Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Majesco | t1602273_8k.htm |

Exhibit 99.1

© 2016 Majesco. All rights reserved 1 Majesco Investor Presentation Ketan Mehta, Co - Founder and CEO September 2016

© 2016 Majesco. All rights reserved 2 2 Cautionary Language Concerning Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act . These forward - looking statements are made on the basis of the current beliefs, expectations and assumptions of management, are not guarantees of performance and are subject to significant risks and uncertainty . These forward - looking statements should, therefore, be considered in light of various important factors, including those set forth in Majesco’s reports that it files from time to time with the Securities and Exchange Commission and which you should review, including those statements under “Item 1 A – Risk Factors” in Majesco’s Annual Report on Form 10 - K . Important factors that could cause actual results to differ materially from those described in forward - looking statements contained in this presentation include, but are not limited to : integration risks ; changes in economic conditions, political conditions, trade protection measures, licensing requirements and tax matters ; technology development risks ; intellectual property rights risks ; competition risks ; additional scrutiny and increased expenses as a result of being a public company ; the financial condition, financing requirements, prospects and cash flow of Majesco ; loss of strategic relationships ; changes in laws or regulations affecting the insurance industry in particular ; restrictions on immigration ; the ability and cost of retaining and recruiting key personnel ; the ability to attract new clients and retain them and the risk of loss of large customers ; continued compliance with evolving laws ; customer data and cybersecurity risk ; and Majesco’s ability to raise capital to fund future growth . These forward - looking statements should not be relied upon as predictions of future events and Majesco cannot assure you that the events or circumstances discussed or reflected in these statements will be achieved or will occur . If such forward - looking statements prove to be inaccurate, the inaccuracy may be material . You should not regard these statements as a representation or warranty by Majesco or any other person that we will achieve our objectives and plans in any specified timeframe, or at all . You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date of this presentation . Majesco disclaims any obligation to publicly update or release any revisions to these forward - looking statements, whether as a result of new information, future events or otherwise, after the date of this presentation or to reflect the occurrence of unanticipated events, except as required by law

© 2016 Majesco. All rights reserved 3 Who is Majesco? 3 Industry Analyst Rated Among Top 3 149 Customers Serves P&C, L&A and Group 43% Revenue Growth FY16 Global Footprint NA - 89% UK - 8% APAC - 3% Insurance Growth 2 Year CAGR @ 23 % Product Solutions: Core, Data, Digital Customers Growth Market

