Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Citizens Community Bancorp Inc. | a8kfigpartnersinvconfprese.htm |

September 19, 2016

Exhibit 99.1

• This presentation includes forward-looking statements about the financial condition, results of operations and

business of Citizens Community Bancorp, Inc. and its wholly owned subsidiary, Citizens Community Federal N.A.

Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts.

These statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,”

“could,” “expect,” “intend,” “may,” “planned,” “potential,” “should,” “will,” “would” or the negative of those terms or

other words of similar meaning. These forward-looking statements are intended to be covered by the safe-harbor

provisions of the Private Securities Litigation Reform Act of 1995.

• Such forward-looking statements in this presentation are inherently subject to many uncertainties in our

operations and business environment. These uncertainties include general economic conditions, in particular, relating

to consumer demand for our products and services; our ability to maintain current deposit and loan levels at current

interest rates; deteriorating credit quality, including changes in the interest-rate environment reducing interest

margins; prepayment speeds, loan origination and sale volumes, charge-offs and loan loss provisions; and other

matters described in the Company's SEC filings, including under the section "Risk Factors" in Item 1A of the Company's

Form 10-K Report for the fiscal year ending September 30, 2015. Shareholders, potential investors and other readers

are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements. The forward-looking statements made herein are only

made as of the date of this presentation and we undertake no obligation to publicly update such forward-looking

statements to reflect subsequent events or circumstances occurring after the date of this presentation.

Cautionary Note Regarding Forward Looking

Statements

Executive Management

Stephen M. Bianchi is President and CEO of Citizens Community Bancorp, Inc.

Prior to joining the Bank, he was President and CEO of HF Financial Corp in

Sioux Falls, SD. Prior experience includes Senior Vice President at Associated

Bank, where he served as Minnesota Regional President and Minnesota

Regional Commercial Banking Manager from July 2006 to April 2010. Before

that, he was Twin Cities Business Banking Manager for Wells Fargo Bank,

where he held several other management positions over 21 years. Mr. Bianchi

received his B.S. degree in Finance and M.B.A. from Providence College.

Mark C. Oldenberg is Executive Vice President and CFO of Citizens Community

Bancorp, Inc. Mr. Oldenberg has worked in the financial services industry for

over twenty years, previously as Chief Financial Officer for Security Financial

Bank in Durand, WI and Fidelity National Bank in Medford, WI. He also was a

Commercial and Consumer lender for eight years at Heritage Bank in Spencer,

WI. A graduate of University of Wisconsin Eau Claire with a B.S. in Finance and

Accounting, he is also a Certified Public Accountant who is a member of the

Wisconsin Institute of Certified Public Accountants and Treasurer of the Boys &

Girls Club of the Greater Chippewa Valley.

