Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | a20160912-coverpagexbarcla.htm |

Barclays 2016 Global Financial Services Conference

September 12-14, 2016

2

Forward-Looking Statements; Use of Non-GAAP Financial Measures; Peer Group Key

Statements in this presentation that are based on other than historical data or that express the Company’s expectations regarding future

events or determinations are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. Statements

based on historical data are not intended and should not be understood to indicate the Company’s expectations regarding future events.

Forward-looking statements provide current expectations or forecasts or intentions regarding future events or determinations. These

forward-looking statements are not guarantees of future performance or determinations, nor should they be relied upon as representing

management’s views as of any subsequent date. Forward-looking statements involve significant risks and uncertainties, and actual results

may differ materially from those presented, either expressed or implied, in this presentation. Factors that could cause actual results to

differ materially from those expressed in the forward-looking statements include the actual amount and duration of declines in the price

of oil and gas, our ability to meet our efficiency and noninterest expense goals, as well as other factors discussed in the Company’s most

recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”) and

available at the SEC’s Internet site (http://www.sec.gov).

Except as required by law, the Company specifically disclaims any obligation to update any factors or to publicly announce the result of

revisions to any of the forward-looking statements included herein to reflect future events or developments.

This document contains several references to non-GAAP measures, including pre-provision net revenue and the “efficiency ratio,” which

are common industry terms used by investors and financial services analysts. Certain of these non-GAAP measures are key inputs into

Zions’ management compensation and are used in Zions’ strategic goals that have been and may continue to be articulated to investors.

Therefore, the use of such non-GAAP measures are believed by management to be of substantial interest to the consumers of these

financial disclosures and are used prominently throughout the disclosures. A full reconciliation of the difference between such measures

and GAAP financials is provided within the document, and users of this document are encouraged to carefully review this reconciliation.

ASB: Associated Banc-Corp

BAC: Bank of America

BBT: BB&T Corporation

BOKF: BOK Financial Corporation

C: Citigroup, Inc.

CBSH: Commerce Bancshares, Inc.

CFG: Citizens Financial Group, Inc.

CMA: Comerica Incorporated

EWBC: East West Bancorp, Inc.

FHN: First Horizon National Corporation

FITB: Fifth Third Bancorp

FMER: FirstMerit Corporation

FRC: First Republic Bank

HBAN: Huntington Bancshares Incorporated

JPM: JPMorgan Chase & Co.

KEY: KeyCorp

MTB: M&T Bank Corporation

PBCT: People’s United Financial, Inc.

PNC: PNC Financial Services Group

RF: Regions Financial Corporation

SNV: Synovus Financial Corp.

STI: SunTrust Banks, Inc.

UB: Union Bank

USB: US Bank

WFC: Wells Fargo & Co.

ZION: Zions Bancorporation

3

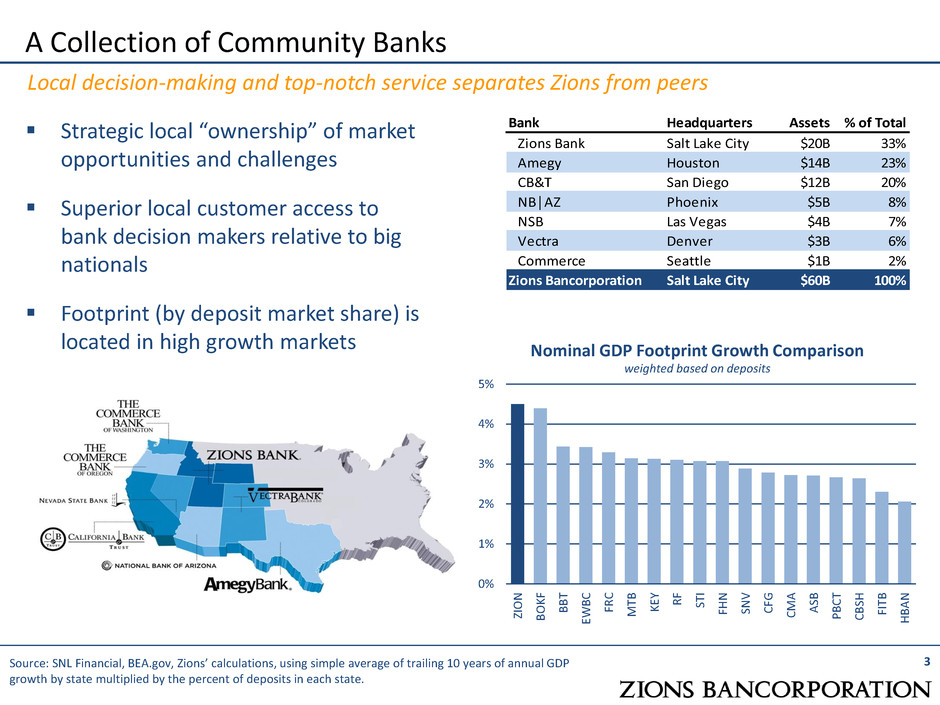

A Collection of Community Banks

Local decision-making and top-notch service separates Zions from peers

Source: SNL Financial, BEA.gov, Zions’ calculations, using simple average of trailing 10 years of annual GDP

growth by state multiplied by the percent of deposits in each state.

Strategic local “ownership” of market

opportunities and challenges

Superior local customer access to

bank decision makers relative to big

nationals

Footprint (by deposit market share) is

located in high growth markets

0%

1%

2%

3%

4%

5%

ZI

O

N

B

O

K

F

B

B

T

EWB

C

FR

C

M

TB K

EY R

F

ST

I

FH

N

SN

V

C

FG

C

M

A

A

SB

PB

C

T

C

B

SH

FI

TB

H

BA

N

Nominal GDP Footprint Growth Comparison

weighted based on deposits

Bank Headquarters Assets % of Total

Zions Bank Salt Lake City $20B 33%

Amegy Houston $14B 23%

CB&T San Diego $12B 20%

NB│AZ Phoenix $5B 8%

NSB Las Vegas $4B 7%

Vectra Denver $3B 6%

Commerce Seattle $1B 2%

Zions Bancorporation Salt Lake City $60B 100%

4

Superior Brand: Nationally Recognized for Excellence

(1) One of five winning teams, 2015, Zions Bank. (2) Readers of the San Diego Union-Tribune, August 2016, for

six consecutive years; Orange County Register, for three consecutive years. (3) Ranking Arizona, 2015.

Ranked #1 nationally by Greenwich Associates (2015)

31 Greenwich Excellence Awards in small business and middle market banking

This year including:

Excellence: Overall Satisfaction (seven consecutive years)

Excellence: Likelihood to Recommend

Excellence: Treasury Management (seven consecutive years)

Excellence: Treasury Management Product Capabilities (sole winner in 2015)

Zions is one of only four banks that have been consistently awarded more than 10

Excellence Awards since 2009, when the first survey was conducted

The largest four domestic U.S. banks experienced a median of only one award in 2015

Top team of women bankers – American Banker (1)

California Bank & Trust consistently voted Best Bank in San Diego and Orange

Counties (2)

National Bank of Arizona voted #1 Bank in Arizona 13 straight years (3)

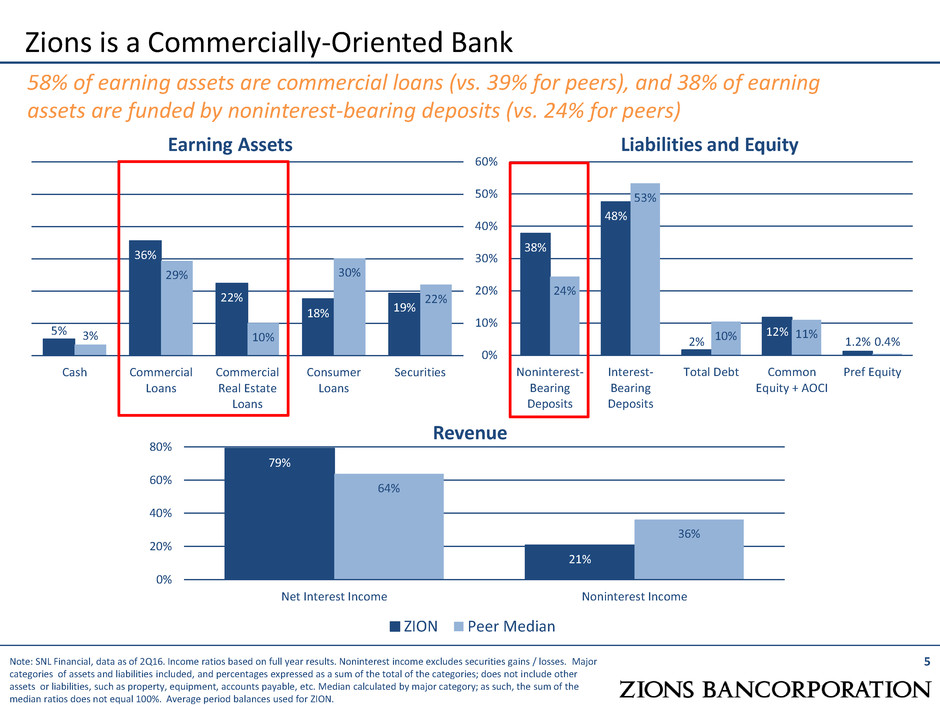

Zions is a Commercially-Oriented Bank

Earning Assets Liabilities and Equity

5

58% of earning assets are commercial loans (vs. 39% for peers), and 38% of earning

assets are funded by noninterest-bearing deposits (vs. 24% for peers)

5%

36%

22%

18% 19%

3%

29%

10%

30%

22%

Cash Commercial

Loans

Commercial

Real Estate

Loans

Consumer

Loans

Securities

38%

48%

2%

12%

1.2%

24%

53%

10% 11% 0.4%

0%

10%

20%

30%

40%

50%

60%

Noninterest-

Bearing

Deposits

Interest-

Bearing

Deposits

Total Debt Common

Equity + AOCI

Pref Equity

Revenue

79%

21%

64%

36%

0%

20%

40%

60%

80%

Net Interest Income Noninterest Income

ZION Peer Median

Note: SNL Financial, data as of 2Q16. Income ratios based on full year results. Noninterest income excludes securities gains / losses. Major

categories of assets and liabilities included, and percentages expressed as a sum of the total of the categories; does not include other

assets or liabilities, such as property, equipment, accounts payable, etc. Median calculated by major category; as such, the sum of the

median ratios does not equal 100%. Average period balances used for ZION.

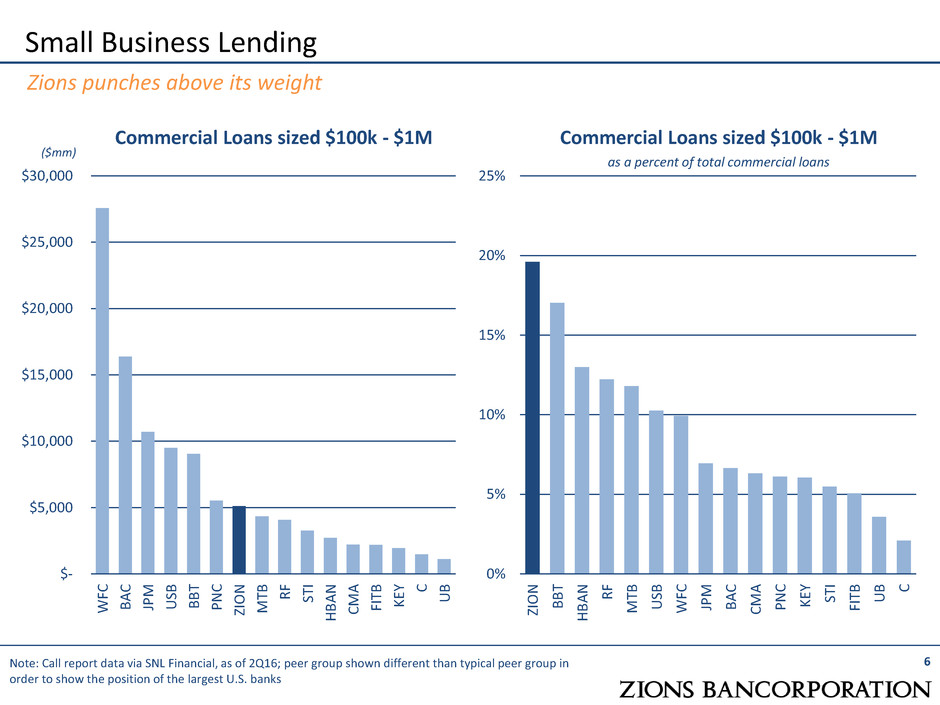

Small Business Lending

Commercial Loans sized $100k - $1M

Commercial Loans sized $100k - $1M

as a percent of total commercial loans

6

0%

5%

10%

15%

20%

25%

ZIO

N

B

B

T

H

B

A

N R

F

M

TB

US

B

WF

C

JP

M

B

A

C

CM

A

P

N

C

KE

Y

ST

I

FIT

B

U

B C

Note: Call report data via SNL Financial, as of 2Q16; peer group shown different than typical peer group in

order to show the position of the largest U.S. banks

$-

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

WF

C

B

A

C

JP

M

US

B

B

B

T

P

N

C

ZIO

N

M

TB R

F

ST

I

H

B

A

N

CM

A

FIT

B

KE

Y C

U

B

Zions punches above its weight

($mm)

