Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - Vantage Energy Inc. | a2229675zex-99_4.htm |

| EX-99.7 - EX-99.7 - Vantage Energy Inc. | a2229675zex-99_7.htm |

| EX-99.6 - EX-99.6 - Vantage Energy Inc. | a2229675zex-99_6.htm |

| EX-99.5 - EX-99.5 - Vantage Energy Inc. | a2229675zex-99_5.htm |

| EX-99.3 - EX-99.3 - Vantage Energy Inc. | a2229675zex-99_3.htm |

| EX-99.2 - EX-99.2 - Vantage Energy Inc. | a2229675zex-99_2.htm |

| EX-99.1 - EX-99.1 - Vantage Energy Inc. | a2229675zex-99_1.htm |

| EX-23.5 - EX-23.5 - Vantage Energy Inc. | a2229675zex-23_5.htm |

| EX-23.4 - EX-23.4 - Vantage Energy Inc. | a2229675zex-23_4.htm |

| EX-23.3 - EX-23.3 - Vantage Energy Inc. | a2229675zex-23_3.htm |

| EX-23.2 - EX-23.2 - Vantage Energy Inc. | a2229675zex-23_2.htm |

| EX-23.1 - EX-23.1 - Vantage Energy Inc. | a2229675zex-23_1.htm |

| EX-2.2 - EX-2.2 - Vantage Energy Inc. | a2229675zex-2_2.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on September 13, 2016

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VANTAGE ENERGY INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

| 1311 (Primary Standard Industrial Classification Code Number) |

| 46-5608050 (I.R.S. Employer Identification No.) |

116 Inverness Drive East, Suite 107

Englewood, Colorado 80112

(303) 386-8600

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Thomas B. Tyree, Jr.

President and Chief Financial Officer

116 Inverness Drive East, Suite 107

Englewood, Colorado 80112

(303) 386-8600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

Douglas E. McWilliams Julian J. Seiguer Vinson & Elkins L.L.P. 1001 Fannin, Suite 2500 Houston, Texas 77002 (713) 758-2222 |

|

Matthew R. Pacey Eric M. Willis Kirkland & Ellis LLP 600 Travis Street, Suite 3300 Houston, Texas 77002 (713) 835-3600 |

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer ý (Do not check if a smaller reporting company) |

| Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

| | ||

| Title of Each Class of Securities to be Registered |

| Proposed Maximum Offering Price(1)(2) |

| Amount of Registration Fee(3)(4) |

|---|---|---|---|---|

Common Stock, par value $0.01 per share |

| $100,000,000 | | $10,070 |

|

||||

- (1)

- Includes

common stock issuable upon exercise of the underwriters' option to purchase additional common stock.

- (2)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as

amended (the "Securities Act").

- (3)

- To

be paid in connection with the initial filing of the registration statement.

- (4)

- A registration fee of $94,182.10 for 27,082,500 shares of common stock was previously paid in connection with the filing of a registration statement on Form S-1 (File No. 333-197265) on September 15, 2014. Pursuant to Rule 457(p) under the Securities Act, such previously paid registration fee is being used to offset the total registration fee due hereunder.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 13, 2016

PROSPECTUS

Shares

Vantage Energy Inc.

Common Stock

This is the initial public offering of the common stock of Vantage Energy Inc., a Delaware corporation. We are offering shares of our common stock. No public market currently exists for our common stock. We are an "emerging growth company" and are eligible for reduced reporting requirements. Please see "Prospectus Summary — Emerging Growth Company Status".

We have applied to list our common stock on the New York Stock Exchange under the symbol "VEI".

We anticipate that the initial public offering price will be between $ and $ per share.

Investing in our common stock involves risks. Please see "Risk Factors" beginning on page 22 of this prospectus.

|

| Per share | | Total |

| |

| | | | | | | |

Price to the public |

| $ | | | $ | |

Underwriting discounts and commissions(1) |

| $ | | | $ | |

Proceeds to us (before expenses) |

| $ | | | $ | |

- (1)

- Please see "Underwriting" for a description of all underwriting compensation payable in connection with this offering.

We have granted the underwriters the option to purchase up to additional shares of common stock on the same terms and conditions set forth above if the underwriters sell more than shares of common stock in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2016.

Joint Book-Running Managers

| Goldman, Sachs & Co. | | Barclays | | Credit Suisse |

| Citigroup | | J.P. Morgan | | Wells Fargo Securities |

| Senior Co-Managers | ||

BofA Merrill Lynch |

|

Capital One Securities |

| Deutsche Bank Securities | | KeyBanc Capital Markets |

| SunTrust Robinson Humphrey | | Tudor, Pickering, Holt & Co. |

| Co-Managers | ||||

ABN AMRO |

|

Baird |

|

BOK Financial Securities, Inc. |

| Fifth Third Securities | | Heikkinen Energy Advisors | | Williams Trading, LLC |

Prospectus dated , 2016

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us or on behalf of us or to the information which we have referred you. Neither we nor the underwriters have authorized anyone to provide you with information different from that contained in this prospectus and any free writing prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please see "Risk Factors" and "Cautionary Statement Regarding Forward-Looking Statements".

i

As used in this prospectus, unless the context indicates or otherwise requires, the terms listed below have the following meanings:

- •

- "Vantage", "we", "our", "us" or like terms refer collectively to our predecessor and Vantage I, together with their

consolidated subsidiaries before the completion of our corporate reorganization described in "Corporate Reorganization" (except as otherwise disclosed) and to Vantage Energy Inc. and its

consolidated subsidiaries, including Vantage I and Vantage II, as of and following the completion of our corporate reorganization;

- •

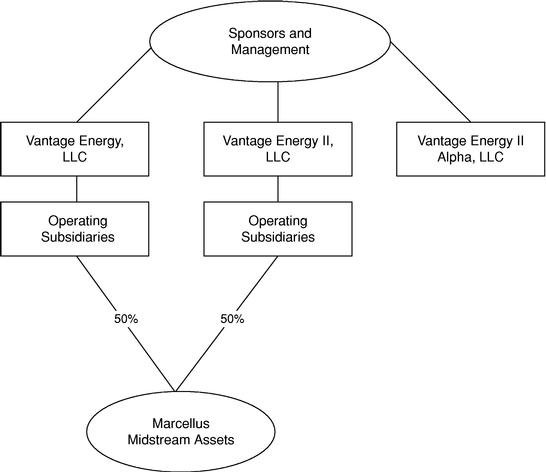

- "Vantage I" refers to Vantage Energy, LLC;

- •

- "Vantage II" refers to Vantage Energy II, LLC;

- •

- "Vantage II Alpha" refers to Vantage Energy II Alpha, LLC;

- •

- "Vantage II Consolidation" refers to the merger of Vantage II Alpha with and into Vantage II or its direct or indirect wholly owned

subsidiary that will be completed prior to our corporate reorganization;

- •

- "Vantage Investment I" refers to Vantage Energy Investment LLC;

- •

- "Vantage Investment II" refers to Vantage Energy Investment II LLC;

- •

- "Alpha Acquisition" refers to Vantage II Alpha's June 2016 acquisition of certain natural gas properties located in Greene County,

Pennsylvania from a wholly owned subsidiary of Alpha Natural Resources, Inc. ("Alpha Natural Resources");

- •

- "Existing Owners" refers, collectively, to the Sponsors and the Management Members that own equity interests in Vantage I, Vantage II

and Vantage II Alpha prior to the completion of our corporate reorganization and in Vantage Investment I, Vantage Investment II and us directly as of and following the completion of our corporate

reorganization;

- •

- "Management Members" refers, collectively, to our individual officers and employees and other individuals who, together with the

Sponsors, initially formed Vantage I, Vantage II and Vantage II Alpha;

- •

- "our predecessor" or "Predecessor" refer, collectively, to (a) Vantage II and its consolidated subsidiaries and (b) for

the periods after the closing of the Alpha Acquisition and prior to the completion of the Vantage II Consolidation, Vantage II Alpha; and

- •

- "Sponsors" refers, collectively, to investment funds affiliated with or managed by Quantum Energy Partners ("Quantum"), Riverstone Holdings LLC ("Riverstone") and Lime Rock Partners ("Lime Rock").

