Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - DTE ENERGY CO | heismanreleasefinal9-263.htm |

| 8-K - 8-K - DTE ENERGY CO | a8-kgspacquisition9262016.htm |

Gas Midstream Acquisition

and 2016 Guidance Update

September 27, 2016

EXHIBIT 99.1

Safe Harbor Statement

2

Certain information presented herein includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995 with respect to the financial condition, results of operations, and businesses of DTE Energy. Words such as “anticipate,” “believe,” “expect,”

“projected,” “aspiration,” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and

conditions, but rather are subject to numerous assumptions, risks, and uncertainties that may cause actual future results to be materially different

from those contemplated, projected, estimated, or budgeted. Many factors may impact these forward-looking statements including, but not limited

to, the following: the failure to consummate the transaction, the risk that we will not achieve expected synergies, the risk that the operations being

acquired in the acquisition will not be successfully integrated or that such integration will take longer than expected, the risk that the operations

being acquired will not perform as expected; and the risks discussed in our public filings with the Securities and Exchange Commission.

Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. New factors emerge from

time to time. We cannot predict what factors may arise or how such factors may cause results to differ materially from those contained in any

forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no

obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect

the occurrence of unanticipated events. This document should also be read in conjunction with the Forward-Looking Statements section of the joint

DTE Energy and DTE Electric 2015 Form 10-K and 2016 Forms 10-Q (which sections are incorporated by reference herein), and in conjunction

with other SEC reports filed by DTE Energy.

DTE Energy Investor Relations

www.dteenergy.com/investors

(313) 235-8030

3

Contact Us

• Gas Midstream Acquisition

• 2016 Guidance Update

4

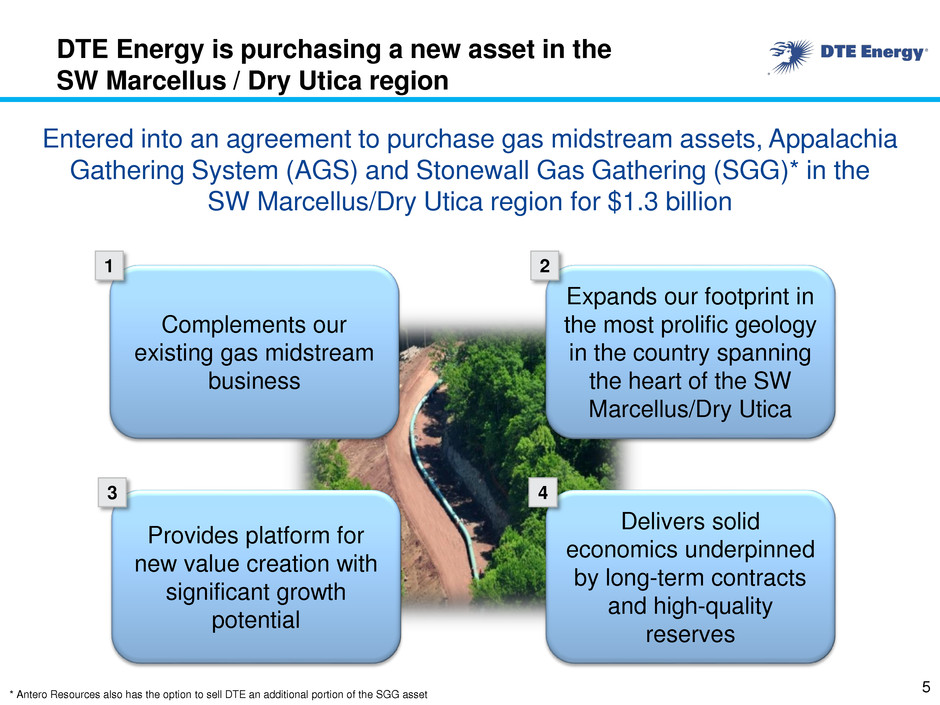

Delivers solid

economics underpinned

by long-term contracts

and high-quality

reserves

Expands our footprint in

the most prolific geology

in the country spanning

the heart of the SW

Marcellus/Dry Utica

Provides platform for

new value creation with

significant growth

potential

Complements our

existing gas midstream

business

5

Entered into an agreement to purchase gas midstream assets, Appalachia

Gathering System (AGS) and Stonewall Gas Gathering (SGG)* in the

SW Marcellus/Dry Utica region for $1.3 billion

1

3 4

2

DTE Energy is purchasing a new asset in the

SW Marcellus / Dry Utica region

* Antero Resources also has the option to sell DTE an additional portion of the SGG asset

