Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Sesen Bio, Inc. | d261598dex992.htm |

| EX-99.1 - EX-99.1 - Sesen Bio, Inc. | d261598dex991.htm |

| EX-10.9 - EX-10.9 - Sesen Bio, Inc. | d261598dex109.htm |

| EX-10.8 - EX-10.8 - Sesen Bio, Inc. | d261598dex108.htm |

| EX-10.7 - EX-10.7 - Sesen Bio, Inc. | d261598dex107.htm |

| EX-10.6 - EX-10.6 - Sesen Bio, Inc. | d261598dex106.htm |

| EX-10.5 - EX-10.5 - Sesen Bio, Inc. | d261598dex105.htm |

| EX-10.4 - EX-10.4 - Sesen Bio, Inc. | d261598dex104.htm |

| EX-10.3 - EX-10.3 - Sesen Bio, Inc. | d261598dex103.htm |

| EX-10.2 - EX-10.2 - Sesen Bio, Inc. | d261598dex102.htm |

| EX-10.1 - EX-10.1 - Sesen Bio, Inc. | d261598dex101.htm |

| EX-4.1 - EX-4.1 - Sesen Bio, Inc. | d261598dex41.htm |

| EX-2.1 - EX-2.1 - Sesen Bio, Inc. | d261598dex21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 20, 2016

ELEVEN BIOTHERAPEUTICS, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware | 001-36296 | 26-2025616 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 215 First Street, Suite 400 Cambridge, MA |

02142 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (617) 871-9911

None

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 | Entry into a Material Definitive Agreement. |

Share Purchase Agreement

On September 20, 2016, Eleven Biotherapeutics, Inc. (“Eleven” or the “Company”) entered into a Share Purchase Agreement with Viventia Bio Inc., a corporation incorporated under the laws of the Province of Ontario, Canada (“Viventia”), the shareholders of Viventia named therein (the “Selling Shareholders”) and, solely in its capacity as seller representative, Clairmark Investments Ltd., a corporation incorporated under the laws of the Province of Ontario, Canada (“Clairmark”) (the “Share Purchase Agreement”), pursuant to which Eleven agreed to and simultaneously completed the acquisition of all of the outstanding capital stock of Viventia from the Selling Shareholders (the “Acquisition”). In connection with the closing of the Acquisition, Eleven issued 4,013,431 shares of its common stock to the Selling Shareholders, which represented approximately 19.9% of the voting power of Eleven as of immediately prior to the issuance of such shares of Eleven common stock.

In addition, under the Share Purchase Agreement, Eleven will be obligated to pay to the Selling Shareholders certain post-closing contingent cash payments upon the achievement of specified milestones and based upon net sales, in each case subject to the terms and conditions set forth in the Share Purchase Agreement, including: (i) a one-time milestone payment of $12.5 million payable upon the first sale of ViciniumTM or any variant or derivative thereof, other than ProxiniumTM (the “Purchased Product”), in the United States; (ii) a one-time milestone payment of $7.0 million payable upon the first sale of the Purchased Product in any one of certain specified European countries; (iii) a one-time milestone payment of $3.0 million payable upon the first sale of the Purchased Product in Japan; and (iv) and quarterly earn-out payments equal to two percent (2%) of net sales of the Purchased Product during specified earn-out periods. Such earn-out payments are payable with respect to net sales in a country beginning on the date of the first sale in such country and ending on the earlier of (i) December 31, 2033 and (ii) fifteen years after the date of such sale, subject to early termination in certain circumstances if a biosimilar product is on the market in the applicable country. Under the Share Purchase Agreement, Eleven, its affiliates, licensees and subcontractors are required to use commercially reasonable efforts, for first seven years following the closing of the Acquisition, to achieve marketing authorizations throughout the world and, during the applicable earn-out period, to commercialize the Purchased Product in the United States, France, Germany, Italy, Spain, United Kingdom, Japan, China and Canada.

In connection with the closing of the Acquisition and pursuant to the Share Purchase Agreement, the Board of Directors of Eleven (the “Board”) elected Stephen A. Hurly and Leslie L. Dan to serve as members of the Board. The Board of Eleven also appointed Mr. Hurly as the Company’s President and Chief Executive Officer to succeed Abbie C. Celniker, with Dr. Celniker continuing to serve as a member of the Board. Also in connection with the Acquisition, Arthur P. DeCillis, M.D., Viventia’s Chief Medical Officer, was appointed as Chief Medical Officer of Eleven, and Karen L. Tubridy, Eleven’s Chief Development Officer, resigned from Eleven. In addition, Gregory Adams, Ph.D., Viventia’s Chief Development Officer and Glen MacDonald, Ph.D., Viventia’s Chief Scientific Officer, will join Eleven’s management team. John J. McCabe, will continue to serve as Chief Financial Officer of Eleven.

Each of Eleven, Viventia and the Selling Shareholders has agreed to customary representations, warranties and covenants in the Share Purchase Agreement. The Share Purchase Agreement also includes indemnification obligations in favor of Eleven from the Selling Shareholders, including for breaches of representations, warranties, covenants and agreements made by Viventia and the Selling Shareholders in the Share Purchase Agreement. In connection with the closing of the Acquisition, Eleven deposited 401,343 shares of its common stock (representing approximately 10% of the Eleven common stock portion of the aggregate closing consideration owed to the Selling Shareholders pursuant to the Share Purchase Agreement) into an escrow fund for the purposes of securing the indemnification obligations of the Selling Shareholders to Eleven for any and all losses for which Eleven is entitled to indemnification pursuant to the Share Purchase Agreement. The Share Purchase Agreement also includes indemnification obligations in favor of the Selling Shareholders from Eleven, including for breaches of representations, warranties, covenants and agreements made by Eleven in the Share Purchase Agreement.

The closing of the Acquisition was not subject to approval by any applicable governmental entity or the approval of the stockholders of Eleven. The NASDAQ Stock Market, LLC has approved the listing of additional shares of Eleven’s common stock in connection with the Acquisition.

As a result of the Acquisition, Viventia became a wholly owned subsidiary of Eleven and the business conducted by Eleven includes the business conducted by Viventia immediately prior to the Acquisition.

As of September 19, 2016, there were 20,167,997 shares of Eleven common stock outstanding. As of immediately after the closing of the Acquisition, the Selling Shareholders beneficially owned approximately 16.6% of the outstanding shares of common stock of Eleven. The Share Purchase Agreement provides that the Selling Shareholders may not, except in limited circumstances, sell or transfer, or engage in swap or similar transactions with respect to, shares of Eleven’s common stock, including shares received in connection with the Acquisition, for a period of 180 days following the closing of the Acquisition. The shares of Eleven’s common stock issued to the Selling Shareholders were issued in reliance upon the exemptions from registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Regulation S and/or Rule 506 of Regulation D promulgated thereunder. Each Selling Shareholder represented that it was either an accredited investor or not a U.S. person and was acquiring the shares for its own account for investment purposes only and not with a view to, or for sale in connection with, any distribution thereof and that they could bear the risks of the investment and could hold the shares for an indefinite period of time.