We have also included a glossary of some of the oil and natural gas industry terms used in this prospectus in Annex A to this prospectus.

Presentation of Financial and Operating Data

Unless otherwise indicated, the summary historical consolidated financial information presented in this prospectus is that of our predecessor. The financial information of our predecessor presented in this prospectus treats the Vantage II Consolidation as a reorganization of entities under common control. The pro forma financial information presented in this prospectus treats the combination of Vantage I and Vantage II in connection with our corporate reorganization as an acquisition in a business combination of Vantage I by our predecessor. Please see "Corporate

ii

Reorganization" and the unaudited pro forma financial statements included elsewhere in this prospectus.

In addition, unless otherwise indicated, the reserve and operational data presented in this prospectus is that of our predecessor and Vantage I on a combined basis as of the dates and for the periods presented. Unless another date is specified, (a) all acreage, well count, hedging and drilling location data presented in this prospectus is as of June 30, 2016 and (b) all other financial, reserve and operational data presented in this prospectus in respect of dates or periods occurring prior to the consummation of the Alpha Acquisition does not include the assets or operations acquired in the Alpha Acquisition. Unless otherwise noted, references to production volumes refer to sales volumes net to our interests.

Certain amounts and percentages included in this prospectus have been rounded. Accordingly, in certain instances, the sum of the numbers in a column of a table may not exactly equal the total figure for that column.

The market data and certain other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled "Risk Factors". These and other factors could cause results to differ materially from those expressed in these publications.

We own or have rights to various trademarks, service marks and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks and trade names of third parties, which are the property of their respective owners. Our use or display of third parties' trademarks, service marks, trade names or products in this prospectus is not intended to, and does not imply a relationship with, or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks, service marks and trade names.

iii

This summary provides a brief overview of information contained elsewhere in this prospectus. You should read this entire prospectus and the documents to which we refer you before making an investment decision. You should carefully consider the information set forth under "Risk Factors", "Cautionary Statement Regarding Forward-Looking Statements" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the historical and pro forma financial statements and the related notes to those financial statements included elsewhere in this prospectus. Where applicable, we have assumed an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus). Unless otherwise indicated, the information presented in this prospectus assumes that the underwriters' option to purchase additional shares of common stock is not exercised. Unless otherwise indicated, the estimated reserve volumes, estimated reserve values and EURs presented in this prospectus were prepared by our independent reserve engineers based on the Securities and Exchange Commission ("SEC") pricing at December 31, 2015, as described in "— Reserve and Operating Data". Certain operational terms used in this prospectus are defined in the "Glossary of Oil and Natural Gas Terms" set forth in Annex A hereto.

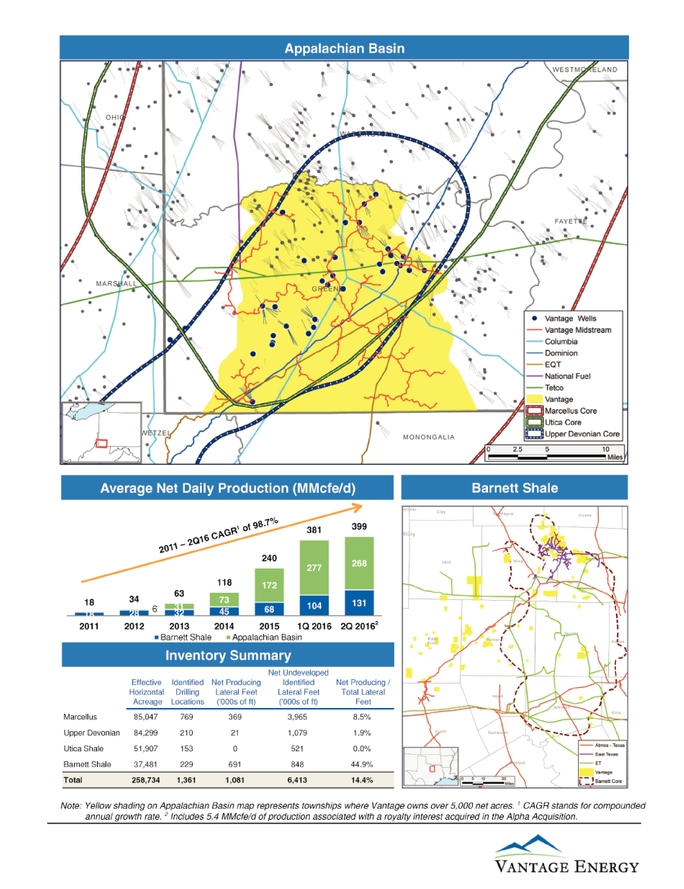

Our Company

We are a growth-oriented, independent oil and natural gas company engaged in the acquisition, development, exploitation and exploration of oil and natural gas properties in the United States, with a focus on the Appalachian Basin. We are the largest leaseholder in Greene County, Pennsylvania, an area with significant dry natural gas resources and stacked reservoirs. We hold a largely contiguous acreage position in what we believe to be the core of the Marcellus, Upper Devonian and Utica Shales. Additionally, we have a sizeable position in what we believe to be the core of the Barnett Shale in Texas. We believe these areas are among the most prolific unconventional resource plays in North America, and are generally characterized by high well recoveries relative to drilling and completion costs, predictable production profiles, significant hydrocarbons in place and constructive operating environments.

We own interests in 88,634 net acres in Greene County, of which 13,642 acres are held in fee and 5,027 of such fee acres are leased to third parties. We believe that substantially all of this acreage is prospective for the Marcellus, Upper Devonian and Utica Shales. The Marcellus Shale is the largest unconventional natural gas field in the U.S. and the Upper Devonian and Utica Shales are stacked reservoirs above and below the Marcellus Shale, respectively. Based on our drilling results, as well as drilling results publicly released by other operators, we believe that the Marcellus Shale in Greene County offers some of the most attractive single-well rates of return in North America.

We own and operate midstream infrastructure in Greene County, including a natural gas gathering system with complementary water sourcing and distribution assets (see "— Midstream"). We gather all of our operated natural gas production in Greene County and believe that our system will support our future production growth. We believe that Greene County is among the best-served areas in the Appalachian Basin by current and planned infrastructure, and due to this access has the greatest potential for natural gas production growth in the Appalachian Basin. In addition to our midstream system, a number of long-haul transmission pipelines converge in Greene County, including Spectra Energy Partners' TETCo system, Dominion Resources' DTI system, Columbia Gas Transmission's T system, National Fuel Gas' Line N system and EQT Midstream's Equitrans system. The energy content of our Appalachian Basin dry natural gas production, which ranges from 1,000 to 1,060 MBtu/Mcf, enables us to capture incremental revenue on a volumetric basis, while also meeting the specifications of these long-haul transmission pipelines, thereby allowing us to avoid additional processing and blending expenses.

1

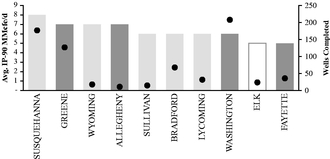

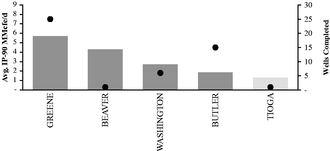

Marcellus and Upper Devonian Shale wells drilled in Greene County have on average the second highest and highest initial production ("IP") rates, respectively, of any county in Pennsylvania. Additionally, operators in Greene County recently completed multiple wells in the Utica Shale in close proximity to our acreage and disclosed 24-hour IP rates as high as 72.9 MMcfe/d. The following charts show the 90-day IP rates for wells drilled in 2015 in the Marcellus and Upper Devonian Shales by county in Pennsylvania.

| Marcellus Shale 90-Day Initial Production |

| Upper Devonian Shale 90-Day Initial Production |

|

|

|

Source: Drillinginfo

In addition to our Appalachian Basin acreage, we have 37,481 net acres in the Barnett Shale, of which 22,623 net acres are located in what we believe to be the core of the Barnett Shale in Tarrant, Denton and Wise Counties in Texas. Covering over 5,000 square miles and 18 counties in North Texas, the Barnett Shale was the first shale reservoir to be successfully exploited using horizontal drilling and fracture stimulation techniques. The Barnett Shale remains one of the most productive shale plays in North America and produced 4.4 Bcf/d of natural gas in 2015 according to the Texas Railroad Commission.