6

Acquisition of attractive gas midstream assets

complements our existing gas midstream business

Connects market to demand in

Michigan, Ohio, Chicago and

Ontario, Canada through NEXUS

Connects geographically and

strategically to our current assets

Provides access to high quality

reserves in the

SW Marcellus/Dry Utica

Broadens and strengthens our

producer relationships and market

reach

1

Utica Shale

Marcellus

Shale

AGS

SGG

NEXUS Pipeline

7

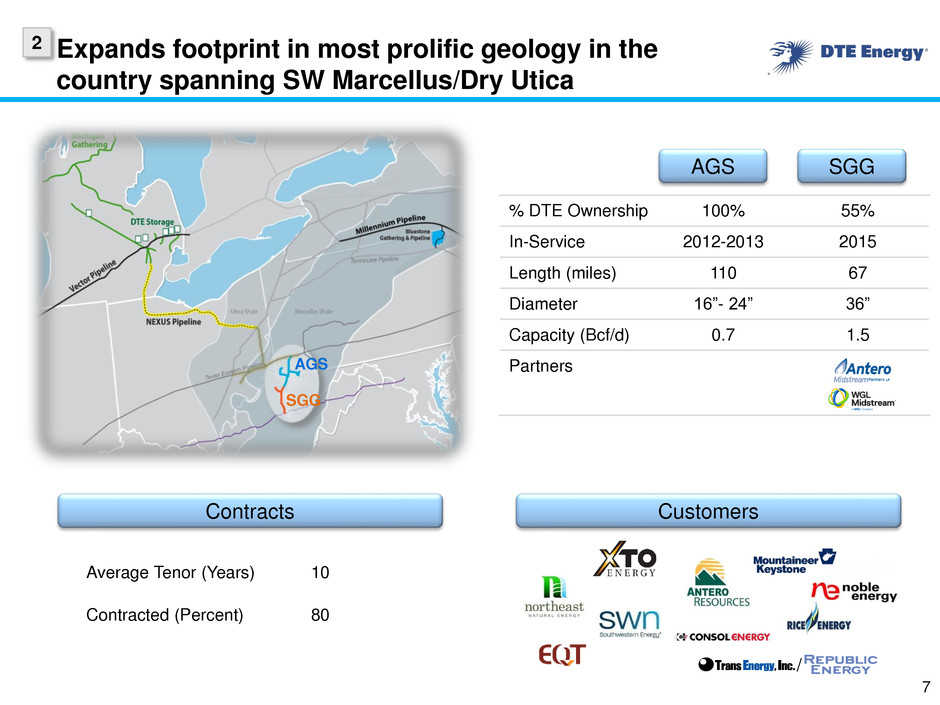

% DTE Ownership 100% 55%

In-Service 2012-2013 2015

Length (miles) 110 67

Diameter 16”- 24” 36”

Capacity (Bcf/d) 0.7 1.5

Partners

Expands footprint in most prolific geology in the

country spanning SW Marcellus/Dry Utica

2

Customers

AGS SGG

AGS

SGG

/

Contracts

Average Tenor (Years)

Contracted (Percent)

