Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENERGIZER HOLDINGS, INC. | form_8-kxbtsxpresentation.htm |

Energizer

Barclays Back-To-School Presentation

September 8, 2016

Brian Hamm, Chief Financial Officer

Mark LaVigne, Chief Operating Officer

Exhibit 99.1

Safe Harbor Statement

2

Unless the context otherwise requires, references in this presentation to “Energizer,” “we,” “our,” and “the Company” refer to Energizer Holdings,

Inc., and its subsidiaries. The following presentation contains “forward looking statements.” Forward-looking statements are not based on

historical facts but instead reflect our expectations concerning future results or events, including our expectations for strategic initiatives and our

outlook for future financial, operational or other potential or expected results. Numerous factors could cause our actual results or performance to

differ materially from those expressed or implied by such statements, including:

• market and economic conditions, including the impact of the United Kingdom's referendum vote and announced intention to exit the European

Union at some future date;

• the ability to integrate the HandStands business successfully and to achieve the anticipated cost savings and other synergies;

• the possibility that other anticipated benefits of the HandStands acquisition will not be realized, including without limitation, anticipated

revenues, expenses, margins, cash flows, earnings and other financial results, and growth and expansion of our operations;

• market trends in the categories in which we compete;

• the success of new products and the ability to continually develop and market new products;

• our ability to attract, retain and improve distribution with key customers;

• our ability to continue planned advertising and other promotional spending;

• our ability to timely execute strategic initiatives, including restructurings, and international go-to-market changes in a manner that will

positively impact our financial condition and results of operations and does not disrupt our business operations;

• the impact of strategic initiatives, including restructurings, on our relationships with employees, customers and vendors;

• our ability to maintain and improve market share in the categories in which we operate despite heightened competitive pressure;

• our ability to improve operations and realize cost savings;

• the impact of foreign currency exchange rates and currency controls, as well as offsetting hedges;

• the impact of raw materials and other commodity costs;

• costs and reputational damage associated with cyber-attacks or information security breaches or other events;

• our ability to acquire and integrate businesses, and to realize the projected results of acquisitions;

• the impact of advertising and product liability claims and other litigation;

• compliance with debt covenants and maintenance of credit ratings as well as the impact of interest and principal repayment of our existing

and any future debt; and

• the impact of legislative or regulatory determinations or changes by federal, state and local, and foreign authorities, including taxing

authorities.

• Additional risks and uncertainties include those detailed in our most recent Annual Report on Form 10-K and other SEC filings. The forward-

looking statements included in this presentation are only made as of the date of this document and we disclaim any obligation to publicly

update any forward-looking statement to reflect subsequent events or circumstances.

Non-GAAP financial measures

3

Market, Industry and Financial Data

Unless indicated otherwise, our financial data contained in this presentation is based on our internal data, and the information

concerning our industry is based on our general knowledge of and expectations concerning the industry. Our market position, market

share and industry market size relate to markets where we compete and are based on estimates using our internal data and estimates,

based on data from various industry analyses, our internal research and adjustments and assumptions that we believe to be

reasonable. We have not independently verified data from industry analyses and cannot guarantee their accuracy or completeness. In

addition, we believe that data regarding the industry, market size and our market position and market share within such industry provide

general guidance but are inherently imprecise. Further, our estimates and assumptions involve risks and uncertainties and are subject

to change based on various factors. These and other factors could cause results to differ materially from those expressed in the

estimates and assumptions.

Non-GAAP financial measures

While the Company reports financial results in accordance with accounting principles generally accepted in the U.S. (“GAAP”), this

presentation includes non-GAAP measures, such as organic revenue, which excludes the impact of changes in foreign currency rates

on a period over period basis versus the U.S. dollar, the impact of our go-to market initiatives, and the change in our Venezuela results

from the deconsolidation of those operations, and free cash flow, as well as ratios derived therefrom. We believe these non-GAAP

measures provide a meaningful comparison to the corresponding historical or future period, assist investors in performing their analysis

and provide investors with visibility into the underlying financial performance of the Company’s business. The Company believes that

these non-GAAP measures are presented in such a way as to allow investors to more clearly understand the nature and amount of the

adjustments to arrive at the non-GAAP measure. Investors should consider non-GAAP measures in addition to, not as a substitute for,

or superior to, the comparable GAAP measures. Additionally, we are unable to provide a reconciliation of forward-looking non-GAAP

measures due to uncertainty regarding future acquisition and integration costs, restructuring related charges, the impact of fluctuations

in foreign currency movements and the cost of raw materials. Further, these non-GAAP measures may differ from similarly titled

measures presented by other companies. A reconciliation of these non-GAAP measures to the nearest comparable GAAP measure is

available at the end of this presentation.

Energizer Holdings, Inc.

