Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Hostess Brands, Inc. | d440437d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

GORES HOLDINGS – HOSTESS RESEARCH ANALYST PRESENTATION

September 2016

|

|

DISCLAIMER

This investor presentation (“Investor Presentation”) is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of Hostess Holdings, L.P. (“Hostess”) or Gores Holdings, Inc. (“Gores”) or any of Hostess’ or Gores’ affiliates’ securities (as such term is defined under the U.S. Federal Securities Law). This presentation has been prepared in connection with the proposed business combination contemplated in the Master Transaction Agreement (the “Business Combination”) of Hostess and Gores and for no other purpose. The information contained herein does not purport to be all-inclusive. The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modeling or back-testing or any other information contained herein. All levels, prices and spreads are historical and do not represent current market levels, prices or spreads, some or all of which may have been changed since the issuance of this document. Any data on past performance, modeling or back-testing contained herein is not an indication as to future performance. Hostess and Gores assume no obligation to update the information in this Investor Presentation.

Use of Projections

This Investor Presentation contains financial forecasts with respect to Hostess’ estimated net revenues, gross profit, Adjusted EBITDA and Adjusted EBITDA Margin for Hostess’ fiscal years 2016 and 2017. Neither Gores’ independent auditors, nor the independent registered public accounting firm of Hostess, audited, reviewed, compiled, or performed any procedures with respect to the projections for the purpose of their inclusion in this Investor Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Investor Presentation. These projections should not be relied upon as being necessarily indicative of future results.

In this Investor Presentation, certain of the above-mentioned estimated information has been repeated (in each case, with an indication that the information is an estimate and is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of Gores or Hostess or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Investor Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved.

Forward Looking Statements

This Investor Presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “forecast,”

“intend,” “seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward looking statements include estimated financial information. Such forward looking statements with respect to revenues, earnings, performance, strategies, prospects and other aspects of the businesses of Gores, Hostess or the combined company after completion of the Business Combination are based on current expectations that are subject to risks and uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward looking statements. These factors include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Master Transaction Agreement and the proposed business combination contemplated thereby; (2) the inability to complete the transactions contemplated by the Master Transaction Agreement due to the failure to obtain approval of the stockholders of Gores or other conditions to closing in the Master Transaction Agreement; (3) the ability to meet NASDAQ’s listing standards following the consummation of the transactions contemplated by the Master Transaction Agreement; (4) the risk that the proposed transaction disrupts current plans and operations of Hostess as a result of the announcement and consummation of the transactions described herein; (5) the ability to recognize the anticipated benefits of the proposed Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; (6) costs related to the proposed Business Combination; (7) changes in applicable laws or regulations; (8) the possibility that Hostess may be adversely affected by other economic, business, and/or competitive factors; and (9) other risks and uncertainties indicated from time to time in the final prospectus of Gores, including those under “Risk Factors” therein, and other documents filed or to be filed with the Securities and Exchange Commission (“SEC”) by Gores. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Gores and Hostess undertake no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Industry and Market Data

In this Investor Presentation, Hostess relies on and refers to information and statistics regarding market shares in the sectors in which it competes and other industry data. Hostess obtained this information and statistics from third-party sources, including reports by market research firms, such as Nielsen. Hostess has supplemented this information where necessary with information from discussions with Hostess customers and its own internal estimates, taking into account publicly available information about other industry participants and

Hostess’ management’s best view as to information that is not publicly available.

Use of Non-GAAP Financial Measures

This Investor Presentation includes non-GAAP financial measures, including earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”), Adjusted EBITDA Margin and Free Cash Flow. In this Investor Presentation, Adjusted EBITDA and Adjusted EBITDA Margin exclude certain add-backs. Adjusted EBITDA Margin represents Adjusted EBITDA divided by total revenues. Free Cash Flow conversion is defined as Adjusted EBITDA minus capital expenditures divided by Adjusted EBITDA. You can find the reconciliation of these measures to the nearest comparable GAAP measures elsewhere in this Investor Presentation. Except as otherwise noted, all references herein to full-year periods refer to Hostess’ fiscal year, which ends on December 31.

Hostess believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Hostess’ financial condition and results of operations. Hostess’ management uses these non-GAAP measures to compare Hostess’ performance to that of prior periods for trend analyses, for purposes of determining management incentive compensation, and for budgeting and planning purposes. These measures are used in monthly financial reports prepared for management and Hostess’ board of directors.

Hostess believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Management of Hostess does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP.

Other companies may calculate Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow and other non-GAAP measures differently, and therefore Hostess’ Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow and other non-GAAP measures may not be directly comparable to similarly titled measures of other companies.

Additional Information

In connection with the proposed Business Combination between Hostess and Gores, Gores intends to file with the SEC a definitive proxy statement and will mail a definitive proxy statement and other relevant documentation to Gores stockholders. This Investor Presentation does not contain all the information that should be considered concerning the proposed Business Combination. It is not intended to form the basis of any investment decision or any other decision in respect to the proposed Business Combination. Gores stockholders and other interested persons are advised to read, when available, the definitive proxy statement in connection with Gores’ solicitation of proxies for the special meeting to be held to approve the transactions contemplated by the proposed Business Combination because these materials will contain important information about Hostess, Gores and the proposed transactions. The definitive proxy statement will be mailed to Gores stockholders as of a record date to be established for voting on the proposed Business Combination when it becomes available. Stockholders will also be able to obtain a copy of the definitive proxy statement once it is available, without charge, at the SEC’s website at http://sec.gov or by directing a request to: Gores Holdings, Inc., c/o The Gores Group LLC, 9800 Wilshire Boulevard, Beverly Hills, CA 90212, attention: Jennifer Kwon Chou (jchou@gores.com).

This Investor Presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination.

Participants in the Solicitation

Gores and its directors and officers may be deemed participants in the solicitation of proxies of Gores stockholders in connection with the proposed business combination. Gores stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of Gores in Gores’ Annual Report on Form 10-K for the fiscal year ended December 31, 2015, which was filed with the SEC on March 16, 2016. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Gores stockholders in connection with the proposed transaction will be set forth in the definitive proxy statement for the transaction when available. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the definitive proxy statement that Gores intends to file with the SEC.

PAGE

1

|

|

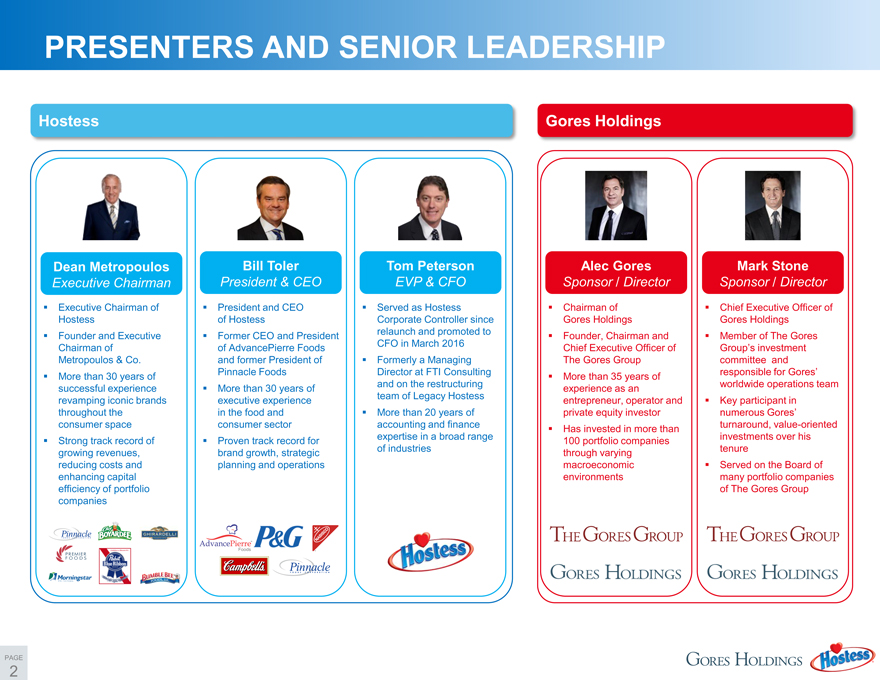

PRESENTERS AND SENIOR LEADERSHIP

Hostess

Dean Metropoulos

Executive Chairman

Executive Chairman of Hostess Founder and Executive Chairman of Metropoulos & Co. More than 30 years of successful experience revamping iconic brands throughout the consumer space Strong track record of growing revenues, reducing costs and enhancing capital efficiency of portfolio companies

