Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of New York | d265481d8k.htm |

©

2016 FEDERAL HOME LOAN BANK OF NEW YORK • 101 PARK AVENUE • NEW YORK, NY 10178 • WWW.FHLBNY.COM Strong Performance for Members, Well-Positioned for the Future Meeting with New York Stockholders September 26, 2016 Exhibit 99.1 |

FHLBNY 2 » “Advances Bank” strategy » Strong performance record for customers and shareholders » Conservatively positioned balance sheet » FHLBank System’s financial results continue to improve since the financial crisis Key Messages |

FHLBNY FHLBNY Is the Third Largest FHLBank Ranked by Advances Total Advances ($ Billions) Change in Advances: 2Q07 vs 2Q16 Data as of 6/30/2016 3 $0 $20 $40 $60 $80 $100 $120 TOP IND DAL BOS CHI SFR PIT CIN NYK ATL DSM -100% 0% 100% 200% 300% 400% 500% TOP IND DAL BOS CHI SFR PIT CIN NYK ATL DSM |

FHLBNY Core Mission Assets Are the Foundation of our Balance Sheet 4 Balance Sheet by Type of Assets Note: Data as of 6/30/2016; ranked by Core Mission Assets (Advances plus MPF)

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% PIT CIN NYK ATL DSM TOP IND BOS CHI SFR DAL Advances MPF/MPP MBS Other Investments Cash and Other |

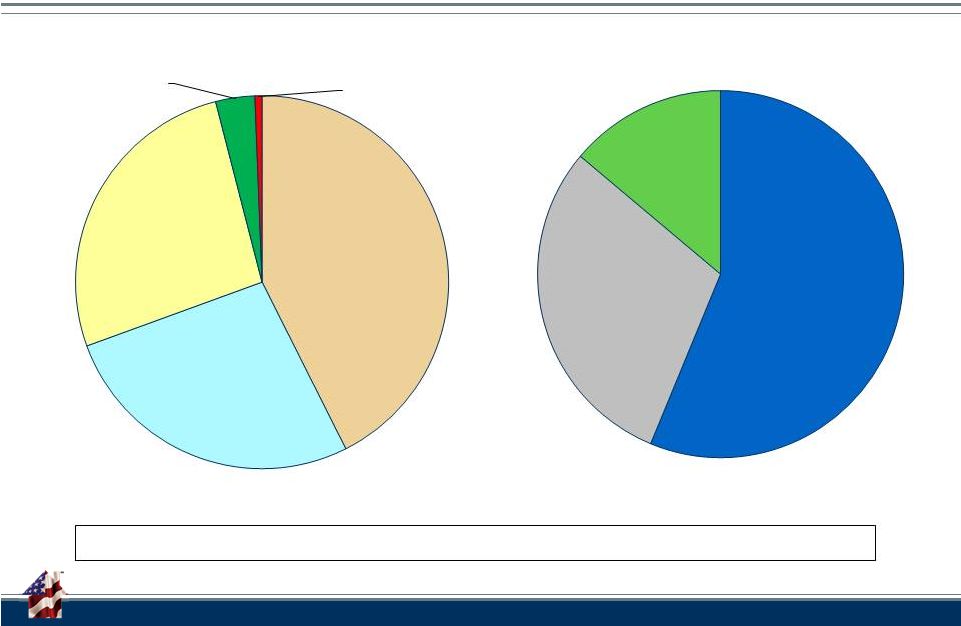

FHLBNY 5 FHLBNY’s Member Base and Borrowers Are Diverse Total Advances (Par) = $94.4 B Top Borrowers Member Type Data as of June 30, 2016 Our New York members held $78 billion in advances at quarter-end Top 5 Borrowers $53.1 All Other Borrowers $28.2 Next 5 Borrowers $13.1 Commercial Bank 138 Credit Union 87 Savings Bank 86 Insurance Company 11 CDFI 2 |