The foregoing description of the Share Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the document attached hereto as Exhibit 2.1, which is incorporated herein by reference.

The Share Purchase Agreement has been included to provide investors and security holders with information regarding its terms. It is not intended to provide any other factual information about Eleven, Viventia, the Selling Shareholders or their respective subsidiaries and affiliates. The Share Purchase Agreement contains representations and warranties by Viventia

and the Selling Shareholders, on the one hand, and by Eleven, on the other hand, made solely for the benefit of the other. The assertions embodied in those representations and warranties are qualified by information in confidential disclosure schedules delivered by each party in connection with the signing of the Share Purchase Agreement, certain representations and warranties in the Share Purchase Agreement were made as of a specified date, may be subject to a contractual standard of materiality different from what might be viewed as material to investors, or may have been used for the purpose of allocating risk between the Selling Shareholders and Eleven. Accordingly, the representations and warranties in the Share Purchase Agreement should not be relied on by any persons as characterizations of the actual state of facts about the Company at the time they were made or otherwise. In addition, information concerning the subject matter of the representations and warranties may change after the date of the Share Purchase Agreement, which subsequent information may or may not be fully reflected in Eleven’s public disclosures.

Registration Rights Agreement

In connection with the Acquisition, the Company entered into a registration rights agreement dated September 20, 2016 (the “Registration Rights Agreement”), with certain of the Selling Shareholders. Under the Registration Rights Agreement, holders of a total of 3,582,328 shares of the Company’s common stock (the “registrable securities”) will have the right to require the Company to register these shares under the Securities Act under specified circumstances. After registration pursuant to these rights, these shares will become freely tradable without restriction under the Securities Act. If not otherwise exercised, the rights under the Registration Rights Agreement described below will expire on September 20, 2021.

Demand and Form S-3 Registration Rights

Beginning 90 days after the date of the Registration Rights Agreement, subject to specified limitations set forth therein, at any time, the holders of at least 50% of the then outstanding registrable securities may demand that the Company register at least 50% of the registrable securities then outstanding under the Securities Act for purposes of a public offering having an aggregate offering price to the public of not less than $5,000,000. The Company is not obligated to file a registration statement pursuant to this provision on more than two occasions, and is not obligated to request that any registration statement filed pursuant to this provision be declared effective prior to the date that is 180 days after the date of the Registration Rights Agreement.

“Piggyback” Registration Rights

If, at any time the Company proposes to register for its own account any of its securities under the Securities Act, the holders of registrable securities will be entitled to notice of the registration and, subject to specified exceptions, have the right to require the Company to use its best efforts to register all or a portion of the registrable securities then held by them in that registration.

In the event that any registration in which the holders of registrable securities participate pursuant to the Registration Rights Agreement, the Company has agreed to enter into an

underwriting agreement containing customary representations and warranties and covenants, including without limitation customary provisions with respect to indemnification of the underwriters of such offering.

In the event that any registration in which the holders of registrable securities participate pursuant to the Registration Rights Agreement, the Company will use its best efforts to include the requested securities, but such inclusions may be limited by market conditions to the extent set forth in the Registration Rights Agreement.

Expenses

Pursuant to the Registration Rights Agreement, the Company is required to pay all registration expenses, including the fees and expenses of one counsel to represent the selling stockholders, other than any underwriting discounts, selling commissions and fees and expenses of a selling stockholder’s own counsel related to any demand or incidental registration. The Company is not required to pay registration expenses if the registration request under the Registration Rights Agreement is withdrawn at the request of holders initiating such registration request, unless the withdrawal is due to discovery of a materially adverse change in the Company’s business after the initiation of such registration request.

The Registration Rights Agreement contains customary cross-indemnification provisions, pursuant to which the Company is obligated to indemnify the stockholders party thereto in the event of material misstatements or omissions in the registration statement attributable to the Company or any violation or alleged violation whether by action or inaction by the Company under the Securities Act, the Securities Exchange Act of 1934, as amended (the “Exchange Act”), any state securities or Blue Sky law or any rule or regulation promulgated under the Securities Act, the Exchange Act or any state securities or Blue Sky law in connection with such registration statement or the qualification or compliance of the offering, and they are obligated to indemnify the Company for material misstatements or omissions in the registration statement attributable to them.

The foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the document attached hereto as Exhibit 4.1, which is incorporated herein by reference.

Material Viventia Agreements

As a result of the Acquisition, the following Viventia agreements and arrangements effectively became agreements and arrangements of Eleven.

Unless the context otherwise requires, all references in this Current Report on Form 8-K to “Eleven,” “we,” “our” and “us” refer to Eleven Biotherapeutics Inc. and its wholly owned subsidiaries after the effective time of the Acquisition, and all references to Viventia refer to Viventia Bio Inc. and its wholly owned subsidiaries and predecessor entities prior to the effective time of the Acquisition.

License Agreement with the University of Zurich

On January 9, 2003, Viventia entered into a license agreement with the University of Zurich (“Zurich”), as amended and restated on October 14, 2015 (the “Zurich Agreement”).

Overview and exclusivity. The Zurich Agreement grants Viventia exclusive rights, with the right to sublicense, to make, have made, use, sell, offer for sale, and import under certain patents primarily directed to Viventia’s targeting agent, including epithelial cell adhesion molecule, or EpCAM, chimera, and related immunoconjugates and methods of use and manufacture of the same. These patents cover some key aspects of Viventia’s product candidates Vicinium and Proxinium. Under the terms of the agreement, Viventia may in the future be obligated to pay an additional $750,000 in milestone payments, for the first product candidate that achieves applicable clinical development milestones. Based on current clinical status, Viventia anticipates that these milestones may be triggered by Vicinium’s clinical development pathway. As part of the consideration, Viventia will also be obligated to pay a 4% royalty, subject to downward adjustment in certain instances, on the net product sales for products covered by or manufactured using a method covered by a valid claim in the Zurich patent rights. There is no obligation to pay royalties in a country if there is no valid claim that covers the product or a method of manufacturing the product. As of the date of the Acquisition, aggregate license fees of $250,000 have been paid to Zurich.

Patent rights. Viventia is responsible for the patent filing, prosecution and maintenance activities pertaining to the patent rights, at its sole expense, while Zurich is afforded reasonable opportunities to review and comment on such activities. If appropriate, Viventia shall apply for an extension of the term of any licensed patent where available in at least the United States, Europe and Japan. In the event of any substantial infringement of the patent rights, Viventia may request Zurich to take action to enforce the licensed patents against third parties. If the infringing activity is not abated within 90 days and Zurich has elected not to take legal action, Viventia may take legal action (in Zurich’s name, if necessary). Such action will be at Viventia’s own expense and Zurich will have the opportunity to join at its own expense. Recoveries from any action shall generally belong to the party bringing the suit, but (a) in the event that Viventia brings the action and an acceptable settlement or monetary damages are awarded, then Zurich will be reimbursed for any amount that would have been due to Zurich if the products sold by the infringer actually had been sold by Viventia and (b) in the event a joint legal action is brought, then the parties shall share the expense and recoveries shall be shared in proportion to the share of expense paid by the respective party. Each party is required to cooperate with the other in litigation proceedings at the expense of the party bringing the action.

