Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - Axar Acquisition Corp. | v449527_ex2-1.htm |

| 8-K - FORM 8-K - Axar Acquisition Corp. | v449527_8k.htm |

Exhibit 99.1

AR CAPITAL ACQUISITION CORP. INVESTOR PRESENTATION September 27, 2016

1 Page 1 DISCLAIMER The information in this presentation (this “Presentation”) is being provided by AR Capital Acquisition Corp . (“AUMA”) to you (“Recipient”, “you” or “your”) in connection with AUMA’s special meeting of stockholders and special meeting of warrant holders relating to the proposed acquisition of all of the founder shares and private placement warrants held by AUMA’s current sponsor by an investment fund managed by Axar Capital Management L . P . (“ Axar”) and the proposals to be voted on at the special meetings (the “Proposals”) including, without limitation, proposals to change AUMA name to Axar Acquisition Corp . and to extend the date by which AUMA must complete a business combination to (i) October 1 , 2017 or (ii) if prior to October 1 , 2017 the SPAC publicly discloses that an extension past October 1 , 2017 will not prevent the SPAC from maintaining the listing of its securities on The Nasdaq Capital Market, December 31 , 2017 . This Presentation is for informational purposes only and does not constitute a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Proposals and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of AUMA, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction . This Presentation has been prepared to assist interested parties in making their own evaluation with respect to the Proposals and for no other purpose . The information contained herein is not, and should not be assumed to be, complete . No securities commission or securities regulatory authority or other regulatory or other authority in the United States or any other jurisdiction has in any way passed upon the merits of, or the accuracy and adequacy of, this Presentation . The data contained herein is derived from various internal and external sources . No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or any other information contained herein . Any data on past performance is no indication as to future performance . Forward Looking Statements This presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . Such forward looking statements are based on current expectations that are subject to risks and uncertainties . A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements including those described in the definitive proxy statement relating to the Proposals (the “Definitive Proxy Statement”) filed with the Securities and Exchange Commission (“SEC”) on September 26 , 2016 , and other filings with the SEC by AUMA . You are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made, and AUMA and Axar undertake no obligation to update or revise the forward - looking statements, whether as a result of new information, future events or otherwise .

2 Page 2 DISCLAIMER Additional Information In connection with the Proposals, AUMA has filed the Definitive Proxy Statement with the SEC and mailed such proxy statement and other relevant documents to AUMA stockholders . This Presentation does not contain all the information that should be considered concerning the Proposals . It is not intended to form the basis of any voting or investment decision or any other decision in connection with the Proposals . AUMA stockholders and other interested persons are advised to read the Definitive Proxy Statement and any amendments thereto, because these materials contain important information about the Proposals . The record date established for voting on the Proposals is September 20 , 2016 . Stockholders may obtain a copy of the Definitive Proxy Statement, without charge, at the SEC’s website at http : //www . sec . gov, or by directing a request to AR Capital Acquisition Corp . , 405 Park Avenue, 14 th Floor, New York, New York 10022 , Attention : Legal Department, Tel . ( 212 ) 415 - 6500 . Participants in the Solicitation AUMA and its directors and officers may be deemed participants in the solicitation of proxies to AUMA’s stockholders with respect to the transaction . A list of the names of those directors and officers and a description of their interests in AUMA is contained in the Definitive Proxy Statement .

3 Page 3 SPAC TRANSACTION OVERVIEW Axar Capital has entered into an agreement to become the new sponsor of AUMA (the “SPAC ”) TRANSACTION OVERVIEW Name: AUMA will change its name to Axar Acquisition Corp. Lead Officer: Andrew Axelrod will become CEO and Executive Chairman. Nicholas Schorsch , William Kahane and Nicholas Radesca will resign from all their roles at the SPAC effective upon approval of the amendment. Expiration: The SPAC will have until (i) October 1, 2017 or (ii) if prior to October 1, 2017 the SPAC publicly discloses that an extension past October 1, 2017 will not prevent the SPAC from maintaining the listing of its securities on The Nasdaq Capital Market, December 31, 2017 to complete a business combination Shareholder Approval Rights: Shareholders will continue to have approval rights and future redemption rights in connection with a business combination Size: Between $25 to $100 million of equity, excluding sponsor support Axar Sponsor Support: Axar will purchase at least $100 million of common stock at $10.00 per share in connection with a business combination Promote: Axar to acquire all of the current sponsor’s founder shares and private placement warrants (“promote structure”), with exercise price of private placement warrants increased to $12.50 per share New Size: Reverse stock split and cash dividend to ensure that no more than $100 million / 10 million public shares remain after the shareholder vote / redemptions Note : The SPAC transaction and terms herein are subject to shareholder and warrant holder approval, as applicable.