FHLBNY The FHLBNY’s Financial Performance Has Been Strong Notes: All $ millions. *Dividends paid during calendar period. 6 FHLBNY - Financial Results Highlights June 30, December 31, December 31, December 31, 2016 2015 2014 2013 Period End Balances Advances $95,273 $93,874 $98,797 $90,765 MBS Investments 14,387 14,065 13,552 13,373 Mortgage Loans 2,631 2,524 2,129 1,928 Total Assets 128,726 123,248 132,825 128,333 Consolidated Obligations 119,972 114,576 123,580 119,146 Retained Earnings 1,323 1,270 1083 999 Capital Stock 5,666 5,585 5,580 5,571 Results Net Interest Income $256 $554 $444 $421 Operating Expenses 49 103 86 83 Net Income 175 415 315 305 Dividend Rate* 4.58% 4.22% 4.19% 4.12% |

FHLBNY HLBNY’s Expense Management Has Been Prudent 7 Operating Expenses as a % of Average Total Assets – 2Q 2016 Note: Operating expenses include compensation, benefits and other expenses, excluding FHFA and OF assessments.

0.00% 0.02% 0.04% 0.06% 0.08% 0.10% 0.12% 0.14% 0.16% 0.18% 0.20% CIN DSM PIT NYK ATL TOP BOS IND DAL SFR CHI |

FHLBNY 8 Our Dividends Have Been Reliable and Exceeded Market Reference Rates FHLBNY Dividend History 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 FHLBNY Dividend 3 Month Libor Fed Funds (Effective Rate) |

FHLBNY FHLBNY Dividends Have Been the Highest Among the FHLBanks 9 0% 1% 2% 3% 4% 5% SEA DAL CHI BOS PIT ATL DSM TOP IND SFR CIN NYK Average HLB Dividend Rates 2009-2015 |

FHLBNY Our Strategic Objectives Balance: Achieving Returns, Managing Risk, Enabling Growth and Managing for the Long-term 10 1. Provide value to the membership through relevant, mission-oriented products and services and appropriate risk adjusted returns on capital stock 2. Protect the par value of member stock from risk and uncertainties and work to ensure the System’s long-term viability 3. Support the growth of the co-operative by pursuing business relationships with members/ prospects and pursuing community investment/outreach opportunities 4. Prepare for future operating environments by enhancing opportunities for employees 5. Adopt technical design strategies that optimize cost, efficiency and resiliency Strategic Plan 2016–2018: Strategic Objectives |

FHLBNY 11 The Theme for our Strategy is “Evolve From a Strong Base” Our Current Position is Strong • “Core mission” focused balance sheet • Strong earnings generation capability • Diversified membership, advances demand & local economy • Strong investor demand for FHLBank debt Threats/Opportunities to Watch • Global economic conditions & member margins • Debt market liquidity and FHLBank funding spreads • Other wholesale funding sources • New regulations • Member mergers |

FHLBNY FHLBank Balance Sheets Are Scalable to Meet Member Liquidity Needs 12 FHLBank System Advances Balances 0 200,000 400,000 600,000 800,000 1,000,000 1,200,000 FHLB System |

FHLBNY System Advances Have Grown Nicely in Recent Years FHLB System Change in Advance Balances 13 6.7% 3.4% 36.6% 6.1% -32.0% -24.2% -12.6% 1.8% 17.1% 14.5% 11.1% 8.8% -40% -30% -20% -10% 0% 10% 20% 30% 40% 50% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1H 16 |

