.70 | 5.81 | 2.84 | ||||||||||

| Corporate bonds | 5.25 | 5.25 | 5.25 | 4.98 | - | ||||||||||

| Other | 2.44 | 2.47 | 2.59 | 4.04 | 4.10 | ||||||||||

| Total investment securities | 2.36 | 2.41 | 2.48 | 2.56 | 2.54 | ||||||||||

| Trading securities | 2.46 | 2.64 | 2.87 | 2.86 | 2.98 | ||||||||||

| Other earning assets: | |||||||||||||||

| Federal funds sold | 0.99 | 1.11 | 1.26 | 1.12 | 1.00 | ||||||||||

| Securities purchased under agreements to resell (d) | 0.08 | 0.15 | 0.11 | (0.14 | ) | (0.06 | ) | ||||||||

| Interest-bearing cash | 0.49 | 0.48 | 0.50 | 0.28 | 0.24 | ||||||||||

| Total other earning assets | 0.25 | 0.28 | 0.34 | 0.09 | 0.12 | ||||||||||

| Interest income/total earning assets | 3.30 | % | 3.27 | % | 3.23 | % | 3.17 | % | 3.20 | % | |||||

| Liabilities: | |||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||

| Interest-bearing deposits: | |||||||||||||||

| Savings | 0.23 | % | 0.21 | % | 0.21 | % | 0.15 | % | 0.15 | % | |||||

| Other interest-bearing deposits | 0.19 | 0.19 | 0.18 | 0.10 | 0.09 | ||||||||||

| Time deposits | 0.59 | 0.61 | 0.58 | 0.60 | 0.65 | ||||||||||

| Total interest-bearing core deposits | 0.23 | 0.22 | 0.22 | 0.16 | 0.15 | ||||||||||

| Certificates of deposit $100,000 and more | 1.06 | 0.98 | 0.95 | 1.03 | 0.85 | ||||||||||

| Federal funds purchased | 0.52 | 0.51 | 0.51 | 0.30 | 0.25 | ||||||||||

| Securities sold under agreements to repurchase | 0.09 | 0.11 | 0.05 | 0.05 | 0.04 | ||||||||||

| Trading liabilities | 1.76 | 1.84 | 2.14 | 2.08 | 2.34 | ||||||||||

| Other short-term borrowings (e) | 0.61 | 0.66 | 0.97 | 0.81 | 0.84 | ||||||||||

| Term borrowings (f) | 2.67 | 2.60 | 2.32 | 2.46 | 2.55 | ||||||||||

| Interest expense/total interest-bearing liabilities | 0.47 | 0.48 | 0.49 | 0.49 | 0.48 | ||||||||||

| Net interest spread | 2.83 | % | 2.79 | % | 2.74 | % | 2.68 | % | 2.72 | % | |||||

| Effect of interest-free sources used to fund earning assets | 0.13 | 0.13 | 0.14 | 0.14 | 0.13 | ||||||||||

| Net interest margin | 2.96 | % | 2.92 | % | 2.88 | % | 2.82 | % | 2.85 | % | |||||

Yields are adjusted to a FTE basis assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes.

| (a) | Earning assets yields are expressed net of unearned income. |

| (b) | Includes loan fees and cash basis interest income. |

| (c) | Includes loans on nonaccrual status. |

| (d) | Amounts in 2015 driven by negative market rates on reverse repurchase agreements. |

| (e) | 3Q16 and 2Q16 rates driven by an increase in FHLB borrowings at a rate lower than other short-term borrowings. |

| (f) | Rates are expressed net of unamortized debenture cost for term borrowings. |

| 11 |

FHN CAPITAL HIGHLIGHTS

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| (Dollars and shares in thousands) | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | ||||||||||||||

| Common equity tier 1 capital (a) (b) | $2,326,522 | $2,260,722 | $2,226,621 | $2,278,580 | $2,226,189 | 3 | % | 5 | % | ||||||||||||

| Tier 1 capital (a) (b) | 2,615,516 | 2,538,876 | 2,493,080 | 2,572,141 | 2,516,194 | 3 | % | 4 | % | ||||||||||||

| Total capital (a) | 2,868,415 | 2,788,558 | 2,744,189 | 2,836,715 | 2,781,354 | 3 | % | 3 | % | ||||||||||||

| Risk-weighted assets (“RWA”) (a) (b) | 23,775,200 | 22,503,305 | 21,559,035 | 21,812,015 | 20,783,031 | 6 | % | 14 | % | ||||||||||||

| Average assets for leverage (a) (b) | 27,481,469 | 26,715,209 | 26,519,986 | 26,109,449 | 25,280,856 | 3 | % | 9 | % | ||||||||||||

| Common equity tier 1 ratio (a) (b) | 9.79 | % | 10.05 | % | 10.33 | % | 10.45 | % | 10.71 | % | |||||||||||

| Tier 1 ratio (a) (b) | 11.00 | 11.28 | 11.56 | 11.79 | 12.11 | ||||||||||||||||

| Total capital ratio (a) | 12.06 | 12.39 | 12.73 | 13.01 | 13.38 | ||||||||||||||||

| Leverage ratio (a) (b) | 9.52 | 9.50 | 9.40 | 9.85 | 9.95 | ||||||||||||||||

| Total equity to total assets | 9.65 | % | 9.77 | % | 9.80 | % | 10.08 | % | 10.16 | % | |||||||||||