Our management team has a proven track record of implementing technically driven growth strategies to target best-in-class returns in some of the most prominent unconventional plays across the United States. Roger Biemans, our Chairman and Chief Executive Officer, and Tom Tyree, our President and Chief Financial Officer, founded our company with investments from affiliates of Quantum Energy Partners, Riverstone Holdings LLC and Lime Rock Partners. We made our initial entry into the Barnett Shale in 2007 and the Appalachian Basin in 2010. Since then, we have been committed to a strategy of disciplined growth through acquisitions and development drilling in the highest quality areas of these plays.

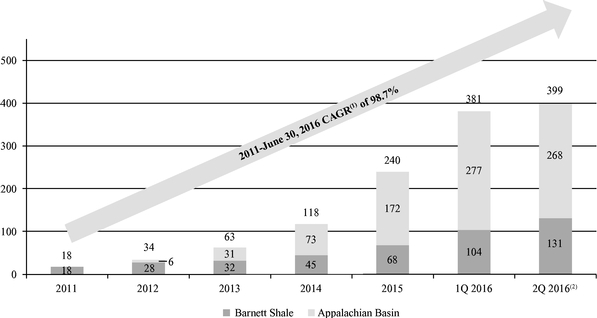

We efficiently exploit our resource base by applying and integrating micro-seismic technology, 3D seismic interpretation and petro-physical core analysis to define the reservoir and optimize formation targeting. This subsurface expertise translates to value maximizing inter-well spacing and highly economic development realized through best-in-class drilling, completion and operational strategies, including multi-well pad drilling, fit for purpose rig utilization, advanced down hole steering, targeted reservoir stimulation and optimized flow back practices. In addition, we have significant experience in our operating areas. We operate 80 gross horizontal wells in the Marcellus Shale, four gross horizontal wells in the Upper Devonian Shale and 185 gross horizontal wells in the Barnett Shale. We believe that our horizontal drilling and completion expertise, coupled with the favorable geologic characteristics of our Appalachian Basin and Barnett Shale acreage, positions us for continued strong well economics and growth. We have organically grown our net daily

2

production from 18 MMcfe/d for the year ended December 31, 2011 to 398.5 MMcfe/d for the three months ended June 30, 2016, representing a compounded annual growth rate of 98.7%.

The following chart shows the growth in our average net daily production in the Appalachian Basin and Barnett Shale since 2011.

Average Net Daily

Production (MMcfe/d)

- (1)

- CAGR stands for compounded annual growth rate.

- (2)

- Includes 5.4 MMcfe/d of average daily production for the three months ended June 30, 2016 associated with a royalty interest acquired in the Alpha Acquisition.

During 2015, we ran a two rig drilling program with one rig operating in the Appalachian Basin and one rig operating in the Barnett Shale. In 2015, we completed 73 wells on our acreage, including 31 wells in the Appalachian Basin and 42 wells in the Barnett Shale. After temporarily reducing the pace of our drilling and completions activities in the first half of 2016 due to depressed commodity prices, we are currently running two rigs in the Marcellus Shale with the intention of adding a third rig in the Marcellus Shale by year end. Due to our temporary reduction in the pace of our drilling and completion activities in the first half of 2016, our average daily production in the second half of 2016 is anticipated to be lower than our average daily production in the first half of 2016. As a result of our increased drilling and completion activities in the second half of 2016, we anticipate that our average daily production in the first half of 2017 will be materially higher than our average daily production in the second half of 2016. We retain the flexibility to adjust our rig count based on the commodity price environment and other factors. As of June 30, 2016, we had 1,361 identified drilling locations, including 769 in the Marcellus Shale, 210 in the Upper Devonian Shale, 153 in the Utica Shale and 229 in the Barnett Shale.

3

Reserve and Operating Data

The following table provides information regarding our proved reserves as of December 31, 2015 and our average net daily production for the three months ended June 30, 2016.

|

| Estimated Proved Reserves(1)(2) | | Average Net Daily |

| ||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | ||||||||||||||||

|

| Natural Gas (Bcf) |

| NGLs (MMBbls) |

| Oil (MMBbls) |

| Total (Bcfe) |

| % Proved Developed |

| Production (MMcfe/d)(3) |

| ||||||||||||||||||

| | | | | | | | | | | | | | | ||||||||||||||||||

Marcellus Shale |

| | 1,220 | | | | — | | | | — | | | | 1,220 | | | | 38 | % | | | 259.8 | | | ||||||

Upper Devonian Shale |

| | 63 | | | | — | | | | — | | | | 63 | | | | 26 | % | | | 8.2 | | | ||||||

| | | | | | | | | | | | | | | ||||||||||||||||||

Total Appalachian Basin |

| | 1,283 | | | | — | | | | — | | | | 1,283 | | | | 38 | % | | | 268.0 | | | ||||||

Barnett Shale(4) |

| | 472 | | | | 24 | | | | 1 | | | | 622 | | | | 46 | % | | | 130.5 | | | ||||||

| | | | | | | | | | | | | | | ||||||||||||||||||

Total |

| | 1,755 | | | | 24 | | | | 1 | | | | 1,905 | | | | 40 | % | | | 398.5 | | | ||||||

| | | | | | | | | | | | | | | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||

| | | | | | | | | | | | | | | ||||||||||||||||||

- (1)

- Our

estimated proved reserves were determined using average first-day-of-the-month prices for the prior 12 months in accordance with

SEC guidance. As of December 31, 2015, the unweighted arithmetic average first-day-of-the-month prices for the prior 12 months (the "SEC Price Deck") were $2.59/Mcf for natural gas,

$16.22/Bbl for NGLs and $50.28/Bbl for oil, representing the prices for Henry Hub natural gas, Mont Belvieu NGLs, and WTI oil, respectively. In determining our reserves, the SEC Price Deck was

adjusted by field or lease for quality, transportation fees, regional price differentials and other factors affecting the price received at the wellhead. The corresponding natural gas prices proximate

to our operating areas were $1.39/Mcf and $2.47/Mcf for Dominion South Point and WAHA, respectively. There were no proved reserves associated with our Utica Shale acreage as of December 31,

2015.

- (2)

- The

reserve data presented is that of Vantage II and Vantage I on a combined basis as of December 31, 2015, assuming a

30-year reserve life.

- (3)

- Includes

5.4 MMcfe/d of average daily production for the three months ended June 30, 2016 associated with a royalty interest

acquired in the Alpha Acquisition.

- (4)

- Includes de minimis reserves and production attributable to our other properties.

The following table provides certain information regarding our Appalachian Basin and Barnett Shale assets and operations as of June 30, 2016 except as otherwise noted.

|

| Effective Horizontal Acreage(1) |

| Identified Drilling Locations(2) |

| Net Producing Lateral Feet(3) (in thousands) |

| Net Undeveloped Identified Lateral Feet(4) (in thousands) |

| Net Producing/ Total Lateral Feet(3)(5) |

| Weighted Average Working Interest |

| Weighted Average Net Revenue Interest(6) |

| Average PUD EUR per 1,000 Feet(7) (Bcfe) |

| Average PUD D&C per 1,000 Feet(8) (in thousands) |

| |||||||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |||||||||||||||||||||||||||

Appalachian Basin |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||||||||

Marcellus Shale |

| | 85,047 | | | | 769 | | | | 369 | | | | 3,965 | | | | 8.5 | % | | | 81.7 | % | | | 68.7 | % | | | 1.93 | | | | $ | 834 | | | ||||||||

Upper Devonian Shale |

| | 84,299 | | | | 210 | | | | 21 | | | | 1,079 | | | | 1.9 | % | | | 80.4 | % | | | 67.5 | % | | | 1.58 | | | | 738 | | | |||||||||

Utica Shale |

| | 51,907 | | | | 153 | | | | — | | | | 521 | | | | 0.0 | % | | | 58.8 | % | | | 50.9 | % | | | — | | | | — | | | |||||||||

Barnett Shale |

| | 37,481 | | | | 229 | | | | 691 | | | | 848 | | | | 44.9 | % | | | 68.0 | % | | | 52.8 | % | | | 1.03 | | | | 428 | | | |||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||||||

Total |

| | 258,734 | (9) | | | 1,361 | | | | 1,081 | | | | 6,413 | | | | 14.4 | % | | | 76.6 | %(10) | | | 63.9 | %(10) | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||||||

- (1)

- We

refer to the summation of our horizontal acreage across the multiple target formations as our "Effective Horizontal Acreage". We believe

this acreage metric more accurately conveys our horizontal drilling opportunities in our target formations than our total surface acreage, and we believe our analysis of engineering, geological,

geochemical and seismic data to estimate our horizontal drilling opportunities is based on industry standards. Our calculation of our Effective Horizontal Acreage is an inexact estimate. We cannot

represent that the Effective Horizontal Acreage in each of our target formations is prospective for such formation. Additionally, we cannot represent what portion of our Effective Horizontal Acreage

will ultimately be drilled. See "Risk Factors — Risks Related to Our Business — Our Effective Horizontal Acreage is based on our and other operators' current

drilling results and our interpretation of available geologic and engineering data and therefore is an inexact estimate subject to various uncertainties". In the Appalachian Basin, 13,642 net acres

are held in fee and 5,027 of such fee acres are leased to third parties.