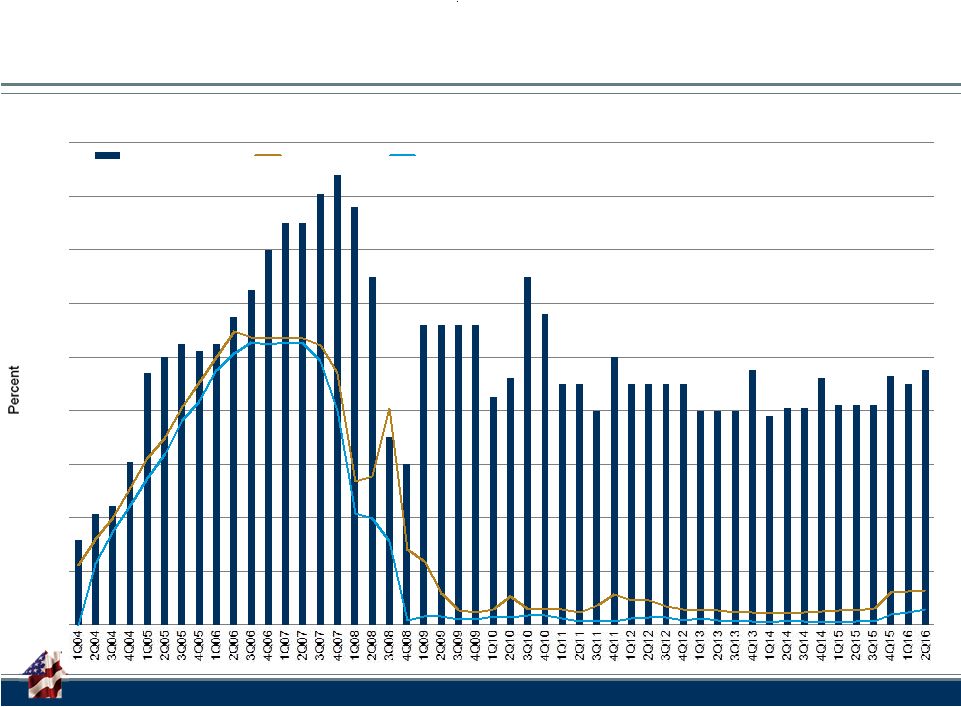

FHLBNY System Financial Performance Has Improved Considerably Since the Financial Crisis FHLBank System Net Income: 2001- 1H 2016 ($Millions) FHLBank System ROE: 2001- 1H 2016 14 Note: Results include gains on PLMBS litigation settlements :$600mm in 1H 2016, $688mm in 2015, $134mm in 2014.

$0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1H 16 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 1H 16 |

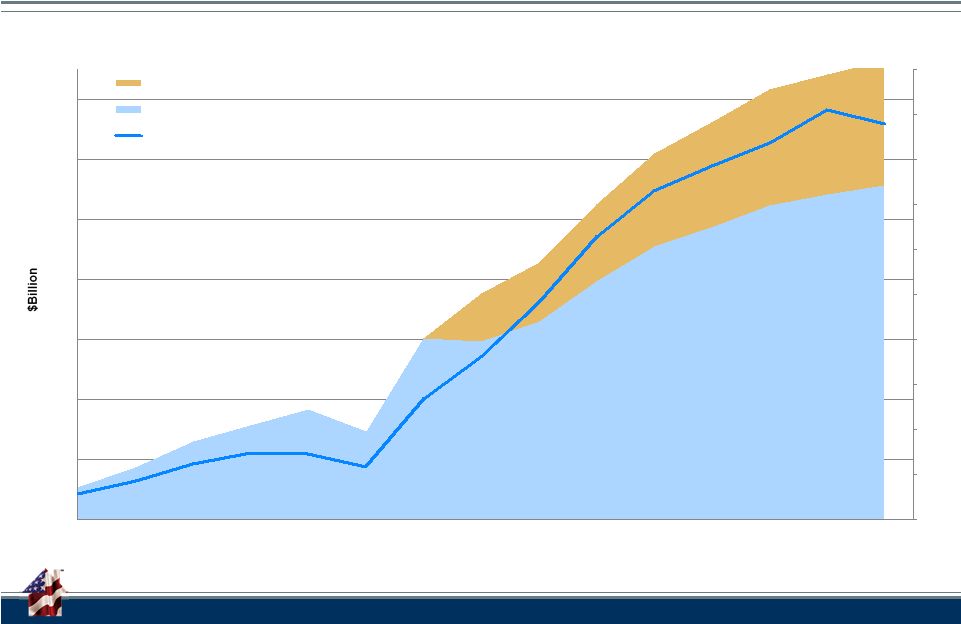

FHLBNY Since the Crisis, System Retained Earnings Have Grown 4x While Assets Have Declined 24% 15 FHLBank System: Retained Earnings Growth Notes: URE = Unrestricted Retained Earnings. RRE = Restricted Retained Earnings.

