Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Silver Bay Realty Trust Corp. | a8-kq32016investorpresenta.htm |

Investor Presentation

September 2016

Forward-Looking Statements

This presentation and related conversations contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate

to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts.

In some cases, readers can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or

indicate future events or trends and which do not relate solely to historical matters. Readers can also identify forward-looking statements by discussions of strategy,

plans or intentions. Examples of forward-looking statements include statements about: expectations related to household formations, home ownership rates, and

other demographics and the impact of such matters on rental demand, rent growth, asset values, and other of our operating results; industry rent forecasts and our

ability to raise rents; intentions related to asset sales, including pricing, volume and identity of such assets and our ability to invest in higher yielding assets; our ability

to lease and operate acquired properties and to improve our operating performance, including our abilities and projections related to turnover rates and timeframes,

operating costs, rent increases, and occupancy rates; our projected financial and operating results; our intentions related to our capital allocation strategy, including

through the use of share repurchases; future real estate values and prices; and the general economy and its impact on Silver Bay’s results.

The forward-looking statements contained in this presentation and related conversations reflect Silver Bay’s current views about future events and are subject to

numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause Silver Bay’s actual results to differ significantly from

those expressed or implied in any forward-looking statement. Silver Bay is not able to predict all of the factors that may affect future results. Readers should not rely

on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that

could cause actual results to differ materially from those in the forward-looking statements include national, regional or local economic, business, competitive, market

and regulatory conditions and the following: those factors described in the discussion on risk factors in Part I, Item 1A, "Risk Factors" in the Company's Annual Report

on Form 10-K for the year ended December 31, 2015 and Part I, Item 2 “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and Part I, Item 3 "Quantitative and Qualitative Disclosures about Market Risk" in the Company's Quarterly Reports on Form 10-Q for the quarters ending March 31,

2016 and June 30, 2016 and other risks and uncertainties detailed in Silver Bay’s other reports and filings with the Securities and Exchange Commission (“SEC”);

defaults on, early terminations of or non-renewal of leases by residents; resident turnover or turnover costs; Silver Bay’s ability to maintain occupancy levels and

leasing traffic or to attract and retain qualified residents in light of increased competition in the leasing market for quality residents, the relatively short duration of

leases, inadequate marketing, reputational damage or other reasons; Silver Bay’s ability to control or reduce operating expenses, including repairs and maintenance

expense and other costs such as real estate taxes, homeowners’ association fees, insurance and other costs outside the Company’s control for reasons including

damage to properties due to storms, other natural causes or residents and other reasons; Silver Bay’s ability to successfully operate its properties; Silver Bay’s ability

to maintain rents at levels that are sufficient to keep pace with rising costs of operations; Silver Bay’s ability to dispose of assets at attractive pricing levels; the

amount of capital available for share repurchases and other purposes; Silver Bay’s ability to implement and manage its service technician initiatives or the impact of

such initiatives to reduce maintenance, turnover and other expenses as predicted; Silver Bay’s ability to obtain financing arrangements; Silver Bay’s failure to meet

the conditions to draw under the revolving credit facility; the Company’s ability to perform under the covenants of its revolving credit facility and securitization loan;

general volatility of the markets in which it participates; interest rates and the market value of Silver Bay’s assets; the impact of changes in governmental regulations,

tax law and rates, and similar matters; difficulties in identifying properties to acquire and completing acquisitions; increased time and/or expense to gain possession

and renovate properties; Silver Bay’s dependence on key personnel to carry its business and investment strategies and its ability to hire and retain skilled managerial,

investment, financial, and operational personnel, and the performance of third-party vendors and service providers, including third party management professionals,

maintenance providers, leasing agents, and property managers; and Silver Bay’s ability to remain qualified as a REIT.

The forward-looking statements in this presentation and related conversations represent Silver Bay’s views as of the date of this presentation. Subsequent events

and developments could cause these views to change. However, while Silver Bay may elect to update these forward-looking statements at some point in the future,

Silver Bay has no current intention of doing so except to the extent required by applicable laws. Readers should, therefore, not rely on these forward-looking

statements as representing Silver Bay’s views as of any date subsequent to the date of this presentation. All subsequent written and oral forward looking statements

concerning Silver Bay or matters attributable to Silver Bay or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements

above.

2

About Silver Bay

Internally Managed REIT

NYSE Listed: SBY

First publicly traded single-family rental REIT formed in 2012

Internally managed REIT focused on acquisition, renovation,

leasing and management of single-family properties in the U.S.

Enterprise Value(1) $1.3 billion

Portfolio(1) 8,911 properties with concentration in Georgia, Florida and

Arizona

Estimated market value per property of $167,000

Average monthly rent of $1,190 for a 3 bed/2 bath home

Operating Metrics(1) Portfolio occupancy rate of 97.6%

Same-Home net operating income (NOI) (2) increased 12%

year over year in the second quarter 2016 to $12.6 million

Trailing four quarter turnover rate of 29.6%

Capital Allocation(1) Continued focus on recycling capital in higher yielding assets

Dividend yield of 2.7% as of September 19, 2016

Opportunistically repurchased 11% of Silver Bay market

capitalization since formation

3

(1) Data as of and for the quarter ended June 30, 2016, unless otherwise stated

(2) NOI is a non-GAAP financial measure. See the non-GAAP reconciliation included in the appendix. GAAP is defined as in

accordance with accounting principles generally accepted in the United States.

Investment Highlights

Strong Fundamentals

Underpin the

Single-Family Rental Industry

Household formations and

low homeownership rates

driving demand

Strong demographics

Prospects for continued

rental growth remain

Single-family rental industry

in early stages of

institutional ownership

Silver Bay is Well Positioned to

Drive Cash Flow and Maximize

Long-term Stockholder Value

Diversified portfolio of assets

in 11 markets

Emphasis on portfolio

optimization

Focus on operational

excellence

Disciplined capital allocation

strategy

4

Single-Family Rental Industry Overview

Households Growing & Housing Starts Lag(1) Homeownership Rates(1) (%)

Household Formations and Lower Homeownership Rates

Driving Rental Demand

6

(1) Current Population Survey/Housing Vacancy Survey, Series H-111, U.S. Census Bureau; National Association of Realtors; US

Census Bureau, Population Division

(2) Single-Family Rental Primer, Green Street Advisors – Advisory & Consulting Group

The number of households in the U.S. has continued to grow while the supply of

new housing has not kept pace

− An estimated 6.6 million total households are expected to be formed over the next 5 years(2)

− Single-family rentals are expected to capture approximately 1.5 million of these formations(2)

The decline in home ownership rates has benefited single-family rental demand

− Millennials (18-35 year-olds) have one of the lowest home ownership rates and it’s declining

0

500

1,000

1,500

2,000

0

20,000

40,000

60,000

80,000

100,000

120,000

1991 1995 1999 2003 2007 2011 2015

Total Households (000's) (LH) Housing Starts (000's) (RH)

