Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOOPER HOLMES INC | hhform8-kreaegispresentati.htm |

Investor

Presentation

September, 2016

Presented By: Henry Dubois, CEO

(NYSE Mkt: HH)

Safe Harbor Statement

2

This presentation contains forward-looking statements, as such term is defined in the Private Securities Litigation Reform Act of 1995,

concerning the Company’s plans, objectives, goals, strategies, future events or performances, which are not statements of historical fact

and can be identified by words such as: “expect,” “continue,” “should,” “may,” “will,” “project,” “anticipate,” “believe,” “plan,” “goal,”

and similar references to future periods. The forward-looking statements contained in this presentation reflect our current beliefs and

expectations. Actual results or performance may differ materially from what is expressed in the forward looking statements. Among

the important factors that could cause actual results to differ materially from those expressed in, or implied by, the forward-looking

statements contained in this presentation are our ability to realize the expected benefits from the acquisition of Accountable Health

Solutions and our strategic alliance with Clinical Reference Laboratory; our ability to successfully implement our business strategy and

integrate Accountable Health Solutions’ business with ours; our ability to retain and grow our customer base; our ability to recognize

operational efficiencies and reduce costs; uncertainty as to our working capital requirements over the next 12 to 24 months; our ability

to maintain compliance with the financial covenants contained in our credit facilities; the rate of growth in the Health and Wellness

market and such other factors as discussed in Part I, Item 1A, Risk Factors, and Part II, Item 7, Management’s Discussion and Analysis of

Financial Conditions and Results of Operations of our Annual Report on Form 10-K for the year ended December 31, 2015. The

Company undertakes no obligation to update or release any revisions to these forward-looking statements to reflect events or

circumstances, or to reflect the occurrence of unanticipated events, after the date of this presentation, except as required by law. This

presentation contains information from third-party sources, including data from studies conducted by others and market data and

industry forecasts obtained from industry publications. Although the Company believes that such information is reliable, the Company

has not independently verified any of this information and the Company does not guarantee the accuracy or completeness of this

information. Any references to documents not included in the presentation itself are qualified by the full text and content of those

documents. During our prepared comments or responses to your questions, we may offer incremental metrics to provide greater

insight into the dynamics of our business or our quarterly results, such as references to EBITDA and other measures of financial

performance. Please be advised that this additional detail may be one-time in nature and we may or may not provide an update in the

future. These and other financial measures may also have been prepared on a non-GAAP basis. For some of these measures, a

reconciliation schedule showing GAAP versus non-GAAP results has been provided in our press release that was issued after the market

closed today.

Hooper Holmes, Inc.

3

Improving Population Health

Health Screenings &

Sample Collections

Education Engagement

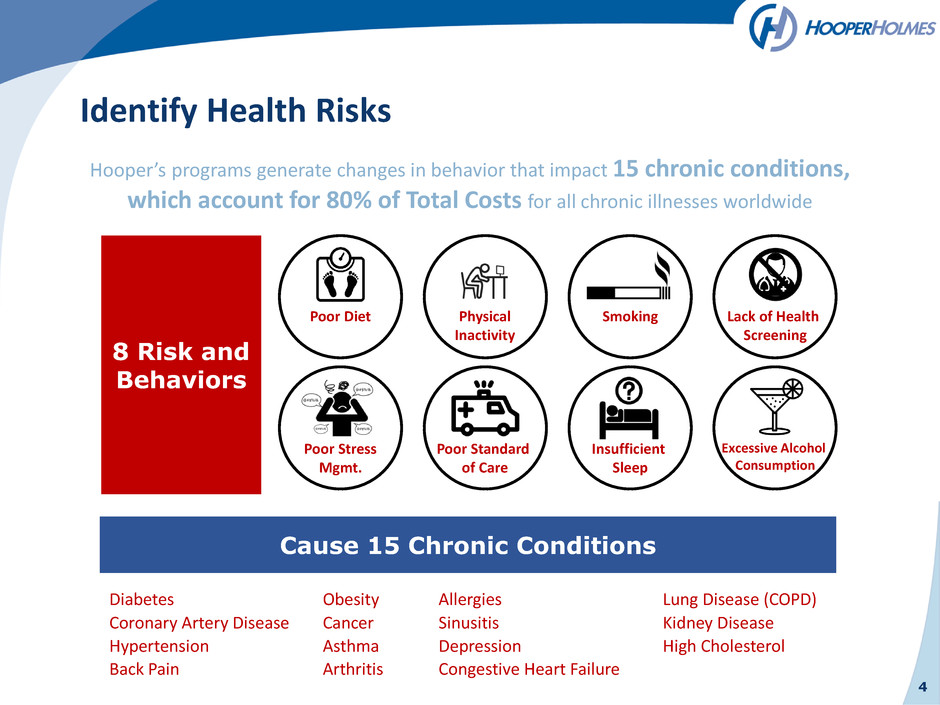

Identify Health Risks

4

Hooper’s programs generate changes in behavior that impact 15 chronic conditions,

