Attached files

| file | filename |

|---|---|

| EX-99.1 - CLIA WAIVERS (PROVIDED TO US BY ILS) - iHealthcare, Inc. | clia_waivers.htm |

| EX-10.2 - DISTRIBUTION AGREEMENT WITH ILS - iHealthcare, Inc. | ilsagreement.htm |

| EX-10.1 - MERGER AGREEMENT - iHealthcare, Inc. | exhibit_mergeragreement.htm |

| EX-3.2 - BY-LAWS - iHealthcare, Inc. | bylaws.htm |

| EX-3.1 - RESTATED CERTIFICATE OF INCORPORATION - iHealthcare, Inc. | restatedarticles.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

Amendment No. 4

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report: September 8, 2016

Ihealthcare, Inc.

(Name of Small Business Issuer in its charter)

| Delaware | 000-55378 | 47-3002847 |

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

141 NE 3rd Avenue, Miami, FL

(Address of Principal Executive Offices)

Telephone: 305-751-2327

(Registrant's telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

-1-

FORWARD LOOKING STATEMENTS

This Current Report on Form 8-K contains forward-looking statements which involve risks and uncertainties, principally in the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis.” All statements other than statements of historical fact contained in this Current Report on Form 8-K, including statements regarding future events, our future financial performance, business strategy and plans and objectives of management for future operations, are forward-looking statements. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” or “should,” or the negative of these terms or other comparable terminology. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks outlined under “Risk Factors” or elsewhere in this Current Report on Form 8-K, which may cause our or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements, except as expressly required by law.

You should not place undue reliance on any forward-looking statement, each of which applies only as of the date of this Current Report on Form 8-K. Before you invest in our securities, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” and elsewhere in this Current Report on Form 8-K could negatively affect our business, operating results, financial condition and stock price. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this Current Report on Form 8-K to conform our statements to actual results or changed expectations.

-2-

-3-

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

Pursuant to the Agreement and Plan of Merger (“Agreement”) dated April 22, 2016, by and between, Ihealthcare, Inc. a Florida Corporation (“Ihealthcare, Inc.-Florida”), and Opulent Acquisition, Inc., a Delaware Corporation, (“Ihealthcare, Inc.-Delaware” or the “Surviving Corporation), jointly the (“Constituent Corporations”) effective as of April 22, 2016, Ihealthcare, Inc.-Florida merged with and into Ihealthcare, Inc.-Delaware with Ihealthcare, Inc.-Delaware continuing as the Surviving Corporation.

The board of directors of the Constituent Corporations have declared the Merger Agreement advisable, fair to and in the best interests of the Constituent Corporations and have approved the Merger. The Merger Agreement was duly approved by the requisite vote of the majority shareholders of the Constituent Corporations by written consent in lieu of a shareholder meeting pursuant to Delaware law, (DGCL). A copy of the Merger Agreement is attached to this report as Exhibit 10.1 and is incorporated herein as reference. The description of the transaction contemplated by such Agreement set forth herein does not purport to be complete and is qualified in its entirety by reference to the full text of Exhibit 10.1 filed herewith.

Immediately before the effective time of the Merger each share of common stock, par value $0.0001 per share of Ihealthcare-Delaware held by Ihealthcare-Florida was cancelled. Each share issued and outstanding of Ihelathcare-Florida held by the shareholders was converted into one hundred validly issued, fully paid, and nonassessable shares of common stock, par value $0.0001 per share of Ihealthcare-Delaware.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

Immediately prior to the Merger, the Company was a “shell company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Item 2.01(f) of Form 8-K states that if the registrant was a “shell” company, such as the Company was immediately before the merger, then the registrant must disclose on Current Report on Form 8-K the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, this report includes all of the information that would be included in a Form 10.

As of the effective date of the Merger, we the Company, Ihealthcare, Inc., “FKA Opulent Acquisition” have adopted the business plan of what was Ihealthcare, Inc.-Florida, which is the sale of goods in the healthcare sector. We currently have a distribution agreement with Innovate Laboratory Solutions, also known as “ILS” to supply us a product known as the “UDT Cup” (also herein known as Multi-Panel [16] urinalysis cup or Drug of Abuse “DOA” Cup). ILS has agreed to provide us the right to purchase the UDT Cup at special pricing in certain quantities. ILS is the developer of the UDT Cup and exclusive global supplier of the UDT Cup, however they have the UDT Cup manufactured by a third party manufacturer of which they have not and will not disclose to us due to confidentiality. ILS does however, have the authority and right to control who manufactures the UDT Cup. We intend to begin conducting sales of the product in the very near future. Our plans relating to this can be found below in the section titled, “Business.”

-4-

FORM 10 DISCLOSURE

As disclosed elsewhere in this report, the Company completed a merger which caused the Company to cease being defined as a “shell company” under the Securities Act of 1933, as amended. Item 2.01(f) of Form 8-K requires that if a registrant was a shell company, immediately before the transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10. Please note that the information provided below relates to the combined enterprises after the completion of the merger.

Corporate History

The Company was originally incorporated with the name Opulent Acquisition, Inc., under the laws of the State of Delaware on November 25, 2014 with an objective to acquire, or merge with, an operating business.

On January 14, 2016 Mr. Jeffrey DeNunzio, the sole shareholder of the Company transferred to Ihealthcare, Inc., a Florida Company, 20,000,000 shares of our common stock which represented all of our issued and outstanding shares at the time of transfer, in consideration of $34,900. The transfer was the result of the sale of the Company to Ihealthcare, Inc., the Florida Company.

On January 14, 2016 Ihealthcare, Inc., a Florida Company, became the controlling shareholder of Opulent Acquisition, Inc. At the time of the sale of Opulent Acquisition, Inc. Mr. Mijares owned 62.5% and Mr. Bingaman owned 37.5% of the issued and outstanding shares of Ihealthcare, Inc., the Florida Company.

On January 14, 2016, Mr. Jeffrey DeNunzio resigned as Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer and Director.

On January 14, 2016, Mr. Noel Mijares was appointed as Chairman of the Board of Directors, Chief Executive Officer, and President.

On January 14, 2016, Mr. David A. Bingaman was appointed as Chief Operating Officer, Vice President, and Secretary.

On April 22, 2016 we, Opulent Acquisition, Inc. (“Ihealthcare, Inc.-Delaware”) entered into and consummated a merger with Ihealthcare, Inc., a Florida Company (“Ihealthcare, Inc.-Florida”). Ihealthcare, Inc.-Delaware is the Surviving Corporation as result of the merger. The officers and directors of Opulent Acquisition, Inc., now known as Ihealthcare, Inc., remain the same and unchanged. Our officers and directors continue to serve their respective positions with the Company.