Bill Toler

President & CEO

President and CEO of Hostess

Former CEO and President of AdvancePierre Foods and former President of Pinnacle Foods More than 30 years of executive experience in the food and consumer sector Proven track record for brand growth, strategic planning and operations

Tom Peterson

EVP & CFO

Served as Hostess

Corporate Controller since relaunch and promoted to CFO in March 2016 Formerly a Managing Director at FTI Consulting and on the restructuring team of Legacy Hostess More than 20 years of accounting and finance expertise in a broad range of industries

Gores Holdings

Alec Gores

Sponsor / Director

Chairman of Gores Holdings

Founder, Chairman and Chief Executive Officer of The Gores Group More than 35 years of experience as an entrepreneur, operator and private equity investor Has invested in more than 100 portfolio companies through varying macroeconomic environments

Mark Stone

Sponsor / Director

Chief Executive Officer of Gores Holdings Member of The Gores

Group’s investment committee and responsible for Gores’ worldwide operations team Key participant in numerous Gores’ turnaround, value-oriented investments over his tenure Served on the Board of many portfolio companies of The Gores Group

PAGE

2

|

|

LONG-TERM SPONSORSHIP FROM PREMIER

INVESTORS

The Gores Group / Gores Holdings, Inc.

Gores Holdings, Inc is sponsored by an affiliate of The Gores Group, a global private equity firm with 28-year track record of operational investing Since 1987, Gores has acquired and operated 110 companies Management team has over 80 years of combined operational, financial, investment and transactional experience Representative investing experience:

Dean Metropoulos: Storied Investor with a History of Turnaround Success

Thought leader and brand revival specialist with deep investing, restructuring and operating experience History of value creation, with over 30 years of partnerships with a number of the major private equity firms to successfully rebuild some of the most well known brands in the consumer space, including:

Leading global alternative investment manager in private equity, credit and real estate with over US$170bn in assets under management Opportunistic, value-oriented investment approach across market cycles and capital structures Representative consumer expertise:

PAGE

3

|

|

AGENDA

I. BUSINESS OVERVIEW

II. PROJECTIONS AND GROWTH OVERVIEW

III. TRANSACTION SUMMARY AND TIMELINE

PAGE

4

|

|

I. BUSINESS OVERVIEW

|

|

KEY INVESTMENT THEMES

Hostess Brand

Hostess business transformation:

Shelf-life Technology

Warehouse Model

Aggressive capital investment drove optimization of manufacturing, distribution and implementation of highly analytical IT systems

Strong customer support – Hostess brand driving Sweet Baked Goods (“SBG”) category growth while providing retailers the premium brand consumers want, improved penny profits, and higher margins

The growth potential of this platform is strong and expanding

- Core: Innovation and Brand extensions – Flavors, Forms, Packaging, Bread, Premium, Better For You- White-space: In-Store Bakery, Frozen Retail, Foodservice, and International opportunities largely untapped

- Acquisitions: Recent purchase of Superior Cake Products (“Superior”) to accelerate development in ISB

Best-in-class financial metrics

- Growth – Sustaining strong top-line growth- Adj. EBITDA margins – Industry leading ~30%- 85%+ Adj. EBITDA to FCF conversion1 by 2017- Clean balance sheet – No legacy issues

Hostess is a $1bn+ brand at Retail with upside potential

1 Defined as (Adj. EBITDA – Capex) / Adj. EBITDA. Capex includes maintenance capex and expansion capex.

PAGE

6

|

|

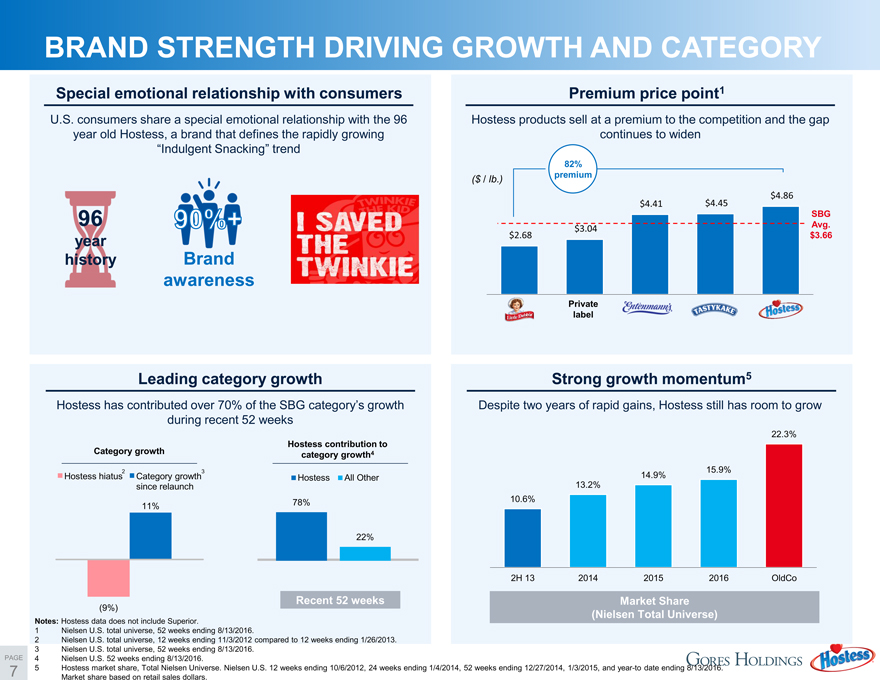

BRAND STRENGTH DRIVING GROWTH AND CATEGORY

Special emotional relationship with consumers

U.S. consumers share a special emotional relationship with the 96 year old Hostess, a brand that defines the rapidly growing

“Indulgent Snacking” trend

96

year history Brand awareness

Premium price point1

Hostess products sell at a premium to the competition and the gap continues to widen

82%

($ / lb.) premium

$4.45 $4.86

$4.41

SBG Avg.

$3.04

$2.68 $3.66

Private label

Leading category growth

Hostess has contributed over 70% of the SBG category’s growth during recent 52 weeks

Hostess contribution to Category growth category growth4

2 3

Hostess hiatus Category growth Hostess All Other since relaunch 11% 78%

22%

Recent 52 weeks

(9%)

Strong growth momentum5

Despite two years of rapid gains, Hostess still has room to grow

22.3%

15.9% 14.9% 13.2% 10.6%

2H 13 2014 2015 2016 OldCo

Market Share (Nielsen Total Universe)

(Nielsen Total Universe)

Notes: Hostess data does not include Superior.

1 Nielsen U.S. total universe, 52 weeks ending 8/13/2016.

2 Nielsen U.S. total universe, 12 weeks ending 11/3/2012 compared to 12 weeks ending 1/26/2013.

3 Nielsen U.S. total universe, 52 weeks ending 8/13/2016.

4 Nielsen U.S. 52 weeks ending 8/13/2016.

5 Hostess market share, Total Nielsen Universe. Nielsen U.S. 12 weeks ending 10/6/2012, 24 weeks ending 1/4/2014, 52 weeks ending 12/27/2014, 1/3/2015, and year-to date ending 8/13/2016. Market share based on retail sales dollars.

