Attached files

| file | filename |

|---|---|

| 8-K - 8-K - JRjr33, Inc. | a9-22x16vegas8k.htm |

Investor Presentation

2016

Exhibit 99.1

2

This presentation includes statements that are, or may be deemed, “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, as amended. In some cases, these forward-looking statements can be identified by the use of

forward-looking terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,” “could,”

“might,” “will,” “should,” “approximately” or, in each case, their negative or other variations thereon or comparable terminology, although

not all forward-looking statements contain these words. They appear in a number of places throughout this presentation and include

statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, our

industry, trends that may affect our industry or us, our business strategy, goals and expectations concerning our market position, future

operations, profitability, forecasted revenue and EBITDA, capital expenditures, liquidity and capital resources and other financial and

operating information.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and,

regulatory and industry developments and depend on the economic circumstances that may or may not occur in the future or may occur on

longer or shorter timelines than anticipated. Although we believe that we have a reasonable basis for each forward-looking statement

contained in this presentation, we caution you that forward-looking statements are not guarantees of future performance and that our actual

results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from

the forward-looking statements contained in this presentation as a result of, among other factors, the factors referenced in the “Risk Factors”

section of our Annual Report on Form 10-K filed with the Securities and Exchange Commission on June 28, 2016, subsequent quarterly

reports on Form 10-Qs and any other filings we make with the SEC. In addition, even if our results of operations, our financial condition

and liquidity, and the development of the industry in which we operate are all consistent with the forward-looking statements contained in

this presentation, they may not be predictive of results or developments in future periods. Any forward-looking statements that we make in

this presentation speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or

circumstances after the date of this presentation, except as required by law.

We ask that you carefully read the factors described in the “Risk Factors” section of our SEC filings to better understand the risks and

uncertainties inherent in our business, our strategy, goals and expectations regarding future operations and profitability and an investment in

our securities generally.

Safe Harbor Statement and Disclaimer

3

Branding Update

On January 28, 2016, CVSL Inc. announced that it would change its name and stock symbol.

The company began doing business as JRJR Networks on March 7, 2016. Its common stock began trading under

the symbol JRJR as of February 16, 2016.

This fresh, new brand identity perfectly fits the identity of the company: A growing, innovative “network of

networks” within the direct-to-consumer industry, led by a family with extraordinary experience and unmatched

expertise in this sector.

4

Investment Thesis

5

Accomplishments by Year

6

About JRJR Networks

7

Acquisition History to Date

8

Acquisition History to Date (continued)

9

What JRJR Brings to Acquired Companies

Proprietary Techniques

JRJR has proprietary, patented methods of analyzing

consumer behavior, finding companies’ strengths and

weaknesses and driving top line growth

Cost Control

Identify SG&A excesses, reduce

operating costs, find synergies and

efficiencies that drive profitability and

free cash flow

“Brand Respect”

Each acquired company’s brand, identity,

sales force, compensation plan and distinct

culture is kept intact

Technology Platform

JRJR leverages its technology leadership

through e-commerce support for the sales

forces

Executive Team and Board

JRJR’s management team has decades of industry success,

tenure and loyalty. Strong board includes a distinguished

litigator, international business experts and a product

development scientist

A Disciplined and Diversified

Acquisition Strategy

There are vast opportunities in the $166 billion+

direct to consumer sector. We target companies

with strong brands, subscription-based,

complementary products and services and

interesting geographic expansion opportunities

10

Prototypical Direct Selling Indicators

11

Our Disciplined Acquisition Process

12

Our Acquisition Opportunity Pipeline is Robust

Category

# of companies

under

consideration

average

revenue

($M)

total

revenue

($M)

Health and

Wellness 20 $205 $4,102

Home 14 462 6,462

Beauty 8 307 2,459

Service 8 303 2,424

Accessories 5 185 927

B2B 2 5 9

Food 2 41 83

Total 59 $279 $16,464

Pipeline by Category

13

A Proven Leadership Team in the

Direct-to-Consumer Sector

JRJR Networks’ management and board leadership has 180+ years of combined success and experience in finance,

operations, marketing, consumer behavior, e-commerce and direct selling compensation plans. Examples of expertise:

14

Global Footprint:

Sales & Operations in Over 40 Countries

15

Case Study: Betterware

Acquired October, 2015

16

Case Study: Kleeneze

Acquired March, 2015

17

Kleeneze/Betterware shows how JRJR Networks uses synergies to increase profitability

Case Study: Kleeneze and Betterware

Operational Efficiencies

18

Case Study: Longaberger

Acquired March, 2013

19

Case Study: Agel

Acquired October, 2013

20

Case Study: Your Inspiration at Home

Acquired August, 2013

21

The Massive Global Direct-to-Consumer Industry

The global direct-to-consumer industry has compound annual growth rate of 5.7% per

year since 2010 and is contra-cyclical to the global economy

(source: World Federation of Direct Selling Associations)

Billion

s

$

22

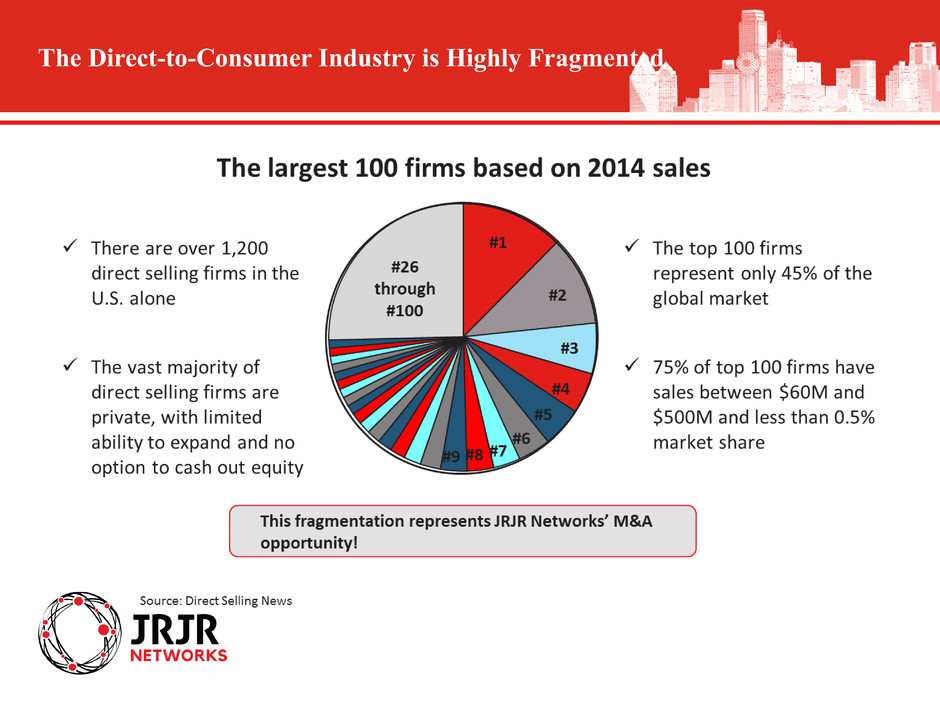

The Direct-to-Consumer Industry is Highly Fragmented

23

A Convergence of Four Powerful Motivating Forces

24

Branding Update

25

Valuation

Sensitivity Analysis

26

Valuation

Net Recruitment

27

Valuation

Valuation