Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LIONS GATE ENTERTAINMENT CORP /CN/ | t1602307_8k.htm |

Exhibit 99.1

EXCERPTS FROM PRELIMINARY FINANCING MATERIALS

As used in these excerpts, unless the context otherwise requires or unless expressly stated otherwise, all references to (i) “LGEC” refers to Lions Gate Entertainment Corp., a corporation organized under the laws of the Province of British Columbia, Canada, and not any of its subsidiaries; (ii) “Lions Gate,” the “Company,” “we,” “us” and “our” refers to LGEC and its consolidated subsidiaries as of the date hereof; (iii) “Starz” refers to Starz, a Delaware corporation, and its consolidated subsidiaries as of the date hereof; and (iv) the “combined company” means Lions Gate Entertainment Corp. and its consolidated subsidiaries, including Starz, after the completion of the merger. As used in these excerpts, the term “Merger Agreement” refers to the Agreement and Plan of Merger, dated as of June 30, 2016, by and among Lions Gate Entertainment Corp., Orion Arm Acquisition Inc., and Starz and the term “Starz Merger” and “merger” refer to the proposed acquisition by Lions Gate of Starz pursuant to the Merger Agreement. As used in these excerpts, “Revolver” refers to a new $1.0 billion five-year revolving credit facility, “Term Loan A” refers to a new $1.0 billion five-year term loan A facility, “Term Loan B” refers to a new $1.9 billion seven-year term loan B facility and “Senior Credit Facilities” refers to the Revolver, the Term Loan A and the Term Loan B. You should not assume that the information set forth below is accurate as of any date other than September 27, 2016.

Caution Regarding Forward-Looking Statements

This communication may contain certain forward-looking statements, including certain plans, expectations, goals, projections, and statements about the benefits of the proposed transaction, the merger parties’ plans, objectives, expectations and intentions, the expected timing of completion of the transaction, and other statements that are not historical facts. Such statements are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. Forward-looking statements may be identified by words such as expect, anticipate, believe, intend, estimate, plan, target, goal, or similar expressions, or future or conditional verbs such as will, may, might, should, would, could, or similar variations.

While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements including: the substantial investment of capital required to produce and market films and television series; increased costs for producing and marketing feature films and television series; budget overruns, limitations imposed by Lionsgate’s or Starz’s credit facilities and notes; unpredictability of the commercial success of Lionsgate’s or Starz’s motion pictures and television programming; risks related to Lionsgate’s or Starz’s acquisition and integration of acquired businesses; the effects of dispositions of businesses or assets, including individual films or libraries; the cost of defending Lionsgate’s or Starz’s intellectual property; technological changes and other trends affecting the entertainment industry; the possibility that the proposed transaction does not close when expected or at all because required regulatory, shareholder or other approvals are not received or other conditions to the closing are not satisfied on a timely basis or at all; the risk that the financing required to fund the transaction is not obtained; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; uncertainties as to the timing of the transaction; competitive responses to the transaction; the possibility that the anticipated benefits of the transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the transaction; Lionsgate’s ability to complete the acquisition and integration of Starz successfully; litigation relating to the transaction; and other factors that may affect future results of Lionsgate and Starz. Additional factors that could cause results to differ materially from those described above can be found in Lionsgate’s Annual Report on Form 10-K for the year ended March 31, 2016, and in its subsequent Quarterly Reports on Form 10-Q, including for the quarter ended June 30, 2016, each of which is on file with the Securities and Exchange Commission (the “SEC”) and available in the “Corporate” section of

Lionsgate’s website, http://www.lionsgate.com, under the heading “Reports” and in other documents Lionsgate files with the SEC, and in Starz’s Annual Report on Form 10-K for the year ended December 31, 2015 and in its subsequent Quarterly Reports on Form 10-Q, including for the quarters ended March 31, 2016 and June 30, 2016, each of which is on file with the SEC and available in the “Starz Corporate” section of Starz’s website, http://www.Starz.com, under the subsection “Investor Relations” and then under the heading “SEC Filings” and in other documents Starz files with the SEC.

All forward-looking statements speak only as of the date they are made and are based on information available at that time. Neither Lionsgate nor Starz assumes any obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Important Additional Information

In connection with the proposed transaction, Lionsgate has filed with the SEC a Registration Statement on Form S-4 that includes a Joint Proxy Statement of Lionsgate and Starz and a Prospectus of Lionsgate, as well as other relevant documents concerning the proposed transaction. The registration statement has not yet become effective and the Joint Proxy Statement included therein is in preliminary form. The proposed transaction involving Lionsgate and Starz will be submitted to Starz’s stockholders and Lionsgate’s stockholders for their consideration. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. STOCKHOLDERS OF LIONSGATE AND STOCKHOLDERS OF STARZ ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Stockholders may obtain a free copy of the definitive joint proxy statement/prospectus, as well as other filings containing information about Lionsgate and Starz, without charge, at the SEC’s website (http://www.sec.gov). Copies of the joint proxy statement/prospectus and the filings with the SEC that are incorporated by reference in the joint proxy statement/prospectus can also be obtained, without charge, by directing a request to James Marsh, Senior Vice President of Lionsgate Investor Relations, 2700 Colorado Avenue, Santa Monica, California, 90404, or at (310) 255-3651, or to Starz, 8900 Liberty Circle, Englewood, Colorado 80112, or at 1-855-807-2929.

Participants in the Solicitation

Lionsgate, Starz, and certain of their respective directors, executive officers, and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding Lionsgate’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on July 28, 2016, and certain of its Current Reports on Form 8-K. Information regarding Starz’s directors and executive officers is available in its definitive proxy statement, which was filed with SEC on April 29, 2016, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph.

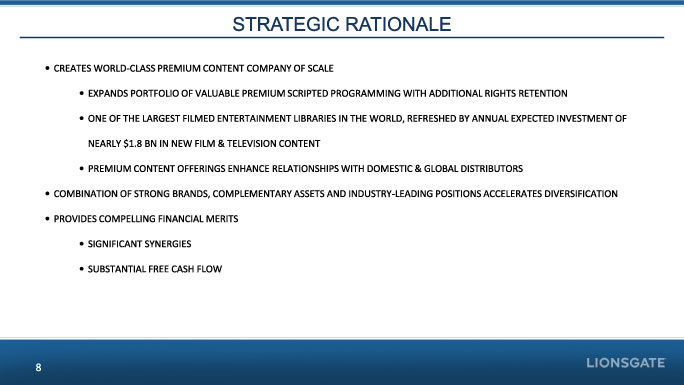

| STRATEGIC RATIONALE CREATES WORLD-CLASS PREMIUM CONTENT COMPANY OF SCALE EXPANDS PORTFOLIO OF VALUABLE PREMIUM SCRIPTED PROGRAMMING WITH ADDITIONAL RIGHTS RETENTION ONE OF THE LARGEST FILMED ENTERTAINMENT LIBRARIES IN THE WORLD, REFRESHED BY ANNUAL EXPECTED INVESTMENT OF NEARLY $1.8 BN IN NEW FILM & TELEVISION CONTENT PREMIUM CONTENT OFFERINGS ENHANCE RELATIONSHIPS WITH DOMESTIC & GLOBAL DISTRIBUTORS COMBINATION OF STRONG BRANDS, COMPLEMENTARY ASSETS AND INDUSTRY-LEADING POSITIONS ACCELERATES DIVERSIFICATION PROVIDES COMPELLING FINANCIAL MERITS SIGNIFICANT SYNERGIES SUBSTANTIAL FREE CASH FLOW 8 |

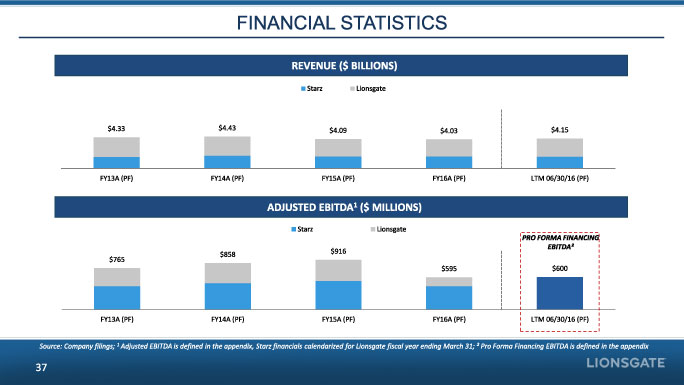

| FINANCIAL STATISTICS REVENUE ($BILLIONS) Starz Lionsgate $4.33 $4.43 $4.09 $4.03 $4.15 FY13A (PF) FY14A (PF) FY15A (PF) FY16A (PF) LTM 06/30/16 (PF) ADJUSTED EBITDA1 ($MILLIONS) Starz Lionsgate PRO FORMA FINANCING EBITDA² $916 $858 $765 $595 $600 FY13A (PF) FY14A (PF) FY15A (PF) FY16A (PF) LTM 06/30/16 (PF) Source: Company filings; 1 Adjusted EBITDA is defined in the appendix, Starz financials calendarized for Lionsgate fiscal year ending March 31; ² Pro Forma Financing EBITDA is defined in the appendix 37 |

Adjusted EBITDA Reconciliation

The Adjusted EBITDA Reconciliation was not included in the Preliminary Financing Materials.