Retained earnings and capital stock are defined on a regulatory basis.

0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% $- $2 $4 $6 $8 $10 $12 $14 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Q1 2016 Q2 2016 RRE (LHS) URE (LHS) %RE/Capital Stock (RHS) |

FHLBNY 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% CHI SFR BOS NYK ATL CIN PIT DAL IND TOP DSM GAAP Regulatory All FHLBanks Exceed Minimum Capital Requirements FHLBanks Capital-to-Assets Ratio As of June 30, 2016 16 |

101

PARK AVENUE • NEW YORK, NY 10178 • WWW.FHLBNY.COM Advancing

Housing and Community Growth The

information provided by the Federal Home Loan Bank of New York (FHLBNY) in this communications is set forth for informational purposes only. The information should not be construed as an opinion, recommendation or solicitation regarding the use of any financial strategy and/or the purchase or sale of any financial instrument. All customers are advised to conduct their own independent due diligence before making any financial decisions. Please note that the past performance of any FHLBNY service or product should not be viewed as a guarantee of future results. Also, the information presented here and/or the services or products provided by the FHLBNY may change at any time without notice. Questions? |

Member Business Update September 26, 2016 © 2016 FEDERAL HOME LOAN BANK OF NEW YORK • 101 PARK AVENUE • NEW YORK, NY 10178 •

WWW.FHLBNY.COM |

FHLBNY Our Mission: To advance housing opportunity and local community development by

supporting members in serving their markets.

Federal Home Loan Bank of New York

Corporate Profile

19

Our Vision:

To be a balanced provider of liquidity to members in all operating

environments. Our Business Lines:

|

FHLBNY FHLBNY Business Update (350) (300) (250) (200) (150) (100) (50) 0 50 ATL DSM TOP SFR DAL CHI CIN IND PIT BOS NYK Net Membership Changes by FHLBank District from 2008 to 2Q16 FHLBNY Membership Trends While membership at the FHLBNY and across the Federal Home Loan Bank (FHLBank) System is down due to M&A and

failures, the FHLBNY has increased its membership (at a declining

pace) during a difficult operating environment. FHLBNY

New Members by Type 20

327 250 260 270 280 290 300 310 320 330 340 350 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2Q16 0 5 10 15 20 25 30 35 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2Q16 Commercial Bank Credit Union Insurance Co. CDFI HFA Thrift |

FHLBNY $50 $60 $70 $80 $90 $100 $110 The Fundamentals of the Business Remain Strong! $100 $150 $200 $250 $300 $350 $400 $450 $500 $550 $600 $650 $700 Over time, members’

Funding Gap has widened creating a need for wholesale funding

where the FHLBNY maintains a dominate share of the

market. Members’

Funding Gap

2002-2Q16

Members’

Advances Outstanding

2006–2Q16

21

All members except Citibank, HSBC Bank USA, Goldman Sachs Bank, Morgan Stanley Private

Bank N.A, Insurance Companies, CDFIs,10-

Bs/HFAs, and non-members |

FHLBNY Advances Outstanding by Institution Type $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2Q2016 Savings Bank/Thrifts Commercial Banks Insurance Companies Credit Unions 10bs Total Advances Outstanding More Diverse Book of Business Historical: Advances Outstanding by Institution Type TOP 10 BORROWERS ($BILLIONS) Customer Name Advances 2Q16 YTD Change Citibank, N.A. $15.550 +$0.800 Metropolitan Life Insurance Co. $13.895 +$1.325 New York Community Bank $11.027 ($1.673) HSBC Bank USA $6.700 +$1.100 First Niagara Bank $5.317 ($0.208) Investors Bank $3.757 +$0.632 Goldman Sachs Bank $2.425 ($0.500) Signature Bank $2.380 ($0.340) Astoria Bank $2.374 +$0.194 M&T $1.352 ($1.750) Total of Top 10 Borrowers $64.777 ($0.420) Total Advances Outstanding $94.397 +$0.859 Top 10 as a % of Total Advances 69% - 2006-2Q16 The FHLBNY advance book is comprised of a more diverse group of institution types.