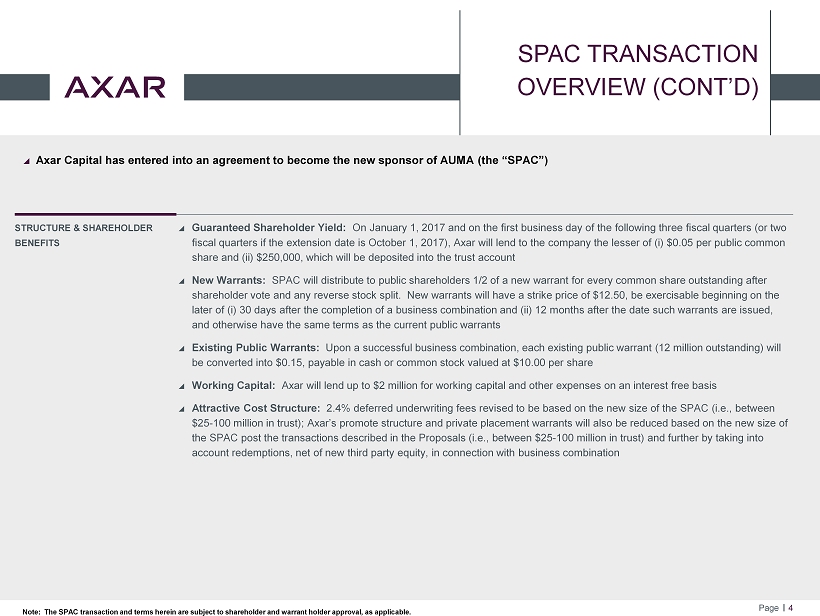

4 Page 4 SPAC TRANSACTION OVERVIEW (CONT’D) Axar Capital has entered into an agreement to become the new sponsor of AUMA (the “SPAC ”) STRUCTURE & SHAREHOLDER BENEFITS Guaranteed Shareholder Yield: On January 1, 2017 and on the first business day of the following three fiscal quarters (or two fiscal quarters if the extension date is October 1, 2017), Axar will lend to the company the lesser of (i) $0.05 per public common share and (ii) $250,000, which will be deposited into the trust account New Warrants: SPAC will distribute to public shareholders 1/2 of a new warrant for every common share outstanding after shareholder vote and any reverse stock split . New warrants will have a strike price of $12.50, be exercisable beginning on the later of (i) 30 days after the completion of a business combination and (ii) 12 months after the date such warrants are issue d, and otherwise have the same terms as the current public warrants Existing Public Warrants: Upon a successful business combination, each existing public warrant (12 million outstanding) will be converted into $0.15, payable in cash or common stock valued at $10.00 per share Working Capital: Axar will lend up to $2 million for working capital and other expenses on an interest free basis Attractive Cost Structure: 2.4% deferred underwriting fees revised to be based on the new size of the SPAC (i.e., between $25 - 100 million in trust); Axar’s promote structure and private placement warrants will also be reduced based on the new size of the SPAC post the transactions described in the Proposals (i.e., between $25 - 100 million in trust) and further by taking into account redemptions, net of new third party equity, in connection with business combination Note : The SPAC transaction and terms herein are subject to shareholder and warrant holder approval, as applicable.

