Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MONSTER WORLDWIDE, INC. | d220594d8k.htm |

| EX-99.2 - EXHIBIT 99.2 - MONSTER WORLDWIDE, INC. | d220594dex992.htm |

Exhibit 99.1

Monster Worldwide, Inc. Delivering Value to Monster Stockholders OCTOBER 4, 2016

| Forward Looking Statements Cautionary Statement Regarding Forward-Looking Statements Statements in this Presentation regarding the planned transaction, the expected timetable for completing the planned transaction, future financial and operating results, future capital structure and liquidity, benefits of the planned transaction, general business outlook and any other statements about the future expectations, beliefs, goals, plans or prospects of the board or management of Monster Worldwide, Inc. (“Monster”) include forward-looking statements. Any statements that are not statements of historical fact (including statements containing the words “expects,” “intends,” “anticipates,” “estimates,” “predicts,” “believes,” “should,” “potential,” “may,” “forecast,” “objective,” “plan,” or “targets” and other similar expressions) are intended to identify forward-looking statements. There are a number of factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including: uncertainties as to the timing of completion of the planned transaction, the ability to obtain requisite regulatory approvals, the tender of a majority of the outstanding shares of common stock of Monster, the possibility that competing offers will be made and the satisfaction or waiver of the other conditions to the consummation of the planned transaction; the potential impact of the announcement or consummation of the planned transaction on relationships, including with employees, suppliers and customers; and the other factors and financial, operational and legal risks or uncertainties described in Monster’s public filings with the Securities and Exchange Commission (the “SEC”), including the “Risk Factors” sections of Monster’s Annual Report on Form 10-K for the year ended December 31, 2015 and subsequent Quarterly Reports on Form 10-Q, as well as the tender offer documents filed and to be filed by Randstad North America, Inc. and Monster. Forward-looking statements speak only as of the date the statement was made. Additional Information and Where to Find It Randstad North America, Inc.’s tender offer for shares of Monster’s common stock commenced on September 6, 2016, and, in connection with the offer, Randstad North America, Inc. and its subsidiary, Merlin Global Acquisition, Inc., filed a tender offer statement on Schedule TO with the SEC and Monster filed a solicitation/recommendation statement on Schedule 14D-9 with the SEC. Monster’s stockholders are strongly advised to read the tender offer statement (including the offer to purchase, letter of transmittal and related tender offer documents) and the related solicitation/recommendation statement on Schedule 14D-9 filed by Monster with the SEC because they contain important information about the proposed transaction. These documents are available at no charge on the SEC’s website at www.sec.gov. In addition, copies of the offer to purchase, letter of transmittal and other related materials are available free of charge by contacting MacKenzie Partners, Inc., the information agent for the tender offer, toll-free at (800) 322-2885 (or at +1 212-929-5500 collect if you are located outside the U.S. and Canada), or by email to monster@mackenziepartners.com. Monster and its directors and executive officers may be deemed to be participants in the solicitation of consent revocations from Monster stockholders in connection with the consent solicitation conducted by MediaNews Group, Inc. and certain of its affiliates. Information about Monster officers and directors and their ownership of Monster shares is set forth in the proxy statement for Monster’s 2016 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2016. Information about Monster officers and directors is set forth in Monster’s Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the SEC on February 11, 2015. Investors and security holders may obtain more detailed information regarding the direct and indirect interests of the participants in the solicitation of consent revocations in connection with the consent solicitation conducted by MediaNews Group, Inc. and certain of its affiliates by reading the preliminary and definitive consent revocation statement statements regarding the transaction, which may be filed by Monster with the SEC. In connection with the consent solicitation, Monster may file a preliminary consent revocation statement with the SEC in response to the consent solicitation. Monster’s stockholders are strongly advised to read such consent revocation statement (including any amendments or supplements thereto) and any other relevant documents that Monster will file with the SEC when they become available because they contain important information. These documents are available at no charge on the SEC’s website at www.sec.gov.