20

30

40

50

60

70

80

Dec-95 Dec-05 Dec-15

Under 35 years 35 to 44 years

Household formations outpacing housing supply and

U.S. homeownership declining

-2,000,000

0

2,000,000

4,000,000

6,000,000

8,000,000

10,000,000

18-24 years 25-44 years 45-64 years

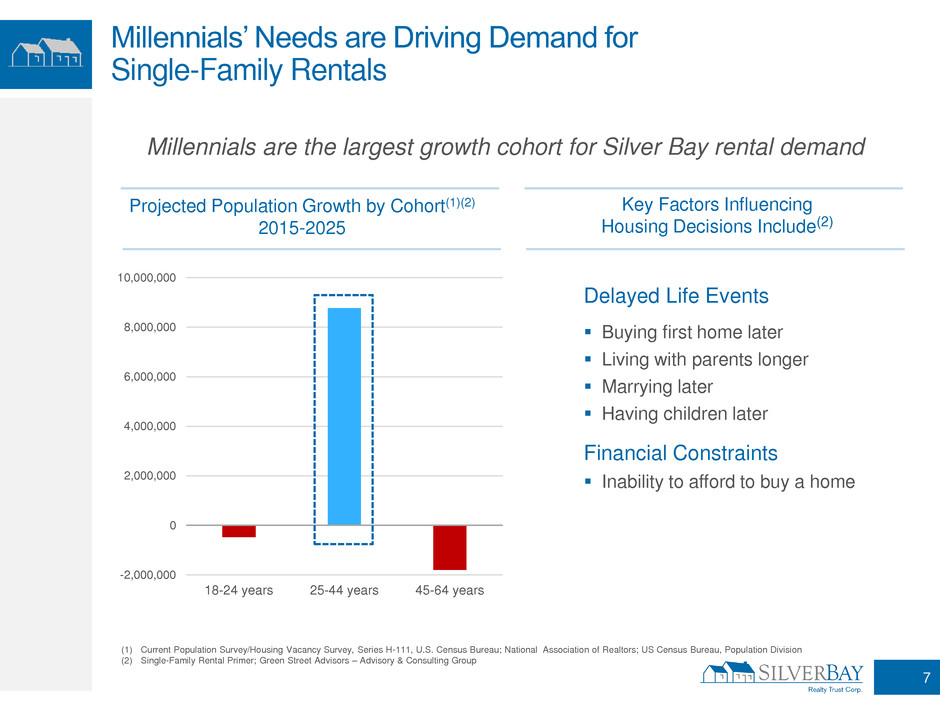

Projected Population Growth by Cohort(1)(2)

2015-2025

Key Factors Influencing

Housing Decisions Include(2)

Millennials’ Needs are Driving Demand for

Single-Family Rentals

7

(1) Current Population Survey/Housing Vacancy Survey, Series H-111, U.S. Census Bureau; National Association of Realtors; US Census Bureau, Population Division

(2) Single-Family Rental Primer; Green Street Advisors – Advisory & Consulting Group

Delayed Life Events

Buying first home later

Living with parents longer

Marrying later

Having children later

Financial Constraints

Inability to afford to buy a home

Millennials are the largest growth cohort for Silver Bay rental demand

3%

97%

3%

46%

42%

9%

Millennials Require More Space as They Start Families

Single-family rental homes

are more spacious than

most apartments

– The vast majority of single-

family rental homes are 3+

bedrooms versus only 9%

of apartments

Silver Bay’s single-family

rentals are priced

attractively at $0.69 per

square foot versus

apartments at $1.03 per

square foot

In comparable markets,

Silver Bay average rent is

33% below apartment

rental rates

(1) Silver Bay data is as of June 30, 2016

(2) Single-Family Rental Primer; Green Street Advisors – Advisory & Consulting Group

SBY Portfolio (1) Apartments (2)

Studio 1 Bedroom 2 Bedrooms 3+ Bedrooms

8

SBY Single-Family Portfolio(1) Apartments(2)

Market Avg. SF

Avg.

Rent Rent/SF

Avg.

SF

Avg.

Rent Rent/SF

Atlanta 1,803 $1,086 $0.60 1,031 $1,054 $1.02

Charlotte 1,646 $1,089 $0.66 965 $987 $1.02

Las Vegas 1,717 $1,209 $0.70 939 $883 $0.94

Phoenix 1,636 $1,118 $0.68 886 $926 $1.04

Tampa 1,623 $1,318 $0.81 938 $1,069 $1.14

Average 1,685 $1,164 $0.69 952 $984 $1.03

Avg. Rent/SF Discount to Multifamily -33%

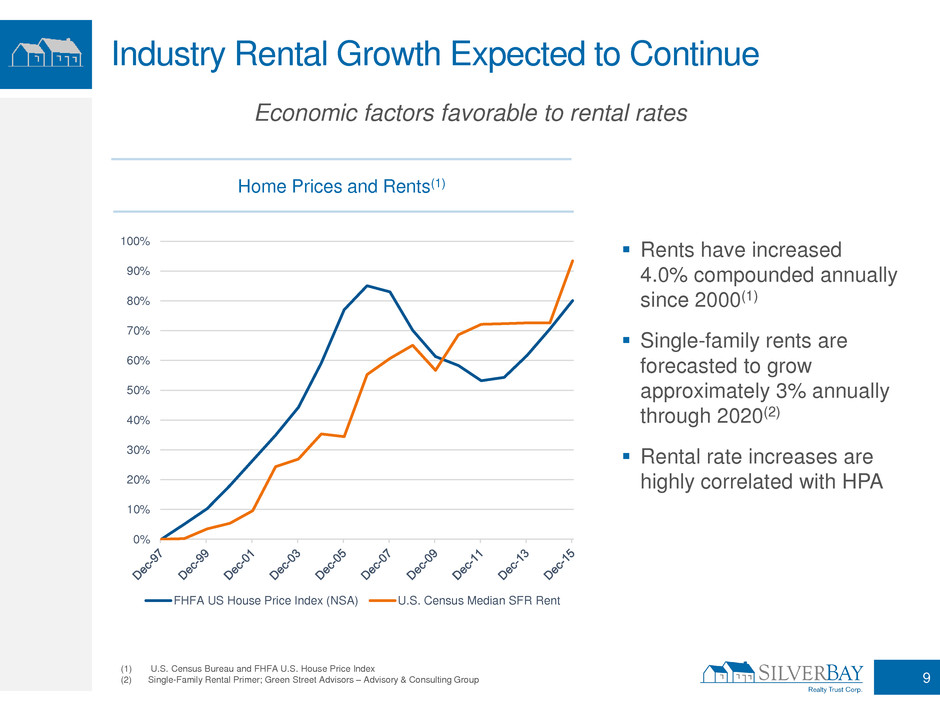

Home Prices and Rents(1)

Industry Rental Growth Expected to Continue

Rents have increased

4.0% compounded annually

since 2000(1)

Single-family rents are

forecasted to grow

approximately 3% annually

through 2020(2)

Rental rate increases are

highly correlated with HPA

(1) U.S. Census Bureau and FHFA U.S. House Price Index

(2) Single-Family Rental Primer; Green Street Advisors – Advisory & Consulting Group

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

FHFA US House Price Index (NSA) U.S. Census Median SFR Rent

Economic factors favorable to rental rates

9

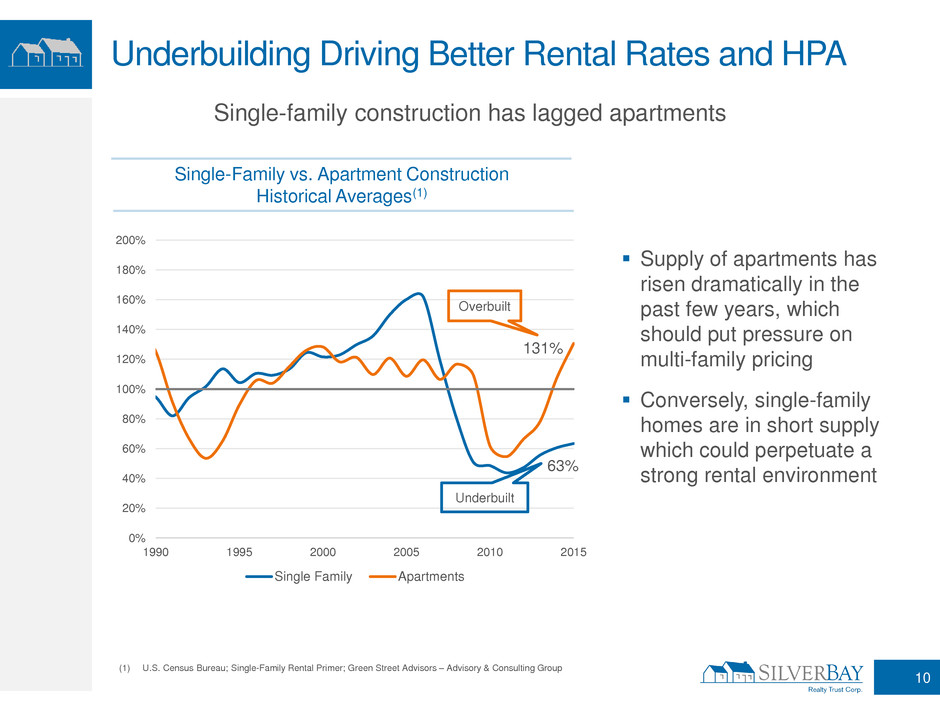

Single-Family vs. Apartment Construction

Historical Averages(1)