PAGE

7

|

|

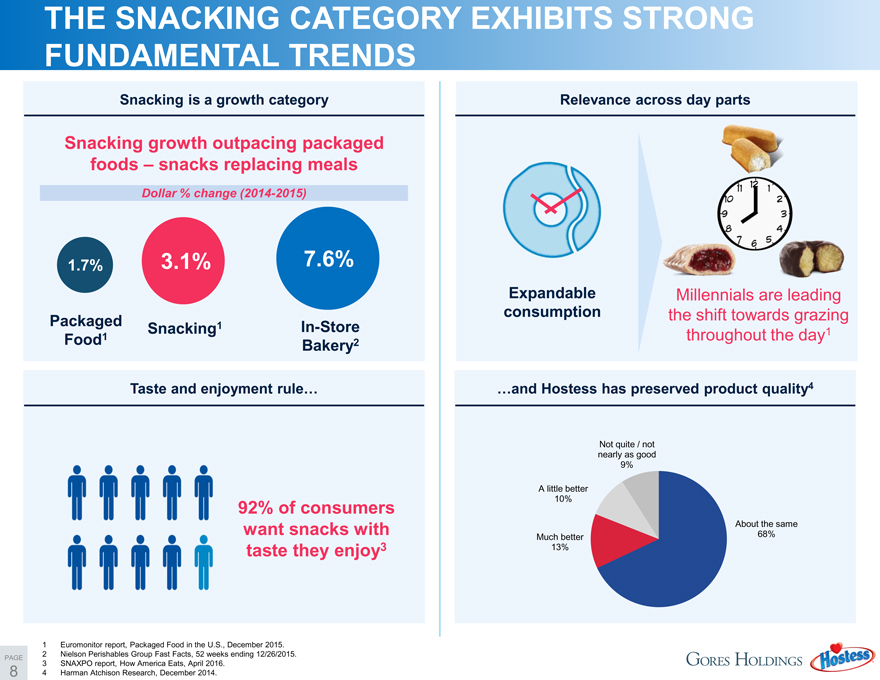

THE SNACKING CATEGORY EXHIBITS STRONG

FUNDAMENTAL TRENDS

Snacking is a growth category

Snacking growth outpacing packaged foods – snacks replacing meals

Dollar % change (2014-2015)

1.7% 3.1% 7.6%

Packaged 1 In-Store Snacking Food1 Bakery2

Taste and enjoyment rule…

92% of consumers want snacks with taste they enjoy3

Relevance across day parts

Expandable Millennials are leading consumption the shift towards grazing throughout the day1

…and Hostess has preserved product quality4

Not quite / not nearly as good 9%

A little better 10%

About the same Much better 68% 13%

1 Euromonitor report, Packaged Food in the U.S., December 2015.

2 Nielson Perishables Group Fast Facts, 52 weeks ending 12/26/2015.

3 SNAXPO report, How America Eats, April 2016.

4 Harman Atchison Research, December 2014.

PAGE

8

|

|

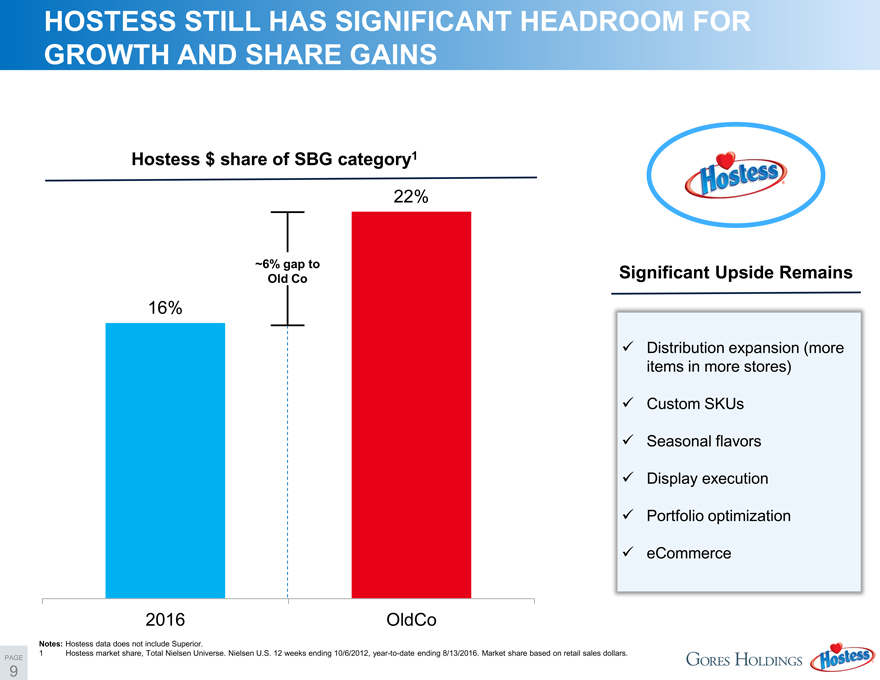

HOSTESS STILL HAS SIGNIFICANT HEADROOM FOR GROWTH AND SHARE GAINS

Hostess $ share of SBG category1

22%

~6% gap to Old Co

16%

2016 OldCo

Significant Upside Remains

Distribution expansion (more items in more stores)

Custom SKUs Seasonal flavors Display execution Portfolio optimization eCommerce

Notes: Hostess data does not include Superior.

1 Hostess market share, Total Nielsen Universe. Nielsen U.S. 12 weeks ending 10/6/2012, year-to-date ending 8/13/2016. Market share based on retail sales dollars.

PAGE

9

|

|

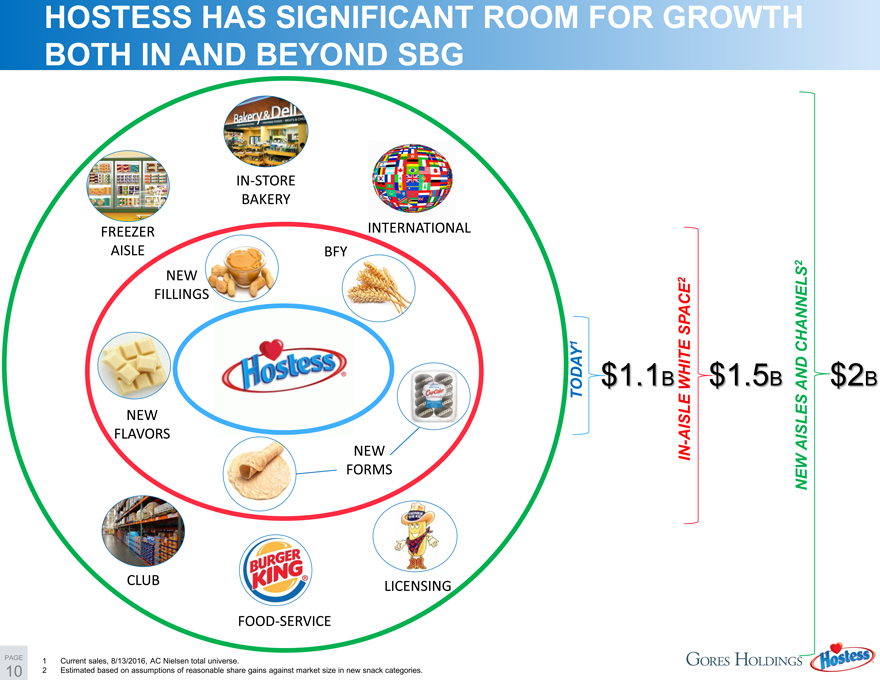

HOSTESS HAS SIGNIFICANT ROOM FOR GROWTH BOTH IN AND BEYOND SBG

IN-STORE BAKERY

FREEZER INTERNATIONAL AISLE BFY

NEW FILLINGS

NEW FLAVORS

NEW FORMS

CLUB LICENSING

FOOD-SERVICE

TODAY1

1. $

B

IN-AISLE WHITE SPACE2

1. $

B

NEW AISLES AND CHANNELS2

$

B

1 Current sales, 8/13/2016, AC Nielsen total universe.

2 Estimated based on assumptions of reasonable share gains against market size in new snack categories.

PAGE

10

|

|

OPPORTUNITIES FOR THE FUTURE

Great Foundation Culture of Growth Innovation

New products and platforms Line extensions and Core flavors Seasonal LTO programs ACV expansion

Frozen Retail Food Service

White Space Club

International School items

Acquisition of Superior Cake Products, Inc.1 Acquisitions & Cross-category licensing partnerships

Licensing

Notes: Mars is a registered trademark of Mars, Incorporated. Ghostbusters is a registered trademark of Columbia Pictures Industries, Inc.