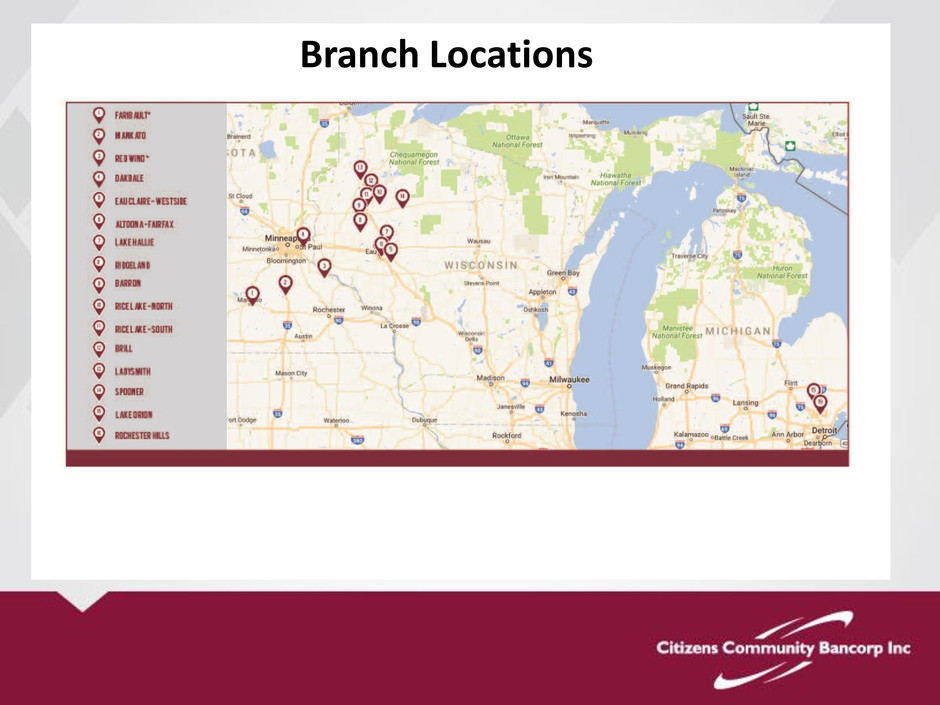

Overview

• Based in Eau Claire County, Wisconsin, Citizens Community

Federal N.A. serves more than 50,000 customers.

• Key markets include:

Eau Claire/Rice Lake, Wisconsin MSA

Mankato, Minnesota MSA

Minneapolis/St. Paul, Metro MSA

Oakland County, Michigan MSA

• 16 branches, excluding 4 locations in Walmart supercenters

scheduled to close.

• Full-service consumer, commercial and ag banking.

• May 16, 2016 - CZWI completes acquisition of Community Bank of Northern

Wisconsin ($168 million in assets).

• May 23, 2016 – CEO Edward Schaefer resigns.

• June 17, 2016 – Hires FIG Partners to explore strategic options.

• June 24, 2016 – Hires ex HF Financial President & CEO Steve Bianchi as President

and CEO.

• July 29, 2016 – Reported earnings reflect a 50% EPS increase.

• August 17, 2016 – Announces intent to close 4 Walmart branches in Eastern

Wisconsin.

• August 22, 2016 – completed core conversion related to CBN Acquisition.

• August 31, 2016 – Announces a 10% stock repurchase plan.

Recent Developments

• Remix loan and deposit composition.

• Improve efficiencies and control expenses.

• Enhance organic growth in core markets.

• Attract new lenders and reposition existing lenders.

• Enhance non-interest income.

Enhancing Performance and Franchise Value

• New CEO with history of maximizing commercial and ag market

growth and operational efficiencies was put in place in June 2016.

• Shareholder focused management recently announced 10% stock

repurchase program.

• Acquired assets has propelled earnings growth.

• Recent focus on branch efficiency is expected to enhance earnings.

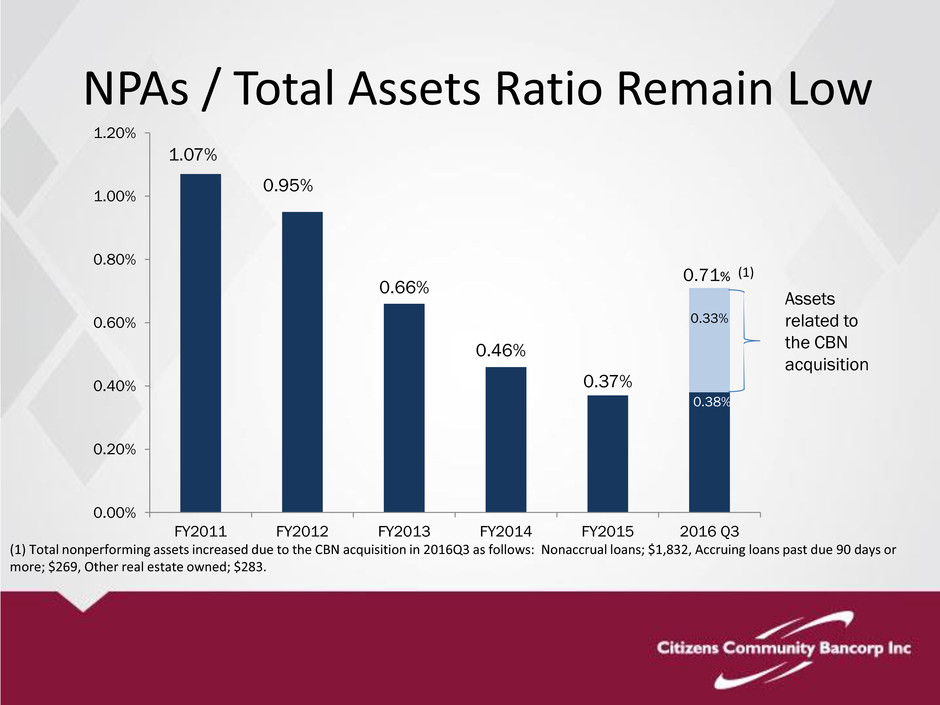

• NPAs/Total Assets of 0.71%, including recently acquired CBN assets.