Strategic Priorities

Delivering Long-Term Value

Agenda

First Year

4

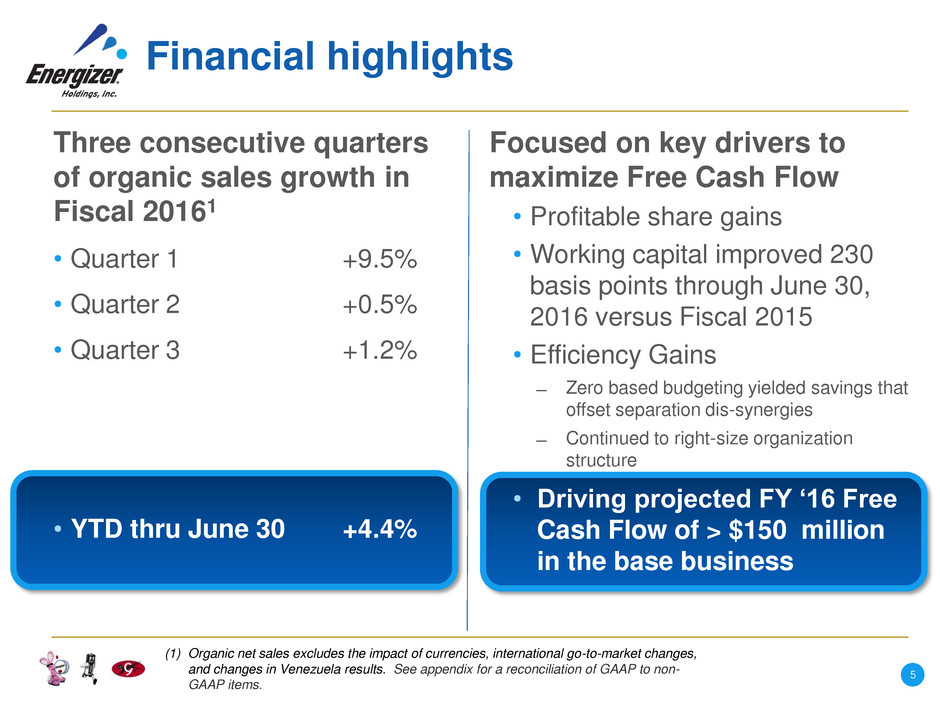

Financial highlights

Three consecutive quarters

of organic sales growth in

Fiscal 20161

• Quarter 1 +9.5%

• Quarter 2 +0.5%

• Quarter 3 +1.2%

• YTD thru June 30 +4.4%

Focused on key drivers to

maximize Free Cash Flow

• Profitable share gains

• Working capital improved 230

basis points through June 30,

2016 versus Fiscal 2015

• Efficiency Gains

̶ Zero based budgeting yielded savings that

offset separation dis-synergies

̶ Continued to right-size organization

structure

• Driving projected FY ‘16 Free

Cash Flow of > $150 million

in the base business

5

(1) Organic net sales excludes the impact of currencies, international go-to-market changes,

and changes in Venezuela results. See appendix for a reconciliation of GAAP to non-

GAAP items.

Balanced capital allocation

HandStands acquisition

• $340 million purchase price,

subject to certain adjustments

• Adjusted EPS accretion $0.15

to $0.20 per share1

• Free Cash Flow +$20 million1

Returning value to Shareholders

since spin

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

Dividend Share

Repurchase

Total Capital

Returned to

Shareholders

M

ill

io

n

$62M

$22M $84M

Total Shareholder Return2

+52%*

6

(2) Post-Spin Total Shareholder Return is calculated from July 1, 2015 to August 15, 2016, inclusive of dividends paid

during that period.

*See appendix for a reconciliation of GAAP to non-GAAP items.

(1) Excludes acquisition and integration costs associated with the transaction.

Agenda

Energizer Holdings, Inc.

Strategic Priorities

Delivering Long-Term Value

First Year

7

We are an innovative, global, brand-driven

household products company

(1) Nielsen Total U.S. xAOC 52 Weeks Ending August 13, 2016.

(2) U.S. Auto Fragrance category includes proprietary market analysis of combined NPD & IRI MULO.

(3) Value share rank data from Nielsen Global Track, 52-weeks ending June 2016 including all Energizer and Eveready branded batteries and

excluding private label.

See appendix for non-GAAP reconciliations.

TTM 6/30/16

Revenue

$1.7

inclusive of pro forma

HandStands revenues

Bil

lio

n

Free Cash Flow

>$170

Million

5,200

customers served,

reaching

BILLIONS of

consumers globally

~

Through

June 2016

Working Capital

As % of sales

11% ~

Energizer

and

Eveready

batteries

are ranked3

globally

#1or#2

(in 32 of 34 measured

markets)

U.S. Value Share

24%

in auto fragrance

category2

33%

in battery category1

8

No. of

manufacturing

facilities today,

strategically

located in North

America, Africa

& Asia

iconic,

globally

recognized

brands 2

140

global markets

We sell in

1

inclusive of pro forma

HandStands

inclusive of HandStands

of the largest

battery

manufacturers

in the world

8

Projected FY 16

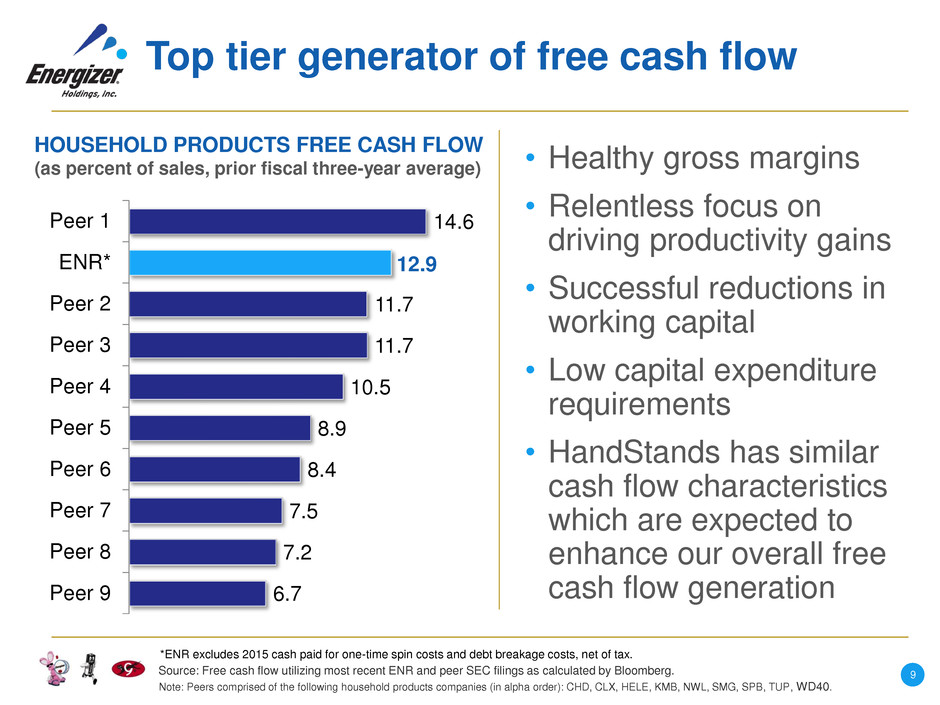

Top tier generator of free cash flow

• Healthy gross margins

• Relentless focus on

driving productivity gains

• Successful reductions in

working capital

• Low capital expenditure

requirements

• HandStands has similar

cash flow characteristics

which are expected to

enhance our overall free

cash flow generation

6.7

7.2

7.5

8.4

8.9

10.5

11.7

11.7

12.9

14.6

Peer 9

Peer 8

Peer 7

Peer 6

Peer 5

Peer 4

Peer 3

Peer 2

ENR*

Peer 1

Source: Free cash flow utilizing most recent ENR and peer SEC filings as calculated by Bloomberg.

Note: Peers comprised of the following household products companies (in alpha order): CHD, CLX, HELE, KMB, NWL, SMG, SPB, TUP, WD40.