Underbuilding Driving Better Rental Rates and HPA

Supply of apartments has

risen dramatically in the

past few years, which

should put pressure on

multi-family pricing

Conversely, single-family

homes are in short supply

which could perpetuate a

strong rental environment

(1) U.S. Census Bureau; Single-Family Rental Primer; Green Street Advisors – Advisory & Consulting Group

63%

131%

0%

20%

40%

60%

80%

100%

120%

140%

160%

180%

200%

1990 1995 2000 2005 2010 2015

Single Family Apartments

Overbuilt

Underbuilt

10

Single-family construction has lagged apartments

Single-Family vs. Commercial Property Prices(1)

Residential Property Prices are Relatively More Stable

Commercial property valuations

are more sensitive to

movements in interest rates. As

interest rates rise, cap rates

typically rise which causes

more volatility in commercial

property prices.

Single-family rentals can be

valued in two ways:

– Following a traditional cap rate

methodology

– Alternatively, via sales

into the owner-occupant market,

offering downside protection in a

rising interest rate environment

(1) FHFA and Green Street Advisors Commercial Property Price Index.

0%

20%

40%

60%

80%

100%

120%

140%

160%

FHFA US House Price Index (NSA)

Green Street Commercial Property Price Index

11

Residential property prices are historically less volatile than commercial

prices highlighting a compelling risk-return profile

Single-Family Rental Industry in Early Stages of

Institutional Ownership

(1) Single-Family Rental Primer; Green Street Advisors – Advisory & Consulting Group

(2) Based on Silver Bay estimates

Institutional ownership represents a minority (1.3%) of total single-family

rentals in the U.S., leaving significant opportunity for portfolio acquisitions

12

Total SFR Units (1) Institutionally Owned Units (2)

15.7 M

200 K

Silver Bay Overview

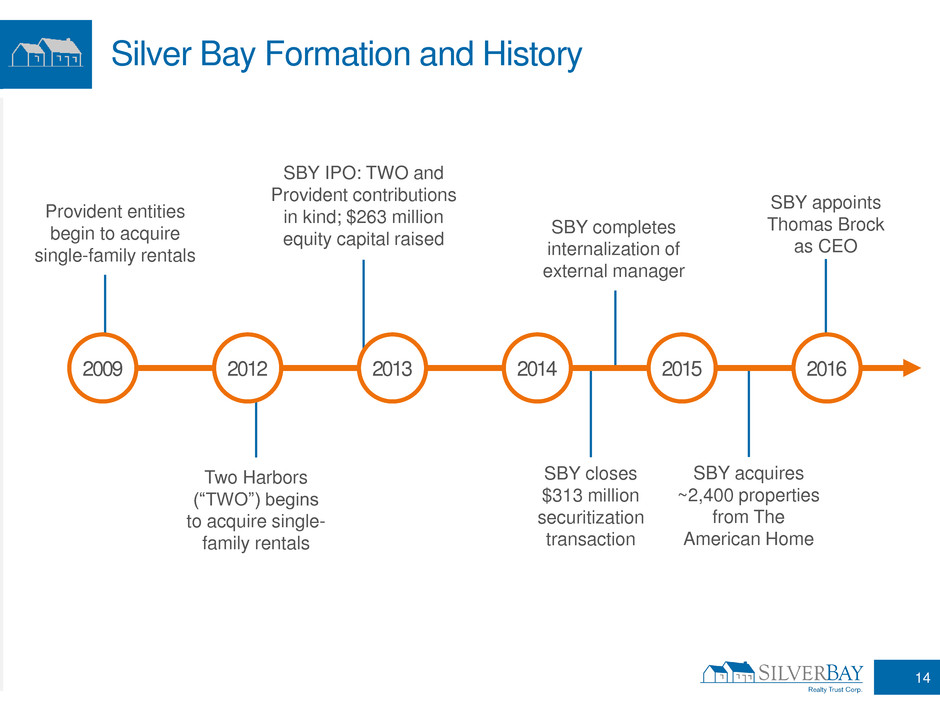

Silver Bay Formation and History

14

Two Harbors

(“TWO”) begins

to acquire single-

family rentals

SBY closes

$313 million

securitization

transaction

SBY acquires

~2,400 properties

from The

American Home

Provident entities

begin to acquire

single-family rentals

SBY IPO: TWO and

Provident contributions

in kind; $263 million

equity capital raised SBY completes internalization of

external manager

SBY appoints

Thomas Brock

as CEO

2009 2012 2013 2014 2015 2016

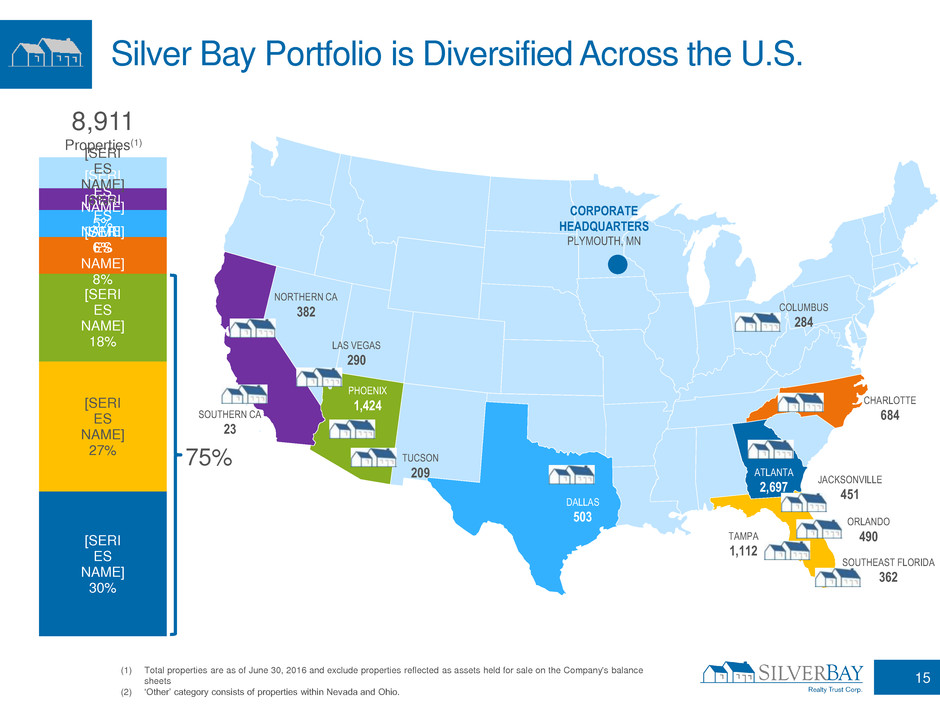

Silver Bay Portfolio is Diversified Across the U.S.