On April 22, 2016, the Company filed with the Delaware Secretary of State an amendment to the Company’s certificate of incorporation, changing its name to Ihealthcare, Inc.

Note: Mr. Jeffrey DeNunzio currently has no affiliation with the Company with the exception of serving as one of the consultants of ETN services, LLC of which we currently have an agreement with, to provide us follow up services to in regards to the preparation and filing of this Form 8-K, originally filed April 22, 2016, and the S-1 Registration Statement filed May 19, 2016.

-5-

Description of Business

We, Ihealthcare, Inc. are a Company that intends to sell and distribute products in the healthcare sector. We currently hold a distribution agreement with Innovate Laboratory Solutions, also known as “ILS” to supply us a product known as the “UDT Cup” (also herein known as Multi-Panel [16] urinalysis cup or Drug of Abuse “DOA” Cup). ILS has agreed to provide us the right to purchase the UDT Cup at special pricing in certain quantities. ILS is the developer of the UDT Cup and exclusive global supplier of the UDT Cup, however they have the UDT Cup manufactured by a third party manufacturer of which they have not and will not disclose to us due to confidentiality. ILS does however, have the authority and right to control who manufactures the UDT Cup.

We entered into and consummated the above agreement with ILS to sell us the UDT Cup at certain price points beginning on February 18, 2016. The term of the agreement is for a span of three years. We may buy the UDT Cup in varying quantities from ILS, provided they have enough inventory to fill our order, otherwise we will be limited to whatever they may have available at that time of order.

If both parties in writing agree to it they can terminate the above mentioned agreement. Our agreement with ILS also has a section titled “Termination for Cause.” This section states that:

“a. Either party will have the right to terminate the Agreement at any time if the other party is in breach of any material term, and which such party fails to cure within 10 calendar day after receiving written notice of the breach and the party’s intention to terminate.

b. ILS shall have the right to terminate this Agreement if Distributor:

1. becomes insolvent;

2. discontinues its business; or

3. becomes the subject of any voluntary or involuntary proceeding in bankruptcy, liquidation, dissolution, receivership, attachment or composition for the benefit of creditors. Such termination will become effective upon the non-terminating party’s receipt of a notice of termination at any time after the specified event.

Such termination will become effective upon the non-terminating party’s receipt of a notice of termination at any time after the specified event.”

As of April 22, 2016 no monies were paid or received under the agreement with ILS, including any up front or execution payments.

Per our agreement with ILS there are no specific laws which we have expressly agreed to abide by. However, in general we have agreed to comply with all Federal and State healthcare laws, rules and regulations, including, but not limited to, Stark, Anti-Kickback, False Claims Act, etc. Non-compliance of any rule, regulation or law, including the aforementioned, could in some way cause us to become the party of a civil or criminal suit. Generally speaking when one is a party in any civil or criminal suit it may negatively affect that party’s image and may also cause them financial harm. If this were to happen to us we may have to curtail operations, or allocate funds towards defending ourselves in any such case. If we were found guilty of violating any rule, regulation, or law our operations may be terminated, suspended, or harmed in some capacity.

The UDT Cup’s intended purpose is for drug screening.

Mission and Vision:

At Ihealthcare, Inc. we are dedicated to reducing costs and improving the quality of medical care through innovative products and services in specialized markets that are currently being underserved by our competition. Our primary focus is to establish sustainable market penetration, one product at a time. Simultaneously, we seek to continue our current efforts to add additional products and/or services to our Company. When these new products and services are available we hope to have already acquired a dedicated customer base who can also benefit from our future products and services. At present, we have identified a number of complementary products and services which we will begin exploring as methods to support our plans to increase revenue and profitability.

Industry Overview:

The drug screening market-size is expected to grow from $4 billion in 2014 to $6.3 billion by 2019, at a CAGR (Compound Annual Growth Rate) of 9.5%. Major factors driving the growth of this market include higher usage of alcohol, prescribed drugs, illicit drugs, and a growing aging population that leads to increased use of alcohol and prescription drugs. Funding by the U.S. Federal Governments for drug testing, enactment of stringent laws in developed countries, and growing awareness for drug testing in developing nations, has increased the awareness surrounding testing patients on a regular basis. In addition, emerging economies such as India, China, and Brazil present an array of opportunities for this market.

Currently, North America dominates the drug screening market, with the U.S. accounting for a major market share. However, the Asia-Pacific region is poised to grow at the highest CAGR during the forecast period. We believe there to be great growth potential in the Asian market due to development of advanced drug and alcohol screening devices in Japan, rising awareness regarding the importance of drug and alcohol screening, and increasing disposable income levels in various countries in Asia.

The North American laboratory, as well as onsite testing market, has increased by more than 5.0% CAGR between 2011 and 2014. With past technologies it was necessary to retest a positive lab test, due to potential inaccuracies, which resulted in a higher cost. New technology enables employers to retest positive results inexpensively, and immediately, with the same, and new, samples from the subject, thus reducing the overall cost.

-6-

Current Product(s):

Ihealthcare, Inc. has acquired the distribution rights and special pricing to the ILS “UDT Cup” Multi-Panel [16] urinalysis cup through our supplier Innovative Laboratory Solutions. The UDT Cup has been specifically designed to meet the latest market needs, needs which have been overlooked by the competition, at substantially lower costs.

The UDT Cup has the following features:

| · | Tests 16 configurable panels simultaneously; |

| · | The configuration can be customized to suit customers’ testing needs; |

| · | 99% accuracy; |

| · | One step lateral flow process; |

| · | Round or Square form factor – ease of scanning results; |

| · | Wider test strips for ease in reading results; |

| · | Tight cap seal which serves to reduce erroneous results due to leakage; |

| · | Test strip seal prevents cross contamination during inversion; |

| · | Design prevents over filling; |

| · | Contains more urine volume for repeat tests as needed; |

| · | Results produced in one minute; |

| · | Built in temperature strip; |

| · | Female user friendly; and |

| · | Integrated Adulteration Parameters with visual integrity check for: pH, specific gravity, creatinine, nitrite, oxidant, blutaraldyhyde, bleach and pyridinium chlorchromate. |