1 May 2016.

PAGE

11

|

|

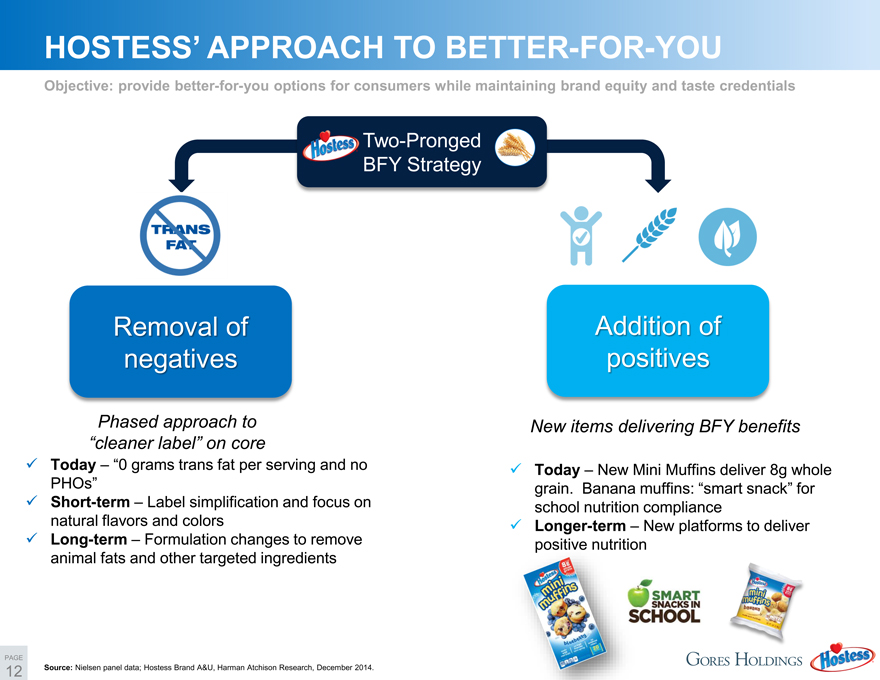

HOSTESS’ APPROACH TO BETTER-FOR-YOU

Objective: provide better-for-you options for consumers while maintaining brand equity and taste credentials

Two-Pronged

®

BFY Strategy

Removal of Addition of negatives positives

Phased approach to

“cleaner label” on core

Today – “0 grams trans fat per serving and no

PHOs”

Short-term – Label simplification and focus on natural flavors and colors Long-term – Formulation changes to remove animal fats and other targeted ingredients

New items delivering BFY benefits

Today – New Mini Muffins deliver 8g whole grain. Banana muffins: “smart snack” for school nutrition compliance Longer-term – New platforms to deliver

Source: Nielsen panel data; Hostess Brand A&U, Harman Atchison Research, December 2014.

PAGE

12

|

|

II. PROJECTIONS AND GROWTH OVERVIEW

|

|

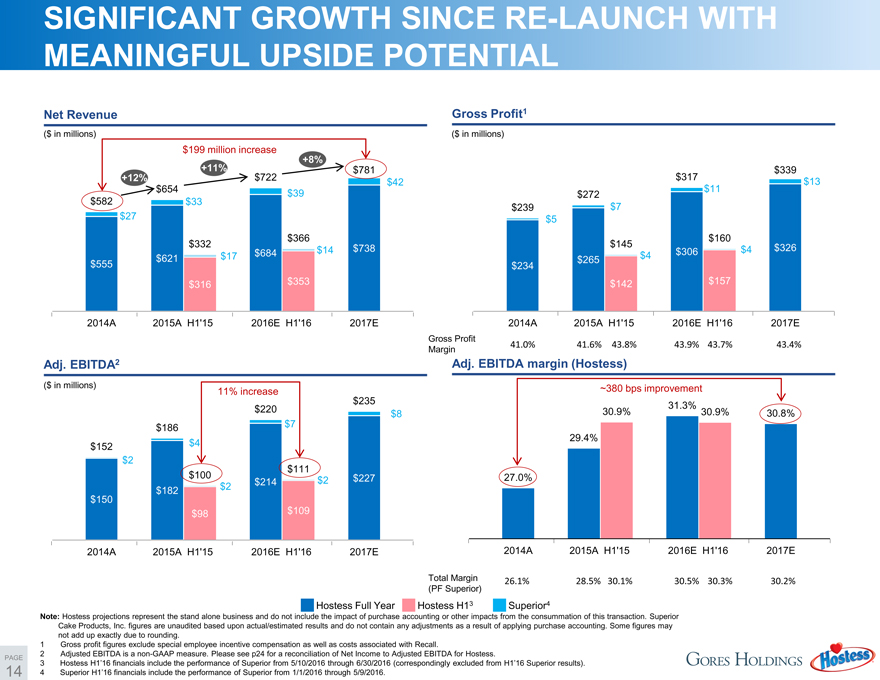

SIGNIFICANT GROWTH SINCE RE-LAUNCH WITH MEANINGFUL UPSIDE POTENTIAL

Net Revenue

($ in millions) $199 million increase

+11% +8% $781 +12% $722 $42 $654 $39 $582 $33 $27

$366 $332

$14 $738

$17 $684 $621 $555 $316 $353

2014A 2015A H1’15 2016E H1’16 2017E

Gross Profit1

($ in millions)

$339 $317 $13 $11 $272 $239 $7 $5 $160 $145 $326 $306 $4 $265 $4 $234 $142 $157

2014A 2015A H1’15 2016E H1’16 2017E

Gross Profit

41.0% 41.6% 43.8% 43.9% 43.7% 43.4%

Margin

Adj. EBITDA2

($ in millions)

11% increase $220 $235 $8 $186 $7 $152 $4

$2 $111 $100 $227 $214 $2 $182 $2 $150

$98 $109

2014A 2015A H1’15 2016E H1’16 2017E

Adj. EBITDA margin (Hostess)

~380 bps improvement 31.3%

30.9% 30.9% 30.8%

29.4%

27.0%

2014A 2015A H1’15 2016E H1’16 2017E

Total Margin 26.1% 28.5% 30.1% 30.5% 30.3% 30.2%

(PF Superior)

Hostess Full Year Hostess H13 Superior4

Note: Hostess projections represent the stand alone business and do not include the impact of purchase accounting or other impacts from the consummation of this transaction. Superior Cake Products, Inc. figures are unaudited based upon actual/estimated results and do not contain any adjustments as a result of applying purchase accounting. Some figures may not add up exactly due to rounding.

1 Gross profit figures exclude special employee incentive compensation as well as costs associated with Recall.

2 Adjusted EBITDA is a non-GAAP measure. Please see p24 for a reconciliation of Net Income to Adjusted EBITDA for Hostess.