| Tangible common equity/tangible assets (“TCE/TA”) (c) | 7.58 | % | 7.63 | % | 7.61 | % | 7.82 | % | 8.00 | % | |||||||||||

| Period-end shares outstanding (d) | 233,235 | 232,019 | 232,547 | 238,587 | 234,237 | 1 | % | * | |||||||||||||

| Cash dividends declared per common share | $0.07 | $0.07 | $0.07 | $0.06 | $0.06 | * | 17 | % | |||||||||||||

| Book value per common share | $10.09 | $9.92 | $9.68 | $9.42 | $9.35 | ||||||||||||||||

| Tangible book value per common share (c) | $9.17 | $8.99 | $8.75 | $8.51 | $8.61 | ||||||||||||||||

| Market capitalization (millions) | $3,552.2 | $3,197.2 | $3,046.4 | $3,464.3 | $3,321.5 | ||||||||||||||||

Certain previously reported amounts have been reclassified to agree with current presentation.

* Amount is less than one percent.

| (a) | Current quarter is an estimate. |

| (b) | See Glossary of Terms for definition. |

| (c) | These non-GAAP measures are reconciled to total equity to total assets (GAAP) and to book value per common share (GAAP), respectively, in the Non-GAAP to GAAP reconciliation on page 22 of this financial supplement. |

| (d) | 4Q15 increase related to shares issued in connection with the TrustAtlantic acquisition. |

| 12 |

FHN BUSINESS SEGMENT HIGHLIGHTS

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| (Thousands) | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | ||||||||||||||

| Regional Banking | |||||||||||||||||||||

| Net interest income | $190,510 | $178,321 | $172,313 | $169,600 | $165,253 | 7 | % | 15 | % | ||||||||||||

| Noninterest income | 65,128 | 61,275 | 59,276 | 62,644 | 62,763 | 6 | % | 4 | % | ||||||||||||

| Total revenues | 255,638 | 239,596 | 231,589 | 232,244 | 228,016 | 7 | % | 12 | % | ||||||||||||

| Provision for loan losses | 8,544 | 10,883 | 14,767 | 5,856 | 6,696 | (21 | )% | 28 | % | ||||||||||||

| Noninterest expense (a) | 144,972 | 164,315 | 145,351 | 147,546 | 135,589 | (12 | )% | 7 | % | ||||||||||||

| Income before income taxes | 102,122 | 64,398 | 71,471 | 78,842 | 85,731 | 59 | % | 19 | % | ||||||||||||

| Provision for income taxes | 37,095 | 22,455 | 25,426 | 28,131 | 30,876 | 65 | % | 20 | % | ||||||||||||

| Net income | $65,027 | $41,943 | $46,045 | $50,711 | $54,855 | 55 | % | 19 | % | ||||||||||||

| Fixed Income | |||||||||||||||||||||

| Net interest income | $2,412 | $3,147 | $2,666 | $3,901 | $3,003 | (23 | )% | (20 | )% | ||||||||||||

| Noninterest income | 72,073 | 78,083 | 67,122 | 61,991 | 51,757 | (8 | )% | 39 | % | ||||||||||||

| Total revenues | 74,485 | 81,230 | 69,788 | 65,892 | 54,760 | (8 | )% | 36 | % | ||||||||||||

| Noninterest expense (b) | 59,575 | 62,881 | 58,668 | 54,605 | 59,844 | (5 | )% | * | |||||||||||||

| Income/(loss) before income taxes | 14,910 | 18,349 | 11,120 | 11,287 | (5,084 | ) | (19 | )% | NM | ||||||||||||

| Provision/(benefit) for income taxes | 5,459 | 6,755 | 3,875 | 3,971 | (2,384 | ) | (19 | )% | NM | ||||||||||||

| Net income/(loss) | $9,451 | $11,594 | $7,245 | $7,316 | $(2,700 | ) | (18 | )% | NM | ||||||||||||

| Corporate | |||||||||||||||||||||

| Net interest income/(expense) | $(18,195 | ) | $(15,850 | ) | $(14,364 | ) | $(19,221 | ) | $(19,027 | ) | (15 | )% | 4 | % | |||||||

| Noninterest income | 5,134 | 4,909 | 5,723 | 5,486 | 8,559 | 5 | % | (40 | )% | ||||||||||||

| Total revenues | (13,061 | ) | (10,941 | ) | (8,641 | ) | (13,735 | ) | (10,468 | ) | (19 | )% | (25 | )% | |||||||

| Noninterest expense | 14,841 | 16,072 | 13,479 | 17,736 | 11,804 | (8 | )% | 26 | % | ||||||||||||

| Loss before income taxes | (27,902 | ) | (27,013 | ) | (22,120 | ) | (31,471 | ) | (22,272 | ) | (3 | )% | (25 | )% | |||||||

| Benefit for income taxes | (16,739 | ) | (12,840 | ) | (11,254 | ) | (27,636 | ) | (24,946 | ) | (30 | )% | 33 | % | |||||||

| Net income/(loss) | $(11,163 | ) | $(14,173 | ) | $(10,866 | ) | $(3,835 | ) | $2,674 | 21 | % | NM | |||||||||

| Non-Strategic | |||||||||||||||||||||

| Net interest income | $10,468 | $10,646 | $11,459 | $12,372 | $14,333 | (2 | )% | (27 | )% | ||||||||||||