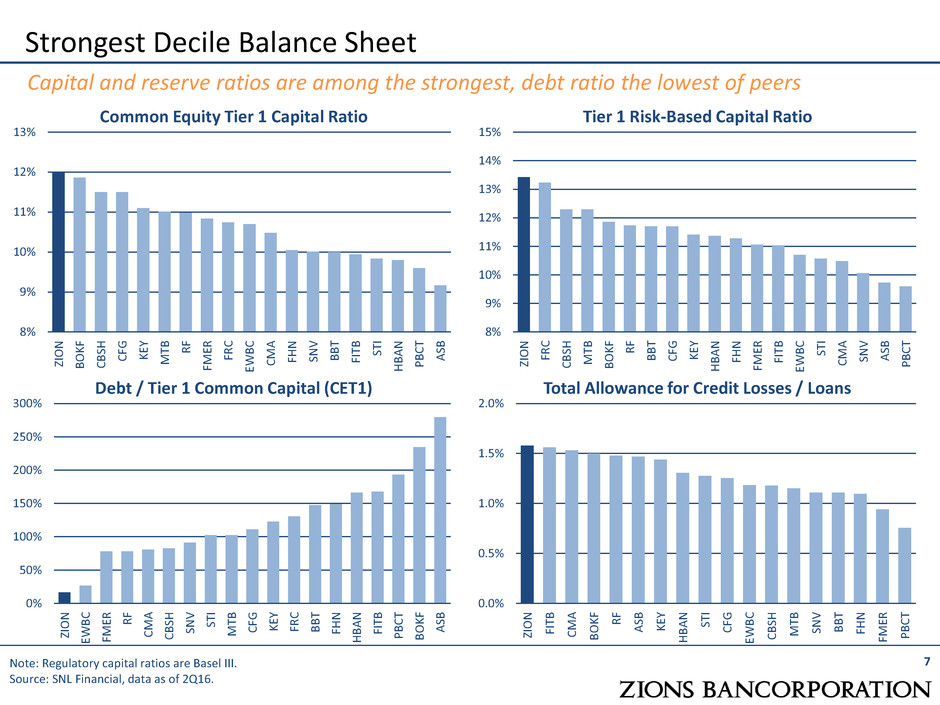

Strongest Decile Balance Sheet

Common Equity Tier 1 Capital Ratio Tier 1 Risk-Based Capital Ratio

8%

9%

10%

11%

12%

13%

14%

15%

ZI

O

N

FR

C

C

B

SH

M

TB

B

O

K

F

R

F

B

B

T

C

FG K

EY

H

BA

N

FH

N

FM

ER

FI

TB

EWB

C

ST

I

C

M

A

SN

V

A

SB

PB

C

T

Note: Regulatory capital ratios are Basel III.

Source: SNL Financial, data as of 2Q16.

8%

9%

10%

11%

12%

13%

ZI

O

N

B

O

K

F

C

B

SH

C

FG K

EY

M

TB R

F

FM

ER

FR

C

EWB

C

C

M

A

FH

N

SN

V

B

B

T

FI

TB ST

I

H

BA

N

PB

C

T

A

SB

Capital and reserve ratios are among the strongest, debt ratio the lowest of peers

Debt / Tier 1 Common Capital (CET1) Total Allowance for Credit Losses / Loans

0.0%

0.5%

1.0%

1.5%

2.0%

ZI

O

N

FI

TB

C

M

A

B

O

K

F

R

F

A

SB K

EY

H

BA

N

ST

I

C

FG

EWB

C

C

B

SH

M

TB

SN

V

B

B

T

FH

N

FM

ER

PB

C

T

0%

50%

100%

150%

200%

250%

300%

ZI

O

N

EWB

C

FM

ER R

F

C

M

A

C

B

SH

SN

V

ST

I

M

TB

C

FG K

EY

FR

C

B

B

T

FH

N

H

BA

N

FI

TB

PB

C

T

B

O

K

F

A

SB

7

0.00%

0.50%

1.00%

1.50%

2.00%

BOKF MTB CBSH EWBC ASB ZION CMA BBT FMER CFG STI RF HBAN FITB KEY FHN SNV

0.00%

0.50%

1.00%

1.50%

2.00%

FR

C

C

B

SH

EWB

C

ST

I

PB

C

T

B

B

T

FI

TB

FM

ER K

EY

H

BA

N

C

M

A

SN

V

C

FG

ZI

O

N

A

SB

B

O

K

F

FH

N

M

TB R

F

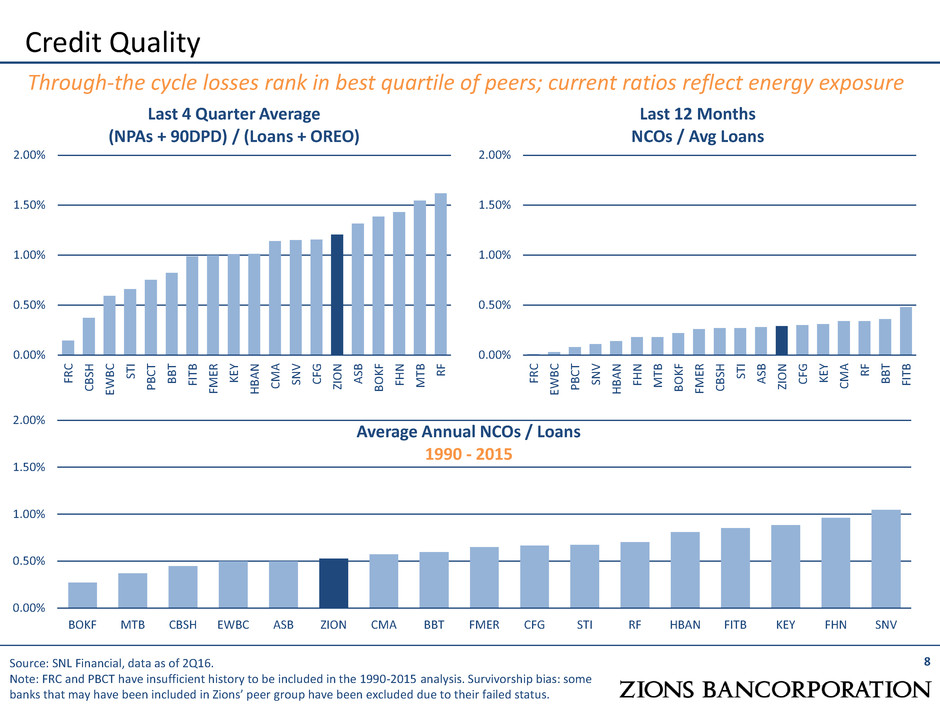

Credit Quality

Last 4 Quarter Average

(NPAs + 90DPD) / (Loans + OREO)

Last 12 Months

NCOs / Avg Loans

8

0.00%

0.50%

1.00%

1.50%

2.00%

FR

C

EWB

C

PB

C

T

SN

V

H

BA

N

FH

N

M

TB

B

O

K

F

FM

ER

C

B

SH ST

I

A

SB

ZI

O

N

C

FG K

EY

C

M

A R

F

B

B

T

FI

TB

Source: SNL Financial, data as of 2Q16.

Note: FRC and PBCT have insufficient history to be included in the 1990-2015 analysis. Survivorship bias: some

banks that may have been included in Zions’ peer group have been excluded due to their failed status.

Through-the cycle losses rank in best quartile of peers; current ratios reflect energy exposure

Average Annual NCOs / Loans

1990 - 2015

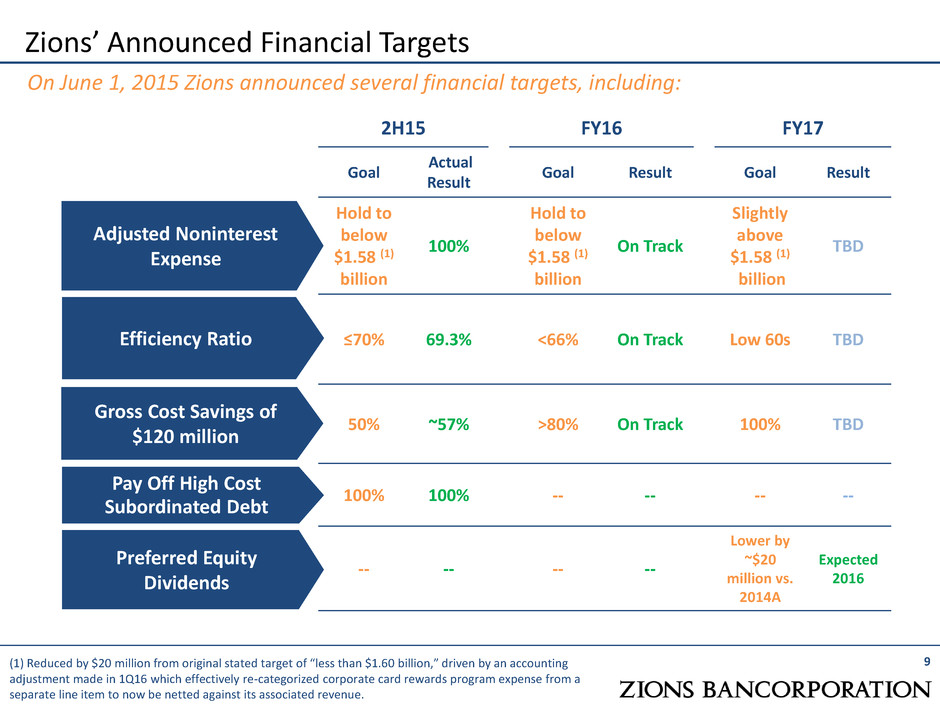

Zions’ Announced Financial Targets

9

On June 1, 2015 Zions announced several financial targets, including:

2H15 FY16 FY17

Goal

Actual

Result

Goal Result Goal Result

Hold to

below

$1.58 (1)

billion

100%

Hold to

below

$1.58 (1)

billion

On Track

Slightly

above

$1.58 (1)

billion

TBD

≤70% 69.3% <66% On Track Low 60s TBD

50% ~57% >80% On Track 100% TBD

100% 100% -- -- -- --

-- -- -- --

Lower by

~$20

million vs.

2014A

Expected

2016

Adjusted Noninterest

Expense

Gross Cost Savings of

$120 million

Pay Off High Cost

Subordinated Debt

Preferred Equity

Dividends

Efficiency Ratio

(1) Reduced by $20 million from original stated target of “less than $1.60 billion,” driven by an accounting

adjustment made in 1Q16 which effectively re-categorized corporate card rewards program expense from a

separate line item to now be netted against its associated revenue.