which account for 80% of Total Costs for all chronic illnesses worldwide

Diabetes

Coronary Artery Disease

Hypertension

Back Pain

Cause 15 Chronic Conditions

8 Risk and

Behaviors

Poor Diet

Physical

Inactivity

Smoking Lack of Health

Screening

Poor Stress

Mgmt.

Poor Standard

of Care

Insufficient

Sleep

Excessive Alcohol

Consumption

Obesity

Cancer

Asthma

Arthritis

Lung Disease (COPD)

Kidney Disease

High Cholesterol

Allergies

Sinusitis

Depression

Congestive Heart Failure

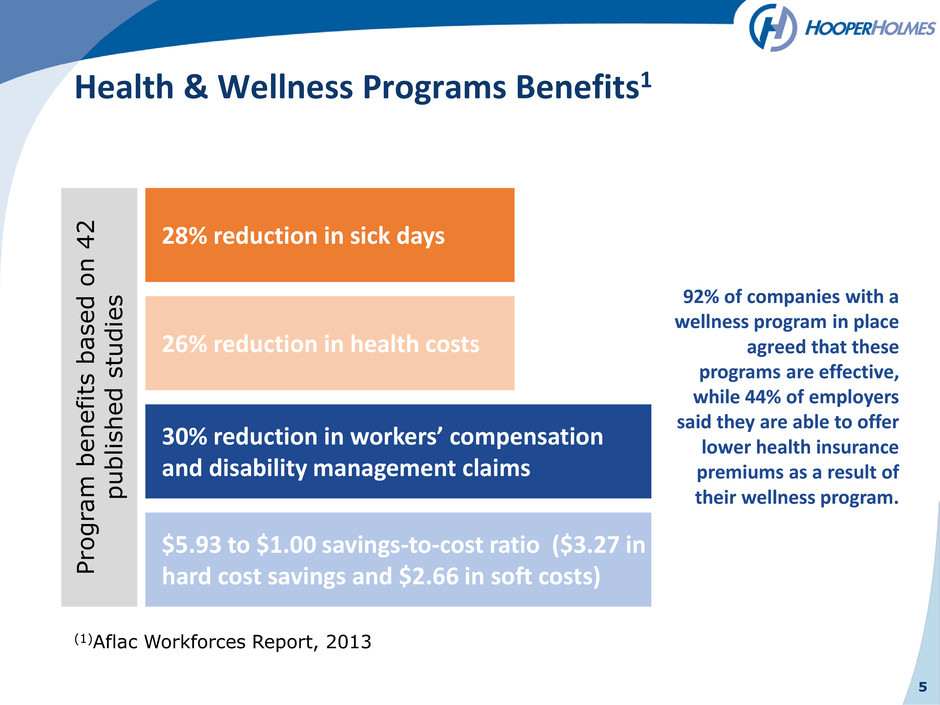

Health & Wellness Programs Benefits1

5

28% reduction in sick days

26% reduction in health costs

30% reduction in workers’ compensation

and disability management claims

$5.93 to $1.00 savings-to-cost ratio ($3.27 in

hard cost savings and $2.66 in soft costs) Prog

ram

b

e

nef

its

base

d

on

42

pub

li

shed

stud

ie

s

(1)Aflac Workforces Report, 2013

92% of companies with a

wellness program in place

agreed that these

programs are effective,

while 44% of employers

said they are able to offer

lower health insurance

premiums as a result of

their wellness program.

