Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST MID BANCSHARES, INC. | form8k-093016.htm |

Mike Taylor

CFO

mtaylor@firstmid.com

217.258.3306

Joe Dively

Chairman and CEO

jdively@firstmid.com

217.258.9520

Since 1865

As of 9/08/16

Disclosures

Forward-looking Statements

This presentation may contain certain forward-looking statements, such as discussions of the Company’s pricing and fee

trends, credit quality and outlook, liquidity, new business results, expansion plans, anticipated expenses and planned

schedules. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-

looking statements contained in the Private Securities Litigation Reform Act of 1955. Forward-looking statements, which are

based on certain assumptions and describe future plans, strategies and expectations of the Company, are identified by use

of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” or similar expressions. Actual results could

differ materially from the results indicated by these statements because the realization of those results is subject to many

risks and uncertainties, including those described in Item 1A – “Risk Factors” and other sections of the Company’s Annual

Report on Form 10-K and the Company’s other filings with the SEC. Furthermore, forward-looking statements speak only

as of the date they are made. Except as required under the federal securities laws or the rules and regulations of the SEC,

we do not undertake any obligation to update or review any forward-looking information, whether as a result of new

information, future events or otherwise.

Non-GAAP Financial Measures

These slides contain non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a

numerical measure of the registrant’s historical or future financial performance, financial position or cash flows that excludes

amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly

comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet or

statement of cash flows (or equivalent statements) of the issuer; or includes amounts, or is subject to adjustments that have

the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented.

In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirement of

Regulation G, First Mid-Illinois Bancshares, Inc. and First Mid-Illinois Bank & Trust, N.A. have provided reconciliations within

the slides, as necessary, of the non-GAAP financial measure to the most directly comparable GAAP financial measure.

2

Corporate Profile

3

Current Company Snapshot

• *Assets: $2.8 billion

• *Deposits: $2.2 billion

• *Loans: $1.8 billion

• Trust and Wealth Management AUM: $1.3 billion

Strong Capital Ratios

• Common Equity Tier-1 Capital/RWA: 11.76%

• Leverage ratio: 9.44%

• Total RBC ratio: 14.11%

Exceptional Asset Quality

• NPAs/Assets: 0.24%

• Loan 30+ days PD/Total loans: 0.62%

Profitability (YTD Q2’16)

• Net Income of $9.7 million

• Net interest margin (TE): 3.37%

• ROAA: 0.92% (annualized for period)

• ROACE: 9.76% (annualized for period)

Financial data as of June 30, 2016.

*Includes assets acquired from First Clover Leaf Financial on 9/08/16

Headquartered in Mattoon with multiple locations throughout

central and southern Illinois and metro-east St. Louis.

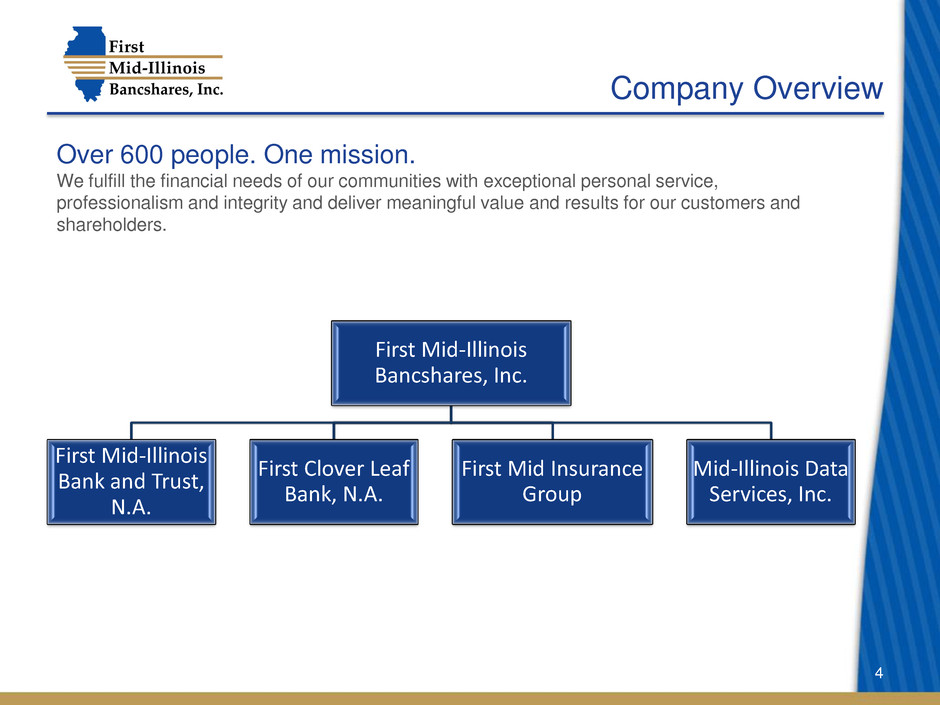

Over 600 people. One mission.

