Attached files

| file | filename |

|---|---|

| 8-K - TAIWAN FUND INC | fp0021699_8k.htm |

Investment objective

The Fund’s investment objective is to seek long-term capital appreciation primarily through investments in equity securities listed in Taiwan.

|

Fund facts

|

(as at 08/31/16)

|

|

Net asset value per share

|

$19.81

|

|

Market price

|

$16.96

|

|

Premium/discount

|

-14.39%

|

|

Total net assets

|

$162.88 m

|

|

Market cap

|

$139.48 m

|

|

Fund statistics

|

|

|

Investment adviser (date of appointment)

|

JF International Management, Inc. (07/22/14)

|

|

Fund manager

|

Shumin Huang

|

|

Listed

|

NYSE

|

|

Launch date

|

12/23/86

|

|

Shares outstanding

|

8,224,330

|

|

Last dividend (Ex-dividend date)

|

$2.6332

(December 26, 2014)

|

|

Benchmark

|

TAIEX Total Return Index

|

|

Fund codes

|

|

|

Bloomberg

|

TWN

|

|

Sedol

|

286987895

|

|

CUSIP

|

874036106

|

|

ISIN

|

US8740361063

|

|

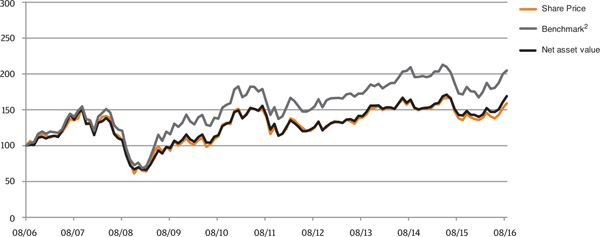

10 year performance data

|

(as at 08/31/16)

|

|

Cumulative Performance1

|

(as at 08/31/16)

|

||||||

|

%

|

1m

|

3m

|

YTD

|

1Y

|

3Y

|

5Y

|

10Y

|

|

The Taiwan Fund, Inc.

|

5.2

|

15.0

|

18.3

|

18.3

|

19.7

|

18.8

|

69.1

|

|

Market Price

|

4.3

|

15.1

|

15.9

|

15.2

|

14.2

|

13.6

|

59.0

|

|

TSE Index

|

1.6

|

9.2

|

12.6

|

13.8

|

6.6

|

7.1

|

42.3

|

|

TAIEX Total Return Index2

|

2.5

|

13.3

|

16.9

|

18.5

|

16.7

|

27.4

|

104.7

|

|

MSCI Taiwan Index

|

1.8

|

13.5

|

17.8

|

16.1

|

21.9

|

29.0

|

70.7

|

|

Rolling 12 month performance1

|

(as at 08/31/16)

|

||||

|

%

|

2016/2015

|

2015/2014

|

2014/2013

|

2013/2012

|

2012/2011

|

|

The Taiwan Fund, Inc.

|

18.3

|

-13.0

|

16.3

|

12.1

|

-11.5

|

|

Market Price

|

15.2

|

-15.2

|

16.8

|

11.2

|

-10.6

|

|

TSE Index

|

13.8

|

-20.4

|

17.8

|

8.5

|

-7.5

|

|

TAIEX Total Return Index2

|

18.5

|

-17.5

|

21.4

|

11.7

|

-3.9

|

|

MSCI Taiwan Index

|

16.1

|

-15.3

|

23.9

|

10.8

|

-4.5

|

|

Top 10 holdings

|

(as at 08/31/16)

|

|

Holding

|

Fund %

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

9.6

|

|

Largan Precision Co., Ltd.

|

5.7

|

|

Hon Hai Precision Industry Co., Ltd.

|

3.7

|

|

Eclat Textile Co., Ltd.

|

3.3

|

|

Ennoconn Corp.

|

3.3

|

|

Cathay Financial Holding Co., Ltd.