Term and termination. The term of the agreement expires as of the expiration date of the last patent to expire within the Zurich patent rights. Viventia is currently projecting an expiration date for the U.S. licensed patents in 2024, subject to any applicable patent term adjustment or extension that may be available on a jurisdictional basis. Zurich has the right to terminate the agreement if Viventia breaches any obligation of the agreement and fails to cure such breach within the applicable cure periods. Viventia has the right to terminate the agreement at any time and for any reason by giving 90 days written notice to Zurich.

The foregoing description of the Zurich Agreement is not complete and is qualified in its entirety by reference to the document attached hereto as Exhibit 10.1, which is incorporated herein by reference.

License Agreement with Merck KGaA

On March 8, 2004, Viventia entered into a license agreement with Biovation Limited, subsequently acquired by Merck KGaA (“Merck”), which was amended and restated on October 14, 2015 (the “Merck Agreement”).

Overview and exclusivity. Pursuant to the Merck Agreement, Viventia was granted an exclusive license, with the right to sublicense, under certain patents and technology relating to the de-immunization of its cytotoxin Bouganin for therapeutic and in vivo diagnostic purposes in humans. The de-immunized cytotoxin is known as deBouganin, and has been incorporated into Viventia’s product candidates, VB6-845d and VB7-756. Viventia has the worldwide exclusive right, with the right to sublicense, under the licensed patents and technology to, among other things, make, have made, use or sell products incorporating deBouganin.

As of the date of the Acquisition, aggregate license fees of $225,000 have been paid to Merck. Under the Merck Agreement, Viventia may be obligated to pay the following clinical development and regulatory milestones for each “licensed product”: (a) $2,000,000 upon the start of the first Phase 3 clinical trial for a licensed product; (b) $2,000,000 upon submission of the first Biologics License Application (“BLA”) or similar application submitted to the FDA or a foreign equivalent of the U.S. Food and Drug Administration (“FDA”) for a licensed product; (c) $2,000,000 upon the approval of the first BLA in certain countries for a licensed product and $1,000,000 upon each of the second and third approvals of a BLA in certain additional countries for the same licensed product (total of $4,000,000); and (d) $2,000,000 upon the approval of the second BLA in certain countries for a licensed product and $1,000,000 upon each of the second and third approvals of the second BLA in certain additional countries for the same licensed product (total of $4,000,000). As part of the consideration, Viventia is obligated to pay a 1.5% royalty on the net product sales up to $150,000,000 and a 2% royalty on the net product sales above such amount.

Patent rights. Viventia has the first right to file, prosecute and maintain licensed patents relating to de-immunized plasmids and proteins and Merck has the first right to file, prosecute and maintain any other licensed patents. Viventia has the first right, but not the obligation, to enforce the licensed patents against third parties for suspected infringement, and, after repayment of costs and expenses, any recoveries under such suit will be treated as net product sales and it shall pay a royalty on the same. Viventia may not settle such patent infringement suit without the prior written consent of Merck, such consent not to be unreasonably delayed or withheld. If Viventia declines to enforce the licensed patents against third parties for suspected infringement, Merck may bring such a patent infringement suit and any recoveries will be retained by Merck.

Term and termination. The Merck Agreement expires on a country-by-country and product-by-product basis upon the later of (i) the expiration of the last to expire patent within the licensed patent rights that covers a licensed product and (ii) 10 years from the first commercial sale of a licensed product in such country; provided that no royalty is payable for more than 15 years from the first commercial launch of a licensed product anywhere in the world. Either party has the right to terminate the agreement for breach of the agreement if the other party fails to cure such breach within the applicable cure period. Viventia has the right to terminate the agreement by giving Merck six months prior written notice.

The foregoing description of the Merck Agreement is not complete and is qualified in its entirety by reference to the document attached hereto as Exhibit 10.2, which is incorporated herein by reference.

License Agreement with Protoden

On October 17, 2014, Viventia entered into an amended and restated exclusive license agreement with Clairmark (as successor in interest to Protoden Technologies Inc.) (the “Protoden Agreement”). Clairmark is controlled by Mr. Dan, who became a director of Eleven in connection with the closing of the Acquisition.

Overview and exclusivity. Pursuant to the Protoden Agreement, Viventia was granted an exclusive, perpetual, irrevocable and non-royalty bearing license, with the right to sublicense, under certain patents and technology relating to bouganin, the precursor to deBouganin. As of the date of the Acquisition, aggregate license fees of $875,000 have been paid to Protoden. Viventia is obligated to pay an on-going licensing fee of $100,000 per year during the term of the agreement. Viventia is also obligated to pay Protoden a $50,000 sublicensing fee if it enters into a sublicense agreement for the patents with a third party between January 1, 2015 and December 31, 2024, up to a maximum of two such payments per calendar year. No royalties for the sale of any product are due to Protoden pursuant to the Protoden Agreement.

Patent rights. Protoden is responsible for the patent prosecution and maintenance activities pertaining to the licensed patents at Viventia’s sole expense. Viventia has the sole right, but not the obligation, to enforce the licensed patents against third parties for suspected infringement, and it will retain any recoveries from such suit.

Term and termination. The term of the Protoden Agreement expires on January 1, 2025, and upon expiration of the term, the licenses granted to Viventia shall become fully paid-up and no further payments to Protoden are required.

This license agreement is not currently significant to the development and commercialization, if approved, of Viventia’s product candidates.

The foregoing description of the Protoden Agreement is not complete and is qualified in its entirety by reference to the document attached hereto as Exhibit 10.3, which is incorporated herein by reference.

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

The information set forth in Item 1.01 regarding the Acquisition is incorporated by reference into this Item 2.01.

Following the Acquisition, we will continue to retain rights to our early stage product candidates in our pipeline existing prior to the Acquisition, rights to our AMP-Rx proprietary protein engineering platform that we have used to discover and develop innovative protein therapeutics to treat diseases of the eye and rights under our License Agreement, dated as of June 10, 2016, with F. Hoffmann-La Roche Ltd and Hoffmann-La Roche Inc. relating to EBI-031 or any other IL-6 antagonist anti-IL-6 monoclonal antibody. However, we expect that our primary business following the Acquisition will consist of the business conducted by Viventia immediately prior to the Acquisition.

Description of Viventia’s Business

Following the Acquisition, we will be a biologics oncology company primarily focused on designing, engineering and developing targeted protein therapeutics, or TPTs. Our TPTs are single-protein therapeutics composed of targeting moieties genetically fused via linker domains to cytotoxic protein payloads that are produced through our proprietary one-step manufacturing process. We target tumor cell surface antigens that allow for rapid internalization into the targeted cancer cell and have limited expression in normal cells. We have designed our TPTs to overcome the fundamental efficacy and safety challenges inherent in existing antibody drug conjugates, or ADCs, where a payload is chemically attached to a targeting antibody.