We fulfill the financial needs of our communities with exceptional personal service,

professionalism and integrity and deliver meaningful value and results for our customers and

shareholders.

Company Overview

4

First Mid-Illinois

Bancshares, Inc.

First Mid-Illinois

Bank and Trust,

N.A.

First Clover Leaf

Bank, N.A.

First Mid Insurance

Group

Mid-Illinois Data

Services, Inc.

NASDAQ listed. Russell Index member.

First Mid-Illinois Bancshares, Inc. is listed and trades on NASDAQ under the ticker symbol

FMBH. In 2016, First Mid was extended membership into the all-cap Russell 3000 and small-

cap Russell 2000 indexes.

Market Overview

Market Overview*

Company Name: First Mid-Illinois Bancshares, Inc.

Headquarters: Mattoon, IL

NASDAQ Ticker: FMBH

Auditor: BKD, LLP

Market Cap: $316 million

Annualized Div.:

Yield:

$0.60

2.37%

Price: $25.35

52wk Range: $21.00 - $26.50

Market Makers: Boenning & Scattergood

FIG Partners

Hovde Group

Raymond James

5 *Market Overview data as of 9/08/16

$20.00

$21.00

$22.00

$23.00

$24.00

$25.00

$26.00

$27.00

$28.00

First Mid-Illinois Bancshares, Inc.

52-Week Price History

Closing Price

History and Recognition

First Mid-Illinois Bancshares has a proud 150+ year history of

service to agricultural, small business and retail customers.

• First National Bank of Mattoon established in 1865

• One of the oldest nationally chartered banks in the country

• First Mid-Illinois Bancshares, Inc. incorporated in 1981

• Committed to our community banking heritage and mission

• Publicly traded on the NASDAQ stock market since 2014

6

Achievements through Performance:

Demographics

7

Current Footprint

• Footprint of 53 branches in 23 counties

• Branches strategically located along major

transportation routes of I-74, I-70 and I-64 East-West

as well as I-57 North-South

• Clusters of branches are located in and around

cities such as St. Louis, Peoria, Champaign-Urbana,

Decatur, Mount Vernon and Carbondale

• Total population approximately 2.6 million

• 2016 median household income: $50,000

Key industries

• Agriculture

• Education

• Manufacturing

• Health care

Unemployment rates

• IL: 5.6%

• MO: 5.2%

• US: 5.0%

Source: SNL Market data as of July 2016

Unemployment data as of July 2016

Market Share

8

Diverse market segments with economies based on agriculture,

manufacturing, education and services

• Top employers in the region include a diverse range of operations such as Ameren, Caterpillar,

State Universities, Sarah Bush Lincoln Health Center, Rural King, and Continental Tire North

America

• First Mid ranks in the Top 10 for market share in 19 of the 23 counties served and ranks in the Top

5 in over 60% of those markets

*Operating Market includes all counties in which First Mid has deposit market share; Excludes State Farm Bank and Scottrade Financial Services, Inc.

Operating Market

Rank Institution Parent City State

# of

Branches

As of June 30, 2015

Total Deposits

($000s) Market Share (%)