6

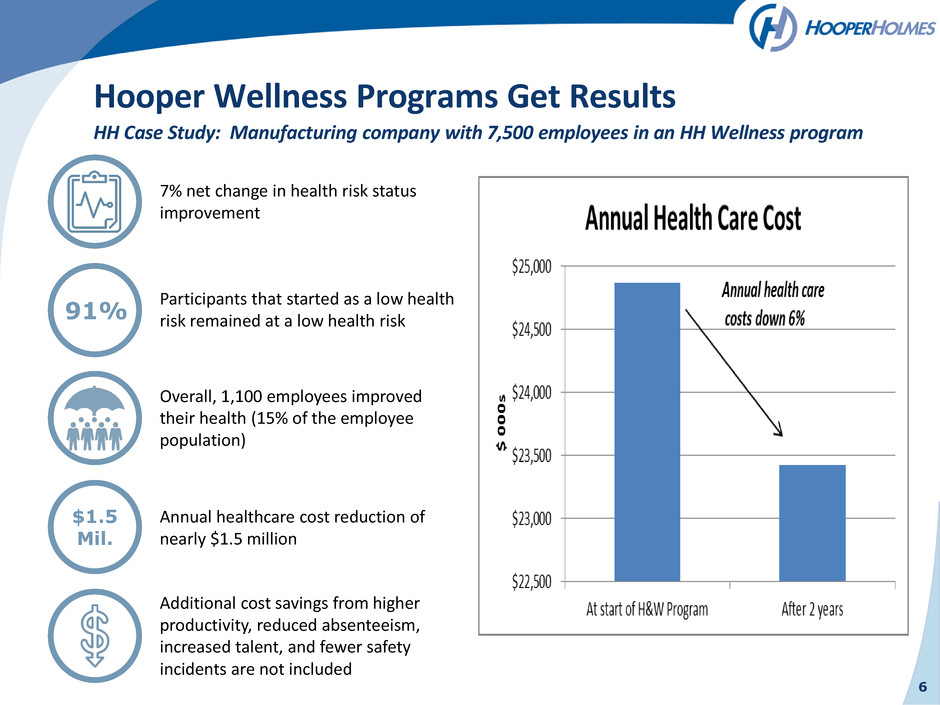

Hooper Wellness Programs Get Results

HH Case Study: Manufacturing company with 7,500 employees in an HH Wellness program

7% net change in health risk status

improvement

Annual healthcare cost reduction of

nearly $1.5 million

Overall, 1,100 employees improved

their health (15% of the employee

population)

Participants that started as a low health

risk remained at a low health risk 91%

$1.5

Mil.

Additional cost savings from higher

productivity, reduced absenteeism,

increased talent, and fewer safety

incidents are not included

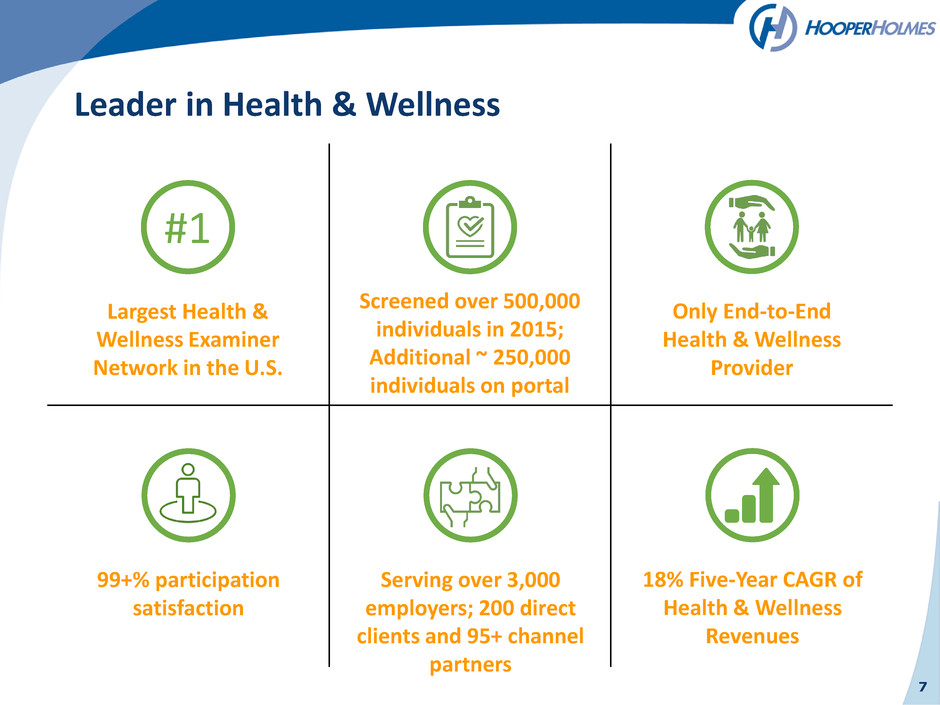

Leader in Health & Wellness

#1

Largest Health &

Wellness Examiner

Network in the U.S.