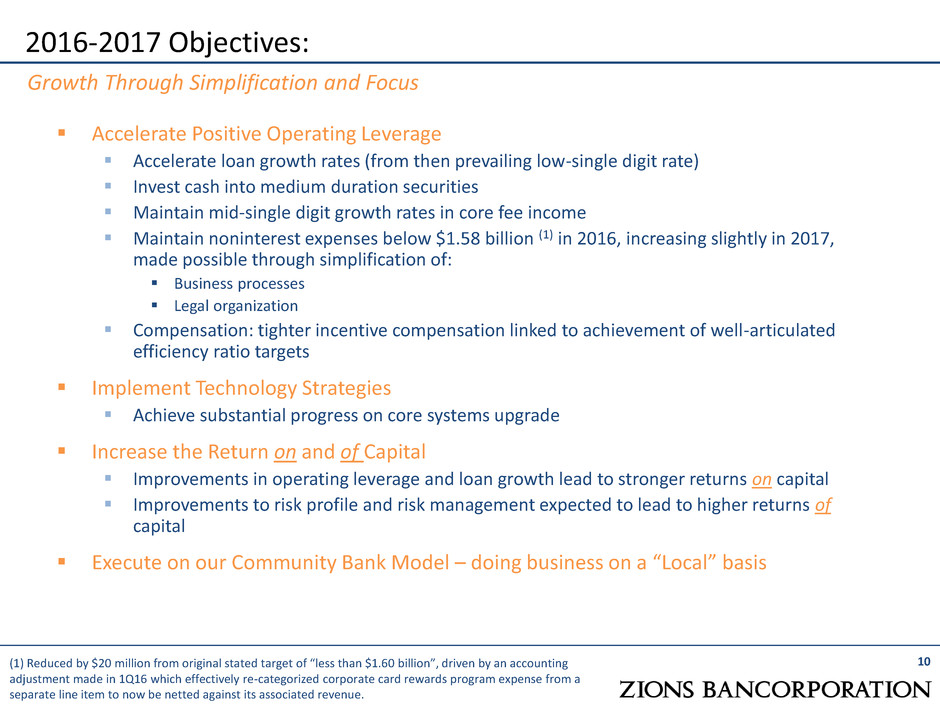

Accelerate Positive Operating Leverage

Accelerate loan growth rates (from then prevailing low-single digit rate)

Invest cash into medium duration securities

Maintain mid-single digit growth rates in core fee income

Maintain noninterest expenses below $1.58 billion (1) in 2016, increasing slightly in 2017,

made possible through simplification of:

Business processes

Legal organization

Compensation: tighter incentive compensation linked to achievement of well-articulated

efficiency ratio targets

Implement Technology Strategies

Achieve substantial progress on core systems upgrade

Increase the Return on and of Capital

Improvements in operating leverage and loan growth lead to stronger returns on capital

Improvements to risk profile and risk management expected to lead to higher returns of

capital

Execute on our Community Bank Model – doing business on a “Local” basis

10

2016-2017 Objectives:

(1) Reduced by $20 million from original stated target of “less than $1.60 billion”, driven by an accounting

adjustment made in 1Q16 which effectively re-categorized corporate card rewards program expense from a

separate line item to now be netted against its associated revenue.

Growth Through Simplification and Focus

Increasing EPS: Diluted earnings per share increased substantially from the year-ago

period

• EPS increased to $0.44 in 2Q16 from $(0.01)

• Adjusting for items used to calculate our efficiency ratio, including the effect of securities gains

and losses (1) and preferred stock redemption expense, EPS increased to $0.48 from $0.41, or

17.2%

Increasing pre-provision net revenue (1): 32% growth over year-ago period

• A 7.3% year-over-year increase in adjusted revenue (1)

• A 2.6% year-over-year decrease in adjusted noninterest expense (1)

Achieving positive operating leverage: five consecutive quarters of positive

operating leverage (1)

Tracking on the efficiency initiative:

• Adjusted noninterest expense declined from the prior quarter, on track to remain below $1.58

billion in 2016

• Efficiency ratio improved by 399 basis points from 1Q16 to 64.5%; YTD, the ratio is 66.5% and

is tracking to be below 66% for the full year

Increasing loans: Strong loan growth of 2.6% (vs. 1Q16)

Maintaining overall healthy credit quality: Credit quality remains stable; oil & gas

loan challenges remain but strong allowance for credit losses in place

11

Second Quarter 2016 Highlights

Solid and improving fundamental performance

(1) Adjusted for items such as severance, provision for unfunded lending commitments, and debt

extinguishment costs. See GAAP to non-GAAP reconciliation tables on slides 37-38.

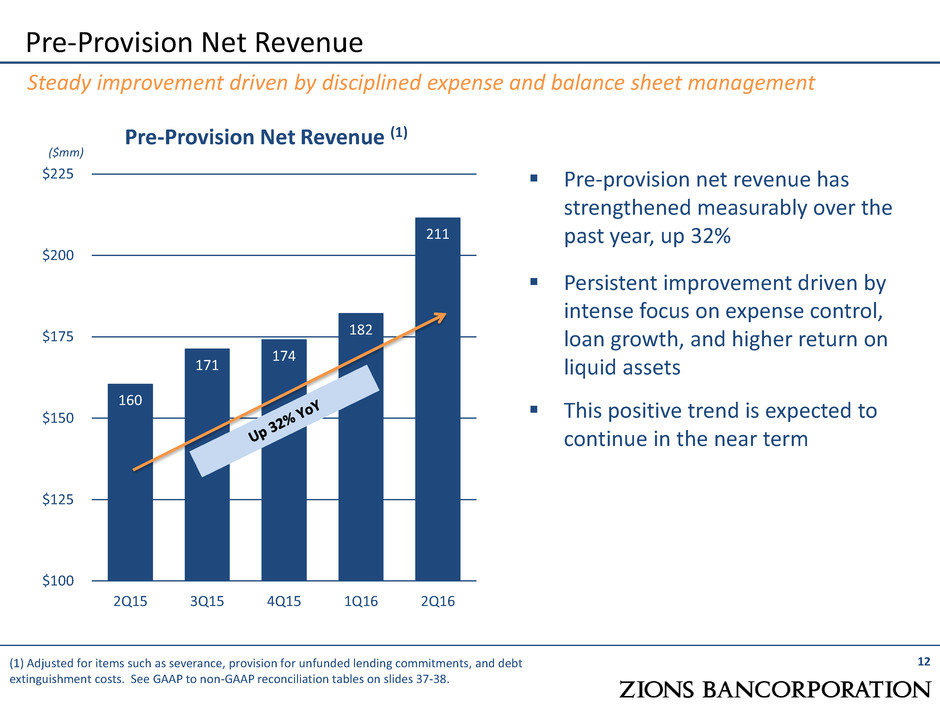

Pre-Provision Net Revenue

Pre-Provision Net Revenue (1)

12

Steady improvement driven by disciplined expense and balance sheet management

(1) Adjusted for items such as severance, provision for unfunded lending commitments, and debt

extinguishment costs. See GAAP to non-GAAP reconciliation tables on slides 37-38.

($mm)

160

171

174

182

211

$100

$125

$150

$175

$200

$225

2Q15 3Q15 4Q15 1Q16 2Q16

Pre-provision net revenue has

strengthened measurably over the

past year, up 32%

Persistent improvement driven by

intense focus on expense control,

loan growth, and higher return on

liquid assets

This positive trend is expected to

continue in the near term

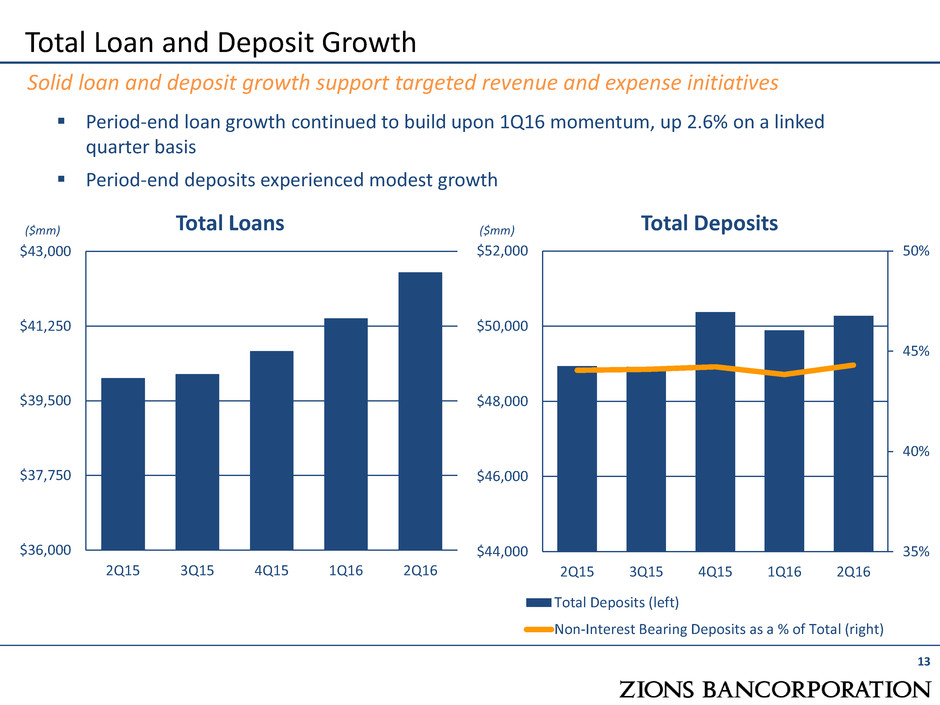

Total Loan and Deposit Growth

Total Loans Total Deposits

13

Solid loan and deposit growth support targeted revenue and expense initiatives

Period-end loan growth continued to build upon 1Q16 momentum, up 2.6% on a linked

quarter basis

Period-end deposits experienced modest growth

($mm)

$36,000

$37,750

$39,500

$41,250

$43,000

2Q15 3Q15 4Q15 1Q16 2Q16

35%

40%

45%

50%

$44,000

$46,000

$48,000

$50,000

$52,000

2Q15 3Q15 4Q15 1Q16 2Q16

Total Deposits (left)

Non-Interest Bearing Deposits as a % of Total (right)

($mm)

C&I (ex-O&G)

Owner Occupied

(ex-NRE)

C&D

Term CRE (ex-

NRE)

1-4 Family

National Real

Estate

O&G

Home Equity

Other

-20%

-10%

0%

10%

20%

30%

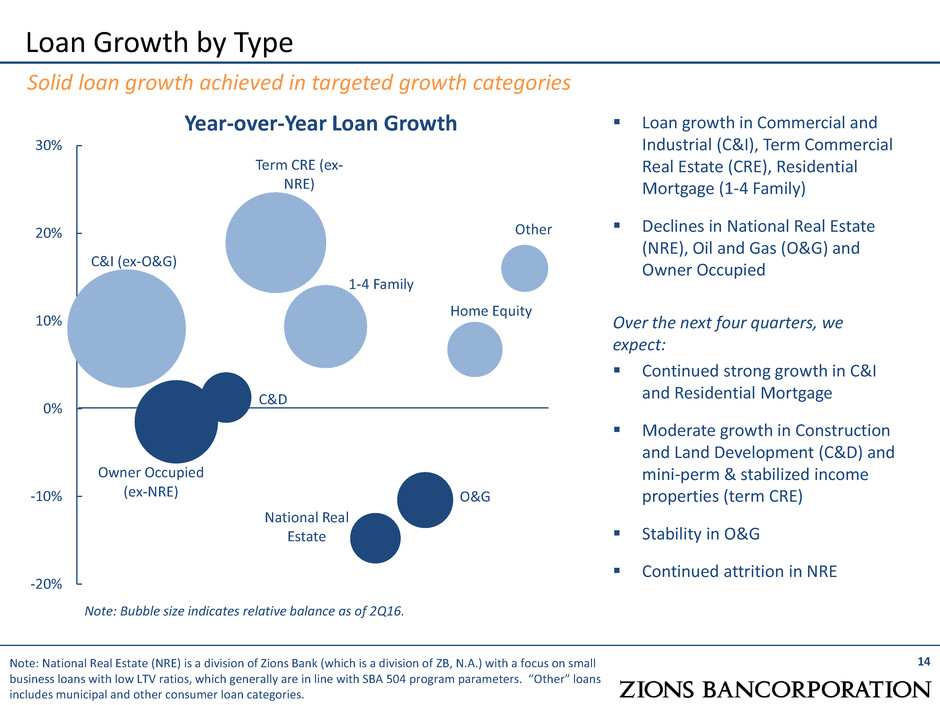

Loan Growth by Type

14

Solid loan growth achieved in targeted growth categories

Year-over-Year Loan Growth Loan growth in Commercial and

Industrial (C&I), Term Commercial

Real Estate (CRE), Residential

Mortgage (1-4 Family)

Declines in National Real Estate

(NRE), Oil and Gas (O&G) and

Owner Occupied

Over the next four quarters, we

expect:

Continued strong growth in C&I

and Residential Mortgage

Moderate growth in Construction

and Land Development (C&D) and

mini-perm & stabilized income

properties (term CRE)

Stability in O&G

Continued attrition in NRE

Note: National Real Estate (NRE) is a division of Zions Bank (which is a division of ZB, N.A.) with a focus on small

business loans with low LTV ratios, which generally are in line with SBA 504 program parameters. “Other” loans

includes municipal and other consumer loan categories.