| · | FDA 510 Cleared |

| · | CLIA Waived |

Lateral Flow Process Expanded Definition

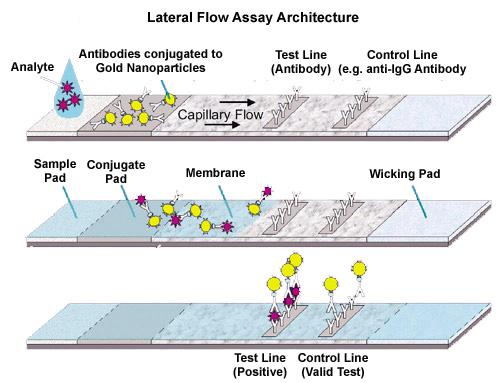

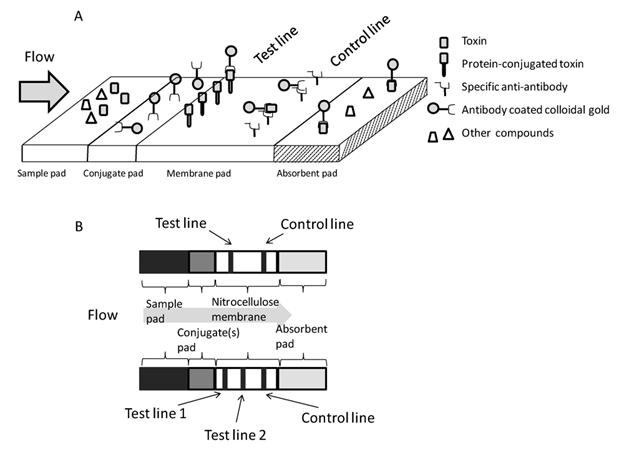

Lateral flow tests also known as lateral flow immunochromatographic assays, are simple devices intended to detect the presence (or absence) of a target analyte in sample (matrix) without the need for specialized and costly equipment Typically, these tests are used for medical diagnostics either for home testing, point of care testing, or laboratory use. In this case, drugs of abuse testing.

The technology is based on a series of capillary beds, such as pieces of porous paper, microstructured polymer, or sintered polymer. Each of these elements has the capacity to transport fluid (e.g., urine) spontaneously. The first element (the sample pad) acts as a sponge and holds an excess of sample fluid. Once soaked, the fluid migrates to the second element (conjugate pad) in which the manufacturer has stored the so-called conjugate, a dried format of bio-active particles (see below) in a salt-sugar matrix that contains everything to guarantee an optimized chemical reaction between the target molecule (e.g., an antigen) and its chemical partner (e.g., antibody) that has been immobilized on the particle's surface.

While the sample fluid dissolves the salt-sugar matrix, it also dissolves the particles and in one combined transport action the sample and conjugate mix while flowing through the porous structure. In this way, the analyte binds to the particles while migrating further through the third capillary bed. This material has one or more areas (often called stripes) where a third molecule has been immobilized by the manufacturer. By the time the sample-conjugate mix reaches these strips, analyte has been bound on the particle and the third 'capture' molecule binds the complex. After a while, when more and more fluid has passed the stripes, particles accumulate and the stripe-area changes color.

Typically there are at least two stripes: one (the control) that captures any particle and thereby shows that reaction conditions and technology worked fine, the second contains a specific capture molecule and only captures those particles onto which an analyte molecule has been immobilized. After passing these reaction zones the fluid enters the final porous material, the wick, that simply acts as a waste container. Lateral flow then means the combination of these proprietary processes that scientifically allow/create the draw or flow of the sample laterally across these membranes for analysis.

Additional Feature Definitions

FDA Cleared: Cleared medical devices: These medical devices are ones that the FDA has determined to be substantially equivalent to another legally marketed device. A pre-market notification, referred to as a 510(k), must be submitted to FDA for clearance. A 510(k) is most often submitted by the medical device manufacturer.

CLIA Waived: Testing on human specimens for health assessment or the diagnosis, prevention, or treatment of disease are regulated under the Clinical Laboratory Improvement Amendments of 1988 (CLIA). As defined by CLIA, waived tests are simple tests with a low risk for an incorrect result. They include certain tests listed in the CLIA regulations, tests cleared by the FDA for home use, and tests approved for waiver by the FDA using the CLIA criteria.

The UDT Cup boasts 16 Drug Screening Panels which include: Amphetamines AMP; Barbiturates BAR; Buprenorphine BUP; Benzodiazepines BZO; Cocaine COC; Methamphetamines [2] mAMP & MDMA; Methadone MTD; Opiates OPI; Oxycodone OXY; Phencyclidine PCP; Marijuana THC; and Tricyclic Antidepressants TCA. Tests for Morphine MOR; Ketamine KET and Propoxyphene PPX or others can be added. Pregnancy tests also available.

Shipping

ILS will be solely responsible for the shipment of all UDT Cups, with their primary shipping location based in Miami, Florida. Shipping will be paid for solely by the consumer and if there are any problems or damage resulting from the shipment of UDT Cups then the liability for replacement products will fall on ILS. In the event that a product is damaged Ihealthcare, Inc. will notify ILS and return the shipment back to the Miami warehouse, whereupon it will be replaced and re-shipped to the consumer at no additional shipping cost to the customer.

The UDT cup that we intend to sell may be purchased by any individual.

Uses and other information regarding the UDT Cup:

The UDT Cup is intended for detecting the presence of drugs in urine. Any situation it may be necessary to screen an individual for drug use would be an appropriate time to utilize the UDT Cup. Examples include but are not limited to screening potential employees, current employees, use in drug treatment centers or medical clinics.

Potential purchasers of the UDT Cup can be anyone however, most notably we anticipate it will be primarily medical clinics, hospitals, drug rehabilitation centers, Employers, Physician groups, transportation companies (used to test drivers for drug use) or wholesalers who will resell the product at a higher cost to make a profit. We have no intentions of limiting who can buy the UDT Cup.

The UDT Cup works by having the individual being tested.

The UDT cup is comprised of two elements, the test cup and dipcard.

Rapid Single/Multi-drug test Cup and Rapid Single/Multi-drug

test Dipcard are lateral flow chromatographic immunoassays designed to qualitatively detect the presence of drugs and drug metabolites

in human urine and are classified under the following product code, classification, regulatory section and panel;

Product Code; Classification; Regulatory Section; Panel

DKZ Class II 862.3100 Amphetamine test system

Toxicology (91)

DJC Class II 862.3610 Methamphetamine test system Toxicology

(91)

DIO Class II 21 CFR 862.3250 Cocaine test system

Toxicology (91)

DNK Class II 21 CFR 862.3640 Morphine test system

Toxicology (91)

LDJ Class II 21 CFR 3870 Cannabinoid test system

Toxicology (91)

DIS Class II 21 CFR 862.3150 Barbiturate test system

Toxicology (91)

JXM Class II 21 CFR 862.3170 Benzodiazepine test system Toxicology (91)

DJR Class II 21 CFR 862.3620 Methadone test system Toxicology

(91)

DJG Class II 21 CFR 862.3650 Opiate test system

Toxicology (91)

LCM Unclassified Enzyme immunoassay, Phencyclidine test system Toxicology (91)

The class to which your device is assigned determines the type of premarketing submission/application required for FDA clearance to market. If your device is classified as Class I or II, and if it is not exempt, a 510k will be required for marketing.

