Attached files

| file | filename |

|---|---|

| 8-K - ONCOCYTE CORPORATION 8-K 9-8-2016 - OncoCyte Corp | form8k.htm |

Exhibit 99.1

Liquid Biopsies Next Generation Cancer Molecular Diagnostics William AnnettChief Executive OfficerSeptember 2016

Forward Looking Statements Statements pertaining to future financial and/or operating results, future research, diagnostic tests and technology under development, clinical development of diagnostic tests, and potential opportunities for OncoCyte Corporation and the diagnostic tests it is developing, along with other statements about the future expectations, beliefs, goals, plans, or prospects expressed by management constitute forward-looking statements. Any statements that are not historical fact (including, but not limited to statements that contain words such as “will,” “may,” “believes,” “plans,” “anticipates,” “expects,” “estimates”) should also be considered to be forward-looking statements. Forward-looking statements involve risks and uncertainties, including, without limitation, risks inherent in the development, testing, marketing and/or commercialization of potential diagnostic tests, including developing or obtaining the resources and capabilities required to do so, uncertainty in the results of clinical trials, need and ability to obtain future capital, and maintenance of intellectual property rights, need to obtain approvals from federal and state regulatory agencies, and uncertainty as to reimbursements or coverage from third party payers such as Medicare, health insurance companies, and health maintenance organizations. Actual results may differ materially from the results anticipated in these forward-looking statements and as such should be evaluated together with the many uncertainties that affect the business of OncoCyte, particularly those mentioned in the Risk Factors and other cautionary statements found in OncoCyte’s latest Annual Report on Form 10-K and other Quarterly Reports and Current Reports filed by OncoCyte with the Securities and Exchange Commission. OncoCyte disclaims any intent or obligation to update these forward-looking statements and/or this presentation, including but not limited to any changes resulting from changes in fact or circumstances. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of OncoCyte Corporation. 2

Investment Highlights Positioned to capitalize on standard of care moving to liquid biopsyAddresses large unmet needs for early, accurate diagnosis in multiple cancersInitial focus on lung, one of the largest markets and a national health priorityCurrent lung cancer standard of care is inaccurate, risky, and expensiveStrong clinical data potentially positions OncoCyte to become standard of careCompelling value proposition for payers, physicians, and patientsOn track for first product launchDeep product pipeline leveraging core R&D competenciesExperienced leadership team with background in commercialization 3

Molecular diagnostics are evolving towardnon-invasive liquid biopsies IMAGING TISSUE BIOPSY LIQUIDBIOPSY MammogramLDCT VeracyteGenomic Health 4

Some molecular diagnostics companies have substantial valuations Source: Bloomberg as of 5/18/2016 In some cases based on incremental improvements and/or small markets 5 OncoCyte is focused on the largest segment and the biggest market opportunity Market Capitalization $100M $200M $300M $400M $500M $600M $700M $800M $900M $3000M

Source of revenue: The 2015 Liquid Biopsy Report Piper Jaffrey September 2015 Recurrence $6.9B Companion Diagnostics $6.7B Diagnosis $15B Prognostic OncoCyte is focused on early diagnosis – the largest market segment, but with low competition 6 Prognosis Diagnosis $15B Companion Diagnostics$6.7B Recurrence$6.9B

Lung cancer is the largest market opportunity Largest % of global diagnostics revenue Most cancer deaths each year in the U.S. Cancer Diagnostics Market: Global Industry Analysis, Size, Share, and Forecast 2014-2020, Transparency Market ResearchDiagnostics include both imaging and molecular diagnostics SEER Stat fact Sheet Estimated deaths 2015 7

Lung cancer is typically diagnosed at later stages, limiting survival rates57% of lung cancer diagnoses are made in stage IV Sources: Cancer SEER Stat Fact SheetsNCCN Guidelines Lung Cancer Screening 2/2014USPSTF Screening for Lung Cancer 8 Colorectal Breast Lung Prostate FDA approval for prostate progression test FDA approval for prostate screening test Bladder Five year survival rate Lung opportunity driven by poor outcomes with little improvement over the last 40 years