3 Hostess H1’16 financials include the performance of Superior from 5/10/2016 through 6/30/2016 (correspondingly excluded from H1’16 Superior results).

4 Superior H1’16 financials include the performance of Superior from 1/1/2016 through 5/9/2016.

PAGE

14

|

|

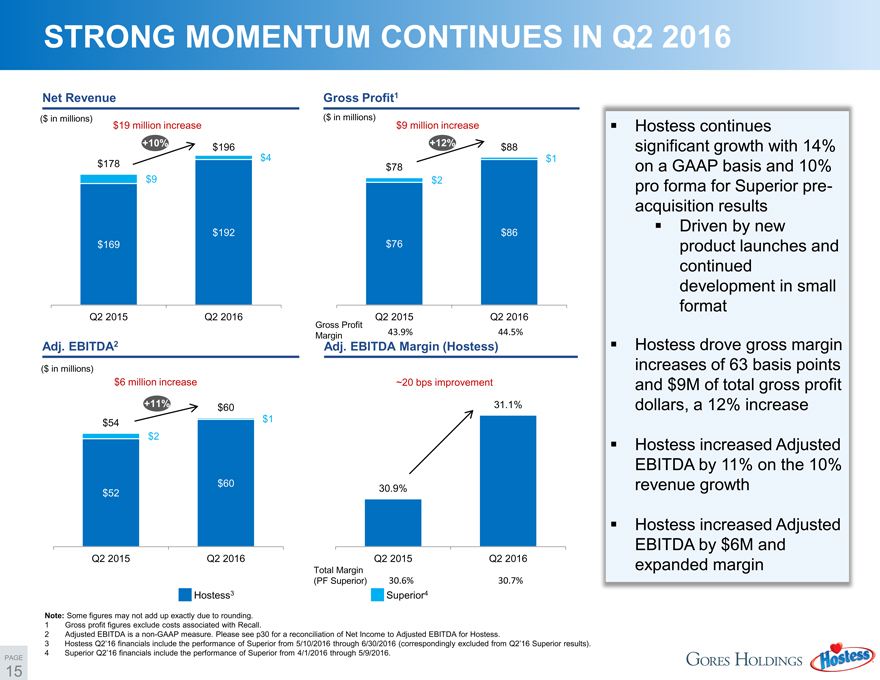

STRONG MOMENTUM CONTINUES IN Q2 2016

Net Revenue

($ in millions) $19 million increase

+10% $196 $4 $178 $9

$192 $169

Q2 2015 Q2 2016

Gross Profit1

($ in millions) $9 million increase

+12% $88

$78 $1 $2

$86 $76

Gross Profit Q2 2015 Q2 2016

Margin 43.9% 44.5%

Adj. EBITDA Margin (Hostess)

~20 bps improvement

31.1%

30.9%

Q2 2015 Q2 2016

Total Margin

(PF Superior) 30.6% 30.7%

Superior4

Hostess3

Note: Some figures may not add up exactly due to rounding.

1 Gross profit figures exclude costs associated with Recall.

2 Adjusted EBITDA is a non-GAAP measure. Please see p30 for a reconciliation of Net Income to Adjusted EBITDA for Hostess.

3 Hostess Q2’16 financials include the performance of Superior from 5/10/2016 through 6/30/2016 (correspondingly excluded from Q2’16 Superior results).

4 Superior Q2’16 financials include the performance of Superior from 4/1/2016 through 5/9/2016.

Hostess continues

significant growth with 14%

on a GAAP basis and 10%

pro forma for Superior pre-

acquisition results

Driven by new

product launches and

continued

development in small

format

Hostess drove gross margin

increases of 63 basis points

and $9M of total gross profit

dollars, a 12% increase

Hostess increased Adjusted

EBITDA by 11% on the 10%

revenue growth

Hostess increased Adjusted

EBITDA by $6M and

expanded margin

PAGE

15

|

|

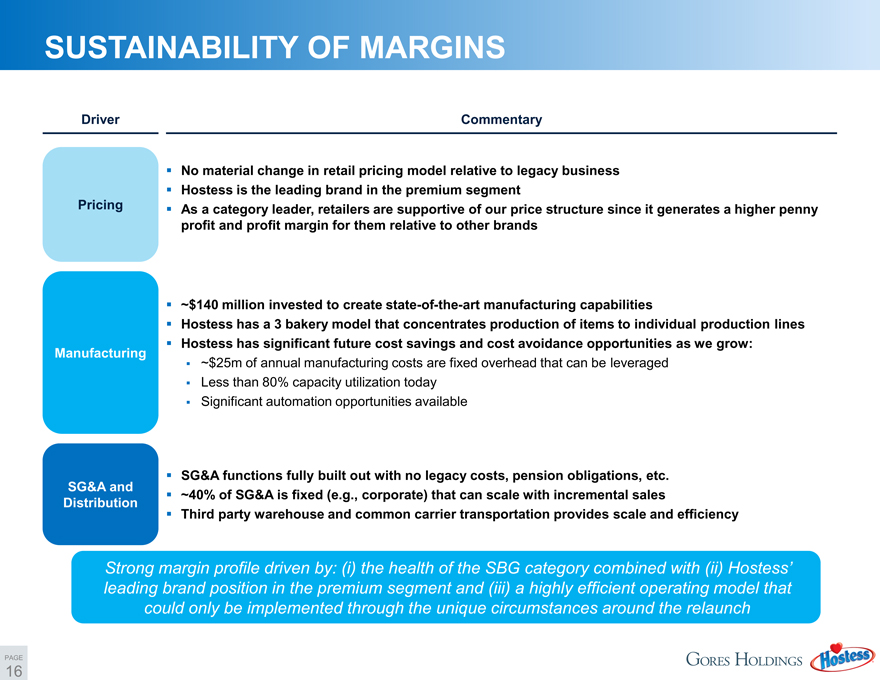

SUSTAINABILITY OF MARGINS

Driver Pricing Manufacturing

SG&A and Distribution

Commentary

No material change in retail pricing model relative to legacy business Hostess is the leading brand in the premium segment

As a category leader, retailers are supportive of our price structure since it generates a higher penny profit and profit margin for them relative to other brands

~$140 million invested to create state-of-the-art manufacturing capabilities

Hostess has a 3 bakery model that concentrates production of items to individual production lines Hostess has significant future cost savings and cost avoidance opportunities as we grow:

~$25m of annual manufacturing costs are fixed overhead that can be leveraged Less than 80% capacity utilization today Significant automation opportunities available

SG&A functions fully built out with no legacy costs, pension obligations, etc. ~40% of SG&A is fixed (e.g., corporate) that can scale with incremental sales

Third party warehouse and common carrier transportation provides scale and efficiency

Strong margin profile driven by: (i) the health of the SBG category combined with (ii) Hostess’ leading brand position in the premium segment and (iii) a highly efficient operating model that could only be implemented through the unique circumstances around the relaunch