- (2)

- Includes

84, 6 and 112 identified drilling locations associated with proved undeveloped reserves as of December 31, 2015 on our

Marcellus Shale, Upper Devonian Shale and Barnett Shale acreage, respectively. For a discussion of how we identify drilling locations, a portion of which constitute estimated locations based on our

acreage and spacing assumptions, please see "Business — Our Operations — Reserve Data — Determination of Identified Drilling Locations".

- (3)

- Net

Producing Lateral Feet is calculated by multiplying the working interest for each of our producing wells in a reservoir by the lateral

length of such well.

- (4)

- Net undeveloped identified lateral feet is calculated by multiplying the working interest for each of our identified drilling locations in a reservoir by the expected lateral length of such identified drilling location. The average lateral length for our identified drilling locations is 6,345, 6,447, 5,777 and 5,448 feet for the Marcellus, Upper Devonian, Utica and Barnett Shales, respectively.

4

- (5)

- Total

Lateral Feet is calculated by adding Net Producing Lateral Feet and Net Undeveloped Identified Lateral Feet in a reservoir. Management

believes that the ratio of Net Producing Lateral Feet to Total Lateral Feet is useful because it provides investors a method for evaluating the estimated future production associated with our

identified drilling locations.

- (6)

- Represents

the average net revenue interest associated with our weighted average working interest in our drilling locations. Our average net

revenue interest equals our working interest percentage multiplied by the net revenue interest.

- (7)

- Represents

the average EUR per 1,000 feet of horizontal lateral associated with the proved undeveloped reserves reflected in our

reserve reports as of December 31, 2015, which assumed a 30-year reserve life.

- (8)

- Represents

the expected average drilling and completion cost per 1,000 feet of horizontal lateral (in thousands), as reviewed by our

third-party auditors, associated with the proved undeveloped reserves reflected in our reserve report as of December 31, 2015, which assumed a 30-year reserve life.

- (9)

- Effective

Horizontal Acreage is represented in multiple stacked reservoirs and therefore represents a multiple of our total acreage. This

acreage metric represents what we believe to be our combined horizontal acreage position that is prospective for hydrocarbon production underneath our total surface acreage. Our total net surface

acreage in the Appalachian Basin and the Barnett Shale as of June 30, 2016, was 88,634 acres and 37,481 acres, respectively.

- (10)

- Represents a weighted average calculated using the number of identified drilling locations in the respective reservoir.

Midstream

We own and operate midstream infrastructure in Greene County, including a natural gas gathering system with complementary water sourcing and distribution assets. We believe our ownership of this midstream infrastructure allows us to reduce our costs, promote overall efficiency of operations and increase our rates of return. We gather all of our operated natural gas production in Greene County and believe that our system will support our future production growth. We also intend to seek out commercial third-party gathering and water opportunities on our system.

Our natural gas gathering infrastructure currently has a demonstrated throughput capacity of over 400 MMcf/d and includes approximately 30 miles of gathering pipeline and 7,100 horsepower of compression. For the six months ended June 30, 2016, gross throughput on our midstream system was 325 MMcf/d, 59 MMcf/d of which was attributable to our joint venture partner's interest in the system, representing a 63% increase from the corresponding period in 2015. Our midstream segment generated pro forma Midstream Segment Adjusted EBITDA of $22.4 million for the six months ended June 30, 2016, compared to $12.5 million for the corresponding period in 2015.

Our natural gas gathering system is designed to grow to an ultimate total throughput capacity of approximately 1,800 MMcf/d with 147 miles of pipeline and 145,000 horsepower of compression. We intend to expand our existing system over time to meet our expected production growth, including increasing our throughput capacity to approximately 600 MMcf/d by 2018 and approximately 1,000 MMcf/d by 2022. Our water sourcing and distribution system is designed for a total supply of 118,000 Bbls/d. We expect the buildout of our water sourcing and distribution system to accommodate the expected future growth of our development activities.

We do not currently own or operate midstream infrastructure in the Barnett Shale and rely on third-party service providers for the gathering of our production in that basin.

Marketing

We routinely manage our commodity and regional price risk through hedging arrangements, firm marketing agreements and active analysis of primary and secondary firm transportation opportunities. As part of our marketing activities, we continually review regional supply and demand fundamentals with a focus on current and forecasted long-haul pipeline utilization. In addition to the numerous takeaway capacity alternatives currently available to producers in Greene County, we believe that planned takeaway capacity additions of approximately 17 Bcf/d expected to come online by December 2018 will be sufficient to meet expected supply growth from producers in and around Greene County for the foreseeable future. Significant new takeaway projects include Tallgrass Energy's Rockies Express Zone 3 Capacity Enhancement, Energy Transfer's Rover Pipeline, Nexus Gas Transmission, Spectra Energy Partners' TETCo Gulf Markets Expansion, multiple Columbia Pipeline Group projects, Dominion Resources' Atlantic Coast Project and EQT's Mountain Valley Pipeline. See "Business — Our Properties — Midstream — Marketing".

5

The following table provides a summary of our hedge position as of July 31, 2016:

Commodity Swaps |

| Aug. – Dec. 2016 |

| 2017 |

| 2018 |

| 2019 |

| ||||||

Natural Gas |

| | | | | | | ||||||||

Waha Fixed Price (MMBtu/d) |

| | 85,000 | | | 56,507 | | 22,397 | | 9,137 | | ||||

Waha Fixed Price ($/MMBtu) |

| | $2.97 | | | $3.07 | | $3.01 | | $3.29 | | ||||

Dominion South Point Fixed Price (MMBtu/d) |

| | 215,209 | | | 200,000 | | 147,260 | | 27,260 | | ||||

Dominion South Point Fixed Price ($/MMBtu) |

| | $2.10 | | | $2.26 | | $2.30 | | $2.58 | | ||||

NGLs (bbl/d) |

| | 1,499 | | | 500 | | — | | — | | ||||

Mt. Belvieu ($/bbl) |

| | $16.78 | | | $15.13 | | $0.00 | | $0.00 | | ||||

Oil (bbl/d) |

| | 85 | | | 50 | | — | | — | | ||||

NYMEX WTI ($/bbl) |

| | $45.66 | | | $44.60 | | $0.00 | | $0.00 | | ||||

- (1)

- Represents the average daily volume of such commodity swaps during the indicated periods. These hedged volumes are not allocated evenly over the periods presented.

Capital Program

Our 2016 capital program is primarily focused on developing low-cost, high-return drilling and midstream opportunities in order to grow production and cash flow.

We are currently running two rigs in the Marcellus Shale with the intention of adding a third rig in the Marcellus Shale by year end, and we retain the flexibility to adjust our rig count based on the commodity price environment and other factors.

For the months ended December 31, 2017, we plan to invest up to $ million in capital expenditures as follows:

|

| Base(1) |

| |

Drilling and Completion |

| $ | | |

Number of Wells Drilled and Cased |

| | ||

Leasehold Acquisitions |

| $ | | |

Midstream |

| $ | | |

| | | | | |

Total |

| $ | | |

| | | | | |

| | | | | |

| | | | | |

- (1)

- Assumes a third rig will be added in the Appalachian Basin during the three months ended .