| Noninterest income (c) | 6,210 | 1,247 | 2,184 | 2,111 | 2,024 | NM | NM | ||||||||||||||

| Total revenues | 16,678 | 11,893 | 13,643 | 14,483 | 16,357 | 40 | % | 2 | % | ||||||||||||

| Provision/(provision credit) for loan losses | (4,544 | ) | (6,883 | ) | (11,767 | ) | (4,856 | ) | (5,696 | ) | 34 | % | 20 | % | |||||||

| Noninterest expense (d) | 14,170 | (16,446 | ) | 9,429 | 23,853 | 8,199 | NM | 73 | % | ||||||||||||

| Income/(loss) before income taxes | 7,052 | 35,222 | 15,981 | (4,514 | ) | 13,854 | (80 | )% | (49 | )% | |||||||||||

| Provision/(benefit) for income taxes | 2,732 | 13,646 | 6,192 | (1,751 | ) | 5,351 | (80 | )% | (49 | )% | |||||||||||

| Net income/(loss) | $4,320 | $21,576 | $9,789 | $(2,763 | ) | $8,503 | (80 | )% | (49 | )% | |||||||||||

| Total Consolidated | |||||||||||||||||||||

| Net interest income | $185,195 | $176,264 | $172,074 | $166,652 | $163,562 | 5 | % | 13 | % | ||||||||||||

| Noninterest income | 148,545 | 145,514 | 134,305 | 132,232 | 125,103 | 2 | % | 19 | % | ||||||||||||

| Total revenues | 333,740 | 321,778 | 306,379 | 298,884 | 288,665 | 4 | % | 16 | % | ||||||||||||

| Provision for loan losses | 4,000 | 4,000 | 3,000 | 1,000 | 1,000 | * | NM | ||||||||||||||

| Noninterest expense | 233,558 | 226,822 | 226,927 | 243,740 | 215,436 | 3 | % | 8 | % | ||||||||||||

| Income before income taxes | 96,182 | 90,956 | 76,452 | 54,144 | 72,229 | 6 | % | 33 | % | ||||||||||||

| Provision for income taxes | 28,547 | 30,016 | 24,239 | 2,715 | 8,897 | (5 | )% | NM | |||||||||||||

| Net income | $67,635 | $60,940 | $52,213 | $51,429 | $63,332 | 11 | % | 7 | % | ||||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | 3Q16 includes a $4.3 million reversal of loss accruals related to legal matters; 2Q16 includes $22.0 million of loss accruals related to legal matters. |

| (b) | 3Q15 includes an $11.6 million charge to litigation and regulatory matters related to the resolution of a legal matter. |

| (c) | 3Q16 includes $4.4 million of gains primarily related to recoveries associated with prior legacy mortgage servicing sales. |

| (d) | 3Q16 includes $4.5 million of loss accruals related to legal matters; 2Q16 includes a $31.4 million reversal of repurchase and foreclosure provision as a result of the settlements of certain repurchase claims, somewhat offset by $4.0 million of loss accruals related to legal matters; 4Q15 includes $14.2 million of loss accruals related to legal matters. |

| 13 |

FHN REGIONAL BANKING

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | |||||||||||||||

| Income Statement (thousands) | |||||||||||||||||||||

| Net interest income | $190,510 | $178,321 | $172,313 | $169,600 | $165,253 | 7 | % | 15 | % | ||||||||||||

| Provision for loan losses | 8,544 | 10,883 | 14,767 | 5,856 | 6,696 | (21 | )% | 28 | % | ||||||||||||

| Noninterest income: | |||||||||||||||||||||

| NSF / Overdraft fees (a) | 10,076 | 8,905 | 9,576 | 11,630 | 11,678 | 13 | % | (14 | )% | ||||||||||||

| Cash management fees | 7,947 | 8,612 | 8,760 | 8,637 | 8,482 | (8 | )% | (6 | )% | ||||||||||||

| Debit card income | 3,496 | 3,464 | 3,221 | 3,302 | 3,313 | 1 | % | 6 | % | ||||||||||||

| Other | 4,215 | 4,466 | 4,288 | 4,382 | 4,398 | (6 | )% | (4 | )% | ||||||||||||

| Total deposit transactions and cash management | 25,734 | 25,447 | 25,845 | 27,951 | 27,871 | 1 | % | (8 | )% | ||||||||||||

| Brokerage, management fees and commissions | 10,828 | 10,665 | 10,415 | 11,021 | 11,620 | 2 | % | (7 | )% | ||||||||||||

| Trust services and investment management | 6,900 | 7,239 | 6,569 | 6,889 | 6,605 | (5 | )% | 4 | % | ||||||||||||

| Bankcard income (b) | 6,151 | 6,432 | 5,132 | 5,423 | 5,257 | (4 | )% | 17 | % | ||||||||||||

| Other service charges | 2,591 | 2,579 | 2,318 | 2,358 | 2,562 | * | 1 | % | |||||||||||||

| Miscellaneous revenue (c) | 12,924 | 8,913 | 8,997 | 9,002 | 8,848 | 45 | % | 46 | % | ||||||||||||

| Total noninterest income | 65,128 | 61,275 | 59,276 | 62,644 | 62,763 | 6 | % | 4 | % | ||||||||||||