PAGE

16

|

|

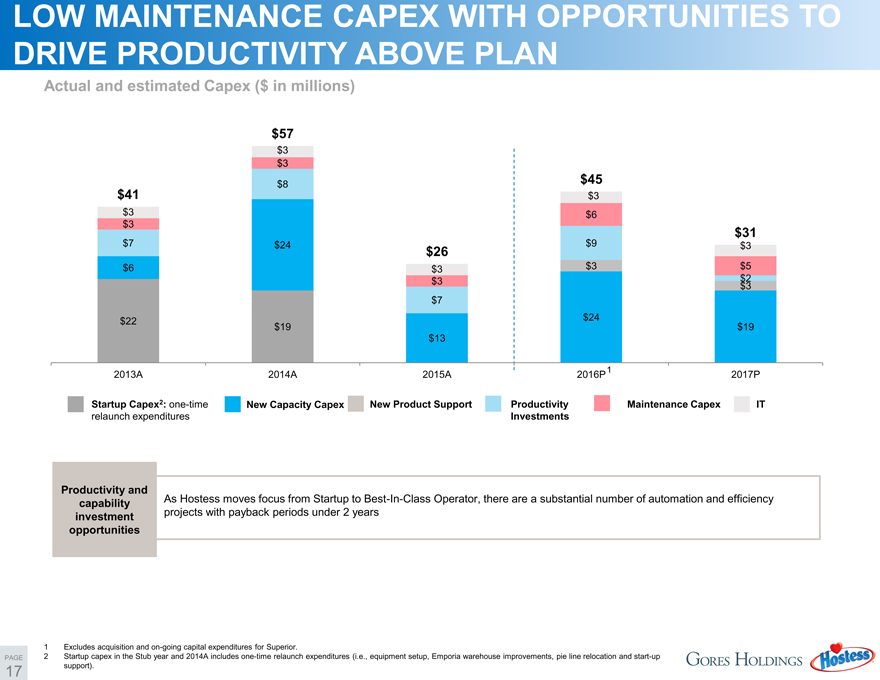

LOW MAINTENANCE CAPEX WITH OPPORTUNITIES TO DRIVE PRODUCTIVITY ABOVE PLAN

Actual and estimated Capex ($ in millions)

$57

$3 $3

$8 $45

$41 $3

$3 $6 $3

$31

$7 $24 $9 $3

$26

$6 $3 $3 $5

$3 $2 $3 $7

$22 $24

$19 $19 $13

1

2013A 2014A 2015A 2016P 2017P

Startup Capex2: one-time New Capacity Capex New Product Support Productivity Maintenance Capex IT relaunch expenditures Investments

Productivity and capability investment opportunities

As Hostess moves focus from Startup to Best-In-Class Operator, there are a substantial number of automation and efficiency projects with payback periods under 2 years

1 Excludes acquisition and on-going capital expenditures for Superior.

2 Startup capex in the Stub year and 2014A includes one-time relaunch expenditures (i.e., equipment setup, Emporia warehouse improvements, pie line relocation and start-up support).

PAGE

17

|

|

III. TRANSACTION SUMMARY AND TIMELINE

|

|

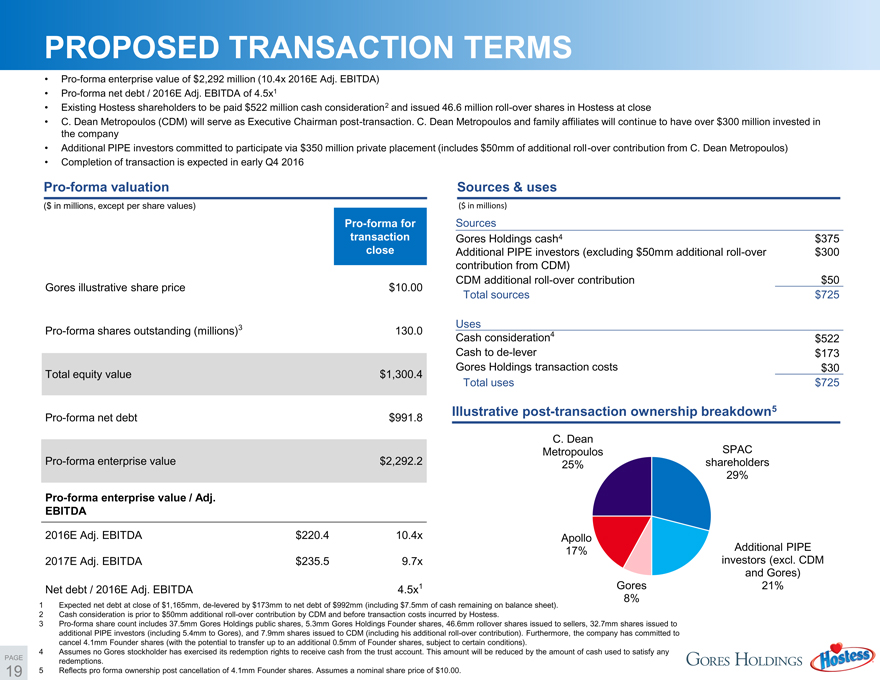

PROPOSED TRANSACTION TERMS

• Pro-forma enterprise value of $2,292 million (10.4x 2016E Adj. EBITDA)

• Pro-forma net debt / 2016E Adj. EBITDA of 4.5x1

• Existing Hostess shareholders to be paid $522 million cash consideration2 and issued 46.6 million roll-over shares in Hostess at close

• C. Dean Metropoulos (CDM) will serve as Executive Chairman post-transaction. C. Dean Metropoulos and family affiliates will continue to have over $300 million invested in the company

• Additional PIPE investors committed to participate via $350 million private placement (includes $50mm of additional roll-over contribution from C. Dean Metropoulos)

• Completion of transaction is expected in early Q4 2016

Pro-forma valuation

($ in millions, except per share values)

Pro-forma for transaction close

Gores illustrative share price $10.00 Pro-forma shares outstanding (millions)3 130.0 Total equity value $1,300.4

Pro-forma net debt $991.8

Pro-forma enterprise value $2,292.2

Pro-forma enterprise value / Adj. EBITDA

2016E Adj. EBITDA $220.4 10.4x

2017E Adj. EBITDA $235.5 9.7x

Net debt / 2016E Adj. EBITDA 4.5x1

Sources & uses

($ in millions)

Sources

Gores Holdings cash4 $375

Additional PIPE investors (excluding $50mm additional roll-over $300 contribution from CDM) CDM additional roll-over contribution $50 Total sources $725

Uses

Cash consideration4 $522 Cash to de-lever $173 Gores Holdings transaction costs $30 Total uses $725

Illustrative post-transaction ownership breakdown5

C. Dean

Metropoulos SPAC 25% shareholders 29%

Apollo Additional PIPE 17% investors (excl. CDM and Gores) Gores 21% 8%

1 Expected net debt at close of $1,165mm, de-levered by $173mm to net debt of $992mm (including $7.5mm of cash remaining on balance sheet).

2 Cash consideration is prior to $50mm additional roll-over contribution by CDM and before transaction costs incurred by Hostess.

3 Pro-forma share count includes 37.5mm Gores Holdings public shares, 5.3mm Gores Holdings Founder shares, 46.6mm rollover shares issued to sellers, 32.7mm shares issued to additional PIPE investors (including 5.4mm to Gores), and 7.9mm shares issued to CDM (including his additional roll-over contribution). Furthermore, the company has committed to cancel 4.1mm Founder shares (with the potential to transfer up to an additional 0.5mm of Founder shares, subject to certain conditions).

4 Assumes no Gores stockholder has exercised its redemption rights to receive cash from the trust account. This amount will be reduced by the amount of cash used to satisfy any redemptions.