Our most advanced product candidate is ViciniumTM, which is a locally-administered TPT. In the third quarter of 2015, Viventia commenced in the United States and Canada a Phase 3 clinical trial of Vicinium intended for the treatment of subjects with high-grade non-muscle invasive bladder cancer, or NMIBC. Our second most advanced product candidate is ProxiniumTM, a locally administered TPT intended for the treatment of squamous cell carcinoma of the head and neck, or SCCHN. We intend to enter into discussions with the FDA relating to our proposed Phase 2 clinical trial design. This Phase 2 clinical trial will explore the potential of Proxinium as a monotherapy and, due to its potential immunogenic effect, in combination with a checkpoint inhibitor for the treatment of SCCHN and is planned to commence enrollment in early 2017. We are also developing cancer therapies for systemic administration utilizing our TPT platform and we may explore additional therapeutic indications for Vicinium and Proxinium.

Our locally-administered TPTs contain a targeting moiety that is designed to bind to EpCAM, which is a surface protein over-expressed in many cancers. This targeting moiety is genetically fused to a truncated form of exotoxin A, or ETA, which is an immunogenic cytotoxic protein payload that is produced by the bacterial species, Pseudomonas. The TPT-EpCAM complex is subsequently internalized into the cell and, once inside the cell, the TPT is cleaved by a cellular enzyme to release the cytotoxic protein payload, thus enabling cancer cell-killing. We believe that our TPTs designed for local administration may not only directly kill cancer cells through targeted delivery of a cytotoxic protein payload, but also potentiate an anti-cancer therapeutic immune response. This immune response is from the release of tumor antigens and the immunologically active setting created by the nature of the cytotoxic protein payloads.

Our early pipeline product candidate, VB6-845d, is being developed for systemic administration as a treatment for multiple types of EpCAM-positive solid tumors. VB6-845d is a TPT consisting of an EpCAM targeting Fab genetically linked to deBouganin a novel plant derived cytotoxic payload that we have optimized for minimal immunogenic potential.

Our Differentiated Approach to Targeted Therapies

Our TPTs are designed to overcome the fundamental efficacy and safety challenges inherent to existing ADCs. We believe they differ in multiple ways. First, our TPTs are designed to deliver a

greater amount of drug to and through the tumor bed. In addition, due to their mechanism of action, our TPTs are designed to kill a broader array of cancer cells with potential activity against both rapidly dividing and quiescent, or cancer stem cells. Also, we believe that our TPTs enhance the immune environment following local administration of the TPT, potentially stimulating greater immune based killing of the tumor cells and establishing a setting where combinations with checkpoint inhibitors and other immuno-oncology drugs may be synergistic. Additionally, we believe that our TPTs can provide improved safety and minimization of off-target toxicity compared to ADCs because our products are stable single fusion proteins and not chemically conjugated antibodies where the payload can come off before the conjugate enters the cell. And lastly, as compared to the complex chemistry involved in making traditional ADCs, we utilize a much simpler and more efficient single-step manufacturing process which we believe improves the cost of goods.

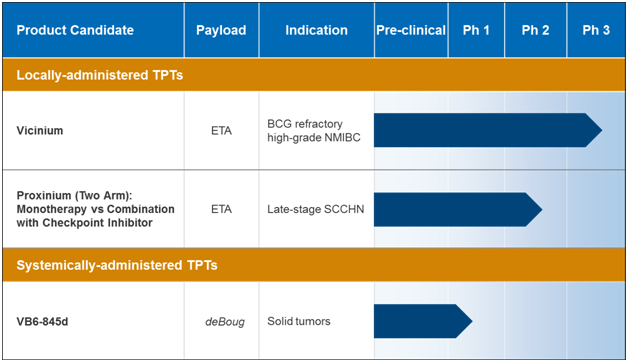

Pipeline

Our most advanced product candidates, Vicinium and Proxinium, use our TPT platform to target EpCAM, which is highly expressed on a variety of cancers, including NMIBC and SCCHN.

| • | Our most advanced locally-administered product candidate, Vicinium, is being developed for the treatment of high-grade NMIBC in subjects who have previously failed two treatments of Bacillus Calmette-Guérin, or BCG, which we refer to as BCG refractory high-grade NMIBC. Vicinium is currently enrolling NMIBC patients in a Phase 3 clincal trial for which we expect to have topline data in the first half of 2018. Vicinium is administered by intravesical injection directly into the bladder. In a completed Phase 2 clinical trial, subjects treated with Vicinium showed evidence of dose dependent clinical efficacy. In this Phase 2 clinical trial, of the 45 evaluable subjects, 44% achieved an overall complete response, or CR, or no evidence of disease, while 16% remained disease-free for at least 18 months. Median time to disease recurrence was 274 days for subjects achieving a CR following a six-week induction phase, and this was extended to 408 days for subjects achieving a CR following a longer 12-week induction phase. Subjects who remain disease-free are able to avoid the surgical removal of their bladder, or a radical cystectomy, which is an important goal in the treatment of bladder cancer. Vicinium was generally well-tolerated with no subjects discontinuing treatment in our Phase 1 and Phase 2 clinical trials. |

| • | Our second most advanced locally-administered product candidate, Proxinium, is being developed as a treatment for patients with late-stage SCCHN. Proxinium is administered via injection directly into the targeted tumors, or intratumoral injection. Proxinium has received Orphan Drug Designation from the FDA and the European Medicines Agency, or the EMA, and Fast Track designation from the FDA. In Viventia’s two Phase 1 clinical trials, subjects whose tumors were either EpCAM positive or EpCAM negative were treated with Proxinium and demonstrated a 53% response rate, which consisted of the subjects that had a complete clinical resolution of a tumor (targeted or non-targeted) or subjects who had clinically and radiologically documented reduction in the size of the target tumor. Additionally, in one subject |

| treated with Proxinium during these clinical trials, the targeted tumor became resectable following treatment, and, subsequently, the tumor was surgically removed. In Viventia’s second Phase 1 clinical trial, 14 of the 16 evaluable EpCAM-positive subjects (87.5%) had either a “complete response,” “response” or “stable” disease following Proxinium treatment, with 25% of subjects achieving a “complete response” of a tumor. In a Phase 2 clinical trial, we observed tumor shrinkage in 10 of the 14 evaluable subjects (71.4%). In addition, based on criteria established by the Eastern Cooperative Oncology Group, eight of the 12 evaluable subjects (66.7%) remained stable or showed improvement by the end of the treatment time point, which averaged approximately two months. In a Phase 3 trial that was initiated but terminated due to operational issues, an early assessment of efficacy demonstrated median survival of approximately 40% over six weeks. |

| • | Our lead systemically-administered product candidate, VB6-845d, is being developed for the treatment of multiple types of EpCAM-positive solid tumors. VB6-845d is administered by intravenous infusion. A Phase 1 clinical trial conducted with VB6-845, the prior version of VB6-845d, revealed no clinically relevant immune response to the deBouganin payload. We submitted an Investigational New Drug Application, or IND, to the FDA and expect to respond to feedback requiring additional preclinical and chemistry, manufacturing and controls, or CMC, information prior to planning to start another Phase 1 trial sometime in 2017. |

The following table summarizes our product candidate pipeline:

Our Strategy

We are committed to designing, engineering, developing and commercializing TPTs to identify and address oncology indications that suffer from a high unmet medical need. The key elements of our strategy are as follows:

| • | Rapidly advance Vicinium through clinical development and obtain regulatory approval. Based upon Viventia’s September 2014 end of Phase 2 meeting with the FDA, in the third quarter of 2015, Viventia commenced an open-label, non-randomized Phase 3 clinical trial of Vicinium in subjects with BCG refractory high-grade NMIBC, and for whom the current standard of care is radical cystectomy, in the United States and Canada. Based on safety and efficacy data observed at the highest dose exposures in Viventia’s Phase 2 clinical trial, the FDA has agreed to our plan to employ a greater dose exposure in our Phase 3 clinical trial, which has similar end points to our Phase 2 clinical trial. Additionally, the FDA has provided guidance regarding appropriate clinical trial design for new therapies for NMIBC, including the use of single-arm studies, and, based on our communications with the FDA, we believe that our Phase 3 clinical trial design is consistent with the FDA’s guidance. We expect to report 12-month data from this Phase 3 clinical trial in the first half of 2018. If this Phase 3 clinical trial is successful, we intend to pursue regulatory approval initially in the United States and Canada. Assuming that we receive positive data in our Phase 3 clinical trial, we intend to initiate discussions with the EMA regarding a regulatory pathway for European Union approval. We also are in negotiations to conduct a Phase 1/2 clinical trial of Vicinium in combination with a checkpoint inhibitor for the treatment of NMIBC. |

| • | Rapidly advance Proxinium through clinical development and obtain regulatory approval. We intend to enter into discussions with the FDA relating to our proposed Phase 2 clinical trial design. The trial will be designed to test Proxinium as a single agent versus Proxinium in combination with a checkpoint inhibitor and is planned to commence in early 2017. |

| • | Advance our systemically-administered product candidates, VB6-845d and VB7-756. We submitted an IND to the FDA for VB6-845d and in preparation of initiating a Phase 1/2 clinical trial in subjects with EpCAM-positive solid tumors and we are responding to the FDA’s request for additional information prior to initiating a trial. |

| • | Explore opportunities in combination therapies. We plan to continue discussions with potential partners that utilize technologies whose mechanism of action could be complementary to our TPT platform. These technologies include, but are not limited to, checkpoint inhibitors, immune modulators and other immuno-oncology agents. |

| • | Expand on the value of selected product candidates through strategic partnerships. We may decide to selectively partner with pharmaceutical and biopharmaceutical companies when we believe that a partner could bring additional resources and expertise to maximize the value of one or more of our product candidates. |

| • | Leverage our TPT platform to develop additional product candidates. We intend to develop additional product candidates based on our TPT platform. Depending on the strategic and financial merits, we may enter into partnerships and collaborations to support these development efforts. |

| • | Maximize the commercial value of our product candidates. We maintain global development, marketing and commercialization rights for all of our product candidates. If we obtain regulatory approval for Vicinium in BCG refractory high-grade NMIBC, we may build a North American specialty urology sales force to market the product or seek commercialization partners. Outside North America, we expect to seek commercialization partners with urology expertise. If we obtain regulatory approval for our other product candidates, including Proxinium, we may seek partners with oncology expertise in order to maximize the commercial value of each asset or a portfolio of assets. |

Intellectual property

Viventia currently owns or exclusively licenses approximately 23 families of patents and applications, which generally relate to its product candidates and evolving our platform of targeting agents, cytotoxins (such as deBouganin) and linker technologies. As our product candidates evolve through clinical development, we continue to monitor advancements and bolster patent coverage with the goal of attaining durable patent protection for at least 15 years from product launch. In addition, we have filed and are in the process of filing a number of additional applications around our platform technology, including our various targeting agents, cytotoxins, and linkers that, if issued, would expire in 2036.

Product Candidates—Vicinium and Proxinium

We exclusively license two families (48 patents and four applications) licensed from the University of Zurich, or Zurich, which, among other things, include composition of matter claims directed to EpCAM antibody chimeras, EpCAM antibody chimera-cytotoxin conjugates, and their potential use in treating bladder and head and neck cancer. These families claim all or portions of Vicinium and Proxinium, as well as certain of their respective indications under clinical development. The first family includes composition of matter claims directed to the EpCAM antibody chimeras that are used in Vicinium and Proxinium. The first family consists of 21 patents in the United States, Canada, Europe and Japan, which expire in April 2020, subject to any applicable patent term adjustment or extension that may be available on a jurisdictional basis. The second family includes claims directed to the use of Vicinium and Proxinium in the treatment of bladder and head and neck cancer, respectively, and consists of 27 issued patents in the United States, Canada, China, Israel and Japan and pending applications in the United States, Hong Kong and Europe. The expiry date of the patents in this family is April 2024, subject to any applicable patent term adjustment or extension that may be available on a jurisdictional basis.

In addition to the Zurich portfolio, we own one issued U.S. patent with composition of matter claims directed to modified nucleic acid sequences that encode Vicinium and Proxinium and are potentially useful for high expression yield of Vicinium and Proxinium. The expiry date of this patent is in September 2028, subject to any applicable patent term adjustment or extension that may be available on a jurisdictional basis. In addition, we have filed and are in the process of

filing a number of additional patent applications with claims around composition of matter, medical applications, and various uses of its various product candidates that, if issued, would expire in 2036.

Bouganin and deBouganin family

We exclusively license a family of patents and applications licensed from Merck KGaA, or Merck, which include claims directed to, among other things, modified de-immunized bouganin protein, EpCAM antibody-bouganin conjugates, and use claims directed to, among other things, methods of using the same to treat various diseases, including cancer. Claims in this family may cover, among other things, both the immunoconjugate, VB6-845d, and the de-immunized bouganin cytotoxins used in our product candidates. Currently the family consists of three issued patents in the United States, as well as 33 issued patents in Australia, Canada, China, Europe, Hong Kong, India, Israel, Japan, South Korea, Mexico, New Zealand, Russia and South Africa and one pending application in each of the United States, Brazil and Norway. The expiry date of this family is in March 2025, subject to any applicable patent term adjustment or extension that may be available on a jurisdictional basis. We also exclusively license from Merck three additional families of patents and applications with, among other things, use claims directed to various de-immunization methodologies, which expire in May 2018, December 2018 and February 2022, subject to any applicable patent term adjustment or extension that may be available on a jurisdictional basis. In addition, we have filed and are in the process of filing a number of additional patent applications with, among other things, composition of matter and use claims around our various product candidates that, if issued, would expire in 2036 and beyond.

We also exclusively license a family of patents directed to the unmodified bouganin cytotoxin from Protoden Technologies Inc., or Protoden, a company owned by Clairmark. The seven patents are in the United States, Canada and Europe and expire in June 2018, subject to any applicable patent term adjustment or extension that may be available on a jurisdictional basis. We do not currently view these patents and applications as significant to the development and commercialization, if approved, of our product candidates.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

The information set forth in Item 1.01 regarding the Acquisition is incorporated by reference into this Item 2.03.