By operating the substantial majority of our acreage, the amount and timing of these capital expenditures is largely discretionary and within our control. We could choose to defer a portion of these planned capital expenditures depending on a variety of factors, including but not limited to the success of our drilling activities, prevailing and anticipated prices for natural gas, NGLs and oil, the availability of necessary equipment, infrastructure and capital, the receipt and timing of required regulatory permits and approvals, seasonal conditions and drilling and acquisition costs. Any reduction in our capital expenditure budget could have the effect of delaying or limiting our development program, which would negatively impact our ability to grow production and could materially and adversely affect our future business, financial condition, results of operations or liquidity.

6

Business Strategy

Our strategy is to leverage our management team's experience in identifying, acquiring and developing economic natural gas and oil resources to cost efficiently grow our reserves, production and cash flow and thus maximize the value of our assets. Our strategy has the following principal elements:

- •

- Growing shareholder value through optimizing development of our extensive drilling

inventory. We began our Barnett Shale development program in 2008 and our Appalachian Basin development program in 2011, and we have

increased production from 18 MMcfe/d for the year ended December 31, 2011 to approximately 398.5 MMcfe/d for the three months ended June 30, 2016. We intend to continue to

drill and develop our portfolio of 1,361 identified drilling locations with the goal of growing production, cash flow and reserves in an economically efficient manner in order to maximize shareholder

value. We are currently running two rigs in the Marcellus Shale with the intention of adding a third rig in the Marcellus Shale by year end, and we retain the flexibility to adjust our rig count based

on the commodity price environment and other factors.

- •

- Enhancing returns by focusing on capital and operating cost

efficiencies. We target best-in-class returns in the Appalachian Basin and Barnett Shale. As the operator of the substantial majority of

our acreage, we are able to manage the timing and level of our capital spending, our exploration and development strategies and our operating costs. We aim to maximize well production and recoveries

relative to drilling and completion costs through optimizing lateral length, the number and distribution of frac stages, perforation cluster spacing and the type of fracture stimulation employed. We

believe we have distinctive competencies in managing costs, and as a result, we believe we will continue to capture incremental capital and operating cost efficiencies.

- •

- Continue growing our acreage position in the core of the Appalachian Basin through opportunistic leasing and

acquisitions. We have selectively built our Appalachian Basin position from less than 200 net acres as of December 31, 2010 to

approximately 88,634 net acres, of which 13,642 acres are held in fee and 5,027 of such fee acres are leased to third parties. We believe that the Appalachian Basin continues to have

significant expansion and consolidation opportunities, and we intend to pursue transactions that meet our strategic and financial objectives, such as our recent 31,323 net acre acquisition from Alpha

Natural Resources. We are currently focused on acreage swaps and infill lease acquisitions that we believe will further consolidate our acreage, increase net lateral lengths and result in operational

efficiencies.

- •

- Utilizing our midstream infrastructure to support upstream operations and enhance access to markets for our natural gas

production. The midstream infrastructure we own and operate in Greene County gathers all of our operated natural gas production in the

Appalachian Basin. Going forward, we expect to continue to invest in our Greene County gas gathering and water systems to (i) optimize our gathering and takeaway capacity, including access to

interstate pipelines, (ii) support our expected production growth, (iii) provide greater control over the direction and planning of our drilling schedule, (iv) achieve lower

capital and operating costs and generate overall efficiencies and (v) provide gathering and water services to third parties.

- •

- Managing commodity price exposure through an active hedging and marketing program to protect our expected future cash flows. We maintain an active commodity price risk management program through hedging, firm marketing arrangements and continuing analysis of primary and secondary firm transportation opportunities. We have historically hedged through basis using primarily fixed price swap contracts at liquid pricing

7

benchmarks to reduce our exposure to price volatility in the underlying commodity as well as regional pricing differentials.

Business Strengths

We have a number of strengths that we believe will help us successfully execute our business strategy and grow stockholder value, including:

- •

- Large and highly contiguous land position in the core of the Appalachian

Basin. Since 2010, we have built a largely contiguous acreage position of 88,634 net acres in the Appalachian Basin through a

disciplined and focused leasing and acquisition program. We are the largest leaseholder in Greene County, which we believe to be the dry natural gas core of the Marcellus, Upper Devonian and Utica

Shales. We benefit from our concentrated, core position through our high net revenue interest and operational efficiencies. We believe our Marcellus Shale acreage offers some of the most attractive

single-well rates of return in North America.

- •

- Multi-year, low-risk drilling inventory. We believe our

concentrated acreage positions in the Appalachian Basin and Barnett Shale are well delineated, characterized by low geological risk and possess repeatable drilling opportunities that we expect will

result in a predictable production growth profile. As of June 30, 2016, we had 1,361 identified drilling locations, including 769 in the Marcellus Shale, 210 in the Upper Devonian Shale, 153 in

the Utica Shale and 229 in the Barnett Shale. Assuming a two rig program, our drilling inventory is approximately 22 years based on our Marcellus Shale locations and approximately

32 years when including our Upper Devonian and Utica Shale locations. We believe that we and other operators in the area have substantially delineated and de-risked our acreage position in the

Marcellus and Barnett Shales. Likewise, we believe the drilling activity and well results of other operators in the area have substantially reduced the risk associated with our drilling locations in

the Upper Devonian and Utica Shales.

- •

- Efficient operations drive low drilling and completion costs resulting in higher

returns. We have historically had an intense focus on managing costs which has translated into meaningful reductions in our overall

drilling and completion costs. We have implemented operational efficiencies to continue lowering our costs, such as pad drilling and the use of less expensive, shallow vertical drilling rigs to drill

to the kick-off point of the horizontal wellbore, and optimized well spacing and completion designs. Our average drilling and completion cost, normalized for each 1,000 feet of horizontal

lateral, decreased by 38% for the first half of 2016 compared to the three months ended December 31, 2014.

- •

- Exceptionally low operating cost structure with significant control across our acreage position. Our acreage position in the Appalachian Basin and Barnett Shale is generally in contiguous blocks which allows us to conduct our operations more cost effectively and develop this acreage more efficiently. Additionally, our operational control allows us to more efficiently manage the pace of development activities, the gathering and marketing of our production and operating costs. We are continually looking to increase efficiencies and decrease our operating cost structure and were able to achieve a lease operating expense per Mcfe of $0.13 for the three months ended June 30, 2016, a reduction of 66% compared to the three months ended December 31, 2014. This reduction was largely attributable to a shift toward recycling substantially all of our produced water in Greene County. Our company, which was comprised of just 63 employees at December 31, 2015, managed total production of 398.5 MMcfe/d for the three months ended June 30, 2016 and deployed $354 million in capital expenditures during the year ended December 31, 2015. Our general and

8

- •

- Strategic, efficient midstream infrastructure supports production growth and access to

markets. We gather all of our operated natural gas production in Greene County, and the concentrated nature of our stacked pay acreage

in that area allows us to build out and operate our midstream infrastructure in a manner that captures significant capital and operating cost efficiencies. For the three months ended

December 31, 2014 and June 30, 2016, our midstream operating expense was approximately $0.04 per Mcf based on our Appalachian Basin throughput volumes. Additionally, our natural gas

gathering system is strategically located with interconnections to multiple downstream pipeline systems including TETCo and Dominion interstate pipelines.

- •

- Complementary position in the core of the Barnett

Shale. We have assembled a large and attractive leasehold position of approximately 37,481 net acres in the Barnett Shale, including

approximately 22,623 net acres in Tarrant, Denton, and Wise Counties in Texas, which we believe constitute the core of the Barnett Shale. Our Barnett Shale acreage position is characterized by mature,

long-lived production profiles that provides us with access to multiple markets and favorable WAHA-based pricing.

- •

- Strong commodity price risk management protects capital

investment. Our focus on commodity price risk management through hedging, firm marketing agreements and firm transportation

opportunities protects our capital investment and future cash flows by reducing exposure to commodity prices. As of July 31, 2016, we had entered into hedging contracts through

December 31, 2019 covering approximately 219 TBtu of future natural gas, NGLs and oil production. Substantially all of the natural gas hedges are linked to Dominion South Point and WAHA

price indices, consistent with the pricing we receive for our natural gas production. The weighted average prices of our WAHA and Dominion South Point natural gas hedges are $3.04 and $2.26 per MMbtu,

respectively. Inclusive of our NGLs and oil hedges, the weighted average price of our hedging contracts was $2.43 per MMbtu.