1 Commerce Bancshares Inc. Kansas City MO 43 5,637,900$ 8.83%

2 U.S. Bancorp Minneapolis MN 84 5,499,096$ 8.61%

3 Bank of America Corp. Charlotte NC 34 4,554,143$ 7.13%

4 First Busey Corp. Champaign IL 33 3,463,994$ 5.42%

5 PNC Financial Services Group Inc. Pittsburgh PA 51 3,161,925$ 4.95%

6 Regions Financial Corp. Birmingham AL 63 2,918,267$ 4.57%

7 First Mid-Illinois Bancshares Inc. Mattoon IL 53 2,237,822$ 3.50%

8 Enterprise Financial Services Corp Clayton MO 4 1,785,517$ 2.80%

9 Fifth Third Bancorp Cincinnati OH 3 1,507,330$ 2.36%

10 Banc Ed Corp. Edwardsville IL 20 1,482,879$ 2.32%

11 First Banks Inc. Clayton MO 31 1,396,024$ 2.19%

12 Midland States Bancorp Inc. Effingham IL 16 1,339,686$ 2.10%

13 Central Banco. Inc. Jefferson City MO 10 1,020,653$ 1.60%

14 JPMorgan hase & Co. New York NY 10 984,749$ 1.54%

15 Stupp Bros. Inc. Saint Louis MO 10 894,271$ 1.40%

16 First Co Bancorp Inc. Collinsville IL 13 844,995$ 1.32%

17 Heartland Bancorp Inc. Bloomington IL 18 735,011$ 1.15%

18 Reliance Bancshares Inc. Frontenac MO 16 728,467$ 1.14%

19 Bank of Montreal Toronto - 10 614,248$ 0.96%

20 First Bankers Trustshares Inc. Quincy IL 5 522,457$ 0.82%

Market Total 1,073 63,880,737$ 100.00%

Strategic Advantages

First Mid-Illinois Bancshares is able to provide strong strategic

advantages in key areas:

• Diverse Geographic Footprint

• Demonstrated Ability to Raise Capital and Successfully Complete

Acquisitions

• Consistent Dividends to Shareholders (Since 1879)

• Experienced Management with Track Record of Growing Shareholder Value

• Diversified Sources of Revenue

• Quality Core Deposit Franchise

• Outstanding Asset Quality Metrics

9

Strength Through Diversity

10

Serving the communities of central

and southern Illinois and metro-east St. Louis.

• 6 regions

• 53 banking centers in 37 communities

• Approximately $2.2 billion total deposits

Regions

Regions Locations Deposits Q2’16

Peoria 9 $249,662,664

Decatur/Champaign 7 114,220,654

Sullivan 7 293,355,864

Central Region 8 559,149,337

*Metro East/St. Louis 10 594,163,663

Southern Region 12 430,647,149

*TOTAL 53 $2,241,199,332

*Includes deposits acquired from First Clover Leaf Financial on 9/08/16

Capital Raises and Acquisitions

11

First Mid-Illinois Bancshares has a demonstrated ability to raise capital, close targeted

acquisitions and complete successful integrations.

Successful Capital Raises

June 2015 Raised $29.3 million through a private placement of common stock. Approximately 90% raised via new institutional

relationships.

February 2011 Commenced offering of $27.5 million in Convertible Preferred Series C; Converted at $20.29 per share in May 2016.

February 2009 Commenced offering of $24.6 million in Convertible Preferred Series B; Converted at $21.62 per share in November 2014.

July 1992 Raised $3.1 million in Convertible Preferred Series A to effect Heartland acquisition.

$-

$0.2

$0.4

$0.6

$0.8

$1.0

$1.2

$1.4

$1.6

$1.8

$2.0

$2.2

$2.4

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

($Bil)

Acquisitions and Asset Growth Timeline

July 1992

Acquired Heartland Federal

S&L ($141 mi llion in total

October 1994

Acquired Downstate

Bancshares, Inc. ($52

mi llion in total assets)

March 1997

Acquired 1 branch from

Firs t of America ($32

mi llion in total deposits)

May 1999

Acquired 4 branches from

Bank One Corp ($64 million

in total assets)

April 2001

Acquired American Bank of

I l linois ($31 million in total

assets)

January 2002

Acquired The Checkley

Agency, Inc., an insurance

broker

May 2006

Acquired Mansfield

Bancorp, Inc. ($124 million

in total assets)

September 2010

Acquired 10 branches

from First Bank ($321

mi llion in total assets)

August 2015

Acquired 12 branches from

Old National Bank ($457

mi llion in total assets)

December 2015

Acquired Illiana Insurance

Agency

September 2016

Acquired First Clover Leaf

Financial Corp. ($660

million in total assets)

Growth Through Acquisitions

12

• 7 banking centers in metro-

east St. Louis and Clayton, MO

• $537M Deposits

• $450M Loans

• Common Culture

• Commitment to Community Banking

• Strong Leadership

Experienced Management Team

13

Joseph R. Dively

Chairman, Chief Executive Officer and President

Joe joined First Mid-Illinois Bank as a Senior Executive VP and

President of the Bank in 2011. He has served on the Board of First

Mid-Illinois Bancshares since 2004. Prior to joining the company,

he was a Senior VP and an officer of Consolidated

Communications where he was employed since 2003.