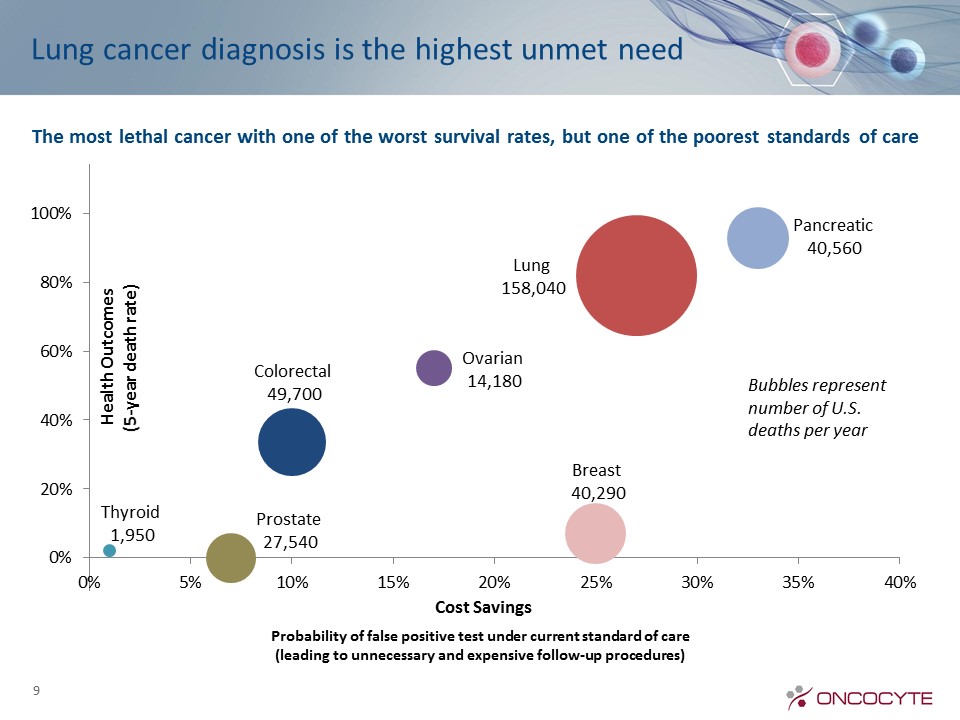

Lung cancer diagnosis is the highest unmet need 9 The most lethal cancer with one of the worst survival rates, but one of the poorest standards of care Bubbles represent number of U.S. deaths per year Probability of false positive test under current standard of care(leading to unnecessary and expensive follow-up procedures)

Early detection of lung cancer is now a national health priority because it has the highest death rate Better diagnosis will increase the survival rate and save livesDecember 2013 USPSTF guidelines recommend annual LDCTs for patients with 30 pack-year history7-10M AmericansFebruary 2015CMS announces Medicare coverage of LDCTsHowever LDCT has a high rate of false positives25% of all LDCTs are indeterminate, requiring additional procedures But 96% of indeterminate LDCTs turn out to be benign – false alarmsSo 96% of follow up procedures are unnecessary Lung cancer is now a major U.S. health priority 10

Current standard of care is risky and expensive Follow up procedures are also expensiveBiopsies via bronchoscopies, surgery, needle biopsyFrequent follow up LDCTs (radiation exposure)Lung biopsies are much riskier than other types of biopsies, and deaths could be avoided:0.5 to 1% mortality (600 to 1,300 annual deaths averted)4-20% major complications (5,000 to 26,000 fewer events annually)2-15% collapsed lung (2,600 to 20,000 fewer events annually )For an average patient a lung biopsy has a higher likelihood of leading to a serious complication than of confirming lung cancer Source: Evaluation of Individuals with Pulmonary Nodules: When Is it Lung Cancer? Chest 2013 May; 143(5 Suppl):e83s-e120sOncoCyte absolute number estimated using TAM 10M and 65% specificity 11

