Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - AVNET INC | d252255dex992.htm |

| EX-2.1 - EX-2.1 - AVNET INC | d252255dex21.htm |

| 8-K - FORM 8-K - AVNET INC | d252255d8k.htm |

Sale of Technology Solutions to Tech Data Corp. Avnet Investor Presentation September 19, 2016 Exhibit 99.1

Safe Harbor Statement This presentation contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are based on management’s current expectations and are subject to uncertainty and changes in factual circumstances. The forward-looking statements herein include statements addressing future financial and operating results of Avnet and may include words such as “will,” “anticipate,” “expect,” “believe,” and “should” and other words and terms of similar meaning in connection with any discussions of future operating or financial performance or business prospects. Actual results may vary materially from the expectations contained in the forward-looking statements. The following factors, among others, could cause actual results to differ materially from those described in the forward-looking statements: the acquisition of Premier Farnell and the sale of the Technology Solutions business, the Company’s ability to retain and grow market share and to generate additional cash flow, risks associated with any acquisition activities and the successful integration of acquired companies, declines in sales, changes in business conditions and the economy in general, changes in market demand and pricing pressures, any material changes in the allocation of product or product rebates by suppliers, and other competitive and/or regulatory factors affecting the businesses of Avnet generally. More detailed information about these and other factors is set forth in Avnet’s filings with the Securities and Exchange Commission, including the Company’s reports on Form 10-K, Form 10-Q and Form 8-K. Except as required by law, Avnet is under no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

A Win Win for Both Companies Avnet to sell TS to Tech Data Corporation for $2.6B $2.4B in cash plus 2.8M shares of Tech Data common stock Tech Data expects deal to be accretive Expected to close in the first or second quarter of calendar 2017 Sale of TS and pending acquisition of Premier Farnell Repositions Avnet as a leading electronic components distributor Broadens exposure to high growth technology segments Provides significant cash and capital allocation alternatives Sale of TS best strategic alternative Value and volume distribution models are converging in IT distribution Provides the best opportunity for TS to achieve breakthrough results

Focuses Avnet on Electronic Components Distribution Two of our greatest strengths: design chain and supply chain services 1,000+ field application engineers supporting 30,000 customers globally Tailored supply chains shipping 87 billion units annually Growth markets Digital transactions/web enablement Embedded solutions Internet of Things Strategies to grow Customer expansion – earlier in their lifecycle – “Maker Market” New products and services that deepen engagement with customers Digital transformation

Update on Pending Premier Farnell Acquisition July 28th - announced offer to acquire Premier Farnell £1.85 per share, approximately £691 million equity value (~$915M) Finance through a combination of offshore cash and new debt September 8th – U.S. antitrust clearance September 12th – General meeting of shareholders Of shares voted, 99.9% in favor of offer Pending EU and Israel antitrust clearance Expected during October Expect to complete transaction in November