Screened over 500,000

individuals in 2015;

Additional ~ 250,000

individuals on portal

Only End-to-End

Health & Wellness

Provider

99+% participation

satisfaction

Serving over 3,000

employers; 200 direct

clients and 95+ channel

partners

18% Five-Year CAGR of

Health & Wellness

Revenues

7

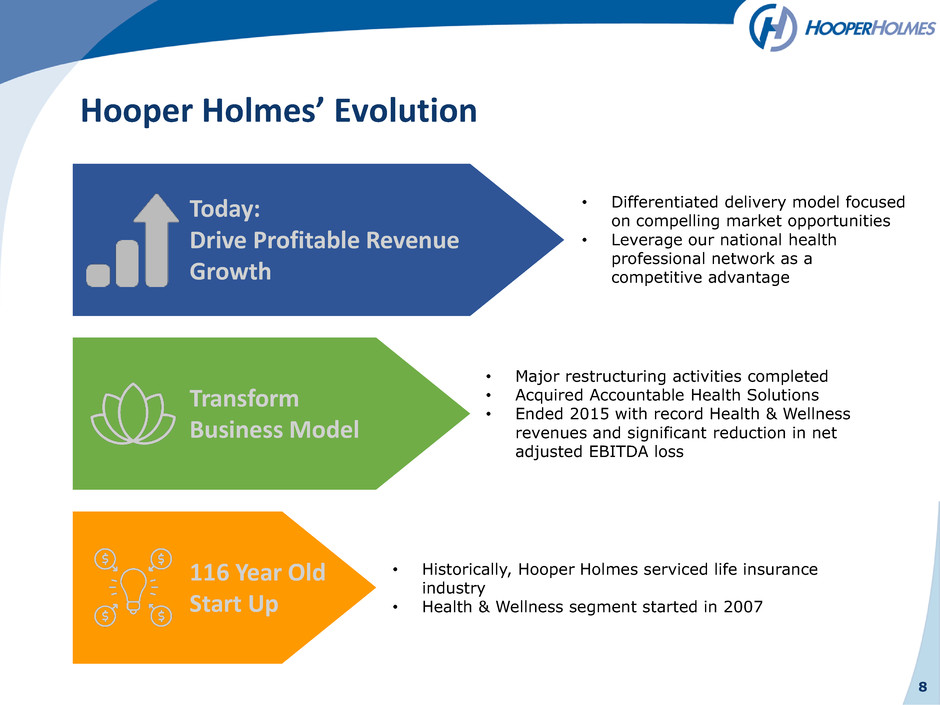

Hooper Holmes’ Evolution

8

Today:

Drive Profitable Revenue

Growth

Transform

Business Model

116 Year Old

Start Up

• Differentiated delivery model focused

on compelling market opportunities

• Leverage our national health

professional network as a

competitive advantage

• Major restructuring activities completed

• Acquired Accountable Health Solutions

• Ended 2015 with record Health & Wellness

revenues and significant reduction in net

adjusted EBITDA loss

• Historically, Hooper Holmes serviced life insurance

industry

• Health & Wellness segment started in 2007

Platform Created to Drive Long-Term

Profitable Growth

9

Built new management team and Board of

Directors with operational and Health &

Wellness experience.

Sold non-core businesses tied to declining life

insurance market to focus on growing Health

& Wellness industry.