22 |

FHLBNY -80 -60 -40 -20 0 20 40 60 80 100 120 140 1 Month 3 Month 1 Year 2 Year 3 Year 5 Year 7 Year 10 Year 6/29/07 COF Curve 3/31/09 COF Curve 3/30/12 COF Curve 8/31/2016 COF Curve FHLBank Debt Issuance Trends A volatile and complex market has impacted the FHLBNY’s cost of funds (COF) to LIBOR.

Our debt is moving in tandem with Treasuries demonstrating strong

investor demand. History of Consolidated Obligations

Against LIBOR Since June 2007

5-Year

FHLBank

Cost

of

Debt

vs.

5-Year

Treasury

23

0.0 0.5 1.0 1.5 2.0 2.5 0.0 1.0 2.0 3.0 4.0 5.0 6.0 5Y Spread 5Y Treasury 5Y FHLBank Debt Linear (5Y FHLBank Debt) |

FHLBNY FHLBNY Advance Rates Remain Attractive FHLBNY Advance Curve Fixed-Rate Advances are at Historic Lows By harnessing the power of our GSE status and credit rating,

we are able to swiftly and cheaply manufacture money for our

members. 24 |

FHLBNY $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 $2,200 $2,400 $2,600 $2,800 $3,000 $3,200 $3,400 $3,600 $3,800 $4,000 $4,200 $4,400 $4,600 $4,800 $5,000 $5,200 $5,400 $5,600 $5,800 $6,000 $6,200 $6,400 $6,600 Community Lending Program (CLP) 25 Project Specific Uses of CLP Advance » Equipment Purchase for Small Business Expansion » Debt Refinancing for Small Businesses » Debt Consolidation for Small Businesses » Handicapped- Accessible Vans » Fire Stations and Trucks » Grocery Stores » Retail Stores » Educational Facilities » Healthcare Facilities » Office Buildings » Daycare Centers » Origination of single- family mortgages Commercial/Economic Development Housing » Refinancing of single- family mortgages » Financing of housing projects: – Property acquisition – Construction – Permanent financing – Re-financing – Renovation/ Rehabilitation – Home Improvement CLP Advances continue to grow as members find value in the program.

Total CLP Advances (Daily Average)

11/8/12

–

FHLBNY initiates

Disaster Relief Funding

program (DRF), designed for

Members to assist in rebuilding

communities affected by

Superstorm

Sandy. FHLBNY

allocates $1B in low-cost

funding. Program closed

12/31/13. |

FHLBNY New Product Development 26 Combines a fixed-rate borrowing with an embedded interest-rate cap in which the rate remains fixed but may be reduced quarterly if 3-month LIBOR rises above the pre-selected cap (with a floor of zero). PRODUCT FEATURES »For liability-sensitive members, the Fixed-Rate Advance with a LIBOR Cap can help

combat net interest margin pressure

»The feature of the embedded cap will provide additional

protection against rising short- term interest

rates by lowering an institution’s cost of funds as rates rise »Flexible medium-to long-term funding option best used to extend liabilities, potentially enhance spreads, and preserve margins Members now have the ability to add symmetry to certain advances with maturities of one

year or greater. The SPA feature allows members to receive

compensation for favorable changes in the Fair Value

of an advance. The Symmetry feature will be available

at the time of booking an advance transaction at a

rate

of an additional two basis points over an advance without symmetry. The Advance Rebate Program was developed to reduce the prepayment expense

associated with restructuring advances, and provide an incentive

for members to retain their wholesale funding with

the cooperative. The Rebate Program is an enhancement

to the FHLBNY’s advance prepayment methodology

and could provide members with up to 17 bps cash rebate (15 bps for Repos) on a portion of the fees paid relating to the early extinguishment of eligible

advances when:

