Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Rennova Health, Inc. | rennova_8k.htm |

Exhibit 99.1

Nasdaq: RNVA Diagnostics and Supportive Software Solutions to Healthcare Providers Sept 2016

This presentation includes forward - looking statements about Rennova Health’s anticipated results that involve risks and uncertainties . Some of the information contained in this presentation, including statements as to industry trends and plans, objectives, expectations and strategy for the combined businesses, contains forward - looking statements that are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by such forward - looking statements . Any statements that are not statements of historical fact are forward - looking statements . When used, the words "believe," "plan," "intend," "anticipate," "target," "estimate," "expect" and the like, and/or future tense or conditional constructions ("will," "may," "could," "should," etc . ), or similar expressions, identify certain of these forward - looking statements . Important factors which could cause actual results to differ materially from those in the forward - looking statements are detailed in filings made by Rennova Health with the Securities and Exchange Commission . Rennova Health undertakes no obligation to update or revise any such forward - looking statements to reflect subsequent events or circumstances, except to the extent required by applicable law or regulation . Note : This presentation includes certain “Non - GAAP” financial measures as defined by SEC rules . As required by the SEC, we have provided a reconciliation of those measures to the most directly comparable GAAP measures on the Regulation G slide included as slide 20 of this presentation . Non - GAAP financial measures should be considered in addition to, but not as a substitute for, reported GAAP results . Forward - Looking Statements and Non - GAAP Information 2

Headquartered in West Palm Beach, Florida Rennova Health (Nasdaq RNVA, RNVAZ) is a healthcare service provider offering a suite of integrated services including but not limited to, Diagnostics, EHR, Laboratory Information Systems software, cancer diagnostics interpretation and medical billing services . Our main business is our diagnostics service for Toxicology, Clinical, Hormone and Pharmacogenomics testing . Software and medical billing services have exited the development phase and are producing initial revenues 3 Healthcare is Being Transformed Who We Are

• Approximately $ 8 M invested in our Laboratories in 2014 and 2015 , with no further significant investment required to enable substantial increases in diagnostics testing . • Approximately $ 5 M invested in our software products in 2014 and 2015 . Investment is ongoing but products are complete and launched • Clinical Laboratories in Florida, New Jersey, New Mexico and California • We operate in a very sizable and well established market place • Capable, experienced management team • Focused strategic growth plan from a solid foundation • EHR & Practice Management product for Substance Abuse sector • Medical Billing services launched to customers • Secured in - network contracts with a number of payers and secondary networks nationwide • Significant opportunity for growth of core business revenues ; • Supportive software solutions provide additional revenue streams and a more sustainable relationship with our customers thereby widening our market entry points and ultimately reducing the historical number of 90 % of total revenues being derived from diagnostics 4 Highlights

• The diagnostics sector has changed dramatically in the last few years • Paper records and faxes meant different vendors to a medical provider could function side by side without communication • Electronic platforms and integration have created a need for providers of solutions to communicate efficiently, accurately, automatically and fast • Medical providers need more than just diagnostics; they need an increasing number of integrated and interoperable solutions to enable their business to function • Our core business has historically been diagnostics: • Historically >90% of our revenue is from diagnostics • The focus on diagnostics combined with supportive software solutions means that is now changing • Compliance needs have increased with an ever more demanding regulatory and payer environment 5 Single Source Solution for Medical Providers Rennova has positioned itself to maintain a sustainable long term relationship with medical providers by providing a number of essential products and services, creating efficiencies for the provider and benefiting from additional revenue for the provision of these services and products

Clinical Lab S ervices Revenue Cycle Management Software S olutions Single Source Solution 5 Clinical Laboratories Integrated Medical Billing Company Proprietary Lab ordering and reporting Laboratory Information System (LIS) EHR / Practice Management Solution Interpretation and Decision Support Our core business is diagnostics: Historically >90% of our revenue has been derived from diagnostics That is changing: 6 Single Source Solution for Medical Providers

Corporate • Received net proceeds of approximately $7.3M in July from a public offering of common shares and warrants • Exchanged all Series C Convertible Preferred Stock and 6,451,611 RNVAW warrants with certain downside protection to Series G Convertible Preferred Stock and new warrants that do not have downside protection. This resulted in a derivative liability being reclassified into stockholders equity • The Company now has no securities issued that offer downside protection to our share price or permit a variable rate conversion • Reported increased revenue for our 2 nd quarter • Acquired ownership stake in Genomas, Inc., a provider of pharmacogenomics diagnostics and interpretation • Repaid certain Notes with a derivative liability enabling the reclassification of the derivative liability into stockholders equity • Exchanged approximately $2.1M of indebtedness and other cash obligations to various related parties for common stock and warrants • Received an additional 180 - day extension from Nasdaq to regain compliance with the minimum bid price requirement of $1.00 without effecting a reverse split on the Company's shares • Continued to consolidate our laboratories and create cost efficiencies and reductions across our business segments 7 Recent Developments