10

80

8

This asset lies in one of the most economically

favorable shale basins

$ / MMBtu

2

$0 $1 $2 $3 $4 $5

Marcellus Shale NE Core

Marcellus Shale SW

Source: Credit Suisse February 2016 report and Wright and Company

Feeds Bluestone/

Millennium

Basin feeding

AGS/SGG

US Shale Basin Economics

NYMEX Gas Price Required for 15% After-Tax IRR

The assets overlay ~40 Tcf of the

Marcellus resource and is economic

at sub $3 prices

These Marcellus reserves alone are

able to fill this system for over 40

years

Our discussions with producers and

3rd party evaluators indicate that this

region is poised for rapid growth

Significant stacked play opportunities

in Dry Utica / Upper Devonian

Platform for new value creation with significant

growth potential

Expansion potential over

1 Bcf/d

New set of producer

relationships

U

p

si

d

e

P

o

tentia

l

3

9

Synergies with NEXUS

Significant stacked play

opportunities

10

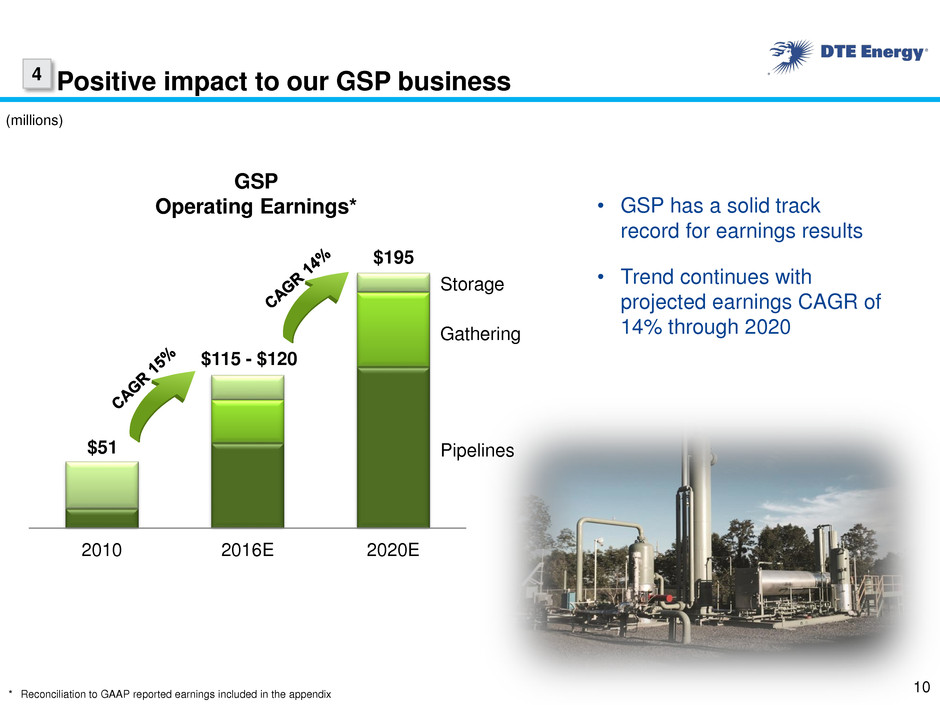

Positive impact to our GSP business 4

* Reconciliation to GAAP reported earnings included in the appendix

GSP

Operating Earnings*

2010 2016E 2020E

$115 - $120

$195

$51 Pipelines

Gathering

Storage

• GSP has a solid track

record for earnings results

• Trend continues with

projected earnings CAGR of

14% through 2020

(millions)

11

Transaction economics are strong and provide

excellent returns

Purchase Price $1.3 billion

EPS Accretion

Accretive beginning in 2017 and $0.10 accretive in 2020

with potential to be significantly higher in out years

Operational /

Regulatory

Construction and regulatory risks eliminated

Financing Plan*

50% mandatory convertible equity units / 50% senior

unsecured debt

Credit Rating Target solid investment grade ratings

Business Mix Within target range of 75%-80% utility

Required Approval Hart-Scott-Rodino

Close Date Expected close in Q4

4

* No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation

to purchase or subscribe for any securities.

