Attached files

| file | filename |

|---|---|

| EX-10.6 - EXHIBIT 6 - Leo Motors, Inc. | ex106.htm |

| S-1 - S-1 - Leo Motors, Inc. | leoms109222016.htm |

| EX-23.1 - EXHIBIT 23.1 - Leo Motors, Inc. | ex231.htm |

| EX-10.20 - EXHIBIT 10.20 - Leo Motors, Inc. | ex1020.htm |

| EX-10.19 - EXHIBIT 10.19 - Leo Motors, Inc. | ex1019.htm |

| EX-10.15 - EXHIBIT 15 - Leo Motors, Inc. | ex1015.htm |

| EX-10.14 - EXHIBIT 14 - Leo Motors, Inc. | ex1014.htm |

| EX-10.8 - EXHIBIT 8 - Leo Motors, Inc. | ex108.htm |

| EX-10.7 - EXHIBIT 7 - Leo Motors, Inc. | ex107.htm |

| EX-10.5 - EXHIBIT 5 - Leo Motors, Inc. | ex105.htm |

| EX-5.1 - EXHIBIT 5.1 - Leo Motors, Inc. | ex51.htm |

Exhibit 10.16

FIRST AMENDMENT TO SECURITIES PURCHASE AGREEMENT

This First Amendment to Securities Purchase Agreement (this "Amendment"), dated as of August 3, 2016, is entered into by and among Leo Motors, Inc., a Nevada corporation (the "Company"), and BOU Trust (the "Purchaser").

RECITALS:

A. On May 17, 2016, the Company entered into a securities purchase agreement (the "Purchase Agreement") pursuant to which the Company has the right to issue and sell to Purchaser from time to time, and Purchaser is obligated to purchase from the Company, up to $10,000,000 worth of shares of the Company's common stock, as more fully described in the Purchase Agreement. Capitalized terms used herein and not defined herein shall have the meanings given to them in the Purchase Agreement.

B. The Company and the Purchaser desire to amend the Purchase Agreement as set forth herein.

AGREEMENTS

NOW, THEREFORE, in consideration of the covenants and mutual promises contained herein and other good and valuable consideration, the receipt and legal sufficiency of which are hereby acknowledged and intending to be legally bound hereby, the parties agree as follows:

1. Section 4.12 of the Purchase Agreement is hereby amended and restated in its entirety to read as follows:

"The Shares. Notwithstanding, anything in this Agreement to the contrary, (i) the Company may not make a Draw Down to the extent that such Draw Down exceeds 4.99% of the then outstanding shares of Common Stock, and (ii) at no time will the Company request a Draw Down which would result in the issuance of an aggregate number of shares of Common Stock pursuant to this Agreement which exceeds 19.9% of the number of shares of Common Stock issued and outstanding on the date hereof without first obtaining stockholder approval of such excess issuance, or such other amount as would require stockholder approval under rules of the principal Trading Market or otherwise without first obtaining stockholder approval, if any, of such excess issuance."

2. Subsection 6.1(c) of the Purchase Agreement is hereby amended and restated in its entirety to read as follows:

"The quantity of Draw Down Shares as to each Draw Down shall be limited to the lesser of: (i) 4.99% of the then-current shares outstanding or (ii) the previous 10-day average trading volume of the Draw Down Shares multiplied by 3. There shall be a minimum Draw Down Investment Amount (the "Investment Amount") of $25,000 and a maximum Draw Down Investment Amount of $1,000,000. For avoidance of doubt, the calculation provided for herein shall be done at the beginning of the Draw Down Pricing Period."

3. Section 8.5 of the Purchase Agreement is hereby amended and restated in its entirety to read as follows:

"Intentionally Omitted."

4. Except as modified herein, the terms of the Purchase Agreement shall remain in full force and effect.

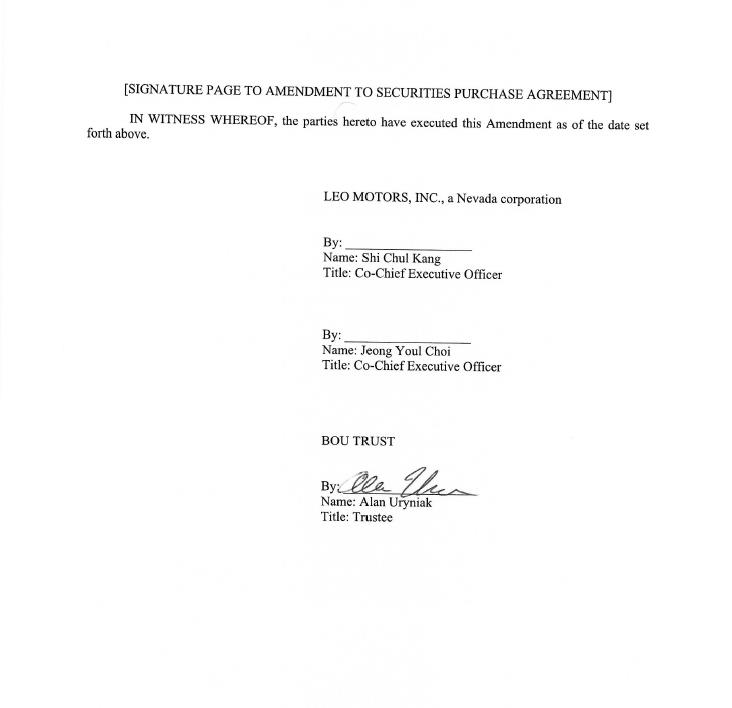

5. This Amendment may be executed in any number of counterparts, each of which when so executed shall be deemed to be an original and shall be binding upon all parties, their successors and assigns, and all of which taken together shall constitute one and the same Amendment. A signature delivered by facsimile shall constitute an original.

[Signature Page Follows]