A company that intends to market in the US a Class I, II, or III medical device intended for human use, for which a Premarket Approval (PMA) is not required, must submit a 510(k) to the FDA unless the device is exempt from the 510(k) requirements of the Federal Food, Drug, and Cosmetic Act (the Act) and does not exceed the limitations of exemptions for each of the device classification regulations (Section .9 of 21 CFR Parts 862 through 892, e.g., 21 CFR 862.9, 21 CFR 864.9, etc.). Under section 510(k) of the FD&C Act, a manufacturer must submit a 510(k) to FDA at least 90 days before introducing, or delivering for introduction, a device into interstate commerce for commercial distribution so the Agency can determine whether or not the device meets the criteria for market clearance (Sections 510(k) and (n) of the FD&C Act (21 U.S.C. §§ 360(k) & (n))). The Agency bases its decision on whether the device is substantially equivalent (SE) to a legally marketed (predicate) device (Section 513(i) of the FD&C Act (21 U.S.C. § 360c(i))). The device cannot be commercialized until FDA issues an order (510(k) clearance) stating that the device has been determined to be SE (Section 513(f)(1) of the FD&C Act (21 U.S.C. § 360c(f)(1)))

Currently, we do not know the identity of the manufacturer of the UDT Cup. Our supplier, Innovative Laboratory Solutions is the only party we are aware of who knows the identity of the manufacturer of the cup. We rely in totality that the manufacturer, of which we do not know the identity of, is in compliance with the 510(k) requirements for the UDT cup.

ILS has informed us that the UDT cup is in compliance with the above and the 510(k) clearance date of the UDT Cup is December 19, 2014.

A

510(k) requires demonstration of substantial equivalence to another legally U.S. marketed device. Substantial equivalence means

that the new device is at least as safe and effective as the predicate. As mentioned previously the ILS Cup is a device classified

as a Rapid Single/Multi-drug test Cup and Rapid Single/Multi-drug Test Dipcard.

A device is substantially equivalent if, in comparison

to a predicate it:

a. has the same intended use as the predicate; and

b. has the same technological characteristics as the

predicate; or

c. has the same intended use as the predicate; and

d. has different technological characteristics and the

information submitted to FDA;

e. does not raise new questions of safety and effectiveness; and

f. demonstrates that the device is at least as safe

and effective as the legally marketed device.

Medical device manufacturers involved in the distribution of devices must follow certain requirements and regulations once devices are on the market. These include such things as tracking systems, reporting of device malfunctions, serious injuries or deaths, and registering the establishments where devices are produced or distributed. Postmarket requirements also include postmarket surveillance studies required under section 522 of the act as well as post-approval studies required at the time of approval of a premarket approval (PMA), humanitarian device exemption (HDE), or product development protocol (PDP) application. In accordance with Section 522 of the Federal Food, Drug and Cosmetic Act postmarket surveillance of a class II or class III device the UDT Cup may be required if the FDA. Should this occur the FDA will send a letter requiring it. For more information regarding such an FDA request please see here: https://www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfCFR/CFRSearch.cfm?fr=822.5.

The Code of Federal Regulations, Title 21, Part 201 encompasses certain requirements that must be on the labeling of any medical product which includes, but is not limited to, the name and place of business of the manufacturer, packer, or distributor, the directions for use, expiration date, and active ingredients in the product. We rely in totality on ILS, our supplier of the UDT Cup, to adhere to the appropriate product labeling so that the product is within the guidelines of Title 21, Part 201.

Our supplier of the UDT Cup, ILS has made previous sales of the UDT Cup to customers in the past, primarily in Florida. The customers comprised of a combination of health centers, rehabilitation clinics, and private parties.

We are only a distributor (reseller) of the UDT Cup. As a distributor of the UDT Cup we are not required to have FDA approvals due to the CLIA waivers that are present for each panel of the UDT Cup.

Our supplier Innovative Laboratory Solutions, however, has obtained the following in order to act as a global supplier, importer, and exporter of the UDT Cup (Drug Of Abuse Cup):

SBD

#155350

FDA User Fee Organization # 394392

Approved 04/03/2015 under the (MDUFA) Medical Device

User Fee Act

Competition:

While we plan to offer what we feel to be the most efficient and cost effective drug screening product on the market today, we do face intense competition from other Companies who offer similar products.

Competing one step products (meaning one device with multiple drug screening panels) include the following: DrugConfirm Advanced [10 panel]; AmeriCup [12 panel]; ECO II [10 panel]; CLIA Screen [12 panel]; T-Cup [10 panel]; EZ Split Key Cup [10 panel]; CentralCheck [11 panel]; NxStep [12 panel]; and others.

We believe the UDT Cup we plan to offer to customers differs from most other drug screening products on the market and may serve as a better alternative to many such products due to the fact that it can provide test results in a lesser amount of time, one minute versus four to ten minutes for most competing products. Additionally, the UDT Cup has an internal seal that may prevent cross contamination of the urine sample when shaken or jostled during testing. This is a feature that most other competing drug screening kits do not have. The UDT Cup’s design is also designed in a way that can make it more suitable for use among both males and females. This however, is our own opinion. The UDT Cup also comes standard with a temperature strip included as part of the kit, something most other drug screening kits offer but only as an “add on feature” for an additional cost.

Launch and Growth Strategy:

We at Ihealthcare, Inc. intend to utilize web-based advertising in order to reach our intended market. We are currently in the exploration stages of determining which internet media outlet will be preferable, but we have plans to consider, and perhaps implement, marketing campaigns via social media networks such as Facebook, Twitter, etc., online marketing platforms, news related websites, industry related websites, etc. We will also be listing our products on Amazon in order to take advantage of the worldwide presence and reach of Amazon in order to reach an even greater audience and sell our products to as many consumers as possible.

In addition to our online presence, we also are in the planning stages of a multimedia campaign which may include, but may not strictly be limited to, telemarketing, print media, making our presence known at trade shows and television advertisements. The exact details of our multimedia plan are currently in the exploration and planning stages.