1

Advances booked under the Community Lending Program

and advances with remaining maturities of less than one year are not Eligible Advances. The FHLBNY’s regular advance terms and conditions will apply, and the FHLBNY reserves the right in its sole discretion to amend, rescind, or reinstate the Rebate Program at any time. 2 If the 30th calendar day falls on a weekend or a banking holiday, the deadline will default to the next business

day. Prepaid advance(s)

have a remaining term

of one year or longer

1

New eligible advance(s)

are obtained within 30

calendar

days

of

the

advance prepayments

2

New replacement

advance(s) have a term

of six months or longer

3

+

+ Symmetrical Prepayment Advance (SPA) Feature Advance Rebate Program Fixed-Rate Advance with a LIBOR CAP Callable Advance A Fixed-Rate Advance that gives members the option of calling (terminating) the advance

on predetermined dates, prior to maturity, without incurring a

prepayment fee. The product offers built-in

prepayment options that can reduce interest rate risk and prepayment risk at minimal added cost. A great way to fund fixed-rate mortgages by taking advantage of downward

movements

in

interest

rates

and

steep

yield

curves.

PRODUCT FEATURES

»Fixed rate for the life of the advance

»No prepayment fee when called on specified date

»Better cash flow match for fixed-rate mortgages and

commercial loans held in portfolio »Whole loan

and security collateral is acceptable Helping members

prepare for a rising rate environment. 1

2 AVAILABLE SPA ADVANCE STRUCTURES Terms One year up to 30 Years (term dictated by individual product parameters) Minimum Transaction Size $3 Million Minimum Partial Prepayment Size $3 Million Advance Types with Symmetrical Prepayment Feature Fixed-Rate Advances Exclusions Amortizing , Putable, Callable, Adjustable-Rate Credit and Community

Lending Program Advances |

FHLBNY JANUARY 2015 Launched Products and Services Committee (PSC) APRIL 2015 Launched first Special since 2009 (Launched second in November) 27 In an effort to serve the evolving needs of our members, the FHLBNY

will continue to add value to the cooperative though innovation and

flexibility. Recent Enhancements

MEMBERSHIP

COLLATERAL

PRODUCT

2015

2016

JUNE 2015

Introduced new

fully Integrated

1LinkSK

Safekeeping

Platform

APRIL 2016

Launched

Symmetrical

Prepayment

Advance option

AUGUST 2016

Launched

ARC with No

Minimum

Coupon

FEBRUARY 2015

Launched

campaign

targeting P&C

insurance

companies

after becoming

eligible in 2014

SEPTEMBER 2015

Launched

Putable

Advance

Re-modification

Program

SEPTEMBER 2015

Updated US VI

law to allow use

of FHLBNY Letters

of Credit as

collateral for

public/

government

deposits

DECEMBER 2015

Launched

Advance

Rebate Program

SEPTEMBER 2015

First P&C

insurance

company

becomes a

member:

American Home

Assurance

SEPTEMBER 2015

Began

accepting

split-rated

private label

CMBS

INFRASTRUCTURE

OCTOBER 2015

California laws

were modified to

allow FHLBNY

MULOCs as

acceptable

collateral for

Municipal

Deposits

DECEMBER 2015

Began

accepting

insurance

companies

with rating of

A-

stable from

rating agencies

APRIL 2016

Enhanced

Community

Lending Program

limits and

exceptions

JANUARY 2015

Began

accepting

whole loan

mortgage

collateral from

insurance

companies |

101 PARK AVENUE • NEW YORK, NY 10178 • WWW.FHLBNY.COM

Advancing Housing and Community Growth

Adam Goldstein

SVP, Chief Business Officer

212-441-6703

goldstein@fhlbny.com

The

information

provided

by

the

Federal

Home

Loan

Bank

of

New

York

(FHLBNY)

in

this

communications

is

set

forth

for

informational

purposes

only.

The

information

should

not

be

construed

as

an

opinion,

recommendation

or

solicitation

regarding

the

use

of

any

financial

strategy

and/or

the

purchase

or

sale

of any financial instrument. All customers are advised to conduct their own independent due diligence before making any financial decisions. Please note that the past performance of any FHLBNY service or product should not be viewed as a guarantee of future results. Also, the information presented here and/or the services or products provided by the FHLBNY may change at any time without notice. |