HOUSEHOLD PRODUCTS FREE CASH FLOW

(as percent of sales, prior fiscal three-year average)

*ENR excludes 2015 cash paid for one-time spin costs and debt breakage costs, net of tax.

9

• Billions of consumers around

the world prefer the Energizer

and EVEREADY brands and

purchase them to meet their

power and lighting needs

• After 27 years, the Energizer

Bunny keeps going and

going, generating millions of

impressions each year

• HandStands acquisition adds

leading brands in the auto

fragrance category

Global leading brands

10

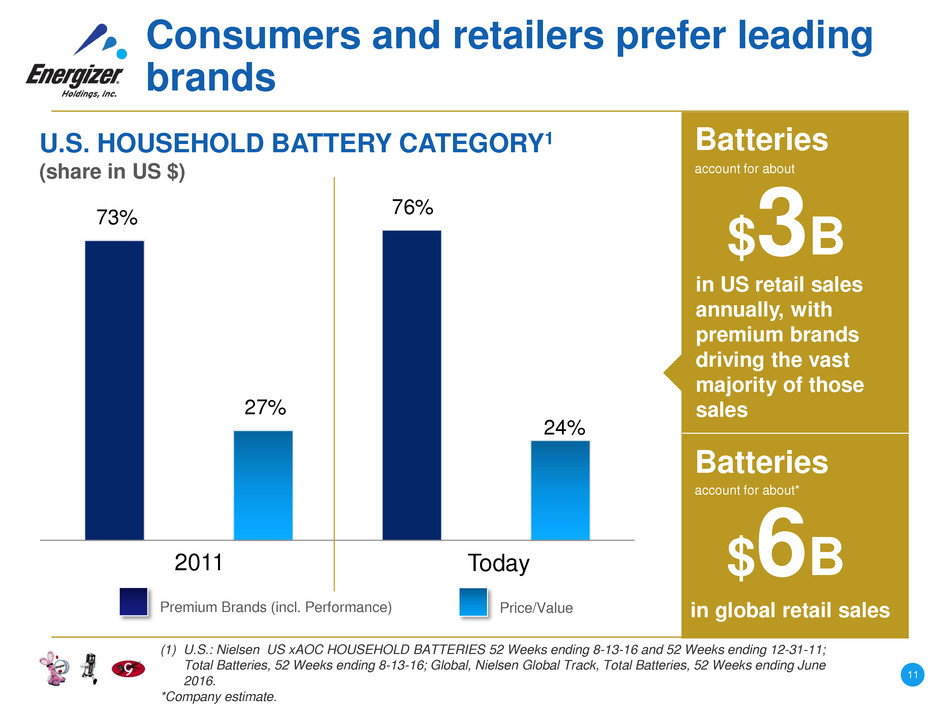

73%

76%

Consumers and retailers prefer leading

brands

(1) U.S.: Nielsen US xAOC HOUSEHOLD BATTERIES 52 Weeks ending 8-13-16 and 52 Weeks ending 12-31-11;

Total Batteries, 52 Weeks ending 8-13-16; Global, Nielsen Global Track, Total Batteries, 52 Weeks ending June

2016.

*Company estimate.

U.S. HOUSEHOLD BATTERY CATEGORY1

(share in US $)

2011 Today

27%

24%

Premium Brands (incl. Performance) Price/Value

$3B

$6B

account for about

Batteries

in US retail sales

annually, with

premium brands

driving the vast

majority of those

sales

in global retail sales

account for about*

Batteries

11

Energizer has leading positions across its

battery and lighting portfolio

#1Brand

in Portable Lights

World’s

Made with

recycled

batteries

#1

in Lithium

#1

in Rechargeable

Now With Recycled Content

#2

in Premium

#1 in

Specialty

batteries

1

st

12 Nielsen Global Track 52-weeks ending June 2016 and Lights: Nielsen Total US xAOC, Portable Lights Category, 52-

weeks ending 8-6-16

EVEREADY provides a portfolio of quality

products at an affordable price

Nielsen Global Track, 52-weeks ending June 2016.

#2

in Value

Alkaline

BRAND #1

in Carbon Zinc

Powerful

second brand

in portfolio that

appeals to

consumers in

the value

segment across

many markets

13

Value share data from Nielsen Global Track, 52-weeks ending June 2016; including all Energizer and Eveready branded

batteries. Brand rank excludes Private Label.