|

3.2

|

|

Fubon Financial Holding Co., Ltd.

|

3.0

|

|

Delta Electronics, Inc.

|

2.9

|

|

Wistron NeWeb Corp.

|

2.8

|

|

Uni-President Enterprises Corp.

|

2.5

|

|

1

|

In US Dollar terms

|

|

2

|

TAIEX Total Return Index (prior to January 1, 2003, TAIEX Index)

|

|

Sector breakdown

|

(as at 08/31/16)

|

||

|

Sector Allocation

|

Fund %

|

Benchmark

|

Deviation

|

|

Automobile

|

0.0%

|

1.4%

|

-1.4%

|

|

Biotechnology & Medical Care

|

0.0%

|

0.9%

|

-0.9%

|

|

Building Material & Construction

|

0.0%

|

1.5%

|

-1.5%

|

|

Cement

|

1.7%

|

1.0%

|

0.7%

|

|

Chemical

|

0.0%

|

1.0%

|

-1.0%

|

|

Communications & Internet

|

2.8%

|

6.9%

|

-4.1%

|

|

Computer & Peripheral Equipment

|

9.1%

|

6.1%

|

3.0%

|

|

Electric & Machinery

|

9.2%

|

2.0%

|

7.2%

|

|

Electrical & Cable

|

0.0%

|

0.3%

|

-0.3%

|

|

Electronic Parts & Components

|

5.8%

|

4.3%

|

1.5%

|

|

Electronic Products Distribution

|

0.0%

|

0.8%

|

-0.8%

|

|

Financial & Insurance

|

10.9%

|

12.7%

|

-1.8%

|

|

Foods

|

2.5%

|

2.1%

|

0.4%

|

|

Glass & Ceramic

|

0.0%

|

0.2%

|

-0.2%

|

|

Information Service

|

0.0%

|

0.2%

|

-0.2%

|

|

Iron & Steel

|

0.0%

|

1.9%

|

-1.9%

|

|

Oil, Gas & Electricity

|

1.7%

|

3.5%

|

-1.8%

|

|

Optoelectronic

|

7.7%

|

4.2%

|

3.5%

|

|

Other

|

7.3%

|

3.7%

|

3.6%

|

|

Other Electronic

|

7.0%

|

7.7%

|

-0.7%

|

|

Paper & Pulp

|

0.0%

|

0.2%

|

-0.2%

|

|

Plastics

|

2.3%

|

6.1%

|

-3.8%

|

|

Rubber

|

0.0%

|

1.4%

|

-1.4%

|

|

Semiconductor

|

22.3%

|

24.5%

|

-2.2%

|

|

Shipping & Transportation

|

0.3%

|

1.4%

|

-1.1%

|

|

Textiles

|

5.0%

|

1.8%

|

3.2%

|

|

Tourism

|

0.0%

|

0.5%

|

-0.5%

|

|

Trading & Consumers' Goods

|

2.8%

|

1.7%

|

1.1%

|

|

Cash

|

1.6%

|

0.0%

|

1.6%

|

|

OVERALL TOTAL

|

100.0%

|

100.0%

|

0.0%

|

Review

The TAIEX Total Return index (TAIEX) gained 2.5% in August on continued foreign buying, staying above the 9,000-point level. The market was mostly range bound for the month with investors anticipating a potential interest rate increase by the US Federal Reserve and second quarter 2016 (2Q16) results generally meeting soft expectations. The technology sector performed largely in line with the benchmark driven by semiconductor names. Among the non-tech sectors, commodity (cement/rubber), machinery and financials outperformed, while tourism, food and transportation were the main underperformers. The Fund outperformed the TAIEX by 2.7% in August.