ADJUSTED EBITDA RECONCILIATION

ADJUSTED EBITDA COMBINES STARZ ADJUSTED OIBDA (WHICH IS SUBSTANTIALLY SIMILAR TO LIONSGATE’S ADJUSTED EBITDA) WITH LIONSGATE’S ADJUSTED EBITDA. LIONSGATE’S ADJUSTED EBITDA REPRESENTS EBITDA (DEFINED AS EARNINGS BEFORE INTEREST, INCOME TAX PROVISION OR BENEFIT, AND DEPRECIATION AND AMORTIZATION) EXCLUDING ALL STOCK-BASED COMPENSATION EXPENSE, AND ADJUSTED FOR PURCHASE ACCOUNTING AND RELATED ADJUSTMENTS, RESTRUCTURING AND OTHER ITEMS, NON-CASH IMPUTED INTEREST CHARGE, START-UP LOSSES OF NEW BUSINESS INITIATIVES, LOSS ON EXTINGUISHMENT OF DEBT AND BACKSTOPPED PRINTS AND ADVERTISING EXPENSE. STARZ ADJUSTED OIBDA IS DEFINED AS REVENUE LESS PROGRAMMING COSTS, PRODUCTION AND ACQUISITION COSTS, HOME VIDEO COST OF SALES, OPERATING EXPENSES AND SELLING, GENERAL AND ADMINISTRATIVE EXPENSES, BUT EXCLUDING ALL STOCK-BASED COMPENSATION EXPENSE. ADJUSTED EBITDA AND ADJUSTED OIBDA ARE NON-GAAP FINANCIAL MEASURES AND SHOULD NOT BE CONSIDERED AS ALTERNATIVES TO OPERATING INCOME OR NET INCOME AS A MEASURE OF OPERATING PERFORMANCE OR CASH FLOWS OR AS A MEASURE OF LIQUIDITY.

| Year Ended | ||||||||||||||||

| March 31, | ||||||||||||||||

| 2013 | 2014 | 2015 | 2016 | |||||||||||||

| (Amounts in millions) | ||||||||||||||||

| LIONSGATE | ||||||||||||||||

| Net income | $ | 232.1 | $ | 152.0 | $ | 181.8 | $ | 42.7 | ||||||||

| Depreciation and amortization | 8.3 | 6.5 | 6.6 | 13.1 | ||||||||||||

| Interest, net | 89.5 | 60.1 | 49.7 | 53.0 | ||||||||||||

| Income tax provision (benefit) | (75.8 | ) | 32.9 | 31.6 | (76.5 | ) | ||||||||||

| EBITDA | $ | 254.2 | $ | 251.6 | $ | 269.7 | $ | 32.3 | ||||||||

| Stock-based compensation | $ | 47.7 | $ | 72.1 | $ | 80.3 | $ | 78.5 | ||||||||

| Restructuring and other items (1) | 2.6 | 7.5 | 10.7 | 19.8 | ||||||||||||

| Non-cash imputed interest charge (2) | - | - | - | 5.3 | ||||||||||||

| Purchase accounting and related adjustments (3) | - | - | - | 8.4 | ||||||||||||

| Start-up losses of new business initiatives (4) | - | - | - | 17.1 | ||||||||||||

| Loss on extinguishment of debt | 24.1 | 39.6 | 11.7 | - | ||||||||||||

| Backstopped prints and advertising expense (5) | 1.2 | - | 12.5 | 1.0 | ||||||||||||

| Adjusted EBITDA | $ | 329.8 | $ | 370.8 | $ | 384.9 | $ | 162.3 | ||||||||

| STARZ (6) | ||||||||||||||||

| Income before income taxes | $ | 356.5 | $ | 398.6 | $ | 436.4 | $ | 321.5 | ||||||||

| Stock compensation | 24.7 | 34.8 | 31.1 | 32.9 | ||||||||||||

| Depreciation and amortization | 19.5 | 17.9 | 19.2 | 19.0 | ||||||||||||

| Interest expense, net of amounts capitalized | 31.0 | 46.3 | 46.2 | 46.7 | ||||||||||||

| Other income (expense), net | 2.8 | (11.0 | ) | (1.9 | ) | 13.1 | ||||||||||

| Adjusted OIBDA | $ | 434.5 | $ | 486.6 | $ | 531.0 | $ | 433.2 | ||||||||

| ADJUSTED EBITDA | $ | 764.3 | $ | 857.4 | $ | 915.9 | $ | 595.5 | ||||||||

Note: Amounts may not add precisely due to rounding

| (1) | Restructuring and other items includes restructuring and severance costs, certain transaction-related costs, and certain unusual items, when applicable, included in general and administrative ("G&A") expense. |

| (2) | Non-cash imputed interest charge represents a charge associated with the interest cost of long-term accounts receivable for Television Production licensed product that become due beyond one year. |

| (3) | Purchase accounting and related adjustments represent the incremental amortization expense associated with the non-cash fair value adjustments on film and television assets and program rights resulting from the application of purchase accounting and the non-cash charges included in G&A expense related to the accretion of the non-controlling interest discount. |

| (4) | Start-up losses of new business initiatives represent losses associated with Lionsgate's direct to consumer initiatives including its SVOD platforms and losses from its equity method investment in Atom Tickets, a theatrical mobile ticketing platform and app. |

| (5) | Backstopped prints and advertising expense (“P&A“) represents the amount of theatrical marketing expense for third party titles that Lionsgate funded and expensed for which a third party provides a first dollar loss guarantee that such expense will be recouped from the performance of the film (which results in minimal risk of loss to Lionsgate). The amount represents the P&A expense incurred and expensed net of the impact of expensing the P&A cost over the revenue streams similar to a participation expense (i.e., the P&A under these arrangements are being expensed similar to a participation cost for purposes of the adjusted measure). |

| (6) | Amounts derived computationally from Starz audited financial statements included in its Annual Report on Form 10-K for the years ended December 31, 2015, 2014, 2013 and 2012 and its Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016, 2015, 2014, 2013 and 2012. |

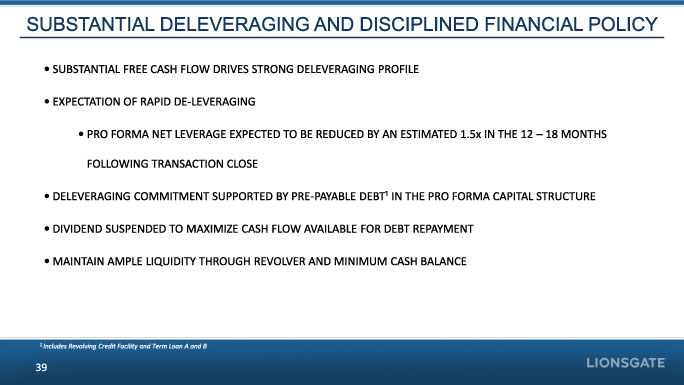

| SUBSTANTIAL DELEVERAGING AND DISCIPLINED FINANCIAL POLICY SUBSTANTIAL FREE CASH FLOW DRIVES STRONG DELEVERAGING PROFILE EXPECTATION OF RAPID DE-LEVERAGING PRO FORMA NET LEVERAGE EXPECTED TO BE REDUCED BY AN ESTIMATED 1.5x IN THE 12 – 18 MONTHS FOLLOWING TRANSACTION CLOSE DELEVERAGING COMMITMENT SUPPORTED BY PRE-PAYABLE DEBT¹ IN THE PRO FORMA CAPITAL STRUCTURE DIVIDEND SUSPENDED TO MAXIMIZE CASH FLOW AVAILABLE FOR DEBT REPAYMENT MAINTAIN AMPLE LIQUIDITY THROUGH REVOLVER AND MINIMUM CASH BALANCE 1 Includes Revolving Credit Facility and Term Loan A and B 39 |

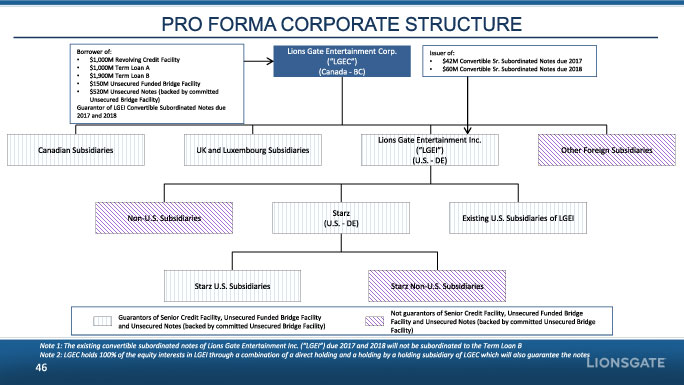

| PRO FORMA CORPORATE STRUCTURE Starz (U.S. - DE) Lions Gate Entertainment Corp. (“LGEC”) (Canada - BC) Borrower of: •$1,000M Revolving Credit Facility •$1,000M Term Loan A •$1,900M Term Loan B •$150M Unsecured Funded Bridge Facility •$520M Unsecured Notes (backed by committed Unsecured Bridge Facility) Guarantor of LGEI Convertible Subordinated Notes due 2017 and 2018 Issuer of: •$42M Convertible Sr. Subordinated Notes due 2017 •$60M Convertible Sr. Subordinated Notes due 2018 Guarantors of Senior Credit Facility, Unsecured Funded Bridge Facility and Unsecured Notes (backed by committed Unsecured Bridge Facility) UK and Luxembourg Subsidiaries Canadian Subsidiaries Lions Gate Entertainment Inc. (“LGEI”) (U.S. - DE) Other Foreign Subsidiaries Existing U.S. Subsidiaries of LGEI Non-U.S. Subsidiaries Starz U.S. Subsidiaries Starz Non-U.S. Subsidiaries Not guarantors of Senior Credit Facility, Unsecured Funded Bridge Facility and Unsecured Notes (backed by committed Unsecured Bridge Facility) 46 Note 1: The existing convertible subordinated notes of Lions Gate Entertainment Inc. (“LGEI”) due 2017 and 2018 will not be subordinated to the Term Loan B Note 2: LGEC holds 100% of the equity interests in LGEI through a combination of a direct holding and a holding by a holding subsidiary of LGEC which will also guarantee the notes |