- •

- Significant liquidity and financial

flexibility. Following the completion of this offering, we estimate that we will have availability under our new revolving credit

facility of approximately $ million and $ million of cash on hand. After giving

effect to this offering, we expect that our capital expenditures through

2017 will be fully funded with proceeds from this offering, cash flows from operations and available capacity under our new revolving credit facility, consistent with our overall financial strategy of

maintaining a strong and stable capitalization profile.

- •

- Proven, experienced and incentivized management and technical teams. We believe our management team's experience and expertise across multiple resource plays provides a distinct competitive advantage. Our management team has an average of over 25 years of industry experience including executive officer positions at public exploration and production companies and key members with significant experience operating in the Appalachian Basin and Barnett Shale. We have assembled a strong technical staff of engineers, geoscientists and field operations managers with extensive experience in horizontal development and operating multi-rig development programs. We have been early adopters of new oilfield service technologies and techniques for drilling and completions. Our management and technical teams have a significant economic interest in us through their interests in our controlling stockholders, Vantage Investment I and Vantage Investment II.

administrative expense per Mcfe was $0.12 for the three months ended June 30, 2016, a reduction of 52% compared to $0.25 for the three months ended December 31, 2014.

9

Recent Developments

Alpha Acquisition

On May 16, 2016, we entered into a purchase and sale agreement with a wholly owned subsidiary of Alpha Natural Resources to purchase certain natural gas properties located in Greene County (the "Alpha Properties") for cash consideration of $339.5 million, subject to post-closing adjustment (the "Alpha Acquisition"). The Alpha Properties consist of approximately 31,323 net acres, of which 5,027 acres are held in fee and leased to third parties, along with non-operating royalty interests in 42 producing Marcellus horizontal wells and certain related midstream and other assets. The Alpha Acquisition was completed in June 2016, with an effective date of April 1, 2016. The Alpha Acquisition added 330 identified drilling locations, including 226 in the Marcellus Shale, 72 in the Upper Devonian Shale and 32 in the Utica Shale.

Midstream Acquisition

We entered into two purchase and sale agreements (the "AMS Purchase Agreements") with Appalachia Midstream Services, L.L.C. ("Seller") to purchase certain midstream assets in Greene County (the "AMS Acquisition"). The AMS Acquisition consists of the remaining 62% interest not currently owned in the Rogersville Gas System and a 67.5% interest in the Wind Ridge Gathering System.

The aggregate purchase price was $50.0 million in cash and the AMS Purchase Agreement contains customary representations and warranties, covenants and indemnification provisions, and has an effective date of April 1, 2016. We and the Seller expect to close the AMS Acquisition in the third quarter of 2016.

Risk Factors

An investment in our common stock involves a number of risks that include the speculative nature of oil and natural gas exploration, competition, volatile commodity prices and other material factors. You should carefully consider, in addition to the other information contained in this prospectus, the risks described in "Risk Factors" before investing in our common stock. These risks could materially affect our business, financial condition and results of operations and cause the trading price of our common stock to decline. You could lose part or all of your investment. You should bear in mind, in reviewing this prospectus, that past experience is no indication of future performance. You should read "Cautionary Statement Regarding Forward-Looking Statements" for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus.

Corporate Reorganization

We have incorporated under the laws of the State of Delaware to become a holding company for Vantage's assets and operations. Vantage I was founded in December 2006 with equity commitments from affiliates of Quantum, Riverstone and Lime Rock, as well the Management Members. Subsequently, Vantage II was founded in July 2012 with equity commitments from affiliates of those same Sponsors and the Management Members. The Vantage II Consolidation will occur prior to our corporate reorganization described below.

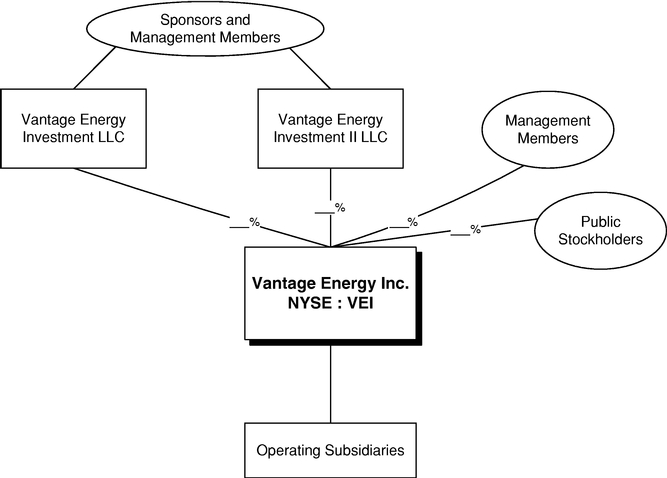

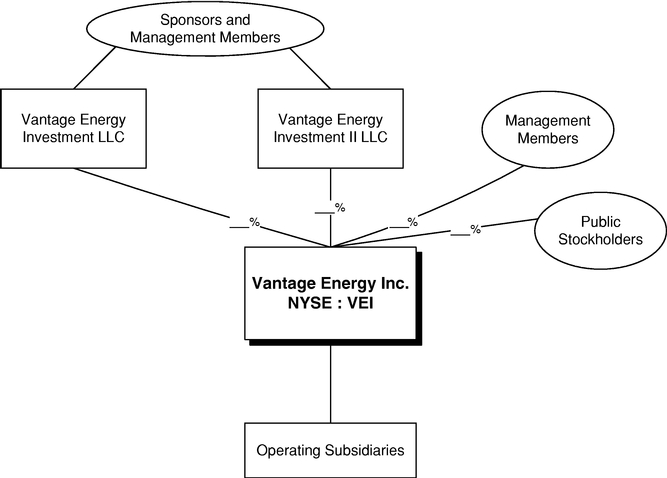

Pursuant to the terms of a corporate reorganization that will be completed simultaneously with the closing of this offering, (i) Vantage I and Vantage II will merge into subsidiaries of newly-formed holding companies, Vantage Investment I and Vantage Investment II, that will be owned by the Existing Owners in equal proportions to their current ownership of Vantage I and Vantage II and (ii) Vantage Investment I and Vantage Investment II will contribute all of the interests in Vantage I

10

and Vantage II to us in exchange for all of our issued and outstanding shares of common stock (prior to the issuance of shares of common stock in this offering). Following this offering, Vantage Investment I and Vantage Investment II will distribute to the Management Members a portion of the shares of common stock associated with such Management Members' initial investments in Vantage I and Vantage II, who will then hold the shares of common stock directly. As a result of the reorganization, Vantage I and Vantage II will become direct, wholly owned subsidiaries of Vantage Energy Inc.

We were incorporated to serve as the issuer in this offering and have no previous operations, assets or liabilities. As a result, we do not qualify as the accounting acquirer. Accordingly, in the corporate reorganization, the combination of our predecessor into us will be accounted for at historical cost, and the combination of Vantage I into us will be accounted for at fair value as a business combination by applying the acquisition method. For more information on our reorganization and the ownership of our common stock by our principal stockholders, please see "Corporate Reorganization", "Security Ownership of Certain Beneficial Owners and Management" and the unaudited pro forma financial statements included elsewhere in this prospectus.

The following diagram indicates our simplified ownership structure after giving effect to our corporate reorganization and this offering (assuming that the underwriters' option to purchase additional shares is not exercised).

Our Principal Stockholders

Following the completion of this offering and our corporate reorganization, Vantage Investment I, Vantage Investment II and the Management Members will directly own %, %

11

and %, respectively, of our common stock, or %, % and %, respectively, if the underwriters' option to purchase additional shares is exercised in full. Vantage Investment I and Vantage Investment II are controlled by Quantum, Riverstone and Lime Rock. Please see "Corporate Reorganization".

Quantum is a Houston-based private investment firm founded in 1998. Focused exclusively on the energy sector, Quantum has built one of the leading energy private equity franchises and has managed more than $11 billion of equity commitments since its inception. Quantum has invested in and built over 70 companies in the upstream, midstream, oil field service and power sectors, both domestically and globally.