Management focused on optimizing cost

structure to produce significant leverage

within financial model

Expanding delivery model to serve growing

markets

Compelling Market Trends

10

Reduce Health

Care Costs

Identify Common

Medical Conditions

Empower

Employees

Hooper Holmes competes in a $7.0 billion market

11

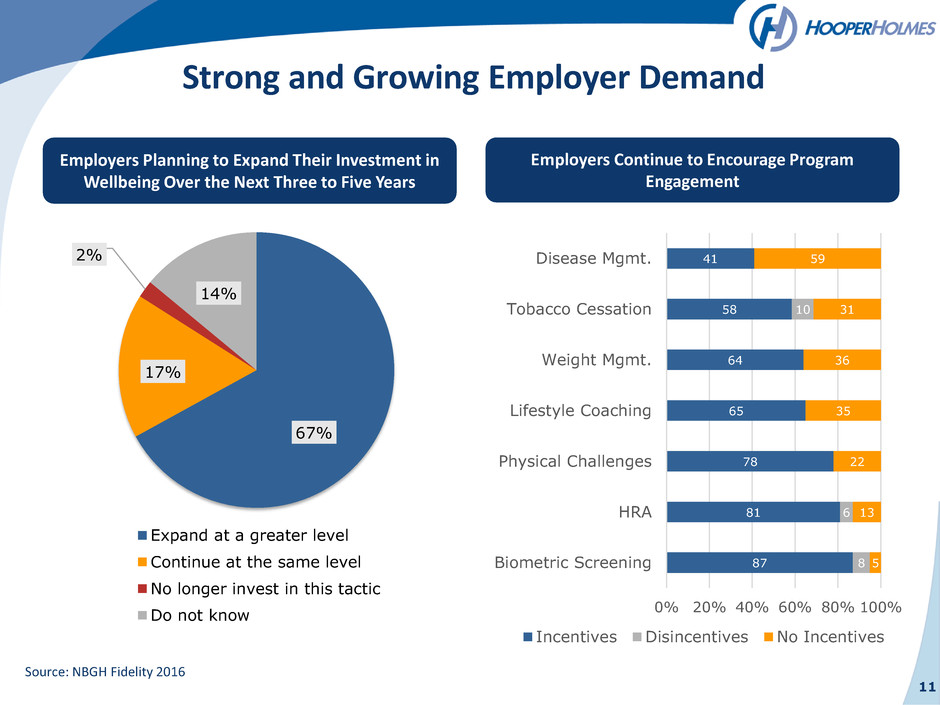

Strong and Growing Employer Demand

Source: NBGH Fidelity 2016

67%

17%

2%

14%

Expand at a greater level

Continue at the same level

No longer invest in this tactic

Do not know

Employers Continue to Encourage Program

Engagement

87

81

78

65

64

58

41

8

6

10

5

13

22

35

36

31

59

0% 20% 40% 60% 80% 100%

Biometric Screening

HRA

Physical Challenges

Lifestyle Coaching

Weight Mgmt.

Tobacco Cessation

Disease Mgmt.

Incentives Disincentives No Incentives

Employers Planning to Expand Their Investment in

Wellbeing Over the Next Three to Five Years

Our Addressable Market

Full Service

Wellness

Channel

Market

Clinical

Research

Organization

Market Size

$6.0B

(includes screening only market)

$2.3B

(screening only market)