| ADJUSTED EBITDA DEFINITION ADJUSTED EBITDA ADJUSTED EBITDA COMBINES STARZ ADJUSTED OIBDA (WHICH IS SUBSTANTIALLY SIMILAR TO LIONSGATE’S ADJUSTED EBITDA) WITH LIONSGATE’S ADJUSTED EBITDA. LIONSGATE’S ADJUSTED EBITDA REPRESENTS EBITDA (DEFINED AS EARNINGS BEFORE INTEREST, INCOME TAX PROVISION OR BENEFIT, AND DEPRECIATION AND AMORTIZATION) EXCLUDING ALL STOCK-BASED COMPENSATION EXPENSE, AND ADJUSTED FOR PURCHASE ACCOUNTING AND RELATED ADJUSTMENTS, RESTRUCTURING AND OTHER ITEMS, NON-CASH IMPUTED INTEREST CHARGE, START-UP LOSSES OF NEW BUSINESS INITIATIVES, LOSS ON EXTINGUISHMENT OF DEBT AND BACKSTOPPED PRINTS AND ADVERTISING EXPENSE. STARZ ADJUSTED OIBDA IS DEFINED AS REVENUE LESS PROGRAMMING COSTS, PRODUCTION AND ACQUISITION COSTS, HOME VIDEO COST OF SALES, OPERATING EXPENSES AND SELLING, GENERAL AND ADMINISTRATIVE EXPENSES, BUT EXCLUDING ALL STOCK-BASED COMPENSATION EXPENSE. ADJUSTED EBITDA AND ADJUSTED OIBDA ARE NON-GAAP FINANCIAL MEASURES AND SHOULD NOT BE CONSIDERED AS ALTERNATIVES TO OPERATING INCOME OR NET INCOME AS A MEASURE OF OPERATING PERFORMANCE OR CASH FLOWS OR AS A MEASURE OF LIQUIDITY. PRO FORMA FINANCING EBITDA REPRESENTS ADJUSTED EBITDA AS DEFINED ABOVE AND INCLUDES ESTIMATED OPERATING SYNERGIES, REDUCTIONS OF ADJUSTED EBITDA FOR EQUITY INTERESTS INCOME, NET, OFFSET BY INCREASES FOR IMPAIRMENT LOSSES AND THE NET NEGATIVE ADJUSTED EBITDA ASSOCIATED WITH UNRESTRICTED SUBSIDIARIES. 49 |

Executive Summary

The combined company is expected to be a premier global content leader across both production and distribution. Consumer demand for high quality film and television continues to be robust and the Company believes global consumption of content will continue to increase for the foreseeable future. In addition, the continued proliferation of channels is leading to new business models that need exclusive, premium content in order to generate audience and brand awareness in an increasingly competitive consumer landscape. Lions Gate believes the combined company is well positioned in this environment as one of the largest independent global content suppliers, spending nearly $1.8 billion per year on new films and television shows. The combined company's on-going content investment not only powers its and other distribution channels but also replenishes its library. The combined company’s library of owned intellectual property and acquired third-party rights consists of over 16,000 films and television titles and is an important source of recurring revenue. This library is the result of continuous long-term investment in content, which makes the combined company an important partner to third-party buyers of content and consumers alike.

The combination of Lions Gate and Starz will scale its television content creation capability and diversify its business with stable, free cash flow generated by Starz’s recurring subscription fees. The improved predictability and stability of the combined company’s free cash flow is expected to enable it to capture the upside of increased content investment without significantly increasing the risk profile. By merging the operations of the two companies, Lions Gate expects to generate over $200 million in annual operating cost savings and cash tax savings as well as generate incremental revenue opportunities.

Lions Gate anticipates that substantial cash flows resulting from the strong and stable Starz subscriber base, the Lions Gate library, and Lions Gate’s television production business, as well as the significant operating and tax savings resulting from the Starz Merger, will be utilized for debt repayment. Lions Gate expects deleveraging of approximately 1.5 times in the 12 to 18 months following the close of the merger due to the combination of Adjusted EBITDA growth and debt repayment.

Transaction Overview

Based upon the number of outstanding Starz shares on June 30, 2016, Lions Gate expects that (a) Lions Gate will issue approximately 4,594,000 Lions Gate voting shares and 62,325,000 Lions Gate non-voting shares in connection with the merger, (b) Lions Gate will reserve approximately 20,563,000 Lions Gate non-voting shares for issuance in respect of Starz equity awards that Lions Gate will assume in connection with the merger, and (c) Lions Gate will pay an aggregate cash amount of approximately $1,584,543,000 to Starz stockholders as merger consideration for their shares of Starz common stock.

Sources and Uses and Pro Forma Capitalization Table at 6/30/16

Illustrative cash sources and uses ($mm)1

| Sources | Uses | |||||||||

| Cash from balance sheet | $ | 83 | Cash consideration to be paid to Starz's stockholders | $ | 1,585 | |||||

| New $1,000mm revolving credit facility2 | 150 | Repayment of the Existing Starz Credit Facility | 352 | |||||||

| New Term Loan A | 1,000 | Repayment of the Starz 2019 Notes | 675 | |||||||

| New Term Loan B | 1,900 | Repayment of the Existing Lions Gate Credit Facility | 225 | |||||||

| New unsecured funded bridge facility | 150 | Repayment of the Lions Gate 2018 Notes | 225 | |||||||

| New senior unsecured notes (backstopped by unsecured bridge facility) | 520 | Repayment of the Existing Lions Gate Term Loan | 400 | |||||||

| Estimated costs associated with debt refinancing | 143 | |||||||||

| Estimated acquisition related costs | 70 | |||||||||

| Cash to balance sheet | 128 | |||||||||

| Total sources | $ | 3,803 | Total uses | $ | 3,803 | |||||

Pro forma capitalization table ($mm)

| Pro Forma | ||||||||||

| Tenor | Amount | x Adj. EBITDA4 | ||||||||

| Cash and cash equivalents | $ | 129 | ||||||||

| $1,000 Revolver | 5 years | 150 | ||||||||

| $1,000 Term Loan A | 5 years | 1,000 | ||||||||

| $1,900 Term Loan B | 7 years | 1,900 | ||||||||

| Capital lease obligations | 62 | |||||||||

| Total Secured Debt | $ | 3,112 | 5.2 | x | ||||||

| Net Secured Debt | $ | 2,983 | 5.0 | x | ||||||

| Unsecured funded bridge | 9 months | 150 | ||||||||

| Unsecured notes (backstopped by unsecured bridge facility) | 8 years | 520 | ||||||||

| Convertible senior subordinated notes | 2017 / 2018 | 102 | ||||||||

| Total Debt 3 | $ | 3,884 | 6.5 | x | ||||||

| Net Debt | $ | 3,755 | 6.3 | x | ||||||

| PF 6/30/16 LTM financing EBITDA4 | $ | 600 | ||||||||

1 Sources and uses does not include equity consideration

2 Company may borrow up to $150 million under Revolving Credit Facility on the closing date of the Starz Merger to pay fees and expenses

3 Excludes production loans

4 Pro Forma financing EBITDA is defined in the Appendix

Transaction Rationale

The combination of Lions Gate and Starz will scale Lions Gate’s television content creation capability and diversify its business with stable, recurring free cash flow generated by Starz. By merging the operations of the two companies, Lions Gate expects to generate over $200 million in annual operating cost savings and cash tax savings as well as generate incremental revenue opportunities.

The merger provides a unique opportunity to scale original, premium television production which is an increasingly important success factor for any content-driven company. The combined company expects to invest nearly $1 billion annually in new television content alone and nearly $1.8 billion annually in new content including investment in motion pictures. The combined company also anticipates spending approximately $700 million annually marketing content on a global basis. This increased investment in original programming will enhance the potential to generate hit content, which will benefit from the strength of the combined distribution platform. Strategically, Lions Gate expects to leverage this strength and capture additional revenue opportunities through increased rights retention and the exploitation of global content distribution rights for series produced for Starz.

As both a buyer and seller of content, the combined company will have the opportunity to expand its existing relationship with distributors, buyers and creators, and Lions Gate anticipates that this will ensure that content investment and monetization potential are maximized.

Starz has built a strong content portfolio with hits such as Power, Outlander, and Black Sails. The combined company expects to capitalize on this success with the expertise of Lions Gate’s television production division, which has been responsible for platform-defining series such as Orange is the New Black for Netflix, Mad Men for AMC, Casual for Hulu and Greenleaf for OWN — all shows that have created or are creating substantial enterprise value for the owners of their networks. Through collaboration with its new colleagues at Starz, Lions Gate will have greater opportunities to generate hit product that may result in additional subscribers and drive significant incremental revenue.

Through diversification and increased financial stability driven by Starz’s recurring subscription fees, the combined company is expected to have improved predictability and stability of free cash flow, enabling it to capture the upside of increased content investment without significantly increasing the risk profile.

The merger is also expected to provide Lions Gate with greater access to the consumer through multiple touchpoints – STARZ and STARZ ENCORE premium networks and each company’s OTT services. Moreover, the combination is expected to accelerate the growth of each company’s OTT services through data-driven customer acquisition/retention analytics, cross-promotional and distribution opportunities, and a combined technological and operational infrastructure.

Finally, Lions Gate believes that Lions Gate and Starz have complementary resources, intellectual property and experienced management teams. The additional scale that the merger provides to Lions Gate's portfolio of content and distribution assets will enable it to compete even more effectively in the global entertainment marketplace.