John W. Hedges

Senior Executive Vice President, Chief Credit Officer

John has been Executive VP since 1999 and Chief Credit Officer

of First Mid-Illinois Bank since 2011. Prior to joining the company,

he was with National City Bank in Decatur, Illinois from 1976 to

1999.

Michael L. Taylor

Senior Executive Vice President, Chief Financial Officer

Mike has been an Executive VP since 2007 and Chief Financial

Officer since 2000. Prior to joining the company, he was with

AMCORE Bank in Rockford, Illinois from 1996 to 2000.

Laurel G. Allenbaugh

Executive Vice President,

Chief Operations & IT Officer

Laurel joined First Mid-Illinois Bank as Controller in 1990 and was

promoted to Executive VP 1998.

Bradley L. Beesley

Executive Vice President,

Chief Trust & Wealth Management Officer

Brad joined First Mid-Illinois Bank in 2007 as Senior VP and

Senior Wealth Management Officer. He assumed the role of

Executive VP in February 2015. Prior to joining the company, he

was Director of Wealth Management at Midland States Bank in

Effingham for 9 years.

Eric S. McRae

Executive Vice President, Senior Lender

Eric joined First Mid-Illinois Bank in 1999 and has been Executive

VP and Senior Lender of First Mid-Illinois Bank since 2008.

Clay M. Dean

Senior Vice President, Chief Executive Officer

First Mid Insurance Group

Clay assumed his current role in September 2014. Previous roles

with the Bank include Senior VP of Deposit Services, a position

he held between 2012 and 2014 and Senior VP of Treasury

Management from 2010 to 2012. Prior to joining the company, he

was employed at NewAlliance Bank in New Haven, Connecticut.

Rhonda R. Gatons

Senior Vice President, Human Resources

Rhonda joined First Mid-Illinois Bank in February 2016 as Senior

VP and Director of Human Resources. She brings more than 20

years of experience in Human Resources to the First Mid

organization. Prior to joining First Mid, she was Director of

Human Resources at Midland States Bank in Effingham for 5

years.

Amanda D. Lewis

Senior Vice President, Chief Deposit Services Officer

Mandy joined First Mid-Illinois Bank in 2001 and was promoted to

her current role as Senior VP in September 2014. Prior to her

current role she served as Director of Marketing for the Bank.

Christopher L. Slabach

Senior Vice President, Chief Risk Officer

Chris joined First Mid-Illinois Bank in 1993 and has been a Senior

VP and Risk Management Officer since 2008. Prior to joining the

company, he worked for the FDIC from 1985 to 1993, ending his

tenure there as a commissioned examiner.

Holly A. Bailey

President, Howell Asphalt Company

President, Howell Paving, Inc.

Director since 2012

Chairman, Compensation Committee

Robert S. Cook

Managing Partner,

TAR CO Investments, LLC

Director since 2014

Joseph R. Dively

Chairman and Chief Executive Officer

Director since 2004

Steven L. Grissom

Chief Executive Officer of SKL Investment Group, LLC

Director since 2000

Audit Committee Financial Expert

Gary W. Melvin

Consultant and Director,

Rural King Farm & Home Supplies Stores

Director since 1990

William S. Rowland

Former Chairman and Chief Executive Officer

First Mid-Illinois Bancshares

Director since 1991

Ray Anthony Sparks

Private Investor, Sparks Investment Group, LP

Senior Advisor, Mattoon Area Family YMCA

Director since 1994

Lead Director

Chairman, Audit Committee

Mary J. Westerhold

Chief Financial Officer,

Madison Communications Co.

Director since 2016

James E. Zimmer

Owner, Zimmer Real Estate Properties, LLC

Co-Founder, Bio-Enzyme

Director since 2014

Setting the Tone at the Top

Aligned with shareholders, dedicated to the mission and committed to measured growth,

First Mid-Illinois Bancshares’ Board of Directors provide a diverse set of experiences and

industry knowledge as well as strong ties to our communities.

14

Providing Value to Shareholders

$0.74

$0.85

$1.05

$1.26

$1.42 $1.44

$1.51

$1.57

$1.67

$1.04 $1.07

$1.29

$1.62

$1.73

$1.85 $1.81

$0.99

$0.17 $0.19 $0.22

$0.29 $0.30 $0.33

$0.35 $0.38 $0.38 $0.38 $0.38 $0.40

$0.42 $0.46

$0.55 $0.59

$0.30

$6.03

$6.79

$7.41

$8.18

$8.49

$9.18

$8.28

$9.36

$10.09

$10.91

$9.38

$11.24

$12.68

$11.75

$15.63

$15.09

$17.01

$10.66

$9.55

$13.09

$15.09

$14.46

$16.37

$15.80

$17.01

$0.00

$5.00

$10.00

$15.00

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 YTD 2016

TB

V

/S

h

ar

e

Ea

rn

in

gs

&

D

iv

id

e

n

d

s/S

h

ar

e

Performance Timeline thru 6/30/16

Diluted EPS Dividends Per Share (Declared) Tangible Book Value Per Share *Fully Converted TBV/Share

15

First Mid-Illinois Bancshares consistently provides value to shareholders by

delivering solid diluted earnings per share and returning competitive dividends.