5 Reflects pro forma ownership post cancellation of 4.1mm Founder shares. Assumes a nominal share price of $10.00.

PAGE

19

|

|

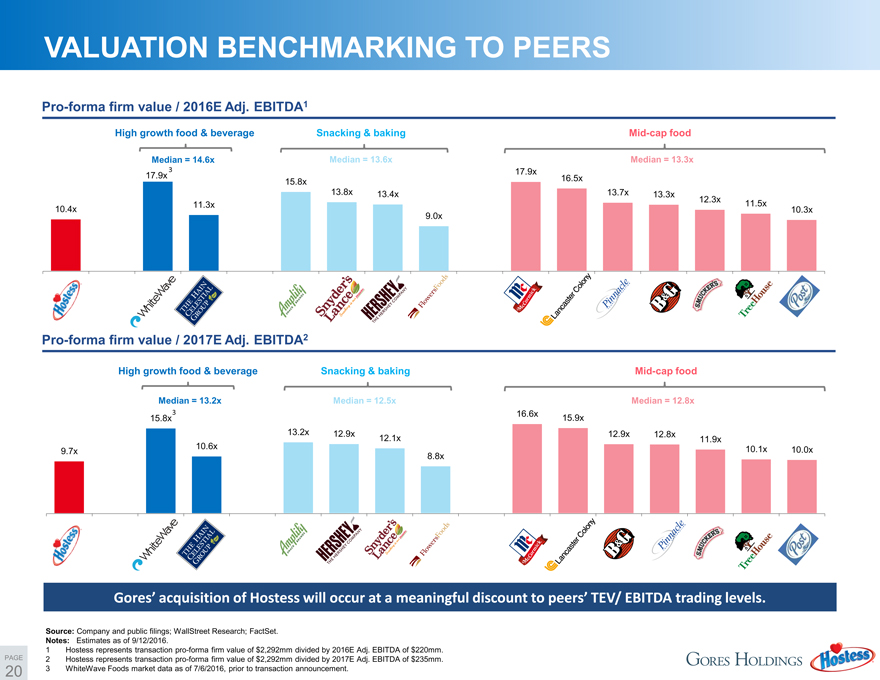

VALUATION BENCHMARKING TO PEERS

Pro-forma firm value / 2016E Adj. EBITDA1

High growth food & beverage Snacking & baking Mid-cap food

Median = 14.6x Median = 13.6x Median = 13.3x

3 17.9x

17.9x 16.5x 15.8x

13.8x 13.4x 13.7x 13.3x 12.3x

11.3x 11.5x

10.4x 10.3x

9.0x

Pro-forma firm value / 2017E Adj. EBITDA2

High growth food & beverage Snacking & baking Mid-cap food

Median = 13.2x Median = 12.5x Median = 12.8x

3 16.6x

15.8x 15.9x

13.2x 12.9x 12.9x 12.8x

10.6x 12.1x 11.9x

9.7x 10.1x 10.0x

8.8x

Gores’ acquisition of Hostess will occur at a meaningful discount to peers’ TEV/ EBITDA trading levels.

Source: Company and public filings; WallStreet Research; FactSet. Notes: Estimates as of 9/12/2016.

1 Hostess represents transaction pro-forma firm value of $2,292mm divided by 2016E Adj. EBITDA of $220mm.

2 Hostess represents transaction pro-forma firm value of $2,292mm divided by 2017E Adj. EBITDA of $235mm.

3 WhiteWave Foods market data as of 7/6/2016, prior to transaction announcement.

PAGE

20

|

|

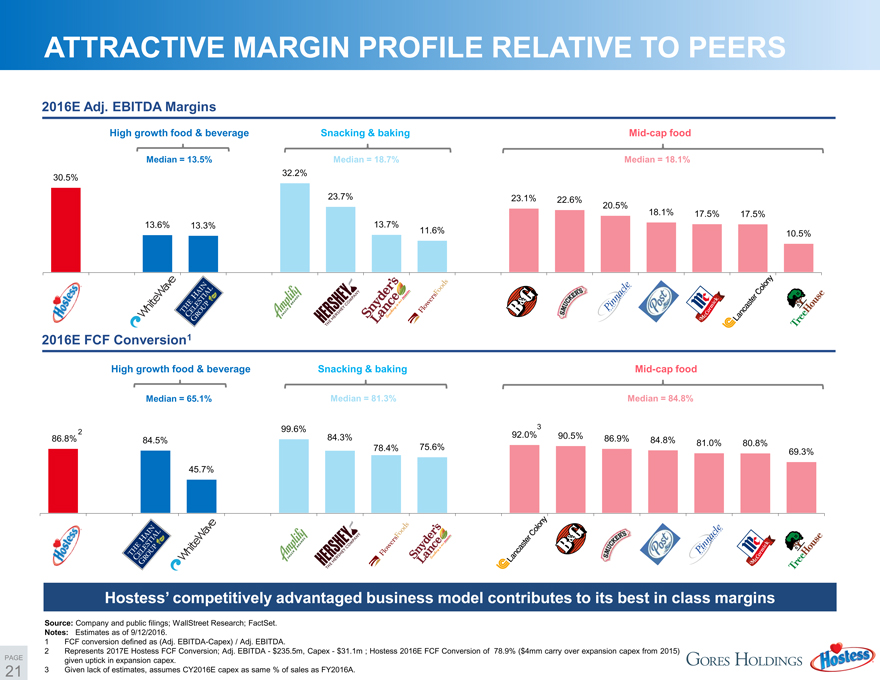

ATTRACTIVE MARGIN PROFILE RELATIVE TO PEERS

2016E Adj. EBITDA Margins

High growth food & beverage Snacking & baking Mid-cap food

Median = 13.5% Median = 18.7% Median = 18.1%

32.2%

30.5%

23.7% 23.1% 22.6%

20.5%

18.1% 17.5% 17.5%

13.6% 13.3% 13.7%

11.6% 10.5%

2016E FCF Conversion1

High growth food & beverage Snacking & baking Mid-cap food

Median = 65.1% Median = 81.3% Median = 84.8%

99.6% 3

2 92.0% 90.5%

86.8% 84.5% 84.3% 86.9% 84.8%

81.0% 80.8%

78.4% 75.6%

69.3%

45.7%

Hostess’ competitively advantaged business model contributes to its best in class margins

Source: Company and public filings; WallStreet Research; FactSet. Notes: Estimates as of 9/12/2016.

1 FCF conversion defined as (Adj. EBITDA-Capex) / Adj. EBITDA.

2 Represents 2017E Hostess FCF Conversion; Adj. EBITDA - $235.5m, Capex - $31.1m ; Hostess 2016E FCF Conversion of 78.9% ($4mm carry over expansion capex from 2015) given uptick in expansion capex.

3 Given lack of estimates, assumes CY2016E capex as same % of sales as FY2016A.

PAGE

21

|

|

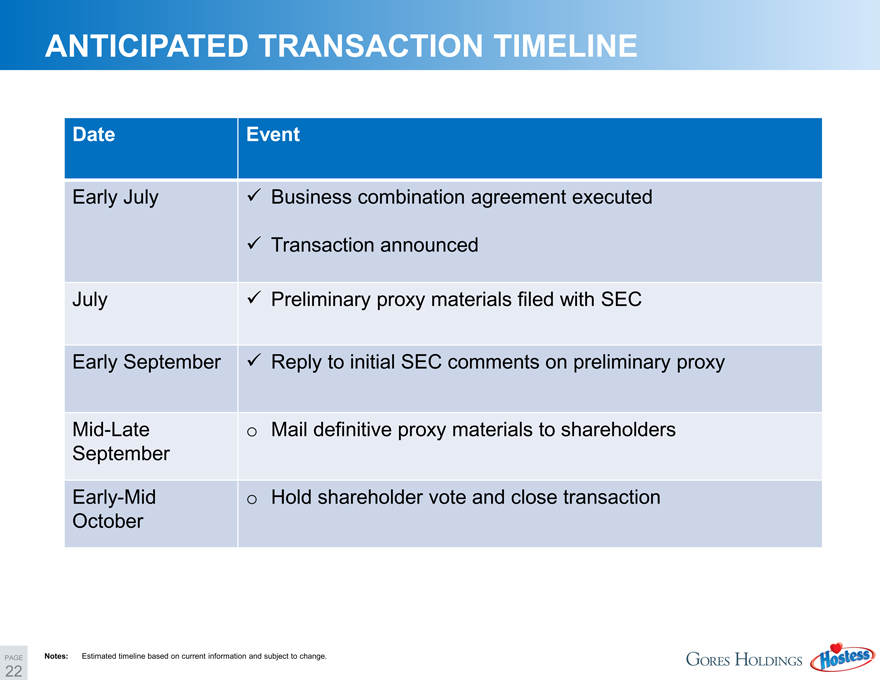

ANTICIPATED TRANSACTION TIMELINE

Date Event

Early July Business combination agreement executed

Transaction announced

July Preliminary proxy materials filed with SEC

Early September Reply to initial SEC comments on preliminary proxy

Mid-Late o Mail definitive proxy materials to shareholders September

Early-Mid o Hold shareholder vote and close transaction October

Notes: Estimated timeline based on current information and subject to change.