6. Key Credit Highlights

Key highlights of combined business

|

Diversified media company of scale | n Combined business represents a diversified revenue mix n The combined entity has a growing emphasis in television production, which can provide increased diversification and predictability to the overall business n Leading producer and supplier of shows for cable, broadcast, digital and premium pay networks, with nearly 90 shows on over 40 platforms n Stable cash flow from pay television network platforms, with approximately 24 million STARZ, 32 million STARZ ENCORE and 10 million Epix pay subscribers n Film platform targeting 14-18 wide releases and 20 plus platform films per year, with limited at-risk capital through pre-licensing model |

|

Platform agnostic global content driven company | n Premier unaligned content provider, which enables Lions Gate to optimize the long term value of its content globally n Maximize content value across distribution platforms n Emerging platforms and business models can provide additional licensing opportunities |

|

Risk-mitigated approach to new film and TV production | n Lions Gate will continue to operate a risk mitigating film production model, targeting on average more than 50% of film net production budgets covered through international licensing n Additional risk mitigation through use of tax incentives, co-financing partners, etc. |

|

Stable sources of recurring revenue | n The Starz Networks business maintains a stable subscriber base, with 24mm STARZ and 32mm STARZ ENCORE subscribers n Recurring library cash flows from approximately16,000 film and television titles n Scaled TV production business that includes premium scripted and unscripted content |

|

Significant operating synergies and tax benefits | n Significant run-rate operating synergies of $52mm as a result of the transaction, achievable within 12-18 months of transaction close n Significant potential tax savings for the combined Company |

|

Substantial cash flow drives strong deleveraging profile | n Expected deleveraging of approximately 1.5x in the 12-18 months following transaction close n Quarterly dividend suspended to focus on deleveraging and growing the core business |

The Lions Gate library consists of approximately 16,000 films and television programs, which generated over $500 million in revenue during fiscal year 2016 and has provided Lions Gate with a consistent stream of cash flow.

Lions Gate’s television segment now makes up nearly one-third of Lions Gate’s revenues and is expected to continue growing as the combined company creates one of the world’s largest television production companies with an expected nearly $1 billion in annual investment in new television content. This segment can provide a visible stream of cash flows for the combined company as television series enter syndication and key series are renewed with multi-year agreements.

Selected historical financial data of Lions Gate

The following tables set forth selected consolidated financial information for Lions Gate as of and for each of the three fiscal years ended March 31, 2016, 2015 and 2014, and as of and for each of the three months ended June 30, 2016 and 2015. All references to “fiscal years,” unless otherwise noted, refer to a 12-month fiscal year.

The summary consolidated financial information for Lions Gate as of and for the fiscal years ended March 31, 2016, 2015 and 2014 was derived from the audited consolidated financial statements of Lions Gate.

The summary historical financial information as of June 30, 2016 and for each of the three-month periods ended June 30, 2016 and 2015 was derived from Lions Gate’s unaudited consolidated financial statements.

The summary consolidated financial data below includes the results of Pilgrim Media Group, LLC (“Pilgrim Studios”) from its acquisition date of November 12, 2015 onwards. Due to the acquisition of Pilgrim Studios, the Company’s results of operations for the year ended March 31, 2016, for the three months ended June 30, 2016, and financial positions as at March 31, 2016 and June 30, 2016 are not directly comparable to the corresponding prior reporting periods.

The summary unaudited pro forma statement of operations data presented below for the twelve months ended June 30, 2016 gives effect to the transactions as if they had occurred on April 1, 2015, the first day of Lions Gate’s fiscal year ended March 31, 2016. The pro forma condensed combined financial information as of June 30, 2016 gives effect to the transactions as if they had occurred on June 30, 2016. Lions Gate and Starz have different fiscal year ends which end on March 31 and December 31, respectively. As a result of Lions Gate and Starz having different fiscal years, Starz’ historical financial results have been aligned to more closely conform to the fiscal periods of Lions Gate’s fiscal year as further described in “Unaudited pro forma condensed combined financial data.”

The summary unaudited pro forma condensed combined financial information presented below for the twelve months ended June 30, 2016 has been derived from, and should be read in conjunction with, the more detailed unaudited pro forma condensed combined financial data for the fiscal year ended March 31, 2016, the three months ended June 30, 2016, and the three months ended June 30, 2015, appearing in “Unaudited pro forma condensed combined financial data”. The unaudited pro forma condensed statement of income for the twelve months ended June 30, 2016 was computationally derived by (i) taking the unaudited pro forma condensed statement of income for the year ended March 31, 2016 (ii) adding the unaudited pro forma condensed statement of income for the quarter ended June 30, 2016 and (iii) subtracting the unaudited pro forma condensed statement of income for the quarter ended June 30, 2015. In addition, the pro forma condensed combined financial information presented below is based on, and should be read in conjunction with, the historical consolidated financial statements and related notes of Lions Gate and Starz for the applicable periods.

The following information should be read together with the consolidated financial statements of Lions Gate, the notes related thereto and the related reports of management on the financial condition and performance of Lions Gate.

Statement of Operations Data

| | | |

Year ended March 31,

|

| |

Three months

ended June 30, |

| |

Pro forma

twelve months ended June 30, 2016(1) |

|||||||||||||||||||||||||||

|

(in millions)

|

| |

2016

|

| |

2015

|

| |

2014

|

| |

2016

|

| |

2015

|

| ||||||||||||||||||||

|

Revenues

|

| | | $ | 2,347.4 | | | | | $ | 2,399.6 | | | | | $ | 2,630.3 | | | | | $ | 553.6 | | | | | $ | 408.9 | | | | | $ | 4,154.3 | |

| Expenses: | | | | | | | | |||||||||||||||||||||||||||||

|

Direct operating

|

| | | | 1,415.3 | | | | | | 1,315.8 | | | | | | 1,369.4 | | | | | | 366.3 | | | | | | 230.3 | | | | | | 2,428.9 | |

|

Distribution and marketing

|

| | | | 661.8 | | | | | | 591.5 | | | | | | 739.5 | | | | | | 125.0 | | | | | | 71.9 | | | | | | 925.7 | |

|

General and administration

|

| | | | 282.2 | | | | | | 263.5 | | | | | | 254.9 | | | | | | 78.7 | | | | | | 60.7 | | | | | | 468.1 | |

|

Depreciation and amortization

|

| | | | 13.1 | | | | | | 6.6 | | | | | | 6.5 | | | | | | 5.6 | | | | | | 1.8 | | | | | | 139.7 | |

|

Total expenses

|

| | | | 2,372.4 | | | | | | 2,177.4 | | | | | | 2,370.3 | | | | | | 575.6 | | | | | | 364.8 | | | | | | 3,962.4 | |

|

Operating income (loss)

|

| | | | (25.0) | | | | | | 222.3 | | | | | | 259.9 | | | | | | (22.0) | | | | | | 44.2 | | | | | | 191.9 | |

| Other expenses (income): | | | | | | | | |||||||||||||||||||||||||||||

|

Interest expense

|

| | | | 54.9 | | | | | | 52.5 | | | | | | 66.2 | | | | | | 15.2 | | | | | | 12.6 | | | | | | 198.4 | |

|

Interest and other income

|

| | | | (1.9) | | | | | | (2.8) | | | | | | (6.0) | | | | | | (0.9) | | | | | | (0.6) | | | | | | 0.9 | |

|

Loss on extinguishment of debt

|

| | | | — | | | | | | 11.7 | | | | | | 39.6 | | | | | | — | | | | | | — | | | | | | — | |

|

Total other expenses, net

|

| | | | 53.0 | | | | | | 61.4 | | | | | | 99.7 | | | | | | 14.3 | | | | | | 12.0 | | | | | | 199.3 | |

|

Income (loss) before equity interests and income taxes

|

| | | | (78.1) | | | | | | 160.9 | | | | | | 160.2 | | | | | | (36.3) | | | | | | 32.1 | | | | | | (7.4) | |

|

Equity interests income (loss)

|

| | | | 44.2 | | | | | | 52.5 | | | | | | 24.7 | | | | | | 10.8 | | | | | | 11.4 | | | | | | 29.0 | |

|

Income (loss) before income taxes

|

| | | | (33.8) | | | | | | 213.4 | | | | | | 185.0 | | | | | | (25.5) | | | | | | 43.5 | | | | | | 21.6 | |

|

Income tax provision (benefit)

|

| | | | (76.5) | | | | | | 31.6 | | | | | | 32.9 | | | | | | (26.3) | | | | | | 2.8 | | | | | | (102.4) | |

|

Net income (loss)

|

| | | | 42.7 | | | | | | 181.8 | | | | | | 152.0 | | | | | | 0.8 | | | | | | 40.7 | | | | | | 124.0 | |

|

Less: Net loss attributable to noncontrolling interest

|

| | | | 7.5 | | | | | | — | | | | | | — | | | | | | 0.4 | | | | | | — | | | | | | 8.6 | |

|

Net income (loss) attributable to Lions

Gate Entertainment Corp. shareholders |

| | | $ | 50.2 | | | | | $ | 181.8 | | | | | $ | 152.0 | | | | | $ | 1.3 | | | | | $ | 40.7 | | | | | $ | 132.6 | |

