Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STANLEY BLACK & DECKER, INC. | newellexhibit991.htm |

| 8-K - 8-K - STANLEY BLACK & DECKER, INC. | newell8-kdocument.htm |

Acquisition of

Newell Tools

OCTOBER 12, 2016

2

Cautionary Statements

Stanley Black & Decker makes forward-looking statements in this presentation which represent its expectations or beliefs about future events and

financial performance. Forward-looking statements are identifiable by words such as "believe," "anticipate," "expect," "intend," "plan," "will,"

"may" and other similar expressions. In addition, any statements that refer to expectations, projections or other characterizations of future events

or circumstances are forward-looking statements. Forward looking statements made in this presentation, include, but are not limited to,

statements concerning: the consummation of the acquisition; Newell Tools’ business complementing and expanding Stanley Black & Decker’s

existing operations; cost savings and synergies, and revenue synergies; and accretion to earnings per share.

You are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are not guarantees of

future events and involve risks, uncertainties and other known and unknown factors that may cause actual results and performance to be

materially different from any future results or performance expressed or implied by such forward-looking statements, including, but not limited to,

the failure to consummate, or a delay in the consummation of, the transaction for various reasons; failure to successfully integrate the Newell

Tools business and achieve expected cost and revenue synergies; or the acquisition-related charges being greater than anticipated.

Forward-looking statements made herein are also subject to risks and uncertainties, described in: Stanley Black & Decker's 2015 Annual Report on

Form 10-K, its subsequently filed Quarterly Reports on Form 10-Q; and other filings Stanley Black & Decker makes with the Securities and Exchange

Commission. In addition, actual results could differ materially from those suggested by the forward-looking statements, and therefore you should

not place undue reliance on the forward-looking statements. Stanley Black & Decker makes no commitment to revise or update any forward-

looking statements to reflect events or circumstances occurring or existing after the date of any forward-looking statement.

3

Executive Summary

• Adds World Class Brands Irwin® & Lenox® To Stanley Black & Decker’s Stellar Brand Portfolio

• Significantly Increases Power Tool Accessories Business And Expands Footprint In Plumbing & Electrical

Trades

• Highly Synergistic Transaction With Identified Annual Cost Synergies Of ~$80 - $90M By Year Three And

Strong Revenue Synergy Potential

• Purchase Price Of $1.95B In Cash | LTM Revenue Of ~$760M | LTM EBITDA ~$150M

Stanley Black & Decker To Acquire Newell Tools, A Highly Strategic & Synergistic Transaction…

…That Aligns With Our Strategic Growth Framework

Acquisition Criteria:

• Strategic Fit

• Organizational Capacity

• Financial Evaluation

» 15% + OM | Organic Growth Consistent With Company Targets

» Accretive Year 1 Excluding Charges

» Achieves CFROI Targets

» Value Creation Opportunity > Share Repurchase

• One-Time Charges Associated With Acquisitions Will Likely

Exceed ~$50M Annual Restructuring Expectation

• ~ 50% Of Free Cash Flow Will Be Deployed Toward Acquisitions

- Expect A Moderate Pace Going Forward

4

Acquisitive Growth / Financial Framework

Active Pipeline For Potential Acquisition Targets…

…Acquisitions Remain An Important Element Of Growth Formula

Engineered Fastening

Infrastructure

Tool Industry

Acquisitive Growth Areas

Product & Regional Sales Mix

Primary Brands

Company Overview

• ~$760M Manufacturer Of Hand Tools & Power Tool Accessories

• Global Footprint With Majority Of Sales In North America

• Diverse & Complementary Product Line

• Strong Presence In Electrical & Plumbing Trades

Newell Tools: Overview

5

Highly Attractive Asset – Strong Brands, Complementary Products, New Channels

N. America

60% APAC

11%

LAG

15%

EMEA

14%

Drilling

25%

Bandsaw

18%Linear

Edge

20%

Other HTs 7%

Cutting / Circ

Saw 12%

Pliers &

Holding

18%

~60% Of Revenue ~40% Of Revenue

Newell Tools: Brand Summary & Sample Products

6

~60%* ~40%*

Hand Tools

~5%*

Accessories

~35%*

Hand Tools

~33%*

Accessories

~27%*

*Represents Percent Of Consolidated Revenue

Saw Blades, Metal & Wood Drilling

Accessories

Pliers, Holding & Clamping Tools, & Saws

Band Saw Blades, Hole Saws & Linear

Edge Cutting Accessories

Hand Saws, Snips &

Screwdrivers

Acquisition Summary

7

Transaction Details Financial Information

Newell Tools Overview

• Currently Owned By Newell Brands

• Leading Global Provider Of Premium Industrial Cutting, Hand Tools & Power Tool

Accessories

• Rich History Dating Back To 1884 (Irwin® & Lenox® Brands Acquired In 2002/2003)

• LTM Revenues Of ~$760M And LTM EBITDA Of ~$150M

EPS Accretion (Ex. 1-Time Charges) & CFROI

• EPS Accretion: Year 1 ~$0.15 | Year 3 ~$0.50

• CFROI: ~12% By Year 5

Timing

• Subject To Customary Closing Conditions, Including Regulatory Approval

• Transaction Expected To Close In First Half Of 2017

Acquisition Related Charges

• ~$125 - $140M Restructuring And Other 1-Time

Charges, Primarily Incurred In Years 1 & 2

• Inventory Step-Up Of ~$40M

• Annual Intangible Amortization ~$50M

Deal Structure & Purchase Price

• 100% Acquisition | Mix Of Stock And Asset

Purchase

• $1.95B Cash Purchase Price

Synergies

• ~$80 - $90M Of Total Annual Cost Synergies

• Realized By Year 3

Strategic Rationale

• Expand Leadership Position In Global Tools & Storage Industry | Leverage Industry