*Fully converted TBV/Share assumes conversion of Preferred Series C shares prior to actual conversion. All shares of Preferred Series C

were converted to common on May 16, 2016.

Diversified Solutions and Sources of Revenue

First Mid-Illinois Bank’s Trust and Wealth Management group provides a stream of non-interest

income through a variety of financial products and services:

– Farm Management

– Investment/Brokerage through an agreement with Raymond James Financial Services, Inc.

– Trust Services

– Retirement Plans

First Mid Insurance Group (FMIG) offers the following products to meet our communities’ needs:

– Property/Casualty and Health Insurance Products for businesses

– Homeowner and Personal Insurance Products

– Senior Care Insurance

16

$

1

,7

8

1,

8

88

$

1

,8

1

1,

0

6

6

$

1

,6

3

7,

52

6

$

1

,7

9

5,

6

2

4

$

2

,1

1

2,

7

6

5

$1,200,000

$1,400,000

$1,600,000

$1,800,000

$2,000,000

$2,200,000

2011 2012 2013 2014 2015

FMIG REVENUE

$

7

0

1

,3

9

8

$

8

2

4

,5

4

6

$

9

6

7

,8

0

3

$

1

,0

2

8,

36

5

$

1

,2

0

7,

61

2

$

1

,2

9

1

,0

03

$450,000

$650,000

$850,000

$1,050,000

$1,250,000

2011 2012 2013 2014 2015 Q2'16

Trust and Wealth Management AUM

($000s)

Quality Core Deposit Franchise

June 30, 2016

Balance %

Checking $ 805,308 47%

Savings $ 335,230 20%

MMDA $ 313,855 18%

CD – Retail/Business $ 231,963 14%

CD – Public $ 7,843 0%

CD – Brokered $ 10,000 1%

Total Deposits $ 1,704,199

17

Deposit Composition ($000s)

Rounded to Nearest Percentage

0.66%

0.48%

0.26%

0.22%

0.19%

0.17%

$500,000

$750,000

$1,000,000

$1,250,000

$1,500,000

$1,750,000

$2,000,000

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

0.70%

2011 2012 2013 2014 2015 Q2'16

Cost of Deposits

COD Total Deposits

First Mid-Illinois Bank & Trust’s Cost of Deposits is in the 12th percentile of peer banks as reported in the 3/31/16 Uniform Bank

Performance Report (UBPR).

*Does not include deposits acquired from First Clover Leaf Financial on 9/08/16

Diversified Loan Portfolio

18

Loan Composition ($000s)

Rounded to Nearest Percentage

$

8

6

0

,0

74

$

9

1

1

,0

65

$

9

8

2

,8

04

$

1

,0

6

2

,4

0

6

$

1

,2

8

1

,8

8

9

$

1

,3

1

5

,1

8

7

$700,000

$800,000

$900,000

$1,000,000

$1,100,000

$1,200,000

$1,300,000

2011 2012 2013 2014 2015 Q2'16

Total Loans ($000s)

June 30, 2016

Balance %

Commercial Real Estate

(Nonfarm/Nonresidential)

$ 445,832 33.9%

Commercial & Industrial Loans $ 301,087 22.8%

1-4 Family Residential Properties $ 220,487 16.8%

Agricultural Real Estate $ 122,311 9.3%

Agricultural Loans $ 72,776 5.5%

Multifamily Residential Properties $ 47,215 3.6%

Construction & Land Development $ 33,812 2.6%

Consumer Loans $ 38,049 2.9%

All Other Loans $ 33,618 2.6%

Total Loans $ 1,315,187

Compound Annual Growth Rate (CAGR) 2011 -

2015 = 7% (Excludes Acquisitions)