(1) Total properties are as of June 30, 2016 and exclude properties reflected as assets held for sale on the Company's balance

sheets

(2) ‘Other’ category consists of properties within Nevada and Ohio.

8,911

Properties(1)

[SERI

ES

NAME]

30%

[SERI

ES

NAME]

27%

[SERI

ES

NAME]

18%

[SERI

ES

NAME]

8%

[SERI

ES

NAME]

6%

[SERI

ES

NAME]

5%

[SERI

ES

NAME]

6%(2)

PERCENTAGE

75%

NORTHERN CA

382

SOUTHERN CA

23

LAS VEGAS

290

PHOENIX

1,424

TUCSON

209

DALLAS

503

SOUTHEAST FLORIDA

362

JACKSONVILLE

451

COLUMBUS

284

ATLANTA

2,697

CHARLOTTE

684

TAMPA

1,112

ORLANDO

490

15

CORPORATE

HEADQUARTERS

PLYMOUTH, MN

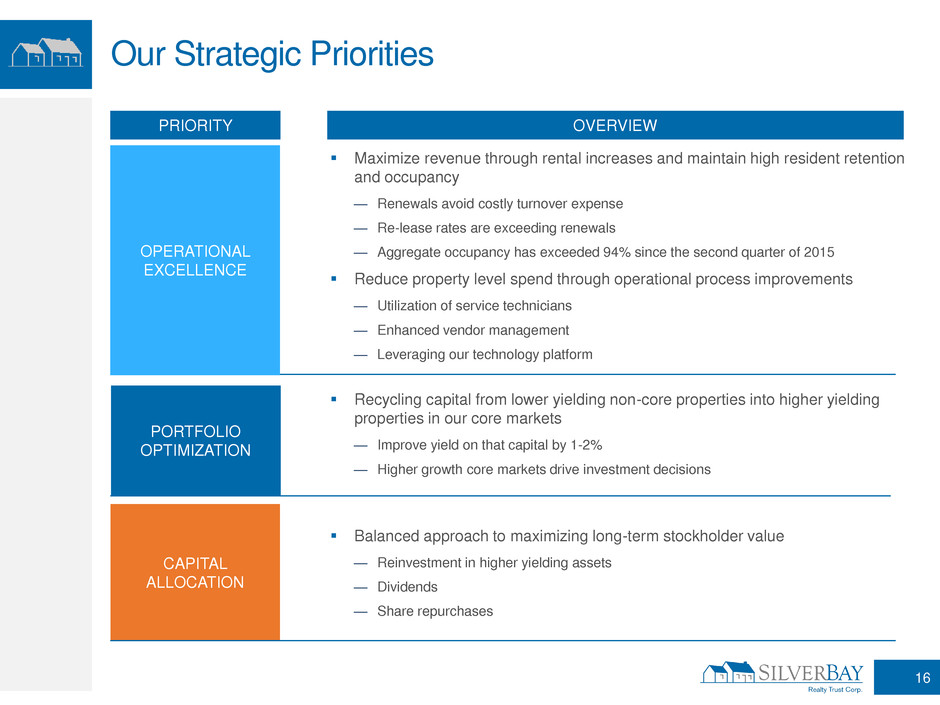

Our Strategic Priorities

PRIORITY OVERVIEW

CAPITAL

ALLOCATION

Balanced approach to maximizing long-term stockholder value

— Reinvestment in higher yielding assets

— Dividends

— Share repurchases

16

PORTFOLIO

OPTIMIZATION

Recycling capital from lower yielding non-core properties into higher yielding

properties in our core markets

— Improve yield on that capital by 1-2%

— Higher growth core markets drive investment decisions

OPERATIONAL

EXCELLENCE

Maximize revenue through rental increases and maintain high resident retention

and occupancy

— Renewals avoid costly turnover expense

— Re-lease rates are exceeding renewals

— Aggregate occupancy has exceeded 94% since the second quarter of 2015

Reduce property level spend through operational process improvements

— Utilization of service technicians

— Enhanced vendor management

— Leveraging our technology platform

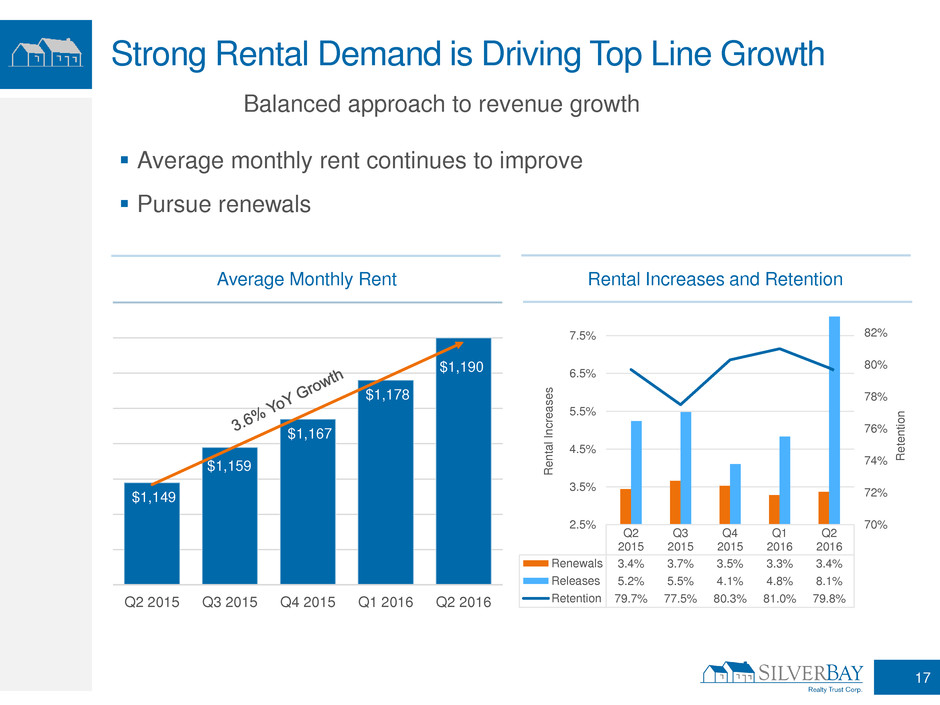

Rental Increases and Retention Average Monthly Rent

Balanced approach to revenue growth

Strong Rental Demand is Driving Top Line Growth

$1,149

$1,159

$1,167

$1,178

$1,190

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Average monthly rent continues to improve

Pursue renewals

Q2

2015

Q3

2015

Q4

2015

Q1

2016

Q2

2016

Renewals 3.4% 3.7% 3.5% 3.3% 3.4%

Releases 5.2% 5.5% 4.1% 4.8% 8.1%

Retention 79.7% 77.5% 80.3% 81.0% 79.8%

70%

72%

74%

76%

78%

80%

82%

2.5%

3.5%

4.5%

5.5%

6.5%

7.5%

Re

te

n

ti

o

n

Re

n

ta

l

In

c

re

a

s

e

s

17

(1) US Census; 12/31/15

The HUD’s housing

expenditure threshold is 30%

of household income

Silver Bay’s annual

average rent of $14,000

represents only 24% of a

resident’s income, well below

the HUD standard

This leaves considerable

room for rental increases while

still staying below the 30%

HUD standard

Silver Bay’s median

household income of $58,000

is slightly higher than the

national average of $56,000

Affordability Gap Gives SBY Ability to Grow Rents

U.S. SBY

$58,000

$17,400

$14,000

100%

30%

100%

50%

SBY Median

Household

Income

30%

50%

24%

Affordability

Gap =

$3,400

18

$56,000

$16,200

U.S. Median

Household

Income(1)

Same-Home NOI

($ in 000's)

Same-Home Revenue

($ in 000's)

$20,852

$21,103 $21,181

$21,672

$22,065

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

High Occupancy and Rental Increases Drive

Same-Home NOI Growth

Same-home portfolio of

5,942 properties

represents approximately

67% of total portfolio

NOI(1) year-over-year

growth in the second

quarter of 2016 was

primarily due to revenue

growth as a result of robust

rental demand and

occupancy and reduced

turn time

(1) NOI is a non-GAAP financial measure. See the non-GAAP reconciliation included in the appendix.