Note: Bubble size indicates relative balance as of 2Q16.

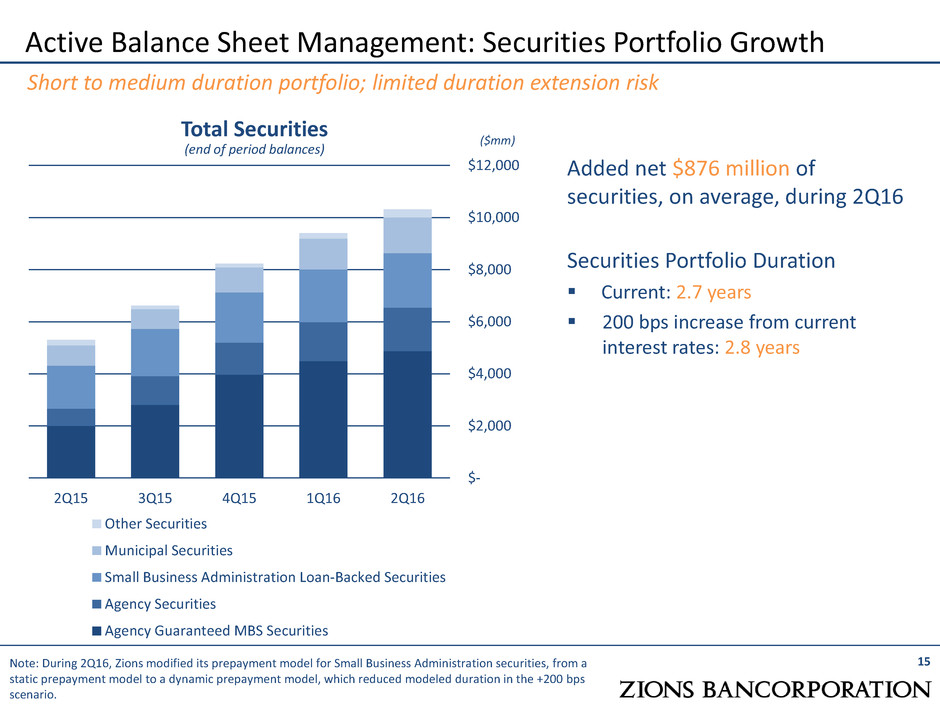

Active Balance Sheet Management: Securities Portfolio Growth

15

Short to medium duration portfolio; limited duration extension risk

Total Securities

(end of period balances)

($mm)

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

2Q15 3Q15 4Q15 1Q16 2Q16

Other Securities

Municipal Securities

Small Business Administration Loan-Backed Securities

Agency Securities

Agency Guaranteed MBS Securities

Added net $876 million of

securities, on average, during 2Q16

Securities Portfolio Duration

Current: 2.7 years

200 bps increase from current

interest rates: 2.8 years

Note: During 2Q16, Zions modified its prepayment model for Small Business Administration securities, from a

static prepayment model to a dynamic prepayment model, which reduced modeled duration in the +200 bps

scenario.

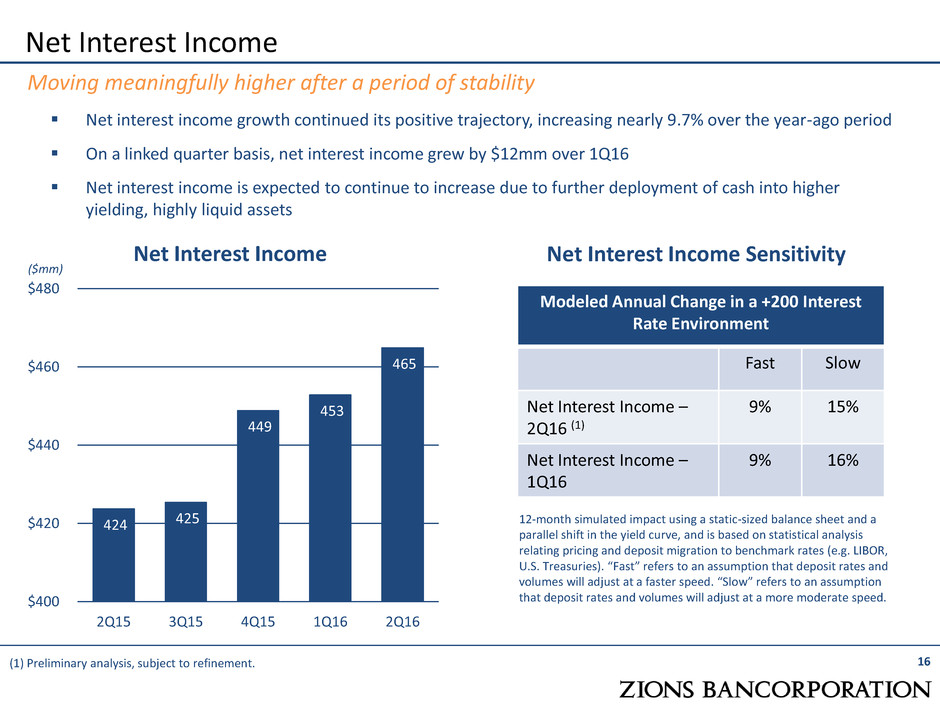

Net interest income growth continued its positive trajectory, increasing nearly 9.7% over the year-ago period

On a linked quarter basis, net interest income grew by $12mm over 1Q16

Net interest income is expected to continue to increase due to further deployment of cash into higher

yielding, highly liquid assets

Net Interest Income

Net Interest Income

16

Moving meaningfully higher after a period of stability

($mm)

424 425

449

453

465

$400

$420

$440

$460

$480

2Q15 3Q15 4Q15 1Q16 2Q16

Modeled Annual Change in a +200 Interest

Rate Environment

Fast Slow

Net Interest Income –

2Q16 (1)

9% 15%

Net Interest Income –

1Q16

9% 16%

12-month simulated impact using a static-sized balance sheet and a

parallel shift in the yield curve, and is based on statistical analysis

relating pricing and deposit migration to benchmark rates (e.g. LIBOR,

U.S. Treasuries). “Fast” refers to an assumption that deposit rates and

volumes will adjust at a faster speed. “Slow” refers to an assumption

that deposit rates and volumes will adjust at a more moderate speed.

(1) Preliminary analysis, subject to refinement.

Net Interest Income Sensitivity

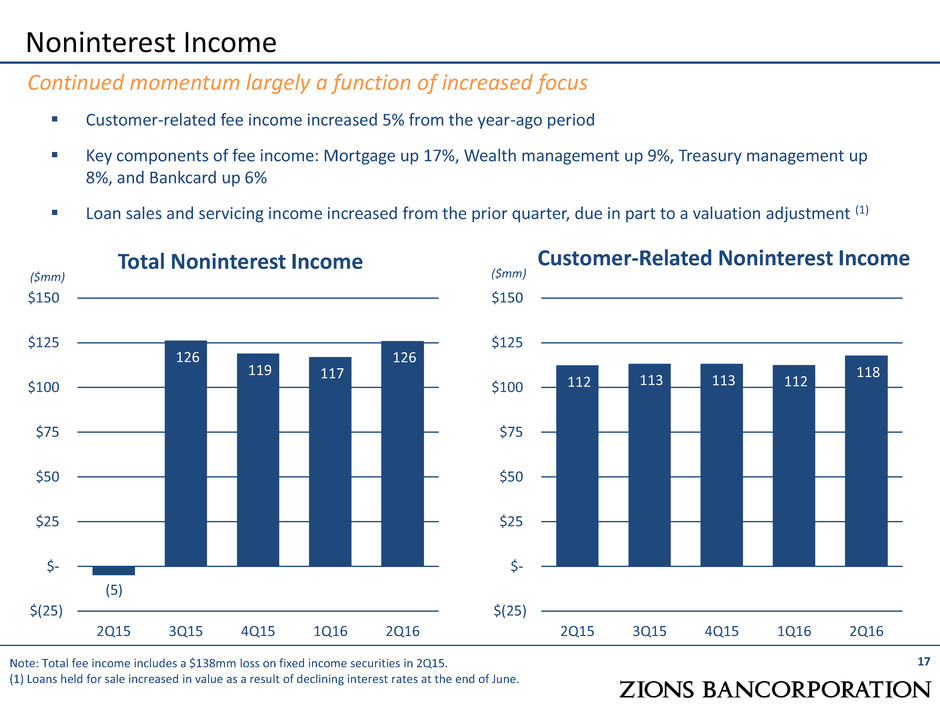

Customer-related fee income increased 5% from the year-ago period

Key components of fee income: Mortgage up 17%, Wealth management up 9%, Treasury management up

8%, and Bankcard up 6%

Loan sales and servicing income increased from the prior quarter, due in part to a valuation adjustment (1)

112 113 113 112

118

$(25)

$-

$25

$50

$75

$100

$125

$150

2Q15 3Q15 4Q15 1Q16 2Q16

Noninterest Income

Customer-Related Noninterest Income

17

($mm)

Continued momentum largely a function of increased focus

Note: Total fee income includes a $138mm loss on fixed income securities in 2Q15.

(1) Loans held for sale increased in value as a result of declining interest rates at the end of June.

Total Noninterest Income

($mm)

(5)

126

119 117

126

$(25)

$-

$25

$50

$75

$100

$125

$150

2Q15 3Q15 4Q15 1Q16 2Q16

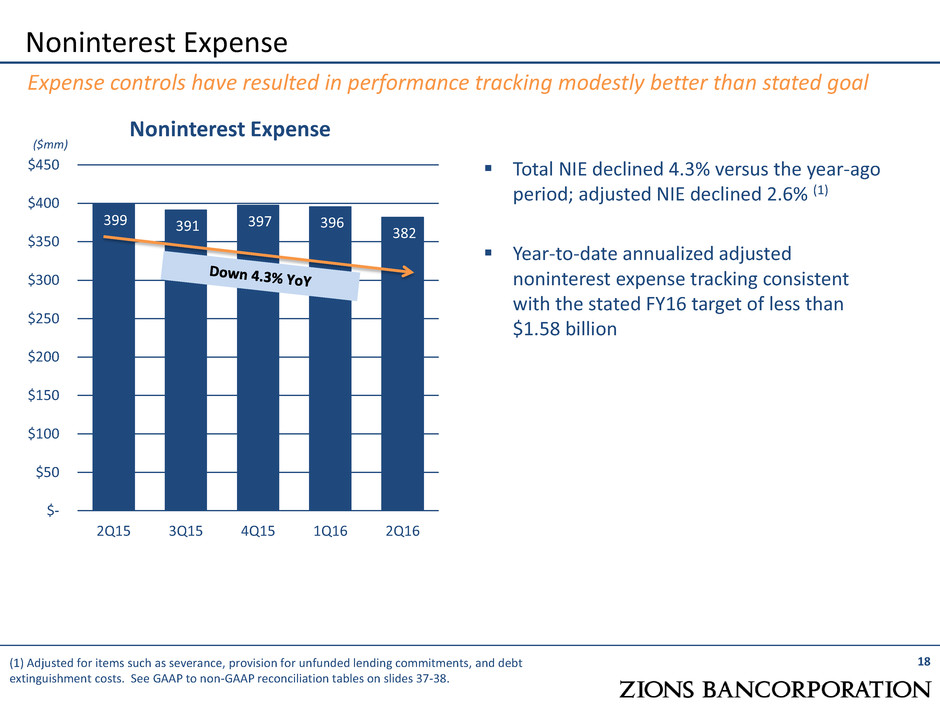

Noninterest Expense

($mm)

399 391 397 396 382

$-

$50

$100

$150

$200

$250

$300

$350

$400

$450

2Q15 3Q15 4Q15 1Q16 2Q16

Noninterest Expense

18

Expense controls have resulted in performance tracking modestly better than stated goal

Total NIE declined 4.3% versus the year-ago

period; adjusted NIE declined 2.6% (1)

Year-to-date annualized adjusted

noninterest expense tracking consistent

with the stated FY16 target of less than

$1.58 billion

(1) Adjusted for items such as severance, provision for unfunded lending commitments, and debt

extinguishment costs. See GAAP to non-GAAP reconciliation tables on slides 37-38.