$1.0B

Market Growth Est.+8% per annum Est. +8-10% per annum Est. +6-8% per annum

Competitive

Landscape

High and growing with limited

barriers to entry

Moderate with large

barriers to entry

Limited for mobile

collections; high for site

collections

Large opportunity given

increasing focus on health

Utilization of biometric

screenings growing

among small to mid-size

companies; higher

penetration among larger

companies

Substantial opportunity

in the research market as

mobile data collection is

a compelling value

proposition and a shift

from current methods

Customer Examples

12

Non-Financial Health & Wellness Benefits

13

Improved

productivity

Stronger culture,

morale and loyalty

Improved health

and wellbeing

Reduced

Health Risks and costs

Attractive HR

Benefit

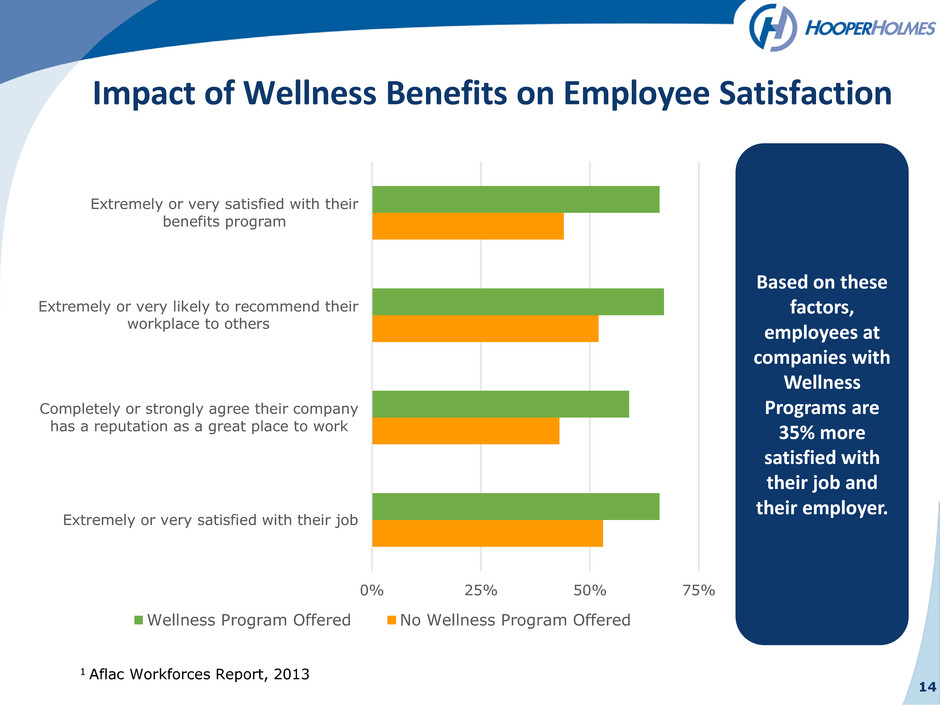

14

Impact of Wellness Benefits on Employee Satisfaction

1 Aflac Workforces Report, 2013

Based on these

factors,

employees at

companies with

Wellness

Programs are

35% more

satisfied with

their job and

their employer.