Positioning and Contributors

Positive contributors to the Fund arose from a variety of sectors. Wistron NeWeb, a wireless communication product manufacturer, benefitted from demand in vehicle connectivity and communication. Eclat Textile rebounded on potential sales recovery in the fourth quarter of 2016. ASPEED Technology, a semiconductor chip maker, revised its third quarter 2016 (3Q16) sales forecast upwards to double digit growth from a single digit decline. Ennoconn, a manufacturer of systems and boards, and POYA International, a retail store operator, both rallied on solid 2Q16 results. On the flip side, Taiwan Paiho, a textile tape maker, and AU Optronics, an optoelectronics company, fell on profit-taking. Uni-President Enterprises also retreated on a weaker outlook for both beverage and instant noodle businesses in China.

There was no change to the Fund's investment strategy and it continues to prefer quality companies with strong growth profiles. The Fund also favors growing consumer discretionary names with sustainable franchises, including those in the sportswear and auto parts sectors. Given the weak overall demand for personal computers (PC), note books (NB), televisions (TV) and handsets, the Fund's tech positions are mainly in the cloud, internet of things (IOT), gaming and semi-conductor sectors. The Fund remains underweight in the telecommunications, basic material and financial sectors.

Outlook

Heading into the 3Q16 results season, Taiwan tech names should see good quarterly momentum on the back of the iPhone 7 launch. However, we are keeping a close eye on the strength of the orders shipped, as expectations are low with analysts already looking for a contraction in volume relative to sales of last year's model. As we head towards a potential interest rate increase by the US Federal Reserve, foreign buying could decline with a slowdown in foreign inflow already in evidence at the end of August.

|

Full portfolio holdings

|

(as at 08/31/16)

|

|

Holding

|

Market Value

USD |

Fund

%

|

|

Semiconductor

|

36,243,625

|

22.3

|

|

Taiwan Semiconductor Manufacturing Co., Ltd.

|

15,686,107

|

9.6

|

|

Realtek Semiconductor Corp.

|

4,014,466

|

2.5

|

|

Advanced Semiconductor Engineering, Inc.

|

3,715,573

|

2.3

|

|

ASPEED Technology, Inc.

|

2,870,983

|

1.8

|

|

MediaTek, Inc.

|

2,642,001

|

1.6

|

|

Powertech Technology, Inc.

|

2,098,019

|

1.3

|

|

Silergy Corp.

|

1,728,116

|

1.1

|

|

Silicon Motion Technology Corp.

|

1,716,320

|

1.0

|

|

Win Semiconductors Corp.

|

668,508

|

0.4

|

|

Chunghwa Precision Test Tech Co., Ltd.

|

661,824

|

0.4

|

|

Siliconware Precision Industries Co., Ltd.

|

441,708

|

0.3

|

|

Financial & Insurance

|

17,669,480

|

10.9

|

|

Cathay Financial Holding Co., Ltd.

|

5,136,713

|

3.2

|

|

Fubon Financial Holding Co., Ltd.

|

4,907,367

|

3.0

|

|

China Life Insurance Co., Ltd.

|

2,640,809

|

1.6

|

|

Yuanta Financial Holding Co., Ltd.

|

2,622,949

|

1.6

|

|

E. Sun Financial Holding Co., Ltd.

|

2,361,642

|

1.5

|

|

Electric & Machinery

|

14,956,623

|

9.2

|

|

Hota Industrial Manufacturing Co., Ltd.

|

3,654,922

|

2.3

|

|

Iron Force Industrial Co., Ltd.

|

2,856,734

|

1.8

|

|

Airtac International Group

|

2,666,488

|

1.6

|

|

Macauto Industrial Co., Ltd.

|

1,675,029

|

1.0

|

|

Yeong Guan Energy Technology Group Co., Ltd.

|

1,424,472

|

0.9

|

|

Hiwin Technologies Corp.

|

1,370,694

|

0.8

|

|

Basso Industry Corp.

|

1,308,284

|

0.8

|

|

Computer & Peripheral Equipment

|

14,875,216

|

9.1

|

|

Ennoconn Corp.