Clinical Laboratory Operations Segment • Reported increased revenue in the 2 nd quarter of 2016 compared to the 1 st quarter • Continue to experience the benefits of our stance on compliance in light of the current disruption in the toxicology sector – a major focus of our Clinical Laboratory Operations segment • Continue to add new customers. We currently have 122 active laboratory customers • Launched pharmacogenomics testing • We now have Medicaid licenses in 23 States • We now have 13 payer contracts with Insurance payers in a number of States allowing us to target our sales efforts toward medical providers who participate in these networks Supportive Software Solutions Segment • Our integrated software solution will create a much more sustainable relationship with our customers as a result of being a contracted service with monthly revenues • We continue to add new EHR clients. We currently have 58 contracted software clients with 38 of them currently active software clients • We continue to add customers to our medical billing. We currently have 11 active medical billing clients • We continue to add products to our software offerings. Initial product launch is complete but further development and improvements will be ongoing into 2017 8 Recent Developments

Nasdaq listing Supportive Software Development Completed Lab Development 9 2015 Accomplishments

Drug and Alcohol Rehabilitation • Large and growing number of facilities in a fragmented market • Total market size estimated at $35 Billion* • Large and growing number of facilities in a fragmented market • Between 14,500 to 16,700 outpatient clinics* • Market growth from high demand: • Over 23 million Americans are addicted to alcohol and other drugs** • The number of Americans in addiction treatment ranges from 2.5 million to 4.1 million*** • 3 to 5 million people who have a diagnostic addiction disorder warranting treatment will gain coverage through healthcare reform**** • Six states currently require some form of urine toxicology testing for the treatment of substance abuse or opioid therapy, and at least nine other states recommend such testing in their medical treatment guidelines Market Drivers Lab Services Drivers • Secular growth • Compliance Value - added services • Efficiency • Cost • Revenue cycle management Sources: *IBIS World, **The National Council on Alcoholism and Drug Dependency , ***SAMHSA, **** National Association of Alcoholism and Drug Abuse Counselors . 10 Our Target Markets

Pain Management Sector • Large and growing number of clinics in a fragmented market • Total Market Size – estimated at $2 - $4 Billion***** • Private clinics in the U.S. estimated between 1,500 and 2,500******** • More than 6,800 doctors specialize in pain management and more than 600,000 doctors are licensed to prescribe pain medication********** • Market growth from high demand: • Chronic pain affects an estimated 100 million Americans, or one - third of the U.S. population****** • Approximately 25 million people experience moderate to severe chronic pain with significant pain - related activity limitations and diminished quality of life***** • Between 5 to 8 million people use opioids for long - term pain management********* • In 2015, U.S. providers wrote 204 million prescriptions for opioid painkillers******* Market Drivers Lab Services Drivers • Secular growth • Compliance Value - added services • Efficiency • Cost • Revenue cycle management Sources: **** National Association of Alcoholism and Drug Abuse Counselors ***** The U.S. Addiction Rehab Market, Bharat Publication, ******NIH, *******IMS Institute for Healthcare Informatics. 11 Our Target Markets ******** U.S. Department of Justice and Federal Trade Commission, “Horizontal Merger Guidelines”, August 2012, ********* National Institutes of Health “Pathways to Prevention Workshop: The Role of Opioids in the Treatment of Chronic Pain”, September 2014, ********** Champion Pain Care Corp 10 - K filing and t he U.S. Addiction Rehab Market, Bharat Publication