Our growth strategy is to spread awareness of our products, via the internet and potentially other sources, all cross the country, beginning in the south east, then moving north and eventually west. When, and if, we have developed a market for our products within the United States we will then evaluate the possibility of expanding to other countries throughout the world.

At this time we do not have not yet identified a definitive timeline as to the length of time it will take us to initialize or carry out the above growth strategy. We are currently investigating the costs that we will incur in carrying out the above endeavors to begin generating sales from our current product.

Before conducting physical sales of the UDT Cup(s) we believe we need to develop a more concrete marketing plan so that we can sell the goods on a large scale (to more than one consumer from time to time). We also believe we need to hire additional staff of which we have begun to do so. To date we have hired what we refer to as an “SVP of Operations.” This individual is responsible for formulating our marketing plan moving forward, amending it as seen fit, contacting and facilitating relationships with potential wholesalers and overseeing any other sales employees we currently have or may hire in the future. Currently we have two sales team members that are commission based. Of course we have not yet conducted any sales so these commissions will be based upon future performance (sales).

Properties:

Our office space is located at 141 NE 3rd Ave, 9th Floor, Miami, FL 33132. This space is provided to the Company rent free by Noel Mijares, who leases the office space on his personal behalf. Besides the aforementioned we do not have any other facilities or properties at which we operate. We believe this space is suitable to carry out current and future operations.

Employees:

Currently, we have a total of three full time employees, two of which are our officers and directors, collectively Noel Mijares, and David A. Bingaman. The third is our recent hire for the position of “SVP of Operations.” As mentioned above on this page the SVP of Operations is responsible for formulating our marketing plan moving forward, amending it as seen fit, contacting and facilitating relationships with potential wholesalers and overseeing any other sales employees we currently have or may hire in the future. Currently we have two sales team members that are commission based employees that work part time at this moment. Of course we have not yet conducted any sales so these commission will be based upon future performance (sales). For the time being we are familiarizing these employees with the product and having them work alongside our SVP of Operations. Besides all of the above we have no other employees of any kind.

Our full time employees including our officers and directors, currently devote and intend to continue to devote 40 hours per week towards the Company. In the future we intend to increase our sales staff however, the number of employees we would hire would depend on our current level of revenue, and cash available to do so. We plan to hire these employees on a need be basis that is currently unidentified.

-7-

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

We will require additional funds in the future to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

We will need to raise additional funds through public or private debt or equity sales in order to fund our future. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current business plan and develop our product line, and as a result, could require us to diminish or suspend our operations and possibly cease our existence.

Even if we are successful in raising capital in the future we will likely need to raise additional capital to continue and/or expand our operations. If we do not raise the additional capital, the value of any investment in our Company may become worthless. In the event we do not raise additional capital from conventional sources, it is likely that we may need to scale back or curtail implementing our business plan.

As of our most recent quarter end we had no cash or cash equivalents. As a result of having no cash to fund our business we have and continue to be exclusively reliant upon our Officers and Directors to fund our operations. We believe our officers and directors will continue to fund our operations for a period of twelve months although there is no guarantee that they will do so.

We have not generated any revenues to date since our inception. Our independent registered public accounting firm, MaloneBailey, LLP has issued a going concern opinion in their audit report in regards to our operations.

In their audit report our PCAOB auditor MaloneBailey, LLP issued a going concern opinion in regards to our operations. The going concern was issued due to the fact we have suffered a net loss and do not have a source of revenue sufficient to cover our operations which raises substantial doubt about our ability to continue. The going concern issued by our independent auditor may have a negative impact on the value of our common stock, although the extent of this negative impact is not known at this time. Additionally, we may have a more difficult time obtaining financing as a result of the going concern.

We are a start-up stage company. Our ability to continue as a going concern is dependent upon our ability to commence a commercially viable operation and to achieve profitability. Since our inception we have not generated any revenues, and currently have only limited operations, as we are presently in the planning stage of our business development as an exploration stage company. These factors raise substantial doubt about our ability to continue as a going concern. We may not be able to generate revenues in the future and as a result the value of our common stock may become worthless. There are no assurances that we will be successful in raising additional capita l or successfully developing and commercializing our products and becoming profitable.

We hold the distribution rights to the UDT Cup, but we rely on the services of a third party supplier (ILS) in order to supply the products we offer for sale. ILS has the right to control who manufacturers the product, the UDT Cup, of which we plan to offer for resale.

Due to the fact that we rely upon ILS in order to supply the UDT Cups we offer for sale we face inherent risks due to the fact that we do not hold the manufacturing rights to the product. If there is a disruption in the supply of UDT Cups caused by any number of situations which could arise with ILS, then we may have difficulty successfully implementing our business plan or meeting the demand for our products when we have commenced operations. These disruptions could include, but are not strictly limited to, shipping difficulties or setbacks, price increases which would require renegotiation of terms, manufacturing difficulties, etc. Additionally, should ISL go out of business then we will be forced to find an alternative product for sale, and an alternative manufacturer, which could delay our business operations substantially or force us to cease operations entirely.

ILS will be solely responsible for the shipping of the UDT Cups.

We will not be responsible for shipping the UDT Cups to any consumers. ILS will be solely responsible for shipping the UDT Cups and any disruptions or hold ups in relation to the shipping of the UDT Cups could cause a disruption that will negatively impact our operations. Consumers may lose faith in our ability to have UDT Cups reliably shipped through situations that are beyond our control.

Due to the fact that we do not have a concrete advertising plan we may not see the sales we anticipate if our advertising plan is not as effective as we plan.

We are in the planning stages of our advertising strategy, and as such we do not have a definitive plan for how we will conduct our marketing efforts. We plan to utilize internet media outlets, and social media, but our plans need to be further developed before we can begin implementing them fully. As such, we may see fewer sales than we anticipate if our marketing plan, once implemented, is not as effective as we plan.

We cannot identify the manufacturer of the UDT Cup.

Due to our agreement with ILS, whereby they provide and will continue to provide us with UDT Cups, they have withheld the name of the manufacturer of the UDT Cup. ILS acts as the distributor who supplies us with physical inventory. Due to the fact that we have no means through which we can identify the manufacturer there are inherent related risks. We rely on ILS to verify that the manufacturer complies with applicable rules and regulations pertaining to a manufacturer of a medical device and we can not directly verify this ourselves. While we do not believe we are subject to any potential product liability, because we believe that it will be either the manufacturer or ILS who will be responsible for product liability, we cannot accurately assess the manufacturer’s financial ability to compensate us for any potential liabilities related to the product.