Statement of Cash Flows Data

| | | |

Year ended March 31,

|

| |

Three months

ended June 30, |

| ||||||||||||||||||||||||

|

(in millions)

|

| |

2016

|

| |

2015

|

| |

2014

|

| |

2016

|

| |

2015

|

| |||||||||||||||

| Operating activities: | | | | | | | |||||||||||||||||||||||||

|

Amortization of films and television

programs |

| | | $ | 1,029.1 | | | | | $ | 900.0 | | | | | $ | 921.3 | | | | | $ | 292.4 | | | | | $ | 160.4 | | |

|

Investment in films and television programs

|

| | | | (1,066.4) | | | | | | (1,012.3) | | | | | | (948.1) | | | | | | (250.0) | | | | | | (315.9) | | |

|

Net cash provided by (used in) operating activities

|

| | | | (19.0) | | | | | | 96.5 | | | | | | 252.5 | | | | | | 143.1 | | | | | | (30.9) | | |

| Investing activities: | | | | | | | |||||||||||||||||||||||||

|

Purchases of property, plant and equipment

|

| | | | (18.4) | | | | | | (17.0) | | | | | | (8.8) | | | | | | (2.9) | | | | | | (3.2) | | |

|

Net cash provided by (used in) investing activities

|

| | | | (162.1) | | | | | | (55.2) | | | | | | (8.6) | | | | | | (7.1) | | | | | | (4.0) | | |

| Financing activities: | | | | | | | |||||||||||||||||||||||||

|

Net cash provided by (used in) financing activities

|

| | | | 135.7 | | | | | | 34.2 | | | | | | (279.3) | | | | | | (124.2) | | | | | | 130.1 | | |

Balance Sheet Data

| | | |

As of March 31,

|

| |

As of June 30,

2016 |

| |

Pro forma

as of June 30, 2016(1) |

|||||||||||||||||||||

|

(in millions)

|

| |

2016

|

| |

2015

|

| |

2014

|

| ||||||||||||||||||||

|

Cash and cash equivalents

|

| | | $ | 57.7 | | | | | $ | 102.7 | | | | | $ | 25.7 | | | | | $ | 69.9 | | | | | $ | 129.0 | |

|

Investment in films and television programs

|

| | | | 1,478.3 | | | | | | 1,381.8 | | | | | | 1,274.6 | | | | | | 1,429.3 | | | | | | 1,687.5 | |

|

Total assets(2)

|

| | | | 3,834.2 | | | | | | 3,272.1 | | | | | | 2,816.9 | | | | | | 3,715.3 | | | | | | 8,912.6 | |

| Corporate debt(2): | | | | | | | ||||||||||||||||||||||||

|

Senior revolving credit

facility(2) |

| | | | 156.1 | | | | | | — | | | | | | 86.3 | | | | | | 221.0 | | | | | | 135.0 | |

|

Other senior debt

|

| | | | 609.0 | | | | | | 580.7 | | | | | | 425.5 | | | | | | 609.9 | | | | | | 3,472.7 | |

|

Convertible senior subordinated notes

|

| | | | 100.0 | | | | | | 114.0 | | | | | | 131.6 | | | | | | 100.6 | | | | | | 100.6 | |

|

Capital lease obligations

|

| | | | — | | | | | | — | | | | | | — | | | | | | — | | | | | | 62.0 | |

|

Total liabilities(2)

|

| | | | 2,893.4 | | | | | | 2,429.8 | | | | | | 2,232.4 | | | | | | 2,753.4 | | | | | | 6,414.4 | |

|

Redeemable noncontrolling interests

|

| | | | 90.5 | | | | | | — | | | | | | — | | | | | | 91.8 | | | | | | 91.8 | |

|

Total shareholders’ equity

|

| | | | 850.3 | | | | | | 842.3 | | | | | | 584.5 | | | | | | 870.1 | | | | | | 2,406.4 | |

1 The amounts in this column were calculated based on the pro forma combined company amounts in the unaudited pro forma condensed combined financial statements as of June 30, 2016 and for the fiscal year ended March 31, 2016, the three months ended June 30, 2016 and the three months ended June 30, 2015.

2 Total assets, corporate debt and total liabilities as of March 31, 2016, 2015, and 2014 have been reclassified to include deferred financing costs as a reduction of debt rather than as an asset for comparability with the June 30, 2016 presentation related to the adoption of a recent accounting pronouncement. As of March 31, 2015, there was no outstanding balance on the senior revolving credit facility, and accordingly, debt issuance costs related to the senior revolving credit facility of $8.1 million are included in total assets.

Unaudited pro forma condensed combined financial data

The notes to the unaudited pro forma condensed combined financial data were not included in the Preliminary Financing Materials.

statements

AS OF JUNE 30, 2016

| | | |

Historical

|

| |

Pro forma adjustments

|

| | | |||||||||||||||||||||||||||||||||||||||||||||

|

(in millions, except per share data)

|

| |

Lions Gate

Entertainment Corp. (note 1) |

| |

Starz

(note 1) |

| |

Lions Gate

reclassification adjustments (note 5) |

| | | | | | | |

Starz

reclassification adjustments (note 5) |

| | | | | | | |

Pro forma

adjustments (note 6) |

| | | | | | | |

Pro forma

combined |

||||||||||||||||||

| ASSETS | | | | | | | | | | | | | | | | |||||||||||||||||||||||||||||||||||||||

|

Cash and cash equivalents

|

| | | $ | 69.9 | | | | | $ | 12.9 | | | | | $ | — | | | | | | | | | | | $ | — | | | | | | | | | | | $ | 46.2 | | | | |

|

A1

|

| | | | $ | 129.0 | |

|

Restricted cash

|

| | | | 10.8 | | | | | | — | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 10.8 | |

|

Accounts receivable, net

|

| | | | 899.7 | | | | | | 289.8 | | | | | | (243.8) | | | | |

|

R1

|

| | | | | 33.6 | | | | |

|

R13

|

| | | | | — | | | | | | | | | | | | 979.3 | |

|

Program rights

|

| | | | — | | | | | | 375.6 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 375.6 | |

|

Other current assets

|

| | | | — | | | | | | 60.5 | | | | | | 47.1 | | | | |

|

R2

|

| | | | | (33.6) | | | | |

|

R13

|

| | | | | — | | | | | | | | | | | | 74.0 | |

|

Total current assets

|

| | | | | | | | | | 738.8 | | | | | | (196.7) | | | | | | | | | | | | | | | | | | | | | | | | 46.2 | | | | | | | | | | | | 1,568.7 | |

|

Accounts receivable, net

|

| | | | — | | | | | | — | | | | | | 243.8 | | | | |

|

R1

|

| | | | | 86.4 | | | | |

|

R14

|

| | | | | — | | | | | | | | | | | | 330.2 | |

|

Program rights

|

| | | | — | | | | | | 326.1 | | | | | | — | | | | |

|

—

|

| | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 326.1 | |

|

Investment in films and television programs, net

|

| | | | 1,429.3 | | | | | | 223.2 | | | | | | (21.0) | | | | |

|

R3

|

| | | | | — | | | | | | | | | | | | 56.0 | | | | |

|

A2

|

| | | | | 1,687.5 | |

|

Property and equipment, net

|

| | | | 42.8 | | | | | | 87.8 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 130.6 | |

|

Investments

|

| | | | 493.1 | | | | | | — | | | | | | — | | | | | | | | | | | | 16.1 | | | | |

|

R15

|

| | | | | (140.9) | | | | |

|

A3

|

| | | | | 368.3 | |

|

Intangible assets

|

| | | | — | | | | | | — | | | | | | 10.9 | | | | |

|

R4

|

| | | | | 4.5 | | | | |

|

R16

|

| | | | | 1,995.5 | | | | |

|

A4

|

| | | | | 2,010.9 | |

|

Goodwill

|

| | | | 534.8 | | | | | | 131.8 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 1,787.0 | | | | |

|

A5

|

| | | | | 2,453.6 | |

|

Other assets

|

| | | | 68.0 | | | | | | 111.3 | | | | | | (37.0) | | | | |

|

R5

|

| | | | | (107.0) | | | | |

|

R17

|

| | | | | — | | | | | | | | | | | | 35.3 | |

|

Deferred tax assets

|

| | | | 166.9 | | | | | | 21.5 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | (187.0) | | | | |

|

A10

|

| | | | | 1.4 | |

|

Total assets

|

| | | $ | 3,715.3 | | | | | $ | 1,640.5 | | | | | $ | — | | | | | | | | | | | $ | — | | | | | | | | | | | $ | 3,556.8 | | | | | | | | | | | $ | 8,912.6 | |

| LIABILITIES | | | | | | | | | | | ||||||||||||||||||||||||||||||||||||||||||||

|

Accounts payable and accrued liabilities

|

| | | $ | 288.8 | | | | | $ | 278.3 | | | | | $ | (22.4) | | | | |

|

R6

|

| | | | $ | (144.1) | | | | |

|

R18

|

| | | | $ | (16.0) | | | | |

|

A6

|

| | | | $ | 384.6 | |

|

Capital lease obligations—short term

portion |

| | | | — | | | | | | 5.8 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 5.8 | |

|

Participations and residuals

|

| | | | — | | | | | | — | | | | | | 475.0 | | | | |

|

R7

|

| | | | | 81.9 | | | | |

|

R19

|

| | | | | — | | | | | | | | | | | | 556.9 | |

|

Film obligations and production loans

|

| | | | — | | | | | | — | | | | | | 551.5 | | | | |

|

R8

|

| | | | | 62.2 | | | | |

|

R20

|

| | | | | — | | | | | | | | | | | | 613.7 | |

|

Corporate debt—short term portion

|

| | | | — | | | | | | — | | | | | | 40.6 | | | | |

|

R9

|

| | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 40.6 | |

|

Deferred revenue

|

| | | | | | | | | | 12.2 | | | | | | 238.2 | | | | |

|

R10

|

| | | | | — | | | | | | | | | | | | (12.2) | | | | |

|

A7

|

| | | | | 238.2 | |

|

Total current liabilities

|

| | | | | | | | | | 296.3 | | | | | | 1,282.9 | | | | | | | | | | | | — | | | | | | | | | | | | (28.2) | | | | | | | | | | | | 1,839.8 | |