Expertise To Drive Cost & Revenue Synergy Opportunities

• Strong Global Brand Presences: Irwin® & Lenox®

• Complementary Product Lines With Emphasis In Hand Tools & Power Tool Accessories

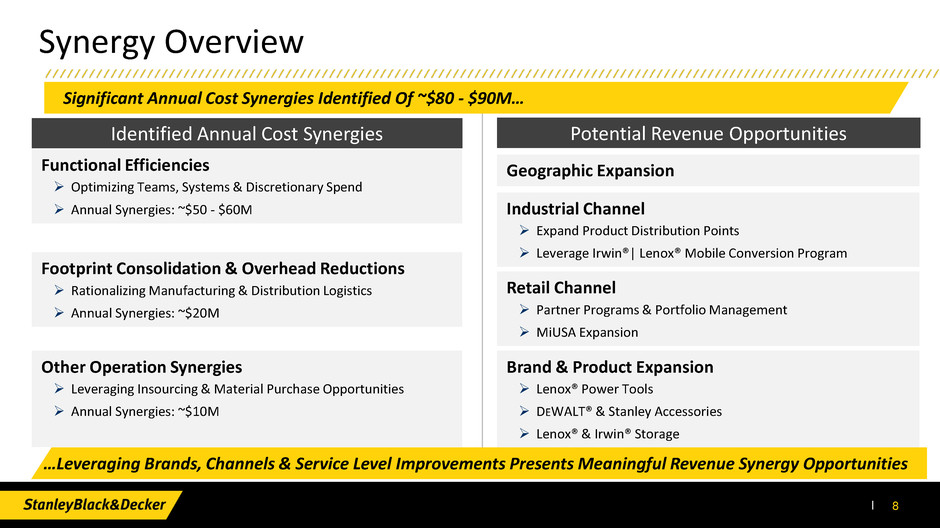

Synergy Overview

8

Footprint Consolidation & Overhead Reductions

Rationalizing Manufacturing & Distribution Logistics

Annual Synergies: ~$20M

Other Operation Synergies

Leveraging Insourcing & Material Purchase Opportunities

Annual Synergies: ~$10M

Retail Channel

Partner Programs & Portfolio Management

MiUSA Expansion

Industrial Channel

Expand Product Distribution Points

Leverage Irwin®| Lenox® Mobile Conversion Program

Functional Efficiencies

Optimizing Teams, Systems & Discretionary Spend

Annual Synergies: ~$50 - $60M

Brand & Product Expansion

Lenox® Power Tools

DEWALT® & Stanley Accessories

Lenox® & Irwin® Storage

Significant Annual Cost Synergies Identified Of ~$80 - $90M…

…Leveraging Brands, Channels & Service Level Improvements Presents Meaningful Revenue Synergy Opportunities

Identified Annual Cost Synergies Potential Revenue Opportunities

Geographic Expansion

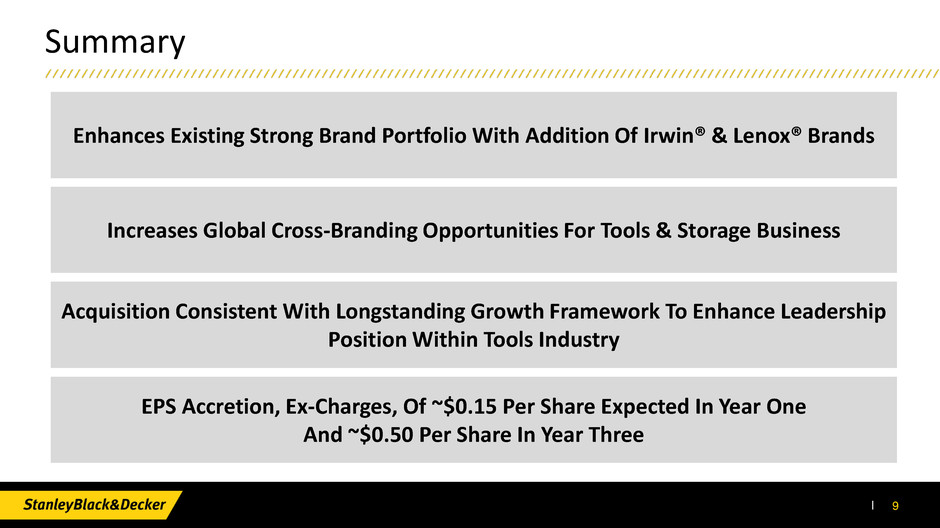

Summary

Enhances Existing Strong Brand Portfolio With Addition Of Irwin® & Lenox® Brands

Increases Global Cross-Branding Opportunities For Tools & Storage Business

Acquisition Consistent With Longstanding Growth Framework To Enhance Leadership

Position Within Tools Industry

EPS Accretion, Ex-Charges, Of ~$0.15 Per Share Expected In Year One

And ~$0.50 Per Share In Year Three

9

THANK YOU!