GAAP is defined as in accordance with accounting principles generally accepted in the United States.

$11,207 $11,241

$11,776

$11,994

$12,555

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

19

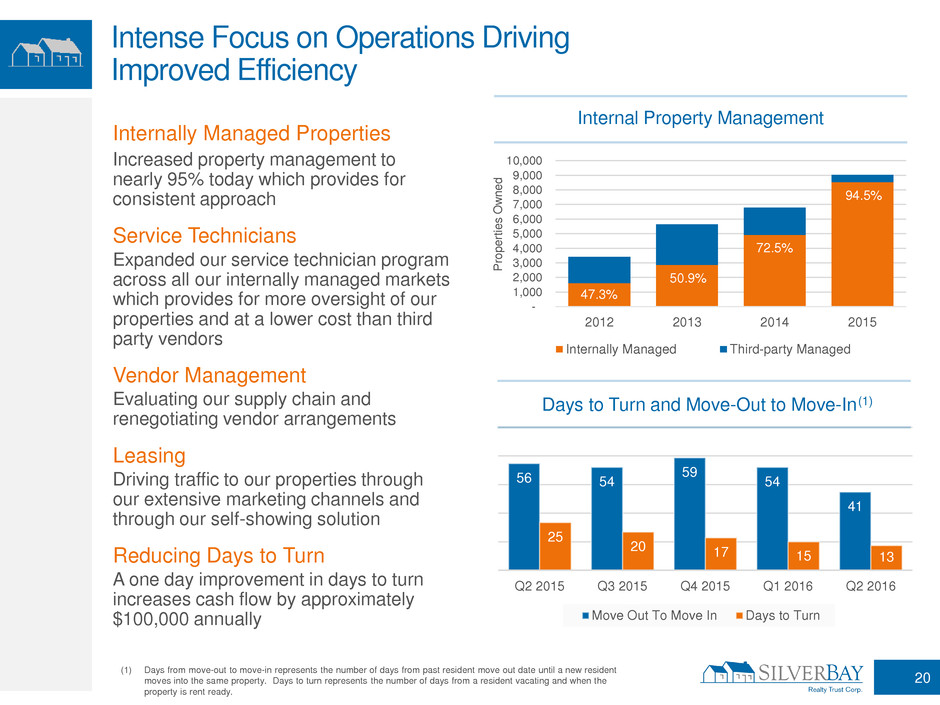

Days to Turn and Move-Out to Move-In (1)

Internal Property Management

56 54

59

54

41

25

20 17 15 13

Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Move Out To Move In Days to Turn

Intense Focus on Operations Driving

Improved Efficiency

(1) Days from move-out to move-in represents the number of days from past resident move out date until a new resident

moves into the same property. Days to turn represents the number of days from a resident vacating and when the

property is rent ready.

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

2012 2013 2014 2015

Pr

o

p

e

rt

ie

s

O

w

n

e

d

Internally Managed Third-party Managed

Internally Managed Properties

Increased property management to

nearly 95% today which provides for

consistent approach

Service Technicians

Expanded our service technician program

across all our internally managed markets

which provides for more oversight of our

properties and at a lower cost than third

party vendors

Vendor Management

Evaluating our supply chain and

renegotiating vendor arrangements

Leasing

Driving traffic to our properties through

our extensive marketing channels and

through our self-showing solution

Reducing Days to Turn

A one day improvement in days to turn

increases cash flow by approximately

$100,000 annually

20

47.3%

50.9%

72.5%

94.5%

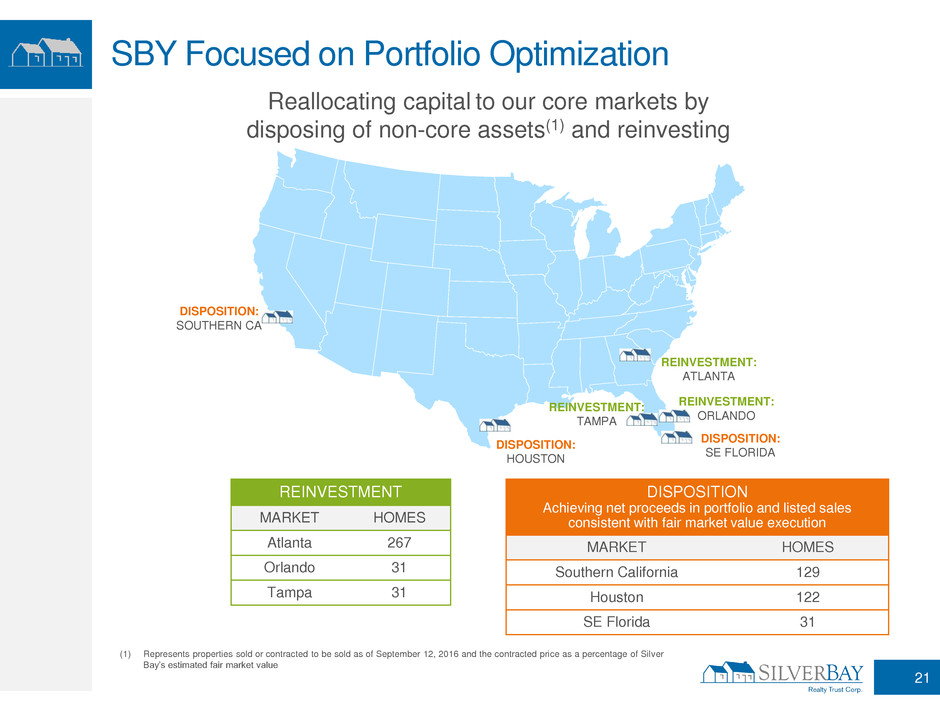

SBY Focused on Portfolio Optimization

(1) Represents properties sold or contracted to be sold as of September 12, 2016 and the contracted price as a percentage of Silver

Bay’s estimated fair market value

(1)

Reallocating capital to our core markets by

disposing of non-core assets(1) and reinvesting

DISPOSITION:

SOUTHERN CA

DISPOSITION:

SE FLORIDA

REINVESTMENT:

ATLANTA

REINVESTMENT:

TAMPA

REINVESTMENT:

ORLANDO

DISPOSITION:

HOUSTON

21

REINVESTMENT

MARKET HOMES

Atlanta 267

Orlando 31

Tampa 31

DISPOSITION

Achieving net proceeds in portfolio and listed sales

consistent with fair market value execution

MARKET HOMES

Southern California 129

Houston 122

SE Florida 31

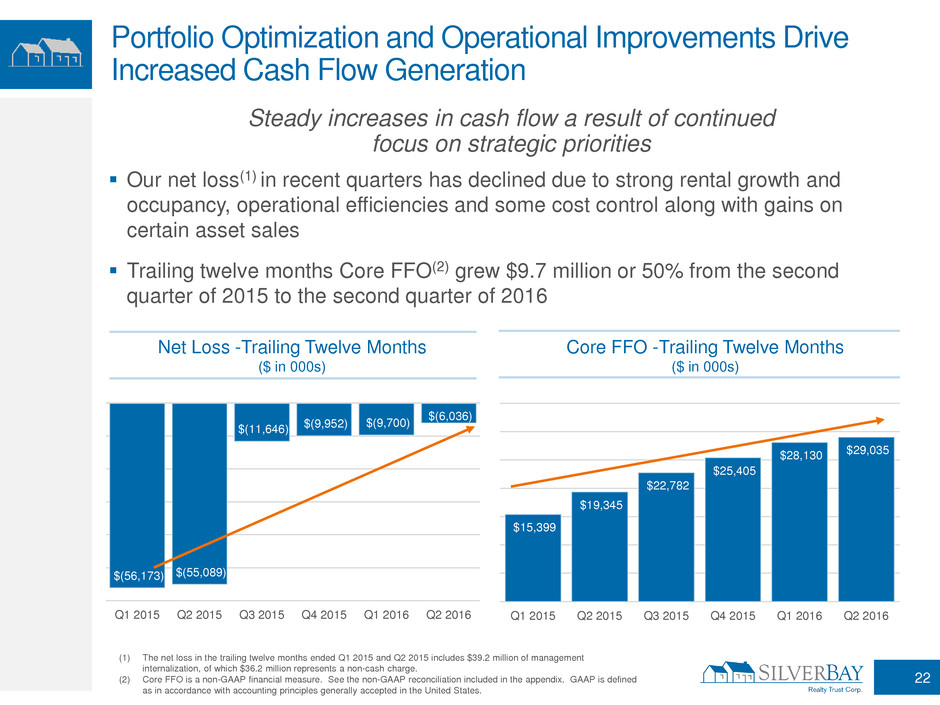

Core FFO -Trailing Twelve Months

($ in 000s)

Net Loss -Trailing Twelve Months

($ in 000s)

$15,399

$19,345

$22,782

$25,405

$28,130 $29,035

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Portfolio Optimization and Operational Improvements Drive

Increased Cash Flow Generation

Steady increases in cash flow a result of continued

focus on strategic priorities

(1) The net loss in the trailing twelve months ended Q1 2015 and Q2 2015 includes $39.2 million of management

internalization, of which $36.2 million represents a non-cash charge.

(2) Core FFO is a non-GAAP financial measure. See the non-GAAP reconciliation included in the appendix. GAAP is defined

as in accordance with accounting principles generally accepted in the United States.

Our net loss(1) in recent quarters has declined due to strong rental growth and

occupancy, operational efficiencies and some cost control along with gains on

certain asset sales

Trailing twelve months Core FFO(2) grew $9.7 million or 50% from the second

quarter of 2015 to the second quarter of 2016

$(56,173) $(55,089)

$(11,646) $(9,952)

$(9,700)

$(6,036)

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

22

$0.22

$0.31

$0.39

$0.46

$0.50 $0.51

Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016

Capital Allocation Strategy

Steady increases in cash flow resulted in strong dividend growth and share

repurchases

– Dividend has grown 13-fold since formation

– Opportunistically repurchased 11% of market cap since formation at $15.82 per share(1)

Continue to focus on portfolio optimization including reinvestment in

higher yielding assets

(1) As of June 30, 2016, 4.2 million shares of SBY stock have been repurchased at an average

price of $15.82 per share. 23

Silver Bay has a balanced approach to maximizing

long-term stockholder value

Dividend Per Share

Trailing Twelve Months

Key Takeaways

Silver Bay participates in an industry with strong fundamentals

Economic conditions driving demand

Strong demographics due to growing millennial population

Low housing supply is resulting in rental rate growth

Majority of single-family ownership is still “mom and pops” allowing for

potential portfolio expansion

Silver Bay is focused on three primary strategic priorities in order

to maximize long-term stockholder value

Focus on operational excellence

Emphasis on portfolio optimization

Disciplined capital allocation strategy

24

Appendix: Q2 Results and

Portfolio Details

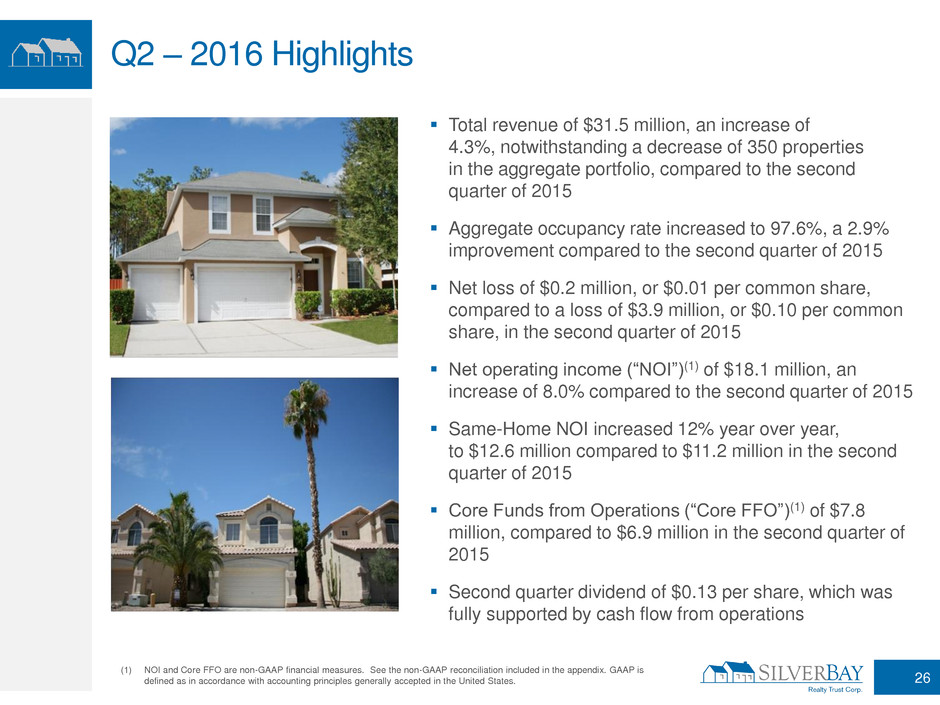

Q2 – 2016 Highlights

Total revenue of $31.5 million, an increase of

4.3%, notwithstanding a decrease of 350 properties

in the aggregate portfolio, compared to the second

quarter of 2015

Aggregate occupancy rate increased to 97.6%, a 2.9%

improvement compared to the second quarter of 2015

Net loss of $0.2 million, or $0.01 per common share,

compared to a loss of $3.9 million, or $0.10 per common

share, in the second quarter of 2015

Net operating income (“NOI”)(1) of $18.1 million, an

increase of 8.0% compared to the second quarter of 2015

Same-Home NOI increased 12% year over year,

to $12.6 million compared to $11.2 million in the second

quarter of 2015

Core Funds from Operations (“Core FFO”)(1) of $7.8

million, compared to $6.9 million in the second quarter of

2015

Second quarter dividend of $0.13 per share, which was

fully supported by cash flow from operations

(1) NOI and Core FFO are non-GAAP financial measures. See the non-GAAP reconciliation included in the appendix. GAAP is

defined as in accordance with accounting principles generally accepted in the United States.

26

Silver Bay Homes are Affordable

Average Property Characteristics(1)

Estimated Market Value per

Property

$167,000

Monthly Rent per Property $1,190

Age (years) 26.8

Square Footage 1,644

Beds 3.3

Baths 2.1

(1) All figures presented are for the SBY portfolio as of June 30, 2016.

