Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AGNC Investment Corp. | agnc8-k9x13x16.htm |

© 2016 American Capital Agency Corp. All Rights Reserved.

* Not affiliated with American Capital, Ltd.

BARCLAYS GLOBAL FINANCIAL

SERVICES CONFERENCE

SEPTEMBER 13, 2016

*

Exhibit 99.1

NASDAQ: AGNC

2

This presentation contains statements that, to the extent they are not

recitations of historical fact, constitute “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995 (the

“Reform Act”). All such forward-looking statements are intended to be

subject to the safe harbor protection provided by the Reform Act. Actual

outcomes and results could differ materially from such forecasts due to the

impact of many factors beyond the control of American Capital Agency

Corp. (“AGNC” or the “Company”). All forward-looking statements included

in this presentation are made only as of the date of this presentation and

are subject to change without notice. Certain important factors that could

cause actual results to differ materially from those contained in the

forward-looking statements are included in our periodic reports filed with

the Securities and Exchange Commission (“SEC”). Copies are available on

the SEC’s website at www.sec.gov. AGNC disclaims any obligation to

update such forward-looking statements unless required by law.

The following slides contain summaries of certain financial and statistical

information about AGNC. They should be read in conjunction with our

periodic reports that are filed from time to time with the SEC. Historical

results discussed in this presentation are not indicative of future results.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT

OF 1995

SAFE HARBOR STATEMENT

NASDAQ: AGNC

3

The AGNC Value Proposition

♦ AGNC offers a compelling value proposition to its shareholders as the largest internally-

managed residential mortgage REIT with one of the lowest operating cost structures in the

industry1 and a proven track record of strong performance since inception2

Favorable Tailwinds for AGNC

♦ We believe the agency-focused model is well-positioned to generate attractive returns

against the likely backdrop of a sustained “lower for longer” interest rate environment

♦ Significantly improved funding environment dynamics, coupled with the creation of AGNC’s

wholly-owned broker-dealer subsidiary with direct access to the Fixed Income Clearing

Corporation (FICC), are expected to provide significant support to agency MBS returns

♦ AGNC has a highly efficient operating cost structure as a result of its recent internalization

AGNC’s Investment Strategy and Outlook

♦ AGNC’s agency-focused investment model has proven to be resilient through a wide range

of market conditions

♦ To further strengthen and diversify its portfolio, AGNC has broadened its investment

guidelines to include investments in credit-based assets with an initial focus on GSE credit

risk transfer (CRT) securities

PRESENTATION OVERVIEW

Note: For additional detail, refer to endnotes in the Appendix.

Source: Company SEC filings and SNL Financial.

NASDAQ: AGNC

4

THE AGNC VALUE PROPOSITION

AS THE LARGEST INTERNALLY-MANAGED RESIDENTIAL MORTGAGE REIT, AGNC

OFFERS A COMPELLING VALUE PROPOSITION TO ITS SHAREHOLDERS

Industry-Leading

Performance

Highly Efficient

Operating Cost

Structure

Disciplined Risk

Management

Stockholder

Focus

Liquidity and

Scale

Since our 2008 IPO, AGNC has delivered industry-

leading performance as measured by total stock

return1 and total economic return2

17%

Annualized

Stock

Return1

16%

Annualized

Economic

Return2

< 0.90%

Operating Expense

Structure as a % of

Stockholders’ Equity3

Monthly

Dividend Payment &

NAV Disclosure

$6.5 Billion

Market Capitalization as

of August 31, 2016

Limited

Duration

Gap4

37

Funding

Counterparties

With an operating expense structure of under 0.90%

of total equity capital, AGNC has one of the lowest

cost structures as a percentage of stockholders’

equity in the residential mortgage REIT space3

AGNC utilizes a comprehensive risk management

framework that is predicated on careful asset

selection, disciplined hedging, and diversified

funding

AGNC has consistently been recognized as an

industry leader for its financial disclosure,

transparency and shareholder-focused approach to

capital management

AGNC is the largest internally-managed residential

mortgage REIT and one of only two residential

mortgage REITs with a market cap over $5 billion

Note: For additional detail, refer to endnotes in the Appendix.