|

5,399,560

|

3.3

|

|

Advantech Co., Ltd.

|

2,428,940

|

1.5

|

|

Micro-Star International Co., Ltd.

|

2,418,162

|

1.5

|

|

Inventec Co., Ltd.

|

2,251,799

|

1.4

|

|

Primax Electronics Ltd.

|

2,050,429

|

1.2

|

|

Pegatron Corp.

|

326,326

|

0.2

|

|

Optoelectronic

|

12,479,419

|

7.7

|

|

Largan Precision Co., Ltd.

|

9,312,176

|

5.7

|

|

Au Optronics Corp.

|

1,137,707

|

0.7

|

|

Innolux Corp.

|

1,057,506

|

0.7

|

|

Epistar Corp.

|

972,030

|

0.6

|

|

Other

|

11,900,801

|

7.3

|

|

Taiwan Paiho Ltd.

|

3,985,141

|

2.4

|

|

Nien Made Enterprise Co., Ltd.

|

3,108,681

|

1.9

|

|

Feng TAY Enterprise Co., Ltd.

|

2,127,767

|

1.3

|

|

Nan Liu Enterprise Co., Ltd.

|

1,718,851

|

1.1

|

|

KMC Kuei Meng International, Inc.

|

960,361

|

0.6

|

|

Other Electronic

|

11,439,730

|

7.0

|

|

Hon Hai Precision Industry Co., Ltd.

|

6,001,189

|

3.7

|

|

Tung Thih Electronic Co., Ltd.

|

3,371,015

|

2.1

|

|

Voltronic Power Technology Corp.

|

1,219,635

|

0.7

|

|

Catcher Technology Co., Ltd.

|

847,891

|

0.5

|

|

Full portfolio holdings (cont'd)

|

||

|

Holding

|

Market Value

USD |

Fund

%

|

|

Electronic Parts & Components

|

9,447,827

|

5.8

|

|

Delta Electronics, Inc.

|

4,701,646

|

2.9

|

|

King Slide Works Co., Ltd.

|

2,308,110

|

1.4

|

|

Himax Technologies, Inc.

|

1,380,600

|

0.8

|

|

Sinbon Electronics Co., Ltd.

|

1,057,471

|

0.7

|

|

Textiles

|

8,098,615

|

5.0

|

|

Eclat Textile Co., Ltd.

|

5,414,258

|

3.3

|

|

Toung Loong Textile Manufacturing Co., Ltd.

|

2,684,357

|

1.7

|

|

Trading & Consumers' Goods

|

4,588,629

|

2.8

|

|

Poya Co., Ltd.

|

2,308,190

|

1.4

|

|

President Chain Store Corp.

|

1,973,495

|

1.2

|

|

Taiwan FamilyMart Co., Ltd.

|

306,944

|

0.2

|

|

Communications & Internet

|

4,547,962

|

2.8

|

|

Wistron NeWeb Corp.

|

4,547,962

|

2.8

|

|

Foods

|

4,090,062

|

2.5

|

|

Uni-President Enterprises Corp.

|

4,090,062

|

2.5

|

|

Plastics

|

3,789,379

|

2.3

|

|

Formosa Chemicals & Fibre Corp.

|

2,163,193

|

1.3

|

|

Formosa Plastics Corp.

|

1,626,186

|

1.0

|

|

Cement

|

2,811,530

|

1.7

|

|

Taiwan Cement Corp.

|

2,811,530

|

1.7

|

|

Oil, Gas & Electricity

|

2,743,304

|

1.7

|

|

Formosa Petrochemical Corp.

|

2,743,304

|

1.7

|

|

Cash

|

2,673,159

|

1.6

|

|

Cash

|

2,673,159

|

1.6

|

|

Shipping & Transportation

|

525,460

|

0.3

|

|

Aerospace Industrial Development Corp.

|

525,460

|

0.3

|

|

Grand Total

|

162,880,821

|

100.0

|

Source: MSCI. Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express of implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

No further distribution or dissemination of the MSCI data is permitted without MSCI's express written consent.