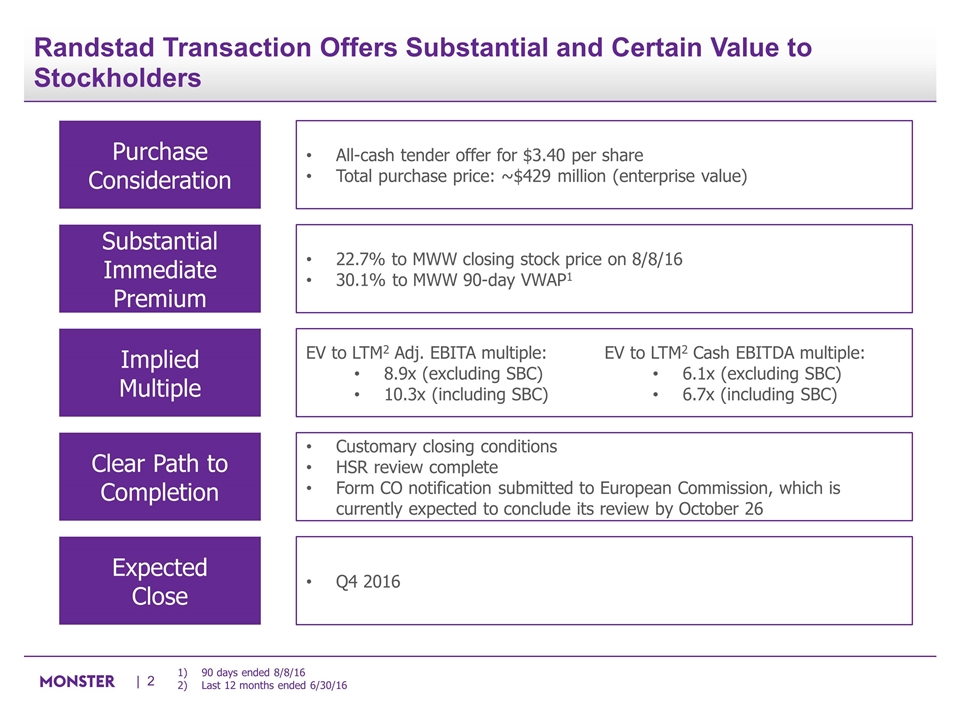

Randstad Transaction Offers Substantial and Certain Value to Stockholders | Purchase Consideration Substantial Immediate Premium Implied Multiple Clear Path to Completion Expected Close All-cash tender offer for $3.40 per share Total purchase price: ~$429 million (enterprise value) 22.7% to MWW closing stock price on 8/8/16 30.1% to MWW 90-day VWAP1 Customary closing conditions HSR review complete Form CO notification submitted to European Commission, which is currently expected to conclude its review by October 26 Q4 2016 90 days ended 8/8/16 Last 12 months ended 6/30/16 EV to LTM2 Adj. EBITA multiple: 8.9x (excluding SBC) 10.3x (including SBC) EV to LTM2 Cash EBITDA multiple: 6.1x (excluding SBC) 6.7x (including SBC)

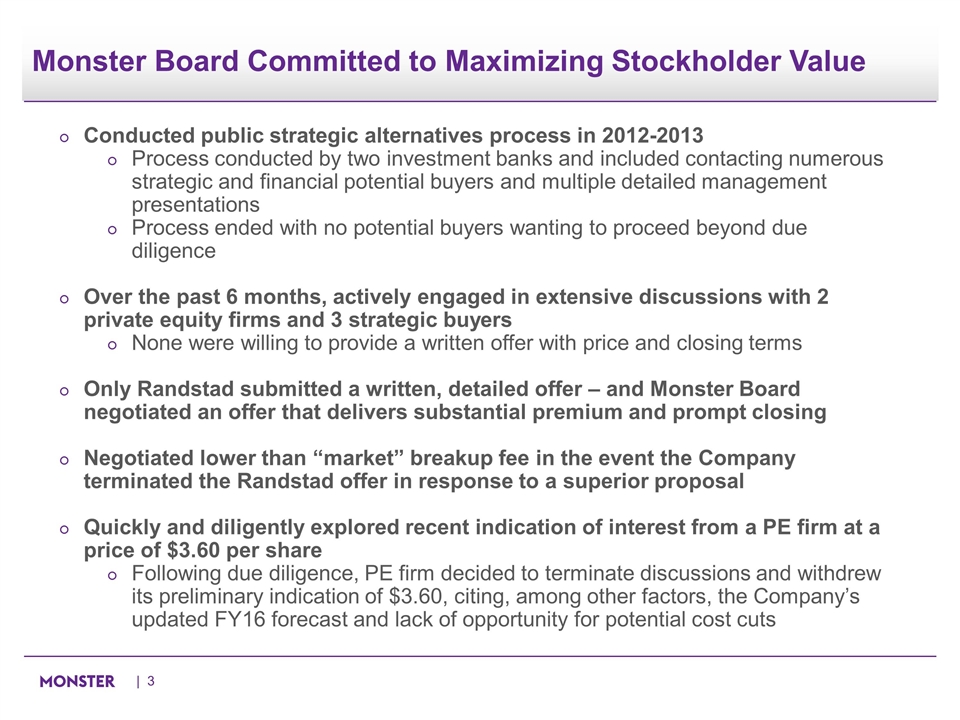

Conducted public strategic alternatives process in 2012-2013 Process conducted by two investment banks and included contacting numerous strategic and financial potential buyers and multiple detailed management presentations Process ended with no potential buyers wanting to proceed beyond due diligence Over the past 6 months, actively engaged in extensive discussions with 2 private equity firms and 3 strategic buyers None were willing to provide a written offer with price and closing terms Only Randstad submitted a written, detailed offer – and Monster Board negotiated an offer that delivers substantial premium and prompt closing Negotiated lower than “market” breakup fee in the event the Company terminated the Randstad offer in response to a superior proposal Quickly and diligently explored recent indication of interest from a PE firm at a price of $3.60 per share Following due diligence, PE firm decided to terminate discussions and withdrew its preliminary indication of $3.60, citing, among other factors, the Company’s updated FY16 forecast and lack of opportunity for potential cost cuts | Monster Board Committed to Maximizing Stockholder Value