|

Corporate debt

|

| | | | 931.5 | | | | | | 1,074.5 | | | | | | (40.6) | | | | |

|

R11

|

| | | | | (56.2) | | | | |

|

R21

|

| | | | | 1,758.5 | | | | |

|

A8

|

| | | | | 3,667.7 | |

|

Capital lease obligations

|

| | | | — | | | | | | — | | | | | | — | | | | | | | | | | | | 56.2 | | | | |

|

R21

|

| | | | | — | | | | | | | | | | | | 56.2 | |

|

Participations and residuals

|

| | | | 650.7 | | | | | | — | | | | | | (475.0) | | | | |

|

R7

|

| | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 175.7 | |

|

Film obligations and production loans

|

| | | | 560.9 | | | | | | | | | | | | (551.5) | | | | |

|

R12

|

| | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 9.4 | |

|

Deferred revenue

|

| | | | 321.5 | | | | | | | | | | | | (238.2) | | | | |

|

R10

|

| | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 83.3 | |

|

Other liabilities

|

| | | | — | | | | | | 34.1 | | | | | | 22.4 | | | | |

|

R6

|

| | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 56.5 | |

|

Deferred tax liabilities

|

| | | | — | | | | | | — | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 712.8 | | | | |

|

A9

|

| | | ||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | (187.0) | | | | |

|

A10

|

| | | | | 525.8 | |

|

Total liabilities

|

| | | $ | 2,753.4 | | | | | $ | 1,404.9 | | | | | $ | — | | | | | | | | | | | $ | — | | | | | | | | | | | $ | 2,256.1 | | | | | | | | | | | $ | 6,414.4 | |

|

Commitments and contingencies

|

| | | | | | | | | | ||||||||||||||||||||||||||||||||||||||||||||

|

Redeemable noncontrolling interest

|

| | | | 91.8 | | | | | | — | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 91.8 | |

| SHAREHOLDERS’ EQUITY | | | | | | | | | | | ||||||||||||||||||||||||||||||||||||||||||||

|

Common shares

|

| | | | 903.2 | | | | | | 1.0 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 1,592.2 | | | | |

|

A11

|

| | | | | 2,496.4 | |

|

Retained earnings

|

| | | | — | | | | | | 237.1 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | (312.0) | | | | |

|

A12

|

| | | | | (74.9) | |

|

Accumulated other comprehensive loss

|

| | | | (33.1) | | | | | | (2.5) | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 20.5 | | | | |

|

A13

|

| | | | | (15.1) | |

|

Total shareholders’ equity

|

| | | | 870.1 | | | | | | 235.6 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 1,300.7 | | | | | | | | | | | | 2,406.4 | |

|

Total liabilities and shareholders’ equity

|

| | | $ | 3,715.3 | | | | | $ | 1,640.5 | | | | | $ | — | | | | | | | | | | | $ | — | | | | | | | | | | | $ | 3,556.8 | | | | | | | | | | | $ | 8,912.6 | |

STATEMENT OF INCOME FOR THE YEAR ENDED

MARCH 31, 2016

| | | |

Historical

|

| |

Pro forma adjustments

|

| | | |||||||||||||||||||||||||||||||||

| | | |

Year ended

March 31, 2016 |

| |

12 months

ended March 31, 2016 |

| | | | | | ||||||||||||||||||||||||||||||

|

(in millions, except per share data)

|

| |

Lions Gate

Entertainment Corp. (note 1) |

| |

Starz

(note 1) |

| |

Starz

reclassification adjustments (note 5) |

| | | | | | | |

Pro forma

adjustments (note 6) |

| | | | | | | |

Pro forma

combined |

|||||||||||||||

|

Revenues

|

| | | $ | 2,347.4 | | | | | $ | 1,681.3 | | | | | $ | — | | | | | | | | | | | $ | (4.3) | | | | |

|

A14

|

| | | | $ | 4,024.4 | |

| Expenses: | | | | | | | | | ||||||||||||||||||||||||||||||||||

|

Direct operating

|

| | | | 1,415.3 | | | | | | — | | | | | | 883.7 | | | | |

|

R22

|

| | | | | (2.9) | | | | |

|

A15

|

| | | ||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 16.0 | | | | |

|

A16

|

| | | | | 2,312.1 | |

|

Programming (including amortization)

|

| | | | — | | | | | | 660.4 | | | | | | (660.4) | | | | |

|

R23

|

| | | | | — | | | | | | | | | | | | — | |

|

Production and acquisition (including

amortization) |

| | | | — | | | | | | 208.6 | | | | | | (208.6) | | | | |

|

R24

|

| | | | | — | | | | | | | | | | | | — | |

|

Home video cost of sales

|

| | | | — | | | | | | 40.6 | | | | | | (40.6) | | | | |

|

R25

|

| | | | | — | | | | | | | | | | | | — | |

|

Operating

|

| | | | — | | | | | | 42.0 | | | | | | (42.0) | | | | |

|

R26

|

| | | | | — | | | | | | | | | | | | — | |

|

Distribution and

marketing |

| | | | 661.8 | | | | | | — | | | | | | 215.3 | | | | |

|

R27

|

| | | | | — | | | | | | | | | | | | 877.1 | |

|

Selling general and administrative

|

| | | | — | | | | | | 329.4 | | | | | | (329.4) | | | | |

|

R28

|

| | | | | — | | | | | | | | | | | | — | |

|

General and administration

|

| | | | 282.2 | | | | | | — | | | | | | 182.0 | | | | |

|

R29

|

| | | | | (5.0) | | | | |

|

A17

|

| | | | | 459.2 | |

|

Depreciation and amortization

|

| | | | 13.1 | | | | | | 19.0 | | | | | | — | | | | | | | | | | | | 103.4 | | | | |

|

A18

|

| | | | | 135.5 | |

|

Total expenses

|

| | | | 2,372.4 | | | | | | 1,300.0 | | | | | | — | | | | | | | | | | | | 111.5 | | | | | | | | | | | | 3,783.9 | |

|

Operating income (loss)

|

| | | | (25.0) | | | | | | 381.3 | | | | | | — | | | | | | | | | | | | (115.8) | | | | | | | | | | | | 240.5 | |

| Other expenses (income): | | | | | | | | | ||||||||||||||||||||||||||||||||||

|

Interest expense

|

| | | | 54.9 | | | | | | 46.7 | | | | | | — | | | | | | | | | | | | 96.2 | | | | |

|

A19

|

| | | | | 197.8 | |

|

Interest and other (income) expense

|

| | | | (1.9) | | | | | | 13.1 | | | | | | (13.2) | | | | |

|

R30

|

| | | | | — | | | | | | | | | | | | (2.0) | |

|

Total other expenses, net

|

| | | | 53.0 | | | | | | 59.8 | | | | | | (13.2) | | | | | | | | | | | | 96.2 | | | | | | | | | | | | 195.8 | |

|

Income (loss) before equity interests and income

taxes |

| | | | (78.0) | | | | | | 321.5 | | | | | | 13.2 | | | | | | | | | | | | (212.0) | | | | | | | | | | | | 44.7 | |

|

Equity interests income

(loss) |

| | | | 44.2 | | | | | | — | | | | | | (13.2) | | | | |

|

R30

|

| | | | | — | | | | | | | | | | | | 31.0 | |

|

Income (loss) before income taxes

|

| | | | (33.8) | | | | | | 321.5 | | | | | | — | | | | | | | | | | | | (212.0) | | | | | | | | | | | | 75.7 | |

|

Income tax provision (benefit)

|

| | | | (76.5) | | | | | | 104.1 | | | | | | — | | | | | | | | | | | | (108.2) | | | | |

|

A20

|

| | | | | (80.6) | |

|

Net income

|

| | | | 42.7 | | | | | | 217.4 | | | | | | — | | | | | | | | | | | | (103.8) | | | | | | | | | | | | 156.3 | |

|

Less: Net loss attributable to noncontrolling interest

|

| | | | 7.5 | | | | | | 1.1 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 8.6 | |

|

Net income attributable to Lions Gate Entertainment Corp. shareholders

|

| | | $ | 50.2 | | | | | $ | 218.5 | | | | | $ | — | | | | | | | | | | | $ | (103.8) | | | | | | | | | | | $ | 164.9 | |

Basic Net Income per Common Share

|

| | | $ | 0.34 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 0.77 | |

Diluted Net Income per Common Share

|

| | | $ | 0.33 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 0.73 | |

Weighted average number of common shares outstanding:

|

| | | | | | | | ||||||||||||||||||||||||||||||||||

Basic

|

| | | | 148.5 | | | | | | | | | | | | | | | | | | | | | | | | 66.9 | | | | |

|

A21

|

| | | | | 215.4 | |

Diluted

|

| | | | 154.1 | | | | | | | | | | | | | | | | | | | | | | | | 76.7 | | | | |

|

A22

|

| | | | | 230.8 | |

STATEMENT OF INCOME FOR THE THREE MONTHS ENDED JUNE 30, 2016

| | | |

Historical

|

| |

Pro forma adjustments

|

| | | |||||||||||||||||||||||||||||||||

|

(in millions, except per share data)

|

| |

Lions Gate

Entertainment Corp. (note 1) |

| |

Starz

(note 1) |

| |

Starz

reclassification adjustments (note 5) |

| | | | | | | |

Pro forma

adjustments (note 6) |

| | | | | | | |

Pro forma

combined |

|||||||||||||||

|

Revenues

|

| | | $ | 553.6 | | | | | $ | 402.6 | | | | | $ | — | | | | | | | | | | | $ | (0.4) | | | | |

|

A14

|

| | | | $ | 955.8 | |

| Expenses: | | | | | | | | | ||||||||||||||||||||||||||||||||||

|

Direct operating

|

| | | | 366.3 | | | | | | — | | | | | | 193.0 | | | | |

|

R22

|

| | | | | (0.7) | | | | |

|

A15

|

| | | ||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2.5 | | | | |

|

A16

|

| | | | | 561.1 | |

|

Programming (including amortization)