Households earning around $45,000 a year

can qualify for a Silver Bay home

27

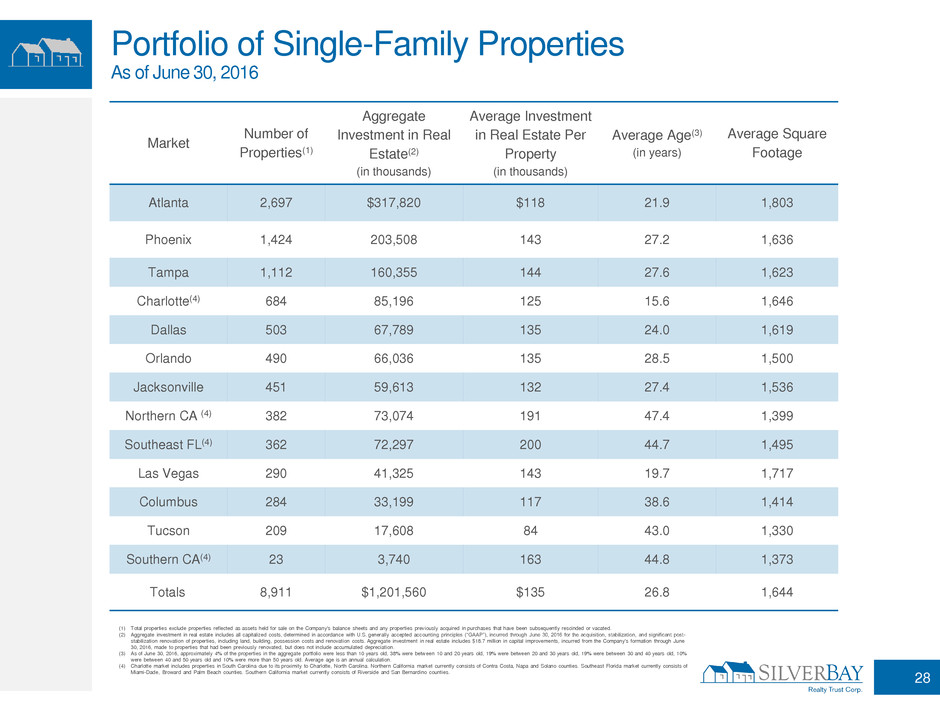

Portfolio of Single-Family Properties

As of June 30, 2016

Market

Number of

Properties(1)

Aggregate

Investment in Real

Estate(2)

(in thousands)

Average Investment

in Real Estate Per

Property

(in thousands)

Average Age(3)

(in years)

Average Square

Footage

Atlanta 2,697 $317,820 $118 21.9 1,803

Phoenix 1,424 203,508 143 27.2 1,636

Tampa 1,112 160,355 144 27.6 1,623

Charlotte(4) 684 85,196 125 15.6 1,646

Dallas 503 67,789 135 24.0 1,619

Orlando 490 66,036 135 28.5 1,500

Jacksonville 451 59,613 132 27.4 1,536

Northern CA (4) 382 73,074 191 47.4 1,399

Southeast FL(4) 362 72,297 200 44.7 1,495

Las Vegas 290 41,325 143 19.7 1,717

Columbus 284 33,199 117 38.6 1,414

Tucson 209 17,608 84 43.0 1,330

Southern CA(4) 23 3,740 163 44.8 1,373

Totals 8,911 $1,201,560 $135 26.8 1,644

(1) Total properties exclude properties reflected as assets held for sale on the Company's balance sheets and any properties previously acquired in purchases that have been subsequently rescinded or vacated.

(2) Aggregate investment in real estate includes all capitalized costs, determined in accordance with U.S. generally accepted accounting principles (“GAAP”), incurred through June 30, 2016 for the acquisition, stabilization, and significant post-

stabilization renovation of properties, including land, building, possession costs and renovation costs. Aggregate investment in real estate includes $18.7 million in capital improvements, incurred from the Company's formation through June

30, 2016, made to properties that had been previously renovated, but does not include accumulated depreciation.

(3) As of June 30, 2016, approximately 4% of the properties in the aggregate portfolio were less than 10 years old, 38% were between 10 and 20 years old, 19% were between 20 and 30 years old, 19% were between 30 and 40 years old, 10%

were between 40 and 50 years old and 10% were more than 50 years old. Average age is an annual calculation.

(4) Charlotte market includes properties in South Carolina due to its proximity to Charlotte, North Carolina. Northern California market currently consists of Contra Costa, Napa and Solano counties. Southeast Florida market currently consists of

Miami-Dade, Broward and Palm Beach counties. Southern California market currently consists of Riverside and San Bernardino counties.

28

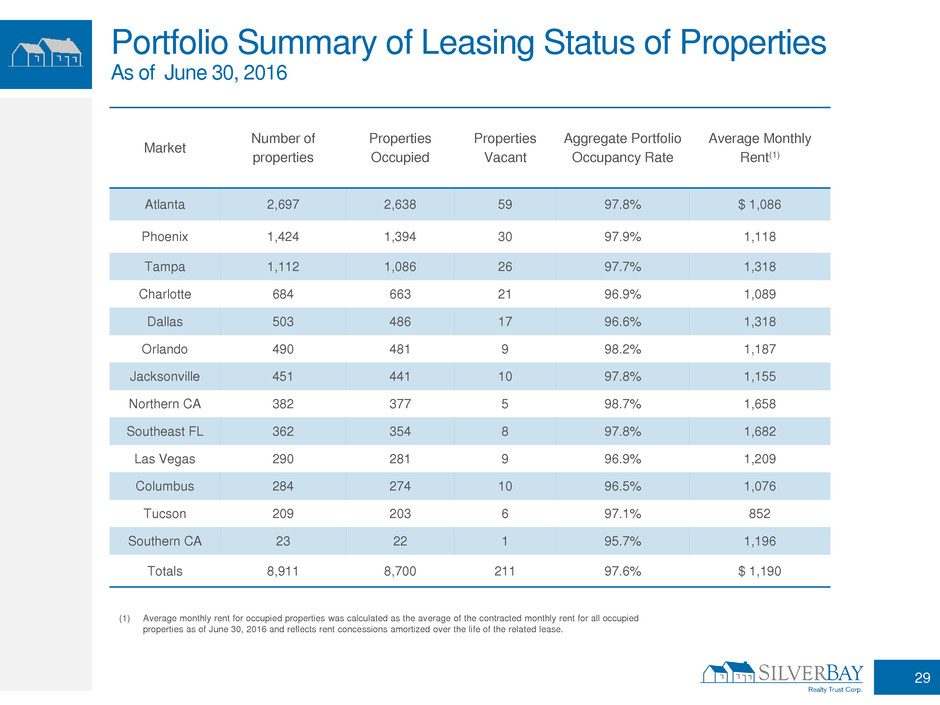

Market

Number of

properties

Properties

Occupied

Properties

Vacant

Aggregate Portfolio

Occupancy Rate

Average Monthly

Rent(1)

Atlanta 2,697 2,638 59 97.8% $ 1,086

Phoenix 1,424 1,394 30 97.9% 1,118

Tampa 1,112 1,086 26 97.7% 1,318

Charlotte 684 663 21 96.9% 1,089

Dallas 503 486 17 96.6% 1,318

Orlando 490 481 9 98.2% 1,187

Jacksonville 451 441 10 97.8% 1,155

Northern CA 382 377 5 98.7% 1,658

Southeast FL 362 354 8 97.8% 1,682

Las Vegas 290 281 9 96.9% 1,209

Columbus 284 274 10 96.5% 1,076

Tucson 209 203 6 97.1% 852

Southern CA 23 22 1 95.7% 1,196

Totals 8,911 8,700 211 97.6% $ 1,190

Portfolio Summary of Leasing Status of Properties

As of June 30, 2016

(1) Average monthly rent for occupied properties was calculated as the average of the contracted monthly rent for all occupied

properties as of June 30, 2016 and reflects rent concessions amortized over the life of the related lease.