Lease Agreement with 131 -149 Hamelin Street Leaseholds Limited

Viventia’s predecessor company, Viventia Biotech Inc., entered into an indenture (the “Lease Agreement”), dated as of March 31, 2000, with an entity owned by Mr. Dan, Almad Investments Limited, for the lease of Viventia’s manufacturing facility in Winnipeg, Manitoba, Canada. The subject property was subsequently transferred to another entity owned by Mr. Dan, 131 - 149 Hamelin Street Leaseholds Limited, and Viventia entered into lease amending agreements, dated as of June 26, 2003, January 26, 2004 and June 25, 2008. The minimum annual base rent for the Facility Lease is currently C$204,300 per annum, plus additional rent

and applicable taxes. On September 16, 2015, Viventia entered into an amendment to the lease extending the term through September 2020, and granting it a right to renew the lease for one subsequent five year term.

The foregoing description of the Lease Agreement is not complete and is qualified in its entirety by reference to the document attached hereto as Exhibit 10.4, which is incorporated herein by reference.

| Item 3.02 | Unregistered Sales of Equity Securities |

The information set forth in Item 1.01 regarding the Acquisition and the issuances of shares of common stock of Eleven as consideration for the Acquisition is incorporated by reference into this Item 3.02.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

In connection with the Acquisition, Cary G. Pfeffer, M.D. resigned from the Board of Eleven and the nominating and corporate governance committee thereof, and Messrs. Dan and Hurly were appointed to the Board of Eleven. Each of Messrs. Dan and Hurly was designated as a Class I member of the Board to serve until the 2018 annual meeting of the stockholders of the Company and, in each case, thereafter until his successor has been duly elected and qualified, or until his earlier death, resignation or removal. Messrs. Dan and Hurly served as directors of Viventia prior to the Acquisition. Each of Mr. Dan, through his controlled affiliate Clairmark, and Mr. Hurly are Selling Shareholders under the Share Purchase Agreement, and Mr. Dan’s controlled affiliate Clairmark is a party to the Registration Rights Agreement. In connection with the closing of the Acquisition, Messrs. Dan and Hurly received their proportional share of the shares of Eleven common stock issued as consideration and will each be entitled, as Selling Shareholders, to receive certain contingent cash payments from Eleven, in each case on the terms and subject to the conditions set forth in the Share Purchase Agreement.

In connection with the Acquisition, each of Dr. Celniker and Ms. Tubridy resigned from her position as an executive officer of the Company, and the Board of Eleven appointed each of the following to serve, as of the effective time of the Acquisition, as executive officers of Eleven:

| Name |

Position with Eleven Following the Acquisition | |

| Stephen A. Hurly | President and Chief Executive Officer | |

| Arthur P. DeCillis, M.D. | Chief Medical Officer | |

Separation Agreements

In connection with their terminations of employment, on September 20, 2016, each of Dr. Celniker and Ms. Tubridy entered into a Separation and Release of Claims Agreement with the Company (together, the “Separation Agreements”). The Separation Agreements set forth the terms of each officer’s resignation, effective as of September 20, 2016, including a general release of claims against the Company arising out of her employment with or resignation from the Company.

Under the Separation Agreement with Dr. Celniker, the Company has agreed to pay Dr. Celniker $450,000, which is an amount equal to her base salary for 12 months, paid in a lump sum pursuant to our regular payroll practices, to pay Dr. Celniker $225,000, which is an amount equal to her target bonus payment for 2016, to accelerate in full the vesting of all of Dr. Celniker’s outstanding equity awards (other than certain equity awards forfeited by Dr. Celniker to the extent necessary to eliminate any “excess parachute payments” within the meaning of Sections 280G and 4999 of the Internal Revenue Code of 1986, as amended), to provide that all stock options granted to Dr. Celniker under Eleven’s Amended and Restated 2009 Stock Incentive Plan shall continue to be exercisable based on her continued service as a non-employee member of the Board and, to the extent allowed by applicable law and the applicable plan documents, to continue to provide Dr. Celniker and certain of her dependents with group health and dental insurance for a period of one month.

Under the Separation Agreement with Ms. Tubridy, the Company has agreed to pay Ms. Tubridy $323,710, which is an amount equal to her base salary for 12 months, paid in a lump sum pursuant to our regular payroll practices, to accelerate in full the vesting of all of Ms. Tubridy’s outstanding equity awards and, to the extent allowed by applicable law and the applicable plan documents, to continue to provide Ms. Tubridy and certain of her dependents with group health and dental insurance for a period of 12 months.

The foregoing descriptions of the terms of the Separation Agreements included in this Item 5.02 are not complete and are qualified in their entirety by reference to the Separation Agreements of Dr. Celniker and Ms. Tubridy attached hereto as Exhibits 10.5 and 10.6, which are incorporated herein by reference.

McCabe Retention Agreement

In connection with the Acquisition, we also entered into a retention letter agreement with Mr. McCabe, who will continue to serve as our Chief Financial Officer following the closing of the Acquisition. The retention letter agreement provides that Mr. McCabe: (i) would receive a $75,000 bonus at the closing of the Acquisition, (ii) is eligible for an additional $75,000 retention bonus payable in six months or earlier if his employment is terminated without cause or for good reason (each as defined in his employment agreement); (iii) may voluntarily resign without good reason (as defined in his employment agreement) within the six-month period following the closing of the Acquisition and receive the post-change in control severance benefits under his employment agreement, provided however, in such case, Mr. McCabe would forego the above described retention bonus, and (iv) would receive options to purchase 100,000 shares of the Company’s common stock at an exercise price of $3.37 per share.

The foregoing description of the terms of the document included in this Item 5.02 is not complete and is qualified in its entirety by reference to the retention letter agreement of Mr. McCabe attached hereto as Exhibit 10.7, which is incorporated herein by reference.

New Executive Officer Employment Agreements

On September 20, 2016, in connection with the Acquisition, we entered into employment agreements with each of Mr. Hurly and Dr. DeCillis. Each of these agreements provides that their employment will continue until either the Company or such executive officer provides notice of termination in accordance with the terms of the applicable employment agreement. In addition, the Company has entered into non-competition, non-solicitation, confidentiality and assignment agreements with each of Mr. Hurly and Dr. DeCillis which prohibit them from competing with Eleven, soliciting the Company’s employees and customers and disclosing confidential information during the term of their employment and for a specified time thereafter.

Pursuant to their respective employment agreements, each of the Company’s new executive officers is entitled to receive an annual base salary as follows: Mr. Hurly: $425,000; and Dr. DeCillis: $417,011.

Pursuant to their respective employment agreements, in connection with their appointment, the Company granted Mr. Hurly options to purchase 350,000 shares of the Company’s common stock and Dr. DeCillis options to purchase 100,000 shares of the Company’s common stock, in each case at an exercise price of $3.37 per share.

In addition, each of the Company’s executive officers is eligible to receive an annual cash bonus, which is based on the achievement of individual and corporate performance objectives, calculated as a percentage of the executive’s annual base salary, and which will be determined by the Company’s Board, in its sole discretion. Mr. Hurly’s target annual bonus is 50% of his annual base salary and Dr. DeCillis’s target bonus is 30% of his annual base salary.