Sale to Randstad – Best Path for Monster Stockholders Sale to Randstad delivers substantial and certain value Monster continues to face significant challenges as a standalone company Competition intensified by companies owned by substantially larger, better capitalized parents who are able to be more aggressive on pricing Secular changes in market continue to accelerate, challenging traditional posting business Monster has already taken actions to address challenges Cutting > $100 M of annual operating expenses over past several years Cutting capex by ~50% over past several years Divesting non-core or underperforming assets Enhancing competitive position within current environment will require continued investment Unlike some competitors, Monster cannot afford to compete aggressively on product marketing and pricing in pursuit of market share Increased investment will likely cause Monster to operate in low growth environment with substantial margin pressure for several years |

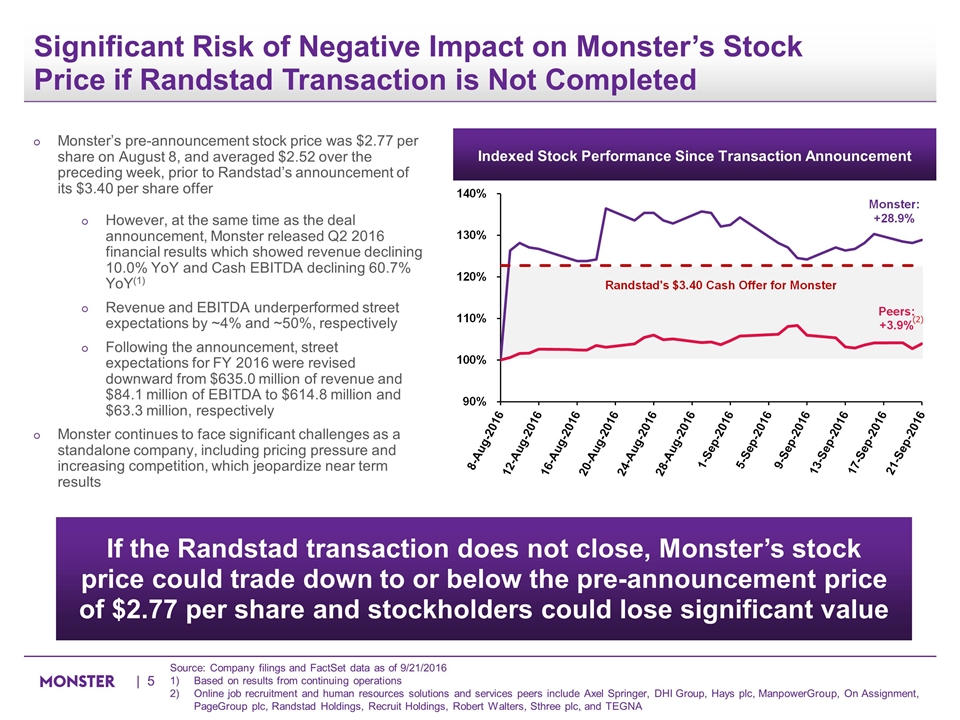

Significant Risk of Negative Impact on Monster’s Stock Price if Randstad Transaction is Not Completed Monster’s pre-announcement stock price was $2.77 per share on August 8, and averaged $2.52 over the preceding week, prior to Randstad’s announcement of its $3.40 per share offer However, at the same time as the deal announcement, Monster released Q2 2016 financial results which showed revenue declining 10.0% YoY and Cash EBITDA declining 60.7% YoY(1) Revenue and EBITDA underperformed street expectations by ~4% and ~50%, respectively Following the announcement, street expectations for FY 2016 were revised downward from $635.0 million of revenue and $84.1 million of EBITDA to $614.8 million and $63.3 million, respectively Monster continues to face significant challenges as a standalone company, including pricing pressure and increasing competition, which jeopardize near term results Indexed Stock Performance Since Transaction Announcement If the Randstad transaction does not close, Monster’s stock price could trade down to or below the pre-announcement price of $2.77 per share and stockholders could lose significant value Source: Company filings and FactSet data as of 9/21/2016 Based on results from continuing operations Online job recruitment and human resources solutions and services peers include Axel Springer, DHI Group, Hays plc, ManpowerGroup, On Assignment, PageGroup plc, Randstad Holdings, Recruit Holdings, Robert Walters, Sthree plc, and TEGNA | (2)