-8-

Our growth strategy is untested, unproven, and as of this point in time not fully developed.

We intend to grow our business starting in the South Eastern States of the United States, and from there spread outward into the North and eventually westward until we spread throughout the entire Country, at which point we will begin exploring international options. However, our exact strategy for how we will grow in this manner is currently in development, alongside our marketing plan, and we can offer no assurances that we will be effective in growing at the rate we anticipate, which could result in lower profit margins, if any.

We have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays that we may encounter because we are a small developing company. As a result, we may not be profitable and we may not be able to generate sufficient revenue to develop as we have planned.

We have only recently adopted a bona fide business plan. We have limited financial resources and limited assets. The likelihood of our success must be considered in light of the expenses and difficulties in development of a customer base nationally, attaining and retaining customers and obtaining financing to meet the needs of our plan of operations. Since we have a limited operating history we may not be profitable and we may not be able to generate sufficient revenues to meet our expenses and support our anticipated activities.

We are an early stage company with an unproven business strategy and may never be able to fully implement our business plan or achieve profitability.

We are at an early stage of development of our operations as a company. We have only recently started to operate business activities, and have not generated revenue from such operations. A commitment of substantial resources to conduct time-consuming research in many respects will be required if we are to complete the development of our company into one that is more profitable. There can be no assurance that we will be able to fully implement our business plan at reasonable costs or successfully operate. We expect it will take several years to implement our business plan fully, if at all.

Our limited operating history makes it difficult for us to accurately forecast net sales and appropriately plan our expenses.

We have a very limited operating history. As a result, it is difficult to accurately forecast our net sales and plan our operating expenses. This inability could cause our net income, if there is any income at all, in a given quarter to be lower than expected.

We operate in a highly competitive environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash flows and prospects could be materially adversely affected.

We operate in a highly competitive environment. Our competition includes all other companies that are in the business of the drug screening market. A highly competitive environment could materially adversely affect our business, financial condition, results of operations, cash flows and prospects.

Because we are small and do not have much capital, our marketing campaign may not be enough to attract sufficient customers to operate profitably. If we do not make a profit, we will suspend or cease operations.

Due to the fact we are small and do not have much capital, we must limit our marketing activities and may not be able to make our product known to potential customers. Because we will be limiting our marketing activities, we may not be able to attract enough customers to operate profitably. If we cannot operate profitably, we may have to suspend or cease operations.

We expect our quarterly financial results to fluctuate.

We expect our net sales and operating results to vary significantly from quarter to quarter due to a number of factors, including unexpected changes in:

• Demand for our drug screening product(s);

• Our ability to obtain new, and retain existing, customers;

• Our ability to manage our services;

• General economic conditions;

• Advertising and other marketing costs.

As a result of the variability of these and other factors, our operating results in future quarters may be below the expectations of public market analysts and investors.

-9-

Our future success is dependent on our implementation of our business plan. We have many significant steps still to take.

Our success will depend in large part in our success in achieving several important steps in the implementation of our business plan, including the following: acquiring business information, development of a customer base, development of relationships with consumers, and management of business process. If we are not successful, we will not be able to fully implement or expand our business plan.

Our growth will place significant strains on our resources.

The Company is currently in the exploration stage, with only limited operations, and has not generated any revenue since inception. The Company's growth, if any, is expected to place a significant strain on the Company's managerial, operational and financial resources. Moving forward, the Company's systems, procedures or controls may not be adequate to support the Company's operations and/or the Company may be unable to achieve the rapid execution necessary to successfully implement its business plan. If the Company is unable to manage growth effectively, the Company's business, results of operations and financial condition will be adversely affected.

Our future success is dependent, in part, on the performance and continued services of Noel Mijares, our Chief Executive Officer, President and Director, as well as David A. Bingaman our Chief Operating Officer, Vice President, and Secretary. Without their continued service, we may be forced to interrupt or eventually cease our operations.

We are presently dependent to a great extent upon the experience, abilities and continued services of both Noel Mijares and David A. Bingaman. The loss of either of their services would delay our business operations substantially.

Our President and CEO, Noel Mijares is also the President and CEO of Pharma Health Corp., Unisources Discovery and The Subpoena Company. Mr. Mijares’s other business interests may result in him being unable to devote enough hours to the Company to further advance operations.

Our President and CEO, Noel Mijares is also the President and CEO of Pharma Health Corp., Unisources Discovery and The Subpoena Company. Mr. Mijares’s other business interests may result in him being unable to devote enough hours to the Company to further advance operations. Despite Mr. Noel Mijares’s other business ventures he believes he is still able to devote 40 hours per week to the Company’s operations however, there is the possibility that he may not be able to do so. If this were to occur it could negatively impact our operations and could cause our results of operations to suffer as a result.

Due to Article IX of our Certificate of Incorporation investors may have difficulty bringing any action against us in a judicial forum.

Article IX of our Certificate of Incorporation states that “unless we, the “Company” also referred to herein as “the Corporation” consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall, to the fullest extent permitted by law, be the sole and exclusive forum for (1) any derivative action or proceeding brought on behalf of the corporation, (2) any action asserting a claim of breach of a fiduciary duty owed by, or other wrongdoing by, any director, officer, employee or agent of the corporation to the corporation or the corporation’s stockholders, (3) any action asserting a claim arising pursuant to any provision of the General Corporation Law or the corporation’s Restated Certificate of Incorporation or Bylaws, (4) any action to interpret, apply, enforce or determine the validity of the corporation’s Restated Certificate of Incorporation or Bylaws or (5) any action asserting a claim governed by the internal affairs doctrine, in each such case subject to said Court of Chancery having personal jurisdiction over the indispensable parties named as defendants therein. Any person or entity purchasing or otherwise acquiring any interest in shares of capital stock of the corporation shall be deemed to have notice of and consented to the provisions of this ARTICLE IX. Due to this provision, if a shareholder does not reside in Delaware then they may face difficulty bringing any action against us in a judicial forum due to the fact that all such claims must be made in the Court of Chancery of the State of Delaware. In addition to the potential inconvenience of physical location, shareholders may find this choice of forum inconvenient for any number of reasons which are subjective to the shareholder(s). This exclusive forum provision may limit a shareholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes. This may discourage lawsuits with respect to such claims against the company and its officers, directors or other employees.