Source: Company SEC filings and SNL Financial.

NASDAQ: AGNC

5

♦ Since the financial crisis in 2008, global central banks have reacted to weak

global growth by lowering interest rates and making substantial asset

purchases

♦ Despite massive quantitative easing (QE) and negative interest rates in

many parts of the world, growth remains subdued, and inflation has

remained well below central bank objectives for many years

♦ We believe the headwinds to global growth and inflation are mostly secular

in nature and thus sustainable for the foreseeable future

Technological advances have reduced the cost of producing, marketing and selling goods

and services and have reduced the employment opportunities for middle class workers in

many parts of the world

Additionally, global competition continues to increase as local demand can be met by

suppliers and workers across the globe

♦ The resulting “lower for longer” interest rate outlook is supportive of

AGNC’s business model over the intermediate to long-term

Low interest rate volatility reduces the need for portfolio rebalancing

AGNC’s careful asset selection and disciplined approach to risk management have

positioned its portfolio to mitigate negative effects of faster prepayments

Low rates tend to reduce bank funding advantages versus other market participants

“LOWER FOR LONGER” EXPECTED TO BE A TAILWIND FOR AGNC

NASDAQ: AGNC

Source: Bloomberg, Credit Suisse and management estimates. 6

AGENCY MBS FUNDING MARKET UPDATE

♦ Recent money market reform policies have caused a shift in asset holdings from prime funds

to government funds

The shift to government assets is supportive of the agency MBS market and thus favorable to AGNC’s business

model

Since mid-2015, government funds have gained approximately $500 billion in assets, while prime funds have

lost a corresponding amount

♦ In turn, AGNC’s funding costs have benefitted from a decreased repo spread to LIBOR

This spread has decreased over 30 bps from a high near 25 bps to a negative spread of almost 10 bps today

♦ Bethesda Securities, AGNC’s wholly-owned broker-dealer subsidiary with direct access to

the FICC, is expected to further enhance AGNC’s funding opportunities

AMPLE LIQUIDITY FOR AGENCY SECURITIES AND FAVORABLE FUNDING DYNAMICS

Agency Repo Spread to LIBOR

(basis points)

Money Market Fund Assets

($ trillions)