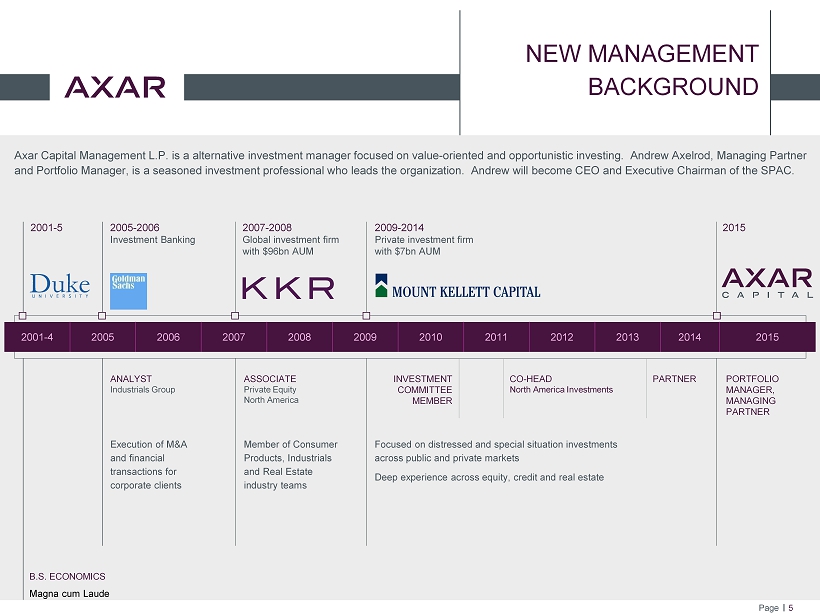

5 Page 5 2001 - 4 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2007 - 2008 Global investment firm with $96bn AUM Axar Capital Management L.P. is a alternative investment manager focused on value - oriented and opportunistic investing. Andrew Axelrod, Managing Partner and Portfolio Manager, is a seasoned investment professional who leads the organization. Andrew will become CEO and Executive Chairman of the SPAC. 2001 - 5 2005 - 2006 Investment Banking B.S. ECONOMICS Magna cum Laude ANALYST Industrials Group ASSOCIATE Private Equity North America 2009 - 2014 Private investment firm with $7bn AUM Execution of M&A and financial transactions for corporate clients Member of Consumer Products, Industrials and Real Estate industry teams Focused on distressed and special situation investments across public and private markets Deep experience across equity, credit and real estate PORTFOLIO MANAGER, MANAGING PARTNER 2015 CO - HEAD North America Investments PARTNER INVESTMENT COMMITTEE MEMBER NEW MANAGEMENT BACKGROUND

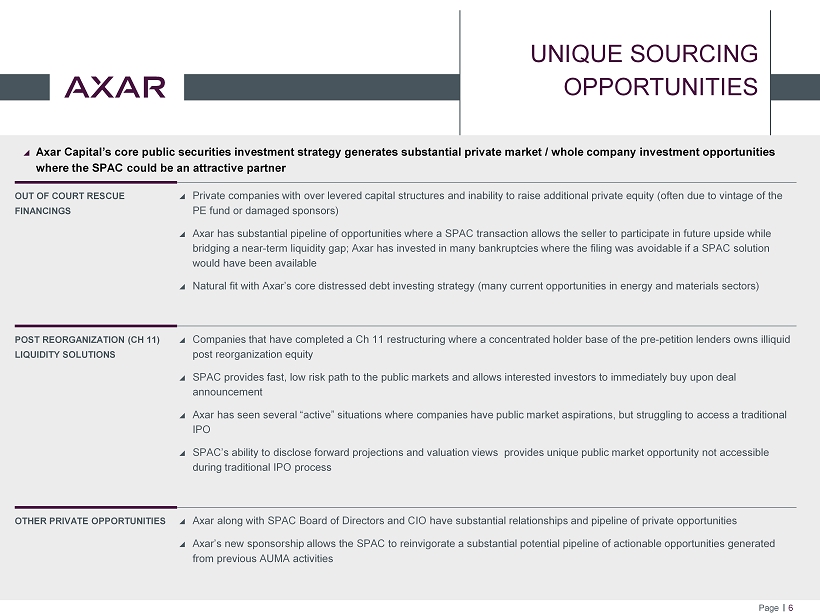

6 Page 6 UNIQUE SOURCING OPPORTUNITIES Axar Capital’s core public securities investment strategy generates substantial private market / whole company investment opportun it ies where the SPAC could be an attractive partner OUT OF COURT RESCUE FINANCINGS Private companies with over levered capital structures and inability to raise additional private equity (often due to vintage of the PE fund or damaged sponsors) Axar has substantial pipeline of opportunities where a SPAC transaction allows the seller to participate in future upside while bridging a near - term liquidity gap; Axar has invested in many bankruptcies where the filing was avoidable if a SPAC solution would have been available Natural fit with Axar’s core distressed debt investing strategy (many current opportunities in energy and materials sectors) POST REORGANIZATION (CH 11) LIQUIDITY SOLUTIONS Companies that have completed a Ch 11 restructuring where a concentrated holder base of the pre - petition lenders owns illiquid post reorganization equity SPAC provides fast, low risk path to the public markets and allows interested investors to immediately buy upon deal announcement Axar has seen several “active” situations where companies have public market aspirations, but struggling to access a traditional IPO SPAC’s ability to disclose forward projections and valuation views provides unique public market opportunity not accessible during traditional IPO process OTHER PRIVATE OPPORTUNITIES Axar along with SPAC Board of Directors and CIO have substantial relationships and pipeline of private opportunities Axar’s new sponsorship allows the SPAC to reinvigorate a substantial potential pipeline of actionable opportunities generated from previous AUMA activities