0% 25% 50% 75%

Extremely or very satisfied with their job

Completely or strongly agree their company

has a reputation as a great place to work

Extremely or very likely to recommend their

workplace to others

Extremely or very satisfied with their

benefits program

Wellness Program Offered No Wellness Program Offered

Hooper Holmes’ Solutions

15

Hooper solutions

focus on educating

employees to drive

behavior change to

help PREVENT these

high-cost conditions

that drive employer

medical costs today

Screening &

Collections

Education Engagement

Industry Leading Services

16

During 2015…

17

Expanding Delivery Model To Serve Growing

Markets

Tobacco DetectSM

The nation’s first fingerstick cotinine test

Onsite service; results available within 5 minutes of test

Indicates all tobacco use; equivalent to clinical lab results

Onsite Flu Vaccines

Conveniently add Trivalent flu shot vaccine to onsite events

Registration via Hooper’s online screening scheduler

Hooper coordinates all aspects of the screening and flu shot events

Compelling long-term potential

Roughly 44% of American adults are vaccinated each year

MinuteClinic®

Expands participant access

MinuteClinic has more than 1,100 locations nationwide

Improves convenience of screenings for mobile workforces and

remote employees

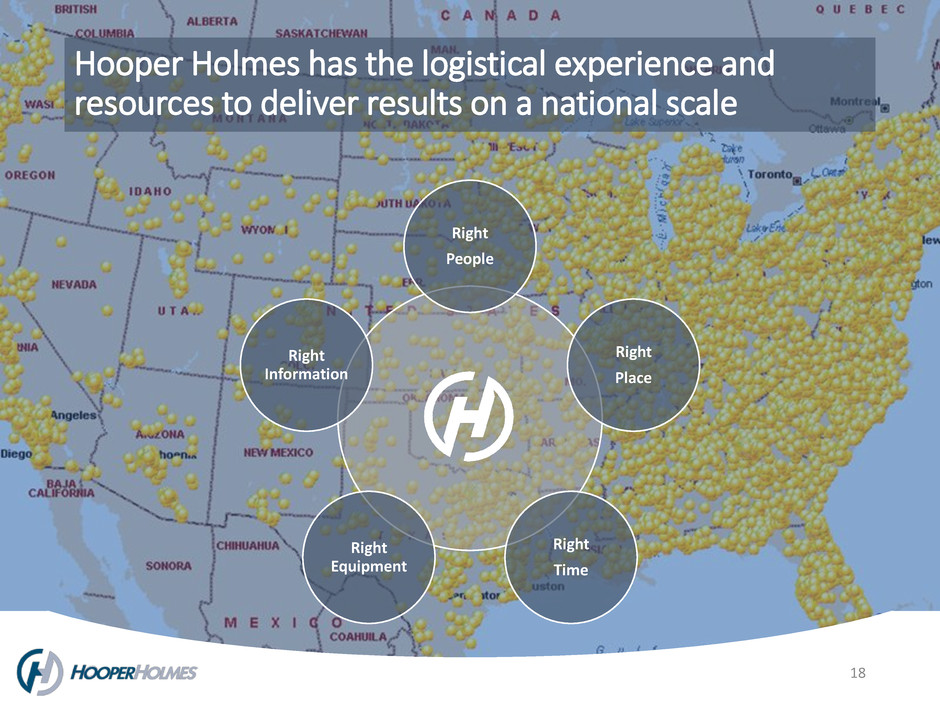

Hooper Holmes has the logistical experience and

resources to deliver results on a national scale

18

Right

People

Right

Place

Right

Time

Right

Equipment

Right

Information

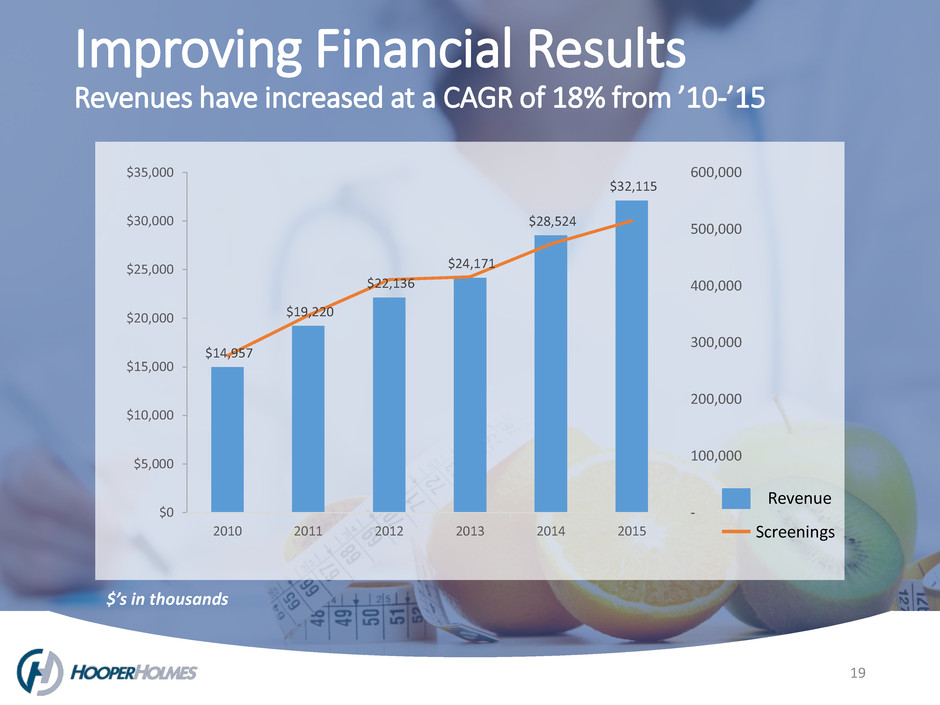

Improving Financial Results

Revenues have increased at a CAGR of 18% from ’10-’15

19

$14,957

$19,220

$22,136

$24,171

$28,524

$32,115

-

100,000

200,000

300,000

400,000