• Well capitalized bank.

Investment Considerations

Branch Locations

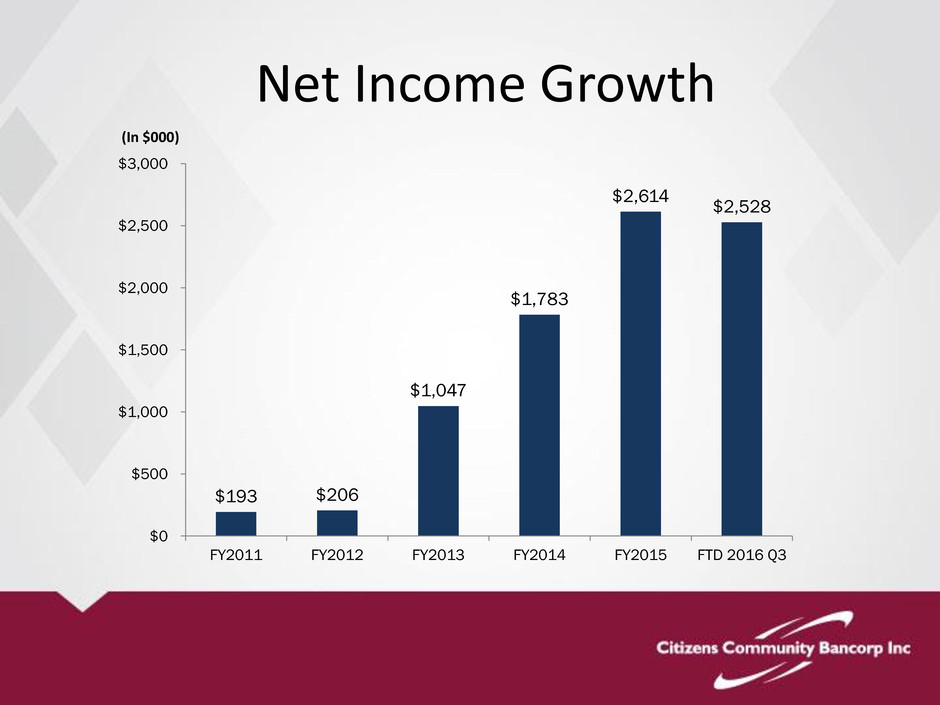

$193 $206

$1,047

$1,783

$2,614

$2,528

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

FY2011 FY2012 FY2013 FY2014 FY2015 FTD 2016 Q3

(In $000)