$1.0

$1.5

$1.5

$1.0

NASDAQ: AGNC

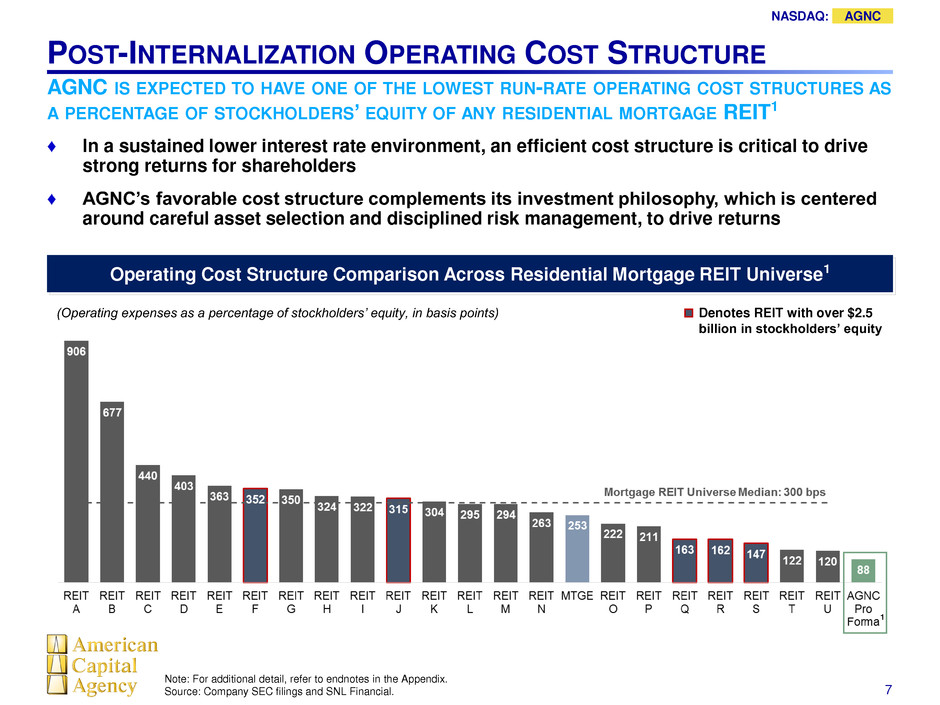

POST-INTERNALIZATION OPERATING COST STRUCTURE

7

AGNC IS EXPECTED TO HAVE ONE OF THE LOWEST RUN-RATE OPERATING COST STRUCTURES AS

A PERCENTAGE OF STOCKHOLDERS’ EQUITY OF ANY RESIDENTIAL MORTGAGE REIT1

Operating Cost Structure Comparison Across Residential Mortgage REIT Universe1

(Operating expenses as a percentage of stockholders’ equity, in basis points) Denotes REIT with over $2.5

billion in stockholders’ equity

1

♦ In a sustained lower interest rate environment, an efficient cost structure is critical to drive

strong returns for shareholders

♦ AGNC’s favorable cost structure complements its investment philosophy, which is centered

around careful asset selection and disciplined risk management, to drive returns

Note: For additional detail, refer to endnotes in the Appendix.

Source: Company SEC filings and SNL Financial.

NASDAQ: AGNC

8

OVERVIEW OF CREDIT RISK TRANSFER SECURITIES

1. Other than a portion of the credit exposure on loans with loan-to-value ratios in excess of 80%, which require loan-level credit

enhancement such as mortgage insurance.

Source: FHFA.

♦ Prior to 2013, the GSEs retained virtually all prime conforming credit exposure1 for

mortgages that they securitized

As a result, private investors did not have an ability to access prime conforming credit in any material or

sustainable fashion

♦ Beginning in 2013, the GSEs, at the direction of the Federal Housing Finance Agency

(FHFA), began to transfer a portion of the credit risk associated with conforming

mortgages to private investors via credit risk sharing transactions

Credit risk transfer (CRT) securities have been the dominant transaction structure utilized to satisfy the FHFA’s

strategic objective of reducing the GSEs’ credit risk exposure through private investor participation

Since the launch of the CRT programs, the GSEs have sold approximately $34.6 billion of credit risk on

mortgages with an aggregate underlying loan balance of approximately $1.0 trillion under the CRT securities

structure

The volume of CRT issuance is expected to dwarf that of other credit-oriented products in the residential

mortgage market, including subordinate classes of jumbo securitizations

♦ CRT securities are structured as GSE debt obligations with cash flows that track the

credit risk performance of a notional reference pool of mortgage loans

The notional reference pools represent diverse cross sections of mortgages acquired by the GSEs, thereby

eliminating the risk of adverse selection and allowing investors to acquire a diversified pool of credit exposure

More stringent underwriting requirements and favorable macroeconomic conditions have resulted in strong

underlying credit fundamentals and projected performance

♦ Residential mortgage market investors have long had the ability to take conforming

MBS interest rate and prepayment risk through agency MBS; CRT securities provide

the opportunity to acquire meaningful credit exposure on the same underlying assets

NASDAQ: AGNC

9

THE CRT INVESTMENT OPPORTUNITY FOR AGNC

1. Dotted lines reflect annualization of 2016 YTD volumes.

2. All pricing dates are during 2016.

Source: Bloomberg.