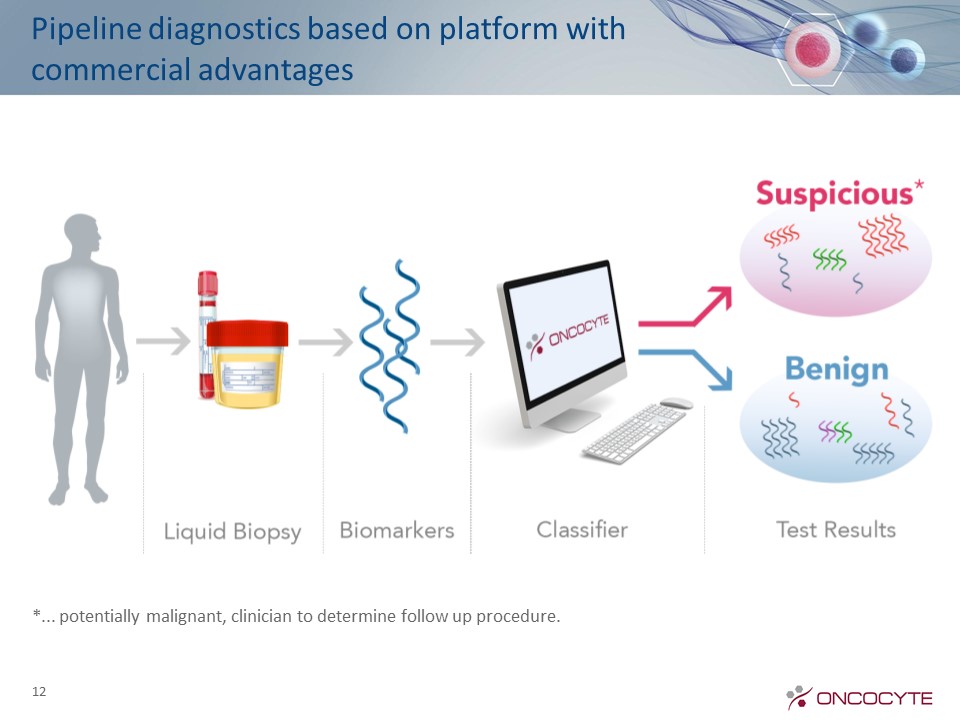

12 Pipeline diagnostics based on platform with commercial advantages Diagnostic Strategy *... potentially malignant, clinician to determine follow up procedure.

13 High-risk patients LDCT screening Clear Biopsy Malignant Benign nodule Follow-upLDCT scans Nodules Confirmatory USPSTF Guidelines Recommend Screening – Covered by Medicare OncoCyte’s initial focus is on confirmatory diagnostic solution No nodules 7-10M Americans 96% False Positive

Prototype classifier presented at American Thoracic Society in 2015Sensitivity: 76%Specificity: 88%Proof of concept for confirmatory diagnostic and screening diagnostic 14 Bioinformatics lab of Dr. Louise C. Showe9+ years developing blood-based tests for lung cancerSignificant sample set (3,000 samples and ongoing collection)OncoCyte exclusive global licensing agreementFollow on pivotal trial (620 subjects) completed February 2016, replicated 2015 studyResults being presented at CHEST 2016, October OncoCyte’s preliminary test shows strong performance

TAM numbers based on company estimates and secondary data 15 Large market opportunity for lung tests USPSTF guidelines for 30 pack-year smokers All indeterminate diagnoses (LDCT +) Downstream procedures performed on indeterminate diagnoses Confirmatory test extended use(1.8-2.5 million patients) Overall screening market(7-10 million patients) Confirmatory test first launch(~180k to 250k patients) Initial Focus