Riverstone is an energy and power-focused private investment firm founded in 2000 with approximately $34 billion of capital raised. Riverstone conducts buyout and growth capital investments in the exploration and production, midstream, oilfield services, power, and renewable sectors of the energy industry. With offices in New York, London, Houston and Mexico City, as of June 30, 2016, the firm has committed approximately $30 billion to 120 investments in North America, Latin America, Europe, Africa and Asia.

Established in 1998, Lime Rock Management LP ("Lime Rock Management") has raised approximately $6.8 billion in private equity funds for investment in the energy industry through Lime Rock Partners ("Lime Rock"), investors of growth capital in exploration and production and oilfield services companies worldwide, and Lime Rock Resources, acquirers and operators of oil and gas properties in the United States. Lime Rock has invested in 89 companies to date and has offices in Westport, Houston, and London.

Emerging Growth Company Status

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act (the "JOBS Act"). For as long as we are an emerging growth company, unlike other public companies that are not emerging growth companies under the JOBS Act, we are not required to:

- •

- provide an auditor's attestation report on management's assessment of the effectiveness of our system of internal control over

financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002;

- •

- provide more than two years of audited financial statements and related management's discussion and analysis of financial condition

and results of operations nor more than two years of selected financial data;

- •

- comply with any new requirements adopted by the Public Company Accounting Oversight Board (the "PCAOB") requiring mandatory audit firm

rotation or a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer;

- •

- provide certain disclosure regarding executive compensation required of larger public companies or hold shareholder advisory votes on

executive compensation required by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"); or

- •

- obtain shareholder approval of any golden parachute payments not previously approved.

We will cease to be an "emerging growth company" upon the earliest of:

- •

- the last day of the fiscal year in which we have $1.0 billion or more in annual revenues;

- •

- the date on which we become a "large accelerated filer" (the fiscal year-end on which the total market value of our common equity securities held by non-affiliates is $700 million or more as of June 30);

12

- •

- the date on which we issue more than $1.0 billion of non-convertible debt over a three-year period; or

- •

- the last day of the fiscal year following the fifth anniversary of our initial public offering.

In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the "Securities Act") for complying with new or revised accounting standards, but we have irrevocably opted out of the extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates in which adoption of such standards is required for other public companies.

Corporate Information

Our principal executive offices are located at 116 Inverness Drive East, Suite 107, Englewood, Colorado 80112, and our telephone number at that address is (303) 386-8600. Our website is located at www.vantageenergy.com. We expect to make our periodic reports and other information filed with or furnished to the SEC available free of charge through our website as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC. Information on, or otherwise accessible through, our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

13

Common stock offered by us |

| shares (or shares, if the underwriters exercise in full their option to purchase additional shares). |

Common stock to be outstanding after the offering |

| shares (or shares, if the underwriters exercise in full their option to purchase additional shares). |

Option to purchase additional shares |

| We have granted the underwriters a 30 day option to purchase up to an aggregate of additional shares of our common stock. |

Use of proceeds |

| We expect to receive approximately $ million of net proceeds (assuming the midpoint of the price range set forth on the cover of this prospectus) from the sale of the common stock offered by us (or approximately $ million, if the underwriters exercise in full their option to purchase additional shares) after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

|

| We intend to use the net proceeds from this offering, together with cash on hand and borrowings under our new revolving credit facility, to repay and retire the Vantage I revolving credit facility, the Vantage I second lien term loan and the Vantage II revolving credit facility. We intend to use the remaining net proceeds for general corporate purposes, including funding our drilling program and expanding our midstream infrastructure. Please see "Use of Proceeds". |

Dividend policy |

| We do not anticipate paying any cash dividends on our common stock. In addition, our new revolving credit facility will place certain restrictions on our ability to pay cash dividends. |

Directed share program |

| At our request, the underwriters have reserved for sale at the initial public offering price up to % of the shares offered by this prospectus for our officers, directors, employees and certain other persons associated with us. We do not know if these persons will choose to purchase all or any portion of these reserved shares, but any purchases they do make will reduce the number of shares available to the general public. Please read "Underwriting". |

Risk factors |

| You should carefully read and consider the information set forth under the heading "Risk Factors" and all other information set forth in this prospectus before deciding to invest in our common stock. |

Listing and trading symbol |

| We have applied to list our common stock on the New York Stock Exchange (the "NYSE") under the symbol "VEI". |

14

The information above excludes shares of common stock reserved for issuance under our long-term incentive plan (the "LTIP") that we intend to adopt in connection with the completion of this offering.

In addition, it does not give effect to the grant of an aggregate of approximately shares of restricted stock (based on the midpoint of the price range set forth on the cover page of this prospectus) that our board of directors intends to make to certain of our directors, officers and employees in connection with the completion of this offering.

15

Summary Historical Consolidated and Unaudited Pro Forma Financial Data

The following table shows summary historical consolidated financial data of our predecessor, and summary unaudited pro forma financial data for the periods and as of the dates indicated.

The summary historical consolidated financial data as of and for the years ended December 31, 2015 and 2014 were derived from the audited historical consolidated financial statements of our predecessor included elsewhere in this prospectus.

The summary historical consolidated financial data as of and for the six months ended June 30, 2016 and 2015 were derived from the unaudited historical consolidated financial statements of our predecessor included elsewhere in this prospectus. The summary unaudited historical consolidated financial data has been prepared on a consistent basis with the audited consolidated financial statements of our predecessor. In the opinion of management, such summary unaudited historical consolidated interim financial data reflects all adjustments (consisting of normal and recurring accruals) considered necessary to present our financial position for the periods presented. The results of operations for the interim periods are not necessarily indicative of the results that may be expected for the full year because of the impact of fluctuations in prices received from oil and natural gas, natural production declines, the uncertainty of exploration and development drilling results and other factors.

The summary unaudited pro forma statements of operations data for the year ended December 31, 2015 and the six months ended June 30, 2016 has been prepared to give pro forma effect to (i) the reorganization transactions described under "Corporate Reorganization" and (ii) this offering and the application of the net proceeds from this offering as if they had been completed as of January 1, 2015. The summary unaudited pro forma balance sheet data has been prepared to give pro forma effect to those transactions as if they had been completed as of June 30, 2016. These data are subject to and give effect to the assumptions and adjustments described in the notes accompanying the unaudited pro forma financial statements included elsewhere in this prospectus. The summary unaudited pro forma financial data are presented for informational purposes only and should not be considered indicative of actual results of operations that would have been achieved had the reorganization transactions and this offering been consummated on the dates indicated, and do not purport to be indicative of statements of financial position or results of operations as of any future date or for any future period.

You should read the following table in conjunction with "Use of Proceeds", "Management's Discussion and Analysis of Financial Condition and Results of Operations", "Corporate Reorganization", the historical consolidated financial statements of our predecessor and the unaudited pro forma financial statements included elsewhere in this prospectus. Among other

16

things, those historical and unaudited pro forma financial statements include more detailed information regarding the basis of presentation for the following information.

|

| Predecessor | | Vantage Energy Inc. Pro Forma |

| ||||||||||||||||||

| | | | | | | | | | | | | | | ||||||||||

|

| Six Months Ended June 30, |

| Year Ended December 31, |

| Six Months Ended June 30, |

| Year Ended December 31, |

| ||||||||||||||

| | | | | | | | | | | | | | | | | | | ||||||

(in thousands, except per share data) |

| 2016 | | 2015 | | 2015 | | 2014 | | 2016 | | 2015 |

| ||||||||||

| | | | | | | | | | | | | | | ||||||||||

Statement of operations data: |

| | | | | | | | | | | ||||||||||||

Operating revenues: |

| | | | | | | | | | | ||||||||||||

Natural gas |

| $ | 46,829 | | $ | 40,375 | | $ | 65,252 | | $ | 43,622 | | | $ | | | | $ | | | ||