| Noninterest expense: | |||||||||||||||||||||

| Employee compensation, incentives, and benefits | 56,440 | 53,413 | 52,173 | 51,507 | 49,204 | 6 | % | 15 | % | ||||||||||||

| Other (d) | 88,532 | 110,902 | 93,178 | 96,039 | 86,385 | (20 | )% | 2 | % | ||||||||||||

| Total noninterest expense | 144,972 | 164,315 | 145,351 | 147,546 | 135,589 | (12 | )% | 7 | % | ||||||||||||

| Income before income taxes | $102,122 | $64,398 | $71,471 | $78,842 | $85,731 | 59 | % | 19 | % | ||||||||||||

| PPNR (e) | 110,666 | 75,281 | 86,238 | 84,698 | 92,427 | 47 | % | 20 | % | ||||||||||||

| Efficiency ratio (f) | 56.71 | % | 68.58 | % | 62.76 | % | 63.53 | % | 59.46 | % | |||||||||||

| Balance Sheet (millions) | |||||||||||||||||||||

| Average loans | $16,844 | $15,859 | $15,224 | $14,760 | $14,312 | 6 | % | 18 | % | ||||||||||||

| Average other earning assets | 46 | 42 | 47 | 42 | 58 | 10 | % | (21 | )% | ||||||||||||

| Total average earning assets | 16,890 | 15,901 | 15,271 | 14,802 | 14,370 | 6 | % | 18 | % | ||||||||||||

| Average core deposits | 18,132 | 17,869 | 17,592 | 17,351 | 16,976 | 1 | % | 7 | % | ||||||||||||

| Average other deposits | 472 | 498 | 461 | 338 | 354 | (5 | )% | 33 | % | ||||||||||||

| Total average deposits | 18,604 | 18,367 | 18,053 | 17,689 | 17,330 | 1 | % | 7 | % | ||||||||||||

| Total period-end deposits | 18,742 | 18,674 | 18,534 | 18,077 | 17,287 | * | 8 | % | |||||||||||||

| Total period-end assets | 18,562 | 17,434 | 16,280 | 16,394 | 15,163 | 6 | % | 22 | % | ||||||||||||

| Net interest margin (g) | 4.55 | % | 4.57 | % | 4.60 | % | 4.61 | % | 4.63 | % | |||||||||||

| Net interest spread | 3.46 | 3.44 | 3.42 | 3.36 | 3.33 | ||||||||||||||||

| Loan yield | 3.61 | 3.59 | 3.57 | 3.48 | 3.45 | ||||||||||||||||

| Deposit average rate | 0.15 | 0.15 | 0.15 | 0.12 | 0.12 | ||||||||||||||||

| Key Statistics | |||||||||||||||||||||

| Financial center locations | 162 | 162 | 174 | 177 | 174 | * | (7 | )% | |||||||||||||

* Amount is less than one percent.

| (a) | 3Q16 and 2Q16 levels driven by changes in consumer behavior; 1Q16 level primarily attributable to seasonality in NSF fees. |

| (b) | 2Q16 increase driven by a significant new relationship. |

| (c) | 3Q16 includes a $1.8 million gain on the sales of properties. |

| (d) | 3Q16 includes a reversal of loss accruals related to legal matters of $4.3 million; 2Q16 includes $22.0 million of loss accruals related to legal matters; 1Q16 includes $3.7 million of impairment related to branch closures; 3Q15 includes a reduction of personnel expenses due to a gain recognized in third quarter related to an employee benefit plan amendment. |

| (e) | Pre-provision net revenue is not a GAAP number but is used in regulatory stress test reporting. The presentation of PPNR in this Financial Supplement follows the regulatory definition. |

| (f) | Noninterest expense divided by total revenue. |

| (g) | Net interest margin is computed using total net interest income adjusted for FTE assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes. |

| 14 |

FHN FIXED INCOME

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | |||||||||||||||

| Income Statement (thousands) | |||||||||||||||||||||

| Net interest income | $2,412 | $3,147 | $2,666 | $3,901 | $3,003 | (23 | )% | (20 | )% | ||||||||||||

| Noninterest income: | |||||||||||||||||||||

| Fixed income product revenue | 59,003 | 69,279 | 57,583 | 52,713 | 42,969 | (15 | )% | 37 | % | ||||||||||||

| Other | 13,070 | 8,804 | 9,539 | 9,278 | 8,788 | 48 | % | 49 | % | ||||||||||||

| Total noninterest income | 72,073 | 78,083 | 67,122 | 61,991 | 51,757 | (8 | )% | 39 | % | ||||||||||||

| Noninterest expense (a) | 59,575 | 62,881 | 58,668 | 54,605 | 59,844 | (5 | )% | * | |||||||||||||

| Income/(loss) before income taxes | $14,910 | $18,349 | $11,120 | $11,287 | $(5,084 | ) | (19 | )% | NM | ||||||||||||

| Efficiency ratio (b) | 79.98 | % | 77.41 | % | 84.07 | % | 82.87 | % | NM | ||||||||||||

| Fixed income product average daily revenue | $922 | $1,082 | $944 | $850 | $671 | (15 | )% | 37 | % | ||||||||||||

| Balance Sheet (millions) | |||||||||||||||||||||

| Average trading inventory | $1,153 | $1,267 | $1,138 | $1,303 | $1,133 | (9 | )% | 2 | % | ||||||||||||

| Average other earning assets | 831 | 893 | 822 | 805 | 763 | (7 | )% | 9 | % | ||||||||||||

| Total average earning assets | 1,984 | 2,160 | 1,960 | 2,108 | 1,896 | (8 | )% | 5 | % | ||||||||||||

| Total period-end assets | 2,516 | 2,540 | 2,361 | 1,779 | 2,363 | (1 | )% | 6 | % | ||||||||||||

| Net interest margin (c) | 0.55 | % | 0.64 | % | 0.63 | % | 0.82 | % | 0.73 | % | |||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | 3Q15 includes an $11.6 million charge to litigation and regulatory matters related to the resolution of a legal matter. |

| (b) | Noninterest expense divided by total revenue. |

| (c) | Net interest margin is computed using total net interest income adjusted for FTE assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes. |