Potential Payments Upon Termination or Change in Control Transaction

Upon execution and effectiveness of a release of claims, each of Mr. Hurly and Dr. DeCillis will be entitled to severance payments if his employment is terminated under specified circumstances.

Mr. Hurly. If the Company terminates Mr. Hurly’s employment without cause, as defined in his employment agreement, or if Mr. Hurly terminates his employment with the Company for good reason, as defined in his employment agreement, absent a change in control transaction, as defined in his employment agreement, the Company is obligated to pay Mr. Hurly’s base salary for a period of 12 months, paid in accordance with the Company’s then-current payroll practices, to pay Mr. Hurly an amount equal to his target bonus payment for the year in which the termination of employment occurs, prorated for the portion of the year in which he was employed, and, to the extent allowed by applicable law and the applicable plan documents, to continue to provide Mr. Hurly and certain of his dependents with group health and dental insurance for a period of 12 months.

If the Company terminates Mr. Hurly’s employment without cause or if Mr. Hurly terminates his employment with the Company for good reason, in each case within 18 months following a change in control transaction, the Company is obligated to pay Mr. Hurly an amount equal to his base salary for 12 months, paid in accordance with the Company’s then-current payroll practices, to pay Mr. Hurly an amount equal to his target bonus payment for the year in which the termination of employment occurs, to accelerate in full the vesting of all of Mr. Hurly’s outstanding equity awards and, to the extent allowed by applicable law and the applicable plan documents, to continue to provide Mr. Hurly and certain of his dependents with group health and dental insurance for a period of 12 months.

Dr. DeCillis. If the Company terminates Dr. DeCillis’s employment without cause, as defined in Dr. DeCillis’s employment agreement, or if Dr. DeCillis terminates his employment with the Company for good reason, as defined in his employment agreement, absent a change in control transaction, as defined in his employment agreement, the Company is obligated to pay Dr. DeCillis’s base salary for a period of 12 months, paid in accordance with the Company’s then-current payroll practices, and, to the extent allowed by applicable law and the applicable plan documents, to continue to provide Dr. DeCillis and certain of his dependents with group health and dental insurance for a period of 12 months.

If the Company terminates Dr. DeCillis’s employment without cause or if Dr. DeCillis terminates his employment with the Company for good reason, in each case within 12 months following a change of control transaction, the Company is obligated to pay Dr. DeCillis’s base salary for a period of 12 months, paid in accordance with the Company’s then-current payroll practices, to accelerate in full the vesting of all outstanding equity awards held by Dr. DeCillis and, to the extent allowed by applicable law and the applicable plan documents, to continue to provide Dr. DeCillis and certain of his dependents with group health and dental insurance for a period of 12 months.

Taxation. To the extent that any severance or other compensation payment to Mr. Hurly or Dr. DeCillis pursuant to his employment agreement or any other agreement constitutes an “excess parachute payment” within the meaning of Sections 280G and 4999 of the Internal Revenue Code of 1986, as amended, then such executive officer will receive the full amount of such severance and other payments, or a reduced amount intended to avoid the application of Sections 280G and 4999, whichever provides the executive with the highest amount on an after-tax basis.

The foregoing descriptions of the employment agreements of Mr. Hurly and Dr. DeCillis are not complete and are qualified in their entirety by reference to employment agreements attached hereto as Exhibit 10.8 and 10.9, which are incorporated herein by reference.

New Executive Officer Biographies

Stephen Hurly

Stephen A. Hurly has served as Viventia’s president since September 2015, Viventia’s chief executive officer since March 2014 and as a member of Viventia’s board of directors since January 2015. Prior to joining Viventia, Mr. Hurly was the chief executive officer of Burrill &

Co.’s Merchant Banking Division, a finance business for life science companies, from June 2011 to October 2014. Prior to that, Mr. Hurly was the head of the Life Sciences Investment Banking Practice at Boenning & Scattergood, a securities, asset management and investment banking firm, from June 2008 to May 2011. Mr. Hurly has more than 15 years of experience in the investment banking business. Mr. Hurly has served on the board of directors of PHusis Therapeutics Inc., a targeted small molecule therapeutics company, since May 2011. He graduated from Swarthmore College with a B.A. degree in Engineering in 1990 and earned an M.B.A. from the University of Chicago in 1997.

Arthur DeCillis

Arthur DeCillis, M.D., joined Viventia as its chief medical officer in September 2015. Prior to joining Viventia, Dr. DeCillis was the Vice President of Medical Affairs at Exelixis, Inc., a biotechnology company which discovers, develops and commercializes small molecules for the treatment of cancer, from July 2011 to September 2015. Prior to that position, Dr. DeCillis served as Exelixis, Inc.’s Vice President of Clinical Research from May 2007 to July 2011. Prior to that, Dr. DeCillis served as a Senior Director and Executive Director at Novartis Pharmaceutical Corp. from 2005 to 2007. Previously, he held positions of increasing responsibility in Oncology Global Clinical Research at Bristol-Myers Squibb Company, culminating as group director. He graduated from Lehigh University with a Bachelor’s degree in Mathematics in 1978, received his Doctor of Medicine degree from the University of Rochester School of Medicine and Dentistry in 1984 and received a M.S. degree in Intelligent Systems from the University of Pittsburgh in 1994. He completed his internship and residency in Internal Medicine at the Medical College of Virginia and a Fellowship in Medical Informatics at the University of Pittsburgh. He is Board Certified in Internal Medicine.

Director Compensation

Mr. Dan will be compensated in the same manner as the Company’s other non-employee directors. Information concerning the current compensation of the Company’s directors is set forth in the Company’s definitive proxy statement on Schedule 14A filed with the U.S. Securities and Exchange Commission (the “SEC”) on April 29, 2016. Accordingly, Mr. Dan received, upon his election to the Board, an option to purchase 16,143 shares of common stock of the Company at an exercise price of $3.37 per share.

As our President and Chief Executive Officer, Mr. Hurly will not receive any additional compensation for his service as a Director.

Director and Executive Officer Indemnification Agreements

On September 20, 2016, in connection with their election to our Board and/or appointment as an executive officer of the Company, each of Mr. Dan, Mr. Hurly and Dr. DeCillis entered into the Company’s standard form of Indemnification Agreement, a copy of which was filed as Exhibit 10.12 to Amendment No. 1 to the Company’s Registration Statement on Form S-1 (File No. 333-193131) filed with the SEC on January 23, 2014. Pursuant to the terms of this agreement, the Company may be required, among other things, to indemnify each director and executive officer for some expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred by each of them in any action or proceeding arising out of each of their service as the Company’s directors.

| Item 7.01 | Regulation FD Disclosure |

The Acquisition represents the completion of the Company’s previously disclosed review of strategic alternatives. Although the Company does not currently anticipate any future imminent transactions in connection with this process, it cannot provide any commitment regarding whether the Company will engage in any future sale, strategic partnership, business combination or other arrangement.

On September 21, 2016, Eleven will host a conference call to provide supplemental information regarding the Acquisition to analysts and investors at 8:30 a.m. Eastern time. To listen to the conference call via the Internet, please visit the investor relations section of Eleven’s website. To access the conference call, please dial (844) 831-3025 (domestic) or (315) 625-6887 (international), conference ID: 85062695.