Net Income Growth

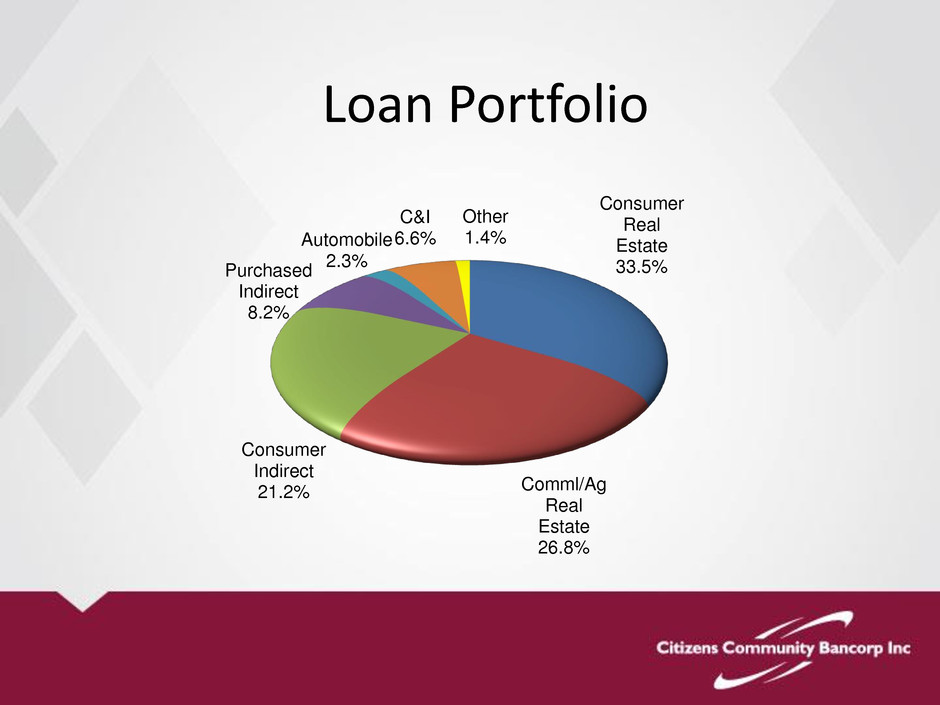

Well Diversified Loan Portfolio

Consumer

Real

Estate

33.5%

Comml/Ag

Real

Estate

26.8%

Consumer

Indirect

21.2%

Purchased

Indirect

8.2%

Automobile

2.3%

C&I

6.6%

Other

1.4%

Loan Portfolio

1.07%

0.95%

0.66%

0.46%

0.37%

0.38%

0.33%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

FY2011 FY2012 FY2013 FY2014 FY2015 2016 Q3

(1) 0.71%

NPAs / Total Assets Ratio Remain Low

(1) Total nonperforming assets increased due to the CBN acquisition in 2016Q3 as follows: Nonaccrual loans; $1,832, Accruing loans past due 90 days or

more; $269, Other real estate owned; $283.