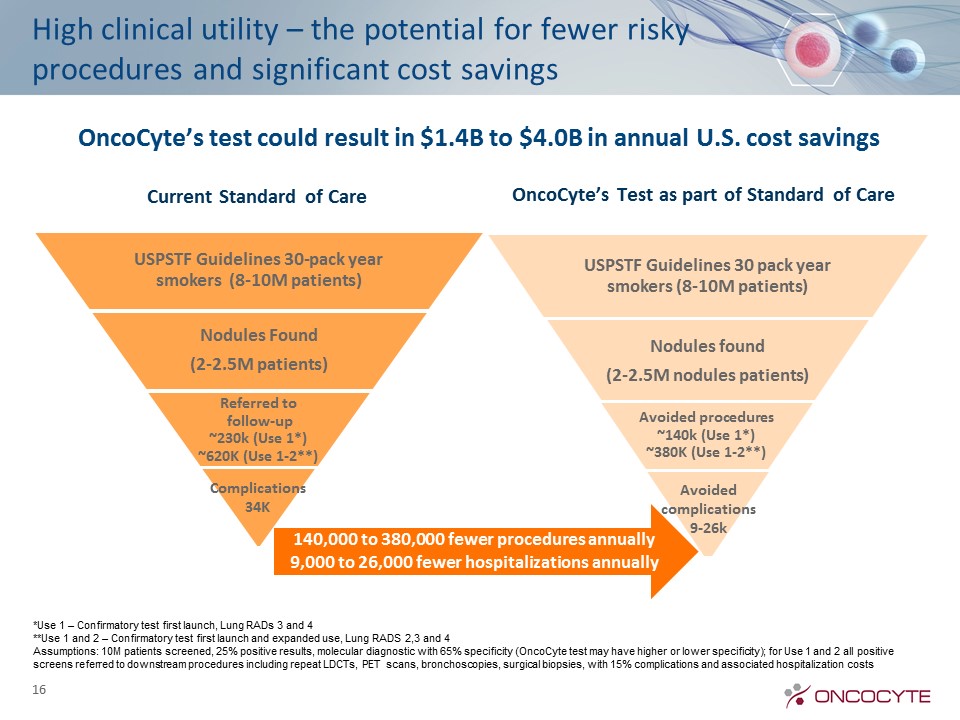

High clinical utility – the potential for fewer risky procedures and significant cost savings Current Standard of Care OncoCyte’s Test as part of Standard of Care OncoCyte’s test could result in $1.4B to $4.0B in annual U.S. cost savings 140,000 to 380,000 fewer procedures annually9,000 to 26,000 fewer hospitalizations annually 16 *Use 1 – Confirmatory test first launch, Lung RADs 3 and 4**Use 1 and 2 – Confirmatory test first launch and expanded use, Lung RADS 2,3 and 4Assumptions: 10M patients screened, 25% positive results, molecular diagnostic with 65% specificity (OncoCyte test may have higher or lower specificity); for Use 1 and 2 all positive screens referred to downstream procedures including repeat LDCTs, PET scans, bronchoscopies, surgical biopsies, with 15% complications and associated hospitalization costs Complications34K Avoided complications 9-26k

Compelling proposition for payers Payers gave diagnostic high ratings for unmet needs Pricing and TPP discussion with payers very positive Asked of 10 Commercial, Managed Medicaid and Managed Medicare payers representing 20M covered livesQ8: Now I would like to ask what is your perception of the overall unmet need for certain oncology screening diagnostics or procedures. On a scale of 1 to 10 where 1 is no unmet need and 10 is significant unmet need for an improved screening procedure/diagnostic 17 “Evidence in lung screening not as well developed.” “Getting tissue in lung biopsy is much more invasive for lung than other cancers” “Not just about the expense, there is also increase morbidity and mortality with biopsies” “High need driven by lack of good screening procedures and a clinical concern to identify patients earlier” “Am concerned with USPSTF guidelines and the high false positives (one in five) and invasiveness of biopsies”

Compelling proposition for prescribers Interest in using the OncoCyte test is very high with a mean rating of 8.5 out of 10Pulmonologists expressed highest interest at 9.3, followed by interventional radiologists at 8.7Reasons provided for high ratings: Useful for smaller nodules with high risk factors Provides additional accuracy and benefit Avoid biopsies Non-invasive blood test Provides clinical utility 18

Commercialization strategy addresses allkey stakeholders ProviderDeterminate diagnosisHigh sensitivity High specificityReduce unnecessary procedures PatientEarlier detectionImproved outcomesReduce anxiety over indeterminate finding PayerImproved health outcomesFewer unnecessary proceduresReduce overall costs Marketing Strategy Benefits Specialty sales forceTPP refinement via market researchPractice guidelinesPeer review journalsKOL influence Reimbursement support out of pocketIncrease awareness to increase LDCT uptake Patient friendly test report Pricing vs comparatorRWE clinical utility studiesCMS 1st coverage focus5 Large health plans 19

Research Assay Development R&D Validation Study CLIA Validation Clinical Utility Studies Breast screening Lung confirmatory May materialize as confirmatory, screening, recurrence or companion diagnostic* Dependent on partnering discussions OncoCyte launch focus Partner focus 20 OncoCyte’s deep product pipeline Breast confirmatory Next 12 months R&D focus Lung screening Bladder Next 12 months R&D focus* Tumor type 4 As of September 2016 Next 12 months R&D focus Commercial Launch Next 9 months R&D Focus