Important Information

This document is issued and approved by JF International Management, Inc. (“JFIMI”), as investment advisor of The Taiwan Fund, Inc. (the ‘'Fund''). JFIMI is an investment advisor registered with the US Securities and Exchange Commission. Certain information herein is believed to be reliable but has not been verified by JFIMI. JFIMI makes no representation or warranty and does not accept any responsibility in relation to such information or for opinion or conclusion which the reader may draw from this newsletter.

The Fund is classified as a diversified investment company under the US Investment Company Act of 1940 as amended. It meets the criteria of a closed end US fund and its shares are listed on the New York Stock Exchange. JFIMI has been appointed investment advisor to the Fund.

This newsletter does not constitute an offer of shares. Closed-end funds, unlike open-end funds, are not continuously offered. After the initial public offering, shares are bought and sold on the open market through a stock exchange. JFIMI, its ultimate and intermediate holding companies, subsidiaries, affiliates, clients, directors or staff may, at any time, have a position in the market referred to herein, and may buy or sell securities, currencies, or any other financial instruments in such markets. The information or opinion expressed in this newsletter should not be construed to be a recommendation to buy or sell any security, including the securities, commodities, currencies or financial instruments referred to herein.

Portfolio holdings are subject to change daily.

It should not be assumed that any of the securities transactions or holdings discussed here were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

Investing in the Fund involves certain considerations in addition to the risks normally associated with making investments in securities. The value of the shares issued by the Fund, and the income from them, may go down as well as up and there can be no assurance that upon sale, or otherwise, investors will receive back the amount originally invested. There can be no assurance that you will receive comparable performance returns. Movements in foreign exchange rates may have a separate effect, unfavorable as well as favorable, on the gain or loss otherwise experienced on an investment. Past performance is not a guide to future returns. Accordingly, the Fund is only suitable for investment by investors who are able and willing to withstand the total loss of their investment. In particular, prospective investors should consider the following risks:

Discretionary investment is not risk-free. The past operating performance does not guarantee a minimum return for the discretionary investment fund. Apart from exercising the duty of care of a prudent adviser, JFIMI will not be responsible for the profit or loss of the discretionary investment fund, nor guarantee a minimum return.

|

•

|

It should be noted that investment in the Fund is only suitable for sophisticated investors who are aware of the risk of investing in Taiwan and should be regarded as long term. Funds which invest in one country carry a higher degree of risk than those with portfolios diversified across a number of markets.

|

|

•

|

Investment in the securities of smaller and unquoted companies can involve greater risk than is customarily associated with investment in larger, more established, companies. In particular, smaller companies often have limited product lines, markets or financial resources and their management may be dependent on a smaller number of key individuals. In addition, the market for stock in smaller companies is often less liquid than that for stock in larger companies, bringing with it potential difficulties in acquiring, valuing and disposing of such stock. Proper information for determining their value, or the risks to which they are exposed, may not be available.

|

|

•

|

Investments within emerging markets such as Taiwan can be of higher risk. Many emerging markets, and the companies quoted on their stock exchanges, are exposed to the risks of political, social and religious instability, expropriation of assets or nationalization, rapid rates of inflation, high interest rates, currency depreciation and fluctuations and changes in taxation which may affect the Fund's income and the value of its investments.

|

|

•

|

The marketability of quoted shares may be limited due to foreign investment restrictions, wide dealing spreads, exchange controls, foreign ownership restrictions, the restricted opening of stock exchanges and a narrow range of investors. Trading volume may be lower than on more developed stock markets, and equities are less liquid. Volatility of prices can also be greater than in more developed stock markets. The infrastructure for clearing, settlement and registration on the primary and secondary markets may be undeveloped. Under certain circumstances, there may be delays in settling transactions in some of the markets.

|