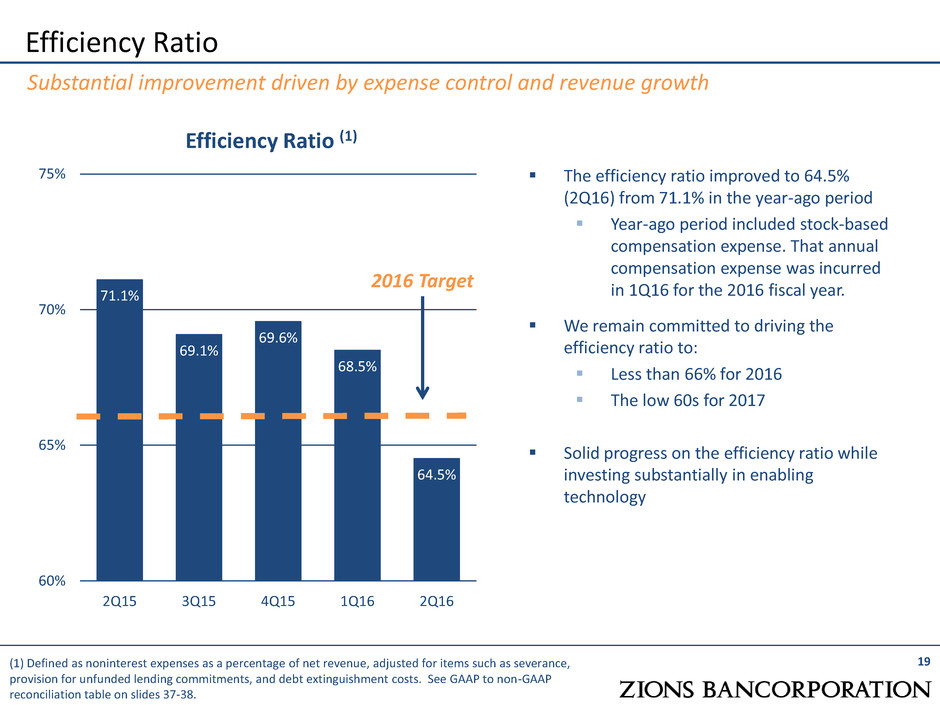

Efficiency Ratio

Efficiency Ratio (1)

19

Substantial improvement driven by expense control and revenue growth

(1) Defined as noninterest expenses as a percentage of net revenue, adjusted for items such as severance,

provision for unfunded lending commitments, and debt extinguishment costs. See GAAP to non-GAAP

reconciliation table on slides 37-38.

The efficiency ratio improved to 64.5%

(2Q16) from 71.1% in the year-ago period

Year-ago period included stock-based

compensation expense. That annual

compensation expense was incurred

in 1Q16 for the 2016 fiscal year.

We remain committed to driving the

efficiency ratio to:

Less than 66% for 2016

The low 60s for 2017

Solid progress on the efficiency ratio while

investing substantially in enabling

technology

71.1%

69.1%

69.6%

68.5%

64.5%

60%

65%

70%

75%

2Q15 3Q15 4Q15 1Q16 2Q16

2016 Target

Credit Quality (Ex-Energy)

20

Key Credit Quality Ratios (Ex-Energy)

Overall credit quality remains pristine outside energy

Overall stable and healthy credit quality

Relative to March 31, 2016:

Classified loans decreased to 2.0% of

loans

NPAs decreased to 0.65% of loans

Annualized NCOs equaled 0.01% of

average loans

Allowance for credit losses remains strong at

1.15% of total loans and leases

1.8x coverage of NPAs

Not meaningful coverage of

annualized NCOs (>50x)

Reaffirming full year 2016 net charge-off

outlook of 30-35 basis points of average

loans (overall, inclusive of Energy)

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

2Q15 3Q15 4Q15 1Q16 2Q16

Classifieds / Loans Nonperforming Assets / Loans

Net Charge-offs / Loans

Note: Net Charge-offs/Loans ratio is annualized for all periods shown. Oil and gas loans discussed in greater

detail later in this presentation.

Capital plan for next four quarters

Increase the dividend payout to an annualized $0.32 from $0.24

Repurchase up to $180 million of common equity (~3% of shares outstanding)

Reduce preferred equity by up to $144 million

Expect improved return on tangible common equity due to improved profitability

and less excess equity outstanding

Actively managing capital lower to better align with risk profile

21

Capital Actions: 2H16 – 1H17

Increased common dividend, common share repurchase and preferred equity

redemption

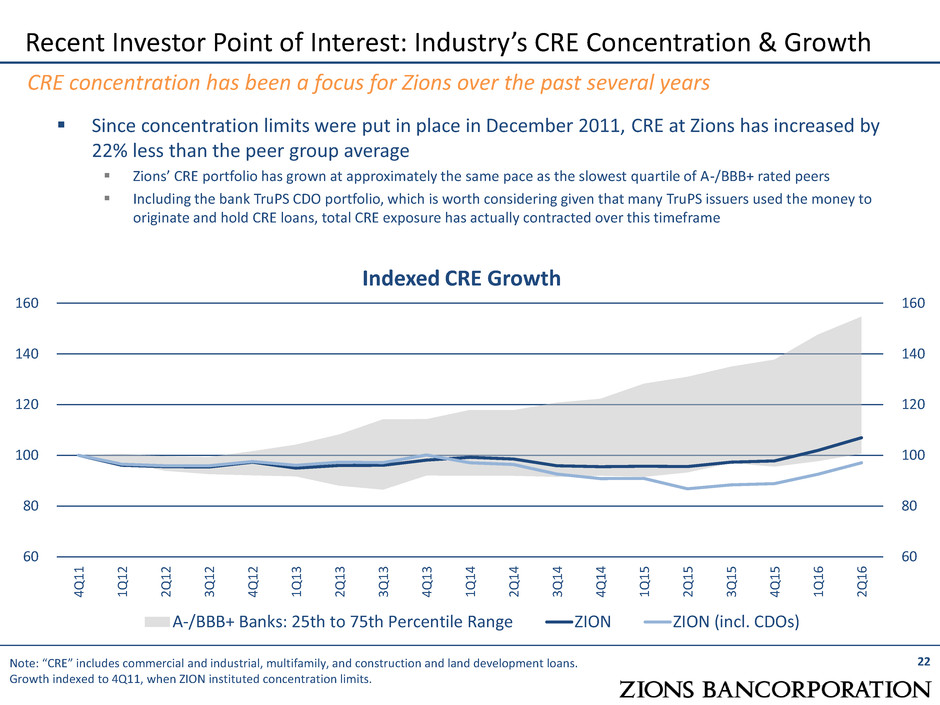

Since concentration limits were put in place in December 2011, CRE at Zions has increased by

22% less than the peer group average

Zions’ CRE portfolio has grown at approximately the same pace as the slowest quartile of A-/BBB+ rated peers

Including the bank TruPS CDO portfolio, which is worth considering given that many TruPS issuers used the money to

originate and hold CRE loans, total CRE exposure has actually contracted over this timeframe

Recent Investor Point of Interest: Industry’s CRE Concentration & Growth

CRE concentration has been a focus for Zions over the past several years

Note: “CRE” includes commercial and industrial, multifamily, and construction and land development loans.

Growth indexed to 4Q11, when ZION instituted concentration limits.

Indexed CRE Growth

60

80

100

120

140

160

60

80

100

120

140

160

4Q

1

1

1Q

1

2

2Q

1

2

3Q

1

2

4Q

1

2

1Q

1

3

2Q

1

3

3Q

1

3

4Q

1

3

1Q

1

4

2Q

1

4

3Q

1

4

4Q1

4

1Q

1

5

2Q

1

5

3Q

1

5

4Q

1

5

1Q

1

6

2Q

1

6

A-/BBB+ Banks: 25th to 75th Percentile Range ZION ZION (incl. CDOs)

22

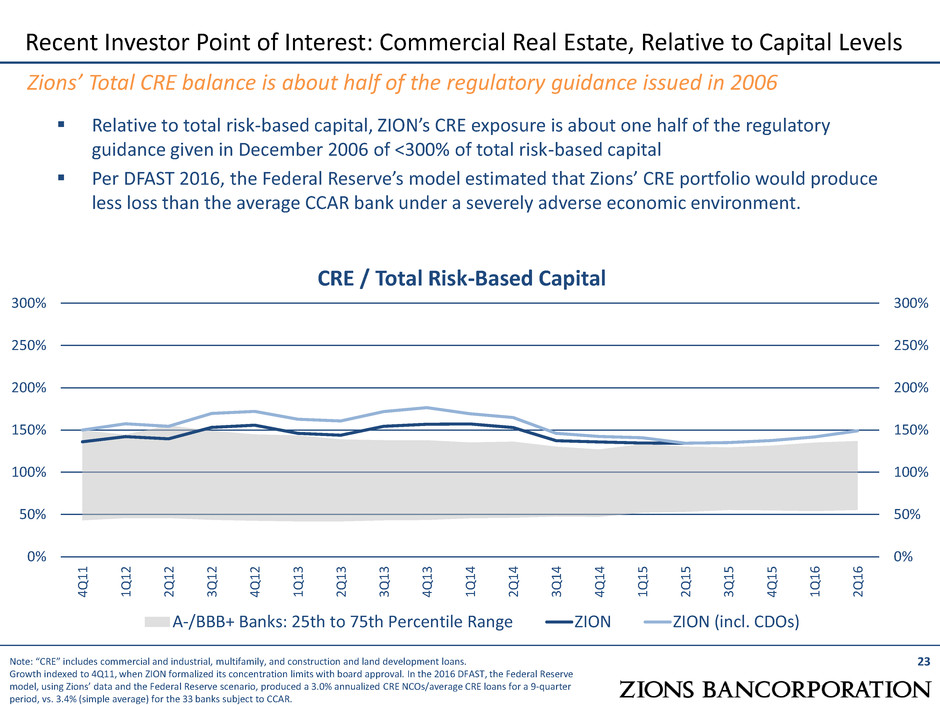

Recent Investor Point of Interest: Commercial Real Estate, Relative to Capital Levels

23

Zions’ Total CRE balance is about half of the regulatory guidance issued in 2006

Note: “CRE” includes commercial and industrial, multifamily, and construction and land development loans.

Growth indexed to 4Q11, when ZION formalized its concentration limits with board approval. In the 2016 DFAST, the Federal Reserve

model, using Zions’ data and the Federal Reserve scenario, produced a 3.0% annualized CRE NCOs/average CRE loans for a 9-quarter

period, vs. 3.4% (simple average) for the 33 banks subject to CCAR.

CRE / Total Risk-Based Capital

0%

50%

100%

150%

200%

250%

300%

0%

50%

100%

150%

200%

250%

300%

4Q

1

1

1Q

1

2

2Q

1

2

3Q

1

2

4Q

1

2

1Q

1

3

2Q

1

3

3Q

1

3

4Q

1

3

1Q

1

4

2Q

1

4

3Q1

4

4Q

1

4

1Q

1

5

2Q

1

5

3Q

1

5

4Q

1

5

1Q

1

6

2Q

1

6

A-/BBB+ Banks: 25th to 75th Percentile Range ZION ZION (incl. CDOs)

Relative to total risk-based capital, ZION’s CRE exposure is about one half of the regulatory

guidance given in December 2006 of <300% of total risk-based capital

Per DFAST 2016, the Federal Reserve’s model estimated that Zions’ CRE portfolio would produce

less loss than the average CCAR bank under a severely adverse economic environment.

Oil & Gas (O&G) Credit Quality

24

O&G Key Credit Quality Ratios

O&G credit quality [has stabilized]

O&G credit quality stabilizing

Relative to March 31, 2016:

Criticized loans increased slightly to

37.8% of loans

Classified loans increased to 31.5% of

loans

NPAs increased to 11.1% of loans

Annualized NCOs equaled 5.8% of

average loans

Allowance for credit losses remains strong at

over 8% of total loans and leases

0.8x coverage of NPAs

1.5x coverage of annualized NCOs

Estimate full year 2016 O&G net charge-offs

of approximately $125 million

0%

5%

10%

15%

20%

25%

30%

35%

40%

2Q15 3Q15 4Q15 1Q16 2Q16

Criticized / Loans Classifieds / Loans

Nonperforming Assets / Loans Net Charge-offs / Loans

Note: Net Charge-offs/Loans ratio is annualized for all periods shown.