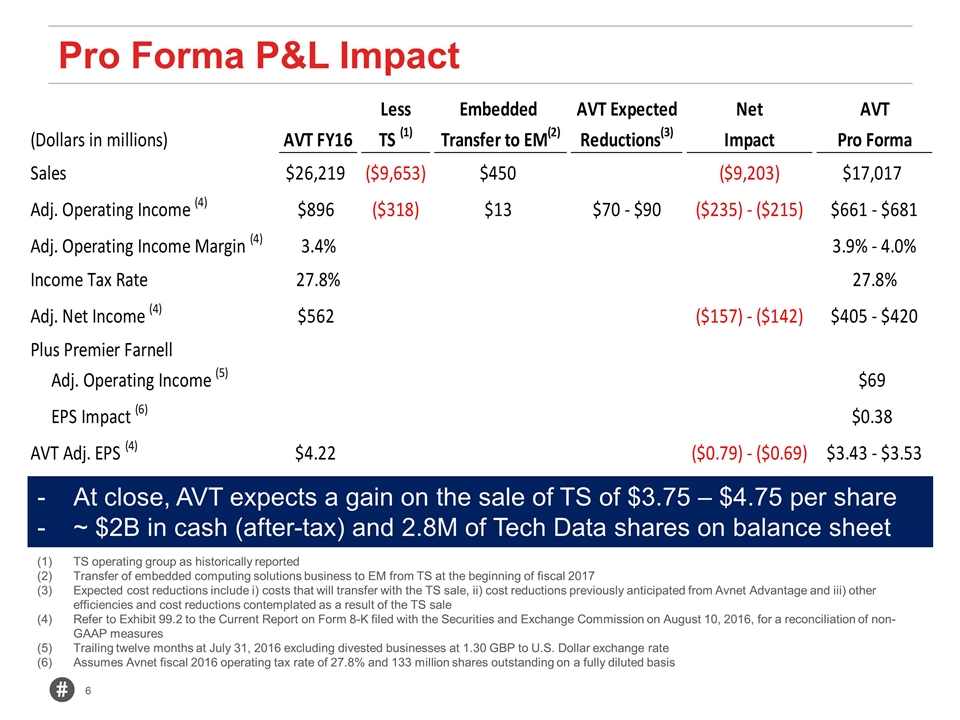

Pro Forma P&L Impact At close, AVT expects a gain on the sale of TS of $3.75 – $4.75 per share ~ $2B in cash (after-tax) and 2.8M of Tech Data shares on balance sheet TS operating group as historically reported Transfer of embedded computing solutions business to EM from TS at the beginning of fiscal 2017 Expected cost reductions include i) costs that will transfer with the TS sale, ii) cost reductions previously anticipated from Avnet Advantage and iii) other efficiencies and cost reductions contemplated as a result of the TS sale Refer to Exhibit 99.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on August 10, 2016, for a reconciliation of non-GAAP measures Trailing twelve months at July 31, 2016 excluding divested businesses at 1.30 GBP to U.S. Dollar exchange rate Assumes Avnet fiscal 2016 operating tax rate of 27.8% and 133 million shares outstanding on a fully diluted basis

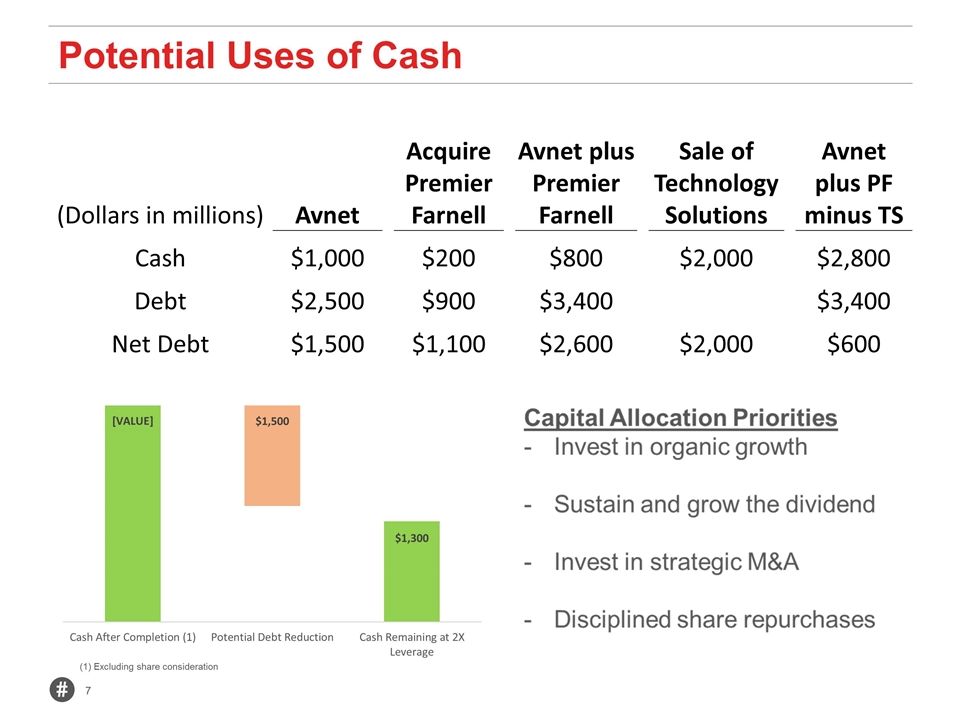

Potential Uses of Cash (Dollars in millions) Avnet Acquire Premier Farnell Avnet plus Premier Farnell Sale of Technology Solutions Avnet plus PF minus TS Cash $1,000 $200 $800 $2,000 $2,800 Debt $2,500 $900 $3,400 $3,400 Net Debt $1,500 $1,100 $2,600 $2,000 $600 (1) Excluding share consideration

Sale of Technology Solutions to Tech Data Corp. Question and Answer Session September 19, 2016

Supplemental and Non-GAAP Financial Information In addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company also discloses in this document certain non-GAAP financial information including adjusted operating income, adjusted net income and adjusted diluted earnings per share. Management believes that operating income adjusted for (i) restructuring, integration and other expenses and (ii) amortization of acquired intangible assets and other, are useful measures to help investors better assess and understand the Company’s operating performance, especially when comparing results with previous periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of Avnet’s normal operating results or non-cash in nature. Management analyzes operating income without the impact of these items as an indicator of ongoing margin performance and underlying trends in the business. Management also uses these non-GAAP measures to establish operational goals and, in many cases, for measuring performance for compensation purposes. Additional non-GAAP metrics management uses are adjusted operating income margin, which is defined as adjusted operating income (as defined above) divided by sales Management also believes net income and diluted EPS adjusted for (i) the impact of the items described above and (ii) certain items impacting income tax expense is useful to investors because it provides a measure of the Company’s net profitability on a more comparable basis to historical periods and provides a more meaningful basis for forecasting future performance. Additionally, because of management’s focus on generating shareholder value, of which net profitability is a primary driver, management believes net income and diluted EPS excluding the impact of these items provides an important measure of the Company’s net profitability for the investing public. Any analysis of results and outlook on a non-GAAP basis should be used as a complement to, and in conjunction with, results presented in accordance with GAAP. Refer to Exhibit 99.2 to the Current Report on Form 8-K filed with the Securities and Exchange Commission on August 10, 2016, for a reconciliation of non-GAAP results.