Assets

related to

the CBN

acquisition

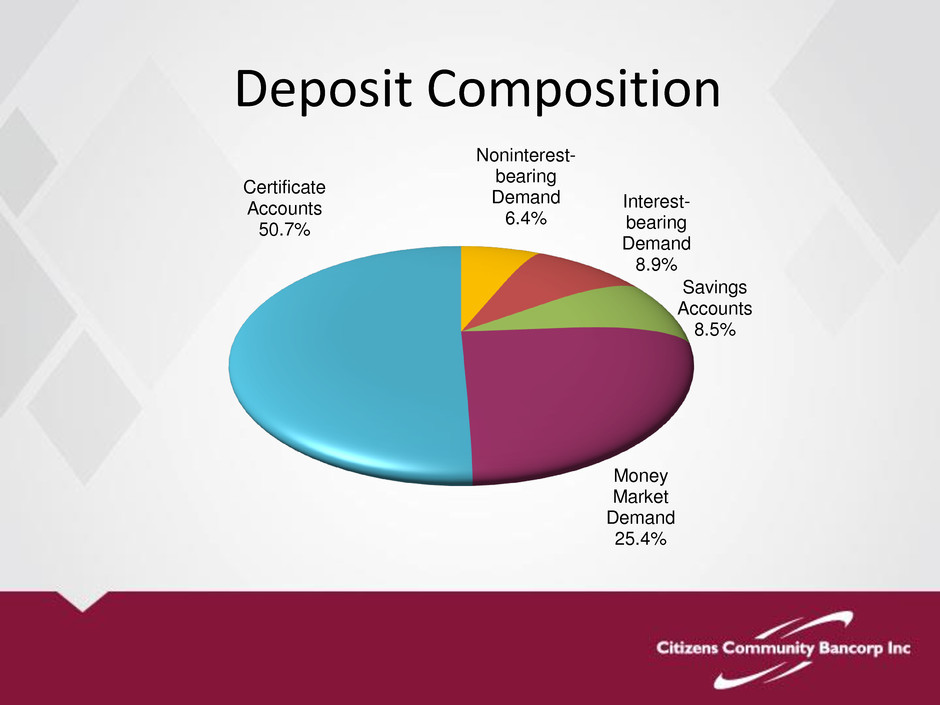

Noninterest-

bearing

Demand

6.4%

Interest-

bearing

Demand

8.9%

Savings

Accounts

8.5%

Money

Market

Demand

25.4%

Certificate

Accounts

50.7%

Deposit Composition

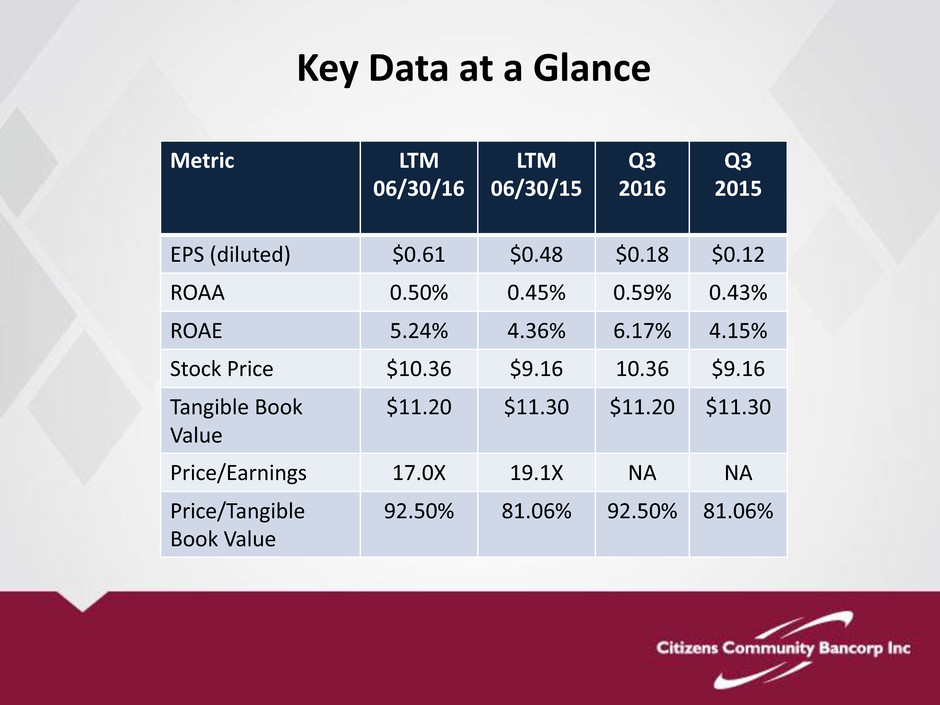

Key Data at a Glance

Metric LTM

06/30/16

LTM

06/30/15

Q3

2016

Q3

2015

EPS (diluted) $0.61 $0.48 $0.18 $0.12

ROAA 0.50% 0.45% 0.59% 0.43%

ROAE 5.24% 4.36% 6.17% 4.15%

Stock Price $10.36 $9.16 10.36 $9.16

Tangible Book

Value

$11.20 $11.30 $11.20 $11.30

Price/Earnings 17.0X 19.1X NA NA

Price/Tangible

Book Value

92.50% 81.06% 92.50% 81.06%

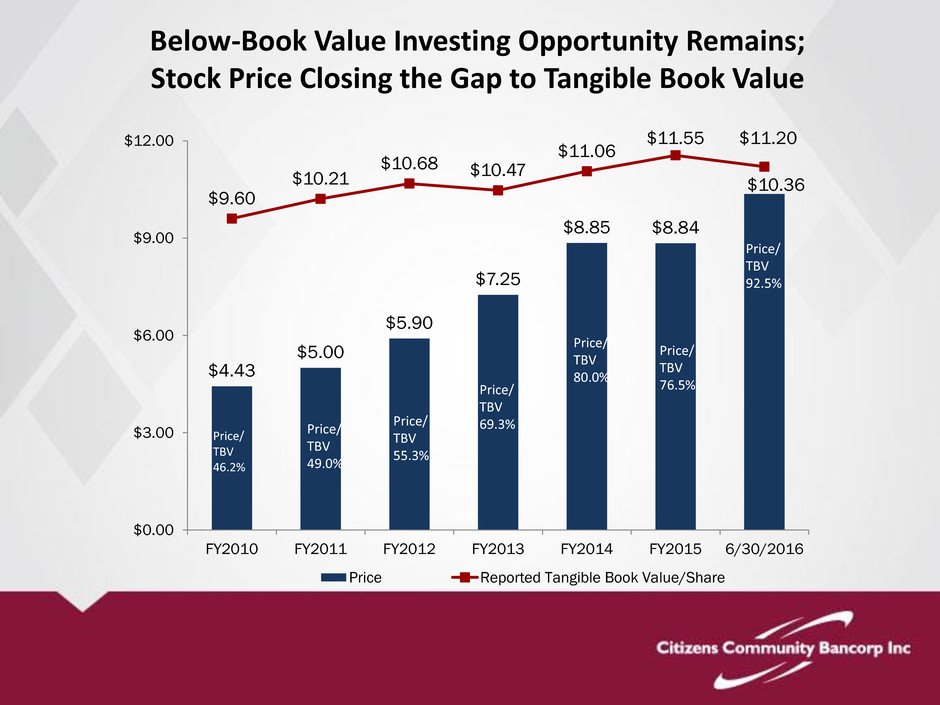

Below-Book Value Investing Opportunity Remains;

Stock Price Closing the Gap to Tangible Book Value

$4.43

$5.00

$5.90

$7.25

$8.85 $8.84

$10.36

$9.60

$10.21

$10.68 $10.47

$11.06

$11.55 $11.20