12

In summary, this transaction adds another platform for

growth and is complementary to DTE’s current portfolio

Supports DTE’s strategy to invest in strategically situated assets…

…gateway to multiple growth opportunities in the area creating synergies with

existing assets

Complements existing assets…

…develops new strategic relationships with producers that will allow for future

partnering and growth opportunities

Provides a new platform for additional value creation with significant upside…

…over 1 Bcf/d of potential economic expansions

…lateral and gathering opportunities in the area

Economics of the acquisition are sound…

…returns in line with other midstream assets; EPS and cash accretive in 2017

• Gas Midstream Acquisition

• 2016 Guidance Update

13

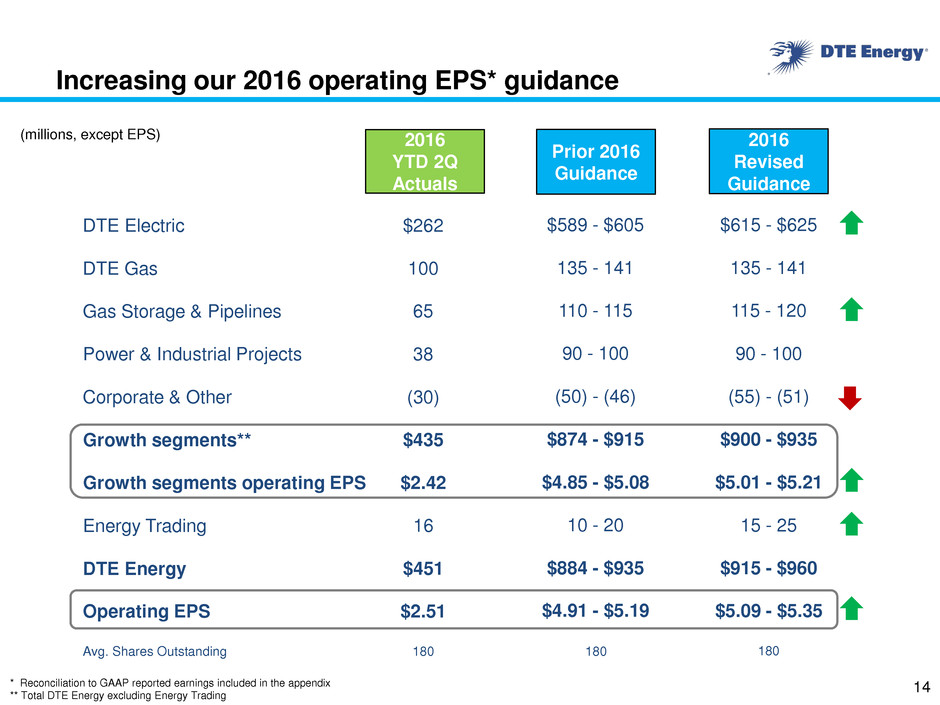

* Reconciliation to GAAP reported earnings included in the appendix

** Total DTE Energy excluding Energy Trading

Prior 2016

Guidance

2016

YTD 2Q

Actuals

DTE Electric

DTE Gas

Gas Storage & Pipelines

Power & Industrial Projects

Corporate & Other

Growth segments**

Growth segments operating EPS

Energy Trading

DTE Energy

Operating EPS

Avg. Shares Outstanding 180

$262

100

65

38

(30)

$435

$2.42

16

$451

180

$2.51

(millions, except EPS)

14

Increasing our 2016 operating EPS* guidance

2016

Revised

Guidance

$5.01 - $5.21

$5.09 - $5.35

$615 - $625

135 - 141

115 - 120

90 - 100

(55) - (51)

$900 - $935

15 - 25

$915 - $960

180

$4.85 - $5.08

$4.91 - $5.19

$589 - $605

135 - 141

110 - 115

90 - 100

(50) - (46)

$874 - $915

10 - 20

$884 - $935

15

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing

operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating

earnings to measure performance against budget and to report to the Board of Directors. Operating earnings are presented both with and without Energy Trading. The term “Growth

Segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward.

June YTD 2016 Reconciliation of Reported to

Operating Earnings YT 2016

DTE

Electric DTE Gas

Gas Storage

and Pipelines

Power and

Industrial

Projects

Corporate

and Other

Growth

Segments

Energy

Trading DTE Energy

Reported Earnings 262$ 100$ 65$ 32$ (30)$ 429$ (30)$ 399$

Plant closure - - - 6 - 6 - 6

Certain mark-to-market transactions - - - - - - 46 46

Operating Earnings 262$ 100$ 65$ 38$ (30)$ 435$ 16$ 451$

Net Income (millions)