21 Screening Population ScreeningMammogram Clear Suspicious DiagnosticMammogram Clear Suspicious Biopsy BIRADS 3/4 BIRADS 1/2 CONFIRMATORY SCREENING Breast cancer confirmatory diagnostic under development

Breast cancer diagnostic overview High false-positive rate of mammography and ultrasound leads to unnecessary biopsies and increased costsTarget population: women with dense breast tissue, genetic mutations (BRCA), a family history of breast cancer, or those who have suspicious diagnostic mammogram screening results (BIRADs 3 or 4) typically sent to biopsyA simple blood test will reduce false positives sent to biopsy, thus reducing invasive procedures, patient stress and health-care costsResults of first study (100 patients) selected for a poster presentation at the San Antonio Breast Cancer Conference in December 2016Data from the initial study merits validation in a larger study Study being designed and developed A significant number of samples have been collected 22

TAM numbers based on company estimates and secondary data 23 Large market opportunity for iterative breast cancer diagnostic tests Guidelines suggest annual mammogram screen Guidelines suggest MRI (dense tissue, BRCA, family history) Indeterminate mammograms Confirmatory test extended use (6 million patients) Overall screening market(38 million patients in 2014) Confirmatory test first launch (1.6-1.9 million BIRADs 3-4)

ROC AUC = 0.91Sensitivity = 90%Specificity = 83% 24 Bladder prototype data presented at AACR 2015 Potential to partner development and/or commercialization of bladder cancer test

25 Classifier performance is strong in areas of greatest health outcome impact High grade bladder cancer is faster growing and more likely to spread than low gradeHigh sensitivity/specificity in high grade hematuria and high grade recurrenceStudy based on 261 patients Data from follow on study presented at ASCO June 2016

TAM numbers based on company estimates and secondary data 26 Large market opportunity for bladder cancer diagnostic tests Hematuria Cancer in remission Indeterminate cytology results Recurrence test (500,000 patients x2) Screening test(3 million patients) Confirmatory test (500,000 patients) Current preliminary data suggest multiple test uses

Management team with commercial experience William Annett CEO CEO BioFx Labs; CEO Corra Life Sciences; Managing Director Accenture Life Science; Led Commercial Strategy, Project Finance Genentech; Harvard MBAKaren Chapman VP Research Advanced Cell Technology; Origen Therapeutics; Geron Corporation; Ph. D. Johns Hopkins University School of MedicineLyssa Friedman VP Clinical and Regulatory Affairs Veracyte VP Clinical Operations, Telomere Diagnostics, VP Clinical Development Carmenta Biosciences, McKesson Oncology Network, Oncology RNLyndal Hesterberg VP Development CEO BaroFold; Carmenta Biosciences; CTO Crescendo Biosciences; EVP Thermo BioStar; Senior Director SomaLogicKristine Mechem VP Marketing Business Analytics Abbott Labs, Market Planning Genentech, Managed Care Consulting, VP Marketing and Business Development Corra Life SciencesWilliam Seltzer VP Clinical Services Lab Director Veracyte, Illumina, Counsyl, Athena DiagnosticsRussell Skibsted CFO CFO BioTime; CFO Proove Biosciences; Managing Director and CFO RSL Ventures, CFO Aeolus Pharmaceuticals; CBO Hana Biosciences; Portfolio Management Partner Asset Management Company 27 Position Experience

Investment Highlights Positioned to capitalize on standard of care moving to liquid biopsyAddresses large unmet needs for early, accurate diagnosis in multiple cancersInitial focus on lung, one of the largest markets and a national health priorityCurrent lung cancer standard of care is inaccurate, risky, and expensiveStrong clinical data potentially positions OncoCyte to develop standard of careCompelling value proposition for payers, physicians, and patientsOn track for first product launchDeep product pipeline leveraging core R&D competenciesExperienced leadership team with background in commercialization 28

William AnnettChief Executive OfficerWAnnett@OncoCyte.com Liquid Biopsies Next Generation Cancer Molecular Diagnostics