The information in this Item 7.01 of this Form 8-K shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 8.01 | Other Events |

On September 21, 2016, the Company issued a press release with respect to the Acquisition. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The Company is filing herewith as Exhibit 99.2 certain risk factors related to the Viventia business that are relevant to the Company after giving effect to the Acquisition.

| Item 9.01 | Financial Statements and Exhibits |

(a) Financial Statements of Businesses Acquired.

The consolidated financial statements of Viventia, including the report of its independent registered public accounting firm, PricewaterhouseCoopers LLP, required by this item have not been filed on this initial Current Report on Form 8-K but will be filed by amendment on or before December 6, 2016.

The unaudited consolidated financial statements of Viventia required by this item have not been filed on this initial Current Report on Form 8-K but will be filed by amendment on or before December 6, 2016.

(b) Pro Forma Financial Information.

The pro forma financial information required by this item has not been filed on this initial Current Report on Form 8-K but will be filed by amendment on or before December 6, 2016.

(d) Exhibits.

| Exhibit |

Description | |

| 2.1* | Share Purchase Agreement, effective as of September 20, 2016, by and between Eleven Biotherapeutics, Inc., Viventia Bio Inc. (“Viventia”) and Clairmark Investments Ltd., as representative of the selling shareholders (the Company hereby agrees to furnish supplementally a copy of any omitted schedules to the SEC upon request). | |

| 4.1* | Registration Rights Agreement, dated as of September 20, 2016 by and among Eleven Biotherapeutics, Inc. and the shareholders named therein. | |

| 10.1*† | License Agreement, effective January 13, 2003, as amended and restated on October 14, 2015, by and between The University of Zurich and Viventia Bio Inc. | |

| 10.2*† | Amended & Restated Exclusive License Agreement, dated October 14, 2015, by and between Merck KGaA and Viventia Bio Inc. | |

| 10.3* | Amended and Restated License Agreement, dated October 17, 2014, by and between Clairmark Investments Ltd. (successor in interest of Protoden Technologies Inc.) and Viventia Bio Inc. | |

| 10.4* | Indenture, dated March 31, 2000, between 131-149 Hamelin Street Leaseholds Limited (successor in interest of Almad Investments Limited) and Viventia Bio Inc. (successor in interest of Viventia Biotech Inc.), as amended by Lease Amending Agreement, dated June 26, 2003, as further amended by Lease Amending Agreement, dated January 26, 2004, and as further amended by Letter Agreement, dated June 25, 2008, and as further amended by Lease Amending Agreement, September 16, 2015. | |

| 10.5* | Separation Agreement dated September 20, 2016 between the Registrant and Abbie C. Celniker | |

| 10.6* | Separation Agreement dated September 20, 2016 between the Registrant and Karen L. Tubridy | |

| 10.7* | Retention Letter Agreement dated September 20, 2016 between the Registrant and John J. McCabe. | |

| 10.8* | Employment Agreement dated September 20, 2016 between the Registrant and Stephen A. Hurly | |

| 10.9* | Employment Agreement dated September 20, 2016 between the Registrant and Arthur P. DeCillis | |

| 99.1* | Press Release, dated September 21, 2016, announcing Eleven’s acquisition of Viventia | |

| 99.2* | Risk Factors of Viventia’s Business | |

| * | Filed herewith. |

| † | Confidential treatment requested as to portions of the exhibit. Confidential materials omitted and filed separately with the Securities and Exchange Commission. |

Cautionary Note on Forward-Looking Statements

Any statements in this Current Report on Form 8-K about future expectations, plans and prospects for the Company, including statements about benefits of the Acquisition, future management of the Company, Viventia’s business, the Company’s strategy and future operations and other statements containing the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “target,” “potential,” “will,” “would,” “could,” “should,” “continue,” and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: the Company’s ability to integrate Viventia’s business, turnover resulting from changes in the Company’s management, the uncertainties inherent in the initiation and conduct of clinical trials, availability and timing of data from clinical trials, whether results of early clinical trials or preclinical studies will be indicative of the results of future trials, the adequacy of any clinical models, uncertainties associated with regulatory review of clinical trials and applications for marketing approvals and other factors discussed in the “Risk Factors of Viventia’s Business” attached hereto as Exhibit 99.2 and in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2016, as filed with the Securities and Exchange Commission. In addition, the forward-looking statements included in this Current Report on Form 8-K represent the Company’s views as of the date hereof. The Company anticipates that subsequent events and developments will cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ELEVEN BIOTHERAPEUTICS, INC. | ||||||

| Date: September 21, 2016 | By: | /s/ John J. McCabe | ||||

| Chief Financial Officer | ||||||

EXHIBIT INDEX

| Exhibit |

Description | |

| 2.1* | Share Purchase Agreement, effective as of September 20, 2016, by and between Eleven Biotherapeutics, Inc., Viventia Bio Inc. (“Viventia”) and Clairmark Investments Ltd., as representative of the selling shareholders (the Company hereby agrees to furnish supplementally a copy of any omitted schedules to the SEC upon request). | |

| 4.1* | Registration Rights Agreement, dated as of September 20, 2016 by and among Eleven Biotherapeutics, Inc. and the shareholders named therein. | |

| 10.1*† | License Agreement, effective January 13, 2003, as amended and restated on October 14, 2015, by and between The University of Zurich and Viventia Bio Inc. | |

| 10.2*† | Amended & Restated Exclusive License Agreement, dated October 14, 2015, by and between Merck KGaA and Viventia Bio Inc. | |

| 10.3* | Amended and Restated License Agreement, dated October 17, 2014, by and between Clairmark Investments Ltd. (successor in interest of Protoden Technologies Inc.) and Viventia Bio Inc. | |

| 10.4* | Indenture, dated March 31, 2000, between 131-149 Hamelin Street Leaseholds Limited (successor in interest of Almad Investments Limited) and Viventia Bio Inc. (successor in interest of Viventia Biotech Inc.), as amended by Lease Amending Agreement, dated June 26, 2003, as further amended by Lease Amending Agreement, dated January 26, 2004, and as further amended by Letter Agreement, dated June 25, 2008, and as further amended by Lease Amending Agreement, September 16, 2015. | |

| 10.5* | Separation Agreement dated September 20, 2016 between the Registrant and Abbie C. Celniker | |

| 10.6* | Separation Agreement dated September 20, 2016 between the Registrant and Karen L. Tubridy | |

| 10.7* | Retention Letter Agreement dated September 20, 2016 between the Registrant and John J. McCabe. | |

| 10.8* | Employment Agreement dated September 20, 2016 between the Registrant and Stephen A. Hurly | |

| 10.9* | Employment Agreement dated September 20, 2016 between the Registrant and Arthur P. DeCillis | |

| 99.1* | Press Release, dated September 21, 2016, announcing Eleven’s acquisition of Viventia | |

| 99.2* | Risk Factors of Viventia’s Business | |

| * | Filed herewith. |

| † | Confidential treatment requested as to portions of the exhibit. Confidential materials omitted and filed separately with the Securities and Exchange Commission. |