|

| | | | — | | | | | | 148.1 | | | | | | (148.1) | | | | |

|

R23

|

| | | | | — | | | | | | | | | | | | — | |

|

Production and acquisition (including amortization)

|

| | | | — | | | | | | 43.2 | | | | | | (43.2) | | | | |

|

R24

|

| | | | | — | | | | | | | | | | | | — | |

|

Home video cost of sales

|

| | | | — | | | | | | 5.1 | | | | | | (5.1) | | | | |

|

R25

|

| | | | | — | | | | | | | | | | | | — | |

|

Operating

|

| | | | — | | | | | | 7.1 | | | | | | (7.1) | | | | |

|

R26

|

| | | | | — | | | | | | | | | | | | — | |

|

Distribution and marketing

|

| | | | 125.0 | | | | | | — | | | | | | 47.2 | | | | |

|

R27

|

| | | | | — | | | | | | | | | | | | 172.2 | |

|

Selling general and

administrative |

| | | | — | | | | | | 79.0 | | | | | | (79.0) | | | | |

|

R28

|

| | | | | — | | | | | | | | | | | | — | |

|

General and administration

|

| | | | 78.7 | | | | | | — | | | | | | 51.8 | | | | |

|

R29

|

| | | | | (19.6) | | | | |

|

A17

|

| | | | | 110.9 | |

|

Merger related

|

| | | | — | | | | | | 9.5 | | | | | | (9.5) | | | | |

|

R31

|

| | | | | — | | | | | | | | | | | | — | |

|

Depreciation and amortization

|

| | | | 5.6 | | | | | | 5.2 | | | | | | — | | | | | | | | | | | | 25.9 | | | | |

|

A18

|

| | | | | 36.7 | |

|

Total expenses

|

| | | | 575.6 | | | | | | 297.2 | | | | | | — | | | | | | | | | | | | 8.1 | | | | | | | | | | | | 880.9 | |

|

Operating income (loss)

|

| | | | (22.0) | | | | | | 105.4 | | | | | | — | | | | | | | | | | | | (8.5) | | | | | | | | | | | | 74.9 | |

| Other expenses (income): | | | | | | | | | ||||||||||||||||||||||||||||||||||

|

Interest expense

|

| | | | 15.2 | | | | | | 11.5 | | | | | | —. | | | | | | | | | | | | 22.5 | | | | |

|

A19

|

| | | | | 49.2 | |

|

Interest and other (income) expense

|

| | | | (0.9) | | | | | | 6.7 | | | | | | (4.7) | | | | |

|

R30

|

| | | | | — | | | | | | | | | | | | 1.1 | |

|

Total other expenses, net

|

| | | | 14.3 | | | | | | 18.2 | | | | | | (4.7) | | | | | | | | | | | | 22.5 | | | | | | | | | | | | 50.3 | |

|

Income (loss) before equity interests and income taxes

|

| | | | (36.3) | | | | | | 87.2 | | | | | | 4.7 | | | | | | | | | | | | (31.0) | | | | | | | | | | | | 24.6 | |

|

Equity interests income (loss)

|

| | | | 10.8 | | | | | | - | | | | | | (4.7) | | | | |

|

R30

|

| | | | | — | | | | | | | | | | | | 6.1 | |

|

Income (loss) before income taxes

|

| | | | (25.5) | | | | | | 87.2 | | | | | | — | | | | | | | | | | | | (31.0) | | | | | | | | | | | | 30.7 | |

|

Income tax provision (benefit)

|

| | | | (26.3) | | | | | | 32.8 | | | | | | — | | | | | | | | | | | | (19.0) | | | | |

|

A20

|

| | | | | (12.5) | |

|

Net income

|

| | | | 0.8 | | | | | | 54.4 | | | | | | — | | | | | | | | | | | | (12.0) | | | | | | | | | | | | 43.2 | |

|

Less: Net loss attributable to noncontrolling interest

|

| | | | 0.4 | | | | | | — | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 0.4 | |

|

Net income attributable to Lions Gate Entertainment Corp. shareholders

|

| | | $ | 1.2 | | | | | $ | 54.4 | | | | | $ | — | | | | | | | | | | | $ | (12.0) | | | | | | | | | | | $ | 43.6 | |

Basic Net Income per Common Share

|

| | | $ | 0.01 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 0.20 | |

Diluted Net Income per Common Share

|

| | | $ | 0.01 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 0.19 | |

Weighted average number of common shares outstanding:

|

| | | | | | | | ||||||||||||||||||||||||||||||||||

Basic

|

| | | | 147.2 | | | | | | | | | | | | | | | | | | | | | | | | 66.9 | | | | |

|

A21

|

| | | | | 214.1 | |

Diluted

|

| | | | 149.6 | | | | | | | | | | | | | | | | | | | | | | | | 78.1 | | | | |

|

A22

|

| | | | | 227.7 | |

STATEMENT OF INCOME FOR THE THREE MONTHS ENDED JUNE 30, 2015

| | | |

Historical

|

| |

Pro forma adjustments

|

| | | |||||||||||||||||||||||||||||||||

|

(in millions, except per share data)

|

| |

Lions Gate

Entertainment Corp. (note 1) |

| |

Starz

(note 1) |

| |

Starz

reclassification adjustments (note 5) |

| | | | | | | |

Pro forma

adjustments (note 6) |

| | | | | | | |

Pro forma

combined |

|||||||||||||||

|

Revenues

|

| | | $ | 408.9 | | | | | $ | 417.7 | | | | | $ | — | | | | | | | | | | | $ | (0.7) | | | | |

|

A14

|

| | | | $ | 825.9 | |

| Expenses: | | | | | | | | | ||||||||||||||||||||||||||||||||||

|

Direct operating

|

| | | | 230.3 | | | | | | — | | | | | | 210.1 | | | | |

|

R22

|

| | | | | (0.4) | | | | |

|

A15

|

| | | ||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 4.3 | | | | |

|

A16

|

| | | | | 444.3 | |

|

Programming (including amortization)

|

| | | | — | | | | | | 154.5 | | | | | | (154.5) | | | | |

|

R23

|

| | | | | — | | | | | | | | | | | | — | |

|

Production and acquisition (including amortization)

|

| | | | — | | | | | | 50.0 | | | | | | (50.0) | | | | |

|

R24

|

| | | | | — | | | | | | | | | | | | — | |

|

Home video cost of sales

|

| | | | — | | | | | | 10.0 | | | | | | (10.0) | | | | |

|

R25

|

| | | | | — | | | | | | | | | | | | — | |

|

Operating

|

| | | | — | | | | | | 12.4 | | | | | | (12.4) | | | | |

|

R26

|

| | | | | — | | | | | | | | | | | | — | |

|

Distribution and marketing

|

| | | | 71.9 | | | | | | — | | | | | | 51.7 | | | | |

|

R27

|

| | | | | — | | | | | | | | | | | | 123.6 | |

|

Selling general and

administrative |

| | | | — | | | | | | 75.5 | | | | | | (75.5) | | | | |

|

R28

|

| | | | | — | | | | | | | | | | | | — | |

|

General and administration

|

| | | | 60.7 | | | | | | — | | | | | | 40.6 | | | | |

|

R29

|

| | | | | 0.7 | | | | |

|

A17

|

| | | | | 102.0 | |

|

Depreciation and amortization

|

| | | | 1.8 | | | | | | 4.8 | | | | | | — | | | | | | | | | | | | 25.9 | | | | |

|

A18

|

| | | | | 32.5 | |

|

Total expenses

|

| | | | 364.7 | | | | | | 307.2 | | | | | | — | | | | | | | | | | | | 30.5 | | | | | | | | | | | | 702.4 | |

|

Operating income (loss)

|

| | | | 44.2 | | | | | | 110.5 | | | | | | — | | | | | | | | | | | | (31.2) | | | | | | | | | | | | 123.5 | |

| Other expenses (income): | | | | | | | | | ||||||||||||||||||||||||||||||||||

|

Interest expense

|

| | | | 12.7 | | | | | | 11.3 | | | | | | — | | | | | | | | | | | | 24.6 | | | | |

|

A19

|

| | | | | 48.6 | |

|

Interest and other (income) expense

|

| | | | (0.6) | | | | | | 2.1 | | | | | | (3.3) | | | | |

|

R30

|

| | | | | — | | | | | | | | | | | | (1.8) | |

|

Total other expenses, net

|

| | | | 12.1 | | | | | | 13.4 | | | | | | (3.3) | | | | | | | | | | | | 24.6 | | | | | | | | | | | | 46.8 | |

|

Income (loss) before equity interests and income taxes

|

| | | | 32.1 | | | | | | 97.1 | | | | | | 3.3 | | | | | | | | | | | | (55.8) | | | | | | | | | | | | 76.7 | |

|

Equity interests income (loss)

|

| | | | 11.4 | | | | | | — | | | | | | (3.3) | | | | |

|

R30

|

| | | | | — | | | | | | | | | | | | 8.1 | |

|

income (loss) before income taxes

|

| | | | 43.5 | | | | | | 97.1 | | | | | | — | | | | | | | | | | | | (55.8) | | | | | | | | | | | | 84.8 | |

|

Income tax provision (benefit)

|

| | | | 2.8 | | | | | | 34.1 | | | | | | — | | | | | | | | | | | | (27.6) | | | | |

|

A20

|

| | | | | 9.3 | |

|

Net income

|

| | | | 40.7 | | | | | | 63.0 | | | | | | — | | | | | | | | | | | | (28.2) | | | | | | | | | | | | 75.5 | |

|

Less: Net loss attributable to noncontrolling interest

|

| | | | — | | | | | | 0.4 | | | | | | — | | | | | | | | | | | | — | | | | | | | | | | | | 0.4 | |

|

Net income attributable to

Lions Gate Entertainment Corp. shareholders |

| | | $ | 40.7 | | | | | $ | 63.4 | | | | | $ | — | | | | | | | | | | | $ | (28.2) | | | | | | | | | | | $ | 75.9 | |