FHN CORPORATE

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | |||||||||||||||

| Income Statement (thousands) | |||||||||||||||||||||

| Net interest income/(expense) | $(18,195 | ) | $(15,850 | ) | $(14,364 | ) | $(19,221 | ) | $(19,027 | ) | (15 | )% | 4 | % | |||||||

| Noninterest income excluding securities gains/(losses) (a) | 5,335 | 4,810 | 4,149 | 4,047 | 8,904 | 11 | % | (40 | )% | ||||||||||||

| Securities gains/(losses), net | (201 | ) | 99 | 1,574 | 1,439 | (345 | ) | NM | 42 | % | |||||||||||

| Noninterest expense (b) | 14,841 | 16,072 | 13,479 | 17,736 | 11,804 | (8 | )% | 26 | % | ||||||||||||

| Loss before income taxes | $(27,902 | ) | $(27,013 | ) | $(22,120 | ) | $(31,471 | ) | $(22,272 | ) | (3 | )% | (25 | )% | |||||||

| Average Balance Sheet (millions) | |||||||||||||||||||||

| Average loans | $91 | $96 | $103 | $110 | $120 | (5 | )% | (24 | )% | ||||||||||||

| Total earning assets | $4,617 | $4,576 | $5,093 | $4,830 | $4,592 | 1 | % | 1 | % | ||||||||||||

| Net interest margin (c) | (1.60 | )% | (1.46 | )% | (1.19 | )% | (1.56 | )% | (1.63 | )% | |||||||||||

NM - Not meaningful

| (a) | 3Q15 includes a $5.8 million gain related to the extinguishment of debt. |

| (b) | 2Q16 includes $2.5 million of negative valuation adjustments associated with derivatives related to prior sales of Visa Class B shares; 4Q15 includes $2.8 million of impairment related to a tax credit investment accounted for under the equity method and $2.7 million of costs related to the TrustAtlantic acquisition. |

| (c) | Net interest margin is computed using total net interest income adjusted for FTE assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes. |

| 15 |

FHN NON-STRATEGIC

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | |||||||||||||||

| Income Statement (thousands) | |||||||||||||||||||||

| Net interest income | $10,468 | $10,646 | $11,459 | $12,372 | $14,333 | (2 | )% | (27 | )% | ||||||||||||

| Provision/(provision credit) for loan losses | (4,544 | ) | (6,883 | ) | (11,767 | ) | (4,856 | ) | (5,696 | ) | 34 | % | 20 | % | |||||||

| Noninterest income (a) | 6,210 | 1,247 | 2,184 | 2,111 | 2,024 | NM | NM | ||||||||||||||

| Noninterest expense (b) | 14,170 | (16,446 | ) | 9,429 | 23,853 | 8,199 | NM | 73 | % | ||||||||||||

| Income/(loss) before income taxes | $7,052 | $35,222 | $15,981 | $(4,514 | ) | $13,854 | (80 | )% | (49 | )% | |||||||||||

| Average Balance Sheet (millions) | |||||||||||||||||||||

| Loans | $1,744 | $1,856 | $1,967 | $2,073 | $2,201 | (6 | )% | (21 | )% | ||||||||||||

| Loans held-for-sale | 100 | 103 | 106 | 109 | 113 | (3 | )% | (12 | )% | ||||||||||||

| Trading securities | 3 | 3 | 4 | 5 | 5 | * | (40 | )% | |||||||||||||

| Allowance for loan losses | (53 | ) | (59 | ) | (69 | ) | (76 | ) | (87 | ) | (10 | )% | (39 | )% | |||||||

| Other assets | 47 | 46 | 34 | 13 | 14 | 2 | % | NM | |||||||||||||

| Total assets | 1,841 | 1,949 | 2,042 | 2,124 | 2,246 | (6 | )% | (18 | )% | ||||||||||||

| Net interest margin (c) | 2.38 | % | 2.30 | % | 2.33 | % | 2.25 | % | 2.46 | % | |||||||||||

| Efficiency ratio (d) | 84.96 | % | NM | 69.11 | % | NM | 50.13 | % | |||||||||||||

NM - Not meaningful

* Amount is less than one percent.