YTD 2016

DTE

Electric DTE Gas

Gas Storage

and Pipelines

Power and

Industrial

Projects

Corporate

and Other

Growth

Segments

Energy

Trading DTE Energy

Reported Earnings 1.46$ 0.56$ 0.36$ 0.18$ (0.17)$ 2.39$ (0.17)$ 2.22$

Plant closure - - - 0.03 - 0.03 - 0.03

Certain mark-to-market transactions - - - - - - 0.26 0.26

Operating Earnings 1.46$ 0.56$ 0.36$ 0.21$ (0.17)$ 2.42$ 0.09$ 2.51$

EPS

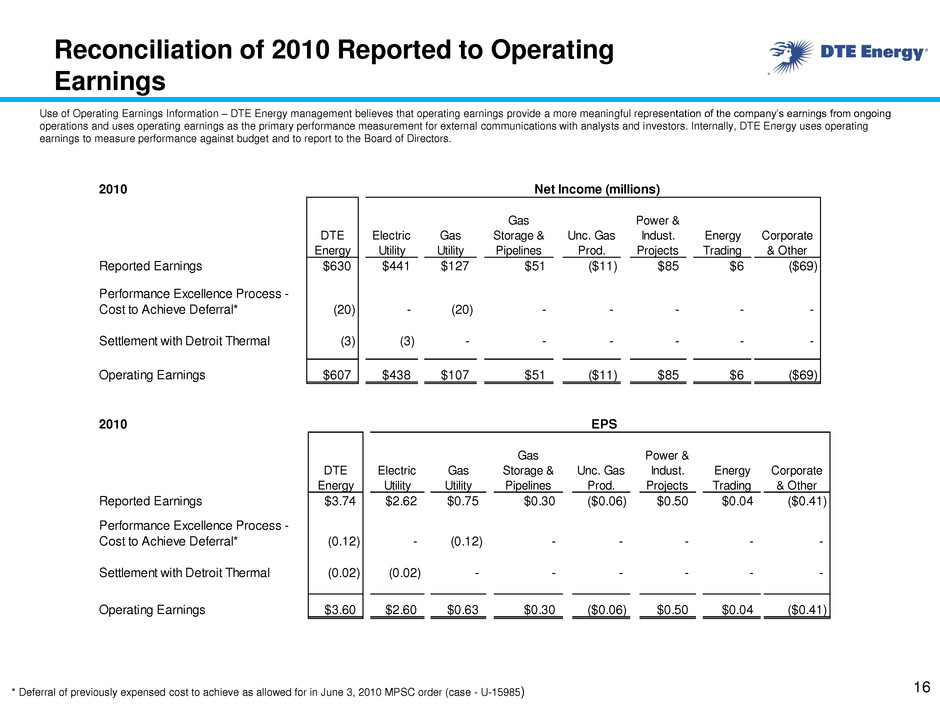

Reconciliation of 2010 Reported to Operating

Earnings

16

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing

operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating

earnings to measure performance against budget and to report to the Board of Directors.

2010

DTE

Energy

Electric

Utility

Gas

Utility

Gas

Storage &

Pipelines

Unc. Gas

Prod.

Power &

Indust.

Projects

Energy

Trading

Corporate

& Other

Reported Earnings $630 $441 $127 $51 ($11) $85 $6 ($69)

Perform ce Excellence Process -

Cos t Achi ve Deferral* (20) - (20) - - - - -

Settlement with Detroit Thermal (3) (3) - - - - - -

Operating Earnings $607 $438 $107 $51 ($11) $85 $6 ($69)

Net Income (millions)

2010

DTE

Energy

Electric

Utility

Gas

Utility

Gas

Storage &

Pipelines

Unc. Gas

Prod.

Power &

Indust.

Projects

Energy

Trading

Corporate

& Other

R ported Earnings $3.74 $2.62 $0.75 $0.30 ($0.06) $0.50 $0.04 ($0.41)

Performance Excellence Process -

Cost to Achieve Deferral* (0.12) - (0.12) - - - - -

Settlement with Detroit Thermal (0.02) (0.02) - - - - - -

Operating Earnings $3.60 $2.60 $0.63 $0.30 ($0.06) $0.50 $0.04 ($0.41)

EPS

* Deferral of previously expensed cost to achieve as allowed for in June 3, 2010 MPSC order (case - U-15985)

Use of Operating Earnings Information – DTE Energy management believes that operating earnings

provide a more meaningful representation of the company’s earnings from ongoing operations and uses

operating earnings as the primary performance measurement for external communications with analysts

and investors. Internally, DTE Energy uses operating earnings to measure performance against budget

and to report to the Board of Directors.

In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that

certain items that impact the company’s future period reported results will be excluded from operating

results. A reconciliation to the comparable future period reported earnings is not provided because it is not

possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from

period to period and may have a significant impact on reported earnings.

17

Reconciliation of Other Reported to Operating

Earnings