$-

$100

$200

$300

$400

$500

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Allowance for Credit Losses Upstream Services Other

Oil & Gas (O&G) Portfolio Trends

25

Loan Balances by O&G Segment Classifieds by O&G Segment

Steadily declining balances in O&G Services

Nonaccruals by O&G Segment

($mm)

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Upstream Services Other

($mm)

($mm)

$-

$100

$200

$300

$400

$500

4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Upstream Services Other

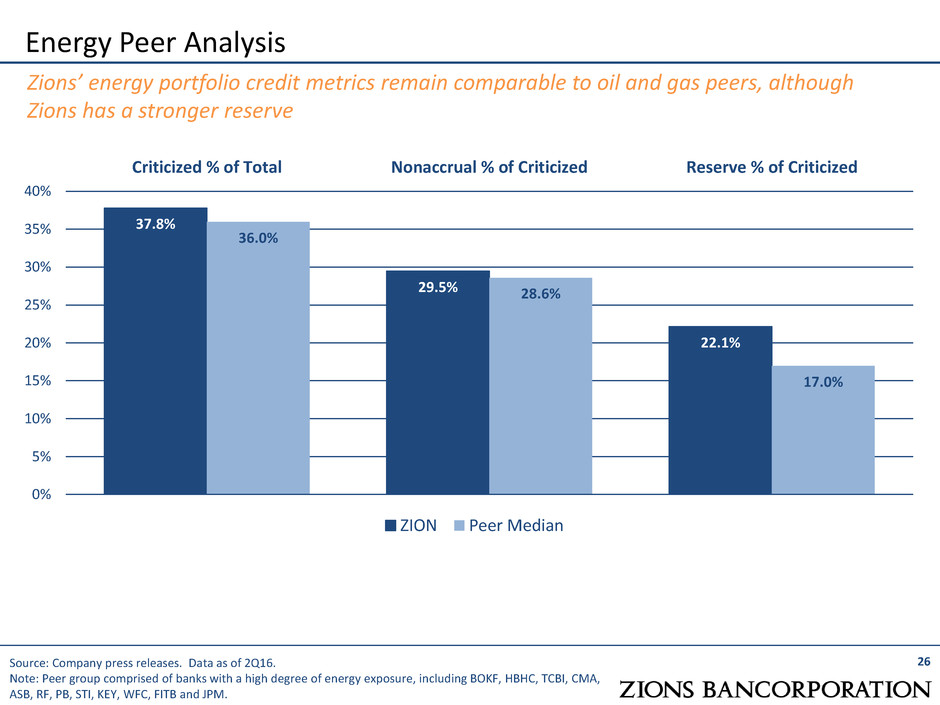

37.8%

29.5%

22.1%

36.0%

28.6%

17.0%

0%

5%

10%

15%

20%

25%

30%

35%

40%

Criticized % of Total Nonaccrual % of Criticized Reserve % of Criticized

ZION Peer Median

Energy Peer Analysis

26

Zions’ energy portfolio credit metrics remain comparable to oil and gas peers, although

Zions has a stronger reserve

Source: Company press releases. Data as of 2Q16.

Note: Peer group comprised of banks with a high degree of energy exposure, including BOKF, HBHC, TCBI, CMA,

ASB, RF, PB, STI, KEY, WFC, FITB and JPM.

O&G Loan Loss Expectation

O&G loan losses are expected to decline moderately in 2H16 (relative to 1H16) and may

decline further in 2017 (1)

Most of the expected loss is likely to come from services loans

60% of classified O&G loans are from services loans

78% of O&G losses incurred since Sep 30, 2014 are from services loans

Healthy sponsor support has resulted in reduced loss levels

Improved borrower and sponsor sentiment in 2Q16

Heading into this cycle, Zions’ lack of second lien or mezzanine debt extended to the

O&G industry is a significant source of protection against very high loss severity

Strong Reserve Against O&G Loans

Zions’ O&G allowance for credit losses more than

8% of O&G loan balances

22% of criticized O&G loan balances

Expect the reserve ratio on O&G loans to stabilize and then decline as losses are taken

or favorable resolutions accelerate and reduce the need for the current reserve level

27

Oil and Gas Loss Outlook and Reserve

O&G NCOs may be in the $125 million area in 2016; Strong reserve against O&G portfolio

(1) Assuming oil and gas commodity prices remain relatively stable.

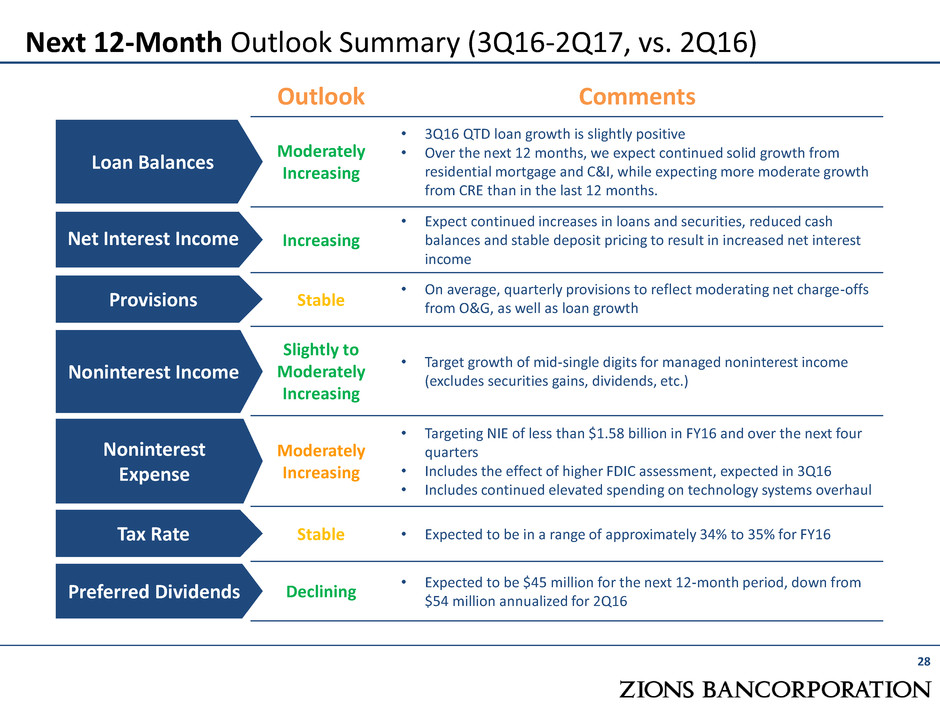

Next 12-Month Outlook Summary (3Q16-2Q17, vs. 2Q16)

28

Outlook Comments

Moderately

Increasing

• 3Q16 QTD loan growth is slightly positive

• Over the next 12 months, we expect continued solid growth from

residential mortgage and C&I, while expecting more moderate growth

from CRE than in the last 12 months.

Increasing

• Expect continued increases in loans and securities, reduced cash

balances and stable deposit pricing to result in increased net interest

income

Stable

• On average, quarterly provisions to reflect moderating net charge-offs

from O&G, as well as loan growth

Slightly to

Moderately

Increasing

• Target growth of mid-single digits for managed noninterest income

(excludes securities gains, dividends, etc.)

Moderately

Increasing

• Targeting NIE of less than $1.58 billion in FY16 and over the next four

quarters

• Includes the effect of higher FDIC assessment, expected in 3Q16

• Includes continued elevated spending on technology systems overhaul

Stable • Expected to be in a range of approximately 34% to 35% for FY16

Declining

• Expected to be $45 million for the next 12-month period, down from

$54 million annualized for 2Q16

Loan Balances

Net Interest Income

Provisions

Noninterest Income

Noninterest

Expense

Tax Rate

Preferred Dividends

Financial Results

Net Interest Income Drivers

Oil & Gas (O&G) Portfolio Detail

Houston CRE Portfolio: Subtype, cash flow coverage, collateral coverage

High Oil & Gas (O&G) Employment Counties: Consumer credit scores

Loan Growth by Bank Brand and Loan Type

GAAP to Non-GAAP Reconciliation

29

Appendix

Financial Results

30

Solid and improving fundamental performance

Three Months Ended

(Dollar amounts in millions, except per share data) June 30,

2016

March 31,

2016

June 30,

2015

Earnings Results:

Diluted Earnings Per Share 0.44 0.38 (0.01)

Net Earnings (Loss) Applicable to Common Shareholders 91 79 (1)

Net Interest Income 465 453 424

Noninterest Income 126 117 (5)

Noninterest Expense 382 396 399

Pre-Provision Net Revenue (1) 211 182 160

Provision for Credit Losses 30 36 (2)

Ratios:

Return on Average Assets 0.77 % 0.62 % 0.10 %

Return on Average Common Equity 5.30 % 4.67 % (0.07) %

Tangible Return on Average Tangible Common Equity 6.31 % 5.59 % 0.03 %

Net Interest Margin 3.39 % 3.35 % 3.18 %

Yield on Loans 4.16 % 4.14 % 4.22 %

Yield on Securities 2.13 % 2.30 % 2.35 %

Average Cost of Deposits* 0.10 % 0.10 % 0.10 %

Efficiency Ratio (1) 64.5 % 68.5 % 71.9 %

Ratio of Nonperforming Assets to Loans, Leases and OREO 1.30 % 1.33 % 0.96 %

Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans 0.36 % 0.35 % 0.11 %

Basel III Common Equity Tier 1 11.94 % 12.13 % 12.00 %

(1) Adjusted for items such as severance, provision for unfunded lending commitments, and debt

extinguishment costs. See GAAP to non-GAAP reconciliation tables on slides 38-39.

* Includes noninterest-bearing deposits.

Loans

76%

Securities

17%

Cash

7%

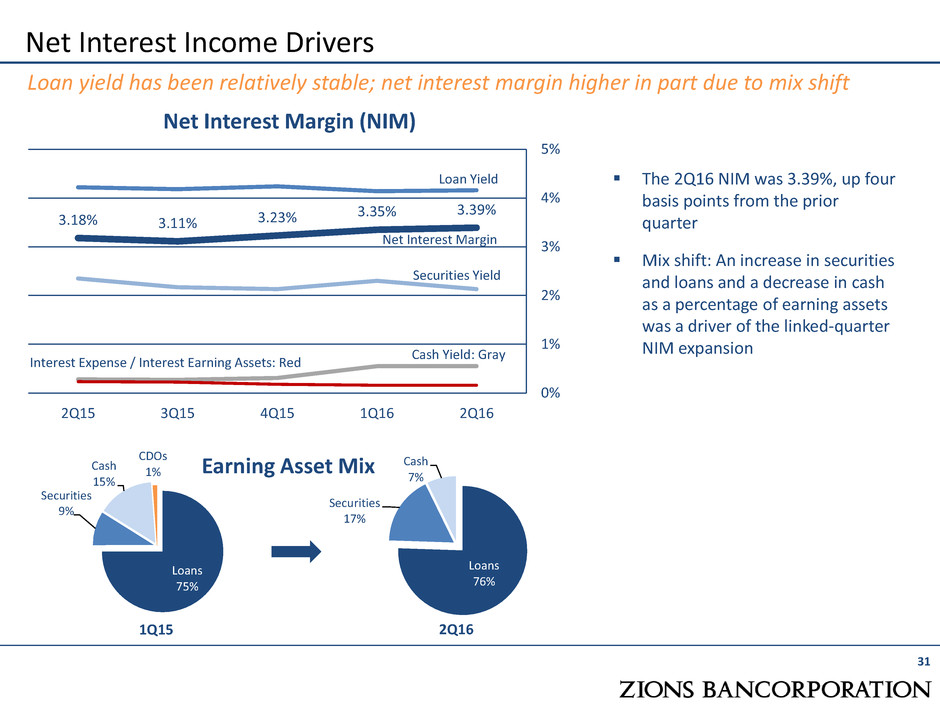

Net Interest Income Drivers

Loan yield has been relatively stable; net interest margin higher in part due to mix shift

Net Interest Margin (NIM)