Midstream revenues(1) |

| 2,895 | | 2,524 | | 4,054 | | 2,990 | | | | | | | | ||||||||

Gain (loss) on commodity derivatives |

| (22,599 | ) | 14,921 | | 51,793 | | 14,434 | | | | | | | | ||||||||

| | | | | | | | | | | | | | | ||||||||||

Total operating revenues |

| 27,125 | | 57,820 | | 121,099 | | 61,046 | | | | | | | | ||||||||

Operating expenses: |

| | | | | | | | | | | ||||||||||||

Production and ad valorem taxes(2) |

| 1,025 | | 512 | | 1,911 | | 1,723 | | | | | | | | ||||||||

Marketing and gathering |

| 7,961 | | 6,063 | | 9,745 | | 5,333 | | | | | | | | ||||||||

Lease operating and workover(3) |

| 1,590 | | 4,451 | | 4,934 | | 2,517 | | | | | | | | ||||||||

Midstream operating expenses |

| 1,428 | | 831 | | 1,834 | | 891 | | | | | | | | ||||||||

General and administrative(3) |

| 4,336 | | 5,487 | | 7,308 | | 5,423 | | | | | | | | ||||||||

Depreciation, depletion, amortization and accretion |

| 19,490 | | 23,357 | | 39,698 | | 18,302 | | | | | | | | ||||||||

Impairment of proved oil and gas properties |

| 81,673 | | — | | 172,673 | | — | | | | | | | | ||||||||

| | | | | | | | | | | | | | | ||||||||||

Total operating expenses |

| 117,503 | | 40,701 | | 238,103 | | 34,189 | | | | | | | | ||||||||

| | | | | | | | | | | | | | | ||||||||||

Operating (loss) income |

| (90,378 | ) | 17,119 | | (117,004 | ) | 26,857 | | | | | | | | ||||||||

Other income (expense) |

| 3 | | (180 | ) | (180 | ) | — | | | | | | | | ||||||||

Interest income, net |

| — | | — | | — | | — | | | | | | | | ||||||||

Interest expense, net of capitalized interest(4) |

| (5,264 | ) | (4,229 | ) | (8,778 | ) | (4,027 | ) | | | | | | | ||||||||

| | | | | | | | | | | | | | | ||||||||||

Income (loss) before income taxes |

| (5,261 | ) | (4,409 | ) | (125,962 | ) | 22,830 | | | | | | | | ||||||||

Income tax expense (benefit) |

| — | | — | | — | | — | | | | | | | | ||||||||

| | | | | | | | | | | | | | | ||||||||||

Net income (loss) |

| $ | (95,639 | ) | $ | 12,710 | | $ | (125,962 | ) | $ | 22,830 | | | $ | | | | $ | | | ||

| | | | | | | | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | ||||||

| | | | | | | | | | | | | | | ||||||||||

Balance sheet data (at period end): |

| | | | | | | | | | | ||||||||||||

Cash |

| $ | 15,085 | | $ | 8,726 | | $ | 2,439 | | $ | 21,185 | | | $ | | | | $ | | | ||

Total oil and gas properties, net |

| 687,495 | | 486,043 | | 373,786 | | 439,076 | | | | | | | | ||||||||

Total midstream system, net |

| 59,764 | | 56,458 | | 59,970 | | 53,116 | | | | | | | | ||||||||

Total assets |

| 780,421 | | 588,640 | | 488,739 | | 551,345 | | | | | | | | ||||||||

Total debt |

| 244,993 | | 225,087 | | 247,041 | | 197,663 | | | | | | | | ||||||||

Total members'/stockholders' capital |

| 474,866 | | 339,263 | | 200,093 | | 326,055 | | | | | | | | ||||||||

Net cash provided by (used in): |

| | | | | | | | | | | ||||||||||||

Operating activities |

| $ | 72,209 | | $ | 39,792 | | $ | 81,633 | | $ | 21,100 | | | $ | | | | $ | | | ||

Investing activities |

| (427,740 | ) | (78,804 | ) | (148,852 | ) | (212,615 | ) | | | | | | | ||||||||

Financing activities |

| 368,177 | | 26,553 | | 48,473 | | 206,921 | | | | | | | | ||||||||

Other financial data (unaudited): |

| | | | | | | | | | | ||||||||||||

E&P Segment Adjusted EBITDA(5) |

| 48,348 | | 28,994 | | 57,229 | | 26,207 | | | 107,566 | | | | 182,020 | | | ||||||

Midstream Segment Adjusted EBITDA(6) |

| 11,195 | | 6,345 | | 14,056 | | 5,317 | | | 22,393 | | | | 28,112 | | | ||||||

Adjusted EBITDA(7) |

| $ | 59,007 | | $ | 40,656 | | $ | 69,983 | | $ | 31,660 | | | $ | 128,872 | | | | $ | 207,528 | | |

Earnings (loss) per share — basic |

| | | | | | | | | | | ||||||||||||

Earnings (loss) per share — diluted |

| | | | | | | | | | | ||||||||||||

- (1)

- Midstream revenues are net of gathering, compression and water fees paid by Vantage II for historical periods and by Vantage I and Vantage II on a pro forma basis. See "Management's Discussion and Analysis of Financial Condition and Results of Operation — Sources of Revenues — Gathering Revenues".

17

- (2)

- Production

and ad valorem taxes include expenses recorded for Pennsylvania impact fees, which are annual fees imposed by the state of

Pennsylvania on natural gas and oil operators in Pennsylvania for each well drilled for a period of fifteen years.

- (3)

- Lease

operating and workover expense includes Council of Petroleum Accountants Society ("COPAS") overhead booked as a reclassification from

general and administrative expense on our operated properties and any COPAS charged to us by other operators on our non-operated properties. On a pro forma basis for the six months ended

June 30, 2016 and for the year ended December 31, 2015, we recorded allocated COPAS overhead charges of $1.1 million and $2.1 million, respectively. General and

administrative expenses are net of overhead recorded to lease operating and workover expenses and the capitalization of certain internal costs. On a pro forma basis for the six months ended

June 30, 2016 and the year ended December 31, 2015, we recorded $7.6 million and $13.3 million, respectively, of general and administrative expense, net of allocated COPAS

overhead of $1.1 million and $2.1 million, respectively and capitalized general and administrative expenses of $5.1 million and $9.8 million, respectively.

- (4)

- On

a pro forma basis for the six months ended June 30, 2016 and for the year ended December 31, 2015, we recorded capitalized interest

of $2.9 million and $5.8 million, respectively.

- (5)

- We

define E&P Segment Adjusted EBITDA as total revenues from our E&P Segment (including net cash from settlement from commodity derivatives)

less E&P Segment operating costs and allocated general and administrative expenses. E&P Segment Adjusted EBITDA for Vantage I was $59.2 million and $124.8 million for the six

months ended June 30, 2016 and the year ended December 31, 2015, respectively. Pro forma E&P Segment Adjusted EBITDA represents the sum of the E&P Segment Adjusted EBITDA for our

predecessor and Vantage I for such period. See Note 11 and Note 13 to the audited consolidated financial statements of our predecessor and Vantage I, respectively, included

elsewhere in this prospectus for a discussion of our segment reporting.

- (6)

- We

define Midstream Segment Adjusted EBITDA as total revenues from our Midstream Segment less Midstream Segment operating costs and allocated

general and administrative expenses. Midstream Segment Adjusted EBITDA for Vantage I was $11.2 million and $14.1 million for the six months ended June 30, 2016 and the year

ended December 31, 2015, respectively. Pro forma Midstream Segment Adjusted EBITDA represents the sum of the Midstream Segment Adjusted EBITDA for our predecessor and Vantage I for such

period. See Note 11 and Note 13 to the audited consolidated financial statements of our predecessor and Vantage I, respectively, included elsewhere in this prospectus for a

discussion of our segment reporting.

- (7)

- Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income (loss), please see "— Non-GAAP Financial Measure" below.

Non-GAAP Financial Measure

Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies.

We define Adjusted EBITDA as net income (loss) before interest, income taxes, impairment of proved oil and gas properties, depreciation, depletion, amortization and accretion and derivative fair value (gain) loss, excluding net cash receipts on settled derivative instruments. Adjusted EBITDA is not a measure of net income as determined by United States generally accepted accounting principles ("GAAP").

Management believes Adjusted EBITDA is a commonly used metric and is useful because it allows investors a consistent method of evaluating our operating performance and compare the results of our operations from period to period and against our peers without regard to our accounting methods or capital structure. We exclude the items listed above from net income in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered an alternative to, or more meaningful than, net income as determined in accordance with GAAP or as an indicator of our operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company's financial performance, such as a company's cost of capital and tax structure, as well as the historic costs of

18