| (a) | 3Q16 includes $4.4 million of gains primarily related to recoveries associated with prior legacy mortgage servicing sales. |

| (b) | 3Q16 includes $4.5 million of loss accruals related to legal matters; 2Q16 includes a $31.4 million reversal of repurchase and foreclosure provision as a result of the settlements of certain repurchase claims, somewhat offset by $4.0 million of loss accruals related to legal matters; 4Q15 includes $14.2 million of loss accruals related to legal matters. |

| (c) | Net interest margin is computed using total net interest income adjusted for FTE assuming a statutory federal income tax rate of 35 percent and, where applicable, state income taxes. |

| (d) | Noninterest expense divided by total revenue excluding securities gains/(losses). |

| 16 |

FHN ASSET QUALITY: CONSOLIDATED

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| (Thousands) | 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | ||||||||||||||

| Allowance for Loan Losses Walk-Forward | |||||||||||||||||||||

| Beginning reserve | $199,807 | $204,034 | $210,242 | $210,814 | $221,351 | (2 | )% | (10 | )% | ||||||||||||

| Provision | 4,000 | 4,000 | 3,000 | 1,000 | 1,000 | * | NM | ||||||||||||||

| Charge-offs | (10,362 | ) | (18,296 | ) | (17,612 | ) | (16,614 | ) | (21,810 | ) | (43 | )% | (52 | )% | |||||||

| Recoveries | 8,112 | 10,069 | 8,404 | 15,042 | 10,273 | (19 | )% | (21 | )% | ||||||||||||

| Ending balance | $201,557 | $199,807 | $204,034 | $210,242 | $210,814 | 1 | % | (4 | )% | ||||||||||||

| Reserve for unfunded commitments | 4,802 | 5,351 | 5,495 | 5,926 | 6,231 | (10 | )% | (23 | )% | ||||||||||||

| Total allowance for loan losses plus reserve for unfunded commitments | $206,359 | $205,158 | $209,529 | $216,168 | $217,045 | 1 | % | (5 | )% | ||||||||||||

| Allowance for Loan Losses | |||||||||||||||||||||

| Regional Banking | $151,397 | $146,351 | $143,088 | $137,586 | $128,942 | 3 | % | 17 | % | ||||||||||||

| Non-Strategic | 50,160 | 53,456 | 60,946 | 72,656 | 81,872 | (6 | )% | (39 | )% | ||||||||||||

| Total allowance for loan losses | $201,557 | $199,807 | $204,034 | $210,242 | $210,814 | 1 | % | (4 | )% | ||||||||||||

| Nonperforming Assets | |||||||||||||||||||||

| Regional Banking | |||||||||||||||||||||

| Nonperforming loans | $50,267 | $60,754 | $72,323 | $56,475 | $50,986 | (17 | )% | (1 | )% | ||||||||||||

| Foreclosed real estate (a) | 5,811 | 7,031 | 11,045 | 16,298 | 17,042 | (17 | )% | (66 | )% | ||||||||||||

| Total Regional Banking | $56,078 | $67,785 | $83,368 | $72,773 | $68,028 | (17 | )% | (18 | )% | ||||||||||||

| Non-Strategic | |||||||||||||||||||||

| Nonperforming loans | $100,572 | $114,947 | $120,335 | $120,946 | $129,951 | (13 | )% | (23 | )% | ||||||||||||

| Nonperforming loans held-for-sale after fair value adjustments | 7,791 | 8,195 | 8,568 | 7,846 | 7,347 | (5 | )% | 6 | % | ||||||||||||

| Foreclosed real estate (a) | 7,867 | 7,119 | 6,415 | 8,679 | 8,830 | 11 | % | (11 | )% | ||||||||||||

| Total Non-Strategic | $116,230 | $130,261 | $135,318 | $137,471 | $146,128 | (11 | )% | (20 | )% | ||||||||||||

| Corporate | |||||||||||||||||||||

| Nonperforming loans | $1,211 | $896 | $927 | $1,677 | $3,043 | 35 | % | (60 | )% | ||||||||||||

| Total nonperforming assets (a) | $173,519 | $198,942 | $219,613 | $211,921 | $217,199 | (13 | )% | (20 | )% | ||||||||||||

| Net Charge-Offs | |||||||||||||||||||||

| Regional Banking | $3,499 | $7,620 | $9,265 | $(2,787 | ) | $10,495 | (54 | )% | (67 | )% | |||||||||||

| Non-Strategic | (1,249 | ) | 607 | (57 | ) | 4,359 | 1,042 | NM | NM | ||||||||||||

| Total net charge-offs | $2,250 | $8,227 | $9,208 | $1,572 | $11,537 | (73 | )% | (80 | )% | ||||||||||||

| Consolidated Key Ratios (b) | |||||||||||||||||||||

| 30+ Delinq. % (c) | 0.32 | % | 0.32 | % | 0.54 | % | 0.42 | % | 0.44 | % | |||||||||||

| NPL % | 0.78 | 0.95 | 1.10 | 1.01 | 1.10 | ||||||||||||||||

| NPA % | 0.85 | 1.03 | 1.20 | 1.15 | 1.25 | ||||||||||||||||

| Net charge-offs % | 0.05 | 0.19 | 0.21 | 0.04 | 0.28 | ||||||||||||||||

| Allowance / loans % | 1.03 | 1.07 | 1.16 | 1.19 | 1.26 | ||||||||||||||||

| Allowance / NPL | 1.33 | x | 1.13 | x | 1.05 | x | 1.17 | x | 1.15 | x | |||||||||||

| Allowance / NPA | 1.22 | x | 1.05 | x | 0.97 | x | 1.03 | x | 1.00 | x | |||||||||||

| Allowance / net charge-offs | 22.51 | x | 6.04 | x | 5.51 | x | NM | 4.61 | x | ||||||||||||

| Other | |||||||||||||||||||||

| Loans past due 90 days or more (d) | $36,562 | $34,175 | $36,958 | $40,591 | $38,455 | 7 | % | (5 | )% | ||||||||||||

| Guaranteed portion (d) | 13,645 | 13,822 | 16,279 | 16,631 | 16,856 | (1 | )% | (19 | )% | ||||||||||||

| Period-end loans, net of unearned income (millions) | 19,556 | 18,589 | 17,575 | 17,687 | 16,725 | 5 | % | 17 | % | ||||||||||||

Certain previously reported amounts have been reclassified to agree with current presentation.