Basic Net Income per Common Share

|

| | | $ | 0.28 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 0.35 | |

Diluted Net Income per Common Share

|

| | | $ | 0.26 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 0.33 | |

Weighted average number of common shares outstanding:

|

| | | | | | | | ||||||||||||||||||||||||||||||||||

Basic

|

| | | | 147.6 | | | | | | | | | | | | | | | | | | | | | | | | 66.9 | | | | |

|

A21

|

| | | | | 214.5 | |

Diluted

|

| | | | 157.5 | | | | | | | | | | | | | | | | | | | | | | | | 72.0 | | | | |

|

A22

|

| | | | | 229.5 | |

|

(in millions)

|

| | | | | | | | | | | |

|

Market value, as of August 19, 2016, of Starz Series A and Series B common stock already owned by Lions Gate(1)

|

| | | | | | | | | $ | 157.4 | |

| Cash consideration to be paid to Starz stockholders | | | | |||||||||

|

Starz Series A common stock at $18.00

|

| | | $ | 1,531.8 | | | | ||||

|

Starz Series B common stock at $7.26

|

| | | | 52.7 | | | | ||||

| | | | | | | | | | | | 1,584.5 | |

|

Fair value of Lions Gate voting and non-voting shares to be issued to Starz’s stockholders

|

| | | |||||||||

|

Starz Series A common stock at exchange ratio of 0.6784 Lions Gate non-voting shares

|

| | | | 1,218.7 | | | | ||||

|

Starz Series B common stock at exchange ratio of 0.6321 Lions Gate voting shares

|

| | | | 99.9 | | | | ||||

|

Starz Series B common stock at exchange ratio of 0.6321 Lions Gate non-voting shares

|

| | | | 97.0 | | | | ||||

| | | | | | | | | | | | 1,415.6 | |

|

Replacement of Starz share-based payment awards

|

| | | | | | | | | | 177.6 | |

|

Total preliminary estimated purchase consideration

|

| | | | | | | | | $ | 3,335.1 | |

| | Weighted average assumptions: | | | ||

| |

Risk-free interest rate(1)

|

| |

0.3% – 1.0%

|

|

| |

Expected option lives (years)(2)

|

| |

0.2 – 4.8 years

|

|

| |

Expected volatility(3)

|

| |

35%

|

|

| |

Expected dividend yield(4)

|

| |

0%

|

|

|

(in millions)

|

| |

10% increase

in Lions Gate share price |

| |

10% decrease

in Lions Gate share price |

|||||

|

Starz shares already owned by Lions Gate(1)

|

| | | $ | 167.5 | | | | | $ | 147.4 |

|

Cash consideration to be paid to Starz stockholders (no change)

|

| | | | 1,584.5 | | | | | | 1,584.5 |

|

Fair value of Lions Gate voting and non-voting shares to be issued to Starz’s stockholders

|

| | | | 1,557.2 | | | | | | 1,274.0 |

|

Replacement of Starz share-based payment awards(1)

|

| | | | 191.3 | | | | | | 164.1 |

|

Total preliminary estimated purchase consideration

|

| | | $ | 3,500.5 | | | | | $ | 3,170.0 |

|

Estimated goodwill

|

| | | $ | 2,084.2 | | | | | $ | 1,753.7 |

|

(in millions)

|

| | | | | |

| Sources: | | | ||||

|

Available cash

|

| | | $ | 82.8 | |

|

Proceeds from notes

|

| | | | 520.0 | |

|

Proceeds from Senior Credit Facilities

|

| | | | 3,050.0 | |

|

Proceeds from Bridge Facility

|

| | | | 150.0 | |

|

Total sources

|

| | | $ | 3,802.8 | |

| Uses: | | | ||||

|

Cash consideration to be paid to Starz’s stockholders

|

| | | $ | 1,584.5 | |

|

Repayment of the Existing Starz Credit Facility

|

| | | | 352.0 | |

|

Repayment of the Starz 2019 Notes

|

| | | | 675.0 | |

|

Repayment of the Existing Lions Gate Credit Facility

|

| | | | 225.0 | |

|

Repayment of the Existing Lions Gate Term Loan

|

| | | | 400.0 | |

|

Repayment of the Lions Gate 2018 Notes

|

| | | | 225.0 | |

|

Estimated costs associated with debt refinancing

|

| | | | 142.8 | |

|

Estimated acquisition related costs

|

| | | | 69.5 | |

|

Cash to fund operations

|

| | | | 129.0 | |

|

Total uses

|

| | | $ | 3,802.8 | |

|

(in millions)

|

| | | | |

|

Cash and cash equivalents

|

| | | $ | 12.9 |

|

Accounts receivable, net

|

| | | | 409.8 |

|

Program rights

|

| | | | 701.7 |

|

Investment in films and television programs, net

|

| | | | 279.2 |

|

Property and equipment, net

|

| | | | 87.8 |

|

Investments

|

| | | | 16.1 |

|

Intangible assets

|

| | | | 2,000.0 |

|

Other assets

|

| | | | 31.2 |

|

Accounts payable and accrued liabilities

|

| | | | (157.5) |

|

Corporate debt

|

| | | | (1,101.7) |

|

Deferred tax liabilities

|

| | | | (685.0) |

|

Other liabilities

|

| | | | (178.2) |

|

Fair value of net assets acquired

|

| | | | 1,416.3 |

|

Goodwill

|

| | | | 1,918.8 |

|

Total estimated purchase consideration

|

| | | $ | 3,335.1 |

|

(in millions)

|

| |

Estimated

fair value |

| |

Average

estimated useful life |

| |||

|

Customer relationships

|

| | | $ | 1,780 | | | |

17 years

|

|

|

Trade names

|

| | | | 220 | | | |

indefinite-lived

|

|

| | | | | $ | 2,000 | | | | | |

| |

R1

|

| |

To reclassify the noncurrent portion of accounts receivable

|

| | |

$

|

(243.8)

|

| |

R2

|

| |

To reclassify the current portion of other assets

|

| | | $ | 26.1 |

| | | | |

To reclassify product inventory from investment in films and television

programs to other current assets |

| | | | 21.0 |

| | | | | | | | | $ | 47.1 |

| | R3 | | |

To reclassify product inventory from investment in films and television

programs to other current assets |

| | | $ | (21.0) |

| | R4 | | |

To reclassify intangible assets from noncurrent other assets

|

| | | $ | 10.9 |

| |

R5

|

| |

To reclassify the current portion of other assets

|

| | | $ | (26.1) |

| | | | |

To reclassify intangible assets from noncurrent other assets

|

| | | | (10.9) |

| | | | | | | | | $ | (37.0) |

| | R6 | | |

To reclassify deferred rent from accounts payable and accrued liabilities to

other liabilities |

| | | $ | (22.4) |

| | R7 | | |

To reclassify the current portion of participations and residuals

|

| | | $ | 475.0 |

| | R8 | | |

To reclassify the current portion of film obligations and production loans

|

| | | $ | 551.5 |

| | R9 | | |

To reclassify the current portion of convertible senior subordinated notes

|

| | | $ | 40.6 |

| | R10 | | |

To reclassify the current portion of deferred revenue

|

| | | $ | 238.2 |

| | R11 | | |

To reclassify the current portion of convertible senior subordinated notes

|

| | | $ | (40.6) |

| | R12 | | |

To reclassify the current portion of film obligations and production loans

|

| | | $ | (551.5) |

| | R13 | | |

To reclassify the current portion of tax credit receivables and other

receivables from other current assets to current accounts receivables |

| | | $ | 33.6 |

| |

R14

|

| |

To reclassify the noncurrent portion of tax credit receivables and other

receivables from other noncurrent assets to noncurrent accounts receivables |

| | |

$

|

86.4

|

| | R15 | | |

To reclassify equity method investments from other noncurrent assets to

investments |

| | | $ | 16.1 |

| | R16 | | |

To reclassify intangible assets from other noncurrent assets to intangible

assets |

| | | $ | 4.5 |

| |

R17

|

| |

To reclassify the noncurrent portion of tax credit receivables and other

receivables from other noncurrent assets to noncurrent accounts receivables |

| | | $ | (86.4) |

| | | | |

To reclassify equity method investments from other noncurrent assets to

investments |

| | | | (16.1) |

| | | | |

To reclassify intangible assets from other noncurrent assets to intangible

assets |

| | | | (4.5) |

| | | | | | | | | $ | (107.0) |

| |

R18

|

| |

To reclassify royalties, residuals and participations liabilities from accrued

liabilities to current participations and residuals |

| | | $ | (81.9) |

| | | | |

To reclassify program rights payable from accrued liabilities to current film

obligations and production loans |

| | | | (62.2) |

| | | | | | | | | $ | (144.1) |

| | R19 | | |

To reclassify royalties, residuals and participations liabilities from accrued

liabilities to current participations and residuals |

| | | $ | 81.9 |

| | R20 | | |

To reclassify program rights payable from accrued liabilities to current film

obligations and production loans |

| | | $ | 62.2 |

| | R21 | | |

To reclassify the noncurrent portion of capital lease obligations from

corporate debt to capital lease obligations |

| | | $ | (56.2) |

|

(in millions)

|

| |

Twelve months

ended March 31, 2016 |

| |

Three months

ended June 30, 2016 |

| |

Three months

ended June 30, 2015 |

|||||||||||

|

R22

|

| |

To reclassify programming expense to direct

operating expense |

| | | $ | 657.7 | | | | | $ | 147.5 | | | | | $ | 153.8 |

| | | |

To reclassify production and acquisition expense to