MediaNews Group’s Activist Campaign MediaNews Group (“MNG”) acquired almost half of its 11.6% Monster stake before the announcement of the Randstad offer (at below the deal price) and the remainder on the day of announcement bringing their stake VWAP to $3.04 MNG has not put forth a proposal to acquire the Company MNG’s consent solicitation is an attempt to derail the Randstad offer and take control of Monster without paying a control premium MNG's public comments defy the facts and attempt to distort the process by suggesting that other potential buyers are somehow unable to submit bids MNG has no real plan MNG’s few points it has revealed are shifting and pinned on incorrect, unsupportable assumptions, while demonstrating a lack of understanding of the Company and industry There is significant risk to what MNG has stated it intends to do and yet they have not outlined any alternatives in the event their actions are not achievable, creating significant downside risk for investors In a clear indication that MNG had no thoughtfully planned strategy, MNG had NO directors lined up when it announced its noisy campaign to replace the Monster Board and its now announced slate has little experience in the recruiting industry |

MNG’s Proposed Actions Lack Credibility MNG claims it can restructure Monster’s operations to curtail further revenue declines and significantly increase profitability as a standalone company MNG’s proposed actions create significant downside risk, calling for further expense cuts, reduction in capex and asset divestitures MNG’s limited proposals are uninformed, lack basic due diligence and, as MNG is a relatively new shareholder, ignore what MWW’s longer-term shareholders know: Expense cuts, reducing capex and divesting assets have already been executed by Monster’s Board and management and have not reversed revenue declines or reduced headwinds Monster has: Cut > $100 M of annual operating expenses over the past several years Cut capex by ~50% over the past several years – further cuts will further reduce needed investments in product enhancements to meet current, intensified competition Divested non-core or underperforming assets Competition is intensifying from companies owned by substantially larger, better capitalized parents that can fund aggressive product pricing in pursuit of market share | “We contend that termination of the Randstad offer would be disastrous for MWW shareholders.” (Avondale Partners - August 22, 2016)1 Permission to use quotation neither sought nor obtained

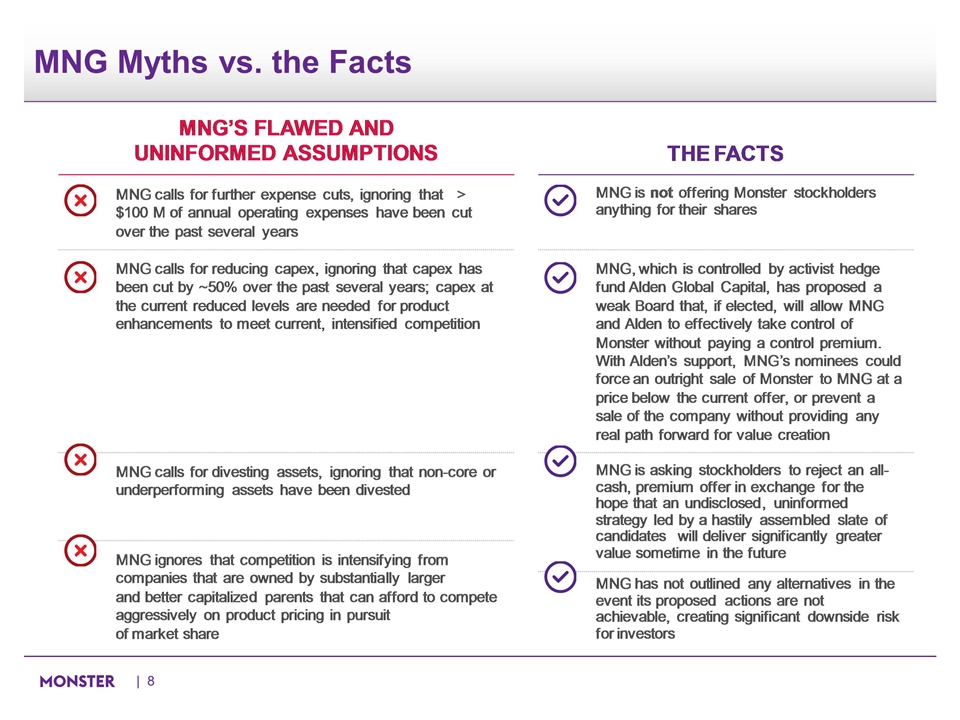

MNG Myths vs. the Facts |

Randstad Offer in the Best Interests of All Stockholders Monster engaged with multiple buyers Randstad offer is the single best offer and offers substantial and certain cash value Merger Agreement does not prevent the Company from evaluating and accepting superior offers Significant challenges as a standalone company | All 7 directors, 6 of whom are independent, unanimously urge Monster’s stockholders to tender into the Randstad offer