Attached files

| file | filename |

|---|---|

| EX-10.8 - PREFERRED STOCK PURCHASE AGREEMENT - PROTEO INC | proteo_8k-ex1008.htm |

| 8-K - FORM 8-K - PROTEO INC | proteo_8k.htm |

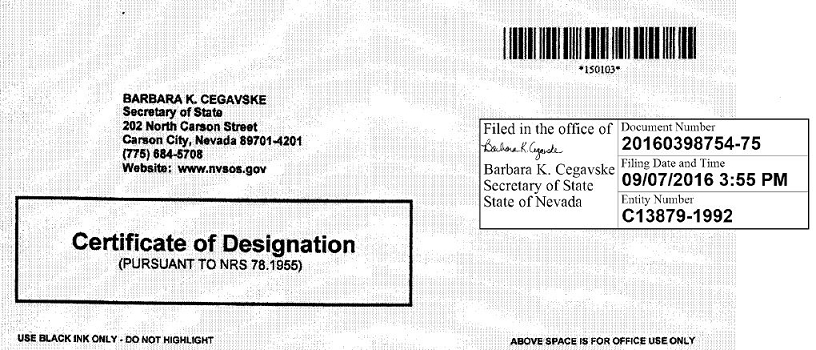

Exhibit 3.1

Certificate of Designation for

Nevada Profit Corporations

(Pursuant to NRS 78.1955

1. Name of Corporation:

PROTEO, INC.

2. By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock.

The Corporation hereby creates one million (1,000,000) shares Preferred Stock designated as "Series B-1 Preferred Stock" each of which shall possess the rights, restrictions, and limitations detailed in the Certificate of Designation of Series B-1 Preferred Stock of Proteo, Inc. attached hereto as Exhibit A.

3. Effective date of filing: (optional)

4. Signature: (required)

/s/ Birge Bargmann

Signature of Officer

| 1 |

Exhibit A

CERTIFICATE OF DESIGNATION OF SERIES B-1 PREFERRED STOCK

OF

PROTEO, INC.

A NEVADA CORPORATION

Proteo, Inc., a Nevada corporation (the “Corporation”), hereby certifies that the following resolution was adopted by the Board of Directors of the Corporation:

RESOLVED, that pursuant to the authority vested in the Board of Directors of this Corporation (the “Board of Directors”) in accordance with the provisions of the Articles of Incorporation of the Corporation, there is hereby created, a series of Preferred Stock consisting of 1,000,000 shares, which series shall have the following powers, designations, preferences and relative, participating, optional and other special rights, and the following qualifications, limitations and restrictions as follows:

Section 1. DESIGNATION AND AMOUNT. The shares of Preferred Stock created hereby shall be designated as “Series B-1 Preferred Stock” and the authorized number of shares constituting such series shall be 1,000,000.

Section 2. DIVIDENDS AND DISTRIBUTIONS.

(A) The holders of the then outstanding shares of Series B-1 Preferred Stock shall be entitled to receive, when, as and if declared by the Board of Directors, out of funds of the Corporation legally available therefore, preferential dividends at the per share rate of one point five (1.5) times the per share amount of each and any cash and non-cash dividend distributed to holders of the Corporation’s Common Stock when, as and if declared by the Board of Directors. In the event, the Company shall (i) subdivide the outstanding Common Stock, or (ii) combine the outstanding Common Stock into a smaller number of shares by a reverse stock split or otherwise, the amount set forth in the preceding sentence shall be adjusted at the same rate.

(B) No dividend shall be paid or declared on any share of Common Stock or Series A Preferred Stock, unless a dividend, payable in the same consideration and manner, is simultaneously paid or declared, as the case may be, on each share of Series B-1 Preferred Stock in an amount determined as set forth in paragraph (A) above. For purposes hereof, the term “dividends” shall include any pro rata distribution by the Corporation, out of funds of the Corporation legally available therefore, of cash, property, securities (including, but not limited to, rights, warrants or options) or other property or assets to the holders of the Common Stock, whether or not paid out of capital, surplus or earnings.

(C) The Board of Directors may fix a record date for the determination of holders of shares of Series B-1 Preferred Stock entitled to receive any dividend or distribution as provided in Paragraph (A) above.

Section 3. VOTING RIGHTS. Except as otherwise required by law, the shares of Series B-1 Preferred Stock shall have no voting rights. Except as otherwise required by law, the Series B-1 Preferred Stock shall not be entitled to vote as a separate class on any matter to be voted on by stockholders of the Corporation.

Section 4. REACQUIRED SHARES. Any shares of Series B-1 Preferred Stock purchased or otherwise acquired by the Company in any manner whatsoever shall be retired and cancelled promptly after the acquisition thereof. All such shares shall upon their cancellation become authorized but unissued shares of Preferred Stock and may be reissued as part of Series B-1 Preferred Stock or of any other series of Preferred Stock as designated by the Board of Directors from time to time.

Section 5. LIQUIDATION, DISSOLUTION OR WINDING UP. Upon any liquidation, voluntary or otherwise, dissolution or winding up of the Company, holders of Series B-1 Preferred Stock shall be entitled to receive per share distributions equal to one point five (1.5) times the rate of per share distributions to be made to the holders of Common Stock. No distributions shall be made unless any accrued and unpaid dividends and distributions on the Series B-1 Preferred Stock have been made prior thereto. In the event, the Company shall have (i) subdivided the outstanding Common Stock, or (ii) combined the outstanding Common Stock into a smaller number of shares by a reverse stock split or otherwise, after the issuance of Series B-1 Preferred Stock, distributions payable to Series B-1 Preferred Stock under this Section 5 shall be adjusted accordingly.

| 2 |

Section 6. CONSOLIDATION; MERGER; ETC. In the event the Company shall enter into any consolidation, merger combination or other transaction in which the shares of Common Stock are exchanged into other stock or securities, cash and /or any other property, then in any such case each share of Series B-1 Preferred Stock shall automatically be simultaneously exchanged for or converted into the same stock or securities, cash and/or other property at a rate per share equal to one point five (1.5) times the rate per share that the Common Stock is being exchanged or converted. In the event, the Company shall (i) subdivide the outstanding Common Stock, or (ii) combine the outstanding Common Stock into a smaller number of shares by a reverse stock split or otherwise, the amount set forth in the preceding sentence shall be adjusted at the same rate.

Section 7. REDEMPTION. The shares of Series B-1 Preferred Stock shall not be redeemable.

Section 8. RANKING. The Series B-1 Preferred Stock shall rank equal to the Series A Preferred Stock as to the payment of dividends and the distribution of assets. The Series B-1 Preferred Stock may rank junior to any other series of the Corporation’s Preferred Stock as to the payment of dividends and the distribution of assets as may be determined in the designation of any such series of Preferred Stock.

Section 9. AMENDMENT. At any time when any shares of Series B-1 Preferred Stock are outstanding, neither the Articles of Incorporation of the Corporation nor this Certificate of Designation shall be amended or altered in any manner which would materially alter or change the powers, preferences or special rights of the Series B-1 Preferred Stock so as to affect them adversely without the affirmative vote of holders representing a majority of the outstanding shares of Series B-1 Preferred Stock, voting separately as a class.

IN WITNESS WHEREOF, the undersigned have executed this Certificate and do affirm the foregoing as true and correct this 5th day of September 2016.

/s/ Birge Bargmann

Birge Bargmann

President, CEO andCFO

| Attest: /s/ Oliver Weidow Oliver Wiedow Secretary |

| 3 |