The recently enacted JOBS Act will allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

-10-

MANAGEMENT’S DISCUSSION AND ANALYSIS

For our (Ihealthcare, Inc., FKA Opulent Acquistion, Inc.) fiscal year ended November 30, 2015 we did not generate any revenues. We had no cash and or cash equivalents as of our fiscal year end. Our net loss was $7,496 and was attributable to professional fees and related operating expenses.

Pursuant to the Agreement and Plan of Merger (“Agreement”) dated April 22, 2016 , by and between, Ihealthcare, Inc. a Florida Corporation (“Ihealthcare, Inc.-Florida”), and Opulent Acquisition, Inc., a Delaware Corporation, (“Ihealthcare, Inc.-Delaware” or the “Surviving Corporation), jointly the (“Constituent Corporations”) effective as of April 22, 2016 , Ihealthcare, Inc.-Florida merged with and into Ihealthcare, Inc.-Delaware with Ihealthcare, Inc.-Delaware continuing as the Surviving Corporation.

The board of directors of the Constituent Corporations declared the Merger Agreement advisable, fair to and in the best interests of the Constituent Corporations and have approved the Merger.

Immediately prior to the Merger, the Company was a “shell company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As of the effective date of the Merger, we the Company, Ihealthcare, Inc., “FKA Opulent Acquisition” have adopted the business plan of what was Ihealthcare, Inc.-Florida, which is the sale of goods in the healthcare sector. We currently have a distribution agreement with Innovate Laboratory Solutions, also known as “ILS” to supply us a product known as the “UDT Cup” (also herein known as Multi-Panel [16] urinalysis cup or Drug of Abuse “DOA” Cup). ILS has agreed to provide us the right to purchase the UDT Cup at special pricing in certain quantities. ILS is the developer of the UDT Cup and exclusive global supplier of the UDT Cup, however they have the UDT Cup manufactured by a third party manufacturer of which they have not and will not disclose to us due to confidentiality. ILS does however, have the authority and right to control who manufactures the UDT Cup.

We intend to begin conducting sales of the UDT Cup in the very near future. Our plans relating to this can be found in the above section titled, “Business.”

Before conducting physical sales of the UDT Cup(s) we believe we need to develop a more concrete marketing plan so that we can sell the goods on a large scale (to more than one consumer from time to time). We also believe we need to hire additional staff of which we have begun to do so. To date we have hired what we refer to as an “SVP of Operations.” This individual is responsible for formulating our marketing plan moving forward, amending it as seen fit, contacting and facilitating relationships with potential wholesalers and overseeing any other sales employees we currently have or may hire in the future. Currently we have two sales team members that are commission based. Of course we have not yet conducted any sales so these commissions will be based upon future performance (sales).

As of December 31, 2015 Ihealthcare, Inc., a Florida Company had cash and or cash equivalents in the amount of $100. From inception through December 31, 2015, the Company had no revenues and a net loss of $3,000 attributable to professional fees and related expenses. As of the fiscal year end the Company had received $25,200 for common stock issued of which $25,000 was deposited into escrow for the purchase of Opulent Acquistion, Inc., a Delaware Company.

We believe that to develop the Company’s current business plan that we must raise capital in the next twelve months. The Company has no immediate plans to raise such capital. Thus far the Company has relied solely on funds provided by our officers and directors, Noel Mijares, our Chief Executive officer, President, Director and David A. Bingaman, our Chief Operating Officer, Vice President, and Secretary. If we can not raise such funds we will have to continue to rely on funds provided to us by our officers and directors.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of the date of this report, following the aforementioned merger, we have 1,000,000 shares of common stock and no shares of preferred stock issued and outstanding. The below table is as of September 8, 2016.

| Name and Address of Beneficial Owner | Shares of Common Stock Beneficially Owned | Common Stock Voting Percentage Beneficially Owned | Voting Shares Preferred Stock Are Able to Vote | Preferred Stock Voting Percentage Beneficially Owned | Total Voting Percentage Beneficially Owned (1) |

| Executive Officers and Directors | |||||

| Noel Mijares | 625,000 | 100.0% | 0 | 0.0% | 62.50% |

| David A. Bingaman | 375,000 | 100.0% | 0 | 0.0% | 37.50% |

| 5% Shareholders | |||||

| N/A | - | - | - | - | - |

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person’s actual voting power at any particular date.

-11-

DIRECTORS AND EXECUTIVE OFFICERS

Biographical information regarding the officers and Directors of the Company, who will continue to serve as officers and Directors of Ihealthcare, Inc.

Noel Mijares, Age 42 Chairman of the Board of Directors, Chief Executive Officer, and President

Background of Mr. Noel Mijares

Noel Mijares has extensive business experience and has amassed a great deal of knowledge over the years through his executive roles with a wide array of companies. In 1992 Mijares formed Global Traders and became an authorized dealer for NCR. Mr. Mijares held the position of both President and CEO at Global Traders until 2000. Several years later in 1995 Mr. Mijares founded Safe Wrap of America, an international baggage wrap security company operating in nine countries at which he served as the Company’s President and CEO from 1996 until 2000. Subsequently, in 2001 Mr. Mijares saw an opportunity to revolutionize legal resources for professionals and he founded The Subpoena Company of which became a formidable legal vendor amongst attorneys and publicly-traded insurance companies, nationwide. In 2009 Mr. Mijares expanded his reach with the legal sector and formed Unisource Discovery, Inc., a digital records retrieval, eDiscovery company and became a thought leader and well-published author in this area. More recently in 2015 Mr. Mijares was the CEO of Millennium Healthcare. From 2015 to April 2016 he has served as the Chairman, CEO, and President of Ihealthcare, Inc., a Florida Corporation of which has merged with and into the Company.

Recent Experience:

Education:

- Miami Dade College 1992

Publications:

- Automating Document Retrieval – ALA Link: http://www.slideshare.net/NoelMijares/automatingdocumentretrievalala

- Records Tracking and Congestion – ALA Link: http://www.slideshare.net/NoelMijares/records-tracking-and-congestion-ala

David A. Bingaman, Age 60, Chief Operating Officer, Vice President, and Secretary

Background of Mr. David Bingaman

Mr. Bingaman has over 30 years’ experience in the healthcare and software industry. He has served 15 years in senior executive C - level roles in both private and public companies. Mr. Bingaman joined American Medical Response as Executive Vice President and Chief Operating Officer, a position he held from 1992 to 1994. With the publicly traded American Medical Response, a medical transportation company, Mr. Bingaman led AMRs highest performing business unit from $36 million to $125 million in revenue in just 4 years as regional CEO and Senior Corporate Vice President from 1994 to 2008. Promoted to Senior Vice President for National Operations from 1998 to 2002, he led a $1.3 Billion mission critical medical services business with operations in 44 states, 250 sites and 22,000 employees then conducted 4 years of successful turnarounds and roll outs of major technology and business process improvement initiatives producing a net profit swing of approximately $37 million. He also met and exceeded all financial targets in nearly 20 consecutive quarters through organic and acquisition growth. Mr. Bingaman secured $1.05 billion career medical business development revenue from multi-year high performance service contracts [SLAs] of $1-$25 million in commercial and government sectors. Mr. Bingaman holds a BA 2008 and MBA 2010 from The Corllins University and is graduate of the Valley Medical Center School of Medicine’s Paramedicine Program 1976. Most recently he has served an executive position at the positions listed below.