NM - Not meaningful

* Amount is less than one percent.

| (a) | Excludes foreclosed real estate from government-insured mortgages. | |

| (b) | See Glossary of Terms for definitions of Consolidated Key Ratios. | |

| (c) | 30+ Delinquency % includes all accounts delinquent more than one month and still accruing interest. | |

| (d) | Includes loans held-for-sale. | |

| 17 |

FHN ASSET QUALITY: CONSOLIDATED

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | |||||||||||||||

| Key Portfolio Details | |||||||||||||||||||||

| C&I | |||||||||||||||||||||

| Period-end loans ($ millions) | $12,118 | $11,179 | $10,239 | $10,436 | $9,610 | 8 | % | 26 | % | ||||||||||||

| 30+ Delinq. % (a) (b) | 0.05 | % | 0.04 | % | 0.37 | % | 0.08 | % | 0.09 | % | |||||||||||

| NPL % | 0.25 | 0.27 | 0.38 | 0.25 | 0.31 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | 0.04 | 0.24 | 0.23 | NM | 0.26 | ||||||||||||||||

| Allowance / loans % | 0.72 | % | 0.72 | % | 0.79 | % | 0.71 | % | 0.74 | % | |||||||||||

| Allowance / charge-offs | 17.23 | x | 3.21 | x | 3.50 | x | NM | 2.83 | x | ||||||||||||

| Commercial Real Estate | |||||||||||||||||||||

| Period-end loans ($ millions) | $2,066 | $1,969 | $1,849 | $1,675 | $1,488 | 5 | % | 39 | % | ||||||||||||

| 30+ Delinq. % (a) (c) | 0.18 | % | 0.15 | % | 0.18 | % | 0.27 | % | 0.43 | % | |||||||||||

| NPL % | 0.17 | 0.40 | 0.51 | 0.52 | 0.54 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | NM | NM | 0.10 | 0.29 | NM | ||||||||||||||||

| Allowance / loans % | 1.57 | % | 1.54 | % | 1.39 | % | 1.50 | % | 1.70 | % | |||||||||||

| Allowance / charge-offs | NM | NM | 15.16 | x | 5.39 | x | NM | ||||||||||||||

| Consumer Real Estate | |||||||||||||||||||||

| Period-end loans ($ millions) | $4,578 | $4,641 | $4,690 | $4,767 | $4,814 | (1 | )% | (5 | )% | ||||||||||||

| 30+ Delinq. % (a) | 0.86 | % | 0.80 | % | 0.82 | % | 1.00 | % | 0.92 | % | |||||||||||

| NPL % | 1.95 | 2.31 | 2.43 | 2.33 | 2.32 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | NM | 0.04 | 0.10 | 0.09 | 0.18 | ||||||||||||||||

| Allowance / loans % | 1.16 | % | 1.27 | % | 1.44 | % | 1.69 | % | 1.71 | % | |||||||||||

| Allowance / charge-offs | NM | 29.40 | x | 14.06 | x | 18.49 | x | 9.41 | x | ||||||||||||

| Permanent Mortgage | |||||||||||||||||||||

| Period-end loans ($ millions) | $436 | $439 | $443 | $454 | $464 | (1 | )% | (6 | )% | ||||||||||||

| 30+ Delinq. % (a) | 2.46 | % | 2.21 | % | 2.50 | % | 2.11 | % | 2.01 | % | |||||||||||

| NPL % | 6.67 | 6.97 | 6.83 | 6.97 | 7.30 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | 0.12 | NM | NM | NM | 0.67 | ||||||||||||||||

| Allowance / loans % | 3.80 | % | 4.01 | % | 4.24 | % | 4.17 | % | 4.33 | % | |||||||||||

| Allowance / charge-offs | 31.11 | x | NM | NM | NM | 6.25 | x | ||||||||||||||

| Credit Card and Other | |||||||||||||||||||||

| Period-end loans ($ millions) | $358 | $361 | $354 | $355 | $349 | (1 | )% | 3 | % | ||||||||||||

| 30+ Delinq. % (a) | 1.04 | % | 1.19 | % | 1.13 | % | 1.08 | % | 1.19 | % | |||||||||||

| NPL % | 0.04 | 0.20 | 0.38 | 0.38 | 0.21 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | 2.95 | 2.73 | 2.86 | 2.56 | 2.79 | ||||||||||||||||

| Allowance / loans % | 3.48 | % | 3.30 | % | 3.23 | % | 3.35 | % | 3.28 | % | |||||||||||

| Allowance / charge-offs | 1.17 | x | 1.21 | x | 1.13 | x | 1.30 | x | 1.16 | x | |||||||||||