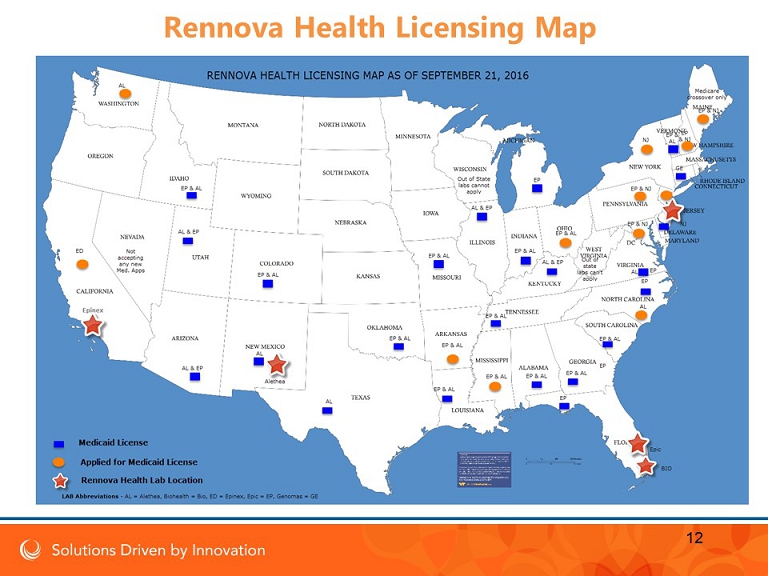

12 Rennova Health Licensing Map

• Initiated Medicaid Licensing & Third Party Payer Initiative in December 2015 • Applied for Medicaid Licenses in 34 States • As of September 21, 2016, we possess Medicaid Licenses in 23 States • Current Third Party Insurance Payer Contracts • Blue Shield of California • Coventry (National Contract) • Corvel • Multiplan • PrimeHealth • FedMed • HealthSmart • America’s Choice Provider Network • Tricare – South (Humana Military) • Health Net Services (Tricare North) • Three Rivers Provider Network • Galaxy Health Network • WellCare of Kentucky Managed Care 13 Our Payers

Strategy 14

Create a sustainable relationship with our customers to grow recurring revenue and provide value to our shareholders How? Build from a toxicology - focused company to: 1. A significant and diverse diagnostics business 2. Offering supportive software solutions that add value by generating sustainable customer relationships and revenue 3. Exploring and developing new opportunities to improve provider and patient experiences and outcomes. Remain proactive to the needs of patients and medical providers. 15 Long Term Strategy

• Strengthen Core Diagnostic Business • Capitalize on recent disruption in toxicology sector • Increase Clinical testing • Grow Pharmacogenomics testing with Genomas • Launch DTC (direct to consumer) testing • Accelerate Growth and/or Launch: • Supportive software product sales (EHR in Rehab sector) • Medical Billing services as an integrated service • Interpretation and decision support in cancer diagnostics directly to doctors and public • Investigate opportunities for cancer diagnostics leveraging Genomas capabilities 16 2016 Goals

Program Objectives: • Ensure consistency in messaging and information • Provide effective and easy to use platform • Make information accessible anytime and from anywhere • Enable opportunity for monitoring and assessment Initially for sales reps, but to be expanded over time for all employees. Goal is 100% training compliance. 17 Online Training Program Launch to Deliver Increased Sales

Epinex Diagnostics, Inc. Genomas Genomics based diagnostics - drug management solution Diabetes and rapid diagnostic tests for providers & consumers 18 Business Development Opportunities

19 History in Numbers 41,889 59,429 37,877 23,030 4,933 14,775 19,749 1,386 2,217 (9,980) (20,000) (10,000) 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 2013 2014 2015 1st half 2015 1st half 2016 Adjusted Revenues Adjusted EBITDA ($000’s)

20 Select Income Statement Items (in thousands) 2013 2014 2015 6 Months 2015 6 Months 2016 GAAP Net Revenue 41,889$ 57,928$ 18,393$ 23,030$ 4,933$ Reserve for Aged Accounts Receivable - 1,501 19,494 - - Adjusted Revenues 41,889$ 59,429$ 37,887$ 23,030$ 4,933$ GAAP Pretax Income (Loss) 13,829$ 15,382$ (44,991)$ (3,150)$ (10,106)$ Depreciation and Amortization 408 1,500 2,750 1,250 1,429 Interest Expense 475 514 2,690 1,048 3,061 Impairment of Goodwill and Intangibles - - 20,143 - - Gain on Change in Fair Value of Derivatives (2,328) - (4,727) Stock Compensation Expense 63 852 3,628 3,069 363 Reserve for Aged Accounts Receivable - 1,501 19,494 - - Adjusted EBITDA 14,775$ 19,749$ 1,386$ 2,217$ (9,980)$