500,000

600,000

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

2010 2011 2012 2013 2014 2015 Screenings

Revenue

$’s in thousands

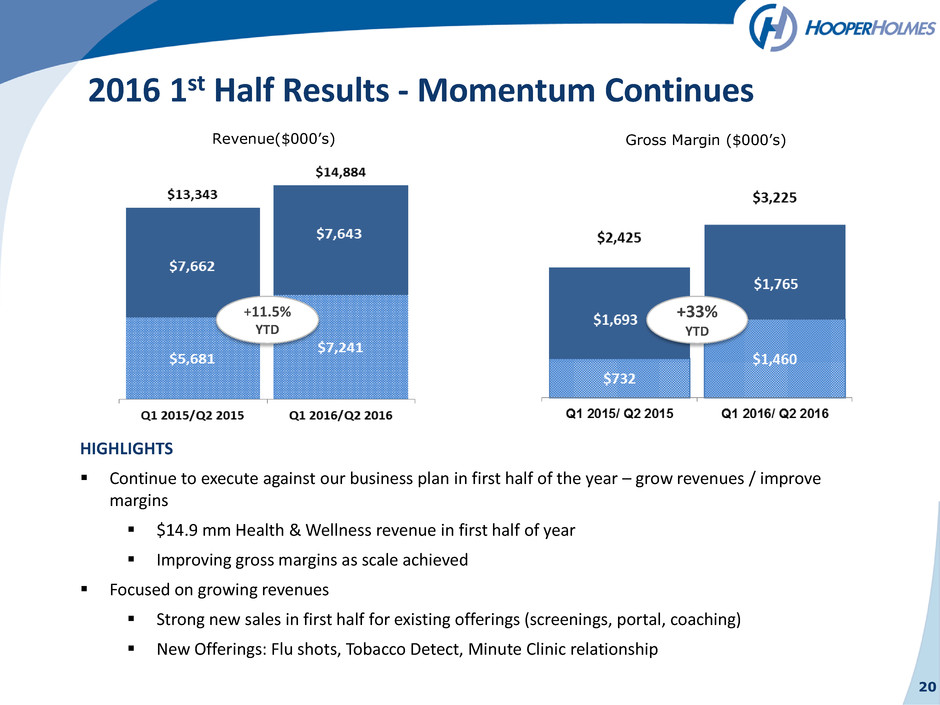

20

HIGHLIGHTS

Continue to execute against our business plan in first half of the year – grow revenues / improve

margins

$14.9 mm Health & Wellness revenue in first half of year

Improving gross margins as scale achieved

Focused on growing revenues

Strong new sales in first half for existing offerings (screenings, portal, coaching)

New Offerings: Flu shots, Tobacco Detect, Minute Clinic relationship

2016 1st Half Results - Momentum Continues

Gross Margin ($000’s)

+33%

YTD

+11.5%

YTD

Revenue($000’s)

21

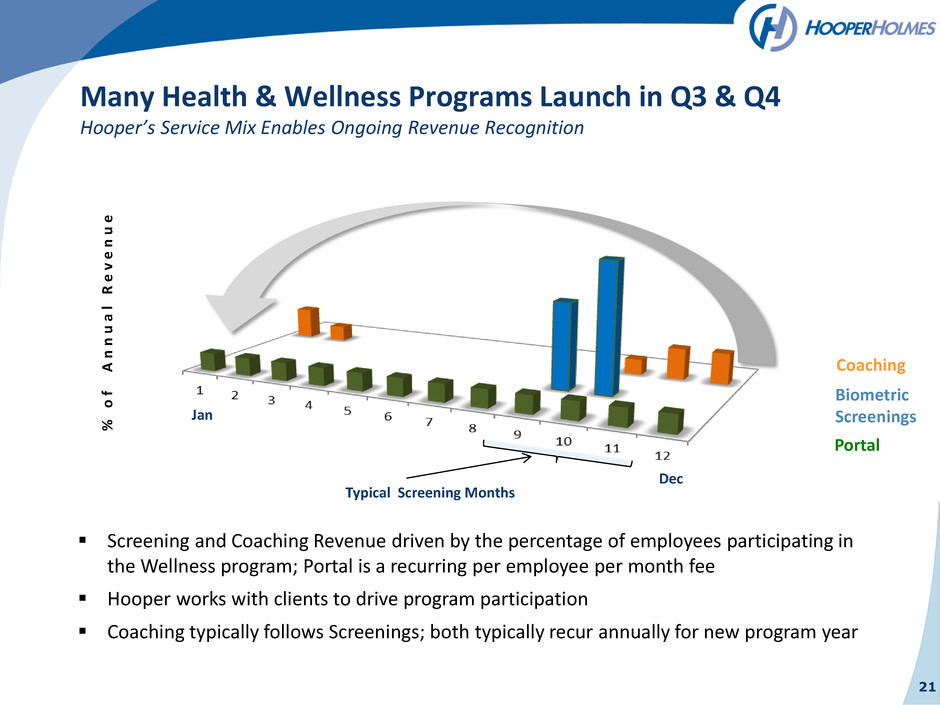

Many Health & Wellness Programs Launch in Q3 & Q4

Hooper’s Service Mix Enables Ongoing Revenue Recognition

Screening and Coaching Revenue driven by the percentage of employees participating in

the Wellness program; Portal is a recurring per employee per month fee

Hooper works with clients to drive program participation

Coaching typically follows Screenings; both typically recur annually for new program year

%

o

f

A

n

n

u

a

l

R

e

v

e

n

u

e

Portal

Coaching

Biometric

Screenings

Typical Screening Months

Dec

Jan

Positioned for Long-Term Growth

22

Strong Revenue Growth Improving Financial Results

Health & Wellness Focus Favorable Industry Dynamics

Infrastructure created to manage

significant Health & Wellness

opportunity

Enhancing offerings and

services to differentiate

business

$7.0 Billion annual market

opportunity

Increasing trend towards

preventive medicine

Five-Year CAGR in revenues

Revenues up 12%

Scalable Platform

New Offerings Contributing

Revenue and Margin

18%

Q2