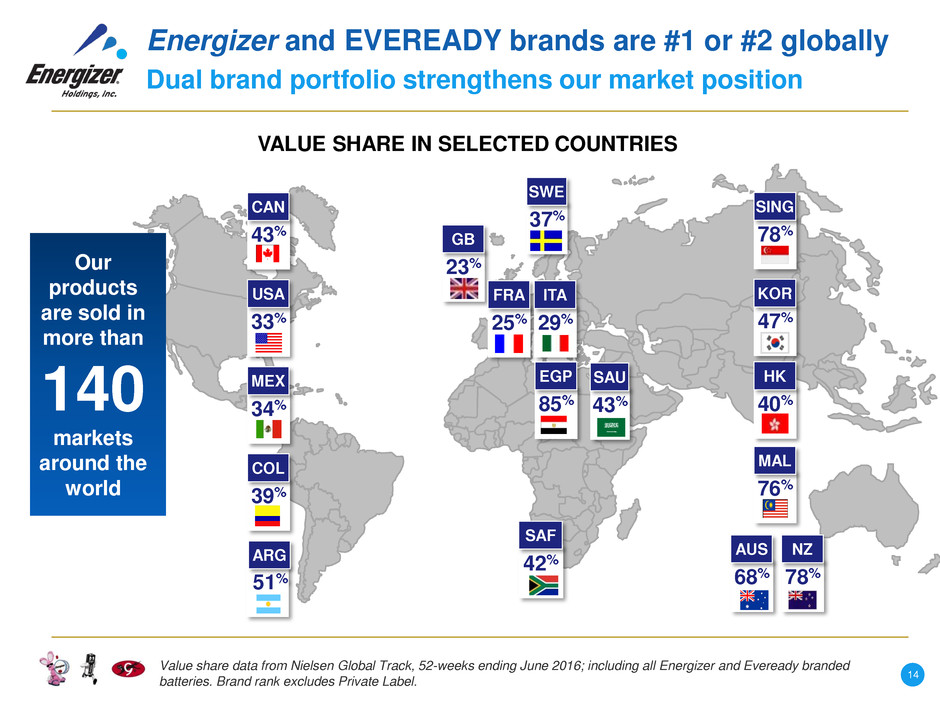

Energizer and EVEREADY brands are #1 or #2 globally

Dual brand portfolio strengthens our market position

23%

GB

VALUE SHARE IN SELECTED COUNTRIES

25%

FRA

29%

ITA

85%

EGP

43%

CAN

33%

USA

34%

MEX

51%

ARG

39%

COL

78%

SING

47%

KOR

40%

HK

76%

MAL

68%

AUS

78%

NZ

42%

SAF

37%

SWE

43%

SAU

Our

products

are sold in

more than

140

markets

around the

world

14

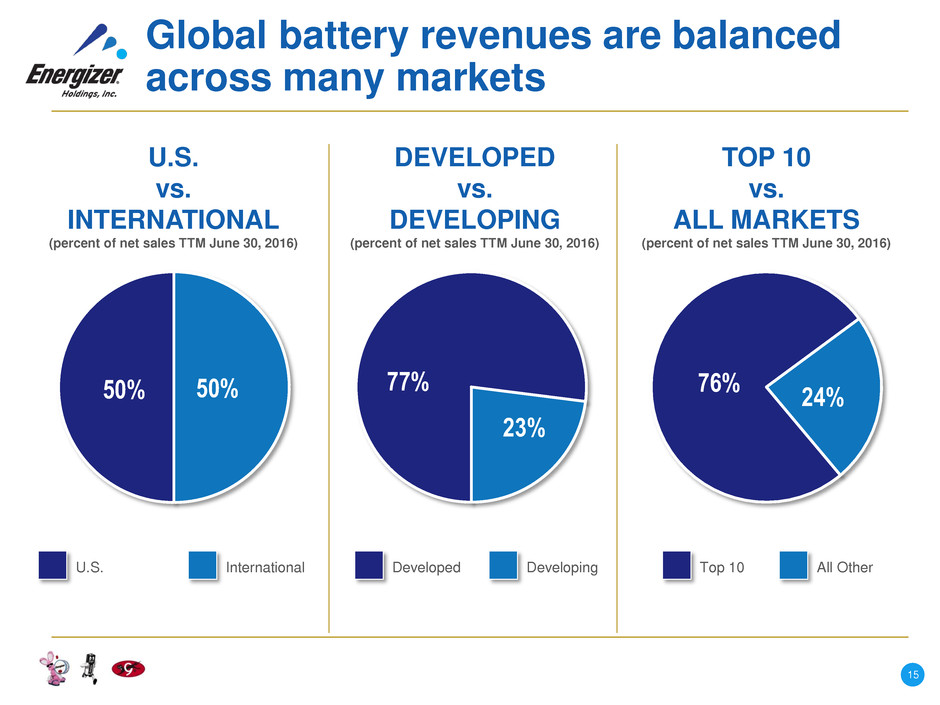

50% 50%

U.S.

vs.

INTERNATIONAL

(percent of net sales TTM June 30, 2016)

77%

23%

Global battery revenues are balanced

across many markets

DEVELOPED

vs.

DEVELOPING

(percent of net sales TTM June 30, 2016)

76%

24%

TOP 10

vs.

ALL MARKETS

(percent of net sales TTM June 30, 2016)

U.S. International Developed Developing Top 10 All Other

15

Strong battery business fundamentals

• Global and U.S. category trends are stable, consistent with our long-term outlook for the

category (flat to slightly down)

• Promotional frequency and depth have declined in the U.S. in the latest 52 weeks

-2.4%

-0.6%

+0.1%

-3.0%

-2.0%

-1.0%

0.0%

1.0%

2.0%

3.0%

2009-2014

Average

Trend

2015 2016

Global Category Value Change1

-2.4%

-0.8%

-3.0%

-2.5%

-2.0%

-1.5%

-1.0%

-0.5%

0.0%

% Volume on

Promotion

% Discount on

Promotion

US Promotion - 52 Week % Chg vs.

Year Ago2

(1) Nielsen Global Track through June 2016, World Monthly Markets.

(2) Nielsen Total U.S. xAOC through August 13, 2016

16

P

re

m

iu

m

P

e

rf

o

rm

a

n

c

e

V

a

lu

e

L

ig

h

ts

Our brand & product portfolio competes

across all consumer segments

BROAD PRODUCT PORTFOLIO

S

p

e

cialt

y

ENR GLOBAL SALES BY PRODUCT SEGMENT

(% of LTM net sales thru June 2016)