Earning Asset Mix

The 2Q16 NIM was 3.39%, up four

basis points from the prior

quarter

Mix shift: An increase in securities

and loans and a decrease in cash

as a percentage of earning assets

was a driver of the linked-quarter

NIM expansion

3.18% 3.11% 3.23%

3.35% 3.39%

0%

1%

2%

3%

4%

5%

2Q15 3Q15 4Q15 1Q16 2Q16

Loan Yield

Securities Yield

Interest Expense / Interest Earning Assets: Red

Net Interest Margin

Cash Yield: Gray

Loans

75%

Securities

9%

Cash

15%

CDOs

1%

1Q15 2Q16

31

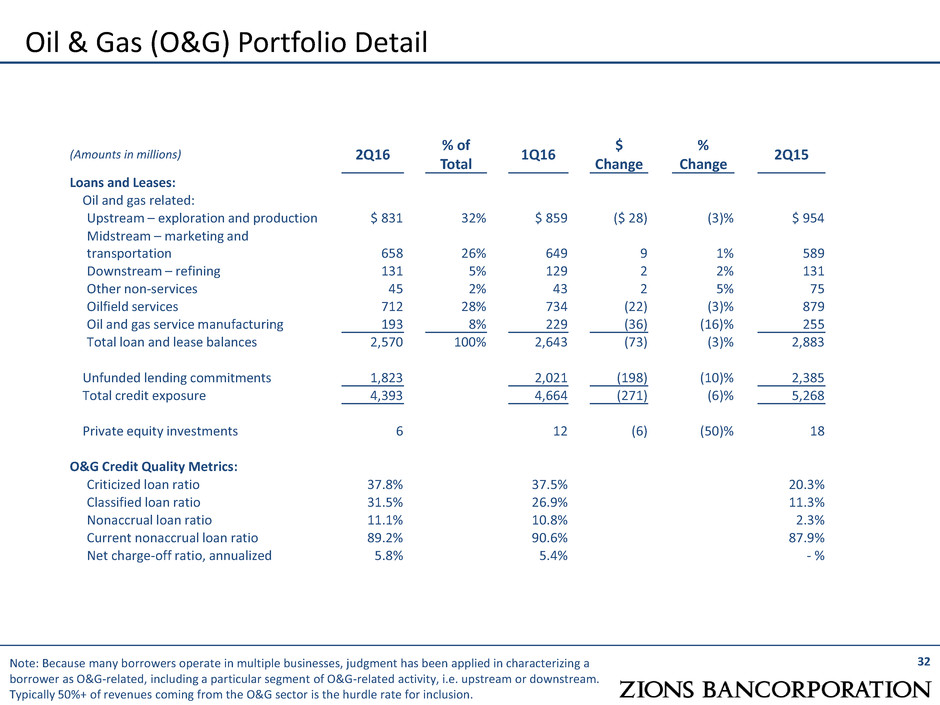

32 Note: Because many borrowers operate in multiple businesses, judgment has been applied in characterizing a

borrower as O&G-related, including a particular segment of O&G-related activity, i.e. upstream or downstream.

Typically 50%+ of revenues coming from the O&G sector is the hurdle rate for inclusion.

Oil & Gas (O&G) Portfolio Detail

(Amounts in millions) 2Q16

% of

Total

1Q16

$

Change

%

Change

2Q15

Loans and Leases:

Oil and gas related:

Upstream – exploration and production $ 831 32% $ 859 ($ 28) (3)% $ 954

Midstream – marketing and

transportation 658 26% 649 9 1% 589

Downstream – refining 131 5% 129 2 2% 131

Other non-services 45 2% 43 2 5% 75

Oilfield services 712 28% 734 (22) (3)% 879

Oil and gas service manufacturing 193 8% 229 (36) (16)% 255

Total loan and lease balances 2,570 100% 2,643 (73) (3)% 2,883

Unfunded lending commitments 1,823 2,021 (198) (10)% 2,385

Total credit exposure 4,393 4,664 (271) (6)% 5,268

Private equity investments 6 12 (6) (50)% 18

O&G Credit Quality Metrics:

Criticized loan ratio 37.8% 37.5% 20.3%

Classified loan ratio 31.5% 26.9% 11.3%

Nonaccrual loan ratio 11.1% 10.8% 2.3%

Current nonaccrual loan ratio 89.2% 90.6% 87.9%

Net charge-off ratio, annualized 5.8% 5.4% - %

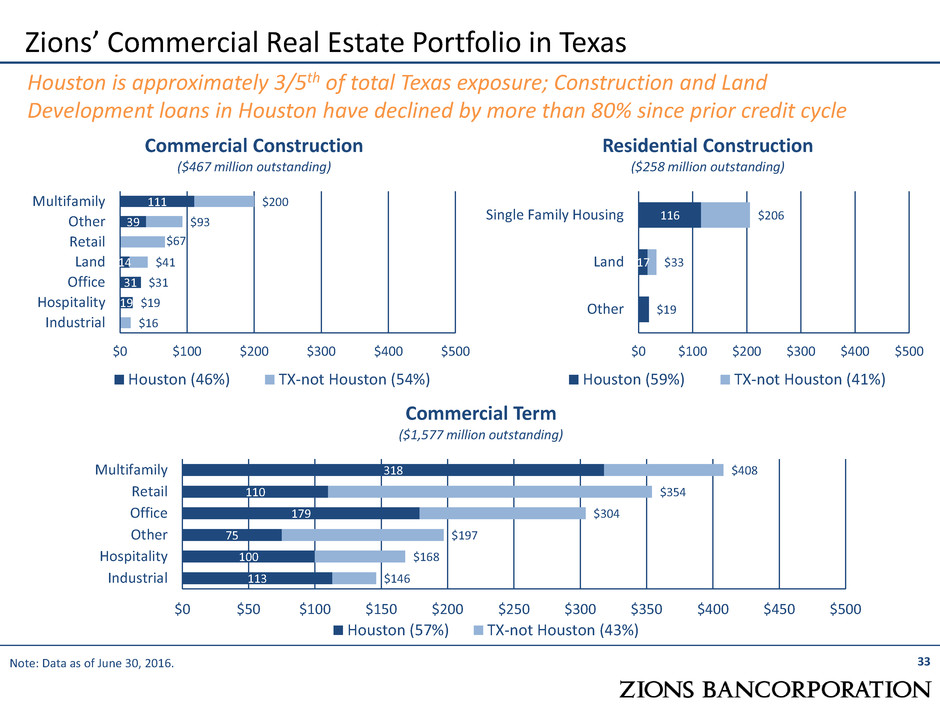

33 Note: Data as of June 30, 2016.

Zions’ Commercial Real Estate Portfolio in Texas

Houston is approximately 3/5th of total Texas exposure; Construction and Land

Development loans in Houston have declined by more than 80% since prior credit cycle

19

31

14

39

111

$16

$19

$31

$41

$67

$93

$200

$0 $100 $200 $300 $400 $500

Industrial

Hospitality

Office

Land

Retail

Other

Multifamily

Commercial Construction

($467 million outstanding)

Houston (46%) TX-not Houston (54%)

17

116

$19

$33

$206

$0 $100 $200 $300 $400 $500

Other

Land

Single Family Housing

Residential Construction

($258 million outstanding)

Houston (59%) TX-not Houston (41%)

113

100

75

179

110

318

$146

$168

$197

$304

$354

$408

$0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500

Industrial

Hospitality

Other

Office

Retail

Multifamily

Commercial Term

($1,577 million outstanding)

Houston (57%) TX-not Houston (43%)

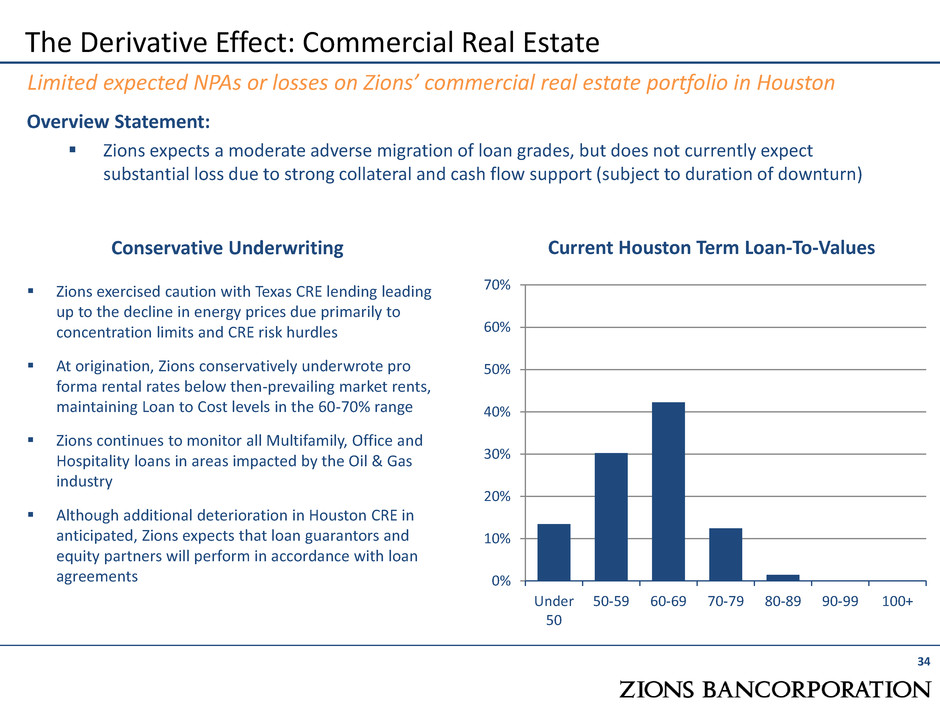

34

The Derivative Effect: Commercial Real Estate

Limited expected NPAs or losses on Zions’ commercial real estate portfolio in Houston

Overview Statement:

Zions expects a moderate adverse migration of loan grades, but does not currently expect

substantial loss due to strong collateral and cash flow support (subject to duration of downturn)

0%

10%

20%

30%

40%

50%

60%

70%

Under

50

50-59 60-69 70-79 80-89 90-99 100+

Current Houston Term Loan-To-Values

Zions exercised caution with Texas CRE lending leading

up to the decline in energy prices due primarily to

concentration limits and CRE risk hurdles

At origination, Zions conservatively underwrote pro

forma rental rates below then-prevailing market rents,

maintaining Loan to Cost levels in the 60-70% range

Zions continues to monitor all Multifamily, Office and

Hospitality loans in areas impacted by the Oil & Gas

industry

Although additional deterioration in Houston CRE in

anticipated, Zions expects that loan guarantors and

equity partners will perform in accordance with loan

agreements

Conservative Underwriting

35

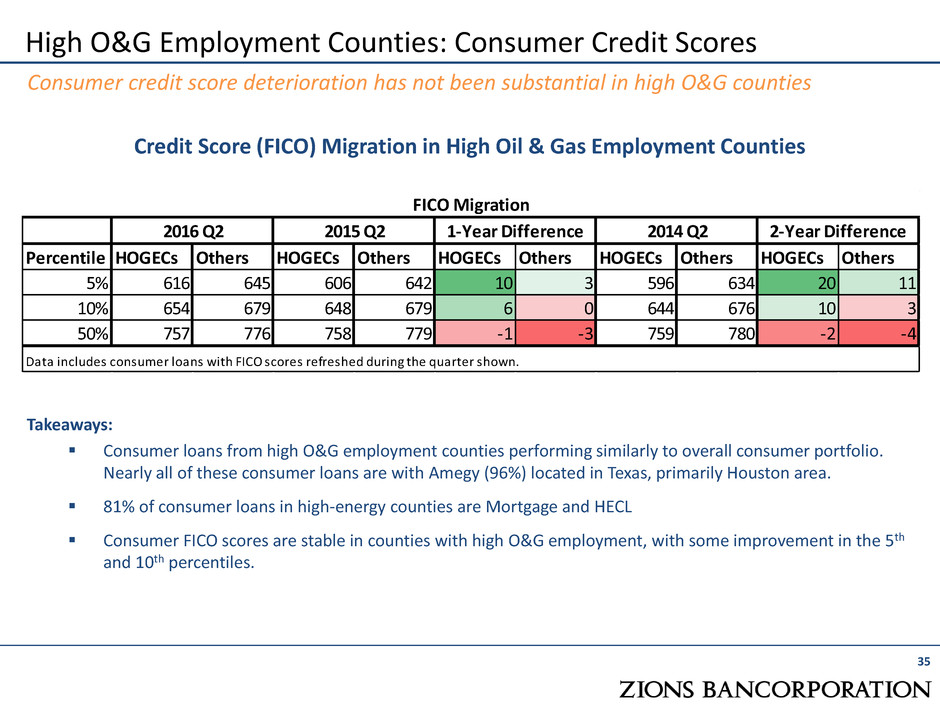

High O&G Employment Counties: Consumer Credit Scores

Consumer credit score deterioration has not been substantial in high O&G counties

Credit Score (FICO) Migration in High Oil & Gas Employment Counties

Percentile HOGECs Others HOGECs Others HOGECs Others HOGECs Others HOGECs Others

5% 616 645 606 642 10 3 596 634 20 11

10% 654 679 648 679 6 0 644 676 10 3

50% 757 776 758 779 -1 -3 759 780 -2 -4

Data includes consumer loans with FICO scores refreshed during the quarter shown.