*Does not include loans acquired from First Clover Leaf Financial on 9/08/16

Outstanding Asset Quality Metrics

Ratios 2011 2012 2013 2014 2015 Q2’16

Non Performing Assets/ Total Assets 0.80% 0.56% 0.44% 0.30% 0.21% 0.24%

Net Charge-Offs/Average Loans 0.29% 0.23% 0.08% 0.03% 0.04% 0.04%

ALLL/Non Performing Loans 149.5% 155.1% 204.8% 301.4% 363.2% 327.5%

Loans 30+ Days Delinquent/Total Loans 0.78% 0.69% 0.35% 0.27% 0.27% 0.28%

ALLL/Total Loans 1.29% 1.29% 1.35% 1.29% 1.14% 1.15%

19

First Mid-Illinois Bancshares’ leading asset quality metrics illustrate our

conservative underwriting process, robust credit analysis and discipline.

KEY FINANCIAL METRICS

20

Delivering earnings growth during difficult times

Selected Income Statement Data ($000s)

2011 2012 2013 2014 2015

YTD

Q2’16

Interest income $56,772 $55,767 $53,459 $54,734 $59,251 $33,862

Interest expense 8,504 6,157 3,535 3,252 3,499 1,805

Net interest income 48,268 49,610 49,924 51,482 55,752 32,057

Provision for loan losses 3,101 2,647 2,193 629 1,318 846

Net interest income after

provision 45,167 46,963 47,731 50,853 54,434 31,211

Other income 15,787 18,310 19,341 18,369 20,544 13,103

Other expenses 43,053 42,838 43,504 44,507 49,248 29,314

Income before income taxes 17,901 22,435 23,568 24,715 25,730 15,000

Income taxes 6,529 8,410 8,846 9,254 9,218 5,265

Net income $11,372 $14,025 $14,722 $15,461 $16,512 $9,735

Selected Income Statement Data

21

Selected Balance Sheet Data ($000s)

ASSETS 2011 2012 2013 2014 2015 Q2’16

Cash and cash equivalents $73,102 $82,712 $65,102 $51,730 $115,784 $53,072

Investment securities 492,198 514,974 488,724 431,506 629,056 643,045

Net loans 848,954 899,289 969,555 1,048,724 1,267,313 1,300,023

Other assets 86,702 81,057 82,117 75,143 102,346 123,643

Total assets $1,500,956 $1,578,032 $1,605,498 $1,607,103 $2,114,499 $2,119,783

LIABILITIES & STOCKHOLDERS’ EQUITY

Deposits $1,170,734 $1,274,065 $1,287,616 $1,272,077 $1,732,568 $1,704,199

Borrowings 181,000 139,104 159,807 162,489 169,462 191,719

Other liabilities 8,255 8,176 8,694 7,621 7,460 7,245

Total liabilities 1,359,989 1,421,345 1,456,117 1,442,187 1,909,490 1,903,163

Stockholders’ equity 140,967 156,687 149,381 164,916 205,009 216,620

Total liabilities and stockholders’

equity $1,500,956 $1,578,032 $1,605,498 $1,607,103 $2,114,499 $2,119,783

Selected Balance Sheet Data

Demonstrating balance sheet strength

22

Capitalization

Ratio 2011 2012 2013 2014 2015 Q2’16

Leverage Ratio 8.99% 9.66% 10.12% 10.52% 9.20% 9.44%

Tier 1 Risk-Based Capital 13.37% 14.51% 14.37% 14.42% 13.23% 13.09%

Total Risk Based Capital 14.48% 15.65% 15.58% 15.60% 14.25% 14.11%

Common Equity Tier-1 Capital to RWA 7.00% 7.54% 7.78% 10.32% 9.92% 11.76%

Tangible Book Value per Common Share1 $11.24 $12.68 $11.75 $15.63 $15.09 $17.01

Tangible Book Value per Common Share (as

converted)2

$15.09 $14.46 $16.37 $15.80 N/A

23

Maintaining a strong regulatory capital position

1Total common equity less goodwill and intangibles divided by shares outstanding as of period end

2Assumes Series B and C Preferred shares converted to common shares at period end for 2012 and 2013. Assumes Series C Preferred

shares converted to common shares at period end for 2014 , 2015. All Series C Preferred Shares were converted to common on May 16,

2016.

Value Proposition

24

Increasing

Shareholder

Value

Experienced Management

Team and Board

Diversified Revenue Streams and

Proven Earnings Engine

Well Positioned Balance Sheet

& Strong Asset Quality

150+ year Operating Track Record Focused on all Stakeholders

Ability to Raise

Capital and Grow

Strategically

Strong Risk

Management

Coupled with

Efficient Operations

25