• Premium Alkaline

• Lithium

• Performance Alkaline

• Rechargeable

• Value Alkaline

• Carbon Zinc

• Specialty Batteries

• Lighting Products

Premium Performance Price/Value Specialty & Lights

50%

16%

17%

17%

17

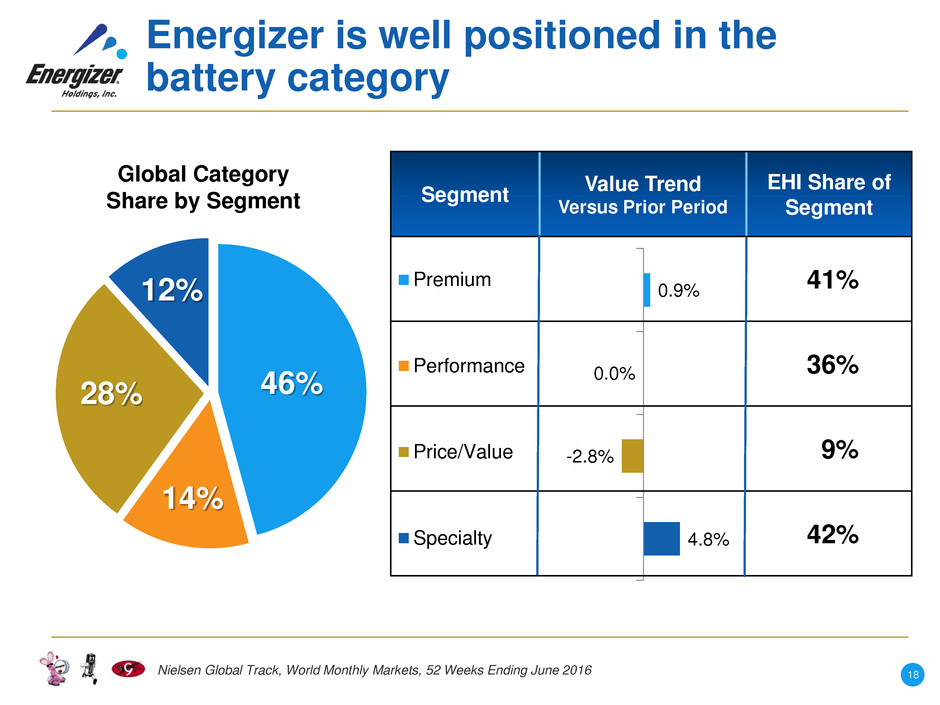

4.8%

-2.8%

0.0%

0.9%

46%

14%

28%

12% Premium

Performance

Price/Value

Specialty

Segment

Value Trend

Versus Prior Period

EHI Share of

Segment

41%

36%

9%

42%

Energizer is well positioned in the

battery category

Nielsen Global Track, World Monthly Markets, 52 Weeks Ending June 2016

Global Category

Share by Segment

18

25%

75%

We have a large and diversified channel

and customer base

BROAD, DIVERSE DISTRIBUTION ENR GLOBAL BATTERY

AND LIGHTS SALES BY

CUSTOMER

(percent of LTM net sales through

June 2016) • Top 5

customers

are ~25% of

sales

• No

customers in

the top 10

are exclusive

Top 5 All Other

Sporting

Goods

Online

DIY

Hobby/

Craft

Con-

venience

Office

Auto

Home

Center

Dollar

Club

Food/

Drug/

Mass

Traditional

Trade

Military

Energizer

19

Multiple in-store consumer purchase points

Our battery

products are

sold in multiple

locations

throughout the

store

20

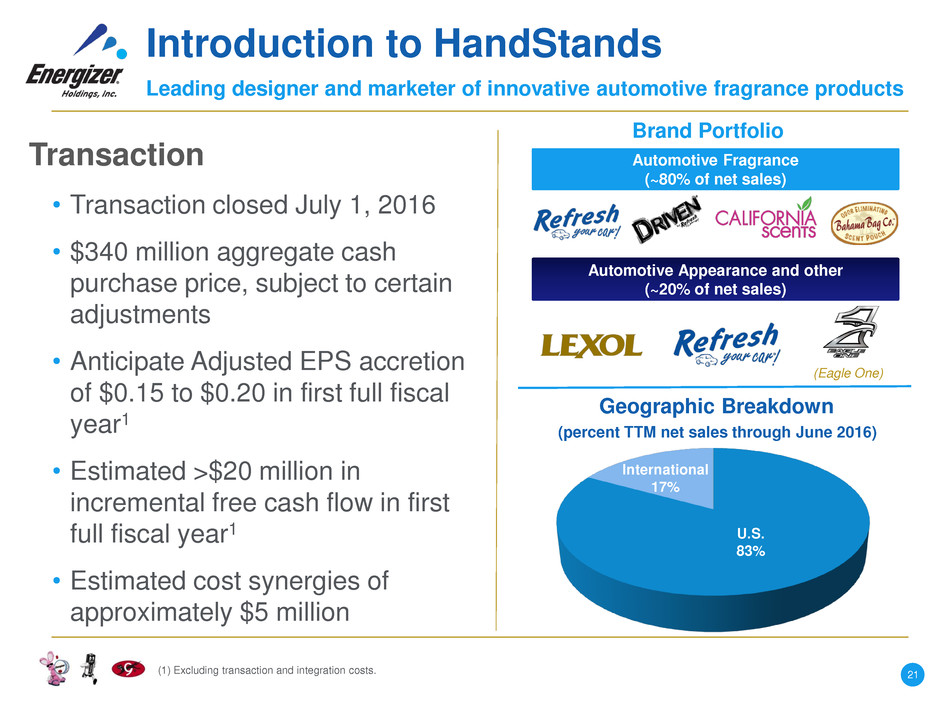

Introduction to HandStands

Leading designer and marketer of innovative automotive fragrance products

Brand Portfolio

Automotive Fragrance

(~80% of net sales)

Automotive Appearance and other

(~20% of net sales)

(Eagle One)

(1) Excluding transaction and integration costs.

Transaction

• Transaction closed July 1, 2016

• $340 million aggregate cash

purchase price, subject to certain

adjustments

• Anticipate Adjusted EPS accretion

of $0.15 to $0.20 in first full fiscal

year1

• Estimated >$20 million in

incremental free cash flow in first

full fiscal year1

• Estimated cost synergies of

approximately $5 million

Geographic Breakdown

U.S.

83%

International

17%

21

(percent TTM net sales through June 2016)

Introduction to HandStands

Broad portfolio in auto fragrance and appearance

22

Strong category fundamentals

Strong category growth rates

A market leader in the growing auto fragrance category

Total # and age of vehicles on the road increasing

Track record of leading with consumer-focused innovation

Highly attractive financial and free cash flow profile

Note: Dollar values in millions.

(1) NPD retail sales for the latest 52 week period ending January 2, 2016; CAGR calculated for the time period January 4,

2014–January 2, 2016; (2) Excludes Motor Oil, Greases and Lubes, Batteries, and Tire and Wheel Accessories (3) U.S. Auto

Fragrance category includes proprietary market analysis of combined NPD, IRI MULO, and Euromonitor data.

Selected Aftermarket Category Growth Rates (2013–2015)1,2

Others Washer

Fluids

Performance

Chemicals

Fluid

Management

Towing &

Hitch

Appearance

Chemicals

Wipers Refrigerants Lighting Air

Fragrance

2.1%

2.8% 3.0%

3.3% 3.4%

3.6%

4.5%

6.2%

7.1%

7.5% HandStands Category

Category: 3.3%2

LEADING POSITION WITH

24%

VALUE SHARE

IN AUTO FRAGRANCE3

23

Other

11%

We have an opportunity to expand HandStands

distribution into multiple channels and geographies

OPPORTUNITY TO EXPAND

CHANNEL DISTRIBUTION

HANDSTANDS U.S. SALES

BY CHANNEL

(percent of LTM net sales through June 2016)

HANDSTANDS SALES

BY GEOGRAPHY

(percent of LTM net sales through June 2016)

• 83% of sales

in the U.S.