Recent Experience:

2010 - 2014: President: Aspen Ventures, Venture Firm

2014 - 2015: Chief Operating Officer: East Coast Ambulance LLC., Healthcare Industry

2015 - 2015: President: Millennium Healthcare, Inc, Healthcare Industry

2015 - April 2016: Chief Operating Officer, EVP, Secretary: Ihealthcare, Inc. (Florida Corporation)

Corporate governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission (the “SEC”) and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company's financial statements and other services provided by the Company’s independent public accountants. The Board of Directors reviews the Company's internal accounting controls, practices and policies.

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. Our sole Director believes that it is not necessary to have such committees, at this time, because the Director(s) can adequately perform the functions of such committees.

-12-

Audit Committee Financial Expert

Our Board of Directors has determined that we do not have a board member that qualifies as an "audit committee financial expert" as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as "independent" as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our Director(s) are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Director(s) of our Company does not believe that it is necessary to have an audit committee because management believes that the Board of Directors can adequately perform the functions of an audit committee. In addition, we believe that retaining an independent Director who would qualify as an "audit committee financial expert" would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact that we have not generated any positive cash flows from operations to date.

Involvement in Certain Legal Proceedings

Our officers and directors have not been involved in any of the following events during the past ten years.

| 1. | bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

| 5. | Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated; |

| 6. | Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| 7. | Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:(i) Any Federal or State securities or commodities law or regulation; or(ii) Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or(iii) Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| 8. | Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Independence of Directors

We are not required to have independent members of our Board of Directors, and do not anticipate having independent Directors until such time as we are required to do so.

Code of Ethics

We have not adopted a formal Code of Ethics. The Board of Directors evaluated the business of the Company and the number of employees and determined that since the business is operated by a small number of persons, general rules of fiduciary duty and federal and state criminal, business conduct and securities laws are adequate ethical guidelines. In the event our operations, employees and/or Directors expand in the future, we may take actions to adopt a formal Code of Ethics.

Shareholder Proposals

Our Company does not have any defined policy or procedural requirements for shareholders to submit recommendations or nominations for Directors. The Board of Directors believes that, given the stage of our development, a specific nominating policy would be premature and of little assistance until our business operations develop to a more advanced level. Our Company does not currently have any specific or minimum criteria for the election of nominees to the Board of Directors and we do not have any specific process or procedure for evaluating such nominees. The Board of Directors will assess all candidates, whether submitted by management or shareholders, and make recommendations for election or appointment.

A shareholder who wishes to communicate with our Board of Directors may do so by directing a written request addressed to our President, at the address appearing on the first page of this Information Statement.

-13-

Summary Compensation Table (Ihealthcare, Inc. FKA Opulent Acquisition, Inc. a Delaware Company):

The below table is in regards to our past two fiscal year ends:

Name and principal position |

Year | Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

Noel Mijares, Chief Executive Officer, President, Director |

2014 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Noel Mijares, Chief Executive Officer, President, Director | 2015 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

David A Bingaman, Chief Operating Officer, Vice President, and Secretary. |

2014 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

David A. Bingaman, Chief Operating Officer, Vice President, and Secretary. |

2015 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Jeffrey DeNunzio, Former sole officer and director |

2014 | 0 | 0 | 2,000 | 0 | 0 | 0 | 0 | 2,000 |

Jeffrey DeNunzio, Former sole officer and director |

2015 | 0 | 0 | 2,000 | 0 | 0 | 0 | 0 | 2,000 |

*On January 14, 2016 Mr. Jeffrey DeNunzio, the sole shareholder of the Company transferred to Ihealthcare, Inc., a Florida Company, 20,000,000 shares of our common stock which represented all of our issued and outstanding shares at the time of transfer. The transfer was the result of the sale of the Company to Ihealthcare, Inc., the Florida Company.

On January 14, 2016 Ihealthcare, Inc., a Florida Company, became the controlling shareholder of Opulent Acquisition, Inc. At the time of the sale of Opulent Acquisition, Inc. Mr. Mijares owned 62.5% and Mr. Bingaman owned 37.5% of the issued and outstanding shares of Ihealthcare, Inc., the Florida Company.

Pursuant to the Agreement and Plan of Merger (“Agreement”) dated April 22, 2016, by and between, Ihealthcare, Inc. a Florida Corporation (“Ihealthcare, Inc.-Florida”), and Opulent Acquisition, Inc., a Delaware Corporation, (“Ihealthcare, Inc.-Delaware” or the “Surviving Corporation), jointly the (“Constituent Corporations”) effective as of April 22, 2016, Ihealthcare, Inc.-Florida merged with and into Ihealthcare, Inc.-Delaware with Ihealthcare, Inc.-Delaware continuing as the Surviving Corporation.

The board of directors of the Constituent Corporations have declared the Merger Agreement advisable, fair to and in the best interests of the Constituent Corporations and have approved the Merger.

Immediately before the effective time of the Merger each share of common stock, par value $0.0001 per share of Ihealthcare-Delaware held by Ihealthcare-Florida was cancelled. Each share issued and outstanding of Ihelathcare-Florida held by the shareholders was converted into one hundred validly issued, fully paid, and nonassessable shares of common stock, par value $0.0001 per share of Ihealthcare-Delaware.

Compensation of Directors

The table above summarizes all compensation of our directors as of December 31, 2015.

Stock Option Grants

We have not granted any stock options to our executive officers since our incorporation.

Employment Agreements

We do not have an employment or consulting agreement with any officers or Directors as of the date of this filing.

-14-

Compensation Discussion and Analysis

Director Compensation

Our Board of Directors does not currently receive any consideration for their services as members of the Board of Directors. The Board of Directors reserves the right in the future to award the members of the Board of Directors cash or stock based consideration for their services to the Company, which awards, if granted shall be in the sole determination of the Board of Directors.

Executive Compensation Philosophy