29

Non-GAAP Definitions

Net Operating Income and Same-Home Net Operating Income. The Company defines net operating income ("NOI") as

total revenue less property operating and maintenance, real estate taxes, homeowners’ association fees, and property

management expenses. NOI excludes depreciation and amortization, portfolio acquisition expense, general and administrative

expenses, share-based compensation, severance and other, interest expense, net gain on disposition of real estate, income

tax expense, net and other non-comparable items as applicable. The Company considers NOI to be a meaningful financial

measure when considered with the financial statements determined in accordance with GAAP. The Company believes NOI is

helpful to investors in understanding the core performance of its real estate operations without regard to items excluded from

the calculation of such measure, which can vary substantially from company to company depending upon accounting methods,

book value of assets, capital structure and the method by which assets were acquired, among other factors.

The Company believes Same-Home NOI is a useful measure of performance because the population of properties in this

analysis is consistent from period to period, thereby eliminating the effects of changes in the composition of the portfolio.

Core Funds From Operations. Core funds from operations ("Core FFO") is a non-GAAP financial measure that the Company

uses and believes, when considered with the financial statements determined in accordance with GAAP, is helpful to investors

in understanding its performance because it captures features particular to real estate performance by recognizing that real

estate generally appreciates over time or maintains residual value to a much greater extent than do other depreciable assets.

The Company believes this supplemental measure of performance is helpful to investors as it provides a more consistent

measurement of its performance across reporting periods by removing the impact of certain items that are not comparable

from period to period. The Company adjusts net income for depreciation and amortization, gains or losses from sales of, and

impairment losses recognized with respect to, depreciable property, expensed acquisition fees and costs, including those

associated with the portfolio acquisition, share-based compensation, severance and other, income tax expense on the

disposition of real estate, and certain other non-cash or non-comparable costs to arrive at Core FFO.

Core FFO should not be considered an alternative to net income (loss) or net cash flows from operating activities, as

determined in accordance with GAAP, as indications of the Company's performance or a measure of liquidity. This non-GAAP

measure is not necessarily indicative of cash available to fund future cash needs. In addition, although the Company uses this

non-GAAP measure for comparability in assessing the Company’s performance against other REITs, not all REITs compute

this non-GAAP measure in the same manner. Accordingly, there can be no assurance that the Company's basis for computing

this non-GAAP measure is comparable with that of other REITs. This is due in part to the differences in capitalization policies

used by different companies and the significant effect these capitalization policies have on Core FFO. Real estate costs

incurred in connection with real estate operations which are accounted for as capital improvements are added to the carrying

value of the property and depreciated over time, whereas real estate costs that are expenses are accounted for as a current

period expense. This impacts Core FFO because costs that are accounted for as expenses reduce Core FFO. Conversely,

real estate costs associated with assets that are capitalized and then subsequently depreciated are excluded from the

calculation of Core FFO. Core FFO is calculated on a gross basis and, as such, does not reflect adjustments for the

noncontrolling interests - Operating Partnership.

30

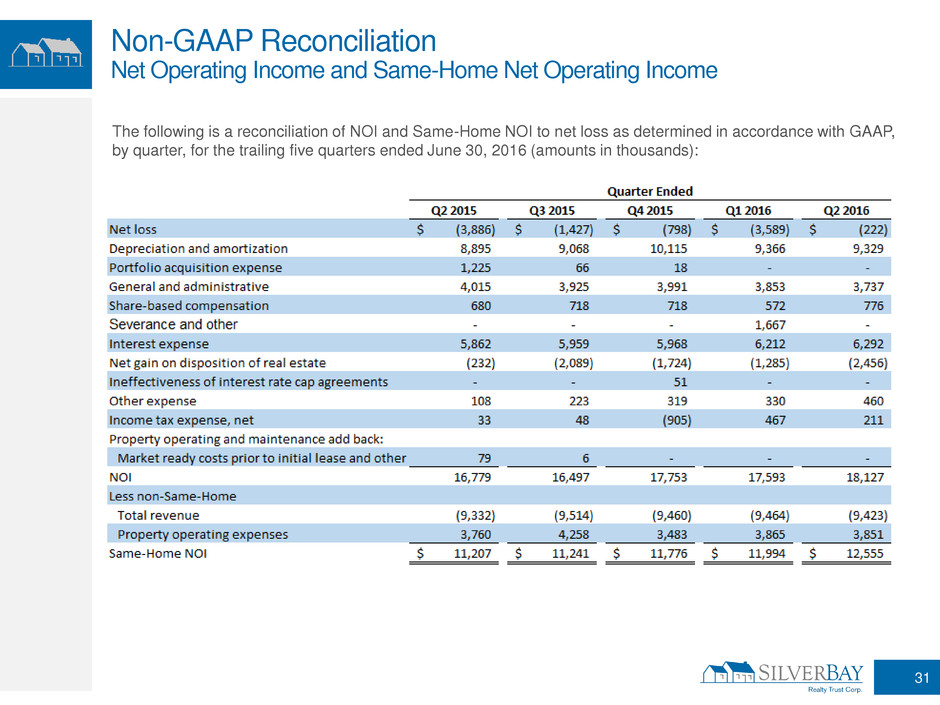

Non-GAAP Reconciliation

Net Operating Income and Same-Home Net Operating Income

The following is a reconciliation of NOI and Same-Home NOI to net loss as determined in accordance with GAAP,

by quarter, for the trailing five quarters ended June 30, 2016 (amounts in thousands):

31

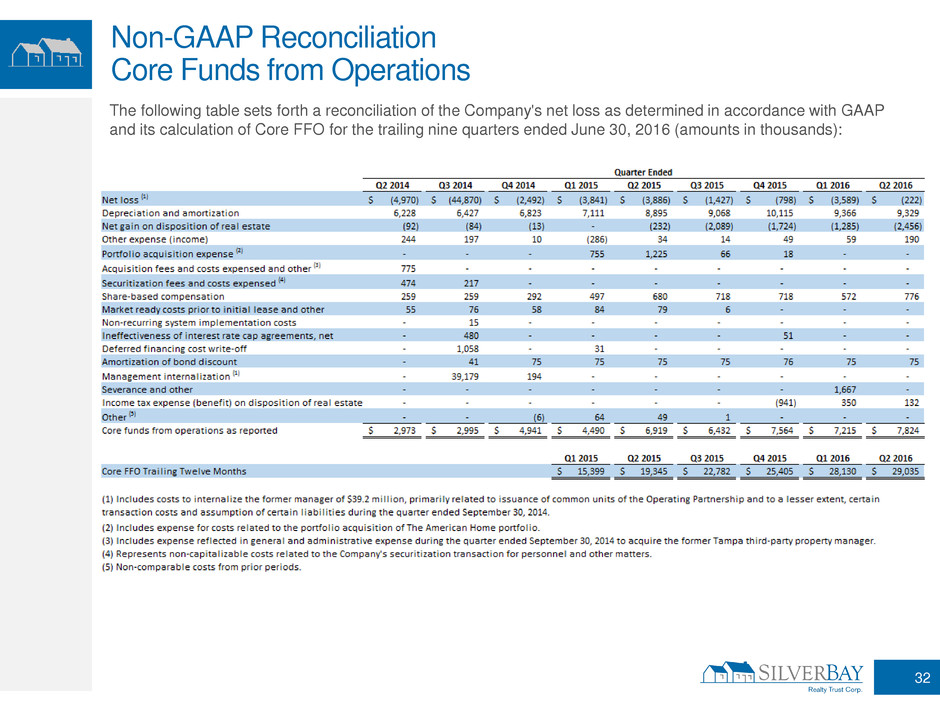

Non-GAAP Reconciliation

Core Funds from Operations

The following table sets forth a reconciliation of the Company's net loss as determined in accordance with GAAP

and its calculation of Core FFO for the trailing nine quarters ended June 30, 2016 (amounts in thousands):

32