• 75% of U.S.

sales overlap

with existing

ENR

customers

•Opportunity to

expand

distribution

with existing

customers

and into new

channels and

geographies

Sporting

Goods

Online

DIY

Hobby/

Craft

C & G

Office

Auto

Home

Center

Dollar

Club

Food/

Drug/

Mass

Traditional

Trade

Military

HandStands

Food/Drug/Mass 37%

Auto 28%

Dollar 24%

U.S.

83%

International

17%

24

Agenda

Energizer Holdings, Inc.

Strategic Priorities

Delivering Long-Term Value

First Year

25

Energizer Strategic Priorities

A foundation for delivering long-term value to our shareholders, customers

and consumers

FOCUS

ON

MAXIMIZING

CASH

FLOWS

26

Leading with innovation is key to our

success in the battery and lights category

Improved Brightness

The World’s First AA

Battery Made With 4%

Recycled Batteries is

Now EVEN Longer

Lasting

The World’s First

Rechargeable AA &

AAA Batteries Made

With 4% Recycled

Batteries

World’s Longest Lasting

and Highest Energy AA

Battery

Our Longest

Lasting Energizer

MAX Ever

Our Longest Lasting

Hearing Aid Batteries

Patented

Digital Focus Technology

Improved Brightness

Patented

Touch Technology

Expansion of the

Emergency & Safety

Product Line

27

Leading with innovation is key to our

success in the auto fragrance category

Refresh Your Car®

Antibacterial

HandStands brings to market the

world’s first anti-bacterial cleaner

specially formulated to condition

and protect a car’s interior surfaces.

Refresh Your Car®

Mini Diffuser

Pairing our proven diffuser

technology with a 2-pack smaller

device results in incredible value for

the consumer.

Refresh Your Car®

Refillable Fragrance System

Building on the electric fragrance

segment HandStands pioneered,

the new Refillable System features

a refill capsule that can be used

alone, or on a 12-V and Visor

mounted device.

Refresh Your Car®

Active Odor Elimination

The first line of automotive air

fresheners to both attack odor

molecules and remove odors at

their source. Available in four

platforms.

28

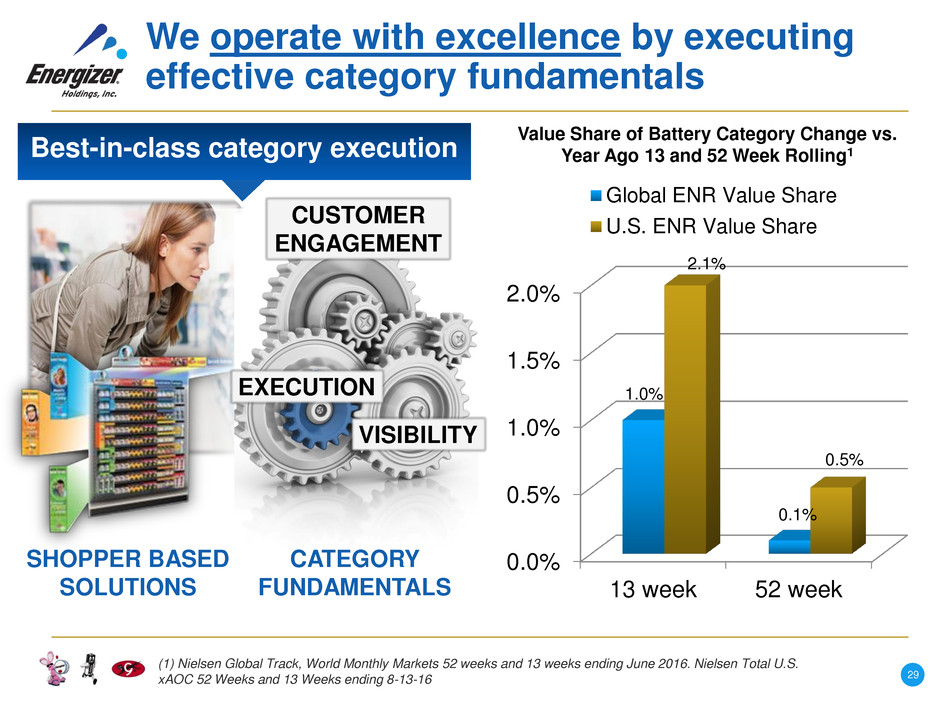

We operate with excellence by executing

effective category fundamentals

EXECUTION

VISIBILITY

CUSTOMER

ENGAGEMENT

SHOPPER BASED

SOLUTIONS

CATEGORY

FUNDAMENTALS

Best-in-class category execution

Value Share of Battery Category Change vs.

Year Ago 13 and 52 Week Rolling1

(1) Nielsen Global Track, World Monthly Markets 52 weeks and 13 weeks ending June 2016. Nielsen Total U.S.

xAOC 52 Weeks and 13 Weeks ending 8-13-16

0.0%

0.5%

1.0%

1.5%

2.0%

13 week 52 week

1.0%

0.1%

2.1%

0.5%

Global ENR Value Share

U.S. ENR Value Share

29

WORKING CAPITAL

(from FY’11 – Q3 FY’16, by driver)

Track record of driving productivity gains

Led to 440 basis points of

gross margin improvement

through FY’15

Led to 12 percentage point

reduction in working capital

as a percent of sales

Offset dis-synergies from

the spin

SG&A

pre-spin

Dis-

synergies

ZBB

Savings

SG&A

post-spin

0

20

40

60

80

100

120

DSO DII DPO

48

103

42

24

96

66

FY '11 Q3 FY '16

2013 RESTRUCTURING

(through 9/30/15, by category)

$218M of cost savings > $200M cash flow

improvement

~

ZERO BASED BUDGETING

(FY’16)