Favorable CRT Supply Strong Return Profile

♦ The emergence of CRT securities offers AGNC the opportunity to diversify its

portfolio by investing in a credit-centric asset based on a cross section of the

conforming mortgage market

Programmatic issuance of CRT securities by the GSEs should create favorable supply dynamics for

opportunistic investors such as AGNC

Financing is available and improving for CRT investments

Floating rate CRT investments complement AGNC’s largely fixed rate agency investment portfolio

♦ Investments in CRT securities, as currently structured, would be limited by REIT

income rules among other constraints

The income associated with CRT securities does not qualify as “good” REIT income for purposes of the

75% gross income test

(basis points) ($ billions)

1

2

NASDAQ: AGNC

CONCLUSION AND OUTLOOK

10

♦ AGNC’s agency-focused investment model provides a strong

foundation to generate attractive returns

♦ The recent internalization provides AGNC with a highly efficient

operating cost structure, further enhancing AGNC’s return potential and

more closely aligning management and shareholder interests over the

long-term

♦ We believe the addition of certain credit assets to AGNC’s portfolio will

complement its existing business model

Such diversification will provide greater investment flexibility and the ability to shift

asset allocations as appropriate in response to varying market conditions

The CRT investment opportunity allows AGNC to gain credit exposure to a diverse

cross section of the conforming mortgage market that was historically only available

to the GSEs

♦ We anticipate the growth of non-agency securities within AGNC’s

investment portfolio to be opportunistic and gradual

Over the long-term, we expect the majority of AGNC’s capital will continue to be

deployed in agency MBS

APPENDIX

ENDNOTES

NASDAQ: AGNC

12

1) Mortgage REIT universe comprised of AJX, ANH, ARR, CHMI, CIM, CMO, CYS, DX, EARN, IVR, MFA, MITT, MTGE, NLY, NRZ,

NYMT, OAKS, ORC, PMT, RWT, TWO and WMC. Mortgage REIT cost structures based on last twelve months’ operating expenses

and average stockholders’ equity over the same period as publicly reported by such REITs. Operating costs include expenses for

compensation and benefits, management fees and G&A and may include one-time or nonrecurring expenses. Operating costs

exclude direct costs associated with operating activities, such as loan acquisition costs, securitization costs, servicing expenses, etc.

to the extent publicly disclosed by such REITs. AGNC’s ratio is based on total stockholders’ equity as of June 30, 2016 and excludes

nonrecurring transaction-related charges and non-cash expenses, such as non-cash amortization charges, associated with the

internalization transaction. AGNC’s ratio also excludes the net economic benefit associated with receipt of the MTGE management

fee and incremental G&A expenses associated with AGNC’s management of MTGE that will be reimbursed by MTGE.

2) Performance as measured by total stock return and total economic return. Total stock return measured from IPO through August 31,

2016. Total stock return over a period includes price appreciation and dividend reinvestment; dividends are assumed to be

reinvested at the closing price of the security on the ex-dividend date. Total economic return measured from December 31, 2008

through June 30, 2016. Total economic return represents the change in net asset value (NAV) per common share and dividends

declared on common stock during the period over the beginning NAV per common share. For agency-focused residential mortgage

REIT peer comparison purposes, AGNC’s peer group is comprised of ANH, ARR, CMO, CYS, HTS and NLY (ARR and CYS are

included following the date that each company went public in 2009; HTS is included prior to its sale to NLY in 2016).

ENDNOTES

Endnotes to Slide 3

Endnotes to Slide 4

1) Stock return measured from IPO through August 31, 2016. See Endnote #2 to Slide 3 above for further details.

2) Economic return measured from December 31, 2008 through June 30, 2016. See Endnote #2 to Slide 3 above for further details.

3) See Endnote #1 to Slide 3 above for further details.

4) The duration of an asset or liability measures how much its price is expected to change if interest rates move in a parallel manner; it

is a model estimate and is measured in years as of a point in time. Duration gap is a measure of the difference in the interest rate

exposure, or estimated price sensitivity, of our assets and our liabilities (including hedges). AGNC uses a risk management system

and models provided by BlackRock Solutions to generate these calculations and as a tool for helping us to measure other exposures,

including exposure to larger interest rate moves and yield curve changes. The inputs and results from these models are not audited

by our independent auditors.

Endnotes to Slide 7

1) See Endnote #1 to Slide 3 above for further details.