$0.00

$3.00

$6.00

$9.00

$12.00

FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 6/30/2016

Price Reported Tangible Book Value/Share

Price/

TBV

49.0%

Price/

TBV

55.3%

Price/

TBV

69.3%

Price/

TBV

76.5%

Price/

TBV

80.0%

Price/

TBV

46.2%

Price/

TBV

92.5%

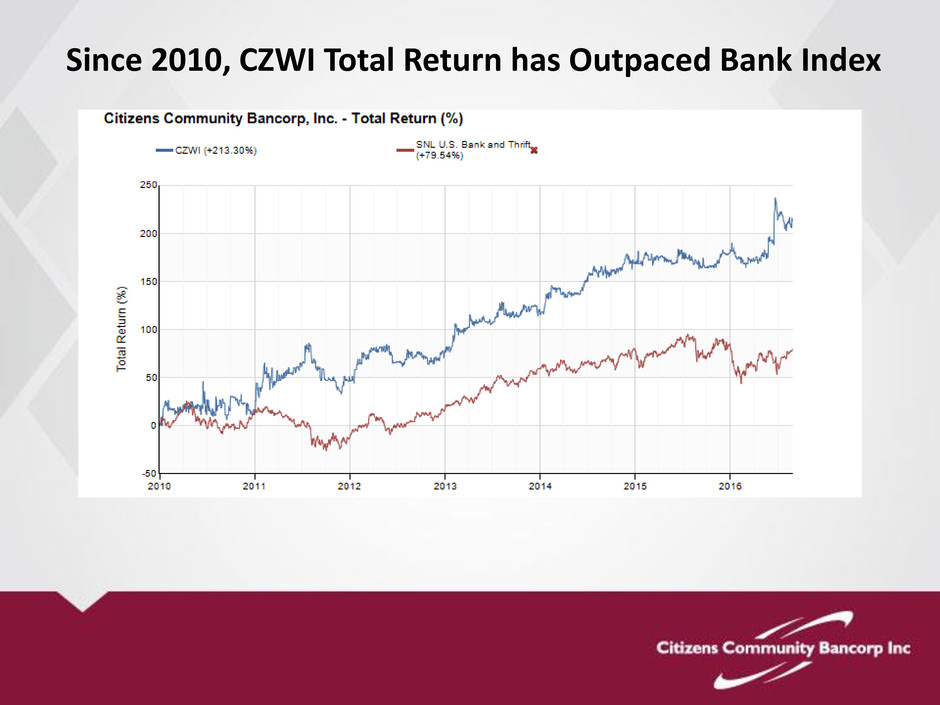

Since 2010, CZWI Total Return has Outpaced Bank Index

Building Franchise and Shareholder Value

• Increasing profitability due to growth, efficiencies to be

recognized in the acquisition, and branch rationalization.

• Accelerating commercial banking business with strong asset

quality metrics.

• Consistent tangible book value growth.

• Commitment to returning capital to shareholders through

increasing dividends and share repurchase authorization.

• Stock price approaching Tangible Book Value.

• Market and investor recognition of proven management team.