66%

18%

16%

COGS SG&A Other

30

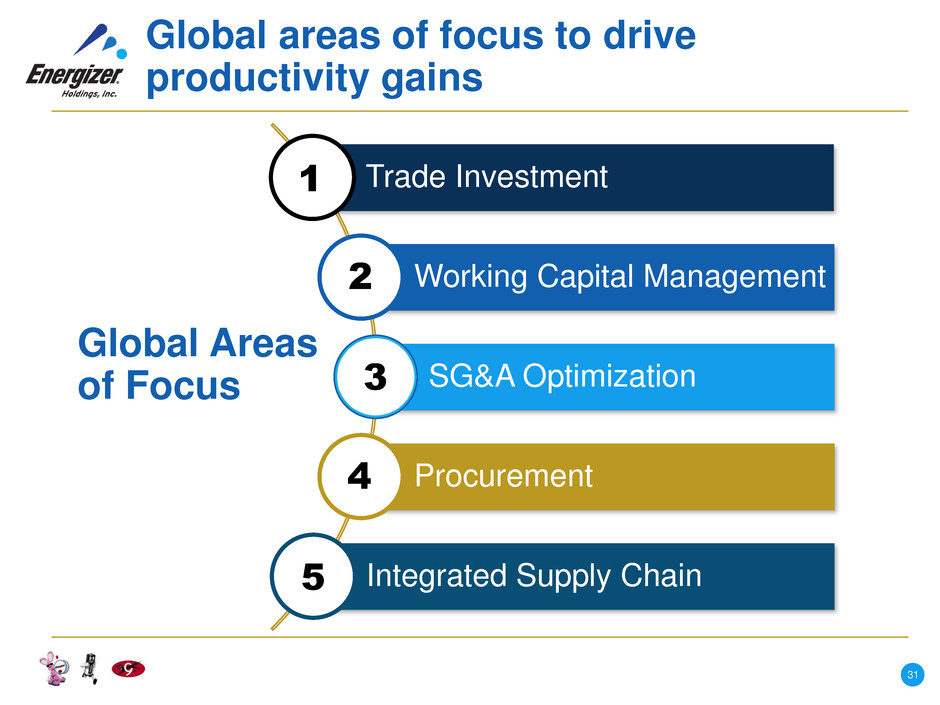

Trade Investment

Working Capital Management

SG&A Optimization

Procurement

Integrated Supply Chain

1

2

3

4

5

Global areas of focus to drive

productivity gains

Global Areas

of Focus

31

Global Areas

of Focus

Global areas of focus to drive

productivity gains

Trade Investment 1

Accomplishments

• Established center-led Revenue Management

team

• Announced price increases in Canada,

Russia and several Latin American, Middle

East Africa and Asian markets

• Frequency and depth of promotion decreased

Objectives

• Disciplined and ROI based approach to

pricing and promotion management

• Focused on profitable share through strategic

joint business planning with our retail partners

32

Global Areas

of Focus

Global areas of focus to drive

productivity gains

Working Capital Management 2

Accomplishments

• Working Capital % of Sales reduced from

23% to 11%

• Driver of leading Free Cash Flow

performance

Objectives

• Improve Days in Inventory through SKU

optimization and simplification

• Maintain leading Days Sales Outstanding

and Days Payable Outstanding positions

33

Global Areas

of Focus

Global areas of focus to drive

productivity gains

SG&A Optimization 3

Accomplishments

• Offset separation dis-synergies

• Implemented Zero Based Budgeting

• Established cultural mindset of relentless

focus on eliminating non-critical/non-strategic

costs

Objectives

• Annual cost optimization

• Continue Zero Based Budgeting

• Continuous challenge through internal and

peer benchmarking

34

Global Areas

of Focus

Global areas of focus to drive

productivity gains

Procurement 4

Accomplishments

• >$60 million of savings as part of the 2013

Restructuring

• Improved Days Payable Outstanding by 24

days

Objectives

• Annual cost optimization

• Optimize and standardize vendor payment

terms

35

Global Areas

of Focus

Global areas of focus to drive

productivity gains

Integrated Supply Chain 5

Accomplishments

• $86 million of savings as part of the 2013

Restructuring

• Reduced the number of battery manufacturing

facilities from 14 to 7

Objectives

• Annual cost optimization

• Partner with our commercial teams to meet retail

partner expectations

• Support innovation efforts

• Leverage global supply chain in acquisition

integration

36

Agenda

Energizer Holdings, Inc.

Strategic Priorities

Delivering Long-Term Value

First Year

37

Balanced approach to capital allocation

Maximize Free Cash Flow

Reinvest

in

our

Business

Return of

Capital

Selective,

Disciplined

M&A

Deliver Value

Our foundation

Pillars

to our

success

Relentless focus on

delivering value to

shareholders, customers

and consumers

38

Balanced capital allocation

• Reinvested in the business to drive innovation and

productivity gains

• Returned $84 million cash to shareholders since spin

̶ $1 per share dividend to be increased to $1.10 per share starting FY ‘17

̶ $22 million or 600,000 shares repurchased

• Executed highly accretive M&A transaction with the

acquisition of HandStands

̶ Adjusted EPS accretion $0.15 to $0.20 per share1

̶ >$20 million of free cash flow1

(1) Excluding transaction and integration costs.