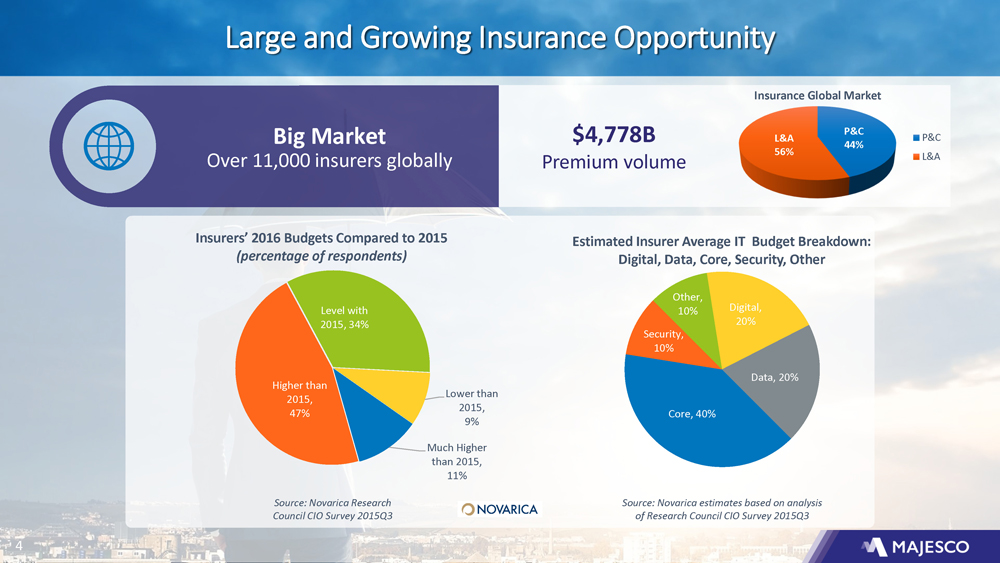

© 2016 Majesco. All rights reserved 4 Large and Growing Insurance Opportunity 4 $4,778B Premium volume P&C 44% L&A 56% Insurance Global Market P&C L&A Core , 40% Security , 10% Other , 10% Digital , 20% Data , 20% Estimated Insurer Average IT Budget Breakdown: Digital, Data, Core, Security, Other Source: Novarica estimates based on analysis of Research Council CIO Survey 2015Q3 Much Higher than 2015 , 11% Higher than 2015 , 47% Level with 2015 , 34% Lower than 2015 , 9% Insurers’ 2016 Budgets Compared to 2015 (percentage of respondents) Source: Novarica Research Council CIO Survey 2015Q3 Big Market Over 11,000 insurers globally

© 2016 Majesco. All rights reserved 5 INSURANCE COMPANIES Pressure on the Insurance Industry is coming from three directions People Changing Market Demographics Changing Risk Profiles & Needs Shifting Customer Expectations Emerging Technologies Explosion of New Data Technology New Competitors Shifting & Expanding Channels Fading Industry Boundaries Market Boundaries NEW INNOVATIONS

© 2016 Majesco. All rights reserved 6 Market Dynamics Driven by Customer Demands Source: SMA Research; Novarica Strong preference to buy vs. build Digital and Data strategies drive need to improve customer experience and insights Channel strategies demand distribution and digital solutions Demand for fewer trusted partners with size and scale Top 5 software suite vendors get majority of new deals Increased adoption of cloud for core and more for innovation and speed

© 2016 Majesco. All rights reserved 7 Enabling the Entire Insurance Value Chain Across All Lines of Business Consulting Policy Billing Claims Digital Data Cloud Services Partner Ecosystem Breadth of Solutions Across All Lines of Business Depth of Solutions » Multiple entry points to a relationship » Consulting and services around core to enable business transformation » Growth opportunities through cross - selling breadth and depth of solutions Distribution