FICO Migration

2016 Q2 2015 Q2 1-Year Difference 2014 Q2 2-Year Difference

Takeaways:

Consumer loans from high O&G employment counties performing similarly to overall consumer portfolio.

Nearly all of these consumer loans are with Amegy (96%) located in Texas, primarily Houston area.

81% of consumer loans in high-energy counties are Mortgage and HECL

Consumer FICO scores are stable in counties with high O&G employment, with some improvement in the 5th

and 10th percentiles.

36

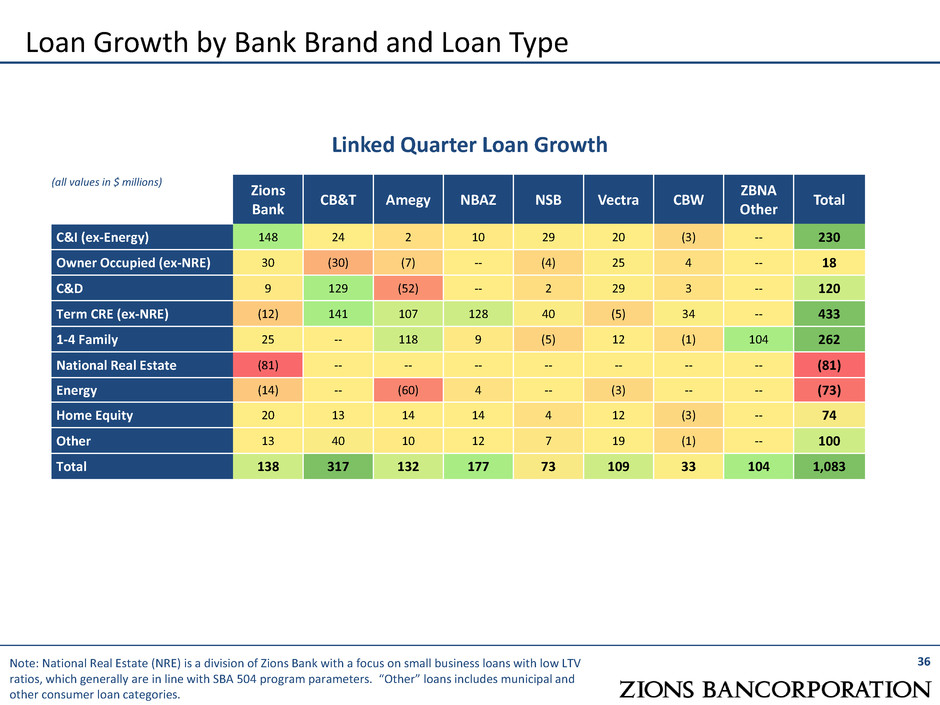

Loan Growth by Bank Brand and Loan Type

Note: National Real Estate (NRE) is a division of Zions Bank with a focus on small business loans with low LTV

ratios, which generally are in line with SBA 504 program parameters. “Other” loans includes municipal and

other consumer loan categories.

Linked Quarter Loan Growth

(all values in $ millions)

Zions

Bank

CB&T Amegy NBAZ NSB Vectra CBW

ZBNA

Other

Total

C&I (ex-Energy) 148 24 2 10 29 20 (3) -- 230

Owner Occupied (ex-NRE) 30 (30) (7) -- (4) 25 4 -- 18

C&D 9 129 (52) -- 2 29 3 -- 120

Term CRE (ex-NRE) (12) 141 107 128 40 (5) 34 -- 433

1-4 Family 25 -- 118 9 (5) 12 (1) 104 262

National Real Estate (81) -- -- -- -- -- -- -- (81)

Energy (14) -- (60) 4 -- (3) -- -- (73)

Home Equity 20 13 14 14 4 12 (3) -- 74

Other 13 40 10 12 7 19 (1) -- 100

Total 138 317 132 177 73 109 33 104 1,083

37 (1) In Q1 2016, to be consistent with industry practice, the Company reclassified its bankcard rewards expense

from “Other noninterest expense” to “Other service charges, commissions and fees”, offsetting this expense

against associated noninterest income. Prior period amounts have also been reclassified.

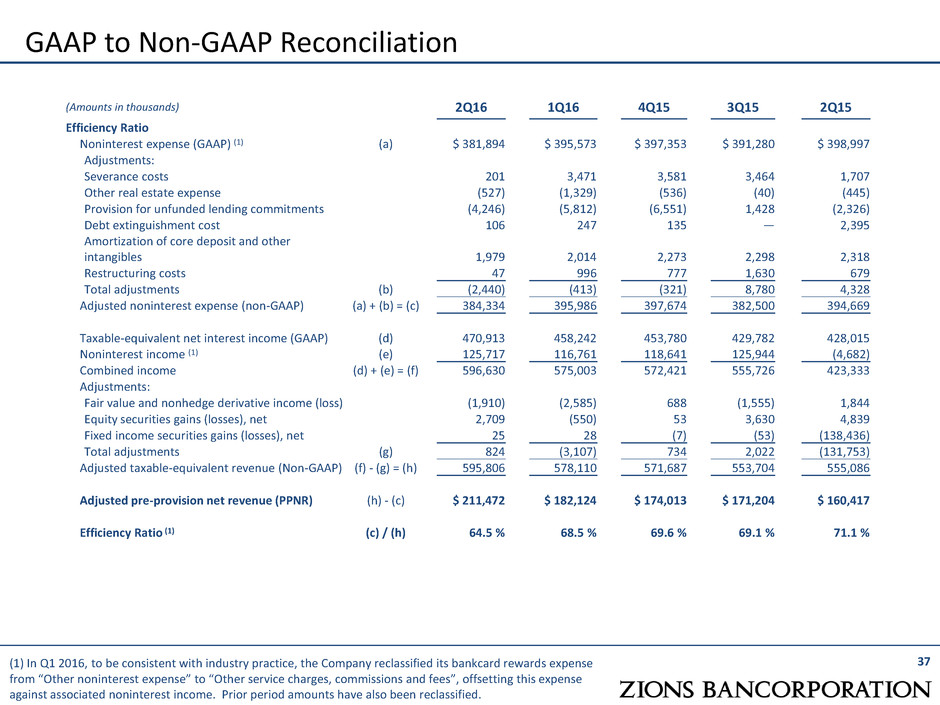

GAAP to Non-GAAP Reconciliation

(Amounts in thousands) 2Q16 1Q16 4Q15 3Q15 2Q15

Efficiency Ratio

Noninterest expense (GAAP) (1) (a) $ 381,894 $ 395,573 $ 397,353 $ 391,280 $ 398,997

Adjustments:

Severance costs 201 3,471 3,581 3,464 1,707

Other real estate expense (527) (1,329) (536) (40) (445)

Provision for unfunded lending commitments (4,246) (5,812) (6,551) 1,428 (2,326)

Debt extinguishment cost 106 247 135 — 2,395

Amortization of core deposit and other

intangibles 1,979 2,014 2,273 2,298 2,318

Restructuring costs 47 996 777 1,630 679

Total adjustments (b) (2,440) (413) (321) 8,780 4,328

Adjusted noninterest expense (non-GAAP) (a) + (b) = (c) 384,334 395,986 397,674 382,500 394,669

Taxable-equivalent net interest income (GAAP) (d) 470,913 458,242 453,780 429,782 428,015

Noninterest income (1) (e) 125,717 116,761 118,641 125,944 (4,682)

Combined income (d) + (e) = (f) 596,630 575,003 572,421 555,726 423,333

Adjustments:

Fair value and nonhedge derivative income (loss) (1,910) (2,585) 688 (1,555) 1,844

Equity securities gains (losses), net 2,709 (550) 53 3,630 4,839

Fixed income securities gains (losses), net 25 28 (7) (53) (138,436)

Total adjustments (g) 824 (3,107) 734 2,022 (131,753)

Adjusted taxable-equivalent revenue (Non-GAAP) (f) - (g) = (h) 595,806 578,110 571,687 553,704 555,086

Adjusted pre-provision net revenue (PPNR) (h) - (c) $ 211,472 $ 182,124 $ 174,013 $ 171,204 $ 160,417

Efficiency Ratio (1) (c) / (h) 64.5 % 68.5 % 69.6 % 69.1 % 71.1 %

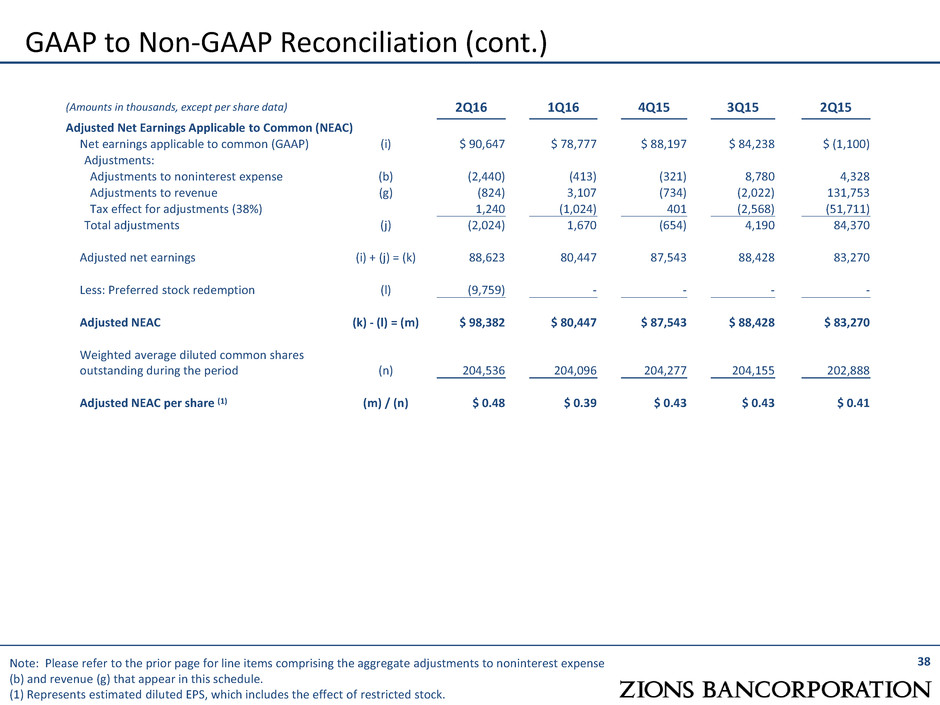

38 Note: Please refer to the prior page for line items comprising the aggregate adjustments to noninterest expense

(b) and revenue (g) that appear in this schedule.

(1) Represents estimated diluted EPS, which includes the effect of restricted stock.

GAAP to Non-GAAP Reconciliation (cont.)

(Amounts in thousands, except per share data) 2Q16 1Q16 4Q15 3Q15 2Q15

Adjusted Net Earnings Applicable to Common (NEAC)

Net earnings applicable to common (GAAP) (i) $ 90,647 $ 78,777 $ 88,197 $ 84,238 $ (1,100)

Adjustments:

Adjustments to noninterest expense (b) (2,440) (413) (321) 8,780 4,328

Adjustments to revenue (g) (824) 3,107 (734) (2,022) 131,753

Tax effect for adjustments (38%) 1,240 (1,024) 401 (2,568) (51,711)

Total adjustments (j) (2,024) 1,670 (654) 4,190 84,370

Adjusted net earnings (i) + (j) = (k) 88,623 80,447 87,543 88,428 83,270

Less: Preferred stock redemption (l) (9,759) - - - -

Adjusted NEAC (k) - (l) = (m) $ 98,382 $ 80,447 $ 87,543 $ 88,428 $ 83,270

Weighted average diluted common shares

outstanding during the period (n) 204,536 204,096 204,277 204,155 202,888

Adjusted NEAC per share (1) (m) / (n) $ 0.48 $ 0.39 $ 0.43 $ 0.43 $ 0.41