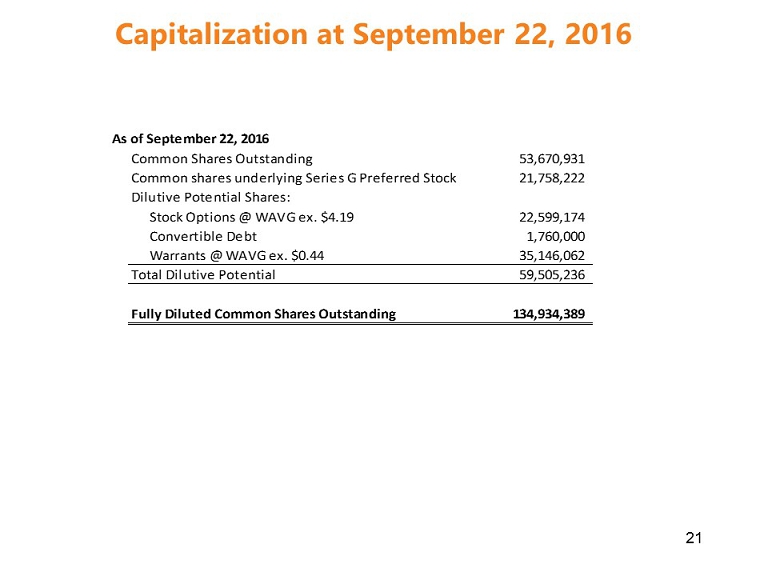

21 Capitalization at September 22, 2016 As of September 22, 2016 Common Shares Outstanding 53,670,931 Common shares underlying Series G Preferred Stock 21,758,222 Dilutive Potential Shares: Stock Options @ WAVG ex. $4.19 22,599,174 Convertible Debt 1,760,000 Warrants @ WAVG ex. $0.44 35,146,062 Total Dilutive Potential 59,505,236 Fully Diluted Common Shares Outstanding 134,934,389

Seamus Lagan CEO • 20 years experience in the restructuring, development and management of startup and small companies Jason Adams CFO • CFO in behavorial health sector and Senior Financial Management of public companies Victoria Nemerson, Esq. Corporate Counsel • 25 years experience as a trial and defense attorney in the healthcare sector Steven Burdelski Chief Compliance Officer • 25 years with the FBI with responsibility for corporate and legal compliance to improve performance Jack Seeley Marketing & Sales – Diagnostics sector • 14 years experience in toxicology and Former VP for Solstas Lab Partners (now Quest Diagnostics) Al Lechner EVP of Sales, Software Solutions • 30 years with GE Healthcare • Responsible for healthcare technology & software sales Sebastien Sainsbury Investor & Public Relations • Banking and wealth management and 10 years on the Board of AIG International 22 Rennova Management

Thomas Mika Chairman of Rennova, CEO of CollabRx (subsidiary) • 10 years as Chairman and CEO of a Nasdaq listed Company • Oversaw a number of public offerings • Bachelor of Science degree in Microbiology, MBA Harvard Seamus Lagan CEO • 20 years experience in the restructuring, development and management of startup and small companies • Founder, investor and shareholder Christopher Diamantis Director • Chairman and CEO of Integrated Financial Settlements, Inc., a structured settlement consulting firm Michael Goldberg Director • 16 years as CEO of an AMEX - listed healthcare company that acquired 23 labs and 2 hospitals under his tenure Dr. Paul Billings Director • A nationally recognized expert on genomic and precision medicine. Has served as Chief Medical Officer or Director of some of the nation‘s largest health care companies Benjamin Frank Director • Retired lawyer and businessman who served as Chairman of the Board of the Healthcare District of Palm Beach County Robert Lee Director • 16 years as a Managing Director of Morgan Stanley Dean Witter • Managing Director of the M&A group at Morgan Stanley, where he worked closely with financial sponsors • Chairman of numerous audit committees 23 Board of Directors

• Approximately $ 8 M invested in our Laboratories in 2014 and 2015 , with no further significant investment required to enable substantial increases in diagnostics testing . • Approximately $ 5 M invested in our software products in 2014 and 2015 . Investment is ongoing but products are complete and launched • Clinical Laboratories in Florida, New Jersey, New Mexico and California • We operate in a very sizable and well established market place • Capable, experienced management team • Focused strategic growth plan from a solid foundation • EHR & Practice Management product for Substance Abuse sector • Medical Billing services launched to customers • Secured in - network contracts with a number of payers and secondary networks nationwide • Significant opportunity for growth of core business revenues ; • Supportive software solutions provide additional revenue streams and a more sustainable relationship with our customers thereby widening our market entry points and ultimately reducing the historical number of 90 % of total revenues being derived from diagnostics 24 Highlights