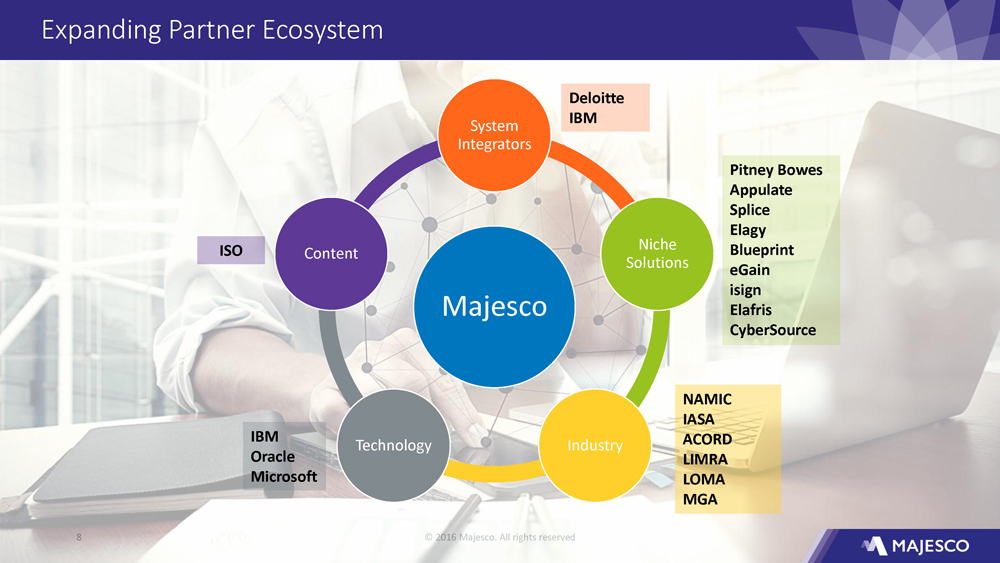

© 2016 Majesco. All rights reserved 8 Expanding Partner Ecosystem Majesco System Integrators Niche Solutions Industry Technology Content Deloitte IBM Pitney Bowes Appulate Splice Elagy Blueprint eGain isign Elafris CyberSource IBM Oracle Microsoft ISO NAMIC IASA ACORD LIMRA LOMA MGA

© 2016 Majesco. All rights reserved 9 Majesco CloudInsurer Platform – Market Leading Solution 16 Why Majesco is Uniquely Positioned Partner Ecosystem of Content and Solutions Implementation and Post Production Services Over 30 Customer Success Stories More Experience than the Competition Out - of - the - box Repeatable, Scalable Cloud Platform with Single Accountability vs. Build - it Model with Many Providers and Limited Control Majesco has all the components Digital and Data Extensions Core Software Ready to Use Content

© 2016 Majesco. All rights reserved 10 Broad, Growing Client Base Startups, Greenfield, Incubator - Market Entry Mid - Market Compete & Grow Large New Initiatives Our clients represent 35% of North America P&C Industry DWP

© 2016 Majesco. All rights reserved 11 Insurance Customers by Tier FY14 FY16 >$5 B 9 17 $1B to <$5B 21 27 24 $100M to <$1B 42 23 <$100M 56 15 Source: Majesco Direct Written Premium

© 2016 Majesco. All rights reserved 12 Customer Analysis – NA P&C Customer Grouping by Solution Policy Billing Claims 35 3 18 0 35 1 2 » Total P&C customer base of 94 » Potential cross selling opportunities across the 3 products

© 2016 Majesco. All rights reserved 13 Fiscal 2016 Revenue Model North America , 88.8% United Kingdom , 7.9% Others , 3.3% Revenue by Geography Property & Casualty , 79.1% Life & Annuities , 17.8% Non - Insurance , 3.1% Revenue by Line of Business Sevices , 61.0% Cloud - Recurring Revenue , 5.7% Cloud - Services , 12.0% License , 6.7% Maintenance , 14.6% Revenue by Offering % to Revenue FY 2016 FY 2015 Top Client 10.2% 8.7% Top 5 Clients 26.5% 30.9% Top 10 Clients 40.7% 46.3% Client Concentration %

© 2016 Majesco. All rights reserved 14 Majesco Business Results Fiscal Year 2016 Customer Success 34 Go - Lives Product Investment increased by 57% Product Innovation - Majesco Business Analytics, Majesco DigitalConnect, Majesco Testing Services, Cloud and updates to all core software Market Penetration • 17 New Logos • 43% revenue growth year on year • 12 Month Executable Backlog up by 47% Company Integration Partner Ecosystem Cover - All and Agile Technologies successfully integrated • Deepened IBM & Deloitte SI partnerships • Expanded ecosystem with 10 partners

© 2016 Majesco. All rights reserved 15 Quarter on Quarter Revenue and Adjusted EBITDA Note : The terms EBITDA and Adjusted EBITDA are not defined under U.S. generally accepted accounting principles (U.S. GAAP), an d are not a measure of operating income, operating performance or liquidity presented in accordance with U.S. GAAP. 15 Dollars in millions $16.9 $19.1 $21.6 $21.7 $23.2 $23.2 $28.2 $29.6 $32.3 $32.6 - 7.6% 4.2% 0.2% 5.8% 5.2% 5.2% 0.2% - 3.7% 1.3% 3.1% -10.0% -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 Q115 - Q116 Q215 - Q216 Q315 - Q316 Q415 - Q416 Q116 - Q117 Prior Year Rev. Current Year Rev. Prior Year Adj. EBITDA Current Year Adj. EBITDA