PAGE

22

|

|

HOSTESS NON-GAAP RECONCILIATION (UNAUDITED)

(in millions)

Net income (loss)

Plus non-GAAP adjustments: Interest expense, net Loss on debt extinguishment1 Depreciation and amortization Related party expenses2 Unit-based compensation Other (income) expense3

Impairment of property and equipment

Loss on sale/abandonment of property and equipment and bakery shutdown costs4

Special employee incentive compensation5

Distributions for Cash taxes and tax sharing and income tax provision

Adjusted EBITDA6

Superior Adjusted EBITDA7

Combined Adjusted EBITDA

Twelve Twelve ThreeTwelveThreeTwelve

Months Months Six MonthsSix Months

MonthsMonthsMonthsMonths

(Estimated) (Estimated) EndedEnded

EndedEndedEndedEnded

Ending Ending 30-Jun-1630-Jun-15

31-Dec-17 31-Dec-16 30-Jun-1631-Dec-1530-Jun-1531-Dec-14

$ 101.8 $74.9$48.0$29.5$88.8$75.7$43.2$81.5

50.1 59.635.717.950.017.78.637.4

- ---25.97.87.8-

15.3 11.55.63.09.84.52.47.1

- 2.52.41.14.32.51.24.5

0.2 0.30.40.31.40.40.30.4

- 9.99.27.7(8.7)(12.1)(12.1)0.6

- 7.37.3-2.70.40.413.2

- 0.20.20.14.20.90.55.2

- ---3.9---

60.1 47.40.30.3----

$ 227.5 $213.8$109.2$59.8$182.2$97.7$52.3$149.8

8.0 6.62.00.64.22.31.42.1

$ 235.5 $220.4$111.2$60.4$186.5$100.0$53.6$151.9

Notes: Hostess projections represent the stand alone business and do not include the impact of purchase accounting or other impacts from the consummation of this transaction.

1 During the year ended December 31, 2015, the Company recorded a loss on extinguishment related to our original Term Loan of $25.9 million, which consisted of prepayment penalties of $9.9 million and write-off of deferred financing costs of $16.0 million, during the third quarter of 2015. During the three and six months ended June 30, 2015, the Company recorded a loss on a partial extinguishment of its original Term Loan of $7.8 million, which consisted of prepayment penalties of $3.0 million and write-off of deferred financing costs of $4.8 million.

2 Related party expenses consist of expenses associated with the Company’s employment agreement with Mr. Metropoulos as the Chief Executive Officer and/or Executive Chairman. The Company classifies all expenses associated with this arrangement as related party expenses.

3 2016 estimate includes $7.7 million of exceptional one-time items, $2.1mm of fees for professional services and $0.1 million of other expenses. During the three and six months ended June 30, 2016, other income consisted of legal and professional fees of $3.7mm and $5.2mm, respectively, and $4.0mm of flour-related recall costs. During the year ended December 31, 2015, other income consisted of $12.0 million of proceeds from the sale of foreign trademark rights and perpetual irrevocable licenses to certain “know how” in certain countries in the Middle East, partially offset by $3.3 million for professional service fees related to our pursuit of a potential sale of the Company. Other income during the three and six months ended June 30, 2015, primarily consisted of $12.0 million of proceeds from the sale of foreign trademark rights and perpetual irrevocable licenses to certain “know how” in certain countries in the Middle East. During the year ended December 31, 2014, other expense was $0.6 million.

4 During the three and six months ended June 30, 2016 , the Company incurred bakery shutdown costs of $0.1 million and $0,2 million, in expenses associated with utilities, insurance, maintenance, and taxes related to the assets that were held for sale. During the years ended December 31, 2015 and December 31, 2014, the Company incurred expenses associated with the closure and relocation of assets of $1.2 million and $1.4 million, respectively. Also, during the year ended December 31, 2014, the Company incurred expenses associated with employee severance and Worker Adjustment and Retraining Notification (WARN) ACT payments of $2.9 million. The Company recorded a loss on sale and abandonment of property and equipment of $3.0 million and $0.8 million during the years ended December 31, 2015 and December 31, 2014, respectively. During the three and six months ended June 30, 2015, the Company incurred bakery shutdown costs of $0.5 million and $0.9 million, respectively, associated with the closure and relocation of assets.

5 For the year ended December 31, 2015, a one-time special bonus payment of $2.6 million and $1.3 million was paid to employees at our bakery facilities and corporate employees, respectively, as compensation for their efforts in the successful recapitalization of the Company and was recorded on a separate line in the Consolidated Income Statement as a deduction from gross profit.

6 Hostess H1’16 financials include the performance of Superior from May 10, 2016 through June 30, 2016 (correspondingly excluded from H1’16 Superior results).

7 Superior H1’16 financials include the performance of Superior from January 1, 2016 through May 9, 2016.

PAGE

23

|

|

APPENDIX

PAGE

24

|

|

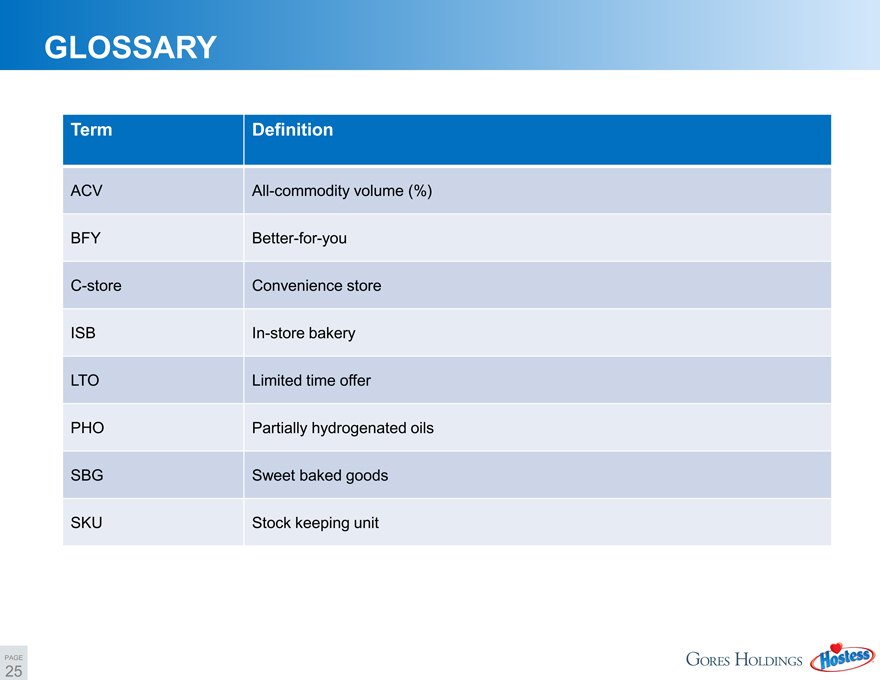

GLOSSARY

Term Definition

ACV All-commodity volume (%) BFY Better-for-you C-store Convenience store ISB In-store bakery LTO Limited time offer PHO Partially hydrogenated oils SBG Sweet baked goods SKU Stock keeping unit

PAGE

25