39

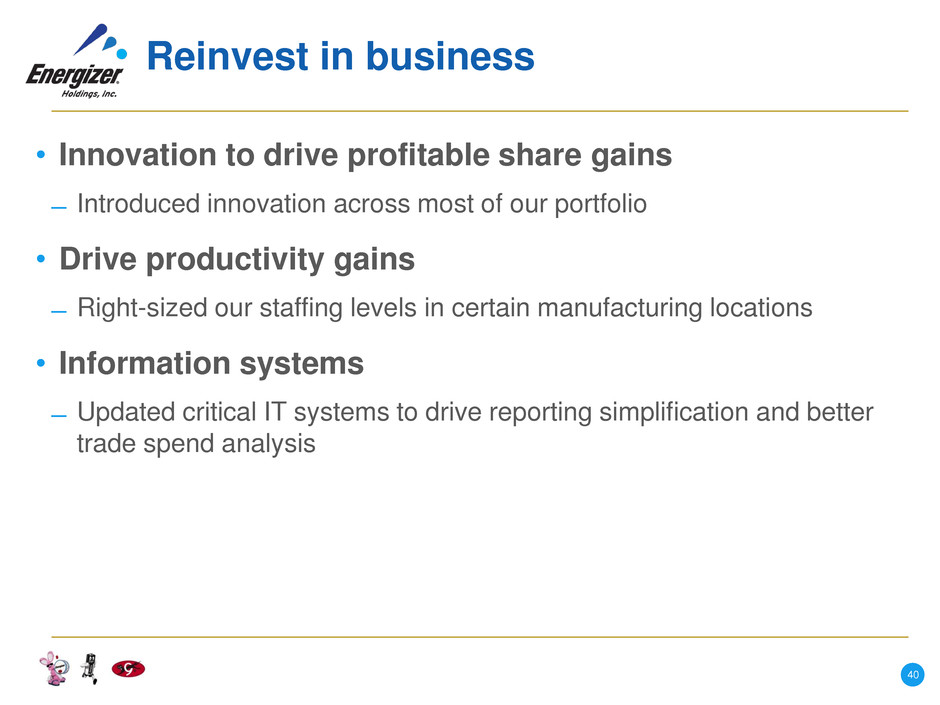

Reinvest in business

• Innovation to drive profitable share gains

̶ Introduced innovation across most of our portfolio

• Drive productivity gains

̶ Right-sized our staffing levels in certain manufacturing locations

• Information systems

̶ Updated critical IT systems to drive reporting simplification and better

trade spend analysis

40

0

1

2

3

4

5

6

7

8

Share

Authorization

on July 1, 2015

Shares

Repurchased

in FY 16

Remaining on

Authorization

Dividend and share repurchase are an important

part of delivering long-term shareholder value

0%

10%

20%

30%

40%

50%

60%

70%

80%

U.S.Cash

Flow

Adjusted

Net Income

~70%

~40%

FY 16 FY 17

$1.00

$1.10 7.5 0.6

6.9

pro forma TTM

as of June 30, 2016*

Dividend Payments as a % Per Share Dividend1 Share Repurchases

*Normalized Cash Flow, including pro forma HandStands cash flow and net income.

1Future dividends declarations are subject to approval by the Board of Directors.

41

Selective and disciplined approach to M & A

Right Business

Branded Household Products

Defensible business models

Leverage Energizer’s core

competencies

Similar financial profile

Right Time

Maintaining core business

performance is a priority

Balance with other integration

efforts, initiatives and

investments

Right Place

Customer, channel and

geographic overlap

Leverage existing global

battery platform and integrated

supply chain

Right Price

Maximizing long-term

shareholder value drives our

decision process

Maintain healthy balance

sheet

42

Our strong balance sheet and free cash flow supports

our balanced approach to capital allocation

Summary Capitalization

($M Pro-Forma)

Cash $300

Total Debt $1,050

Projected Free Cash

Flow1

>$170

• Substantially all cash is

offshore

• Credit metrics:

– ~3x debt to EBITDA

– 75% at fixed rates

– ~7.5 year average maturity

– ~5% average interest rate

– $300 million revolver

availability

43 (1) inclusive of pro-forma HandStands

Long-term financial outlook

(inclusive of HandStands)

Growth rate at or above the category Organic Revenue

Consistent low single-digit growth Adjusted EBITDA

Corporate rate in the range of 30% to 31%

Tax Rate

(ex unusuals)

In the range of $30 million to $35 million

Low to mid single-digit growth

Free Cash Flow

(ex unusuals)

Meaningful and competitive dividend, subject to

Board approval

Dividends

METRIC LONG-TERM OUTLOOK

Capital

Expenditures

44

Key take-aways

• Strong start to first full year as a stand-alone

company

• Solid business fundamentals

• Executing on our three strategic initiatives

• Maximizing free cash flow

• Balanced approach to capital allocation to

drive long-term shareholder value

45

Q&A

BRIAN HAMM – CHIEF FINANCIAL OFFICER

MARK LAVIGNE – CHIEF OPERATING OFFICER

4

6

Appendix

4

7

Net Sales Organic Reconciliation

48

Total Net Sales

Net sales - prior year $ 501.3 $ 356.9 $ 374.3 $ 1232.5

Organic 9.5 % 0.5 % 1.2 % 4.4 %

Int'l Go-to-Market (1.1) (1.1) (1.4) (1.2)

Change in Venezuela results (0.6) % (1.5) % — % (0.7) %

Impact of currency (6.7) % (4.3) % (3.4) % (5.0) %

Net sales - current year $ 506.8 1.1 $ 334.0 (6.4) $ 361.0 (3.6) $ 1201.8 (2.5)

Q1'16 % chg Q2'16 % chg Q3'16 YTD Q3'16 % chg% chg

47.4 1.9 4.5 53.8

(5.6) (3.9) (5.2) (14.7)

(3.1) (5.4) — (8.5)

(33.2) (15.5) (12.6) (61.3)

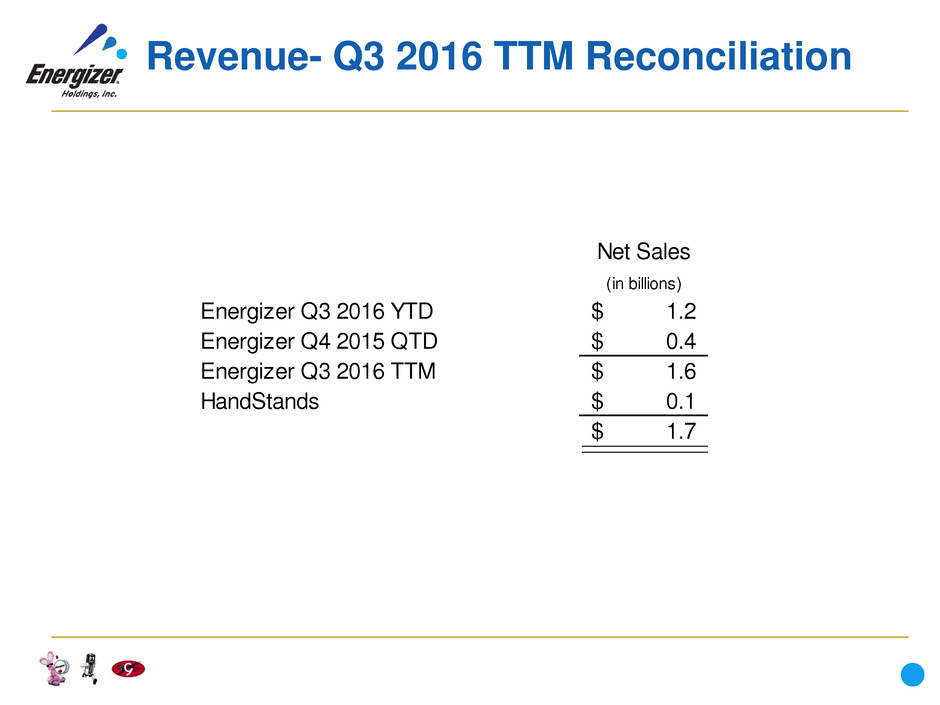

Revenue- Q3 2016 TTM Reconciliation

Net Sales

(in billions)

Energizer Q3 2016 YTD 1.2$

Energizer Q4 2015 QTD 0.4$

Energizer Q3 2016 TTM 1.6$

HandStands 0.1$

1.7$