NM - Not meaningful

| (a) | 30+ Delinquency % includes all accounts delinquent more than one month and still accruing interest. |

| (b) | 1Q16 increase was driven by regional bank C&I but over half were favorably resolved in early second quarter 2016. |

| (c) | 3Q15 was due to 2 purchased credit impaired loans from the 2013 MNB acquisition. |

| 18 |

FHN ASSET QUALITY: REGIONAL BANKING

Quarterly, Unaudited

| 3Q16 Changes vs. | |||||||||||||||||||||

| 3Q16 | 2Q16 | 1Q16 | 4Q15 | 3Q15 | 2Q16 | 3Q15 | |||||||||||||||

| Total Regional Banking | |||||||||||||||||||||

| Period-end loans ($ millions) | $17,789 | $16,703 | $15,570 | $15,571 | $14,483 | 7 | % | 23 | % | ||||||||||||

| 30+ Delinq. % (a) | 0.17 | % | 0.16 | % | 0.39 | % | 0.23 | % | 0.25 | % | |||||||||||

| NPL % | 0.28 | 0.36 | 0.46 | 0.36 | 0.35 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | 0.08 | 0.19 | 0.24 | NM | 0.29 | ||||||||||||||||

| Allowance / loans % | 0.85 | % | 0.88 | % | 0.92 | % | 0.88 | % | 0.89 | % | |||||||||||

| Allowance / charge-offs | 10.88 | x | 4.78 | x | 3.84 | x | NM | 3.10 | x | ||||||||||||

| Key Portfolio Details | |||||||||||||||||||||

| C&I | |||||||||||||||||||||

| Period-end loans ($ millions) | $11,698 | $10,759 | $9,818 | $10,015 | $9,178 | 9 | % | 27 | % | ||||||||||||

| 30+ Delinq. % (a) (b) | 0.05 | % | 0.04 | % | 0.37 | % | 0.08 | % | 0.10 | % | |||||||||||

| NPL % | 0.22 | 0.24 | 0.36 | 0.23 | 0.18 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | 0.05 | 0.25 | 0.24 | NM | 0.33 | ||||||||||||||||

| Allowance / loans % | 0.73 | % | 0.74 | % | 0.81 | % | 0.72 | % | 0.72 | % | |||||||||||

| Allowance / charge-offs | 16.76 | x | 3.23 | x | 3.48 | x | NM | 2.21 | x | ||||||||||||

| Commercial Real Estate | |||||||||||||||||||||

| Period-end loans ($ millions) | $2,066 | $1,969 | $1,849 | $1,675 | $1,488 | 5 | % | 39 | % | ||||||||||||

| 30+ Delinq. % (a) (c) | 0.18 | % | 0.15 | % | 0.18 | % | 0.27 | % | 0.43 | % | |||||||||||

| NPL % | 0.17 | 0.40 | 0.51 | 0.52 | 0.54 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | NM | NM | 0.10 | 0.31 | NM | ||||||||||||||||

| Allowance / loans % | 1.57 | % | 1.54 | % | 1.39 | % | 1.50 | % | 1.70 | % | |||||||||||

| Allowance / charge-offs | NM | NM | 14.23 | x | 4.99 | x | NM | ||||||||||||||

| Consumer Real Estate | |||||||||||||||||||||

| Period-end loans ($ millions) | $3,608 | $3,577 | $3,531 | $3,515 | $3,469 | 1 | % | 4 | % | ||||||||||||

| 30+ Delinq. % (a) | 0.46 | % | 0.40 | % | 0.46 | % | 0.52 | % | 0.48 | % | |||||||||||

| NPL % | 0.57 | 0.73 | 0.76 | 0.68 | 0.75 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | 0.01 | NM | 0.06 | 0.11 | 0.11 | ||||||||||||||||

| Allowance / loans % | 0.56 | % | 0.68 | % | 0.75 | % | 0.83 | % | 0.79 | % | |||||||||||

| Allowance / charge-offs | 57.14 | x | NM | 11.78 | x | 7.68 | x | 7.62 | x | ||||||||||||

| Credit Card, Permanent Mortgage, and Other | |||||||||||||||||||||

| Period-end loans ($ millions) | $417 | $398 | $372 | $366 | $348 | 5 | % | 20 | % | ||||||||||||

| 30+ Delinq. % (a) | 0.97 | % | 1.16 | % | 1.18 | % | 1.13 | % | 1.33 | % | |||||||||||

| NPL % | 0.10 | 0.10 | 0.28 | 0.29 | 0.14 | ||||||||||||||||

| Charge-offs % (qtr. annualized) | 2.64 | 2.54 | 2.82 | 2.40 | 2.49 | ||||||||||||||||

| Allowance / loans % | 3.19 | % | 3.07 | % | 3.06 | % | 3.04 | % | 3.00 | % | |||||||||||

| Allowance / charge-offs | 1.23 | x | 1.25 | x | 1.10 | x | 1.29 | x | 1.19 | x | |||||||||||

| ASSET QUALITY: CORPORATE | |||||||||||||||||||||

| Permanent Mortgage | |||||||||||||||||||||

| Period-end loans ($ millions) | $79 | $85 | $92 | $97 | $107 | (7 | )% | (26 | )% | ||||||||||||

| 30+ Delinq. % (a) | 4.37 | % | 4.92 | % | 3.66 | % | 2.92 | % | 2.95 | % | |||||||||||

| NPL % | 1.54 | 1.06 | 1.00 | 1.72 | 2.85 | ||||||||||||||||