© 2016 Majesco. All rights reserved 16 Fiscal 2017 First Quarter Highlights Financial Highlights Increase in Revenues Adjusted EBITDA margin of 3.1% is up 180 basis points from FY16 Q4 TTM Order Book Revenue Highlights Implementation revenues up 39.6% as a result of last year’s 17 new client wins Cloud revenues increased 42.0% and represented 18.4% of FY17 Q1 revenues 41% $152.8 million Revenue

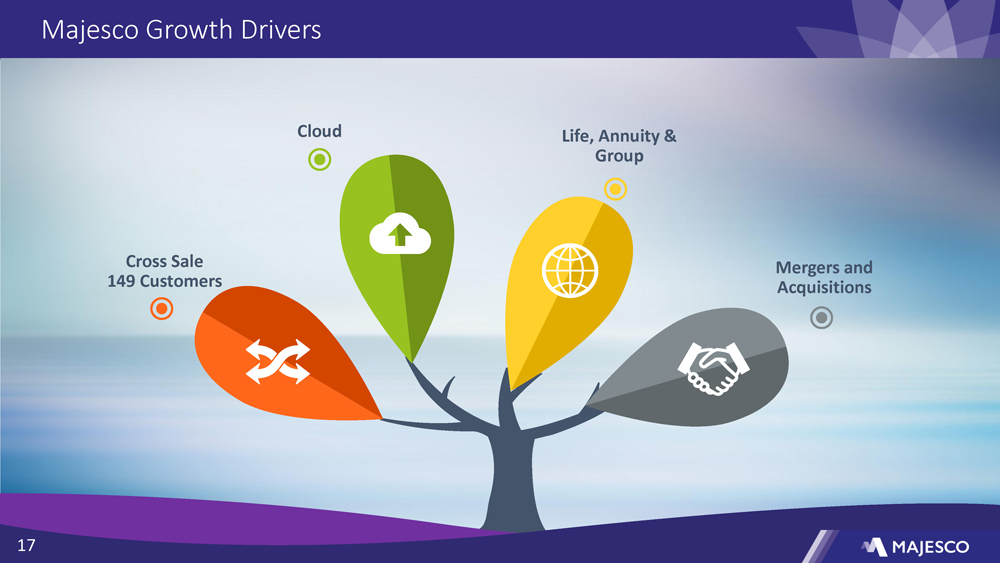

© 2016 Majesco. All rights reserved 17 Majesco Growth Drivers Cross Sale 149 Customers Cloud Life, Annuity & Group Mergers and Acquisitions 17

© 2016 Majesco. All rights reserved 18 An Opportunity to Create a Market Leader in the Insurance Solutions Space Huge Market Opportunity Leading Solution Portfolio Marquee Client Base Growth Oriented Business model Cloud Offerings Are a Key Differentiator • 43% Y - o - Y growth in 2016 • 149 customers presents significant upsell and cross - selling opportunities • Growth in the L&A business (currently comprises only 18% of Majesco’s revenues) • Majesco has invested in leading analytics and Cloud based capabilities • Cloud solutions have seen rapid adoption by mid - sized insurance companies ▪ Faster go to market ▪ Lower cost of implementation • More than 30 current Cloud customers • Over 60% of the pipeline is in Cloud • 149 Global client base across all Tiers of Carriers • Rated among top 3 solutions across majority of Property and Casualty and Life and Annuities software products • Majesco offers clients a single point of accountability – from consulting to implementation to support services • Large Addressable market covering P&A and L&A industries globally • 75% of Insurers currently use outdated IT systems and need to update their platforms • Market is well poised for modern solutions like Majesco

© 2016 Majesco. All rights reserved 19 Thank You